7e5a57f7614ff035c7c6fc4b327915d1.ppt

- Количество слайдов: 15

Savings and Investment

Savings and Investment

Why do we invest? If we have money we can. . . Spend It Save It Put It In The Bank Invest It What are the Advantages/R isks of each option?

Why do we invest? If we have money we can. . . Spend It Save It Put It In The Bank Invest It What are the Advantages/R isks of each option?

Investment - redirecting resources from being consumed today so that they may create benefits in the future If you had $1, 000 Spend it now, take advantage of the utility and value of your money. You Could. . . Or, invest your money now in order to receive benefits in the future. Ways to Invest: - Save money in a bank and collect interest - Buy Stock - Buy Bonds Return - the money an investor receives above and beyond the sum of money initially invested.

Investment - redirecting resources from being consumed today so that they may create benefits in the future If you had $1, 000 Spend it now, take advantage of the utility and value of your money. You Could. . . Or, invest your money now in order to receive benefits in the future. Ways to Invest: - Save money in a bank and collect interest - Buy Stock - Buy Bonds Return - the money an investor receives above and beyond the sum of money initially invested.

Ways to Invest Savings in the Bank Bonds - Government, Municipal, Corporate Shares of Stock

Ways to Invest Savings in the Bank Bonds - Government, Municipal, Corporate Shares of Stock

Saving in Bank Rather than save money hidden in your house, you can save your money in a bank, where it is still easily accessible if you need it, but safe, insured, and collecting interest. Interest gained on money saved in the bank is based on an Annual Percentage Rate (APR). Typically, the interest percentage an individual earns on savings accounts is about 2% The catch is that you have to leave your money in the savings account so that the bank can use it.

Saving in Bank Rather than save money hidden in your house, you can save your money in a bank, where it is still easily accessible if you need it, but safe, insured, and collecting interest. Interest gained on money saved in the bank is based on an Annual Percentage Rate (APR). Typically, the interest percentage an individual earns on savings accounts is about 2% The catch is that you have to leave your money in the savings account so that the bank can use it.

How You and Banks make Money • You open a savings account at the bank. • The bank pays you interest on the money that you deposit and leave in that account. • The bank then loans that money out to other people, only they charge a slightly higher interest rate on the loan than what they pay you for your account.

How You and Banks make Money • You open a savings account at the bank. • The bank pays you interest on the money that you deposit and leave in that account. • The bank then loans that money out to other people, only they charge a slightly higher interest rate on the loan than what they pay you for your account.

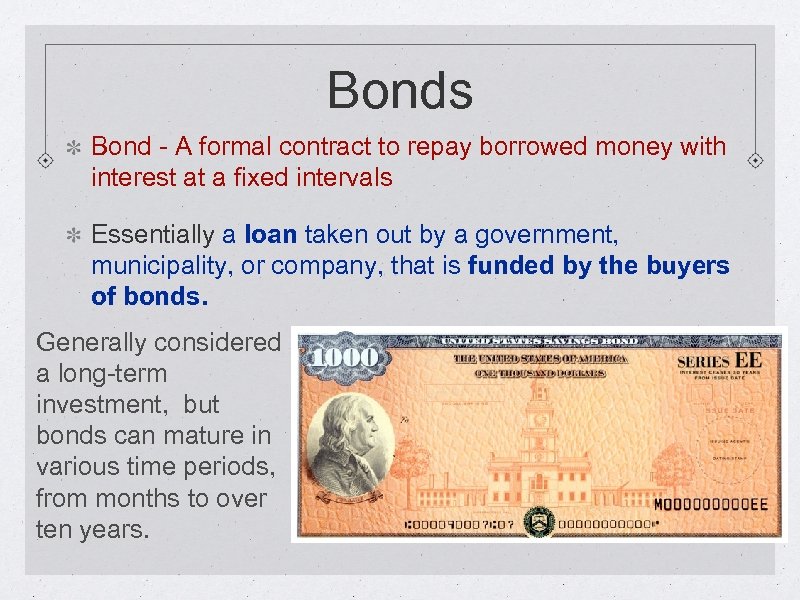

Bonds Bond - A formal contract to repay borrowed money with interest at a fixed intervals Essentially a loan taken out by a government, municipality, or company, that is funded by the buyers of bonds. Generally considered a long-term investment, but bonds can mature in various time periods, from months to over ten years.

Bonds Bond - A formal contract to repay borrowed money with interest at a fixed intervals Essentially a loan taken out by a government, municipality, or company, that is funded by the buyers of bonds. Generally considered a long-term investment, but bonds can mature in various time periods, from months to over ten years.

Types of Bonds Government Bond - Issued by a government in order to acquire money to pay their bills and finance programs. The more stable the issuing government, the less risk in the investment. Municipal Bond - Issued by a state, city, county, or district, in order to raise funds and finance projects such as hospitals, power plants, streets, schools, or airports. Corporate Bond - Issued by businesses to help pay expenses or fund growth. Risk is determined by the stability and future of the company

Types of Bonds Government Bond - Issued by a government in order to acquire money to pay their bills and finance programs. The more stable the issuing government, the less risk in the investment. Municipal Bond - Issued by a state, city, county, or district, in order to raise funds and finance projects such as hospitals, power plants, streets, schools, or airports. Corporate Bond - Issued by businesses to help pay expenses or fund growth. Risk is determined by the stability and future of the company

Buying Stocks

Buying Stocks

How do you buy stocks? Stockbroker - someone who brings together buyers and sellers of stock to make a trade. Brokerage Firms - Brokerage firms are companies that specialize in trading stocks and employ stockbrokers.

How do you buy stocks? Stockbroker - someone who brings together buyers and sellers of stock to make a trade. Brokerage Firms - Brokerage firms are companies that specialize in trading stocks and employ stockbrokers.

Stock Exchange - A market for buying and selling stock NYSE - New York Stock Exchange. The country’s largest and most powerful exchange. NYSE handles transactions for only the largest and most established companies. Does the Performance of one company’s Stock Represent the Health of the Economy? How Can We Determine the Health of the Economy through the Stock Markets?

Stock Exchange - A market for buying and selling stock NYSE - New York Stock Exchange. The country’s largest and most powerful exchange. NYSE handles transactions for only the largest and most established companies. Does the Performance of one company’s Stock Represent the Health of the Economy? How Can We Determine the Health of the Economy through the Stock Markets?

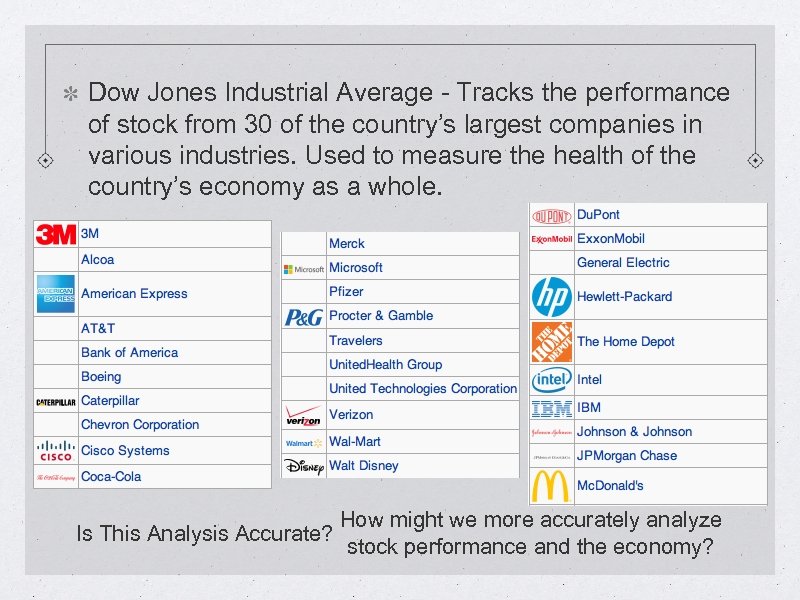

Dow Jones Industrial Average - Tracks the performance of stock from 30 of the country’s largest companies in various industries. Used to measure the health of the country’s economy as a whole. How might we more accurately analyze Is This Analysis Accurate? stock performance and the economy?

Dow Jones Industrial Average - Tracks the performance of stock from 30 of the country’s largest companies in various industries. Used to measure the health of the country’s economy as a whole. How might we more accurately analyze Is This Analysis Accurate? stock performance and the economy?

S & P 500 - Standard & Poor’s 500 gives a broader picture of stock performance. Tracks 500 companies and measures overall stock market performance. Bull Market - When the stock market rises steadily over a period of time Bear Market - When the stock market falls for a period of time

S & P 500 - Standard & Poor’s 500 gives a broader picture of stock performance. Tracks 500 companies and measures overall stock market performance. Bull Market - When the stock market rises steadily over a period of time Bear Market - When the stock market falls for a period of time

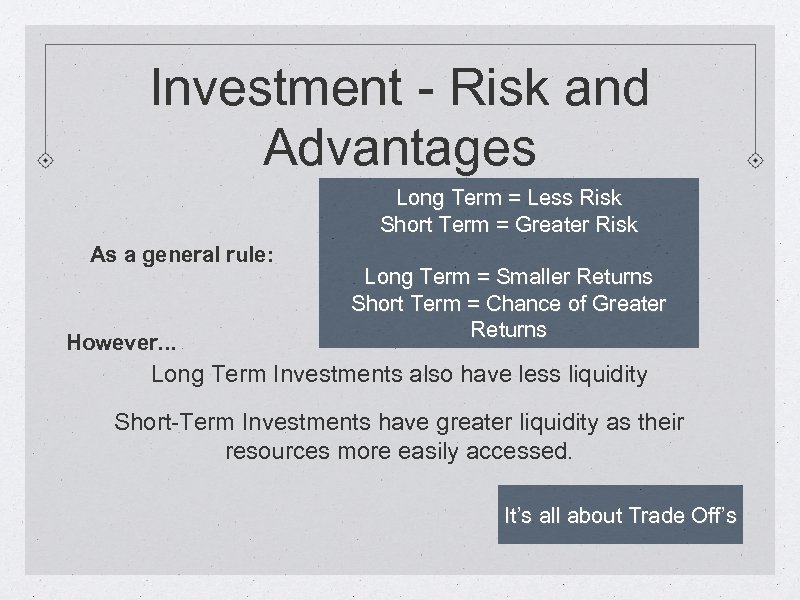

Investment - Risk and Advantages Long Term = Less Risk Short Term = Greater Risk As a general rule: However. . . Long Term = Smaller Returns Short Term = Chance of Greater Returns Long Term Investments also have less liquidity Short-Term Investments have greater liquidity as their resources more easily accessed. It’s all about Trade Off’s

Investment - Risk and Advantages Long Term = Less Risk Short Term = Greater Risk As a general rule: However. . . Long Term = Smaller Returns Short Term = Chance of Greater Returns Long Term Investments also have less liquidity Short-Term Investments have greater liquidity as their resources more easily accessed. It’s all about Trade Off’s

How can we Minimize Risk in Investment? Diversification The strategy of spreading out investments to reduce risk. If I wanted to invest my money I could. . . Buy Stock In: Buy: OR British Petroleum Stock Royal Dutch Microsoft A Government Bond Shell Target Money in Savings Account Chevron

How can we Minimize Risk in Investment? Diversification The strategy of spreading out investments to reduce risk. If I wanted to invest my money I could. . . Buy Stock In: Buy: OR British Petroleum Stock Royal Dutch Microsoft A Government Bond Shell Target Money in Savings Account Chevron