779178c3e5a6aacf6584ca64d3c15cf4.ppt

- Количество слайдов: 42

SAS Analytics: The Power to Deliver Profitable Business Results Analytics Consulting SAS Institute – Darius Baer, Jim Hornell, & Ross Bettinger Copyright © 2004, SAS Institute Inc. All rights reserved. April 12, 2005 SAS is a registered trademark or trademark of SAS Institute Inc. in the USA and other countries. ® indicates USA registration. Other brand product names are registered trademarks or Trademarks of their respective companies

Beyond BI with SAS Analytics Objective § Discuss the value of analytics as part of the solution to business problems § Demonstrate two examples of using analytics to solve business problems Copyright © 2005, SAS Institute Inc. All rights reserved. 2

Agenda § Overview • • Why Analytics? Business Problems that can be addressed with analytics Analytic approaches to solving business problems Introduction to the two examples § Marketing Performance Optimization Trade Promotion Optimization § Bank Call Center Text Mining § Conclusion Copyright © 2005, SAS Institute Inc. All rights reserved. 3

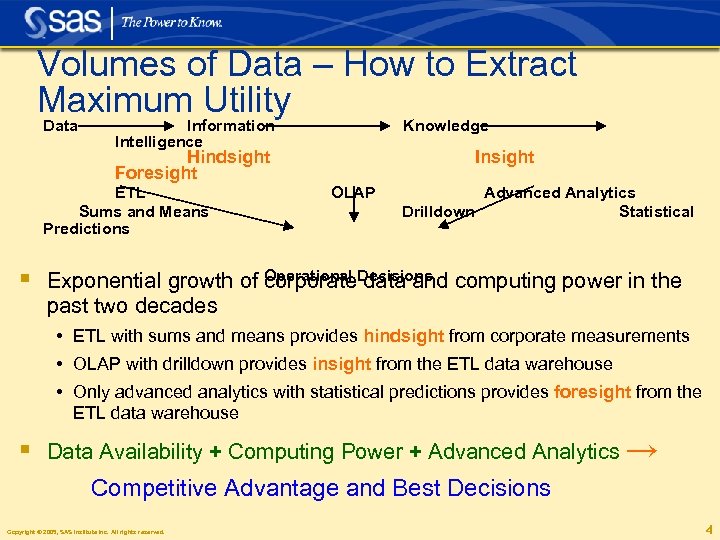

Volumes of Data – How to Extract Maximum Utility Data Information Intelligence Knowledge Hindsight Foresight ETL Sums and Means Predictions Insight OLAP Advanced Analytics Drilldown Statistical § Exponential growth of Operational Decisions computing power in the corporate data and past two decades • ETL with sums and means provides hindsight from corporate measurements • OLAP with drilldown provides insight from the ETL data warehouse • Only advanced analytics with statistical predictions provides foresight from the ETL data warehouse § Data Availability + Computing Power + Advanced Analytics → Competitive Advantage and Best Decisions Copyright © 2005, SAS Institute Inc. All rights reserved. 4

Interpreting the Variability of a Population § Means are useful. Understanding the distribution around the mean and what contributes to that distribution is essential to compare populations and make predictions § Statistical techniques “predict” the future by apportioning variance in the population to explanatory variables § As sales change over time in a well defined pattern, future sales can be predicted § If the likelihood of buying a product is associated with demographic characteristics, then we can predict how likely a particular individual is to buy that product § With a goal of maximum profits and knowing constraints within which a company operates, we can solve a series of linear (or non-linear) equations to obtain an optimal solution Copyright © 2005, SAS Institute Inc. All rights reserved. 5

The Problem Defines the Solution § Business executives and analysts have always made operational decisions • Intuition and experience can be used • Sums and means can provide an historical direction • OLAP and drilldown can provide a better or more detailed perspective • Only advanced analytics can provide a sophisticated point of view on the future of the business § The problem provides processes and parameters that must be addressed by the solution • How would you make the business decision if you did not have advanced analytics? • How can you structure your analysis to follow that process and use those parameters? Copyright © 2005, SAS Institute Inc. All rights reserved. 6

Problem Defines Solution – Example 1 § Railroad must have efficient schedules to move freight • Before computers, colored strings on a bulletin board were used – time on the X-axis and distance on the Y-axis • Constraints included no crossing of trains except at sidings and stations § With computers, the business analyst could manipulate the trains and visualize on the screen • However, there was no guarantee of a “best” decision that produced optimal usage of the tracks to move the most freight in the minimum amount of time § With analytics, one takes the problem and goal as stated above • One has constraints of the trains such as: Minimum and Maximum departure and arrival times Minimum and Maximum Speeds Departure and Arrival Stations Available routes • The goal is solved for using an OR algorithmic approach with PROC NETFLOW and visually represented on a screen • Interaction is provided to the user to modify the analytic result as desired Copyright © 2005, SAS Institute Inc. All rights reserved. 7

§ Problem Defines Solution – Example 2 Herbicide producer wants to deliver time sensitive herbicide to farmers immediately prior to the planting of the corn • Chemical company uses hindsight as to when the farmers planted the corn in previous years • Business experts also have a “sense” for whether the planting will be earlier or later than previous years § Since the problem is to know beforehand when the farmers will plant their corn → Go visit the farmers! • Farmer walks out of house in the morning and sticks wet finger in air to gauge temperature, kicks dirt to gauge moisture, and looks over horizon to see if neighbors are planting their corn. § With analytics, one takes the problem and understands process • Using a linear regression approach in each of 98 agricultural districts with the following inputs: − Daily temperatures combined as necessary in day groups − Precipitation amounts grouped as appropriate − Records of previous years plantings • Each year and each district provide a regression equation • Using a model selection approach provided a limited set of predictive equations for the current year resulting in forecasts being within 2 -3 days for 95 out of the 98 districts Copyright © 2005, SAS Institute Inc. All rights reserved. 8

Analytic approaches to solving business problems § The best solutions often involve the combination of a number of analytic techniques (as necessary) combined with business rules that also constrain the solution § SAS/OR – Finds optimal solution in system of constraints § Enterprise Miner – Predictive modeling, e. g. , which customers are most profitable and/or most likely to respond to an offer § ETS and HPF – Forecasting, e. g. , what are the future sales or demand based on history and other related factors § SAS/STAT – Regression, ANOVA, Factor Analysis – how can we explain the largest amount of variance using statistical techniques Copyright © 2005, SAS Institute Inc. All rights reserved. 9

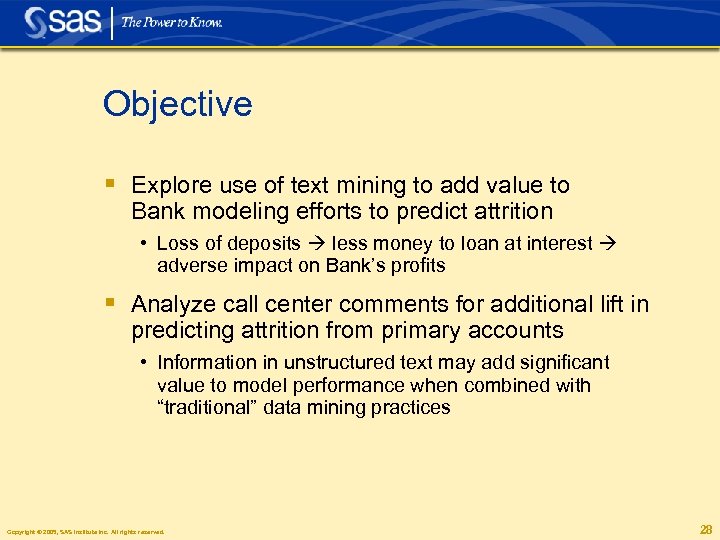

Business Cases § Marketing Performance Optimization / Trade Promotion Optimization • Understand predict the ROI on promotions, advertising and other mass marketing tactics • What’s the optimum mix of marketing tactics? § Bank Call Center Text Mining • Explore use of text mining to add value to Bank modeling efforts to predict attrition • Analyze call center comments for additional lift in predicting attrition from primary accounts Copyright © 2005, SAS Institute Inc. All rights reserved. 10

– MPO/TPO – Marketing Performance Optimization Trade Promotion Optimization Jim Hornell Analytical Consultant April 12, 2005 Copyright © 2004, SAS Institute Inc. All rights reserved. SAS is a registered trademark or trademark of SAS Institute Inc. in the USA and other countries. ® indicates USA registration. Other brand product names are registered trademarks or Trademarks of their respective companies

“Half of my advertising is wasted; I just don’t know which half. ” -- John Wanamaker, retail pioneer in the late 1800’s Copyright © 2005, SAS Institute Inc. All rights reserved. 12

Questions, with historically few answers § Marketers have tried – for years – to understand predict the ROI on promotions, advertising and other mass marketing tactics • How much does each marketing tactic contribute? • What is the effect of events and activities I cannot control? • What is the “right” level of spend? Overall? By tactic? • How do seasonality and geography affect results? • What’s the optimum mix of marketing tactics? Copyright © 2005, SAS Institute Inc. All rights reserved. 13

![“The transformation of TPM [Trade Promotion Modeling], in conjunction with MMM [Market Mix Modeling], “The transformation of TPM [Trade Promotion Modeling], in conjunction with MMM [Market Mix Modeling],](https://present5.com/presentation/779178c3e5a6aacf6584ca64d3c15cf4/image-14.jpg)

“The transformation of TPM [Trade Promotion Modeling], in conjunction with MMM [Market Mix Modeling], from a tactical to a more overarching and encompassing strategic function is well on the way. At this very moment…the question of full functionality is less of an ‘if’ , but ‘when. ’” -- Michael Forhez and Charlie Chase, in ‘Consumer Goods Technology’, March 2005. Copyright © 2005, SAS Institute Inc. All rights reserved. 14

The “When” is Now § MPO/TPO is designed to: • Calculate the business impact of multiple marketing channels. − In isolation − In combination • Consider any and all potential variables - controllable and uncontrollable • Allow for changes in variables and desired outcomes with minimal effort • Predict future business outcomes based on specific marketing mix and promotional scenarios • Provide the platform for marketing mix optimization Copyright © 2005, SAS Institute Inc. All rights reserved. 15

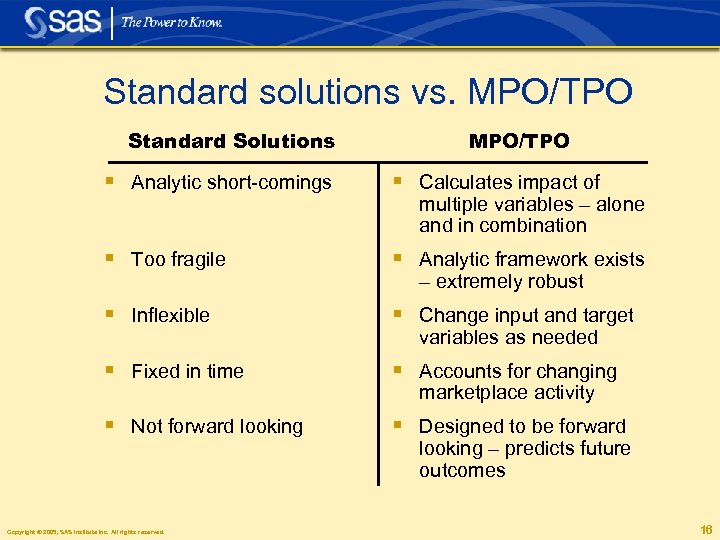

Standard solutions vs. MPO/TPO Standard Solutions MPO/TPO § Analytic short-comings § Calculates impact of § Too fragile § Analytic framework exists § Inflexible § Change input and target § Fixed in time § Accounts for changing § Not forward looking § Designed to be forward Copyright © 2005, SAS Institute Inc. All rights reserved. multiple variables – alone and in combination – extremely robust variables as needed marketplace activity looking – predicts future outcomes 16

The MPO/TPO Offering § Foundational elements include: • Flexible data model • Model automation procedures • User interface elements − Interactive − Web based • Executable Master Marketing and Promotional Plan • Marketing campaign scenario forecasts to test effectiveness and cross product cannibalism § Customized elements include: • • Client-specific data inventory Coverage of client specific markets and segments Coverage of client specific products Customized interface reflecting client needs Copyright © 2005, SAS Institute Inc. All rights reserved. 17

Sample Variables for a Financial Client § The MPO/TPO offering considers the effect of multiple variables, across multiple geographies, on marketing performance • • • Product transaction data Advertising data Promotion data Direct marketing data Econometric data Demographic composition and segment distribution Share of market Share of voice PR activity Event / sponsorship activity Distribution data Brand data Copyright © 2005, SAS Institute Inc. All rights reserved. 18

Sample Variables for a CPG Client § The MPO/TPO offering considers the effect of multiple variables, across multiple distributors, on trade promotion performance • • • Syndicated data (AC Nielsen, IRI) Shipment and Order history Promotion calendars Fund allocations Pricing Brand/category/market development index Copyright © 2005, SAS Institute Inc. All rights reserved. 19

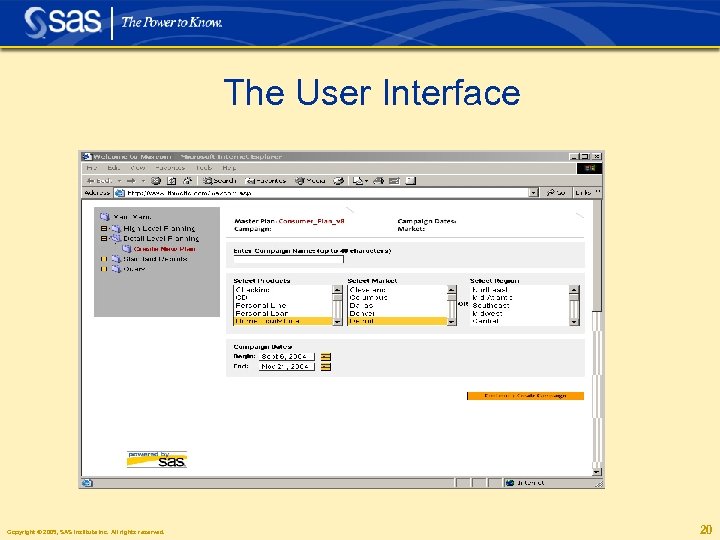

The User Interface Copyright © 2005, SAS Institute Inc. All rights reserved. 20

Accesses the Modeling Procedure § Assimilates past business history using: • Singular Value Decomposition • Linear regression with Lagged Values • Dynamic Neural Network Modeling § By correlation rather than causal modeling § Resulting in Week by Week Forecasts over your planning horizon. Copyright © 2005, SAS Institute Inc. All rights reserved. 21

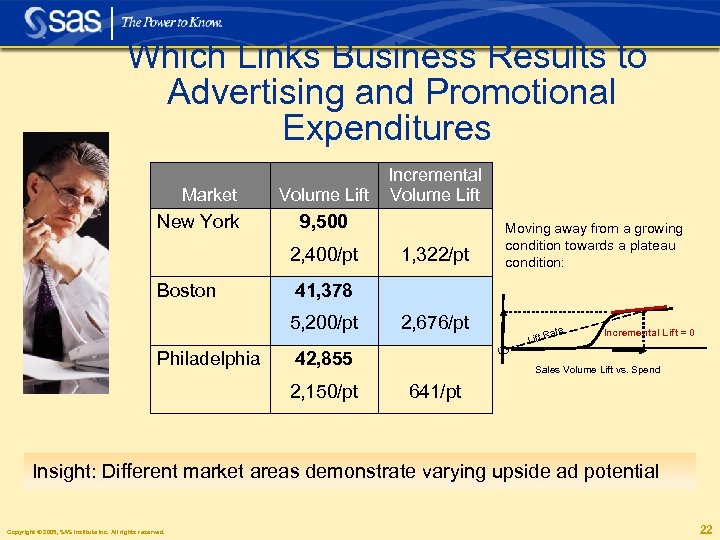

Which Links Business Results to Advertising and Promotional Expenditures Market New York Volume Lift 9, 500 2, 400/pt Boston 1, 322/pt Moving away from a growing condition towards a plateau condition: 41, 378 5, 200/pt Philadelphia Incremental Volume Lift 2, 676/pt 42, 855 2, 150/pt Lift R ate Incremental Lift = 0 Sales Volume Lift vs. Spend 641/pt Insight: Different market areas demonstrate varying upside ad potential Copyright © 2005, SAS Institute Inc. All rights reserved. 22

Delivery and Implementation § SAS Software Foundation and Analytics § Consulting for customization to business needs • Requirements − Client data access − Customized analytics − Customized reporting • Design • Customized Development • Testing, Documentation, and Installation § With Domain Partners • THMG, Thompson Hill Marketing Group • CSC, Computer Sciences Corporation Copyright © 2005, SAS Institute Inc. All rights reserved. 24

The Commencement of a New Era § Advertising and promotional spending is coming under increased scrutiny § Getting the spend “right” is a complex problem § More and more data are available • Robust data management, sophisticated modeling, and content expertise are ‘must haves’ to predict results and optimize spending § SAS has assembled the right software, partners, and experience to make this work § Questions? ? Copyright © 2005, SAS Institute Inc. All rights reserved. 25

Bank Call Center Text Mining Ross Bettinger Analytical Consultant April 12, 2005 Copyright © 2004, SAS Institute Inc. All rights reserved. SAS is a registered trademark or trademark of SAS Institute Inc. in the USA and other countries. ® indicates USA registration. Other brand product names are registered trademarks or Trademarks of their respective companies

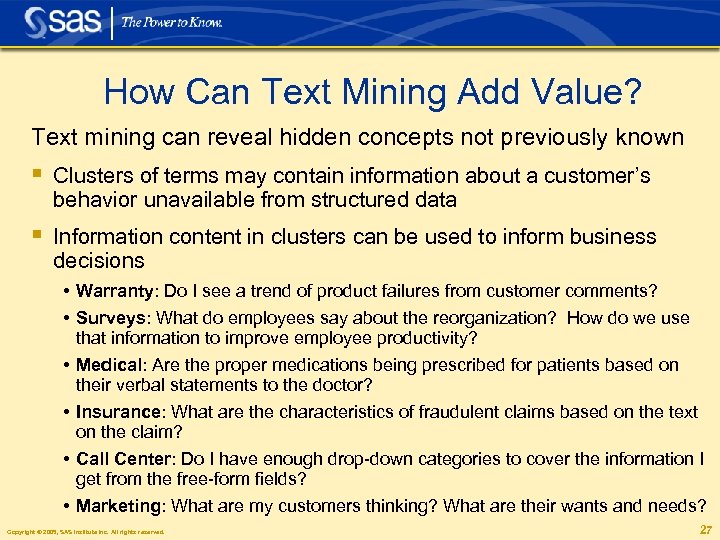

How Can Text Mining Add Value? Text mining can reveal hidden concepts not previously known § Clusters of terms may contain information about a customer’s behavior unavailable from structured data § Information content in clusters can be used to inform business decisions • Warranty: Do I see a trend of product failures from customer comments? • Surveys: What do employees say about the reorganization? How do we use that information to improve employee productivity? • Medical: Are the proper medications being prescribed for patients based on their verbal statements to the doctor? • Insurance: What are the characteristics of fraudulent claims based on the text on the claim? • Call Center: Do I have enough drop-down categories to cover the information I get from the free-form fields? • Marketing: What are my customers thinking? What are their wants and needs? Copyright © 2005, SAS Institute Inc. All rights reserved. 27

Objective § Explore use of text mining to add value to Bank modeling efforts to predict attrition • Loss of deposits less money to loan at interest adverse impact on Bank’s profits § Analyze call center comments for additional lift in predicting attrition from primary accounts • Information in unstructured text may add significant value to model performance when combined with “traditional” data mining practices Copyright © 2005, SAS Institute Inc. All rights reserved. 28

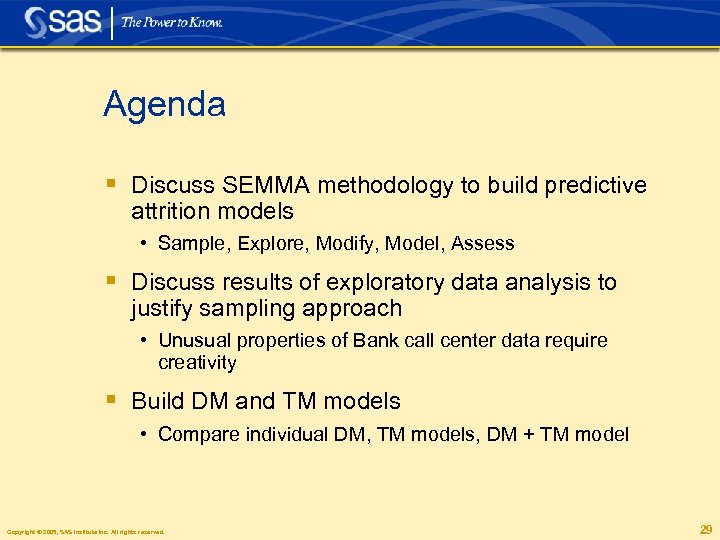

Agenda § Discuss SEMMA methodology to build predictive attrition models • Sample, Explore, Modify, Model, Assess § Discuss results of exploratory data analysis to justify sampling approach • Unusual properties of Bank call center data require creativity § Build DM and TM models • Compare individual DM, TM models, DM + TM model Copyright © 2005, SAS Institute Inc. All rights reserved. 29

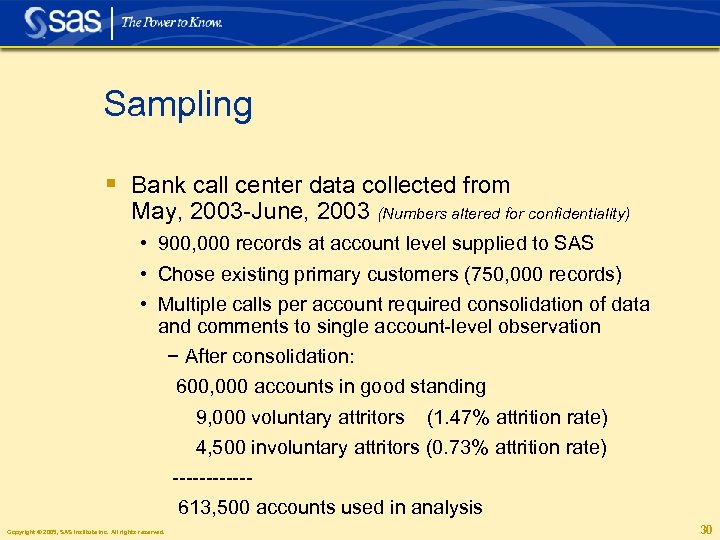

Sampling § Bank call center data collected from May, 2003 -June, 2003 (Numbers altered for confidentiality) • 900, 000 records at account level supplied to SAS • Chose existing primary customers (750, 000 records) • Multiple calls per account required consolidation of data and comments to single account-level observation − After consolidation: 600, 000 accounts in good standing 9, 000 voluntary attritors (1. 47% attrition rate) 4, 500 involuntary attritors (0. 73% attrition rate) ------613, 500 accounts used in analysis Copyright © 2005, SAS Institute Inc. All rights reserved. 30

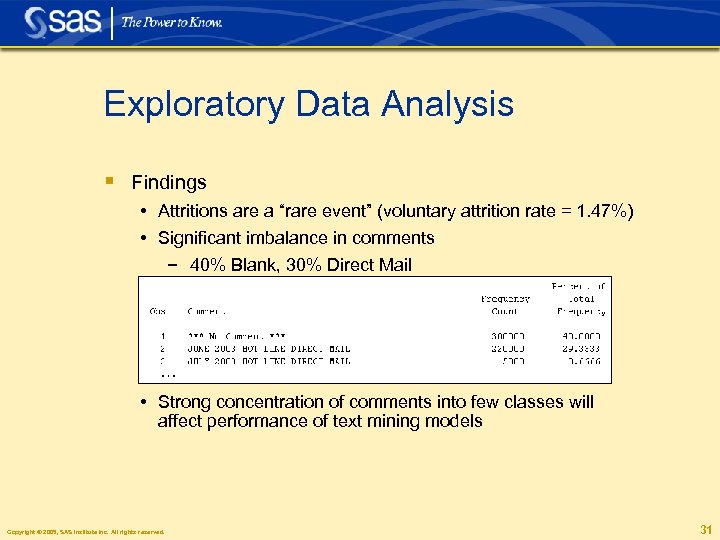

Exploratory Data Analysis § Findings • Attritions are a “rare event” (voluntary attrition rate = 1. 47%) • Significant imbalance in comments − 40% Blank, 30% Direct Mail • Strong concentration of comments into few classes will affect performance of text mining models Copyright © 2005, SAS Institute Inc. All rights reserved. 31

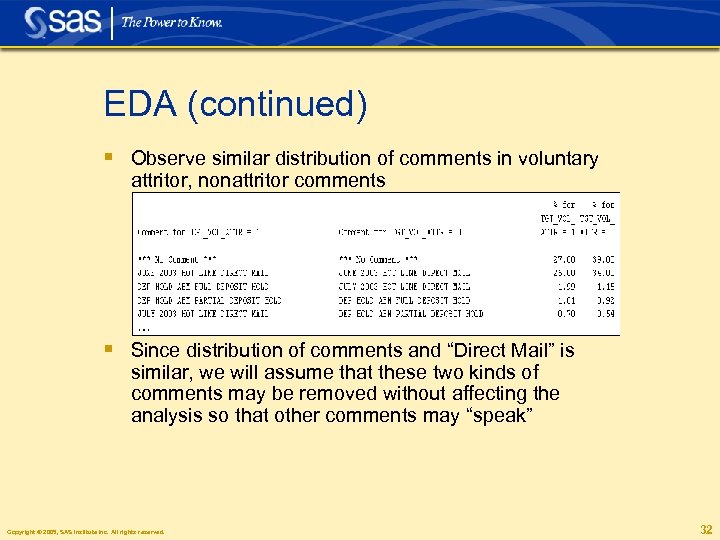

EDA (continued) § Observe similar distribution of comments in voluntary attritor, nonattritor comments § Since distribution of comments and “Direct Mail” is similar, we will assume that these two kinds of comments may be removed without affecting the analysis so that other comments may “speak” Copyright © 2005, SAS Institute Inc. All rights reserved. 32

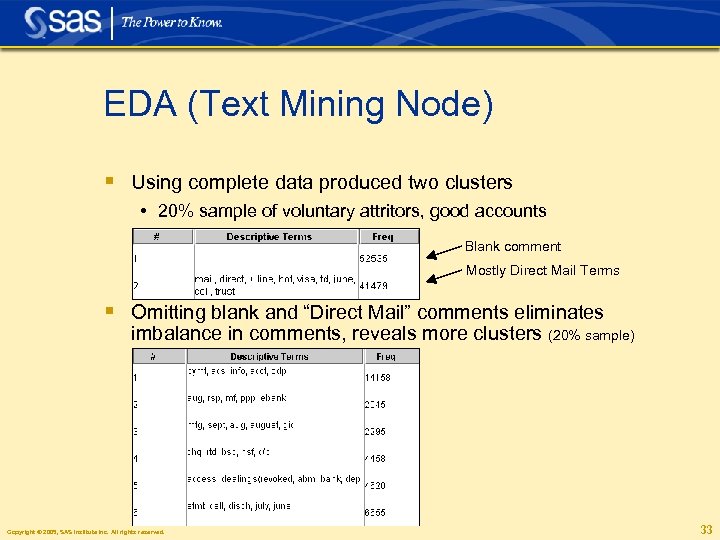

EDA (Text Mining Node) § Using complete data produced two clusters • 20% sample of voluntary attritors, good accounts Blank comment Mostly Direct Mail Terms § Omitting blank and “Direct Mail” comments eliminates imbalance in comments, reveals more clusters (20% sample) Copyright © 2005, SAS Institute Inc. All rights reserved. 33

Modify § Perform “optimal binning” of interval variables with respect to target variable to change them into ordinal variables • Represent continuous variable as set of ordered indicator variables to better concentrate target variable into small number of bins • Variables Age_Yrs, Cust_Tenure_Mo, N_Phone_Calls were transformed − For example, Age_Yrs was binned into following intervals 0 -24, 24 -38, 38 -75, 75+ Copyright © 2005, SAS Institute Inc. All rights reserved. 34

Model § Modeled voluntary attrition to predict who would deliberately close account § Partitioned data • 50% Training / 25% Validation / 25% Test (Holdout) § Built stratified models based on voluntary attrition • Used all voluntary attritors (N=9, 000), randomly-selected nonattritors (N=9, 000) • Data Mining model (no text-based information) • Text Mining model (only text-based information) • Hybrid Data + Text Mining model − structured data + structured text-based information Copyright © 2005, SAS Institute Inc. All rights reserved. 35

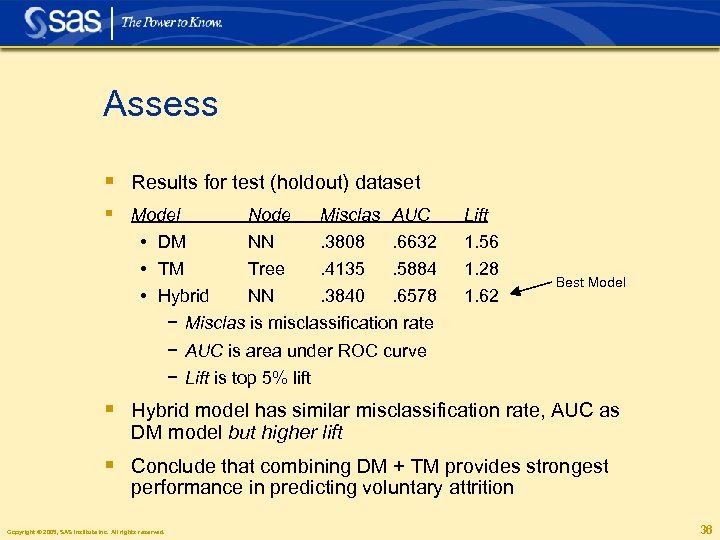

Assess § Results for test (holdout) dataset § Model Node Misclas AUC • DM NN. 3808. 6632 • TM Tree. 4135. 5884 • Hybrid NN. 3840. 6578 − Misclas is misclassification rate − AUC is area under ROC curve − Lift is top 5% lift Lift 1. 56 1. 28 1. 62 Best Model § Hybrid model has similar misclassification rate, AUC as DM model but higher lift § Conclude that combining DM + TM provides strongest performance in predicting voluntary attrition Copyright © 2005, SAS Institute Inc. All rights reserved. 36

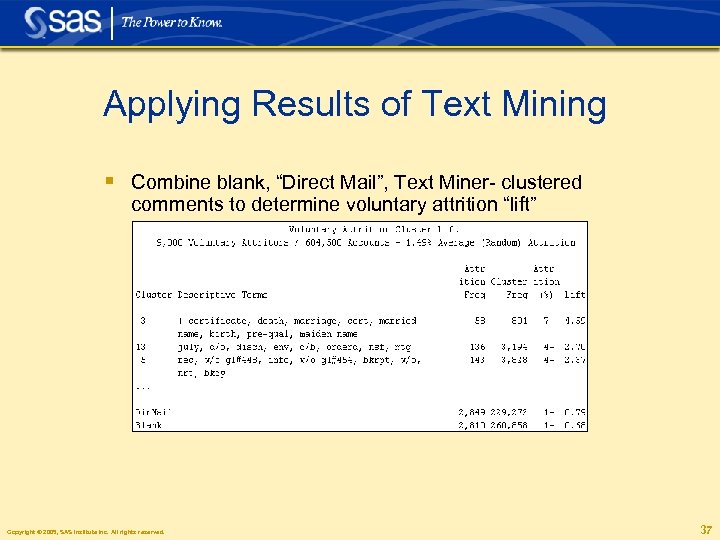

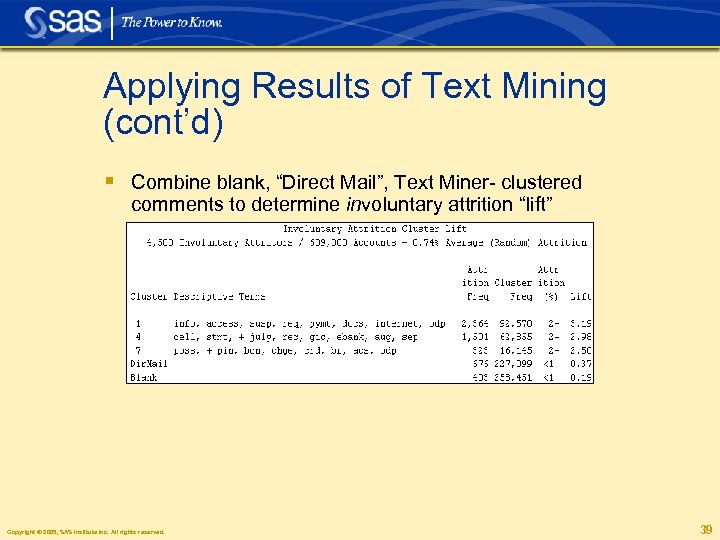

Applying Results of Text Mining § Combine blank, “Direct Mail”, Text Miner- clustered comments to determine voluntary attrition “lift” Copyright © 2005, SAS Institute Inc. All rights reserved. 37

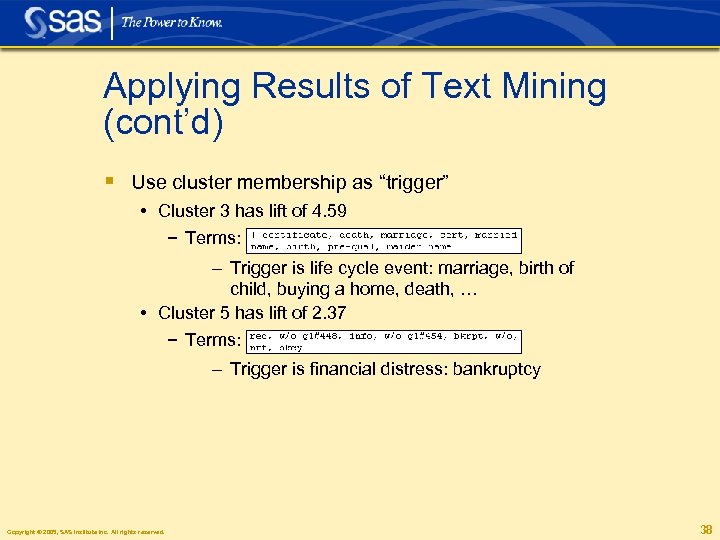

Applying Results of Text Mining (cont’d) § Use cluster membership as “trigger” • Cluster 3 has lift of 4. 59 − Terms: – Trigger is life cycle event: marriage, birth of child, buying a home, death, … • Cluster 5 has lift of 2. 37 − Terms: – Trigger is financial distress: bankruptcy Copyright © 2005, SAS Institute Inc. All rights reserved. 38

Applying Results of Text Mining (cont’d) § Combine blank, “Direct Mail”, Text Miner- clustered comments to determine involuntary attrition “lift” Copyright © 2005, SAS Institute Inc. All rights reserved. 39

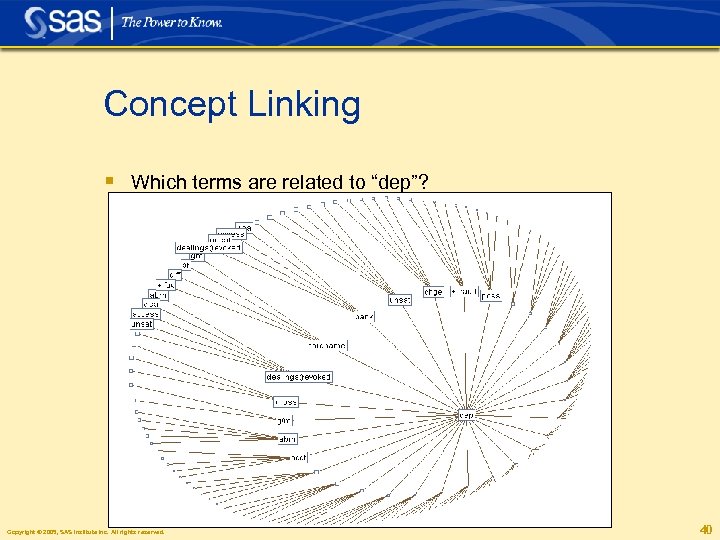

Concept Linking § Which terms are related to “dep”? Copyright © 2005, SAS Institute Inc. All rights reserved. 40

Value Proposition § Use Enterprise Miner to extract information from “structured” data § Use Text Miner to turn “unstructured” text into “structured” data for “traditional” data mining § Use Enterprise Miner and Text Miner give you an unbeatable combination for business advantage Copyright © 2005, SAS Institute Inc. All rights reserved. 41

Conclusion § Hindsight with ETL and Sums & Means is Good • Important to get a view into your data § Insight with OLAP and Drilldown is Better • You obtain a better sense of where your business is now and at whatever level of summary or detail you want § Foresight with Analytics is Best • You obtain a confidence of where your business is going in the future so that you can take appropriate action now to be prepared. Beyond BI with SAS Analytics Copyright © 2005, SAS Institute Inc. All rights reserved. 42

Copyright © 2005, SAS Institute Inc. All rights reserved. 2003, 43

779178c3e5a6aacf6584ca64d3c15cf4.ppt