042dd6367978fc9869a9c60ef8466b23.ppt

- Количество слайдов: 24

Schedule D in the Real World • All audio is streamed through your computer speakers. • There will be several attendance verification questions during the LIVE webinar that must be answered via the online quiz at the conclusion to qualify for CPE. • Today’s webinar will begin at 2: 00 pm EDT • Please note: You will not hear any sound until the webinar begins. 1

Schedule D in the Real World • All audio is streamed through your computer speakers. • There will be several attendance verification questions during the LIVE webinar that must be answered via the online quiz at the conclusion to qualify for CPE. • Today’s webinar will begin at 2: 00 pm EDT • Please note: You will not hear any sound until the webinar begins. 1

Schedule D – In the Real World! Presenters: Kathy Hettick, EA, ABA, ATP and Gene Bell, EA, ATA, CFP® Date: June 25, 2015 Time: 2: 00 -3: 00 PM Eastern 2

Schedule D – In the Real World! Presenters: Kathy Hettick, EA, ABA, ATP and Gene Bell, EA, ATA, CFP® Date: June 25, 2015 Time: 2: 00 -3: 00 PM Eastern 2

Learning Objectives Upon completion of this course, you will be able to: • Report the sale of a capital asset on Schedule D • Determine when to use Form 8949 • Recognize the reportable aspects of a 1099 -B • Apply the process of reporting correct information for the sale of a capital asset 3

Learning Objectives Upon completion of this course, you will be able to: • Report the sale of a capital asset on Schedule D • Determine when to use Form 8949 • Recognize the reportable aspects of a 1099 -B • Apply the process of reporting correct information for the sale of a capital asset 3

Schedule D Summary Information Form 8949 Covered vs. Non Covered Basis, basis & more basis Adjustment Codes 4

Schedule D Summary Information Form 8949 Covered vs. Non Covered Basis, basis & more basis Adjustment Codes 4

Schedule D Form 1099 -B (Proceeds From Broker and Barter) Form 1099 -DIV (Capital Gain Distributions) Form 4797 (Business Assets) Form 6252 (Installment Sales) Form 8824 (Like-Kind Exchanges) Form K -1 (Partnerships, S Corps, Estates, Trusts) 5

Schedule D Form 1099 -B (Proceeds From Broker and Barter) Form 1099 -DIV (Capital Gain Distributions) Form 4797 (Business Assets) Form 6252 (Installment Sales) Form 8824 (Like-Kind Exchanges) Form K -1 (Partnerships, S Corps, Estates, Trusts) 5

Why do we have a Schedule D? Tax code complexities Capital gains tax rates Netting rules Tax computation worksheet Capital loss carryforward Prior year due diligence 6

Why do we have a Schedule D? Tax code complexities Capital gains tax rates Netting rules Tax computation worksheet Capital loss carryforward Prior year due diligence 6

What is a Capital Asset? IRC § 1221 Any property held by a taxpayer, except. . . Inventory Accounts or notes receivable from trade or business Depreciable property used in trade or business Real estate used in trade or business, or rental property Supplies used in a trade or business US Govt publications Commodities-derivative instruments held by dealer The right to receive future ordinary income payments Self created copyrights, literary, musical or artistic comps, etc. 7

What is a Capital Asset? IRC § 1221 Any property held by a taxpayer, except. . . Inventory Accounts or notes receivable from trade or business Depreciable property used in trade or business Real estate used in trade or business, or rental property Supplies used in a trade or business US Govt publications Commodities-derivative instruments held by dealer The right to receive future ordinary income payments Self created copyrights, literary, musical or artistic comps, etc. 7

What is a Capital Asset? Malat v. Riddell, 383 U. S. 569, 572 (1966) U. S. Supreme Court Case Differentiate the profits and losses from everyday business operations and the long term realization of appreciation. United States v. Winthrop, 417 (1969) 7 factors for consideration No one factor controls 8

What is a Capital Asset? Malat v. Riddell, 383 U. S. 569, 572 (1966) U. S. Supreme Court Case Differentiate the profits and losses from everyday business operations and the long term realization of appreciation. United States v. Winthrop, 417 (1969) 7 factors for consideration No one factor controls 8

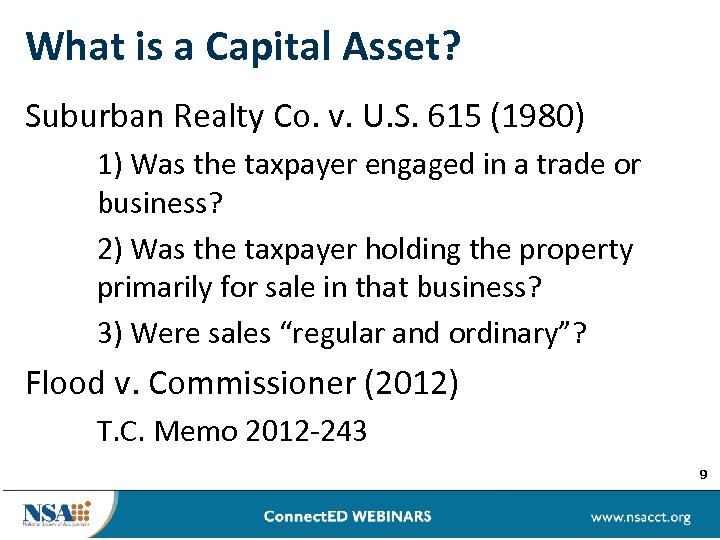

What is a Capital Asset? Suburban Realty Co. v. U. S. 615 (1980) 1) Was the taxpayer engaged in a trade or business? 2) Was the taxpayer holding the property primarily for sale in that business? 3) Were sales “regular and ordinary”? Flood v. Commissioner (2012) T. C. Memo 2012 -243 9

What is a Capital Asset? Suburban Realty Co. v. U. S. 615 (1980) 1) Was the taxpayer engaged in a trade or business? 2) Was the taxpayer holding the property primarily for sale in that business? 3) Were sales “regular and ordinary”? Flood v. Commissioner (2012) T. C. Memo 2012 -243 9

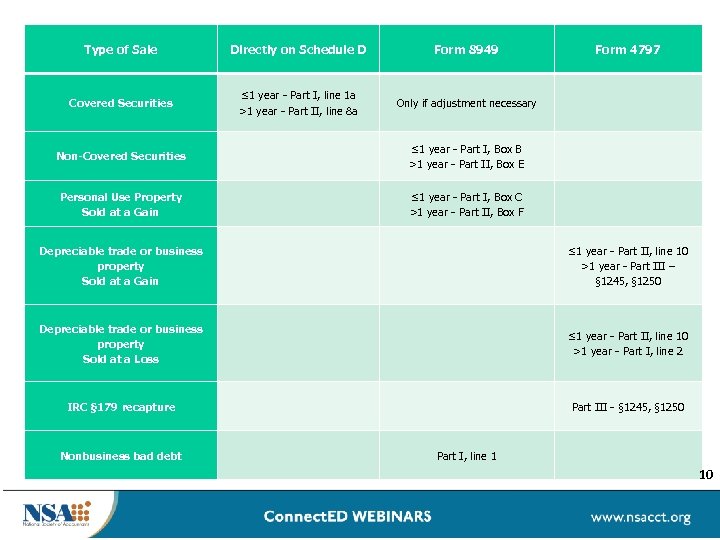

Type of Sale Directly on Schedule D Form 8949 Form 4797 Covered Securities ≤ 1 year - Part I, line 1 a >1 year - Part II, line 8 a Only if adjustment necessary Non-Covered Securities ≤ 1 year - Part I, Box B >1 year - Part II, Box E Personal Use Property Sold at a Gain ≤ 1 year - Part I, Box C >1 year - Part II, Box F Depreciable trade or business property Sold at a Gain ≤ 1 year - Part II, line 10 >1 year - Part III – § 1245, § 1250 Depreciable trade or business property Sold at a Loss ≤ 1 year - Part II, line 10 >1 year - Part I, line 2 IRC § 179 recapture Part III - § 1245, § 1250 Nonbusiness bad debt Part I, line 1 10

Type of Sale Directly on Schedule D Form 8949 Form 4797 Covered Securities ≤ 1 year - Part I, line 1 a >1 year - Part II, line 8 a Only if adjustment necessary Non-Covered Securities ≤ 1 year - Part I, Box B >1 year - Part II, Box E Personal Use Property Sold at a Gain ≤ 1 year - Part I, Box C >1 year - Part II, Box F Depreciable trade or business property Sold at a Gain ≤ 1 year - Part II, line 10 >1 year - Part III – § 1245, § 1250 Depreciable trade or business property Sold at a Loss ≤ 1 year - Part II, line 10 >1 year - Part I, line 2 IRC § 179 recapture Part III - § 1245, § 1250 Nonbusiness bad debt Part I, line 1 10

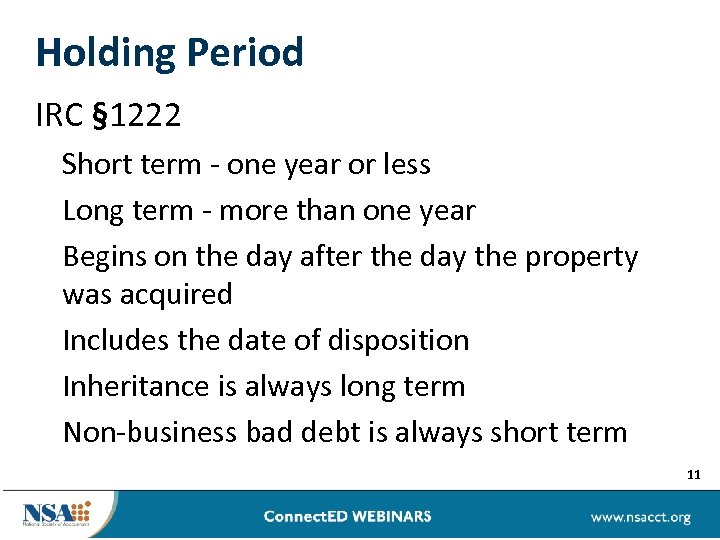

Holding Period IRC § 1222 Short term - one year or less Long term - more than one year Begins on the day after the day the property was acquired Includes the date of disposition Inheritance is always long term Non-business bad debt is always short term 11

Holding Period IRC § 1222 Short term - one year or less Long term - more than one year Begins on the day after the day the property was acquired Includes the date of disposition Inheritance is always long term Non-business bad debt is always short term 11

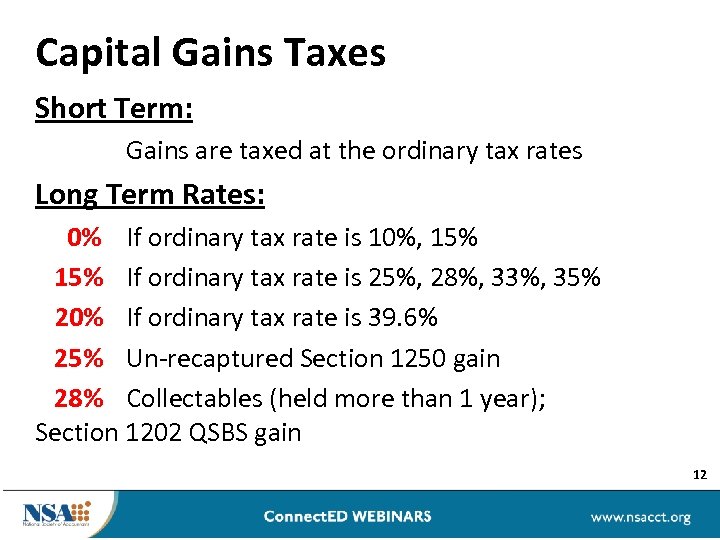

Capital Gains Taxes Short Term: Gains are taxed at the ordinary tax rates Long Term Rates: 0% If ordinary tax rate is 10%, 15% If ordinary tax rate is 25%, 28%, 33%, 35% 20% If ordinary tax rate is 39. 6% 25% Un-recaptured Section 1250 gain 28% Collectables (held more than 1 year); Section 1202 QSBS gain 12

Capital Gains Taxes Short Term: Gains are taxed at the ordinary tax rates Long Term Rates: 0% If ordinary tax rate is 10%, 15% If ordinary tax rate is 25%, 28%, 33%, 35% 20% If ordinary tax rate is 39. 6% 25% Un-recaptured Section 1250 gain 28% Collectables (held more than 1 year); Section 1202 QSBS gain 12

Capital Gains Taxes Net Investment Income Tax 3. 8% Additional Tax! Applies when MAGI is $250 K (MFJ), $200 K (S), $125 K (MFS) Capital Loss Deductible up to $3, 000 per year Additional is carried forward 13

Capital Gains Taxes Net Investment Income Tax 3. 8% Additional Tax! Applies when MAGI is $250 K (MFJ), $200 K (S), $125 K (MFS) Capital Loss Deductible up to $3, 000 per year Additional is carried forward 13

Form 8949 New form effective as of 2011 IRS matching program Separate pages for short term & long term Covered vs. Non Covered Can summarize and attach details Sale of personal residence Reportable or non reportable losses 14

Form 8949 New form effective as of 2011 IRS matching program Separate pages for short term & long term Covered vs. Non Covered Can summarize and attach details Sale of personal residence Reportable or non reportable losses 14

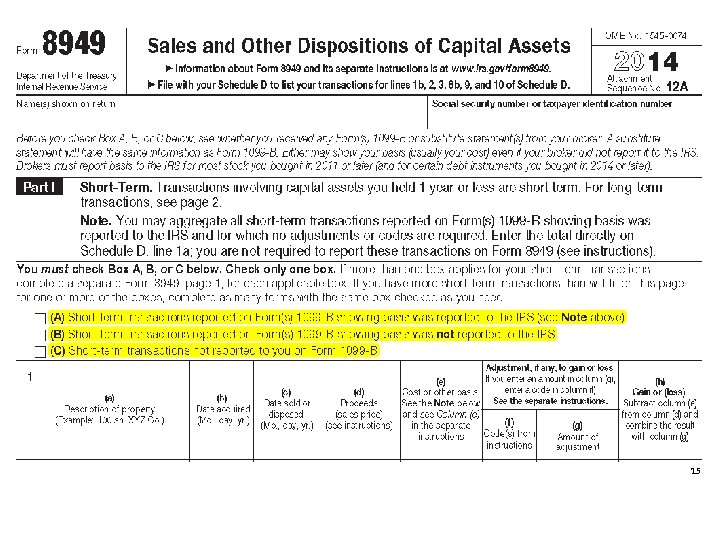

15

15

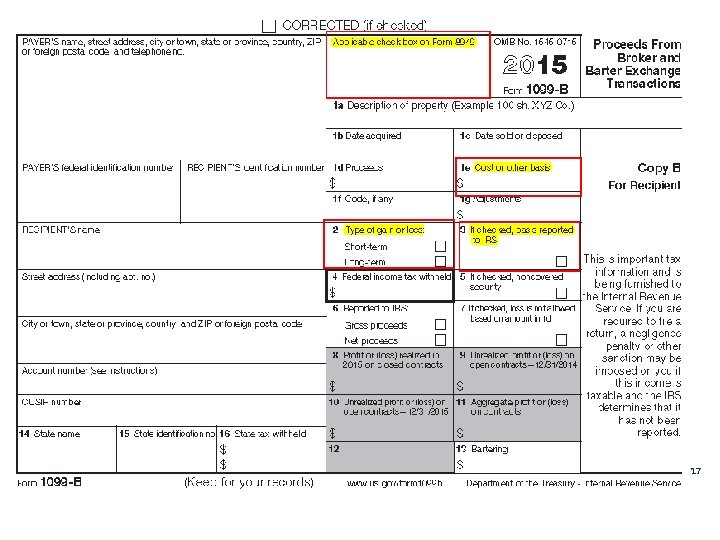

Form 1099 B How Do I Read It Basis issues Didn’t get it Correcting it Consolidated forms 16

Form 1099 B How Do I Read It Basis issues Didn’t get it Correcting it Consolidated forms 16

17

17

Adjustment Codes Correcting reporting errors How do I use them? When do I use them? Where do I put them? Will they cause IRS correspondence? Asking the right questions to get the right answers 18

Adjustment Codes Correcting reporting errors How do I use them? When do I use them? Where do I put them? Will they cause IRS correspondence? Asking the right questions to get the right answers 18

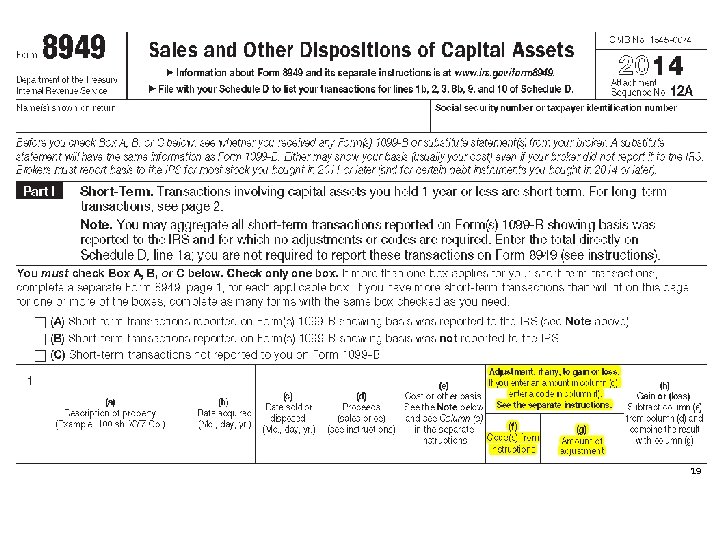

19

19

Basis Issues Getting it right when the form is wrong! Use adjustment codes Inherited property Basis is FMV at date of death Gifts Basis is lesser of FMV or donor’s basis Burden of proof…. WHO? * Preparers * Clients * Brokers 20

Basis Issues Getting it right when the form is wrong! Use adjustment codes Inherited property Basis is FMV at date of death Gifts Basis is lesser of FMV or donor’s basis Burden of proof…. WHO? * Preparers * Clients * Brokers 20

Who’s Doing the Return? Preparers beware Software input tax return output Check the result of your input Did it show up where expected Be diligent 21

Who’s Doing the Return? Preparers beware Software input tax return output Check the result of your input Did it show up where expected Be diligent 21

Practice Management Tip Ask yourself, have you Been Reasonable Been Prudent Been Ethical Asked the Right Questions 22

Practice Management Tip Ask yourself, have you Been Reasonable Been Prudent Been Ethical Asked the Right Questions 22

Upcoming Webinars and Presentations by Kathy Hettick & Gene Bell Catch us at the 2015 IRS Tax Forums National Harbor, Denver, Atlanta, San Diego & Orlando Check out all the great information and get the member discount; http: //www. nsacct. org/education-events/irs-tax-forums Be sure to check out our webinar schedule at; http: //webinars. nsacct. org/ 23

Upcoming Webinars and Presentations by Kathy Hettick & Gene Bell Catch us at the 2015 IRS Tax Forums National Harbor, Denver, Atlanta, San Diego & Orlando Check out all the great information and get the member discount; http: //www. nsacct. org/education-events/irs-tax-forums Be sure to check out our webinar schedule at; http: //webinars. nsacct. org/ 23

Thank you for participating in this webinar. Below is the link to the online survey and CPE quiz: http: //webinars. nsacct. org/postevent. php? id=15875 Use your password for this webinar that is in your email confirmation. You must complete this survey and the quiz or final exam (for the recorded version) to qualify to receive CPE credit. National Society of Accountants 1010 North Fairfax Street Alexandria, VA 22314 -1574 Phone: (800) 966 -6679 members@nsacct. org 24

Thank you for participating in this webinar. Below is the link to the online survey and CPE quiz: http: //webinars. nsacct. org/postevent. php? id=15875 Use your password for this webinar that is in your email confirmation. You must complete this survey and the quiz or final exam (for the recorded version) to qualify to receive CPE credit. National Society of Accountants 1010 North Fairfax Street Alexandria, VA 22314 -1574 Phone: (800) 966 -6679 members@nsacct. org 24