f6db83d5595c6e508e9f3cb8613444e6.ppt

- Количество слайдов: 72

se i tw ee tr S By Tony Alvarez Copyright The REO Mentor 2009

Tonight’s Goal… 1. The practical side of the REO Business 2. How to attack a new “Target Market” & find the GOLD! 3. “Overcoming the Most Common Obstacles to Getting an REO Deal a Week” 4. The “ULTIMATE SOLUTION” 5. biggest hurdle

Who am I & What did I do? • Real Estate Investor 1980 • Cert. Gen. App. – Banks, Insurance, Feds • Real Estate Broker 1999 • BK 1994 • Antelope Valley 1995 • Turned $6, 000 to$7, 200, 000 in 7 years Copyright The REO Mentor 2009

What gave me the edge? • I was broke – Highly motivated, determined & Committed • Action – I knew where I wanted to go & Went! • Appraiser - Understood how to identify VALUE/DEAL Quickly! • Knowledgeable - Understood TARGET MARKET THOROUGHLY • Initial Cash - Found Investors/partners for equity portion • Financing - Hard Money Lender – Interviewed & Informed • Credibility - Partnered with experienced successful investors • Relationships - Created an interdependent team of area Pros • Systemized Operations- Simple, clear, repeatable • Timing – Entered the market at the bottom • Education – Sought true consultants, mentors & educators • Focused – Acquisitions = REO Agents Copyright The REO Mentor 2009

Over the past 28 years 90% of the properties I have purchased were bought working with REO Agent’s Copyright The REO Mentor 2009

The Practical Side of the REO Business Copyright The REO Mentor 2009

Why work with REO Agents When REO’s dry up you’ll still be getting deals delivered into your hands whether it’s problem properties or problem situations • • Probates Major & minor fixers Divorces Rental Houses Pre-foreclosures Short sales Fire & water damaged properties Copyright The REO Mentor 2009

Broad Strokes Or… Buy Hold & Rent Long Term Copyright The REO Mentor 2009

Level I Investor Chasing Deals = Short Term Thinking! Copyright The REO Mentor 2009

Level II Investor Develop long term relationships with area PROS YOU TRUST! Then… Let the deals come to YOU! Copyright The REO Mentor 2009

Relationship Requirements • • • Motion & Action Be Consistent Get Personal Uniquely Communicate- BE DIFFERENT! Diverse Contact & Interaction Important, Informative, Friendly Email, Friendly phone call, Snail Mail (cards or notes), Office Visit, Common Interest (gym, sports) Copyright The REO Mentor 2009

Foundation & Fiber Building long term business relationships/friendships… – Common interest – Trust – Honesty – Interdependency – Mutually beneficial – Equally highly profitable Copyright The REO Mentor 2009 X

#1 Benefit $ Consistent Income $ Copyright The REO Mentor 2009

Why do MOST Investors reject this kind of thinking? • • Looking for a deal NOW! Want cash NOW! Too time consuming Not a people person Not relationship oriented Too difficult Do not believe they will succeed Fear based thinking on false beliefs! Copyright The REO Mentor 2009

3 Important Steps 1. Decide what you want to do? - Buy to rent, sell retail or wholesale? 2. Choose a specific target market - Friendly to your specific needs 3. Load your GPS = Set achievable destination ® Commitment & Action! Copyright The REO Mentor 2009

You have to understand the details of your specific target market… - Supply & demand - Available financing - Investor capital & sentiment - Available work force - Cost of labor & materials - Local Gov. Attitude - Rental market statistics Copyright The REO Mentor 2009

Load Your GPS !!! ® • Goal • Plan • Systems Without it you’re lost! Copyright The REO Mentor 2009

Program Your GPS® For Success! Goal: Where do you want to Go? Plan: How you are going to get there System: Techniques – Daily actions to work plans Copyright The REO Mentor 2009

My Goal - 1995 When I headed to the foreclosure capital of the United States – Antelope Valley – Equity= $1, 000 – Monthly $= $10, 000 – Paid off= 10 houses Copyright The REO Mentor 2009

By 2002 - Equity (before taxes) $7, 200, 000 - Monthly Income $53, 000 - Total Houses Owned 83 - LTV 70% By this time I was ready to call it quits! But… Copyright The REO Mentor 2009

10 words from Bruce Norris “Hang in a bit longer, your area isn’t done yet” 10 words 3 more years… $3, 000 Copyright The REO Mentor 2009

Started liquidating in 2005 for $10, 000 Thanks Again Bruce! Copyright The REO Mentor 2009

Short Term Goal 2009 - Equity $1, 500, 000 ? ? ? - Monthly Income $20, 000 - # of Unit Purchases 30 - LTV 0 Copyright The REO Mentor 2009

Long Term Goal 2021 • • • Equity $20, 000 Monthly Income $100, 000 Total houses 330 Rentals Held 200 30 houses a year until 2021 LTV 65% Copyright The REO Mentor 2009

Acquisition Strategies A. Buying REO’s: MLS 1. REO Brokers/Agents – Relationship Driven - Broker Call – Prelisting -Broker Call – Pending Dying Deal 2. AUTO PILOT= Preset searches on MLS - Auto Prospecting – Search by Agent/Office ID, Property Details, Area or Price - First day listings – Rare- I DON’T COMPETE! - BOM (Back on Market)- Contingency Active 3. Shot Gun Style (Click Here to View Example) Copyright The REO Mentor 2009

Acquisition Strategies B. Short Sales= SLOT MACHINES • First day (Listing Agent) – Pending – Non MLS= We hand to favorite agent to complete. (cont. ) D. TD Sales – Loan funds – Buy from TD Buyer – Partner with TD Buyer E. HUD C. FSBO – Offers = Agent – Cash – Seller financing – Subject Too Copyright The REO Mentor 2009

Financing • Local Banks • Credit Unions • Home Path (Fannie Mae 10? ) • Home Steps (Freddie Mac) • Hard Money (The Norris Group) • Private Investors (401 K, IRA) Copyright The REO Mentor 2009

Financing Techniques Financing: How do I finance my REO deals? – Retail (LOCAL- SMALL- NEW Banks) Relationship driven! • 75% LTV, 6 1/2% Interest, Amortized over 30 years due in 5 years. FNMA 10 LOAN LIMIT- Home path/ FREDDIE MAC Home steps – Private Money( LOCAL) My favorite source = REO Brokers & Agents!!! • Private Investor Capital (Pay 8 to 10%) NO POINTS! • Pay people to help me find Investor capital = Financial planners – Hard Money- Norris Group- Or Local • Interest Rate= 12% Points=3. 5 Term-36 months Copyright The REO Mentor 2009

Type of Repairs We Do From minor repairs at around $5 psf to complete remodels at around $20 psf. 1. Minor Repair – Paint, carpet, appliances, cleaning 2. Medium repair – Minor maint. , & A/C & heat repair, paint, carpet, appliances, cleaning 3. Major Repair – Complete remodel. New kitchen, bath, floors, lighting, windows, roofing, fixtures – Everything upgraded & replaced. - Bonus to Contractor or Crew Leader for early completion or under budget paid from Home Depot discounts & holding cost reserves Copyright The REO Mentor 2009

Repair Model • Employee’s • Independent Contractors 1. State of California states that if an Independent Contractors does not have any employees, they do not need workers comp. 2. MAKE SURE EVERYONE HAS WORKER’S COMP. & liability insurance. This way you’re covered no matter what happens! Copyright The REO Mentor 2009

Exit Strategies • Sales (MLS driven market) – Relisting with REO Agent that got us the deal • Rental (Declining rental market) – Renting at 10% below TRUE market & offering an incentive (Free Rent) • Wholesale – Seldom Copyright The REO Mentor 2009

Selling Obstacles Low Appraisals - Lack of remodeled comparables - Out of area appraisers - “Geographic Competence” - Capital improvements not fully recognized - Financing Restrictions - Inspection Requirements - Lender Appraiser Property Inspector Termite Copyright The REO Mentor 2009

Appraisal Solutions Hand the Appraiser the File • Cover letter – Who you are, what’s in file • Rent comparables – sold, pending, actives • Capital Improvements (detailed list, remodeled repairs) • Additional backup offers • Copy of accepted offer • Market Update – dqnews. com, Latimes, Local, MLS Copyright The REO Mentor 2009

Spanking the Appraiser • Get appraisal copy • Rebuttal letter (you) • Send to loan agent • Use Local appraisers • File complaint -www. OREA. ca. gov -916 -552 -9000 • E & O – small claims • Never complain directly to Appraiser! Copyright The REO Mentor 2009

Deal Review Time Copyright The REO Mentor 2009

Recent Deal Review We started buying in August 2008 To date we have purchased 35 properties Sold 10 In Escrow 3 Active 1 Rented 20 Rehab 1 Copyright The REO Mentor 2009

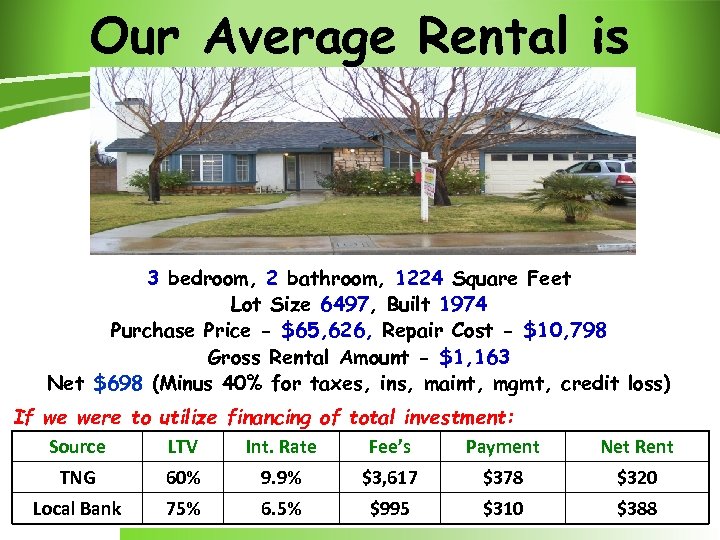

Our Average Rental is 3 bedroom, 2 bathroom, 1224 Square Feet Lot Size 6497, Built 1974 Purchase Price - $65, 626, Repair Cost - $10, 798 Gross Rental Amount - $1, 163 Net $698 (Minus 40% for taxes, ins, maint, mgmt, credit loss) If we were to utilize financing of total investment: Source LTV Int. Rate Fee’s Payment Net Rent TNG 60% 9. 9% $3, 617 $378 $320 Local Bank 75% 6. 5% $995 $310 $388

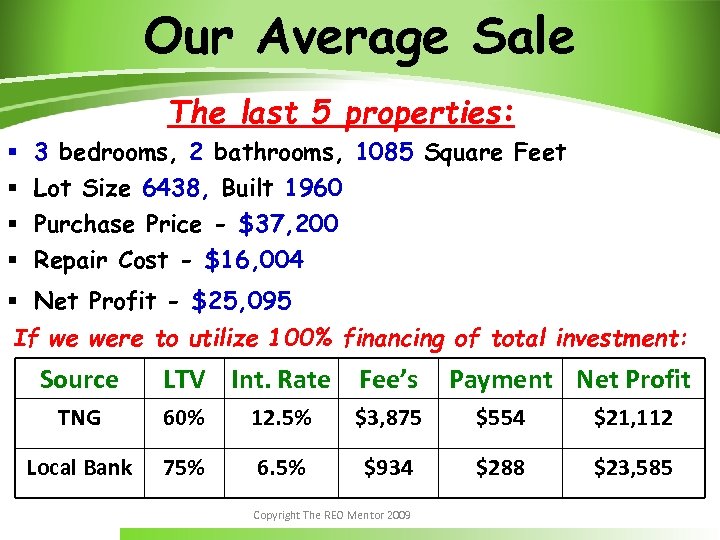

Our Average Sale The last 5 properties: § § 3 bedrooms, 2 bathrooms, 1085 Square Feet Lot Size 6438, Built 1960 Purchase Price - $37, 200 Repair Cost - $16, 004 § Net Profit - $25, 095 If we were to utilize 100% financing of total investment: Source LTV Int. Rate Fee’s TNG 60% 12. 5% $3, 875 $554 $21, 112 Local Bank 75% 6. 5% $934 $288 $23, 585 Copyright The REO Mentor 2009 Payment Net Profit

Ugly Duckling 3+1 w/garage conv. 1438 sq ft, 1954

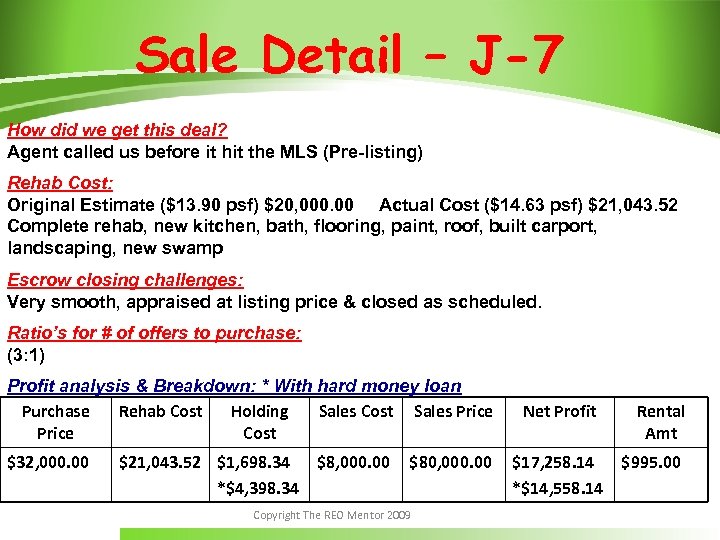

Sale Detail – J-7 How did we get this deal? Agent called us before it hit the MLS (Pre-listing) Rehab Cost: Original Estimate ($13. 90 psf) $20, 000. 00 Actual Cost ($14. 63 psf) $21, 043. 52 Complete rehab, new kitchen, bath, flooring, paint, roof, built carport, landscaping, new swamp Escrow closing challenges: Very smooth, appraised at listing price & closed as scheduled. Ratio’s for # of offers to purchase: (3: 1) Profit analysis & Breakdown: * With hard money loan Purchase Rehab Cost Holding Sales Cost Sales Price Cost $32, 000. 00 $21, 043. 52 $1, 698. 34 $8, 000. 00 *$4, 398. 34 $80, 000. 00 Copyright The REO Mentor 2009 Net Profit Rental Amt $17, 258. 14 $995. 00 *$14, 558. 14

Kirkland 4+2, 2 Car Gar. 1573 sq ft, 1957

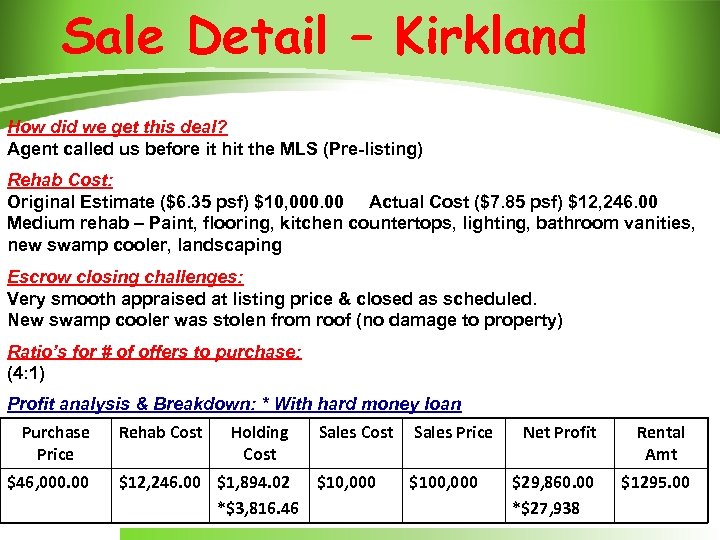

Sale Detail – Kirkland How did we get this deal? Agent called us before it hit the MLS (Pre-listing) Rehab Cost: Original Estimate ($6. 35 psf) $10, 000. 00 Actual Cost ($7. 85 psf) $12, 246. 00 Medium rehab – Paint, flooring, kitchen countertops, lighting, bathroom vanities, new swamp cooler, landscaping Escrow closing challenges: Very smooth appraised at listing price & closed as scheduled. New swamp cooler was stolen from roof (no damage to property) Ratio’s for # of offers to purchase: (4: 1) Profit analysis & Breakdown: * With hard money loan Purchase Price $46, 000. 00 Rehab Cost Holding Cost Sales Cost $12, 246. 00 $1, 894. 02 $10, 000 *$3, 816. 46 Sales Price $100, 000 Net Profit Rental Amt $29, 860. 00 *$27, 938 $1295. 00

Overcoming the 14 Most Common Obstacles to Getting an REO Deal a Week Copyright The REO Mentor 2009

se i tw ee tr S Copyright The REO Mentor 2009

The Obstacles 1. No Cash! 2. No Financing! 3. No Contacts! 4. No Experience! 5. I don’t know how to identify a deal (value)! 6. I don’t know how to analyze my target market! 7. I don’t have a plan and I don’t know how to create one! Copyright The REO Mentor 2009

The Obstacles (cont) 8. I don’t have enough time to do this business! 9. I don’t know how to structure an offer that gets accepted! 10. They don’t call me back! 11. I don’t know any normal contractor or repair guys I trust! 12. I don’t know how to budget & estimate repair cost! 13. I don’t believe this works! 14. I don’t believe I can do it! Copyright The REO Mentor 2009

The best solution that solves most of these obstacles is PARTNERING!!! Copyright The REO Mentor 2009

$ The Odd Couple Make Bank $ Andrea & Rick Batman Robin § Met in 2002 @ Bruce Norris Seminar § Andrea knew nothing about Real Estate – People Person § Rick was an appraiser & bought discounted notes § Each started with $50, 000 equity & borrowed from Rick’s IRA § First deal 2003 sold in 2005 for $140, 000 profit § Exit strategies wholesale, retail & hold long term rental Made over $1, 000 EACH in four years

Determination! Son & her Fat Team Ken ve & Ste § § § § Started 14 months ago No formal real estate education – No seminars Ken used to be in SFR new construction Steve owns a computer business Chose an area near their home Chose specific properties to target NO FHA, Fannie Mae ok - 3+2, only specific areas Learned the market by “Getting out there & looking at properties” Copyright The REO Mentor 2009

NO FEAR!!! Erin Joey From: S. Africa Prior Job: Waiter From: Wash. State Prior Job: Comm. Fishing in Alaska § Met @ job interview December 2009 § Got their 1 st deal in May 2009 § Started with $1000 from credit card & $1000 borrowed from girlfriend. § Financed a mobile home on credit card § Done 8 deals since May 09 – Net approx $200, 000 § Finance 100% of the deal through Private Party or Hard Money § Goal is the retire by the time they are 30 years old

What’s the Lesson? The right compatible partners can and will solve all of the obstacles you believe are keeping you from participating successfully in today’s Real Estate Market Start creating & nurturing relationships. Take action now. Do something today! You’ll create a small change & that’s all you need to start the ball rolling in a new direction Copyright The REO Mentor 2009

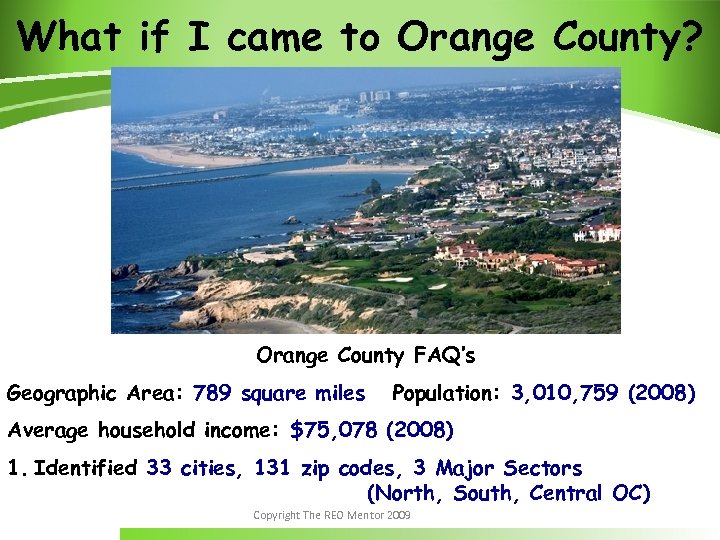

What if I came to Orange County? Orange County FAQ’s Geographic Area: 789 square miles Population: 3, 010, 759 (2008) Average household income: $75, 078 (2008) 1. Identified 33 cities, 131 zip codes, 3 Major Sectors (North, South, Central OC) Copyright The REO Mentor 2009

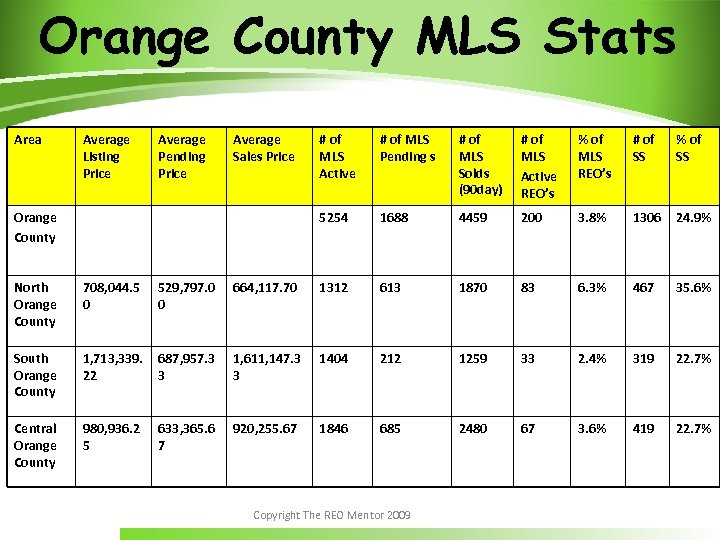

Orange County MLS Stats Area Average Listing Price Average Pending Price Average Sales Price # of MLS Pending s # of MLS Solds (90 day) # of MLS Active REO’s % of MLS REO’s # of SS % of SS 5254 Orange County # of MLS Active 1688 4459 200 3. 8% 1306 24. 9% North Orange County 708, 044. 5 0 529, 797. 0 0 664, 117. 70 1312 613 1870 83 6. 3% 467 35. 6% South Orange County 1, 713, 339. 22 687, 957. 3 3 1, 611, 147. 3 3 1404 212 1259 33 2. 4% 319 22. 7% Central Orange County 980, 936. 2 5 633, 365. 6 7 920, 255. 67 1846 685 2480 67 3. 6% 419 22. 7% Copyright The REO Mentor 2009

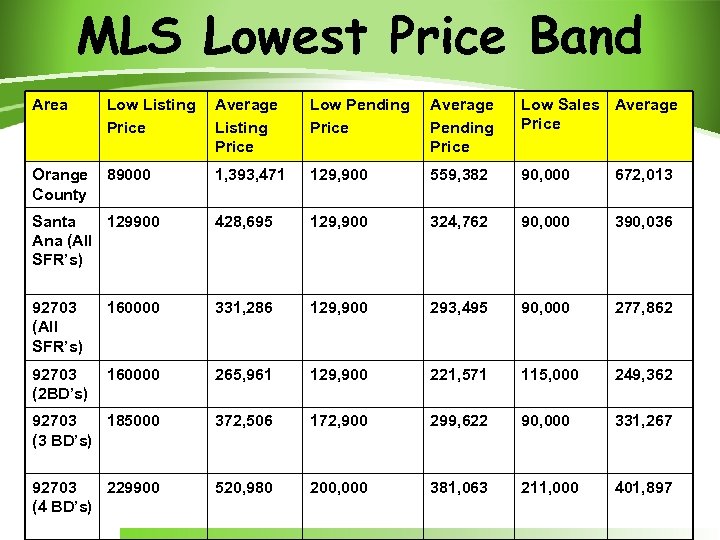

MLS Lowest Price Band Area Low Listing Price Average Listing Price Low Pending Price Average Pending Price Low Sales Average Price Orange County 89000 1, 393, 471 129, 900 559, 382 90, 000 672, 013 Santa 129900 Ana (All SFR’s) 428, 695 129, 900 324, 762 90, 000 390, 036 92703 (All SFR’s) 160000 331, 286 129, 900 293, 495 90, 000 277, 862 92703 (2 BD’s) 160000 265, 961 129, 900 221, 571 115, 000 249, 362 92703 185000 (3 BD’s) 372, 506 172, 900 299, 622 90, 000 331, 267 92703 229900 (4 BD’s) 520, 980 200, 000 381, 063 211, 000 401, 897

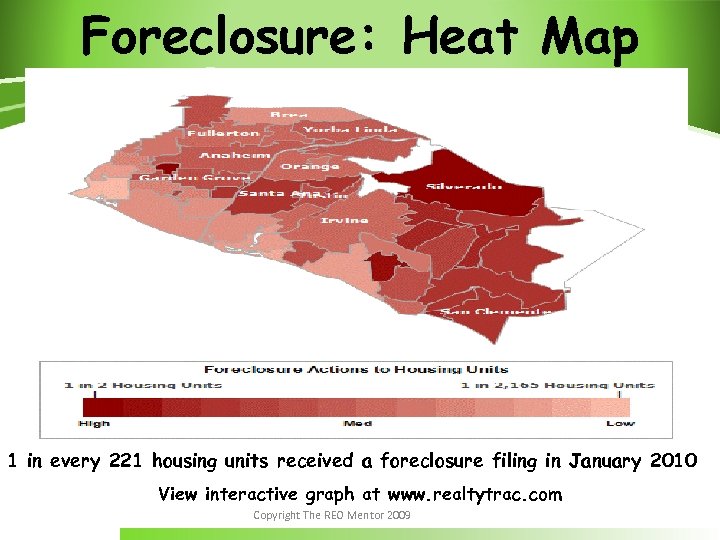

Foreclosure: Heat Map 1 in every 221 housing units received a foreclosure filing in January 2010 View interactive graph at www. realtytrac. com Copyright The REO Mentor 2009

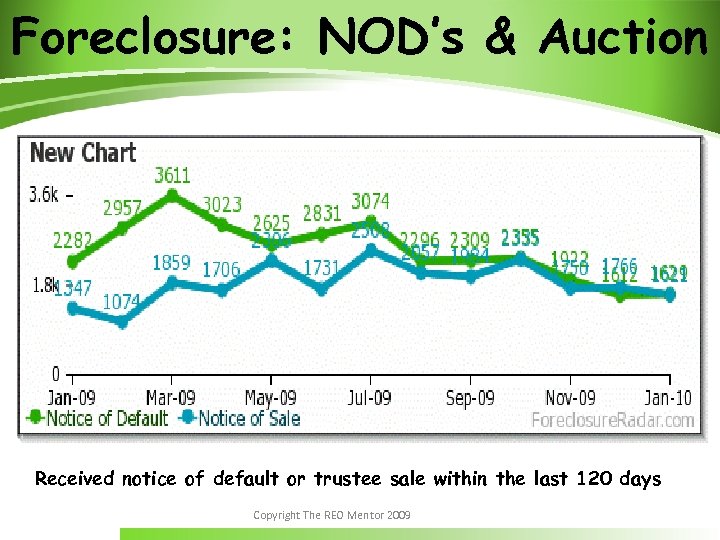

Foreclosure: NOD’s & Auction Received notice of default or trustee sale within the last 120 days Copyright The REO Mentor 2009

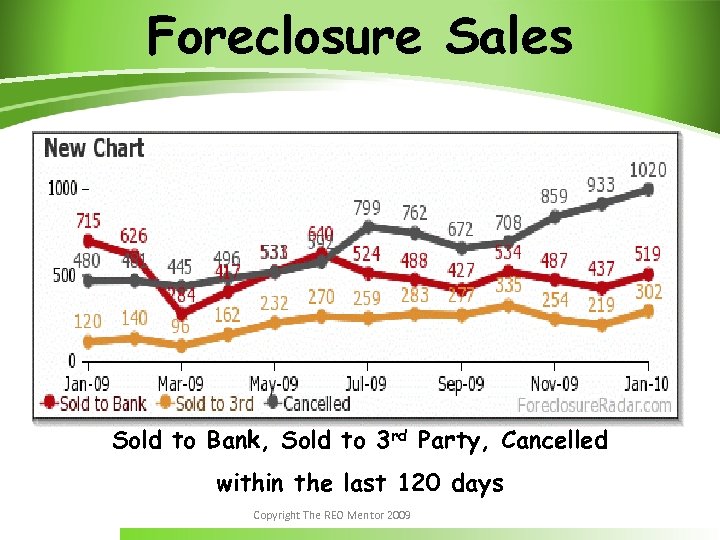

Foreclosure Sales Sold to Bank, Sold to 3 rd Party, Cancelled within the last 120 days Copyright The REO Mentor 2009

Average Sales Price Copyright The REO Mentor 2009

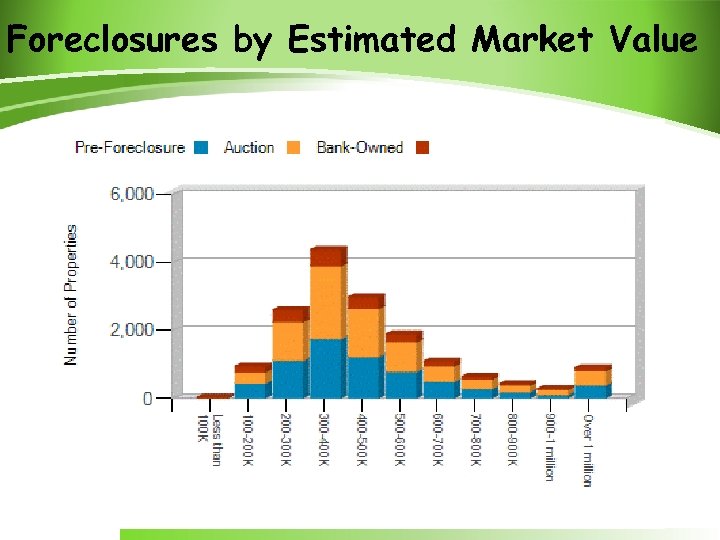

Foreclosures by Estimated Market Value Copyright The REO Mentor 2009

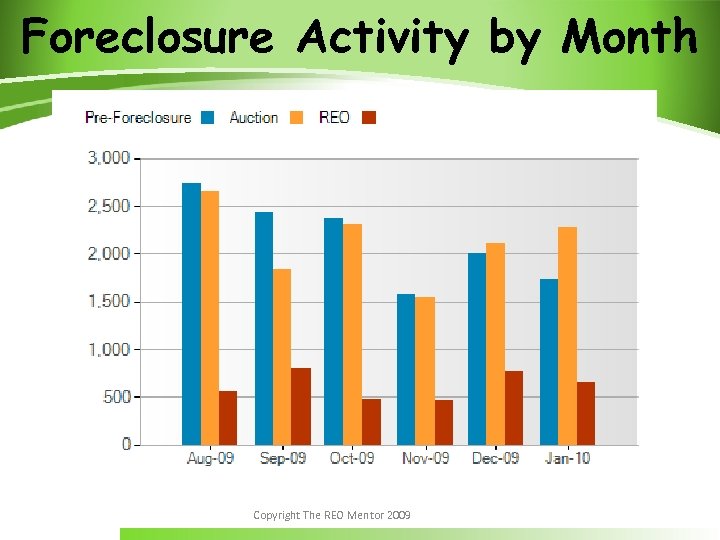

Foreclosure Activity by Month Copyright The REO Mentor 2009

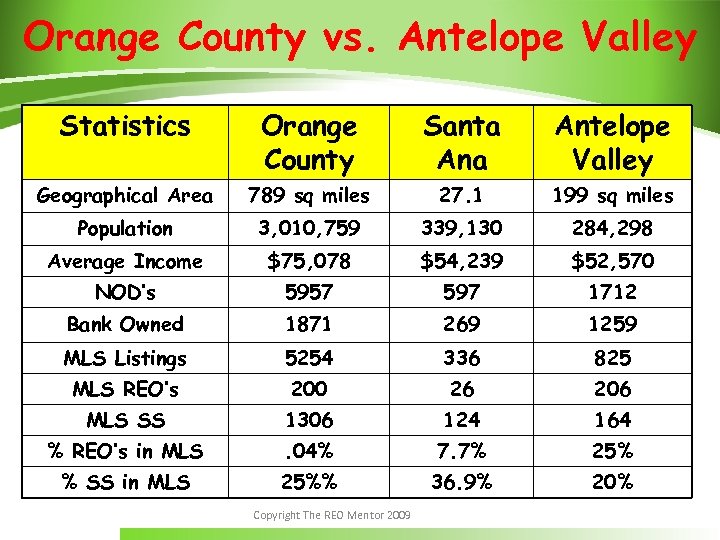

Orange County vs. Antelope Valley Statistics Orange County Santa Antelope Valley Geographical Area 789 sq miles 27. 1 199 sq miles Population 3, 010, 759 339, 130 284, 298 Average Income $75, 078 $54, 239 $52, 570 NOD’s 5957 597 1712 Bank Owned 1871 269 1259 MLS Listings 5254 336 825 MLS REO’s 200 26 206 MLS SS 1306 124 164 % REO’s in MLS . 04% 7. 7% 25% % SS in MLS 25%% 36. 9% 20% Copyright The REO Mentor 2009

Target Market • • Any blue collar neighborhood College student rentals Section 8 neighborhoods Inner city near supporting facilities Copyright The REO Mentor 2009

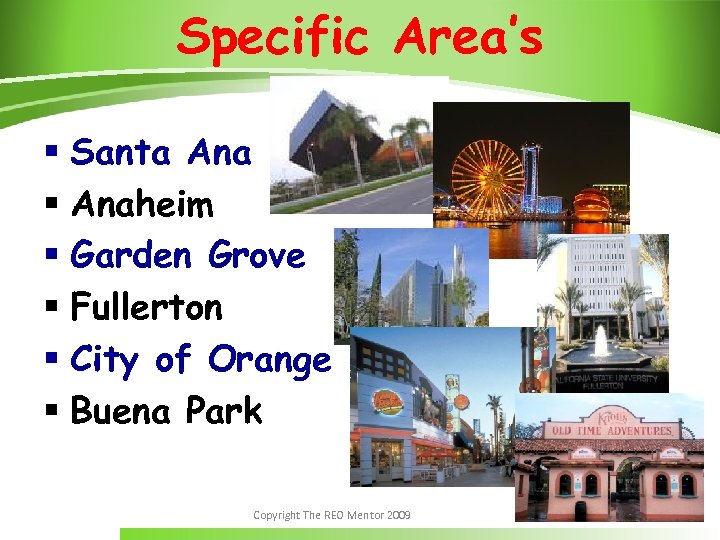

Specific Area’s § Santa Ana § Anaheim § Garden Grove § Fullerton § City of Orange § Buena Park Copyright The REO Mentor 2009

Research Methods • MLS – Tempo. socalmls. com • Agents/Brokers – Called local Agents with listings • Online websites – City-data. com (City Stats) – Chamberofcommerce. com (City Stats) – Orangecounty. net (County Information) – Quickfactscensus. gov (Area Info) – Ocmls. com (Search active listings) – Foreclosureradar. com (Foreclosure info) – Realtytrac. com (Search foreclosure info) – Rentometer. com (Rental stats) – Nrba. com (Search for Brokers & Agents) – Reobroker. com (Search for Brokers & Agents)

The Ultimate Solution Understanding the difference between: 1. Psychological Fear 2. Physical Fear Copyright The REO Mentor 2009 ical holog Psyc ar Fe Ph ys Fe ica ar l

Physical Fear It’s ok to RUN!!! Copyright The REO Mentor 2009

Psychological Fear Copyright The REO Mentor 2009

Saving Private Ryan Copyright The REO Mentor 2009

The Brave Copyright The REO Mentor 2009

The Protector Copyright The REO Mentor 2009

The Unstoppable Spirit! Copyright The REO Mentor 2009

The REO Mentor 1 -800 -276 -7888 Ext. 201 www. thereomentor. com Email: thereomentor@yahoo. com Copyright The REO Mentor 2009

f6db83d5595c6e508e9f3cb8613444e6.ppt