ad795ea10b0f9ec2b7d585418147e163.ppt

- Количество слайдов: 40

Section 538 Guaranteed Rural Rental Housing Program (GRRHP) Introduction

Section 538 Guaranteed Rural Rental Housing Program (GRRHP) Introduction

The Notice

The Notice

Facts about the Notice A Notice provides the public with information on: • proposal prerequisites, application requirements and submission deadlines; • the availability of funding (if known); • priorities for the selection of proposed projects; • ranking and scoring of priority criteria; and • lender eligibility and approval requirements.

Facts about the Notice A Notice provides the public with information on: • proposal prerequisites, application requirements and submission deadlines; • the availability of funding (if known); • priorities for the selection of proposed projects; • ranking and scoring of priority criteria; and • lender eligibility and approval requirements.

The GRRHP Pre-Application

The GRRHP Pre-Application

Contents of a GRRHP Pre-Application www. rurdev. usda. gov/regs/hblist. html#hbw 6 HB-1 -3565, Chapter 4, section 4. 4 • Descriptive information on the project • Proposed financing • Proposed borrower

Contents of a GRRHP Pre-Application www. rurdev. usda. gov/regs/hblist. html#hbw 6 HB-1 -3565, Chapter 4, section 4. 4 • Descriptive information on the project • Proposed financing • Proposed borrower

Description of Proposed Project • Location in town, county, state and congressional district • Evidence of site control or purchase option • Type of construction, lot size, number of units, building type, and improvements • Environmental issues • Amount of loan to be guaranteed • Development schedule • Type of project (e. g. elderly, family) • Development cost • Rent structure and area median income

Description of Proposed Project • Location in town, county, state and congressional district • Evidence of site control or purchase option • Type of construction, lot size, number of units, building type, and improvements • Environmental issues • Amount of loan to be guaranteed • Development schedule • Type of project (e. g. elderly, family) • Development cost • Rent structure and area median income

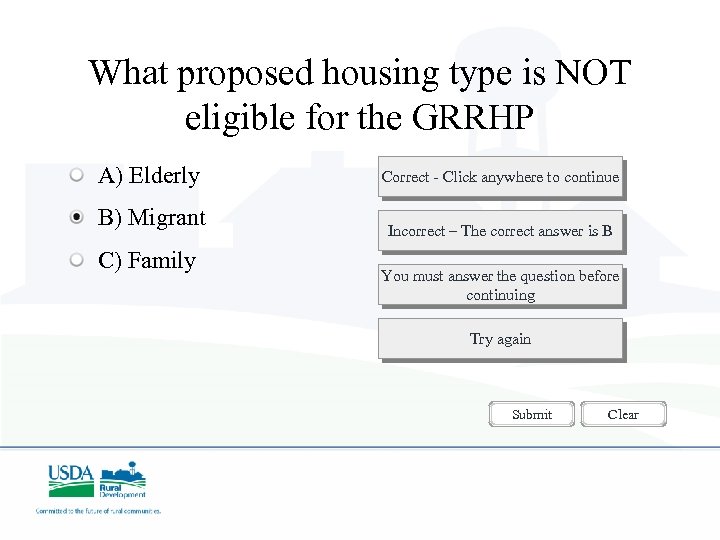

Important Elements to Determine Eligibility from Project Description • Location in an eligible rural area • Tenant rents are equal to or less than 30% of 115% of area median income • Proposed housing is not transient in nature (e. g. student, migrant or homeless shelters) • Evidence of Site Control

Important Elements to Determine Eligibility from Project Description • Location in an eligible rural area • Tenant rents are equal to or less than 30% of 115% of area median income • Proposed housing is not transient in nature (e. g. student, migrant or homeless shelters) • Evidence of Site Control

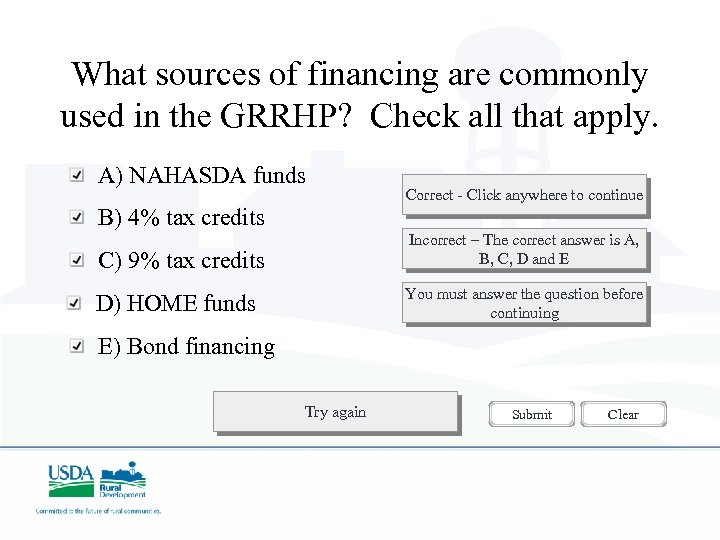

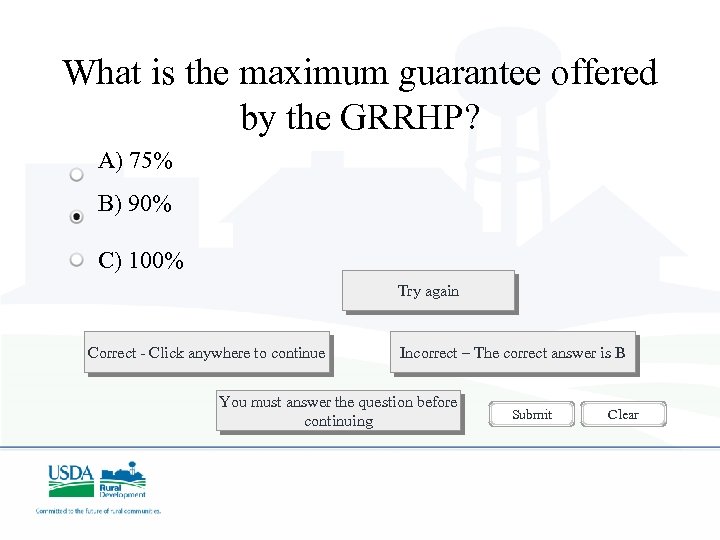

Proposed Financing • Loan amount, amount of borrower’s equity and source • • Sources and uses of funds (include rates and terms for sources) (e. g. 4% or 9% tax credits, bonds, HOME funds, NAHASDA funds) Proposed Agency guarantee percentage for guaranteed loan (cannot be greater than 90% of loan amount) • Collateral for security (first position on the mortgage) • Total cost and cost/unit information • • Loan to development cost ratio for guaranteed loan Interest credit request with maximum basis points to be charged above the Applicable Federal Rate (AFR) on the day of closing on the first $1. 5 M of the loan amount.

Proposed Financing • Loan amount, amount of borrower’s equity and source • • Sources and uses of funds (include rates and terms for sources) (e. g. 4% or 9% tax credits, bonds, HOME funds, NAHASDA funds) Proposed Agency guarantee percentage for guaranteed loan (cannot be greater than 90% of loan amount) • Collateral for security (first position on the mortgage) • Total cost and cost/unit information • • Loan to development cost ratio for guaranteed loan Interest credit request with maximum basis points to be charged above the Applicable Federal Rate (AFR) on the day of closing on the first $1. 5 M of the loan amount.

Important Elements to Determine Eligibility from Project Financing Information • Borrower’s equity is at least 10% of loan amount for-profit entities and 3% of loan amount for non-profit entities. • The GRRHP has a first position lien on the property. • The percent guarantee requested is less than or equal to 90%.

Important Elements to Determine Eligibility from Project Financing Information • Borrower’s equity is at least 10% of loan amount for-profit entities and 3% of loan amount for non-profit entities. • The GRRHP has a first position lien on the property. • The percent guarantee requested is less than or equal to 90%.

Proposed Borrower • Name of borrower and type of ownership entity (list partners or officers of LLC) • Borrower’s contact name and information • Evidence that borrower and principals of ownership entity are not barred or delinquent on any Federal debt • Borrower’s unaudited or audited financial statements • Statement of borrower’s housing development experience

Proposed Borrower • Name of borrower and type of ownership entity (list partners or officers of LLC) • Borrower’s contact name and information • Evidence that borrower and principals of ownership entity are not barred or delinquent on any Federal debt • Borrower’s unaudited or audited financial statements • Statement of borrower’s housing development experience

Important Elements to Determine Eligibility of Proposed Borrower • Is the borrower or any of its principals delinquent on Federal debt or debarred? • Do the borrower’s audited or unaudited financial statements demonstrate the financial capacity to undertake the proposed project? • Does the borrower have multi-family housing experience? Are the borrower’s other properties performing well? • Is the borrower a legal entity?

Important Elements to Determine Eligibility of Proposed Borrower • Is the borrower or any of its principals delinquent on Federal debt or debarred? • Do the borrower’s audited or unaudited financial statements demonstrate the financial capacity to undertake the proposed project? • Does the borrower have multi-family housing experience? Are the borrower’s other properties performing well? • Is the borrower a legal entity?

Click here to view a Sample Pre-Application Enter the Pre-Application in the Guaranteed Loan System (GLS) once you receive it from the lender

Click here to view a Sample Pre-Application Enter the Pre-Application in the Guaranteed Loan System (GLS) once you receive it from the lender

Once you determine the GRRHP Pre-Application is eligible for a GRRHP guarantee, what’s next? Step 1: Verify Lender Eligibility and Approval

Once you determine the GRRHP Pre-Application is eligible for a GRRHP guarantee, what’s next? Step 1: Verify Lender Eligibility and Approval

Step 1: Verify Lender Eligibility and Approval Verify the lender’s eligibility to participate in the program. Click here to view a List of Eligible and Approved Lenders. • Approved lenders have at least one Loan Note Guarantee and an executed Lender’s Agreement. • Eligible lenders have been reviewed and deemed eligible for participation. These lenders become approved when a Lender’s Agreement is executed and the first Loan Note Guarantee is issued.

Step 1: Verify Lender Eligibility and Approval Verify the lender’s eligibility to participate in the program. Click here to view a List of Eligible and Approved Lenders. • Approved lenders have at least one Loan Note Guarantee and an executed Lender’s Agreement. • Eligible lenders have been reviewed and deemed eligible for participation. These lenders become approved when a Lender’s Agreement is executed and the first Loan Note Guarantee is issued.

Step 1: Verify Lender Eligibility and Approval Continuation • If you receive a pre-application that is deemed eligible for the Section 538 program from a lender who is NOT an eligible Section 538 lender, contact the lender for the submission of a lender application. • Refer the lender to regulation 7 CFR 3565 subpart C, the Notice and Chapter 2, section 1 of the GRRHP handbook for lender application requirements. • Follow-up with the National Office to verify the issuance of lender approval after 30 days.

Step 1: Verify Lender Eligibility and Approval Continuation • If you receive a pre-application that is deemed eligible for the Section 538 program from a lender who is NOT an eligible Section 538 lender, contact the lender for the submission of a lender application. • Refer the lender to regulation 7 CFR 3565 subpart C, the Notice and Chapter 2, section 1 of the GRRHP handbook for lender application requirements. • Follow-up with the National Office to verify the issuance of lender approval after 30 days.

Step 2: Issue Lender Notice to Proceed with GRRHP Application • If the lender is eligible and the pre-application meets program requirements, send the lender a letter to proceed with the submission of the GRRHP application for the proposed project. • Click here to view a Sample Notice to Proceed with a GRRHP Application

Step 2: Issue Lender Notice to Proceed with GRRHP Application • If the lender is eligible and the pre-application meets program requirements, send the lender a letter to proceed with the submission of the GRRHP application for the proposed project. • Click here to view a Sample Notice to Proceed with a GRRHP Application

Test your knowledge of Pre-Application Processing

Test your knowledge of Pre-Application Processing

What proposed housing type is NOT eligible for the GRRHP A) Elderly B) Migrant C) Family Correct - Click anywhere to continue Incorrect – The correct answer is B You must answer the question before continuing Try again Submit Clear

What proposed housing type is NOT eligible for the GRRHP A) Elderly B) Migrant C) Family Correct - Click anywhere to continue Incorrect – The correct answer is B You must answer the question before continuing Try again Submit Clear

What sources of financing are commonly used in the GRRHP? Check all that apply. A) NAHASDA funds B) 4% tax credits Correct - Click anywhere to continue C) 9% tax credits Incorrect – The correct answer is A, B, C, D and E D) HOME funds You must answer the question before continuing E) Bond financing Try again Submit Clear

What sources of financing are commonly used in the GRRHP? Check all that apply. A) NAHASDA funds B) 4% tax credits Correct - Click anywhere to continue C) 9% tax credits Incorrect – The correct answer is A, B, C, D and E D) HOME funds You must answer the question before continuing E) Bond financing Try again Submit Clear

What is the maximum guarantee offered by the GRRHP? A) 75% B) 90% C) 100% Try again Correct - Click anywhere to continue Incorrect – The correct answer is B You must answer the question before continuing Submit Clear

What is the maximum guarantee offered by the GRRHP? A) 75% B) 90% C) 100% Try again Correct - Click anywhere to continue Incorrect – The correct answer is B You must answer the question before continuing Submit Clear

If a lender requests interest credit subsidy for the project, what information must be provided with the request? A) The borrower’s bank account information. B) The maximum basis points above the AFR on the day of closing that the lender will charge the borrower for the loan. C) The interest rate that will be charged on the loan. Correct - Click anywhere to continue Try again Incorrect – The correct answer is B You must answer the question before continuing Submit Clear

If a lender requests interest credit subsidy for the project, what information must be provided with the request? A) The borrower’s bank account information. B) The maximum basis points above the AFR on the day of closing that the lender will charge the borrower for the loan. C) The interest rate that will be charged on the loan. Correct - Click anywhere to continue Try again Incorrect – The correct answer is B You must answer the question before continuing Submit Clear

Check one of the statements below that is true for an approved lender but NOT true for an eligible lender? A) The lender has submitted a lender application for approval. B) The lender has been favorably reviewed. C) The lender has been issued a Loan Note Guarantee and an executed Lender’s Agreement. Correct - Click anywhere to continue Try again Incorrect – The correct answer is C You must answer the question before continuing Submit Clear

Check one of the statements below that is true for an approved lender but NOT true for an eligible lender? A) The lender has submitted a lender application for approval. B) The lender has been favorably reviewed. C) The lender has been issued a Loan Note Guarantee and an executed Lender’s Agreement. Correct - Click anywhere to continue Try again Incorrect – The correct answer is C You must answer the question before continuing Submit Clear

True or false. You can verify lender eligibility for participation in the GRRHP in…(select only true answers) A) True/False - the daily issue of the Wall Street Journal. B) True/False – a duly executed Lender’s Agreement. C) True/False – the GRRHP Lender’s List. D) True/False - the IRS website. Correct - Click anywhere to continue Try again Incorrect – The correct answer is C You must answer the question before continuing Submit Clear

True or false. You can verify lender eligibility for participation in the GRRHP in…(select only true answers) A) True/False - the daily issue of the Wall Street Journal. B) True/False – a duly executed Lender’s Agreement. C) True/False – the GRRHP Lender’s List. D) True/False - the IRS website. Correct - Click anywhere to continue Try again Incorrect – The correct answer is C You must answer the question before continuing Submit Clear

Congratulations! You are ready to process a GRRHP Pre -Application.

Congratulations! You are ready to process a GRRHP Pre -Application.

The GRRHP Application

The GRRHP Application

Contents of the GRRHP Application Section 538 GRRHP Application Checklist Chapter 4, Attachment 4 -C at www. rurdev. usda. gov/regs/hblist. html#hbw 6 • Agency Forms • Borrower’s Information • Project Information • Lender’s Narrative, Supporting Documentation and Certifications

Contents of the GRRHP Application Section 538 GRRHP Application Checklist Chapter 4, Attachment 4 -C at www. rurdev. usda. gov/regs/hblist. html#hbw 6 • Agency Forms • Borrower’s Information • Project Information • Lender’s Narrative, Supporting Documentation and Certifications

GRRHP Application - Agency Forms • • Form RD 3565 -1, Application for Loan Guarantee Form RD 1940 -20, Request for Environmental Information HB-1 -3565, Attachment 4 -G, Housing Allowances for Utilities and Other Public Services Form RD 1944 -37, Previous Participation Certification Form RD 1944 -30, Identity of Interest Disclosure Certificate RD Instruction 1940 -Q Exhibit A-2, Statement for Loan Guarantees Form HUD 9832, Management Entity Profile Form FEMA Form 81 -93, Standard Flood Hazard Determination • • • Form RD 1944 -31, Identity of Interest Qualification Form RD 1910 -11, Applicant Certification, Federal Collection Policies for Consumer or Commercial Debts Form HUD 935. 2, Affirmative Fair Housing Marketing Plan Form AD 1047, Certification Regarding Debarment Suspension Form AD 1048, Certification Regarding Debarment, Suspension, Ineligibility and Voluntary Exclusion - Lower Tier-Covered Transactions Form RD 1924 -13, Estimate and Certificate of Actual Cost

GRRHP Application - Agency Forms • • Form RD 3565 -1, Application for Loan Guarantee Form RD 1940 -20, Request for Environmental Information HB-1 -3565, Attachment 4 -G, Housing Allowances for Utilities and Other Public Services Form RD 1944 -37, Previous Participation Certification Form RD 1944 -30, Identity of Interest Disclosure Certificate RD Instruction 1940 -Q Exhibit A-2, Statement for Loan Guarantees Form HUD 9832, Management Entity Profile Form FEMA Form 81 -93, Standard Flood Hazard Determination • • • Form RD 1944 -31, Identity of Interest Qualification Form RD 1910 -11, Applicant Certification, Federal Collection Policies for Consumer or Commercial Debts Form HUD 935. 2, Affirmative Fair Housing Marketing Plan Form AD 1047, Certification Regarding Debarment Suspension Form AD 1048, Certification Regarding Debarment, Suspension, Ineligibility and Voluntary Exclusion - Lower Tier-Covered Transactions Form RD 1924 -13, Estimate and Certificate of Actual Cost

Agency Forms Required Prior to Obligation • Form RD 3565 -1, Application for Loan Guarantee • Form RD 1940 -20, Request for Environmental Information • Form RD 1944 -37, Previous Participation Certification • Form RD 1944 -30, Identity of Interest Disclosure Certificate • Form RD 1944 -31, Identity of Interest Qualification • Form AD 1047, Certification Regarding Debarment Suspension • Form AD 1048, Certification Regarding Debarment, Suspension, Ineligibility and Voluntary Exclusion - Lower Tier-Covered Transactions

Agency Forms Required Prior to Obligation • Form RD 3565 -1, Application for Loan Guarantee • Form RD 1940 -20, Request for Environmental Information • Form RD 1944 -37, Previous Participation Certification • Form RD 1944 -30, Identity of Interest Disclosure Certificate • Form RD 1944 -31, Identity of Interest Qualification • Form AD 1047, Certification Regarding Debarment Suspension • Form AD 1048, Certification Regarding Debarment, Suspension, Ineligibility and Voluntary Exclusion - Lower Tier-Covered Transactions

GRRHP Application - Borrower Information for Assessment of Legal Status • Tax-exempt ruling from the IRS or copy of depending request for 501(c)(3) or (4) designation (if applicable) • Enabling statute or state law of organization (for public body) • Evidence of organization under State law or copies of pending application • Proposed LP agreement and certificate (for LP) • Articles of Organization & Operating Agreement (for LLC) • List of Board members (if applicable)

GRRHP Application - Borrower Information for Assessment of Legal Status • Tax-exempt ruling from the IRS or copy of depending request for 501(c)(3) or (4) designation (if applicable) • Enabling statute or state law of organization (for public body) • Evidence of organization under State law or copies of pending application • Proposed LP agreement and certificate (for LP) • Articles of Organization & Operating Agreement (for LLC) • List of Board members (if applicable)

GRRHP Application - Borrower Information for Assessment of Financial Capacity • Audited financial statements (except for new entities) • Lender’s verification of borrower’s financial position and capacity to undertake project

GRRHP Application - Borrower Information for Assessment of Financial Capacity • Audited financial statements (except for new entities) • Lender’s verification of borrower’s financial position and capacity to undertake project

GRRHP Application - Project Information for Assessing Team and Operations • Development team, contractor, property manager, architect, lawyer, syndicator • Management plan and proposed management agreement

GRRHP Application - Project Information for Assessing Team and Operations • Development team, contractor, property manager, architect, lawyer, syndicator • Management plan and proposed management agreement

GRRHP Application - Project Information for Assessing Quality and Construction • Project name, location, number and type of units, type of construction (e. g. family, elderly) • Plot and site plan (including contour lines) • Working plans, designs and specs • Floor plan of units and other spaces • Exterior elevations and exterior wall sections • Description and justification for related facilities with separate schedule of charges • Compliance with historic and architectural laws (if applicable)

GRRHP Application - Project Information for Assessing Quality and Construction • Project name, location, number and type of units, type of construction (e. g. family, elderly) • Plot and site plan (including contour lines) • Working plans, designs and specs • Floor plan of units and other spaces • Exterior elevations and exterior wall sections • Description and justification for related facilities with separate schedule of charges • Compliance with historic and architectural laws (if applicable)

GRRHP Application - Project Information for Property Valuation and Consideration • State clearinghouse comments and recommendations • Appraisal or market study • Capital needs assessment (for rehab only)

GRRHP Application - Project Information for Property Valuation and Consideration • State clearinghouse comments and recommendations • Appraisal or market study • Capital needs assessment (for rehab only)

GRRHP Application - Project Financing Financial Info. Provided by Lender – • Pro-forma budget including first year and typical year’s operations • Disclosure of changes in financing (including terms) since submission of project proposal • Interest credit request with justification • A non-refundable application fee of $2, 500

GRRHP Application - Project Financing Financial Info. Provided by Lender – • Pro-forma budget including first year and typical year’s operations • Disclosure of changes in financing (including terms) since submission of project proposal • Interest credit request with justification • A non-refundable application fee of $2, 500

GRRHP Application - Project Financing Agency’s responsibility – • Preparation of SAUCE disc and hard copy • Review of Lender’s project financing information

GRRHP Application - Project Financing Agency’s responsibility – • Preparation of SAUCE disc and hard copy • Review of Lender’s project financing information

GRRHP Application - Environmental Info. • Phase I Environmental Site Assessment Report prescribed by American Society for Testing and Materials • Comments regarding off-site conditions • Land survey

GRRHP Application - Environmental Info. • Phase I Environmental Site Assessment Report prescribed by American Society for Testing and Materials • Comments regarding off-site conditions • Land survey

GRRHP Application - Lender Narrative and Certification • Lender’s narrative, including analysis of market conditions, appraisal, project financials and recommendation • Signed lender’s conditional commitment letter on letterhead • Lender certifies: – Borrower’s eligibility – Management plan has been reviewed and approved to be consistent with program requirements – Borrower and development team have the financial capacity and experience to undertake the project – Borrower, project and proposed financing meet lender’s loan making standards

GRRHP Application - Lender Narrative and Certification • Lender’s narrative, including analysis of market conditions, appraisal, project financials and recommendation • Signed lender’s conditional commitment letter on letterhead • Lender certifies: – Borrower’s eligibility – Management plan has been reviewed and approved to be consistent with program requirements – Borrower and development team have the financial capacity and experience to undertake the project – Borrower, project and proposed financing meet lender’s loan making standards

How do I process a GRRHP Application? Steps in processing a GRRHP Application: 1. Hold a pre-application conference with lender, project architect, borrower and environmental coordinator to discuss program requirements within 30 days of issuing a Notice to Proceed with Application Processing (See “Planning Meeting Agenda” in Chapter 4, Attachment 4 -H at www. rurdev. usda. gov/regs/hblist. html#hbw 6 ) 2. Start the environmental review process Form RD 3565 -1, Application for Loan and Guarantee, and Form RD 1940 -20, Request for Environmental Information, are submitted 3. Review all materials submitted by lender to determine compliance with program requirements

How do I process a GRRHP Application? Steps in processing a GRRHP Application: 1. Hold a pre-application conference with lender, project architect, borrower and environmental coordinator to discuss program requirements within 30 days of issuing a Notice to Proceed with Application Processing (See “Planning Meeting Agenda” in Chapter 4, Attachment 4 -H at www. rurdev. usda. gov/regs/hblist. html#hbw 6 ) 2. Start the environmental review process Form RD 3565 -1, Application for Loan and Guarantee, and Form RD 1940 -20, Request for Environmental Information, are submitted 3. Review all materials submitted by lender to determine compliance with program requirements

How do I process a GRRHP Application? (cont. ) Steps in processing a GRRHP Application: 4. Discuss with lender any discrepancies with program requirements and/or concerns with submitted materials 5. Review and approve the final plans and specs 6. Prepare the SAUCE for the project 7. Submit the application fee of $2, 500 to the Finance Office via the lockbox 8. Update project and financial information in the GLS 9. Approve the GRRHP application in the GLS

How do I process a GRRHP Application? (cont. ) Steps in processing a GRRHP Application: 4. Discuss with lender any discrepancies with program requirements and/or concerns with submitted materials 5. Review and approve the final plans and specs 6. Prepare the SAUCE for the project 7. Submit the application fee of $2, 500 to the Finance Office via the lockbox 8. Update project and financial information in the GLS 9. Approve the GRRHP application in the GLS

Obligation of GRRHP Funds Steps in the obligation of funds: 1. Verify that the Agency required environmental review is complete, an application fee of $2, 500 is paid and the GRRHP application is approved in the GLS 2. Complete, sign and submit to the National Office Form RD 1940 -3, Request for Obligation of Funds, and Guaranteed Loans and the Allocation of Obligation Form, which is sent to state office every year. 3. The National Office will fax to you notification of obligation of funds after the National Office obligates funds to the project in the GLS. 4. The obligation of funds triggers the issuance of the Conditional Commitment.

Obligation of GRRHP Funds Steps in the obligation of funds: 1. Verify that the Agency required environmental review is complete, an application fee of $2, 500 is paid and the GRRHP application is approved in the GLS 2. Complete, sign and submit to the National Office Form RD 1940 -3, Request for Obligation of Funds, and Guaranteed Loans and the Allocation of Obligation Form, which is sent to state office every year. 3. The National Office will fax to you notification of obligation of funds after the National Office obligates funds to the project in the GLS. 4. The obligation of funds triggers the issuance of the Conditional Commitment.