aa3275e454a05f6bd2b2e9e03dfd8d23.ppt

- Количество слайдов: 15

Section Two Regulatory Situation in Asia/Pacific Jan D. HAIZMANN – Director Regulatory Affairs, London Mike GRIMES – Manager, Public Affairs, Tokyo Singapore, 27 th April 2001

Section Two Regulatory Situation in Asia/Pacific Jan D. HAIZMANN – Director Regulatory Affairs, London Mike GRIMES – Manager, Public Affairs, Tokyo Singapore, 27 th April 2001

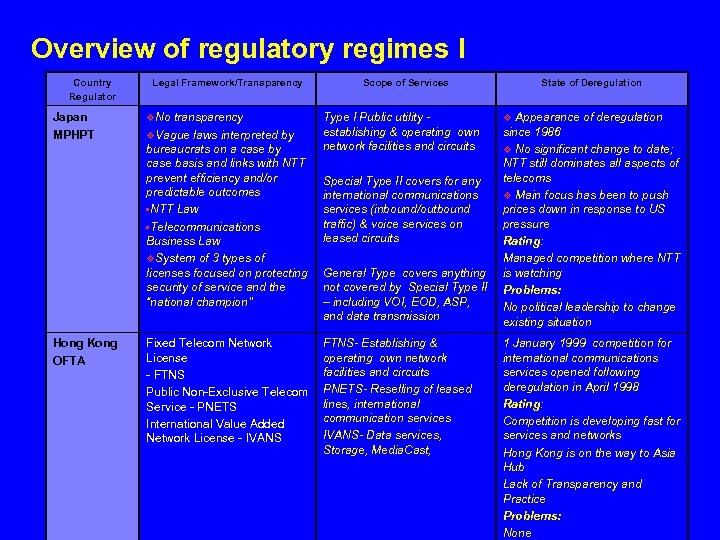

Overview of regulatory regimes I Country Regulator Japan MPHPT Legal Framework/Transparency v. No transparency v. Vague laws interpreted by bureaucrats on a case by case basis and links with NTT prevent efficiency and/or predictable outcomes • NTT Law • Telecommunications Business Law v. System of 3 types of licenses focused on protecting security of service and the “national champion” Hong Kong OFTA Fixed Telecom Network License - FTNS Public Non-Exclusive Telecom Service - PNETS International Value Added Network License - IVANS Scope of Services Type I Public utility establishing & operating own network facilities and circuits Special Type II covers for any international communications services (inbound/outbound traffic) & voice services on leased circuits General Type covers anything not covered by Special Type II – including VOI, EOD, ASP, and data transmission FTNS- Establishing & operating own network facilities and circuits PNETS- Reselling of leased lines, international communication services IVANS- Data services, Storage, Media. Cast, State of Deregulation v Appearance of deregulation since 1986 v No significant change to date; NTT still dominates all aspects of telecoms v Main focus has been to push prices down in response to US pressure Rating: Managed competition where NTT is watching Problems: No political leadership to change existing situation 1 January 1999 competition for international communications services opened following deregulation in April 1998 Rating: Competition is developing fast for services and networks Hong Kong is on the way to Asia Hub Lack of Transparency and Practice Problems: None

Overview of regulatory regimes I Country Regulator Japan MPHPT Legal Framework/Transparency v. No transparency v. Vague laws interpreted by bureaucrats on a case by case basis and links with NTT prevent efficiency and/or predictable outcomes • NTT Law • Telecommunications Business Law v. System of 3 types of licenses focused on protecting security of service and the “national champion” Hong Kong OFTA Fixed Telecom Network License - FTNS Public Non-Exclusive Telecom Service - PNETS International Value Added Network License - IVANS Scope of Services Type I Public utility establishing & operating own network facilities and circuits Special Type II covers for any international communications services (inbound/outbound traffic) & voice services on leased circuits General Type covers anything not covered by Special Type II – including VOI, EOD, ASP, and data transmission FTNS- Establishing & operating own network facilities and circuits PNETS- Reselling of leased lines, international communication services IVANS- Data services, Storage, Media. Cast, State of Deregulation v Appearance of deregulation since 1986 v No significant change to date; NTT still dominates all aspects of telecoms v Main focus has been to push prices down in response to US pressure Rating: Managed competition where NTT is watching Problems: No political leadership to change existing situation 1 January 1999 competition for international communications services opened following deregulation in April 1998 Rating: Competition is developing fast for services and networks Hong Kong is on the way to Asia Hub Lack of Transparency and Practice Problems: None

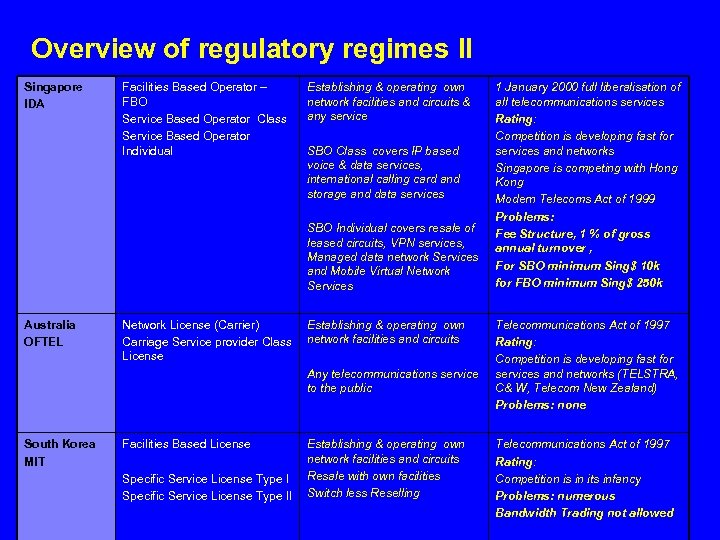

Overview of regulatory regimes II Singapore IDA Facilities Based Operator – FBO Service Based Operator Class Service Based Operator Individual Establishing & operating own network facilities and circuits & any service SBO Class covers IP based voice & data services, international calling card and storage and data services SBO Individual covers resale of leased circuits, VPN services, Managed data network Services and Mobile Virtual Network Services Australia OFTEL Network License (Carrier) Carriage Service provider Class License Establishing & operating own network facilities and circuits Any telecommunications service to the public South Korea MIT Facilities Based License Specific Service License Type II Establishing & operating own network facilities and circuits Resale with own facilities Switch less Reselling 1 January 2000 full liberalisation of all telecommunications services Rating: Competition is developing fast for services and networks Singapore is competing with Hong Kong Modern Telecoms Act of 1999 Problems: Fee Structure, 1 % of gross annual turnover , For SBO minimum Sing$ 10 k for FBO minimum Sing$ 250 k Telecommunications Act of 1997 Rating: Competition is developing fast for services and networks (TELSTRA, C& W, Telecom New Zealand) Problems: none Telecommunications Act of 1997 Rating: Competition is in its infancy Problems: numerous Bandwidth Trading not allowed

Overview of regulatory regimes II Singapore IDA Facilities Based Operator – FBO Service Based Operator Class Service Based Operator Individual Establishing & operating own network facilities and circuits & any service SBO Class covers IP based voice & data services, international calling card and storage and data services SBO Individual covers resale of leased circuits, VPN services, Managed data network Services and Mobile Virtual Network Services Australia OFTEL Network License (Carrier) Carriage Service provider Class License Establishing & operating own network facilities and circuits Any telecommunications service to the public South Korea MIT Facilities Based License Specific Service License Type II Establishing & operating own network facilities and circuits Resale with own facilities Switch less Reselling 1 January 2000 full liberalisation of all telecommunications services Rating: Competition is developing fast for services and networks Singapore is competing with Hong Kong Modern Telecoms Act of 1999 Problems: Fee Structure, 1 % of gross annual turnover , For SBO minimum Sing$ 10 k for FBO minimum Sing$ 250 k Telecommunications Act of 1997 Rating: Competition is developing fast for services and networks (TELSTRA, C& W, Telecom New Zealand) Problems: none Telecommunications Act of 1997 Rating: Competition is in its infancy Problems: numerous Bandwidth Trading not allowed

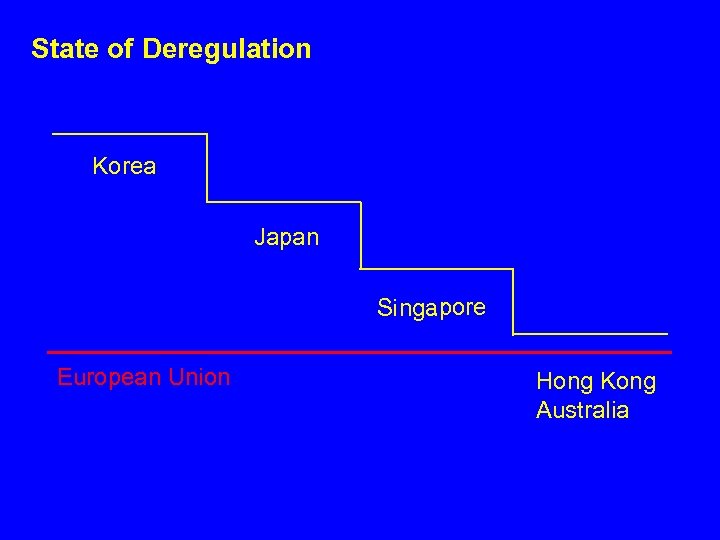

State of Deregulation Korea Japan Singapore European Union Hong Kong Australia

State of Deregulation Korea Japan Singapore European Union Hong Kong Australia

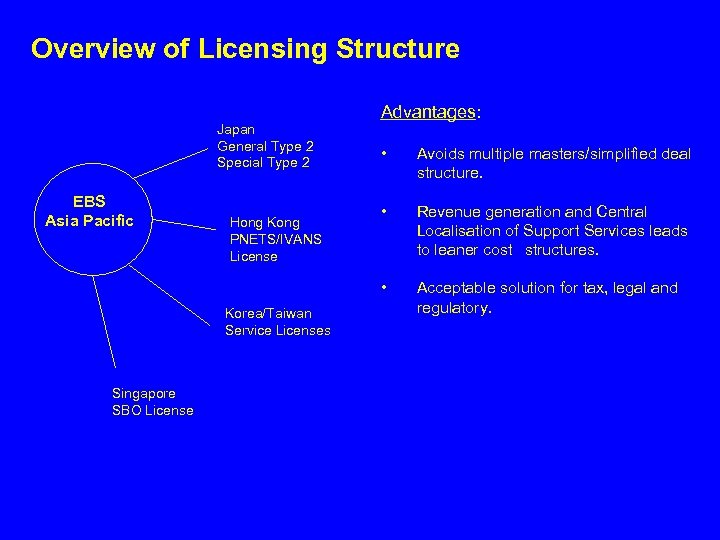

Overview of Licensing Structure Japan General Type 2 Special Type 2 Advantages: Hong Kong PNETS/IVANS License Korea/Taiwan Service Licenses Singapore SBO License Avoids multiple masters/simplified deal structure. • Revenue generation and Central Localisation of Support Services leads to leaner cost structures. • EBS Asia Pacific • Acceptable solution for tax, legal and regulatory.

Overview of Licensing Structure Japan General Type 2 Special Type 2 Advantages: Hong Kong PNETS/IVANS License Korea/Taiwan Service Licenses Singapore SBO License Avoids multiple masters/simplified deal structure. • Revenue generation and Central Localisation of Support Services leads to leaner cost structures. • EBS Asia Pacific • Acceptable solution for tax, legal and regulatory.

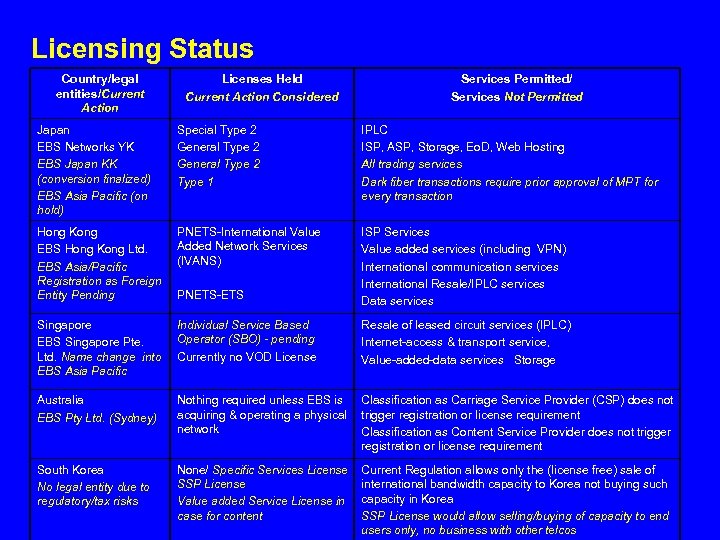

Licensing Status Country/legal entities/Current Action Licenses Held Current Action Considered Services Permitted/ Services Not Permitted Japan EBS Networks YK EBS Japan KK (conversion finalized) EBS Asia Pacific (on hold) Special Type 2 General Type 2 Type 1 IPLC ISP, ASP, Storage, Eo. D, Web Hosting All trading services Dark fiber transactions require prior approval of MPT for every transaction Hong Kong EBS Hong Kong Ltd. EBS Asia/Pacific Registration as Foreign Entity Pending PNETS-International Value Added Network Services (IVANS) PNETS-ETS ISP Services Value added services (including VPN) International communication services International Resale/IPLC services Data services Singapore EBS Singapore Pte. Ltd. Name change into EBS Asia Pacific Individual Service Based Operator (SBO) - pending Currently no VOD License Resale of leased circuit services (IPLC) Internet-access & transport service, Value-added-data services Storage Australia EBS Pty Ltd. (Sydney) Nothing required unless EBS is acquiring & operating a physical network Classification as Carriage Service Provider (CSP) does not trigger registration or license requirement Classification as Content Service Provider does not trigger registration or license requirement South Korea No legal entity due to regulatory/tax risks None/ Specific Services License SSP License Value added Service License in case for content Current Regulation allows only the (license free) sale of international bandwidth capacity to Korea not buying such capacity in Korea SSP License would allow selling/buying of capacity to end users only, no business with other telcos

Licensing Status Country/legal entities/Current Action Licenses Held Current Action Considered Services Permitted/ Services Not Permitted Japan EBS Networks YK EBS Japan KK (conversion finalized) EBS Asia Pacific (on hold) Special Type 2 General Type 2 Type 1 IPLC ISP, ASP, Storage, Eo. D, Web Hosting All trading services Dark fiber transactions require prior approval of MPT for every transaction Hong Kong EBS Hong Kong Ltd. EBS Asia/Pacific Registration as Foreign Entity Pending PNETS-International Value Added Network Services (IVANS) PNETS-ETS ISP Services Value added services (including VPN) International communication services International Resale/IPLC services Data services Singapore EBS Singapore Pte. Ltd. Name change into EBS Asia Pacific Individual Service Based Operator (SBO) - pending Currently no VOD License Resale of leased circuit services (IPLC) Internet-access & transport service, Value-added-data services Storage Australia EBS Pty Ltd. (Sydney) Nothing required unless EBS is acquiring & operating a physical network Classification as Carriage Service Provider (CSP) does not trigger registration or license requirement Classification as Content Service Provider does not trigger registration or license requirement South Korea No legal entity due to regulatory/tax risks None/ Specific Services License SSP License Value added Service License in case for content Current Regulation allows only the (license free) sale of international bandwidth capacity to Korea not buying such capacity in Korea SSP License would allow selling/buying of capacity to end users only, no business with other telcos

Challenges in Japan v Current Status: Telecommunications trading not contemplated by regulatory scheme – but is not expressly prohibited • • • v Approach: Manage policy developments to support trading • • • v Expand transparency by coordinating support for trading with other stakeholders Make involved ministries aware of the economic benefits deriving from trading Demonstrate that trading can occur within existing scheme without affecting communications security Current Status: Multiple licenses inhibit operational flexibility • • v MPT Minister has broad authority under vaguely drafted laws – the accepted procedure is to gain approval in private meetings with bureaucrats Telecom – IT convergence is a high profile issue for several ministries which are trying to influence policy for their constituents Large group of stakeholders focused on telecom policy developments, with NTT (46% government owned) still largely in control One company cannot hold both General Type 2 and Special Type 2 licenses, so that services will have to be “sourced” from two license holders Some services require tariffs, which mean price caps and equal treatment for all customers, regardless of time of purchase or credit-worthiness Approach: Eliminate restrictions tying business to license • Operate all trading under General Type 2 license

Challenges in Japan v Current Status: Telecommunications trading not contemplated by regulatory scheme – but is not expressly prohibited • • • v Approach: Manage policy developments to support trading • • • v Expand transparency by coordinating support for trading with other stakeholders Make involved ministries aware of the economic benefits deriving from trading Demonstrate that trading can occur within existing scheme without affecting communications security Current Status: Multiple licenses inhibit operational flexibility • • v MPT Minister has broad authority under vaguely drafted laws – the accepted procedure is to gain approval in private meetings with bureaucrats Telecom – IT convergence is a high profile issue for several ministries which are trying to influence policy for their constituents Large group of stakeholders focused on telecom policy developments, with NTT (46% government owned) still largely in control One company cannot hold both General Type 2 and Special Type 2 licenses, so that services will have to be “sourced” from two license holders Some services require tariffs, which mean price caps and equal treatment for all customers, regardless of time of purchase or credit-worthiness Approach: Eliminate restrictions tying business to license • Operate all trading under General Type 2 license

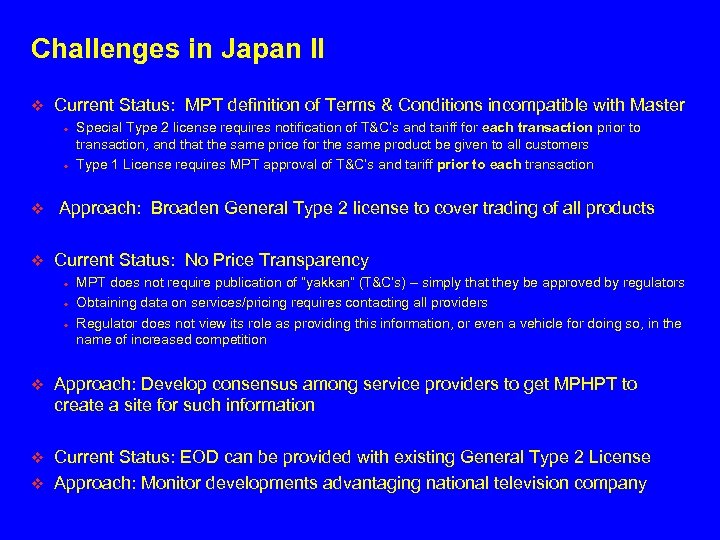

Challenges in Japan II v Current Status: MPT definition of Terms & Conditions incompatible with Master • • v v Approach: Broaden General Type 2 license to cover trading of all products Current Status: No Price Transparency • • • v Special Type 2 license requires notification of T&C’s and tariff for each transaction prior to transaction, and that the same price for the same product be given to all customers Type 1 License requires MPT approval of T&C’s and tariff prior to each transaction MPT does not require publication of “yakkan” (T&C’s) – simply that they be approved by regulators Obtaining data on services/pricing requires contacting all providers Regulator does not view its role as providing this information, or even a vehicle for doing so, in the name of increased competition Approach: Develop consensus among service providers to get MPHPT to create a site for such information Current Status: EOD can be provided with existing General Type 2 License v Approach: Monitor developments advantaging national television company v

Challenges in Japan II v Current Status: MPT definition of Terms & Conditions incompatible with Master • • v v Approach: Broaden General Type 2 license to cover trading of all products Current Status: No Price Transparency • • • v Special Type 2 license requires notification of T&C’s and tariff for each transaction prior to transaction, and that the same price for the same product be given to all customers Type 1 License requires MPT approval of T&C’s and tariff prior to each transaction MPT does not require publication of “yakkan” (T&C’s) – simply that they be approved by regulators Obtaining data on services/pricing requires contacting all providers Regulator does not view its role as providing this information, or even a vehicle for doing so, in the name of increased competition Approach: Develop consensus among service providers to get MPHPT to create a site for such information Current Status: EOD can be provided with existing General Type 2 License v Approach: Monitor developments advantaging national television company v

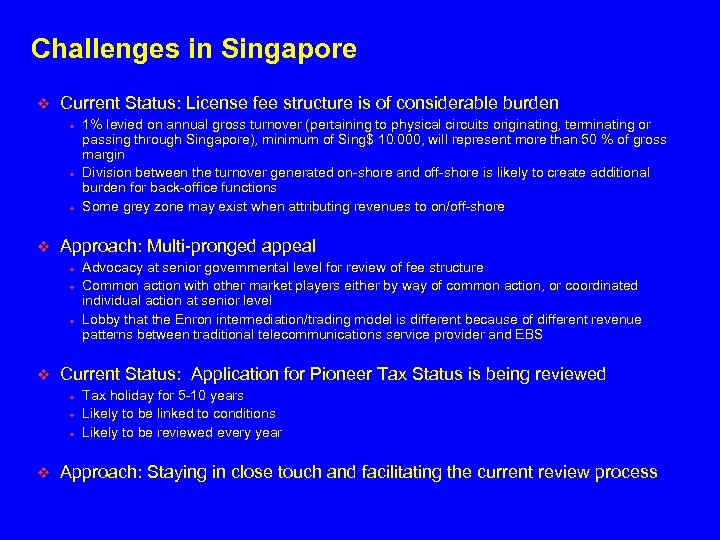

Challenges in Singapore v Current Status: License fee structure is of considerable burden • • • v Approach: Multi-pronged appeal • • • v Advocacy at senior governmental level for review of fee structure Common action with other market players either by way of common action, or coordinated individual action at senior level Lobby that the Enron intermediation/trading model is different because of different revenue patterns between traditional telecommunications service provider and EBS Current Status: Application for Pioneer Tax Status is being reviewed • • • v 1% levied on annual gross turnover (pertaining to physical circuits originating, terminating or passing through Singapore), minimum of Sing$ 10. 000, will represent more than 50 % of gross margin Division between the turnover generated on-shore and off-shore is likely to create additional burden for back-office functions Some grey zone may exist when attributing revenues to on/off-shore Tax holiday for 5 -10 years Likely to be linked to conditions Likely to be reviewed every year Approach: Staying in close touch and facilitating the current review process

Challenges in Singapore v Current Status: License fee structure is of considerable burden • • • v Approach: Multi-pronged appeal • • • v Advocacy at senior governmental level for review of fee structure Common action with other market players either by way of common action, or coordinated individual action at senior level Lobby that the Enron intermediation/trading model is different because of different revenue patterns between traditional telecommunications service provider and EBS Current Status: Application for Pioneer Tax Status is being reviewed • • • v 1% levied on annual gross turnover (pertaining to physical circuits originating, terminating or passing through Singapore), minimum of Sing$ 10. 000, will represent more than 50 % of gross margin Division between the turnover generated on-shore and off-shore is likely to create additional burden for back-office functions Some grey zone may exist when attributing revenues to on/off-shore Tax holiday for 5 -10 years Likely to be linked to conditions Likely to be reviewed every year Approach: Staying in close touch and facilitating the current review process

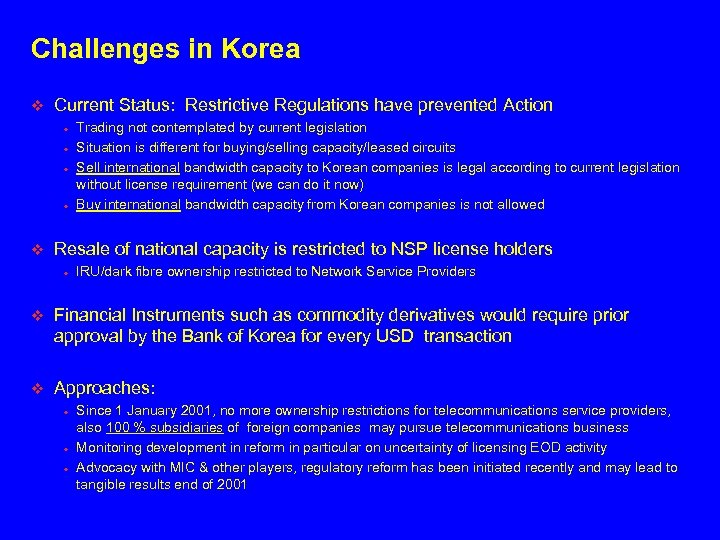

Challenges in Korea v Current Status: Restrictive Regulations have prevented Action • • v Trading not contemplated by current legislation Situation is different for buying/selling capacity/leased circuits Sell international bandwidth capacity to Korean companies is legal according to current legislation without license requirement (we can do it now) Buy international bandwidth capacity from Korean companies is not allowed Resale of national capacity is restricted to NSP license holders • IRU/dark fibre ownership restricted to Network Service Providers v Financial Instruments such as commodity derivatives would require prior approval by the Bank of Korea for every USD transaction v Approaches: • • • Since 1 January 2001, no more ownership restrictions for telecommunications service providers, also 100 % subsidiaries of foreign companies may pursue telecommunications business Monitoring development in reform in particular on uncertainty of licensing EOD activity Advocacy with MIC & other players, regulatory reform has been initiated recently and may lead to tangible results end of 2001

Challenges in Korea v Current Status: Restrictive Regulations have prevented Action • • v Trading not contemplated by current legislation Situation is different for buying/selling capacity/leased circuits Sell international bandwidth capacity to Korean companies is legal according to current legislation without license requirement (we can do it now) Buy international bandwidth capacity from Korean companies is not allowed Resale of national capacity is restricted to NSP license holders • IRU/dark fibre ownership restricted to Network Service Providers v Financial Instruments such as commodity derivatives would require prior approval by the Bank of Korea for every USD transaction v Approaches: • • • Since 1 January 2001, no more ownership restrictions for telecommunications service providers, also 100 % subsidiaries of foreign companies may pursue telecommunications business Monitoring development in reform in particular on uncertainty of licensing EOD activity Advocacy with MIC & other players, regulatory reform has been initiated recently and may lead to tangible results end of 2001

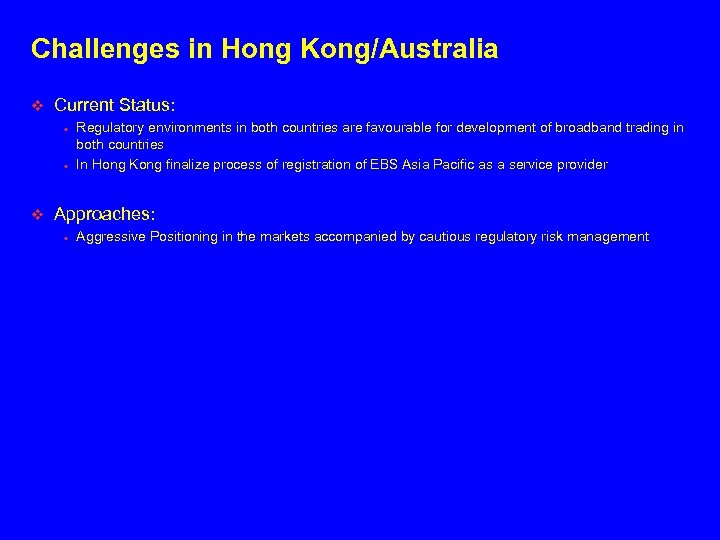

Challenges in Hong Kong/Australia v Current Status: • • v Regulatory environments in both countries are favourable for development of broadband trading in both countries In Hong Kong finalize process of registration of EBS Asia Pacific as a service provider Approaches: • Aggressive Positioning in the markets accompanied by cautious regulatory risk management

Challenges in Hong Kong/Australia v Current Status: • • v Regulatory environments in both countries are favourable for development of broadband trading in both countries In Hong Kong finalize process of registration of EBS Asia Pacific as a service provider Approaches: • Aggressive Positioning in the markets accompanied by cautious regulatory risk management

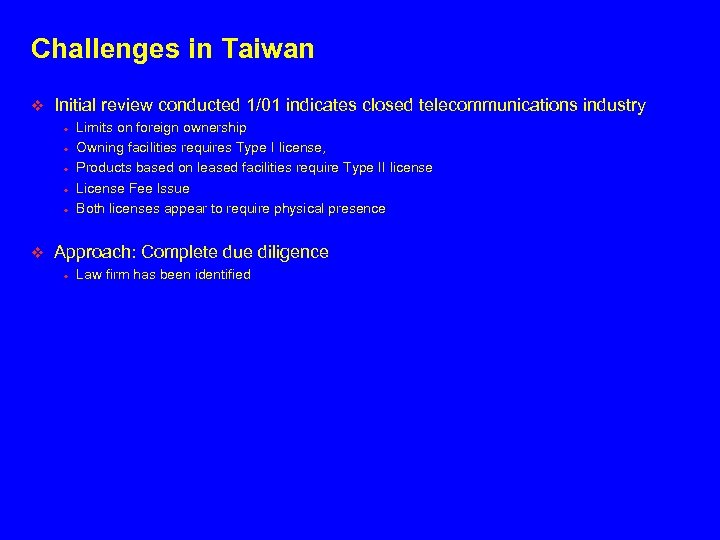

Challenges in Taiwan v Initial review conducted 1/01 indicates closed telecommunications industry • • • v Limits on foreign ownership Owning facilities requires Type I license, Products based on leased facilities require Type II license License Fee Issue Both licenses appear to require physical presence Approach: Complete due diligence • Law firm has been identified

Challenges in Taiwan v Initial review conducted 1/01 indicates closed telecommunications industry • • • v Limits on foreign ownership Owning facilities requires Type I license, Products based on leased facilities require Type II license License Fee Issue Both licenses appear to require physical presence Approach: Complete due diligence • Law firm has been identified

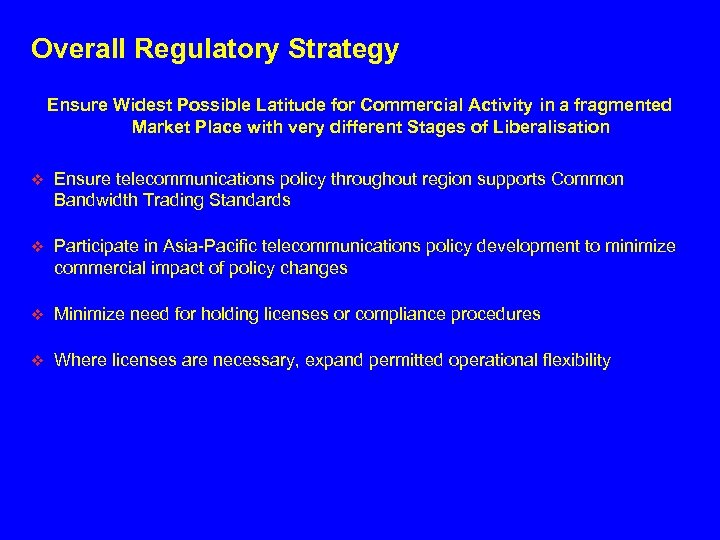

Overall Regulatory Strategy Ensure Widest Possible Latitude for Commercial Activity in a fragmented Market Place with very different Stages of Liberalisation v Ensure telecommunications policy throughout region supports Common Bandwidth Trading Standards v Participate in Asia-Pacific telecommunications policy development to minimize commercial impact of policy changes v Minimize need for holding licenses or compliance procedures v Where licenses are necessary, expand permitted operational flexibility

Overall Regulatory Strategy Ensure Widest Possible Latitude for Commercial Activity in a fragmented Market Place with very different Stages of Liberalisation v Ensure telecommunications policy throughout region supports Common Bandwidth Trading Standards v Participate in Asia-Pacific telecommunications policy development to minimize commercial impact of policy changes v Minimize need for holding licenses or compliance procedures v Where licenses are necessary, expand permitted operational flexibility

Next Steps Transition from License Compliance to Advocacy v Leverage relationships with policy makers to efficiently impart consistent message across region • Tailor EBS policy message to each country – consonant with commercial strategy • Cultivate relationships with policy makers – US & local governments, politicians, competitors – to efficiently effect policy changes • Influence Singapore legislation to eliminate impact of license fee • Use relationships to help define telecommunications policy to permit the freest use of market mechanism to support innovative service offerings and delivery vehicles

Next Steps Transition from License Compliance to Advocacy v Leverage relationships with policy makers to efficiently impart consistent message across region • Tailor EBS policy message to each country – consonant with commercial strategy • Cultivate relationships with policy makers – US & local governments, politicians, competitors – to efficiently effect policy changes • Influence Singapore legislation to eliminate impact of license fee • Use relationships to help define telecommunications policy to permit the freest use of market mechanism to support innovative service offerings and delivery vehicles

More Steps v Closely Monitor regulatory reform process – to identify potential in new markets and to minimize legislative/regulatory impact on commercial activity (Regulatory Risk Management) v Ongoing rregulatory due diligence for other target countries in region: • • • Taiwan Korea Any other country (Malaysia/Indonesia etc. ) v Leverage efforts by using regional organizations like APEC to promote a market-oriented environment v Ensure rate consistency/consistency of service filings across region v Co-ordinate with PR to ensure consistency of public messages across region and regulatory strategy v Develop and manage regional license compliance program v Establish biweekly conference call among legal, tax, accounting and regulatory staff

More Steps v Closely Monitor regulatory reform process – to identify potential in new markets and to minimize legislative/regulatory impact on commercial activity (Regulatory Risk Management) v Ongoing rregulatory due diligence for other target countries in region: • • • Taiwan Korea Any other country (Malaysia/Indonesia etc. ) v Leverage efforts by using regional organizations like APEC to promote a market-oriented environment v Ensure rate consistency/consistency of service filings across region v Co-ordinate with PR to ensure consistency of public messages across region and regulatory strategy v Develop and manage regional license compliance program v Establish biweekly conference call among legal, tax, accounting and regulatory staff