fb7e33a10a986641f4574ca31b05b5f1.ppt

- Количество слайдов: 40

SECURE TRADING AND CLEARING

SECURE TRADING AND CLEARING

SECTION ONE: NGX BACKGROUND 2

SECTION ONE: NGX BACKGROUND 2

Introduction to NGX • Business Concept: –Provide electronic trading and clearing services to North American energy market participants –NGX is a service provider and therefore does not trade or take positions • Headquartered in Calgary, Alberta, Canada • Incorporated in 1993, began trading operations in Feb 1994 • Ownership History –Initial Ownership by Westcoast Energy Inc. –Acquired by OM on Jan 1, 2001 –Acquired by TSX Group March 1, 2004 3

Introduction to NGX • Business Concept: –Provide electronic trading and clearing services to North American energy market participants –NGX is a service provider and therefore does not trade or take positions • Headquartered in Calgary, Alberta, Canada • Incorporated in 1993, began trading operations in Feb 1994 • Ownership History –Initial Ownership by Westcoast Energy Inc. –Acquired by OM on Jan 1, 2001 –Acquired by TSX Group March 1, 2004 3

Ownership: Introduction to TSX • TSX Group is a cornerstone of the Canadian financial system and is at the centre of Canada’s equity capital market • TSX Group owns and operates Canada’s two national stock exchanges, the Toronto Stock Exchange, serving the senior equity market, and TSX Venture Exchange, serving the public venture equity market • From its preeminent domestic base, TSX Group’s reach continues to extend internationally, through TSX Markets and TSX Datalinx which provide the trading and data to the global financial community who access Canada’s equity capital market 4

Ownership: Introduction to TSX • TSX Group is a cornerstone of the Canadian financial system and is at the centre of Canada’s equity capital market • TSX Group owns and operates Canada’s two national stock exchanges, the Toronto Stock Exchange, serving the senior equity market, and TSX Venture Exchange, serving the public venture equity market • From its preeminent domestic base, TSX Group’s reach continues to extend internationally, through TSX Markets and TSX Datalinx which provide the trading and data to the global financial community who access Canada’s equity capital market 4

NGX Core Competencies • Electronic Trading –Over 12 years of experience developing and operating high-reliability, high-performance electronic trading systems • Clearinghouse Operations –Physically and financially settled over 850, 000 trades –Zero-default history • Liquidity Development –Focus on customers and quality of service –Commitment to the reduction of trading impediments 5

NGX Core Competencies • Electronic Trading –Over 12 years of experience developing and operating high-reliability, high-performance electronic trading systems • Clearinghouse Operations –Physically and financially settled over 850, 000 trades –Zero-default history • Liquidity Development –Focus on customers and quality of service –Commitment to the reduction of trading impediments 5

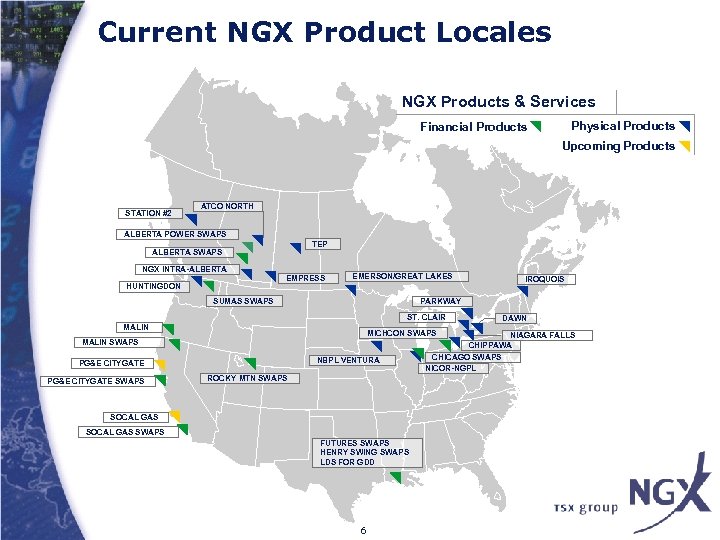

Current NGX Product Locales NGX Products & Services Physical Products Financial Products Upcoming Products STATION #2 ATCO NORTH ALBERTA POWER SWAPS TEP ALBERTA SWAPS NGX INTRA-ALBERTA EMPRESS HUNTINGDON EMERSON/GREAT LAKES SUMAS SWAPS PARKWAY ST. CLAIR MALIN MICHCON SWAPS MALIN SWAPS NBPL VENTURA PG&E CITYGATE SWAPS IROQUOIS ROCKY MTN SWAPS SOCAL GAS SWAPS FUTURES SWAPS HENRY SWING SWAPS LDS FOR GDD 6 DAWN NIAGARA FALLS CHIPPAWA CHICAGO SWAPS NICOR-NGPL

Current NGX Product Locales NGX Products & Services Physical Products Financial Products Upcoming Products STATION #2 ATCO NORTH ALBERTA POWER SWAPS TEP ALBERTA SWAPS NGX INTRA-ALBERTA EMPRESS HUNTINGDON EMERSON/GREAT LAKES SUMAS SWAPS PARKWAY ST. CLAIR MALIN MICHCON SWAPS MALIN SWAPS NBPL VENTURA PG&E CITYGATE SWAPS IROQUOIS ROCKY MTN SWAPS SOCAL GAS SWAPS FUTURES SWAPS HENRY SWING SWAPS LDS FOR GDD 6 DAWN NIAGARA FALLS CHIPPAWA CHICAGO SWAPS NICOR-NGPL

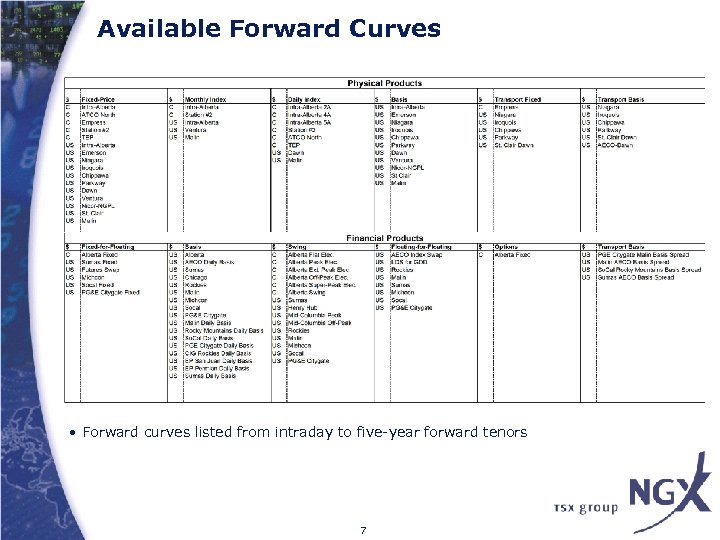

Available Forward Curves • Forward curves listed from intraday to five-year forward tenors 7

Available Forward Curves • Forward curves listed from intraday to five-year forward tenors 7

Current NGX Services • Marketplace –Centralized electronic trading –Standardized contracts –Pipeline balancing instruments –Market advocacy (facilitating transactions) –Market agency (facilitating order entry) –Real-Time Price Index Generation • Clearing House –Assured performance –Trade and counterparty netting –Centralized collateral management –Centralized risk management 8

Current NGX Services • Marketplace –Centralized electronic trading –Standardized contracts –Pipeline balancing instruments –Market advocacy (facilitating transactions) –Market agency (facilitating order entry) –Real-Time Price Index Generation • Clearing House –Assured performance –Trade and counterparty netting –Centralized collateral management –Centralized risk management 8

Operational Statistics • 134 NGX Contracting Parties –“Member” firms eligible to transact through the Exchange • List 102 physical and derivative products • Average in Excess of 400 Traders Online Daily • Approximately 100 View-Only Users Online Daily • 2005 Trading Statistics: –Volume = 8. 8 Tcf –Transactions = 185, 878 • Average Daily Deliveries in Excess of 12. 0 Bcf 9

Operational Statistics • 134 NGX Contracting Parties –“Member” firms eligible to transact through the Exchange • List 102 physical and derivative products • Average in Excess of 400 Traders Online Daily • Approximately 100 View-Only Users Online Daily • 2005 Trading Statistics: –Volume = 8. 8 Tcf –Transactions = 185, 878 • Average Daily Deliveries in Excess of 12. 0 Bcf 9

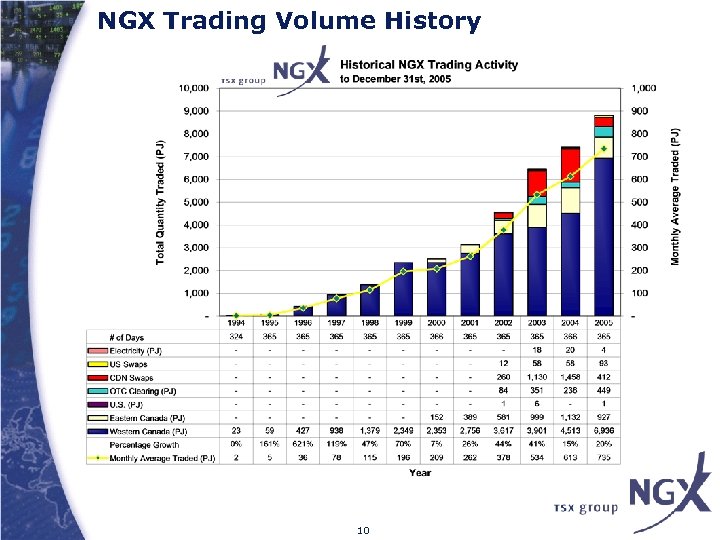

NGX Trading Volume History 10

NGX Trading Volume History 10

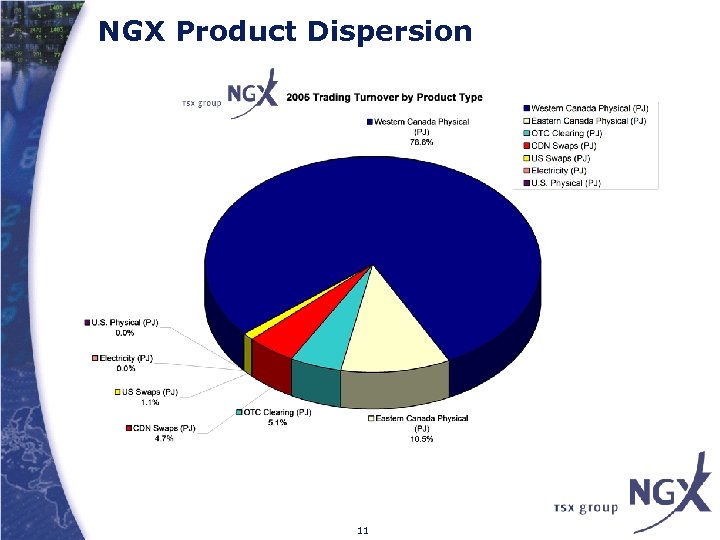

NGX Product Dispersion 11

NGX Product Dispersion 11

SECTION TWO : CLEARING STRUCTURE 12

SECTION TWO : CLEARING STRUCTURE 12

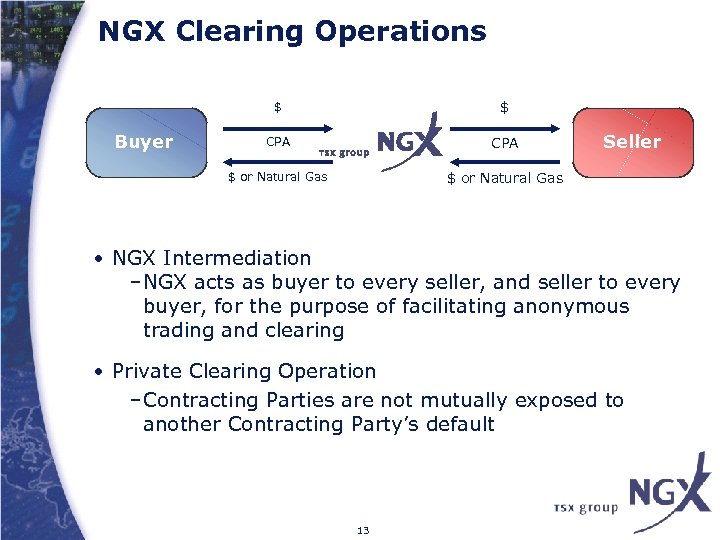

NGX Clearing Operations $ CPA $ or Natural Gas Buyer $ $ or Natural Gas Seller • NGX Intermediation –NGX acts as buyer to every seller, and seller to every buyer, for the purpose of facilitating anonymous trading and clearing • Private Clearing Operation –Contracting Parties are not mutually exposed to another Contracting Party’s default 13

NGX Clearing Operations $ CPA $ or Natural Gas Buyer $ $ or Natural Gas Seller • NGX Intermediation –NGX acts as buyer to every seller, and seller to every buyer, for the purpose of facilitating anonymous trading and clearing • Private Clearing Operation –Contracting Parties are not mutually exposed to another Contracting Party’s default 13

How is Counterparty Risk Mitigated? • Standard Rules –All Contracting Parties are subject to the same rules and regulations as set forth in the CPA –Contracting Parties must meet minimum creditworthiness test and meet credit requirements on an ongoing basis • Collateral Provisions –The requirement for liquid collateral to be placed on deposit with NGX in advance and in excess of margin requirements provides the security against default • Liquidation Rights –NGX has a number of rights if a Contracting Party default occurs, including the ability to close-out (or accelerate) all forward positions for the defaulting party –Collateral is utilized to cover any liquidated damages 14

How is Counterparty Risk Mitigated? • Standard Rules –All Contracting Parties are subject to the same rules and regulations as set forth in the CPA –Contracting Parties must meet minimum creditworthiness test and meet credit requirements on an ongoing basis • Collateral Provisions –The requirement for liquid collateral to be placed on deposit with NGX in advance and in excess of margin requirements provides the security against default • Liquidation Rights –NGX has a number of rights if a Contracting Party default occurs, including the ability to close-out (or accelerate) all forward positions for the defaulting party –Collateral is utilized to cover any liquidated damages 14

How is Counterparty Risk Mitigated? • Backstopping –Delivery risks are mitigated through the use of backstopping services provided by various market participants, including storage facilities, large shippers, and pipeline operators –Backstopping is typically an arrangement for immediate provision of supply/market at a predetermined price (usually based on index) • Settlement Bank –The settlement bank daylight and overdraft facilities provide for clearing operation liquidity during a default situation and assist in managing timing issues on settlement day • Emergency Fund –NGX provides a trust fund for Contracting Parties to access in the event of an exchange default, backed by a parental guarantee from TSX 15

How is Counterparty Risk Mitigated? • Backstopping –Delivery risks are mitigated through the use of backstopping services provided by various market participants, including storage facilities, large shippers, and pipeline operators –Backstopping is typically an arrangement for immediate provision of supply/market at a predetermined price (usually based on index) • Settlement Bank –The settlement bank daylight and overdraft facilities provide for clearing operation liquidity during a default situation and assist in managing timing issues on settlement day • Emergency Fund –NGX provides a trust fund for Contracting Parties to access in the event of an exchange default, backed by a parental guarantee from TSX 15

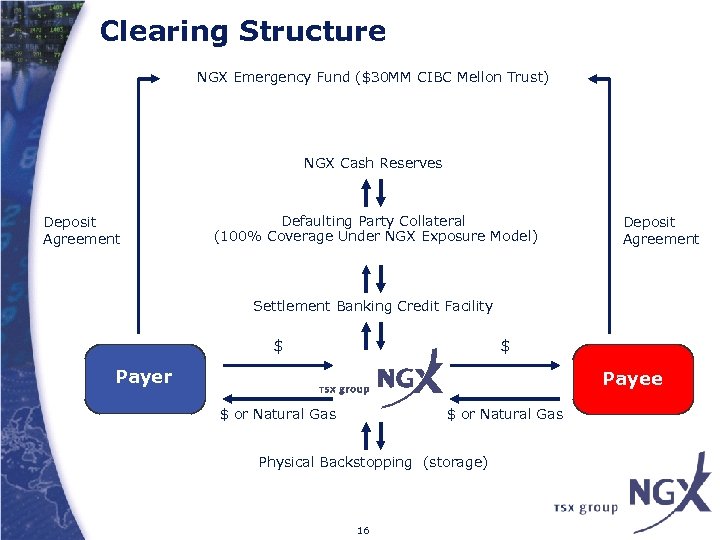

Clearing Structure NGX Emergency Fund ($30 MM CIBC Mellon Trust) NGX Cash Reserves Deposit Agreement Defaulting Party Collateral (100% Coverage Under NGX Exposure Model) Deposit Agreement Settlement Banking Credit Facility $ $ Payer Payee $ or Natural Gas Physical Backstopping (storage) 16

Clearing Structure NGX Emergency Fund ($30 MM CIBC Mellon Trust) NGX Cash Reserves Deposit Agreement Defaulting Party Collateral (100% Coverage Under NGX Exposure Model) Deposit Agreement Settlement Banking Credit Facility $ $ Payer Payee $ or Natural Gas Physical Backstopping (storage) 16

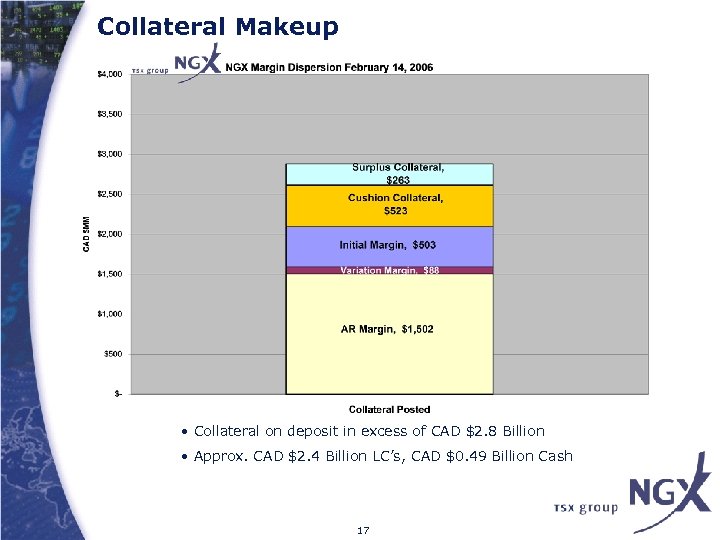

Collateral Makeup • Collateral on deposit in excess of CAD $2. 8 Billion • Approx. CAD $2. 4 Billion LC’s, CAD $0. 49 Billion Cash 17

Collateral Makeup • Collateral on deposit in excess of CAD $2. 8 Billion • Approx. CAD $2. 4 Billion LC’s, CAD $0. 49 Billion Cash 17

NGX Central Clearing Benefits • Neutral, Independent Risk Management –NGX is impartial and the nature of the clearing business provides a strong incentive to maintain a default-free clearing operation –NGX is not a market participant, does not take a market view and earnings are not directed by commodity prices • Centralized Collateral Requirements –Concentration of capital affords most efficient use across all other contracting parties 18

NGX Central Clearing Benefits • Neutral, Independent Risk Management –NGX is impartial and the nature of the clearing business provides a strong incentive to maintain a default-free clearing operation –NGX is not a market participant, does not take a market view and earnings are not directed by commodity prices • Centralized Collateral Requirements –Concentration of capital affords most efficient use across all other contracting parties 18

NGX Central Clearing Benefits • Counterparty Netting Facilities –Central clearing operator and standardized netting rules create an environment to net physical and financial exposures across multiple counter parties and locations • Acceleration, Liquidation, Close-Out Procedure –NGX has embedded, and has enforced, rights of acceleration for all contracts traded through the Exchange to mitigate risks to all Contracting Parties 19

NGX Central Clearing Benefits • Counterparty Netting Facilities –Central clearing operator and standardized netting rules create an environment to net physical and financial exposures across multiple counter parties and locations • Acceleration, Liquidation, Close-Out Procedure –NGX has embedded, and has enforced, rights of acceleration for all contracts traded through the Exchange to mitigate risks to all Contracting Parties 19

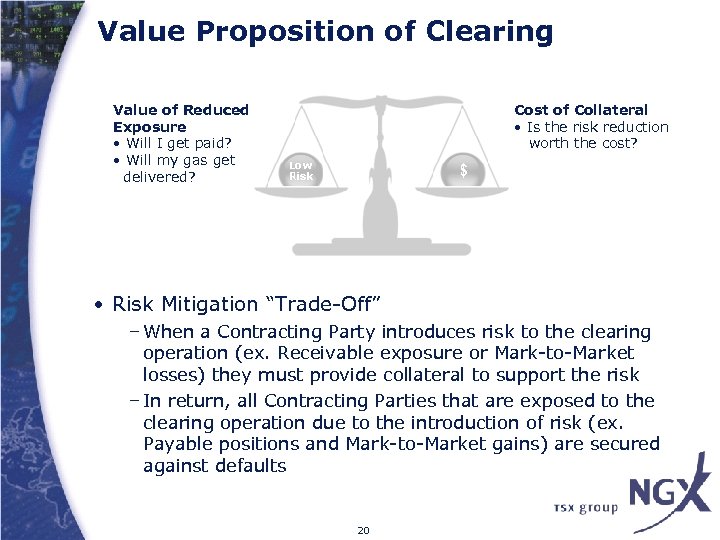

Value Proposition of Clearing Value of Reduced Exposure • Will I get paid? • Will my gas get delivered? Cost of Collateral • Is the risk reduction worth the cost? • Risk Mitigation “Trade-Off” – When a Contracting Party introduces risk to the clearing operation (ex. Receivable exposure or Mark-to-Market losses) they must provide collateral to support the risk – In return, all Contracting Parties that are exposed to the clearing operation due to the introduction of risk (ex. Payable positions and Mark-to-Market gains) are secured against defaults 20

Value Proposition of Clearing Value of Reduced Exposure • Will I get paid? • Will my gas get delivered? Cost of Collateral • Is the risk reduction worth the cost? • Risk Mitigation “Trade-Off” – When a Contracting Party introduces risk to the clearing operation (ex. Receivable exposure or Mark-to-Market losses) they must provide collateral to support the risk – In return, all Contracting Parties that are exposed to the clearing operation due to the introduction of risk (ex. Payable positions and Mark-to-Market gains) are secured against defaults 20

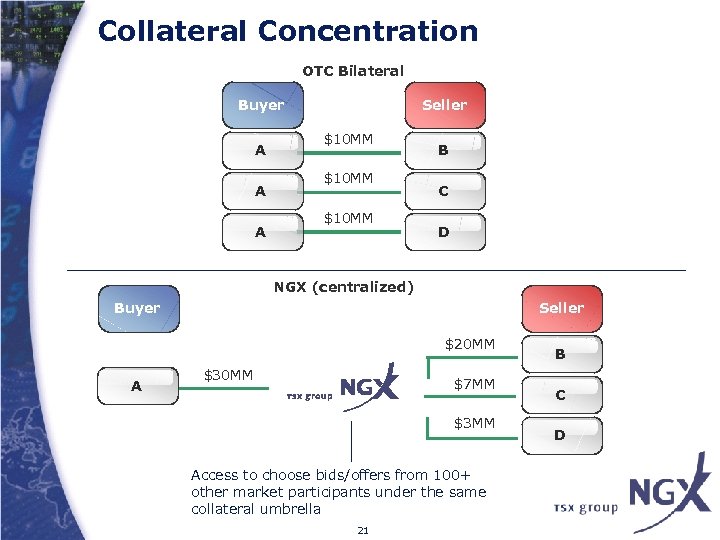

Collateral Concentration OTC Bilateral Buyer A A A Seller $10 MM B C D NGX (centralized) Buyer Seller $20 MM A $30 MM $7 MM $3 MM Access to choose bids/offers from 100+ other market participants under the same collateral umbrella 21 B C D

Collateral Concentration OTC Bilateral Buyer A A A Seller $10 MM B C D NGX (centralized) Buyer Seller $20 MM A $30 MM $7 MM $3 MM Access to choose bids/offers from 100+ other market participants under the same collateral umbrella 21 B C D

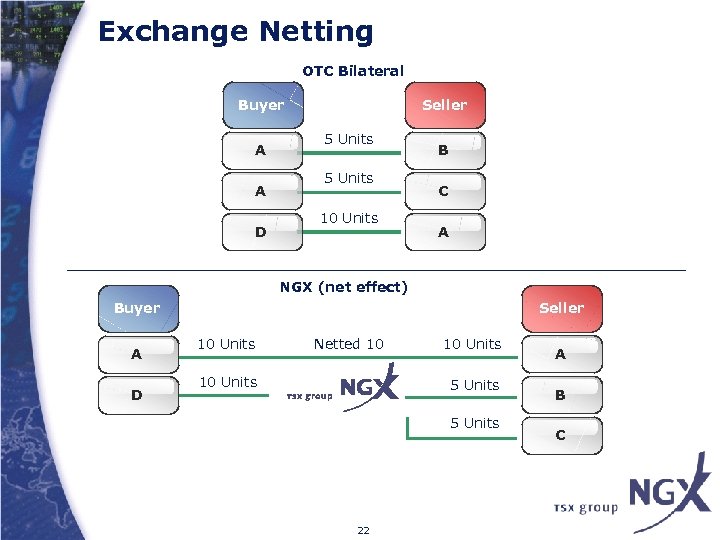

Exchange Netting OTC Bilateral Buyer A A D Seller 5 Units 10 Units B C A NGX (net effect) Buyer A D Seller 10 Units Netted 10 10 Units 5 Units 22 A B C

Exchange Netting OTC Bilateral Buyer A A D Seller 5 Units 10 Units B C A NGX (net effect) Buyer A D Seller 10 Units Netted 10 10 Units 5 Units 22 A B C

Clearing Statistics • Cleared Transactions – 180, 000+ transactions cleared annually –Notional value of transactions consummated through NGX is in excess of CAD $60 Billion annually • Margin –Over 130 corporate margin accounts held by NGX –Manage margin accounts in excess of CAD $4. 0 Billion in cash and letters of credit • Settlement –Settlement of $US and $CAD cash streams –Monthly settlement values over CAD $2 Billion processed by the clearing house 23

Clearing Statistics • Cleared Transactions – 180, 000+ transactions cleared annually –Notional value of transactions consummated through NGX is in excess of CAD $60 Billion annually • Margin –Over 130 corporate margin accounts held by NGX –Manage margin accounts in excess of CAD $4. 0 Billion in cash and letters of credit • Settlement –Settlement of $US and $CAD cash streams –Monthly settlement values over CAD $2 Billion processed by the clearing house 23

Oversight • Regulatory –ASC – Exemption order, compliance with operating principles –CFTC – 2(h)(iii) exemption, “Eligible Commercial Market” status • Clearing Bank –TD Bank, NGX’s Clearing Bank, maintains oversight of NGX clearing operations to support credit facility, $300 MM daylight, $30 MM LC, $20 MM demand –Clearing Bank controls segregated collateral accounts –Clearing Bank authorizes movement of funds from collateral accounts –Clearing Bank has full access to NGX trade/clearing data and reporting, ensures collateral accounts are sufficient to manage Contracting Party margin requirements 24

Oversight • Regulatory –ASC – Exemption order, compliance with operating principles –CFTC – 2(h)(iii) exemption, “Eligible Commercial Market” status • Clearing Bank –TD Bank, NGX’s Clearing Bank, maintains oversight of NGX clearing operations to support credit facility, $300 MM daylight, $30 MM LC, $20 MM demand –Clearing Bank controls segregated collateral accounts –Clearing Bank authorizes movement of funds from collateral accounts –Clearing Bank has full access to NGX trade/clearing data and reporting, ensures collateral accounts are sufficient to manage Contracting Party margin requirements 24

SECTION THREE: RISK MANAGEMENT 25

SECTION THREE: RISK MANAGEMENT 25

Performance Risks • Failure to Make/Take Delivery –NGX is exposed to the price at which an alternative supply/market can be found –Risk is managed with backstopping contracts, penalty mechanisms, collateral requirements and credit policy • Failure to Pay –NGX is exposed to receivables risk on settlement dates –Risk is managed with penalty mechanisms, collateral requirements and credit policy • Failure to Provide Collateral –NGX is exposed to the risk that Contracting Parties will not provide sufficient collateral to manage their risks –Risk is managed with liquidation provisions 26

Performance Risks • Failure to Make/Take Delivery –NGX is exposed to the price at which an alternative supply/market can be found –Risk is managed with backstopping contracts, penalty mechanisms, collateral requirements and credit policy • Failure to Pay –NGX is exposed to receivables risk on settlement dates –Risk is managed with penalty mechanisms, collateral requirements and credit policy • Failure to Provide Collateral –NGX is exposed to the risk that Contracting Parties will not provide sufficient collateral to manage their risks –Risk is managed with liquidation provisions 26

Margin Requirements • Risk Measurement –Performance risks are quantified through NGX’s margining methodology, which attempts to estimate probable worst-case portfolio value • Collateral –NGX collects collateral from Contracting Parties to secure their portfolios and protect the clearing operation from defaults • Margin Triggers –If margin requirements reach 80% of collateral deposited, NGX will request additional collateral –At 90%, NGX may restrict the Contracting Parties trading capabilities –At 95%, NGX is entitled to invoke the liquidation procedure 27

Margin Requirements • Risk Measurement –Performance risks are quantified through NGX’s margining methodology, which attempts to estimate probable worst-case portfolio value • Collateral –NGX collects collateral from Contracting Parties to secure their portfolios and protect the clearing operation from defaults • Margin Triggers –If margin requirements reach 80% of collateral deposited, NGX will request additional collateral –At 90%, NGX may restrict the Contracting Parties trading capabilities –At 95%, NGX is entitled to invoke the liquidation procedure 27

Collateral • Collateral Policy –Contracting Parties must have sufficient collateral to cover their Margin Requirement, utilizing any combination of the forms of collateral and offsets below –Collateral is held to support the Contracting Party’s traded positions and can only be used to remedy a performance failure by the Contracting Party itself • Collateral Requirements –Collateral is accepted in the form of cash and irrevocable letter of credit from an A or higher rated bank –Collateral requirement can be reduced with an accounts payable or positive variation margin offset 28

Collateral • Collateral Policy –Contracting Parties must have sufficient collateral to cover their Margin Requirement, utilizing any combination of the forms of collateral and offsets below –Collateral is held to support the Contracting Party’s traded positions and can only be used to remedy a performance failure by the Contracting Party itself • Collateral Requirements –Collateral is accepted in the form of cash and irrevocable letter of credit from an A or higher rated bank –Collateral requirement can be reduced with an accounts payable or positive variation margin offset 28

Risk Measurement • Accounts Receivable/Payable –A calculation of the value of gas delivered –Margin requirements are increased if gas has been taken prior to payment, and decreased if gas has been delivered prior to payment • Variation Margin (Mark-to-Market) –A calculation of the price at which a forward position could be instantaneously liquidated given current market prices • Initial Margin –A calculation of the probability of a movement in market prices during a two-day holding period –Initial margin coverage protects against a prolonged liquidation 29

Risk Measurement • Accounts Receivable/Payable –A calculation of the value of gas delivered –Margin requirements are increased if gas has been taken prior to payment, and decreased if gas has been delivered prior to payment • Variation Margin (Mark-to-Market) –A calculation of the price at which a forward position could be instantaneously liquidated given current market prices • Initial Margin –A calculation of the probability of a movement in market prices during a two-day holding period –Initial margin coverage protects against a prolonged liquidation 29

Position Tracking • Consolidation and Netting –Positions within each product and date range are consolidated into gross long and short positions –Liquidation risk is managed against the net of the long and short positions • Instruments and Date Ranges –Trades across all instruments in a product are grouped by date ranges in real-time –Instruments may overlap, but date ranges are unique –Ex. A M-Nov instrument and a WB-Nov instrument would each populate a position for November 1 to November 30 th 30

Position Tracking • Consolidation and Netting –Positions within each product and date range are consolidated into gross long and short positions –Liquidation risk is managed against the net of the long and short positions • Instruments and Date Ranges –Trades across all instruments in a product are grouped by date ranges in real-time –Instruments may overlap, but date ranges are unique –Ex. A M-Nov instrument and a WB-Nov instrument would each populate a position for November 1 to November 30 th 30

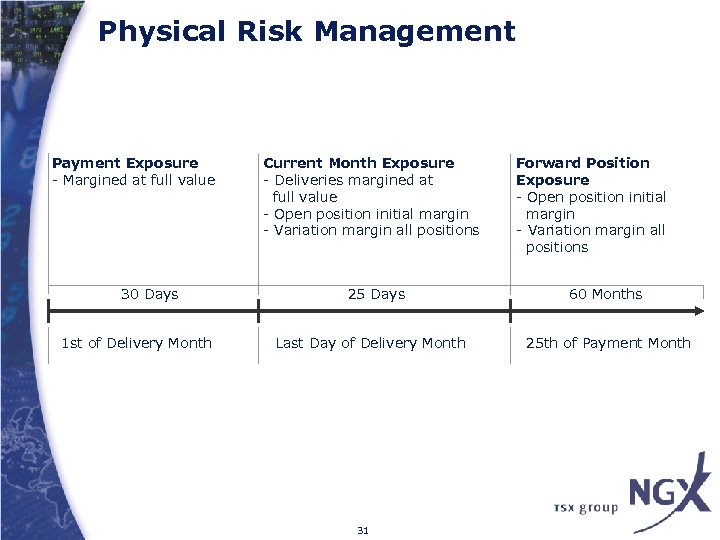

Physical Risk Management Payment Exposure - Margined at full value 30 Days 1 st of Delivery Month Current Month Exposure - Deliveries margined at full value - Open position initial margin - Variation margin all positions 25 Days Last Day of Delivery Month 31 Forward Position Exposure - Open position initial margin - Variation margin all positions 60 Months 25 th of Payment Month

Physical Risk Management Payment Exposure - Margined at full value 30 Days 1 st of Delivery Month Current Month Exposure - Deliveries margined at full value - Open position initial margin - Variation margin all positions 25 Days Last Day of Delivery Month 31 Forward Position Exposure - Open position initial margin - Variation margin all positions 60 Months 25 th of Payment Month

What are Initial Margins? • Defined –Initial Margin is an estimation of the value to which the clearing house might be exposed during a period of liquidation –Initial Margin is intended to measure potential change in a value of a portfolio beyond the last mark-tomarket price during a period of liquidation • How Does NGX Utilize Initial Margin? –NGX applies initial margin to Contracting Parties’ net open positions that would be subject to liquidation in the event of a default –Initial margin acts as additional position coverage that NGX can utilize in the event of a default to ensure that the clearing operation remains secure 32

What are Initial Margins? • Defined –Initial Margin is an estimation of the value to which the clearing house might be exposed during a period of liquidation –Initial Margin is intended to measure potential change in a value of a portfolio beyond the last mark-tomarket price during a period of liquidation • How Does NGX Utilize Initial Margin? –NGX applies initial margin to Contracting Parties’ net open positions that would be subject to liquidation in the event of a default –Initial margin acts as additional position coverage that NGX can utilize in the event of a default to ensure that the clearing operation remains secure 32

Initial Margin Methodology • Utilization of Va. R –NGX utilizes a Value-at-Risk methodology to determine initial margins –Va. R is a method of assessing risk that uses standard statistical techniques routinely used in a variety of technical fields –NGX’s Va. R calculation measures the worst expected price change in a date range for a product over a given time interval under normal market conditions at a given confidence level –Va. R, while imperfect and subject to several limitations, provides a measurement tool that has historically been an accurate measure to evaluate potential exposure in a portfolio 33

Initial Margin Methodology • Utilization of Va. R –NGX utilizes a Value-at-Risk methodology to determine initial margins –Va. R is a method of assessing risk that uses standard statistical techniques routinely used in a variety of technical fields –NGX’s Va. R calculation measures the worst expected price change in a date range for a product over a given time interval under normal market conditions at a given confidence level –Va. R, while imperfect and subject to several limitations, provides a measurement tool that has historically been an accurate measure to evaluate potential exposure in a portfolio 33

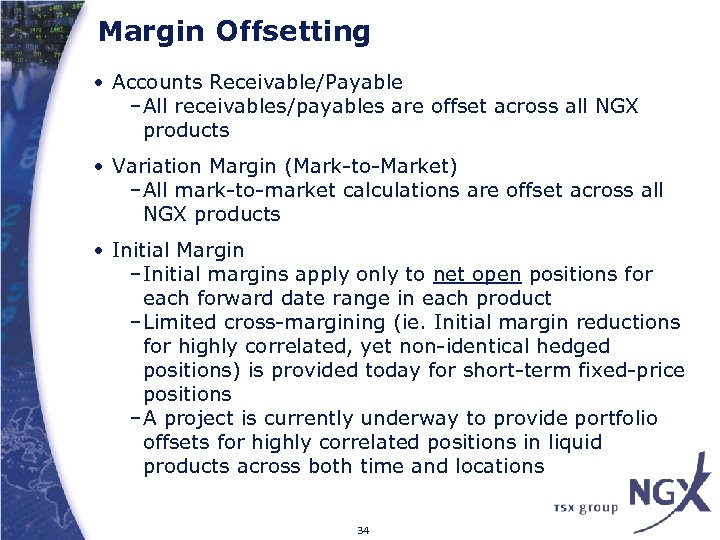

Margin Offsetting • Accounts Receivable/Payable –All receivables/payables are offset across all NGX products • Variation Margin (Mark-to-Market) –All mark-to-market calculations are offset across all NGX products • Initial Margin –Initial margins apply only to net open positions for each forward date range in each product –Limited cross-margining (ie. Initial margin reductions for highly correlated, yet non-identical hedged positions) is provided today for short-term fixed-price positions –A project is currently underway to provide portfolio offsets for highly correlated positions in liquid products across both time and locations 34

Margin Offsetting • Accounts Receivable/Payable –All receivables/payables are offset across all NGX products • Variation Margin (Mark-to-Market) –All mark-to-market calculations are offset across all NGX products • Initial Margin –Initial margins apply only to net open positions for each forward date range in each product –Limited cross-margining (ie. Initial margin reductions for highly correlated, yet non-identical hedged positions) is provided today for short-term fixed-price positions –A project is currently underway to provide portfolio offsets for highly correlated positions in liquid products across both time and locations 34

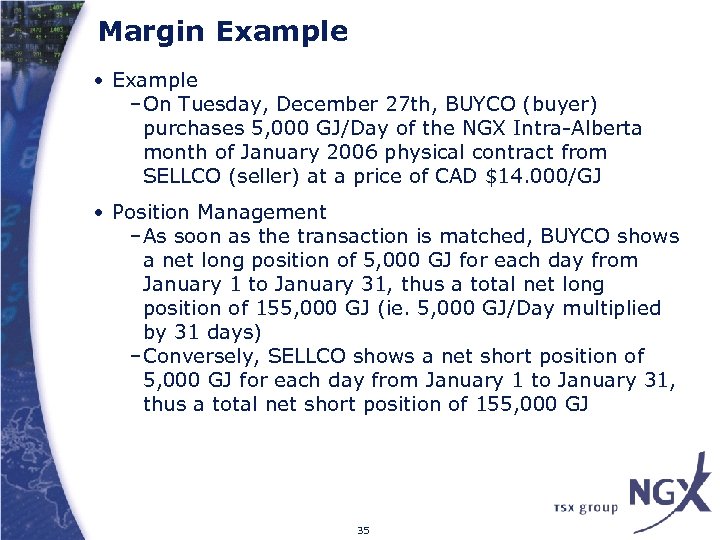

Margin Example • Example –On Tuesday, December 27 th, BUYCO (buyer) purchases 5, 000 GJ/Day of the NGX Intra-Alberta month of January 2006 physical contract from SELLCO (seller) at a price of CAD $14. 000/GJ • Position Management –As soon as the transaction is matched, BUYCO shows a net long position of 5, 000 GJ for each day from January 1 to January 31, thus a total net long position of 155, 000 GJ (ie. 5, 000 GJ/Day multiplied by 31 days) –Conversely, SELLCO shows a net short position of 5, 000 GJ for each day from January 1 to January 31, thus a total net short position of 155, 000 GJ 35

Margin Example • Example –On Tuesday, December 27 th, BUYCO (buyer) purchases 5, 000 GJ/Day of the NGX Intra-Alberta month of January 2006 physical contract from SELLCO (seller) at a price of CAD $14. 000/GJ • Position Management –As soon as the transaction is matched, BUYCO shows a net long position of 5, 000 GJ for each day from January 1 to January 31, thus a total net long position of 155, 000 GJ (ie. 5, 000 GJ/Day multiplied by 31 days) –Conversely, SELLCO shows a net short position of 5, 000 GJ for each day from January 1 to January 31, thus a total net short position of 155, 000 GJ 35

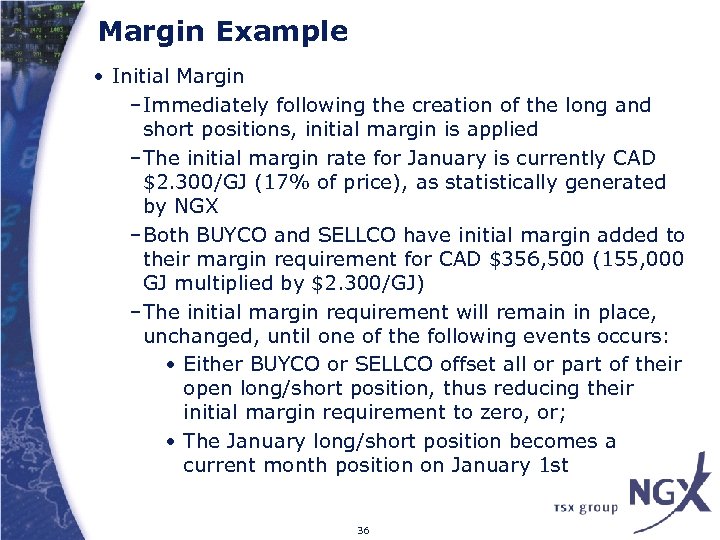

Margin Example • Initial Margin –Immediately following the creation of the long and short positions, initial margin is applied –The initial margin rate for January is currently CAD $2. 300/GJ (17% of price), as statistically generated by NGX –Both BUYCO and SELLCO have initial margin added to their margin requirement for CAD $356, 500 (155, 000 GJ multiplied by $2. 300/GJ) –The initial margin requirement will remain in place, unchanged, until one of the following events occurs: • Either BUYCO or SELLCO offset all or part of their open long/short position, thus reducing their initial margin requirement to zero, or; • The January long/short position becomes a current month position on January 1 st 36

Margin Example • Initial Margin –Immediately following the creation of the long and short positions, initial margin is applied –The initial margin rate for January is currently CAD $2. 300/GJ (17% of price), as statistically generated by NGX –Both BUYCO and SELLCO have initial margin added to their margin requirement for CAD $356, 500 (155, 000 GJ multiplied by $2. 300/GJ) –The initial margin requirement will remain in place, unchanged, until one of the following events occurs: • Either BUYCO or SELLCO offset all or part of their open long/short position, thus reducing their initial margin requirement to zero, or; • The January long/short position becomes a current month position on January 1 st 36

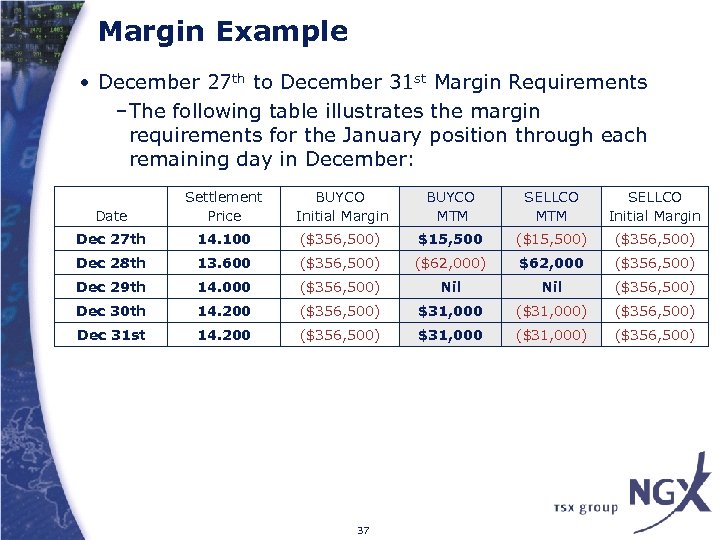

Margin Example • December 27 th to December 31 st Margin Requirements –The following table illustrates the margin requirements for the January position through each remaining day in December: Date Settlement Price BUYCO Initial Margin BUYCO MTM SELLCO Initial Margin Dec 27 th 14. 100 ($356, 500) $15, 500 ($15, 500) ($356, 500) Dec 28 th 13. 600 ($356, 500) ($62, 000) $62, 000 ($356, 500) Dec 29 th 14. 000 ($356, 500) Nil ($356, 500) Dec 30 th 14. 200 ($356, 500) $31, 000 ($31, 000) ($356, 500) Dec 31 st 14. 200 ($356, 500) $31, 000 ($31, 000) ($356, 500) 37

Margin Example • December 27 th to December 31 st Margin Requirements –The following table illustrates the margin requirements for the January position through each remaining day in December: Date Settlement Price BUYCO Initial Margin BUYCO MTM SELLCO Initial Margin Dec 27 th 14. 100 ($356, 500) $15, 500 ($15, 500) ($356, 500) Dec 28 th 13. 600 ($356, 500) ($62, 000) $62, 000 ($356, 500) Dec 29 th 14. 000 ($356, 500) Nil ($356, 500) Dec 30 th 14. 200 ($356, 500) $31, 000 ($31, 000) ($356, 500) Dec 31 st 14. 200 ($356, 500) $31, 000 ($31, 000) ($356, 500) 37

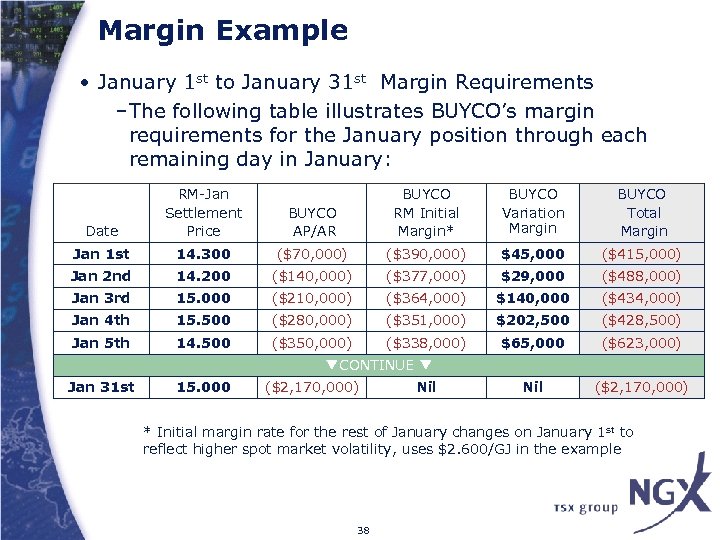

Margin Example • January 1 st to January 31 st Margin Requirements –The following table illustrates BUYCO’s margin requirements for the January position through each remaining day in January: Date RM-Jan Settlement Price BUYCO AP/AR BUYCO RM Initial Margin* BUYCO Variation Margin BUYCO Total Margin Jan 1 st 14. 300 ($70, 000) ($390, 000) $45, 000 ($415, 000) Jan 2 nd 14. 200 ($140, 000) ($377, 000) $29, 000 ($488, 000) Jan 3 rd 15. 000 ($210, 000) ($364, 000) $140, 000 ($434, 000) Jan 4 th 15. 500 ($280, 000) ($351, 000) $202, 500 ($428, 500) Jan 5 th 14. 500 ($350, 000) ($338, 000) $65, 000 ($623, 000) Nil ($2, 170, 000) CONTINUE Jan 31 st 15. 000 ($2, 170, 000) Nil * Initial margin rate for the rest of January changes on January 1 st to reflect higher spot market volatility, uses $2. 600/GJ in the example 38

Margin Example • January 1 st to January 31 st Margin Requirements –The following table illustrates BUYCO’s margin requirements for the January position through each remaining day in January: Date RM-Jan Settlement Price BUYCO AP/AR BUYCO RM Initial Margin* BUYCO Variation Margin BUYCO Total Margin Jan 1 st 14. 300 ($70, 000) ($390, 000) $45, 000 ($415, 000) Jan 2 nd 14. 200 ($140, 000) ($377, 000) $29, 000 ($488, 000) Jan 3 rd 15. 000 ($210, 000) ($364, 000) $140, 000 ($434, 000) Jan 4 th 15. 500 ($280, 000) ($351, 000) $202, 500 ($428, 500) Jan 5 th 14. 500 ($350, 000) ($338, 000) $65, 000 ($623, 000) Nil ($2, 170, 000) CONTINUE Jan 31 st 15. 000 ($2, 170, 000) Nil * Initial margin rate for the rest of January changes on January 1 st to reflect higher spot market volatility, uses $2. 600/GJ in the example 38

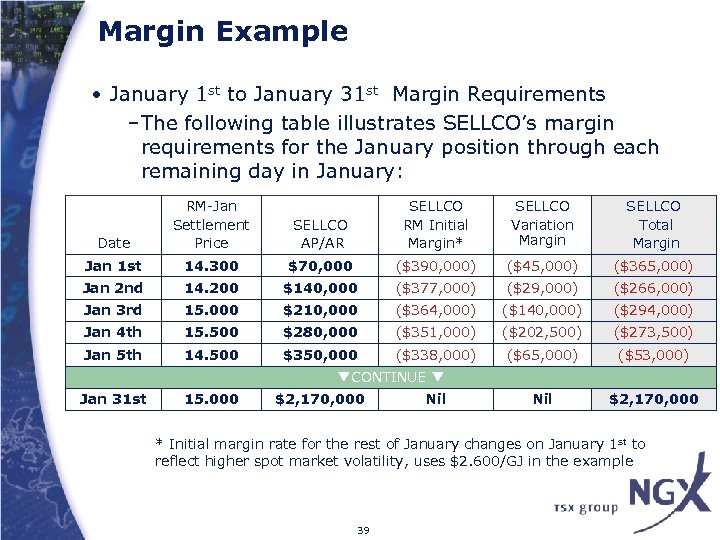

Margin Example • January 1 st to January 31 st Margin Requirements –The following table illustrates SELLCO’s margin requirements for the January position through each remaining day in January: Date RM-Jan Settlement Price SELLCO AP/AR SELLCO RM Initial Margin* SELLCO Variation Margin SELLCO Total Margin Jan 1 st 14. 300 $70, 000 ($390, 000) ($45, 000) ($365, 000) Jan 2 nd 14. 200 $140, 000 ($377, 000) ($29, 000) ($266, 000) Jan 3 rd 15. 000 $210, 000 ($364, 000) ($140, 000) ($294, 000) Jan 4 th 15. 500 $280, 000 ($351, 000) ($202, 500) ($273, 500) Jan 5 th 14. 500 $350, 000 ($338, 000) ($65, 000) ($53, 000) Nil $2, 170, 000 CONTINUE Jan 31 st 15. 000 $2, 170, 000 Nil * Initial margin rate for the rest of January changes on January 1 st to reflect higher spot market volatility, uses $2. 600/GJ in the example 39

Margin Example • January 1 st to January 31 st Margin Requirements –The following table illustrates SELLCO’s margin requirements for the January position through each remaining day in January: Date RM-Jan Settlement Price SELLCO AP/AR SELLCO RM Initial Margin* SELLCO Variation Margin SELLCO Total Margin Jan 1 st 14. 300 $70, 000 ($390, 000) ($45, 000) ($365, 000) Jan 2 nd 14. 200 $140, 000 ($377, 000) ($29, 000) ($266, 000) Jan 3 rd 15. 000 $210, 000 ($364, 000) ($140, 000) ($294, 000) Jan 4 th 15. 500 $280, 000 ($351, 000) ($202, 500) ($273, 500) Jan 5 th 14. 500 $350, 000 ($338, 000) ($65, 000) ($53, 000) Nil $2, 170, 000 CONTINUE Jan 31 st 15. 000 $2, 170, 000 Nil * Initial margin rate for the rest of January changes on January 1 st to reflect higher spot market volatility, uses $2. 600/GJ in the example 39

Questions and Contact Information Gary Gault – Vice President 403. 974. 1707 gary. gault@ngx. com Dan Zastawny – Vice President, Clearing & Compliance 403. 974. 4335 dan. zastawny@ngx. com Kenny Foo – Clearing Manager 403. 974. 1737 kenny. foo@ngx. com Natural Gas Exchange Inc. Suite 2330, 140 4 th Avenue SW Calgary, Alberta Canada T 2 P 3 N 3 Phone 403. 974. 1700 Fax 403. 974. 1719 40

Questions and Contact Information Gary Gault – Vice President 403. 974. 1707 gary. gault@ngx. com Dan Zastawny – Vice President, Clearing & Compliance 403. 974. 4335 dan. zastawny@ngx. com Kenny Foo – Clearing Manager 403. 974. 1737 kenny. foo@ngx. com Natural Gas Exchange Inc. Suite 2330, 140 4 th Avenue SW Calgary, Alberta Canada T 2 P 3 N 3 Phone 403. 974. 1700 Fax 403. 974. 1719 40