bc9435c192ba8ef3bfeb109f72865cd4.ppt

- Количество слайдов: 26

SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 (LODR) BSE Ltd. 1

Introduction & Applicability Introduction § SEBI has notified the SEBI (Listing Obligations and Disclosure Requirements) Regulations (“LODR” or “Listing Regulations”) on Sep 02, 2015 - effective December 1. ü Provisions related to ordinary resolution for approval of all material RPT and ü reclassification of Promoters as public shareholders as prescribed in Regulation 31 A have been made applicable with immediate effect § The LODR is the consolidation of the compliance requirements by every listed entity into one single document across various types of securities listed on SE. § Regulation consists of 11 Chapters and 10 Schedules. § For operationalizing certain sections, SEBI is issuing separate circulars § Shortened version of Listing Agreement has been notified - required to be executed by ALL listed companies within 6 months. § Single LA to be signed for multiple type of securities listed at exchanges. Prepared by BSE Listing Compliance 2

Introduction & Applicability To whom is LODR applicable ? Provisions of LODR are applicable to the listed entities having the following securities listed : § Specified securities listed on Main Board, SME platform and ITP § Non-convertible debt securities § Non-convertible redeemable preference shares § Perpetual debt instruments § Perpetual non-cumulative preference shares § Indian Depository receipts § Securitized Debt Instruments § Units issued by Mutual Funds § Any other securities as may be specified by SEBI Prepared by BSE Listing Compliance 3

Regulation Overview The main features of LODR are as follows: § § Chapter I – Covers Definitions § § Chapter III – Contains common obligations applicable to all listed entities. § Chapter V – Obligation of listed entities which has listed its (a) non-convertible debt securities; or (b) non-convertible redeemable preference shares or both § Chapter VI – Obligation of Listed entities which has listed its specified securities and (a) nonconvertible debt securities; or (b) non-convertible redeemable preference shares or both § § Chapter VII – Obligation of listed entity which has its IDR listed Chapter II – Provides principles for periodic disclosures by listed entities and also incorporates the principles for corporate governance. In the event of the absence of specific requirements or ambiguity, these principles would serve to guide the listed entities. Chapter IV – Obligations of listed entity which has listed its specified securities i. e. (a) equity shares and (b) convertible securities Chapter VIII – Obligation of listed entity which has its Securitized Debt Instruments listed. Chapter IX – Obligation of listed entity which has its Mutual Fund Units listed. Chapter X and XI - Obligations of stock exchanges to monitor compliance or adequacy / accuracy of compliance with provisions of these regulations and to take action for non-compliance. Provisions in case of default Prepared by BSE Listing Compliance 4

LODR v/s LA Provisions of the Listing Agreement that are enhanced in Listing Regulations

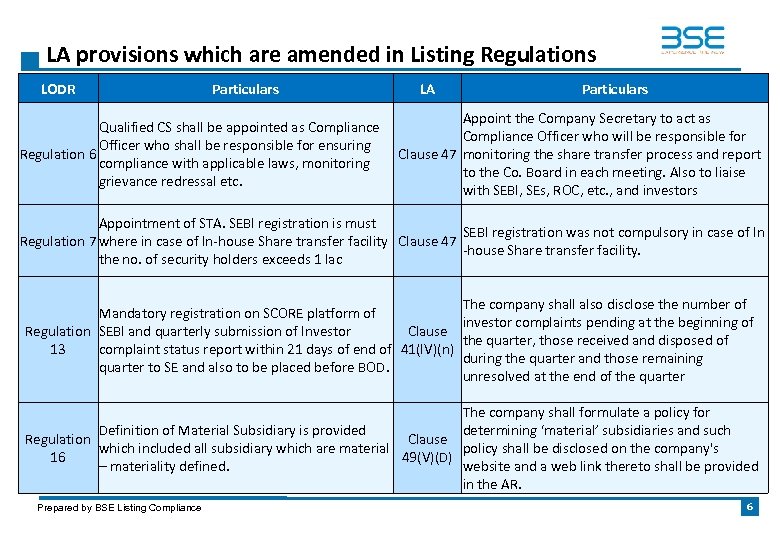

LA provisions which are amended in Listing Regulations LODR Particulars Qualified CS shall be appointed as Compliance Officer who shall be responsible for ensuring Regulation 6 compliance with applicable laws, monitoring grievance redressal etc. LA Particulars Appoint the Company Secretary to act as Compliance Officer who will be responsible for Clause 47 monitoring the share transfer process and report to the Co. Board in each meeting. Also to liaise with SEBI, SEs, ROC, etc. , and investors Appointment of STA. SEBI registration is must SEBI registration was not compulsory in case of In Regulation 7 where in case of In-house Share transfer facility Clause 47 -house Share transfer facility. the no. of security holders exceeds 1 lac The company shall also disclose the number of Mandatory registration on SCORE platform of investor complaints pending at the beginning of Regulation SEBI and quarterly submission of Investor Clause the quarter, those received and disposed of 13 complaint status report within 21 days of end of 41(IV)(n) during the quarter and those remaining quarter to SE and also to be placed before BOD. unresolved at the end of the quarter The company shall formulate a policy for Definition of Material Subsidiary is provided determining ‘material’ subsidiaries and such Regulation Clause which included all subsidiary which are material policy shall be disclosed on the company's 16 49(V)(D) – materiality defined. website and a web link thereto shall be provided in the AR. Prepared by BSE Listing Compliance 6

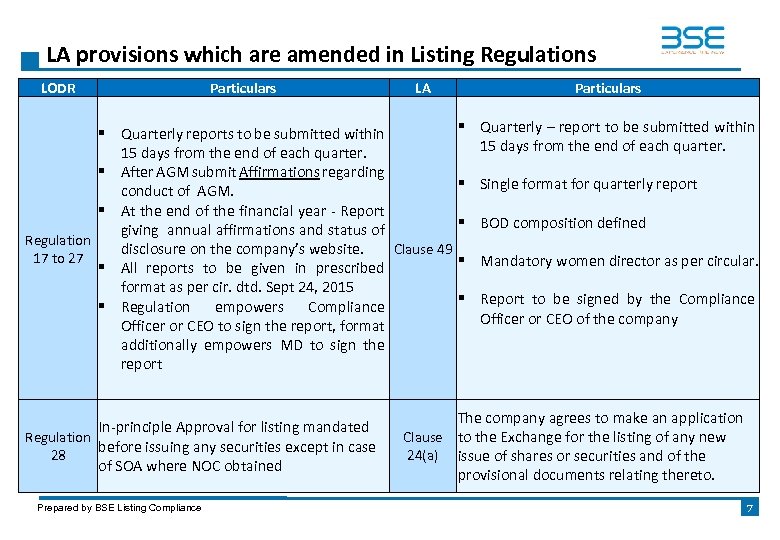

LA provisions which are amended in Listing Regulations LODR Particulars LA § Quarterly reports to be submitted within 15 days from the end of each quarter. § After AGM submit Affirmations regarding conduct of AGM. § At the end of the financial year - Report giving annual affirmations and status of Regulation Clause 49 disclosure on the company’s website. 17 to 27 § All reports to be given in prescribed format as per cir. dtd. Sept 24, 2015 § Regulation empowers Compliance Officer or CEO to sign the report, format additionally empowers MD to sign the report In-principle Approval for listing mandated Regulation before issuing any securities except in case 28 of SOA where NOC obtained Prepared by BSE Listing Compliance Particulars § Quarterly – report to be submitted within 15 days from the end of each quarter. § Single format for quarterly report § BOD composition defined § Mandatory women director as per circular. § Report to be signed by the Compliance Officer or CEO of the company The company agrees to make an application Clause to the Exchange for the listing of any new 24(a) issue of shares or securities and of the provisional documents relating thereto. 7

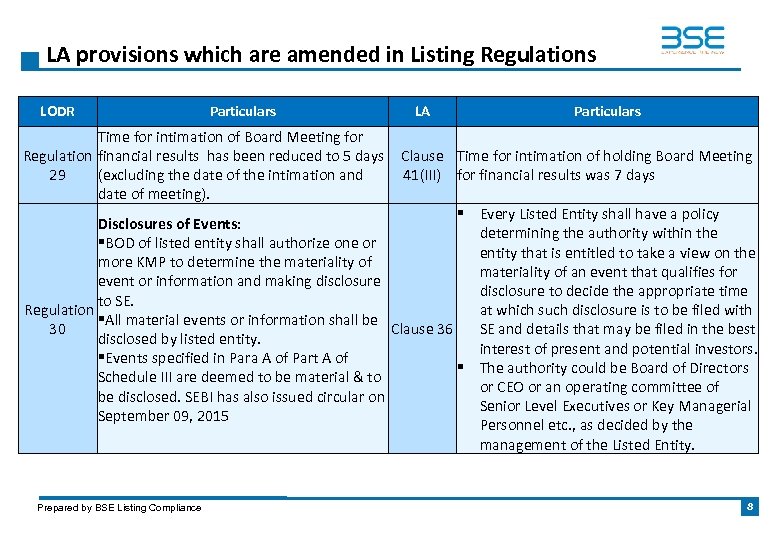

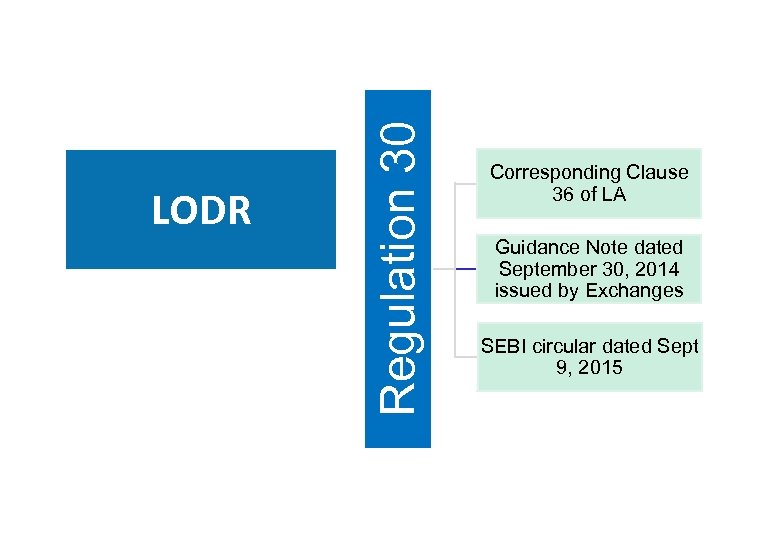

LA provisions which are amended in Listing Regulations LODR Particulars Time for intimation of Board Meeting for Regulation financial results has been reduced to 5 days 29 (excluding the date of the intimation and date of meeting). LA Clause Time for intimation of holding Board Meeting 41(III) for financial results was 7 days § Disclosures of Events: §BOD of listed entity shall authorize one or more KMP to determine the materiality of event or information and making disclosure to SE. Regulation §All material events or information shall be 30 Clause 36 disclosed by listed entity. §Events specified in Para A of Part A of § Schedule III are deemed to be material & to be disclosed. SEBI has also issued circular on September 09, 2015 Prepared by BSE Listing Compliance Particulars Every Listed Entity shall have a policy determining the authority within the entity that is entitled to take a view on the materiality of an event that qualifies for disclosure to decide the appropriate time at which such disclosure is to be filed with SE and details that may be filed in the best interest of present and potential investors. The authority could be Board of Directors or CEO or an operating committee of Senior Level Executives or Key Managerial Personnel etc. , as decided by the management of the Listed Entity. 8

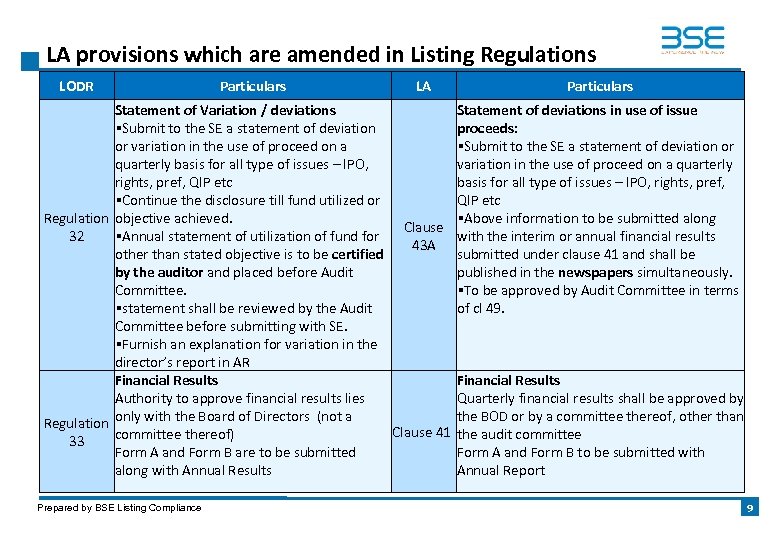

LA provisions which are amended in Listing Regulations LODR Particulars LA Statement of Variation / deviations §Submit to the SE a statement of deviation or variation in the use of proceed on a quarterly basis for all type of issues – IPO, rights, pref, QIP etc §Continue the disclosure till fund utilized or Regulation objective achieved. Clause 32 §Annual statement of utilization of fund for 43 A other than stated objective is to be certified by the auditor and placed before Audit Committee. §statement shall be reviewed by the Audit Committee before submitting with SE. §Furnish an explanation for variation in the director’s report in AR Financial Results Authority to approve financial results lies Regulation only with the Board of Directors (not a Clause 41 committee thereof) 33 Form A and Form B are to be submitted along with Annual Results Prepared by BSE Listing Compliance Particulars Statement of deviations in use of issue proceeds: §Submit to the SE a statement of deviation or variation in the use of proceed on a quarterly basis for all type of issues – IPO, rights, pref, QIP etc §Above information to be submitted along with the interim or annual financial results submitted under clause 41 and shall be published in the newspapers simultaneously. §To be approved by Audit Committee in terms of cl 49. Financial Results Quarterly financial results shall be approved by the BOD or by a committee thereof, other than the audit committee Form A and Form B to be submitted with Annual Report 9

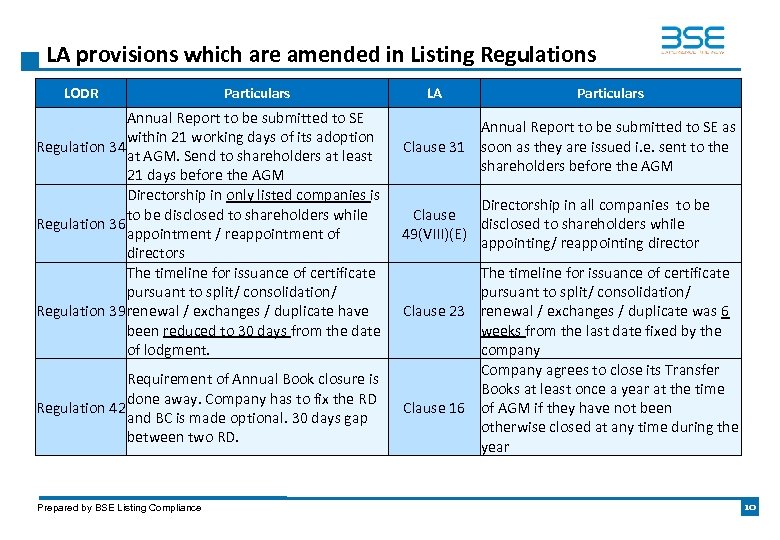

LA provisions which are amended in Listing Regulations LODR Particulars Annual Report to be submitted to SE within 21 working days of its adoption Regulation 34 at AGM. Send to shareholders at least 21 days before the AGM Directorship in only listed companies is to be disclosed to shareholders while Regulation 36 appointment / reappointment of directors The timeline for issuance of certificate pursuant to split/ consolidation/ Regulation 39 renewal / exchanges / duplicate have been reduced to 30 days from the date of lodgment. Requirement of Annual Book closure is done away. Company has to fix the RD Regulation 42 and BC is made optional. 30 days gap between two RD. Prepared by BSE Listing Compliance LA Particulars Annual Report to be submitted to SE as Clause 31 soon as they are issued i. e. sent to the shareholders before the AGM Directorship in all companies to be Clause disclosed to shareholders while 49(VIII)(E) appointing/ reappointing director The timeline for issuance of certificate pursuant to split/ consolidation/ Clause 23 renewal / exchanges / duplicate was 6 weeks from the last date fixed by the company Company agrees to close its Transfer Books at least once a year at the time Clause 16 of AGM if they have not been otherwise closed at any time during the year 10

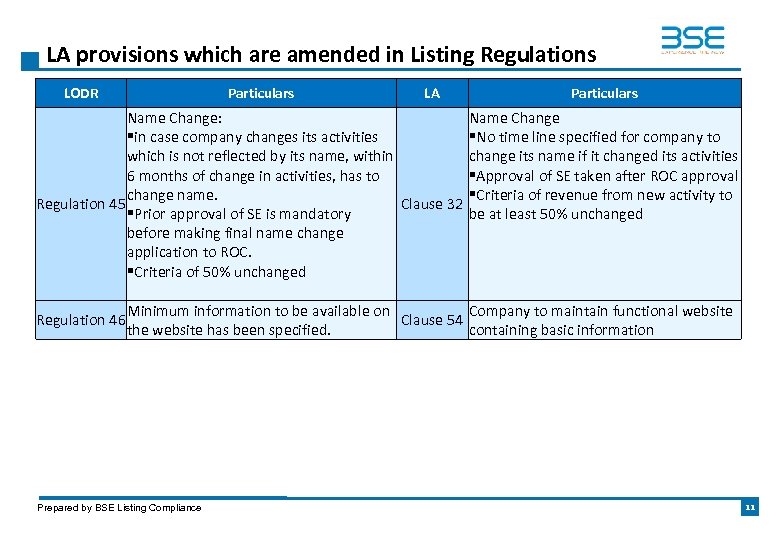

LA provisions which are amended in Listing Regulations LODR Particulars LA Name Change: §in case company changes its activities which is not reflected by its name, within 6 months of change in activities, has to change name. Regulation 45 Clause 32 §Prior approval of SE is mandatory before making final name change application to ROC. §Criteria of 50% unchanged Regulation 46 Particulars Name Change §No time line specified for company to change its name if it changed its activities §Approval of SE taken after ROC approval §Criteria of revenue from new activity to be at least 50% unchanged Minimum information to be available on Company to maintain functional website Clause 54 the website has been specified. containing basic information Prepared by BSE Listing Compliance 11

LODR New Provisions

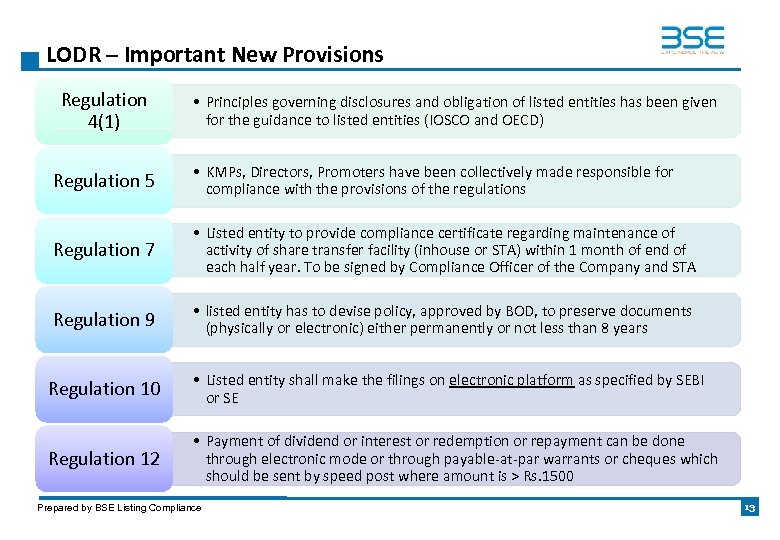

LODR – Important New Provisions Regulation 4(1) • Principles governing disclosures and obligation of listed entities has been given for the guidance to listed entities (IOSCO and OECD) Regulation 5 • KMPs, Directors, Promoters have been collectively made responsible for compliance with the provisions of the regulations Regulation 7 • Listed entity to provide compliance certificate regarding maintenance of activity of share transfer facility (inhouse or STA) within 1 month of end of each half year. To be signed by Compliance Officer of the Company and STA Regulation 9 • listed entity has to devise policy, approved by BOD, to preserve documents (physically or electronic) either permanently or not less than 8 years Regulation 10 • Listed entity shall make the filings on electronic platform as specified by SEBI or SE Regulation 12 • Payment of dividend or interest or redemption or repayment can be done through electronic mode or through payable-at-par warrants or cheques which should be sent by speed post where amount is > Rs. 1500 Prepared by BSE Listing Compliance 13

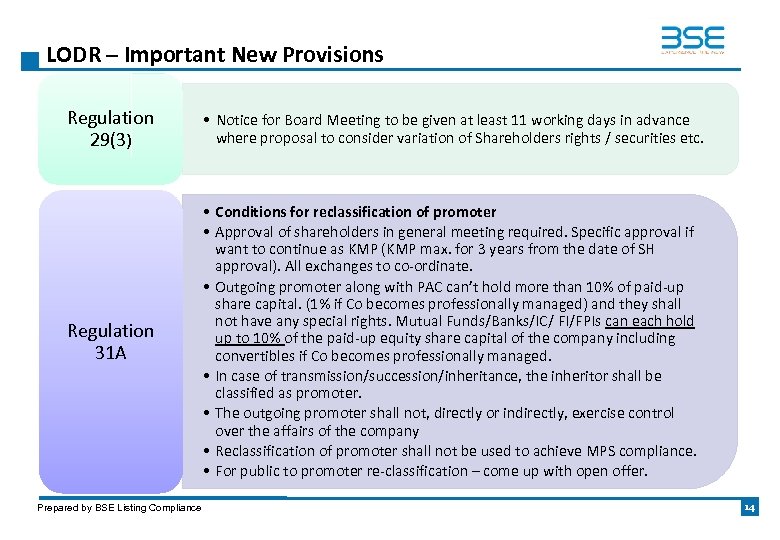

LODR – Important New Provisions Regulation 29(3) • Notice for Board Meeting to be given at least 11 working days in advance where proposal to consider variation of Shareholders rights / securities etc. Regulation 31 A • Conditions for reclassification of promoter • Approval of shareholders in general meeting required. Specific approval if want to continue as KMP (KMP max. for 3 years from the date of SH approval). All exchanges to co-ordinate. • Outgoing promoter along with PAC can’t hold more than 10% of paid-up share capital. (1% if Co becomes professionally managed) and they shall not have any special rights. Mutual Funds/Banks/IC/ FI/FPIs can each hold up to 10% of the paid-up equity share capital of the company including convertibles if Co becomes professionally managed. • In case of transmission/succession/inheritance, the inheritor shall be classified as promoter. • The outgoing promoter shall not, directly or indirectly, exercise control over the affairs of the company • Reclassification of promoter shall not be used to achieve MPS compliance. • For public to promoter re-classification – come up with open offer. Prepared by BSE Listing Compliance 14

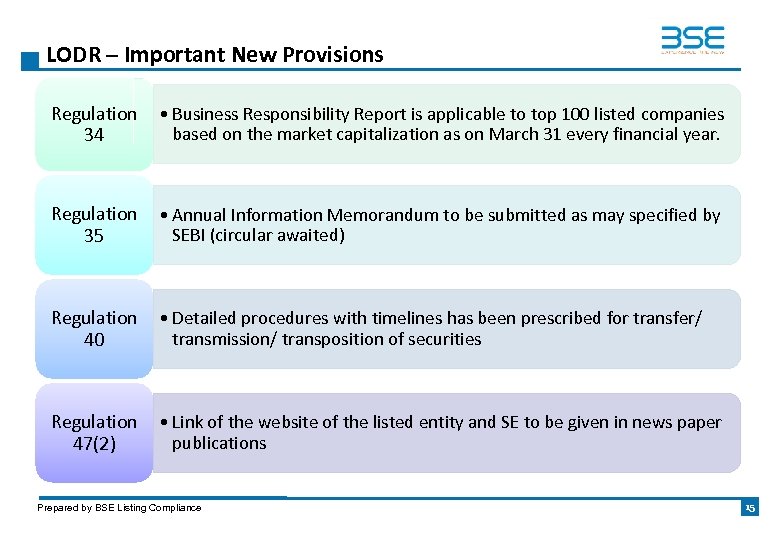

LODR – Important New Provisions Regulation 34 • Business Responsibility Report is applicable to top 100 listed companies based on the market capitalization as on March 31 every financial year. Regulation 35 • Annual Information Memorandum to be submitted as may specified by SEBI (circular awaited) Regulation 40 • Detailed procedures with timelines has been prescribed for transfer/ transmission/ transposition of securities Regulation 47(2) • Link of the website of the listed entity and SE to be given in news paper publications Prepared by BSE Listing Compliance 15

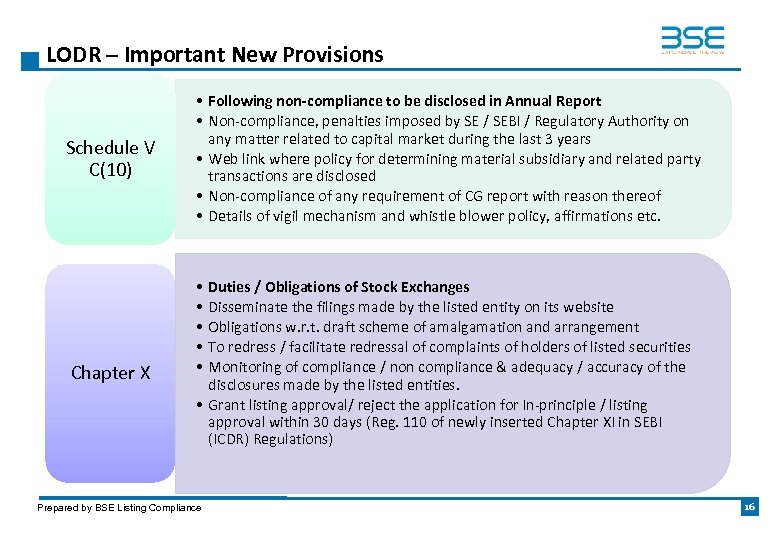

LODR – Important New Provisions Schedule V C(10) Chapter X • Following non-compliance to be disclosed in Annual Report • Non-compliance, penalties imposed by SE / SEBI / Regulatory Authority on any matter related to capital market during the last 3 years • Web link where policy for determining material subsidiary and related party transactions are disclosed • Non-compliance of any requirement of CG report with reason thereof • Details of vigil mechanism and whistle blower policy, affirmations etc. • • • Duties / Obligations of Stock Exchanges Disseminate the filings made by the listed entity on its website Obligations w. r. t. draft scheme of amalgamation and arrangement To redress / facilitate redressal of complaints of holders of listed securities Monitoring of compliance / non compliance & adequacy / accuracy of the disclosures made by the listed entities. • Grant listing approval/ reject the application for In-principle / listing approval within 30 days (Reg. 110 of newly inserted Chapter XI in SEBI (ICDR) Regulations) Prepared by BSE Listing Compliance 16

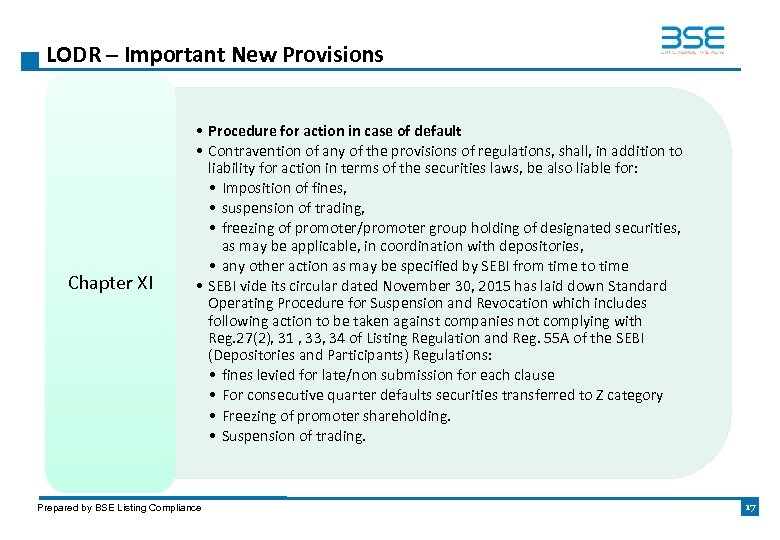

LODR – Important New Provisions Chapter XI • Procedure for action in case of default • Contravention of any of the provisions of regulations, shall, in addition to liability for action in terms of the securities laws, be also liable for: • Imposition of fines, • suspension of trading, • freezing of promoter/promoter group holding of designated securities, as may be applicable, in coordination with depositories, • any other action as may be specified by SEBI from time to time • SEBI vide its circular dated November 30, 2015 has laid down Standard Operating Procedure for Suspension and Revocation which includes following action to be taken against companies not complying with Reg. 27(2), 31 , 33, 34 of Listing Regulation and Reg. 55 A of the SEBI (Depositories and Participants) Regulations: • fines levied for late/non submission for each clause • For consecutive quarter defaults securities transferred to Z category • Freezing of promoter shareholding. • Suspension of trading. Prepared by BSE Listing Compliance 17

Regulation 30 LODR Corresponding Clause 36 of LA Guidance Note dated September 30, 2014 issued by Exchanges SEBI circular dated Sept 9, 2015

Regulation 30 The disclosures have been broadly divided into two categories: i. The events that have to be necessarily disclosed without applying any test of materiality ii. The events that should be disclosed by the listed entity, if considered material. Where the securities/derivatives are listed outside India, parity in disclosures shall be followed and whatever is disclosed on overseas stock exchange(s) by the listed entity shall be simultaneously disclosed on the stock exchange(s) where the entity is listed in India Certain examples of events that have been included in the list for mandatory disclosure for the first time: i. Awarding of order(s) / contract(s) ii. Loan / any other Agreements which are binding and not in normal course of business iii. Shareholder / Joint Venture / Family Settlement Agreements to the extent that it impacts management and control of the listed entity iv. Fraud / defaults by Promoter / KMP / Listed Entity OR Arrest of KMP Prepared by BSE Listing Compliance 19

Regulation 30 …cont’d. . The listed entity shall consider the following criteria for determination of materiality of events/ information: a) the omission of an event or information, which is likely to result in discontinuity or alteration of event or information already available publicly; or b) the omission of an event or information is likely to result in significant market reaction if the said omission came to light at a later date; c) In case where the criteria specified in sub-clauses (a) and (b) are not applicable, an event/information may be treated as being material if in the opinion of the board of directors of listed entity, the event / information is considered material. a) The listed entity to frame a materiality policy, duly approved by its board of directors, shall be disclosed on its website. b) The responsibility is cast on the Boards of listed entities, to authorize one or more KMPs to determine materiality of an event or information and make disclosures to the stock exchange. c) Further, SEBI vide its Circular dated September 09, 2015 clearly prescribed the extent of details required to be disclosed & when an event is deemed to have occurred. § Prepared by BSE Listing Compliance 20

Regulation 30 …cont’d. . Types of materiality • • • Deemed material events — Para A of Part A of Schedule III Material based on application of guidelines — Para B of Part A of Schedule III, read with Reg 30 (4) Implications of materiality – Intimation to stock exchange within 24 hours • If based on board meeting outcome, then within 30 min – Put material developments on website and retain for 5 years – Continue to provide updates of material developments on such events – Question of closure of trading window may also arise Disclosures also required for material subsidiaries Response to rumors - Reg 30 (11) allows the company the option to confirm or deny rumors about material developments Prepared by BSE Listing Compliance 21

Regulation 30 …cont’d. . Events Deemed to be material as per Para A of Part A of Schedule III § Scheme of Arrangement (amalgamation/ merger/ demerger/restructuring), § Sale or disposal of any unit(s), division(s) or subsidiary of the Company § Issuance or forfeiture of securities § Split or consolidation of shares § Buyback of securities § Any restriction on transferability of securities or alteration in terms § Structure of existing securities including forfeiture, reissue of forfeited securities, alteration of calls, redemption of securities etc. § Agreements impacting management and control of the listed entity. Prepared by BSE Listing Compliance 22

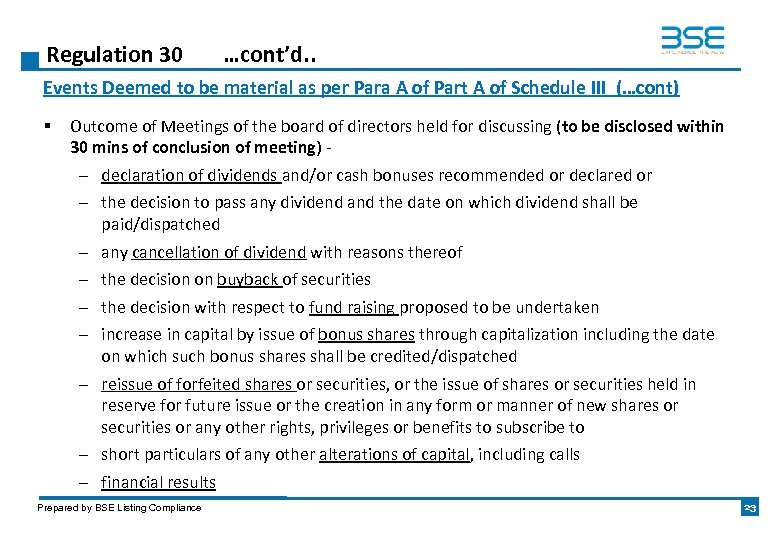

Regulation 30 …cont’d. . Events Deemed to be material as per Para A of Part A of Schedule III (…cont) § Outcome of Meetings of the board of directors held for discussing (to be disclosed within 30 mins of conclusion of meeting) - – declaration of dividends and/or cash bonuses recommended or declared or – the decision to pass any dividend and the date on which dividend shall be paid/dispatched – any cancellation of dividend with reasons thereof – the decision on buyback of securities – the decision with respect to fund raising proposed to be undertaken – increase in capital by issue of bonus shares through capitalization including the date on which such bonus shares shall be credited/dispatched – reissue of forfeited shares or securities, or the issue of shares or securities held in reserve for future issue or the creation in any form or manner of new shares or securities or any other rights, privileges or benefits to subscribe to – short particulars of any other alterations of capital, including calls – financial results Prepared by BSE Listing Compliance 23

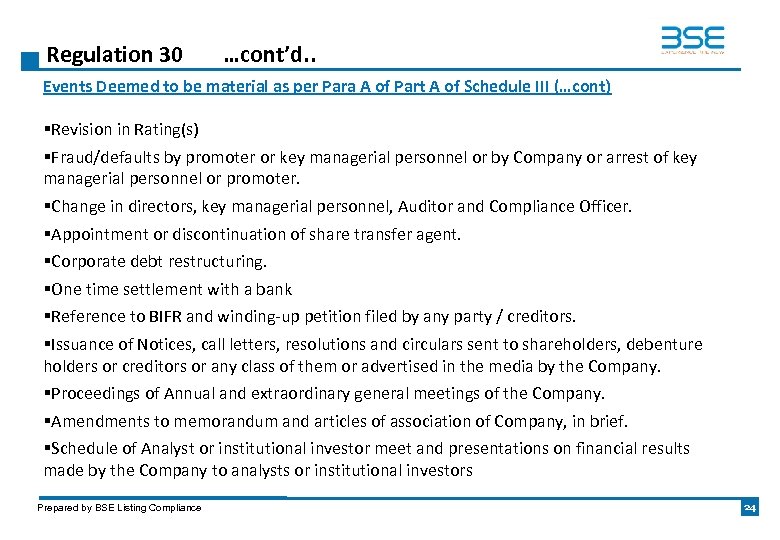

Regulation 30 …cont’d. . Events Deemed to be material as per Para A of Part A of Schedule III (…cont) §Revision in Rating(s) §Fraud/defaults by promoter or key managerial personnel or by Company or arrest of key managerial personnel or promoter. §Change in directors, key managerial personnel, Auditor and Compliance Officer. §Appointment or discontinuation of share transfer agent. §Corporate debt restructuring. §One time settlement with a bank §Reference to BIFR and winding-up petition filed by any party / creditors. §Issuance of Notices, call letters, resolutions and circulars sent to shareholders, debenture holders or creditors or any class of them or advertised in the media by the Company. §Proceedings of Annual and extraordinary general meetings of the Company. §Amendments to memorandum and articles of association of Company, in brief. §Schedule of Analyst or institutional investor meet and presentations on financial results made by the Company to analysts or institutional investors Prepared by BSE Listing Compliance 24

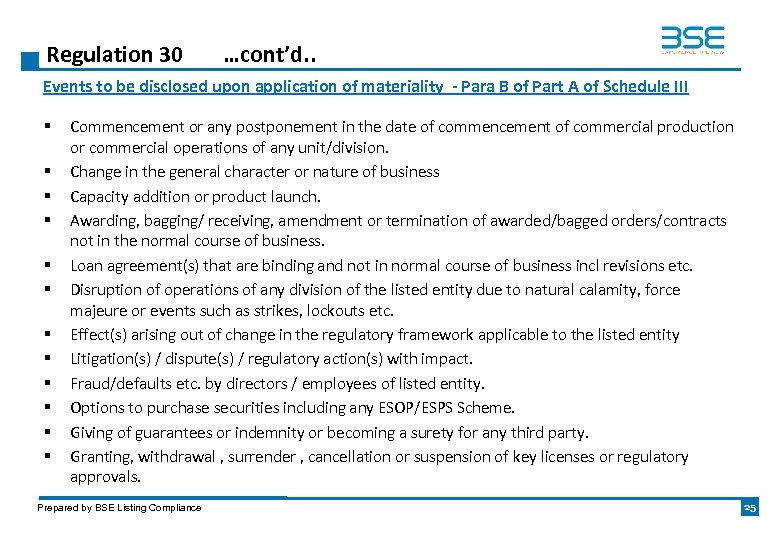

Regulation 30 …cont’d. . Events to be disclosed upon application of materiality - Para B of Part A of Schedule III § § § Commencement or any postponement in the date of commencement of commercial production or commercial operations of any unit/division. Change in the general character or nature of business Capacity addition or product launch. Awarding, bagging/ receiving, amendment or termination of awarded/bagged orders/contracts not in the normal course of business. Loan agreement(s) that are binding and not in normal course of business incl revisions etc. Disruption of operations of any division of the listed entity due to natural calamity, force majeure or events such as strikes, lockouts etc. Effect(s) arising out of change in the regulatory framework applicable to the listed entity Litigation(s) / dispute(s) / regulatory action(s) with impact. Fraud/defaults etc. by directors / employees of listed entity. Options to purchase securities including any ESOP/ESPS Scheme. Giving of guarantees or indemnity or becoming a surety for any third party. Granting, withdrawal , surrender , cancellation or suspension of key licenses or regulatory approvals. Prepared by BSE Listing Compliance 25

This presentation is to be used for internal purposes only. It is not meant for further distribution to any person or published, in whole or in part, for any purpose whatsoever, without the consent of BSE. The information provided in the presentation has been compiled for general information and does not constitute professional guidance or legal opinion. Readers should obtain appropriate professional advice. BSE does not warrant that the information will be free of any error, omission, defect, shortcoming or limitation of any nature. The user of the information assumes the entire risk as to the suitability, use, results of use, accuracy, completeness, currentness of the information and shall waive any claim of detrimental reliance upon the information. Any dispute out of or in connection with the use of the information provided by this presentation is subject to the exclusive jurisdiction of the courts of Mumbai and shall be governed by Indian law. 26

bc9435c192ba8ef3bfeb109f72865cd4.ppt