631b8f7531b8a4ad3fc3703587a6fa6e.ppt

- Количество слайдов: 62

Section 2 The Foreign Exchange Market 1

Section 2 The Foreign Exchange Market 1

Content • • Objectives Exchange Rates The Foreign Exchange Market Interest Parity Conditions Equilibrium in the For. Ex Market Imperfect Markets Summary 2

Content • • Objectives Exchange Rates The Foreign Exchange Market Interest Parity Conditions Equilibrium in the For. Ex Market Imperfect Markets Summary 2

Objectives • To know how to define and quote an exchange rate. • To know how to classify exchange rates by types of transactions and by maturity. • To know about triangular arbitrage • To understand the interest parity conditions. • To know how to determine the spot exchange rate in the foreign exchange market equilibrium. 3

Objectives • To know how to define and quote an exchange rate. • To know how to classify exchange rates by types of transactions and by maturity. • To know about triangular arbitrage • To understand the interest parity conditions. • To know how to determine the spot exchange rate in the foreign exchange market equilibrium. 3

Exchange Rates • An exchange rate is the price of a currency in terms of another currency. – – The price of a car is $20 000/car. The price of a Canadian dollar is USD 0. 7649/CAD. The price of a US dollar in CAD is CAD 1. 3074/USD So, S(USD/CAD) = 1/S(CAD/USD) • An exchange rate quote is an announcement of a price at which a currency can be traded for another. 4

Exchange Rates • An exchange rate is the price of a currency in terms of another currency. – – The price of a car is $20 000/car. The price of a Canadian dollar is USD 0. 7649/CAD. The price of a US dollar in CAD is CAD 1. 3074/USD So, S(USD/CAD) = 1/S(CAD/USD) • An exchange rate quote is an announcement of a price at which a currency can be traded for another. 4

Exchange Rates • Direct versus Indirect Quotes – A direct quote is the amount of home currency per unit of foreign currency. – An indirect quote is the amount of foreign currency per unit of home currency. • Example: In the U. S. , S(USD/CAD) = USD 0. 72/CAD is a direct quote for the Canadian dollar, but an indirect quote for the U. S. dollar. 5

Exchange Rates • Direct versus Indirect Quotes – A direct quote is the amount of home currency per unit of foreign currency. – An indirect quote is the amount of foreign currency per unit of home currency. • Example: In the U. S. , S(USD/CAD) = USD 0. 72/CAD is a direct quote for the Canadian dollar, but an indirect quote for the U. S. dollar. 5

Exchange Rates • Terminology: – Depreciation: A fall in the foreign exchange value of a floating currency. – Devaluation: A fall in the foreign exchange value of a currency pegged to another currency. – Soft or Weak: A currency that is expected to devalue or depreciate relative to major currencies. – The exchange rate is the price of the currency in the denominator: S = USD 0. 75/CAD 6

Exchange Rates • Terminology: – Depreciation: A fall in the foreign exchange value of a floating currency. – Devaluation: A fall in the foreign exchange value of a currency pegged to another currency. – Soft or Weak: A currency that is expected to devalue or depreciate relative to major currencies. – The exchange rate is the price of the currency in the denominator: S = USD 0. 75/CAD 6

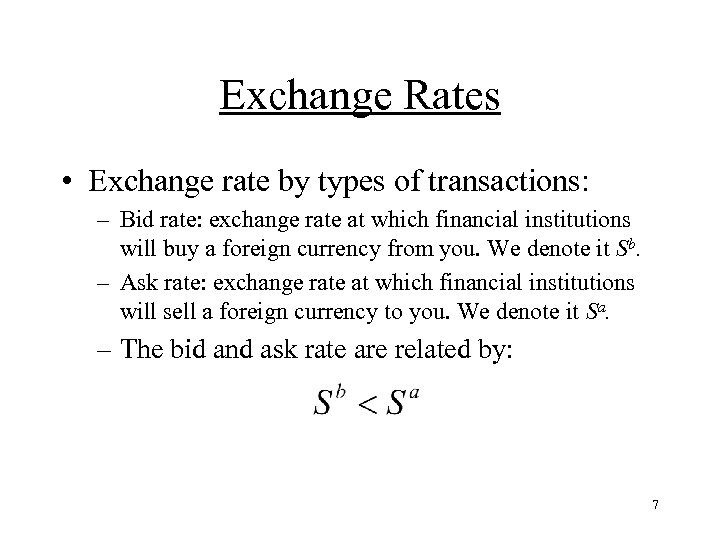

Exchange Rates • Exchange rate by types of transactions: – Bid rate: exchange rate at which financial institutions will buy a foreign currency from you. We denote it Sb. – Ask rate: exchange rate at which financial institutions will sell a foreign currency to you. We denote it Sa. – The bid and ask rate are related by: 7

Exchange Rates • Exchange rate by types of transactions: – Bid rate: exchange rate at which financial institutions will buy a foreign currency from you. We denote it Sb. – Ask rate: exchange rate at which financial institutions will sell a foreign currency to you. We denote it Sa. – The bid and ask rate are related by: 7

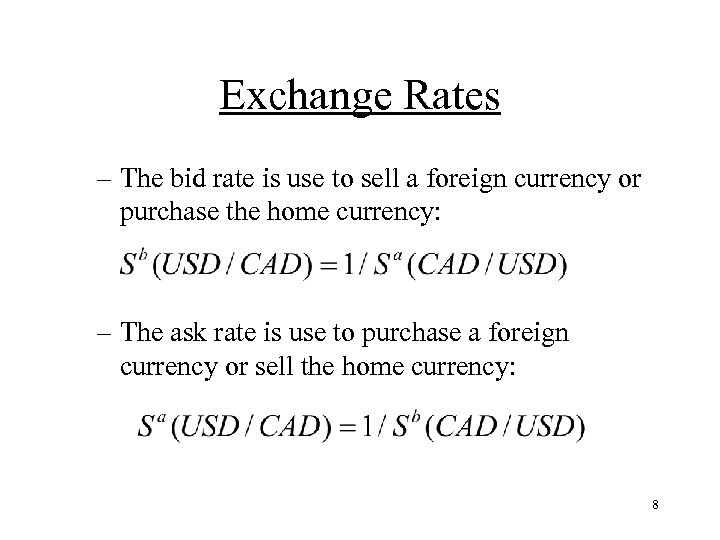

Exchange Rates – The bid rate is use to sell a foreign currency or purchase the home currency: – The ask rate is use to purchase a foreign currency or sell the home currency: 8

Exchange Rates – The bid rate is use to sell a foreign currency or purchase the home currency: – The ask rate is use to purchase a foreign currency or sell the home currency: 8

Exchange Rates – The spread (Sa – Sb) ensures that financial institutions make revenues from foreign exchange transactions. • These revenues are required to cover transaction costs incurred by acting as a financial intermediary between parties buying and selling currencies. • These revenues are also essential to make some profits. 9

Exchange Rates – The spread (Sa – Sb) ensures that financial institutions make revenues from foreign exchange transactions. • These revenues are required to cover transaction costs incurred by acting as a financial intermediary between parties buying and selling currencies. • These revenues are also essential to make some profits. 9

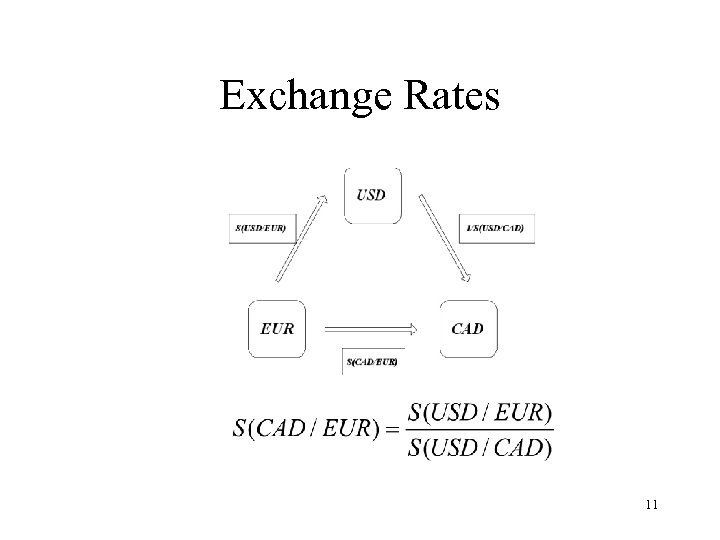

Exchange Rates • Triangular Arbitrage and Cross Rates: – I trade EUR z to obtain USD x: • USDx = EUR z S(USD/EUR) – I trade USD x to obtain CAD y: • CAD y = USD x/S(USD/CAD) – I trade EUR z to obtain CAD y: • CAD y = EUR z S(CAD/EUR) – So, 10

Exchange Rates • Triangular Arbitrage and Cross Rates: – I trade EUR z to obtain USD x: • USDx = EUR z S(USD/EUR) – I trade USD x to obtain CAD y: • CAD y = USD x/S(USD/CAD) – I trade EUR z to obtain CAD y: • CAD y = EUR z S(CAD/EUR) – So, 10

Exchange Rates 11

Exchange Rates 11

Exchange Rates • Domestic and Foreign Prices – The exchange rate enables us to compute the foreign currency price of goods in terms of home currency. – Example: The USD price of a CAD 20 compact disc with an exchange rate of USD 0. 75/CAD is (USD 0. 75/CAD) x (CAD 20) = USD 15. 12

Exchange Rates • Domestic and Foreign Prices – The exchange rate enables us to compute the foreign currency price of goods in terms of home currency. – Example: The USD price of a CAD 20 compact disc with an exchange rate of USD 0. 75/CAD is (USD 0. 75/CAD) x (CAD 20) = USD 15. 12

Exchange Rates • A depreciation of the home country’s currency – A rise in the price of a foreign currency – Raises the home currency price of foreign goods – Example: If the exchange rate is USD 0. 80/CAD, the USD price of a CAD 20 compact disc is (USD 0. 80/CAD) x (CAD 20) = USD 16. 13

Exchange Rates • A depreciation of the home country’s currency – A rise in the price of a foreign currency – Raises the home currency price of foreign goods – Example: If the exchange rate is USD 0. 80/CAD, the USD price of a CAD 20 compact disc is (USD 0. 80/CAD) x (CAD 20) = USD 16. 13

Exchange Rates • An appreciation of the home country’s currency – A reduction in the price of a foreign currency – Reduces the home currency price of foreign goods – Example: If the exchange rate is USD 0. 70/CAD, the USD price of a CAD 20 compact disc is (USD 0. 70/CAD) x (CAD 20) = USD 14. 14

Exchange Rates • An appreciation of the home country’s currency – A reduction in the price of a foreign currency – Reduces the home currency price of foreign goods – Example: If the exchange rate is USD 0. 70/CAD, the USD price of a CAD 20 compact disc is (USD 0. 70/CAD) x (CAD 20) = USD 14. 14

Exchange Rates • An appreciation of a country’s currency: – Raises the relative price of its goods (exports) – Lowers the relative price of foreign goods (imports) • Depreciation of a country’s currency: – Lowers the relative price of its goods (exports) – Raises the relative price of foreign goods (imports) 15

Exchange Rates • An appreciation of a country’s currency: – Raises the relative price of its goods (exports) – Lowers the relative price of foreign goods (imports) • Depreciation of a country’s currency: – Lowers the relative price of its goods (exports) – Raises the relative price of foreign goods (imports) 15

The Foreign Exchange Market • Exchange rates are determined in the foreign exchange market. • Geographically, the foreign exchange market spans the globe. – The market is most liquid early in the European afternoon, when the markets of both Europe and the U. S. East coast are open. – The market is thinnest at the end of the day in California, when the markets in Asia are about to open. 16

The Foreign Exchange Market • Exchange rates are determined in the foreign exchange market. • Geographically, the foreign exchange market spans the globe. – The market is most liquid early in the European afternoon, when the markets of both Europe and the U. S. East coast are open. – The market is thinnest at the end of the day in California, when the markets in Asia are about to open. 16

The Foreign Exchange Market • The BIS estimated that in 1992, the daily volume of trading on the foreign exchange market was about 5 to 10 times that of international trade in goods and services. • The volume has ballooned in recent years. • New technologies are used in the major trading centers (London, New York, Tokyo, Frankfurt, and Singapore). • In 2001, around 90% of transactions between banks involved exchanges of foreign currencies for U. S. dollars. 17

The Foreign Exchange Market • The BIS estimated that in 1992, the daily volume of trading on the foreign exchange market was about 5 to 10 times that of international trade in goods and services. • The volume has ballooned in recent years. • New technologies are used in the major trading centers (London, New York, Tokyo, Frankfurt, and Singapore). • In 2001, around 90% of transactions between banks involved exchanges of foreign currencies for U. S. dollars. 17

The Foreign Exchange Market • The main functions are: – Transfer of purchasing power – Provision of credit – Minimizing Foreign Exchange Risk 18

The Foreign Exchange Market • The main functions are: – Transfer of purchasing power – Provision of credit – Minimizing Foreign Exchange Risk 18

The Foreign Exchange Market • The major participants are: – Commercial banks – International corporations – Nonbank financial institutions – Central banks – Speculators and arbitragers • Interbank trading accounts for most of the volume. 19

The Foreign Exchange Market • The major participants are: – Commercial banks – International corporations – Nonbank financial institutions – Central banks – Speculators and arbitragers • Interbank trading accounts for most of the volume. 19

The Foreign Exchange Market • Spot exchange rates (S) – A spot transaction requires almost immediate delivery of foreign exchange. • Forward exchange rates (F) – A forward transaction requires delivery at a future date of a specified amount of a currency for a specified amount of another currency. 20

The Foreign Exchange Market • Spot exchange rates (S) – A spot transaction requires almost immediate delivery of foreign exchange. • Forward exchange rates (F) – A forward transaction requires delivery at a future date of a specified amount of a currency for a specified amount of another currency. 20

The Foreign Exchange Market • Foreign Exchange Swaps – A swap transaction involves the simultaneous purchase and sale of a given amount of foreign exchange for two different value dates. 21

The Foreign Exchange Market • Foreign Exchange Swaps – A swap transaction involves the simultaneous purchase and sale of a given amount of foreign exchange for two different value dates. 21

The Foreign Exchange Market • Futures contract – A promise that a specified amount of foreign currency will be delivered on a specified date in the future. • Options contract – Gives the right (not the obligation) to buy or sell a specified amount of foreign currency at a specified price at any time up to a specified expiration date. 22

The Foreign Exchange Market • Futures contract – A promise that a specified amount of foreign currency will be delivered on a specified date in the future. • Options contract – Gives the right (not the obligation) to buy or sell a specified amount of foreign currency at a specified price at any time up to a specified expiration date. 22

Interest Parity Conditions • Covered Interest Parity – This is an application of the law of one price. – Assets that have same maturity, liquidity, and risk should have the same price. – The rate of return of an asset is inversely related to its price. – Example: The rate of return on a risk-free asset that promises to pay 1 unit tomorrow for a price q units today is: 23

Interest Parity Conditions • Covered Interest Parity – This is an application of the law of one price. – Assets that have same maturity, liquidity, and risk should have the same price. – The rate of return of an asset is inversely related to its price. – Example: The rate of return on a risk-free asset that promises to pay 1 unit tomorrow for a price q units today is: 23

Interest Parity Conditions • Consider the return from purchasing a home money market instrument that pays in a year. – I purchase USD x of the asset. I get in a year: – The return is 24

Interest Parity Conditions • Consider the return from purchasing a home money market instrument that pays in a year. – I purchase USD x of the asset. I get in a year: – The return is 24

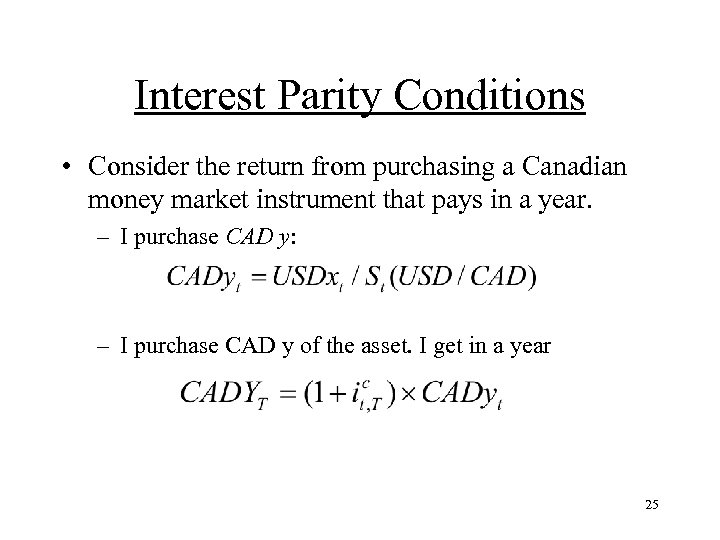

Interest Parity Conditions • Consider the return from purchasing a Canadian money market instrument that pays in a year. – I purchase CAD y: – I purchase CAD y of the asset. I get in a year 25

Interest Parity Conditions • Consider the return from purchasing a Canadian money market instrument that pays in a year. – I purchase CAD y: – I purchase CAD y of the asset. I get in a year 25

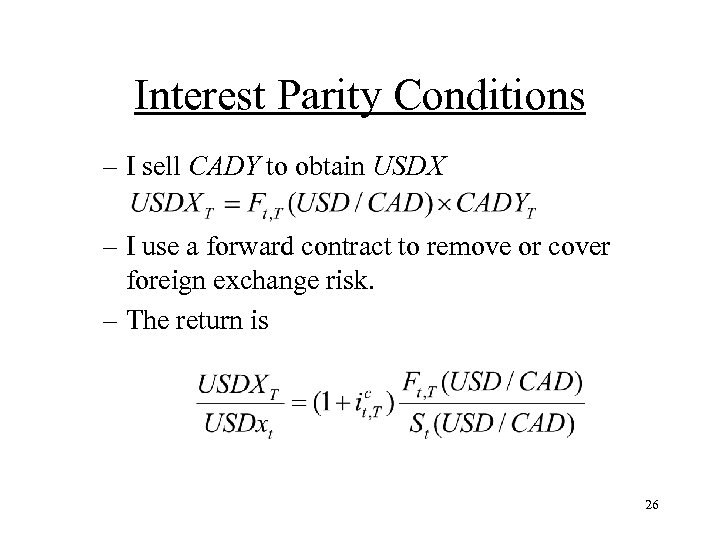

Interest Parity Conditions – I sell CADY to obtain USDX – I use a forward contract to remove or cover foreign exchange risk. – The return is 26

Interest Parity Conditions – I sell CADY to obtain USDX – I use a forward contract to remove or cover foreign exchange risk. – The return is 26

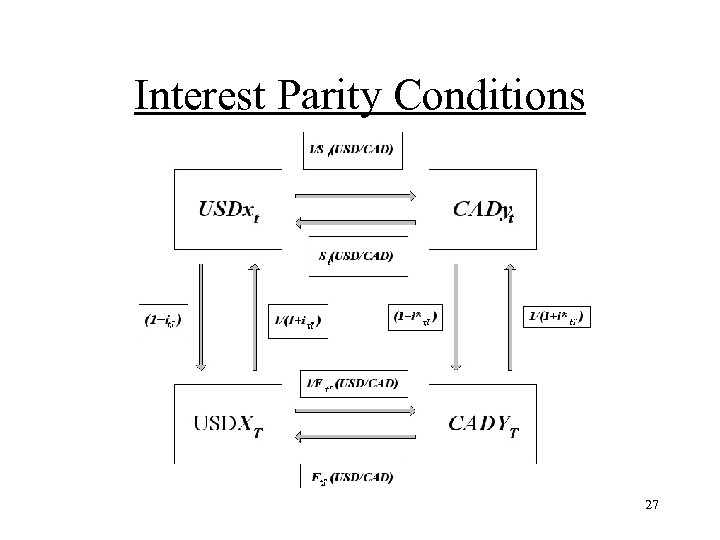

Interest Parity Conditions 27

Interest Parity Conditions 27

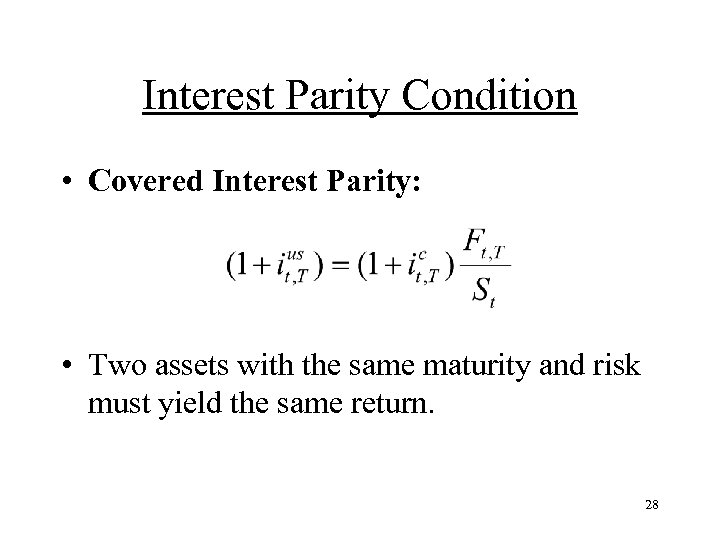

Interest Parity Condition • Covered Interest Parity: • Two assets with the same maturity and risk must yield the same return. 28

Interest Parity Condition • Covered Interest Parity: • Two assets with the same maturity and risk must yield the same return. 28

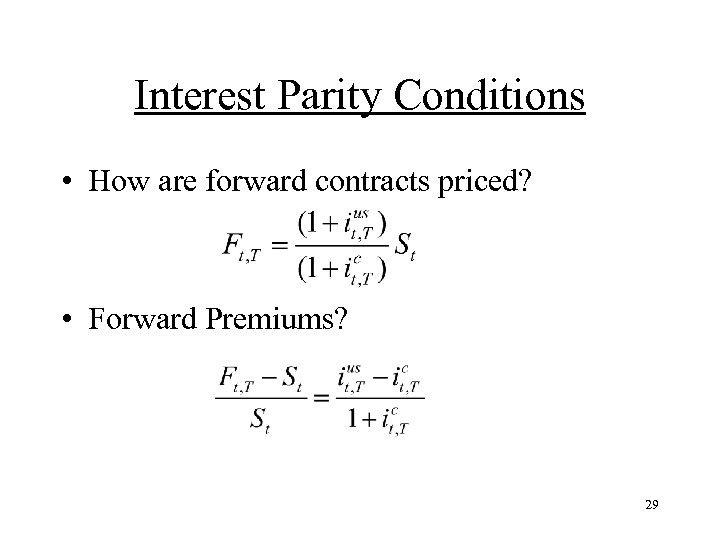

Interest Parity Conditions • How are forward contracts priced? • Forward Premiums? 29

Interest Parity Conditions • How are forward contracts priced? • Forward Premiums? 29

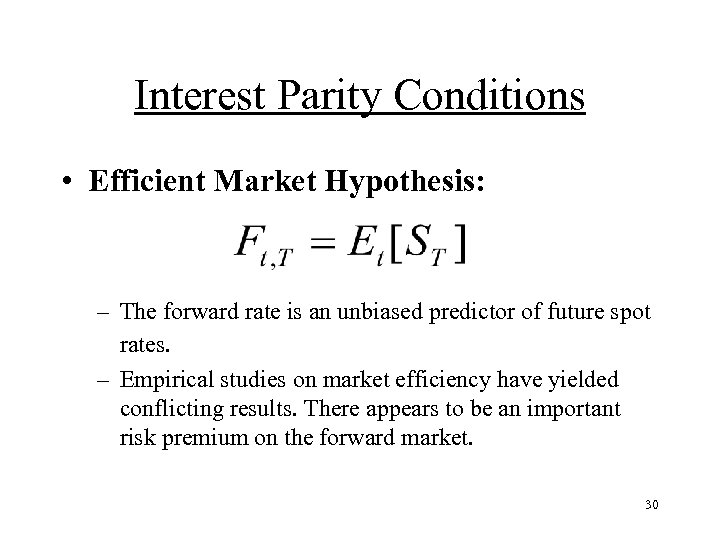

Interest Parity Conditions • Efficient Market Hypothesis: – The forward rate is an unbiased predictor of future spot rates. – Empirical studies on market efficiency have yielded conflicting results. There appears to be an important risk premium on the forward market. 30

Interest Parity Conditions • Efficient Market Hypothesis: – The forward rate is an unbiased predictor of future spot rates. – Empirical studies on market efficiency have yielded conflicting results. There appears to be an important risk premium on the forward market. 30

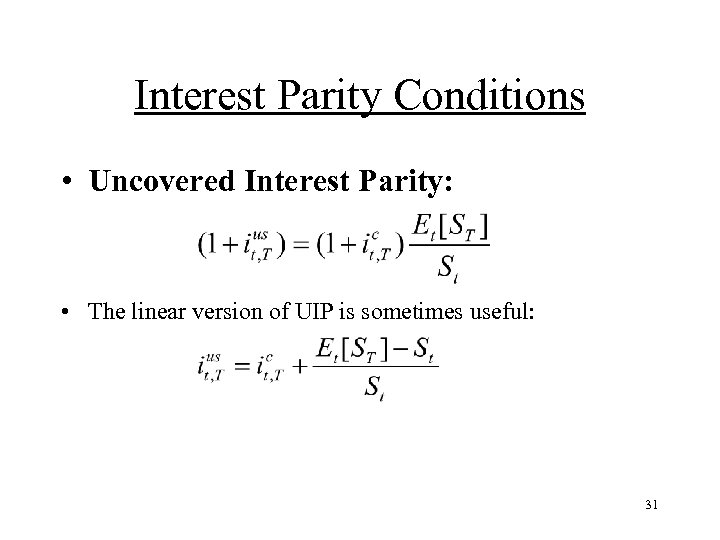

Interest Parity Conditions • Uncovered Interest Parity: • The linear version of UIP is sometimes useful: 31

Interest Parity Conditions • Uncovered Interest Parity: • The linear version of UIP is sometimes useful: 31

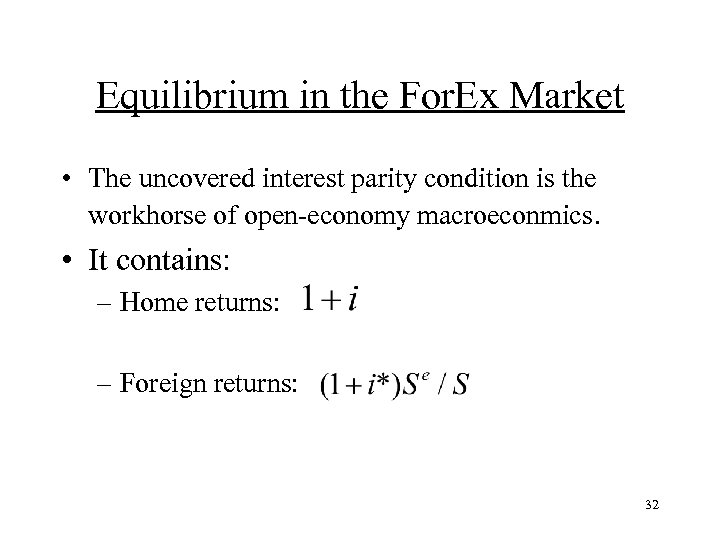

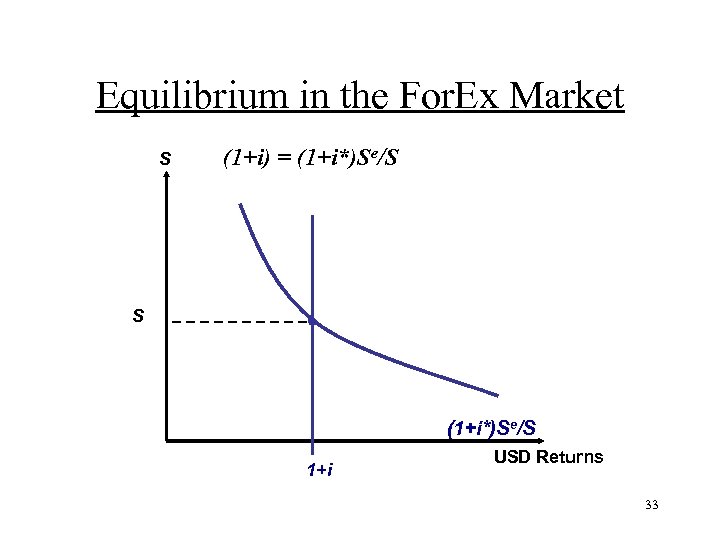

Equilibrium in the For. Ex Market • The uncovered interest parity condition is the workhorse of open-economy macroeconmics. • It contains: – Home returns: – Foreign returns: 32

Equilibrium in the For. Ex Market • The uncovered interest parity condition is the workhorse of open-economy macroeconmics. • It contains: – Home returns: – Foreign returns: 32

Equilibrium in the For. Ex Market S (1+i) = (1+i*)Se/S S (1+i*)Se/S 1+i USD Returns 33

Equilibrium in the For. Ex Market S (1+i) = (1+i*)Se/S S (1+i*)Se/S 1+i USD Returns 33

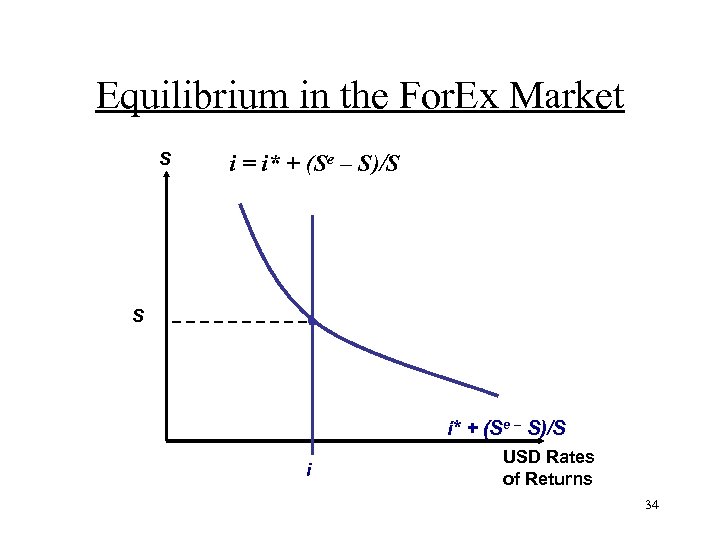

Equilibrium in the For. Ex Market S i = i* + (Se – S)/S S i* + (Se – S)/S i USD Rates of Returns 34

Equilibrium in the For. Ex Market S i = i* + (Se – S)/S S i* + (Se – S)/S i USD Rates of Returns 34

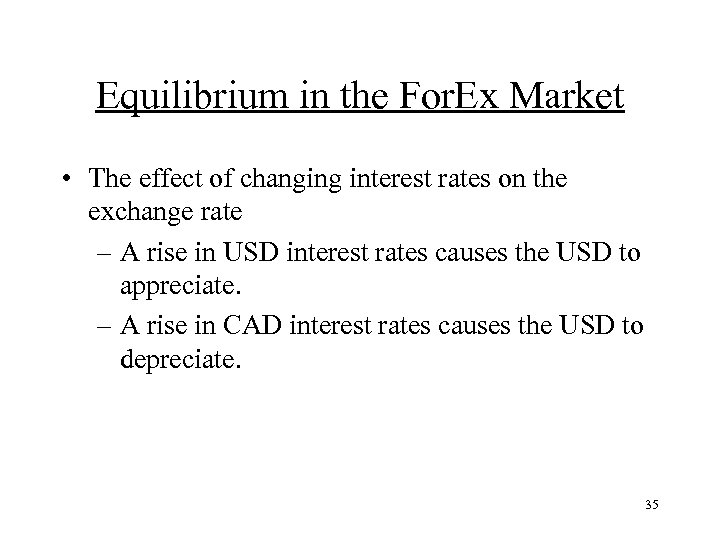

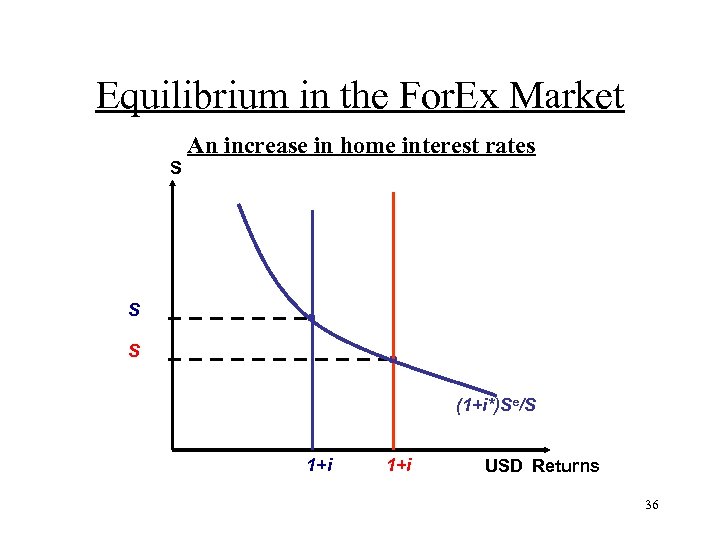

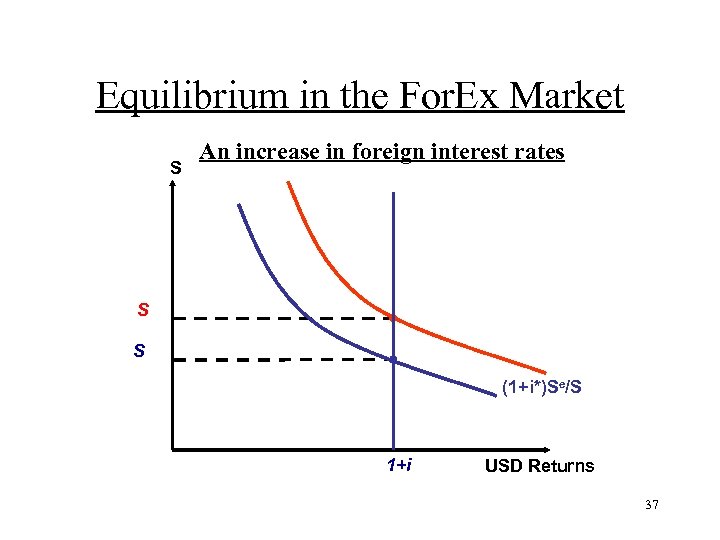

Equilibrium in the For. Ex Market • The effect of changing interest rates on the exchange rate – A rise in USD interest rates causes the USD to appreciate. – A rise in CAD interest rates causes the USD to depreciate. 35

Equilibrium in the For. Ex Market • The effect of changing interest rates on the exchange rate – A rise in USD interest rates causes the USD to appreciate. – A rise in CAD interest rates causes the USD to depreciate. 35

Equilibrium in the For. Ex Market An increase in home interest rates S S S (1+i*)Se/S 1+i USD Returns 36

Equilibrium in the For. Ex Market An increase in home interest rates S S S (1+i*)Se/S 1+i USD Returns 36

Equilibrium in the For. Ex Market S An increase in foreign interest rates S S (1+i*)Se/S 1+i USD Returns 37

Equilibrium in the For. Ex Market S An increase in foreign interest rates S S (1+i*)Se/S 1+i USD Returns 37

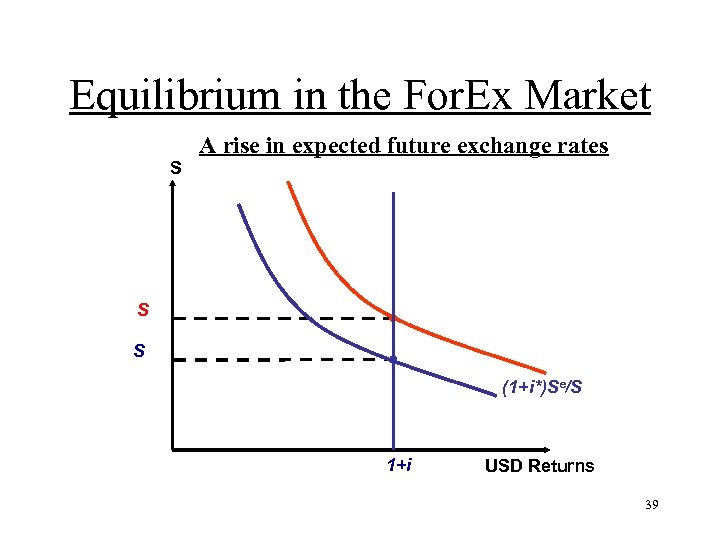

Equilibrium in the For. Ex Market • The effect of changing expectations on the exchange rate – A rise in the expected future exchange rate raises the current exchange rate. – A fall in the expected future exchange rate reduces the current exchange rate. 38

Equilibrium in the For. Ex Market • The effect of changing expectations on the exchange rate – A rise in the expected future exchange rate raises the current exchange rate. – A fall in the expected future exchange rate reduces the current exchange rate. 38

Equilibrium in the For. Ex Market S A rise in expected future exchange rates S S (1+i*)Se/S 1+i USD Returns 39

Equilibrium in the For. Ex Market S A rise in expected future exchange rates S S (1+i*)Se/S 1+i USD Returns 39

Imperfect Markets • In reality, we have bid-ask spreads. • This influences the notion of arbitrage used to construct cross-rates and covered interest parity. 40

Imperfect Markets • In reality, we have bid-ask spreads. • This influences the notion of arbitrage used to construct cross-rates and covered interest parity. 40

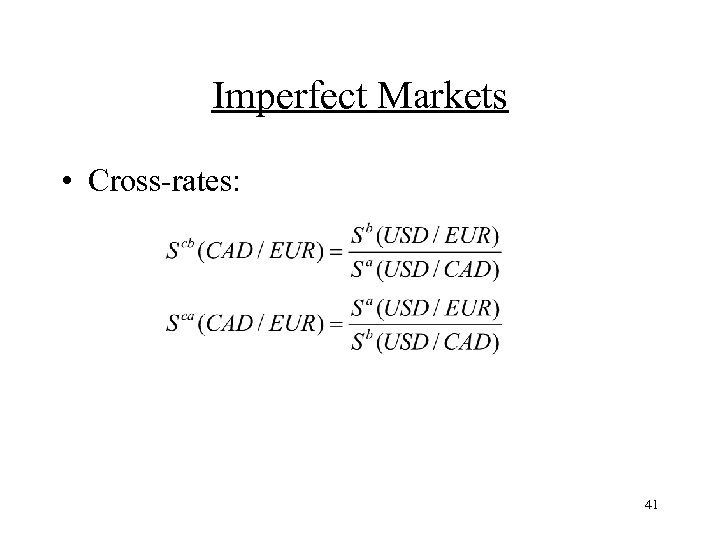

Imperfect Markets • Cross-rates: 41

Imperfect Markets • Cross-rates: 41

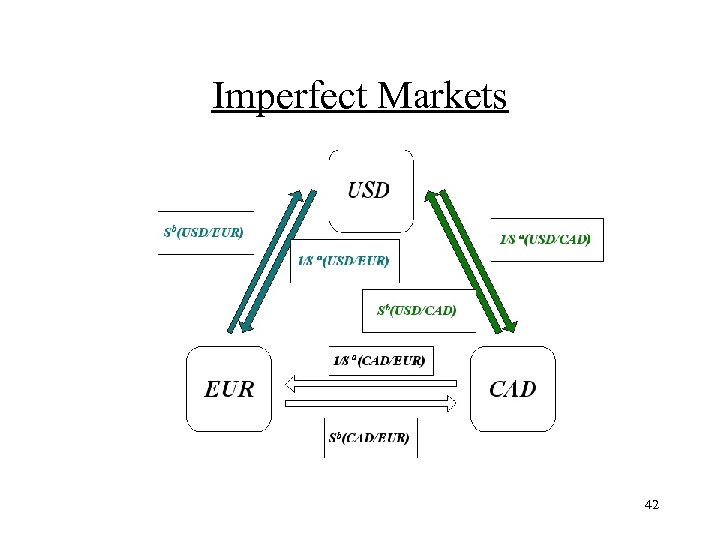

Imperfect Markets 42

Imperfect Markets 42

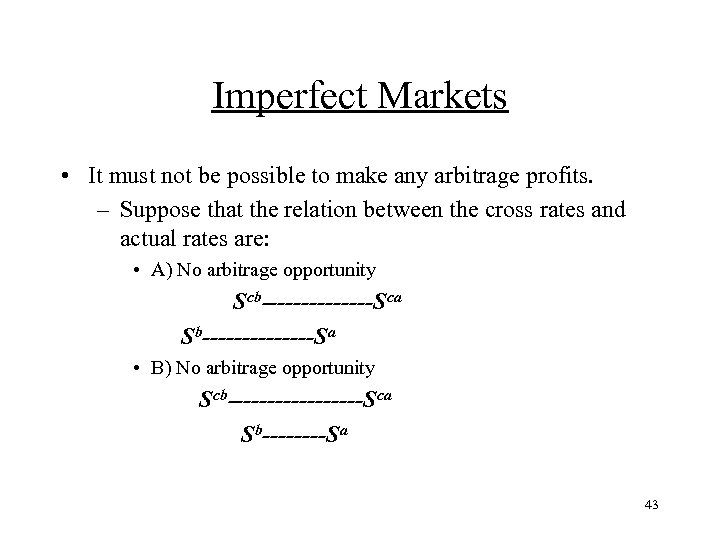

Imperfect Markets • It must not be possible to make any arbitrage profits. – Suppose that the relation between the cross rates and actual rates are: • A) No arbitrage opportunity Scb-------Sca Sb-------Sa • B) No arbitrage opportunity Scb---------Sca Sb----Sa 43

Imperfect Markets • It must not be possible to make any arbitrage profits. – Suppose that the relation between the cross rates and actual rates are: • A) No arbitrage opportunity Scb-------Sca Sb-------Sa • B) No arbitrage opportunity Scb---------Sca Sb----Sa 43

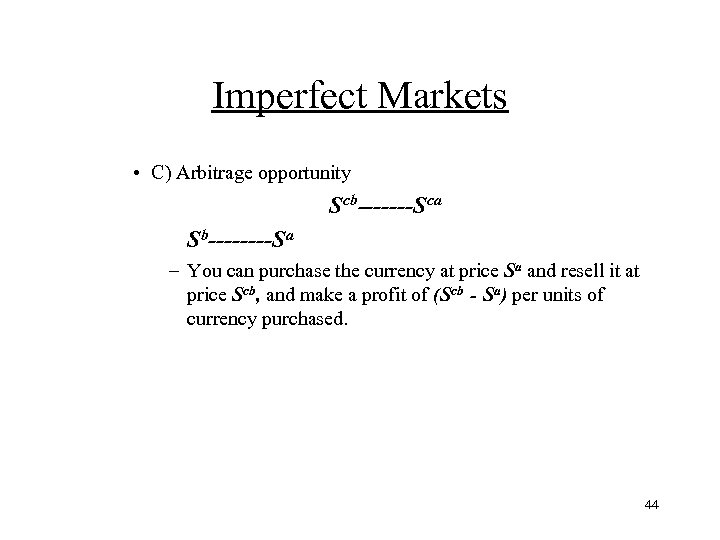

Imperfect Markets • C) Arbitrage opportunity Scb-------Sca Sb----Sa – You can purchase the currency at price Sa and resell it at price Scb, and make a profit of (Scb - Sa) per units of currency purchased. 44

Imperfect Markets • C) Arbitrage opportunity Scb-------Sca Sb----Sa – You can purchase the currency at price Sa and resell it at price Scb, and make a profit of (Scb - Sa) per units of currency purchased. 44

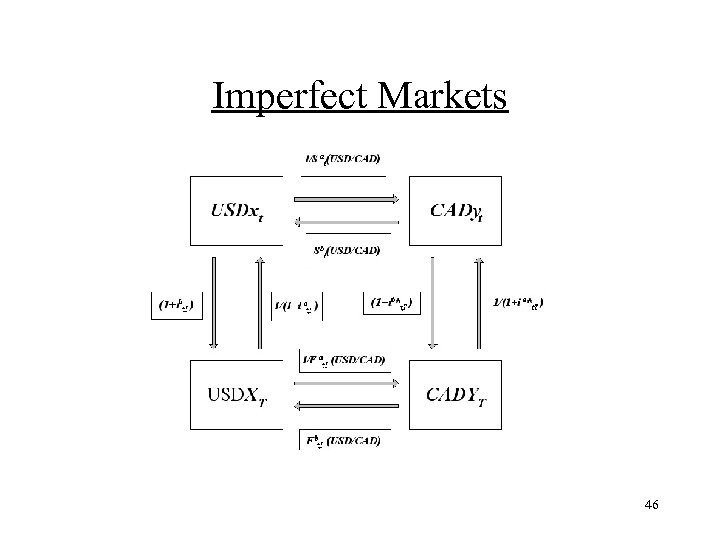

Imperfect Markets • International investments are also affected. • It must not be possible to make any arbitrage profits. • There are bid-ask rates in the foreign exchange market. • Borrowing rates (ia) are larger than lending rates (ib). So, ia > ib 45

Imperfect Markets • International investments are also affected. • It must not be possible to make any arbitrage profits. • There are bid-ask rates in the foreign exchange market. • Borrowing rates (ia) are larger than lending rates (ib). So, ia > ib 45

Imperfect Markets 46

Imperfect Markets 46

Imperfect Markets • Example: The manager of a U. S. firm intends to buy Canadian maple syrup in 1 year. The syrup is worth CAD 1 m. International prices are as follows: – Spot rate: USD 0. 66 ----0. 80/CAD – Forward rate: USD 0. 65 ----0. 77/CAD – Interest rates (Canada): 8 ---10 percent per annum – Interest rates (U. S. ): 5 ---6 percent per annum • How much money should the manager put aside today for this purchase? 47

Imperfect Markets • Example: The manager of a U. S. firm intends to buy Canadian maple syrup in 1 year. The syrup is worth CAD 1 m. International prices are as follows: – Spot rate: USD 0. 66 ----0. 80/CAD – Forward rate: USD 0. 65 ----0. 77/CAD – Interest rates (Canada): 8 ---10 percent per annum – Interest rates (U. S. ): 5 ---6 percent per annum • How much money should the manager put aside today for this purchase? 47

Imperfect Markets • Investing in the US: CADYT = USDxt (1+ib, us)/ Fa(USD/CAD) or USDxt = CADYT Fa(USD/CAD)/(1+ib, us) USDxt = CAD 1 m (USD 0. 77/CAD)/(1+0. 05) = USD 0. 73 m 48

Imperfect Markets • Investing in the US: CADYT = USDxt (1+ib, us)/ Fa(USD/CAD) or USDxt = CADYT Fa(USD/CAD)/(1+ib, us) USDxt = CAD 1 m (USD 0. 77/CAD)/(1+0. 05) = USD 0. 73 m 48

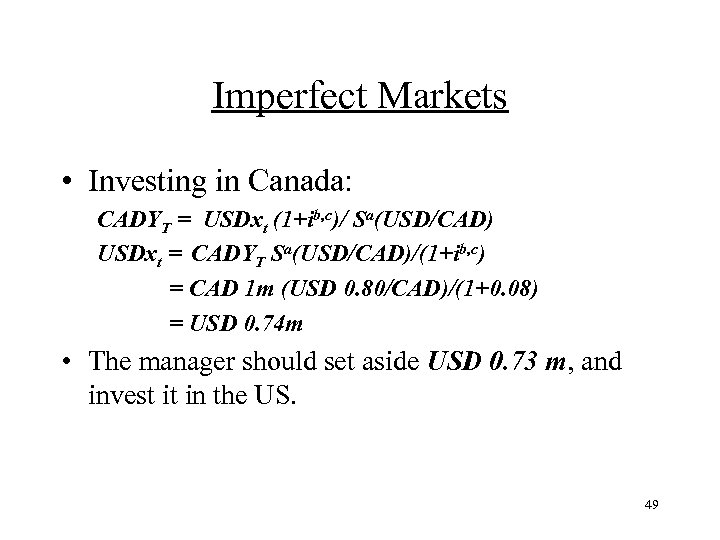

Imperfect Markets • Investing in Canada: CADYT = USDxt (1+ib, c)/ Sa(USD/CAD) USDxt = CADYT Sa(USD/CAD)/(1+ib, c) = CAD 1 m (USD 0. 80/CAD)/(1+0. 08) = USD 0. 74 m • The manager should set aside USD 0. 73 m, and invest it in the US. 49

Imperfect Markets • Investing in Canada: CADYT = USDxt (1+ib, c)/ Sa(USD/CAD) USDxt = CADYT Sa(USD/CAD)/(1+ib, c) = CAD 1 m (USD 0. 80/CAD)/(1+0. 08) = USD 0. 74 m • The manager should set aside USD 0. 73 m, and invest it in the US. 49

Imperfect Markets • Is there an arbitrage opportunity? • To answer this question, we construct the USD return to borrowing and investing abroad. • Then, we can compare the rates obtained abroad to those in the US. 50

Imperfect Markets • Is there an arbitrage opportunity? • To answer this question, we construct the USD return to borrowing and investing abroad. • Then, we can compare the rates obtained abroad to those in the US. 50

Imperfect Markets • Investing at Home: HRb = 1+ib • Borrowing at Home: HRa = 1+ia • As expected, HRb < HRa 51

Imperfect Markets • Investing at Home: HRb = 1+ib • Borrowing at Home: HRa = 1+ia • As expected, HRb < HRa 51

Imperfect Markets • Investing Abroad: FRb = (1+i*b) Fb/Sa • Borrowing Abroad: FRa = (1+i*a) Fa/Sb • As expected, FRb < FRa 52

Imperfect Markets • Investing Abroad: FRb = (1+i*b) Fb/Sa • Borrowing Abroad: FRa = (1+i*a) Fa/Sb • As expected, FRb < FRa 52

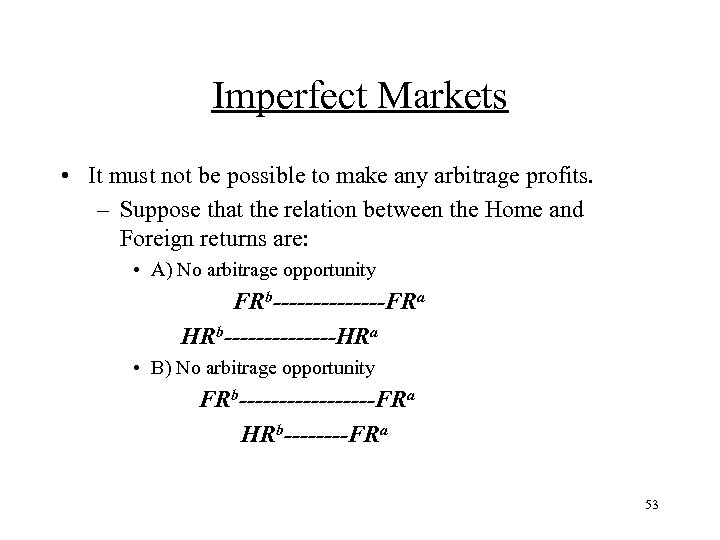

Imperfect Markets • It must not be possible to make any arbitrage profits. – Suppose that the relation between the Home and Foreign returns are: • A) No arbitrage opportunity FRb-------FRa HRb-------HRa • B) No arbitrage opportunity FRb---------FRa HRb----FRa 53

Imperfect Markets • It must not be possible to make any arbitrage profits. – Suppose that the relation between the Home and Foreign returns are: • A) No arbitrage opportunity FRb-------FRa HRb-------HRa • B) No arbitrage opportunity FRb---------FRa HRb----FRa 53

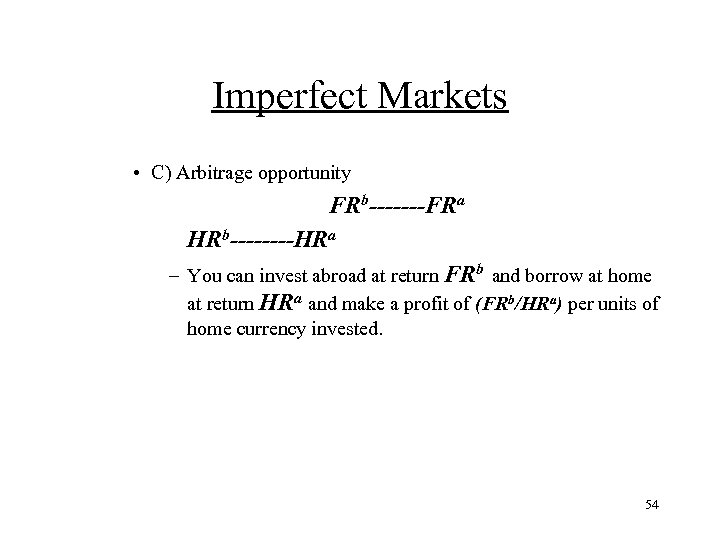

Imperfect Markets • C) Arbitrage opportunity FRb-------FRa HRb----HRa – You can invest abroad at return FRb and borrow at home at return HRa and make a profit of (FRb/HRa) per units of home currency invested. 54

Imperfect Markets • C) Arbitrage opportunity FRb-------FRa HRb----HRa – You can invest abroad at return FRb and borrow at home at return HRa and make a profit of (FRb/HRa) per units of home currency invested. 54

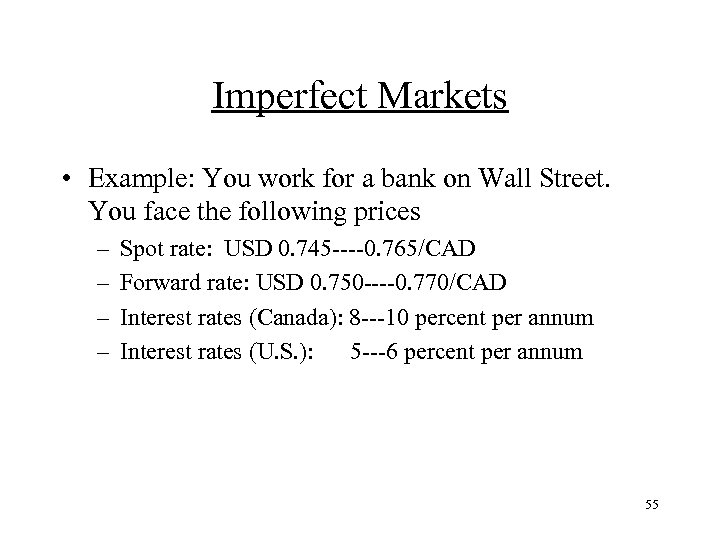

Imperfect Markets • Example: You work for a bank on Wall Street. You face the following prices – – Spot rate: USD 0. 745 ----0. 765/CAD Forward rate: USD 0. 750 ----0. 770/CAD Interest rates (Canada): 8 ---10 percent per annum Interest rates (U. S. ): 5 ---6 percent per annum 55

Imperfect Markets • Example: You work for a bank on Wall Street. You face the following prices – – Spot rate: USD 0. 745 ----0. 765/CAD Forward rate: USD 0. 750 ----0. 770/CAD Interest rates (Canada): 8 ---10 percent per annum Interest rates (U. S. ): 5 ---6 percent per annum 55

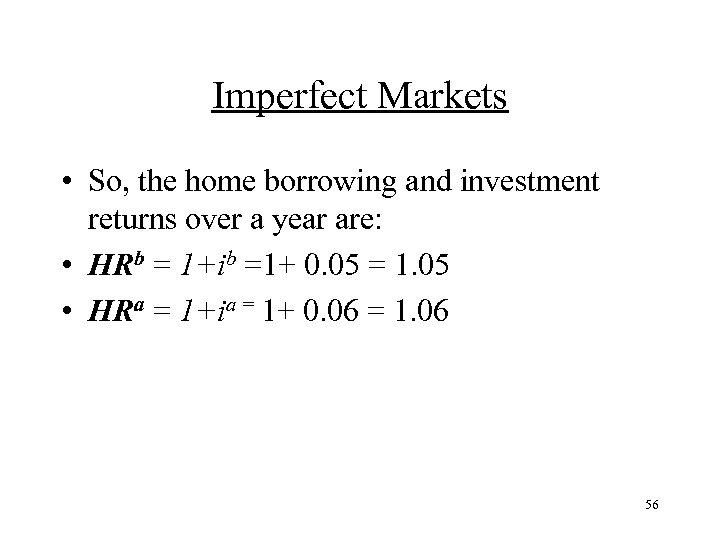

Imperfect Markets • So, the home borrowing and investment returns over a year are: • HRb = 1+ib =1+ 0. 05 = 1. 05 • HRa = 1+ia = 1+ 0. 06 = 1. 06 56

Imperfect Markets • So, the home borrowing and investment returns over a year are: • HRb = 1+ib =1+ 0. 05 = 1. 05 • HRa = 1+ia = 1+ 0. 06 = 1. 06 56

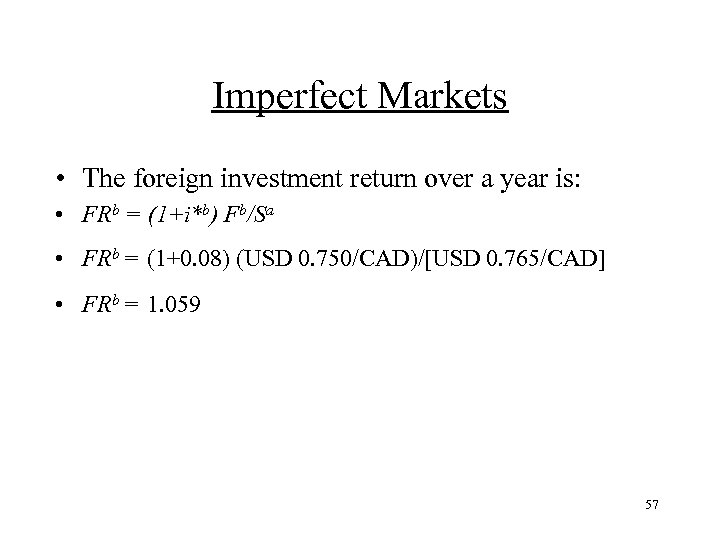

Imperfect Markets • The foreign investment return over a year is: • FRb = (1+i*b) Fb/Sa • FRb = (1+0. 08) (USD 0. 750/CAD)/[USD 0. 765/CAD] • FRb = 1. 059 57

Imperfect Markets • The foreign investment return over a year is: • FRb = (1+i*b) Fb/Sa • FRb = (1+0. 08) (USD 0. 750/CAD)/[USD 0. 765/CAD] • FRb = 1. 059 57

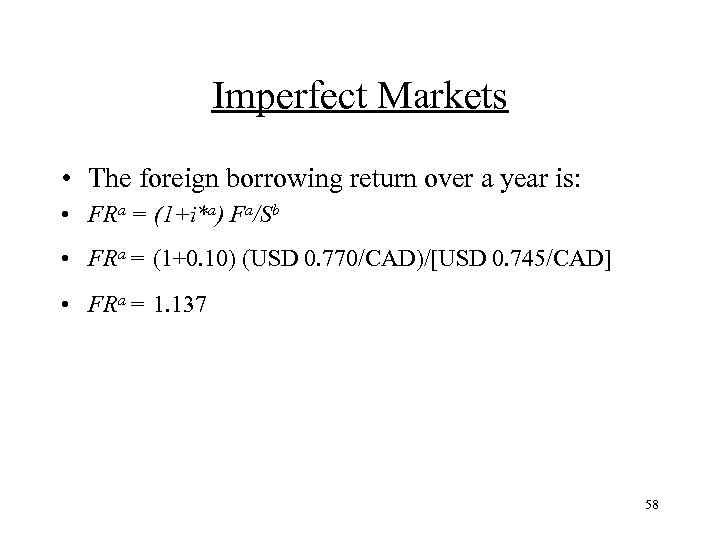

Imperfect Markets • The foreign borrowing return over a year is: • FRa = (1+i*a) Fa/Sb • FRa = (1+0. 10) (USD 0. 770/CAD)/[USD 0. 745/CAD] • FRa = 1. 137 58

Imperfect Markets • The foreign borrowing return over a year is: • FRa = (1+i*a) Fa/Sb • FRa = (1+0. 10) (USD 0. 770/CAD)/[USD 0. 745/CAD] • FRa = 1. 137 58

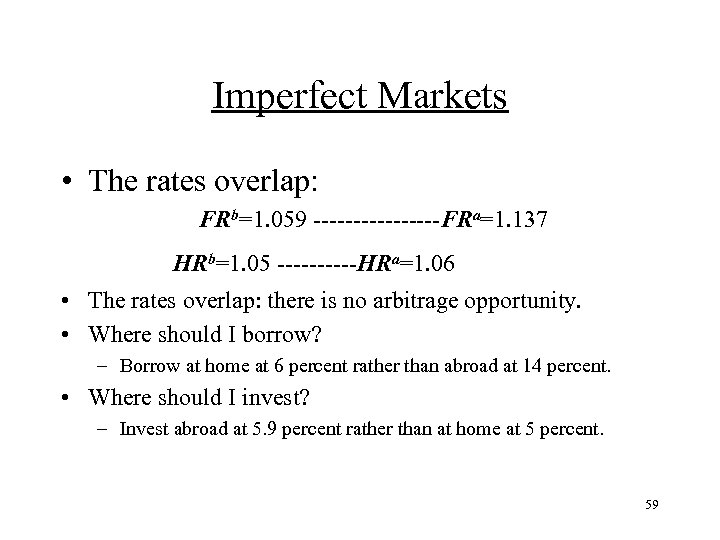

Imperfect Markets • The rates overlap: FRb=1. 059 --------FRa=1. 137 HRb=1. 05 -----HRa=1. 06 • The rates overlap: there is no arbitrage opportunity. • Where should I borrow? – Borrow at home at 6 percent rather than abroad at 14 percent. • Where should I invest? – Invest abroad at 5. 9 percent rather than at home at 5 percent. 59

Imperfect Markets • The rates overlap: FRb=1. 059 --------FRa=1. 137 HRb=1. 05 -----HRa=1. 06 • The rates overlap: there is no arbitrage opportunity. • Where should I borrow? – Borrow at home at 6 percent rather than abroad at 14 percent. • Where should I invest? – Invest abroad at 5. 9 percent rather than at home at 5 percent. 59

Summary • Exchange rates enable us to translate different countries’ prices into comparable terms. • A depreciation (appreciation) of a country’s currency against foreign currencies makes its exports cheaper (more expensive) and its imports more expensive (cheaper). • Exchange rates are determined in the foreign exchange market. 60

Summary • Exchange rates enable us to translate different countries’ prices into comparable terms. • A depreciation (appreciation) of a country’s currency against foreign currencies makes its exports cheaper (more expensive) and its imports more expensive (cheaper). • Exchange rates are determined in the foreign exchange market. 60

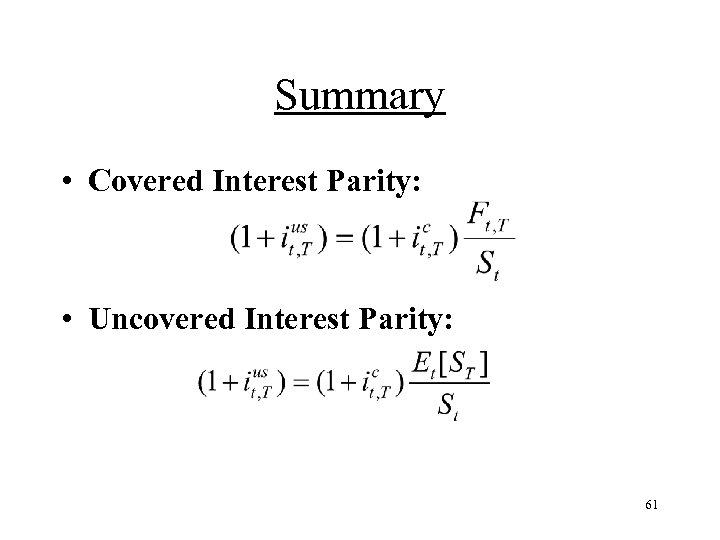

Summary • Covered Interest Parity: • Uncovered Interest Parity: 61

Summary • Covered Interest Parity: • Uncovered Interest Parity: 61

Summary • Equilibrium in the foreign exchange market requires uncovered interest parity. • A rise in USD interest rates causes the USD to appreciate against foreign currencies. • The exchange rate depends on its expected future level. • Market imperfections affect both cross-rates and interest rate parity conditions. 62

Summary • Equilibrium in the foreign exchange market requires uncovered interest parity. • A rise in USD interest rates causes the USD to appreciate against foreign currencies. • The exchange rate depends on its expected future level. • Market imperfections affect both cross-rates and interest rate parity conditions. 62