f8af635e979cbdce3be268d376fc5286.ppt

- Количество слайдов: 47

Satellite Communications A Part - Final The Future -Professor Barry G Evans- Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 1

Satellite Communications A Part - Final The Future -Professor Barry G Evans- Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 1

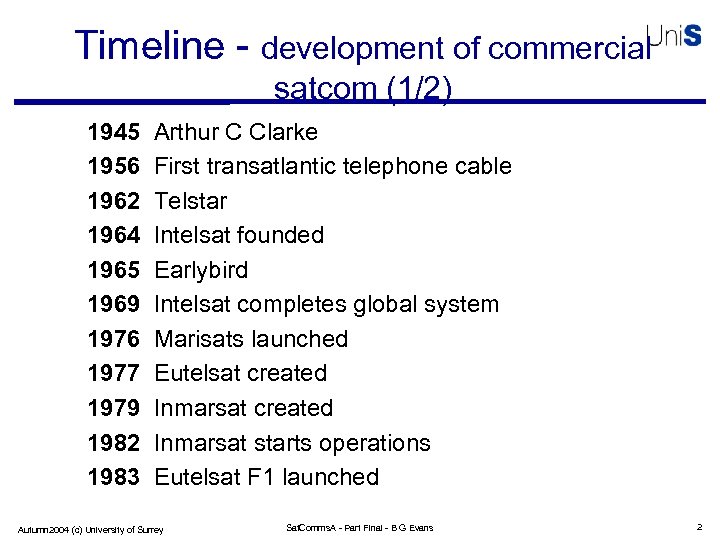

Timeline - development of commercial satcom (1/2) 1945 1956 1962 1964 1965 1969 1976 1977 1979 1982 1983 Arthur C Clarke First transatlantic telephone cable Telstar Intelsat founded Earlybird Intelsat completes global system Marisats launched Eutelsat created Inmarsat starts operations Eutelsat F 1 launched Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 2

Timeline - development of commercial satcom (1/2) 1945 1956 1962 1964 1965 1969 1976 1977 1979 1982 1983 Arthur C Clarke First transatlantic telephone cable Telstar Intelsat founded Earlybird Intelsat completes global system Marisats launched Eutelsat created Inmarsat starts operations Eutelsat F 1 launched Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 2

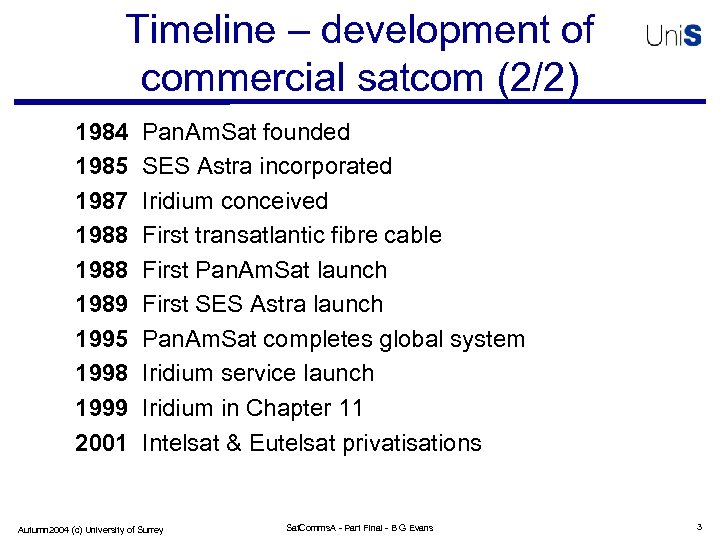

Timeline – development of commercial satcom (2/2) 1984 1985 1987 1988 1989 1995 1998 1999 2001 Pan. Am. Sat founded SES Astra incorporated Iridium conceived First transatlantic fibre cable First Pan. Am. Sat launch First SES Astra launch Pan. Am. Sat completes global system Iridium service launch Iridium in Chapter 11 Intelsat & Eutelsat privatisations Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 3

Timeline – development of commercial satcom (2/2) 1984 1985 1987 1988 1989 1995 1998 1999 2001 Pan. Am. Sat founded SES Astra incorporated Iridium conceived First transatlantic fibre cable First Pan. Am. Sat launch First SES Astra launch Pan. Am. Sat completes global system Iridium service launch Iridium in Chapter 11 Intelsat & Eutelsat privatisations Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 3

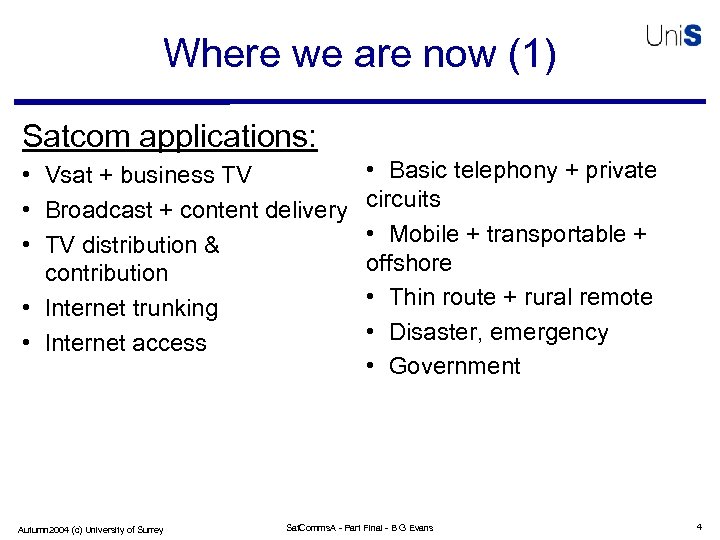

Where we are now (1) Satcom applications: • Vsat + business TV • Broadcast + content delivery • TV distribution & contribution • Internet trunking • Internet access Autumn 2004 (c) University of Surrey • Basic telephony + private circuits • Mobile + transportable + offshore • Thin route + rural remote • Disaster, emergency • Government Sat. Comms. A - Part Final - B G Evans 4

Where we are now (1) Satcom applications: • Vsat + business TV • Broadcast + content delivery • TV distribution & contribution • Internet trunking • Internet access Autumn 2004 (c) University of Surrey • Basic telephony + private circuits • Mobile + transportable + offshore • Thin route + rural remote • Disaster, emergency • Government Sat. Comms. A - Part Final - B G Evans 4

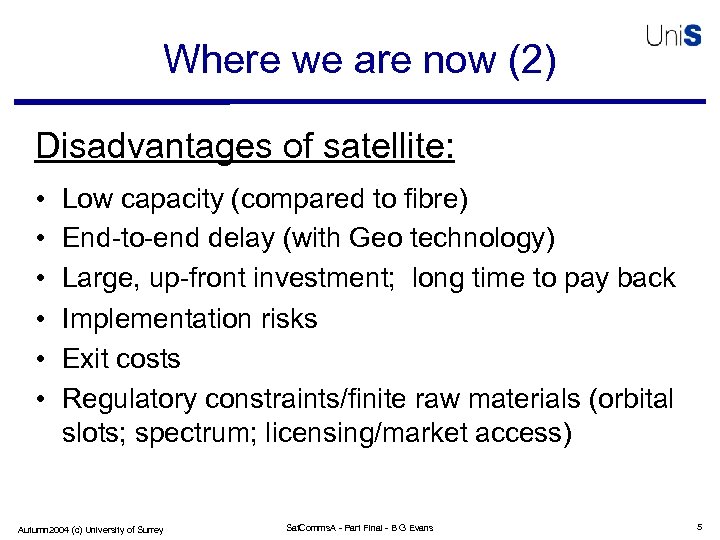

Where we are now (2) Disadvantages of satellite: • • • Low capacity (compared to fibre) End-to-end delay (with Geo technology) Large, up-front investment; long time to pay back Implementation risks Exit costs Regulatory constraints/finite raw materials (orbital slots; spectrum; licensing/market access) Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 5

Where we are now (2) Disadvantages of satellite: • • • Low capacity (compared to fibre) End-to-end delay (with Geo technology) Large, up-front investment; long time to pay back Implementation risks Exit costs Regulatory constraints/finite raw materials (orbital slots; spectrum; licensing/market access) Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 5

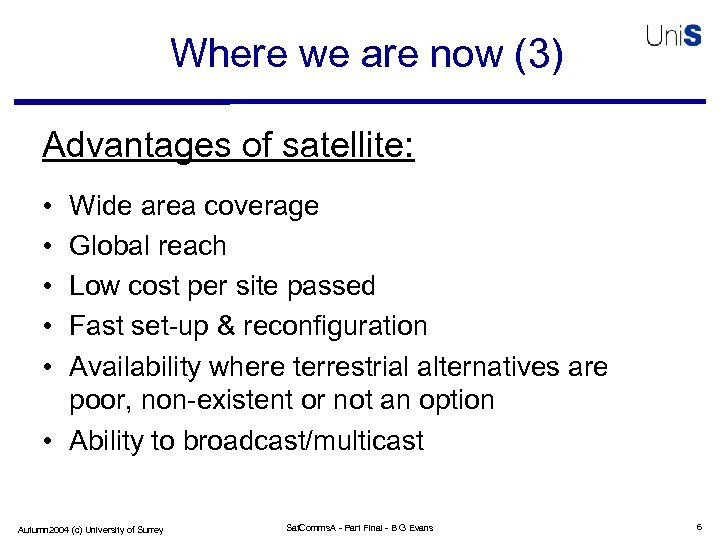

Where we are now (3) Advantages of satellite: • • • Wide area coverage Global reach Low cost per site passed Fast set-up & reconfiguration Availability where terrestrial alternatives are poor, non-existent or not an option • Ability to broadcast/multicast Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 6

Where we are now (3) Advantages of satellite: • • • Wide area coverage Global reach Low cost per site passed Fast set-up & reconfiguration Availability where terrestrial alternatives are poor, non-existent or not an option • Ability to broadcast/multicast Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 6

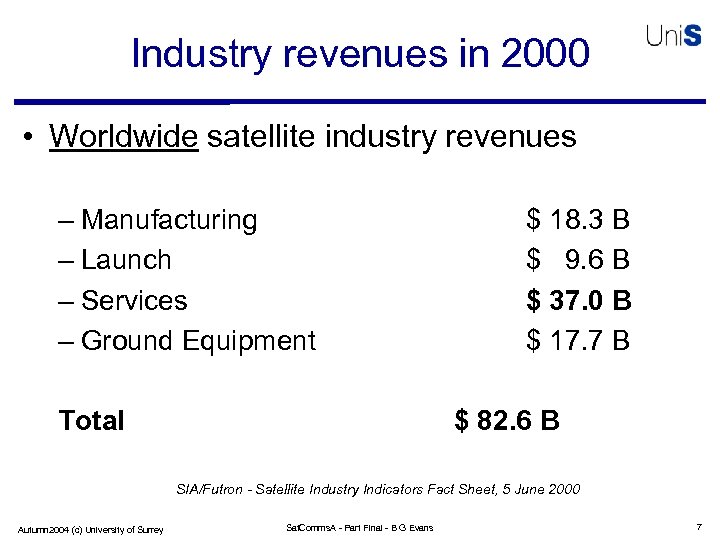

Industry revenues in 2000 • Worldwide satellite industry revenues – Manufacturing – Launch – Services – Ground Equipment Total $ 18. 3 B $ 9. 6 B $ 37. 0 B $ 17. 7 B $ 82. 6 B SIA/Futron - Satellite Industry Indicators Fact Sheet, 5 June 2000 Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 7

Industry revenues in 2000 • Worldwide satellite industry revenues – Manufacturing – Launch – Services – Ground Equipment Total $ 18. 3 B $ 9. 6 B $ 37. 0 B $ 17. 7 B $ 82. 6 B SIA/Futron - Satellite Industry Indicators Fact Sheet, 5 June 2000 Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 7

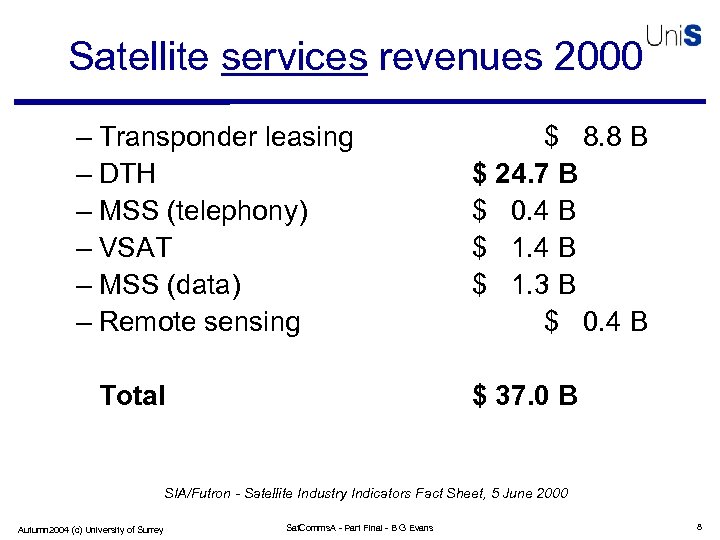

Satellite services revenues 2000 – Transponder leasing – DTH – MSS (telephony) – VSAT – MSS (data) – Remote sensing Total $ 8. 8 B $ 24. 7 B $ 0. 4 B $ 1. 3 B $ 0. 4 B $ 37. 0 B SIA/Futron - Satellite Industry Indicators Fact Sheet, 5 June 2000 Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 8

Satellite services revenues 2000 – Transponder leasing – DTH – MSS (telephony) – VSAT – MSS (data) – Remote sensing Total $ 8. 8 B $ 24. 7 B $ 0. 4 B $ 1. 3 B $ 0. 4 B $ 37. 0 B SIA/Futron - Satellite Industry Indicators Fact Sheet, 5 June 2000 Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 8

Satellite services customers 2000 • DTH – Subscribers 67. 0 M • VSAT – Units in operation 610, 000 • MSS – Data units in operation 854, 000 – Telephony units in operation 274, 300 SIA/Futron - Satellite Industry Indicators Fact Sheet, 5 June 2000 Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 9

Satellite services customers 2000 • DTH – Subscribers 67. 0 M • VSAT – Units in operation 610, 000 • MSS – Data units in operation 854, 000 – Telephony units in operation 274, 300 SIA/Futron - Satellite Industry Indicators Fact Sheet, 5 June 2000 Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 9

Global projections • Projected revenues of the satellite industry – 2001 – 2010 $ 100. 0 B $ 200 -300. 0 B • Projected subscribers to digital radio – 2010 50 M • Projected revenues from broadband services – 2008 $ 37 B. SIA/Futron - Satellite Industry Indicators Fact Sheet, 5 June 2000; ISBC State of the Space Industry 2000; Pioneer Consulting Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 10

Global projections • Projected revenues of the satellite industry – 2001 – 2010 $ 100. 0 B $ 200 -300. 0 B • Projected subscribers to digital radio – 2010 50 M • Projected revenues from broadband services – 2008 $ 37 B. SIA/Futron - Satellite Industry Indicators Fact Sheet, 5 June 2000; ISBC State of the Space Industry 2000; Pioneer Consulting Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 10

Satellite is essential infrastructure • Broadcasting to businesses and homes (DTH) • Broadcasting to cable head-ends – Cable TV distribution dependent upon satellite • ISP connectivity; caching; multicasting – Distribution of internet content • Private Networks – VSAT networks key corporate private network • SNG – Broadcast stations and news bureaus rely on satellite links. Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 11

Satellite is essential infrastructure • Broadcasting to businesses and homes (DTH) • Broadcasting to cable head-ends – Cable TV distribution dependent upon satellite • ISP connectivity; caching; multicasting – Distribution of internet content • Private Networks – VSAT networks key corporate private network • SNG – Broadcast stations and news bureaus rely on satellite links. Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 11

Changing Scenes • 1995 – Bright prospects for terrestrial mobile and satellites • 2000 – Terrestrial mobile booming satellites collapse with Iridium/Globalstar failures • 2002 – Satellite broadcasting and Internet booming terrestrial 3 G in Doldrums “Our ability to predict the telecoms market and to provide affordable services is poor” Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 12

Changing Scenes • 1995 – Bright prospects for terrestrial mobile and satellites • 2000 – Terrestrial mobile booming satellites collapse with Iridium/Globalstar failures • 2002 – Satellite broadcasting and Internet booming terrestrial 3 G in Doldrums “Our ability to predict the telecoms market and to provide affordable services is poor” Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 12

2002: What’s new • • Internet drives FSS DVB – Direct TV success Satellite radio (DAB/DARS) prospects Mobile SPCN’s crash –end of constellations? • INMARSAT niche still strong Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 13

2002: What’s new • • Internet drives FSS DVB – Direct TV success Satellite radio (DAB/DARS) prospects Mobile SPCN’s crash –end of constellations? • INMARSAT niche still strong Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 13

General Climate of Change (1/3) • Deregulation / Liberalisation – Inmarsat / Intelsat / Eutelsat: private companies – Global operations via acquisitions • • 1. SES-Global (>$1 billion turnover) 2. Intelsat 3. Panamsat 4. Eutelsat – Consolidation of manufacturers • Europe: Alcatel Space, Astrium, Alenia • US: Boeing, Lockheed, Loral Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 14

General Climate of Change (1/3) • Deregulation / Liberalisation – Inmarsat / Intelsat / Eutelsat: private companies – Global operations via acquisitions • • 1. SES-Global (>$1 billion turnover) 2. Intelsat 3. Panamsat 4. Eutelsat – Consolidation of manufacturers • Europe: Alcatel Space, Astrium, Alenia • US: Boeing, Lockheed, Loral Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 14

General Climate of Change (2/3) • Standards – Satellite moving same way as Mobile –GMR standards and now S-UMTS • Spectrum – Limited (WRC 00 – Little for satellites) – Sharing/Pricing –Satellite advantage – Efficiency –Can satellites provide? Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 15

General Climate of Change (2/3) • Standards – Satellite moving same way as Mobile –GMR standards and now S-UMTS • Spectrum – Limited (WRC 00 – Little for satellites) – Sharing/Pricing –Satellite advantage – Efficiency –Can satellites provide? Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 15

General Climate of Change (3/3) • Convergence – Fixed/Mobile/Broadcasting – Service mobility – Billing convergence • Investment –Changes rapidly – Satellites poor at moment • Competition –Cable, fixed radio, HAPS Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 16

General Climate of Change (3/3) • Convergence – Fixed/Mobile/Broadcasting – Service mobility – Billing convergence • Investment –Changes rapidly – Satellites poor at moment • Competition –Cable, fixed radio, HAPS Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 16

Where we are now • Total satcom industry revenues were $27 Bn in 2000 (around 3% of global telecom revenues) - Source: ESA • Internet via satellite services generated $800 M global revenues in 2000, from zero in 1997 - Source: DTT Consulting • Total satcom industry revenues are projected to grow to $106 Bn by 2007. The majority of the growth will come from broadband data and video services. Interactive multimedia revenues are forecast to be $18 Bn by 2007, DARS $9 Bn - Source: ESA Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 17

Where we are now • Total satcom industry revenues were $27 Bn in 2000 (around 3% of global telecom revenues) - Source: ESA • Internet via satellite services generated $800 M global revenues in 2000, from zero in 1997 - Source: DTT Consulting • Total satcom industry revenues are projected to grow to $106 Bn by 2007. The majority of the growth will come from broadband data and video services. Interactive multimedia revenues are forecast to be $18 Bn by 2007, DARS $9 Bn - Source: ESA Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 17

Lessons to learn (1) Commercial: • A “big-bang”, high-profile service launch date is unwise • There is no such thing as a global service launch • The satellite owner/operator will be badly let down by uncommitted or poorly-performing distributors • Bad news about one satellite project is bad news for all • Satellite systems can not charge whatever they like • Confirmed access to spectrum is vital • Market access is crucial to business success • The first to market is not necessarily the winner • Finding killer applications is difficult Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 18

Lessons to learn (1) Commercial: • A “big-bang”, high-profile service launch date is unwise • There is no such thing as a global service launch • The satellite owner/operator will be badly let down by uncommitted or poorly-performing distributors • Bad news about one satellite project is bad news for all • Satellite systems can not charge whatever they like • Confirmed access to spectrum is vital • Market access is crucial to business success • The first to market is not necessarily the winner • Finding killer applications is difficult Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 18

Lessons to learn (2) Financial: • Year one forecasts must be realistic • The investors are highly dependent on the performance of the distribution chain. • Financing a start-up satellite system is very hard • Do not rely on investment banks • Exit costs are extremely high • Flotation too soon leads to exposure and inflexibility Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 19

Lessons to learn (2) Financial: • Year one forecasts must be realistic • The investors are highly dependent on the performance of the distribution chain. • Financing a start-up satellite system is very hard • Do not rely on investment banks • Exit costs are extremely high • Flotation too soon leads to exposure and inflexibility Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 19

Lessons to learn (3) Technology: • The satellite manufacturer will not deliver on time • Be realistic about time to market • Do not design a satellite system around just one application • User terminals can be among the most difficult elements in a “mass-market” satellite project • Good technology does not assure commercial success • Alternative, non-satellite technologies do not stand still • Do not underestimate the complexity and costs of non Geo systems Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 20

Lessons to learn (3) Technology: • The satellite manufacturer will not deliver on time • Be realistic about time to market • Do not design a satellite system around just one application • User terminals can be among the most difficult elements in a “mass-market” satellite project • Good technology does not assure commercial success • Alternative, non-satellite technologies do not stand still • Do not underestimate the complexity and costs of non Geo systems Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 20

Lessons to learn (4) Service: • Motivating distributors is vital • It is essential to have service delivery experience at the forefront • For the mass-market, continuous service availability is very important • User expectations must be carefully managed • Distribution strategy must be coherent and focussed • Service provision/distribution channels must be aligned closely with the overall interests of the enterprise. They must be up to speed right at the start • Service and useful functions are the ultimate deliverables Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 21

Lessons to learn (4) Service: • Motivating distributors is vital • It is essential to have service delivery experience at the forefront • For the mass-market, continuous service availability is very important • User expectations must be carefully managed • Distribution strategy must be coherent and focussed • Service provision/distribution channels must be aligned closely with the overall interests of the enterprise. They must be up to speed right at the start • Service and useful functions are the ultimate deliverables Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 21

Remember the advantages of Satellite • • Wide area coverage –broadcast Quick roll-out of services Provides wide bands (high bit rates) Coverage areas that are expensive for terrestrial • Avoids terrestrial infrastructure Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 22

Remember the advantages of Satellite • • Wide area coverage –broadcast Quick roll-out of services Provides wide bands (high bit rates) Coverage areas that are expensive for terrestrial • Avoids terrestrial infrastructure Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 22

FSS - Focus on the Internet • Satellite delivery of IP-based services increased 800% over past two years • 11% of all ISPs use some satellite links to connect to the Internet backbone • By 2001 total ISP demand for satellite links will equal 216 transponders • Internet specific satellite transponder lease revenue will jump from $601 M in 2001 to $8. 5 B in 2006 • End-user and ISP satellite multicast equipment to reach over $7 B in 2005. DDT Consulting; Frost & Sullivan; Pioneer Consulting Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 23

FSS - Focus on the Internet • Satellite delivery of IP-based services increased 800% over past two years • 11% of all ISPs use some satellite links to connect to the Internet backbone • By 2001 total ISP demand for satellite links will equal 216 transponders • Internet specific satellite transponder lease revenue will jump from $601 M in 2001 to $8. 5 B in 2006 • End-user and ISP satellite multicast equipment to reach over $7 B in 2005. DDT Consulting; Frost & Sullivan; Pioneer Consulting Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 23

Internet Services • 30 -40% Intelsat resources now IP • Multicasting from satellites • Caching provision offers improved bandwidth and response times • Satellite products available – Comsat – CLA 2000 • TCP/IP • Spoofing • Slow start/Variable windows – LINKWAY 2000 • • Multiservice BOD ATM/IP/FR/ISDN IP routing protocols (RSVP) BOD adaption Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 24

Internet Services • 30 -40% Intelsat resources now IP • Multicasting from satellites • Caching provision offers improved bandwidth and response times • Satellite products available – Comsat – CLA 2000 • TCP/IP • Spoofing • Slow start/Variable windows – LINKWAY 2000 • • Multiservice BOD ATM/IP/FR/ISDN IP routing protocols (RSVP) BOD adaption Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 24

Broadband • • • Ka and constellations lost momentum Back to GEO’s and DVB-S IP to the customer DVB-RCS e-Europe / Broadband Britain – Satellite role 4500 (36 MHz equivalent transponders) 7000 by 2007 Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 25

Broadband • • • Ka and constellations lost momentum Back to GEO’s and DVB-S IP to the customer DVB-RCS e-Europe / Broadband Britain – Satellite role 4500 (36 MHz equivalent transponders) 7000 by 2007 Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 25

Satellite Direct To Home (DTH) • 67 M subscribers globally - urban, suburban and rural • 25 M satellite households in Western Europe alone – In Spain, Italy, UK and France more satellite households than cable households. • DTH taking market share from cable in US • Cable increasingly expensive to lay (rights of way) - cable companies looking at satellite options to reach customers • DTH presages 2 -way internet/broadband demand – 52% of Astra users own PCs and 27% have online access. Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 26

Satellite Direct To Home (DTH) • 67 M subscribers globally - urban, suburban and rural • 25 M satellite households in Western Europe alone – In Spain, Italy, UK and France more satellite households than cable households. • DTH taking market share from cable in US • Cable increasingly expensive to lay (rights of way) - cable companies looking at satellite options to reach customers • DTH presages 2 -way internet/broadband demand – 52% of Astra users own PCs and 27% have online access. Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 26

80% of European digital TV delivered by satellite "Another important area is digital television. The market for digital TV doubles or even triples a year in several EU countries. Europe has closed the gap with the USA with over 10 million subscribers. New services are rolled out, ranging from Internet access to digital TVbased e-commerce. " From a speech by Mr. Erkki Liikanen, "e. Europe and e-Business" Europay International, Key Members' Conference Amsterdam, 1 July 2000 Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 27

80% of European digital TV delivered by satellite "Another important area is digital television. The market for digital TV doubles or even triples a year in several EU countries. Europe has closed the gap with the USA with over 10 million subscribers. New services are rolled out, ranging from Internet access to digital TVbased e-commerce. " From a speech by Mr. Erkki Liikanen, "e. Europe and e-Business" Europay International, Key Members' Conference Amsterdam, 1 July 2000 Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 27

Satellite Broadcasting • DBS in USA (>15 m subscribers), 43% of digital services Direc. TV and Echo. Star • SNG market growing – 97 mods to DVB-S allow 90 cm-1. 5 m SCPC – 8 Mb/s with 8 PSK/TCM/16 QAM option • DVB-RCS now becoming standard for IP delivery Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 28

Satellite Broadcasting • DBS in USA (>15 m subscribers), 43% of digital services Direc. TV and Echo. Star • SNG market growing – 97 mods to DVB-S allow 90 cm-1. 5 m SCPC – 8 Mb/s with 8 PSK/TCM/16 QAM option • DVB-RCS now becoming standard for IP delivery Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 28

Digital Radio (DAB-DARS) • US – – Xm Radio (GEO) – up --services operation SIRIUS Radio (HEO) --services operation Infrastructure in place – Deals with leading car/truck companies Radio’s in shops (US) and in cars/trucks • Worldwide – Worldspace – 3 world coverage satellites – Infrastructure/Radios – in place • Europe – Global Radio / Worldspace • S-DAB – Convergence broadcasting/mobile – Multimedia and multicasting Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 29

Digital Radio (DAB-DARS) • US – – Xm Radio (GEO) – up --services operation SIRIUS Radio (HEO) --services operation Infrastructure in place – Deals with leading car/truck companies Radio’s in shops (US) and in cars/trucks • Worldwide – Worldspace – 3 world coverage satellites – Infrastructure/Radios – in place • Europe – Global Radio / Worldspace • S-DAB – Convergence broadcasting/mobile – Multimedia and multicasting Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 29

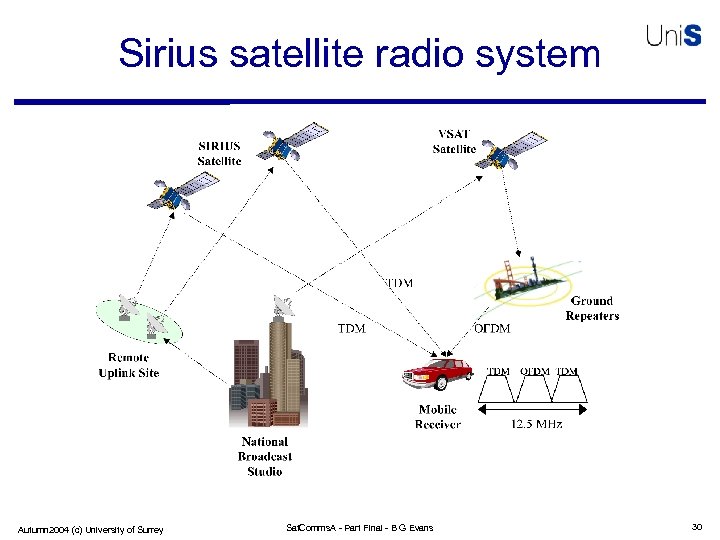

Sirius satellite radio system Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 30

Sirius satellite radio system Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 30

Satellite: competitive local access • Satellite DTH has successfully competed with cable in urban, suburban and rural areas for decades • Satellite is a competitive means of local access – Only wireless technologies bypass the incumbent’s pipes and offer consumers a real “last mile” choice • No other “last mile” technology - DSL, WLL, etc. - has a proven track such as satellite. • Satellite will be a critical access means for bandwidth hungry, converged services. Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 31

Satellite: competitive local access • Satellite DTH has successfully competed with cable in urban, suburban and rural areas for decades • Satellite is a competitive means of local access – Only wireless technologies bypass the incumbent’s pipes and offer consumers a real “last mile” choice • No other “last mile” technology - DSL, WLL, etc. - has a proven track such as satellite. • Satellite will be a critical access means for bandwidth hungry, converged services. Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 31

Mobile Satellite Systems • S-PCS (Iridium/Globalstar) failed –lead on competition with terrestrial will not succeed • Inmarsat niche market area successful but small 200 k users, and expensive • Constellations not popular Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 32

Mobile Satellite Systems • S-PCS (Iridium/Globalstar) failed –lead on competition with terrestrial will not succeed • Inmarsat niche market area successful but small 200 k users, and expensive • Constellations not popular Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 32

GEO-Mobiles • • • ACES/THURAYA etc. 200 spots from 14 m deployables On board dsp – channel to beam routing GSM/GPRS services –GMR standards Can they provide services economically? Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 33

GEO-Mobiles • • • ACES/THURAYA etc. 200 spots from 14 m deployables On board dsp – channel to beam routing GSM/GPRS services –GMR standards Can they provide services economically? Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 33

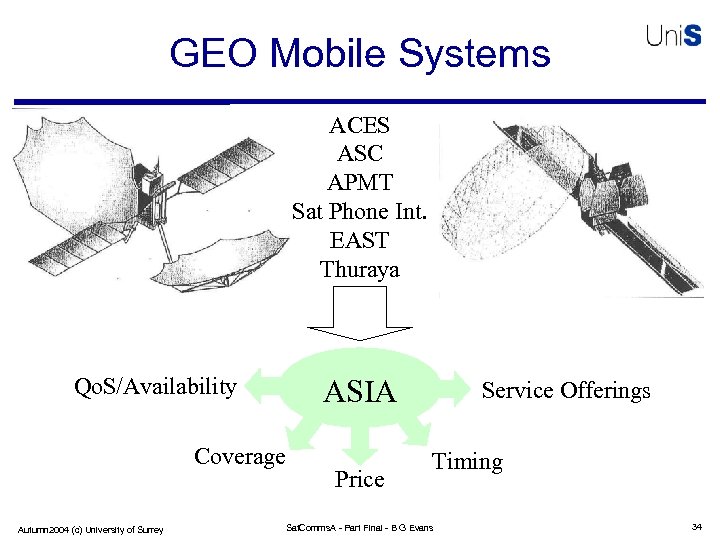

GEO Mobile Systems ACES ASC APMT Sat Phone Int. EAST Thuraya Qo. S/Availability Coverage Autumn 2004 (c) University of Surrey ASIA Price Service Offerings Timing Sat. Comms. A - Part Final - B G Evans 34

GEO Mobile Systems ACES ASC APMT Sat Phone Int. EAST Thuraya Qo. S/Availability Coverage Autumn 2004 (c) University of Surrey ASIA Price Service Offerings Timing Sat. Comms. A - Part Final - B G Evans 34

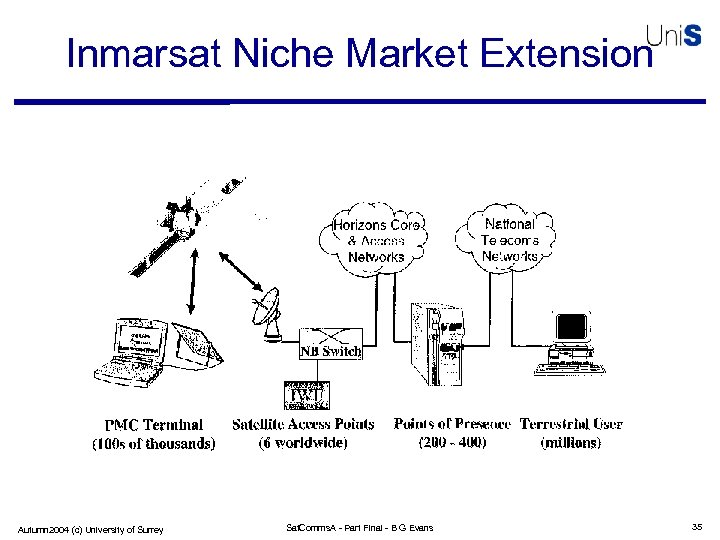

Inmarsat Niche Market Extension Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 35

Inmarsat Niche Market Extension Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 35

Convergence: Mobile / Broadcasting (positioning) • • • Broadcast / Multicasting with caching Push and store services Vehicle’s and handhelds S + T (UMTS) or DVB/DABS with UMTS Location based services tied with Galileo Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 36

Convergence: Mobile / Broadcasting (positioning) • • • Broadcast / Multicasting with caching Push and store services Vehicle’s and handhelds S + T (UMTS) or DVB/DABS with UMTS Location based services tied with Galileo Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 36

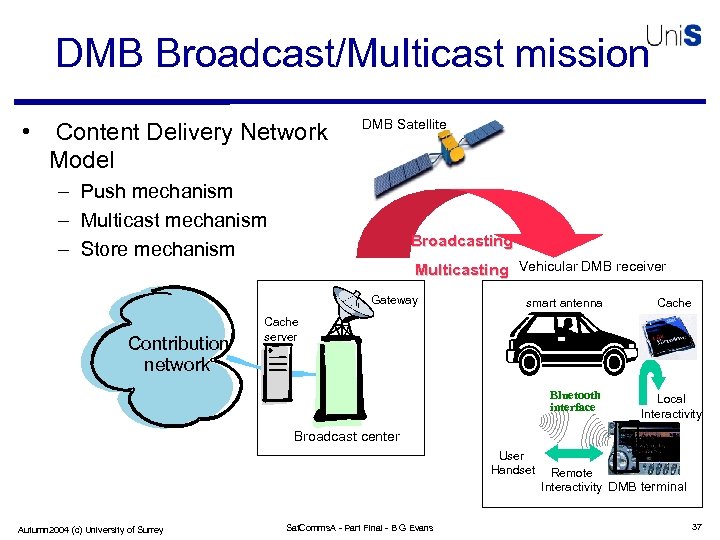

DMB Broadcast/Multicast mission • Content Delivery Network Model DMB Satellite – Push mechanism – Multicast mechanism – Store mechanism Broadcasting Multicasting Vehicular DMB receiver Gateway Contribution network smart antenna Cache server Bluetooth interface Local Interactivity Broadcast center User Handset Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans Remote Interactivity DMB terminal 37

DMB Broadcast/Multicast mission • Content Delivery Network Model DMB Satellite – Push mechanism – Multicast mechanism – Store mechanism Broadcasting Multicasting Vehicular DMB receiver Gateway Contribution network smart antenna Cache server Bluetooth interface Local Interactivity Broadcast center User Handset Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans Remote Interactivity DMB terminal 37

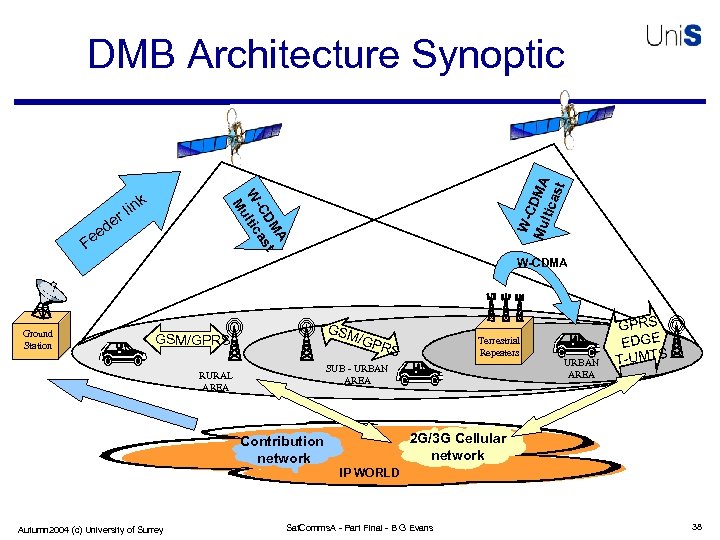

k A DM t -C as W ltic Mu in rl W-C Mu DMA ltic ast DMB Architecture Synoptic e ed e F W-CDMA Ground Station GSM /GP GSM/GPRS Terrestrial Repeaters RS SUB - URBAN AREA RURAL AREA URBAN AREA GPRS EDGE T-UMTS 2 G/3 G Cellular network Contribution network IP WORLD Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 38

k A DM t -C as W ltic Mu in rl W-C Mu DMA ltic ast DMB Architecture Synoptic e ed e F W-CDMA Ground Station GSM /GP GSM/GPRS Terrestrial Repeaters RS SUB - URBAN AREA RURAL AREA URBAN AREA GPRS EDGE T-UMTS 2 G/3 G Cellular network Contribution network IP WORLD Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 38

Opportunity for Satellite – Where are terrestrial networks weak points? • • • Infrastructure cost Deployment of UMTS islands in a GPRS world Traffic costs Limited bandwidth per cell Environmental (tower, pylon, radiation) Designed for symmetric traffic – Where will UMTS network never go? • Broadband broadcast/multicast services (not addressed in R 99) – Don’t you feel any fresh air, there? Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 39

Opportunity for Satellite – Where are terrestrial networks weak points? • • • Infrastructure cost Deployment of UMTS islands in a GPRS world Traffic costs Limited bandwidth per cell Environmental (tower, pylon, radiation) Designed for symmetric traffic – Where will UMTS network never go? • Broadband broadcast/multicast services (not addressed in R 99) – Don’t you feel any fresh air, there? Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 39

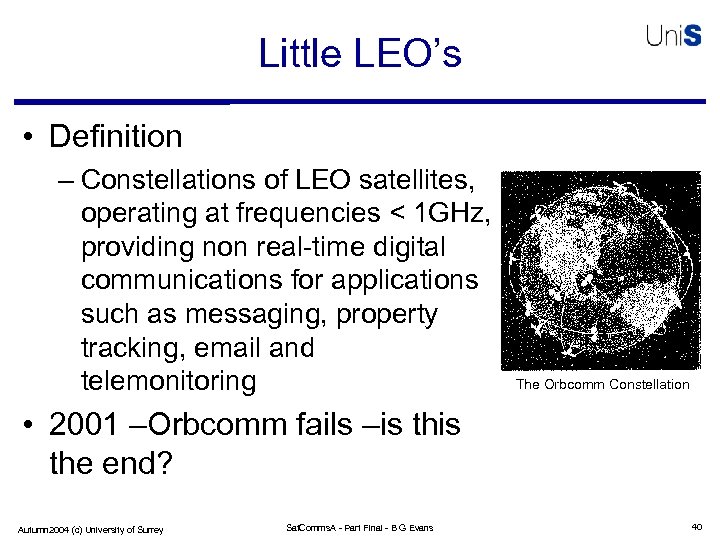

Little LEO’s • Definition – Constellations of LEO satellites, operating at frequencies < 1 GHz, providing non real-time digital communications for applications such as messaging, property tracking, email and telemonitoring The Orbcomm Constellation • 2001 –Orbcomm fails –is the end? Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 40

Little LEO’s • Definition – Constellations of LEO satellites, operating at frequencies < 1 GHz, providing non real-time digital communications for applications such as messaging, property tracking, email and telemonitoring The Orbcomm Constellation • 2001 –Orbcomm fails –is the end? Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 40

Future Opportunities • Keys are –BROADBAND –INTERACTIVITY –INTEGRATION –MOBILITY Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 41

Future Opportunities • Keys are –BROADBAND –INTERACTIVITY –INTEGRATION –MOBILITY Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 41

Future Opportunities • Convergence of Satellite delivered broadcast/multicast with terrestrial delivery of other services • Broadband internet access and interactivity • DVB-RCS –standardisation • Mass markets rather than niche • Cooperating service provision plus completing terminal networks Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 42

Future Opportunities • Convergence of Satellite delivered broadcast/multicast with terrestrial delivery of other services • Broadband internet access and interactivity • DVB-RCS –standardisation • Mass markets rather than niche • Cooperating service provision plus completing terminal networks Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 42

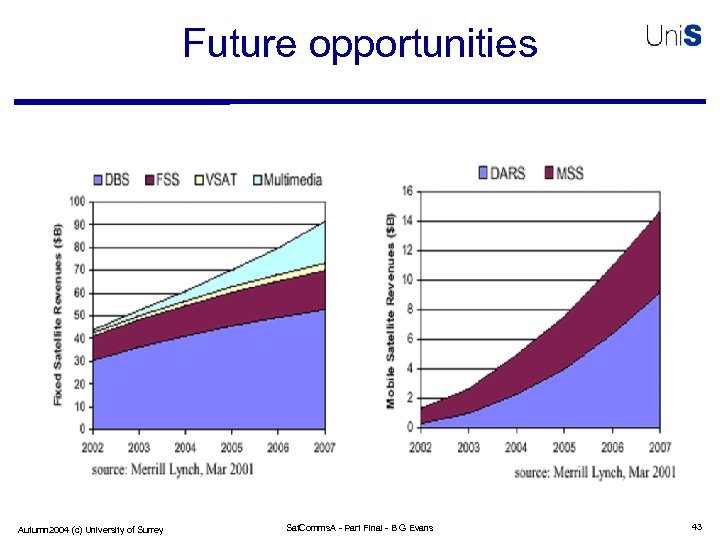

Future opportunities Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 43

Future opportunities Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 43

Key Constraints • Spectrum availability at right time • Poor perspective of satellites by terrestrial operations – Will they embrace as part of global network • Unavailability of finance • Regulatory issues and standard bodies Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 44

Key Constraints • Spectrum availability at right time • Poor perspective of satellites by terrestrial operations – Will they embrace as part of global network • Unavailability of finance • Regulatory issues and standard bodies Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 44

Future satellites: Product Developments • Reliable low cost launch capability • Large GEO platforms (3 -4 tons) – 15 Kw – Long life, high power/strange/dissipation – Autonomy: low cost, rapid production • Small LEO platforms – Medium life, pointing agility/stability – Autonomy: low cost, rapid production • Large deployable reflectors – 12 -14 m (Tx/Rx) – 100 spots • Active antennas – BFNs – Phased arrays • OBP – Beam forming – channelising – Regeneration – switching • Miniature, active/passive, microwave equipment (L/s, Ku, KA) • ISLs (optical) Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 45

Future satellites: Product Developments • Reliable low cost launch capability • Large GEO platforms (3 -4 tons) – 15 Kw – Long life, high power/strange/dissipation – Autonomy: low cost, rapid production • Small LEO platforms – Medium life, pointing agility/stability – Autonomy: low cost, rapid production • Large deployable reflectors – 12 -14 m (Tx/Rx) – 100 spots • Active antennas – BFNs – Phased arrays • OBP – Beam forming – channelising – Regeneration – switching • Miniature, active/passive, microwave equipment (L/s, Ku, KA) • ISLs (optical) Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 45

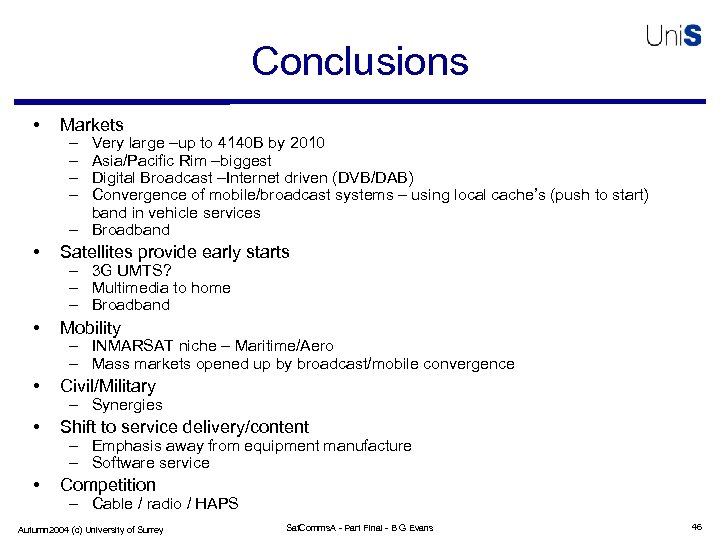

Conclusions • Markets • Satellites provide early starts • Mobility • Civil/Military • Shift to service delivery/content • Competition – – Very large –up to 4140 B by 2010 Asia/Pacific Rim –biggest Digital Broadcast –Internet driven (DVB/DAB) Convergence of mobile/broadcast systems – using local cache’s (push to start) band in vehicle services – Broadband – 3 G UMTS? – Multimedia to home – Broadband – INMARSAT niche – Maritime/Aero – Mass markets opened up by broadcast/mobile convergence – Synergies – Emphasis away from equipment manufacture – Software service – Cable / radio / HAPS Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 46

Conclusions • Markets • Satellites provide early starts • Mobility • Civil/Military • Shift to service delivery/content • Competition – – Very large –up to 4140 B by 2010 Asia/Pacific Rim –biggest Digital Broadcast –Internet driven (DVB/DAB) Convergence of mobile/broadcast systems – using local cache’s (push to start) band in vehicle services – Broadband – 3 G UMTS? – Multimedia to home – Broadband – INMARSAT niche – Maritime/Aero – Mass markets opened up by broadcast/mobile convergence – Synergies – Emphasis away from equipment manufacture – Software service – Cable / radio / HAPS Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 46

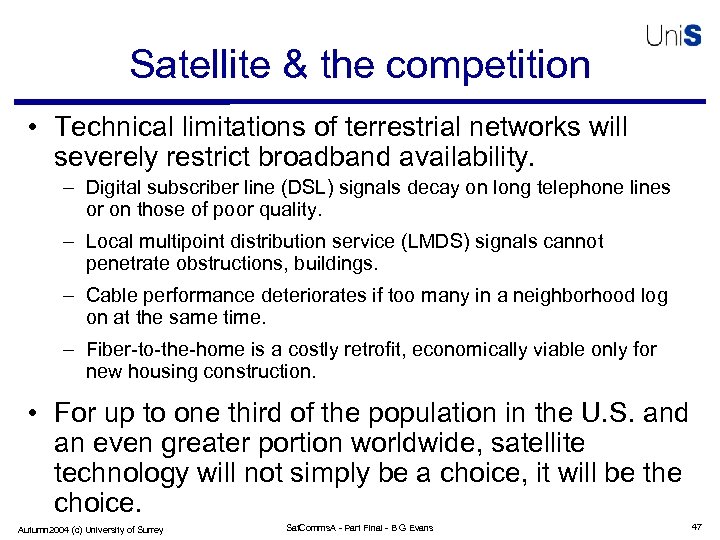

Satellite & the competition • Technical limitations of terrestrial networks will severely restrict broadband availability. – Digital subscriber line (DSL) signals decay on long telephone lines or on those of poor quality. – Local multipoint distribution service (LMDS) signals cannot penetrate obstructions, buildings. – Cable performance deteriorates if too many in a neighborhood log on at the same time. – Fiber-to-the-home is a costly retrofit, economically viable only for new housing construction. • For up to one third of the population in the U. S. and an even greater portion worldwide, satellite technology will not simply be a choice, it will be the choice. Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 47

Satellite & the competition • Technical limitations of terrestrial networks will severely restrict broadband availability. – Digital subscriber line (DSL) signals decay on long telephone lines or on those of poor quality. – Local multipoint distribution service (LMDS) signals cannot penetrate obstructions, buildings. – Cable performance deteriorates if too many in a neighborhood log on at the same time. – Fiber-to-the-home is a costly retrofit, economically viable only for new housing construction. • For up to one third of the population in the U. S. and an even greater portion worldwide, satellite technology will not simply be a choice, it will be the choice. Autumn 2004 (c) University of Surrey Sat. Comms. A - Part Final - B G Evans 47