b99df59ba98567f3d490d72426ba8e25.ppt

- Количество слайдов: 68

Section 5 The Exchange Rate in the Short Run 1

Section 5 The Exchange Rate in the Short Run 1

Content • • • Objectives Aggregate Demand Output Market Equilibrium Asset Market Equilibrium The Short-Run Equilibrium Temporary Policy Changes Permanent Policy Changes The J-Curve Summary 2

Content • • • Objectives Aggregate Demand Output Market Equilibrium Asset Market Equilibrium The Short-Run Equilibrium Temporary Policy Changes Permanent Policy Changes The J-Curve Summary 2

Objectives • To understand the determinants of aggregate demand. • To know how output is determined using aggregate demand aggregate supply. • To know the effects of fiscal and monetary policy. • To know the J-curve 3

Objectives • To understand the determinants of aggregate demand. • To know how output is determined using aggregate demand aggregate supply. • To know the effects of fiscal and monetary policy. • To know the J-curve 3

Aggregate Demand • Aggregate demand comes from • Aggregate demand is the amount of a country’s output demanded by throughout the world. • It consists of – – Consumption demand (C) Investment demand (I) Government demand (G) Current account (CA) 4

Aggregate Demand • Aggregate demand comes from • Aggregate demand is the amount of a country’s output demanded by throughout the world. • It consists of – – Consumption demand (C) Investment demand (I) Government demand (G) Current account (CA) 4

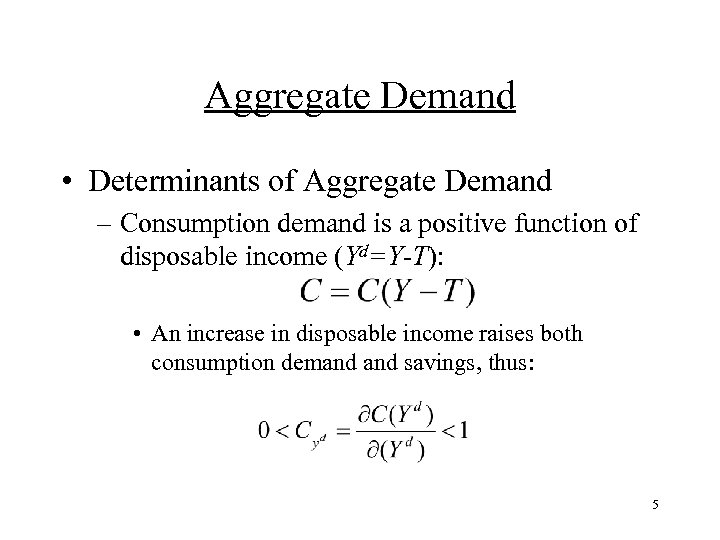

Aggregate Demand • Determinants of Aggregate Demand – Consumption demand is a positive function of disposable income (Yd=Y-T): • An increase in disposable income raises both consumption demand savings, thus: 5

Aggregate Demand • Determinants of Aggregate Demand – Consumption demand is a positive function of disposable income (Yd=Y-T): • An increase in disposable income raises both consumption demand savings, thus: 5

Aggregate Demand – Investment demand is assumed to be exogenous for now. In more complex models, investment demand is a positive function of income and a negative function of the interest rate. – Government demand is a policy variable. It is assumed exogenous. 6

Aggregate Demand – Investment demand is assumed to be exogenous for now. In more complex models, investment demand is a positive function of income and a negative function of the interest rate. – Government demand is a policy variable. It is assumed exogenous. 6

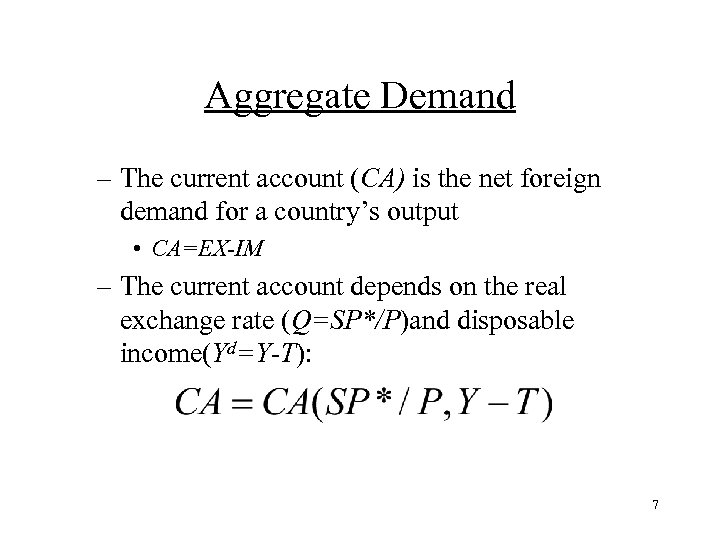

Aggregate Demand – The current account (CA) is the net foreign demand for a country’s output • CA=EX-IM – The current account depends on the real exchange rate (Q=SP*/P)and disposable income(Yd=Y-T): 7

Aggregate Demand – The current account (CA) is the net foreign demand for a country’s output • CA=EX-IM – The current account depends on the real exchange rate (Q=SP*/P)and disposable income(Yd=Y-T): 7

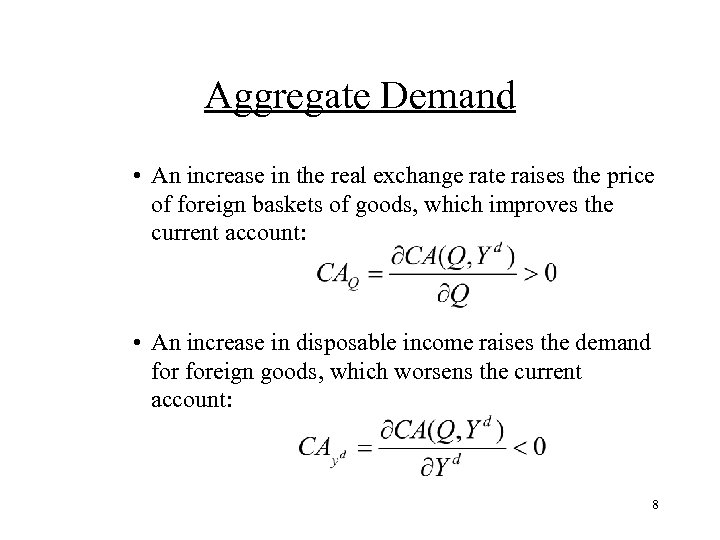

Aggregate Demand • An increase in the real exchange rate raises the price of foreign baskets of goods, which improves the current account: • An increase in disposable income raises the demand foreign goods, which worsens the current account: 8

Aggregate Demand • An increase in the real exchange rate raises the price of foreign baskets of goods, which improves the current account: • An increase in disposable income raises the demand foreign goods, which worsens the current account: 8

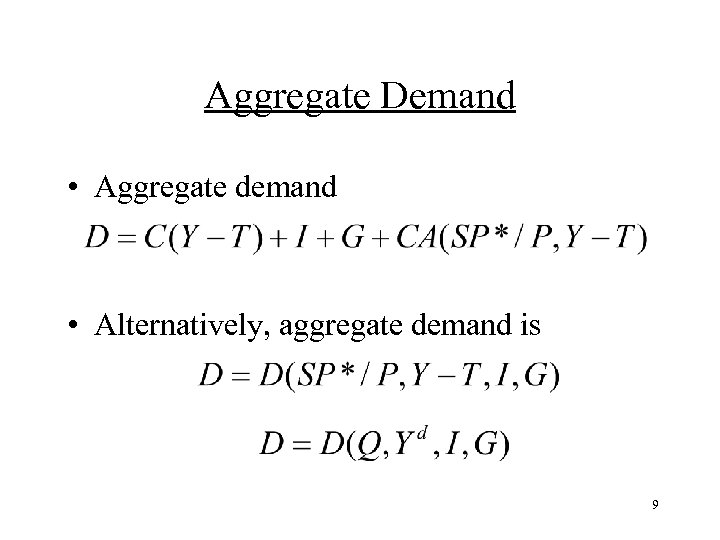

Aggregate Demand • Aggregate demand • Alternatively, aggregate demand is 9

Aggregate Demand • Aggregate demand • Alternatively, aggregate demand is 9

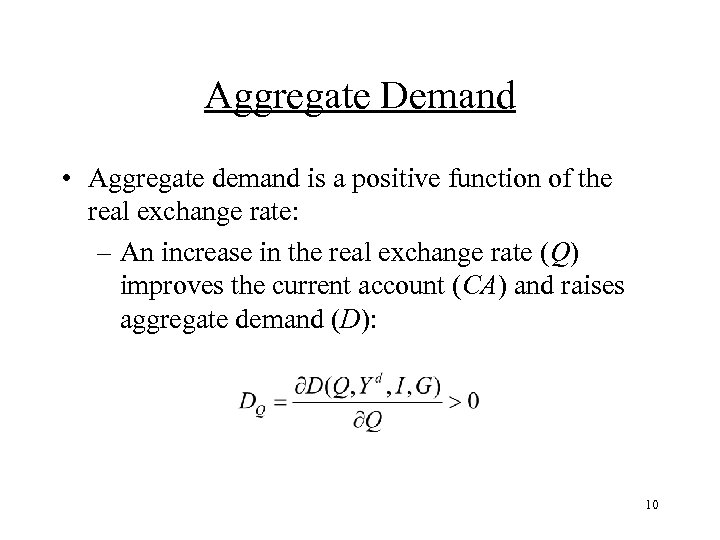

Aggregate Demand • Aggregate demand is a positive function of the real exchange rate: – An increase in the real exchange rate (Q) improves the current account (CA) and raises aggregate demand (D): 10

Aggregate Demand • Aggregate demand is a positive function of the real exchange rate: – An increase in the real exchange rate (Q) improves the current account (CA) and raises aggregate demand (D): 10

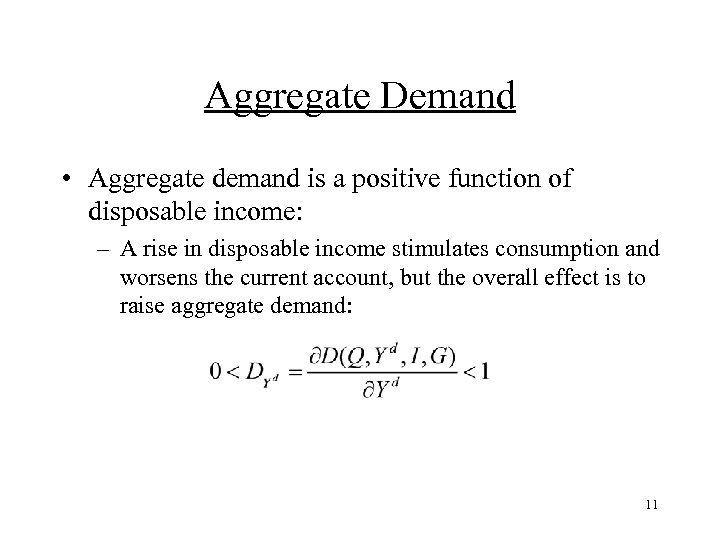

Aggregate Demand • Aggregate demand is a positive function of disposable income: – A rise in disposable income stimulates consumption and worsens the current account, but the overall effect is to raise aggregate demand: 11

Aggregate Demand • Aggregate demand is a positive function of disposable income: – A rise in disposable income stimulates consumption and worsens the current account, but the overall effect is to raise aggregate demand: 11

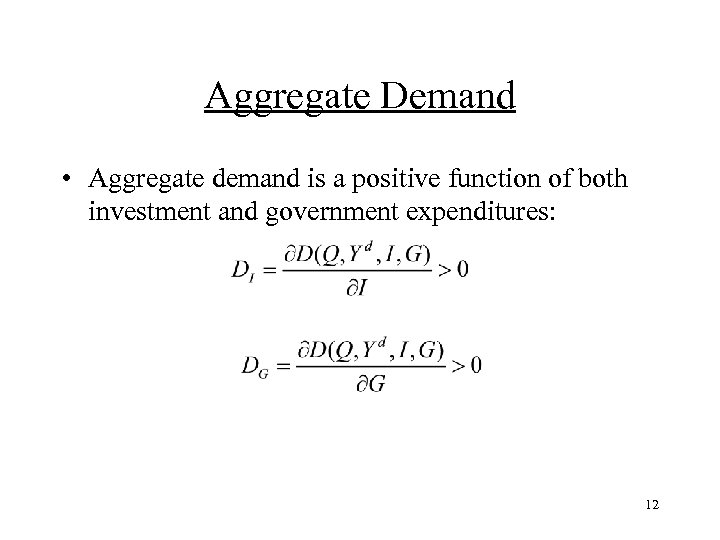

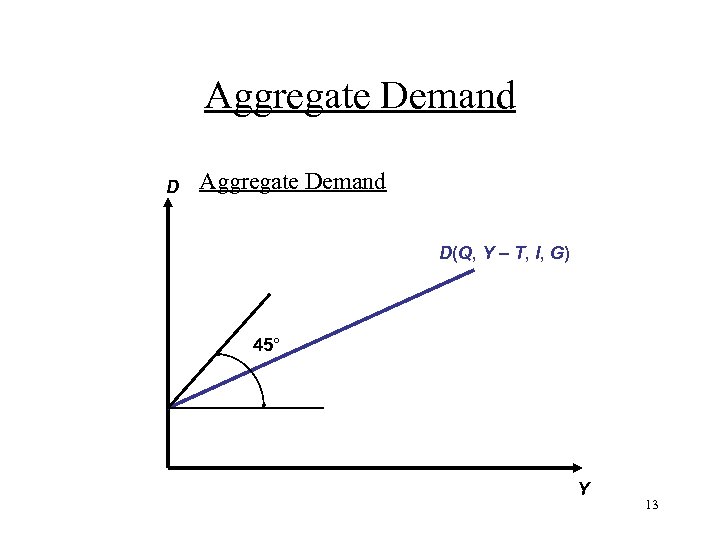

Aggregate Demand • Aggregate demand is a positive function of both investment and government expenditures: 12

Aggregate Demand • Aggregate demand is a positive function of both investment and government expenditures: 12

Aggregate Demand D(Q, Y – T, I, G) 45° Y 13

Aggregate Demand D(Q, Y – T, I, G) 45° Y 13

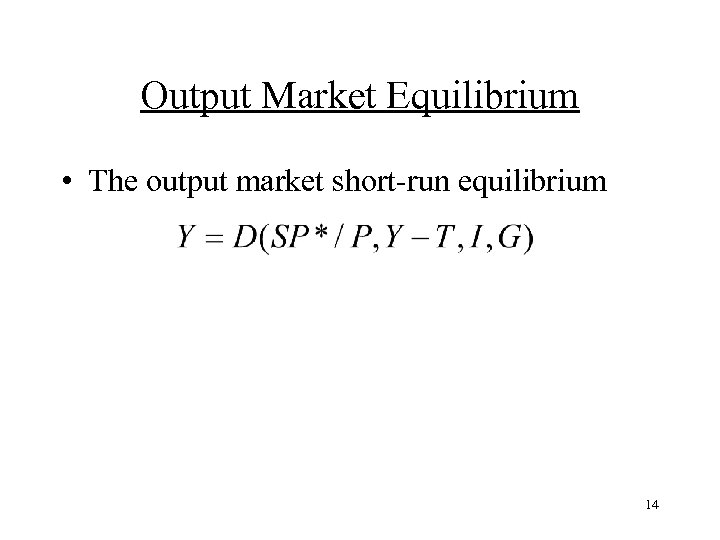

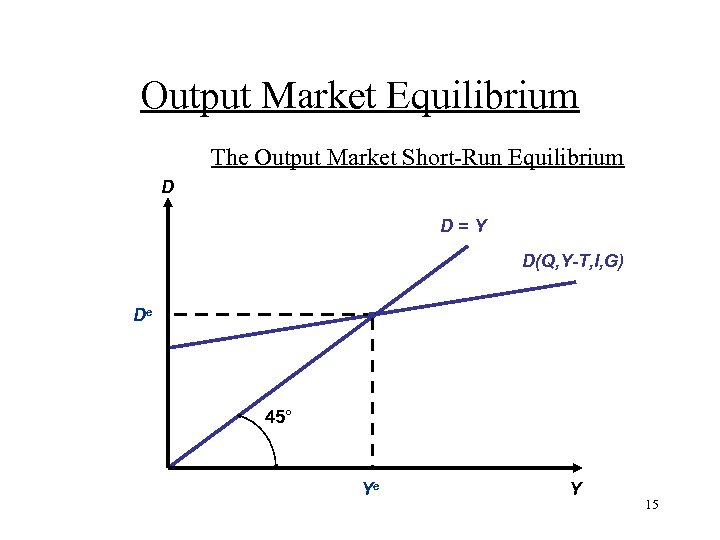

Output Market Equilibrium • The output market short-run equilibrium 14

Output Market Equilibrium • The output market short-run equilibrium 14

Output Market Equilibrium The Output Market Short-Run Equilibrium D D=Y D(Q, Y-T, I, G) De 45° Ye Y 15

Output Market Equilibrium The Output Market Short-Run Equilibrium D D=Y D(Q, Y-T, I, G) De 45° Ye Y 15

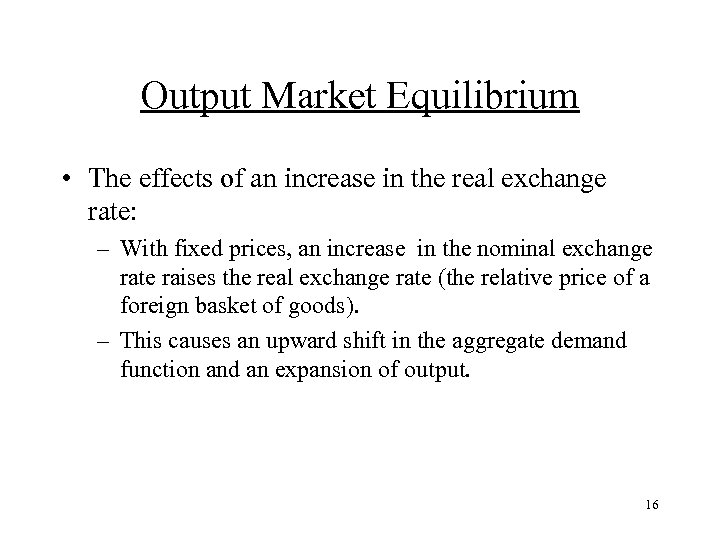

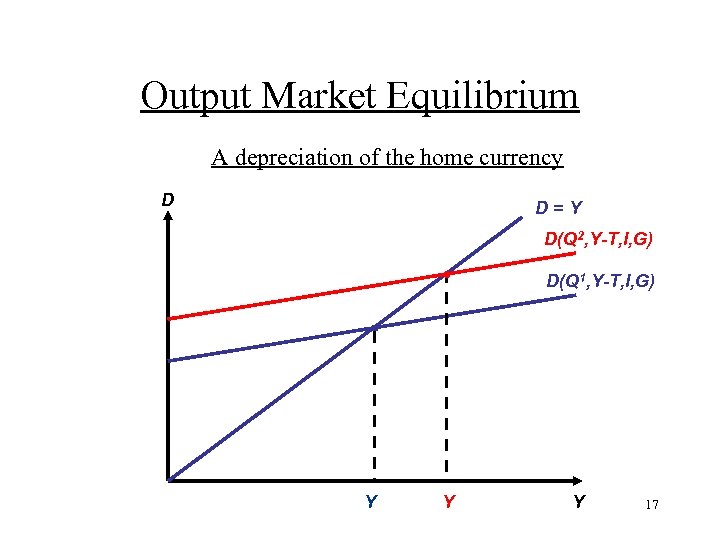

Output Market Equilibrium • The effects of an increase in the real exchange rate: – With fixed prices, an increase in the nominal exchange rate raises the real exchange rate (the relative price of a foreign basket of goods). – This causes an upward shift in the aggregate demand function and an expansion of output. 16

Output Market Equilibrium • The effects of an increase in the real exchange rate: – With fixed prices, an increase in the nominal exchange rate raises the real exchange rate (the relative price of a foreign basket of goods). – This causes an upward shift in the aggregate demand function and an expansion of output. 16

Output Market Equilibrium A depreciation of the home currency D D=Y D(Q 2, Y-T, I, G) D(Q 1, Y-T, I, G) Y Y Y 17

Output Market Equilibrium A depreciation of the home currency D D=Y D(Q 2, Y-T, I, G) D(Q 1, Y-T, I, G) Y Y Y 17

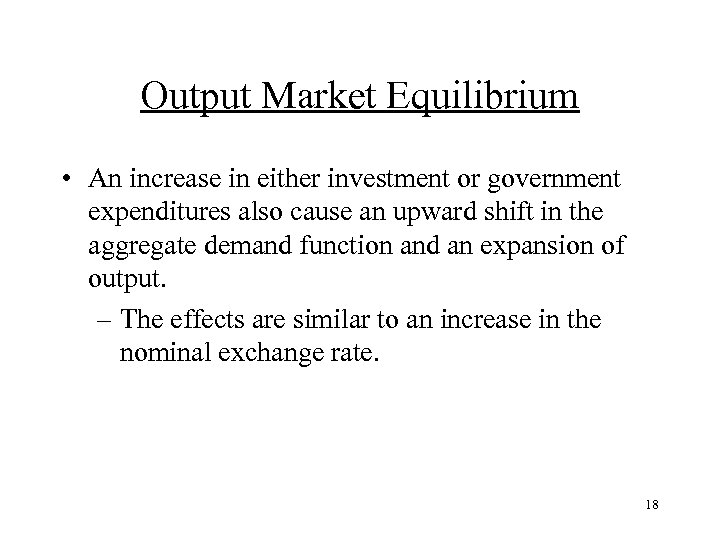

Output Market Equilibrium • An increase in either investment or government expenditures also cause an upward shift in the aggregate demand function and an expansion of output. – The effects are similar to an increase in the nominal exchange rate. 18

Output Market Equilibrium • An increase in either investment or government expenditures also cause an upward shift in the aggregate demand function and an expansion of output. – The effects are similar to an increase in the nominal exchange rate. 18

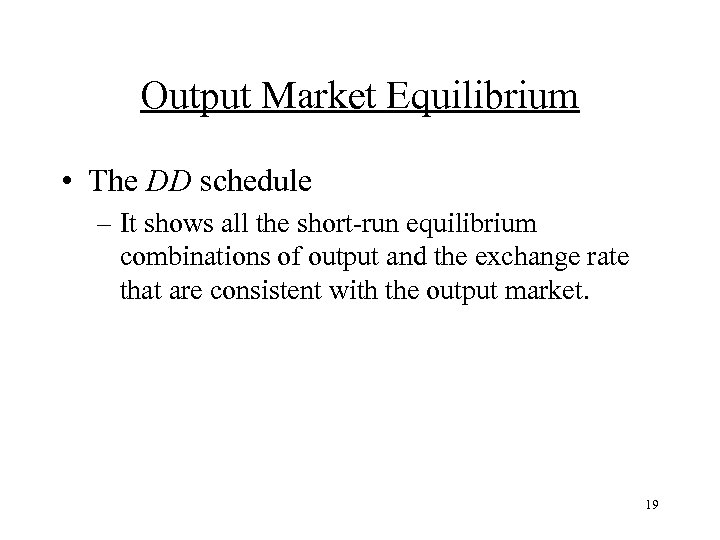

Output Market Equilibrium • The DD schedule – It shows all the short-run equilibrium combinations of output and the exchange rate that are consistent with the output market. 19

Output Market Equilibrium • The DD schedule – It shows all the short-run equilibrium combinations of output and the exchange rate that are consistent with the output market. 19

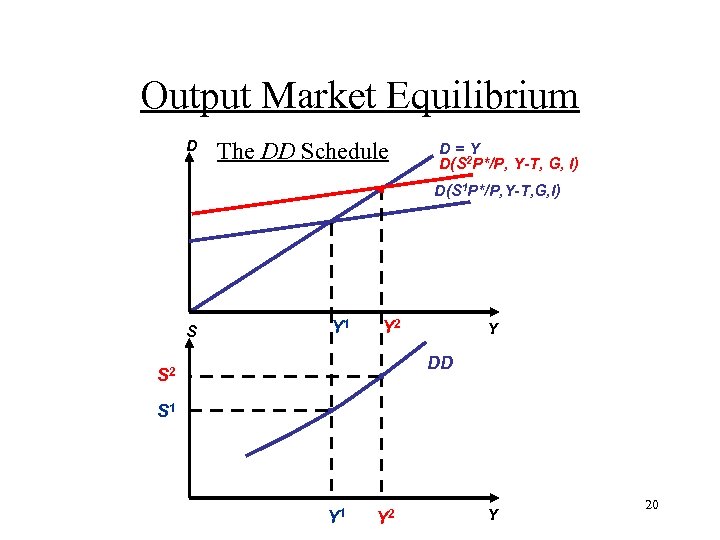

Output Market Equilibrium D The DD Schedule D=Y D(S 2 P*/P, Y-T, G, I) D(S 1 P*/P, Y-T, G, I) S Y 1 Y 2 Y DD S 2 S 1 Y 2 Y 20

Output Market Equilibrium D The DD Schedule D=Y D(S 2 P*/P, Y-T, G, I) D(S 1 P*/P, Y-T, G, I) S Y 1 Y 2 Y DD S 2 S 1 Y 2 Y 20

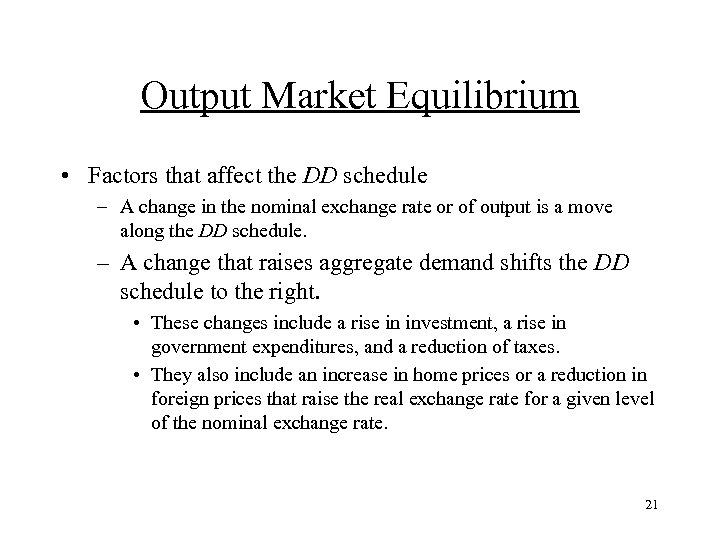

Output Market Equilibrium • Factors that affect the DD schedule – A change in the nominal exchange rate or of output is a move along the DD schedule. – A change that raises aggregate demand shifts the DD schedule to the right. • These changes include a rise in investment, a rise in government expenditures, and a reduction of taxes. • They also include an increase in home prices or a reduction in foreign prices that raise the real exchange rate for a given level of the nominal exchange rate. 21

Output Market Equilibrium • Factors that affect the DD schedule – A change in the nominal exchange rate or of output is a move along the DD schedule. – A change that raises aggregate demand shifts the DD schedule to the right. • These changes include a rise in investment, a rise in government expenditures, and a reduction of taxes. • They also include an increase in home prices or a reduction in foreign prices that raise the real exchange rate for a given level of the nominal exchange rate. 21

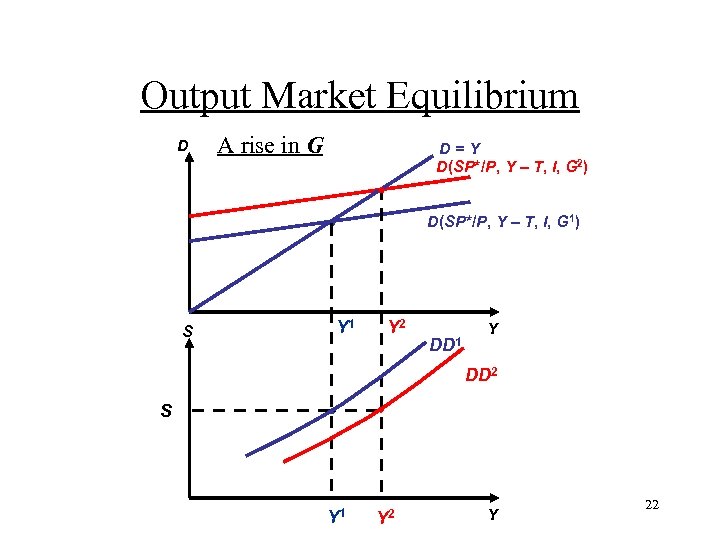

Output Market Equilibrium D A rise in G D=Y D(SP*/P, Y – T, I, G 2) D(SP*/P, Y – T, I, G 1) S Y 1 Y 2 DD 1 Y DD 2 S Y 1 Y 22

Output Market Equilibrium D A rise in G D=Y D(SP*/P, Y – T, I, G 2) D(SP*/P, Y – T, I, G 1) S Y 1 Y 2 DD 1 Y DD 2 S Y 1 Y 22

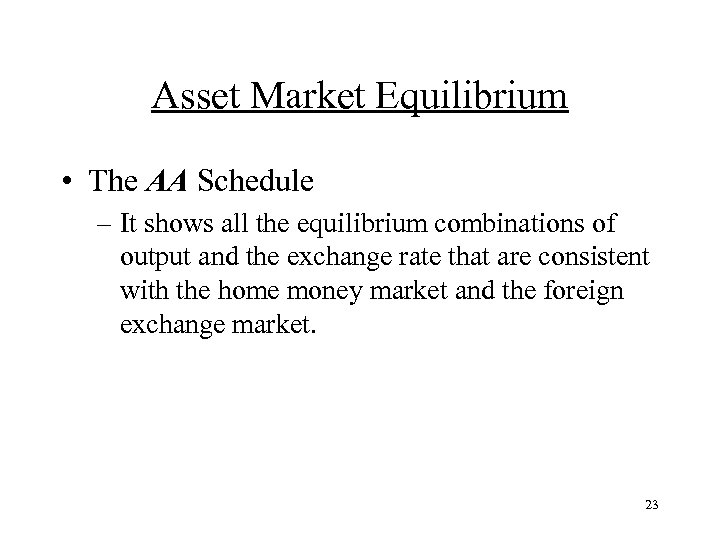

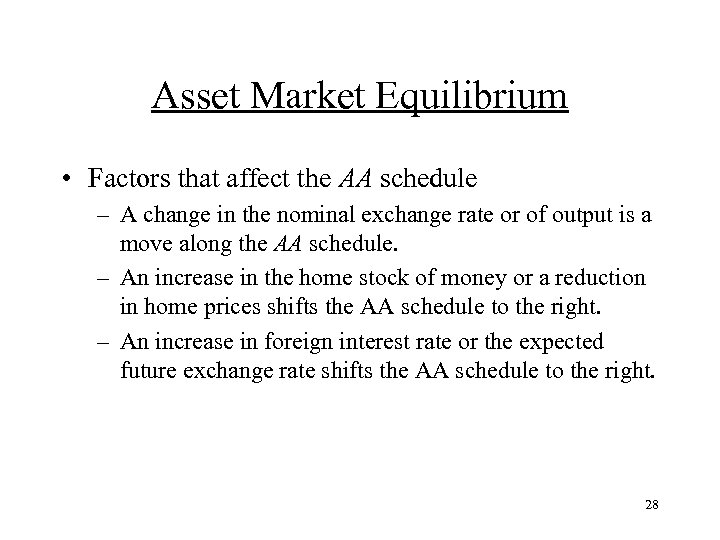

Asset Market Equilibrium • The AA Schedule – It shows all the equilibrium combinations of output and the exchange rate that are consistent with the home money market and the foreign exchange market. 23

Asset Market Equilibrium • The AA Schedule – It shows all the equilibrium combinations of output and the exchange rate that are consistent with the home money market and the foreign exchange market. 23

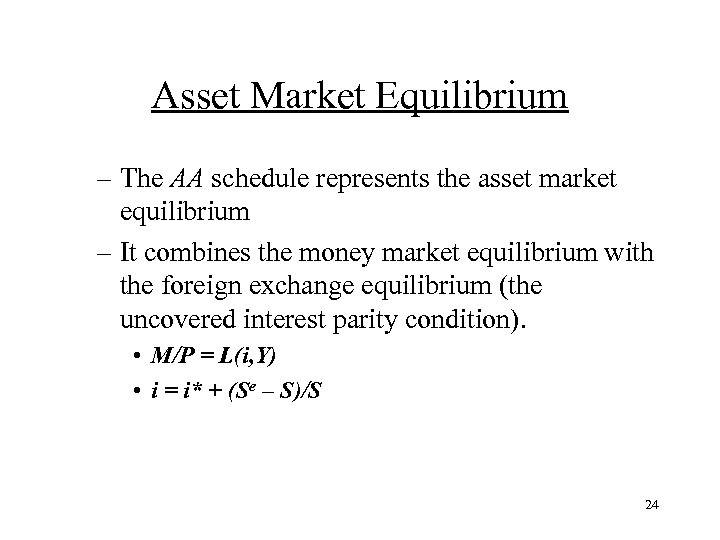

Asset Market Equilibrium – The AA schedule represents the asset market equilibrium – It combines the money market equilibrium with the foreign exchange equilibrium (the uncovered interest parity condition). • M/P = L(i, Y) • i = i* + (Se – S)/S 24

Asset Market Equilibrium – The AA schedule represents the asset market equilibrium – It combines the money market equilibrium with the foreign exchange equilibrium (the uncovered interest parity condition). • M/P = L(i, Y) • i = i* + (Se – S)/S 24

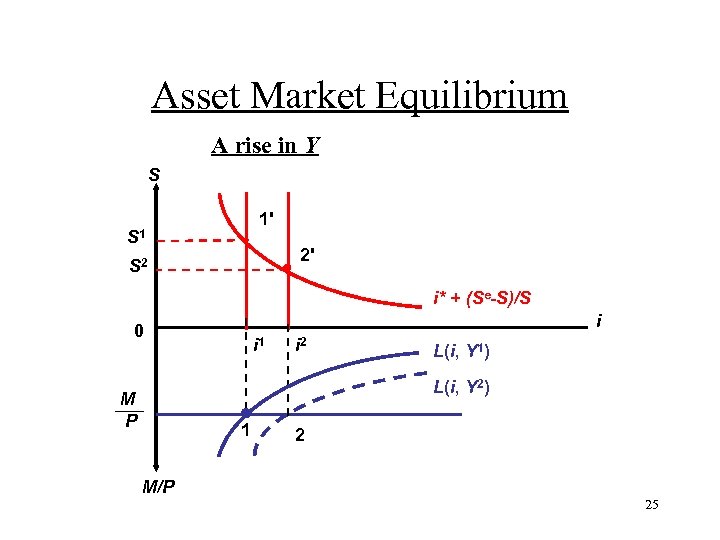

Asset Market Equilibrium A rise in Y S 1' S 1 2' S 2 i* + (Se-S)/S i 0 i 1 i 2 L(i, Y 1) L(i, Y 2) M P 1 2 M/P 25

Asset Market Equilibrium A rise in Y S 1' S 1 2' S 2 i* + (Se-S)/S i 0 i 1 i 2 L(i, Y 1) L(i, Y 2) M P 1 2 M/P 25

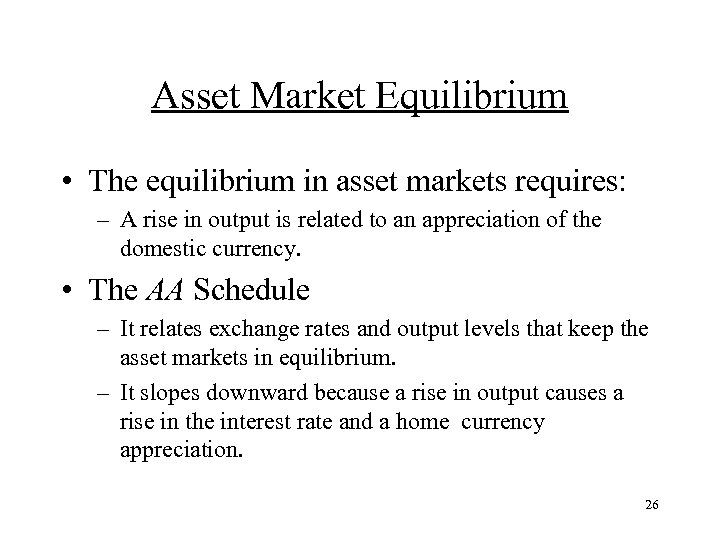

Asset Market Equilibrium • The equilibrium in asset markets requires: – A rise in output is related to an appreciation of the domestic currency. • The AA Schedule – It relates exchange rates and output levels that keep the asset markets in equilibrium. – It slopes downward because a rise in output causes a rise in the interest rate and a home currency appreciation. 26

Asset Market Equilibrium • The equilibrium in asset markets requires: – A rise in output is related to an appreciation of the domestic currency. • The AA Schedule – It relates exchange rates and output levels that keep the asset markets in equilibrium. – It slopes downward because a rise in output causes a rise in the interest rate and a home currency appreciation. 26

Asset Market Equilibrium S S 1 The AA Schedule 1 2 S 2 AA Y 1 Y 27

Asset Market Equilibrium S S 1 The AA Schedule 1 2 S 2 AA Y 1 Y 27

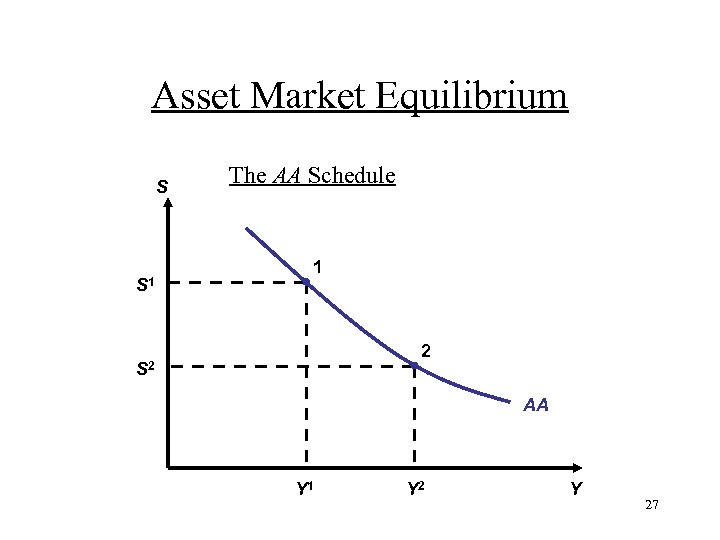

Asset Market Equilibrium • Factors that affect the AA schedule – A change in the nominal exchange rate or of output is a move along the AA schedule. – An increase in the home stock of money or a reduction in home prices shifts the AA schedule to the right. – An increase in foreign interest rate or the expected future exchange rate shifts the AA schedule to the right. 28

Asset Market Equilibrium • Factors that affect the AA schedule – A change in the nominal exchange rate or of output is a move along the AA schedule. – An increase in the home stock of money or a reduction in home prices shifts the AA schedule to the right. – An increase in foreign interest rate or the expected future exchange rate shifts the AA schedule to the right. 28

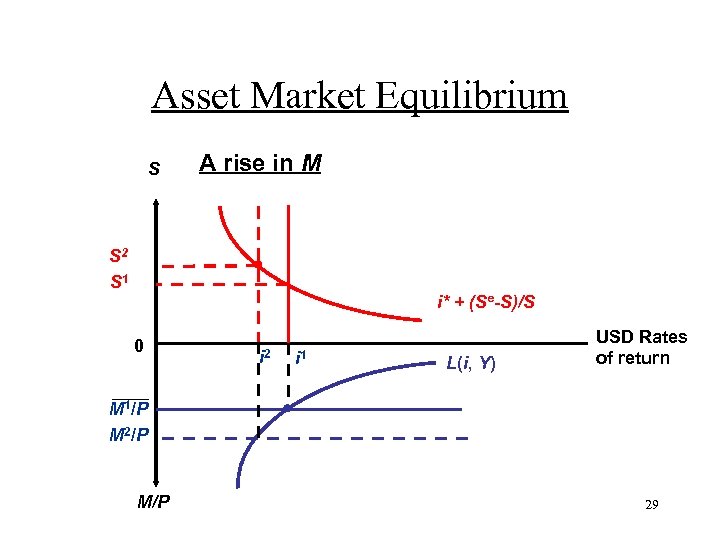

Asset Market Equilibrium S A rise in M S 2 S 1 i* + (Se-S)/S 0 i 2 i 1 L(i, Y) USD Rates of return M 1/P M 2/P M/P 29

Asset Market Equilibrium S A rise in M S 2 S 1 i* + (Se-S)/S 0 i 2 i 1 L(i, Y) USD Rates of return M 1/P M 2/P M/P 29

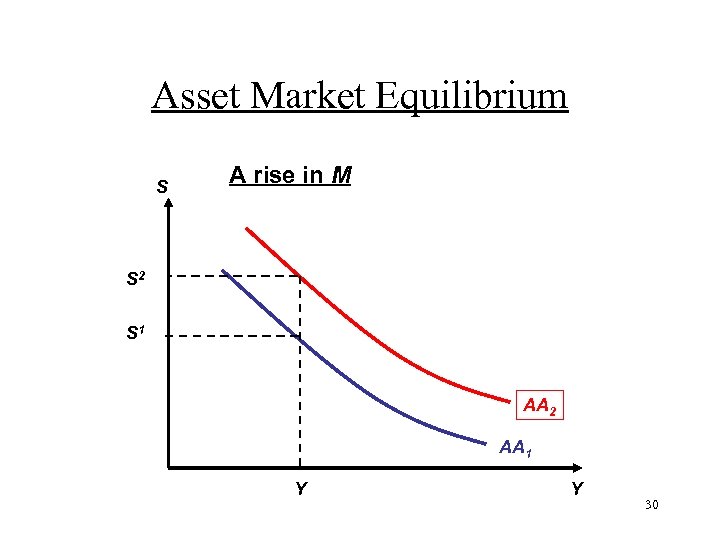

Asset Market Equilibrium S A rise in M S 2 S 1 AA 2 AA 1 Y Y 30

Asset Market Equilibrium S A rise in M S 2 S 1 AA 2 AA 1 Y Y 30

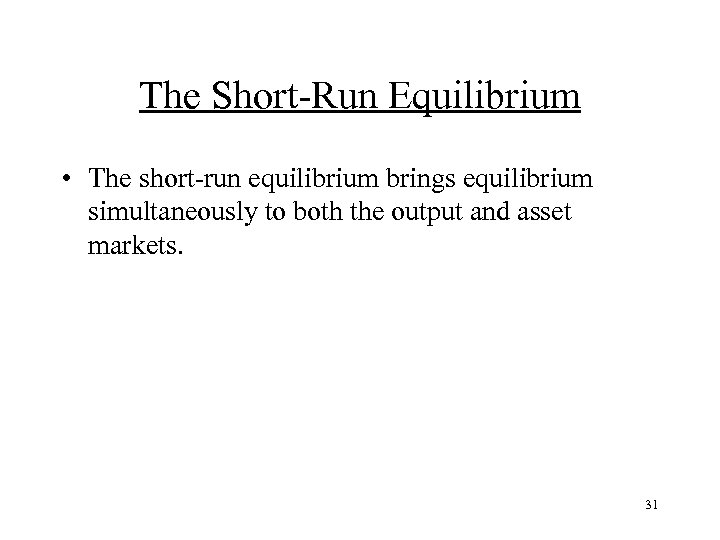

The Short-Run Equilibrium • The short-run equilibrium brings equilibrium simultaneously to both the output and asset markets. 31

The Short-Run Equilibrium • The short-run equilibrium brings equilibrium simultaneously to both the output and asset markets. 31

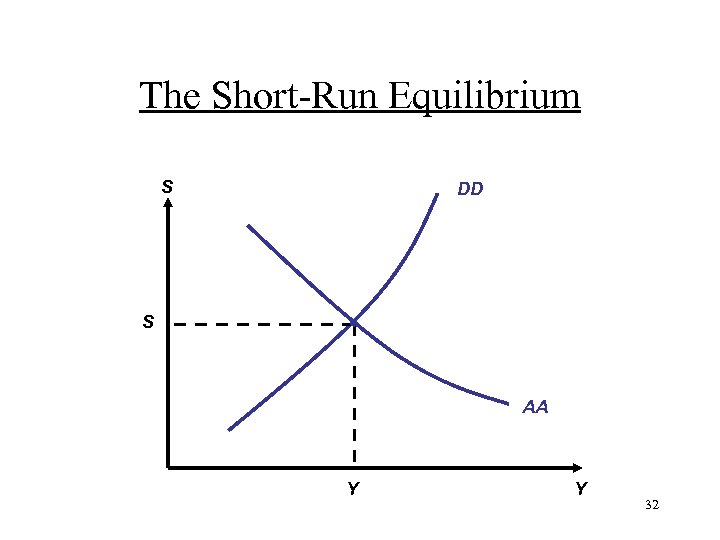

The Short-Run Equilibrium S DD S AA Y Y 32

The Short-Run Equilibrium S DD S AA Y Y 32

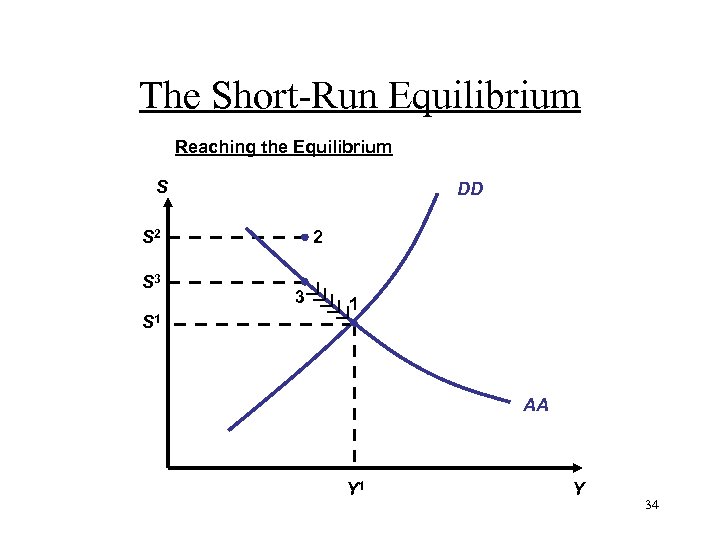

The Short-Run Equilibrium • Reaching the short-run equilibrium. – The asset markets always reacts more rapidly. • So, we first must move toward the AA schedule. – The goods market is sticky (from sticky prices), and reacts more slowly. 33

The Short-Run Equilibrium • Reaching the short-run equilibrium. – The asset markets always reacts more rapidly. • So, we first must move toward the AA schedule. – The goods market is sticky (from sticky prices), and reacts more slowly. 33

The Short-Run Equilibrium Reaching the Equilibrium S DD S 2 S 3 S 1 2 3 1 AA Y 1 Y 34

The Short-Run Equilibrium Reaching the Equilibrium S DD S 2 S 3 S 1 2 3 1 AA Y 1 Y 34

The Short-Run Equilibrium • Reaching the short-run equilibrium – At point 2, the foreign exchange market is out of equilibrium. S is so high that i> i*+(Se-S)/S. • There is an excess demand for home currency. • So, S jumps down toward the AA schedule. 35

The Short-Run Equilibrium • Reaching the short-run equilibrium – At point 2, the foreign exchange market is out of equilibrium. S is so high that i> i*+(Se-S)/S. • There is an excess demand for home currency. • So, S jumps down toward the AA schedule. 35

The Short-Run Equilibrium – At point 3, the goods market is out of equilibrium. S is so high that Q = SP*/P is above its equilibrium level. • This generates an excess demand for home goods. • In response, the home economy ups Y and reduces S, to reduce the excess demand. So, S and Y move along the AA schedule slowly toward the DD schedule 36

The Short-Run Equilibrium – At point 3, the goods market is out of equilibrium. S is so high that Q = SP*/P is above its equilibrium level. • This generates an excess demand for home goods. • In response, the home economy ups Y and reduces S, to reduce the excess demand. So, S and Y move along the AA schedule slowly toward the DD schedule 36

Temporary Policy Changes • Monetary policy – Policy instrument is the stock of money supplied. • Fiscal policy – Policy instrument is either taxes or government expenditures. 37

Temporary Policy Changes • Monetary policy – Policy instrument is the stock of money supplied. • Fiscal policy – Policy instrument is either taxes or government expenditures. 37

Temporary Policy Changes • Temporary Policy Changes – These policies have no effects on the expectations of future exchange rates. – We expect these changes to be temporary, and to have no effect on the long-run expected exchange rate. – So, we only worry about the short run, because we go back to the initial equilibrium. • For the following analysis, we assume that the different scenario involve no responses of foreign macroeconomic policies. 38

Temporary Policy Changes • Temporary Policy Changes – These policies have no effects on the expectations of future exchange rates. – We expect these changes to be temporary, and to have no effect on the long-run expected exchange rate. – So, we only worry about the short run, because we go back to the initial equilibrium. • For the following analysis, we assume that the different scenario involve no responses of foreign macroeconomic policies. 38

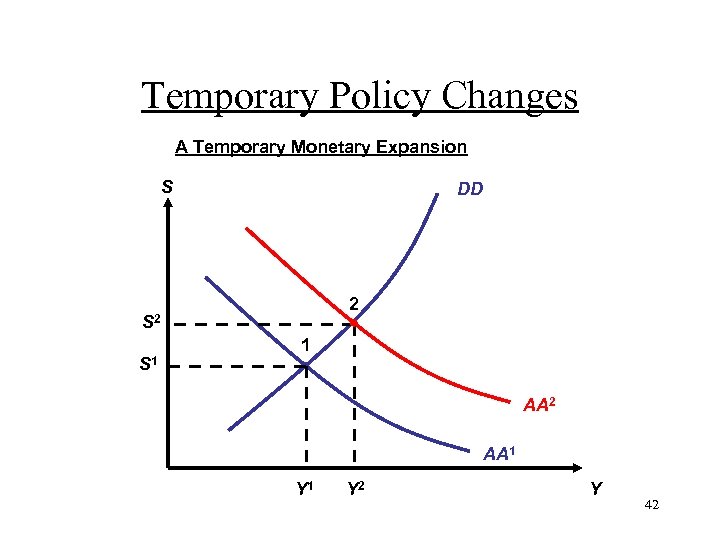

Temporary Policy Changes • A Temporary Increase in Money Supply – The Money Market • For fixed prices, the increase in the stock of money generates an excess supply of money. This reduces the home interest rate. • The expansionary monetary policy also raises output, which increases money demand. The effect, however, is small. It slightly diminishes the reduction in the home interest rate. 39

Temporary Policy Changes • A Temporary Increase in Money Supply – The Money Market • For fixed prices, the increase in the stock of money generates an excess supply of money. This reduces the home interest rate. • The expansionary monetary policy also raises output, which increases money demand. The effect, however, is small. It slightly diminishes the reduction in the home interest rate. 39

Temporary Policy Changes – The Foreign Exchange Market • The lower interest rate makes foreign investment more attractive. This generate an excess demand of foreign currency. The result is that the foreign currency appreciates (or the home currency depreciates). • This is a shift of the AA schedule to the right. 40

Temporary Policy Changes – The Foreign Exchange Market • The lower interest rate makes foreign investment more attractive. This generate an excess demand of foreign currency. The result is that the foreign currency appreciates (or the home currency depreciates). • This is a shift of the AA schedule to the right. 40

Temporary Policy Changes – The Goods Market • The appreciation of the foreign currency raises the real exchange rate (the price of a foreign basket of goods). This creates an excess demand for home goods: the home current account improves and pushes output up. • This is a slide along the DD schedule. • In the long run: – The initial equilibrium is restored. 41

Temporary Policy Changes – The Goods Market • The appreciation of the foreign currency raises the real exchange rate (the price of a foreign basket of goods). This creates an excess demand for home goods: the home current account improves and pushes output up. • This is a slide along the DD schedule. • In the long run: – The initial equilibrium is restored. 41

Temporary Policy Changes A Temporary Monetary Expansion S DD 2 S 1 1 AA 2 AA 1 Y 2 Y 42

Temporary Policy Changes A Temporary Monetary Expansion S DD 2 S 1 1 AA 2 AA 1 Y 2 Y 42

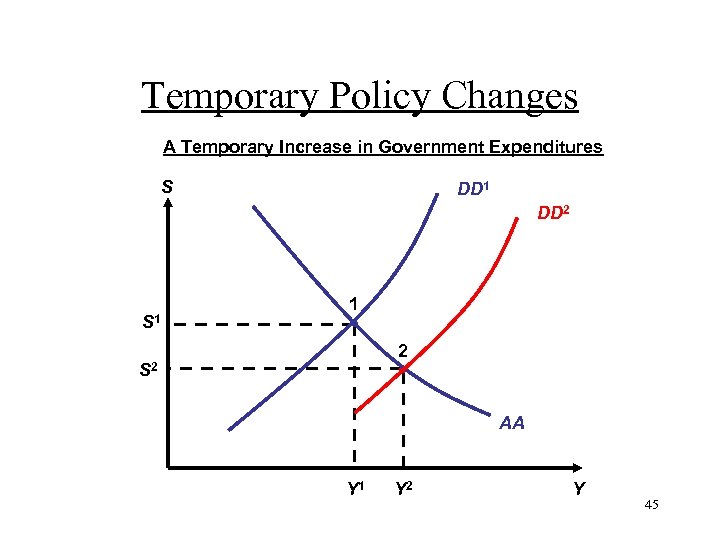

Temporary Policy Changes • A Temporary Increase in Government Expenditures • In the short run: – The Goods Market • The increase in expenditures raises output. • This is a right shift of the DD schedule. • The ensuing reduction in the nominal exchange rate lowers the real exchange rate, which generates a deterioration of the current account. This small effects slightly diminishes the increase in output 43

Temporary Policy Changes • A Temporary Increase in Government Expenditures • In the short run: – The Goods Market • The increase in expenditures raises output. • This is a right shift of the DD schedule. • The ensuing reduction in the nominal exchange rate lowers the real exchange rate, which generates a deterioration of the current account. This small effects slightly diminishes the increase in output 43

Temporary Policy Changes – The Money Market • For fixed prices, the higher output raises the demand for money and the home interest rate. – The Foreign Exchange Market • The higher interest rate makes foreign investment less attractive. The result is that the foreign currency depreciates. • This is a slide along the AA schedule. 44

Temporary Policy Changes – The Money Market • For fixed prices, the higher output raises the demand for money and the home interest rate. – The Foreign Exchange Market • The higher interest rate makes foreign investment less attractive. The result is that the foreign currency depreciates. • This is a slide along the AA schedule. 44

Temporary Policy Changes A Temporary Increase in Government Expenditures S DD 1 DD 2 S 1 1 2 S 2 AA Y 1 Y 2 Y 45

Temporary Policy Changes A Temporary Increase in Government Expenditures S DD 1 DD 2 S 1 1 2 S 2 AA Y 1 Y 2 Y 45

Temporary Policy Changes • The Business Cycle • Temporary fiscal and monetary policies can be used to neutralize the effects of outside disturbances that create recessions. 46

Temporary Policy Changes • The Business Cycle • Temporary fiscal and monetary policies can be used to neutralize the effects of outside disturbances that create recessions. 46

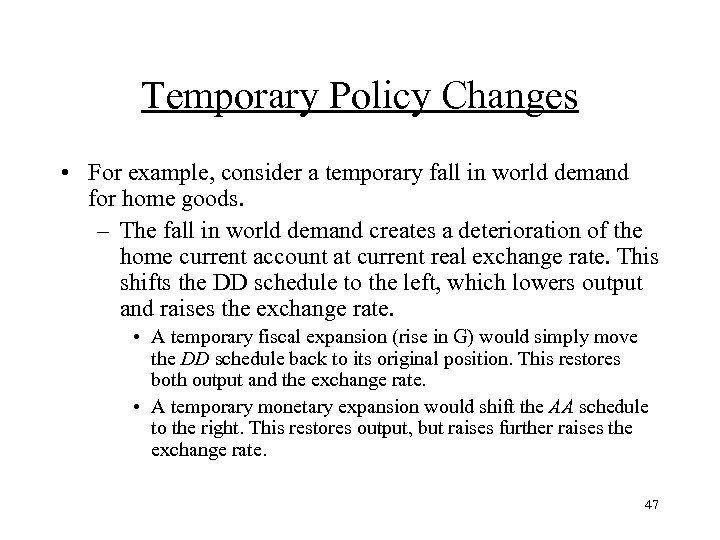

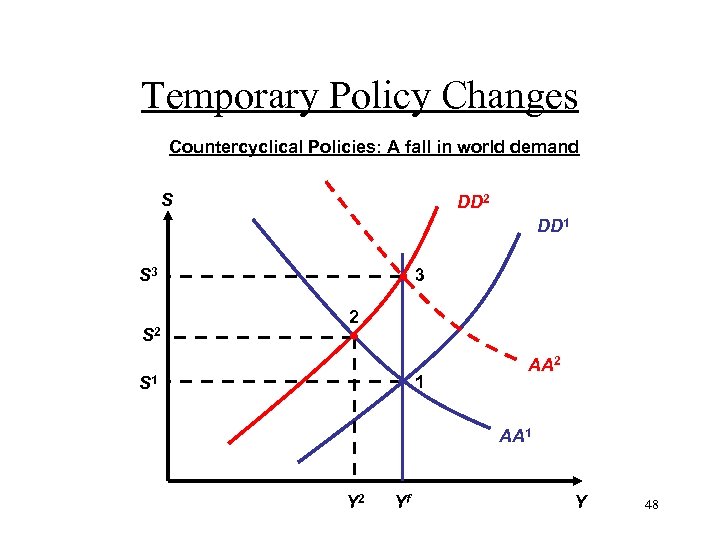

Temporary Policy Changes • For example, consider a temporary fall in world demand for home goods. – The fall in world demand creates a deterioration of the home current account at current real exchange rate. This shifts the DD schedule to the left, which lowers output and raises the exchange rate. • A temporary fiscal expansion (rise in G) would simply move the DD schedule back to its original position. This restores both output and the exchange rate. • A temporary monetary expansion would shift the AA schedule to the right. This restores output, but raises further raises the exchange rate. 47

Temporary Policy Changes • For example, consider a temporary fall in world demand for home goods. – The fall in world demand creates a deterioration of the home current account at current real exchange rate. This shifts the DD schedule to the left, which lowers output and raises the exchange rate. • A temporary fiscal expansion (rise in G) would simply move the DD schedule back to its original position. This restores both output and the exchange rate. • A temporary monetary expansion would shift the AA schedule to the right. This restores output, but raises further raises the exchange rate. 47

Temporary Policy Changes Countercyclical Policies: A fall in world demand S DD 2 DD 1 S 3 S 2 3 2 1 S 1 AA 2 AA 1 Y 2 Yf Y 48

Temporary Policy Changes Countercyclical Policies: A fall in world demand S DD 2 DD 1 S 3 S 2 3 2 1 S 1 AA 2 AA 1 Y 2 Yf Y 48

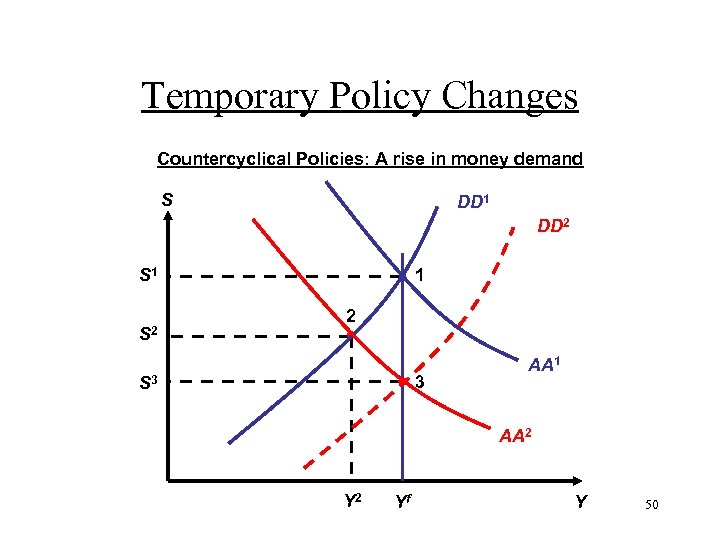

Temporary Policy Changes • For example, consider a temporary rise in money demand. – The rise in money demand raises the home interest rate, which generates an appreciation of the home currency and a reduction of home output (via a deterioration in the current account). This shifts the AA schedule to the left. • A temporary monetary expansion would shift the AA schedule back to its original position, and restores both output and the exchange rate. • A temporary fiscal expansion (rise in G) would shift the DD schedule to the right. This restores output, but further reduces the exchange rate. 49

Temporary Policy Changes • For example, consider a temporary rise in money demand. – The rise in money demand raises the home interest rate, which generates an appreciation of the home currency and a reduction of home output (via a deterioration in the current account). This shifts the AA schedule to the left. • A temporary monetary expansion would shift the AA schedule back to its original position, and restores both output and the exchange rate. • A temporary fiscal expansion (rise in G) would shift the DD schedule to the right. This restores output, but further reduces the exchange rate. 49

Temporary Policy Changes Countercyclical Policies: A rise in money demand S DD 1 DD 2 S 1 S 2 1 2 3 S 3 AA 1 AA 2 Yf Y 50

Temporary Policy Changes Countercyclical Policies: A rise in money demand S DD 1 DD 2 S 1 S 2 1 2 3 S 3 AA 1 AA 2 Yf Y 50

Permanent Policy Changes • Unlike temporary changes, permanent policy changes potentially have long-run effects. • These changes may affect the long-run exchange rate, and our expectations of the future exchange rate. 51

Permanent Policy Changes • Unlike temporary changes, permanent policy changes potentially have long-run effects. • These changes may affect the long-run exchange rate, and our expectations of the future exchange rate. 51

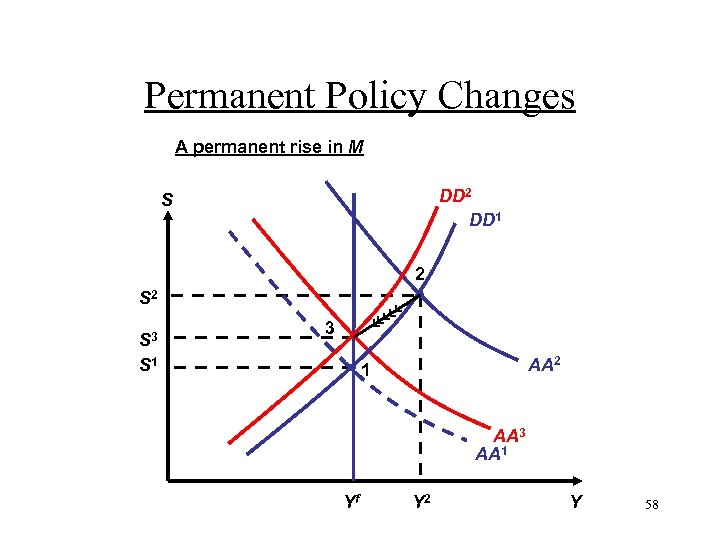

Permanent Policy Changes • A Permanent Increase in the Money Supply • The Long Run: Perfect Price Flexibility – The Money Market • The rise in M only raises P. Money is neutral in the long run. – The Foreign Exchange Market • The rise in P engineers a long-run depreciation of the home currency (an increase in S). • This is a shift of the AA schedule to the right. 52

Permanent Policy Changes • A Permanent Increase in the Money Supply • The Long Run: Perfect Price Flexibility – The Money Market • The rise in M only raises P. Money is neutral in the long run. – The Foreign Exchange Market • The rise in P engineers a long-run depreciation of the home currency (an increase in S). • This is a shift of the AA schedule to the right. 52

Permanent Policy Changes – The Goods Market • The rise in S offset any effects of the rise in P on the real exchange rate and the current account. • However, at the initial exchange rate, the higher P means a reduction of the real exchange rate and a reduction in output. This shifts the DD schedule to the left. • Thus, there are both movements of the DD schedule and movements along the DD schedule. 53

Permanent Policy Changes – The Goods Market • The rise in S offset any effects of the rise in P on the real exchange rate and the current account. • However, at the initial exchange rate, the higher P means a reduction of the real exchange rate and a reduction in output. This shifts the DD schedule to the left. • Thus, there are both movements of the DD schedule and movements along the DD schedule. 53

Permanent Policy Changes • The Short Run: Fixed Price – The Money Market • The increase in the stock of money reduces the home interest rate. • It also raises output, which increases money demand. The effect, however, is small. • So, overall, the increase in M reduces i. 54

Permanent Policy Changes • The Short Run: Fixed Price – The Money Market • The increase in the stock of money reduces the home interest rate. • It also raises output, which increases money demand. The effect, however, is small. • So, overall, the increase in M reduces i. 54

Permanent Policy Changes – The Foreign Exchange Market • The lower interest rate makes foreign investment more attractive. The result is that the foreign currency appreciates. • In addition, the rise in the long-run exchange rate generates an increase in the expectations of the future exchange rate. This further appreciates the foreign currency. • This is a shift of the AA schedule to the right. 55

Permanent Policy Changes – The Foreign Exchange Market • The lower interest rate makes foreign investment more attractive. The result is that the foreign currency appreciates. • In addition, the rise in the long-run exchange rate generates an increase in the expectations of the future exchange rate. This further appreciates the foreign currency. • This is a shift of the AA schedule to the right. 55

Permanent Policy Changes – The Goods Market • The appreciation of the foreign currency raises the real exchange rate. This generates an improvement in the current account and pushes output up. • This is a slide along the DD schedule. 56

Permanent Policy Changes – The Goods Market • The appreciation of the foreign currency raises the real exchange rate. This generates an improvement in the current account and pushes output up. • This is a slide along the DD schedule. 56

Permanent Policy Changes • The adjustment: the short run to the long run – The Money Market: • As prices rise, the interest rate and output are slowly restored to the initial level. – The Foreign Exchange Market: • The rising home interest rate generates a depreciation of the foreign currency. – The Goods Market: 57

Permanent Policy Changes • The adjustment: the short run to the long run – The Money Market: • As prices rise, the interest rate and output are slowly restored to the initial level. – The Foreign Exchange Market: • The rising home interest rate generates a depreciation of the foreign currency. – The Goods Market: 57

Permanent Policy Changes A permanent rise in M DD 2 DD 1 S 2 S 3 S 1 3 AA 2 1 AA 3 AA 1 Yf Y 2 Y 58

Permanent Policy Changes A permanent rise in M DD 2 DD 1 S 2 S 3 S 1 3 AA 2 1 AA 3 AA 1 Yf Y 2 Y 58

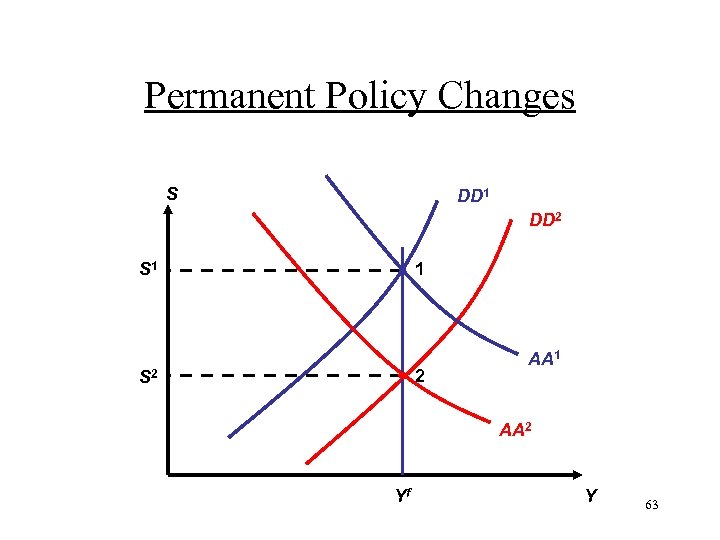

Permanent Policy Changes • A Permanent Rise in Government Exp. • The Long Run: Perfect Price Flexibility – The Goods Market • The increase in expenditures raises output. • This raises the demand for home goods, and lowers the price of foreign goods. • The reduction in the real exchange rate lowers the nominal exchange rate. 59

Permanent Policy Changes • A Permanent Rise in Government Exp. • The Long Run: Perfect Price Flexibility – The Goods Market • The increase in expenditures raises output. • This raises the demand for home goods, and lowers the price of foreign goods. • The reduction in the real exchange rate lowers the nominal exchange rate. 59

Permanent Policy Changes – The Money Market • No changes in the long run. – The Foreign Exchange Market • The expected future exchange rate drops, lowering the foreign return schedule. 60

Permanent Policy Changes – The Money Market • No changes in the long run. – The Foreign Exchange Market • The expected future exchange rate drops, lowering the foreign return schedule. 60

Permanent Policy Changes • The Short Run: Fixed Price – The Goods Market • The increase in expenditures raises output. • This is a right shift of the DD schedule. • The ensuing reduction in the nominal exchange rate lowers the real exchange rate and generates a deterioration of the current account. This effect cancels out the rise in output. 61

Permanent Policy Changes • The Short Run: Fixed Price – The Goods Market • The increase in expenditures raises output. • This is a right shift of the DD schedule. • The ensuing reduction in the nominal exchange rate lowers the real exchange rate and generates a deterioration of the current account. This effect cancels out the rise in output. 61

Permanent Policy Changes – The Money Market • No changes. – The Foreign Exchange Market • The lower long-run exchange rate reduces the expectations of future exchange rate. This generates an immediate depreciation of the foreign currency. • This is a left shift of the AA schedule. 62

Permanent Policy Changes – The Money Market • No changes. – The Foreign Exchange Market • The lower long-run exchange rate reduces the expectations of future exchange rate. This generates an immediate depreciation of the foreign currency. • This is a left shift of the AA schedule. 62

Permanent Policy Changes S DD 1 DD 2 S 1 1 2 S 2 AA 1 AA 2 Yf Y 63

Permanent Policy Changes S DD 1 DD 2 S 1 1 2 S 2 AA 1 AA 2 Yf Y 63

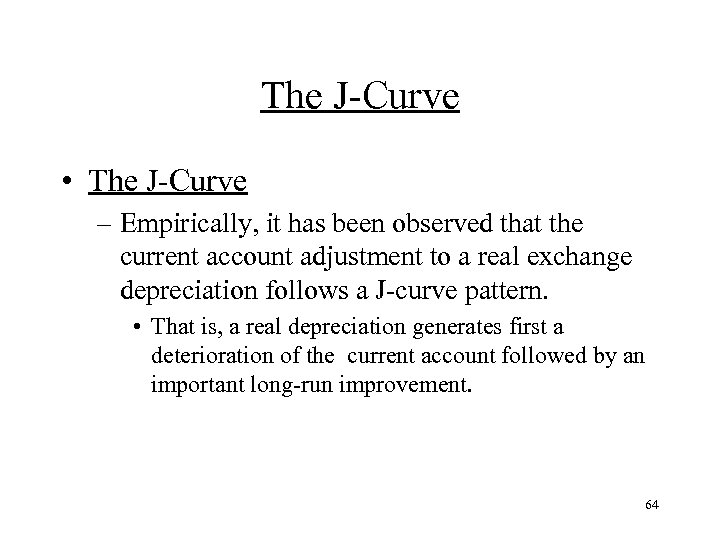

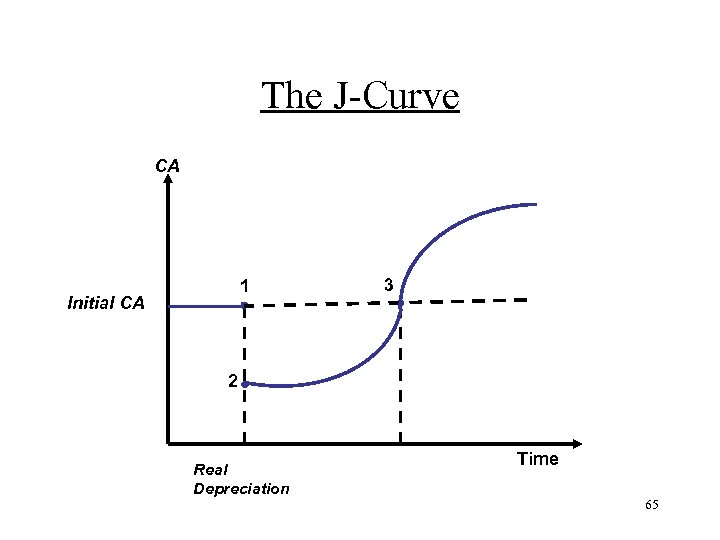

The J-Curve • The J-Curve – Empirically, it has been observed that the current account adjustment to a real exchange depreciation follows a J-curve pattern. • That is, a real depreciation generates first a deterioration of the current account followed by an important long-run improvement. 64

The J-Curve • The J-Curve – Empirically, it has been observed that the current account adjustment to a real exchange depreciation follows a J-curve pattern. • That is, a real depreciation generates first a deterioration of the current account followed by an important long-run improvement. 64

The J-Curve CA 1 Initial CA 3 2 Real Depreciation Time 65

The J-Curve CA 1 Initial CA 3 2 Real Depreciation Time 65

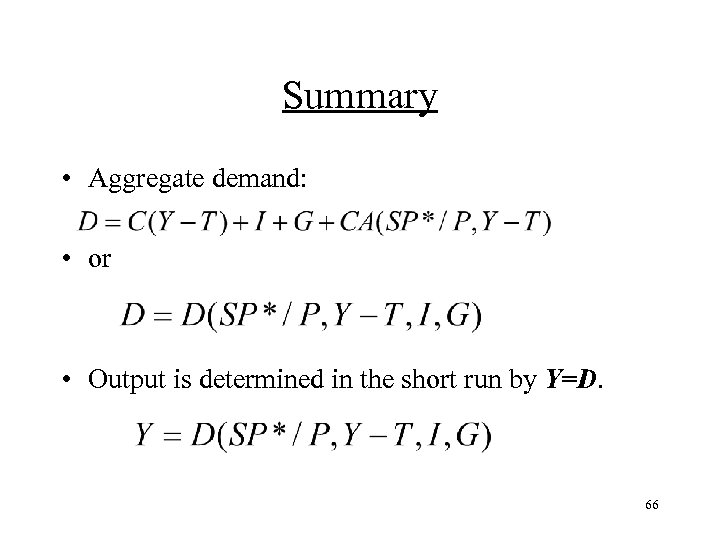

Summary • Aggregate demand: • or • Output is determined in the short run by Y=D. 66

Summary • Aggregate demand: • or • Output is determined in the short run by Y=D. 66

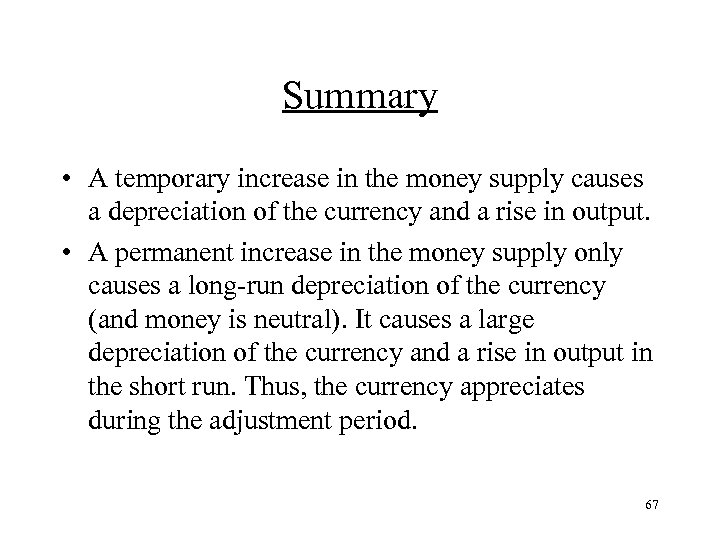

Summary • A temporary increase in the money supply causes a depreciation of the currency and a rise in output. • A permanent increase in the money supply only causes a long-run depreciation of the currency (and money is neutral). It causes a large depreciation of the currency and a rise in output in the short run. Thus, the currency appreciates during the adjustment period. 67

Summary • A temporary increase in the money supply causes a depreciation of the currency and a rise in output. • A permanent increase in the money supply only causes a long-run depreciation of the currency (and money is neutral). It causes a large depreciation of the currency and a rise in output in the short run. Thus, the currency appreciates during the adjustment period. 67

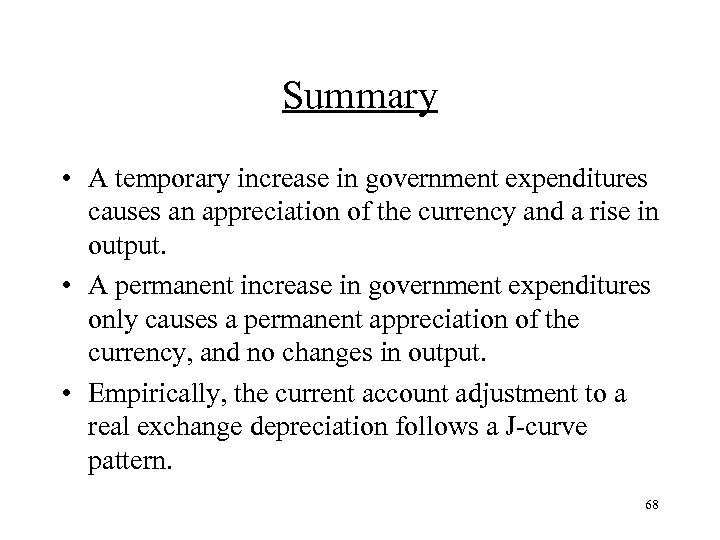

Summary • A temporary increase in government expenditures causes an appreciation of the currency and a rise in output. • A permanent increase in government expenditures only causes a permanent appreciation of the currency, and no changes in output. • Empirically, the current account adjustment to a real exchange depreciation follows a J-curve pattern. 68

Summary • A temporary increase in government expenditures causes an appreciation of the currency and a rise in output. • A permanent increase in government expenditures only causes a permanent appreciation of the currency, and no changes in output. • Empirically, the current account adjustment to a real exchange depreciation follows a J-curve pattern. 68