6ea5dc6c427faf720d27be3456f85951.ppt

- Количество слайдов: 19

*

*

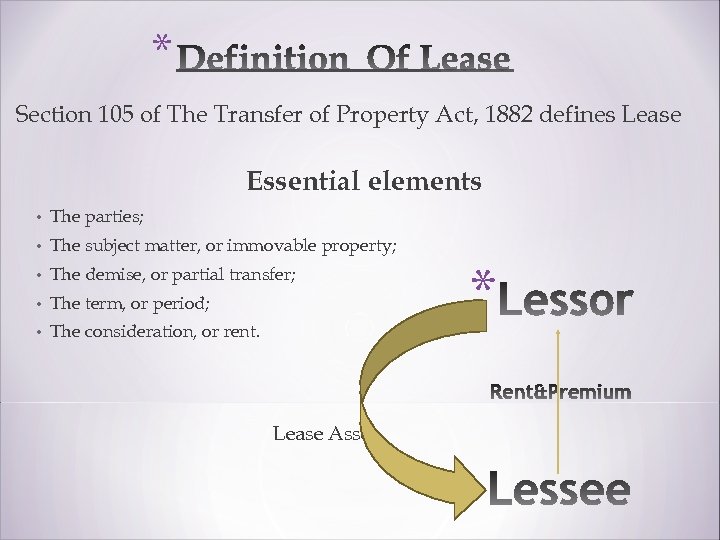

* Section 105 of The Transfer of Property Act, 1882 defines Lease Essential elements • The parties; • The subject matter, or immovable property; • The demise, or partial transfer; • The term, or period; • The consideration, or rent. Lease Asset *

* Section 105 of The Transfer of Property Act, 1882 defines Lease Essential elements • The parties; • The subject matter, or immovable property; • The demise, or partial transfer; • The term, or period; • The consideration, or rent. Lease Asset *

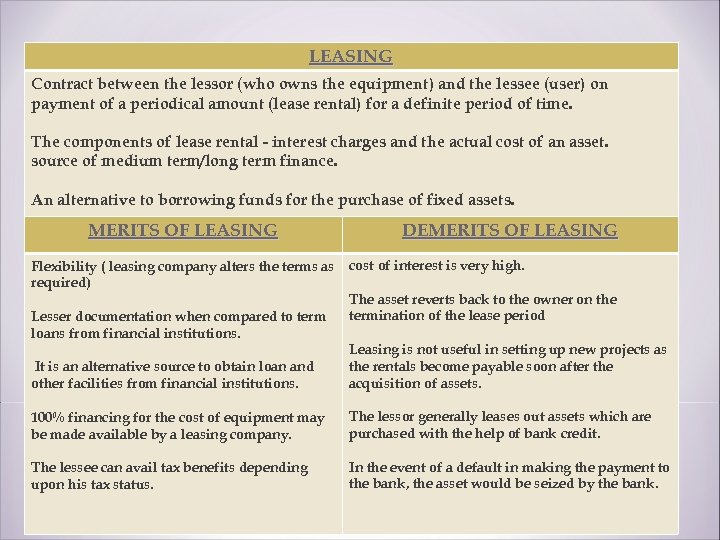

LEASING Contract between the lessor (who owns the equipment) and the lessee (user) on payment of a periodical amount (lease rental) for a definite period of time. The components of lease rental - interest charges and the actual cost of an asset. source of medium term/long term finance. An alternative to borrowing funds for the purchase of fixed assets. MERITS OF LEASING Flexibility ( leasing company alters the terms as required) Lesser documentation when compared to term loans from financial institutions. DEMERITS OF LEASING cost of interest is very high. The asset reverts back to the owner on the termination of the lease period It is an alternative source to obtain loan and other facilities from financial institutions. Leasing is not useful in setting up new projects as the rentals become payable soon after the acquisition of assets. 100% financing for the cost of equipment may be made available by a leasing company. The lessor generally leases out assets which are purchased with the help of bank credit. The lessee can avail tax benefits depending upon his tax status. In the event of a default in making the payment to the bank, the asset would be seized by the bank.

LEASING Contract between the lessor (who owns the equipment) and the lessee (user) on payment of a periodical amount (lease rental) for a definite period of time. The components of lease rental - interest charges and the actual cost of an asset. source of medium term/long term finance. An alternative to borrowing funds for the purchase of fixed assets. MERITS OF LEASING Flexibility ( leasing company alters the terms as required) Lesser documentation when compared to term loans from financial institutions. DEMERITS OF LEASING cost of interest is very high. The asset reverts back to the owner on the termination of the lease period It is an alternative source to obtain loan and other facilities from financial institutions. Leasing is not useful in setting up new projects as the rentals become payable soon after the acquisition of assets. 100% financing for the cost of equipment may be made available by a leasing company. The lessor generally leases out assets which are purchased with the help of bank credit. The lessee can avail tax benefits depending upon his tax status. In the event of a default in making the payment to the bank, the asset would be seized by the bank.

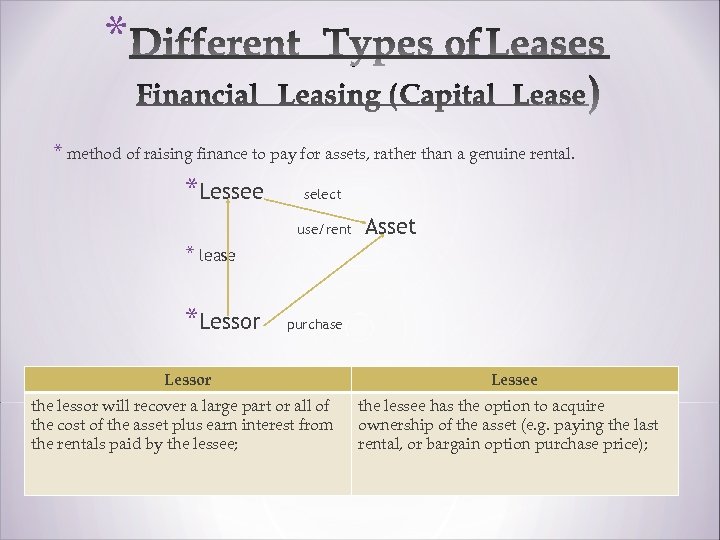

* * method of raising finance to pay for assets, rather than a genuine rental. *Lessee select use/rent Asset * lease *Lessor purchase Lessor the lessor will recover a large part or all of the cost of the asset plus earn interest from the rentals paid by the lessee; Lessee the lessee has the option to acquire ownership of the asset (e. g. paying the last rental, or bargain option purchase price);

* * method of raising finance to pay for assets, rather than a genuine rental. *Lessee select use/rent Asset * lease *Lessor purchase Lessor the lessor will recover a large part or all of the cost of the asset plus earn interest from the rentals paid by the lessee; Lessee the lessee has the option to acquire ownership of the asset (e. g. paying the last rental, or bargain option purchase price);

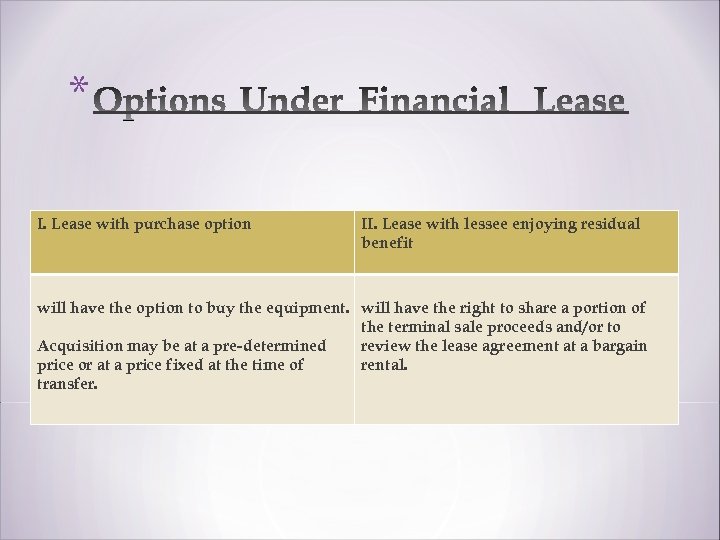

* I. Lease with purchase option II. Lease with lessee enjoying residual benefit will have the option to buy the equipment. will have the right to share a portion of the terminal sale proceeds and/or to Acquisition may be at a pre-determined review the lease agreement at a bargain price or at a price fixed at the time of rental. transfer.

* I. Lease with purchase option II. Lease with lessee enjoying residual benefit will have the option to buy the equipment. will have the right to share a portion of the terminal sale proceeds and/or to Acquisition may be at a pre-determined review the lease agreement at a bargain price or at a price fixed at the time of rental. transfer.

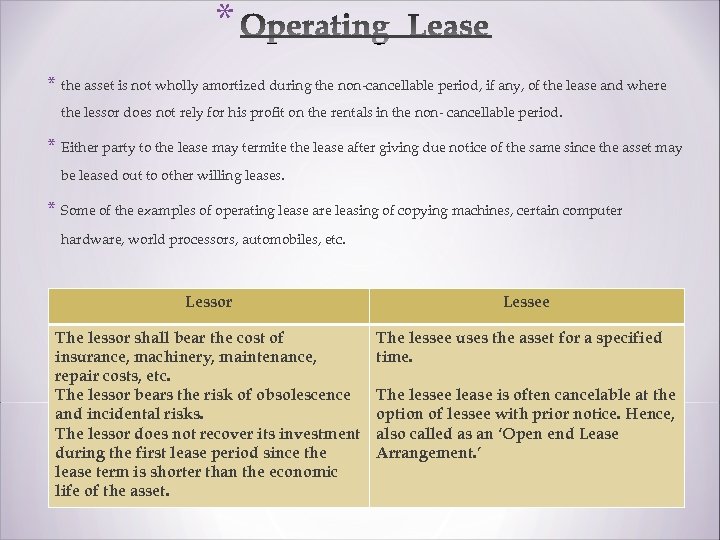

* * the asset is not wholly amortized during the non-cancellable period, if any, of the lease and where the lessor does not rely for his profit on the rentals in the non- cancellable period. * Either party to the lease may termite the lease after giving due notice of the same since the asset may be leased out to other willing leases. * Some of the examples of operating lease are leasing of copying machines, certain computer hardware, world processors, automobiles, etc. Lessor The lessor shall bear the cost of insurance, machinery, maintenance, repair costs, etc. The lessor bears the risk of obsolescence and incidental risks. The lessor does not recover its investment during the first lease period since the lease term is shorter than the economic life of the asset. Lessee The lessee uses the asset for a specified time. The lessee lease is often cancelable at the option of lessee with prior notice. Hence, also called as an ‘Open end Lease Arrangement. ’

* * the asset is not wholly amortized during the non-cancellable period, if any, of the lease and where the lessor does not rely for his profit on the rentals in the non- cancellable period. * Either party to the lease may termite the lease after giving due notice of the same since the asset may be leased out to other willing leases. * Some of the examples of operating lease are leasing of copying machines, certain computer hardware, world processors, automobiles, etc. Lessor The lessor shall bear the cost of insurance, machinery, maintenance, repair costs, etc. The lessor bears the risk of obsolescence and incidental risks. The lessor does not recover its investment during the first lease period since the lease term is shorter than the economic life of the asset. Lessee The lessee uses the asset for a specified time. The lessee lease is often cancelable at the option of lessee with prior notice. Hence, also called as an ‘Open end Lease Arrangement. ’

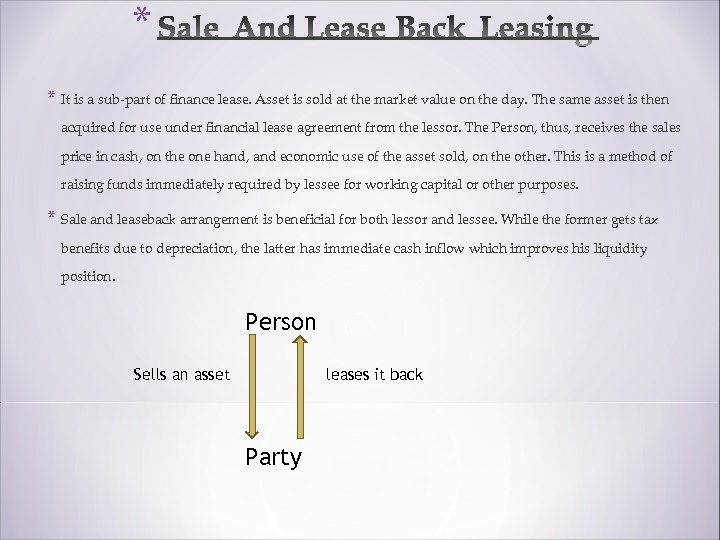

* * It is a sub-part of finance lease. Asset is sold at the market value on the day. The same asset is then acquired for use under financial lease agreement from the lessor. The Person, thus, receives the sales price in cash, on the one hand, and economic use of the asset sold, on the other. This is a method of raising funds immediately required by lessee for working capital or other purposes. * Sale and leaseback arrangement is beneficial for both lessor and lessee. While the former gets tax benefits due to depreciation, the latter has immediate cash inflow which improves his liquidity position. Person Sells an asset leases it back Party

* * It is a sub-part of finance lease. Asset is sold at the market value on the day. The same asset is then acquired for use under financial lease agreement from the lessor. The Person, thus, receives the sales price in cash, on the one hand, and economic use of the asset sold, on the other. This is a method of raising funds immediately required by lessee for working capital or other purposes. * Sale and leaseback arrangement is beneficial for both lessor and lessee. While the former gets tax benefits due to depreciation, the latter has immediate cash inflow which improves his liquidity position. Person Sells an asset leases it back Party

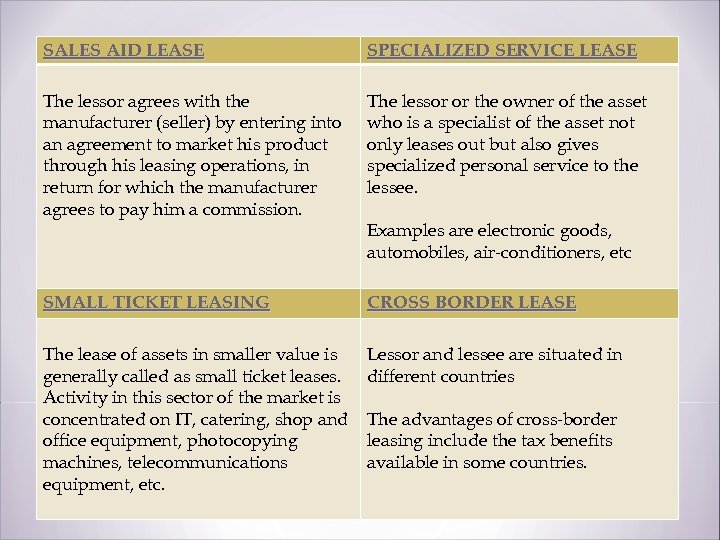

SALES AID LEASE SPECIALIZED SERVICE LEASE The lessor agrees with the manufacturer (seller) by entering into an agreement to market his product through his leasing operations, in return for which the manufacturer agrees to pay him a commission. The lessor or the owner of the asset who is a specialist of the asset not only leases out but also gives specialized personal service to the lessee. SMALL TICKET LEASING CROSS BORDER LEASE The lease of assets in smaller value is generally called as small ticket leases. Activity in this sector of the market is concentrated on IT, catering, shop and office equipment, photocopying machines, telecommunications equipment, etc. Lessor and lessee are situated in different countries Examples are electronic goods, automobiles, air-conditioners, etc The advantages of cross-border leasing include the tax benefits available in some countries.

SALES AID LEASE SPECIALIZED SERVICE LEASE The lessor agrees with the manufacturer (seller) by entering into an agreement to market his product through his leasing operations, in return for which the manufacturer agrees to pay him a commission. The lessor or the owner of the asset who is a specialist of the asset not only leases out but also gives specialized personal service to the lessee. SMALL TICKET LEASING CROSS BORDER LEASE The lease of assets in smaller value is generally called as small ticket leases. Activity in this sector of the market is concentrated on IT, catering, shop and office equipment, photocopying machines, telecommunications equipment, etc. Lessor and lessee are situated in different countries Examples are electronic goods, automobiles, air-conditioners, etc The advantages of cross-border leasing include the tax benefits available in some countries.

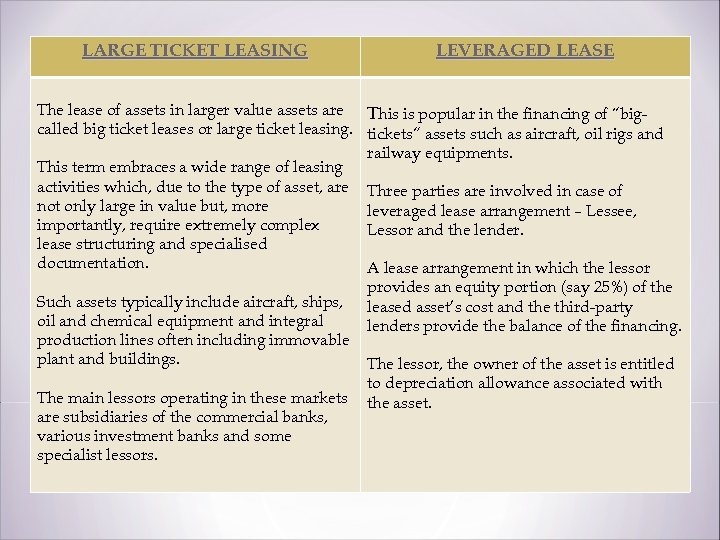

LARGE TICKET LEASING LEVERAGED LEASE The lease of assets in larger value assets are This is popular in the financing of “bigcalled big ticket leases or large ticket leasing. tickets” assets such as aircraft, oil rigs and railway equipments. This term embraces a wide range of leasing activities which, due to the type of asset, are Three parties are involved in case of not only large in value but, more leveraged lease arrangement – Lessee, importantly, require extremely complex Lessor and the lender. lease structuring and specialised documentation. A lease arrangement in which the lessor provides an equity portion (say 25%) of the Such assets typically include aircraft, ships, leased asset’s cost and the third-party oil and chemical equipment and integral lenders provide the balance of the financing. production lines often including immovable plant and buildings. The lessor, the owner of the asset is entitled The main lessors operating in these markets are subsidiaries of the commercial banks, various investment banks and some specialist lessors. to depreciation allowance associated with the asset.

LARGE TICKET LEASING LEVERAGED LEASE The lease of assets in larger value assets are This is popular in the financing of “bigcalled big ticket leases or large ticket leasing. tickets” assets such as aircraft, oil rigs and railway equipments. This term embraces a wide range of leasing activities which, due to the type of asset, are Three parties are involved in case of not only large in value but, more leveraged lease arrangement – Lessee, importantly, require extremely complex Lessor and the lender. lease structuring and specialised documentation. A lease arrangement in which the lessor provides an equity portion (say 25%) of the Such assets typically include aircraft, ships, leased asset’s cost and the third-party oil and chemical equipment and integral lenders provide the balance of the financing. production lines often including immovable plant and buildings. The lessor, the owner of the asset is entitled The main lessors operating in these markets are subsidiaries of the commercial banks, various investment banks and some specialist lessors. to depreciation allowance associated with the asset.

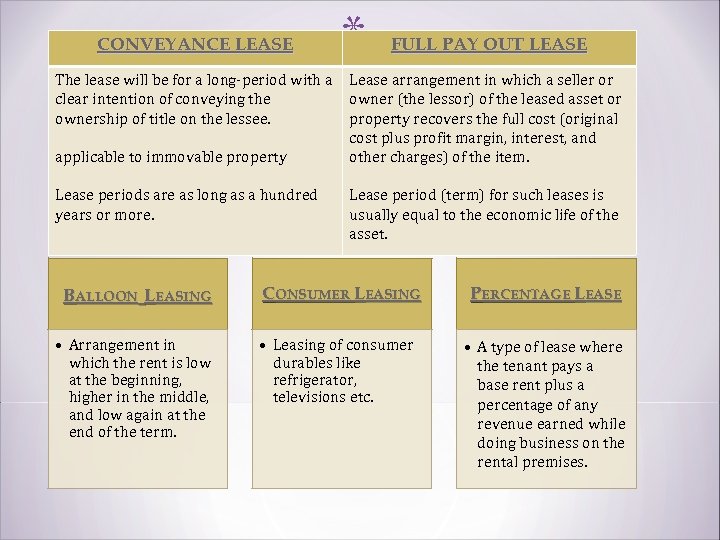

CONVEYANCE LEASE * FULL PAY OUT LEASE The lease will be for a long-period with a Lease arrangement in which a seller or clear intention of conveying the owner (the lessor) of the leased asset or ownership of title on the lessee. property recovers the full cost (original cost plus profit margin, interest, and applicable to immovable property other charges) of the item. Lease periods are as long as a hundred years or more. Lease period (term) for such leases is usually equal to the economic life of the asset. BALLOON LEASING CONSUMER LEASING PERCENTAGE LEASE • Arrangement in which the rent is low at the beginning, higher in the middle, and low again at the end of the term. • Leasing of consumer durables like refrigerator, televisions etc. • A type of lease where the tenant pays a base rent plus a percentage of any revenue earned while doing business on the rental premises.

CONVEYANCE LEASE * FULL PAY OUT LEASE The lease will be for a long-period with a Lease arrangement in which a seller or clear intention of conveying the owner (the lessor) of the leased asset or ownership of title on the lessee. property recovers the full cost (original cost plus profit margin, interest, and applicable to immovable property other charges) of the item. Lease periods are as long as a hundred years or more. Lease period (term) for such leases is usually equal to the economic life of the asset. BALLOON LEASING CONSUMER LEASING PERCENTAGE LEASE • Arrangement in which the rent is low at the beginning, higher in the middle, and low again at the end of the term. • Leasing of consumer durables like refrigerator, televisions etc. • A type of lease where the tenant pays a base rent plus a percentage of any revenue earned while doing business on the rental premises.

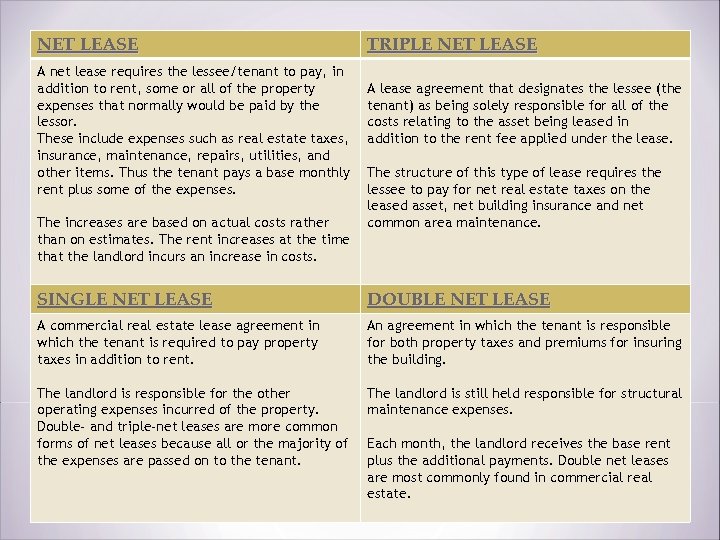

NET LEASE A net lease requires the lessee/tenant to pay, in addition to rent, some or all of the property expenses that normally would be paid by the lessor. These include expenses such as real estate taxes, insurance, maintenance, repairs, utilities, and other items. Thus the tenant pays a base monthly rent plus some of the expenses. The increases are based on actual costs rather than on estimates. The rent increases at the time that the landlord incurs an increase in costs. TRIPLE NET LEASE A lease agreement that designates the lessee (the tenant) as being solely responsible for all of the costs relating to the asset being leased in addition to the rent fee applied under the lease. The structure of this type of lease requires the lessee to pay for net real estate taxes on the leased asset, net building insurance and net common area maintenance. SINGLE NET LEASE DOUBLE NET LEASE A commercial real estate lease agreement in which the tenant is required to pay property taxes in addition to rent. An agreement in which the tenant is responsible for both property taxes and premiums for insuring the building. The landlord is responsible for the other operating expenses incurred of the property. Double- and triple-net leases are more common forms of net leases because all or the majority of the expenses are passed on to the tenant. The landlord is still held responsible for structural maintenance expenses. Each month, the landlord receives the base rent plus the additional payments. Double net leases are most commonly found in commercial real estate.

NET LEASE A net lease requires the lessee/tenant to pay, in addition to rent, some or all of the property expenses that normally would be paid by the lessor. These include expenses such as real estate taxes, insurance, maintenance, repairs, utilities, and other items. Thus the tenant pays a base monthly rent plus some of the expenses. The increases are based on actual costs rather than on estimates. The rent increases at the time that the landlord incurs an increase in costs. TRIPLE NET LEASE A lease agreement that designates the lessee (the tenant) as being solely responsible for all of the costs relating to the asset being leased in addition to the rent fee applied under the lease. The structure of this type of lease requires the lessee to pay for net real estate taxes on the leased asset, net building insurance and net common area maintenance. SINGLE NET LEASE DOUBLE NET LEASE A commercial real estate lease agreement in which the tenant is required to pay property taxes in addition to rent. An agreement in which the tenant is responsible for both property taxes and premiums for insuring the building. The landlord is responsible for the other operating expenses incurred of the property. Double- and triple-net leases are more common forms of net leases because all or the majority of the expenses are passed on to the tenant. The landlord is still held responsible for structural maintenance expenses. Each month, the landlord receives the base rent plus the additional payments. Double net leases are most commonly found in commercial real estate.

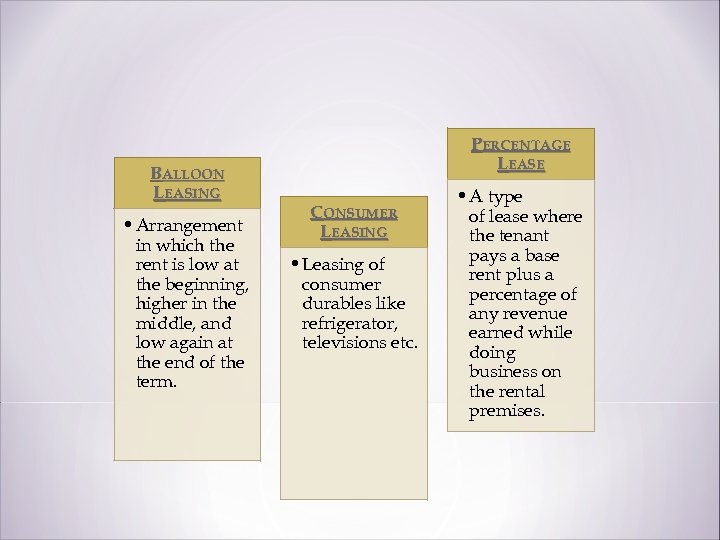

BALLOON LEASING • Arrangement in which the rent is low at the beginning, higher in the middle, and low again at the end of the term. PERCENTAGE LEASE CONSUMER LEASING • Leasing of consumer durables like refrigerator, televisions etc. • A type of lease where the tenant pays a base rent plus a percentage of any revenue earned while doing business on the rental premises.

BALLOON LEASING • Arrangement in which the rent is low at the beginning, higher in the middle, and low again at the end of the term. PERCENTAGE LEASE CONSUMER LEASING • Leasing of consumer durables like refrigerator, televisions etc. • A type of lease where the tenant pays a base rent plus a percentage of any revenue earned while doing business on the rental premises.

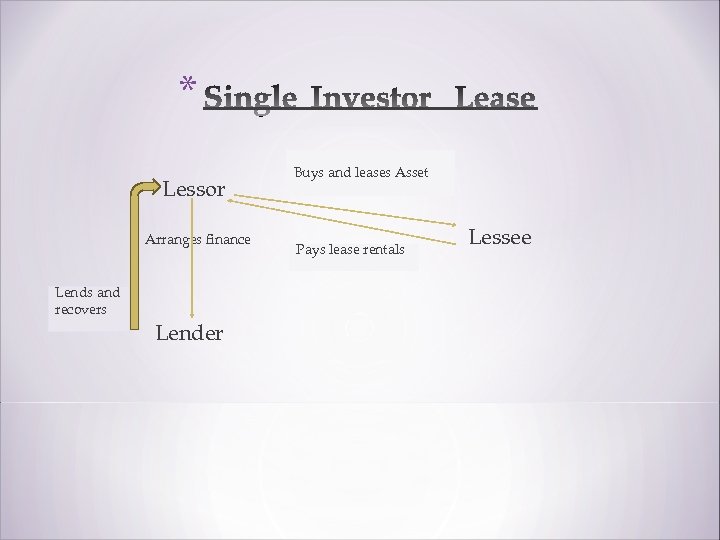

* Lessor Arranges finance Lends and recovers * Lender Buys and leases Asset Pays lease rentals Lessee

* Lessor Arranges finance Lends and recovers * Lender Buys and leases Asset Pays lease rentals Lessee

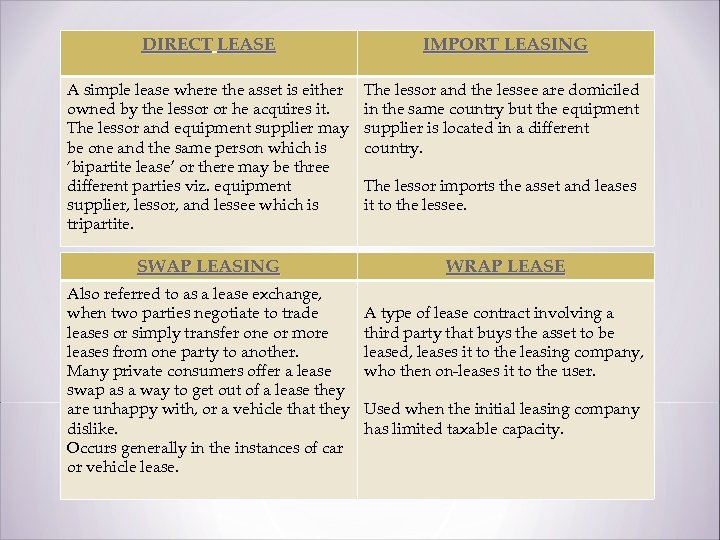

DIRECT LEASE IMPORT LEASING A simple lease where the asset is either owned by the lessor or he acquires it. The lessor and equipment supplier may be one and the same person which is ‘bipartite lease’ or there may be three different parties viz. equipment supplier, lessor, and lessee which is tripartite. The lessor and the lessee are domiciled in the same country but the equipment supplier is located in a different country. SWAP LEASING WRAP LEASE Also referred to as a lease exchange, when two parties negotiate to trade leases or simply transfer one or more leases from one party to another. Many private consumers offer a lease swap as a way to get out of a lease they are unhappy with, or a vehicle that they dislike. Occurs generally in the instances of car or vehicle lease. The lessor imports the asset and leases it to the lessee. A type of lease contract involving a third party that buys the asset to be leased, leases it to the leasing company, who then on-leases it to the user. Used when the initial leasing company has limited taxable capacity.

DIRECT LEASE IMPORT LEASING A simple lease where the asset is either owned by the lessor or he acquires it. The lessor and equipment supplier may be one and the same person which is ‘bipartite lease’ or there may be three different parties viz. equipment supplier, lessor, and lessee which is tripartite. The lessor and the lessee are domiciled in the same country but the equipment supplier is located in a different country. SWAP LEASING WRAP LEASE Also referred to as a lease exchange, when two parties negotiate to trade leases or simply transfer one or more leases from one party to another. Many private consumers offer a lease swap as a way to get out of a lease they are unhappy with, or a vehicle that they dislike. Occurs generally in the instances of car or vehicle lease. The lessor imports the asset and leases it to the lessee. A type of lease contract involving a third party that buys the asset to be leased, leases it to the leasing company, who then on-leases it to the user. Used when the initial leasing company has limited taxable capacity.

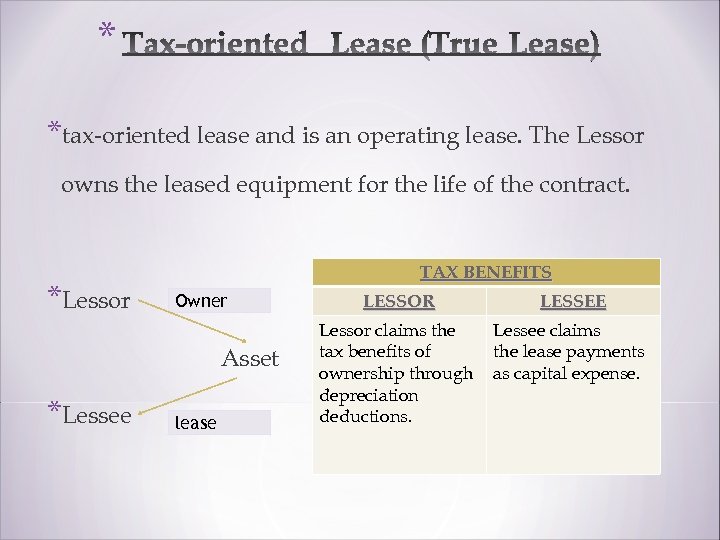

* *tax-oriented lease and is an operating lease. The Lessor owns the leased equipment for the life of the contract. *Lessor TAX BENEFITS Owner Asset *Lessee lease LESSOR LESSEE Lessor claims the tax benefits of ownership through depreciation deductions. Lessee claims the lease payments as capital expense.

* *tax-oriented lease and is an operating lease. The Lessor owns the leased equipment for the life of the contract. *Lessor TAX BENEFITS Owner Asset *Lessee lease LESSOR LESSEE Lessor claims the tax benefits of ownership through depreciation deductions. Lessee claims the lease payments as capital expense.

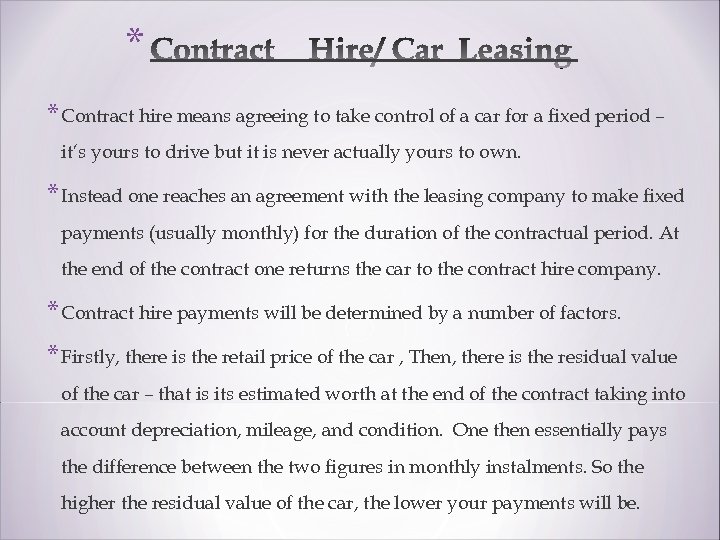

* * Contract hire means agreeing to take control of a car for a fixed period – it’s yours to drive but it is never actually yours to own. * Instead one reaches an agreement with the leasing company to make fixed payments (usually monthly) for the duration of the contractual period. At the end of the contract one returns the car to the contract hire company. * Contract hire payments will be determined by a number of factors. * Firstly, there is the retail price of the car , Then, there is the residual value of the car – that is its estimated worth at the end of the contract taking into account depreciation, mileage, and condition. One then essentially pays the difference between the two figures in monthly instalments. So the higher the residual value of the car, the lower your payments will be.

* * Contract hire means agreeing to take control of a car for a fixed period – it’s yours to drive but it is never actually yours to own. * Instead one reaches an agreement with the leasing company to make fixed payments (usually monthly) for the duration of the contractual period. At the end of the contract one returns the car to the contract hire company. * Contract hire payments will be determined by a number of factors. * Firstly, there is the retail price of the car , Then, there is the residual value of the car – that is its estimated worth at the end of the contract taking into account depreciation, mileage, and condition. One then essentially pays the difference between the two figures in monthly instalments. So the higher the residual value of the car, the lower your payments will be.

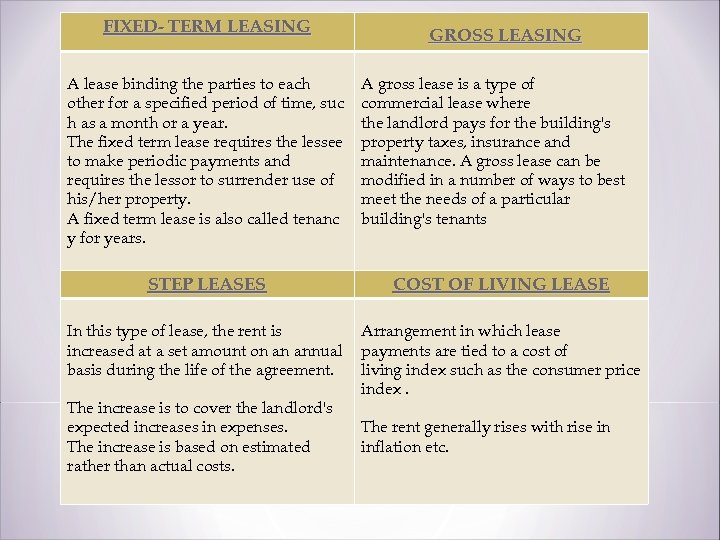

FIXED- TERM LEASING A lease binding the parties to each other for a specified period of time, suc h as a month or a year. The fixed term lease requires the lessee to make periodic payments and requires the lessor to surrender use of his/her property. A fixed term lease is also called tenanc y for years. GROSS LEASING A gross lease is a type of commercial lease where the landlord pays for the building's property taxes, insurance and maintenance. A gross lease can be modified in a number of ways to best meet the needs of a particular building's tenants STEP LEASES COST OF LIVING LEASE In this type of lease, the rent is increased at a set amount on an annual basis during the life of the agreement. Arrangement in which lease payments are tied to a cost of living index such as the consumer price index. The increase is to cover the landlord's expected increases in expenses. The increase is based on estimated rather than actual costs. The rent generally rises with rise in inflation etc.

FIXED- TERM LEASING A lease binding the parties to each other for a specified period of time, suc h as a month or a year. The fixed term lease requires the lessee to make periodic payments and requires the lessor to surrender use of his/her property. A fixed term lease is also called tenanc y for years. GROSS LEASING A gross lease is a type of commercial lease where the landlord pays for the building's property taxes, insurance and maintenance. A gross lease can be modified in a number of ways to best meet the needs of a particular building's tenants STEP LEASES COST OF LIVING LEASE In this type of lease, the rent is increased at a set amount on an annual basis during the life of the agreement. Arrangement in which lease payments are tied to a cost of living index such as the consumer price index. The increase is to cover the landlord's expected increases in expenses. The increase is based on estimated rather than actual costs. The rent generally rises with rise in inflation etc.

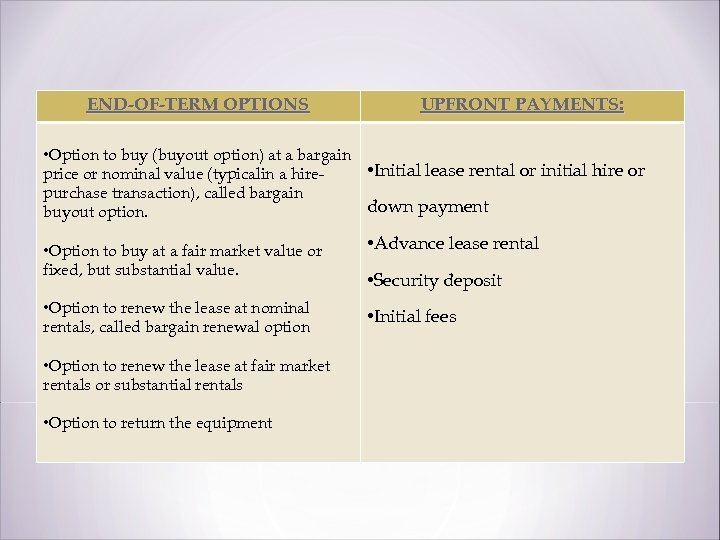

END-OF-TERM OPTIONS UPFRONT PAYMENTS: • Option to buy (buyout option) at a bargain • Initial lease rental or initial hire or price or nominal value (typicalin a hirepurchase transaction), called bargain down payment buyout option. • Option to buy at a fair market value or fixed, but substantial value. • Option to renew the lease at nominal rentals, called bargain renewal option • Option to renew the lease at fair market rentals or substantial rentals • Option to return the equipment • Advance lease rental • Security deposit • Initial fees

END-OF-TERM OPTIONS UPFRONT PAYMENTS: • Option to buy (buyout option) at a bargain • Initial lease rental or initial hire or price or nominal value (typicalin a hirepurchase transaction), called bargain down payment buyout option. • Option to buy at a fair market value or fixed, but substantial value. • Option to renew the lease at nominal rentals, called bargain renewal option • Option to renew the lease at fair market rentals or substantial rentals • Option to return the equipment • Advance lease rental • Security deposit • Initial fees

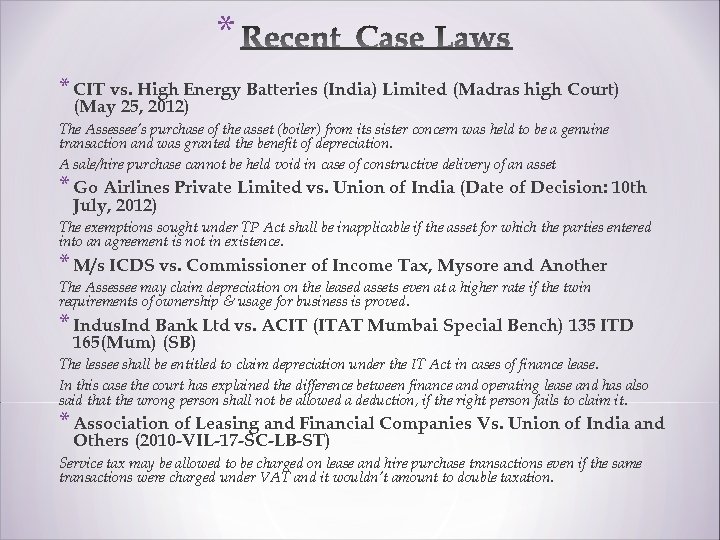

* * CIT vs. High Energy Batteries (India) Limited (Madras high Court) (May 25, 2012) The Assessee’s purchase of the asset (boiler) from its sister concern was held to be a genuine transaction and was granted the benefit of depreciation. A sale/hire purchase cannot be held void in case of constructive delivery of an asset * Go Airlines Private Limited vs. Union of India (Date of Decision: 10 th July, 2012) The exemptions sought under TP Act shall be inapplicable if the asset for which the parties entered into an agreement is not in existence. * M/s ICDS vs. Commissioner of Income Tax, Mysore and Another The Assessee may claim depreciation on the leased assets even at a higher rate if the twin requirements of ownership & usage for business is proved. * Indus. Ind Bank Ltd vs. ACIT (ITAT Mumbai Special Bench) 135 ITD 165(Mum) (SB) The lessee shall be entitled to claim depreciation under the IT Act in cases of finance lease. In this case the court has explained the difference between finance and operating lease and has also said that the wrong person shall not be allowed a deduction, if the right person fails to claim it. * Association of Leasing and Financial Companies Vs. Union of India and Others (2010 -VIL-17 -SC-LB-ST) Service tax may be allowed to be charged on lease and hire purchase transactions even if the same transactions were charged under VAT and it wouldn’t amount to double taxation.

* * CIT vs. High Energy Batteries (India) Limited (Madras high Court) (May 25, 2012) The Assessee’s purchase of the asset (boiler) from its sister concern was held to be a genuine transaction and was granted the benefit of depreciation. A sale/hire purchase cannot be held void in case of constructive delivery of an asset * Go Airlines Private Limited vs. Union of India (Date of Decision: 10 th July, 2012) The exemptions sought under TP Act shall be inapplicable if the asset for which the parties entered into an agreement is not in existence. * M/s ICDS vs. Commissioner of Income Tax, Mysore and Another The Assessee may claim depreciation on the leased assets even at a higher rate if the twin requirements of ownership & usage for business is proved. * Indus. Ind Bank Ltd vs. ACIT (ITAT Mumbai Special Bench) 135 ITD 165(Mum) (SB) The lessee shall be entitled to claim depreciation under the IT Act in cases of finance lease. In this case the court has explained the difference between finance and operating lease and has also said that the wrong person shall not be allowed a deduction, if the right person fails to claim it. * Association of Leasing and Financial Companies Vs. Union of India and Others (2010 -VIL-17 -SC-LB-ST) Service tax may be allowed to be charged on lease and hire purchase transactions even if the same transactions were charged under VAT and it wouldn’t amount to double taxation.