f0206f20b653de3303730d5eb83e33aa.ppt

- Количество слайдов: 43

Scenario-Based Strategic Planning: Renal Division Case Study Global Benchmarking Council August 10, 2000 Michelle Robinette-Das Baxter Healthcare

Overview Baxter's Renal Division with over $1. 5 billion in revenues, faced a number of strategic growth alternatives. Through scenario-based strategic planning, the senior management team evaluated alternatives and invested in a new growth trajectory. This presentation will provide a real-world example of the strengths and weaknesses of scenario-based strategic planning as a decision tool.

Outline I. Renal’s Strategic Position and Competitive Issues II. Strategic Plan Framework at Renal III. Process for Developing Strategic Profiles of Baxter’s Renal Business and Competitors/Simulation Model IV. Product Development and HD Business Unit Examples V. Benefits and Issues from Scenarios and Simulations

Renal Division Highlights Ø Worldwide leader with sales of greater than $1 billion Ø Global portfolio - 75% of sales outside U. S. Ø Technology innovator Ø Strong cash flow and EVA

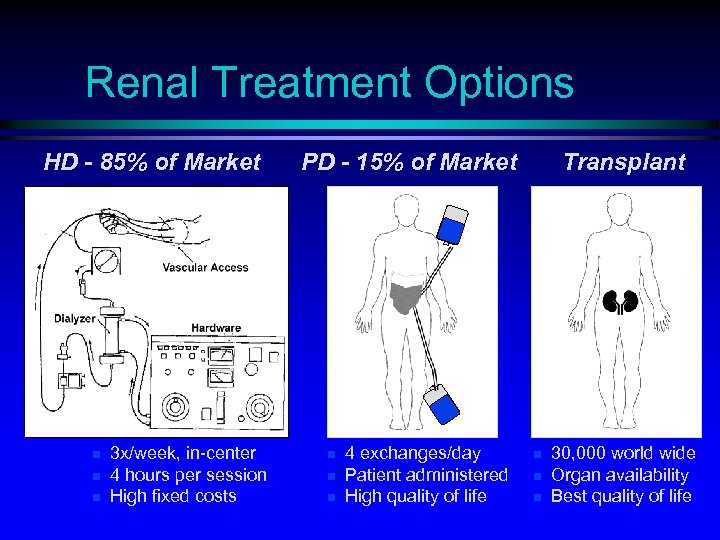

Renal Treatment Options HD - 85% of Market n n n 3 x/week, in-center 4 hours per session High fixed costs PD - 15% of Market n n n 4 exchanges/day Patient administered High quality of life Transplant n n n 30, 000 world wide Organ availability Best quality of life

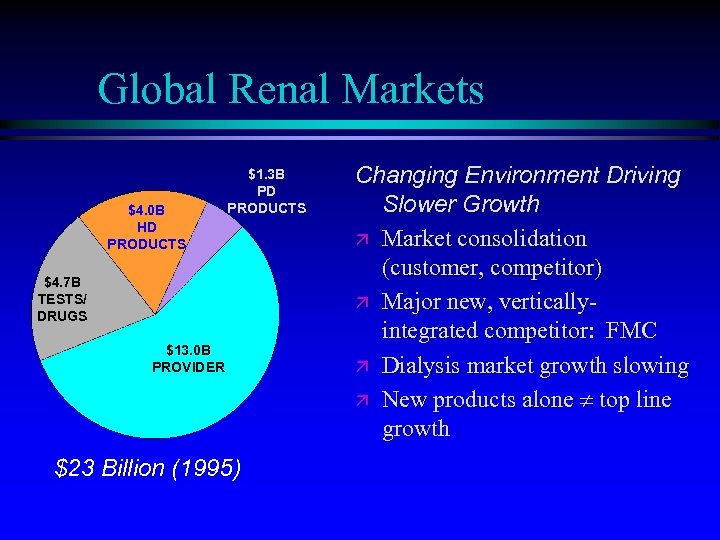

Global Renal Markets $4. 0 B HD PRODUCTS $1. 3 B PD PRODUCTS $4. 7 B TESTS/ DRUGS $13. 0 B PROVIDER $23 Billion (1995) Changing Environment Driving Slower Growth ä Market consolidation (customer, competitor) ä Major new, verticallyintegrated competitor: FMC ä Dialysis market growth slowing ä New products alone ¹ top line growth

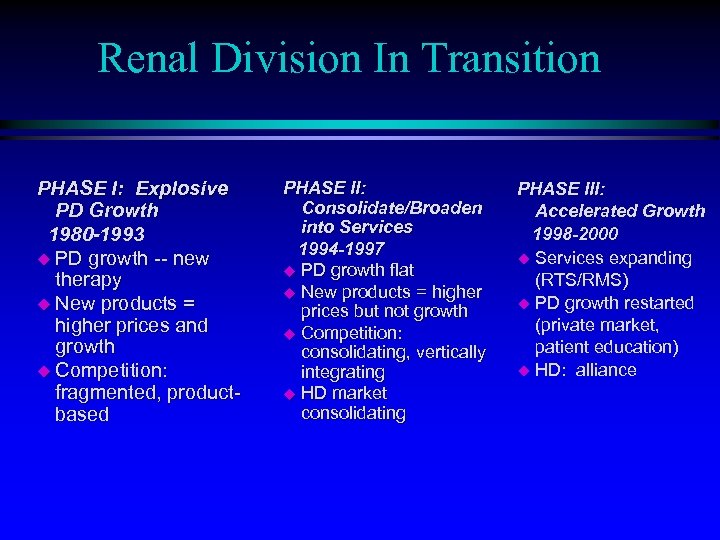

Renal Division In Transition PHASE I: Explosive PD Growth 1980 -1993 u PD growth -- new therapy u New products = higher prices and growth u Competition: fragmented, productbased PHASE II: Consolidate/Broaden into Services 1994 -1997 u PD growth flat u New products = higher prices but not growth u Competition: consolidating, vertically integrating u HD market consolidating PHASE III: Accelerated Growth 1998 -2000 u Services expanding (RTS/RMS) u PD growth restarted (private market, patient education) u HD: alliance

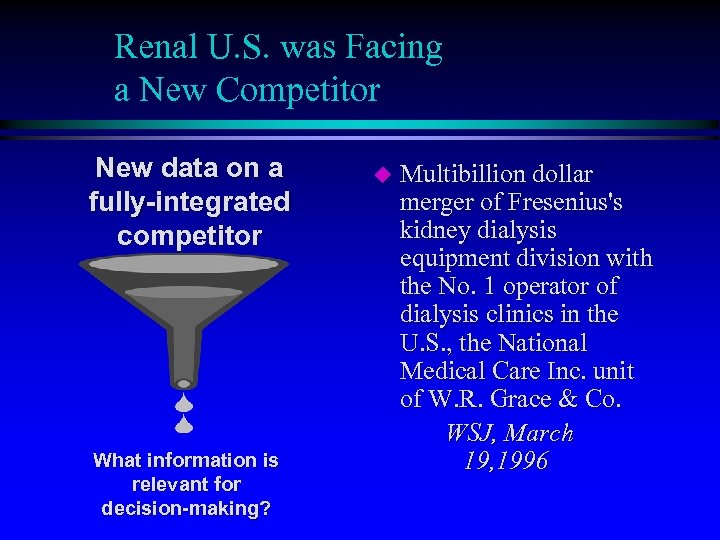

Renal U. S. was Facing a New Competitor New data on a fully-integrated competitor What information is relevant for decision-making? u Multibillion dollar merger of Fresenius's kidney dialysis equipment division with the No. 1 operator of dialysis clinics in the U. S. , the National Medical Care Inc. unit of W. R. Grace & Co. WSJ, March 19, 1996

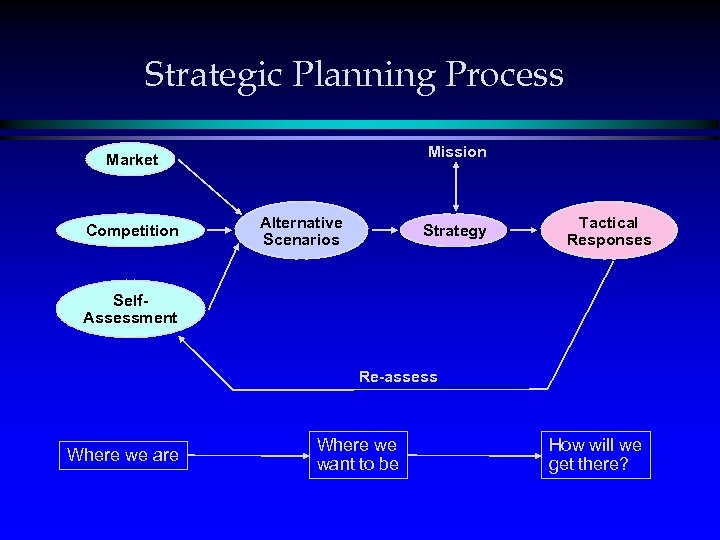

Strategic Planning Process Mission Market Competition Alternative Scenarios Strategy Tactical Responses Self. Assessment Re-assess Where we are Where we want to be How will we get there?

Pulling It All Together: Strategic Alternatives/Scenarios based upon: • historical trends • fundamental changes • other factors OPPORTUNITIES & THREATS • Market • Competition • Environmental Scenarios • Vision • Values • Policies Issues and Options Scenarios • Expectations/Risks • Aspirations • Gaps RESOURCES • Strengths • Weaknesses • Core Competencies

Game Theory u “Many people view games egocentrically -- that is, they focus on their own position. The primary insight of game theory is the importance of focusing on others - namely, allocentrism. u To look forward and reason backward, you have to put yourself in the shoes - even the heads -- of other players. ” Source: HBR, The Right Game, Use Game Theory to Shape Strategy; July/August 1995 -

What Information is Needed to Understand the Need for Strategy and Change? u u Most organizations have tons of data. Strategic Decisions require new types of data and help to “Question and challenge a company’s strategy” “What is important is not the tools. It is the concepts behind them. ” New capability …for rethinking strategy. . Peter Drucker, Managing in a Time of Great Change, 1995

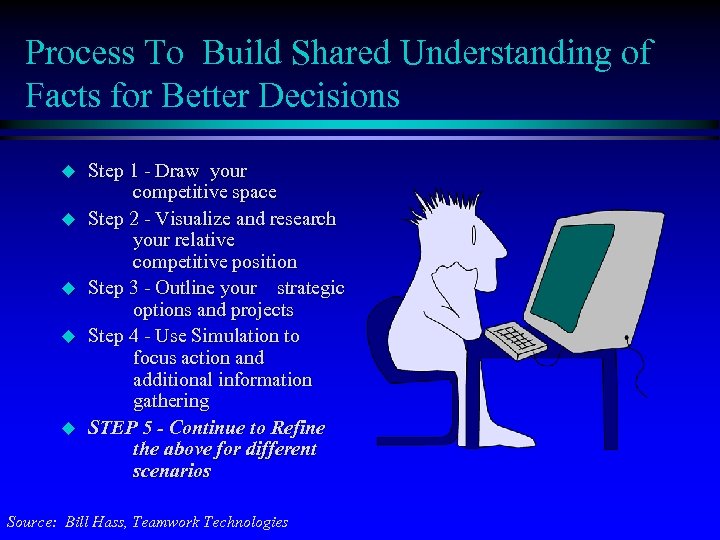

Process To Build Shared Understanding of Facts for Better Decisions u u u Step 1 - Draw your competitive space Step 2 - Visualize and research your relative competitive position Step 3 - Outline your strategic options and projects Step 4 - Use Simulation to focus action and additional information gathering STEP 5 - Continue to Refine the above for different scenarios Source: Bill Hass, Teamwork Technologies

Step 1 - Draw Your Competitive Space and Served Market Trends -- on a Blank Sheet u Estimate historic served market shares and trends u Describe current and potential competitor personalities and issues IMPORTANT!!! To Get Early Buy-In -- START WITH A BLANK SHEET-- Source: Bill Hass, Teamwork Technologies

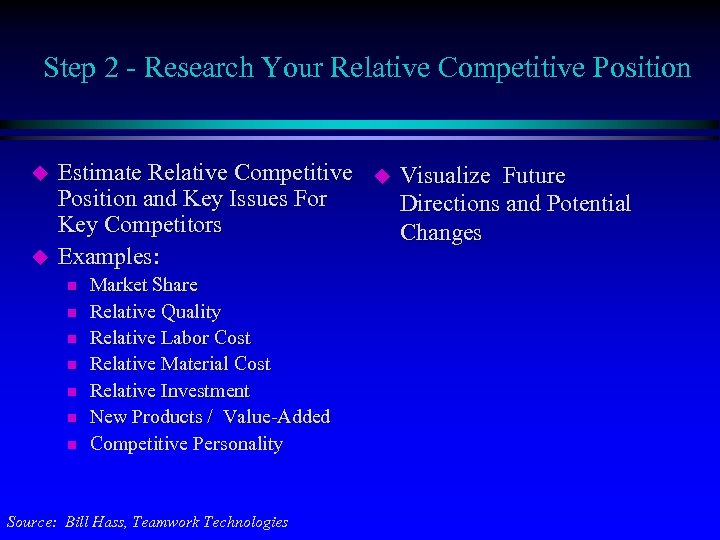

Step 2 - Research Your Relative Competitive Position u u Estimate Relative Competitive Position and Key Issues For Key Competitors Examples: n n n n Market Share Relative Quality Relative Labor Cost Relative Material Cost Relative Investment New Products / Value-Added Competitive Personality Source: Bill Hass, Teamwork Technologies u Visualize Future Directions and Potential Changes

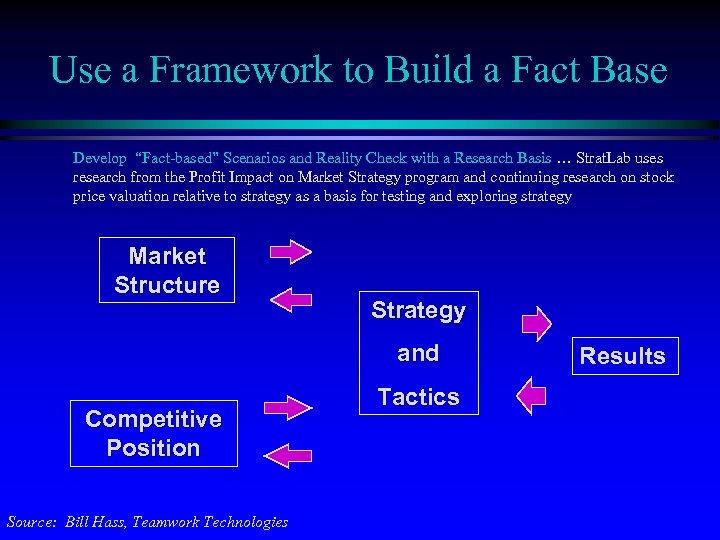

Use a Framework to Build a Fact Base Develop “Fact-based” Scenarios and Reality Check with a Research Basis … Strat. Lab uses research from the Profit Impact on Market Strategy program and continuing research on stock price valuation relative to strategy as a basis for testing and exploring strategy Market Structure Strategy and Competitive Position Source: Bill Hass, Teamwork Technologies Tactics Results

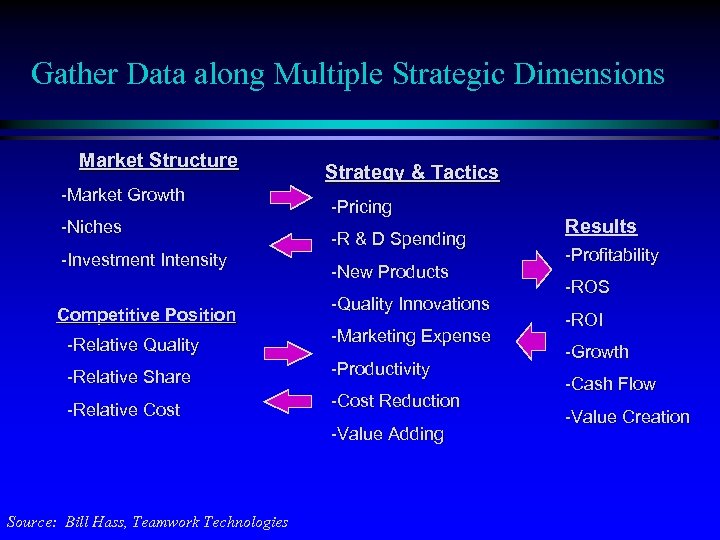

Gather Data along Multiple Strategic Dimensions Market Structure -Market Growth -Niches -Investment Intensity Competitive Position Strategy & Tactics -Pricing -R & D Spending -New Products -Quality Innovations -Relative Quality -Marketing Expense -Relative Share -Productivity -Relative Cost -Cost Reduction -Value Adding Source: Bill Hass, Teamwork Technologies Results -Profitability -ROS -ROI -Growth -Cash Flow -Value Creation

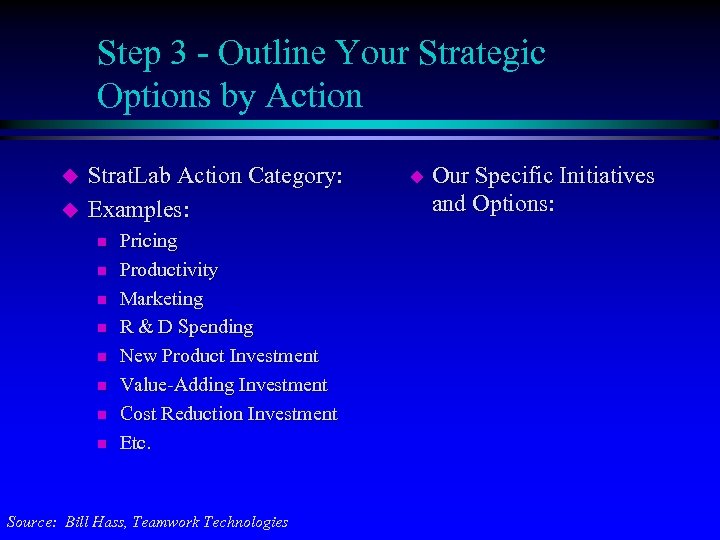

Step 3 - Outline Your Strategic Options by Action u u Strat. Lab Action Category: Examples: n n n n Pricing Productivity Marketing R & D Spending New Product Investment Value-Adding Investment Cost Reduction Investment Etc. Source: Bill Hass, Teamwork Technologies u Our Specific Initiatives and Options:

Step 4 - Use Simulation to Aid Decision Making, Action & New Data Gathering Efforts Let’s try another u Take Action and Gather Information on Areas with Greatest Strategic Impact for Your Competitive Position You don’t learn to throw darts in a seminar Source: Bill Hass, Teamwork Technologies

Define Objectives, Themes and Challenges u Basic Objectives: n n u Theme Possibilities: n n u Develop Common Language for Strategic Discussions/Thinking Develop Leader’s Business Model War Business Development Activities Test New Directions Strategic Leadership Training Challenge Possibilities: n n n Achieve Global Leadership Survival Increase Business Value Source: Bill Hass, Teamwork Technologies

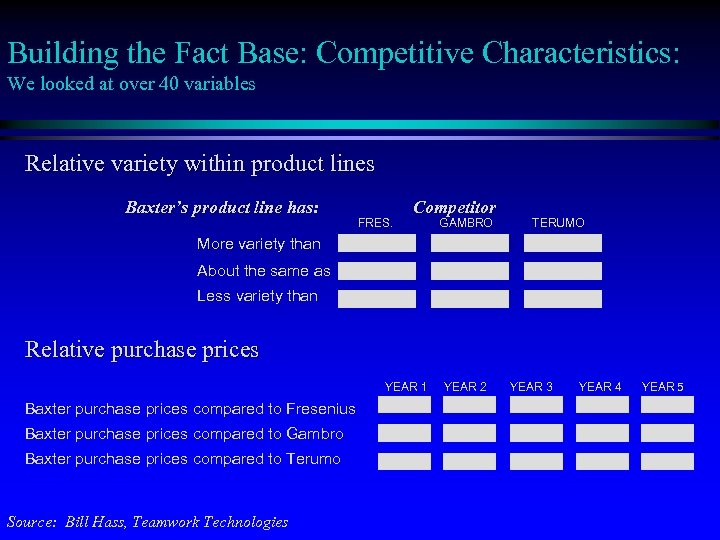

Building the Fact Base: Competitive Characteristics: We looked at over 40 variables Relative variety within product lines Baxter’s product line has: FRES. Competitor GAMBRO TERUMO More variety than About the same as Less variety than Relative purchase prices YEAR 1 Baxter purchase prices compared to Fresenius Baxter purchase prices compared to Gambro Baxter purchase prices compared to Terumo Source: Bill Hass, Teamwork Technologies YEAR 2 YEAR 3 YEAR 4 YEAR 5

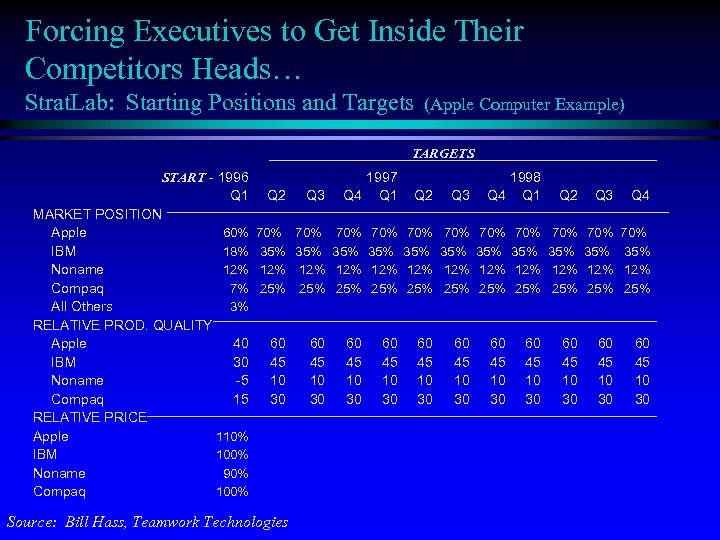

Forcing Executives to Get Inside Their Competitors Heads… Strat. Lab: Starting Positions and Targets (Apple Computer Example) TARGETS START - 1996 Q 1 MARKET POSITION Apple 60% IBM 18% Noname 12% Compaq 7% All Others 3% RELATIVE PROD. QUALITY Apple 40 IBM 30 Noname -5 Compaq 15 RELATIVE PRICE Apple 110% IBM 100% Noname 90% Compaq 100% Q 2 Q 3 1997 Q 4 Q 1 70% 70% 35% 35% 12% 12% 25% 25% 60 45 10 30 Source: Bill Hass, Teamwork Technologies 60 45 10 30 1998 Q 4 Q 1 Q 2 Q 3 70% 35% 12% 25% 60 45 10 30 Q 2 Q 3 Q 4 70% 35% 12% 25% 60 45 10 30

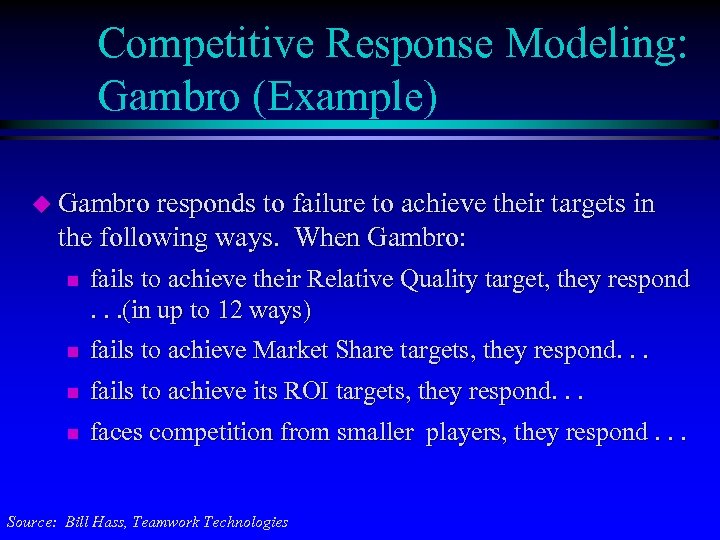

Competitive Response Modeling: Gambro (Example) u Gambro responds to failure to achieve their targets in the following ways. When Gambro: n fails to achieve their Relative Quality target, they respond. . . (in up to 12 ways) n fails to achieve Market Share targets, they respond. . . n fails to achieve its ROI targets, they respond. . . n faces competition from smaller players, they respond. . . Source: Bill Hass, Teamwork Technologies

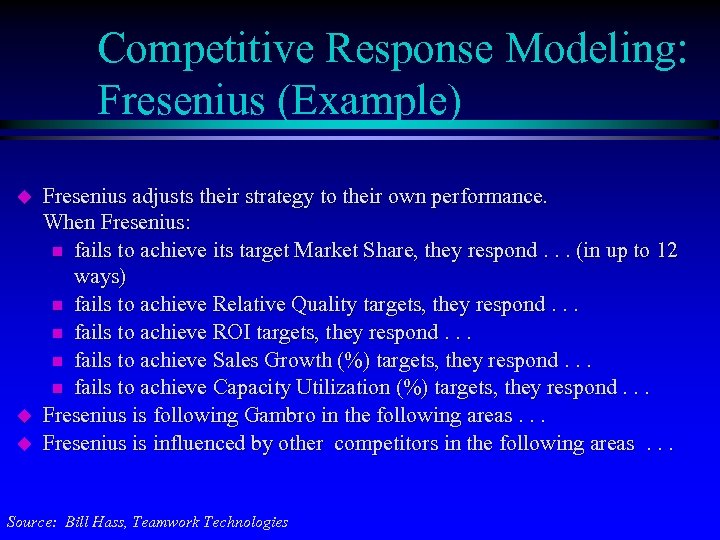

Competitive Response Modeling: Fresenius (Example) u u u Fresenius adjusts their strategy to their own performance. When Fresenius: n fails to achieve its target Market Share, they respond. . . (in up to 12 ways) n fails to achieve Relative Quality targets, they respond. . . n fails to achieve ROI targets, they respond. . . n fails to achieve Sales Growth (%) targets, they respond. . . n fails to achieve Capacity Utilization (%) targets, they respond. . . Fresenius is following Gambro in the following areas. . . Fresenius is influenced by other competitors in the following areas. . . Source: Bill Hass, Teamwork Technologies

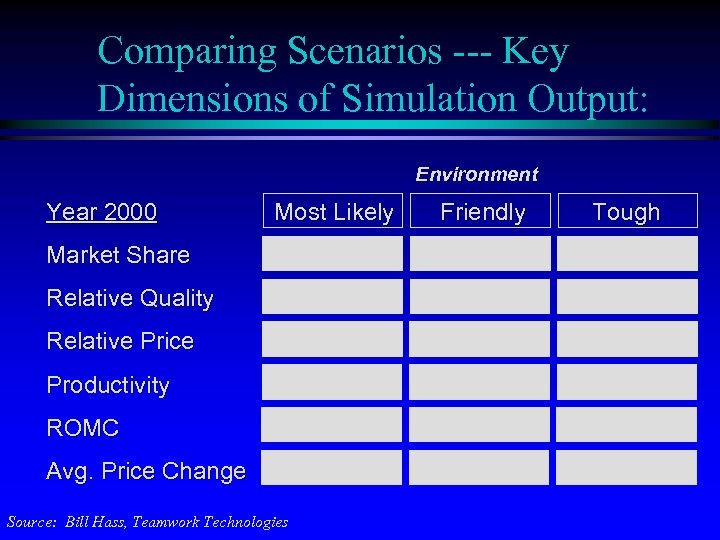

Comparing Scenarios --- Key Dimensions of Simulation Output: Environment Year 2000 Most Likely Market Share Relative Quality Relative Price Productivity ROMC Avg. Price Change Source: Bill Hass, Teamwork Technologies Friendly Tough

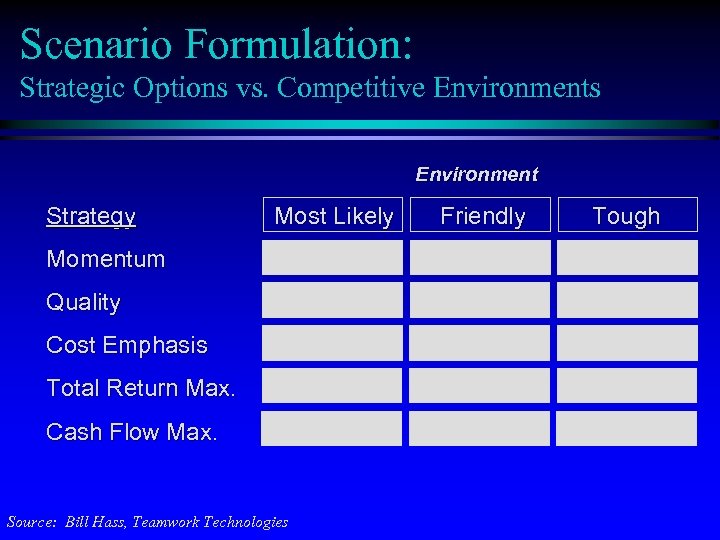

Scenario Formulation: Strategic Options vs. Competitive Environments Environment Strategy Most Likely Momentum Quality Cost Emphasis Total Return Max. Cash Flow Max. Source: Bill Hass, Teamwork Technologies Friendly Tough

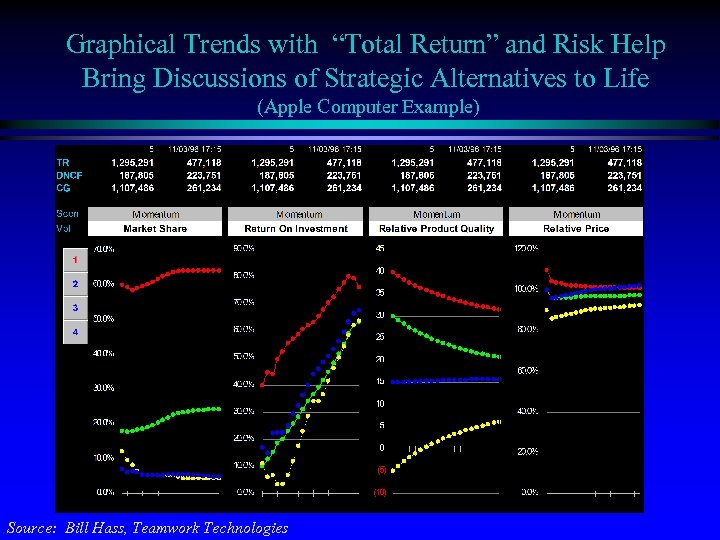

Graphical Trends with “Total Return” and Risk Help Bring Discussions of Strategic Alternatives to Life (Apple Computer Example) Source: Bill Hass, Teamwork Technologies

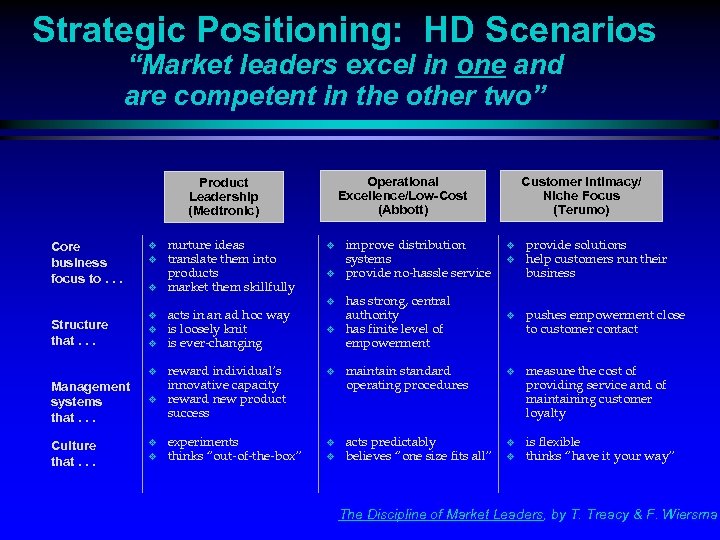

Strategic Positioning: HD Scenarios “Market leaders excel in one and are competent in the other two” Operational Excellence/Low-Cost (Abbott) Product Leadership (Medtronic) Structure that. . . v nurture ideas translate them into products market them skillfully v v v acts in an ad hoc way is loosely knit is ever-changing v Core business focus to. . . reward individual’s innovative capacity reward new product success v maintain standard operating procedures v measure the cost of providing service and of maintaining customer loyalty experiments thinks “out-of-the-box” v v acts predictably believes “one size fits all” v v is flexible thinks “have it your way” v v Management systems that. . . v Culture that. . . v v v improve distribution systems provide no-hassle service Customer Intimacy/ Niche Focus (Terumo) has strong, central authority has finite level of empowerment v v provide solutions help customers run their business v pushes empowerment close to customer contact The Discipline of Market Leaders, by T. Treacy & F. Wiersma

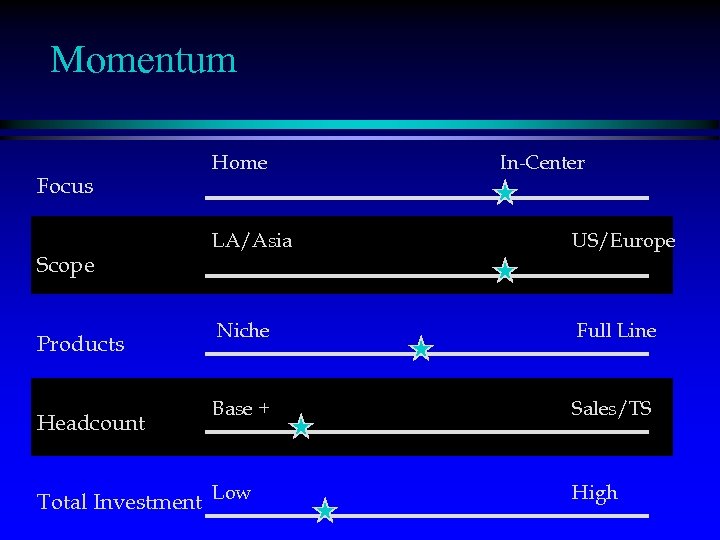

Momentum Focus Scope Products Headcount Home In-Center LA/Asia US/Europe Niche Full Line Base + Sales/TS Total Investment Low High

Base Plus Focus Scope Products Headcount Home HD In-Center LA/Asia US/Europe Niche Full Line Base + Sales/TS Total Investment Low High

Full Throttle Focus Scope Products Headcount Home HD In-Center LA/Asia US/Europe Niche Full Line Base + Sales/TS Total Investment Low High

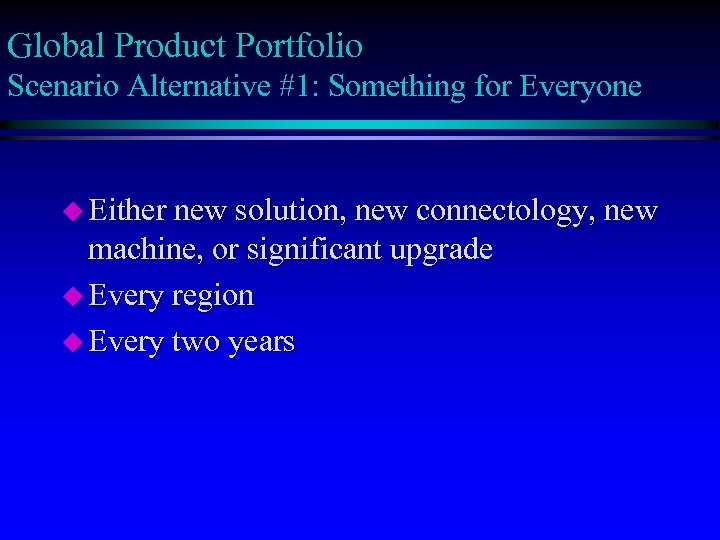

Global Product Portfolio Scenario Alternative #1: Something for Everyone u Either new solution, new connectology, new machine, or significant upgrade u Every region u Every two years

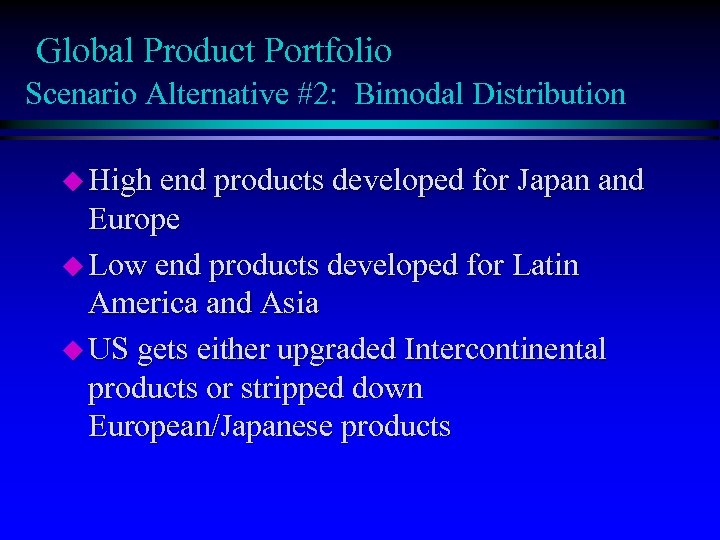

Global Product Portfolio Scenario Alternative #2: Bimodal Distribution u High end products developed for Japan and Europe u Low end products developed for Latin America and Asia u US gets either upgraded Intercontinental products or stripped down European/Japanese products

Global Product Portfolio Scenario Alternative #3: Solutions R US u Absolute solution leadership in both PD and HD u Machines and connectology are secondary

Global Product Portfolio Scenario Alternative #4: Home Run, Singles, Doubles u One Breakthrough product and u One new product or upgrade for every region, every three years

Global Product Portfolio Scenario Alternative #5: Therapy Leadership u Fund only products that support the goals of: improving adequacy n decreasing peritonitis n

Lessons Learned From Scenario Simulation u Balancing executive insight and empirical experience in a bayesian way promotes discipline u Creative thinking and teamwork is fostered by promoting discussion and trial-and-error, with fast feedback u “System overview” of the competitive situation and their words helps deal with the complexity u Both quantitative and qualitative data must be built in for realism u IT TAKES TIME

Simulation Helps Building Realistic Scenarios Using Competitor Data: u Helps understand complex and unfamiliar situations u Helps identify what you really need to know about a particular competitor by letting you discover what aspects make a significant difference u Measures the impact of what you have learned about a competitor u Helps explore widely different scenarios u Helps you to find a counterstrategy

Issues with Scenario Planning u Senior Level Focus/Culture u Time to Really Work Through Alternatives u Translating Back to P&L, Budgets

Scenarios Promote Decision Making u u u Permits learning by trial and error Encourages input from all functions Permits evaluation of strategic moves in a low-risk environment Encourages innovation by forcing the team to consider out-of-the-box moves Provides an ongoing framework for organizing strategic thoughts and competitive intelligence Forces thinking in a higher-level strategic language

Summary u Scenario planning is a great tool u Need to involve senior management u Must balance complexity/computer simulation team involvement with “business knowledge” of senior management

Questions and Answers

Appendix Additional References: http: //members. aol. com/theteamtec PIMS Principles, Buzzell and Gale(1987 Free Press) Intellectual Capital, Edvinsson and Malone(1997, Harper. Collins) Learning from the Future, Competitive Foresight Scenarios, Liam Fahey

f0206f20b653de3303730d5eb83e33aa.ppt