95d61e7055ee528a7392ef96560216c1.ppt

- Количество слайдов: 21

Scottish Treasury Management Forum CIPFA Scottish Treasury Management Forum Current Investment Practices And Investment Framework

Scottish Treasury Management Forum CIPFA Scottish Treasury Management Forum Current Investment Practices And Investment Framework

Scottish Treasury Management Forum Investments - Overview The 2009 remit was to: “review the current investment management practices and bring forward proposals which would form a framework for authorities to work within which will ensure a consistency of approach based on a sound risk assessment in relation to investment opportunities”

Scottish Treasury Management Forum Investments - Overview The 2009 remit was to: “review the current investment management practices and bring forward proposals which would form a framework for authorities to work within which will ensure a consistency of approach based on a sound risk assessment in relation to investment opportunities”

Scottish Treasury Management Forum 2009 Summary • Authorities have taken a range of pro-active measures to manage and mitigate the investments risks over the last two years • Authorities have different requirements and therefore different appetites for risk • In light of their risk appetite, authorities should continue to consider how they manage their counterparty risk e. g. from the perspective of number, level of commitment, quality etc • The lessons of BCCI should not be lost on authorities • Where appropriate, authorities should consider other investment opportunities

Scottish Treasury Management Forum 2009 Summary • Authorities have taken a range of pro-active measures to manage and mitigate the investments risks over the last two years • Authorities have different requirements and therefore different appetites for risk • In light of their risk appetite, authorities should continue to consider how they manage their counterparty risk e. g. from the perspective of number, level of commitment, quality etc • The lessons of BCCI should not be lost on authorities • Where appropriate, authorities should consider other investment opportunities

Scottish Treasury Management Forum 2009 - Other Investment Options • Premature Debt Redemption • Money Market Funds? • Collective Local Authority Investment Product? • Government Backed Certificates of Deposit • Treasury Bills • Other Products?

Scottish Treasury Management Forum 2009 - Other Investment Options • Premature Debt Redemption • Money Market Funds? • Collective Local Authority Investment Product? • Government Backed Certificates of Deposit • Treasury Bills • Other Products?

Scottish Treasury Management Forum ty ri u Liquidity S c e Yield

Scottish Treasury Management Forum ty ri u Liquidity S c e Yield

Scottish Treasury Management Forum Security - 2009 Actions Already Taken • Significant premature repayment of PWLB debt to de-risk investment portfolio • A reduction in the periods which deposits are placed for • A tightening of credit criteria used to produce the counterparty list • Investment with counterparties which would be most likely to receive UK Government and Central Bank support • Greater use of instant access accounts • Inclusion of additional more secure counterparties such as the DMO

Scottish Treasury Management Forum Security - 2009 Actions Already Taken • Significant premature repayment of PWLB debt to de-risk investment portfolio • A reduction in the periods which deposits are placed for • A tightening of credit criteria used to produce the counterparty list • Investment with counterparties which would be most likely to receive UK Government and Central Bank support • Greater use of instant access accounts • Inclusion of additional more secure counterparties such as the DMO

Scottish Treasury Management Forum Refinancing Risk v. Counterparty Risk

Scottish Treasury Management Forum Refinancing Risk v. Counterparty Risk

Scottish Treasury Management Forum 31 March 2011 Debt LGov Fin Stats Total Debt £ 11, 490, 801 (‘ 000) TMF Gross Debt £ 10, 507, 658 (‘ 000)

Scottish Treasury Management Forum 31 March 2011 Debt LGov Fin Stats Total Debt £ 11, 490, 801 (‘ 000) TMF Gross Debt £ 10, 507, 658 (‘ 000)

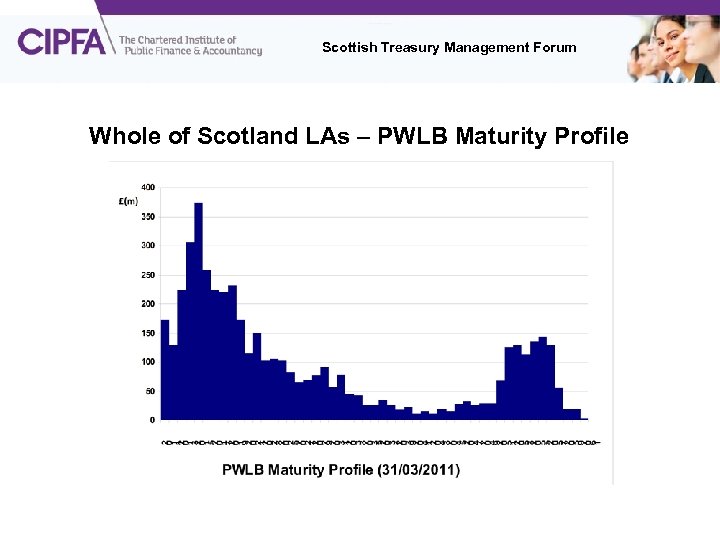

Scottish Treasury Management Forum Whole of Scotland LAs – PWLB Maturity Profile

Scottish Treasury Management Forum Whole of Scotland LAs – PWLB Maturity Profile

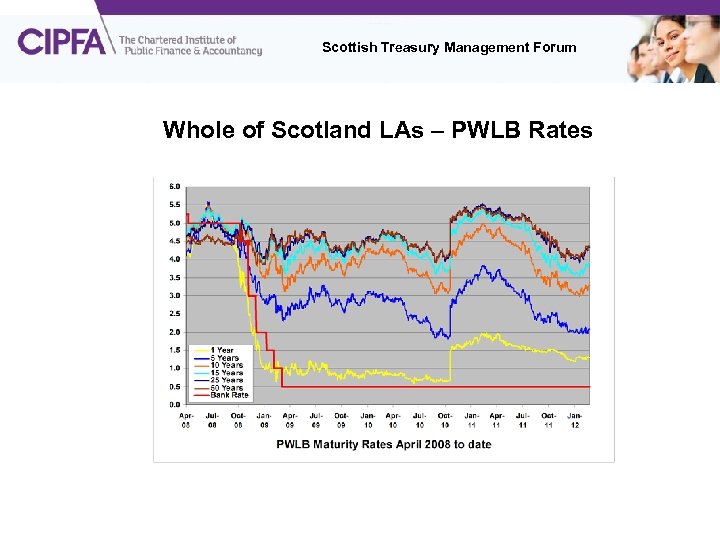

Scottish Treasury Management Forum Whole of Scotland LAs – PWLB Rates

Scottish Treasury Management Forum Whole of Scotland LAs – PWLB Rates

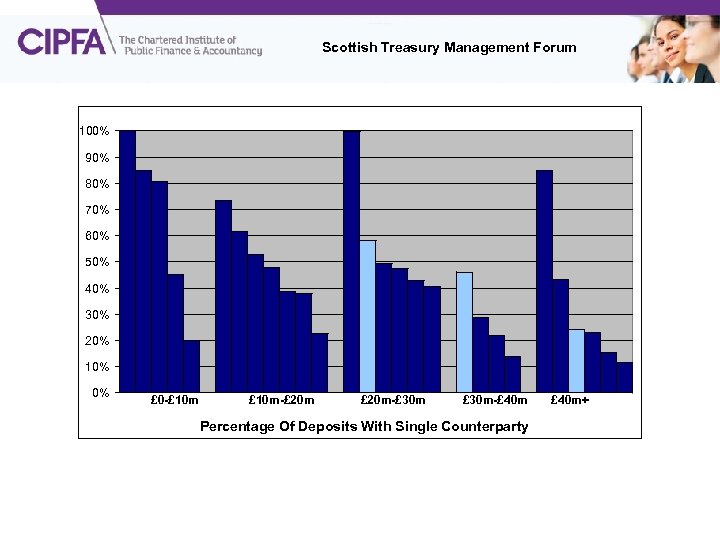

Scottish Treasury Management Forum 100% Security - Counterparty Concentration - 2009 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% £ 0 -£ 10 m-£ 20 m-£ 30 m-£ 40 m Percentage Of Deposits With Single Counterparty £ 40 m+

Scottish Treasury Management Forum 100% Security - Counterparty Concentration - 2009 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% £ 0 -£ 10 m-£ 20 m-£ 30 m-£ 40 m Percentage Of Deposits With Single Counterparty £ 40 m+

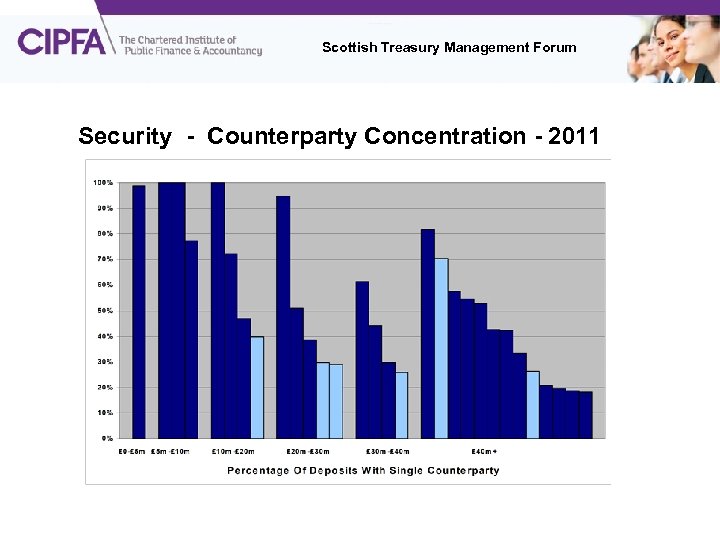

Scottish Treasury Management Forum Security - Counterparty Concentration - 2011

Scottish Treasury Management Forum Security - Counterparty Concentration - 2011

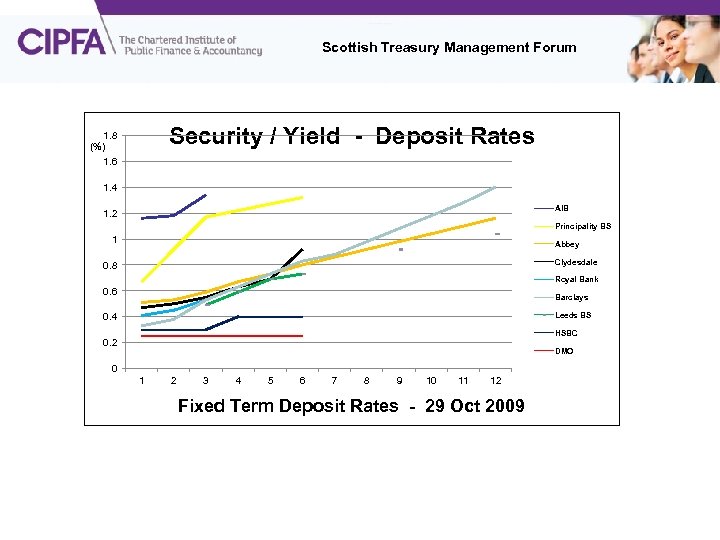

Scottish Treasury Management Forum Security / Yield - Deposit Rates 1. 8 (%) 1. 6 1. 4 AIB 1. 2 Principality BS 1 Abbey Clydesdale 0. 8 Royal Bank 0. 6 Barclays Leeds BS 0. 4 HSBC 0. 2 DMO 0 1 2 3 4 5 6 7 8 9 10 11 12 Fixed Term Deposit Rates - 29 Oct 2009

Scottish Treasury Management Forum Security / Yield - Deposit Rates 1. 8 (%) 1. 6 1. 4 AIB 1. 2 Principality BS 1 Abbey Clydesdale 0. 8 Royal Bank 0. 6 Barclays Leeds BS 0. 4 HSBC 0. 2 DMO 0 1 2 3 4 5 6 7 8 9 10 11 12 Fixed Term Deposit Rates - 29 Oct 2009

Scottish Treasury Management Forum Investments - Scotland-wide Summary + £ 748 million 2009 2011 £ 1, 003, 225, 985 £ 1, 751, 095, 700

Scottish Treasury Management Forum Investments - Scotland-wide Summary + £ 748 million 2009 2011 £ 1, 003, 225, 985 £ 1, 751, 095, 700

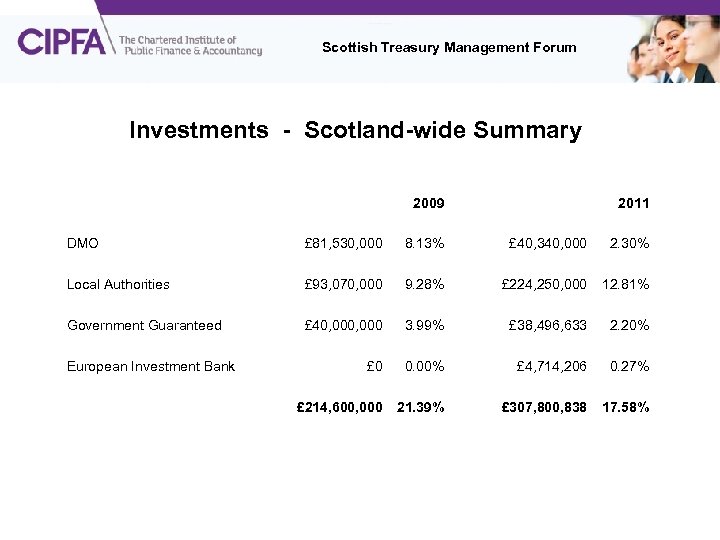

Scottish Treasury Management Forum Investments - Scotland-wide Summary 2009 2011 DMO £ 81, 530, 000 8. 13% £ 40, 340, 000 2. 30% Local Authorities £ 93, 070, 000 9. 28% £ 224, 250, 000 12. 81% Government Guaranteed £ 40, 000 3. 99% £ 38, 496, 633 2. 20% £ 0 0. 00% £ 4, 714, 206 0. 27% £ 214, 600, 000 21. 39% £ 307, 800, 838 17. 58% European Investment Bank

Scottish Treasury Management Forum Investments - Scotland-wide Summary 2009 2011 DMO £ 81, 530, 000 8. 13% £ 40, 340, 000 2. 30% Local Authorities £ 93, 070, 000 9. 28% £ 224, 250, 000 12. 81% Government Guaranteed £ 40, 000 3. 99% £ 38, 496, 633 2. 20% £ 0 0. 00% £ 4, 714, 206 0. 27% £ 214, 600, 000 21. 39% £ 307, 800, 838 17. 58% European Investment Bank

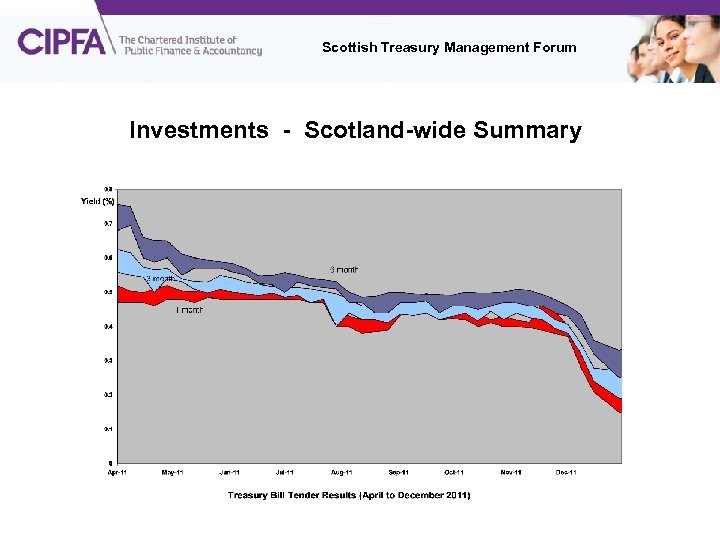

Scottish Treasury Management Forum Investments - Scotland-wide Summary

Scottish Treasury Management Forum Investments - Scotland-wide Summary

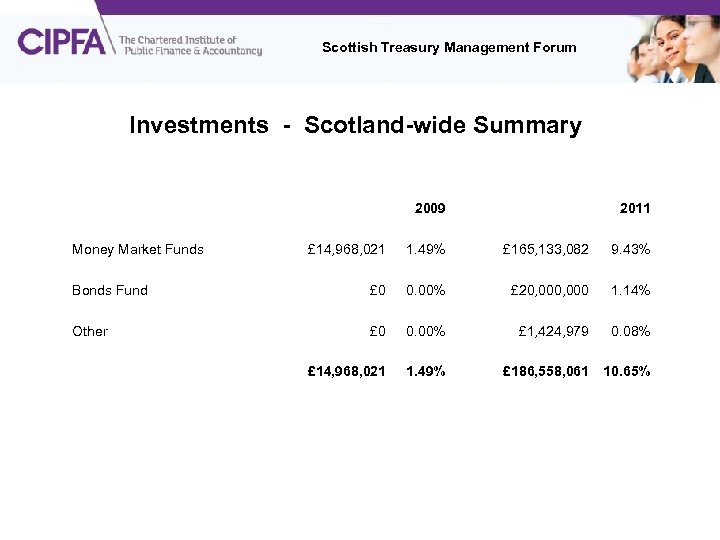

Scottish Treasury Management Forum Investments - Scotland-wide Summary 2009 Money Market Funds 2011 £ 14, 968, 021 1. 49% £ 165, 133, 082 9. 43% Bonds Fund £ 0 0. 00% £ 20, 000 1. 14% Other £ 0 0. 00% £ 1, 424, 979 0. 08% £ 14, 968, 021 1. 49% £ 186, 558, 061 10. 65%

Scottish Treasury Management Forum Investments - Scotland-wide Summary 2009 Money Market Funds 2011 £ 14, 968, 021 1. 49% £ 165, 133, 082 9. 43% Bonds Fund £ 0 0. 00% £ 20, 000 1. 14% Other £ 0 0. 00% £ 1, 424, 979 0. 08% £ 14, 968, 021 1. 49% £ 186, 558, 061 10. 65%

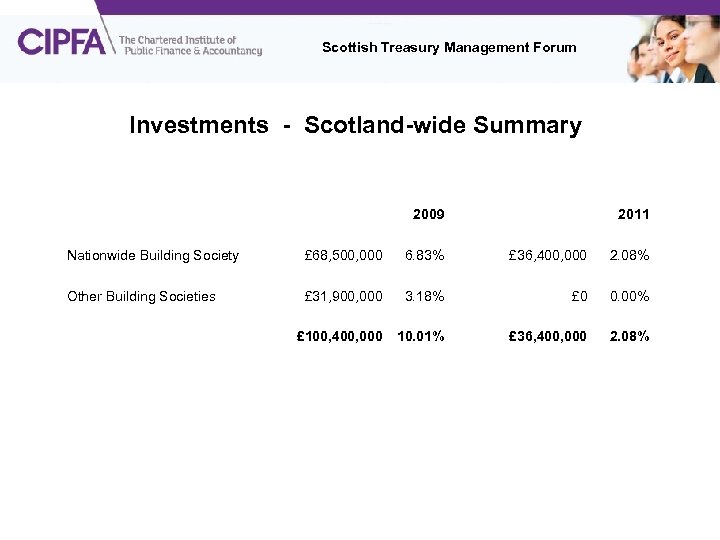

Scottish Treasury Management Forum Investments - Scotland-wide Summary 2009 2011 Nationwide Building Society £ 68, 500, 000 6. 83% £ 36, 400, 000 2. 08% Other Building Societies £ 31, 900, 000 3. 18% £ 0 0. 00% £ 100, 400, 000 10. 01% £ 36, 400, 000 2. 08%

Scottish Treasury Management Forum Investments - Scotland-wide Summary 2009 2011 Nationwide Building Society £ 68, 500, 000 6. 83% £ 36, 400, 000 2. 08% Other Building Societies £ 31, 900, 000 3. 18% £ 0 0. 00% £ 100, 400, 000 10. 01% £ 36, 400, 000 2. 08%

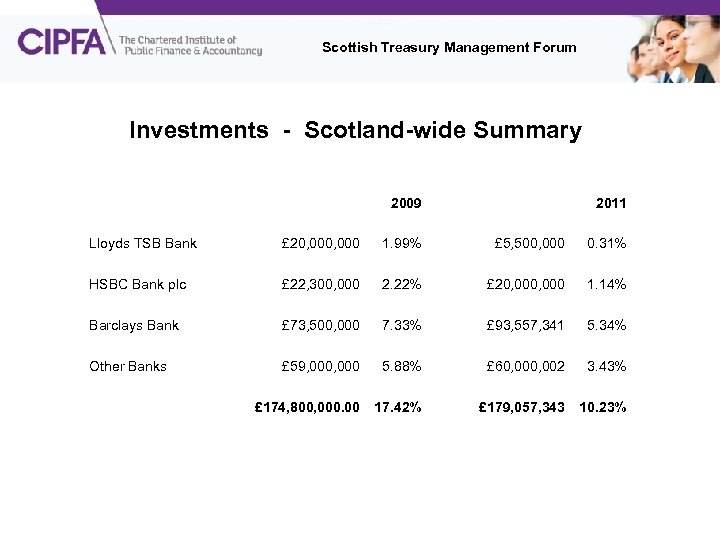

Scottish Treasury Management Forum Investments - Scotland-wide Summary 2009 2011 Lloyds TSB Bank £ 20, 000 1. 99% £ 5, 500, 000 0. 31% HSBC Bank plc £ 22, 300, 000 2. 22% £ 20, 000 1. 14% Barclays Bank £ 73, 500, 000 7. 33% £ 93, 557, 341 5. 34% Other Banks £ 59, 000 5. 88% £ 60, 002 3. 43% £ 174, 800, 000. 00 17. 42% £ 179, 057, 343 10. 23%

Scottish Treasury Management Forum Investments - Scotland-wide Summary 2009 2011 Lloyds TSB Bank £ 20, 000 1. 99% £ 5, 500, 000 0. 31% HSBC Bank plc £ 22, 300, 000 2. 22% £ 20, 000 1. 14% Barclays Bank £ 73, 500, 000 7. 33% £ 93, 557, 341 5. 34% Other Banks £ 59, 000 5. 88% £ 60, 002 3. 43% £ 174, 800, 000. 00 17. 42% £ 179, 057, 343 10. 23%

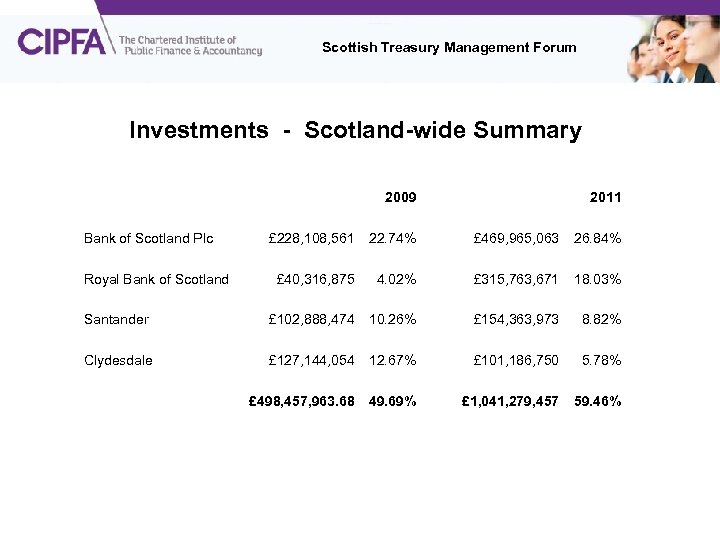

Scottish Treasury Management Forum Investments - Scotland-wide Summary 2009 Bank of Scotland Plc 2011 £ 228, 108, 561 22. 74% £ 469, 965, 063 26. 84% £ 40, 316, 875 4. 02% £ 315, 763, 671 18. 03% Santander £ 102, 888, 474 10. 26% £ 154, 363, 973 8. 82% Clydesdale £ 127, 144, 054 12. 67% £ 101, 186, 750 5. 78% £ 498, 457, 963. 68 49. 69% £ 1, 041, 279, 457 59. 46% Royal Bank of Scotland

Scottish Treasury Management Forum Investments - Scotland-wide Summary 2009 Bank of Scotland Plc 2011 £ 228, 108, 561 22. 74% £ 469, 965, 063 26. 84% £ 40, 316, 875 4. 02% £ 315, 763, 671 18. 03% Santander £ 102, 888, 474 10. 26% £ 154, 363, 973 8. 82% Clydesdale £ 127, 144, 054 12. 67% £ 101, 186, 750 5. 78% £ 498, 457, 963. 68 49. 69% £ 1, 041, 279, 457 59. 46% Royal Bank of Scotland

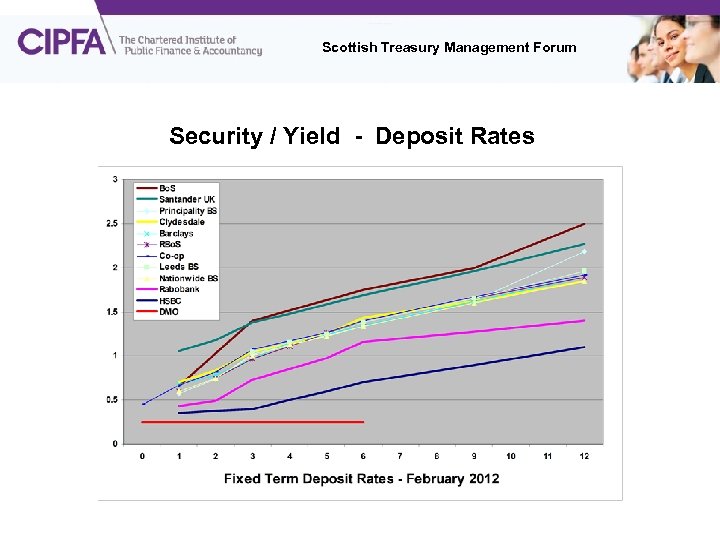

Scottish Treasury Management Forum Security / Yield - Deposit Rates

Scottish Treasury Management Forum Security / Yield - Deposit Rates