Section Focus: 1. What are the different

- Размер: 7.6 Mегабайта

- Количество слайдов: 44

Описание презентации Section Focus: 1. What are the different по слайдам

Section Focus: 1. What are the different types of business organizations ? 2. Describe the characteristics of sole proprietorships, partnerships, and corporations. 3. Analyze the advantages and disadvantages of business organizations. 4. What is the difference between stocks [owner] and bonds [lender] ? 5. What are the advantages and disadvantages of franchises ? 6. What makes Mc. Donald’s the greatest franchise ever ? [not the greatest hamburgers, just the greatest franchise]

Section Focus: 1. What are the different types of business organizations ? 2. Describe the characteristics of sole proprietorships, partnerships, and corporations. 3. Analyze the advantages and disadvantages of business organizations. 4. What is the difference between stocks [owner] and bonds [lender] ? 5. What are the advantages and disadvantages of franchises ? 6. What makes Mc. Donald’s the greatest franchise ever ? [not the greatest hamburgers, just the greatest franchise]

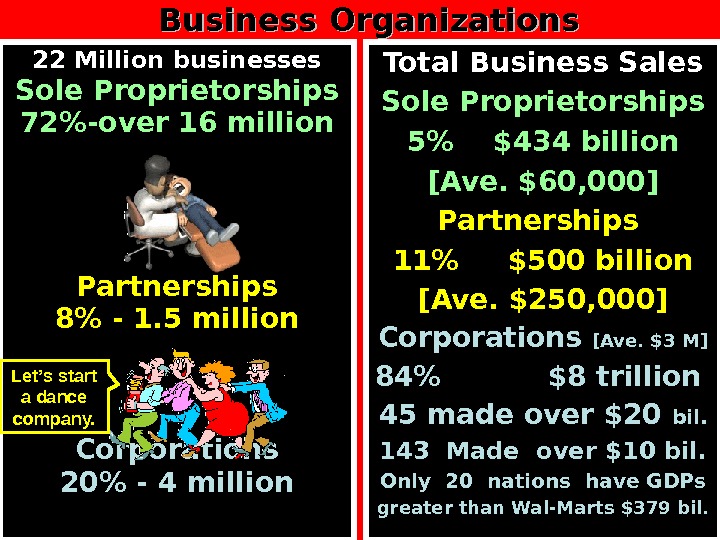

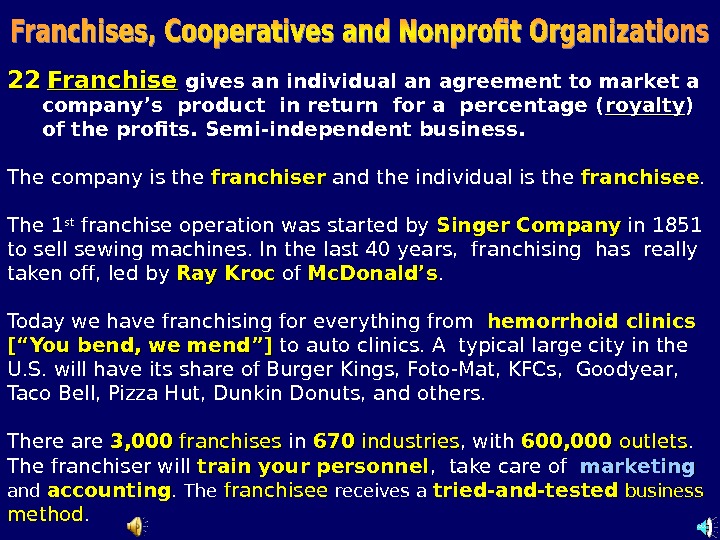

![Total Business Sales Sole Proprietorships 5 $434 billion [Ave. $60, 000] Partnerships 11 $500 billion Total Business Sales Sole Proprietorships 5 $434 billion [Ave. $60, 000] Partnerships 11 $500 billion](/docs//business_organizations_images/business_organizations_3.jpg) Total Business Sales Sole Proprietorships 5% $434 billion [Ave. $60, 000] Partnerships 11% $500 billion [Ave. $250, 000] Corporations [Ave. $3 M] 84% $8 trillion 45 made over $20 bil. 143 Made over $10 bil. Only 20 nations have GDPs greater than Wal-Marts $379 bil. 22 Million businesses Sole Proprietorships 72%-over 16 million Partnerships 8% — 1. 5 million Corporations 20% — 4 million Business Organizations Let’s start a dance company.

Total Business Sales Sole Proprietorships 5% $434 billion [Ave. $60, 000] Partnerships 11% $500 billion [Ave. $250, 000] Corporations [Ave. $3 M] 84% $8 trillion 45 made over $20 bil. 143 Made over $10 bil. Only 20 nations have GDPs greater than Wal-Marts $379 bil. 22 Million businesses Sole Proprietorships 72%-over 16 million Partnerships 8% — 1. 5 million Corporations 20% — 4 million Business Organizations Let’s start a dance company.

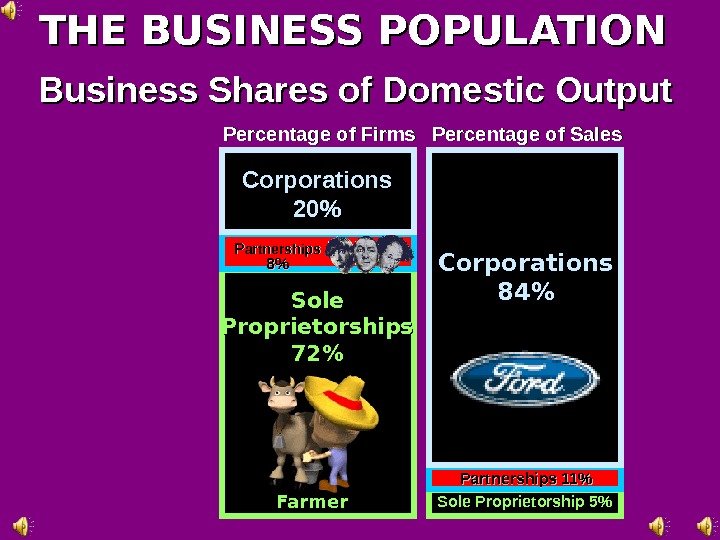

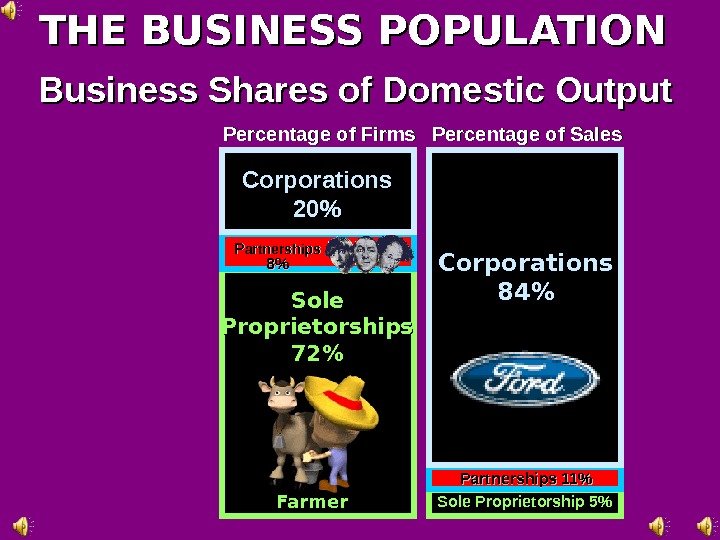

THE BUSINESS POPULATION Business Shares of Domestic Output Corporations 20%20% PP artnerships 8%8% Sole Proprietorships 72%72% Partnerships 11%Corporations 84%84%Percentage of Firms Percentage of Sales Farmer Sole Proprietorship 5%

THE BUSINESS POPULATION Business Shares of Domestic Output Corporations 20%20% PP artnerships 8%8% Sole Proprietorships 72%72% Partnerships 11%Corporations 84%84%Percentage of Firms Percentage of Sales Farmer Sole Proprietorship 5%

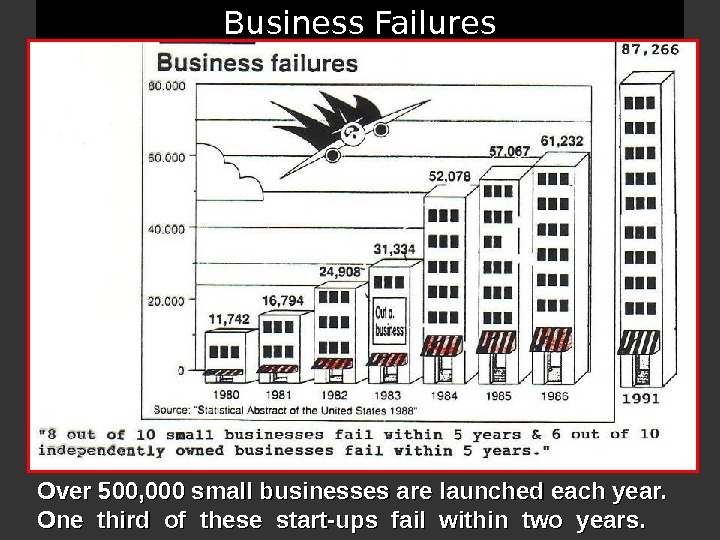

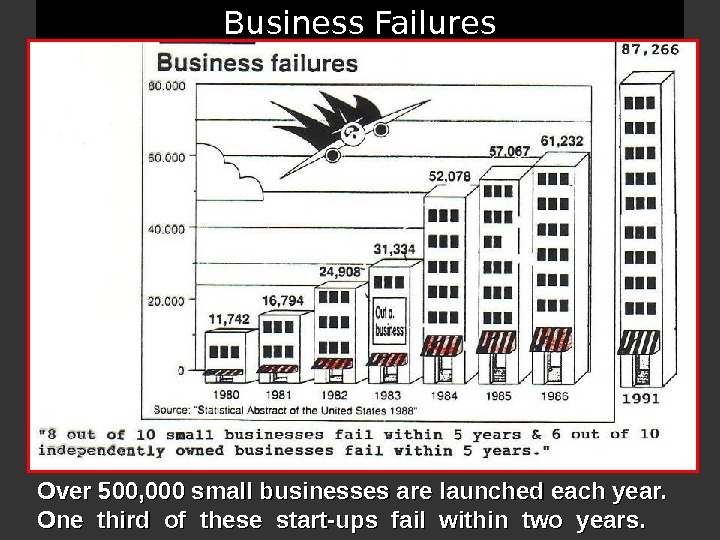

Business Failures Over 500, 000 small businesses are launched each year. One third of these start-ups fail within two years.

Business Failures Over 500, 000 small businesses are launched each year. One third of these start-ups fail within two years.

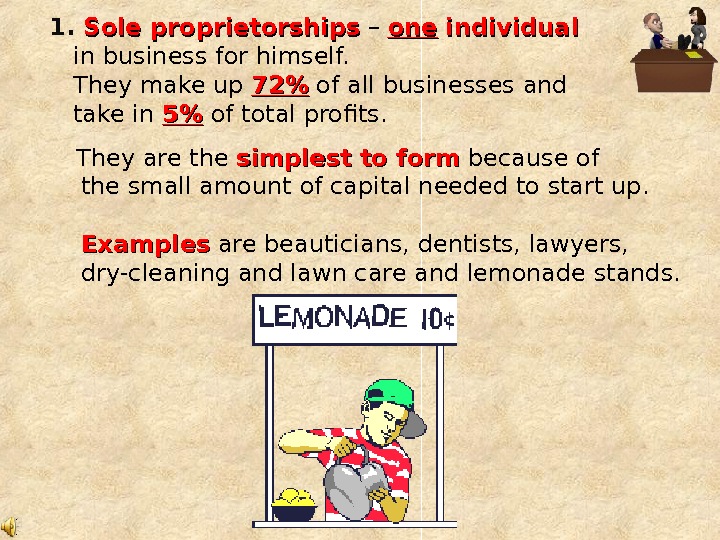

They are the simplest to form because of the small amount of capital needed to start up. Examples are beauticians, dentists, lawyers, dry-cleaning and lawn care and lemonade stands. 1. Sole proprietorships – oneone individual in business for himself. They make up 72%72% of all businesses and take in 5%5% of total profits.

They are the simplest to form because of the small amount of capital needed to start up. Examples are beauticians, dentists, lawyers, dry-cleaning and lawn care and lemonade stands. 1. Sole proprietorships – oneone individual in business for himself. They make up 72%72% of all businesses and take in 5%5% of total profits.

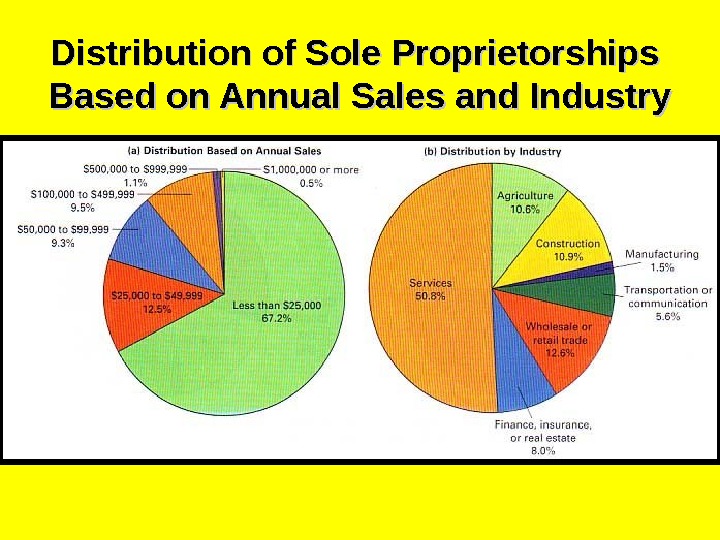

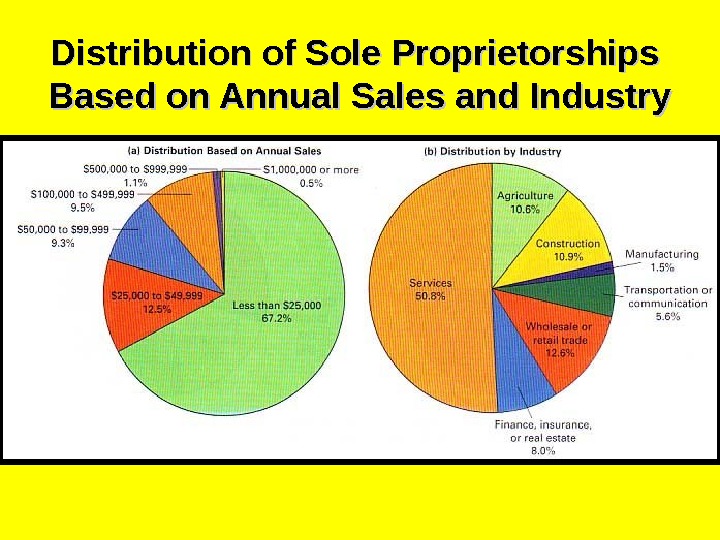

Distribution of Sole Proprietorships Based on Annual Sales and Industry

Distribution of Sole Proprietorships Based on Annual Sales and Industry

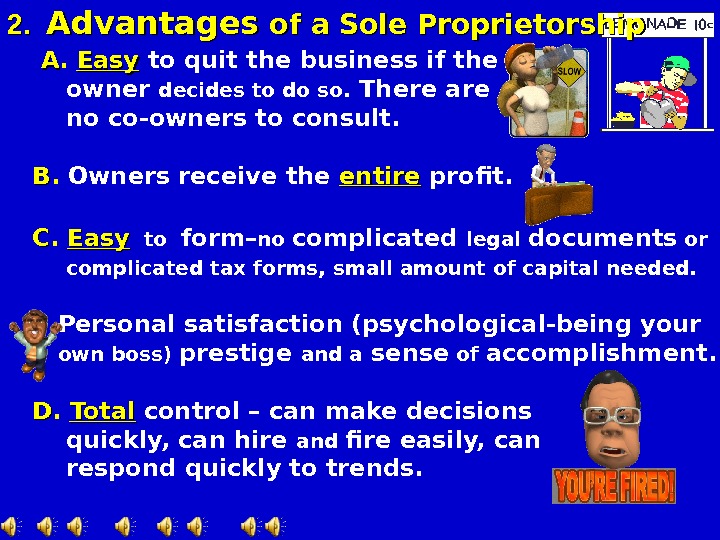

AA. Easy to quit the business if the owner decides to do so. There are no co-owners to consult. BB. Owners receive the entire profit. CC. Easy to form– no complicated legal documents or complicated tax forms, small amount of capital needed. Personal satisfaction (psychological-being your own boss) prestige and a sense of accomplishment. DD. Total control – can make decisions quickly, can hire and fire easily, can respond quickly to trends. 2. Advantages of a Sole Proprietorship

AA. Easy to quit the business if the owner decides to do so. There are no co-owners to consult. BB. Owners receive the entire profit. CC. Easy to form– no complicated legal documents or complicated tax forms, small amount of capital needed. Personal satisfaction (psychological-being your own boss) prestige and a sense of accomplishment. DD. Total control – can make decisions quickly, can hire and fire easily, can respond quickly to trends. 2. Advantages of a Sole Proprietorship

AA. Unlimited liability (debt) — have to forfeit their personal possessions as well as their businesses. (auto, other business, house, savings) B. B. Burden of sole responsibility – must have business sense. C. C. Limited potential for growth – collateral (any thing of value to guarantee a loan [like giving up your personal possessions) [Let’s say you put your home up for collateral but have to give it up] D. D. Difficult to attract qualified employees–can’t offer fringe benefits. [Let’s say you ask for more benefits] E. E. Short life span – depends on owner’s health and competence. If the owner dies , it is over. 3. Disadvantages of Sole proprietorships I want medical benefits!

AA. Unlimited liability (debt) — have to forfeit their personal possessions as well as their businesses. (auto, other business, house, savings) B. B. Burden of sole responsibility – must have business sense. C. C. Limited potential for growth – collateral (any thing of value to guarantee a loan [like giving up your personal possessions) [Let’s say you put your home up for collateral but have to give it up] D. D. Difficult to attract qualified employees–can’t offer fringe benefits. [Let’s say you ask for more benefits] E. E. Short life span – depends on owner’s health and competence. If the owner dies , it is over. 3. Disadvantages of Sole proprietorships I want medical benefits!

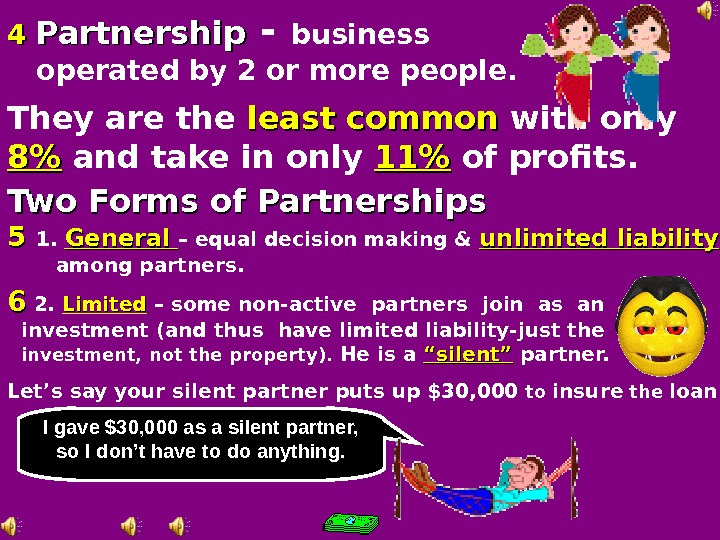

44 Partnership — business operated by 2 or more people. They are the least common with only 8%8% and take in only 11%11% of profits. 66 2. Limited – some non-active partners join as an investment (and thus have limited liability-just the investment, not the property). He is a “silent” partner. I gave $30, 000 as a silent partner, so I don’t have to do anything. Two Forms of Partnerships 55 1. General – equal decision making & unlimited liability among partners. Let’s say your silent partner puts up $30, 000 to insure the loan.

44 Partnership — business operated by 2 or more people. They are the least common with only 8%8% and take in only 11%11% of profits. 66 2. Limited – some non-active partners join as an investment (and thus have limited liability-just the investment, not the property). He is a “silent” partner. I gave $30, 000 as a silent partner, so I don’t have to do anything. Two Forms of Partnerships 55 1. General – equal decision making & unlimited liability among partners. Let’s say your silent partner puts up $30, 000 to insure the loan.

Specialization – specific duties assigned to different partners. A. A. Sharing of losses. Can borrow more and can sustain heavier losses. B. B. Easy to form. Small amount of money to start & operate. C. C. Shared decision making – more informed decisions. D. Personal satisfaction – sense of accomplishment. Advantages of Partnerships [“Two heads are better than one. ”] Two Heads better than One Head

Specialization – specific duties assigned to different partners. A. A. Sharing of losses. Can borrow more and can sustain heavier losses. B. B. Easy to form. Small amount of money to start & operate. C. C. Shared decision making – more informed decisions. D. Personal satisfaction – sense of accomplishment. Advantages of Partnerships [“Two heads are better than one. ”] Two Heads better than One Head

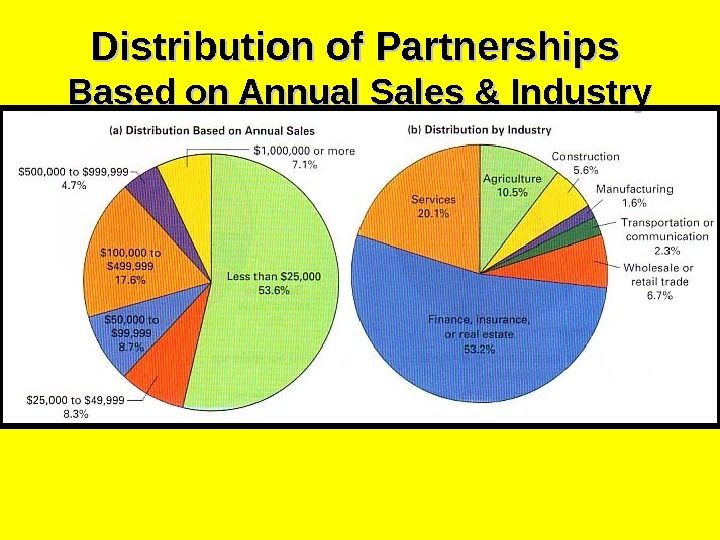

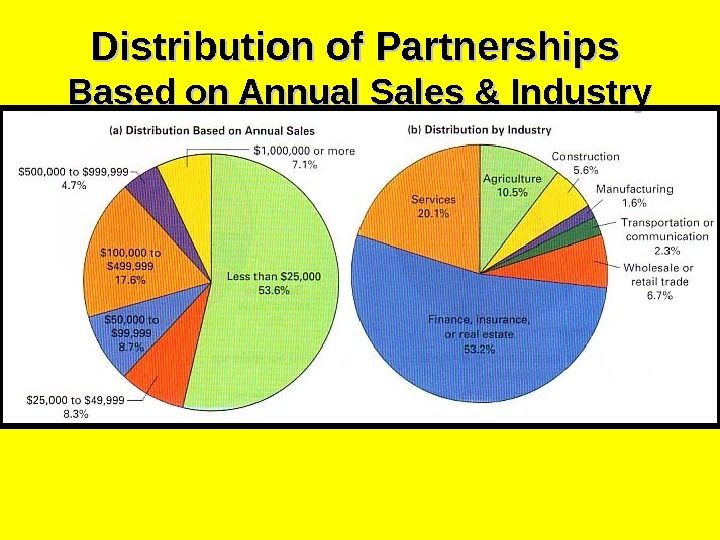

Distribution of Partnerships Based on Annual Sales & Industry

Distribution of Partnerships Based on Annual Sales & Industry

8. 8. Disadvantages of Partnerships A. A. Disagreements among partners – conflicts delay decisions, lower employee morale, & lessen efficiency. Each partner is responsible for the acts of all other partners. Must choose good partners. B. B. Have to share the profits. C. Unlimited liability – can lose their business and personal possessions. D. Limited life – sickness, conflicts, or death can end the partnership. Take That!

8. 8. Disadvantages of Partnerships A. A. Disagreements among partners – conflicts delay decisions, lower employee morale, & lessen efficiency. Each partner is responsible for the acts of all other partners. Must choose good partners. B. B. Have to share the profits. C. Unlimited liability – can lose their business and personal possessions. D. Limited life – sickness, conflicts, or death can end the partnership. Take That!

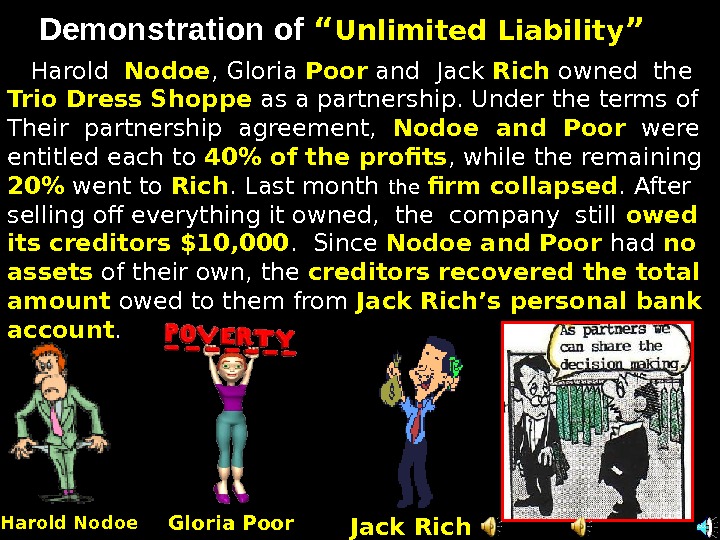

Demonstration of ““ Unlimited Liability ”” Harold Nodoe , Gloria Poor and Jack Rich owned the Trio Dress Shoppe as a partnership. Under the terms of Their partnership agreement, Nodoe and Poor were entitled each to 40% of the profits , while the remaining 20%20% went to Rich. Last month the firm collapsed. After selling off everything it owned, the company still owed its creditors $10, 000. Since Nodoe and Poor had nono assets of their own, the creditors recovered the total amount owed to them from Jack Rich’s personal bank account. Harold Nodoe Gloria Poor Jack Rich

Demonstration of ““ Unlimited Liability ”” Harold Nodoe , Gloria Poor and Jack Rich owned the Trio Dress Shoppe as a partnership. Under the terms of Their partnership agreement, Nodoe and Poor were entitled each to 40% of the profits , while the remaining 20%20% went to Rich. Last month the firm collapsed. After selling off everything it owned, the company still owed its creditors $10, 000. Since Nodoe and Poor had nono assets of their own, the creditors recovered the total amount owed to them from Jack Rich’s personal bank account. Harold Nodoe Gloria Poor Jack Rich

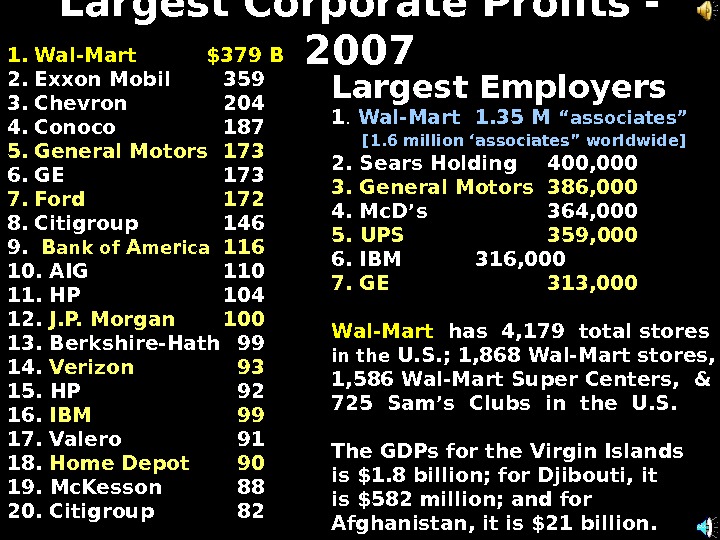

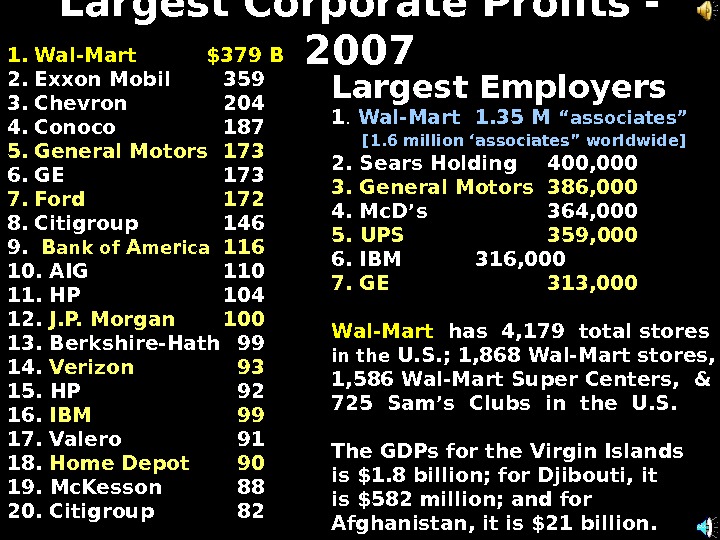

Largest Corporate Profits — 20071. 1. Wal-Mart $379 B 2. Exxon Mobil 359 3. Chevron 204 4. Conoco 187 5. General Motors 173 6. GE 173 7. Ford 172 8. Citigroup 146 9. B ank of A merica 116 10. AIG 110 11. HP 104 12. J. P. Morgan 100 13. Berkshire-Hath 99 14. Verizon 93 15. HP 92 16. IBM 99 17. Valero 91 18. Home Depot 90 19. Mc. Kesson 88 20. Citigroup 82 Largest Employers 1. Wal-Mart 1. 35 M “associates” [1. 6 million ‘associates” worldwide] 2. Sears Holding 400, 000 3. General Motors 386, 000 4. Mc. D’s 364, 000 5. UPS 359, 000 6. IBM 316, 000 7. GE 313, 000 Wal-Mart has 4, 179 total stores in the U. S. ; 1, 868 Wal-Mart stores, 1, 586 Wal-Mart Super Centers, & 725 Sam’s Clubs in the U. S. The GDPs for the Virgin Islands is $1. 8 billion; for Djibouti, it is $582 million; and for Afghanistan, it is $21 billion.

Largest Corporate Profits — 20071. 1. Wal-Mart $379 B 2. Exxon Mobil 359 3. Chevron 204 4. Conoco 187 5. General Motors 173 6. GE 173 7. Ford 172 8. Citigroup 146 9. B ank of A merica 116 10. AIG 110 11. HP 104 12. J. P. Morgan 100 13. Berkshire-Hath 99 14. Verizon 93 15. HP 92 16. IBM 99 17. Valero 91 18. Home Depot 90 19. Mc. Kesson 88 20. Citigroup 82 Largest Employers 1. Wal-Mart 1. 35 M “associates” [1. 6 million ‘associates” worldwide] 2. Sears Holding 400, 000 3. General Motors 386, 000 4. Mc. D’s 364, 000 5. UPS 359, 000 6. IBM 316, 000 7. GE 313, 000 Wal-Mart has 4, 179 total stores in the U. S. ; 1, 868 Wal-Mart stores, 1, 586 Wal-Mart Super Centers, & 725 Sam’s Clubs in the U. S. The GDPs for the Virgin Islands is $1. 8 billion; for Djibouti, it is $582 million; and for Afghanistan, it is $21 billion.

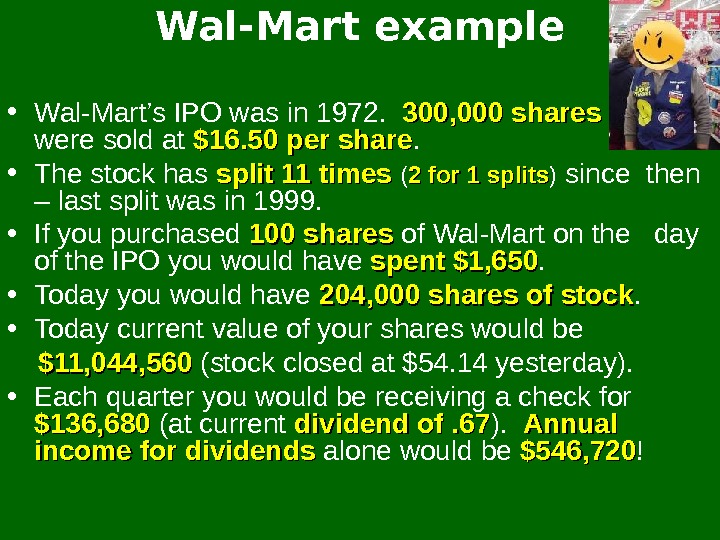

Wal-Mart example • Wal-Mart’s IPO was in 1972. 300, 000 shares were sold at $16. 50 per share. • The stock has split 11 times ( 2 for 1 splits ) since then – last split was in 1999. • If you purchased 100 shares of Wal-Mart on the day of the IPO you would have spent $1, 650. • Today you would have 204, 000 shares of stock. • Today current value of your shares would be $11, 044, 560 (stock closed at $54. 14 yesterday). • Each quarter you would be receiving a check for $136, 680 (at current dividend of. 67 ). Annual income for dividends alone would be $546, 720 !

Wal-Mart example • Wal-Mart’s IPO was in 1972. 300, 000 shares were sold at $16. 50 per share. • The stock has split 11 times ( 2 for 1 splits ) since then – last split was in 1999. • If you purchased 100 shares of Wal-Mart on the day of the IPO you would have spent $1, 650. • Today you would have 204, 000 shares of stock. • Today current value of your shares would be $11, 044, 560 (stock closed at $54. 14 yesterday). • Each quarter you would be receiving a check for $136, 680 (at current dividend of. 67 ). Annual income for dividends alone would be $546, 720 !

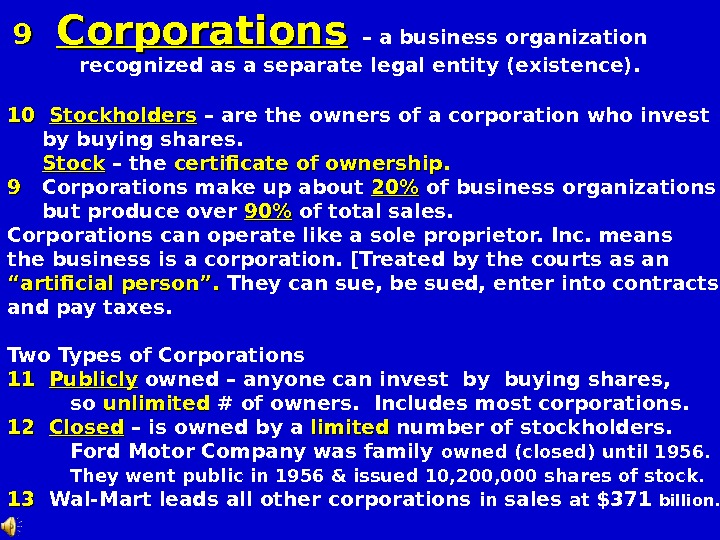

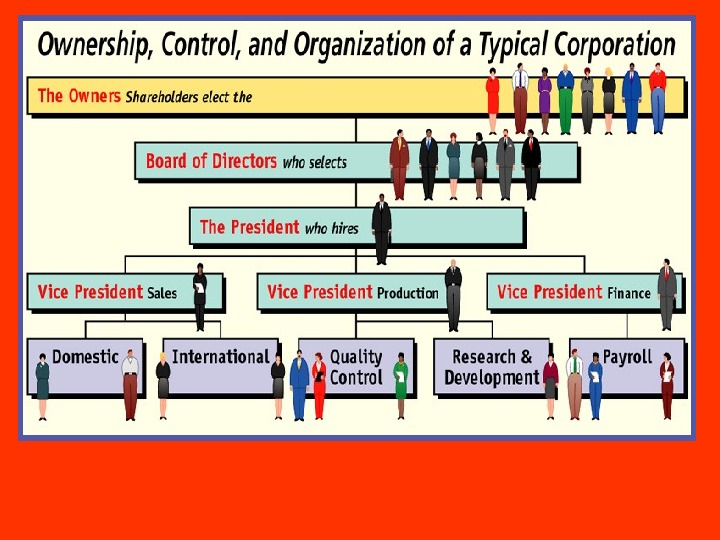

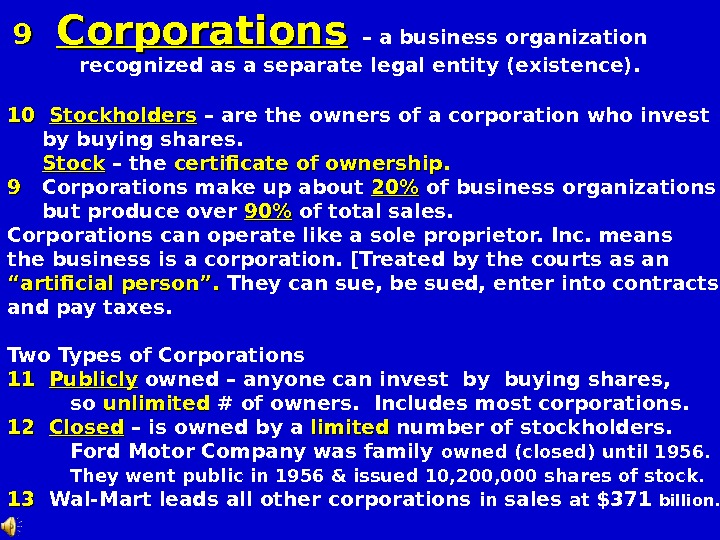

9 9 Corporations – a business organization recognized as a separate legal entity (existence). 10 10 Stockholders – are the owners of a corporation who invest by buying shares. Stock – the certificate of ownership. 99 Corporations make up about 20%20% of business organizations but produce over 90%90% of total sales. Corporations can operate like a sole proprietor. Inc. means the business is a corporation. [Treated by the courts as an ““ artificial person”. They can sue, be sued, enter into contracts, and pay taxes. Two Types of Corporations 1111 Publicly owned – anyone can invest by buying shares, so unlimited # of owners. Includes most corporations. 1212 Closed – is owned by a limited number of stockholders. Ford Motor Company was family owned (closed) until 1956. They went public in 1956 & issued 10, 200, 000 shares of stock. 1313 Wal-Mart leads all other corporations in sales at $371 billion.

9 9 Corporations – a business organization recognized as a separate legal entity (existence). 10 10 Stockholders – are the owners of a corporation who invest by buying shares. Stock – the certificate of ownership. 99 Corporations make up about 20%20% of business organizations but produce over 90%90% of total sales. Corporations can operate like a sole proprietor. Inc. means the business is a corporation. [Treated by the courts as an ““ artificial person”. They can sue, be sued, enter into contracts, and pay taxes. Two Types of Corporations 1111 Publicly owned – anyone can invest by buying shares, so unlimited # of owners. Includes most corporations. 1212 Closed – is owned by a limited number of stockholders. Ford Motor Company was family owned (closed) until 1956. They went public in 1956 & issued 10, 200, 000 shares of stock. 1313 Wal-Mart leads all other corporations in sales at $371 billion.

Corporate Trivia • A corporation can be sued but the people who own the corporation ( stockholders ) can not be sued. • A corporation has potentially perpetual life. • 1. ) Nearly all large companies are corporations. • 2. ) Nearly all corporations are small companies. • 3. ) Therefore, a small minority of corporations constitute nearly all the large companies. • In other words, of 4 million corporations , about 2, 000 are large companies , and these 2, 000 large corporations constitute the vast majority of the nation’s large companies. • Also, the 15% of corporations that do more than $1 million in sales take in in 85% of the receipts of corporations.

Corporate Trivia • A corporation can be sued but the people who own the corporation ( stockholders ) can not be sued. • A corporation has potentially perpetual life. • 1. ) Nearly all large companies are corporations. • 2. ) Nearly all corporations are small companies. • 3. ) Therefore, a small minority of corporations constitute nearly all the large companies. • In other words, of 4 million corporations , about 2, 000 are large companies , and these 2, 000 large corporations constitute the vast majority of the nation’s large companies. • Also, the 15% of corporations that do more than $1 million in sales take in in 85% of the receipts of corporations.

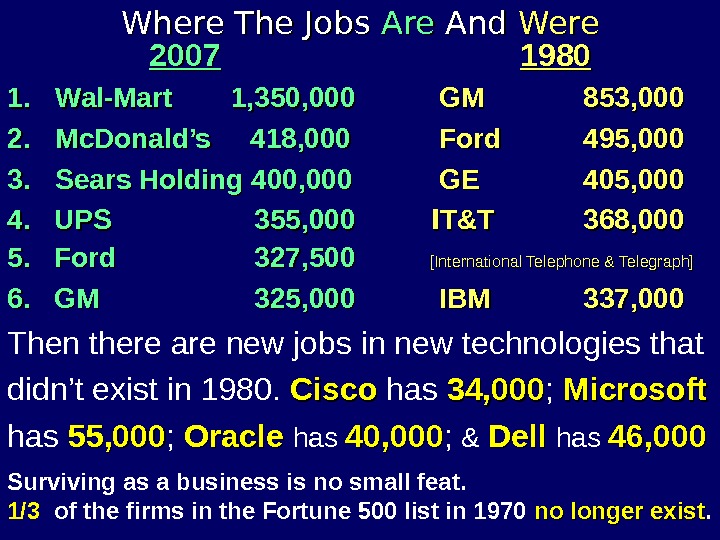

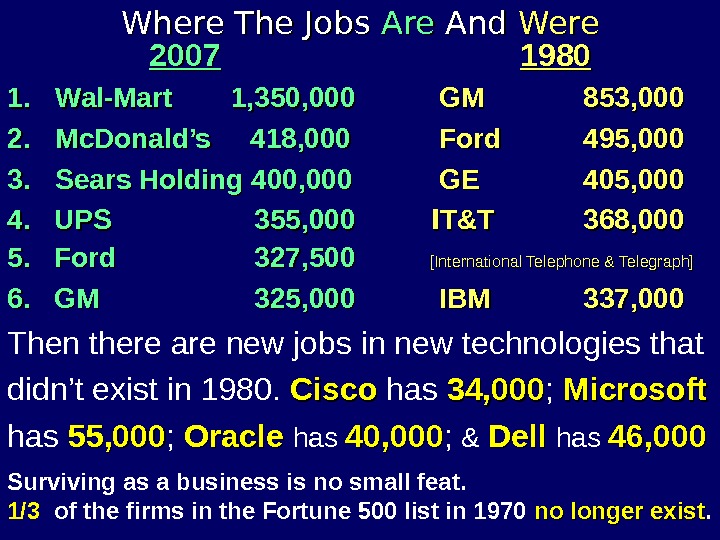

Where The Jobs Are And Were 2007 1980 1. 1. Wal-Mart 1, 350, 000 GMGM 853, 000 2. 2. Mc. Donald’s 418, 000 Ford 495, 000 3. 3. Sears Holding 400, 000 GEGE 405, 000 4. 4. UPSUPS 355, 000 II T&TT&T 368, 000 5. Ford 327, 500 [International Telephone & Telegraph] 6. GM 325, 000 IBMIBM 337, 000 Then there are new jobs in new technologies that didn’t exist in 1980. Cisco has 34, 000 ; Microsoft has 55, 000 ; Oracle has 40, 000 ; & Dell has 46, 000 Surviving as a business is no small feat. 1/3 of the firms in the Fortune 500 list in 1970 no longer exist.

Where The Jobs Are And Were 2007 1980 1. 1. Wal-Mart 1, 350, 000 GMGM 853, 000 2. 2. Mc. Donald’s 418, 000 Ford 495, 000 3. 3. Sears Holding 400, 000 GEGE 405, 000 4. 4. UPSUPS 355, 000 II T&TT&T 368, 000 5. Ford 327, 500 [International Telephone & Telegraph] 6. GM 325, 000 IBMIBM 337, 000 Then there are new jobs in new technologies that didn’t exist in 1980. Cisco has 34, 000 ; Microsoft has 55, 000 ; Oracle has 40, 000 ; & Dell has 46, 000 Surviving as a business is no small feat. 1/3 of the firms in the Fortune 500 list in 1970 no longer exist.

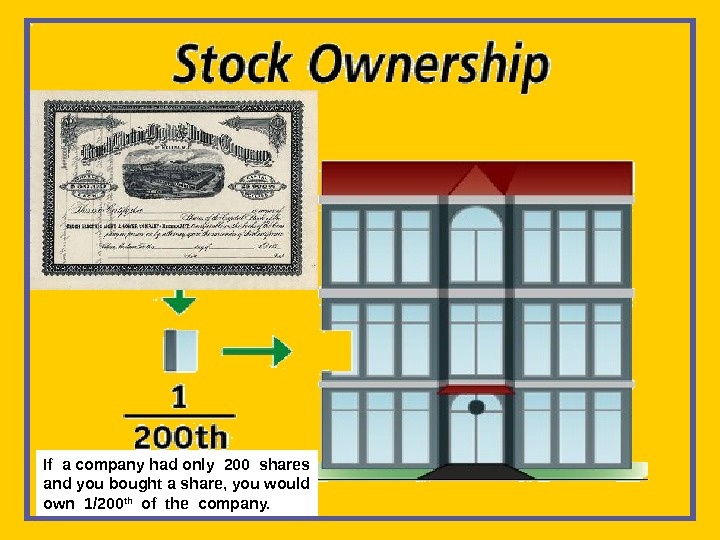

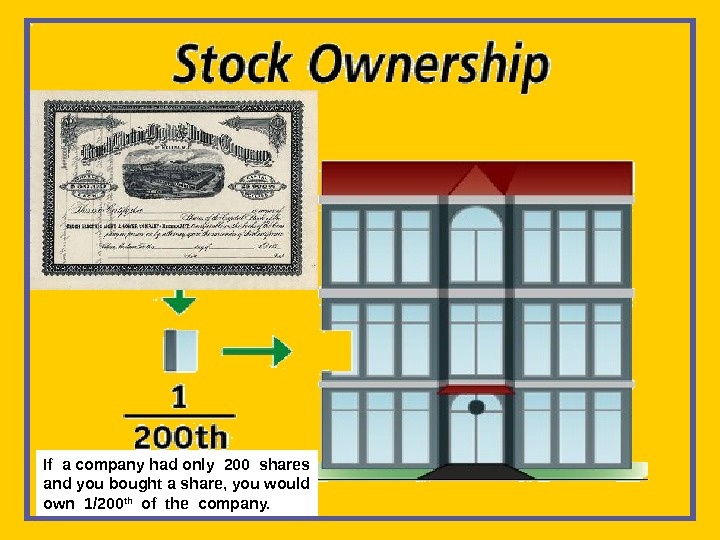

If a company had only 200 shares and you bought a share, you would own 1/200 th of the company.

If a company had only 200 shares and you bought a share, you would own 1/200 th of the company.

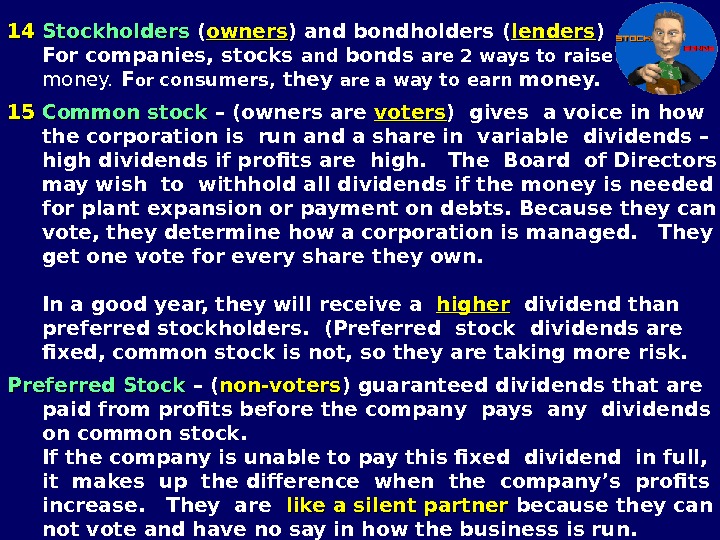

1414 Stockholders ( owners ) and bondholders ( l enders ) For companies, stocks and bonds are 2 ways to raise money. F or consumers, they are a way to earn money. 1515 Common stock – (owners are voters ) gives a voice in how the corporation is run and a share in variable dividends – high dividends if profits are high. The Board of Directors may wish to withhold all dividends if the money is needed for plant expansion or payment on debts. Because they can vote, they determine how a corporation is managed. They get one vote for every share they own. In a good year, they will receive a higher dividend than preferred stockholders. (Preferred stock dividends are fixed, common stock is not, so they are taking more risk. Preferred Stock – ( non-voters ) guaranteed dividends that are paid from profits before the company pays any dividends on common stock. If the company is unable to pay this fixed dividend in full, it makes up the difference when the company’s profits increase. They are like a silent partner because they can not vote and have no say in how the business is run.

1414 Stockholders ( owners ) and bondholders ( l enders ) For companies, stocks and bonds are 2 ways to raise money. F or consumers, they are a way to earn money. 1515 Common stock – (owners are voters ) gives a voice in how the corporation is run and a share in variable dividends – high dividends if profits are high. The Board of Directors may wish to withhold all dividends if the money is needed for plant expansion or payment on debts. Because they can vote, they determine how a corporation is managed. They get one vote for every share they own. In a good year, they will receive a higher dividend than preferred stockholders. (Preferred stock dividends are fixed, common stock is not, so they are taking more risk. Preferred Stock – ( non-voters ) guaranteed dividends that are paid from profits before the company pays any dividends on common stock. If the company is unable to pay this fixed dividend in full, it makes up the difference when the company’s profits increase. They are like a silent partner because they can not vote and have no say in how the business is run.

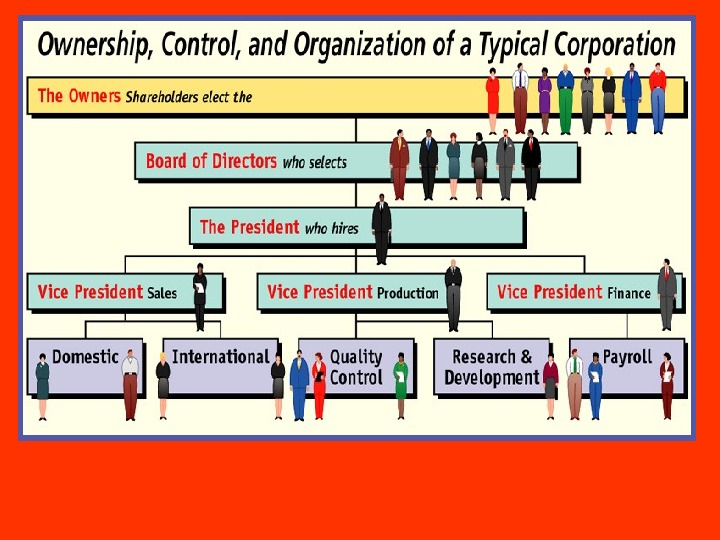

1616 Corporate Bonds – a certificate issued by a corporation in exchange for money borrowed from investors. There is a written promise to repay the amount borrowed at a later date (an I. O. U. ) lending money for 10, 20, or 30 years. Bondholders are creditors , not owners. 1717 Advantages of Corporations from a Stockholders Viewpoint AA 1. Limited liability – limited to the amount invested. His personal assets may not be seized to pay corporate debts. BB 2. May earn a profit without working. 1818 Advantages From the Corporation’s Viewpoint AA 1. Separation of ownership from management – can hire the best management available. Specialized talent can be hired in all areas. BB 2. Easy to raise capital – can issue stocks or sell bonds allowing the corporation to tap the savings of thousands. CC 3. Longevity – they have a life independent of their owners.

1616 Corporate Bonds – a certificate issued by a corporation in exchange for money borrowed from investors. There is a written promise to repay the amount borrowed at a later date (an I. O. U. ) lending money for 10, 20, or 30 years. Bondholders are creditors , not owners. 1717 Advantages of Corporations from a Stockholders Viewpoint AA 1. Limited liability – limited to the amount invested. His personal assets may not be seized to pay corporate debts. BB 2. May earn a profit without working. 1818 Advantages From the Corporation’s Viewpoint AA 1. Separation of ownership from management – can hire the best management available. Specialized talent can be hired in all areas. BB 2. Easy to raise capital – can issue stocks or sell bonds allowing the corporation to tap the savings of thousands. CC 3. Longevity – they have a life independent of their owners.

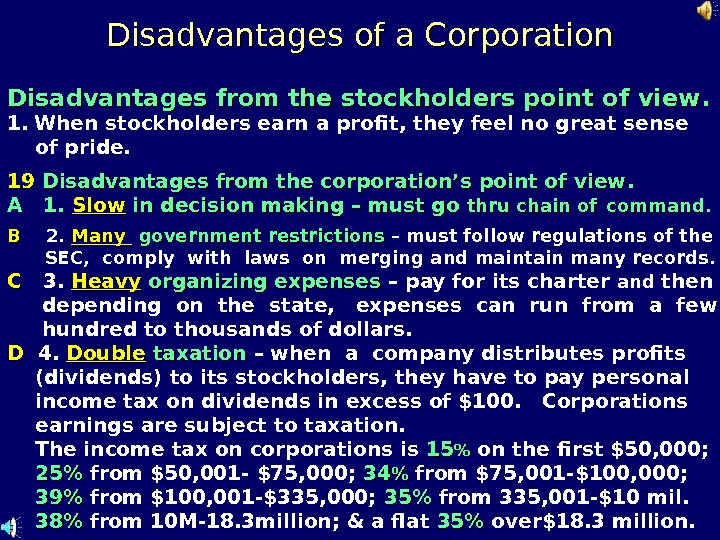

Disadvantages of a Corporation Disadvantages from the stockholders point of view. 1. When stockholders earn a profit, they feel no great sense of pride. BB 2. Many government restrictions – must follow regulations of the SEC, comply with laws on merging and maintain many records. CC 3. Heavy organizing expenses – pay for its charter and then depending on the state, expenses can run from a few hundred to thousands of dollars. DD 4. Double taxation – when a company distributes profits (dividends) to its stockholders, they have to pay personal income tax on dividends in excess of $100. Corporations earnings are subject to taxation. The income tax on corporations is 1515 %% on the first $50, 000; 25%25% from $50, 001 — $75, 000; 3434 %% from $75, 001 -$100, 000; 39%39% from $100, 001 -$335, 000; 35%35% from 335, 001 -$10 mil. 38%38% from 10 M-18. 3 million; & a flat 35%35% over$18. 3 million. 1919 Disadvantages from the corporation’s point of view. A 1. Slow in decision making – must go thru chain of command.

Disadvantages of a Corporation Disadvantages from the stockholders point of view. 1. When stockholders earn a profit, they feel no great sense of pride. BB 2. Many government restrictions – must follow regulations of the SEC, comply with laws on merging and maintain many records. CC 3. Heavy organizing expenses – pay for its charter and then depending on the state, expenses can run from a few hundred to thousands of dollars. DD 4. Double taxation – when a company distributes profits (dividends) to its stockholders, they have to pay personal income tax on dividends in excess of $100. Corporations earnings are subject to taxation. The income tax on corporations is 1515 %% on the first $50, 000; 25%25% from $50, 001 — $75, 000; 3434 %% from $75, 001 -$100, 000; 39%39% from $100, 001 -$335, 000; 35%35% from 335, 001 -$10 mil. 38%38% from 10 M-18. 3 million; & a flat 35%35% over$18. 3 million. 1919 Disadvantages from the corporation’s point of view. A 1. Slow in decision making – must go thru chain of command.

Bull andand Bear Markets Then there is the kangaroo market.

Bull andand Bear Markets Then there is the kangaroo market.

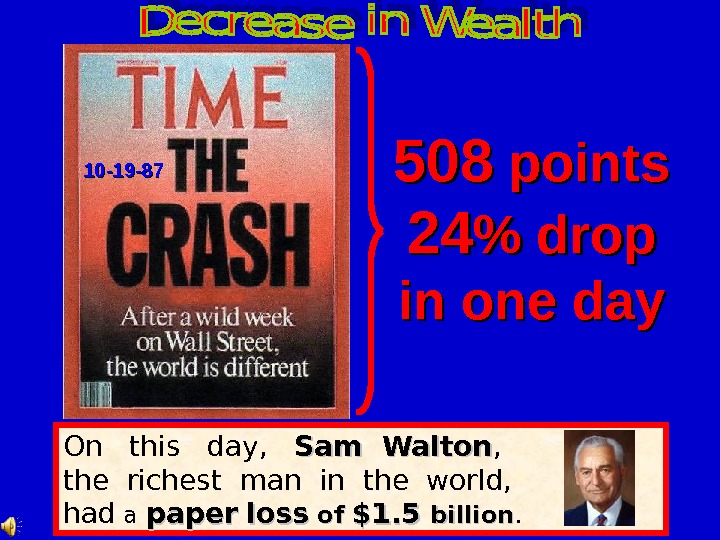

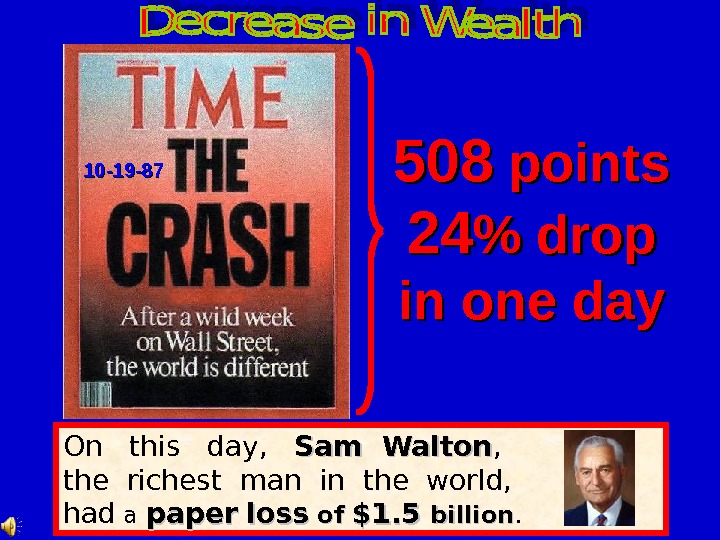

On this day, Sam Walton , the richest man in the world, had a paper loss of of $1. 5 billion. 508508 points 2424 % drop in one day 10 -19 —

On this day, Sam Walton , the richest man in the world, had a paper loss of of $1. 5 billion. 508508 points 2424 % drop in one day 10 -19 —

Date Decline % Decline 10/19/87 508 points 24% 10/28/29 38 points 13% 10/29/29 31 points 12% 11/26/29 26 points 10% 12/18/1899 6 points 8% 8/12/32 6 points 8% 3/14/07 7 points 8% 10/26/87 156 points 8% 7/21/33 8 points 8% 10/18/37 11 points 8% 2/01/17 7 points 7% 10/27/97 554 points 7% [$700 billion lost in one day] 4/14/2000 661 points 6% 6% 3/2000 -2/2003 $7. 7 trillion was lost [Market value was worth $17 trillion ]

Date Decline % Decline 10/19/87 508 points 24% 10/28/29 38 points 13% 10/29/29 31 points 12% 11/26/29 26 points 10% 12/18/1899 6 points 8% 8/12/32 6 points 8% 3/14/07 7 points 8% 10/26/87 156 points 8% 7/21/33 8 points 8% 10/18/37 11 points 8% 2/01/17 7 points 7% 10/27/97 554 points 7% [$700 billion lost in one day] 4/14/2000 661 points 6% 6% 3/2000 -2/2003 $7. 7 trillion was lost [Market value was worth $17 trillion ]

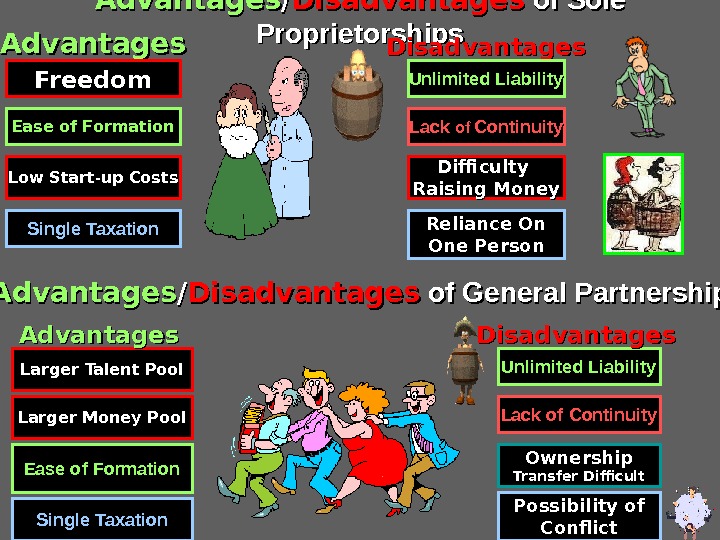

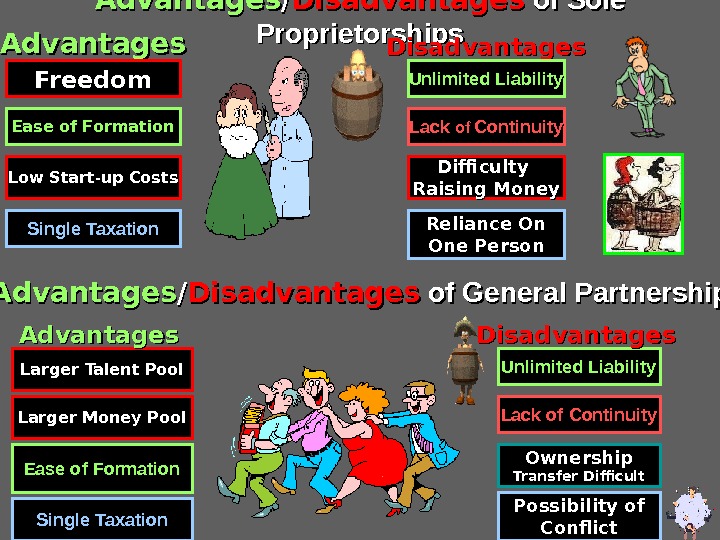

Advantages // Disadvantages of Sole Proprietorships Ease of Formation Single Taxation Unlimited Liability. Lack of of Continuity Lack of Continuity. Advantages Disadvantages Unlimited Liability Freedom Low Start — up Costs Difficulty Raising Money Reliance On One Person Ownership Transfer Difficult Possibility of Conflict. Larger Talent Pool Larger Money Pool Advantages // Disadvantages of General Partnership Advantages Disadvantages

Advantages // Disadvantages of Sole Proprietorships Ease of Formation Single Taxation Unlimited Liability. Lack of of Continuity Lack of Continuity. Advantages Disadvantages Unlimited Liability Freedom Low Start — up Costs Difficulty Raising Money Reliance On One Person Ownership Transfer Difficult Possibility of Conflict. Larger Talent Pool Larger Money Pool Advantages // Disadvantages of General Partnership Advantages Disadvantages

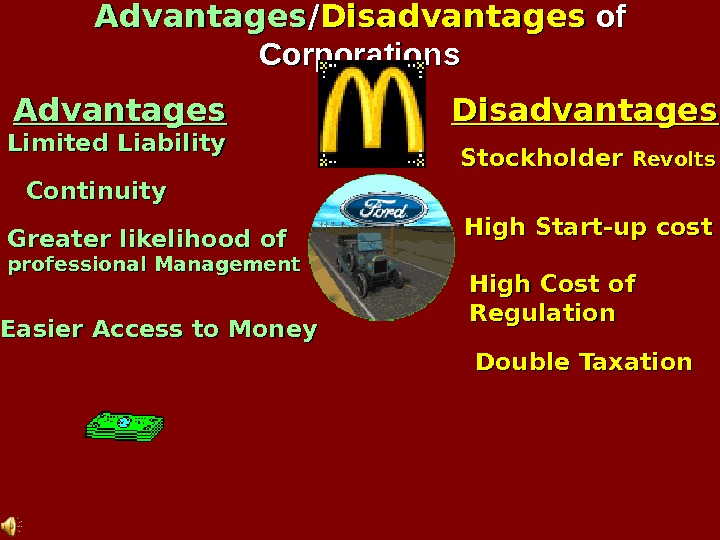

Advantages // Disadvantages of of Corporations Stockholder Revolts High Start-up cost High Cost of Regulation Double Taxation. Advantages Disadvantages Easier Access to Money Greater likelihood of professional Management Continuity. Limited Liability

Advantages // Disadvantages of of Corporations Stockholder Revolts High Start-up cost High Cost of Regulation Double Taxation. Advantages Disadvantages Easier Access to Money Greater likelihood of professional Management Continuity. Limited Liability

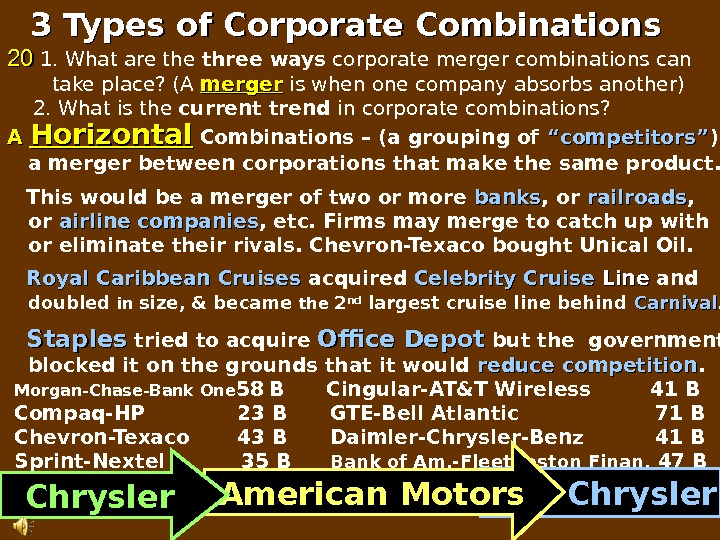

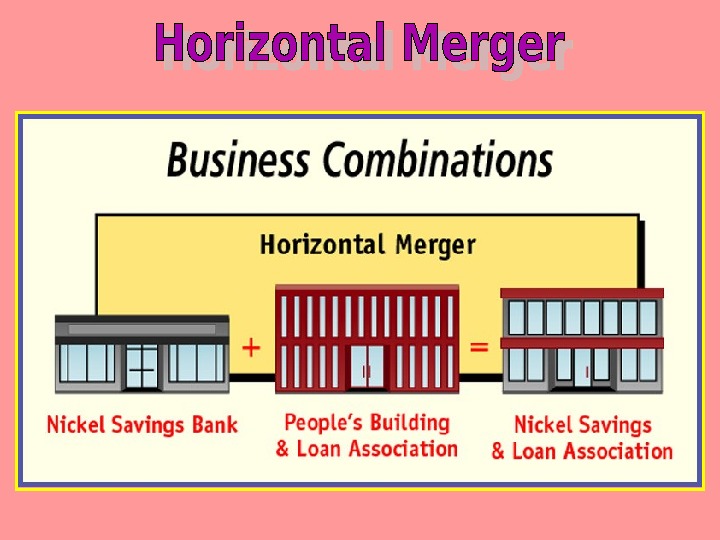

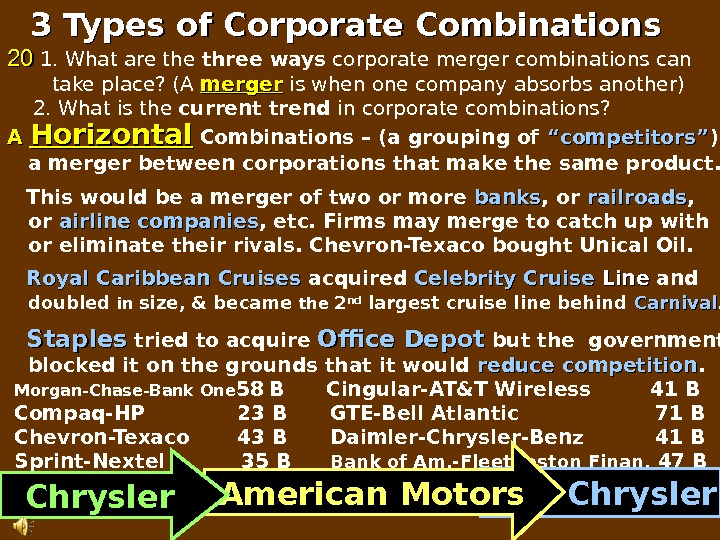

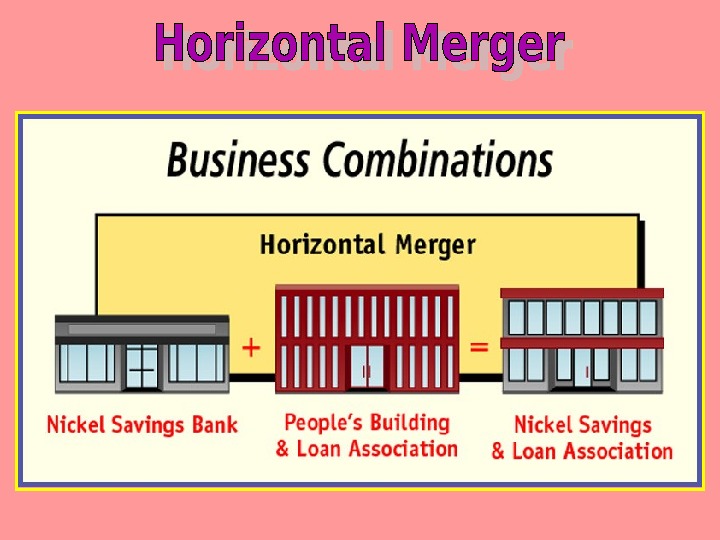

AA Horizontal Combinations – (a grouping of “competitors” ) a merger between corporations that make the same product. This would be a merger of two or more banks , or railroads , or airline companies , etc. Firms may merge to catch up with or eliminate their rivals. Chevron-Texaco bought Unical Oil. Royal Caribbean Cruises acquired Celebrity Cruise Line and doubled in size, & became the 2 nd largest cruise line behind Carnival. Staples tried to acquire Office Depot but the government blocked it on the grounds that it would reduce competition. Morgan-Chase-Bank One 58 B Cingular-AT&T Wireless 41 B Compaq-HP 23 B GTE-Bell Atlantic 71 B Chevron-Texaco 43 B Daimler-Chrysler-Benz 41 B Sprint-Nextel 35 B Bank of Am. -Fleet. Boston Finan. 47 B Chrysler American Motors Chrysler 3 Types of Corporate Combinations 2020 1. What are three ways corporate merger combinations can take place? (A merger is when one company absorbs another) 2. What is the current trend in corporate combinations?

AA Horizontal Combinations – (a grouping of “competitors” ) a merger between corporations that make the same product. This would be a merger of two or more banks , or railroads , or airline companies , etc. Firms may merge to catch up with or eliminate their rivals. Chevron-Texaco bought Unical Oil. Royal Caribbean Cruises acquired Celebrity Cruise Line and doubled in size, & became the 2 nd largest cruise line behind Carnival. Staples tried to acquire Office Depot but the government blocked it on the grounds that it would reduce competition. Morgan-Chase-Bank One 58 B Cingular-AT&T Wireless 41 B Compaq-HP 23 B GTE-Bell Atlantic 71 B Chevron-Texaco 43 B Daimler-Chrysler-Benz 41 B Sprint-Nextel 35 B Bank of Am. -Fleet. Boston Finan. 47 B Chrysler American Motors Chrysler 3 Types of Corporate Combinations 2020 1. What are three ways corporate merger combinations can take place? (A merger is when one company absorbs another) 2. What is the current trend in corporate combinations?

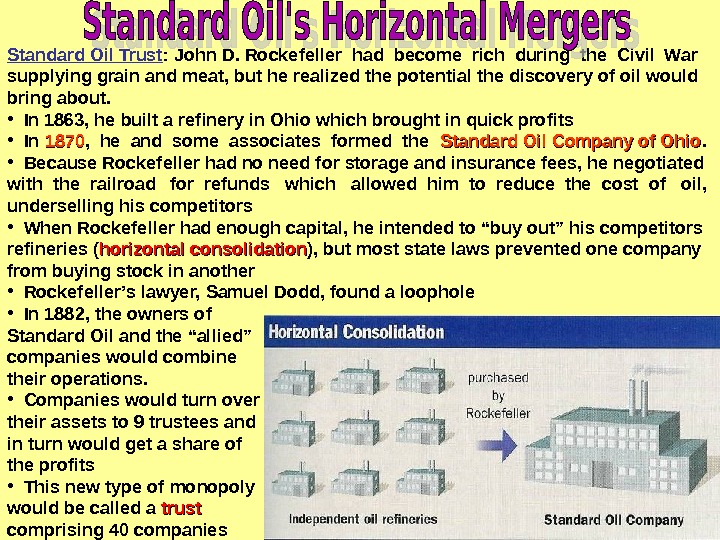

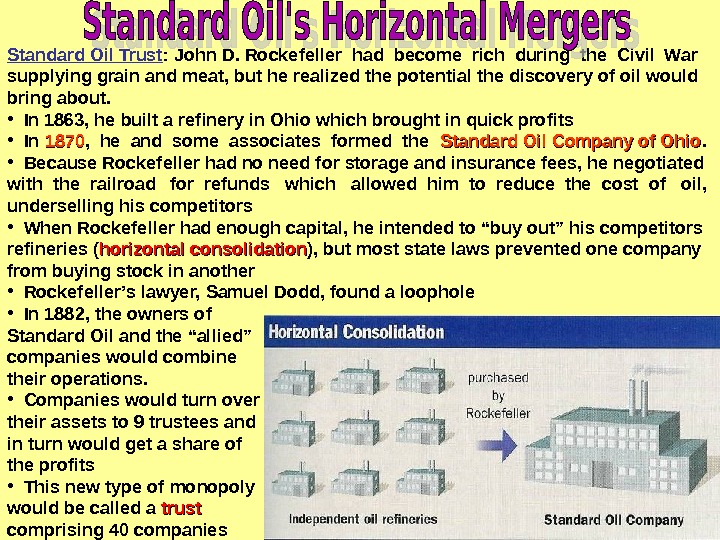

Standard Oil Trust : John D. Rockefeller had become rich during the Civil War supplying grain and meat, but he realized the potential the discovery of oil would bring about. • In 1863, he built a refinery in Ohio which brought in quick profits • In 1870 , he and some associates formed the Standard Oil Company of Ohio. • Because Rockefeller had no need for storage and insurance fees, he negotiated with the railroad for refunds which allowed him to reduce the cost of oil, underselling his competitors • When Rockefeller had enough capital, he intended to “buy out” his competitors refineries ( horizontal consolidation ), but most state laws prevented one company from buying stock in another • Rockefeller’s lawyer, Samuel Dodd, found a loophole • In 1882, the owners of Standard Oil and the “allied” companies would combine their operations. • Companies would turn over their assets to 9 trustees and in turn would get a share of the profits • This new type of monopoly would be called a trust comprising 40 companies

Standard Oil Trust : John D. Rockefeller had become rich during the Civil War supplying grain and meat, but he realized the potential the discovery of oil would bring about. • In 1863, he built a refinery in Ohio which brought in quick profits • In 1870 , he and some associates formed the Standard Oil Company of Ohio. • Because Rockefeller had no need for storage and insurance fees, he negotiated with the railroad for refunds which allowed him to reduce the cost of oil, underselling his competitors • When Rockefeller had enough capital, he intended to “buy out” his competitors refineries ( horizontal consolidation ), but most state laws prevented one company from buying stock in another • Rockefeller’s lawyer, Samuel Dodd, found a loophole • In 1882, the owners of Standard Oil and the “allied” companies would combine their operations. • Companies would turn over their assets to 9 trustees and in turn would get a share of the profits • This new type of monopoly would be called a trust comprising 40 companies

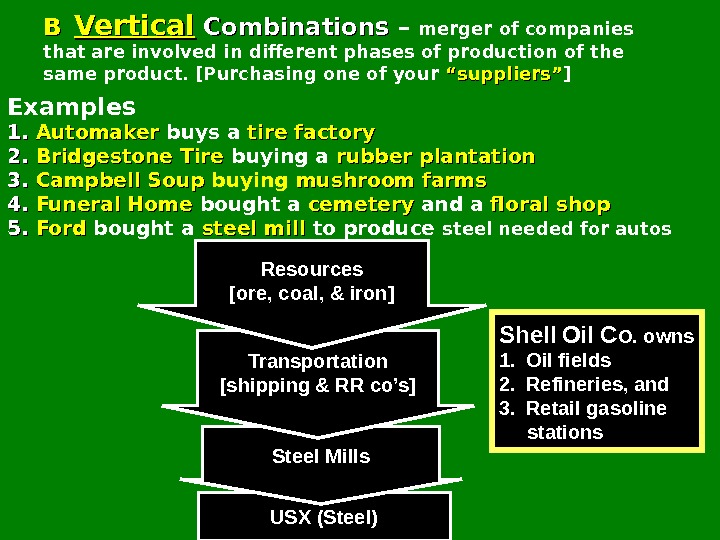

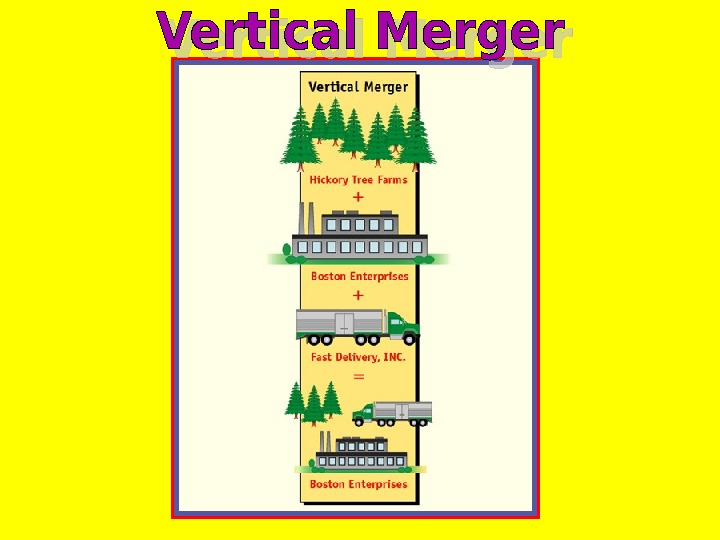

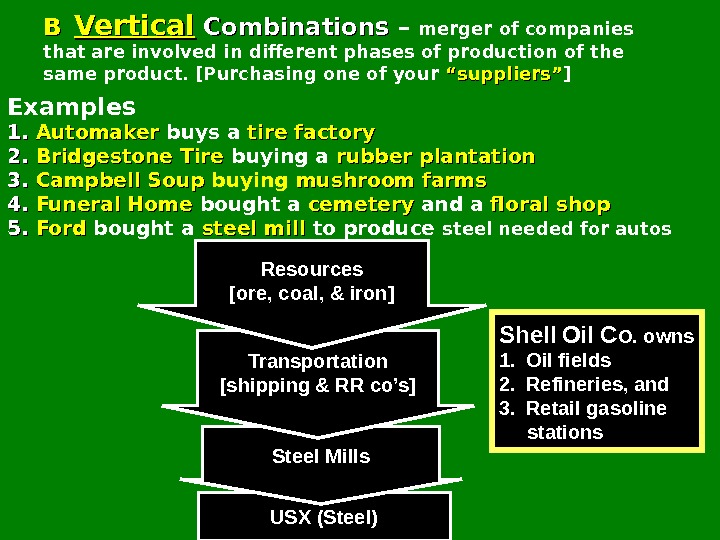

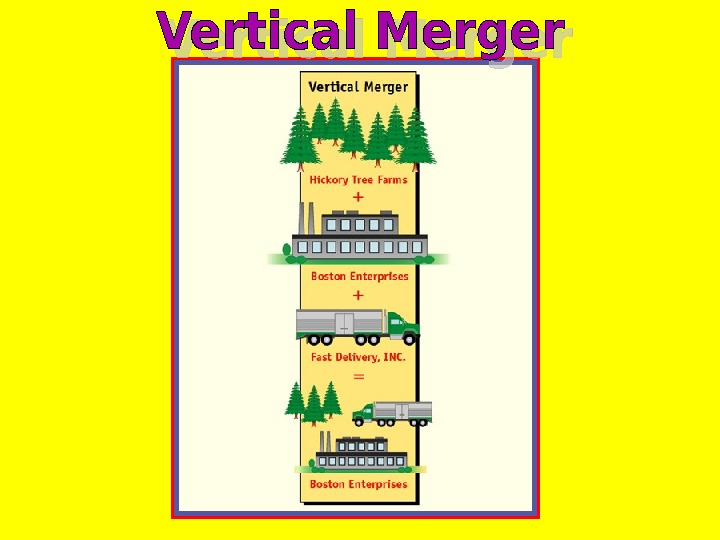

BB Vertical Combinations – merger of companies that are involved in different phases of production of the same product. [Purchasing one of your “suppliers” ] Examples 1. 1. Automaker buys a tire factory 2. 2. Bridgestone Tire buying a rubber plantation 3. 3. Campbell Soup buying mushroom farms 4. 4. Funeral Home bought a cemetery and a floral shop 5. 5. Ford bought a steel mill to produce steel needed for autos USX (Steel) Steel Mills. Transportation [shipping & RR co’s] Resources [ore, coal, & iron] Shell Oil Co. owns 1. Oil fields 2. Refineries, and 3. Retail gasoline stations

BB Vertical Combinations – merger of companies that are involved in different phases of production of the same product. [Purchasing one of your “suppliers” ] Examples 1. 1. Automaker buys a tire factory 2. 2. Bridgestone Tire buying a rubber plantation 3. 3. Campbell Soup buying mushroom farms 4. 4. Funeral Home bought a cemetery and a floral shop 5. 5. Ford bought a steel mill to produce steel needed for autos USX (Steel) Steel Mills. Transportation [shipping & RR co’s] Resources [ore, coal, & iron] Shell Oil Co. owns 1. Oil fields 2. Refineries, and 3. Retail gasoline stations

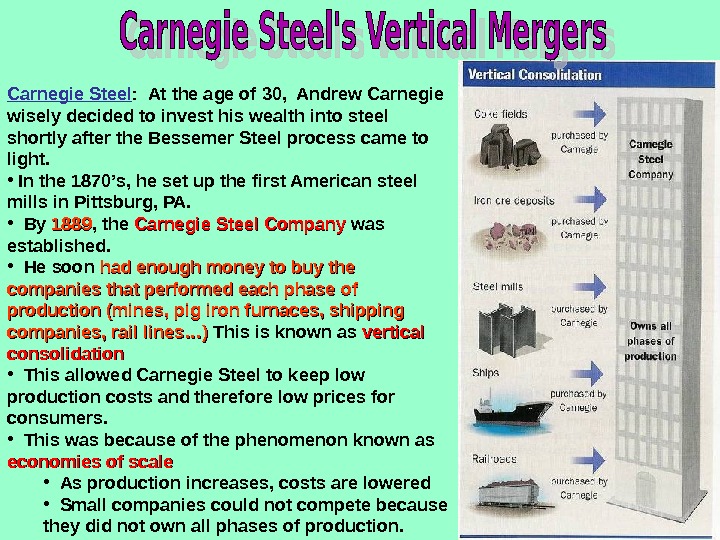

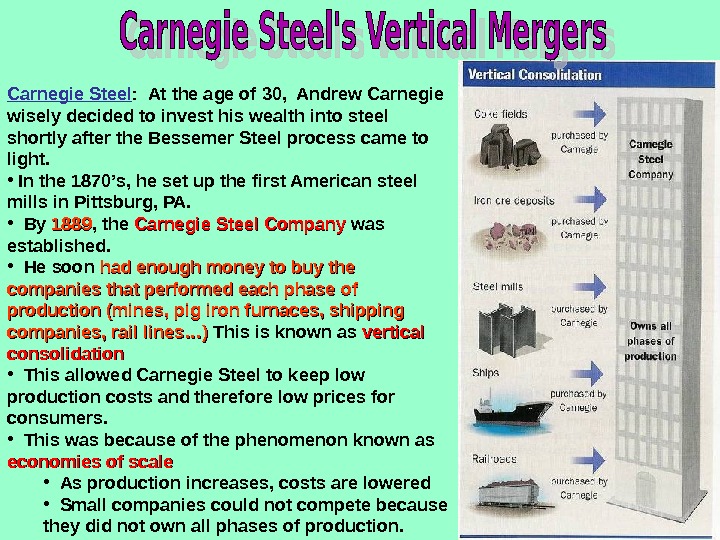

Carnegie Steel : At the age of 30, Andrew Carnegie wisely decided to invest his wealth into steel shortly after the Bessemer Steel process came to light. • In the 1870’s, he set up the first American steel mills in Pittsburg, PA. • By 1889 , the Carnegie Steel Company was established. • He soon had enough money to buy the companies that performed each phase of production (mines, pig iron furnaces, shipping companies, rail lines…) This is known as vertical consolidation • This allowed Carnegie Steel to keep low production costs and therefore low prices for consumers. • This was because of the phenomenon known as economies of scale • As production increases, costs are lowered • Small companies could not compete because they did not own all phases of production.

Carnegie Steel : At the age of 30, Andrew Carnegie wisely decided to invest his wealth into steel shortly after the Bessemer Steel process came to light. • In the 1870’s, he set up the first American steel mills in Pittsburg, PA. • By 1889 , the Carnegie Steel Company was established. • He soon had enough money to buy the companies that performed each phase of production (mines, pig iron furnaces, shipping companies, rail lines…) This is known as vertical consolidation • This allowed Carnegie Steel to keep low production costs and therefore low prices for consumers. • This was because of the phenomenon known as economies of scale • As production increases, costs are lowered • Small companies could not compete because they did not own all phases of production.

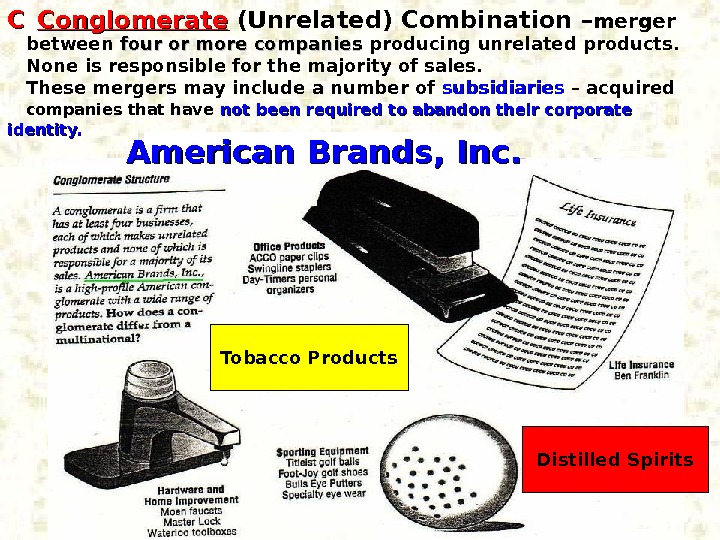

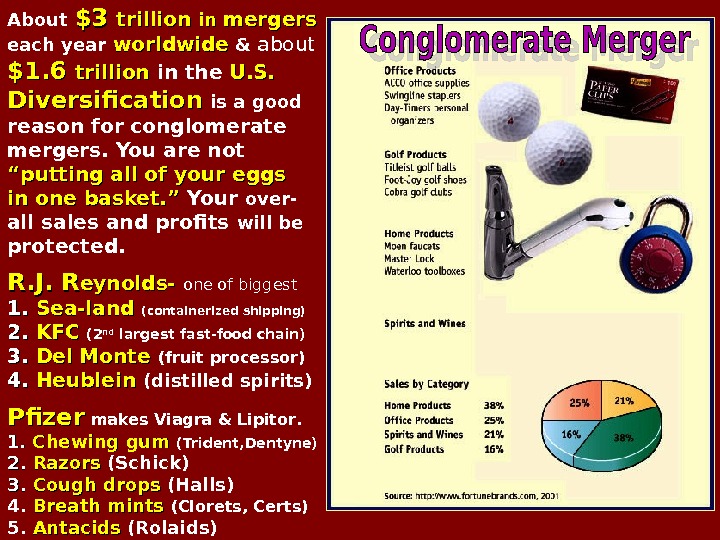

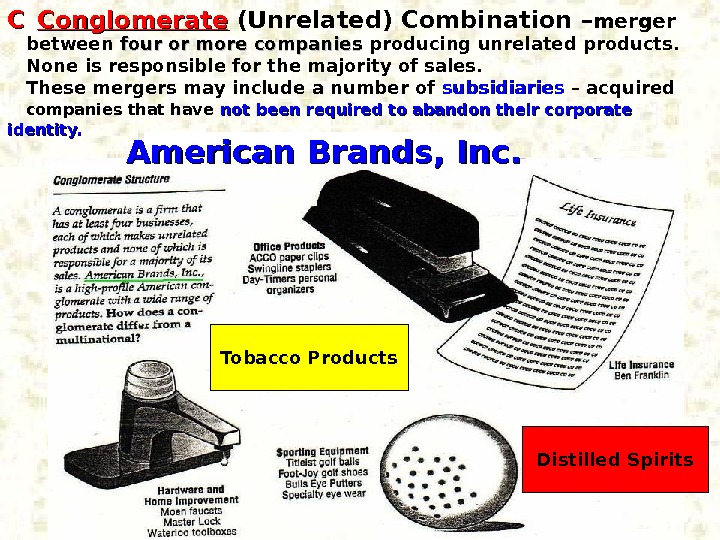

CC Conglomerate (Unrelated) Combination – merger between four or more companies producing unrelated products. None is responsible for the majority of sales. These mergers may include a number of subsidiaries – acquired companies that have not been required to abandon their corporate identity. Tobacco Products Distilled Spirits. American Brands, Inc.

CC Conglomerate (Unrelated) Combination – merger between four or more companies producing unrelated products. None is responsible for the majority of sales. These mergers may include a number of subsidiaries – acquired companies that have not been required to abandon their corporate identity. Tobacco Products Distilled Spirits. American Brands, Inc.

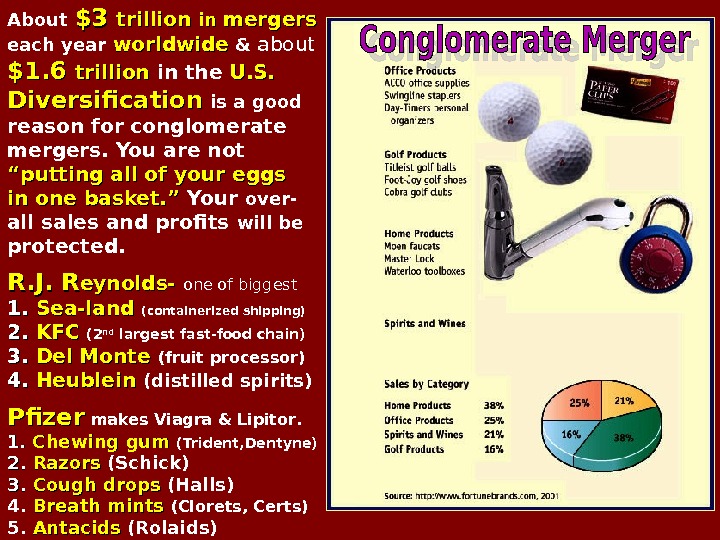

About $3 $3 trillion in in mergers each year worldwide & about $1. 6 trillion in the U. S. Diversification is a good reason for conglomerate mergers. You are not ““ putting all of your eggs in one basket. ” Your over- all sales and profits will be protected. R. J. R eynolds- one of biggest 1. 1. Sea-land (containerized shipping) 2. 2. KFCKFC (2 nd largest fast-food chain) 3. 3. Del Monte (fruit processor) 4. 4. Heublein (distilled spirits) Pfizer makes Viagra & Lipitor. 1. 1. Chewing gum (Trident, Dentyne) 2. 2. Razors (Schick) 3. 3. Cough drops (Halls) 4. Breath mints (Clorets, Certs) 5. Antacids (Rolaids)

About $3 $3 trillion in in mergers each year worldwide & about $1. 6 trillion in the U. S. Diversification is a good reason for conglomerate mergers. You are not ““ putting all of your eggs in one basket. ” Your over- all sales and profits will be protected. R. J. R eynolds- one of biggest 1. 1. Sea-land (containerized shipping) 2. 2. KFCKFC (2 nd largest fast-food chain) 3. 3. Del Monte (fruit processor) 4. 4. Heublein (distilled spirits) Pfizer makes Viagra & Lipitor. 1. 1. Chewing gum (Trident, Dentyne) 2. 2. Razors (Schick) 3. 3. Cough drops (Halls) 4. Breath mints (Clorets, Certs) 5. Antacids (Rolaids)

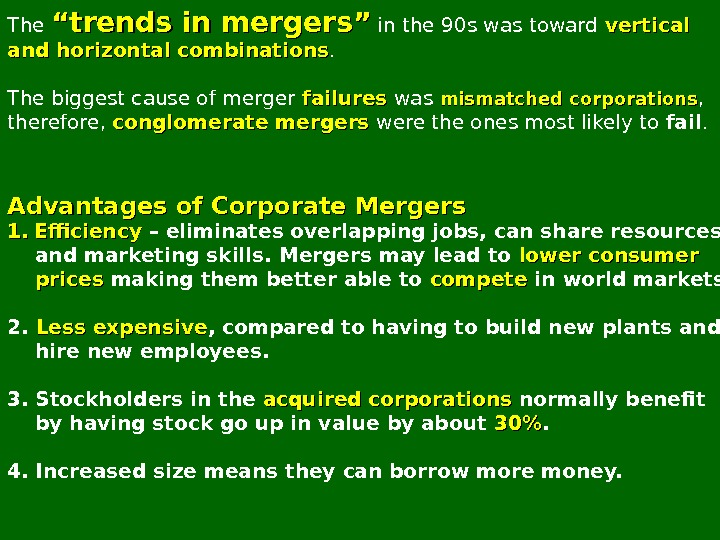

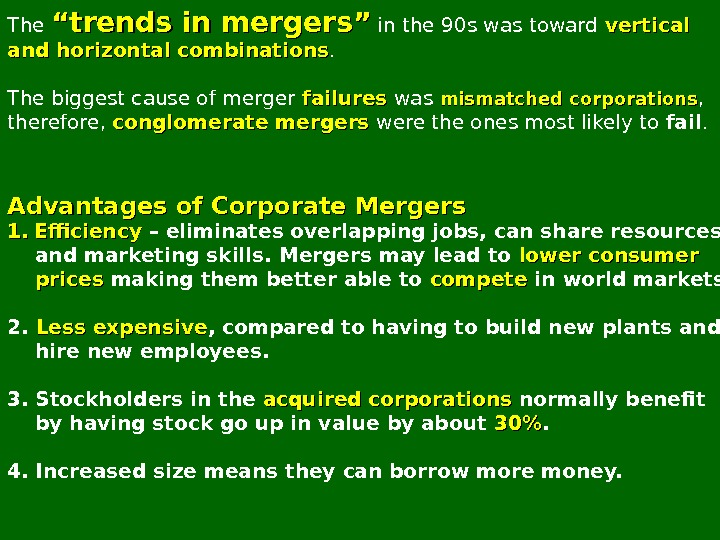

The ““ trends in mergers ”” in the 90 s was toward vertical and horizontal combinations. The biggest cause of merger failures was mismatched corporations , therefore, conglomerate mergers were the ones most likely to fail. Advantages of Corporate Mergers 1. 1. Efficiency – eliminates overlapping jobs, can share resources and marketing skills. Mergers may lead to lower consumer prices making them better able to compete in world markets. 2. Less expensive , compared to having to build new plants and hire new employees. 3. Stockholders in the acquired corporations normally benefit by having stock go up in value by about 30%30%. 4. Increased size means they can borrow more money.

The ““ trends in mergers ”” in the 90 s was toward vertical and horizontal combinations. The biggest cause of merger failures was mismatched corporations , therefore, conglomerate mergers were the ones most likely to fail. Advantages of Corporate Mergers 1. 1. Efficiency – eliminates overlapping jobs, can share resources and marketing skills. Mergers may lead to lower consumer prices making them better able to compete in world markets. 2. Less expensive , compared to having to build new plants and hire new employees. 3. Stockholders in the acquired corporations normally benefit by having stock go up in value by about 30%30%. 4. Increased size means they can borrow more money.

1. 1. Managers of merged corporations may not have the necessary supervisory skills. 2. Added unemployment when some positions are eliminated. 12, 500 were laid off in Fleet Boston- Bank of America merger saving $650 M. When Cingular bought AT&T Wireless , 10, 000 were laid off. 3. Purchasing corporation’s stock normally declines. 4. Higher prices and fewer choices for consumers. 5. Acquiring corporation normally goes into debt.

1. 1. Managers of merged corporations may not have the necessary supervisory skills. 2. Added unemployment when some positions are eliminated. 12, 500 were laid off in Fleet Boston- Bank of America merger saving $650 M. When Cingular bought AT&T Wireless , 10, 000 were laid off. 3. Purchasing corporation’s stock normally declines. 4. Higher prices and fewer choices for consumers. 5. Acquiring corporation normally goes into debt.

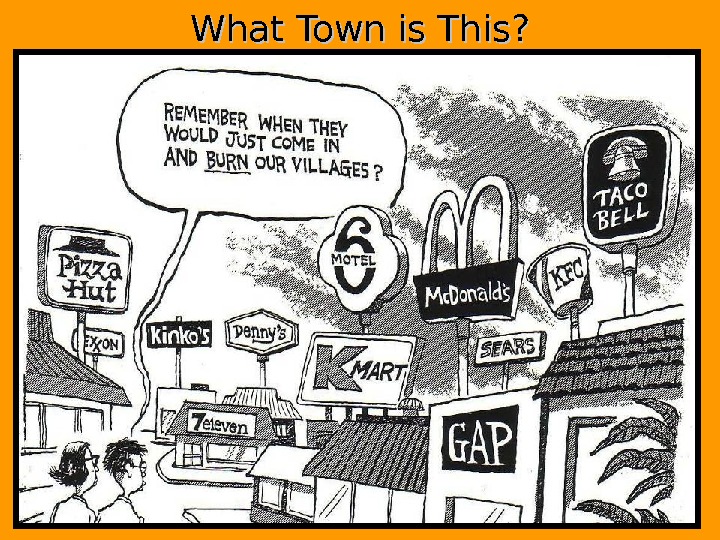

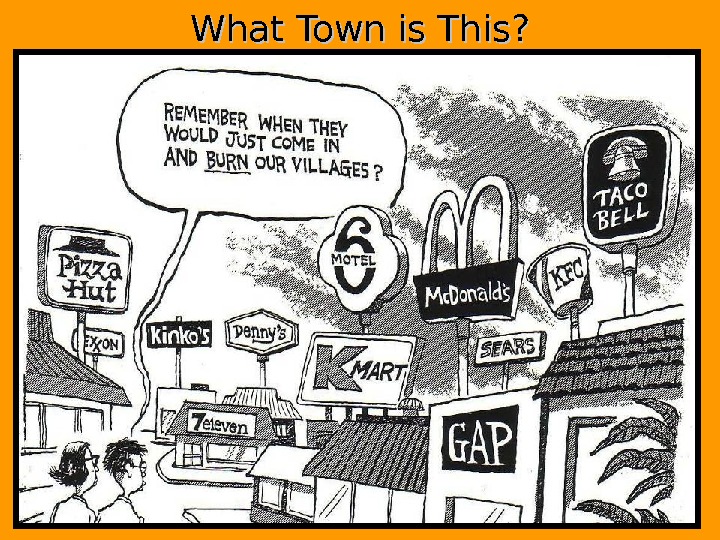

What Town is This?

What Town is This?

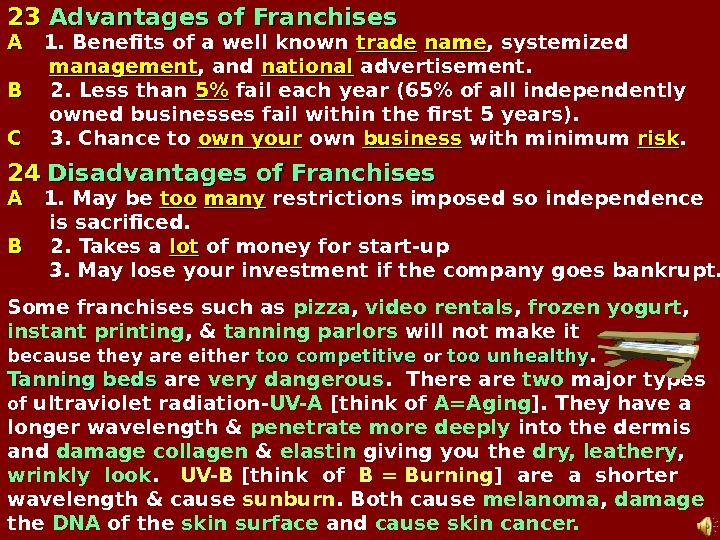

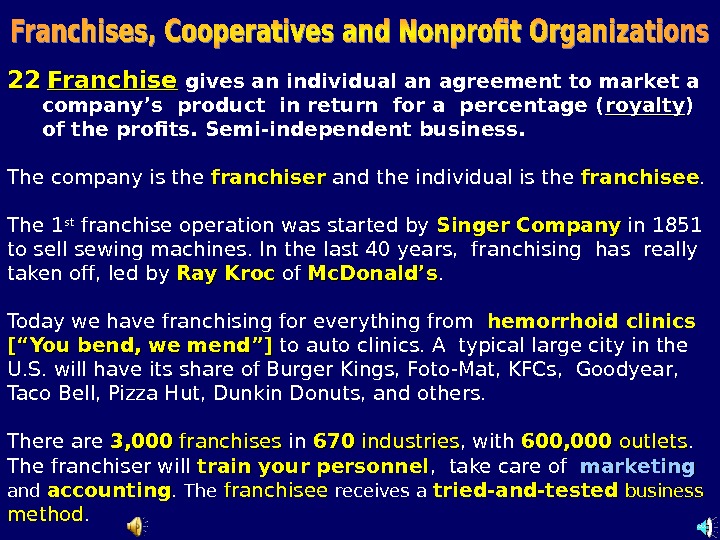

2222 Franchise gives an individual an agreement to market a company’s product in return for a percentage ( royalty ) of the profits. Semi-independent business. The company is the franchiser and the individual is the franchisee. The 1 st franchise operation was started by Singer Company in 1851 to sell sewing machines. In the last 40 years, franchising has really taken off, led by Ray Kroc of Mc. Donald’s. Today we have franchising for everything from hemorrhoid clinics [“You bend, we mend”] to auto clinics. A typical large city in the U. S. will have its share of Burger Kings, Foto-Mat, KFCs, Goodyear, Taco Bell, Pizza Hut, Dunkin Donuts, and others. There are 3, 000 franchises in 670670 industries , with 600, 000 outlets. The franchiser will train your personnel , take care of marketing and accounting. The franchisee receives a tried-and-tested business method.

2222 Franchise gives an individual an agreement to market a company’s product in return for a percentage ( royalty ) of the profits. Semi-independent business. The company is the franchiser and the individual is the franchisee. The 1 st franchise operation was started by Singer Company in 1851 to sell sewing machines. In the last 40 years, franchising has really taken off, led by Ray Kroc of Mc. Donald’s. Today we have franchising for everything from hemorrhoid clinics [“You bend, we mend”] to auto clinics. A typical large city in the U. S. will have its share of Burger Kings, Foto-Mat, KFCs, Goodyear, Taco Bell, Pizza Hut, Dunkin Donuts, and others. There are 3, 000 franchises in 670670 industries , with 600, 000 outlets. The franchiser will train your personnel , take care of marketing and accounting. The franchisee receives a tried-and-tested business method.

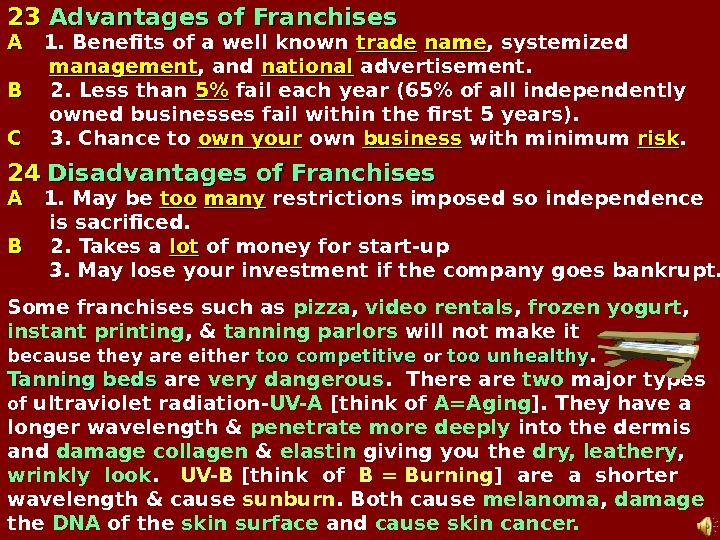

2323 Advantages of Franchises AA 1. Benefits of a well known trade name , systemized management , and national advertisement. BB 2. Less than 5%5% fail each year (65% of all independently owned businesses fail within the first 5 years). CC 3. Chance to own your own business with minimum risk. 2424 Disadvantages of Franchises AA 1. May be tootoo many restrictions imposed so independence is sacrificed. BB 2. Takes a lotlot of money for start-up 3. May lose your investment if the company goes bankrupt. Some franchises such as pizza , video rentals , frozen yogurt , instant printing , & tanning parlors will not make it because they are either too competitive or too unhealthy. Tanning beds are very dangerous. There are two major types of ultraviolet radiation- UV-A [think of A=Aging ]. They have a longer wavelength & penetrate more deeply into the dermis and damage collagen & elastin giving you the dry, leathery , wrinkly look. UV-B [think of B = Burning ] are a shorter wavelength & cause sunburn. Both cause melanoma , damage the DNA of the skin surface and cause skin cancer.

2323 Advantages of Franchises AA 1. Benefits of a well known trade name , systemized management , and national advertisement. BB 2. Less than 5%5% fail each year (65% of all independently owned businesses fail within the first 5 years). CC 3. Chance to own your own business with minimum risk. 2424 Disadvantages of Franchises AA 1. May be tootoo many restrictions imposed so independence is sacrificed. BB 2. Takes a lotlot of money for start-up 3. May lose your investment if the company goes bankrupt. Some franchises such as pizza , video rentals , frozen yogurt , instant printing , & tanning parlors will not make it because they are either too competitive or too unhealthy. Tanning beds are very dangerous. There are two major types of ultraviolet radiation- UV-A [think of A=Aging ]. They have a longer wavelength & penetrate more deeply into the dermis and damage collagen & elastin giving you the dry, leathery , wrinkly look. UV-B [think of B = Burning ] are a shorter wavelength & cause sunburn. Both cause melanoma , damage the DNA of the skin surface and cause skin cancer.

2525 Cooperatives – voluntary association of people formed to carry on some kind of economic activity benefiting members. Different Types of Cooperatives: 1. Producer Coop – group of farmers who join to get better prices for their goods. They eliminate the middle-man charges. 2. Housing Coop – formed by members to buy the building they live in. 3. Purchasing Coop – retail store owned and operated by its customers. 4. Credit Union – members pool their savings so they can borrow from it at lower rates (the most common form of coop ) 5. Service Coop – provides service to its members (electrical or telephone) 6. Baby-Sitting Coop – families swap baby-sitting duties without ever exchanging money. 2626 Nonprofit Organizations – provides products without making a profit. Churches are the most common. (Boy Scouts, Y. M. C. A. , Salvation Army, & Goodwill)

2525 Cooperatives – voluntary association of people formed to carry on some kind of economic activity benefiting members. Different Types of Cooperatives: 1. Producer Coop – group of farmers who join to get better prices for their goods. They eliminate the middle-man charges. 2. Housing Coop – formed by members to buy the building they live in. 3. Purchasing Coop – retail store owned and operated by its customers. 4. Credit Union – members pool their savings so they can borrow from it at lower rates (the most common form of coop ) 5. Service Coop – provides service to its members (electrical or telephone) 6. Baby-Sitting Coop – families swap baby-sitting duties without ever exchanging money. 2626 Nonprofit Organizations – provides products without making a profit. Churches are the most common. (Boy Scouts, Y. M. C. A. , Salvation Army, & Goodwill)