555c535fd939e6cc2246552024fc9415.ppt

- Количество слайдов: 21

Second OECD World Forum on "Statistics, Knowledge and Policy" Understanding retirement saving and pensions Len Cook Former Government Statistician

Second OECD World Forum on "Statistics, Knowledge and Policy" Understanding retirement saving and pensions Len Cook Former Government Statistician

The context, impacts and options

The context, impacts and options

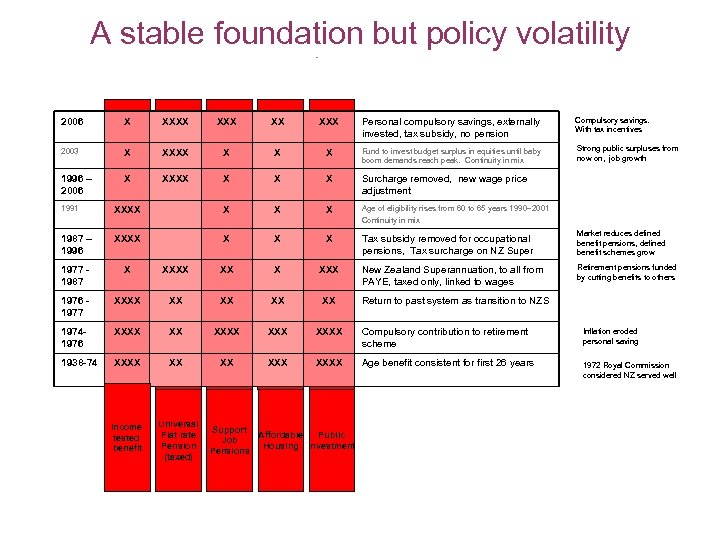

A stable foundation but policy volatility - 2006 X XXX XX XXX Personal compulsory savings, externally invested, tax subsidy, no pension Compulsory savings. With tax incentives 2003 X XXXX X Fund to invest budget surplus in equities until baby boom demands reach peak. Continuity in mix Strong public surpluses from now on, job growth 1996 – 2006 X XXXX X Surcharge removed, new wage price adjustment 1991 XXXX X Age of eligibility rises from 60 to 65 years 1990– 2001 Continuity in mix 1987 – 1996 XXXX X Tax subsidy removed for occupational pensions, Tax surcharge on NZ Super Market reduces defined benefit pensions, defined benefit schemes grow 1977 1987 X XXXX XXX New Zealand Superannuation, to all from PAYE, taxed only, linked to wages Retirement pensions funded by cutting benefits to others 1976 1977 XXXX XX XX 19741976 XXXX XXX XXXX Compulsory contribution to retirement scheme Inflation eroded personal saving 1938 -74 XXXX XXXX Age benefit consistent for first 26 years 1972 Royal Commission considered NZ served well Income tested benefit Universal Flat rate Pension (taxed) Support Affordable Public Job Housing Investment Pensions Return to past system as transition to NZS

A stable foundation but policy volatility - 2006 X XXX XX XXX Personal compulsory savings, externally invested, tax subsidy, no pension Compulsory savings. With tax incentives 2003 X XXXX X Fund to invest budget surplus in equities until baby boom demands reach peak. Continuity in mix Strong public surpluses from now on, job growth 1996 – 2006 X XXXX X Surcharge removed, new wage price adjustment 1991 XXXX X Age of eligibility rises from 60 to 65 years 1990– 2001 Continuity in mix 1987 – 1996 XXXX X Tax subsidy removed for occupational pensions, Tax surcharge on NZ Super Market reduces defined benefit pensions, defined benefit schemes grow 1977 1987 X XXXX XXX New Zealand Superannuation, to all from PAYE, taxed only, linked to wages Retirement pensions funded by cutting benefits to others 1976 1977 XXXX XX XX 19741976 XXXX XXX XXXX Compulsory contribution to retirement scheme Inflation eroded personal saving 1938 -74 XXXX XXXX Age benefit consistent for first 26 years 1972 Royal Commission considered NZ served well Income tested benefit Universal Flat rate Pension (taxed) Support Affordable Public Job Housing Investment Pensions Return to past system as transition to NZS

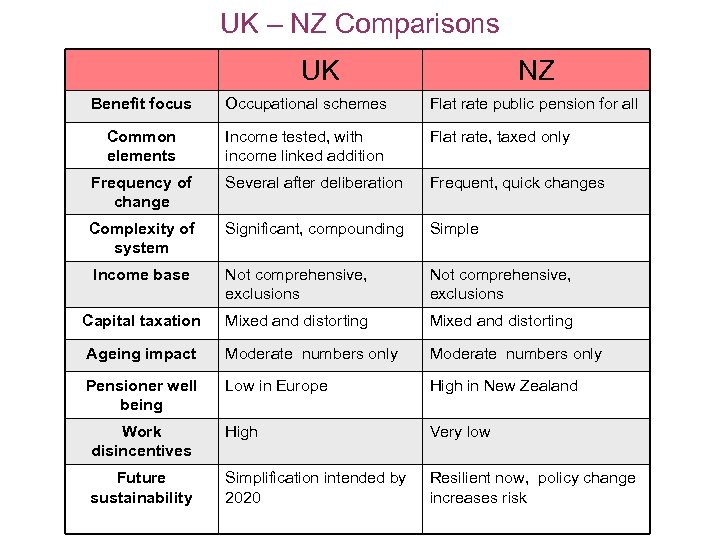

UK – NZ Comparisons UK NZ Benefit focus Occupational schemes Flat rate public pension for all Common elements Income tested, with income linked addition Flat rate, taxed only Frequency of change Several after deliberation Frequent, quick changes Complexity of system Significant, compounding Simple Income base Not comprehensive, exclusions Capital taxation Mixed and distorting Ageing impact Moderate numbers only Pensioner well being Low in Europe High in New Zealand Work disincentives High Very low Future sustainability Simplification intended by 2020 Resilient now, policy change increases risk

UK – NZ Comparisons UK NZ Benefit focus Occupational schemes Flat rate public pension for all Common elements Income tested, with income linked addition Flat rate, taxed only Frequency of change Several after deliberation Frequent, quick changes Complexity of system Significant, compounding Simple Income base Not comprehensive, exclusions Capital taxation Mixed and distorting Ageing impact Moderate numbers only Pensioner well being Low in Europe High in New Zealand Work disincentives High Very low Future sustainability Simplification intended by 2020 Resilient now, policy change increases risk

Durability of NZ arrangements Characteristics 1. No coherence in long run path 2. Despite continual change, sometimes reversals, NZ system is still simple. 3. Generates risk of continuing tinkering 4. No accepted framework for understanding long term drivers of change, across cohorts Population impact 1. 2. 3. 4. 5. Reduced capacity for understanding handed down by others Continued change may increase risk aversion among population Strong incentives for continued labour market participation Limited scale and continuity of equity investment Financial services do not match demand (annuities, reverse mortgages, fund management fees) 6. Unclear commitments to emigrant and immigrants as mobility increases

Durability of NZ arrangements Characteristics 1. No coherence in long run path 2. Despite continual change, sometimes reversals, NZ system is still simple. 3. Generates risk of continuing tinkering 4. No accepted framework for understanding long term drivers of change, across cohorts Population impact 1. 2. 3. 4. 5. Reduced capacity for understanding handed down by others Continued change may increase risk aversion among population Strong incentives for continued labour market participation Limited scale and continuity of equity investment Financial services do not match demand (annuities, reverse mortgages, fund management fees) 6. Unclear commitments to emigrant and immigrants as mobility increases

New Zealand Superannuation – its context • demographic change, • • • Post war baby boom Near replacement fertility since late 1970’s Migration strong, 15% of net growth • living standards, • • Retired have high standard of living since 1970’s Many have retirement pension higher than working life income • savings and investment • • Housing dominant, equities and finance low Non financial investments unknown but strong • economic necessity • • • Response to 1980’s downturn within model Voluntary increase in post 65 employment Failure of equities during 1980’s Inflation from 1970 to early 1990’s No tax subsidies to capture by high incomes • judgements about the well-being of the retired • • Incomes adequate as judged by RCSS in 1972 Retirement age fixation reduced training of older workers

New Zealand Superannuation – its context • demographic change, • • • Post war baby boom Near replacement fertility since late 1970’s Migration strong, 15% of net growth • living standards, • • Retired have high standard of living since 1970’s Many have retirement pension higher than working life income • savings and investment • • Housing dominant, equities and finance low Non financial investments unknown but strong • economic necessity • • • Response to 1980’s downturn within model Voluntary increase in post 65 employment Failure of equities during 1980’s Inflation from 1970 to early 1990’s No tax subsidies to capture by high incomes • judgements about the well-being of the retired • • Incomes adequate as judged by RCSS in 1972 Retirement age fixation reduced training of older workers

New Zealand Superannuation – its future • demographic change, 1. NZ ageing slower than OECD, fertility good, (50, 000 births in 2040) 2. Migration part of national fabric 3. High loss of educated young, and others • living standards, • • Sustainable per capita cost Divergence between baby boom and later cohorts Changes in life course Increasing longevity not seen in all groups • savings and investment • • Human capital, non-financial investments substantial Concentration on housing is a risk Regional imbalances in infrastructure Savings and investment linkages uncertain and changing

New Zealand Superannuation – its future • demographic change, 1. NZ ageing slower than OECD, fertility good, (50, 000 births in 2040) 2. Migration part of national fabric 3. High loss of educated young, and others • living standards, • • Sustainable per capita cost Divergence between baby boom and later cohorts Changes in life course Increasing longevity not seen in all groups • savings and investment • • Human capital, non-financial investments substantial Concentration on housing is a risk Regional imbalances in infrastructure Savings and investment linkages uncertain and changing

Information issues affecting the retired • • Attitudes to forms of saving Underestimation of longevity Policy failures result in unintended capital loss Insufficient information on future market volatility for equity based saving • Impact of economic cycle on affordability

Information issues affecting the retired • • Attitudes to forms of saving Underestimation of longevity Policy failures result in unintended capital loss Insufficient information on future market volatility for equity based saving • Impact of economic cycle on affordability

The baby boomers bonus 1. Increased longevity has come alongside a healthier lifestyle at each age, 2. The stages of the life course have been extended 3. Labour market flexibility has created opportunity for new working patterns, after the usual age of eligibility for pension 4. Labour supply constraints from the clustering of the baby boom generation in some occupations have extended working opportunities as they retire. These occupations span the whole range of occupational classes 5. House price appreciation has benefited all income levels in the baby boom cohorts because of their high home ownership rates regardless of incomes. This benefit continues. 6. Uncertainty about access to health care as increased longevity and active life course has generated demands for health care that may be mitigated by technological change, or need rationing through user pays 7. The baby boomers as consumers are an increasingly significant economic force

The baby boomers bonus 1. Increased longevity has come alongside a healthier lifestyle at each age, 2. The stages of the life course have been extended 3. Labour market flexibility has created opportunity for new working patterns, after the usual age of eligibility for pension 4. Labour supply constraints from the clustering of the baby boom generation in some occupations have extended working opportunities as they retire. These occupations span the whole range of occupational classes 5. House price appreciation has benefited all income levels in the baby boom cohorts because of their high home ownership rates regardless of incomes. This benefit continues. 6. Uncertainty about access to health care as increased longevity and active life course has generated demands for health care that may be mitigated by technological change, or need rationing through user pays 7. The baby boomers as consumers are an increasingly significant economic force

After the baby boomers 1. Health improvements appear to be less evenly distributed, and some such as obesity, diabetes, heart conditions are strongly influenced by economic well being when young 2. Social mobility among later age cohorts is declining significantly 3. Job growth from labour market flexibility affects returns from work of lower income groups much more 4. Significantly reduced levels of home ownership of cohorts born after 1960 5. Individual funding of training for skilled occupations leaves high levels of debt held by people at conclusion of education 6. Growth in numbers living at home after the age of twenty reflects economic restraints 7. High targeting of benefits for single parents, unemployment and disability create long periods of low accumulation of assets 8. Lessening of employer contribution of retirement pensions 9. Uncertainty about life expectancy trends and health gradient

After the baby boomers 1. Health improvements appear to be less evenly distributed, and some such as obesity, diabetes, heart conditions are strongly influenced by economic well being when young 2. Social mobility among later age cohorts is declining significantly 3. Job growth from labour market flexibility affects returns from work of lower income groups much more 4. Significantly reduced levels of home ownership of cohorts born after 1960 5. Individual funding of training for skilled occupations leaves high levels of debt held by people at conclusion of education 6. Growth in numbers living at home after the age of twenty reflects economic restraints 7. High targeting of benefits for single parents, unemployment and disability create long periods of low accumulation of assets 8. Lessening of employer contribution of retirement pensions 9. Uncertainty about life expectancy trends and health gradient

A framework for understanding long term drivers of change, across cohorts

A framework for understanding long term drivers of change, across cohorts

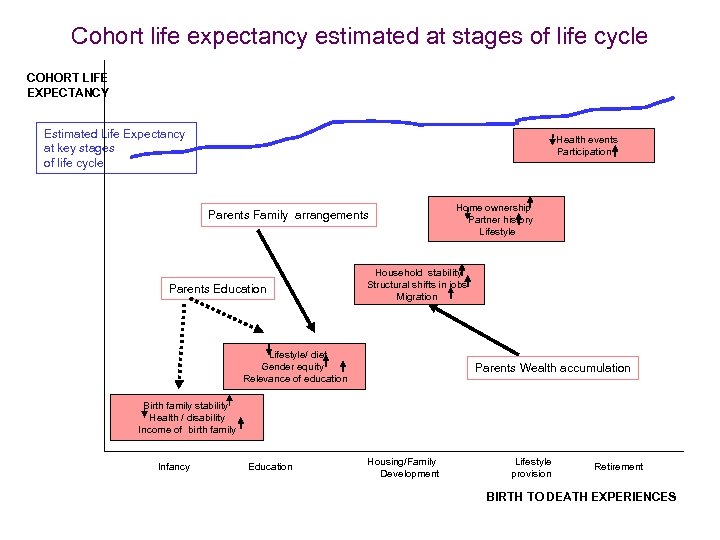

Cohort life expectancy estimated at stages of life cycle COHORT LIFE EXPECTANCY Estimated Life Expectancy at key stages of life cycle Health events Participation Parents Family arrangements Parents Education Home ownership Partner history Lifestyle Household stability Structural shifts in jobs Migration Lifestyle/ diet Gender equity Relevance of education Parents Wealth accumulation Birth family stability Health / disability Income of birth family Infancy Education Housing/Family Development Lifestyle provision Retirement BIRTH TO DEATH EXPERIENCES

Cohort life expectancy estimated at stages of life cycle COHORT LIFE EXPECTANCY Estimated Life Expectancy at key stages of life cycle Health events Participation Parents Family arrangements Parents Education Home ownership Partner history Lifestyle Household stability Structural shifts in jobs Migration Lifestyle/ diet Gender equity Relevance of education Parents Wealth accumulation Birth family stability Health / disability Income of birth family Infancy Education Housing/Family Development Lifestyle provision Retirement BIRTH TO DEATH EXPERIENCES

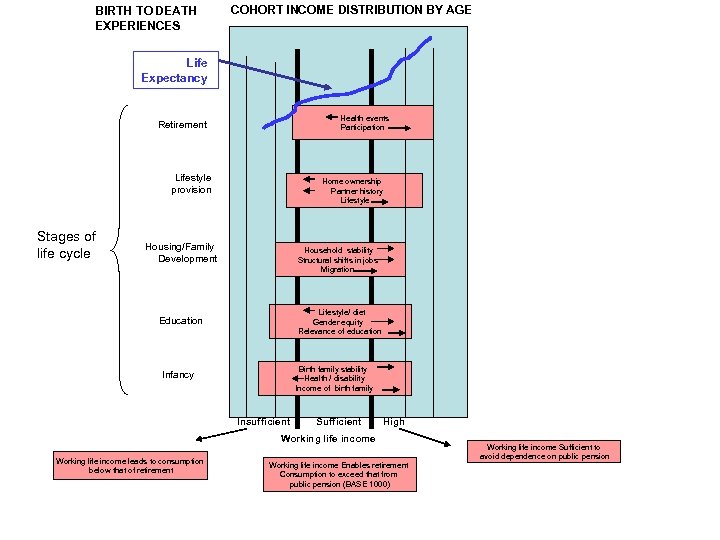

BIRTH TO DEATH EXPERIENCES COHORT INCOME DISTRIBUTION BY AGE Life Expectancy Health events Participation Retirement Lifestyle provision Stages of life cycle Home ownership Partner history Lifestyle Housing/Family Development Household stability Structural shifts in jobs Migration Lifestyle/ diet Gender equity Relevance of education Education Birth family stability Health / disability Income of birth family Infancy Insufficient Sufficient High Working life income leads to consumption below that of retirement Working life income Enables retirement Consumption to exceed that from public pension (BASE 1000) Working life income Sufficient to avoid dependence on public pension

BIRTH TO DEATH EXPERIENCES COHORT INCOME DISTRIBUTION BY AGE Life Expectancy Health events Participation Retirement Lifestyle provision Stages of life cycle Home ownership Partner history Lifestyle Housing/Family Development Household stability Structural shifts in jobs Migration Lifestyle/ diet Gender equity Relevance of education Education Birth family stability Health / disability Income of birth family Infancy Insufficient Sufficient High Working life income leads to consumption below that of retirement Working life income Enables retirement Consumption to exceed that from public pension (BASE 1000) Working life income Sufficient to avoid dependence on public pension

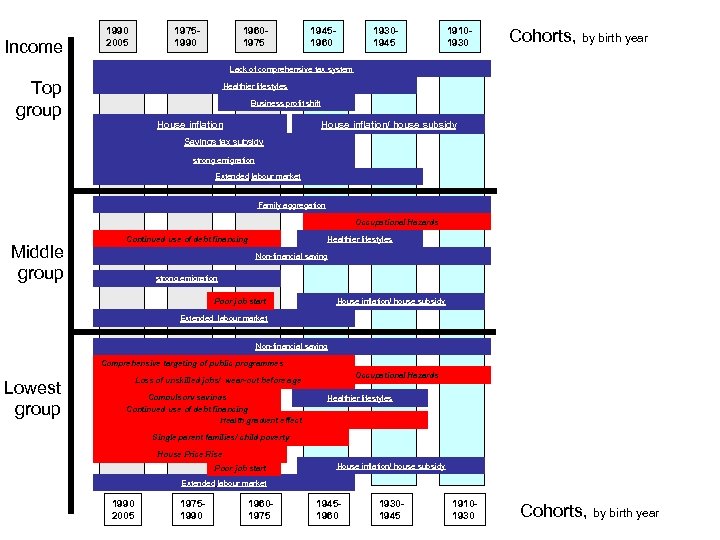

Income 1990 2005 19751990 19601975 19451960 19301945 19101930 Cohorts, by birth year Lack of comprehensive tax system Top group Healthier lifestyles Business profit shift House inflation/ house subsidy Savings tax subsidy strong emigration Extended labour market Family aggregation Occupational Hazards Middle group Continued use of debt financing Healthier lifestyles Non-financial saving strong emigration Poor job start House inflation/ house subsidy Extended labour market Non-financial saving Comprehensive targeting of public programmes Lowest group Occupational Hazards Loss of unskilled jobs/ wear-out before age 65 Compulsory savings Continued use of debt financing Health gradient effect Healthier lifestyles Single parent families/ child poverty House Price Rise Poor job start House inflation/ house subsidy Extended labour market 1990 2005 19751990 19601975 19451960 19301945 19101930 Cohorts, by birth year

Income 1990 2005 19751990 19601975 19451960 19301945 19101930 Cohorts, by birth year Lack of comprehensive tax system Top group Healthier lifestyles Business profit shift House inflation/ house subsidy Savings tax subsidy strong emigration Extended labour market Family aggregation Occupational Hazards Middle group Continued use of debt financing Healthier lifestyles Non-financial saving strong emigration Poor job start House inflation/ house subsidy Extended labour market Non-financial saving Comprehensive targeting of public programmes Lowest group Occupational Hazards Loss of unskilled jobs/ wear-out before age 65 Compulsory savings Continued use of debt financing Health gradient effect Healthier lifestyles Single parent families/ child poverty House Price Rise Poor job start House inflation/ house subsidy Extended labour market 1990 2005 19751990 19601975 19451960 19301945 19101930 Cohorts, by birth year

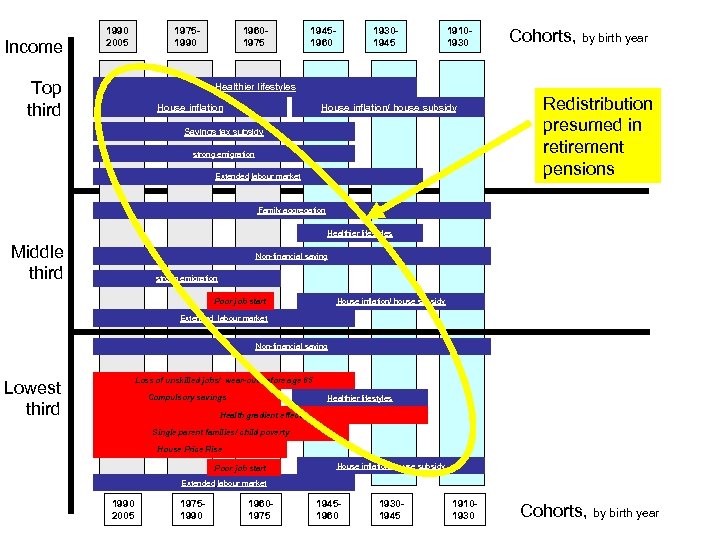

Income 1990 2005 Top third 19751990 19601975 19451960 19301945 19101930 Cohorts, by birth year Healthier lifestyles House inflation/ house subsidy Savings tax subsidy strong emigration Extended labour market Redistribution presumed in retirement pensions Family aggregation Healthier lifestyles Middle third Non-financial saving strong emigration Poor job start House inflation/ house subsidy Extended labour market Non-financial saving Loss of unskilled jobs/ wear-out before age 65 Lowest third Compulsory savings Healthier lifestyles Health gradient effect Single parent families/ child poverty House Price Rise Poor job start House inflation/ house subsidy Extended labour market 1990 2005 19751990 19601975 19451960 19301945 19101930 Cohorts, by birth year

Income 1990 2005 Top third 19751990 19601975 19451960 19301945 19101930 Cohorts, by birth year Healthier lifestyles House inflation/ house subsidy Savings tax subsidy strong emigration Extended labour market Redistribution presumed in retirement pensions Family aggregation Healthier lifestyles Middle third Non-financial saving strong emigration Poor job start House inflation/ house subsidy Extended labour market Non-financial saving Loss of unskilled jobs/ wear-out before age 65 Lowest third Compulsory savings Healthier lifestyles Health gradient effect Single parent families/ child poverty House Price Rise Poor job start House inflation/ house subsidy Extended labour market 1990 2005 19751990 19601975 19451960 19301945 19101930 Cohorts, by birth year

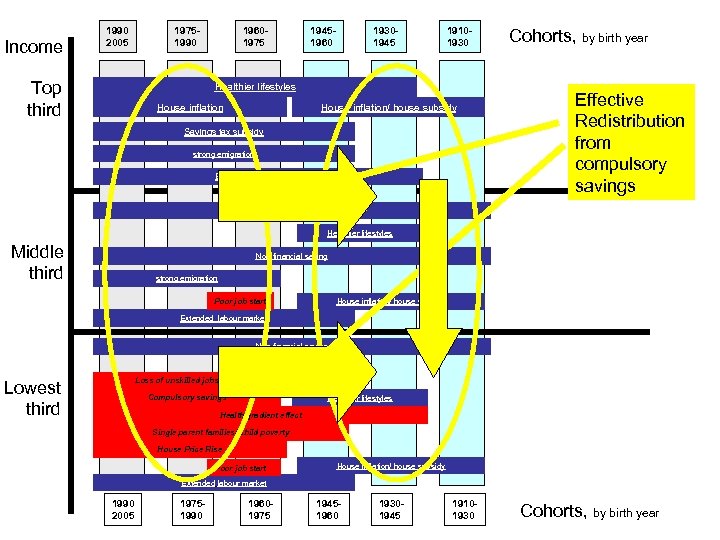

Income 1990 2005 Top third 19751990 19601975 19451960 19301945 19101930 Healthier lifestyles House inflation/ house subsidy Savings tax subsidy strong emigration Extended labour market Cohorts, by birth year Effective Redistribution from compulsory savings Family aggregation Healthier lifestyles Middle third Non-financial saving strong emigration Poor job start House inflation/ house subsidy Extended labour market Non-financial saving Loss of unskilled jobs/ wear-out before age 65 Lowest third Compulsory savings Healthier lifestyles Health gradient effect Single parent families/ child poverty House Price Rise Poor job start House inflation/ house subsidy Extended labour market 1990 2005 19751990 19601975 19451960 19301945 19101930 Cohorts, by birth year

Income 1990 2005 Top third 19751990 19601975 19451960 19301945 19101930 Healthier lifestyles House inflation/ house subsidy Savings tax subsidy strong emigration Extended labour market Cohorts, by birth year Effective Redistribution from compulsory savings Family aggregation Healthier lifestyles Middle third Non-financial saving strong emigration Poor job start House inflation/ house subsidy Extended labour market Non-financial saving Loss of unskilled jobs/ wear-out before age 65 Lowest third Compulsory savings Healthier lifestyles Health gradient effect Single parent families/ child poverty House Price Rise Poor job start House inflation/ house subsidy Extended labour market 1990 2005 19751990 19601975 19451960 19301945 19101930 Cohorts, by birth year

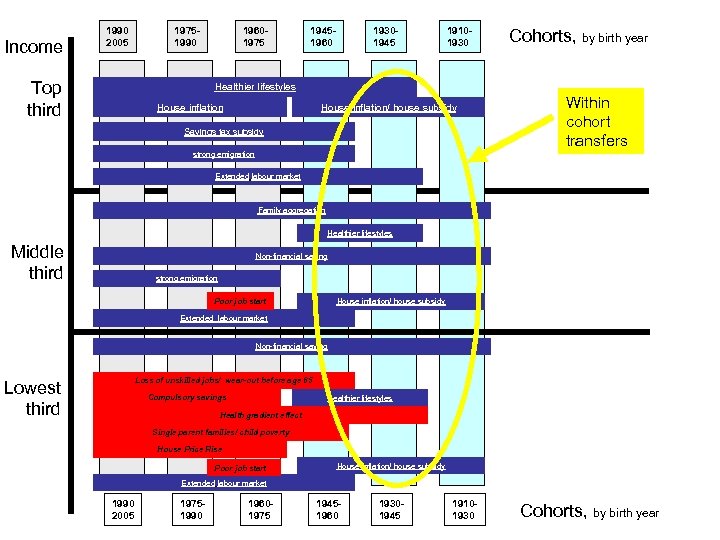

Income 1990 2005 Top third 19751990 19601975 19451960 19301945 19101930 Cohorts, by birth year Healthier lifestyles House inflation/ house subsidy Savings tax subsidy strong emigration Within cohort transfers Extended labour market Family aggregation Healthier lifestyles Middle third Non-financial saving strong emigration Poor job start House inflation/ house subsidy Extended labour market Non-financial saving Loss of unskilled jobs/ wear-out before age 65 Lowest third Compulsory savings Healthier lifestyles Health gradient effect Single parent families/ child poverty House Price Rise Poor job start House inflation/ house subsidy Extended labour market 1990 2005 19751990 19601975 19451960 19301945 19101930 Cohorts, by birth year

Income 1990 2005 Top third 19751990 19601975 19451960 19301945 19101930 Cohorts, by birth year Healthier lifestyles House inflation/ house subsidy Savings tax subsidy strong emigration Within cohort transfers Extended labour market Family aggregation Healthier lifestyles Middle third Non-financial saving strong emigration Poor job start House inflation/ house subsidy Extended labour market Non-financial saving Loss of unskilled jobs/ wear-out before age 65 Lowest third Compulsory savings Healthier lifestyles Health gradient effect Single parent families/ child poverty House Price Rise Poor job start House inflation/ house subsidy Extended labour market 1990 2005 19751990 19601975 19451960 19301945 19101930 Cohorts, by birth year

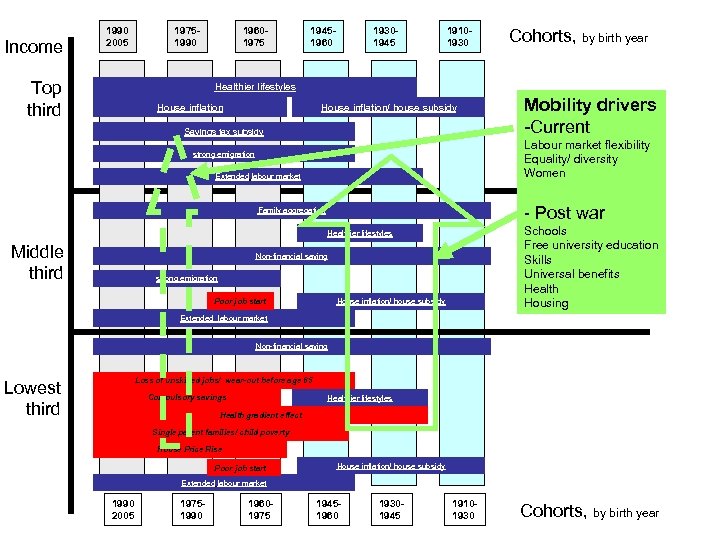

Income 1990 2005 Top third 19751990 19601975 19451960 19301945 19101930 Cohorts, by birth year Healthier lifestyles House inflation/ house subsidy Savings tax subsidy Labour market flexibility Equality/ diversity Women strong emigration Extended labour market - Post war Family aggregation Schools Free university education Skills Universal benefits Health Housing Healthier lifestyles Middle third Mobility drivers -Current Non-financial saving strong emigration Poor job start House inflation/ house subsidy Extended labour market Non-financial saving Loss of unskilled jobs/ wear-out before age 65 Lowest third Compulsory savings Healthier lifestyles Health gradient effect Single parent families/ child poverty House Price Rise Poor job start House inflation/ house subsidy Extended labour market 1990 2005 19751990 19601975 19451960 19301945 19101930 Cohorts, by birth year

Income 1990 2005 Top third 19751990 19601975 19451960 19301945 19101930 Cohorts, by birth year Healthier lifestyles House inflation/ house subsidy Savings tax subsidy Labour market flexibility Equality/ diversity Women strong emigration Extended labour market - Post war Family aggregation Schools Free university education Skills Universal benefits Health Housing Healthier lifestyles Middle third Mobility drivers -Current Non-financial saving strong emigration Poor job start House inflation/ house subsidy Extended labour market Non-financial saving Loss of unskilled jobs/ wear-out before age 65 Lowest third Compulsory savings Healthier lifestyles Health gradient effect Single parent families/ child poverty House Price Rise Poor job start House inflation/ house subsidy Extended labour market 1990 2005 19751990 19601975 19451960 19301945 19101930 Cohorts, by birth year

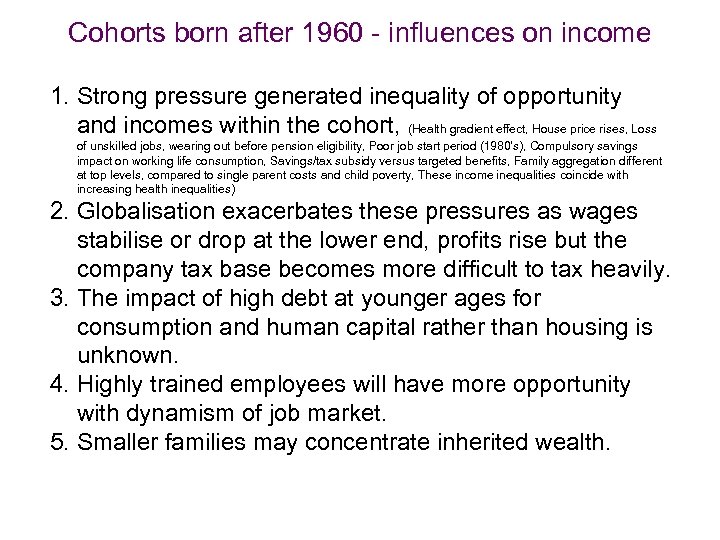

Cohorts born after 1960 - influences on income 1. Strong pressure generated inequality of opportunity and incomes within the cohort, (Health gradient effect, House price rises, Loss of unskilled jobs, wearing out before pension eligibility, Poor job start period (1980’s), Compulsory savings impact on working life consumption, Savings/tax subsidy versus targeted benefits, Family aggregation different at top levels, compared to single parent costs and child poverty, These income inequalities coincide with increasing health inequalities) 2. Globalisation exacerbates these pressures as wages stabilise or drop at the lower end, profits rise but the company tax base becomes more difficult to tax heavily. 3. The impact of high debt at younger ages for consumption and human capital rather than housing is unknown. 4. Highly trained employees will have more opportunity with dynamism of job market. 5. Smaller families may concentrate inherited wealth.

Cohorts born after 1960 - influences on income 1. Strong pressure generated inequality of opportunity and incomes within the cohort, (Health gradient effect, House price rises, Loss of unskilled jobs, wearing out before pension eligibility, Poor job start period (1980’s), Compulsory savings impact on working life consumption, Savings/tax subsidy versus targeted benefits, Family aggregation different at top levels, compared to single parent costs and child poverty, These income inequalities coincide with increasing health inequalities) 2. Globalisation exacerbates these pressures as wages stabilise or drop at the lower end, profits rise but the company tax base becomes more difficult to tax heavily. 3. The impact of high debt at younger ages for consumption and human capital rather than housing is unknown. 4. Highly trained employees will have more opportunity with dynamism of job market. 5. Smaller families may concentrate inherited wealth.

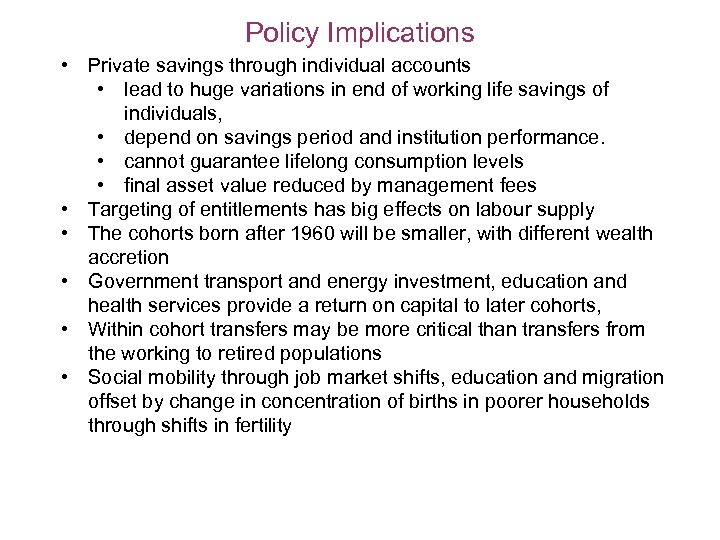

Policy Implications • Private savings through individual accounts • lead to huge variations in end of working life savings of individuals, • depend on savings period and institution performance. • cannot guarantee lifelong consumption levels • final asset value reduced by management fees • Targeting of entitlements has big effects on labour supply • The cohorts born after 1960 will be smaller, with different wealth accretion • Government transport and energy investment, education and health services provide a return on capital to later cohorts, • Within cohort transfers may be more critical than transfers from the working to retired populations • Social mobility through job market shifts, education and migration offset by change in concentration of births in poorer households through shifts in fertility

Policy Implications • Private savings through individual accounts • lead to huge variations in end of working life savings of individuals, • depend on savings period and institution performance. • cannot guarantee lifelong consumption levels • final asset value reduced by management fees • Targeting of entitlements has big effects on labour supply • The cohorts born after 1960 will be smaller, with different wealth accretion • Government transport and energy investment, education and health services provide a return on capital to later cohorts, • Within cohort transfers may be more critical than transfers from the working to retired populations • Social mobility through job market shifts, education and migration offset by change in concentration of births in poorer households through shifts in fertility

Limitations of Dependency Ratio • Implications that people in all cohorts are similar at any particular age • Implication that threshold ages relate to people of similar attributes, across long time periods • Emphasises cross cohort links rather than within cohort links • Use usually assumes some linearity of trends and consistency in cross cohort relationships • Does not include consideration of changes in relative inequalities across cohorts

Limitations of Dependency Ratio • Implications that people in all cohorts are similar at any particular age • Implication that threshold ages relate to people of similar attributes, across long time periods • Emphasises cross cohort links rather than within cohort links • Use usually assumes some linearity of trends and consistency in cross cohort relationships • Does not include consideration of changes in relative inequalities across cohorts