92d2bf5f7569af00e6af60ece43719a5.ppt

- Количество слайдов: 49

Second Annual Biotech Supply Chain Academy Keynote Address Regulatory Influences in Biogenerics-the Next Horizon Gillian R. Woollett, M. A. , D. Phil. Chief Scientist Engel & Novitt, LLP The Law Firm That Knows Its Science October 19, 2009, San Francisco, CA The material and viewpoints set forth in this slide deck and conveyed during this presentation are presented by the author in her capacity as Chief Scientist of Engel & Novitt, LLP. They do not represent and do not purport to represent the views of the law firm or any current or former-client of the firm, and should not be construed as such. ENGEL & NOVITT, LLP The Law Firm That Knows its Science 1

OUTLINE n The premise of competition when patents expire n Biotech products and the biotech pipeline – a n n n whole lot more are on the way… Minimal terminology for the biologics debate The current US regulatory framework Biologics - the need for them is global, but can they be made for a global market? Biologics business models and lessons from the EU biosimilars experience Current legislative efforts to create a new regulatory pathway Opportunities and Conclusions ENGEL & NOVITT, LLP The Law Firm That Knows its Science 2

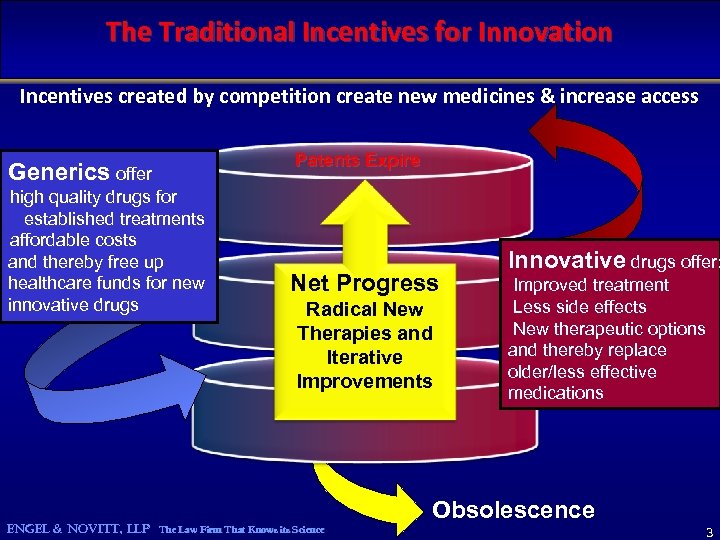

The Traditional Incentives for Innovation Incentives created by competition create new medicines & increase access Generics offer high quality drugs for established treatments affordable costs and thereby free up healthcare funds for new innovative drugs Patents Expire Net Progress Radical New Therapies and Iterative Improvements ENGEL & NOVITT, LLP The Law Firm That Knows its Science Innovative drugs offer: Improved treatment Less side effects New therapeutic options and thereby replace older/less effective medications Obsolescence 3

The Context for ALL Biologics The 200 year history of biologics is the basis for their future: n Started with the very complicated – smallpox vaccine – and the decisions were empirical, and the studies “unethical” n The biotech industry is much younger (first recombinant insulin 1982), and the original biotech products were “biosimilars” essentially biotech was a means of manufacturing previously approved naturally-sourced products. Now we can do way more as in Never-before-seen-in-nature products… n FOBs are not just biosimilars, but also bioidenticals, second- generation products, biobetters, and bio-I-just-don’t-knows n Biobetters can be clinically-better, but also perhaps safer, more stable, more reliably manufactured and cheaper, or all of the above ENGEL & NOVITT, LLP The Law Firm That Knows its Science 4

The Economic Issues for Biologics Matter NOW n Healthcare costs are high and increasing - all economies are under pressure, but access is life/death n Individual biopharmaceuticals are more expensive than drugs on a per-patient basis, so prices have become conspicuous - attracting political and media attention. n Medicines are a critical part of healthcare worldwide, but there is considerable price and product disparity, yet the companies and the patients are the same n Biologics are, or are coming, off-patent n Arguments for free-market pricing of drugs evoke an expectation of competition in the marketplace at the conclusion of patent terms n The opportunities from multiple sponsors are increasingly apparent to all stakeholders; conversely their lack is a liability to biopharma and patients ENGEL & NOVITT, LLP The Law Firm That Knows its Science 5

BIOTECHNOLOGY ENGEL & NOVITT, LLP The Law Firm That Knows its Science 6

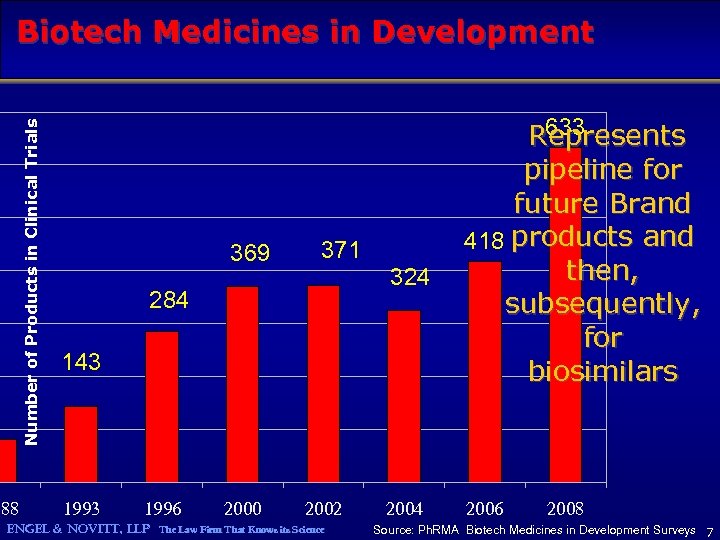

Number of Products in Clinical Trials Biotech Medicines in Development 988 369 371 324 284 143 1996 2000 2002 ENGEL & NOVITT, LLP The Law Firm That Knows its Science 2004 633 Represents pipeline for future Brand 418 products and then, subsequently, for biosimilars 2006 2008 Source: Ph. RMA Biotech Medicines in Development Surveys 7

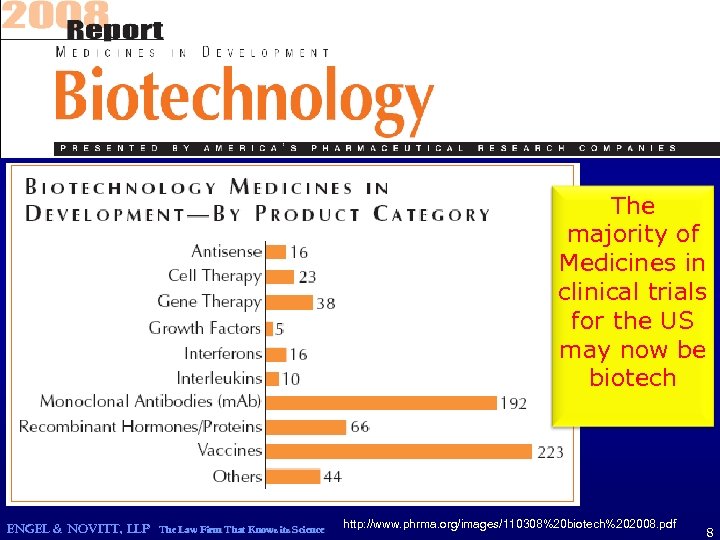

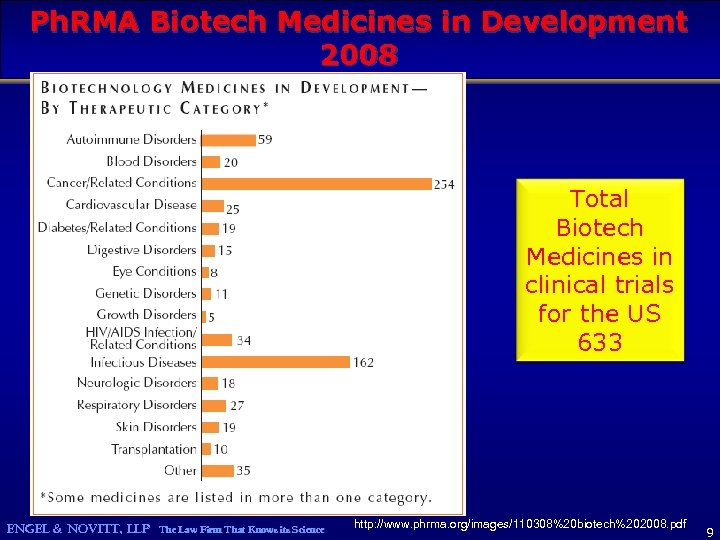

The majority of Medicines in clinical trials for the US may now be biotech ENGEL & NOVITT, LLP The Law Firm That Knows its Science http: //www. phrma. org/images/110308%20 biotech%202008. pdf 8

Ph. RMA Biotech Medicines in Development 2008 Total Biotech Medicines in clinical trials for the US 633 ENGEL & NOVITT, LLP The Law Firm That Knows its Science http: //www. phrma. org/images/110308%20 biotech%202008. pdf 9

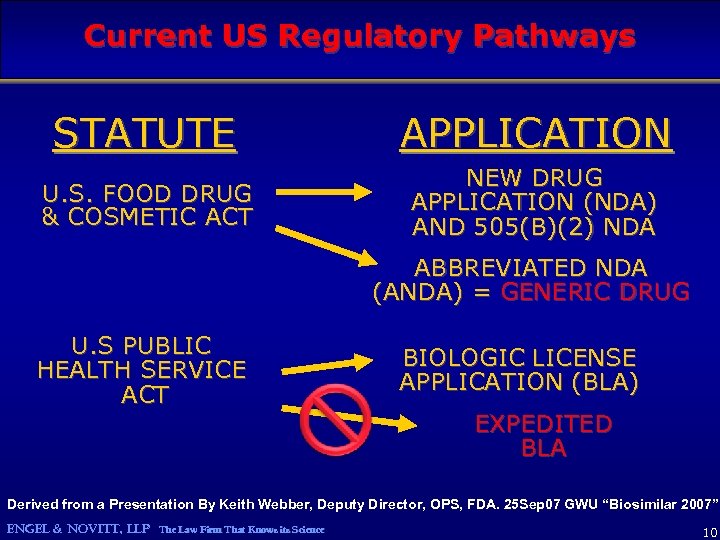

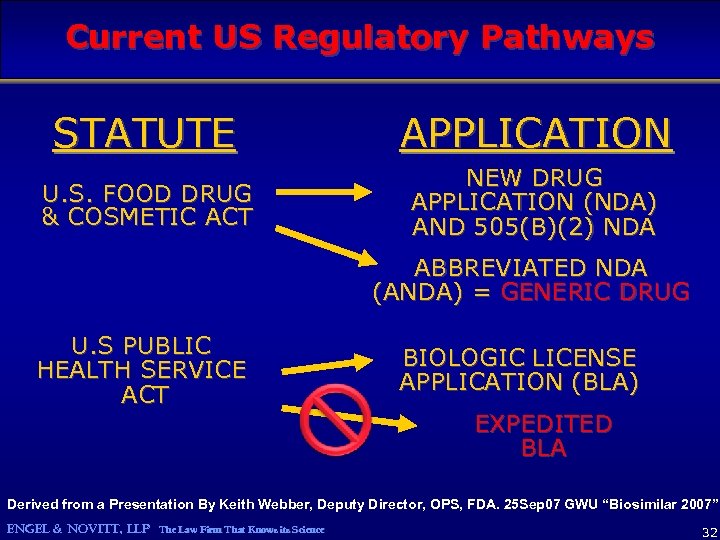

Current US Regulatory Pathways STATUTE APPLICATION U. S. FOOD DRUG & COSMETIC ACT NEW DRUG APPLICATION (NDA) AND 505(B)(2) NDA ABBREVIATED NDA (ANDA) = GENERIC DRUG U. S PUBLIC HEALTH SERVICE ACT BIOLOGIC LICENSE APPLICATION (BLA) EXPEDITED BLA Derived from a Presentation By Keith Webber, Deputy Director, OPS, FDA. 25 Sep 07 GWU “Biosimilar 2007” ENGEL & NOVITT, LLP The Law Firm That Knows its Science 10

Terminology has been distracting… n Biologic – is a prophylactic, in vivo diagnostic, or therapeutic substance that is made in a living system, and that, generally, has a large and complex molecular structure n Follow-on Biologic (FOB) – a subsequent version of a biologic, independently developed and approved, but that shares the same mechanism of action as a previously approved product (includes so -called EU Biosimilars, plus some second generation biologics) n Second-generation biologic - subsequent versions of biologics that are independently developed and approved, share the same mechanism of action as a previously approved product but are explicitly different in some manner, e. g. inhaled. Sometimes called “evergreened”. n Biogeneric, or Generic Biologic Drugs – should only be applied to ANDAs for biologic drugs approved by FD&C Act. ANDAs are interchangeable with their reference product ENGEL & NOVITT, LLP The Law Firm That Knows its Science 11

And please remember, while there may be a debate on naming… …THE NAME DOES NOT CHANGE THE CONTENTS OF THE TUBE ENGEL & NOVITT, LLP The Law Firm That Knows its Science 12

So how do you tell what is in the tube… …with DATA And hence the issue for any biologic sponsor is what data, to demonstrate what, and to whom, at what price to get what market… Answer: data to show safety, purity and potency or a relationship to a reference product (with known safety, purity and potency) at the structural, functional, and clinical levels to the regulators ENGEL & NOVITT, LLP The Law Firm That Knows its Science 13

Where are we with biosimilars today? n Generally accepted that the science is sufficient for some/most biosimilars today n Europe, Australia, Canada, Japan have biosimilars and competition is beginning n No Enacted US legislation but bills in play (albeit drowned in the larger health care reform debate) n Recognition of need for biologics competition in US as patents expire, but aggressive defense by some Brands n Huge confusion on the role of reimbursement, and need for interchangeability to gain savings and access n Health care reform an Administration priority, and biosimilars seen to have potential to increase access and save money n Global issues ENGEL & NOVITT, LLP The Law Firm That Knows its Science 14

The Biosimilars Story of Europe – a Timeline n 17 Dec 03 European Parliament “Future Medicines Legislation” (also called “Pharma Review Package”) n 31 Mar 04 Directive 2004/27/EC (also known as Directive 2001/83/EC as amended) and Regulation 726/2004. Came into effect 20 Nov 05 n EMEA published general guidelines on biosimilars, as well as “class”-specific ones, but accepts and reviews applications concurrently n Approvals: April 06 First biosimilar approval was Omnitrope (somatropin); August 07 First glycosylated protein approved as a biosimilar, Binocrit (Epoetin alfa); March 09 EMEA Guideline on LMWH – first for a naturally-sourced biosimilar n EMEA meeting on Biosimilar Monoclonal Antibodies Jul 09 ENGEL & NOVITT, LLP The Law Firm That Knows its Science 15

Selected Therapeutic Biologics by Product Class Average ~150 Kd Average <50 Kd

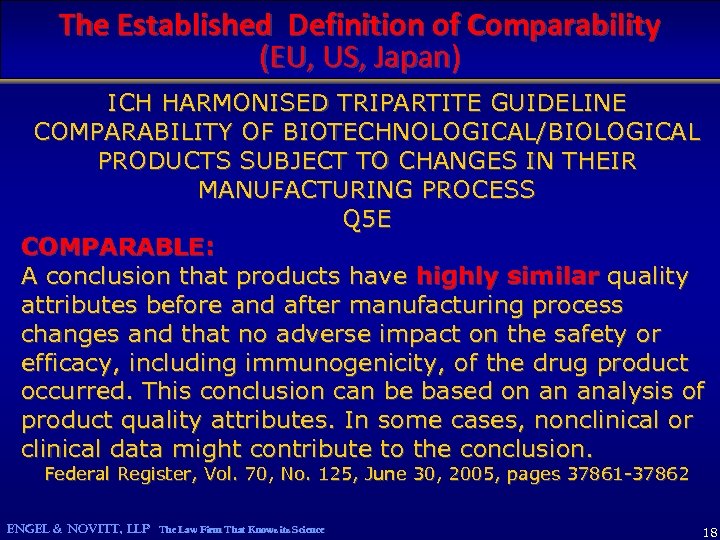

European Biosimilars are based on wellestablished regulatory standards n 1996 US Guidance on Comparability for Manufacturing Changes for drugs and biologics developed by FDA and Pharma n Early 2000’s ICH Q 5 E Comparability standards adopted by EU US and Japan – HIGHLY SIMILAR n EU Biosimilars based on similarity and guidelines developed, but MEANWHILE biosimilars were developed and approved. n No central EU regulatory designation of interchangeability, up to the health authorities in each country n Review and approval not coupled to patents n Innovator exclusivity 8+2+1 for all medicines (drugs and biologics are the same) ENGEL & NOVITT, LLP The Law Firm That Knows its Science 17

The Established Definition of Comparability (EU, US, Japan) ICH HARMONISED TRIPARTITE GUIDELINE COMPARABILITY OF BIOTECHNOLOGICAL/BIOLOGICAL PRODUCTS SUBJECT TO CHANGES IN THEIR MANUFACTURING PROCESS Q 5 E COMPARABLE: A conclusion that products have highly similar quality attributes before and after manufacturing process changes and that no adverse impact on the safety or efficacy, including immunogenicity, of the drug product occurred. This conclusion can be based on an analysis of product quality attributes. In some cases, nonclinical or clinical data might contribute to the conclusion. Federal Register, Vol. 70, No. 125, June 30, 2005, pages 37861 -37862 ENGEL & NOVITT, LLP The Law Firm That Knows its Science 18

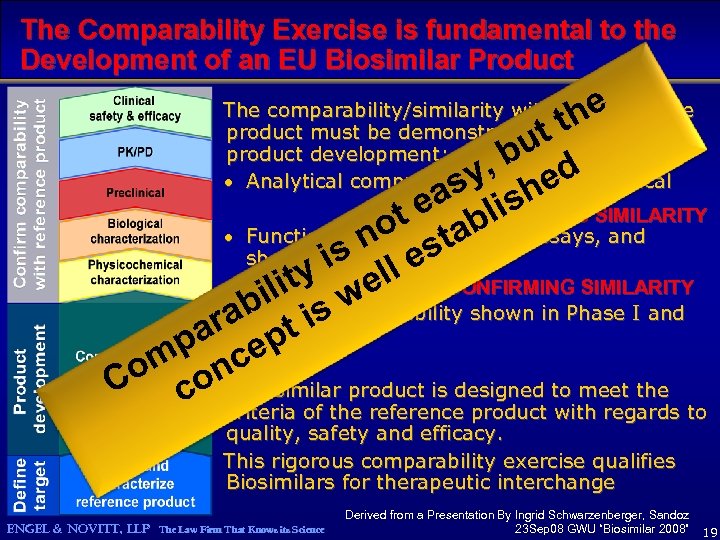

The Comparability Exercise is fundamental to the Development of an EU Biosimilar Product he tt The comparability/similarity with the reference product must be demonstrated at all levels of product development: · Analytical comparability - physicochemical bu d y, he as lis e t ESTABLISHING SIMILARITY o tab · Functional Comparability in assays, and n s sanimalestudies shown by y i ell CONFIRMING SIMILARITY lit w bi is r·a. Clinical Comparability shown in Phase I and III studies pa cept om on biosimilar product is designed to meet the C c A criteria of the reference product with regards to quality, safety and efficacy. This rigorous comparability exercise qualifies Biosimilars for therapeutic interchange ENGEL & NOVITT, LLP The Law Firm That Knows its Science Derived from a Presentation By Ingrid Schwarzenberger, Sandoz 23 Sep 08 GWU “Biosimilar 2008” 19

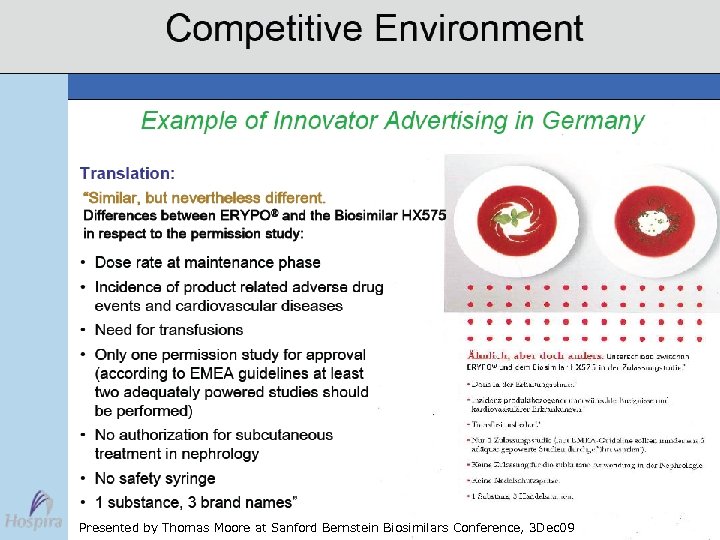

Presented by Thomas Moore at Sanford Bernstein Biosimilars Conference, 3 Dec 09 ENGEL & NOVITT, LLP The Law Firm That Knows its Science 20

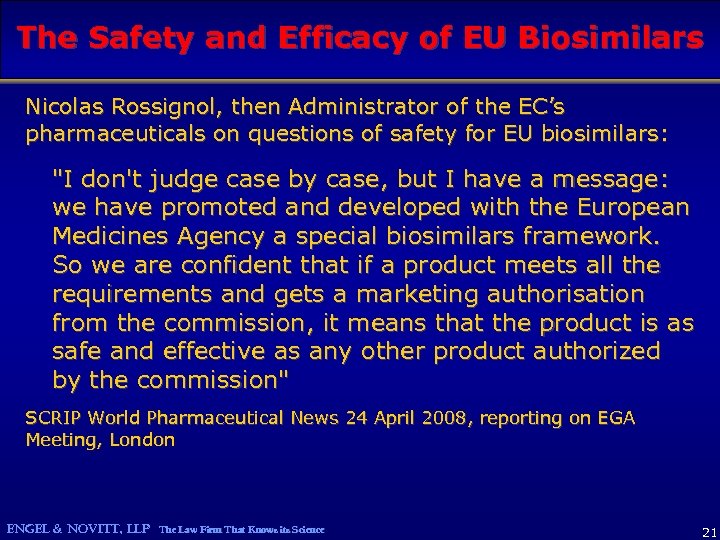

The Safety and Efficacy of EU Biosimilars Nicolas Rossignol, then Administrator of the EC’s pharmaceuticals on questions of safety for EU biosimilars: "I don't judge case by case, but I have a message: we have promoted and developed with the European Medicines Agency a special biosimilars framework. So we are confident that if a product meets all the requirements and gets a marketing authorisation from the commission, it means that the product is as safe and effective as any other product authorized by the commission" SCRIP World Pharmaceutical News 24 April 2008, reporting on EGA Meeting, London ENGEL & NOVITT, LLP The Law Firm That Knows its Science 21

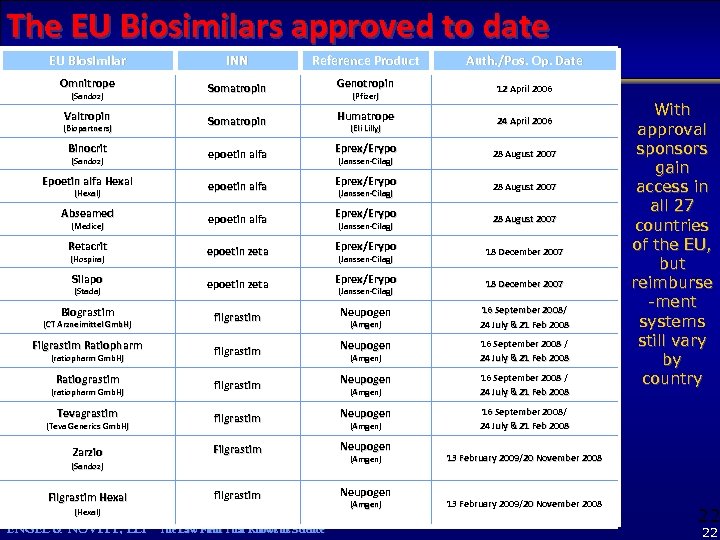

The EU Biosimilars approved to date EU Biosimilar INN Reference Product Auth. /Pos. Op. Date Omnitrope Somatropin Genotropin 12 April 2006 Valtropin Somatropin Humatrope 24 April 2006 Binocrit epoetin alfa Eprex/Erypo 28 August 2007 Epoetin alfa Hexal epoetin alfa Eprex/Erypo 28 August 2007 Abseamed epoetin alfa Eprex/Erypo 28 August 2007 Retacrit epoetin zeta Eprex/Erypo 18 December 2007 Silapo epoetin zeta Eprex/Erypo 18 December 2007 Biograstim filgrastim Neupogen 16 September 2008/ 24 July & 21 Feb 2008 Filgrastim Ratiopharm filgrastim Neupogen 16 September 2008 / 24 July & 21 Feb 2008 Ratiograstim filgrastim Neupogen 16 September 2008 / 24 July & 21 Feb 2008 Tevagrastim filgrastim Neupogen 16 September 2008/ 24 July & 21 Feb 2008 Zarzio Filgrastim Neupogen filgrastim Neupogen (Sandoz) (Biopartners) (Sandoz) (Hexal) (Medice) (Hospira) (Stada) (CT Arzneimittel Gmb. H) (ratiopharm Gmb. H) (Teva Generics Gmb. H) (Sandoz) Filgrastim Hexal (Hexal) ENGEL & NOVITT, LLP The Law Firm That Knows its Science (Pfizer) (Eli Lilly) (Janssen-Cilag) (Janssen-Cilag) (Amgen) (Amgen) With approval sponsors gain access in all 27 countries of the EU, but reimburse -ment systems still vary by country 13 February 2009/20 November 2008 22 22

ENGEL & NOVITT, LLP The Law Firm That Knows its Science 23

But, for all biologics suppliers… n Regulatory requirements have increased as the collective ability to do “more science” has increased - sameness has become pursuing everything with every technique every time to show the absence of a difference… n Reference standards are not routinely available. No API commercial model for biologics n Comparability has become increasingly difficult, even for innovators with their own products, e. g. when getting new facilities on line, resulting in shortages. This drives pressures for more suppliers. Quality matters. n Alternative sources/products are needed, and also incented by the expanding markets (range of products, and more patients needing access), and manufacturing can be more efficient… n Products in one market drive demands in others – global needs ENGEL & NOVITT, LLP The Law Firm That Knows its Science 24

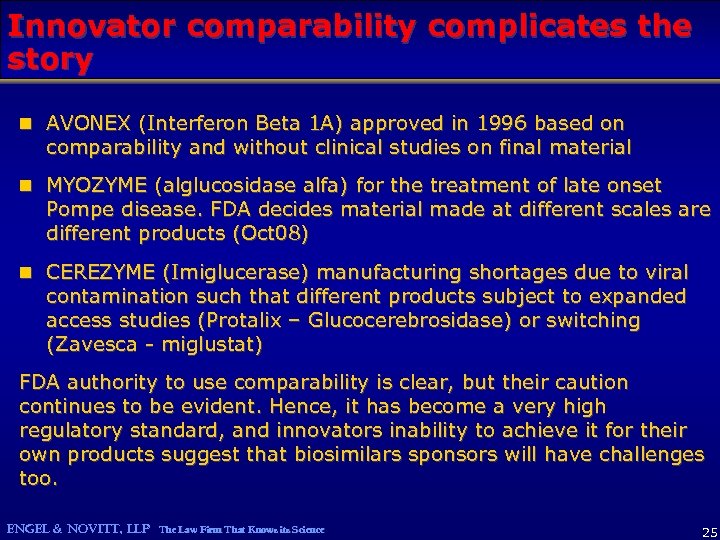

Innovator comparability complicates the story n AVONEX (Interferon Beta 1 A) approved in 1996 based on comparability and without clinical studies on final material n MYOZYME (alglucosidase alfa) for the treatment of late onset Pompe disease. FDA decides material made at different scales are different products (Oct 08) n CEREZYME (Imiglucerase) manufacturing shortages due to viral contamination such that different products subject to expanded access studies (Protalix – Glucocerebrosidase) or switching (Zavesca - miglustat) FDA authority to use comparability is clear, but their caution continues to be evident. Hence, it has become a very high regulatory standard, and innovators inability to achieve it for their own products suggest that biosimilars sponsors will have challenges too. ENGEL & NOVITT, LLP The Law Firm That Knows its Science 25

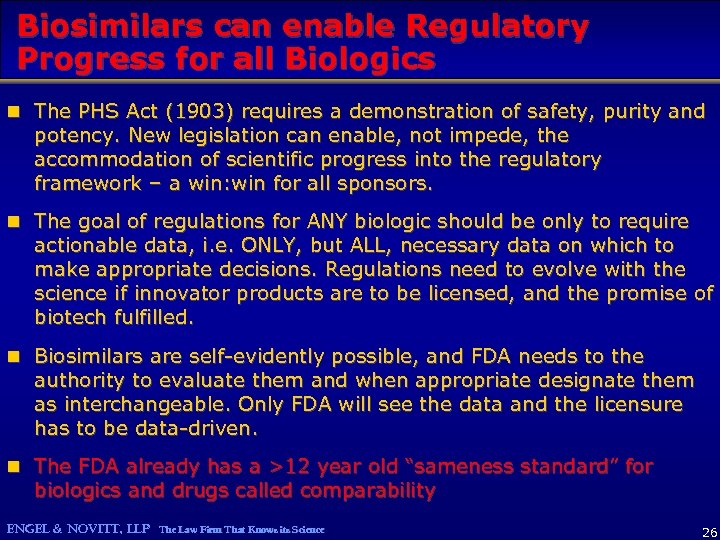

Biosimilars can enable Regulatory Progress for all Biologics n The PHS Act (1903) requires a demonstration of safety, purity and potency. New legislation can enable, not impede, the accommodation of scientific progress into the regulatory framework – a win: win for all sponsors. n The goal of regulations for ANY biologic should be only to require actionable data, i. e. ONLY, but ALL, necessary data on which to make appropriate decisions. Regulations need to evolve with the science if innovator products are to be licensed, and the promise of biotech fulfilled. n Biosimilars are self-evidently possible, and FDA needs to the authority to evaluate them and when appropriate designate them as interchangeable. Only FDA will see the data and the licensure has to be data-driven. n The FDA already has a >12 year old “sameness standard” for biologics and drugs called comparability ENGEL & NOVITT, LLP The Law Firm That Knows its Science 26

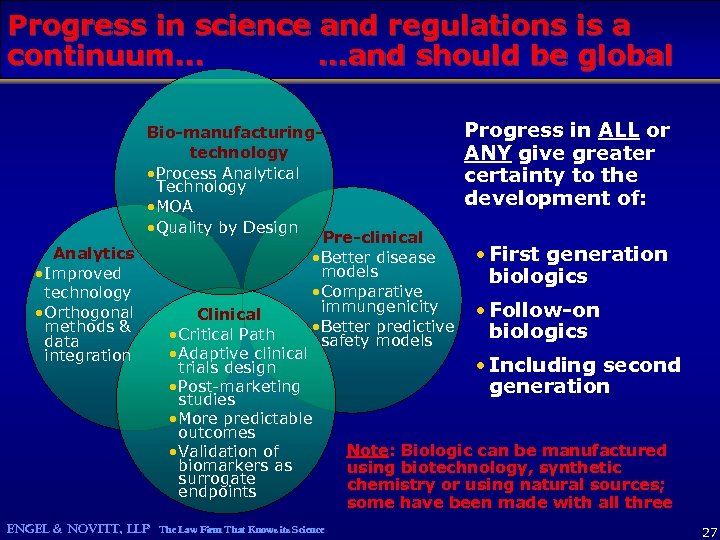

Progress in science and regulations is a continuum… …and should be global Analytics • Improved technology • Orthogonal methods & data integration Progress in ALL or Bio-manufacturingtechnology ANY give greater • Process Analytical certainty to the Technology development of: • MOA • Quality by Design Pre-clinical • First generation • Better disease models biologics • Comparative immungenicity • Follow-on Clinical • Better predictive biologics • Critical Path safety models • Adaptive clinical • Including second trials design • Post-marketing generation studies • More predictable outcomes Note: Biologic can be manufactured • Validation of biomarkers as using biotechnology, synthetic surrogate chemistry or using natural sources; endpoints some have been made with all three ENGEL & NOVITT, LLP The Law Firm That Knows its Science 27

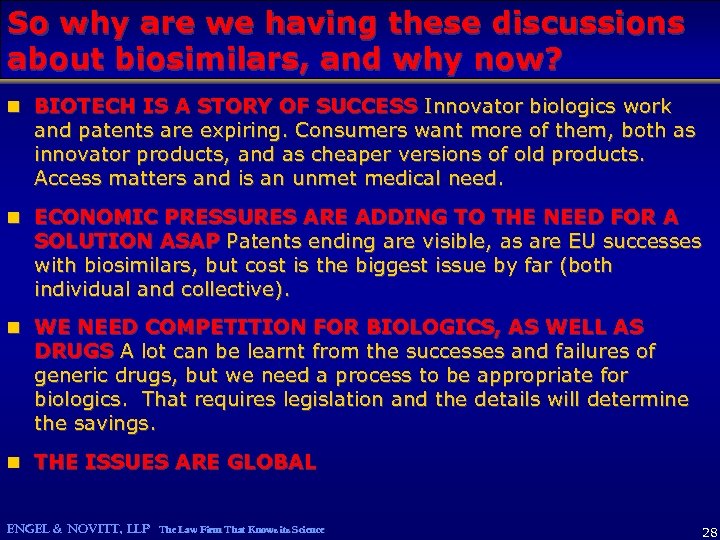

So why are we having these discussions about biosimilars, and why now? n BIOTECH IS A STORY OF SUCCESS Innovator biologics work and patents are expiring. Consumers want more of them, both as innovator products, and as cheaper versions of old products. Access matters and is an unmet medical need. n ECONOMIC PRESSURES ARE ADDING TO THE NEED FOR A SOLUTION ASAP Patents ending are visible, as are EU successes with biosimilars, but cost is the biggest issue by far (both individual and collective). n WE NEED COMPETITION FOR BIOLOGICS, AS WELL AS DRUGS A lot can be learnt from the successes and failures of generic drugs, but we need a process to be appropriate for biologics. That requires legislation and the details will determine the savings. n THE ISSUES ARE GLOBAL ENGEL & NOVITT, LLP The Law Firm That Knows its Science 28

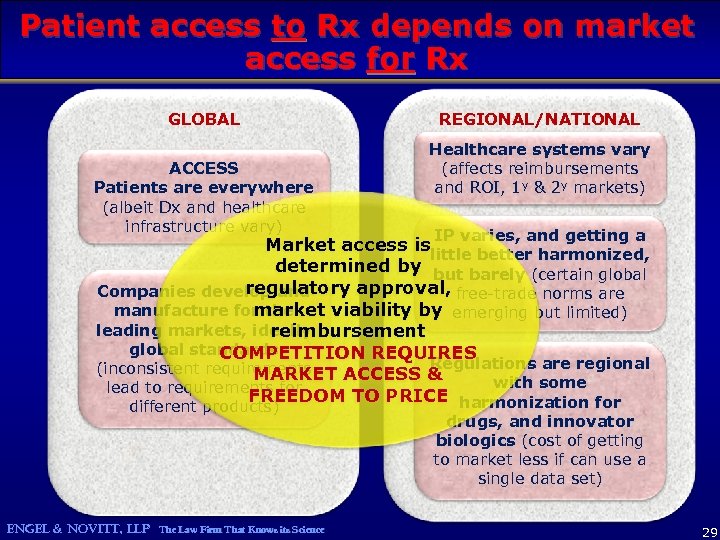

Patient access to Rx depends on market access for Rx GLOBAL ACCESS Patients are everywhere (albeit Dx and healthcare infrastructure vary) REGIONAL/NATIONAL Healthcare systems vary (affects reimbursements and ROI, 1 y & 2 y markets) IP varies, and getting a Market access is little better harmonized, determined by but barely (certain global regulatory approval, free-trade norms are Companies develop and market viability by emerging but limited) manufacture for the leading markets, ideally reimbursement global standards COMPETITION REQUIRES Regulations are regional (inconsistent requirements MARKET ACCESS & with some lead to requirements for FREEDOM TO PRICE harmonization for different products) ENGEL & NOVITT, LLP The Law Firm That Knows its Science drugs, and innovator biologics (cost of getting to market less if can use a single data set) 29

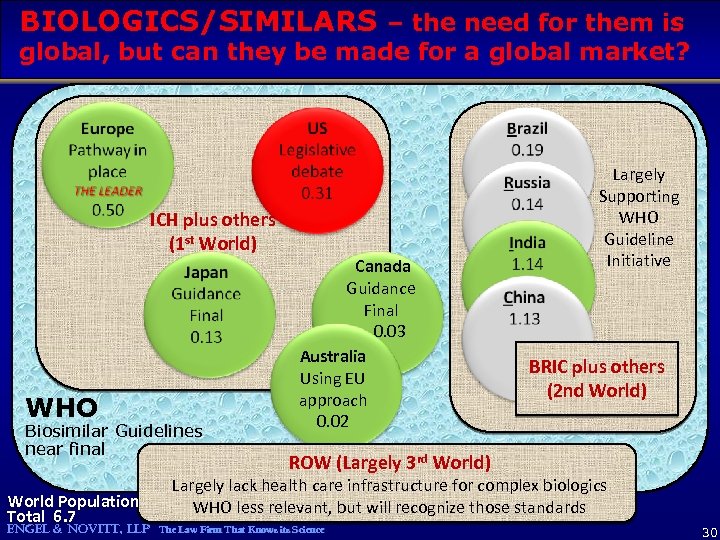

BIOLOGICS/SIMILARS – the need for them is global, but can they be made for a global market? ICH plus others (1 st World) WHO Biosimilar Guidelines near final World Population Total 6. 7 Canada Guidance Final 0. 03 Australia Using EU approach 0. 02 Largely Supporting WHO Guideline Initiative BRIC plus others (2 nd World) ROW (Largely 3 rd World) Largely lack health care infrastructure for complex biologics WHO less relevant, but will recognize those standards ENGEL & NOVITT, LLP The Law Firm That Knows its Science 30

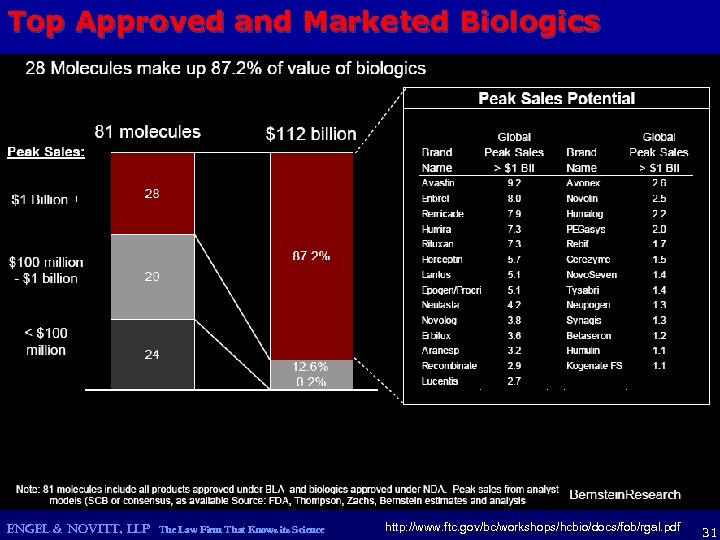

Top Approved and Marketed Biologics ENGEL & NOVITT, LLP The Law Firm That Knows its Science http: //www. ftc. gov/bc/workshops/hcbio/docs/fob/rgal. pdf 31

Current US Regulatory Pathways STATUTE APPLICATION U. S. FOOD DRUG & COSMETIC ACT NEW DRUG APPLICATION (NDA) AND 505(B)(2) NDA ABBREVIATED NDA (ANDA) = GENERIC DRUG U. S PUBLIC HEALTH SERVICE ACT BIOLOGIC LICENSE APPLICATION (BLA) EXPEDITED BLA Derived from a Presentation By Keith Webber, Deputy Director, OPS, FDA. 25 Sep 07 GWU “Biosimilar 2007” ENGEL & NOVITT, LLP The Law Firm That Knows its Science 32

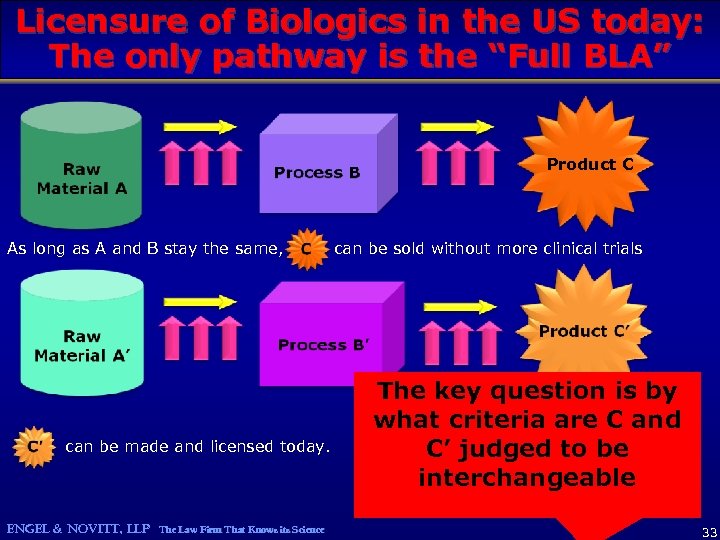

Licensure of Biologics in the US today: The only pathway is the “Full BLA” Product C As long as A and B stay the same, can be made and licensed today. ENGEL & NOVITT, LLP The Law Firm That Knows its Science can be sold without more clinical trials The key question is by what criteria are C and C’ judged to be interchangeable 33

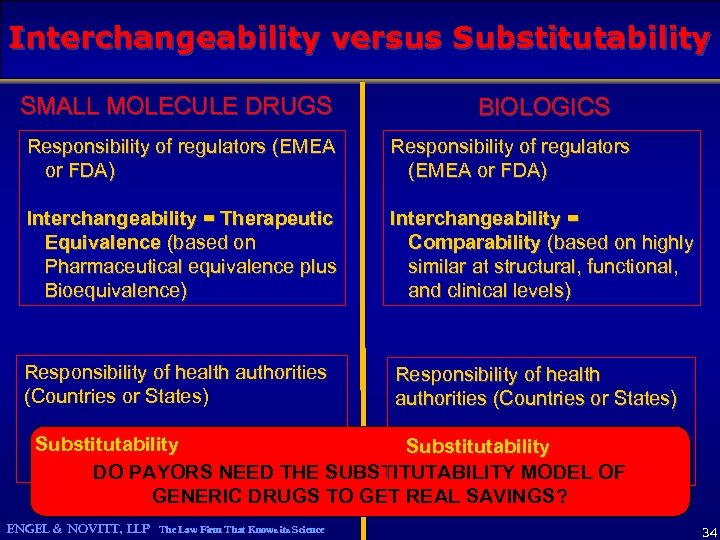

Interchangeability versus Substitutability SMALL MOLECULE DRUGS BIOLOGICS Responsibility of regulators (EMEA or FDA) Interchangeability = Therapeutic Equivalence (based on Pharmaceutical equivalence plus Bioequivalence) Interchangeability = Comparability (based on highly similar at structural, functional, and clinical levels) Responsibility of health authorities (Countries or States) Substitutability DO PAYORS NEED THE SUBSTITUTABILITY MODEL OF GENERIC DRUGS TO GET REAL SAVINGS? ENGEL & NOVITT, LLP The Law Firm That Knows its Science 34

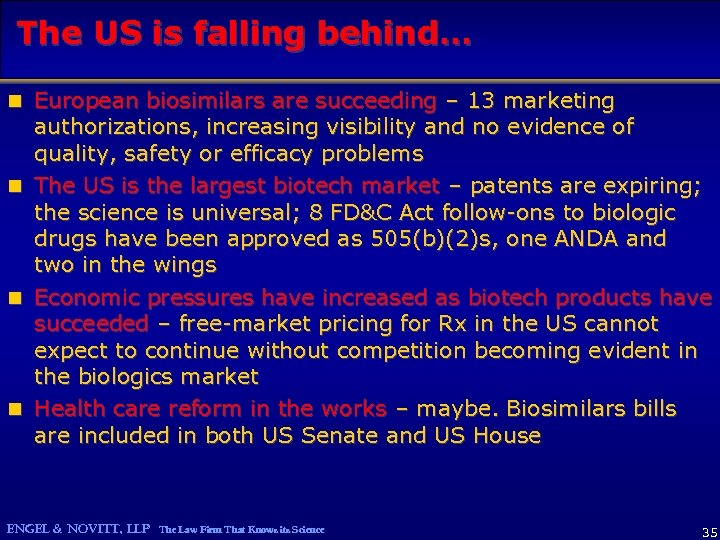

The US is falling behind… n European biosimilars are succeeding – 13 marketing authorizations, increasing visibility and no evidence of quality, safety or efficacy problems n The US is the largest biotech market – patents are expiring; the science is universal; 8 FD&C Act follow-ons to biologic drugs have been approved as 505(b)(2)s, one ANDA and two in the wings n Economic pressures have increased as biotech products have succeeded – free-market pricing for Rx in the US cannot expect to continue without competition becoming evident in the biologics market n Health care reform in the works – maybe. Biosimilars bills are included in both US Senate and US House ENGEL & NOVITT, LLP The Law Firm That Knows its Science 35

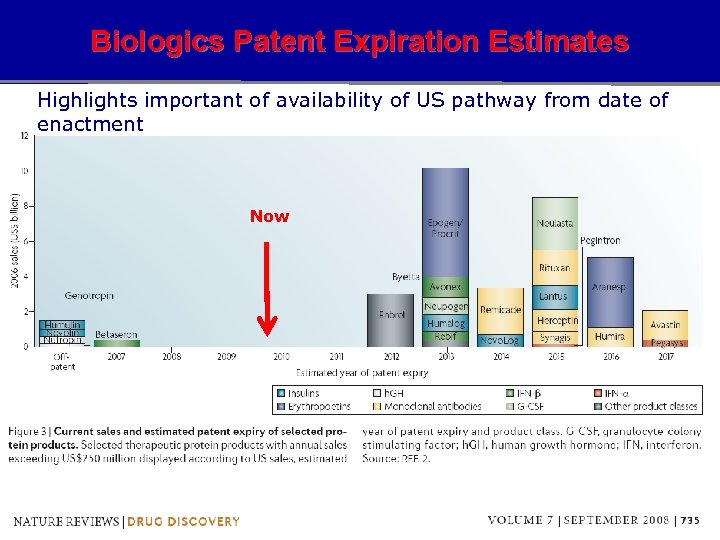

Biologics Patent Expiration Estimates Highlights important of availability of US pathway from date of enactment Now

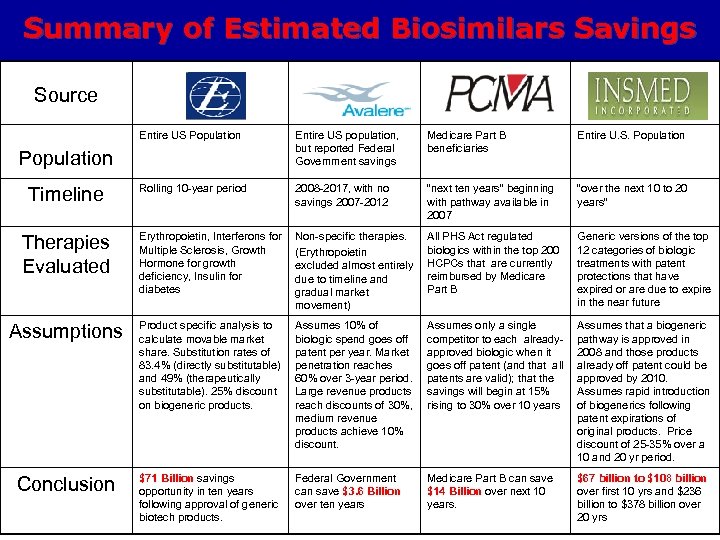

Summary of Estimated Biosimilars Savings Source Entire US Population Entire US population, but reported Federal Government savings Medicare Part B beneficiaries Entire U. S. Population Rolling 10 -year period 2008 -2017, with no savings 2007 -2012 “next ten years” beginning with pathway available in 2007 “over the next 10 to 20 years” Therapies Evaluated Erythropoietin, Interferons for Multiple Sclerosis, Growth Hormone for growth deficiency, Insulin for diabetes Non-specific therapies. (Erythropoietin excluded almost entirely due to timeline and gradual market movement) All PHS Act regulated biologics within the top 200 HCPCs that are currently reimbursed by Medicare Part B Generic versions of the top 12 categories of biologic treatments with patent protections that have expired or are due to expire in the near future Assumptions Product specific analysis to calculate movable market share. Substitution rates of 83. 4% (directly substitutable) and 49% (therapeutically substitutable). 25% discount on biogeneric products. Assumes 10% of biologic spend goes off patent per year. Market penetration reaches 60% over 3 -year period. Large revenue products reach discounts of 30%, medium revenue products achieve 10% discount. Assumes only a single competitor to each alreadyapproved biologic when it goes off patent (and that all patents are valid); that the savings will begin at 15% rising to 30% over 10 years Assumes that a biogeneric pathway is approved in 2008 and those products already off patent could be approved by 2010. Assumes rapid introduction of biogenerics following patent expirations of original products. Price discount of 25 -35% over a 10 and 20 yr period. Conclusion $71 Billion savings opportunity in ten years following approval of generic biotech products. Federal Government can save $3. 6 Billion over ten years Medicare Part B can save $14 Billion over next 10 years. $67 billion to $108 billion over first 10 yrs and $236 billion to $378 billion over 20 yrs Population Timeline

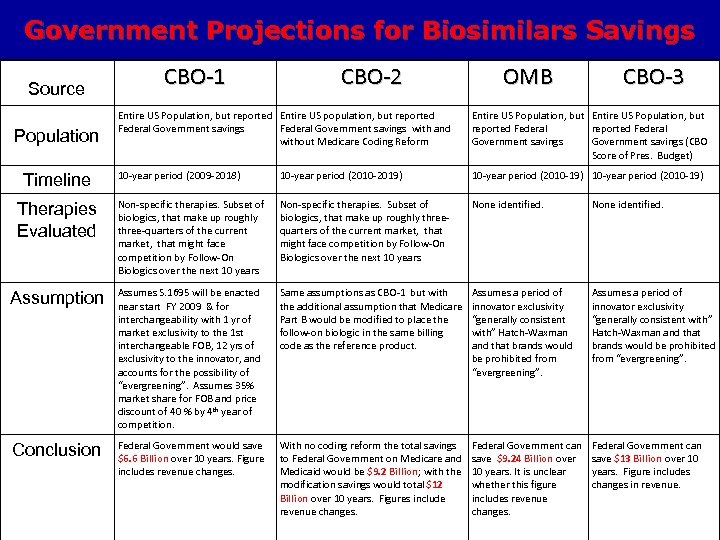

Government Projections for Biosimilars Savings Source CBO-1 CBO-2 OMB CBO-3 Entire US Population, but reported Entire US population, but reported Federal Government savings with and without Medicare Coding Reform Entire US Population, but reported Federal Government savings (CBO Score of Pres. Budget) 10 -year period (2009 -2018) 10 -year period (2010 -2019) 10 -year period (2010 -19) Therapies Evaluated Non-specific therapies. Subset of biologics, that make up roughly three-quarters of the current market, that might face competition by Follow-On Biologics over the next 10 years Non-specific therapies. Subset of biologics, that make up roughly threequarters of the current market, that might face competition by Follow-On Biologics over the next 10 years None identified. Assumption Assumes S. 1695 will be enacted near start FY 2009 & for interchangeability with 1 yr of market exclusivity to the 1 st interchangeable FOB, 12 yrs of exclusivity to the innovator, and accounts for the possibility of “evergreening”. Assumes 35% market share for FOB and price discount of 40 % by 4 th year of competition. Same assumptions as CBO-1 but with the additional assumption that Medicare Part B would be modified to place the follow-on biologic in the same billing code as the reference product. Assumes a period of innovator exclusivity “generally consistent with” Hatch-Waxman and that brands would be prohibited from “evergreening”. Conclusion Federal Government would save $6. 6 Billion over 10 years. Figure includes revenue changes. With no coding reform the total savings to Federal Government on Medicare and Medicaid would be $9. 2 Billion; with the modification savings would total $12 Billion over 10 years. Figures include revenue changes. Federal Government can save $9. 24 Billion over 10 years. It is unclear whether this figure includes revenue changes. Federal Government can save $13 Billion over 10 years. Figure includes changes in revenue. Population Timeline

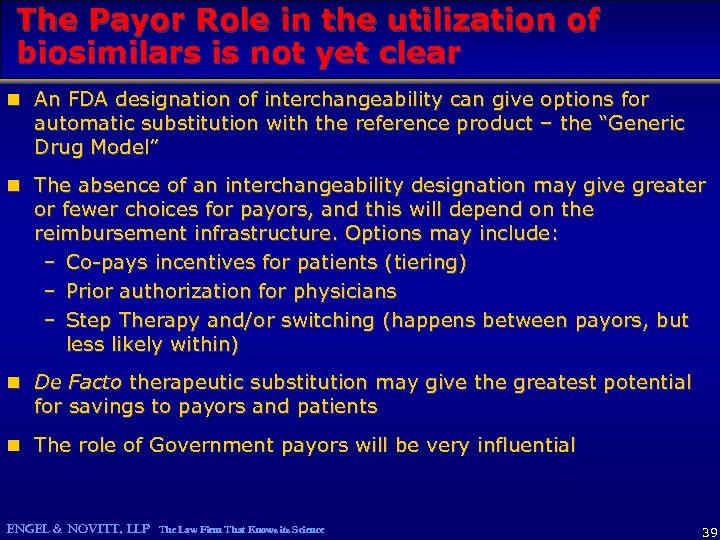

The Payor Role in the utilization of biosimilars is not yet clear n An FDA designation of interchangeability can give options for automatic substitution with the reference product – the “Generic Drug Model” n The absence of an interchangeability designation may give greater or fewer choices for payors, and this will depend on the reimbursement infrastructure. Options may include: – Co-pays incentives for patients (tiering) – Prior authorization for physicians – Step Therapy and/or switching (happens between payors, but less likely within) n De Facto therapeutic substitution may give the greatest potential for savings to payors and patients n The role of Government payors will be very influential ENGEL & NOVITT, LLP The Law Firm That Knows its Science 39

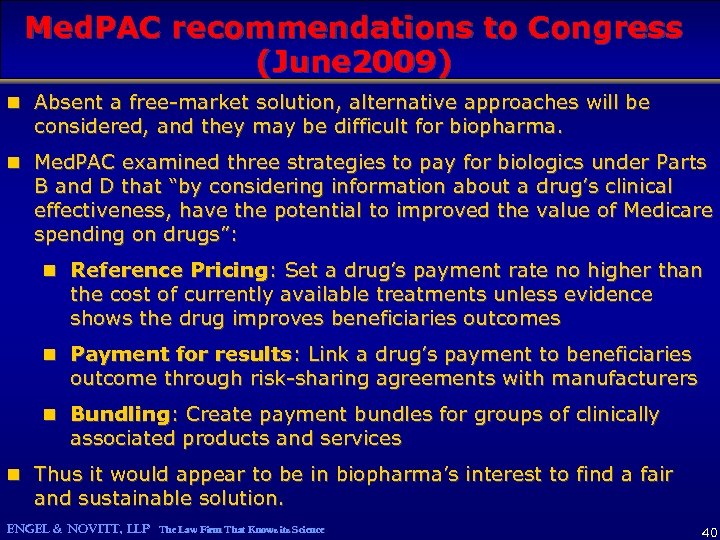

Med. PAC recommendations to Congress (June 2009) n Absent a free-market solution, alternative approaches will be considered, and they may be difficult for biopharma. n Med. PAC examined three strategies to pay for biologics under Parts B and D that “by considering information about a drug’s clinical effectiveness, have the potential to improved the value of Medicare spending on drugs”: n Reference Pricing: Set a drug’s payment rate no higher than the cost of currently available treatments unless evidence shows the drug improves beneficiaries outcomes n Payment for results: Link a drug’s payment to beneficiaries outcome through risk-sharing agreements with manufacturers n Bundling: Create payment bundles for groups of clinically associated products and services n Thus it would appear to be in biopharma’s interest to find a fair and sustainable solution. ENGEL & NOVITT, LLP The Law Firm That Knows its Science 40

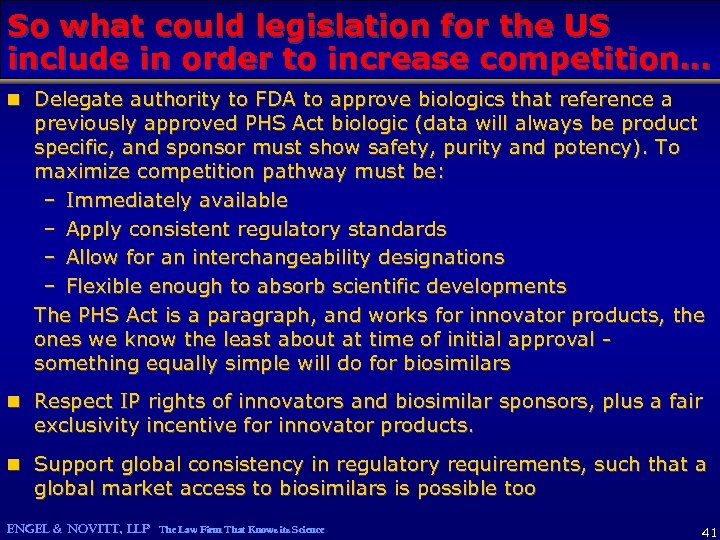

So what could legislation for the US include in order to increase competition… n Delegate authority to FDA to approve biologics that reference a previously approved PHS Act biologic (data will always be product specific, and sponsor must show safety, purity and potency). To maximize competition pathway must be: – Immediately available – Apply consistent regulatory standards – Allow for an interchangeability designations – Flexible enough to absorb scientific developments The PHS Act is a paragraph, and works for innovator products, the ones we know the least about at time of initial approval something equally simple will do for biosimilars n Respect IP rights of innovators and biosimilar sponsors, plus a fair exclusivity incentive for innovator products. n Support global consistency in regulatory requirements, such that a global market access to biosimilars is possible too ENGEL & NOVITT, LLP The Law Firm That Knows its Science 41

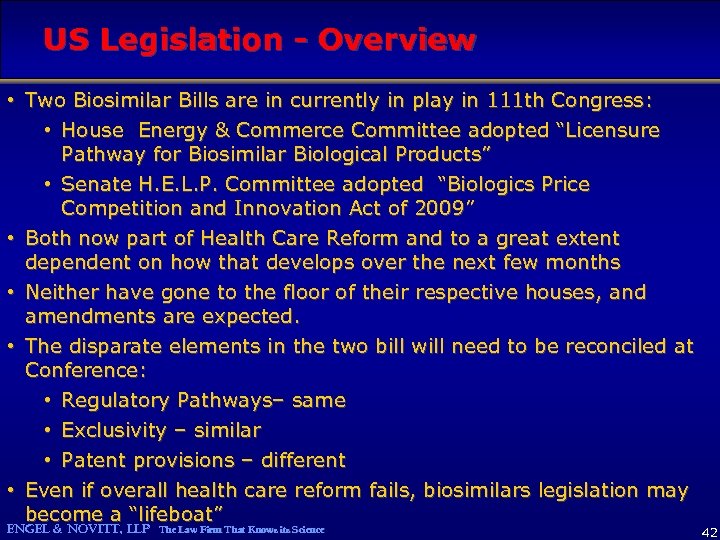

US Legislation - Overview • Two Biosimilar Bills are in currently in play in 111 th Congress: • House Energy & Commerce Committee adopted “Licensure Pathway for Biosimilar Biological Products” • Senate H. E. L. P. Committee adopted “Biologics Price Competition and Innovation Act of 2009” • Both now part of Health Care Reform and to a great extent dependent on how that develops over the next few months • Neither have gone to the floor of their respective houses, and amendments are expected. • The disparate elements in the two bill will need to be reconciled at Conference: • Regulatory Pathways– same • Exclusivity – similar • Patent provisions – different • Even if overall health care reform fails, biosimilars legislation may become a “lifeboat” ENGEL & NOVITT, LLP The Law Firm That Knows its Science 42

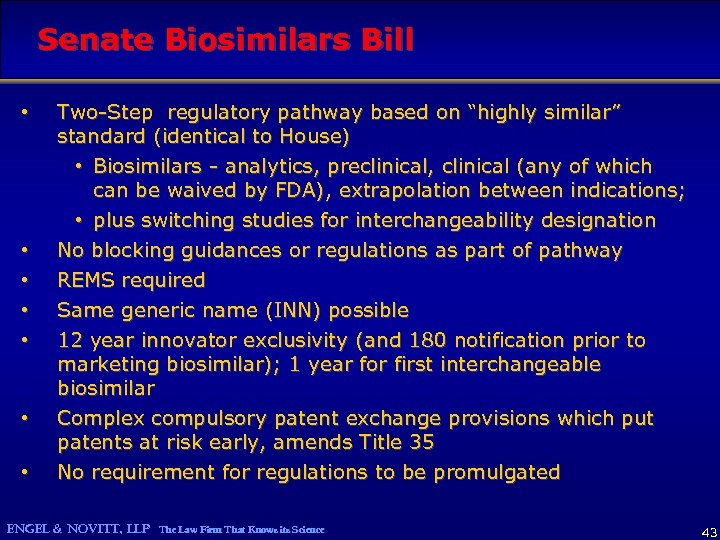

Senate Biosimilars Bill • • Two-Step regulatory pathway based on “highly similar” standard (identical to House) • Biosimilars - analytics, preclinical, clinical (any of which can be waived by FDA), extrapolation between indications; • plus switching studies for interchangeability designation No blocking guidances or regulations as part of pathway REMS required Same generic name (INN) possible 12 year innovator exclusivity (and 180 notification prior to marketing biosimilar); 1 year for first interchangeable biosimilar Complex compulsory patent exchange provisions which put patents at risk early, amends Title 35 No requirement for regulations to be promulgated ENGEL & NOVITT, LLP The Law Firm That Knows its Science 43

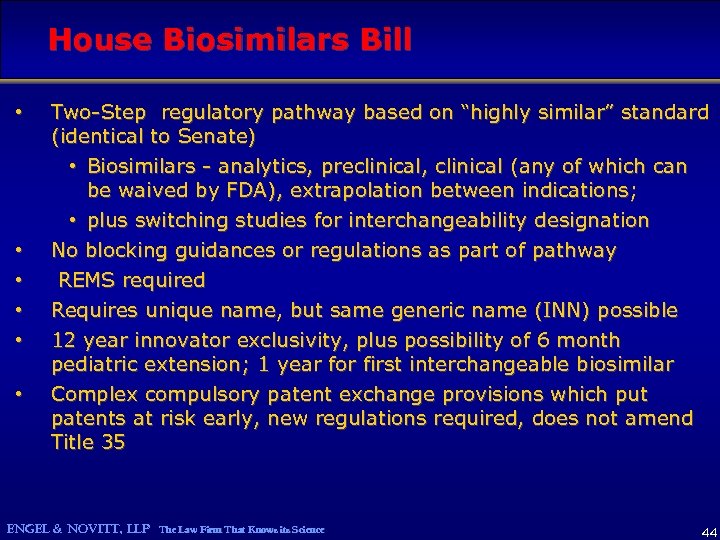

House Biosimilars Bill • • • Two-Step regulatory pathway based on “highly similar” standard (identical to Senate) • Biosimilars - analytics, preclinical, clinical (any of which can be waived by FDA), extrapolation between indications; • plus switching studies for interchangeability designation No blocking guidances or regulations as part of pathway REMS required Requires unique name, but same generic name (INN) possible 12 year innovator exclusivity, plus possibility of 6 month pediatric extension; 1 year for first interchangeable biosimilar Complex compulsory patent exchange provisions which put patents at risk early, new regulations required, does not amend Title 35 ENGEL & NOVITT, LLP The Law Firm That Knows its Science 44

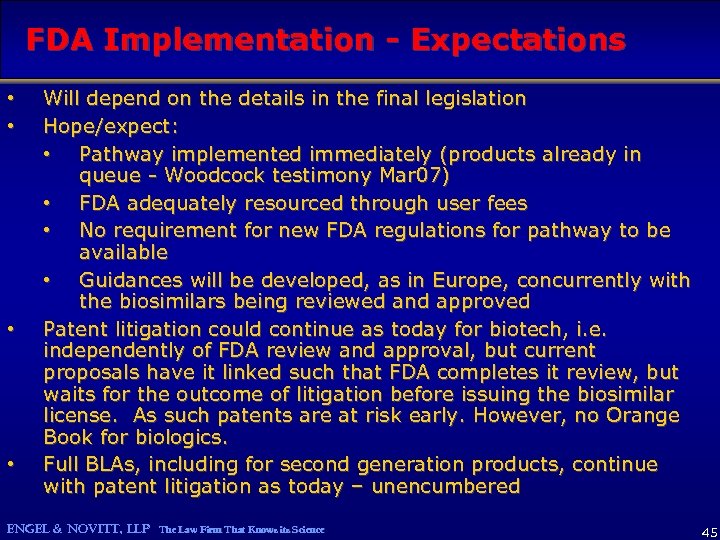

FDA Implementation - Expectations • • Will depend on the details in the final legislation Hope/expect: • Pathway implemented immediately (products already in queue - Woodcock testimony Mar 07) • FDA adequately resourced through user fees • No requirement for new FDA regulations for pathway to be available • Guidances will be developed, as in Europe, concurrently with the biosimilars being reviewed and approved Patent litigation could continue as today for biotech, i. e. independently of FDA review and approval, but current proposals have it linked such that FDA completes it review, but waits for the outcome of litigation before issuing the biosimilar license. As such patents are at risk early. However, no Orange Book for biologics. Full BLAs, including for second generation products, continue with patent litigation as today – unencumbered ENGEL & NOVITT, LLP The Law Firm That Knows its Science 45

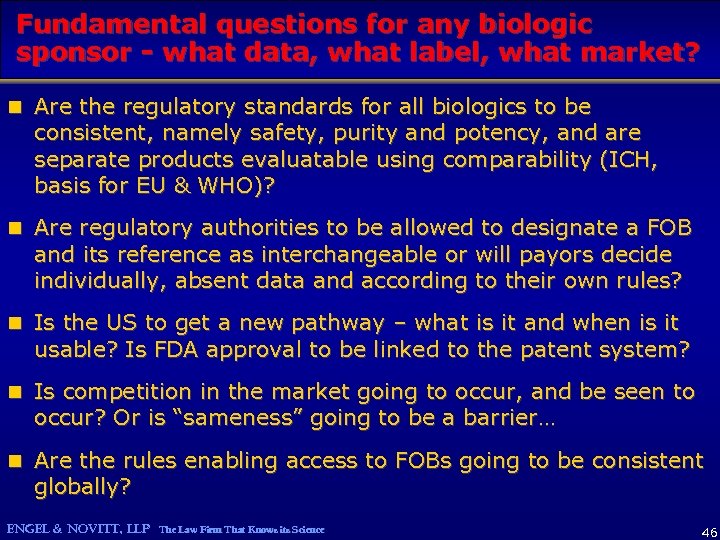

Fundamental questions for any biologic sponsor - what data, what label, what market? n Are the regulatory standards for all biologics to be consistent, namely safety, purity and potency, and are separate products evaluatable using comparability (ICH, basis for EU & WHO)? n Are regulatory authorities to be allowed to designate a FOB and its reference as interchangeable or will payors decide individually, absent data and according to their own rules? n Is the US to get a new pathway – what is it and when is it usable? Is FDA approval to be linked to the patent system? n Is competition in the market going to occur, and be seen to occur? Or is “sameness” going to be a barrier… n Are the rules enabling access to FOBs going to be consistent globally? ENGEL & NOVITT, LLP The Law Firm That Knows its Science 46

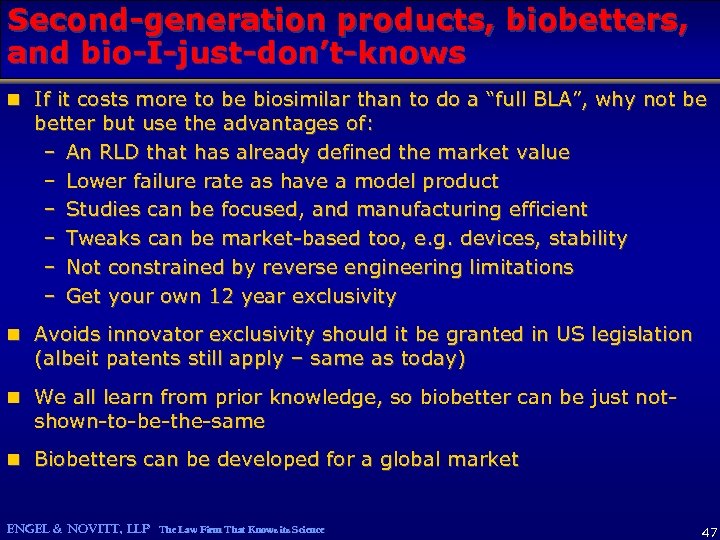

Second-generation products, biobetters, and bio-I-just-don’t-knows n If it costs more to be biosimilar than to do a “full BLA”, why not be better but use the advantages of: – An RLD that has already defined the market value – Lower failure rate as have a model product – Studies can be focused, and manufacturing efficient – Tweaks can be market-based too, e. g. devices, stability – Not constrained by reverse engineering limitations – Get your own 12 year exclusivity n Avoids innovator exclusivity should it be granted in US legislation (albeit patents still apply – same as today) n We all learn from prior knowledge, so biobetter can be just not- shown-to-be-the-same n Biobetters can be developed for a global market ENGEL & NOVITT, LLP The Law Firm That Knows its Science 47

Opportunities and Conclusions n We can learn from generic drugs, but we do not repeat the n n n mistakes – no need to reinvent the patent morass All stakeholders understanding their own interests, and engaging to generate an expedited pathway to enable/increase competition and access will be a collective win: win. Poles are not helpful. Quality will always matter, especially in the Post-Eprex and Post. Vioxx world, and that affects the whole supply chain Realistic expectations of biologics, as well as drugs, such that the new products can reach patients and drive the upward cycle of innovation, access and health matters. That means new biologic approvals too Global consistency in regulatory requirements key – lessons from Europe and beyond are useful Reimbursement models must recognize biosimilars in a manner that fosters legitimate competition, not therapeutic substitution Result can be creation of a regulatory pathway for FOBs in the US, that enables competition in the biologics market when patents expire ENGEL & NOVITT, LLP The Law Firm That Knows its Science 48

Thank You! Gillian R. Woollett, M. A. , D. Phil. Chief scientist Engel & Novitt, LLP The Law Firm That Knows Its Science www. engelnovitt. com 202. 207. 3307 gwoollett@engelnovitt. com The material and viewpoints set forth in this slide deck and conveyed during this presentation are presented by the author in her capacity as Chief Scientist of Engel & Novitt, LLP. They do not represent and do not purport to represent the views of the law firm or any current or former-client of the firm, and should not be construed as such. ENGEL & NOVITT, LLP The Law Firm That Knows its Science 49

92d2bf5f7569af00e6af60ece43719a5.ppt