89671a5d44120c9f7c970f61ec0e0a28.ppt

- Количество слайдов: 19

Section 2 - Investment Options

Section 2 - Investment Options

Investment Options Low risk/low return Medium risk/medium return High risk/high return Primary Market issues new investments on an exchange(initial purchase offerings) Secondary Market investors buy and sell investments from other investors(e. Trade)

Investment Options Low risk/low return Medium risk/medium return High risk/high return Primary Market issues new investments on an exchange(initial purchase offerings) Secondary Market investors buy and sell investments from other investors(e. Trade)

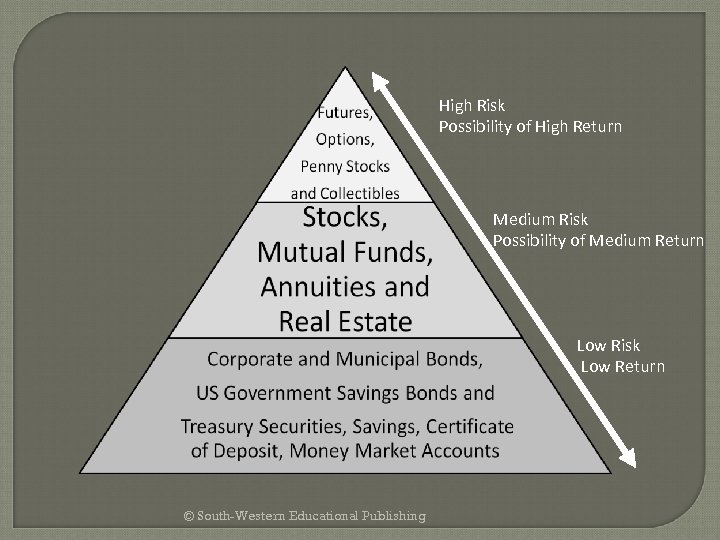

High Risk Possibility of High Return Medium Risk Possibility of Medium Return Low Risk Low Return © South-Western Educational Publishing

High Risk Possibility of High Return Medium Risk Possibility of Medium Return Low Risk Low Return © South-Western Educational Publishing

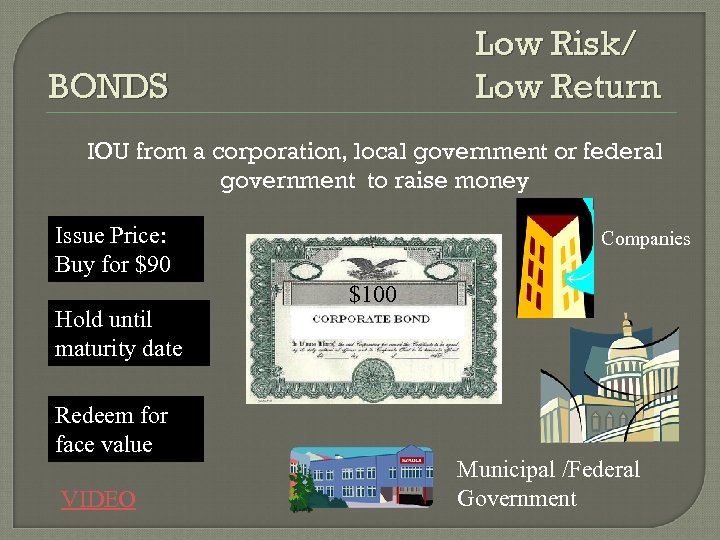

Low Risk/ Low Return BONDS IOU from a corporation, local government or federal government to raise money Issue Price: Buy for $90 Hold until maturity date Redeem for face value VIDEO Companies $100 Municipal /Federal Government

Low Risk/ Low Return BONDS IOU from a corporation, local government or federal government to raise money Issue Price: Buy for $90 Hold until maturity date Redeem for face value VIDEO Companies $100 Municipal /Federal Government

Medium Risk/ Medium Return Stocks Mutual Funds Retirement Plans Real Estate

Medium Risk/ Medium Return Stocks Mutual Funds Retirement Plans Real Estate

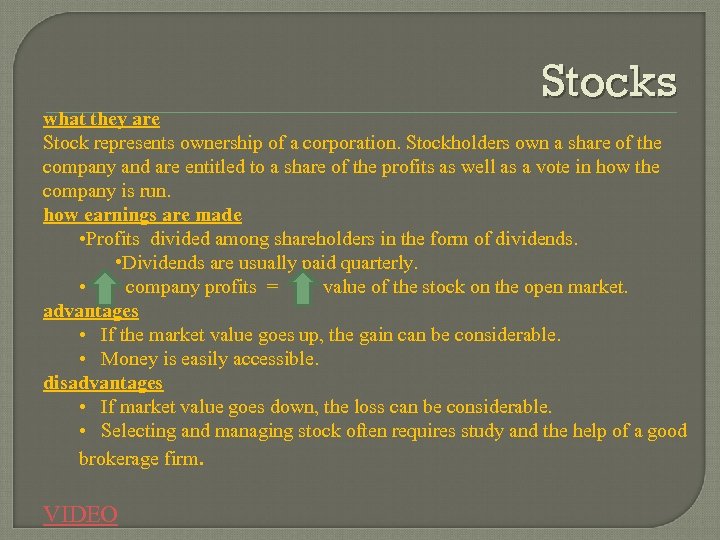

Stocks what they are Stock represents ownership of a corporation. Stockholders own a share of the company and are entitled to a share of the profits as well as a vote in how the company is run. how earnings are made • Profits divided among shareholders in the form of dividends. • Dividends are usually paid quarterly. • company profits = value of the stock on the open market. advantages • If the market value goes up, the gain can be considerable. • Money is easily accessible. disadvantages • If market value goes down, the loss can be considerable. • Selecting and managing stock often requires study and the help of a good brokerage firm. VIDEO

Stocks what they are Stock represents ownership of a corporation. Stockholders own a share of the company and are entitled to a share of the profits as well as a vote in how the company is run. how earnings are made • Profits divided among shareholders in the form of dividends. • Dividends are usually paid quarterly. • company profits = value of the stock on the open market. advantages • If the market value goes up, the gain can be considerable. • Money is easily accessible. disadvantages • If market value goes down, the loss can be considerable. • Selecting and managing stock often requires study and the help of a good brokerage firm. VIDEO

what affects a stock’s price 1. Stocks The company prices change daily due to supply and demand based on a company’s perceived value and predictions for future success High demand = higher prices • company profits (earnings) • company expectations (launching new, innovative products to create growth) 2. 3. The market overall long-term predictions for economy (growing or slowing down) Interest rates cost of capital driven by interest rates (if businesses have to spend more for loans because of high interest rates, their profits won’t be as high) VIDEO

what affects a stock’s price 1. Stocks The company prices change daily due to supply and demand based on a company’s perceived value and predictions for future success High demand = higher prices • company profits (earnings) • company expectations (launching new, innovative products to create growth) 2. 3. The market overall long-term predictions for economy (growing or slowing down) Interest rates cost of capital driven by interest rates (if businesses have to spend more for loans because of high interest rates, their profits won’t be as high) VIDEO

Bull Market: Bear Market: a prolonged period of rising stock prices and a falling stock prices and a general feeling of investor pessimism; optimism;

Bull Market: Bear Market: a prolonged period of rising stock prices and a falling stock prices and a general feeling of investor pessimism; optimism;

Vocabulary-Stocks Stockholder- also known as shareholders, are the owners of a corporation Dividends-profits that the corporation pays to stockholders Capital Gains- increase in the value of the stock above the price initially paid for it Purchas ed Jan. 2010 $50 Sold Jan. 2011 $55

Vocabulary-Stocks Stockholder- also known as shareholders, are the owners of a corporation Dividends-profits that the corporation pays to stockholders Capital Gains- increase in the value of the stock above the price initially paid for it Purchas ed Jan. 2010 $50 Sold Jan. 2011 $55

Vocabulary- Stocks Cont. Blue Chips- stock of large well established corporations with a solid record of profitability ex: Stock Split- a direct increase in the amount of outstanding or available stock by splitting stocks (ex: 1 to 2), which in turn has an effect upon the price (for 1 to 2, price is cut in half). $10. 00 $5. 00 Dividend Reinvestment- using dividends previously earned on stocks to buy more shares

Vocabulary- Stocks Cont. Blue Chips- stock of large well established corporations with a solid record of profitability ex: Stock Split- a direct increase in the amount of outstanding or available stock by splitting stocks (ex: 1 to 2), which in turn has an effect upon the price (for 1 to 2, price is cut in half). $10. 00 $5. 00 Dividend Reinvestment- using dividends previously earned on stocks to buy more shares

Vocabulary- Stocks Cont. Market Value- the price at which stock is bought and sold in the market place Buy Common $50 Sell $65 Stock-a type of stock that pays a variable o r $45 dividend and gives the holder voting rights Preferred Stock-stock that pays a fixed dividend and caries no voting rights Growth Stock- stocks in corporations that reinvest their profits into the business so it can grow, with little or no dividends paid out. Generally a long term investment

Vocabulary- Stocks Cont. Market Value- the price at which stock is bought and sold in the market place Buy Common $50 Sell $65 Stock-a type of stock that pays a variable o r $45 dividend and gives the holder voting rights Preferred Stock-stock that pays a fixed dividend and caries no voting rights Growth Stock- stocks in corporations that reinvest their profits into the business so it can grow, with little or no dividends paid out. Generally a long term investment

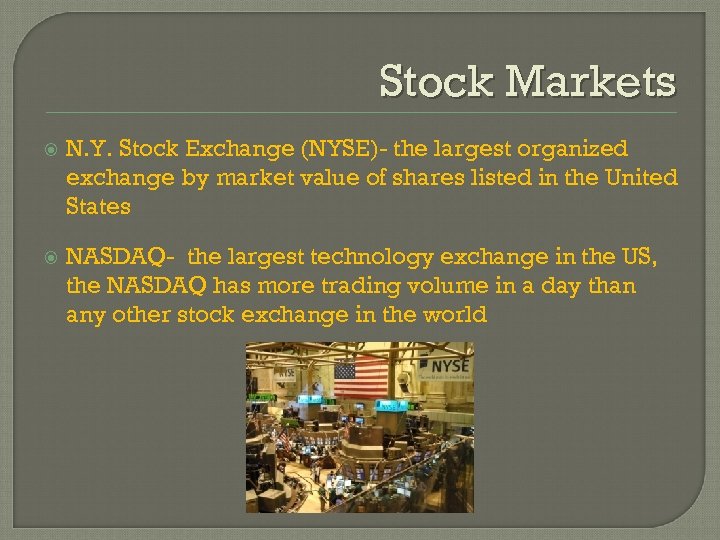

Stock Markets N. Y. Stock Exchange (NYSE)- the largest organized exchange by market value of shares listed in the United States NASDAQ- the largest technology exchange in the US, the NASDAQ has more trading volume in a day than any other stock exchange in the world

Stock Markets N. Y. Stock Exchange (NYSE)- the largest organized exchange by market value of shares listed in the United States NASDAQ- the largest technology exchange in the US, the NASDAQ has more trading volume in a day than any other stock exchange in the world

Stock Indexes Index- a benchmark that investors use to judge the performance of their investments • Dow Jones Industrial- an average of the price movements of 30 major stocks listed on the NYSE • NASDAQ Composite- averages stocks of some volatile high-tech companies • Standard and Poor’s 500 - the second most widely followed index (behind the DOW), consists of companies traded on either the NYSE or NASDAQ Market Indexes‘ VIDEO

Stock Indexes Index- a benchmark that investors use to judge the performance of their investments • Dow Jones Industrial- an average of the price movements of 30 major stocks listed on the NYSE • NASDAQ Composite- averages stocks of some volatile high-tech companies • Standard and Poor’s 500 - the second most widely followed index (behind the DOW), consists of companies traded on either the NYSE or NASDAQ Market Indexes‘ VIDEO

Mutual Funds what they are Professionally managed portfolios made of stocks, bonds, and other investments. up how they work Individuals buy shares, and fund uses money to purchase stocks, bonds, and other investments. Profits returned to shareholders monthly, quarterly, or semi-annually in the form of dividends. advantages Allows small investors to take advantage of professional account management and diversification normally only available to large investors. VIDEO

Mutual Funds what they are Professionally managed portfolios made of stocks, bonds, and other investments. up how they work Individuals buy shares, and fund uses money to purchase stocks, bonds, and other investments. Profits returned to shareholders monthly, quarterly, or semi-annually in the form of dividends. advantages Allows small investors to take advantage of professional account management and diversification normally only available to large investors. VIDEO

Types of mutual funds Balanced Fund includes a variety of stocks and bonds. companies from around the world. Global Stock Fund has stocks from companies in many parts of the world. Growth Fund emphasizes companies that are expected to increase in value; also has higher risk. Income Fund features stock and bonds with high dividends and interest. Industry Fund invests in stocks of companies in a single industry (such as technology, health care, banking). Municipal Bond Fund features debt instruments of state and local governments. Regional Stock Fund involves stocks of companies from one geographic region of the world (such as Asia or Latin America).

Types of mutual funds Balanced Fund includes a variety of stocks and bonds. companies from around the world. Global Stock Fund has stocks from companies in many parts of the world. Growth Fund emphasizes companies that are expected to increase in value; also has higher risk. Income Fund features stock and bonds with high dividends and interest. Industry Fund invests in stocks of companies in a single industry (such as technology, health care, banking). Municipal Bond Fund features debt instruments of state and local governments. Regional Stock Fund involves stocks of companies from one geographic region of the world (such as Asia or Latin America).

Retirement Plans what they are and how they work • Plans that help individuals set aside money to be used after they retire. • Federal income tax not immediately due on money put into a retirement account, or on the interest it makes. • Income tax paid when money is withdrawn. • Penalty charges apply if money is withdrawn before retirement age, except under certain circumstances. • Income after retirement is usually lower, so tax rate is lower.

Retirement Plans what they are and how they work • Plans that help individuals set aside money to be used after they retire. • Federal income tax not immediately due on money put into a retirement account, or on the interest it makes. • Income tax paid when money is withdrawn. • Penalty charges apply if money is withdrawn before retirement age, except under certain circumstances. • Income after retirement is usually lower, so tax rate is lower.

types Individual Retirement Account (IRA) Allows a person to contribute up to $3, 000 of pre-tax earnings per year. Contributions can be made in installments or in a lump sum. Roth IRA (also called the IRA Plus) While the $3, 000 annual contribution to this plan is not tax-deductible, the earnings on the account are tax-free after five years. The funds from the Roth IRA may be withdrawn after age 59, if the account owner is disabled, for educational expenses, or for the purchase of a first home. 401(k) Allows a person to contribute to a savings plan from his or her pre-tax earnings, reducing the amount of tax that must be paid. Employer matches contributions up to a certain level. Keogh Plan Allows a self-employed person to set aside up to 15% of income (but not more than $35, 000 per year). VIDEO

types Individual Retirement Account (IRA) Allows a person to contribute up to $3, 000 of pre-tax earnings per year. Contributions can be made in installments or in a lump sum. Roth IRA (also called the IRA Plus) While the $3, 000 annual contribution to this plan is not tax-deductible, the earnings on the account are tax-free after five years. The funds from the Roth IRA may be withdrawn after age 59, if the account owner is disabled, for educational expenses, or for the purchase of a first home. 401(k) Allows a person to contribute to a savings plan from his or her pre-tax earnings, reducing the amount of tax that must be paid. Employer matches contributions up to a certain level. Keogh Plan Allows a self-employed person to set aside up to 15% of income (but not more than $35, 000 per year). VIDEO

Real Estate Residential Land ways to invest • Buy a house, live in it, and sell it later at a profit. • Buy income property (such as an apartment house or a commercial building)and rent it. • Buy land hold it until it rises in value. advantages • Excellent protection against inflation. disadvantages Commercial • Can be difficult to convert into cash. • A specialized type of investment requiring study and knowledge of business. capital gains: profits from the sale of a capital asset such as stocks, bonds, or real estate. These profits are tax-deferred; you do not have to pay the tax on these profits until the asset is sold. • Long-term capital gains occur on investments held more than 12 months. • Short-term capital gains occur on investments held less than 12 months. VIDEO

Real Estate Residential Land ways to invest • Buy a house, live in it, and sell it later at a profit. • Buy income property (such as an apartment house or a commercial building)and rent it. • Buy land hold it until it rises in value. advantages • Excellent protection against inflation. disadvantages Commercial • Can be difficult to convert into cash. • A specialized type of investment requiring study and knowledge of business. capital gains: profits from the sale of a capital asset such as stocks, bonds, or real estate. These profits are tax-deferred; you do not have to pay the tax on these profits until the asset is sold. • Long-term capital gains occur on investments held more than 12 months. • Short-term capital gains occur on investments held less than 12 months. VIDEO

High Risk/ High Return Futures- purchase or sell an asset, such as a oil, corn or a stock, at a predetermined future date and price. Penny stock-stocks that trade for less than $5 per share. Collectibles- An item that is worth far more than it appears because of its rarity and/or demand. Common categories of collectibles include antiques, toys, coins, comic books and stamps.

High Risk/ High Return Futures- purchase or sell an asset, such as a oil, corn or a stock, at a predetermined future date and price. Penny stock-stocks that trade for less than $5 per share. Collectibles- An item that is worth far more than it appears because of its rarity and/or demand. Common categories of collectibles include antiques, toys, coins, comic books and stamps.