4d08a97dbea2a5e98220ab419e9092ce.ppt

- Количество слайдов: 109

Saving, Investment, and the Financial System • The financial system consists of the group of institutions in the economy that help to match one person’s saving with another person’s investment. • It moves the economy’s scarce resources from savers to borrowers. © 2007 Thomson South-Western

Saving, Investment, and the Financial System • The financial system consists of the group of institutions in the economy that help to match one person’s saving with another person’s investment. • It moves the economy’s scarce resources from savers to borrowers. © 2007 Thomson South-Western

FINANCIAL INSTITUTIONS IN THE U. S. ECONOMY • The financial system is made up of financial institutions that coordinate the actions of savers and borrowers. • Financial institutions can be grouped into two different categories: – Financial markets – Financial intermediaries © 2007 Thomson South-Western

FINANCIAL INSTITUTIONS IN THE U. S. ECONOMY • The financial system is made up of financial institutions that coordinate the actions of savers and borrowers. • Financial institutions can be grouped into two different categories: – Financial markets – Financial intermediaries © 2007 Thomson South-Western

FINANCIAL INSTITUTIONS IN THE U. S. ECONOMY • Financial Markets – Stock Market – Bond Market • Financial Intermediaries – Banks – Mutual Funds © 2007 Thomson South-Western

FINANCIAL INSTITUTIONS IN THE U. S. ECONOMY • Financial Markets – Stock Market – Bond Market • Financial Intermediaries – Banks – Mutual Funds © 2007 Thomson South-Western

FINANCIAL INSTITUTIONS IN THE U. S. ECONOMY • Financial markets are the institutions through which savers can directly provide funds to borrowers. • Financial intermediaries are financial institutions through which savers can indirectly provide funds to borrowers. © 2007 Thomson South-Western

FINANCIAL INSTITUTIONS IN THE U. S. ECONOMY • Financial markets are the institutions through which savers can directly provide funds to borrowers. • Financial intermediaries are financial institutions through which savers can indirectly provide funds to borrowers. © 2007 Thomson South-Western

Financial Intermediaries: Banks • • Banks take deposits from people who want to save and use the deposits to make loans to people who want to borrow. Banks pay depositors interest on their deposits and charge borrowers slightly higher interest on their loans.

Financial Intermediaries: Banks • • Banks take deposits from people who want to save and use the deposits to make loans to people who want to borrow. Banks pay depositors interest on their deposits and charge borrowers slightly higher interest on their loans.

Financial Markets • The Bond Market • A bond is a certificate of indebtedness that specifies obligations of the borrower to the holder of the bond. • Characteristics of a Bond • Term: The length of time until the bond matures. • Credit Risk: The probability that the borrower will fail to pay some of the interest or principal. • Tax Treatment: The way in which the tax laws treat the interest on the bond. • Municipal bonds are federal tax exempt. © 2007 Thomson South-Western

Financial Markets • The Bond Market • A bond is a certificate of indebtedness that specifies obligations of the borrower to the holder of the bond. • Characteristics of a Bond • Term: The length of time until the bond matures. • Credit Risk: The probability that the borrower will fail to pay some of the interest or principal. • Tax Treatment: The way in which the tax laws treat the interest on the bond. • Municipal bonds are federal tax exempt. © 2007 Thomson South-Western

• Bond Prices react to interest rates. • If a bond is paying 10% and interest rates go to 5% is the bonds price going to go up or down? • What if interest rates go to 15% what is that bond going to be worth? • See 2010 Question 2 AP Test. • So if interest rates go up bond prices go down and vice versa. © 2007 Thomson South-Western

• Bond Prices react to interest rates. • If a bond is paying 10% and interest rates go to 5% is the bonds price going to go up or down? • What if interest rates go to 15% what is that bond going to be worth? • See 2010 Question 2 AP Test. • So if interest rates go up bond prices go down and vice versa. © 2007 Thomson South-Western

Financial Markets • The Stock Market • Stock represents a claim to partial ownership in a firm and is therefore, a claim to the profits that the firm makes. • The sale of stock to raise money is called equity financing. • Compared to bonds, stocks offer both higher risk and potentially higher returns. • The most important stock exchanges in the United States are the New York Stock Exchange, the American Stock Exchange, and NASDAQ. © 2007 Thomson South-Western

Financial Markets • The Stock Market • Stock represents a claim to partial ownership in a firm and is therefore, a claim to the profits that the firm makes. • The sale of stock to raise money is called equity financing. • Compared to bonds, stocks offer both higher risk and potentially higher returns. • The most important stock exchanges in the United States are the New York Stock Exchange, the American Stock Exchange, and NASDAQ. © 2007 Thomson South-Western

Banks • • • Banks help create a medium of exchange by allowing people to write checks against their deposits. A medium of exchanges is an item that people can easily use to engage in transactions. This facilitates the purchases of goods and services.

Banks • • • Banks help create a medium of exchange by allowing people to write checks against their deposits. A medium of exchanges is an item that people can easily use to engage in transactions. This facilitates the purchases of goods and services.

National Income Accounts • National saving-the total income in the economy that remains after paying for the consumption and government purchases.

National Income Accounts • National saving-the total income in the economy that remains after paying for the consumption and government purchases.

• Remember that GDP can be divided up into four components: consumption, investment, government purchases, and net exports.

• Remember that GDP can be divided up into four components: consumption, investment, government purchases, and net exports.

National Savings • To make the concept easy pretend we have a closed economy where no trade occurs. • So for our GDP equation it would be • Y=C+I+G

National Savings • To make the concept easy pretend we have a closed economy where no trade occurs. • So for our GDP equation it would be • Y=C+I+G

National Savings • So Y=C+G+I • To isolate investment, we can subtract C and G from both sides: • Y-C-G=I • Or GDP-Consumption-Government Purchases =Investment • What is left is called national savings. • Savings=Y-C-G=I • Savings =Investing

National Savings • So Y=C+G+I • To isolate investment, we can subtract C and G from both sides: • Y-C-G=I • Or GDP-Consumption-Government Purchases =Investment • What is left is called national savings. • Savings=Y-C-G=I • Savings =Investing

• You will have to keep reminding students what the term “investment” means to macroeconomists. Outside of the economics profession, most people use the terms “saving” and “investing” interchangeably. • In macroeconomics, investment refers to the purchase of new capital, such as equipment or buildings. (factories) • If an individual spends less than he earns and uses the rest to buy stocks or mutual funds, economists call this saving.

• You will have to keep reminding students what the term “investment” means to macroeconomists. Outside of the economics profession, most people use the terms “saving” and “investing” interchangeably. • In macroeconomics, investment refers to the purchase of new capital, such as equipment or buildings. (factories) • If an individual spends less than he earns and uses the rest to buy stocks or mutual funds, economists call this saving.

• Definition of National Saving (Saving): the total income in the economy that remains after paying for consumption and government purchases

• Definition of National Saving (Saving): the total income in the economy that remains after paying for consumption and government purchases

Saving Continued • Savings=GDP-Consumption-Govt Spending • If T= Taxes and Transfer payments back to SS and Welfare It can be broken down also like this S=(Y-T-C) + (T-G) This breaks down into private savings and public savings

Saving Continued • Savings=GDP-Consumption-Govt Spending • If T= Taxes and Transfer payments back to SS and Welfare It can be broken down also like this S=(Y-T-C) + (T-G) This breaks down into private savings and public savings

• Private Saving: the income that households have left after paying for taxes and consumption. • Public Saving: the tax revenue that the government has left after paying for its spending. • Budget Surplus: an excess of tax revenue over government spending. • Budget Deficit: a shortfall of tax revenue from government spending.

• Private Saving: the income that households have left after paying for taxes and consumption. • Public Saving: the tax revenue that the government has left after paying for its spending. • Budget Surplus: an excess of tax revenue over government spending. • Budget Deficit: a shortfall of tax revenue from government spending.

Breaking down National Savings NS=(Y-T-C) Private Savings • Private Savings-is the amount of income that households have left after paying their taxes and paying for their consumption + (T-G) Public Savings-is the amount of tax revenue that the government has left after paying for it spending

Breaking down National Savings NS=(Y-T-C) Private Savings • Private Savings-is the amount of income that households have left after paying their taxes and paying for their consumption + (T-G) Public Savings-is the amount of tax revenue that the government has left after paying for it spending

Types of Savings • Budget surplus-If govt receives more then they pay out. T-G is positive

Types of Savings • Budget surplus-If govt receives more then they pay out. T-G is positive

Types of Savings • Budget Deficit T-G is negative

Types of Savings • Budget Deficit T-G is negative

• The important point to make here is that with a government budget deficit, public saving is negative and the public sector is thus “dissaving. ” To make up for this shortfall, it must go to the loanable funds market and borrow the money. This will reduce the supply of loanable funds available for investment.

• The important point to make here is that with a government budget deficit, public saving is negative and the public sector is thus “dissaving. ” To make up for this shortfall, it must go to the loanable funds market and borrow the money. This will reduce the supply of loanable funds available for investment.

New Stuff

New Stuff

Then, after many With pressure from bill collectors (and his At first the job seeker rejections, he wife), he holds up optimistically looks becomes a reluctant for his next job. discouraged worker. an ATM called Kenny and shoots it.

Then, after many With pressure from bill collectors (and his At first the job seeker rejections, he wife), he holds up optimistically looks becomes a reluctant for his next job. discouraged worker. an ATM called Kenny and shoots it.

And his kids will And – the Texas Eventually he is cry because they Justice System will tell him to, can no longer go caught and “Take that. ” to college. incarcerated.

And his kids will And – the Texas Eventually he is cry because they Justice System will tell him to, can no longer go caught and “Take that. ” to college. incarcerated.

Crime rates move with the business cycle…rising during periods of high unemployment and falling during periods of low unemployment. The crime unemployment statistics released in the fall of 1997 bear this out. With unemployment at a 25 -year low at 4. 9% the rate of violent crime was down for a fifth consecutive year, and the murder rate fell to its lowest level since 1969. FBI crime statistics show that both property crime and violent crime increased sharply between 1985 and 1991 and fell dramatically from 1991 to 1997 in step with unemployment

Crime rates move with the business cycle…rising during periods of high unemployment and falling during periods of low unemployment. The crime unemployment statistics released in the fall of 1997 bear this out. With unemployment at a 25 -year low at 4. 9% the rate of violent crime was down for a fifth consecutive year, and the murder rate fell to its lowest level since 1969. FBI crime statistics show that both property crime and violent crime increased sharply between 1985 and 1991 and fell dramatically from 1991 to 1997 in step with unemployment

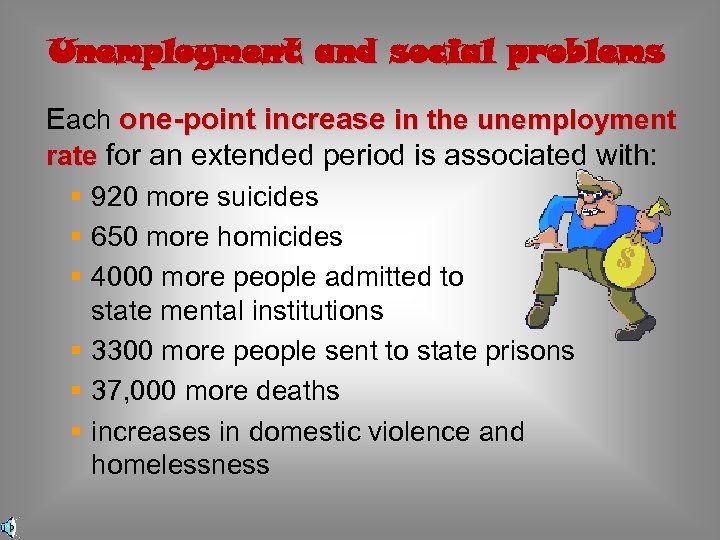

Unemployment and social problems Each one-point increase in the unemployment rate for an extended period is associated with: § 920 more suicides § 650 more homicides § 4000 more people admitted to state mental institutions § 3300 more people sent to state prisons § 37, 000 more deaths § increases in domestic violence and homelessness

Unemployment and social problems Each one-point increase in the unemployment rate for an extended period is associated with: § 920 more suicides § 650 more homicides § 4000 more people admitted to state mental institutions § 3300 more people sent to state prisons § 37, 000 more deaths § increases in domestic violence and homelessness

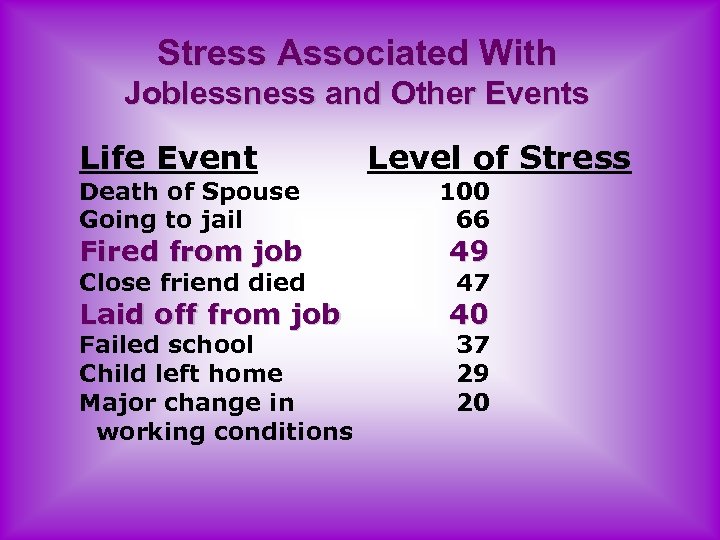

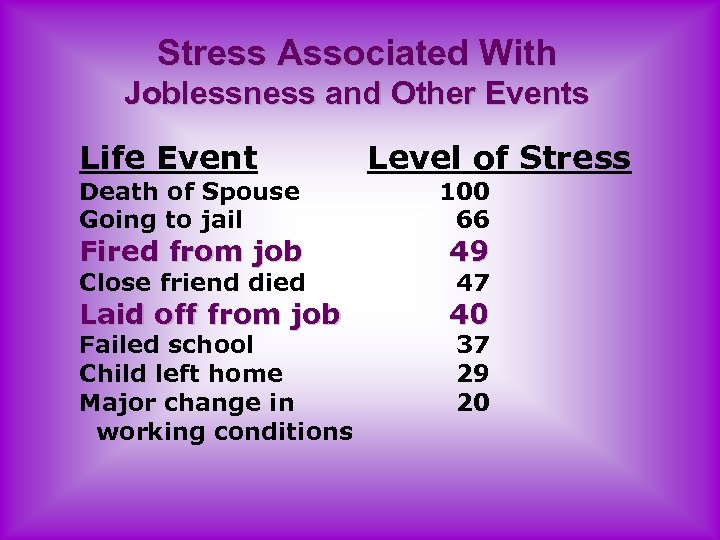

Stress Associated With Joblessness and Other Events Life Event Death of Spouse Going to jail Fired from job Close friend died Laid off from job Failed school Child left home Major change in working conditions Level of Stress 100 66 49 47 40 37 29 20

Stress Associated With Joblessness and Other Events Life Event Death of Spouse Going to jail Fired from job Close friend died Laid off from job Failed school Child left home Major change in working conditions Level of Stress 100 66 49 47 40 37 29 20

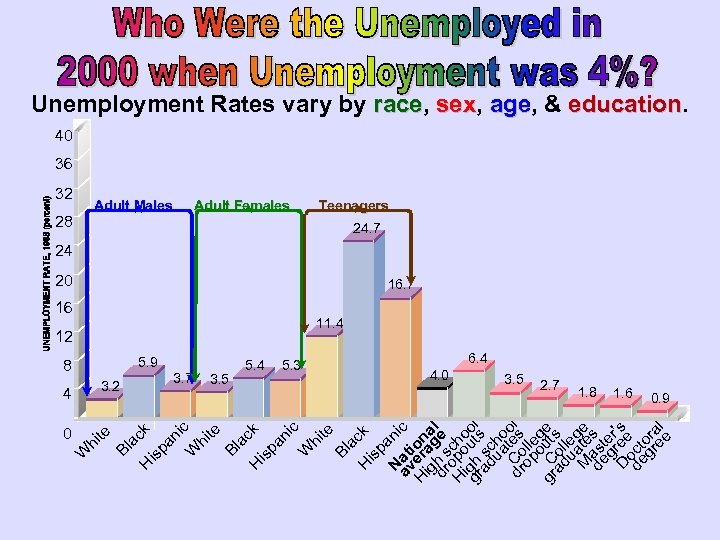

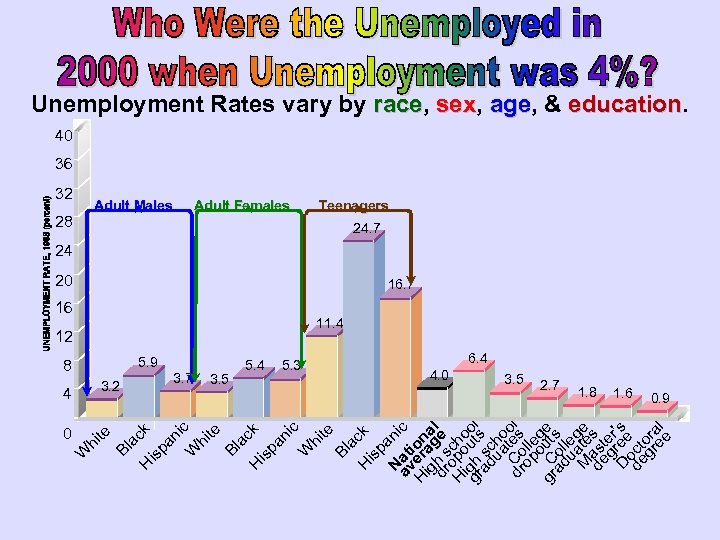

0 hi te Bl a H ck is pa ni c W hi te Bl ac k H is p N anic av at i H eraon ig a dr h s ge l H opocho grigh uts ol ad sc ua ho dr Co tesol op lle o g gr C uts e ad ol ualeg M te e deast s g er D ree 's deoct gr ora ee l W Unemployment Rates vary by race, sex, age, & education. race sex age education 40 36 32 28 Adult Males 8 4 3. 2 Adult Females 16 12 5. 9 3. 7 3. 5 5. 4 5. 3 Teenagers 24. 7 24 20 16. 7 11. 4 6. 4 4. 0 3. 5 2. 7 1. 8 1. 6 0. 9

0 hi te Bl a H ck is pa ni c W hi te Bl ac k H is p N anic av at i H eraon ig a dr h s ge l H opocho grigh uts ol ad sc ua ho dr Co tesol op lle o g gr C uts e ad ol ualeg M te e deast s g er D ree 's deoct gr ora ee l W Unemployment Rates vary by race, sex, age, & education. race sex age education 40 36 32 28 Adult Males 8 4 3. 2 Adult Females 16 12 5. 9 3. 7 3. 5 5. 4 5. 3 Teenagers 24. 7 24 20 16. 7 11. 4 6. 4 4. 0 3. 5 2. 7 1. 8 1. 6 0. 9

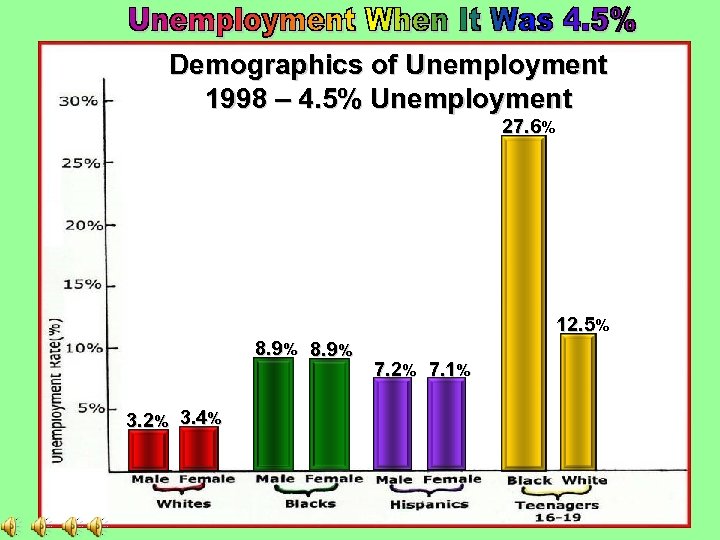

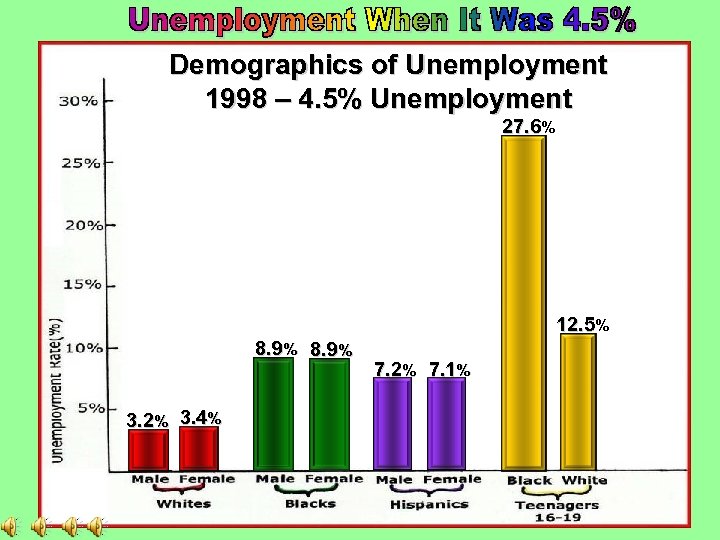

Demographics of Unemployment 1998 – 4. 5% Unemployment 27. 6% 12. 5% 8. 9% 3. 2% 3. 4% 7. 2% 7. 1%

Demographics of Unemployment 1998 – 4. 5% Unemployment 27. 6% 12. 5% 8. 9% 3. 2% 3. 4% 7. 2% 7. 1%

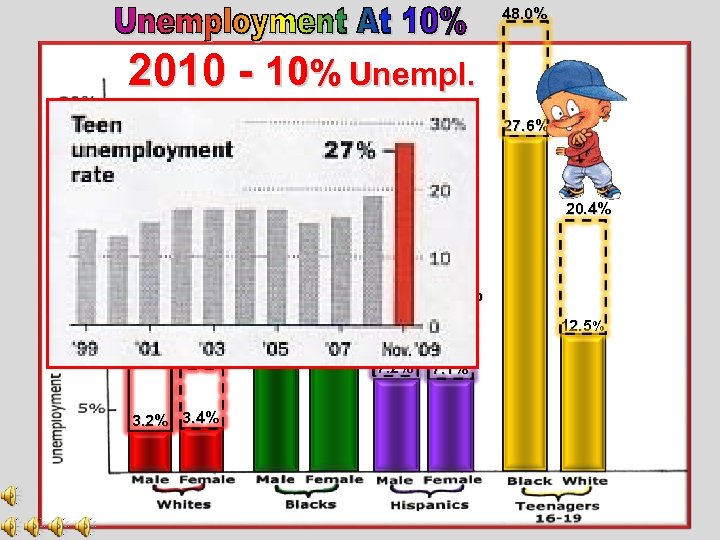

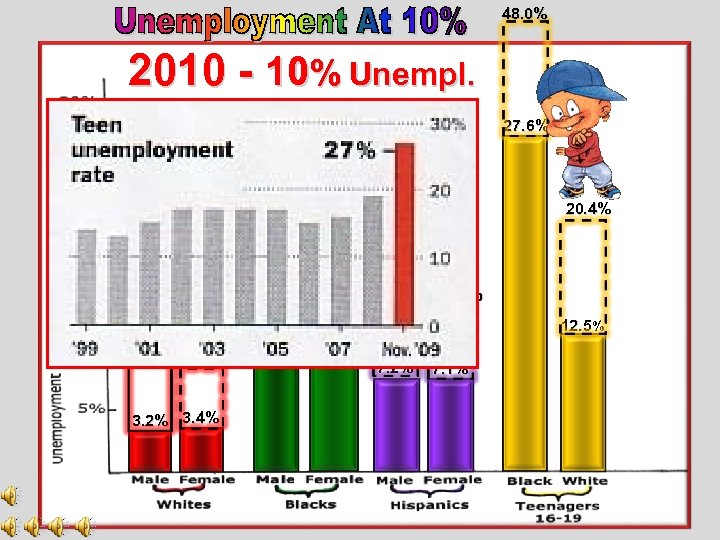

48. 0% 2010 - 10% Unempl. In Jan, 2010 as unemployment hit 10%, teenage unemployment hit an all time high of 27%. 18. 9% 27. 6% 20. 4% 17. 2% 15. 2% 13. 9% 12. 5% 9. 3% 9. 0% 3. 2% 3. 4% 8. 9% 7. 2% 7. 1%

48. 0% 2010 - 10% Unempl. In Jan, 2010 as unemployment hit 10%, teenage unemployment hit an all time high of 27%. 18. 9% 27. 6% 20. 4% 17. 2% 15. 2% 13. 9% 12. 5% 9. 3% 9. 0% 3. 2% 3. 4% 8. 9% 7. 2% 7. 1%

![2010 Overall Unemployment Rate = 9. 8% [Unemployment Rate & Median Earnings by Education] 2010 Overall Unemployment Rate = 9. 8% [Unemployment Rate & Median Earnings by Education]](https://present5.com/presentation/4d08a97dbea2a5e98220ab419e9092ce/image-32.jpg) 2010 Overall Unemployment Rate = 9. 8% [Unemployment Rate & Median Earnings by Education] 16% 14% 15. 6% Unemployment Rate - 1998 12% 10% 8% $23 K 10. 5% $32 K 7% 8. 0% 6% 5% 5. 0% 4% 3% 2% 1% 0 Less Than High School Diploma 3. 8% High School Grad $38 K Associates Degree $53 K College $60 K Master’s Advanced Degree 3. 0% $75 K

2010 Overall Unemployment Rate = 9. 8% [Unemployment Rate & Median Earnings by Education] 16% 14% 15. 6% Unemployment Rate - 1998 12% 10% 8% $23 K 10. 5% $32 K 7% 8. 0% 6% 5% 5. 0% 4% 3% 2% 1% 0 Less Than High School Diploma 3. 8% High School Grad $38 K Associates Degree $53 K College $60 K Master’s Advanced Degree 3. 0% $75 K

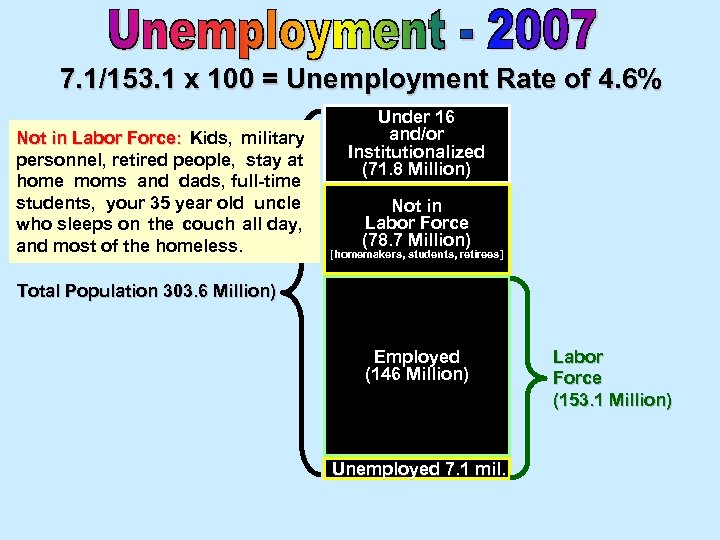

7. 1/153. 1 x 100 = Unemployment Rate of 4. 6% Not in Labor Force: Kids, military personnel, retired people, stay at home moms and dads, full-time students, your 35 year old uncle who sleeps on the couch all day, and most of the homeless. Under 16 and/or Institutionalized (71. 8 Million) Not in Labor Force (78. 7 Million) [homemakers, students, retirees] Total Population 303. 6 Million) Employed (146 Million) Unemployed 7. 1 mil. Labor Force (153. 1 Million)

7. 1/153. 1 x 100 = Unemployment Rate of 4. 6% Not in Labor Force: Kids, military personnel, retired people, stay at home moms and dads, full-time students, your 35 year old uncle who sleeps on the couch all day, and most of the homeless. Under 16 and/or Institutionalized (71. 8 Million) Not in Labor Force (78. 7 Million) [homemakers, students, retirees] Total Population 303. 6 Million) Employed (146 Million) Unemployed 7. 1 mil. Labor Force (153. 1 Million)

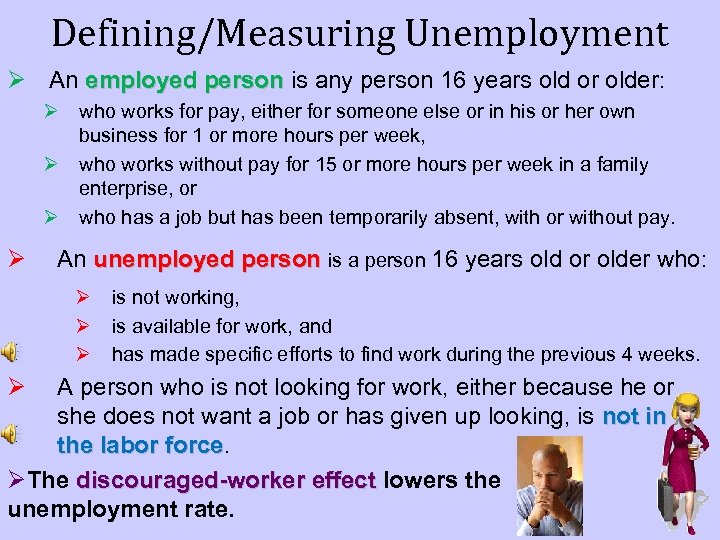

Defining/Measuring Unemployment Ø An employed person is any person 16 years old or older: Ø who works for pay, either for someone else or in his or her own business for 1 or more hours per week, Ø who works without pay for 15 or more hours per week in a family enterprise, or Ø who has a job but has been temporarily absent, with or without pay. Ø An unemployed person is a person 16 years old or older who: Ø Ø is not working, is available for work, and has made specific efforts to find work during the previous 4 weeks. A person who is not looking for work, either because he or she does not want a job or has given up looking, is not in the labor force ØThe discouraged-worker effect lowers the unemployment rate.

Defining/Measuring Unemployment Ø An employed person is any person 16 years old or older: Ø who works for pay, either for someone else or in his or her own business for 1 or more hours per week, Ø who works without pay for 15 or more hours per week in a family enterprise, or Ø who has a job but has been temporarily absent, with or without pay. Ø An unemployed person is a person 16 years old or older who: Ø Ø is not working, is available for work, and has made specific efforts to find work during the previous 4 weeks. A person who is not looking for work, either because he or she does not want a job or has given up looking, is not in the labor force ØThe discouraged-worker effect lowers the unemployment rate.

![BLS calls 60, 000 households every month. [Current Population Survey] They ask three questions: BLS calls 60, 000 households every month. [Current Population Survey] They ask three questions:](https://present5.com/presentation/4d08a97dbea2a5e98220ab419e9092ce/image-35.jpg) BLS calls 60, 000 households every month. [Current Population Survey] They ask three questions: questions 1. Are you working? If the answer is “yes”, “yes” you are member of the labor force. But, force if the answer is no, you get a 2 nd question. no 2. Did you work at all this month-even 1 day? If “yes”, you are a member of the LF. But, “yes” LF if the answer is no, you get a 3 rd question. no 3. Did you look for work during the last month? [agency, resume, interview] A “yes” counts you as part of the LF. A “no” means you are not counted. LF counted You are a “discouraged worker. ” The labor force consists of the employed and unemployed

BLS calls 60, 000 households every month. [Current Population Survey] They ask three questions: questions 1. Are you working? If the answer is “yes”, “yes” you are member of the labor force. But, force if the answer is no, you get a 2 nd question. no 2. Did you work at all this month-even 1 day? If “yes”, you are a member of the LF. But, “yes” LF if the answer is no, you get a 3 rd question. no 3. Did you look for work during the last month? [agency, resume, interview] A “yes” counts you as part of the LF. A “no” means you are not counted. LF counted You are a “discouraged worker. ” The labor force consists of the employed and unemployed

How is Unemployment Measured? • Natural Rate of Unemployment • The natural rate of unemployment is unemployment that does not go away on its own even in the long run. • It is the amount of unemployment that the economy normally experiences. © 2007 Thomson South-Western

How is Unemployment Measured? • Natural Rate of Unemployment • The natural rate of unemployment is unemployment that does not go away on its own even in the long run. • It is the amount of unemployment that the economy normally experiences. © 2007 Thomson South-Western

How Is Unemployment Measured? • Cyclical Unemployment • Cyclical unemployment refers to the year-to-year fluctuations in unemployment around its natural rate. • It is associated with short-term ups and downs of the business cycle. © 2007 Thomson South-Western

How Is Unemployment Measured? • Cyclical Unemployment • Cyclical unemployment refers to the year-to-year fluctuations in unemployment around its natural rate. • It is associated with short-term ups and downs of the business cycle. © 2007 Thomson South-Western

How Is Unemployment Measured? • Describing Unemployment: Three Basic Questions • How does government measure the economy’s rate of unemployment? • What problems arise in interpreting the unemployment data? • How long are the unemployed typically without work? © 2007 Thomson South-Western

How Is Unemployment Measured? • Describing Unemployment: Three Basic Questions • How does government measure the economy’s rate of unemployment? • What problems arise in interpreting the unemployment data? • How long are the unemployed typically without work? © 2007 Thomson South-Western

How Is Unemployment Measured? • Employed vs. unemployed • The BLS considers a person an adult if he or she is over 16 years old. • A person is considered employed if he or she has spent some of the previous week working at a paid job. • A person is unemployed if he or she is on temporary layoff, is looking for a job, or is waiting for the start date of a new job. • A person who fits neither of these categories, such as a fulltime student, homemaker, or retiree, is not in the labor force. © 2007 Thomson South-Western

How Is Unemployment Measured? • Employed vs. unemployed • The BLS considers a person an adult if he or she is over 16 years old. • A person is considered employed if he or she has spent some of the previous week working at a paid job. • A person is unemployed if he or she is on temporary layoff, is looking for a job, or is waiting for the start date of a new job. • A person who fits neither of these categories, such as a fulltime student, homemaker, or retiree, is not in the labor force. © 2007 Thomson South-Western

UNEMPLOYMENT • 3 GROUPS • 1 st • UNDER 16 YEARS OLD • Institutionalized or prison don’t count

UNEMPLOYMENT • 3 GROUPS • 1 st • UNDER 16 YEARS OLD • Institutionalized or prison don’t count

UNEMPLOYMENT • 2 nd • Not in labor forcethose who could but choose not to work. Like my wife who is staying home with our kids

UNEMPLOYMENT • 2 nd • Not in labor forcethose who could but choose not to work. Like my wife who is staying home with our kids

UNEMPLOYMENT • 3 rd Labor force • Those who are able and willing to work. • About half the population last year. • GOVT surveys 60 k households to determine unemployement

UNEMPLOYMENT • 3 rd Labor force • Those who are able and willing to work. • About half the population last year. • GOVT surveys 60 k households to determine unemployement

How Is Unemployment Measured? • Labor Force • The labor force is the total number of workers, including both the employed and the unemployed. • The BLS defines the labor force as the sum of the employed and the unemployed. © 2007 Thomson South-Western

How Is Unemployment Measured? • Labor Force • The labor force is the total number of workers, including both the employed and the unemployed. • The BLS defines the labor force as the sum of the employed and the unemployed. © 2007 Thomson South-Western

Unemployment rate • Unemployed • *100 • Labor Force

Unemployment rate • Unemployed • *100 • Labor Force

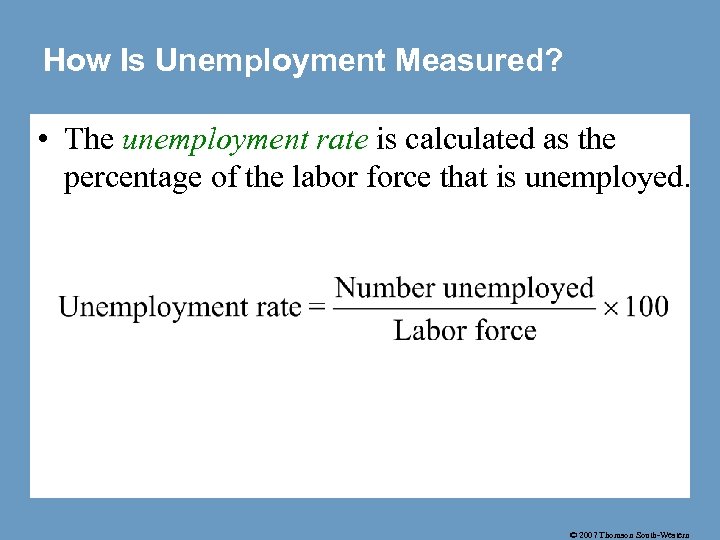

How Is Unemployment Measured? • The unemployment rate is calculated as the percentage of the labor force that is unemployed. © 2007 Thomson South-Western

How Is Unemployment Measured? • The unemployment rate is calculated as the percentage of the labor force that is unemployed. © 2007 Thomson South-Western

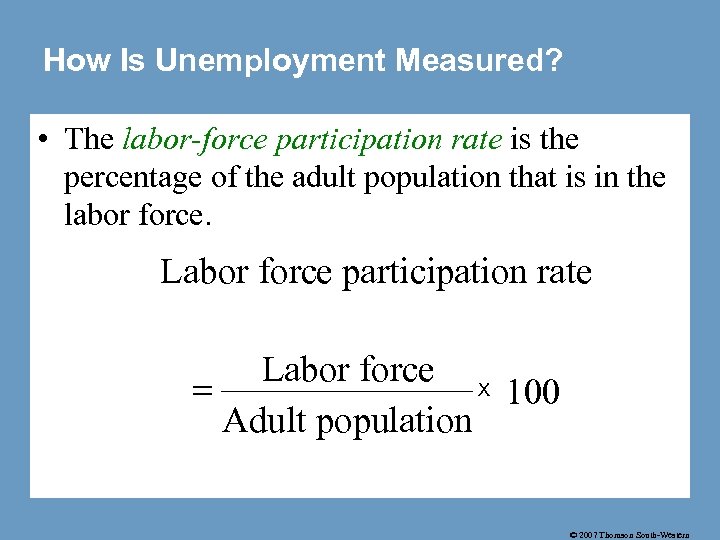

How Is Unemployment Measured? • The labor-force participation rate is the percentage of the adult population that is in the labor force. Labor force participation rate Labor force X = 100 Adult population © 2007 Thomson South-Western

How Is Unemployment Measured? • The labor-force participation rate is the percentage of the adult population that is in the labor force. Labor force participation rate Labor force X = 100 Adult population © 2007 Thomson South-Western

ALTERNATIVE CLASSROOM EXAMPLE: The country of Bada has collected the following information: Population 240, 000 Employed 180, 000 Unemployed 30, 000 Labor Force = 180, 000 + 30, 000 = 210. 000 Unemployment rate = (30, 000/210, 000) × 100% = 14. 3% Labor-force participation rate = (210, 000/240, 000) × 100% = 87. 5%

ALTERNATIVE CLASSROOM EXAMPLE: The country of Bada has collected the following information: Population 240, 000 Employed 180, 000 Unemployed 30, 000 Labor Force = 180, 000 + 30, 000 = 210. 000 Unemployment rate = (30, 000/210, 000) × 100% = 14. 3% Labor-force participation rate = (210, 000/240, 000) × 100% = 87. 5%

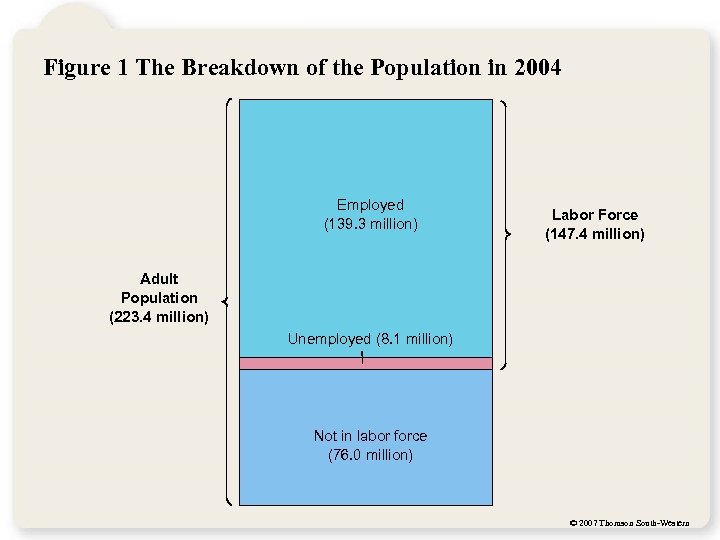

Figure 1 The Breakdown of the Population in 2004 Employed (139. 3 million) Labor Force (147. 4 million) Adult Population (223. 4 million) Unemployed (8. 1 million) Not in labor force (76. 0 million) © 2007 Thomson South-Western

Figure 1 The Breakdown of the Population in 2004 Employed (139. 3 million) Labor Force (147. 4 million) Adult Population (223. 4 million) Unemployed (8. 1 million) Not in labor force (76. 0 million) © 2007 Thomson South-Western

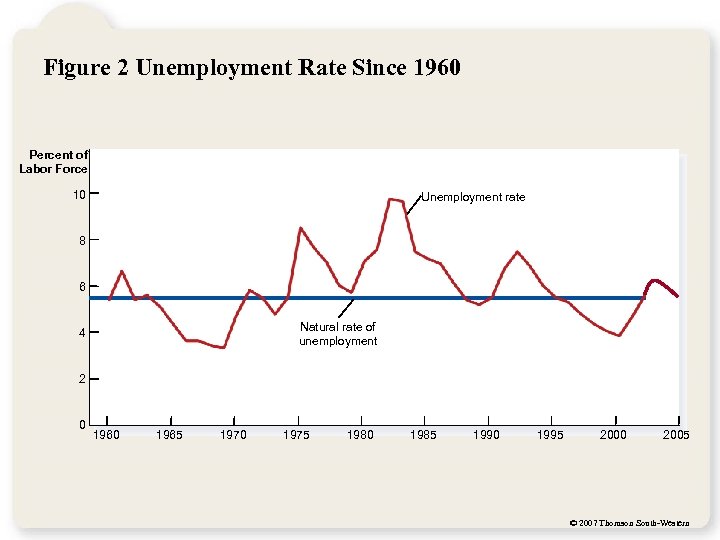

Figure 2 Unemployment Rate Since 1960 Percent of Labor Force 10 Unemployment rate 8 6 Natural rate of unemployment 4 2 0 1965 1970 1975 1980 1985 1990 1995 2000 2005 © 2007 Thomson South-Western

Figure 2 Unemployment Rate Since 1960 Percent of Labor Force 10 Unemployment rate 8 6 Natural rate of unemployment 4 2 0 1965 1970 1975 1980 1985 1990 1995 2000 2005 © 2007 Thomson South-Western

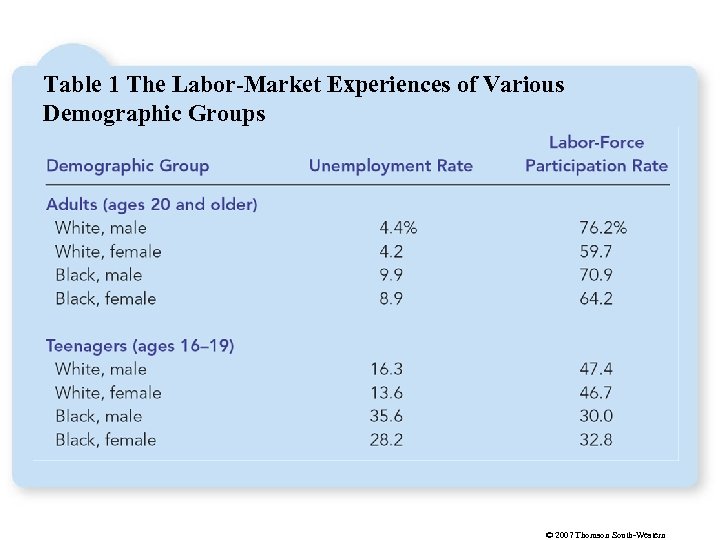

Table 1 The Labor-Market Experiences of Various Demographic Groups © 2007 Thomson South-Western

Table 1 The Labor-Market Experiences of Various Demographic Groups © 2007 Thomson South-Western

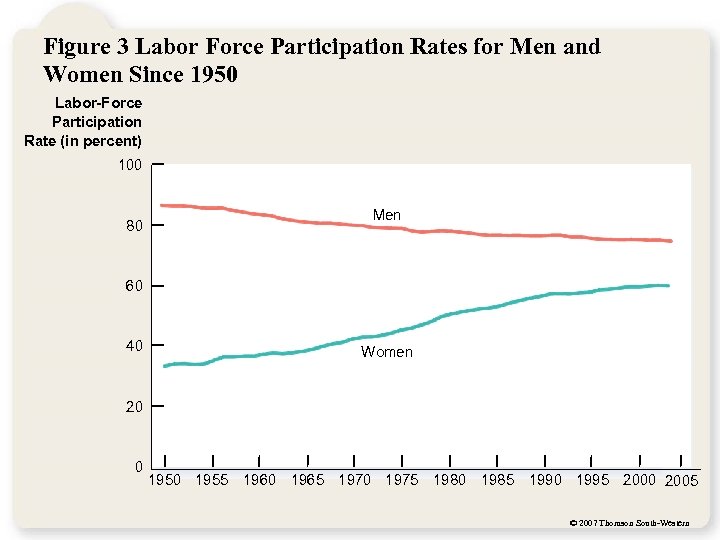

Figure 3 Labor Force Participation Rates for Men and Women Since 1950 Labor-Force Participation Rate (in percent) 100 80 Men 60 40 Women 20 0 1955 1960 1965 1970 1975 1980 1985 1990 1995 2000 2005 © 2007 Thomson South-Western

Figure 3 Labor Force Participation Rates for Men and Women Since 1950 Labor-Force Participation Rate (in percent) 100 80 Men 60 40 Women 20 0 1955 1960 1965 1970 1975 1980 1985 1990 1995 2000 2005 © 2007 Thomson South-Western

Problems with Unemployment Rate • Part time workers are counted as fully employed • Must be actively seeking employment. Some get discouraged and are not seeking employment. So they don’t count in the labor force.

Problems with Unemployment Rate • Part time workers are counted as fully employed • Must be actively seeking employment. Some get discouraged and are not seeking employment. So they don’t count in the labor force.

Does the Unemployment Rate Measure What We Want It To? • It is difficult to distinguish between a person who is unemployed and a person who is not in the labor force. • Discouraged workers, people who would like to work but have given up looking for jobs after an unsuccessful search, don’t show up in unemployment statistics. • Other people may claim to be unemployed in order to receive financial assistance, even though they aren’t looking for work. © 2007 Thomson South-Western

Does the Unemployment Rate Measure What We Want It To? • It is difficult to distinguish between a person who is unemployed and a person who is not in the labor force. • Discouraged workers, people who would like to work but have given up looking for jobs after an unsuccessful search, don’t show up in unemployment statistics. • Other people may claim to be unemployed in order to receive financial assistance, even though they aren’t looking for work. © 2007 Thomson South-Western

How Long Are the Unemployed without Work? • Most spells of unemployment are short. • Most unemployment observed at any given time is long-term. • Most of the economy’s unemployment problem is attributable to relatively few workers who are jobless for long periods of time. © 2007 Thomson South-Western

How Long Are the Unemployed without Work? • Most spells of unemployment are short. • Most unemployment observed at any given time is long-term. • Most of the economy’s unemployment problem is attributable to relatively few workers who are jobless for long periods of time. © 2007 Thomson South-Western

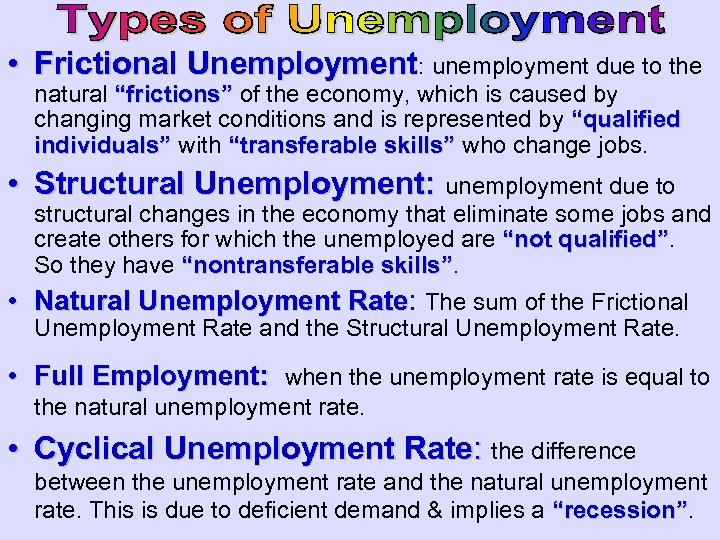

• Frictional Unemployment: unemployment due to the natural “frictions” of the economy, which is caused by changing market conditions and is represented by “qualified individuals” with “transferable skills” who change jobs. • Structural Unemployment: unemployment due to structural changes in the economy that eliminate some jobs and create others for which the unemployed are “not qualified” So they have “nontransferable skills” • Natural Unemployment Rate: The sum of the Frictional Rate Unemployment Rate and the Structural Unemployment Rate. • Full Employment: when the unemployment rate is equal to the natural unemployment rate. • Cyclical Unemployment Rate: the difference between the unemployment rate and the natural unemployment rate. This is due to deficient demand & implies a “recession”

• Frictional Unemployment: unemployment due to the natural “frictions” of the economy, which is caused by changing market conditions and is represented by “qualified individuals” with “transferable skills” who change jobs. • Structural Unemployment: unemployment due to structural changes in the economy that eliminate some jobs and create others for which the unemployed are “not qualified” So they have “nontransferable skills” • Natural Unemployment Rate: The sum of the Frictional Rate Unemployment Rate and the Structural Unemployment Rate. • Full Employment: when the unemployment rate is equal to the natural unemployment rate. • Cyclical Unemployment Rate: the difference between the unemployment rate and the natural unemployment rate. This is due to deficient demand & implies a “recession”

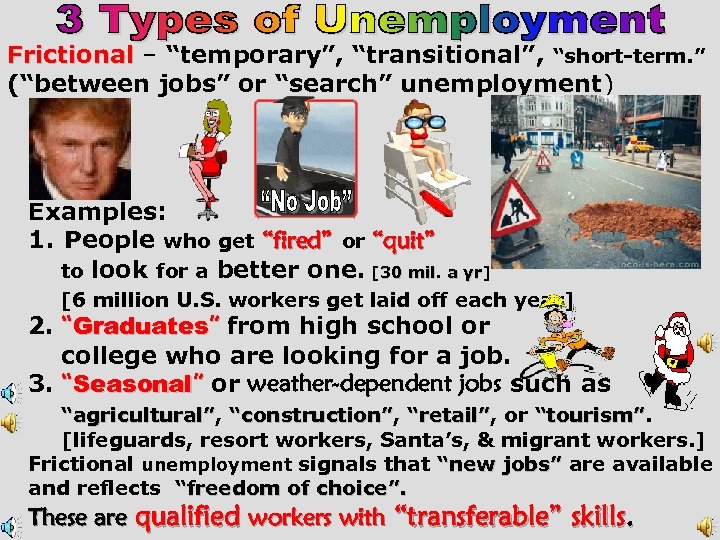

Frictional – “temporary”, “transitional”, “short-term. ” (“between jobs” or “search” unemployment) Examples: 1. People who get “fired” or “quit” to look for a better one. [30 mil. a yr] mil yr [6 million U. S. workers get laid off each year] 2. “Graduates” from high school or college who are looking for a job. 3. “Seasonal” or weather-dependent jobs such as “agricultural”, “construction”, “retail”, or “tourism”. “agricultural” “construction” “retail” “tourism” [lifeguards, resort workers, Santa’s, & migrant workers. ] Frictional unemployment signals that “new jobs” are available and reflects “freedom of choice”. These are qualified workers with “transferable” skills.

Frictional – “temporary”, “transitional”, “short-term. ” (“between jobs” or “search” unemployment) Examples: 1. People who get “fired” or “quit” to look for a better one. [30 mil. a yr] mil yr [6 million U. S. workers get laid off each year] 2. “Graduates” from high school or college who are looking for a job. 3. “Seasonal” or weather-dependent jobs such as “agricultural”, “construction”, “retail”, or “tourism”. “agricultural” “construction” “retail” “tourism” [lifeguards, resort workers, Santa’s, & migrant workers. ] Frictional unemployment signals that “new jobs” are available and reflects “freedom of choice”. These are qualified workers with “transferable” skills.

• Frictional unemployment refers to the unemployment that results from the time that it takes to match workers with jobs. – In other words, it takes time for workers to search for the jobs that are best suit their tastes and skills.

• Frictional unemployment refers to the unemployment that results from the time that it takes to match workers with jobs. – In other words, it takes time for workers to search for the jobs that are best suit their tastes and skills.

Types of Unemployment • Frictional-people between jobs. Voluntarily going from low pay to higher pay jobs

Types of Unemployment • Frictional-people between jobs. Voluntarily going from low pay to higher pay jobs

• Frictional unemployment consists of those searching for jobs or waiting to take jobs soon; it is regarded as somewhat desirable, because it indicates that there is mobility as people change or seek jobs.

• Frictional unemployment consists of those searching for jobs or waiting to take jobs soon; it is regarded as somewhat desirable, because it indicates that there is mobility as people change or seek jobs.

Why Some Frictional Unemployment Is Inevitable • Search unemployment is inevitable because the economy is always changing. • Changes in the composition of demand among industries or regions are called sectoral shifts. • It takes time for workers to search for and find jobs in new sectors. © 2007 Thomson South-Western

Why Some Frictional Unemployment Is Inevitable • Search unemployment is inevitable because the economy is always changing. • Changes in the composition of demand among industries or regions are called sectoral shifts. • It takes time for workers to search for and find jobs in new sectors. © 2007 Thomson South-Western

• Frictional unemployment often occurs because of a change in the demand for labor among different firms. • a. When workers decide to stop buying a good produced by Firm A and instead start buying a good produced by Firm B, some workers at Firm A will likely lose their jobs. • b. New jobs will be created at Firm B, but it will take some time to move the displaced workers from Firm A to these openings. • c. The result of this transition is temporary unemployment. • d. The same type of situation can occur across industries as well. © 2007 Thomson South-Western

• Frictional unemployment often occurs because of a change in the demand for labor among different firms. • a. When workers decide to stop buying a good produced by Firm A and instead start buying a good produced by Firm B, some workers at Firm A will likely lose their jobs. • b. New jobs will be created at Firm B, but it will take some time to move the displaced workers from Firm A to these openings. • c. The result of this transition is temporary unemployment. • d. The same type of situation can occur across industries as well. © 2007 Thomson South-Western

2. Structural Unemployment Structural – “technological” or “long term”. There are basic changes in the “structure” of the labor force which make certain “skills obsolete”. [also caused by “international competition”] Automation may result in job losses. Consumer taste may make a good “obsolete”. The auto reduced the need for carriage makers. Farm machinery reduced the need for farm laborers “Creative destruction” means as jobs are created, other jobs are lost. Jobs of the future destroy jobs of today. Frictional and Structural make up the “natural rate of unemployment”. “These jobs do not come back. ” “Non-transferable skills” – choice is prolonged unemployment or retraining.

2. Structural Unemployment Structural – “technological” or “long term”. There are basic changes in the “structure” of the labor force which make certain “skills obsolete”. [also caused by “international competition”] Automation may result in job losses. Consumer taste may make a good “obsolete”. The auto reduced the need for carriage makers. Farm machinery reduced the need for farm laborers “Creative destruction” means as jobs are created, other jobs are lost. Jobs of the future destroy jobs of today. Frictional and Structural make up the “natural rate of unemployment”. “These jobs do not come back. ” “Non-transferable skills” – choice is prolonged unemployment or retraining.

• Structural unemployment is the unemployment that results because the number of jobs available in some labor markets is insufficient to provide a job for everyone who wants one. © 2007 Thomson South-Western

• Structural unemployment is the unemployment that results because the number of jobs available in some labor markets is insufficient to provide a job for everyone who wants one. © 2007 Thomson South-Western

Types of Unemployment • Structural-Skills become obsolete-some one who used to be a cotton picker. Then the cotton gin comes and they are out of a job.

Types of Unemployment • Structural-Skills become obsolete-some one who used to be a cotton picker. Then the cotton gin comes and they are out of a job.

Structural unemployment: due to changes in the structure of demand for labor; e. g. , when certain skills become obsolete or geographic distribution of jobs changes • a. Glass blowers were replaced by bottle-making machines. • b. Oil-field workers were displaced when oil demand fell in 1980 s. • c. Airline mergers displaced many airline workers in 1980 s. • d. Foreign competition has led to downsizing in U. S. industry and loss of jobs. • e. Military cutbacks have led to displacement of workers in military-related industries.

Structural unemployment: due to changes in the structure of demand for labor; e. g. , when certain skills become obsolete or geographic distribution of jobs changes • a. Glass blowers were replaced by bottle-making machines. • b. Oil-field workers were displaced when oil demand fell in 1980 s. • c. Airline mergers displaced many airline workers in 1980 s. • d. Foreign competition has led to downsizing in U. S. industry and loss of jobs. • e. Military cutbacks have led to displacement of workers in military-related industries.

The difference between the Two • Frictionally unemployed have able skills • Usually short term • Structurally unemployed need to be retrained in skills that are needed • Longer term

The difference between the Two • Frictionally unemployed have able skills • Usually short term • Structurally unemployed need to be retrained in skills that are needed • Longer term

Public Policy and Job Search • Structural unemployment occurs when the quantity of labor supplied exceeds the quantity demanded. • Structural unemployment is often thought to explain longer spells of unemployment. • Why is there Structural Unemployment? • Minimum-wage laws • Unions • Efficiency wages © 2007 Thomson South-Western

Public Policy and Job Search • Structural unemployment occurs when the quantity of labor supplied exceeds the quantity demanded. • Structural unemployment is often thought to explain longer spells of unemployment. • Why is there Structural Unemployment? • Minimum-wage laws • Unions • Efficiency wages © 2007 Thomson South-Western

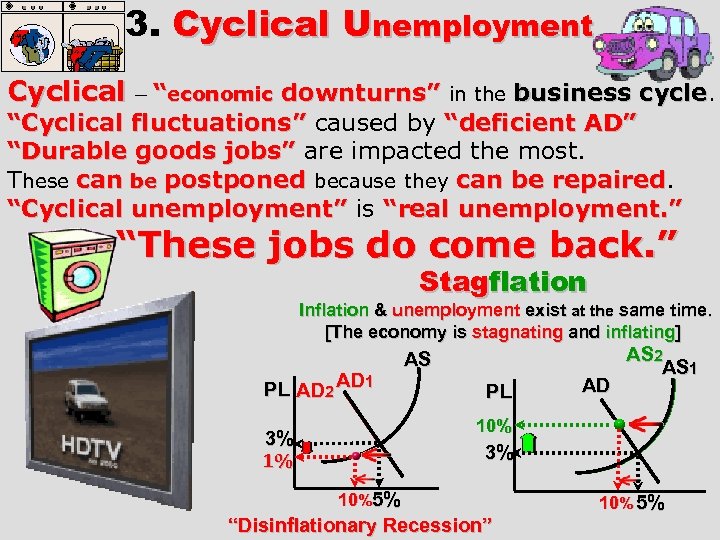

3. Cyclical Unemployment Cyclical – “economic downturns” in the business cycle. “Cyclical fluctuations” caused by “deficient AD” “Durable goods jobs” are impacted the most. These can be postponed because they can be repaired “Cyclical unemployment” is “real unemployment. ” “These jobs do come back. ” Stagflation Inflation & unemployment exist at the same time. [The economy is stagnating and inflating] PL AD 2 AD 1 AS PL AD AS 2 AS 1 10% 3% 10%5% “Disinflationary Recession” 10% 5%

3. Cyclical Unemployment Cyclical – “economic downturns” in the business cycle. “Cyclical fluctuations” caused by “deficient AD” “Durable goods jobs” are impacted the most. These can be postponed because they can be repaired “Cyclical unemployment” is “real unemployment. ” “These jobs do come back. ” Stagflation Inflation & unemployment exist at the same time. [The economy is stagnating and inflating] PL AD 2 AD 1 AS PL AD AS 2 AS 1 10% 3% 10%5% “Disinflationary Recession” 10% 5%

Cyclical Unemployment “These jobs do come back. ” If Arnold S. gets laid off producing autos, he says,

Cyclical Unemployment “These jobs do come back. ” If Arnold S. gets laid off producing autos, he says,

Types of Unemployment • Cyclical-When economy down turns and spending drops these unemployed are called cyclical. Most during great depression were cyclical unemployment.

Types of Unemployment • Cyclical-When economy down turns and spending drops these unemployed are called cyclical. Most during great depression were cyclical unemployment.

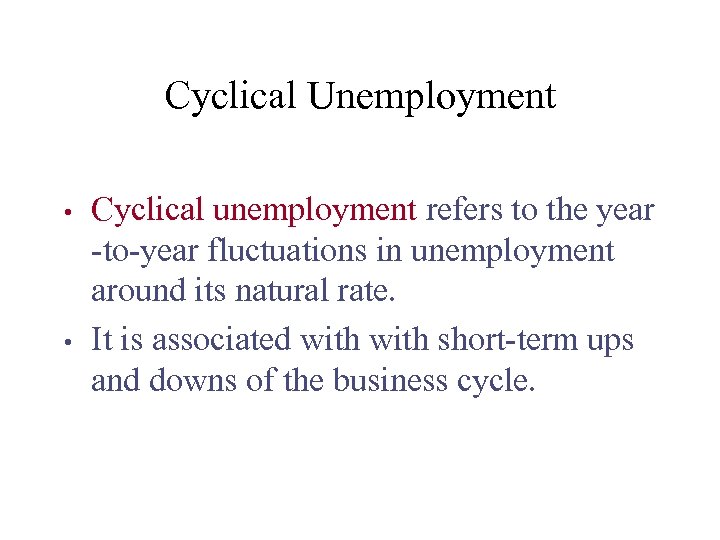

Cyclical Unemployment • • Cyclical unemployment refers to the year -to-year fluctuations in unemployment around its natural rate. It is associated with short-term ups and downs of the business cycle.

Cyclical Unemployment • • Cyclical unemployment refers to the year -to-year fluctuations in unemployment around its natural rate. It is associated with short-term ups and downs of the business cycle.

• 3. Cyclical unemployment is caused by the recession phase of the business cycle, which is sometimes called deficient demand unemployment

• 3. Cyclical unemployment is caused by the recession phase of the business cycle, which is sometimes called deficient demand unemployment

Full Employment • Because Frictional and Structural unemployment are unavoidable does not count against unemployment. • Cyclical unemployment does. • Thus 100 percent employment is not truly 100 percent. • If there were no cyclical unemployed in the economy we would have 100 percent employed.

Full Employment • Because Frictional and Structural unemployment are unavoidable does not count against unemployment. • Cyclical unemployment does. • Thus 100 percent employment is not truly 100 percent. • If there were no cyclical unemployed in the economy we would have 100 percent employed.

If Full Employment • Economist call this full employment rate of unemployment or natural rate of unemployment. (NRU) • At NRU the economy is said to be producing at its potential output. • NRU occurs when the number of job seekers equals the number of job vacancies.

If Full Employment • Economist call this full employment rate of unemployment or natural rate of unemployment. (NRU) • At NRU the economy is said to be producing at its potential output. • NRU occurs when the number of job seekers equals the number of job vacancies.

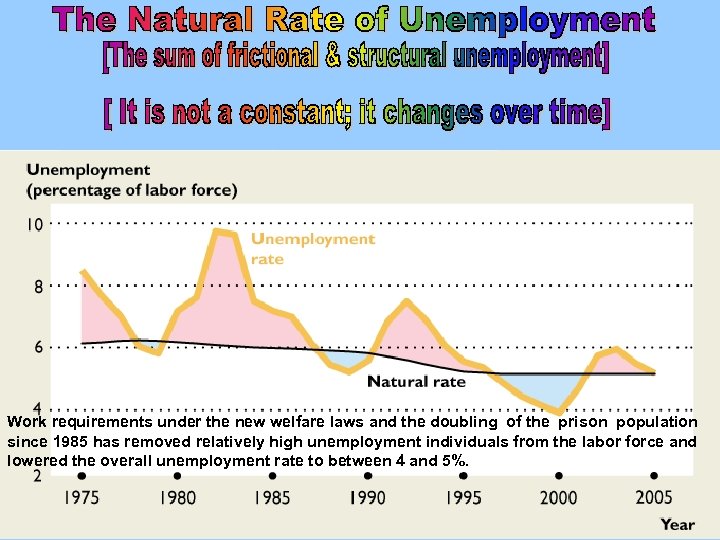

Work requirements under the new welfare laws and the doubling of the prison population since 1985 has removed relatively high unemployment individuals from the labor force and lowered the overall unemployment rate to between 4 and 5%.

Work requirements under the new welfare laws and the doubling of the prison population since 1985 has removed relatively high unemployment individuals from the labor force and lowered the overall unemployment rate to between 4 and 5%.

Natural Rate of Unemployment • • The natural rate of unemployment is unemployment that does not go away on its own even in the long run. It is the amount of unemployment that the economy normally experiences.

Natural Rate of Unemployment • • The natural rate of unemployment is unemployment that does not go away on its own even in the long run. It is the amount of unemployment that the economy normally experiences.

• This implies that, because the economy is always changing, search unemployment is inevitable. Workers in declining industries will find themselves looking for new jobs, and firms in growing industries will be seeking new workers

• This implies that, because the economy is always changing, search unemployment is inevitable. Workers in declining industries will find themselves looking for new jobs, and firms in growing industries will be seeking new workers

• Definition of “Full Employment” • 1. Full employment does not mean zero unemployment. • 2. The full‑employment unemployment rate is equal to the total frictional and structural unemployment. • 3. The full‑employment rate of unemployment is also referred to as the natural rate of unemployment. • 4. The natural rate is achieved when labor markets are in balance; the number of job seekers equals the number of job vacancies. At this point the economy’s potential output is being achieved. The natural rate of unemployment is not fixed, but depends on the demographic makeup of the labor force and the laws and customs of the nations. The recent drop in the natural rate from 6% to 5. 5% has occurred mainly because of the aging of the work force and increased competition in product and labor markets.

• Definition of “Full Employment” • 1. Full employment does not mean zero unemployment. • 2. The full‑employment unemployment rate is equal to the total frictional and structural unemployment. • 3. The full‑employment rate of unemployment is also referred to as the natural rate of unemployment. • 4. The natural rate is achieved when labor markets are in balance; the number of job seekers equals the number of job vacancies. At this point the economy’s potential output is being achieved. The natural rate of unemployment is not fixed, but depends on the demographic makeup of the labor force and the laws and customs of the nations. The recent drop in the natural rate from 6% to 5. 5% has occurred mainly because of the aging of the work force and increased competition in product and labor markets.

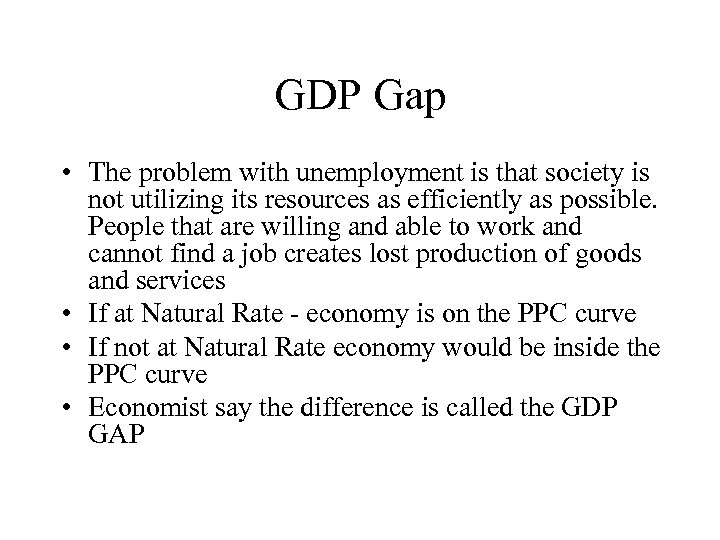

GDP Gap • The problem with unemployment is that society is not utilizing its resources as efficiently as possible. People that are willing and able to work and cannot find a job creates lost production of goods and services • If at Natural Rate - economy is on the PPC curve • If not at Natural Rate economy would be inside the PPC curve • Economist say the difference is called the GDP GAP

GDP Gap • The problem with unemployment is that society is not utilizing its resources as efficiently as possible. People that are willing and able to work and cannot find a job creates lost production of goods and services • If at Natural Rate - economy is on the PPC curve • If not at Natural Rate economy would be inside the PPC curve • Economist say the difference is called the GDP GAP

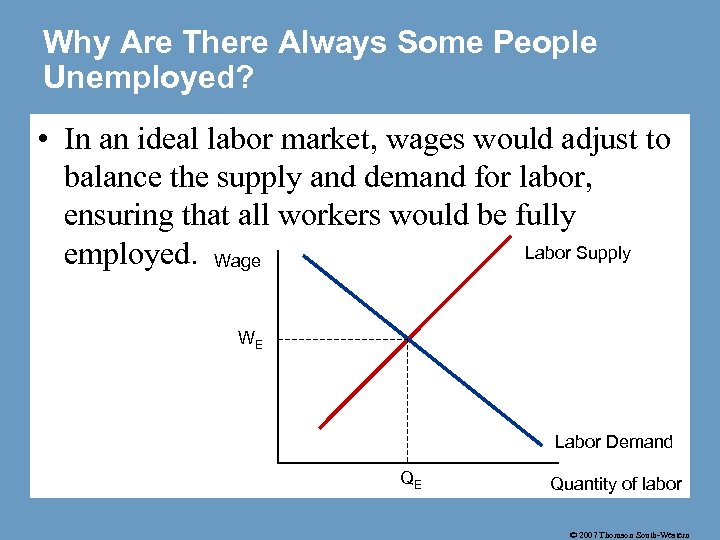

Why Are There Always Some People Unemployed? • In an ideal labor market, wages would adjust to balance the supply and demand for labor, ensuring that all workers would be fully Labor Supply employed. Wage WE Labor Demand QE Quantity of labor © 2007 Thomson South-Western

Why Are There Always Some People Unemployed? • In an ideal labor market, wages would adjust to balance the supply and demand for labor, ensuring that all workers would be fully Labor Supply employed. Wage WE Labor Demand QE Quantity of labor © 2007 Thomson South-Western

Public Policy and Job Search • Government programs can affect the time it takes unemployed workers to find new jobs. • These programs include the following: • Government-run employment agencies • Public training programs • Unemployment insurance © 2007 Thomson South-Western

Public Policy and Job Search • Government programs can affect the time it takes unemployed workers to find new jobs. • These programs include the following: • Government-run employment agencies • Public training programs • Unemployment insurance © 2007 Thomson South-Western

Public Policy and Job Search • Unemployment insurance is a government program that partially protects workers’ incomes when they become unemployed. • Offers workers partial protection against job losses. • Offers partial payment of former wages for a limited time to those who are laid off. © 2007 Thomson South-Western

Public Policy and Job Search • Unemployment insurance is a government program that partially protects workers’ incomes when they become unemployed. • Offers workers partial protection against job losses. • Offers partial payment of former wages for a limited time to those who are laid off. © 2007 Thomson South-Western

Public Policy and Job Search • Unemployment insurance • increases the amount of search unemployment. • reduces the search efforts of the unemployed. • may improve the chances of workers being matched with the right jobs. © 2007 Thomson South-Western

Public Policy and Job Search • Unemployment insurance • increases the amount of search unemployment. • reduces the search efforts of the unemployed. • may improve the chances of workers being matched with the right jobs. © 2007 Thomson South-Western

MINIMUM-WAGE LAWS • When the minimum wage is set above the level that balances supply and demand, it creates unemployment. © 2007 Thomson South-Western

MINIMUM-WAGE LAWS • When the minimum wage is set above the level that balances supply and demand, it creates unemployment. © 2007 Thomson South-Western

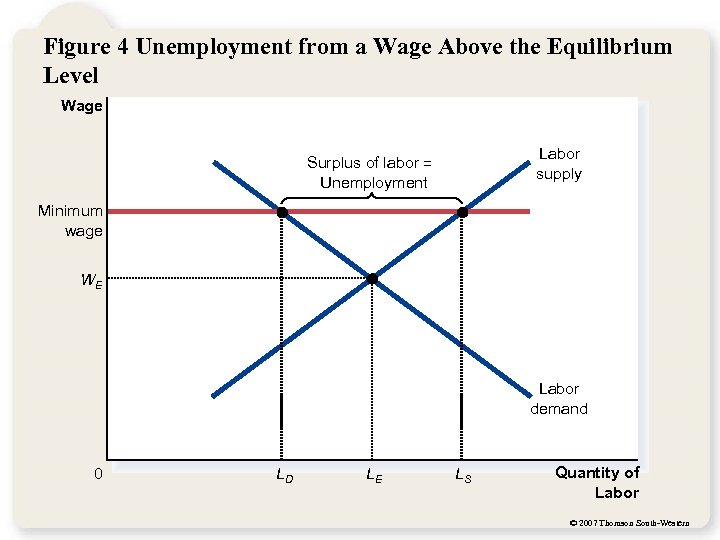

Figure 4 Unemployment from a Wage Above the Equilibrium Level Wage Labor supply Surplus of labor = Unemployment Minimum wage WE Labor demand 0 LD LE LS Quantity of Labor © 2007 Thomson South-Western

Figure 4 Unemployment from a Wage Above the Equilibrium Level Wage Labor supply Surplus of labor = Unemployment Minimum wage WE Labor demand 0 LD LE LS Quantity of Labor © 2007 Thomson South-Western

Summary • The unemployment rate is the percentage of those who would like to work but don’t have jobs. • The Bureau of Labor Statistics calculates this statistic monthly. • The unemployment rate is an imperfect measure of joblessness. © 2007 Thomson South-Western

Summary • The unemployment rate is the percentage of those who would like to work but don’t have jobs. • The Bureau of Labor Statistics calculates this statistic monthly. • The unemployment rate is an imperfect measure of joblessness. © 2007 Thomson South-Western

Summary • In the U. S. economy, most people who become unemployed find work within a short period of time. • Most unemployment observed at any given time is attributable to a few people who are unemployed for long periods of time. © 2007 Thomson South-Western

Summary • In the U. S. economy, most people who become unemployed find work within a short period of time. • Most unemployment observed at any given time is attributable to a few people who are unemployed for long periods of time. © 2007 Thomson South-Western

Summary • One reason for unemployment is the time it takes for workers to search for jobs that best suit their tastes and skills. • A second reason why our economy always has some unemployment is minimum-wage laws. • Minimum-wage laws raise the quantity of labor supplied and reduce the quantity demanded. © 2007 Thomson South-Western

Summary • One reason for unemployment is the time it takes for workers to search for jobs that best suit their tastes and skills. • A second reason why our economy always has some unemployment is minimum-wage laws. • Minimum-wage laws raise the quantity of labor supplied and reduce the quantity demanded. © 2007 Thomson South-Western

Summary • A third reason for unemployment is the market power of unions. • A fourth reason for unemployment is suggested by theory of efficiency wages. • High wages can improve worker health, lower worker turnover, increase worker effort, and raise worker quality. © 2007 Thomson South-Western

Summary • A third reason for unemployment is the market power of unions. • A fourth reason for unemployment is suggested by theory of efficiency wages. • High wages can improve worker health, lower worker turnover, increase worker effort, and raise worker quality. © 2007 Thomson South-Western

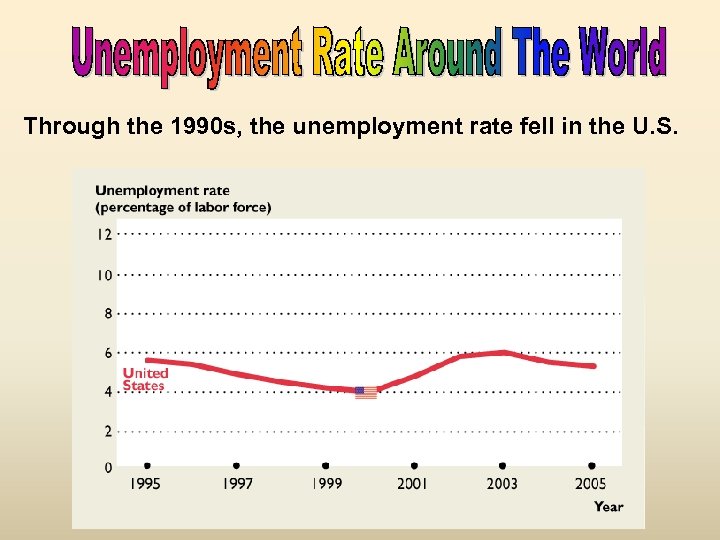

Through the 1990 s, the unemployment rate fell in the U. S.

Through the 1990 s, the unemployment rate fell in the U. S.

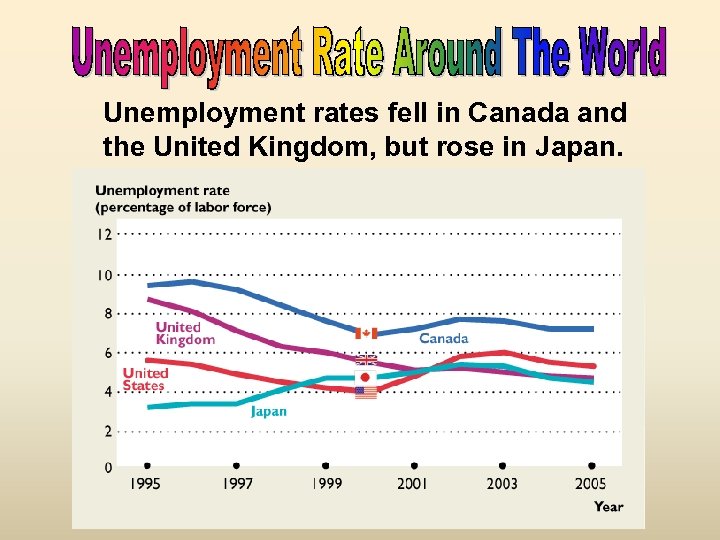

Unemployment rates fell in Canada and the United Kingdom, but rose in Japan.

Unemployment rates fell in Canada and the United Kingdom, but rose in Japan.

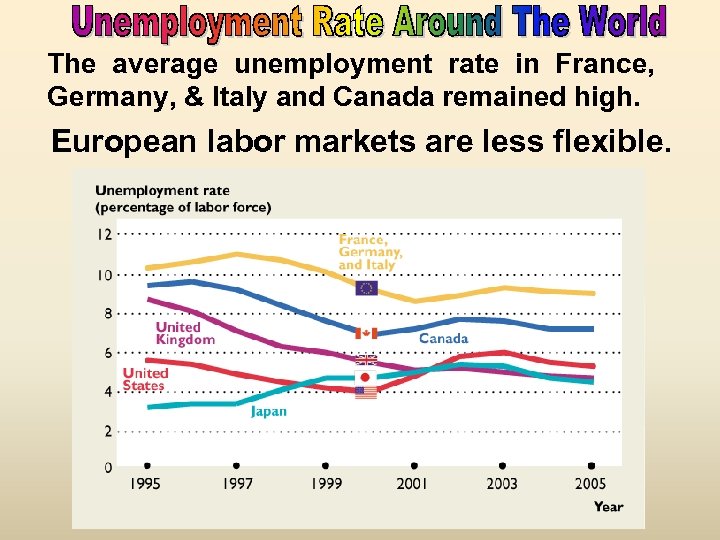

The average unemployment rate in France, Germany, & Italy and Canada remained high. European labor markets are less flexible.

The average unemployment rate in France, Germany, & Italy and Canada remained high. European labor markets are less flexible.

![Recessionary Gap: Potential GDP[$12 tr. ] > Actual GDP[$11 tr. ] AD 1 AS Recessionary Gap: Potential GDP[$12 tr. ] > Actual GDP[$11 tr. ] AD 1 AS](https://present5.com/presentation/4d08a97dbea2a5e98220ab419e9092ce/image-96.jpg) Recessionary Gap: Potential GDP[$12 tr. ] > Actual GDP[$11 tr. ] AD 1 AS AD 2 AD 1 - unemployment rate is too high (cyclical unemployment) - under utilized resources Inflationary Gap: Potential GDP[12] < Actual GDP[13] YR Y YI $11 $12 $13 -unemployment rate is too low - an overheated economy

Recessionary Gap: Potential GDP[$12 tr. ] > Actual GDP[$11 tr. ] AD 1 AS AD 2 AD 1 - unemployment rate is too high (cyclical unemployment) - under utilized resources Inflationary Gap: Potential GDP[12] < Actual GDP[13] YR Y YI $11 $12 $13 -unemployment rate is too low - an overheated economy

0 hi te Bl a H ck is pa ni c W hi te Bl ac k H is p N anic av at i H eraon ig a dr h s ge l H opocho grigh uts ol ad sc ua ho dr Co tesol op lle o g gr C uts e ad ol ualeg M te e deast s g er D ree 's deoct gr ora ee l W Unemployment Rates vary by race, sex, age, & education. race sex age education 40 36 32 28 Adult Males 8 4 3. 2 Adult Females 16 12 5. 9 3. 7 3. 5 5. 4 5. 3 Teenagers 24. 7 24 20 16. 7 11. 4 6. 4 4. 0 3. 5 2. 7 1. 8 1. 6 0. 9

0 hi te Bl a H ck is pa ni c W hi te Bl ac k H is p N anic av at i H eraon ig a dr h s ge l H opocho grigh uts ol ad sc ua ho dr Co tesol op lle o g gr C uts e ad ol ualeg M te e deast s g er D ree 's deoct gr ora ee l W Unemployment Rates vary by race, sex, age, & education. race sex age education 40 36 32 28 Adult Males 8 4 3. 2 Adult Females 16 12 5. 9 3. 7 3. 5 5. 4 5. 3 Teenagers 24. 7 24 20 16. 7 11. 4 6. 4 4. 0 3. 5 2. 7 1. 8 1. 6 0. 9

Demographics of Unemployment 1998 – 4. 5% Unemployment 27. 6% 12. 5% 8. 9% 3. 2% 3. 4% 7. 2% 7. 1%

Demographics of Unemployment 1998 – 4. 5% Unemployment 27. 6% 12. 5% 8. 9% 3. 2% 3. 4% 7. 2% 7. 1%

48. 0% 2010 - 10% Unempl. In Jan, 2010 as unemployment hit 10%, teenage unemployment hit an all time high of 27%. 18. 9% 27. 6% 20. 4% 17. 2% 15. 2% 13. 9% 12. 5% 9. 3% 9. 0% 3. 2% 3. 4% 8. 9% 7. 2% 7. 1%

48. 0% 2010 - 10% Unempl. In Jan, 2010 as unemployment hit 10%, teenage unemployment hit an all time high of 27%. 18. 9% 27. 6% 20. 4% 17. 2% 15. 2% 13. 9% 12. 5% 9. 3% 9. 0% 3. 2% 3. 4% 8. 9% 7. 2% 7. 1%

![2010 Overall Unemployment Rate = 9. 8% [Unemployment Rate & Median Earnings by Education] 2010 Overall Unemployment Rate = 9. 8% [Unemployment Rate & Median Earnings by Education]](https://present5.com/presentation/4d08a97dbea2a5e98220ab419e9092ce/image-100.jpg) 2010 Overall Unemployment Rate = 9. 8% [Unemployment Rate & Median Earnings by Education] 16% 14% 15. 6% Unemployment Rate - 1998 12% 10% 8% $23 K 10. 5% $32 K 7% 8. 0% 6% 5% 5. 0% 4% 3% 2% 1% 0 Less Than High School Diploma 3. 8% High School Grad $38 K Associates Degree $53 K College $60 K Master’s Advanced Degree 3. 0% $75 K

2010 Overall Unemployment Rate = 9. 8% [Unemployment Rate & Median Earnings by Education] 16% 14% 15. 6% Unemployment Rate - 1998 12% 10% 8% $23 K 10. 5% $32 K 7% 8. 0% 6% 5% 5. 0% 4% 3% 2% 1% 0 Less Than High School Diploma 3. 8% High School Grad $38 K Associates Degree $53 K College $60 K Master’s Advanced Degree 3. 0% $75 K

Unemployment and social problems Each one-point increase in the unemployment rate for an extended period is associated with: § 920 more suicides § 650 more homicides § 4000 more people admitted to state mental institutions § 3300 more people sent to state prisons § 37, 000 more deaths § increases in domestic violence and homelessness

Unemployment and social problems Each one-point increase in the unemployment rate for an extended period is associated with: § 920 more suicides § 650 more homicides § 4000 more people admitted to state mental institutions § 3300 more people sent to state prisons § 37, 000 more deaths § increases in domestic violence and homelessness

Stress Associated With Joblessness and Other Events Life Event Death of Spouse Going to jail Fired from job Close friend died Laid off from job Failed school Child left home Major change in working conditions Level of Stress 100 66 49 47 40 37 29 20

Stress Associated With Joblessness and Other Events Life Event Death of Spouse Going to jail Fired from job Close friend died Laid off from job Failed school Child left home Major change in working conditions Level of Stress 100 66 49 47 40 37 29 20

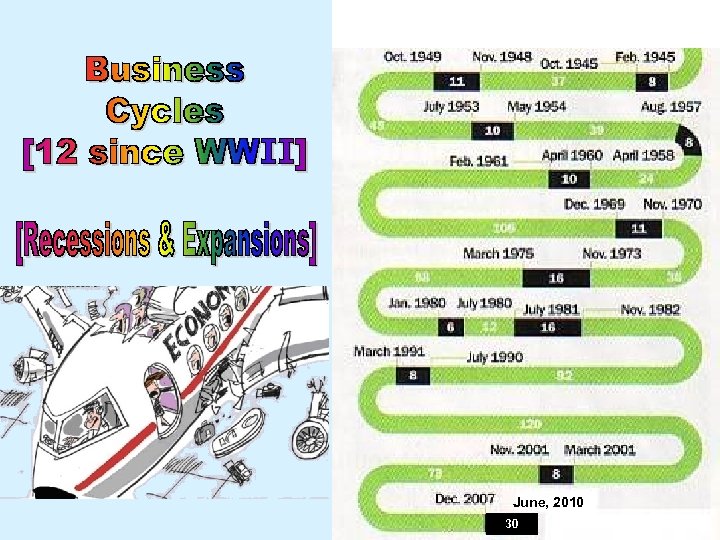

June, 2010 30

June, 2010 30

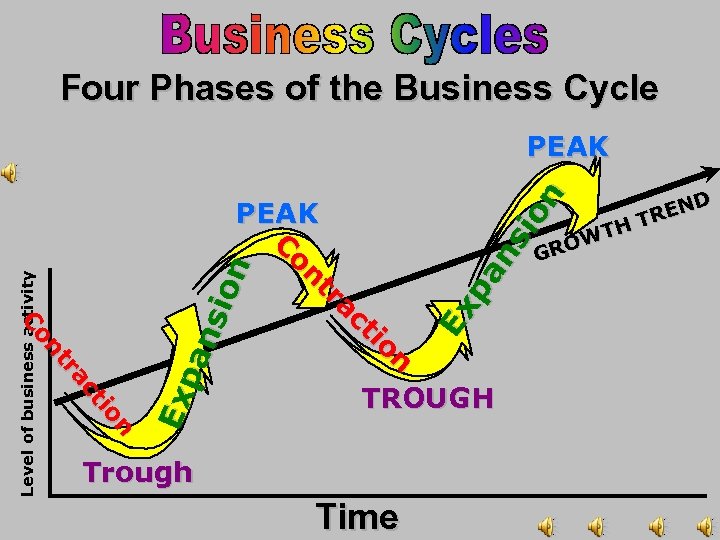

Four Phases of the Business Cycle TROUGH Trough Time D REN T TH W RO G Ex pa ns io n PEAK C on tr ac ti on Ex pa ns ion n on iio ct ct ra ra nt nt Co Co Level of business activity PEAK

Four Phases of the Business Cycle TROUGH Trough Time D REN T TH W RO G Ex pa ns io n PEAK C on tr ac ti on Ex pa ns ion n on iio ct ct ra ra nt nt Co Co Level of business activity PEAK

![[Real GDP per year] Peak R ec es si on Ex pa ns ion [Real GDP per year] Peak R ec es si on Ex pa ns ion](https://present5.com/presentation/4d08a97dbea2a5e98220ab419e9092ce/image-105.jpg) [Real GDP per year] Peak R ec es si on Ex pa ns ion Peak Trough One Cycle Time [Have averaged five years] Expansion: an upturn - real GDP rises. Peak: real GDP reaches its maximum. Recession: real GDP declines 6 months. Trough: real GDP reaches its minimum.

[Real GDP per year] Peak R ec es si on Ex pa ns ion Peak Trough One Cycle Time [Have averaged five years] Expansion: an upturn - real GDP rises. Peak: real GDP reaches its maximum. Recession: real GDP declines 6 months. Trough: real GDP reaches its minimum.

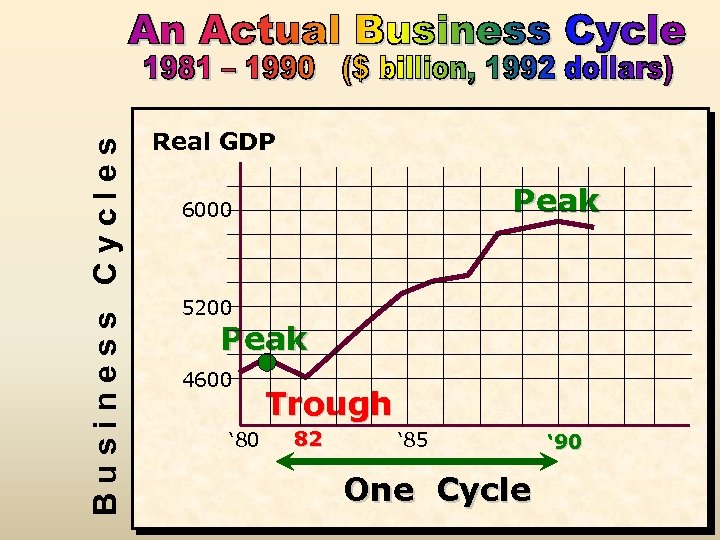

Business Cycles Real GDP Peak 6000 5200 Peak 4600 ‘ 80 Trough 82 ‘ 85 One Cycle ‘ 90

Business Cycles Real GDP Peak 6000 5200 Peak 4600 ‘ 80 Trough 82 ‘ 85 One Cycle ‘ 90

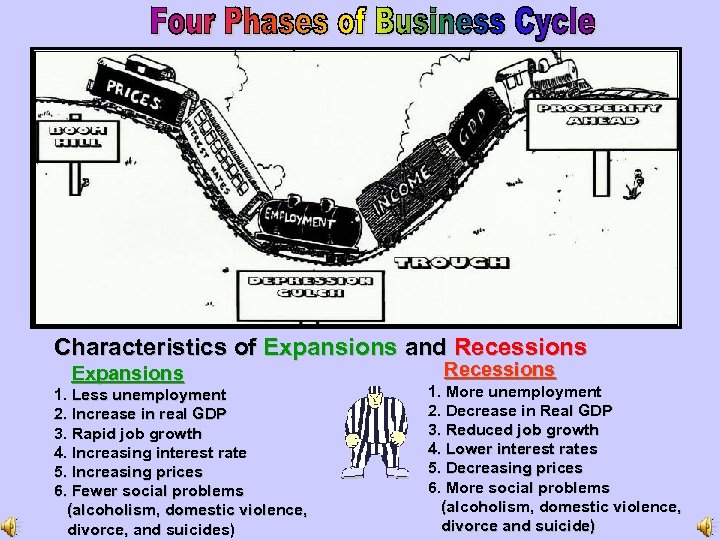

Characteristics of Expansions and Recessions Expansions 1. Less unemployment 2. Increase in real GDP 3. Rapid job growth 4. Increasing interest rate 5. Increasing prices 6. Fewer social problems (alcoholism, domestic violence, divorce, and suicides) Recessions 1. More unemployment 2. Decrease in Real GDP 3. Reduced job growth 4. Lower interest rates 5. Decreasing prices 6. More social problems (alcoholism, domestic violence, divorce and suicide)

Characteristics of Expansions and Recessions Expansions 1. Less unemployment 2. Increase in real GDP 3. Rapid job growth 4. Increasing interest rate 5. Increasing prices 6. Fewer social problems (alcoholism, domestic violence, divorce, and suicides) Recessions 1. More unemployment 2. Decrease in Real GDP 3. Reduced job growth 4. Lower interest rates 5. Decreasing prices 6. More social problems (alcoholism, domestic violence, divorce and suicide)

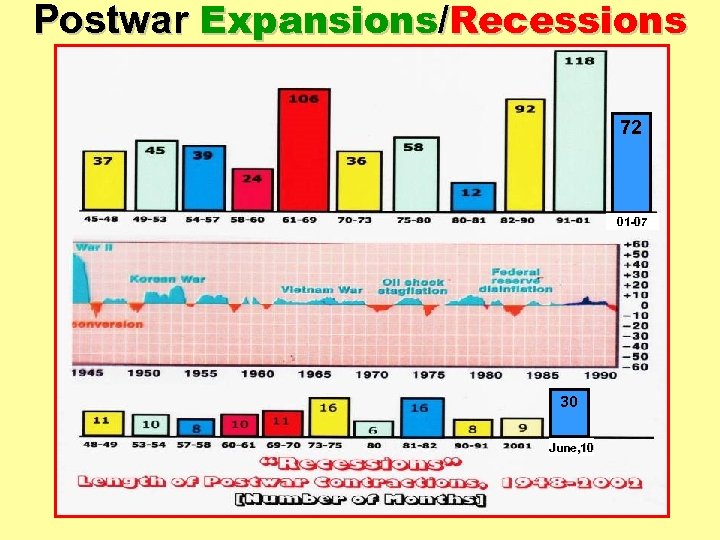

Postwar Expansions/Recessions 72 01 -07 30 June, 10

Postwar Expansions/Recessions 72 01 -07 30 June, 10