dcf66e7df8a04e5369027f4b9b74c201.ppt

- Количество слайдов: 32

Savings, Investment Spending, and the Financial System

Savings, Investment Spending, and the Financial System

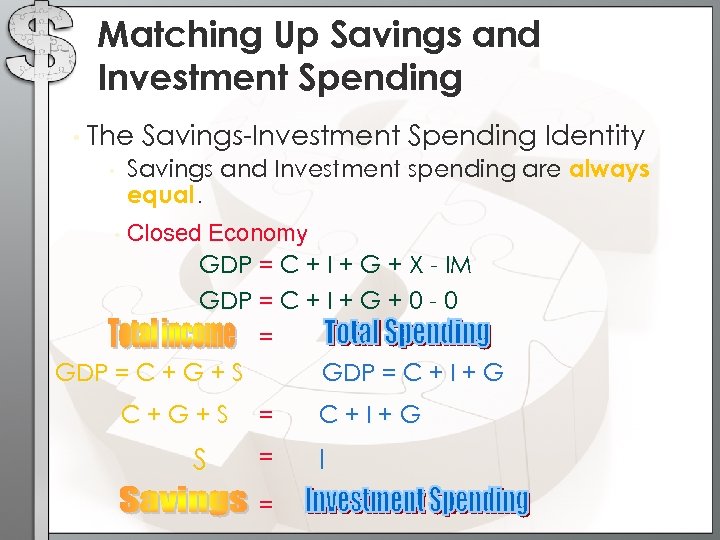

Matching Up Savings and Investment Spending • The Savings-Investment Spending Identity • Savings and Investment spending are always equal. • Closed Economy GDP = C + I + G + X - IM GDP = C + I + G + 0 - 0 = GDP = C + G + S GDP = C + I + G C+G+S S = C+I+G = I =

Matching Up Savings and Investment Spending • The Savings-Investment Spending Identity • Savings and Investment spending are always equal. • Closed Economy GDP = C + I + G + X - IM GDP = C + I + G + 0 - 0 = GDP = C + G + S GDP = C + I + G C+G+S S = C+I+G = I =

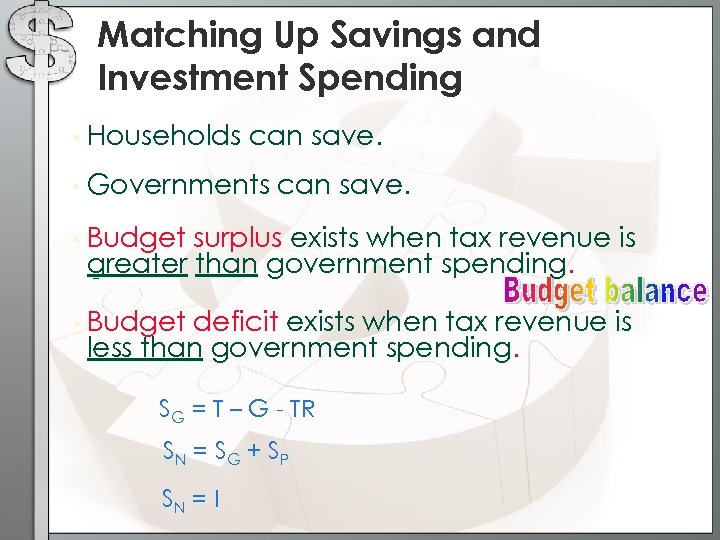

Matching Up Savings and Investment Spending • Households can save. • Governments can save. • Budget surplus exists when tax revenue is greater than government spending. • Budget deficit exists when tax revenue is less than government spending. SG = T – G - TR SN = S G + S P SN = I

Matching Up Savings and Investment Spending • Households can save. • Governments can save. • Budget surplus exists when tax revenue is greater than government spending. • Budget deficit exists when tax revenue is less than government spending. SG = T – G - TR SN = S G + S P SN = I

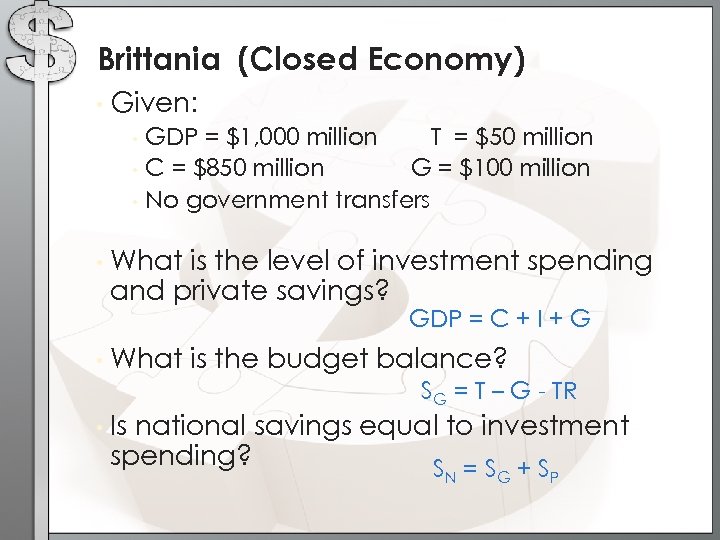

Brittania (Closed Economy) • Given: • • GDP = $1, 000 million T = $50 million C = $850 million G = $100 million No government transfers What is the level of investment spending and private savings? GDP = C + I + G • What is the budget balance? SG = T – G - TR • Is national savings equal to investment spending? S =S +S N G P

Brittania (Closed Economy) • Given: • • GDP = $1, 000 million T = $50 million C = $850 million G = $100 million No government transfers What is the level of investment spending and private savings? GDP = C + I + G • What is the budget balance? SG = T – G - TR • Is national savings equal to investment spending? S =S +S N G P

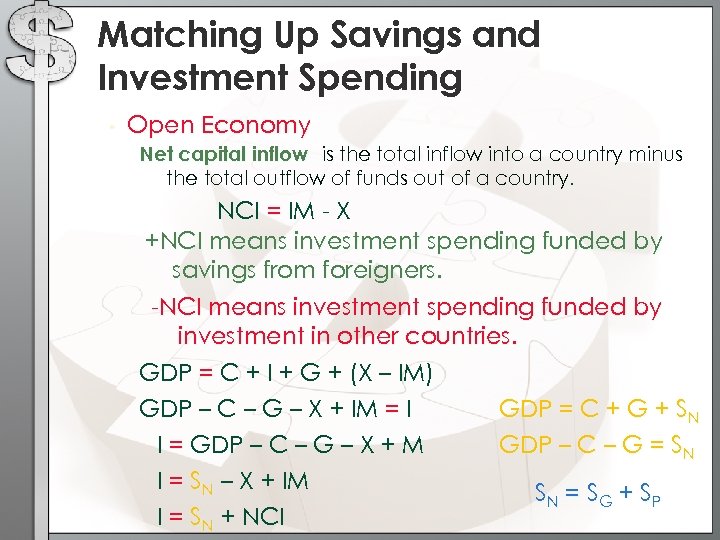

Matching Up Savings and Investment Spending • Open Economy Net capital inflow is the total inflow into a country minus the total outflow of funds out of a country. NCI = IM - X +NCI means investment spending funded by savings from foreigners. -NCI means investment spending funded by investment in other countries. GDP = C + I + G + (X – IM) GDP – C – G – X + IM = I I = GDP – C – G – X + M I = SN – X + IM I = SN + NCI GDP = C + G + SN GDP – C – G = SN SN = S G + S P

Matching Up Savings and Investment Spending • Open Economy Net capital inflow is the total inflow into a country minus the total outflow of funds out of a country. NCI = IM - X +NCI means investment spending funded by savings from foreigners. -NCI means investment spending funded by investment in other countries. GDP = C + I + G + (X – IM) GDP – C – G – X + IM = I I = GDP – C – G – X + M I = SN – X + IM I = SN + NCI GDP = C + G + SN GDP – C – G = SN SN = S G + S P

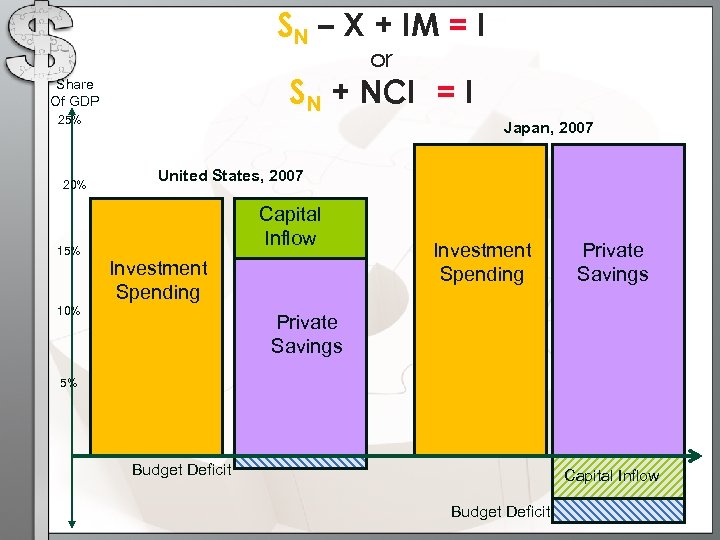

SN – X + IM = I or SN + NCI = I Share Of GDP 25% 20% 15% Japan, 2007 United States, 2007 Capital Inflow Investment Spending 10% Investment Spending Private Savings 5% Budget Deficit Capital Inflow Budget Deficit

SN – X + IM = I or SN + NCI = I Share Of GDP 25% 20% 15% Japan, 2007 United States, 2007 Capital Inflow Investment Spending 10% Investment Spending Private Savings 5% Budget Deficit Capital Inflow Budget Deficit

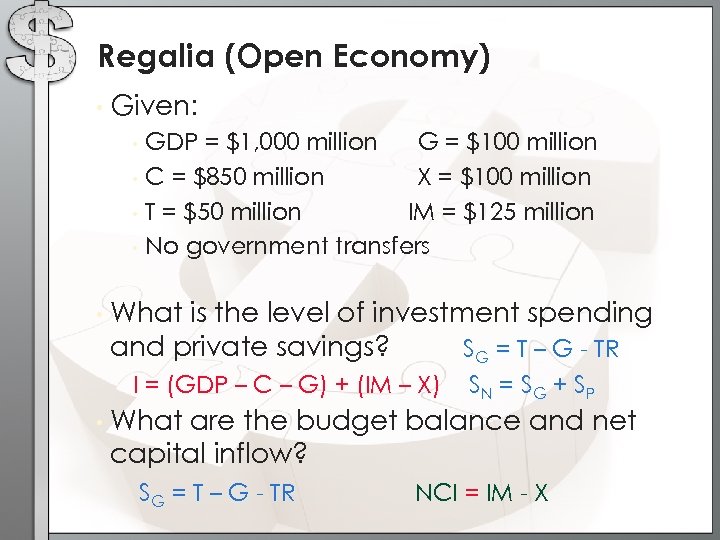

Regalia (Open Economy) • Given: • • • GDP = $1, 000 million G = $100 million C = $850 million X = $100 million T = $50 million IM = $125 million No government transfers What is the level of investment spending and private savings? SG = T – G - TR I = (GDP – C – G) + (IM – X) • SN = S G + S P What are the budget balance and net capital inflow? SG = T – G - TR NCI = IM - X

Regalia (Open Economy) • Given: • • • GDP = $1, 000 million G = $100 million C = $850 million X = $100 million T = $50 million IM = $125 million No government transfers What is the level of investment spending and private savings? SG = T – G - TR I = (GDP – C – G) + (IM – X) • SN = S G + S P What are the budget balance and net capital inflow? SG = T – G - TR NCI = IM - X

Capsland • • Investment spending as percentage of GDP = 20% Private savings as a percentage of GDP = 10% Net capital inflow as a percentage of GDP = 5% What is the budget balance as a percentage of GDP?

Capsland • • Investment spending as percentage of GDP = 20% Private savings as a percentage of GDP = 10% Net capital inflow as a percentage of GDP = 5% What is the budget balance as a percentage of GDP?

Practice: Marsalia • • Investment spending as percentage of GDP = 20% Private savings as a percentage of GDP = 25% Net capital inflow as a percentage of GDP = -2% What is the budget balance as a percentage of GDP?

Practice: Marsalia • • Investment spending as percentage of GDP = 20% Private savings as a percentage of GDP = 25% Net capital inflow as a percentage of GDP = -2% What is the budget balance as a percentage of GDP?

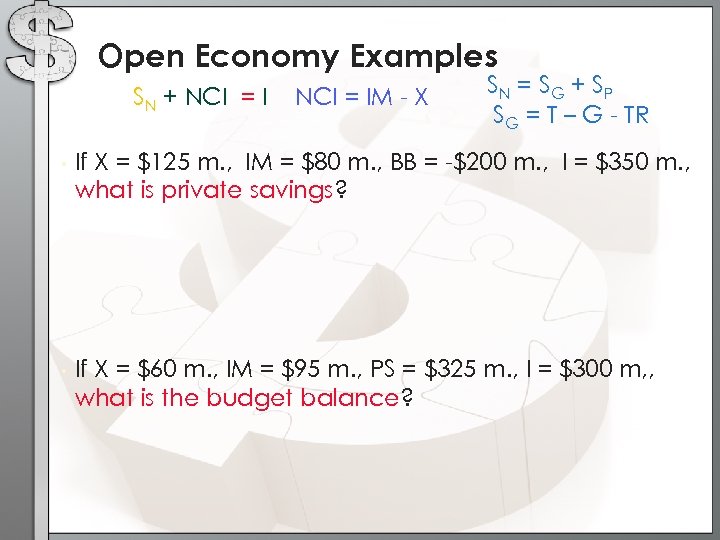

Open Economy Examples SN + NCI = IM - X SN = S G + S P SG = T – G - TR • If X = $125 m. , IM = $80 m. , BB = -$200 m. , I = $350 m. , what is private savings? • If X = $60 m. , IM = $95 m. , PS = $325 m. , I = $300 m, , what is the budget balance?

Open Economy Examples SN + NCI = IM - X SN = S G + S P SG = T – G - TR • If X = $125 m. , IM = $80 m. , BB = -$200 m. , I = $350 m. , what is private savings? • If X = $60 m. , IM = $95 m. , PS = $325 m. , I = $300 m, , what is the budget balance?

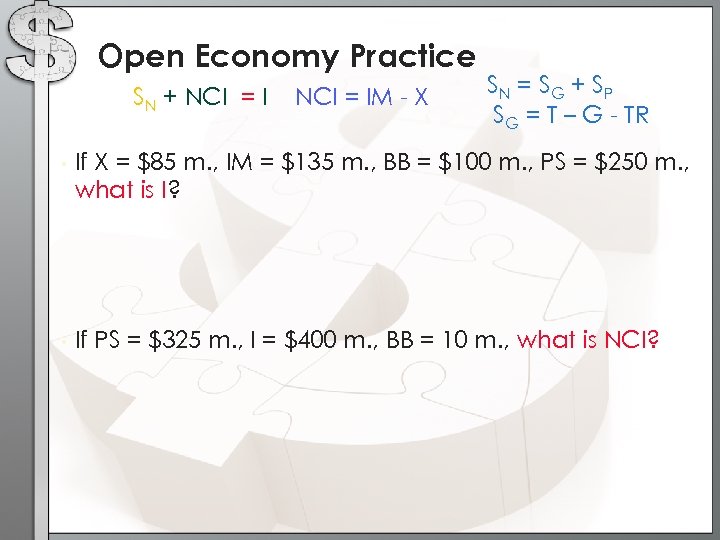

Open Economy Practice SN + NCI = IM - X SN = S G + S P SG = T – G - TR • If X = $85 m. , IM = $135 m. , BB = $100 m. , PS = $250 m. , what is I? • If PS = $325 m. , I = $400 m. , BB = 10 m. , what is NCI?

Open Economy Practice SN + NCI = IM - X SN = S G + S P SG = T – G - TR • If X = $85 m. , IM = $135 m. , BB = $100 m. , PS = $250 m. , what is I? • If PS = $325 m. , I = $400 m. , BB = 10 m. , what is NCI?

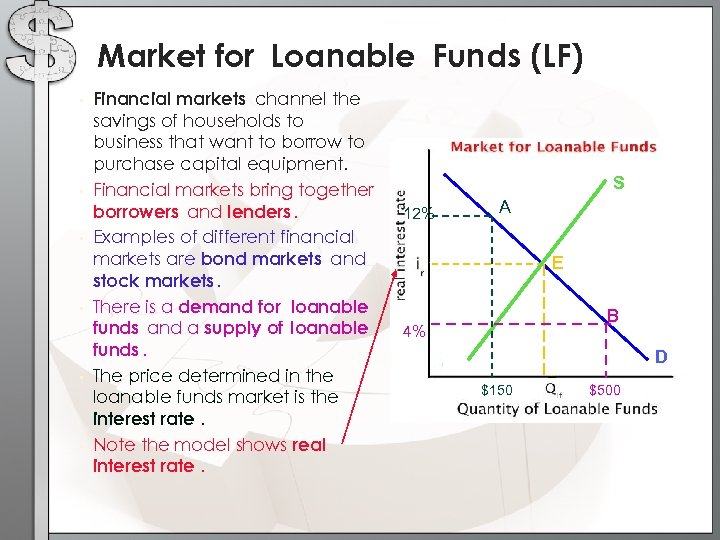

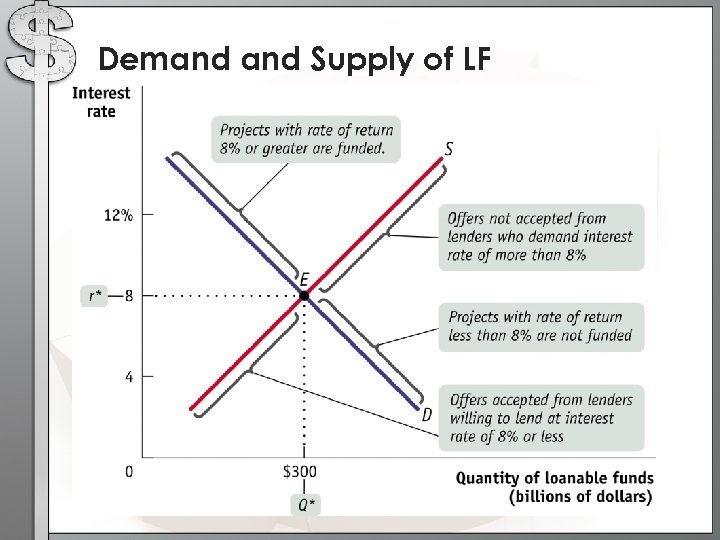

Market for Loanable Funds (LF) • • • Financial markets channel the savings of households to business that want to borrow to purchase capital equipment. Financial markets bring together borrowers and lenders. Examples of different financial markets are bond markets and stock markets. There is a demand for loanable funds and a supply of loanable funds. The price determined in the loanable funds market is the interest rate. Note the model shows real interest rate. S 12% A E B 4% D $150 $500

Market for Loanable Funds (LF) • • • Financial markets channel the savings of households to business that want to borrow to purchase capital equipment. Financial markets bring together borrowers and lenders. Examples of different financial markets are bond markets and stock markets. There is a demand for loanable funds and a supply of loanable funds. The price determined in the loanable funds market is the interest rate. Note the model shows real interest rate. S 12% A E B 4% D $150 $500

Shifts of the Demand for LF • Changes • • in Business Expectations Optimism leads to increased demand of LF. Pessimism leads to declining demand of LF. • Changes in Government Borrowing • • Increased government borrowing leads to increased demand of LF. • Decreased government borrowing leads to declining demand of LF.

Shifts of the Demand for LF • Changes • • in Business Expectations Optimism leads to increased demand of LF. Pessimism leads to declining demand of LF. • Changes in Government Borrowing • • Increased government borrowing leads to increased demand of LF. • Decreased government borrowing leads to declining demand of LF.

Demand Supply of LF

Demand Supply of LF

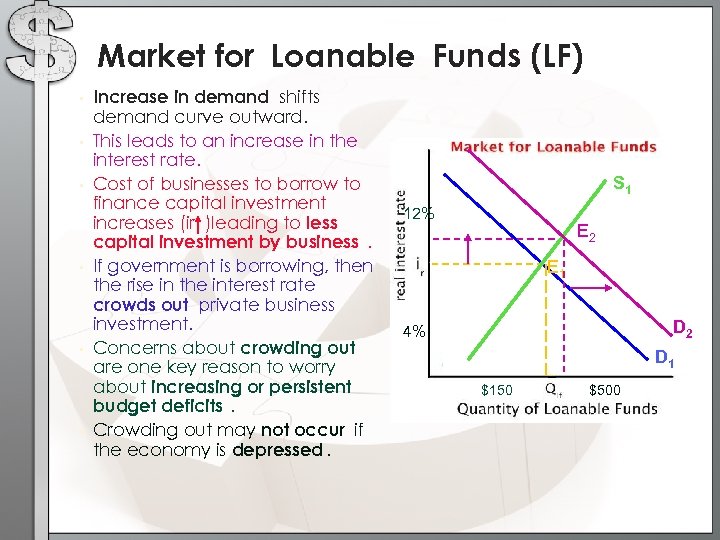

Market for Loanable Funds (LF) • • • Increase in demand shifts demand curve outward. This leads to an increase in the interest rate. Cost of businesses to borrow to finance capital investment increases (ir )leading to less capital investment by business. If government is borrowing, then the rise in the interest rate crowds out private business investment. Concerns about crowding out are one key reason to worry about increasing or persistent budget deficits. Crowding out may not occur if the economy is depressed. S 1 12% E 2 E 1 D 2 4% D 1 $150 $500

Market for Loanable Funds (LF) • • • Increase in demand shifts demand curve outward. This leads to an increase in the interest rate. Cost of businesses to borrow to finance capital investment increases (ir )leading to less capital investment by business. If government is borrowing, then the rise in the interest rate crowds out private business investment. Concerns about crowding out are one key reason to worry about increasing or persistent budget deficits. Crowding out may not occur if the economy is depressed. S 1 12% E 2 E 1 D 2 4% D 1 $150 $500

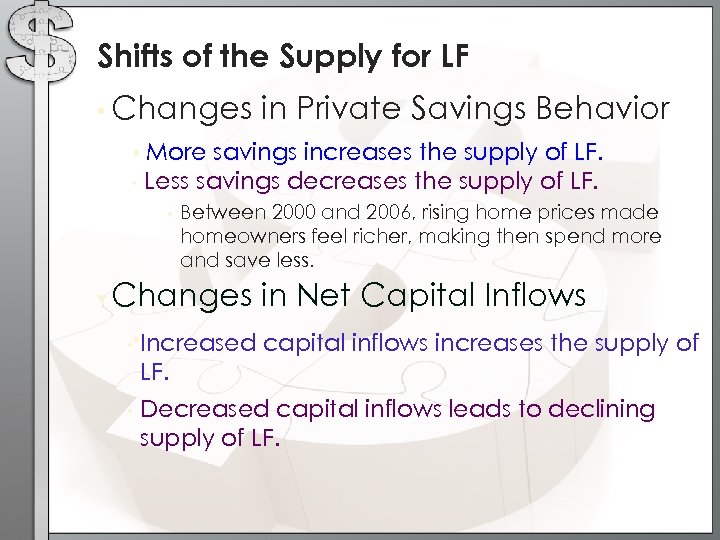

Shifts of the Supply for LF • Changes • • in Private Savings Behavior More savings increases the supply of LF. Less savings decreases the supply of LF. • Between 2000 and 2006, rising home prices made homeowners feel richer, making then spend more and save less. • Changes • • Increased in Net Capital Inflows capital inflows increases the supply of LF. • Decreased capital inflows leads to declining supply of LF.

Shifts of the Supply for LF • Changes • • in Private Savings Behavior More savings increases the supply of LF. Less savings decreases the supply of LF. • Between 2000 and 2006, rising home prices made homeowners feel richer, making then spend more and save less. • Changes • • Increased in Net Capital Inflows capital inflows increases the supply of LF. • Decreased capital inflows leads to declining supply of LF.

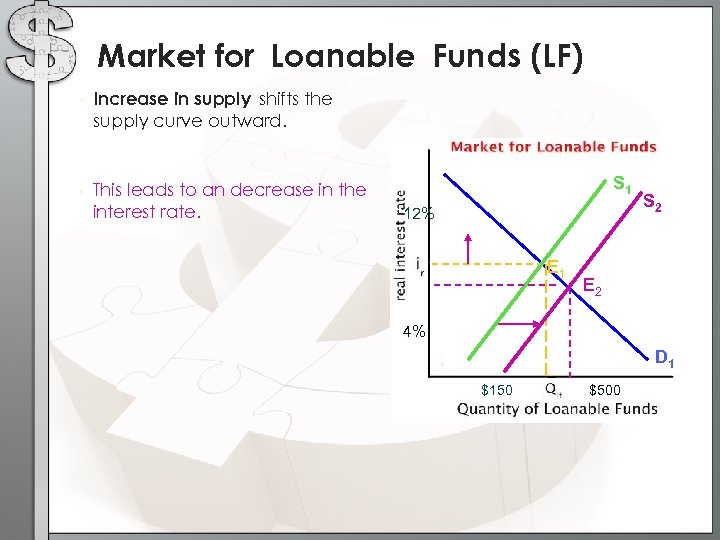

Market for Loanable Funds (LF) • Increase in supply shifts the supply curve outward. • This leads to an decrease in the interest rate. S 1 12% E 1 S 2 E 2 4% D 1 $150 $500

Market for Loanable Funds (LF) • Increase in supply shifts the supply curve outward. • This leads to an decrease in the interest rate. S 1 12% E 1 S 2 E 2 4% D 1 $150 $500

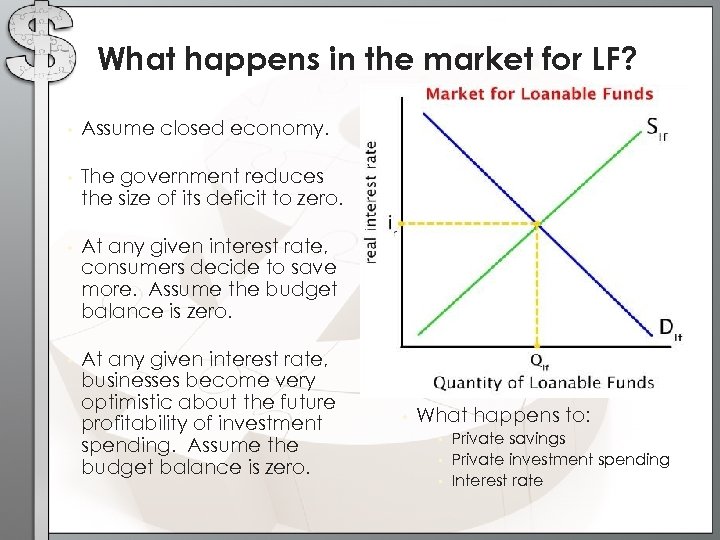

What happens in the market for LF? • • Assume closed economy. • The government reduces the size of its deficit to zero. • At any given interest rate, consumers decide to save more. Assume the budget balance is zero. • At any given interest rate, businesses become very optimistic about the future profitability of investment spending. Assume the budget balance is zero. • What happens to: • • • Private savings Private investment spending Interest rate

What happens in the market for LF? • • Assume closed economy. • The government reduces the size of its deficit to zero. • At any given interest rate, consumers decide to save more. Assume the budget balance is zero. • At any given interest rate, businesses become very optimistic about the future profitability of investment spending. Assume the budget balance is zero. • What happens to: • • • Private savings Private investment spending Interest rate

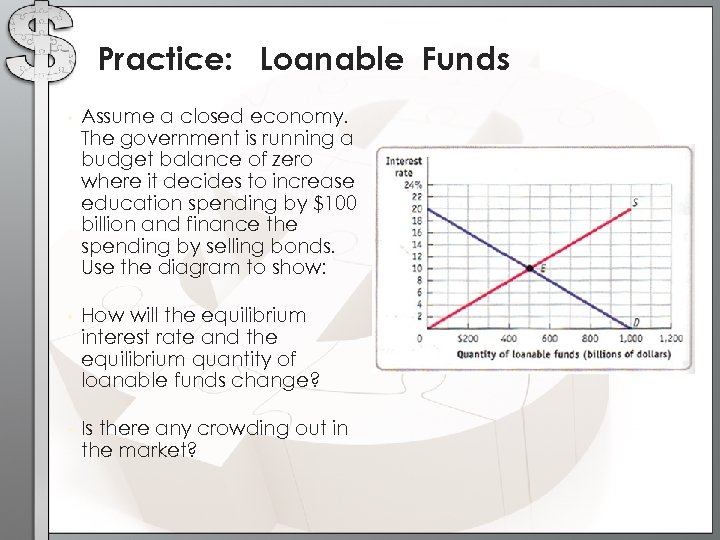

Practice: Loanable Funds • Assume a closed economy. The government is running a budget balance of zero where it decides to increase education spending by $100 billion and finance the spending by selling bonds. Use the diagram to show: • How will the equilibrium interest rate and the equilibrium quantity of loanable funds change? • Is there any crowding out in the market?

Practice: Loanable Funds • Assume a closed economy. The government is running a budget balance of zero where it decides to increase education spending by $100 billion and finance the spending by selling bonds. Use the diagram to show: • How will the equilibrium interest rate and the equilibrium quantity of loanable funds change? • Is there any crowding out in the market?

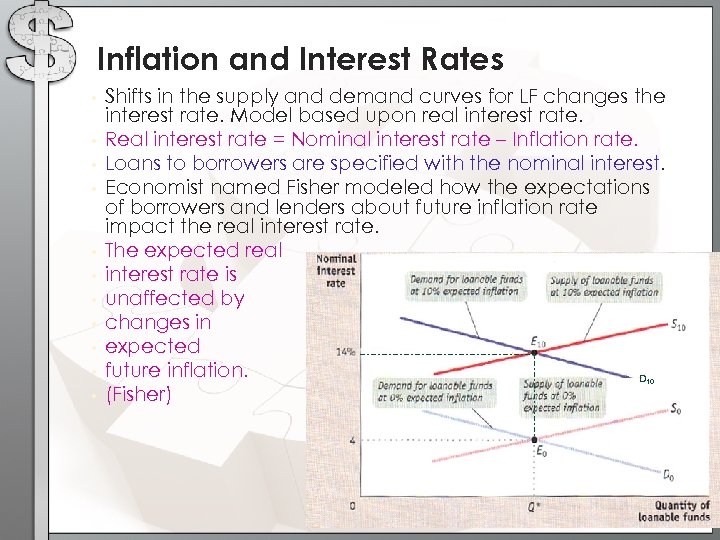

Inflation and Interest Rates • • • Shifts in the supply and demand curves for LF changes the interest rate. Model based upon real interest rate. Real interest rate = Nominal interest rate – Inflation rate. Loans to borrowers are specified with the nominal interest. Economist named Fisher modeled how the expectations of borrowers and lenders about future inflation rate impact the real interest rate. The expected real interest rate is unaffected by changes in expected future inflation. D (Fisher) 10

Inflation and Interest Rates • • • Shifts in the supply and demand curves for LF changes the interest rate. Model based upon real interest rate. Real interest rate = Nominal interest rate – Inflation rate. Loans to borrowers are specified with the nominal interest. Economist named Fisher modeled how the expectations of borrowers and lenders about future inflation rate impact the real interest rate. The expected real interest rate is unaffected by changes in expected future inflation. D (Fisher) 10

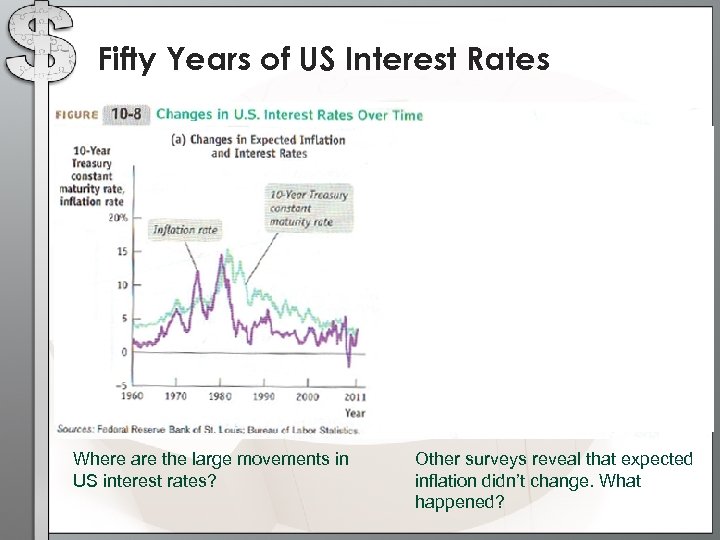

Fifty Years of US Interest Rates Where are the large movements in US interest rates? Other surveys reveal that expected inflation didn’t change. What happened?

Fifty Years of US Interest Rates Where are the large movements in US interest rates? Other surveys reveal that expected inflation didn’t change. What happened?

The Financial System • • • Financial markets are where households invest their current savings and their accumulated savings, or wealth by purchasing financial assets. A financial asset is a paper claim that entitles the buyer to future income from the seller. A physical asset is a tangible object that can be used to generate future income. An investment is the purchase of a financial or physical asset. A liability is a requirement to pay income in the future. Loans, stocks, bonds, and bank deposits are types of financial assets.

The Financial System • • • Financial markets are where households invest their current savings and their accumulated savings, or wealth by purchasing financial assets. A financial asset is a paper claim that entitles the buyer to future income from the seller. A physical asset is a tangible object that can be used to generate future income. An investment is the purchase of a financial or physical asset. A liability is a requirement to pay income in the future. Loans, stocks, bonds, and bank deposits are types of financial assets.

Three Tasks of a Financial System 1. Reduce the transaction costs 2. Reduce the financial risk 3. Provide liquidity

Three Tasks of a Financial System 1. Reduce the transaction costs 2. Reduce the financial risk 3. Provide liquidity

Types of Financial Assets • A loan is a lending agreement between an individual lender and an individual borrower. • The seller of a bond agrees to pay a fixed sum of interest each year and to repay the principal. • Loan-backed securities are assets created by pooling individual loans and selling shares in a pool. • A share of a stock is a financial asset from its owner’s point of view and a liability from the company’s point of view.

Types of Financial Assets • A loan is a lending agreement between an individual lender and an individual borrower. • The seller of a bond agrees to pay a fixed sum of interest each year and to repay the principal. • Loan-backed securities are assets created by pooling individual loans and selling shares in a pool. • A share of a stock is a financial asset from its owner’s point of view and a liability from the company’s point of view.

Financial Intermediaries • A mutual fund is a financial intermediary that creates a stock portfolio and then resells shares of this portfolio to individual investors. • A pension fund is a type of mutual fund that holds assets in order to provide retirement income to its members. • Life insurance companies sell policies which guarantee a payment to policyholder’s beneficiaries when the policyholder dies. • A bank deposit is a claim on a bank that obliges the bank to give the depositor his or her cash when demanded.

Financial Intermediaries • A mutual fund is a financial intermediary that creates a stock portfolio and then resells shares of this portfolio to individual investors. • A pension fund is a type of mutual fund that holds assets in order to provide retirement income to its members. • Life insurance companies sell policies which guarantee a payment to policyholder’s beneficiaries when the policyholder dies. • A bank deposit is a claim on a bank that obliges the bank to give the depositor his or her cash when demanded.

Financial Fluctuations • Demand for stocks is based upon investors’ beliefs about the future value or price of the asset. • Stock prices are determined by the supply and demand for shares. • Stock prices are also affected by changes in the attractiveness of substitute assets, like bonds. • Demand for other assets is similar to stock—including physical assets like real estate.

Financial Fluctuations • Demand for stocks is based upon investors’ beliefs about the future value or price of the asset. • Stock prices are determined by the supply and demand for shares. • Stock prices are also affected by changes in the attractiveness of substitute assets, like bonds. • Demand for other assets is similar to stock—including physical assets like real estate.

Asset Price Expectations 1. The efficient markets hypothesis means that asset prices always embody all publicly available information and so at any point in tick stock prices are fairly valued. 1. 2. Prices change only in response to new information about the underlying fundamentals; hence movement of prices follow a random walk. Markets often behave irrationally.

Asset Price Expectations 1. The efficient markets hypothesis means that asset prices always embody all publicly available information and so at any point in tick stock prices are fairly valued. 1. 2. Prices change only in response to new information about the underlying fundamentals; hence movement of prices follow a random walk. Markets often behave irrationally.

Asset Prices and Macroeconomics • Economists generally believe in efficient markets hypothesis--imply no government interference. • Concern about two huge asset bubbles which created major macroeconomic problems when it burst. • • Late 1990’s, the price of technology stocks collapsed and caused the 2001 recession. In 2008, the collapse of housing prices triggered the severe financial crisis followed by a deep recession.

Asset Prices and Macroeconomics • Economists generally believe in efficient markets hypothesis--imply no government interference. • Concern about two huge asset bubbles which created major macroeconomic problems when it burst. • • Late 1990’s, the price of technology stocks collapsed and caused the 2001 recession. In 2008, the collapse of housing prices triggered the severe financial crisis followed by a deep recession.

Practice: • • • For each of the following, is it an example of investment spending, investing in financial assets, or investing in physical assets? Rupert Moneybucks buys 100 shares of existing Coca Cola stock. Rhonda Moviestar spends $10 million to buy a mansion built in the 1970 s. Ronald Baskerballstar spends $10 million to build a new mansion with a view of the Pacific Ocean. Rawlings builds a new plan to make catcher’s mits. Russia buys $100 million, in US government bonds.

Practice: • • • For each of the following, is it an example of investment spending, investing in financial assets, or investing in physical assets? Rupert Moneybucks buys 100 shares of existing Coca Cola stock. Rhonda Moviestar spends $10 million to buy a mansion built in the 1970 s. Ronald Baskerballstar spends $10 million to build a new mansion with a view of the Pacific Ocean. Rawlings builds a new plan to make catcher’s mits. Russia buys $100 million, in US government bonds.

Practice: • How would you respond to a friend who claims that the government should eliminate all purchases that are financed by borrowing because such borrowing crowds out private investment spending?

Practice: • How would you respond to a friend who claims that the government should eliminate all purchases that are financed by borrowing because such borrowing crowds out private investment spending?

Practice: • • • Explain the effect on a company’s stock price today of each of the following events, other things held constant. The interest rate on bonds falls. Several companies in the same sector announce surprisingly higher sales. A change in the tax law passed last year reduces this year’s profit. The company unexpectedly announces that due to an accounting error, it must amend last year’s accounting statement and reduce last year’s reported profit by $5 million. It also announces that this change has no implications for future profits.

Practice: • • • Explain the effect on a company’s stock price today of each of the following events, other things held constant. The interest rate on bonds falls. Several companies in the same sector announce surprisingly higher sales. A change in the tax law passed last year reduces this year’s profit. The company unexpectedly announces that due to an accounting error, it must amend last year’s accounting statement and reduce last year’s reported profit by $5 million. It also announces that this change has no implications for future profits.

Picture Page Layout Here is a place holder for the text. The coins on this page can be removed. You may delete this text.

Picture Page Layout Here is a place holder for the text. The coins on this page can be removed. You may delete this text.