cde979a7cc51c7258f54ff7172b348d2.ppt

- Количество слайдов: 33

SCITC Technology Trends in Marine Terminal Operations Aaron Newton, Regional Sales Director, Navis © 2011 Navis, LLC. All other trademarks are the property of their respective owners.

SCITC Technology Trends in Marine Terminal Operations Aaron Newton, Regional Sales Director, Navis © 2011 Navis, LLC. All other trademarks are the property of their respective owners.

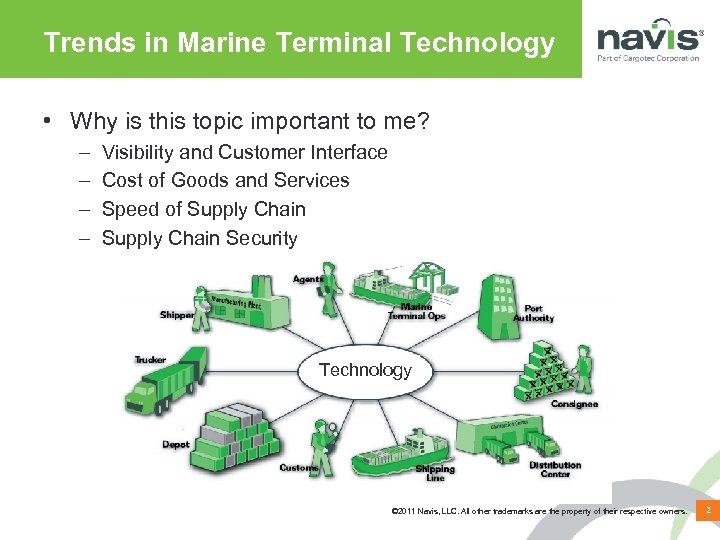

Trends in Marine Terminal Technology • Why is this topic important to me? – – Visibility and Customer Interface Cost of Goods and Services Speed of Supply Chain Security Technology © 2011 Navis, LLC. All other trademarks are the property of their respective owners. 2

Trends in Marine Terminal Technology • Why is this topic important to me? – – Visibility and Customer Interface Cost of Goods and Services Speed of Supply Chain Security Technology © 2011 Navis, LLC. All other trademarks are the property of their respective owners. 2

Technology Areas and Discussion • • • What is Automation? Management System Trends (TOS) Gate Technology Yard Automated Processes Quay Crane Opportunities Challenges © 2011 Navis, LLC. All other trademarks are the property of their respective owners. 3

Technology Areas and Discussion • • • What is Automation? Management System Trends (TOS) Gate Technology Yard Automated Processes Quay Crane Opportunities Challenges © 2011 Navis, LLC. All other trademarks are the property of their respective owners. 3

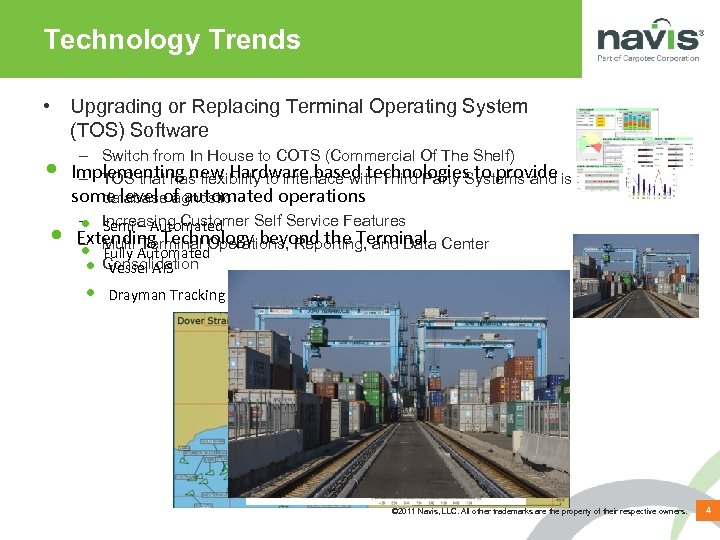

Technology Trends • Upgrading or Replacing Terminal Operating System (TOS) Software • • – Switch from In House to COTS (Commercial Of The Shelf) Implementing new Hardware based technologies to provide is – TOS that has flexibility to interface with Third Party Systems and some level of automated operations database agnostic – Increasing Customer Self Service Features • Semi – Automated Extending Technology beyond the Terminal Center – Multi Terminal Operations, Reporting, and Data • Consolidation Fully Automated • Vessel AIS • Drayman Tracking © 2011 Navis, LLC. All other trademarks are the property of their respective owners. 4

Technology Trends • Upgrading or Replacing Terminal Operating System (TOS) Software • • – Switch from In House to COTS (Commercial Of The Shelf) Implementing new Hardware based technologies to provide is – TOS that has flexibility to interface with Third Party Systems and some level of automated operations database agnostic – Increasing Customer Self Service Features • Semi – Automated Extending Technology beyond the Terminal Center – Multi Terminal Operations, Reporting, and Data • Consolidation Fully Automated • Vessel AIS • Drayman Tracking © 2011 Navis, LLC. All other trademarks are the property of their respective owners. 4

Technology Technicality • Technology is rapidly evolving more over the most recent time period in the maritime space than any other time period in history • Decisions and Process – Not only must the technology “appropriately” address the need, it must also fit the IT direction of the organization deploying the solution – Trending towards purchasers with a high level of Operational and IT knowledge, the silo is disappearing © 2011 Navis, LLC. All other trademarks are the property of their respective owners. 5

Technology Technicality • Technology is rapidly evolving more over the most recent time period in the maritime space than any other time period in history • Decisions and Process – Not only must the technology “appropriately” address the need, it must also fit the IT direction of the organization deploying the solution – Trending towards purchasers with a high level of Operational and IT knowledge, the silo is disappearing © 2011 Navis, LLC. All other trademarks are the property of their respective owners. 5

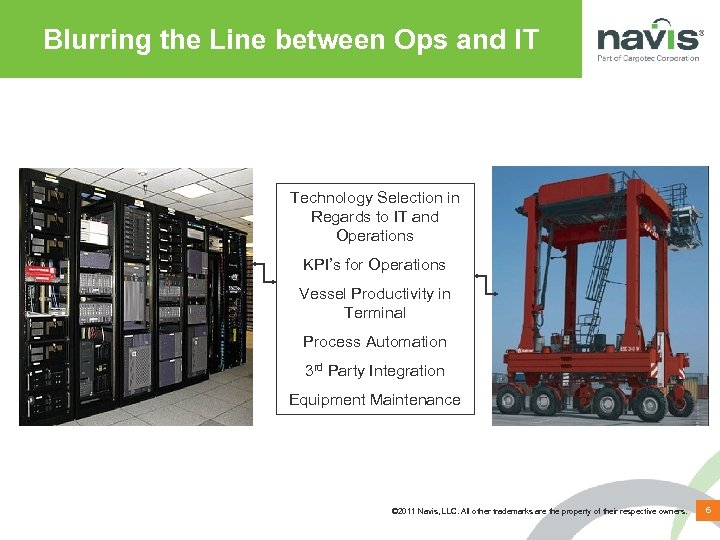

Blurring the Line between Ops and IT Technology Selection in Regards to IT and Operations KPI’s for Operations Vessel Productivity in Terminal Process Automation 3 rd Party Integration Equipment Maintenance © 2011 Navis, LLC. All other trademarks are the property of their respective owners. 6

Blurring the Line between Ops and IT Technology Selection in Regards to IT and Operations KPI’s for Operations Vessel Productivity in Terminal Process Automation 3 rd Party Integration Equipment Maintenance © 2011 Navis, LLC. All other trademarks are the property of their respective owners. 6

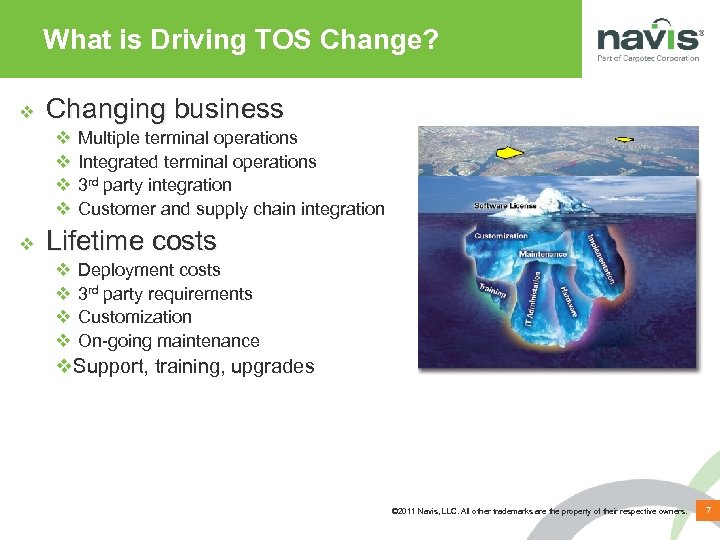

What is Driving TOS Change? v Changing business v v v Multiple terminal operations Integrated terminal operations 3 rd party integration Customer and supply chain integration Lifetime costs v v Deployment costs 3 rd party requirements Customization On-going maintenance v. Support, training, upgrades © 2011 Navis, LLC. All other trademarks are the property of their respective owners. 7

What is Driving TOS Change? v Changing business v v v Multiple terminal operations Integrated terminal operations 3 rd party integration Customer and supply chain integration Lifetime costs v v Deployment costs 3 rd party requirements Customization On-going maintenance v. Support, training, upgrades © 2011 Navis, LLC. All other trademarks are the property of their respective owners. 7

TOS Purchase Provides Highest ROI Terminal operating systems have the highest return on investment versus investment in working terminal space, land or equipment Ramp Space © 2011 Navis, LLC. All other trademarks are the property of their respective owners. 8

TOS Purchase Provides Highest ROI Terminal operating systems have the highest return on investment versus investment in working terminal space, land or equipment Ramp Space © 2011 Navis, LLC. All other trademarks are the property of their respective owners. 8

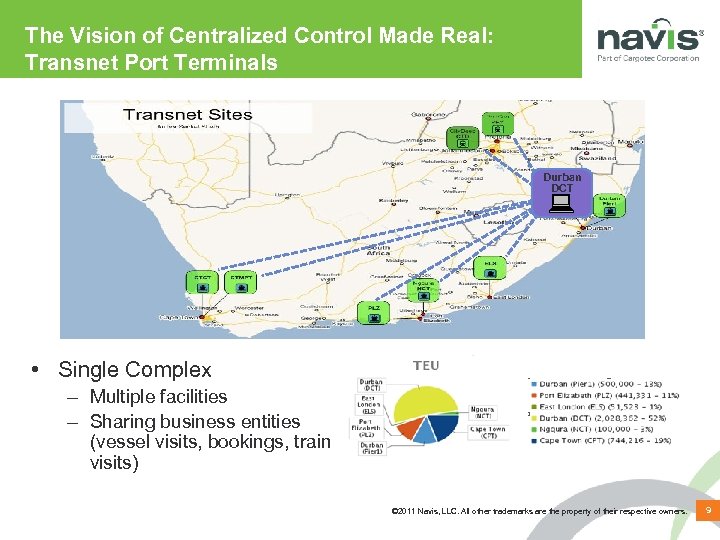

The Vision of Centralized Control Made Real: Transnet Port Terminals Durban DCT • Single Complex – Multiple facilities – Sharing business entities (vessel visits, bookings, train visits) © 2011 Navis, LLC. All other trademarks are the property of their respective owners. 9

The Vision of Centralized Control Made Real: Transnet Port Terminals Durban DCT • Single Complex – Multiple facilities – Sharing business entities (vessel visits, bookings, train visits) © 2011 Navis, LLC. All other trademarks are the property of their respective owners. 9

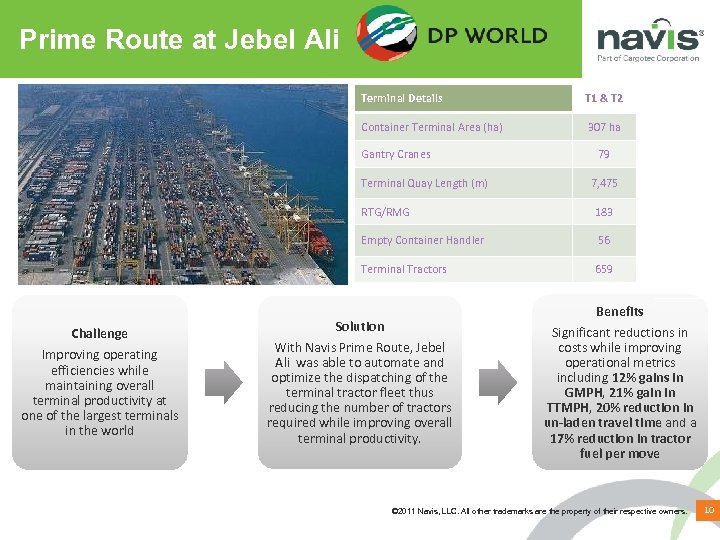

Prime Route at Jebel Ali Terminal Details T 1 & T 2 Container Terminal Area (ha) 307 ha Gantry Cranes Terminal Quay Length (m) 79 7, 475 RTG/RMG Empty Container Handler 56 Terminal Tractors Challenge Improving operating efficiencies while maintaining overall terminal productivity at one of the largest terminals in the world 183 659 Solution With Navis Prime Route, Jebel Ali was able to automate and optimize the dispatching of the terminal tractor fleet thus reducing the number of tractors required while improving overall terminal productivity. Benefits Significant reductions in costs while improving operational metrics including 12% gains in GMPH, 21% gain in TTMPH, 20% reduction in un-laden travel time and a 17% reduction in tractor fuel per move © 2011 Navis, LLC. All other trademarks are the property of their respective owners. 10

Prime Route at Jebel Ali Terminal Details T 1 & T 2 Container Terminal Area (ha) 307 ha Gantry Cranes Terminal Quay Length (m) 79 7, 475 RTG/RMG Empty Container Handler 56 Terminal Tractors Challenge Improving operating efficiencies while maintaining overall terminal productivity at one of the largest terminals in the world 183 659 Solution With Navis Prime Route, Jebel Ali was able to automate and optimize the dispatching of the terminal tractor fleet thus reducing the number of tractors required while improving overall terminal productivity. Benefits Significant reductions in costs while improving operational metrics including 12% gains in GMPH, 21% gain in TTMPH, 20% reduction in un-laden travel time and a 17% reduction in tractor fuel per move © 2011 Navis, LLC. All other trademarks are the property of their respective owners. 10

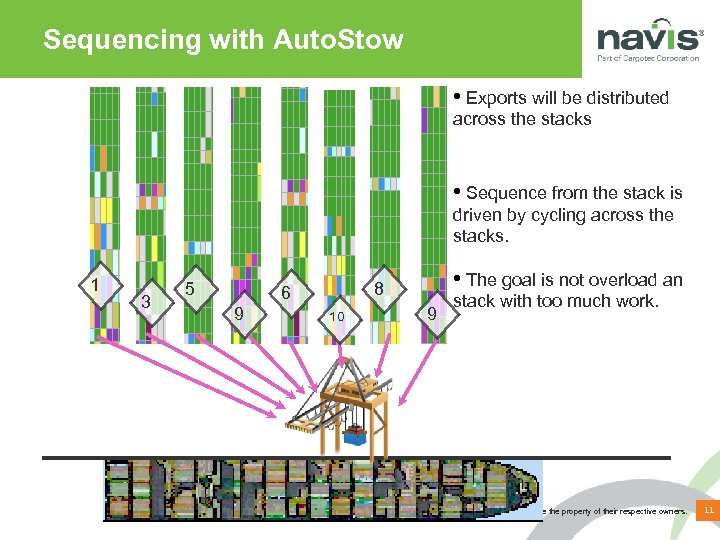

Sequencing with Auto. Stow • Exports will be distributed across the stacks • Sequence from the stack is driven by cycling across the stacks. 1 3 5 9 • The goal is not overload an 8 6 10 9 stack with too much work. © 2011 Navis, LLC. All other trademarks are the property of their respective owners. 11

Sequencing with Auto. Stow • Exports will be distributed across the stacks • Sequence from the stack is driven by cycling across the stacks. 1 3 5 9 • The goal is not overload an 8 6 10 9 stack with too much work. © 2011 Navis, LLC. All other trademarks are the property of their respective owners. 11

Rail OCR Automation • Railcar type, railcar position, and container inventory have to be accurate for effective automation • Integration with Rail OCR System provides the required accuracy © 2011 Navis, LLC. All other trademarks are the property of their respective owners. 12

Rail OCR Automation • Railcar type, railcar position, and container inventory have to be accurate for effective automation • Integration with Rail OCR System provides the required accuracy © 2011 Navis, LLC. All other trademarks are the property of their respective owners. 12

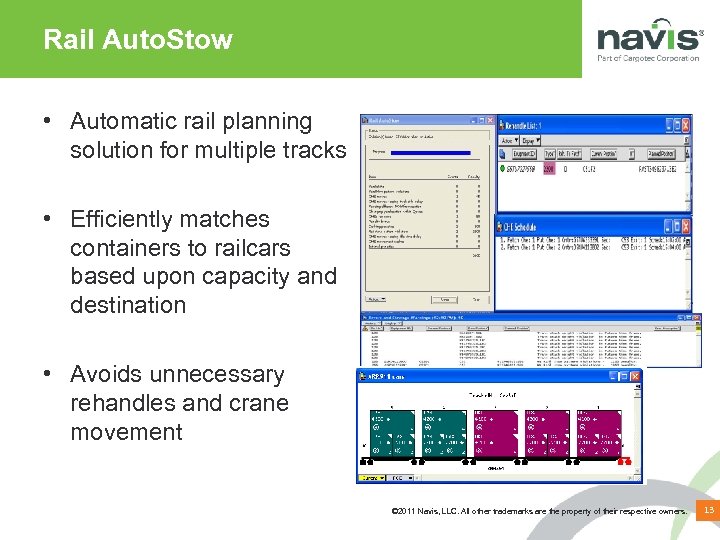

Rail Auto. Stow • Automatic rail planning solution for multiple tracks • Efficiently matches containers to railcars based upon capacity and destination • Avoids unnecessary rehandles and crane movement © 2011 Navis, LLC. All other trademarks are the property of their respective owners. 13

Rail Auto. Stow • Automatic rail planning solution for multiple tracks • Efficiently matches containers to railcars based upon capacity and destination • Avoids unnecessary rehandles and crane movement © 2011 Navis, LLC. All other trademarks are the property of their respective owners. 13

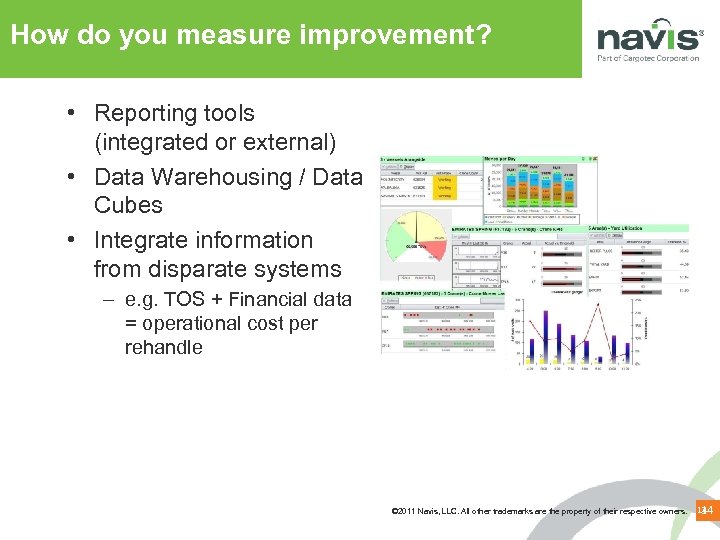

How do you measure improvement? • Reporting tools (integrated or external) • Data Warehousing / Data Cubes • Integrate information from disparate systems – e. g. TOS + Financial data = operational cost per rehandle © 2011 Navis, LLC. All other trademarks are the property of their respective owners. 14 14

How do you measure improvement? • Reporting tools (integrated or external) • Data Warehousing / Data Cubes • Integrate information from disparate systems – e. g. TOS + Financial data = operational cost per rehandle © 2011 Navis, LLC. All other trademarks are the property of their respective owners. 14 14

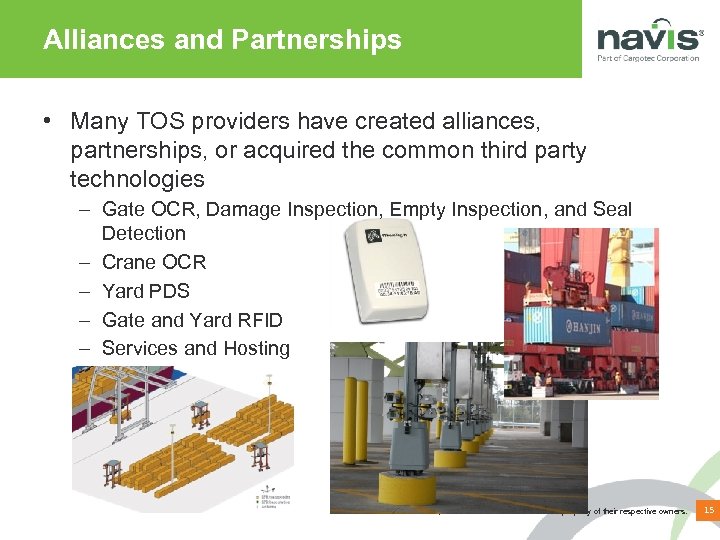

Alliances and Partnerships • Many TOS providers have created alliances, partnerships, or acquired the common third party technologies – Gate OCR, Damage Inspection, Empty Inspection, and Seal Detection – Crane OCR – Yard PDS – Gate and Yard RFID – Services and Hosting © 2011 Navis, LLC. All other trademarks are the property of their respective owners. 15

Alliances and Partnerships • Many TOS providers have created alliances, partnerships, or acquired the common third party technologies – Gate OCR, Damage Inspection, Empty Inspection, and Seal Detection – Crane OCR – Yard PDS – Gate and Yard RFID – Services and Hosting © 2011 Navis, LLC. All other trademarks are the property of their respective owners. 15

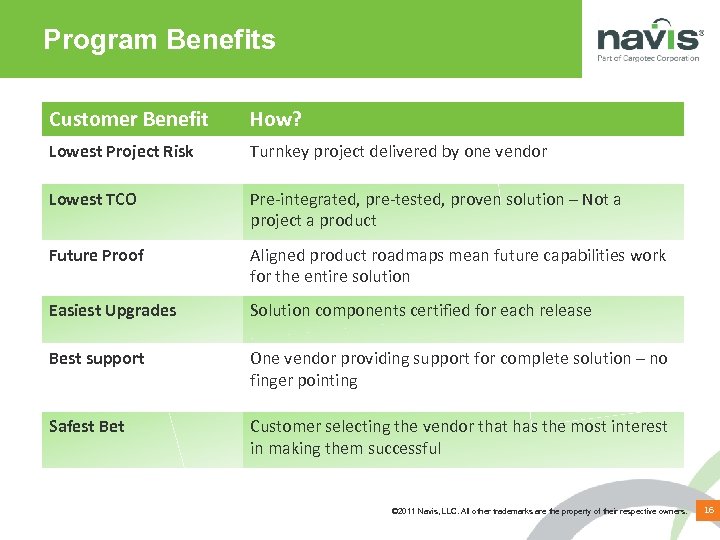

Program Benefits Customer Benefit How? Lowest Project Risk Turnkey project delivered by one vendor Lowest TCO Pre-integrated, pre-tested, proven solution – Not a project a product Future Proof Aligned product roadmaps mean future capabilities work for the entire solution Easiest Upgrades Solution components certified for each release Best support One vendor providing support for complete solution – no finger pointing Safest Bet Customer selecting the vendor that has the most interest in making them successful © 2011 Navis, LLC. All other trademarks are the property of their respective owners. 16

Program Benefits Customer Benefit How? Lowest Project Risk Turnkey project delivered by one vendor Lowest TCO Pre-integrated, pre-tested, proven solution – Not a project a product Future Proof Aligned product roadmaps mean future capabilities work for the entire solution Easiest Upgrades Solution components certified for each release Best support One vendor providing support for complete solution – no finger pointing Safest Bet Customer selecting the vendor that has the most interest in making them successful © 2011 Navis, LLC. All other trademarks are the property of their respective owners. 16

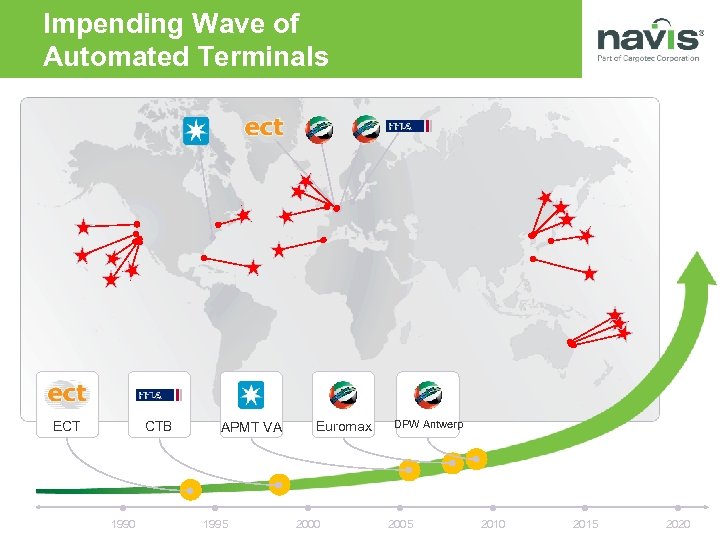

Impending Wave of Automated Terminals CTB ECT Euromax APMT VA 1990 1995 2000 DPW Antwerp 2005 2010 2015 2020 © 2011 Navis, LLC. All other trademarks are the property of their respective owners.

Impending Wave of Automated Terminals CTB ECT Euromax APMT VA 1990 1995 2000 DPW Antwerp 2005 2010 2015 2020 © 2011 Navis, LLC. All other trademarks are the property of their respective owners.

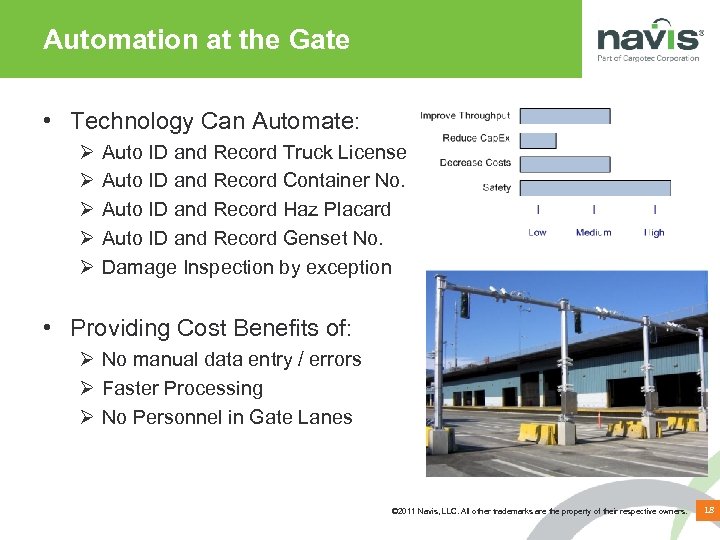

Automation at the Gate • Technology Can Automate: Ø Ø Ø Auto ID and Record Truck License Auto ID and Record Container No. Auto ID and Record Haz Placard Auto ID and Record Genset No. Damage Inspection by exception • Providing Cost Benefits of: Ø No manual data entry / errors Ø Faster Processing Ø No Personnel in Gate Lanes © 2011 Navis, LLC. All other trademarks are the property of their respective owners. 18

Automation at the Gate • Technology Can Automate: Ø Ø Ø Auto ID and Record Truck License Auto ID and Record Container No. Auto ID and Record Haz Placard Auto ID and Record Genset No. Damage Inspection by exception • Providing Cost Benefits of: Ø No manual data entry / errors Ø Faster Processing Ø No Personnel in Gate Lanes © 2011 Navis, LLC. All other trademarks are the property of their respective owners. 18

Gates – Moving into the Future © 2011 Navis, LLC. All other trademarks are the property of their respective owners. 19

Gates – Moving into the Future © 2011 Navis, LLC. All other trademarks are the property of their respective owners. 19

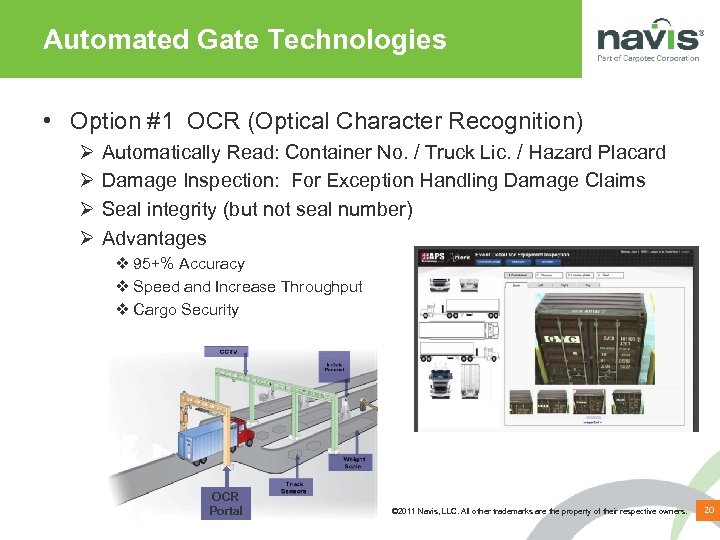

Automated Gate Technologies • Option #1 OCR (Optical Character Recognition) Ø Ø Automatically Read: Container No. / Truck Lic. / Hazard Placard Damage Inspection: For Exception Handling Damage Claims Seal integrity (but not seal number) Advantages v 95+% Accuracy v Speed and Increase Throughput v Cargo Security OCR Portal © 2011 Navis, LLC. All other trademarks are the property of their respective owners. 20

Automated Gate Technologies • Option #1 OCR (Optical Character Recognition) Ø Ø Automatically Read: Container No. / Truck Lic. / Hazard Placard Damage Inspection: For Exception Handling Damage Claims Seal integrity (but not seal number) Advantages v 95+% Accuracy v Speed and Increase Throughput v Cargo Security OCR Portal © 2011 Navis, LLC. All other trademarks are the property of their respective owners. 20

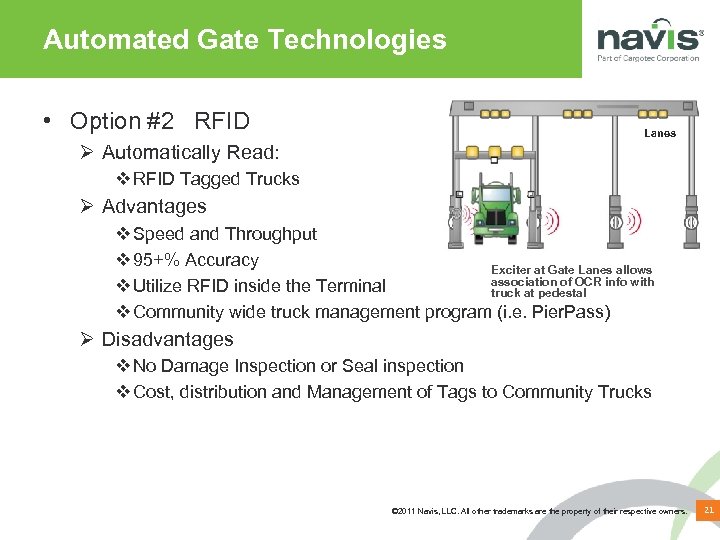

Automated Gate Technologies • Option #2 RFID Lanes Ø Automatically Read: v RFID Tagged Trucks Ø Advantages v Speed and Throughput v 95+% Accuracy Exciter at Gate Lanes allows association of OCR info with v Utilize RFID inside the Terminal truck at pedestal v Community wide truck management program (i. e. Pier. Pass) Ø Disadvantages v No Damage Inspection or Seal inspection v Cost, distribution and Management of Tags to Community Trucks © 2011 Navis, LLC. All other trademarks are the property of their respective owners. 21

Automated Gate Technologies • Option #2 RFID Lanes Ø Automatically Read: v RFID Tagged Trucks Ø Advantages v Speed and Throughput v 95+% Accuracy Exciter at Gate Lanes allows association of OCR info with v Utilize RFID inside the Terminal truck at pedestal v Community wide truck management program (i. e. Pier. Pass) Ø Disadvantages v No Damage Inspection or Seal inspection v Cost, distribution and Management of Tags to Community Trucks © 2011 Navis, LLC. All other trademarks are the property of their respective owners. 21

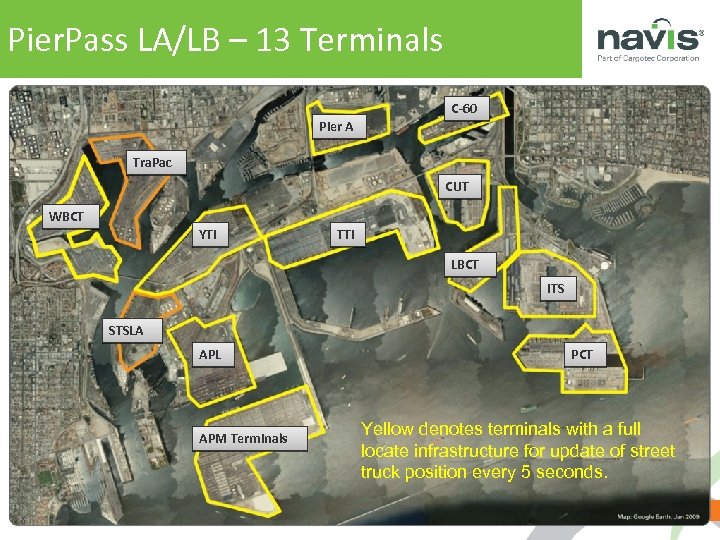

Pier. Pass LA/LB – 13 Terminals C-60 Pier A Tra. Pac CUT WBCT YTI TTI LBCT ITS STSLA APL APM Terminals PCT Yellow denotes terminals with a full locate infrastructure for update of street truck position every 5 seconds. © 2011 Navis, LLC. All other trademarks are the property of their respective owners.

Pier. Pass LA/LB – 13 Terminals C-60 Pier A Tra. Pac CUT WBCT YTI TTI LBCT ITS STSLA APL APM Terminals PCT Yellow denotes terminals with a full locate infrastructure for update of street truck position every 5 seconds. © 2011 Navis, LLC. All other trademarks are the property of their respective owners.

Yard Operations – Moving into the Future Manual Job Stepping Vs. Automated Job Stepping © 2011 Navis, LLC. All other trademarks are the property of their respective owners. 23

Yard Operations – Moving into the Future Manual Job Stepping Vs. Automated Job Stepping © 2011 Navis, LLC. All other trademarks are the property of their respective owners. 23

Yard Operations – Moving into the Future Manual Cargo Hand-Off Vs. Automated Container Hand-Off © 2011 Navis, LLC. All other trademarks are the property of their respective owners. 24

Yard Operations – Moving into the Future Manual Cargo Hand-Off Vs. Automated Container Hand-Off © 2011 Navis, LLC. All other trademarks are the property of their respective owners. 24

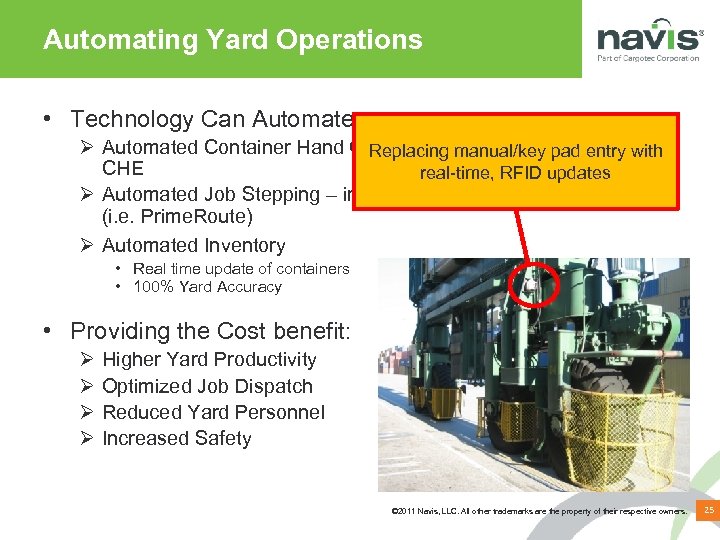

Automating Yard Operations • Technology Can Automate: Ø Automated Container Hand Off – Between Trucks and entry with Replacing manual/key pad Yard CHE real-time, RFID updates Ø Automated Job Stepping – improves optimized dispatch (i. e. Prime. Route) Ø Automated Inventory • Real time update of containers • 100% Yard Accuracy • Providing the Cost benefit: Ø Ø Higher Yard Productivity Optimized Job Dispatch Reduced Yard Personnel Increased Safety © 2011 Navis, LLC. All other trademarks are the property of their respective owners. 25

Automating Yard Operations • Technology Can Automate: Ø Automated Container Hand Off – Between Trucks and entry with Replacing manual/key pad Yard CHE real-time, RFID updates Ø Automated Job Stepping – improves optimized dispatch (i. e. Prime. Route) Ø Automated Inventory • Real time update of containers • 100% Yard Accuracy • Providing the Cost benefit: Ø Ø Higher Yard Productivity Optimized Job Dispatch Reduced Yard Personnel Increased Safety © 2011 Navis, LLC. All other trademarks are the property of their respective owners. 25

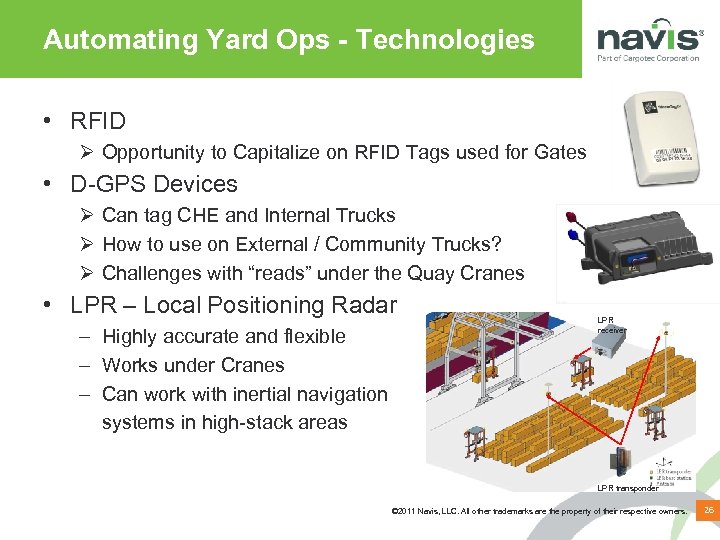

Automating Yard Ops - Technologies • RFID Ø Opportunity to Capitalize on RFID Tags used for Gates • D-GPS Devices Ø Can tag CHE and Internal Trucks Ø How to use on External / Community Trucks? Ø Challenges with “reads” under the Quay Cranes • LPR – Local Positioning Radar – Highly accurate and flexible – Works under Cranes – Can work with inertial navigation systems in high-stack areas LPR receiver LPR transponder © 2011 Navis, LLC. All other trademarks are the property of their respective owners. 26

Automating Yard Ops - Technologies • RFID Ø Opportunity to Capitalize on RFID Tags used for Gates • D-GPS Devices Ø Can tag CHE and Internal Trucks Ø How to use on External / Community Trucks? Ø Challenges with “reads” under the Quay Cranes • LPR – Local Positioning Radar – Highly accurate and flexible – Works under Cranes – Can work with inertial navigation systems in high-stack areas LPR receiver LPR transponder © 2011 Navis, LLC. All other trademarks are the property of their respective owners. 26

Vessel Ops – Moving into the Future Manual Vessel Loading Vs. Automated Vessel Loading © 2011 Navis, LLC. All other trademarks are the property of their respective owners. 27

Vessel Ops – Moving into the Future Manual Vessel Loading Vs. Automated Vessel Loading © 2011 Navis, LLC. All other trademarks are the property of their respective owners. 27

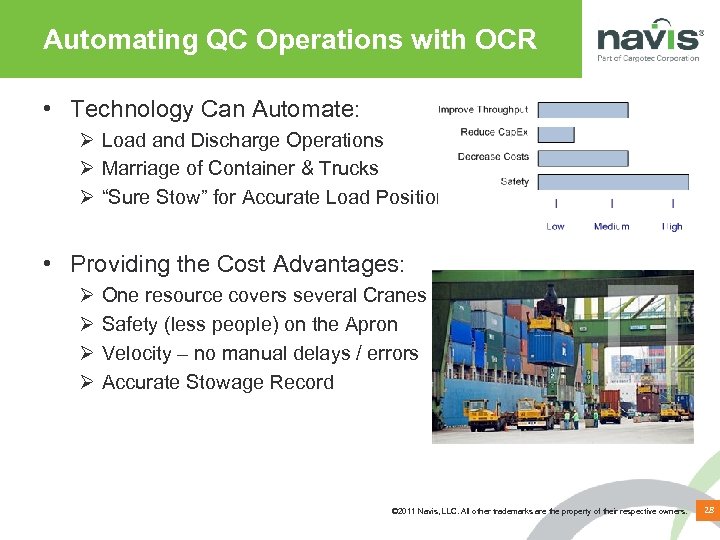

Automating QC Operations with OCR • Technology Can Automate: Ø Load and Discharge Operations Ø Marriage of Container & Trucks Ø “Sure Stow” for Accurate Load Positions • Providing the Cost Advantages: Ø Ø One resource covers several Cranes Safety (less people) on the Apron Velocity – no manual delays / errors Accurate Stowage Record © 2011 Navis, LLC. All other trademarks are the property of their respective owners. 28

Automating QC Operations with OCR • Technology Can Automate: Ø Load and Discharge Operations Ø Marriage of Container & Trucks Ø “Sure Stow” for Accurate Load Positions • Providing the Cost Advantages: Ø Ø One resource covers several Cranes Safety (less people) on the Apron Velocity – no manual delays / errors Accurate Stowage Record © 2011 Navis, LLC. All other trademarks are the property of their respective owners. 28

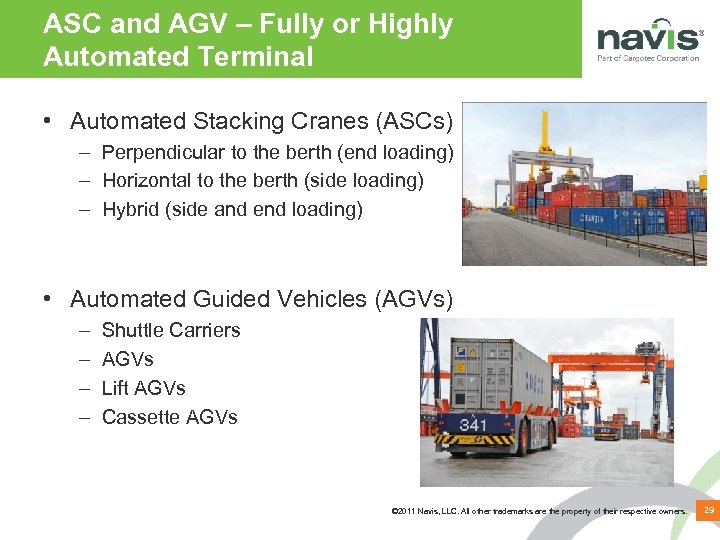

ASC and AGV – Fully or Highly Automated Terminal • Automated Stacking Cranes (ASCs) – Perpendicular to the berth (end loading) – Horizontal to the berth (side loading) – Hybrid (side and end loading) • Automated Guided Vehicles (AGVs) – – Shuttle Carriers AGVs Lift AGVs Cassette AGVs © 2011 Navis, LLC. All other trademarks are the property of their respective owners. 29

ASC and AGV – Fully or Highly Automated Terminal • Automated Stacking Cranes (ASCs) – Perpendicular to the berth (end loading) – Horizontal to the berth (side loading) – Hybrid (side and end loading) • Automated Guided Vehicles (AGVs) – – Shuttle Carriers AGVs Lift AGVs Cassette AGVs © 2011 Navis, LLC. All other trademarks are the property of their respective owners. 29

Automation Reality – “Incremental” • Majority of existing terminals will not fully automate • Majority of new terminals will not fully Automate (lower labor cost regions) • HOWEVER - ØMany terminals will introduce following objectives: v. Improve Productivity: v. Drive down costs: v. Improve Safety: v. Optimize resources: Incremental Automation with the Real-time data exchanges / NO keypads Reduce Personnel/Reduce Carbon Footprint Remove Personnel from Ops areas Equipment, Land Personnel © 2011 Navis, LLC. All other trademarks are the property of their respective owners. 30

Automation Reality – “Incremental” • Majority of existing terminals will not fully automate • Majority of new terminals will not fully Automate (lower labor cost regions) • HOWEVER - ØMany terminals will introduce following objectives: v. Improve Productivity: v. Drive down costs: v. Improve Safety: v. Optimize resources: Incremental Automation with the Real-time data exchanges / NO keypads Reduce Personnel/Reduce Carbon Footprint Remove Personnel from Ops areas Equipment, Land Personnel © 2011 Navis, LLC. All other trademarks are the property of their respective owners. 30

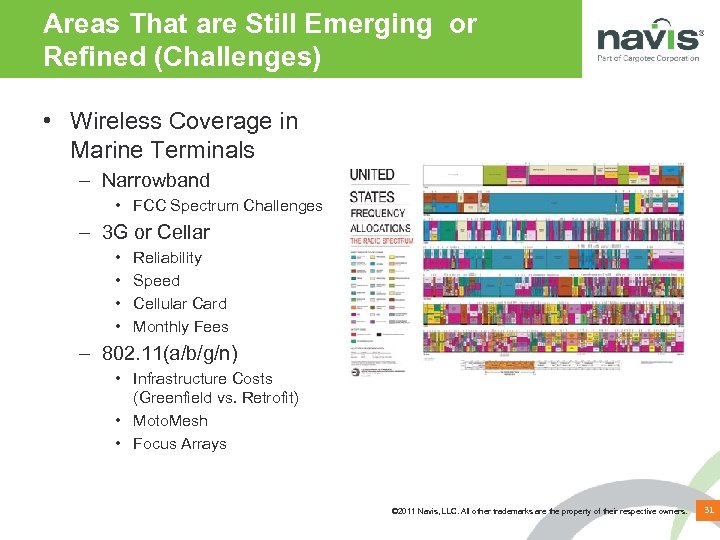

Areas That are Still Emerging or Refined (Challenges) • Wireless Coverage in Marine Terminals – Narrowband • FCC Spectrum Challenges – 3 G or Cellar • • Reliability Speed Cellular Card Monthly Fees – 802. 11(a/b/g/n) • Infrastructure Costs (Greenfield vs. Retrofit) • Moto. Mesh • Focus Arrays © 2011 Navis, LLC. All other trademarks are the property of their respective owners. 31

Areas That are Still Emerging or Refined (Challenges) • Wireless Coverage in Marine Terminals – Narrowband • FCC Spectrum Challenges – 3 G or Cellar • • Reliability Speed Cellular Card Monthly Fees – 802. 11(a/b/g/n) • Infrastructure Costs (Greenfield vs. Retrofit) • Moto. Mesh • Focus Arrays © 2011 Navis, LLC. All other trademarks are the property of their respective owners. 31

What to Expect and Look For • What to Expect…. Ø Early Adopters are proving solution success or failure Ø Increasing Integration of Equipment (hardware) and Software • What to look for…. Ø Ø Ø Proven Solutions and References Expansion potential of base technology (added uses and returns) Purpose Built devices for marine terminal environment Products, not Projects Proven Integration Capabilities Hybrid Solutions Utilizing Different Technologies to Maximize Benefit © 2011 Navis, LLC. All other trademarks are the property of their respective owners. 32

What to Expect and Look For • What to Expect…. Ø Early Adopters are proving solution success or failure Ø Increasing Integration of Equipment (hardware) and Software • What to look for…. Ø Ø Ø Proven Solutions and References Expansion potential of base technology (added uses and returns) Purpose Built devices for marine terminal environment Products, not Projects Proven Integration Capabilities Hybrid Solutions Utilizing Different Technologies to Maximize Benefit © 2011 Navis, LLC. All other trademarks are the property of their respective owners. 32

And to Close the Conference …. We face many changes in technology and Operations, but some aspects of waterfront activities remain the same… © 2011 Navis, LLC. All other trademarks are the property of their respective owners. 33

And to Close the Conference …. We face many changes in technology and Operations, but some aspects of waterfront activities remain the same… © 2011 Navis, LLC. All other trademarks are the property of their respective owners. 33