ec957f263438a292ab4644ce2fcf2385.ppt

- Количество слайдов: 47

Secure Trading and Clearing

Secure Trading and Clearing

SECTION ONE: NGX BACKGROUND 2

SECTION ONE: NGX BACKGROUND 2

Introduction to NGX • Business Concept: –Provide electronic trading and clearing services to North American energy market participants –NGX is a service provider and therefore does not trade or take positions • Headquartered in Calgary, Alberta, Canada • Incorporated in 1993, began trading operations in Feb 1994 • Ownership History –Initial Ownership by Westcoast Energy Inc. –Acquired by OM on Jan 1, 2001 –Acquired by TSX Group March 1, 2004 3

Introduction to NGX • Business Concept: –Provide electronic trading and clearing services to North American energy market participants –NGX is a service provider and therefore does not trade or take positions • Headquartered in Calgary, Alberta, Canada • Incorporated in 1993, began trading operations in Feb 1994 • Ownership History –Initial Ownership by Westcoast Energy Inc. –Acquired by OM on Jan 1, 2001 –Acquired by TSX Group March 1, 2004 3

Ownership: Introduction to TSX • TSX Group is a cornerstone of the Canadian financial system and is at the centre of Canada’s equity capital market • TSX Group owns and operates Canada’s two national stock exchanges, the Toronto Stock Exchange, serving the senior equity market, and TSX Venture Exchange, serving the public venture equity market • From its preeminent domestic base, TSX Group’s reach continues to extend internationally, through TSX Markets and TSX Datalinx which provide the trading and data to the global financial community who access Canada’s equity capital market 4

Ownership: Introduction to TSX • TSX Group is a cornerstone of the Canadian financial system and is at the centre of Canada’s equity capital market • TSX Group owns and operates Canada’s two national stock exchanges, the Toronto Stock Exchange, serving the senior equity market, and TSX Venture Exchange, serving the public venture equity market • From its preeminent domestic base, TSX Group’s reach continues to extend internationally, through TSX Markets and TSX Datalinx which provide the trading and data to the global financial community who access Canada’s equity capital market 4

Ownership: History of TSX • 1861 - Launched the Toronto Stock Exchange • 1977 - Launched the World’s First Computer Assisted Trading System (CATS) • 1996 - Became the first Exchange in North America to introduce Decimal Trading • 1997 – Became the largest stock exchange in North America to close it’s trading floor and choose a floorless electronic trading environment • 1999 – Through realignment, became the sole Exchange for trading senior equities in Canada • 2000 – Demutalized into a “for-profit” exchange • 2001 – Acquired Canadian Venture Exchange • 2004 – Acquired NGX 5

Ownership: History of TSX • 1861 - Launched the Toronto Stock Exchange • 1977 - Launched the World’s First Computer Assisted Trading System (CATS) • 1996 - Became the first Exchange in North America to introduce Decimal Trading • 1997 – Became the largest stock exchange in North America to close it’s trading floor and choose a floorless electronic trading environment • 1999 – Through realignment, became the sole Exchange for trading senior equities in Canada • 2000 – Demutalized into a “for-profit” exchange • 2001 – Acquired Canadian Venture Exchange • 2004 – Acquired NGX 5

NGX Core Competencies • Electronic Trading – 10 years experience developing and operating highreliability, high-performance electronic trading systems • Clearinghouse Operations –Physically and financially settled over 600, 000 trades –Zero-default history • Liquidity Development –Focus on customers and quality of service –Commitment to the reduction of trading impediments 6

NGX Core Competencies • Electronic Trading – 10 years experience developing and operating highreliability, high-performance electronic trading systems • Clearinghouse Operations –Physically and financially settled over 600, 000 trades –Zero-default history • Liquidity Development –Focus on customers and quality of service –Commitment to the reduction of trading impediments 6

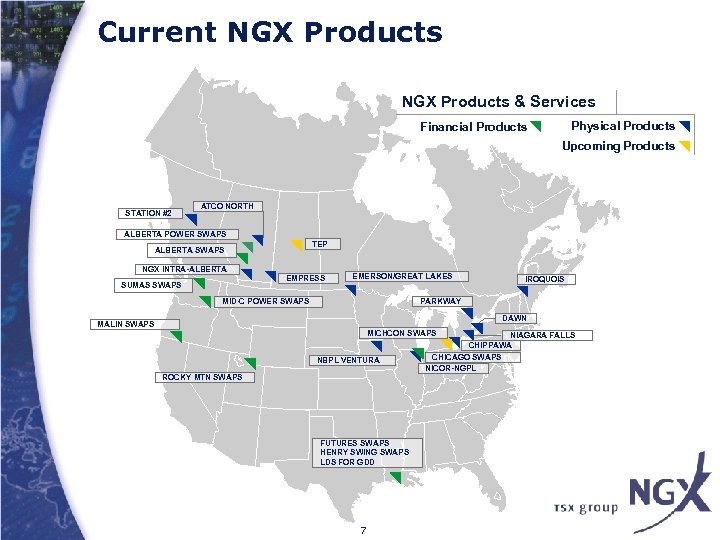

Current NGX Products & Services Physical Products Financial Products Upcoming Products STATION #2 ATCO NORTH ALBERTA POWER SWAPS TEP ALBERTA SWAPS NGX INTRA-ALBERTA EMPRESS SUMAS SWAPS EMERSON/GREAT LAKES IROQUOIS PARKWAY MID-C POWER SWAPS DAWN MALIN SWAPS MICHCON SWAPS NBPL VENTURA ROCKY MTN SWAPS FUTURES SWAPS HENRY SWING SWAPS LDS FOR GDD 7 NIAGARA FALLS CHIPPAWA CHICAGO SWAPS NICOR-NGPL

Current NGX Products & Services Physical Products Financial Products Upcoming Products STATION #2 ATCO NORTH ALBERTA POWER SWAPS TEP ALBERTA SWAPS NGX INTRA-ALBERTA EMPRESS SUMAS SWAPS EMERSON/GREAT LAKES IROQUOIS PARKWAY MID-C POWER SWAPS DAWN MALIN SWAPS MICHCON SWAPS NBPL VENTURA ROCKY MTN SWAPS FUTURES SWAPS HENRY SWING SWAPS LDS FOR GDD 7 NIAGARA FALLS CHIPPAWA CHICAGO SWAPS NICOR-NGPL

Current NGX Services • Marketplace –Centralized electronic trading –Standardized contracts –Pipeline balancing instruments –Market advocacy (facilitating transactions) –Market agency (facilitating order entry) –Real-Time Price Index Generation • Clearing House –Assured performance –Trade and counterparty netting –Centralized collateral management –Centralized risk management 8

Current NGX Services • Marketplace –Centralized electronic trading –Standardized contracts –Pipeline balancing instruments –Market advocacy (facilitating transactions) –Market agency (facilitating order entry) –Real-Time Price Index Generation • Clearing House –Assured performance –Trade and counterparty netting –Centralized collateral management –Centralized risk management 8

Contracting Parties Acanthus Resources Limited Concord Energy LLC J. Aron & Company Conoco. Phillips Canada Limited AEP Energy Services, Inc. Key. Span Energy Canada Constellation Power Source, Inc. Partnership Agrium Partnership Louis Dreyfus Energy Canada L. P. Cook Inlet Energy Supply LLC Alta. Gas Services Inc. Mirant Americas Energy Marketing, Anadarko Canada Corporation Coral Energy Canada Inc. L. P. Devon Canada Corporation Apache Canada Ltd. Mirant Canada Energy Marketing, Direct Energy Marketing Limited Aquila Merchant Services – Ltd. International, Limited Direct Energy Regulated Services Morgan Stanley Capital Group Inc. Astra Canada Resource Dominion Energy Clearinghouse Murphy Canada, Ltd. Marketing Inc. Canada Partnership National Bank of Canada ATCO Midstream Ltd. Dominion Exploration. Canada Ltd. Nexen Marketing Avista Energy, Inc. Dow Chemical Canada Inc. Nexen Marketing U. S. A. Inc. BP Canada Energy Company Duke Energy Marketing Limited NJR Energy Services Company Partnership Barclays Bank PLC Northrock Resources, Limited Burlington Resources Canada Duvernay Oil Corp. Nova Chemicals Corporation Partnership Dynegy Canada Inc. ONEOK Energy Marketing and Calpine Canada Natural Gas El Paso Merchant Energy, L. P. Trading Company, L. P. Partnership Enbridge Gas Services Inc. ONEOK Energy Services Canada, Calpine Energy Services Encana Corporation Ltd. Canada Partnership Encana Gas Marketing Canadian Fertilizer Limited Ontario Power Generation Inc. Encana Gas Storage Canadian Natural Resources OXY Energy Canada, LLC Energy Trust Marketing Ltd. Can. Nat Energy Inc. Pacifi. Corp Energy Canada Ltd. Energy West Resources Cargill Energy Trading Pacific Gas and Electric Company Ener. Mark Inc. Canada Inc. Pan-Alberta Gas Ltd. Enerplus Resources Corporation Cargill, Incorporated Paramount Energy Operating Corp. ENMAX Energy Marketing Inc. Cargill Limited Paramount Resources Enserco Energy Inc. Centra Gas Manitoba Inc. Pengrowth Corporation Chevron Canada Resources Entergy-Koch Trading Canada, ULC Penn West Petroleum Entergy-Koch Trading, LP CIBC World Markets, PLC Petro-Canada Oil and Gas EOG Resources Canada Cinergy Canada, Inc. Petrocom Energy Group Ltd. EPCOR Merchant and Capital L. P. Citadel Financial Products Pioneer Natural Resources Canada Esprit Exploration Ltd. S. a. r. l. Inc. Gas Alberta Inc. City of Medicine Hat Portland General Electric Company Co. Energy Trading Company Gibson Energy Ltd. Powerex Corp. Glencoe Resources Ltd. Primewest Energy Inc. Hunt Oil Company of Canada Inc. Producers Marketing Ltd. Husky Energy Marketing Inc. 9 Husky Gas Marketing Inc. Progress Energy Ltd. Reliant Energy Services, Inc. Royal Bank of Canada Samson Canada, Ltd. San Diego Gas & Electric Company Sask. Energy Incorporated Selkirk Cogen Partners, L. P. Seminole Canada Gas Company Seminole Canada Gas Corporation Sempra Energy Trading Corp. Sprague Energy Corp. Suncor Energy Marketing Inc. Syncrude Canada Ltd. TD Commodity & Energy Trading Inc. Talisman Energy Canada Tenaska Marketing Canada Terasen Gas Inc. The Toronto Dominion Bank Trans. Alta Energy Marketing Corp. Trans. Canada Pipelines Limited Trans. Canada Power TXU Energy Trading Canada Limited UBS Energy Canada Ltd. Union Gas Limited Unocal Canada Limited USGen New England, Inc. Virginia Power Energy Marketing West Fraser Timber Co. Ltd. WGR Canada, Inc. Williams Power Company, Inc. WPS Energy Services of Canada Corp. WPS Energy Services Inc.

Contracting Parties Acanthus Resources Limited Concord Energy LLC J. Aron & Company Conoco. Phillips Canada Limited AEP Energy Services, Inc. Key. Span Energy Canada Constellation Power Source, Inc. Partnership Agrium Partnership Louis Dreyfus Energy Canada L. P. Cook Inlet Energy Supply LLC Alta. Gas Services Inc. Mirant Americas Energy Marketing, Anadarko Canada Corporation Coral Energy Canada Inc. L. P. Devon Canada Corporation Apache Canada Ltd. Mirant Canada Energy Marketing, Direct Energy Marketing Limited Aquila Merchant Services – Ltd. International, Limited Direct Energy Regulated Services Morgan Stanley Capital Group Inc. Astra Canada Resource Dominion Energy Clearinghouse Murphy Canada, Ltd. Marketing Inc. Canada Partnership National Bank of Canada ATCO Midstream Ltd. Dominion Exploration. Canada Ltd. Nexen Marketing Avista Energy, Inc. Dow Chemical Canada Inc. Nexen Marketing U. S. A. Inc. BP Canada Energy Company Duke Energy Marketing Limited NJR Energy Services Company Partnership Barclays Bank PLC Northrock Resources, Limited Burlington Resources Canada Duvernay Oil Corp. Nova Chemicals Corporation Partnership Dynegy Canada Inc. ONEOK Energy Marketing and Calpine Canada Natural Gas El Paso Merchant Energy, L. P. Trading Company, L. P. Partnership Enbridge Gas Services Inc. ONEOK Energy Services Canada, Calpine Energy Services Encana Corporation Ltd. Canada Partnership Encana Gas Marketing Canadian Fertilizer Limited Ontario Power Generation Inc. Encana Gas Storage Canadian Natural Resources OXY Energy Canada, LLC Energy Trust Marketing Ltd. Can. Nat Energy Inc. Pacifi. Corp Energy Canada Ltd. Energy West Resources Cargill Energy Trading Pacific Gas and Electric Company Ener. Mark Inc. Canada Inc. Pan-Alberta Gas Ltd. Enerplus Resources Corporation Cargill, Incorporated Paramount Energy Operating Corp. ENMAX Energy Marketing Inc. Cargill Limited Paramount Resources Enserco Energy Inc. Centra Gas Manitoba Inc. Pengrowth Corporation Chevron Canada Resources Entergy-Koch Trading Canada, ULC Penn West Petroleum Entergy-Koch Trading, LP CIBC World Markets, PLC Petro-Canada Oil and Gas EOG Resources Canada Cinergy Canada, Inc. Petrocom Energy Group Ltd. EPCOR Merchant and Capital L. P. Citadel Financial Products Pioneer Natural Resources Canada Esprit Exploration Ltd. S. a. r. l. Inc. Gas Alberta Inc. City of Medicine Hat Portland General Electric Company Co. Energy Trading Company Gibson Energy Ltd. Powerex Corp. Glencoe Resources Ltd. Primewest Energy Inc. Hunt Oil Company of Canada Inc. Producers Marketing Ltd. Husky Energy Marketing Inc. 9 Husky Gas Marketing Inc. Progress Energy Ltd. Reliant Energy Services, Inc. Royal Bank of Canada Samson Canada, Ltd. San Diego Gas & Electric Company Sask. Energy Incorporated Selkirk Cogen Partners, L. P. Seminole Canada Gas Company Seminole Canada Gas Corporation Sempra Energy Trading Corp. Sprague Energy Corp. Suncor Energy Marketing Inc. Syncrude Canada Ltd. TD Commodity & Energy Trading Inc. Talisman Energy Canada Tenaska Marketing Canada Terasen Gas Inc. The Toronto Dominion Bank Trans. Alta Energy Marketing Corp. Trans. Canada Pipelines Limited Trans. Canada Power TXU Energy Trading Canada Limited UBS Energy Canada Ltd. Union Gas Limited Unocal Canada Limited USGen New England, Inc. Virginia Power Energy Marketing West Fraser Timber Co. Ltd. WGR Canada, Inc. Williams Power Company, Inc. WPS Energy Services of Canada Corp. WPS Energy Services Inc.

Operational Statistics • 119 NGX Contracting Parties –“Member” firms eligible to transact through the Exchange • List 60 physical and derivative products • Average in Excess of 375 Traders Online Daily • Approximately 100 View-Only Users Online Daily • 2003 Trading Statistics: –Volume = 6. 4 Tcf –Transactions = 136, 721 • Average Daily Deliveries in Excess of 10. 0 Bcf 10

Operational Statistics • 119 NGX Contracting Parties –“Member” firms eligible to transact through the Exchange • List 60 physical and derivative products • Average in Excess of 375 Traders Online Daily • Approximately 100 View-Only Users Online Daily • 2003 Trading Statistics: –Volume = 6. 4 Tcf –Transactions = 136, 721 • Average Daily Deliveries in Excess of 10. 0 Bcf 10

NGX Trading Volume History 11

NGX Trading Volume History 11

NGX Product Dispersion 12

NGX Product Dispersion 12

SECTION TWO : CLEARING STRUCTURE 13

SECTION TWO : CLEARING STRUCTURE 13

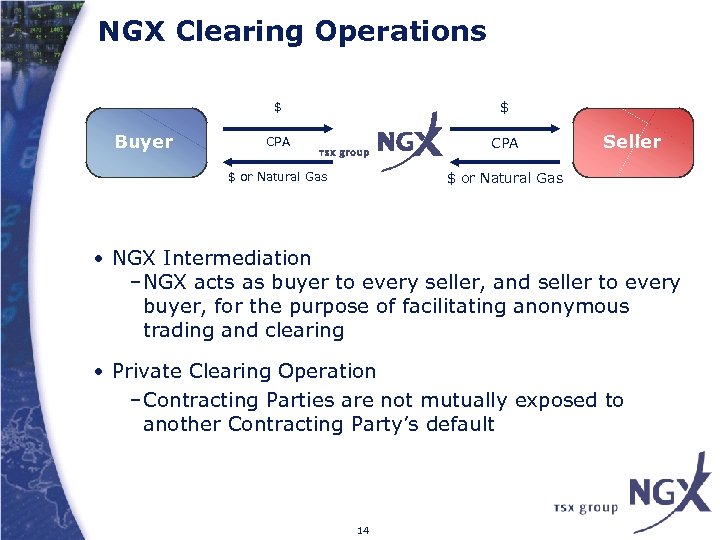

NGX Clearing Operations $ CPA $ or Natural Gas Buyer $ $ or Natural Gas Seller • NGX Intermediation –NGX acts as buyer to every seller, and seller to every buyer, for the purpose of facilitating anonymous trading and clearing • Private Clearing Operation –Contracting Parties are not mutually exposed to another Contracting Party’s default 14

NGX Clearing Operations $ CPA $ or Natural Gas Buyer $ $ or Natural Gas Seller • NGX Intermediation –NGX acts as buyer to every seller, and seller to every buyer, for the purpose of facilitating anonymous trading and clearing • Private Clearing Operation –Contracting Parties are not mutually exposed to another Contracting Party’s default 14

NGX Role as Clearing House • Assure Delivery and Payment –NGX is obligated to assure the delivery of natural gas from seller to buyer, and the payment for all gas deliveries • Standardize Rules –Develop common contract specifications, rules and regulations that provide for a fair and efficient marketplace as well as a secure clearing operation • Measure and Manage Risk –NGX develops and enforces rules to mitigate risk on behalf of all Contracting Parties –Risks must be measured accurately in real-time, and NGX proactively manages risks using worldwide clearing principles 15

NGX Role as Clearing House • Assure Delivery and Payment –NGX is obligated to assure the delivery of natural gas from seller to buyer, and the payment for all gas deliveries • Standardize Rules –Develop common contract specifications, rules and regulations that provide for a fair and efficient marketplace as well as a secure clearing operation • Measure and Manage Risk –NGX develops and enforces rules to mitigate risk on behalf of all Contracting Parties –Risks must be measured accurately in real-time, and NGX proactively manages risks using worldwide clearing principles 15

How is Clearing House Risk Mitigated? • Standard Rules –All Contracting Parties are subject to the same rules and regulations as set forth in the CPA • Collateral Provisions –NGX holds liquid collateral from all Contracting Parties equivalent to their highest probable failure scenario • Liquidation Rights –In the event that a default occurs, NGX is able to close-out (or accelerate) all forward positions for the defaulting party –Collateral is utilized to cover any liquidated damages 16

How is Clearing House Risk Mitigated? • Standard Rules –All Contracting Parties are subject to the same rules and regulations as set forth in the CPA • Collateral Provisions –NGX holds liquid collateral from all Contracting Parties equivalent to their highest probable failure scenario • Liquidation Rights –In the event that a default occurs, NGX is able to close-out (or accelerate) all forward positions for the defaulting party –Collateral is utilized to cover any liquidated damages 16

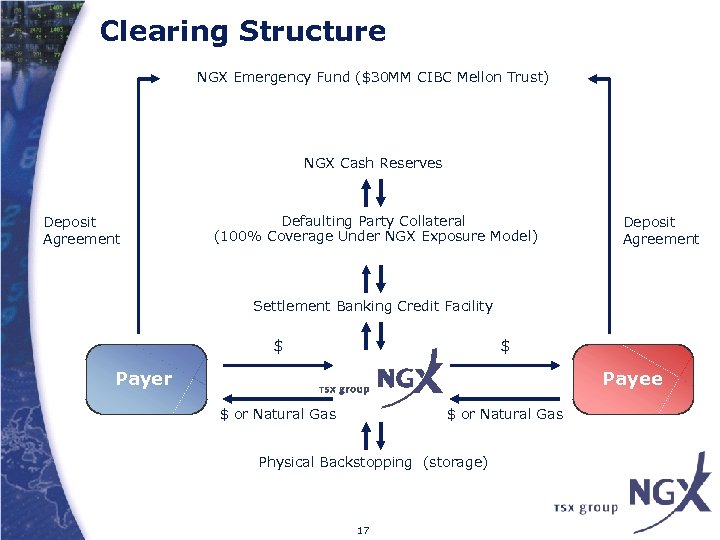

Clearing Structure NGX Emergency Fund ($30 MM CIBC Mellon Trust) NGX Cash Reserves Deposit Agreement Defaulting Party Collateral (100% Coverage Under NGX Exposure Model) Deposit Agreement Settlement Banking Credit Facility $ $ Payer Payee $ or Natural Gas Physical Backstopping (storage) 17

Clearing Structure NGX Emergency Fund ($30 MM CIBC Mellon Trust) NGX Cash Reserves Deposit Agreement Defaulting Party Collateral (100% Coverage Under NGX Exposure Model) Deposit Agreement Settlement Banking Credit Facility $ $ Payer Payee $ or Natural Gas Physical Backstopping (storage) 17

Collateral Makeup 18

Collateral Makeup 18

NGX Central Clearing Benefits • Neutral, Independent Risk Management –NGX is impartial and the nature of the clearing business provides a strong incentive to maintain a default-free clearing operation –NGX is not a market participant, does not take a market view and earnings are not directed by commodity prices • Centralized Collateral Requirements –Concentration of capital affords most efficient use across all other contracting parties 19

NGX Central Clearing Benefits • Neutral, Independent Risk Management –NGX is impartial and the nature of the clearing business provides a strong incentive to maintain a default-free clearing operation –NGX is not a market participant, does not take a market view and earnings are not directed by commodity prices • Centralized Collateral Requirements –Concentration of capital affords most efficient use across all other contracting parties 19

NGX Central Clearing Benefits • Counterparty Netting Facilities –Central clearing operator and standardized netting rules create an environment to net physical and financial exposures across multiple counter parties and locations • Acceleration, Liquidation, Close-Out Procedure –NGX has embedded, and has enforced, rights of acceleration for all contracts traded through the Exchange to mitigate risks to all Contracting Parties 20

NGX Central Clearing Benefits • Counterparty Netting Facilities –Central clearing operator and standardized netting rules create an environment to net physical and financial exposures across multiple counter parties and locations • Acceleration, Liquidation, Close-Out Procedure –NGX has embedded, and has enforced, rights of acceleration for all contracts traded through the Exchange to mitigate risks to all Contracting Parties 20

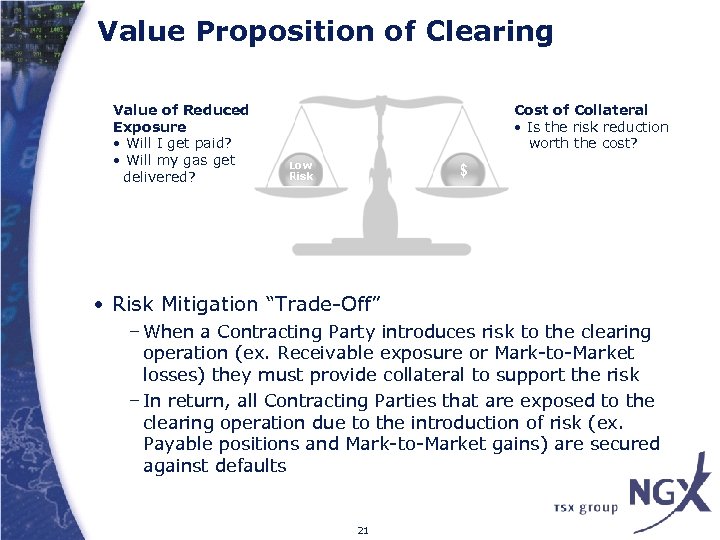

Value Proposition of Clearing Value of Reduced Exposure • Will I get paid? • Will my gas get delivered? Cost of Collateral • Is the risk reduction worth the cost? • Risk Mitigation “Trade-Off” – When a Contracting Party introduces risk to the clearing operation (ex. Receivable exposure or Mark-to-Market losses) they must provide collateral to support the risk – In return, all Contracting Parties that are exposed to the clearing operation due to the introduction of risk (ex. Payable positions and Mark-to-Market gains) are secured against defaults 21

Value Proposition of Clearing Value of Reduced Exposure • Will I get paid? • Will my gas get delivered? Cost of Collateral • Is the risk reduction worth the cost? • Risk Mitigation “Trade-Off” – When a Contracting Party introduces risk to the clearing operation (ex. Receivable exposure or Mark-to-Market losses) they must provide collateral to support the risk – In return, all Contracting Parties that are exposed to the clearing operation due to the introduction of risk (ex. Payable positions and Mark-to-Market gains) are secured against defaults 21

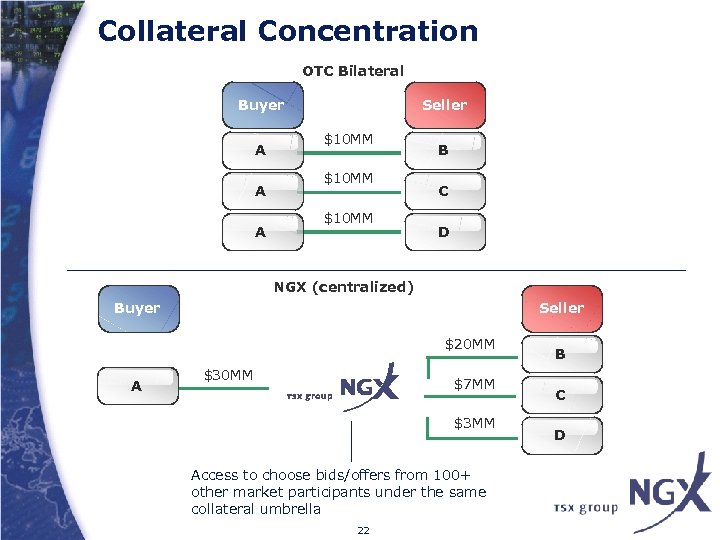

Collateral Concentration OTC Bilateral Buyer A A A Seller $10 MM B C D NGX (centralized) Buyer Seller $20 MM A $30 MM $7 MM $3 MM Access to choose bids/offers from 100+ other market participants under the same collateral umbrella 22 B C D

Collateral Concentration OTC Bilateral Buyer A A A Seller $10 MM B C D NGX (centralized) Buyer Seller $20 MM A $30 MM $7 MM $3 MM Access to choose bids/offers from 100+ other market participants under the same collateral umbrella 22 B C D

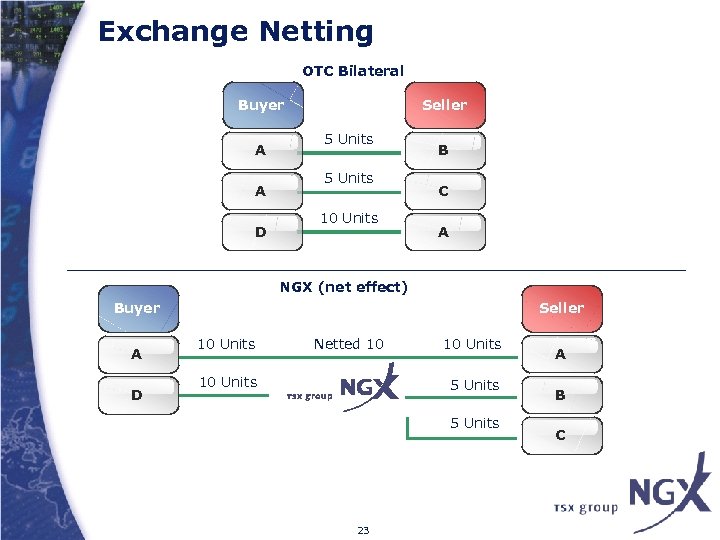

Exchange Netting OTC Bilateral Buyer A A D Seller 5 Units 10 Units B C A NGX (net effect) Buyer A D Seller 10 Units Netted 10 10 Units 5 Units 23 A B C

Exchange Netting OTC Bilateral Buyer A A D Seller 5 Units 10 Units B C A NGX (net effect) Buyer A D Seller 10 Units Netted 10 10 Units 5 Units 23 A B C

Clearing Statistics • Cleared Transactions – 150, 000+ transactions cleared annually –Notional value of transactions consummated through NGX is in excess of CAD $35 Billion annually • Margin –Over 120 corporate margin accounts held by NGX –Manage margin accounts in excess of CAD $1. 5 Billion in cash and letters of credit • Settlement –Settlement of $US and $CAD cash streams –Monthly settlement values over CAD $1 Billion processed by the clearing house 24

Clearing Statistics • Cleared Transactions – 150, 000+ transactions cleared annually –Notional value of transactions consummated through NGX is in excess of CAD $35 Billion annually • Margin –Over 120 corporate margin accounts held by NGX –Manage margin accounts in excess of CAD $1. 5 Billion in cash and letters of credit • Settlement –Settlement of $US and $CAD cash streams –Monthly settlement values over CAD $1 Billion processed by the clearing house 24

Oversight • Regulatory –ASC – Exemption order, compliance with operating principles –CFTC – 2(h)(iii) exemption, “Eligible Commercial Market” status • Clearing Bank –TD Bank, NGX’s Clearing Bank, maintains oversight of NGX clearing operations to support credit facility, $300 MM daylight, $30 MM LC, $20 MM demand –Clearing Bank controls segregated collateral accounts –Clearing Bank authorizes movement of funds from collateral accounts –Clearing Bank has full access to NGX trade/clearing data and reporting, ensures collateral accounts are sufficient to manage Contracting Party margin requirements 25

Oversight • Regulatory –ASC – Exemption order, compliance with operating principles –CFTC – 2(h)(iii) exemption, “Eligible Commercial Market” status • Clearing Bank –TD Bank, NGX’s Clearing Bank, maintains oversight of NGX clearing operations to support credit facility, $300 MM daylight, $30 MM LC, $20 MM demand –Clearing Bank controls segregated collateral accounts –Clearing Bank authorizes movement of funds from collateral accounts –Clearing Bank has full access to NGX trade/clearing data and reporting, ensures collateral accounts are sufficient to manage Contracting Party margin requirements 25

SECTION THREE: RISK MANAGEMENT 26

SECTION THREE: RISK MANAGEMENT 26

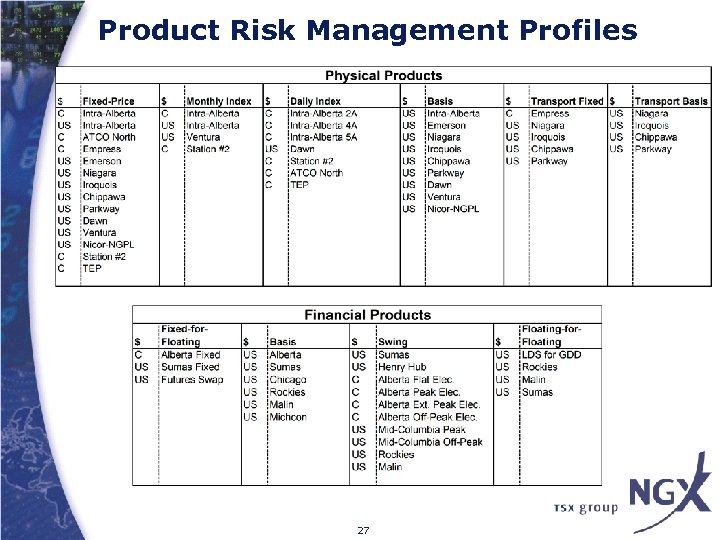

Product Risk Management Profiles 27

Product Risk Management Profiles 27

Position Tracking • Consolidation and Netting –Positions within each product and date range are consolidated into gross long and short positions –Risk is managed against the net of the long and short positions • Instruments and Date Ranges –Trades across all instruments in a product are grouped by date ranges in real-time –Instruments may overlap, but date ranges are unique –Ex. A M-Nov instrument and a WB-Nov instrument would each populate a position for November 1 to November 30 th 28

Position Tracking • Consolidation and Netting –Positions within each product and date range are consolidated into gross long and short positions –Risk is managed against the net of the long and short positions • Instruments and Date Ranges –Trades across all instruments in a product are grouped by date ranges in real-time –Instruments may overlap, but date ranges are unique –Ex. A M-Nov instrument and a WB-Nov instrument would each populate a position for November 1 to November 30 th 28

Exchange Exposure Management • Collateral Requirements –To the fullest extent possible, NGX enforces stringent collateral policies to protect Contracting Parties • Risk Measurement –NGX must accurately determine and measure risks to ensure the collective security of Contracting Parties • Risk Mitigation Tools –NGX utilizes globally accepted, standard clearinghouse practices such as penalty mechanisms and liquidation provisions to mitigate the introduction of risks to the clearing operation 29

Exchange Exposure Management • Collateral Requirements –To the fullest extent possible, NGX enforces stringent collateral policies to protect Contracting Parties • Risk Measurement –NGX must accurately determine and measure risks to ensure the collective security of Contracting Parties • Risk Mitigation Tools –NGX utilizes globally accepted, standard clearinghouse practices such as penalty mechanisms and liquidation provisions to mitigate the introduction of risks to the clearing operation 29

Performance Risks • Failure to Make/Take Delivery –NGX is exposed to the price at which an alternative supply/market can be found –Risk is managed with backstopping contracts, penalty mechanisms, collateral requirements and credit policy • Failure to Pay –NGX is exposed to receivables risk on settlement dates –Risk is managed with penalty mechanisms, collateral requirements and credit policy • Failure to Provide Collateral –NGX is exposed to the risk that Contracting Parties will not provide sufficient collateral to manage their risks –Risk is managed with liquidation provisions 30

Performance Risks • Failure to Make/Take Delivery –NGX is exposed to the price at which an alternative supply/market can be found –Risk is managed with backstopping contracts, penalty mechanisms, collateral requirements and credit policy • Failure to Pay –NGX is exposed to receivables risk on settlement dates –Risk is managed with penalty mechanisms, collateral requirements and credit policy • Failure to Provide Collateral –NGX is exposed to the risk that Contracting Parties will not provide sufficient collateral to manage their risks –Risk is managed with liquidation provisions 30

Collateral • Collateral Policy –Contracting Parties must have sufficient collateral to cover their Margin Requirement, utilizing any combination of the forms of collateral and offsets below –Collateral is held to support the Contracting Party’s traded positions and can only be used to remedy a performance failure by the Contracting Party pledging the collateral • Collateral Requirements –Collateral is accepted in the form of cash and irrevocable letter of credit from an A or higher rated bank –Collateral requirement can be reduced with an accounts payable or positive variation margin offset 31

Collateral • Collateral Policy –Contracting Parties must have sufficient collateral to cover their Margin Requirement, utilizing any combination of the forms of collateral and offsets below –Collateral is held to support the Contracting Party’s traded positions and can only be used to remedy a performance failure by the Contracting Party pledging the collateral • Collateral Requirements –Collateral is accepted in the form of cash and irrevocable letter of credit from an A or higher rated bank –Collateral requirement can be reduced with an accounts payable or positive variation margin offset 31

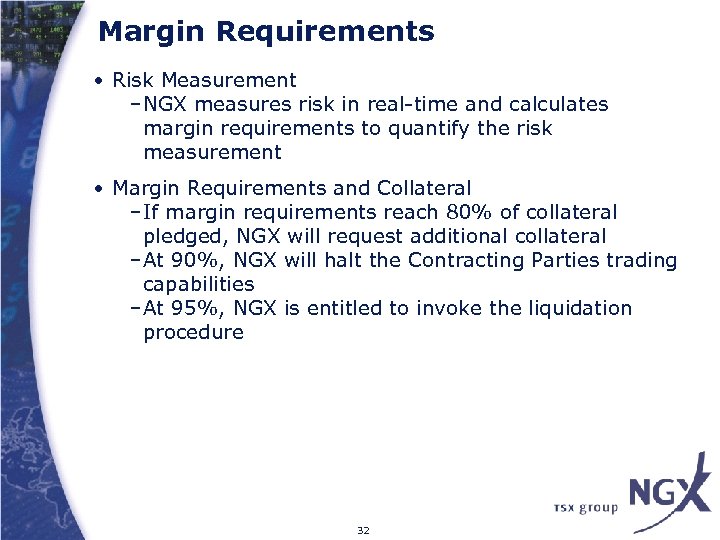

Margin Requirements • Risk Measurement –NGX measures risk in real-time and calculates margin requirements to quantify the risk measurement • Margin Requirements and Collateral –If margin requirements reach 80% of collateral pledged, NGX will request additional collateral –At 90%, NGX will halt the Contracting Parties trading capabilities –At 95%, NGX is entitled to invoke the liquidation procedure 32

Margin Requirements • Risk Measurement –NGX measures risk in real-time and calculates margin requirements to quantify the risk measurement • Margin Requirements and Collateral –If margin requirements reach 80% of collateral pledged, NGX will request additional collateral –At 90%, NGX will halt the Contracting Parties trading capabilities –At 95%, NGX is entitled to invoke the liquidation procedure 32

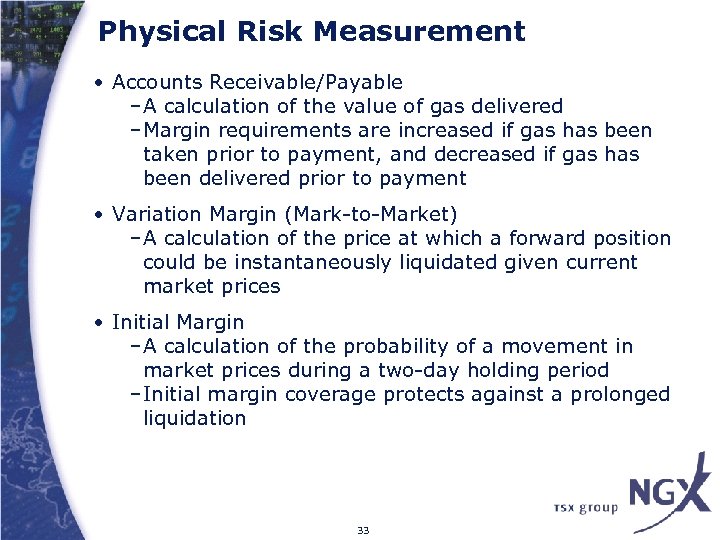

Physical Risk Measurement • Accounts Receivable/Payable –A calculation of the value of gas delivered –Margin requirements are increased if gas has been taken prior to payment, and decreased if gas has been delivered prior to payment • Variation Margin (Mark-to-Market) –A calculation of the price at which a forward position could be instantaneously liquidated given current market prices • Initial Margin –A calculation of the probability of a movement in market prices during a two-day holding period –Initial margin coverage protects against a prolonged liquidation 33

Physical Risk Measurement • Accounts Receivable/Payable –A calculation of the value of gas delivered –Margin requirements are increased if gas has been taken prior to payment, and decreased if gas has been delivered prior to payment • Variation Margin (Mark-to-Market) –A calculation of the price at which a forward position could be instantaneously liquidated given current market prices • Initial Margin –A calculation of the probability of a movement in market prices during a two-day holding period –Initial margin coverage protects against a prolonged liquidation 33

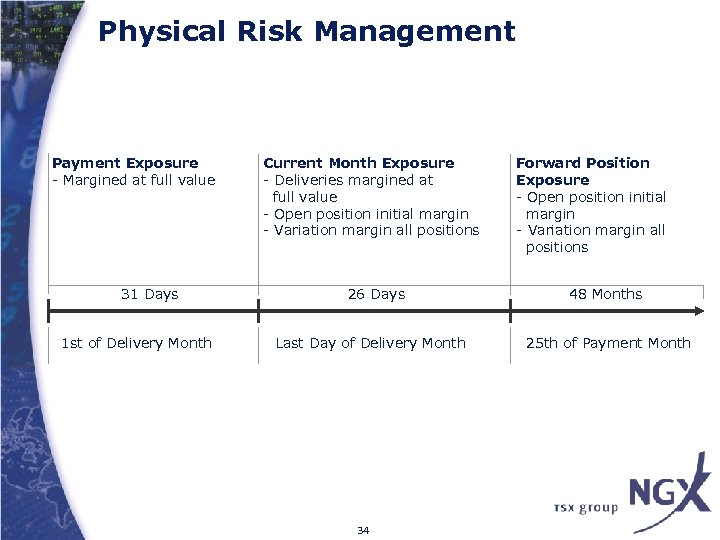

Physical Risk Management Payment Exposure - Margined at full value 31 Days 1 st of Delivery Month Current Month Exposure - Deliveries margined at full value - Open position initial margin - Variation margin all positions 26 Days Last Day of Delivery Month 34 Forward Position Exposure - Open position initial margin - Variation margin all positions 48 Months 25 th of Payment Month

Physical Risk Management Payment Exposure - Margined at full value 31 Days 1 st of Delivery Month Current Month Exposure - Deliveries margined at full value - Open position initial margin - Variation margin all positions 26 Days Last Day of Delivery Month 34 Forward Position Exposure - Open position initial margin - Variation margin all positions 48 Months 25 th of Payment Month

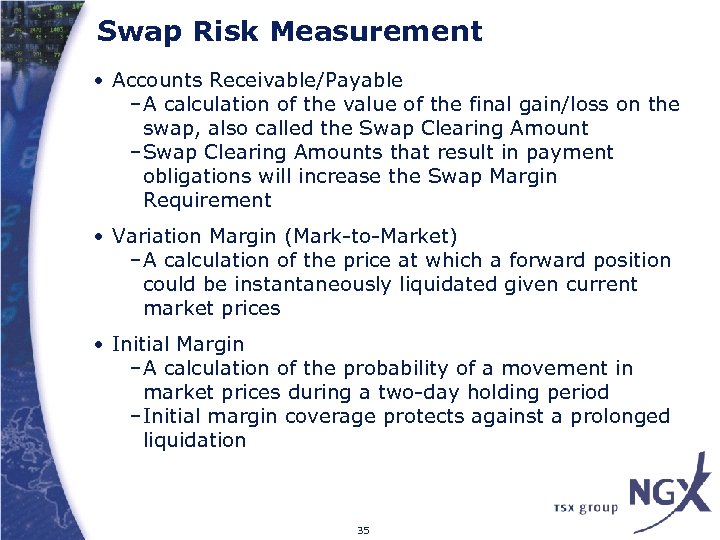

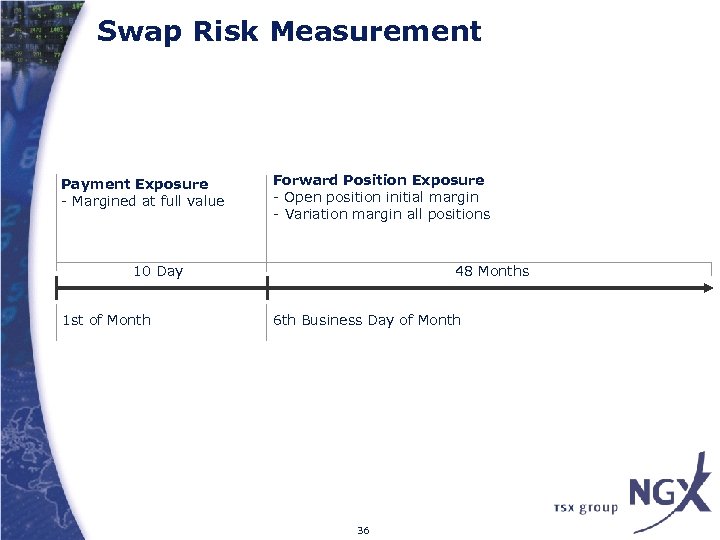

Swap Risk Measurement • Accounts Receivable/Payable –A calculation of the value of the final gain/loss on the swap, also called the Swap Clearing Amount –Swap Clearing Amounts that result in payment obligations will increase the Swap Margin Requirement • Variation Margin (Mark-to-Market) –A calculation of the price at which a forward position could be instantaneously liquidated given current market prices • Initial Margin –A calculation of the probability of a movement in market prices during a two-day holding period –Initial margin coverage protects against a prolonged liquidation 35

Swap Risk Measurement • Accounts Receivable/Payable –A calculation of the value of the final gain/loss on the swap, also called the Swap Clearing Amount –Swap Clearing Amounts that result in payment obligations will increase the Swap Margin Requirement • Variation Margin (Mark-to-Market) –A calculation of the price at which a forward position could be instantaneously liquidated given current market prices • Initial Margin –A calculation of the probability of a movement in market prices during a two-day holding period –Initial margin coverage protects against a prolonged liquidation 35

Swap Risk Measurement Payment Exposure - Margined at full value Forward Position Exposure - Open position initial margin - Variation margin all positions 10 Day 1 st of Month 48 Months 6 th Business Day of Month 36

Swap Risk Measurement Payment Exposure - Margined at full value Forward Position Exposure - Open position initial margin - Variation margin all positions 10 Day 1 st of Month 48 Months 6 th Business Day of Month 36

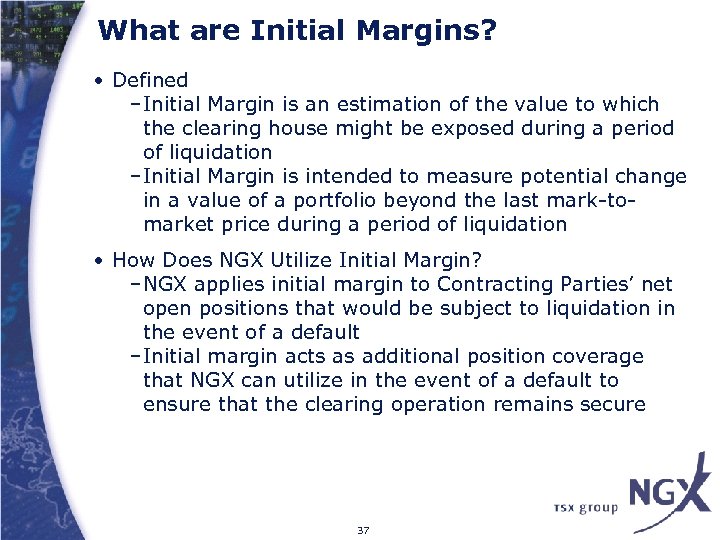

What are Initial Margins? • Defined –Initial Margin is an estimation of the value to which the clearing house might be exposed during a period of liquidation –Initial Margin is intended to measure potential change in a value of a portfolio beyond the last mark-tomarket price during a period of liquidation • How Does NGX Utilize Initial Margin? –NGX applies initial margin to Contracting Parties’ net open positions that would be subject to liquidation in the event of a default –Initial margin acts as additional position coverage that NGX can utilize in the event of a default to ensure that the clearing operation remains secure 37

What are Initial Margins? • Defined –Initial Margin is an estimation of the value to which the clearing house might be exposed during a period of liquidation –Initial Margin is intended to measure potential change in a value of a portfolio beyond the last mark-tomarket price during a period of liquidation • How Does NGX Utilize Initial Margin? –NGX applies initial margin to Contracting Parties’ net open positions that would be subject to liquidation in the event of a default –Initial margin acts as additional position coverage that NGX can utilize in the event of a default to ensure that the clearing operation remains secure 37

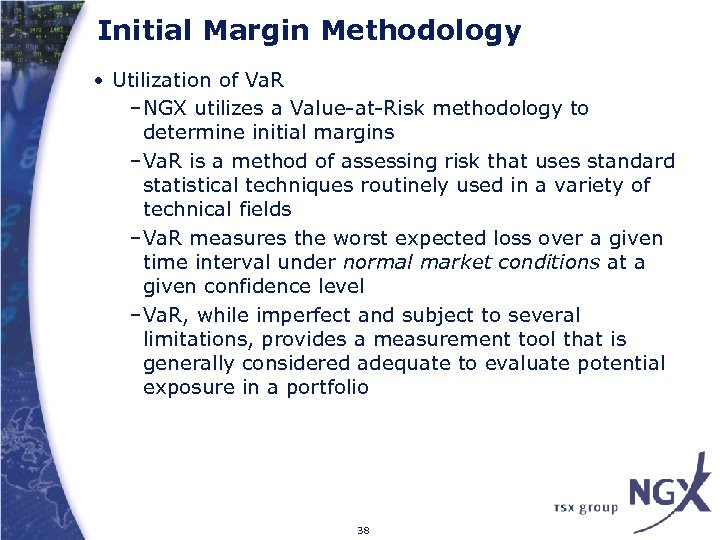

Initial Margin Methodology • Utilization of Va. R –NGX utilizes a Value-at-Risk methodology to determine initial margins –Va. R is a method of assessing risk that uses standard statistical techniques routinely used in a variety of technical fields –Va. R measures the worst expected loss over a given time interval under normal market conditions at a given confidence level –Va. R, while imperfect and subject to several limitations, provides a measurement tool that is generally considered adequate to evaluate potential exposure in a portfolio 38

Initial Margin Methodology • Utilization of Va. R –NGX utilizes a Value-at-Risk methodology to determine initial margins –Va. R is a method of assessing risk that uses standard statistical techniques routinely used in a variety of technical fields –Va. R measures the worst expected loss over a given time interval under normal market conditions at a given confidence level –Va. R, while imperfect and subject to several limitations, provides a measurement tool that is generally considered adequate to evaluate potential exposure in a portfolio 38

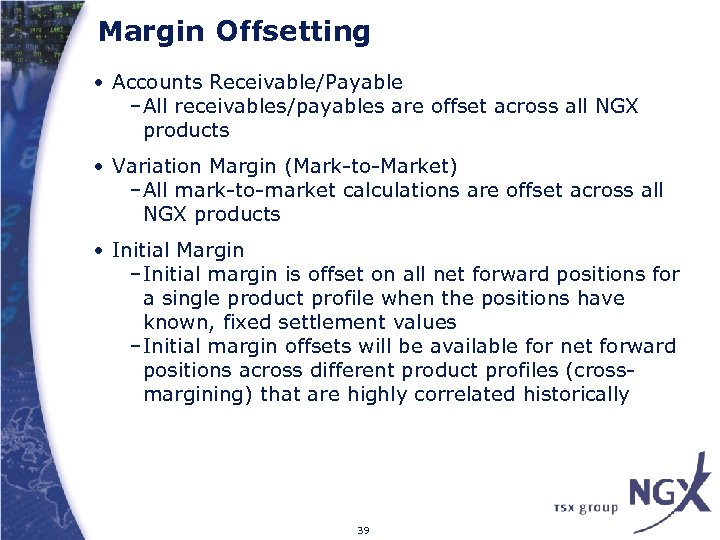

Margin Offsetting • Accounts Receivable/Payable –All receivables/payables are offset across all NGX products • Variation Margin (Mark-to-Market) –All mark-to-market calculations are offset across all NGX products • Initial Margin –Initial margin is offset on all net forward positions for a single product profile when the positions have known, fixed settlement values –Initial margin offsets will be available for net forward positions across different product profiles (crossmargining) that are highly correlated historically 39

Margin Offsetting • Accounts Receivable/Payable –All receivables/payables are offset across all NGX products • Variation Margin (Mark-to-Market) –All mark-to-market calculations are offset across all NGX products • Initial Margin –Initial margin is offset on all net forward positions for a single product profile when the positions have known, fixed settlement values –Initial margin offsets will be available for net forward positions across different product profiles (crossmargining) that are highly correlated historically 39

Margin Example • Example –On Monday, June 24, BUYCO (buyer) purchases 5, 000 GJ/Day of the NGX Intra-Alberta month of July 2002 physical contract from SELLCO (seller) at a price of CAD $3. 500/GJ • Position Management –As soon as the transaction is matched, BUYCO shows a net long position of 5, 000 GJ for each day from July 1 to July 31, thus a total net long position of 155, 000 GJ (ie. 5, 000 GJ/Day multiplied by 31 days) –Conversely, SELLCO shows a net short position of 5, 000 GJ for each day from July 1 to July 31, thus a total net short position of 155, 000 GJ 40

Margin Example • Example –On Monday, June 24, BUYCO (buyer) purchases 5, 000 GJ/Day of the NGX Intra-Alberta month of July 2002 physical contract from SELLCO (seller) at a price of CAD $3. 500/GJ • Position Management –As soon as the transaction is matched, BUYCO shows a net long position of 5, 000 GJ for each day from July 1 to July 31, thus a total net long position of 155, 000 GJ (ie. 5, 000 GJ/Day multiplied by 31 days) –Conversely, SELLCO shows a net short position of 5, 000 GJ for each day from July 1 to July 31, thus a total net short position of 155, 000 GJ 40

Margin Example • Initial Margin –Immediately following the creation of the long and short positions, initial margin is applied –The initial margin rate for July is currently CAD $0. 600/GJ, as statistically generated by NGX –Both BUYCO and SELLCO must have collateral deposited with NGX to cover the initial margin requirement, ie. CAD $93, 000 (155, 000 GJ multiplied by $0. 600/GJ) –The initial margin requirement will remain in place, unchanged, until one of the following events occurs: • Either BUYCO or SELLCO offset all or part of their open long/short position, thus reducing their initial margin requirement to zero, or; • The July long/short position becomes a current month position on July 1 st 41

Margin Example • Initial Margin –Immediately following the creation of the long and short positions, initial margin is applied –The initial margin rate for July is currently CAD $0. 600/GJ, as statistically generated by NGX –Both BUYCO and SELLCO must have collateral deposited with NGX to cover the initial margin requirement, ie. CAD $93, 000 (155, 000 GJ multiplied by $0. 600/GJ) –The initial margin requirement will remain in place, unchanged, until one of the following events occurs: • Either BUYCO or SELLCO offset all or part of their open long/short position, thus reducing their initial margin requirement to zero, or; • The July long/short position becomes a current month position on July 1 st 41

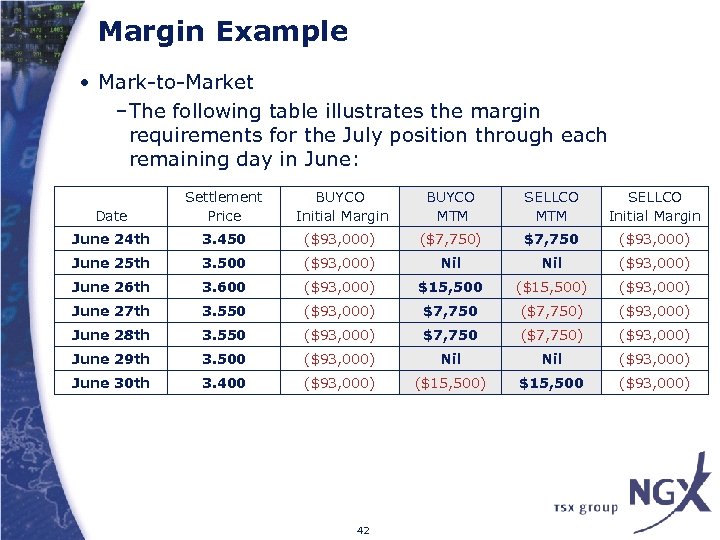

Margin Example • Mark-to-Market –The following table illustrates the margin requirements for the July position through each remaining day in June: Date Settlement Price BUYCO Initial Margin BUYCO MTM SELLCO Initial Margin June 24 th 3. 450 ($93, 000) ($7, 750) $7, 750 ($93, 000) June 25 th 3. 500 ($93, 000) Nil ($93, 000) June 26 th 3. 600 ($93, 000) $15, 500 ($15, 500) ($93, 000) June 27 th 3. 550 ($93, 000) $7, 750 ($7, 750) ($93, 000) June 28 th 3. 550 ($93, 000) $7, 750 ($7, 750) ($93, 000) June 29 th 3. 500 ($93, 000) Nil ($93, 000) June 30 th 3. 400 ($93, 000) ($15, 500) $15, 500 ($93, 000) 42

Margin Example • Mark-to-Market –The following table illustrates the margin requirements for the July position through each remaining day in June: Date Settlement Price BUYCO Initial Margin BUYCO MTM SELLCO Initial Margin June 24 th 3. 450 ($93, 000) ($7, 750) $7, 750 ($93, 000) June 25 th 3. 500 ($93, 000) Nil ($93, 000) June 26 th 3. 600 ($93, 000) $15, 500 ($15, 500) ($93, 000) June 27 th 3. 550 ($93, 000) $7, 750 ($7, 750) ($93, 000) June 28 th 3. 550 ($93, 000) $7, 750 ($7, 750) ($93, 000) June 29 th 3. 500 ($93, 000) Nil ($93, 000) June 30 th 3. 400 ($93, 000) ($15, 500) $15, 500 ($93, 000) 42

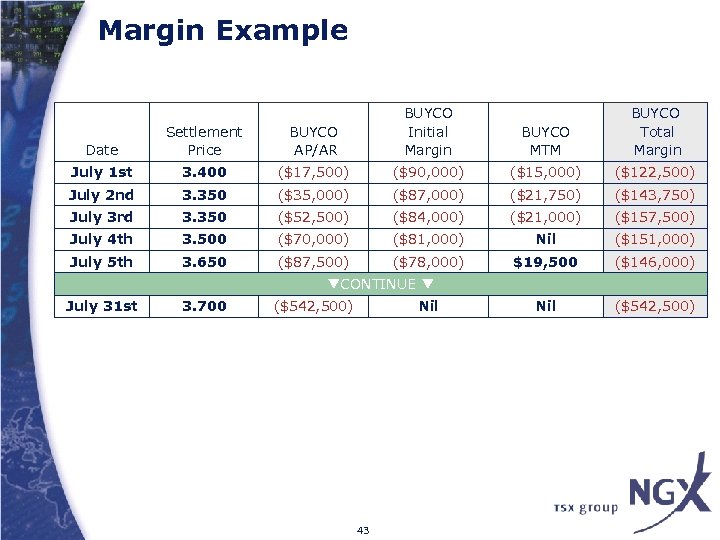

Margin Example Date Settlement Price BUYCO AP/AR BUYCO Initial Margin BUYCO MTM BUYCO Total Margin July 1 st 3. 400 ($17, 500) ($90, 000) ($15, 000) ($122, 500) July 2 nd 3. 350 ($35, 000) ($87, 000) ($21, 750) ($143, 750) July 3 rd 3. 350 ($52, 500) ($84, 000) ($21, 000) ($157, 500) July 4 th 3. 500 ($70, 000) ($81, 000) Nil ($151, 000) July 5 th 3. 650 ($87, 500) ($78, 000) $19, 500 ($146, 000) Nil ($542, 500) CONTINUE July 31 st 3. 700 ($542, 500) Nil 43

Margin Example Date Settlement Price BUYCO AP/AR BUYCO Initial Margin BUYCO MTM BUYCO Total Margin July 1 st 3. 400 ($17, 500) ($90, 000) ($15, 000) ($122, 500) July 2 nd 3. 350 ($35, 000) ($87, 000) ($21, 750) ($143, 750) July 3 rd 3. 350 ($52, 500) ($84, 000) ($21, 000) ($157, 500) July 4 th 3. 500 ($70, 000) ($81, 000) Nil ($151, 000) July 5 th 3. 650 ($87, 500) ($78, 000) $19, 500 ($146, 000) Nil ($542, 500) CONTINUE July 31 st 3. 700 ($542, 500) Nil 43

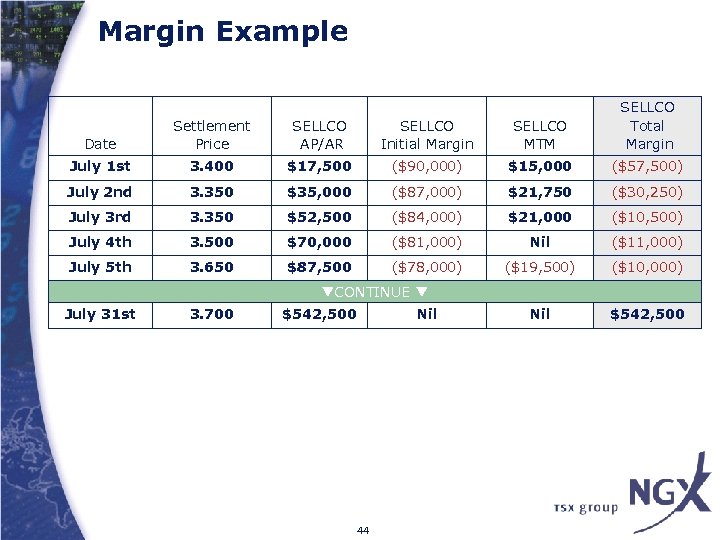

Margin Example Date Settlement Price SELLCO AP/AR SELLCO Initial Margin SELLCO MTM SELLCO Total Margin July 1 st 3. 400 $17, 500 ($90, 000) $15, 000 ($57, 500) July 2 nd 3. 350 $35, 000 ($87, 000) $21, 750 ($30, 250) July 3 rd 3. 350 $52, 500 ($84, 000) $21, 000 ($10, 500) July 4 th 3. 500 $70, 000 ($81, 000) Nil ($11, 000) July 5 th 3. 650 $87, 500 ($78, 000) ($19, 500) ($10, 000) Nil $542, 500 CONTINUE July 31 st 3. 700 $542, 500 44 Nil

Margin Example Date Settlement Price SELLCO AP/AR SELLCO Initial Margin SELLCO MTM SELLCO Total Margin July 1 st 3. 400 $17, 500 ($90, 000) $15, 000 ($57, 500) July 2 nd 3. 350 $35, 000 ($87, 000) $21, 750 ($30, 250) July 3 rd 3. 350 $52, 500 ($84, 000) $21, 000 ($10, 500) July 4 th 3. 500 $70, 000 ($81, 000) Nil ($11, 000) July 5 th 3. 650 $87, 500 ($78, 000) ($19, 500) ($10, 000) Nil $542, 500 CONTINUE July 31 st 3. 700 $542, 500 44 Nil

SECTION FOUR: NEW INITIATIVES 45

SECTION FOUR: NEW INITIATIVES 45

What’s New at NGX? • OTC Clearing – Providing a clearing service for legacy bilateral transactions or OTC transactions at the point-of-sale • Addition of Western Products – Station #2 physical products – Rockies, Malin natural gas swaps – California swaps – PG&E Citygate, Sumas (Huntingdon) physical • Projects Underway – Margin model revisions 46

What’s New at NGX? • OTC Clearing – Providing a clearing service for legacy bilateral transactions or OTC transactions at the point-of-sale • Addition of Western Products – Station #2 physical products – Rockies, Malin natural gas swaps – California swaps – PG&E Citygate, Sumas (Huntingdon) physical • Projects Underway – Margin model revisions 46

Questions and Contact Information Gary Gault – Vice President 403. 974. 1707 gary. gault@ngx. com Dan Zastawny – Vice President, Clearing & Compliance 403. 974. 4335 dan. zastawny@ngx. com Kenny Foo – Clearing Manager 403. 974. 1737 kenny. foo@ngx. com Natural Gas Exchange Inc. Suite 2330, 140 4 th Avenue SW Calgary, Alberta Canada T 2 P 3 N 3 Phone 403. 974. 1700 Fax 403. 974. 1719 47

Questions and Contact Information Gary Gault – Vice President 403. 974. 1707 gary. gault@ngx. com Dan Zastawny – Vice President, Clearing & Compliance 403. 974. 4335 dan. zastawny@ngx. com Kenny Foo – Clearing Manager 403. 974. 1737 kenny. foo@ngx. com Natural Gas Exchange Inc. Suite 2330, 140 4 th Avenue SW Calgary, Alberta Canada T 2 P 3 N 3 Phone 403. 974. 1700 Fax 403. 974. 1719 47