cd76b654971e37fbfb2e6b61c615168d.ppt

- Количество слайдов: 24

SAP TERP 10 Preparation Practice 11 Dr. Gábor Pauler, Associate Professor, Private Entrepeneur Tax Reg. No. : 63673852 -3 -22 Bank account: 50400113 -11065546 Location: 1 st Széchenyi str. 7666 Pogány, Hungary Tel: +36 -309 -015 -488 E-mail: pauler@t-online. hu

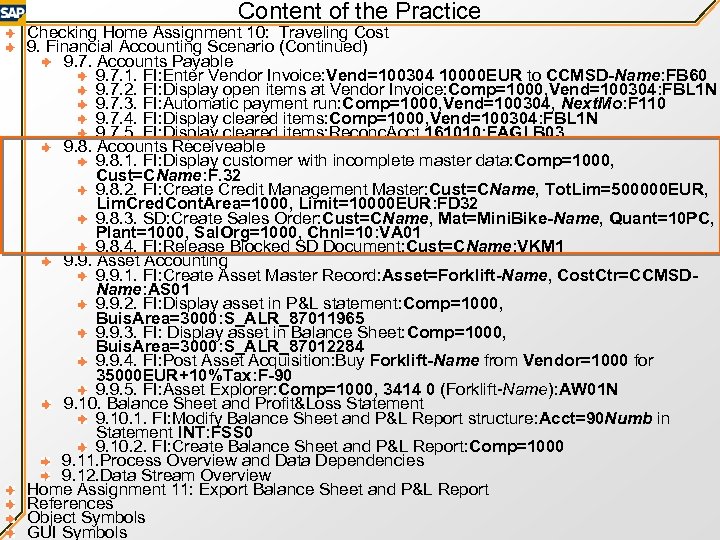

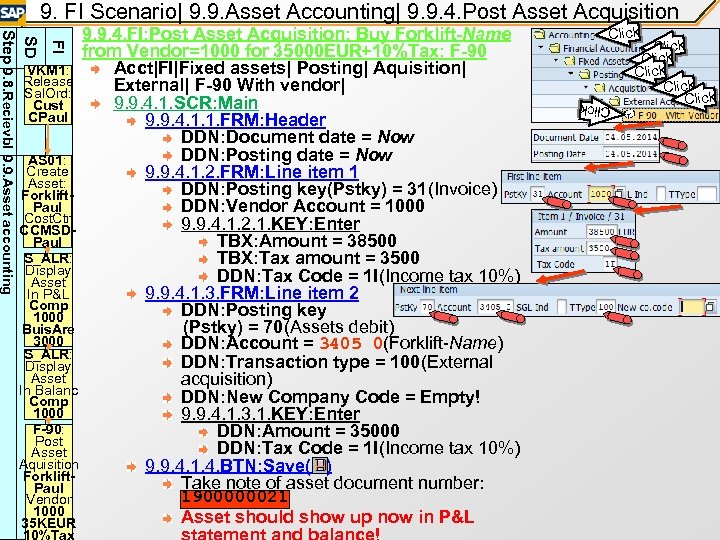

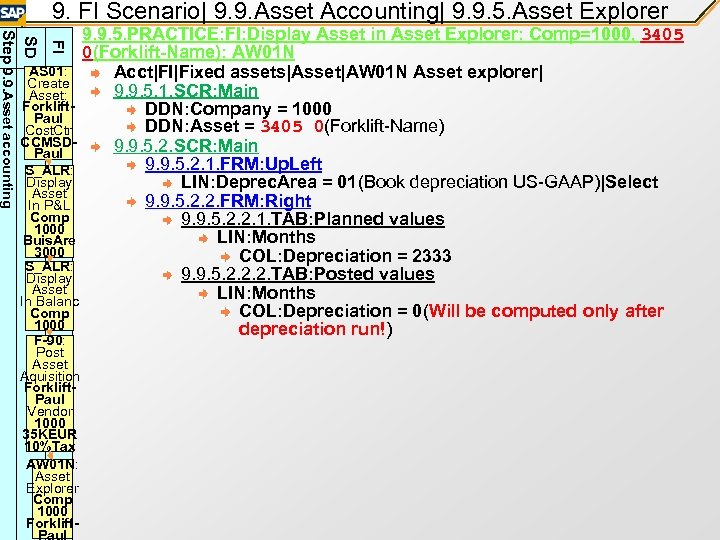

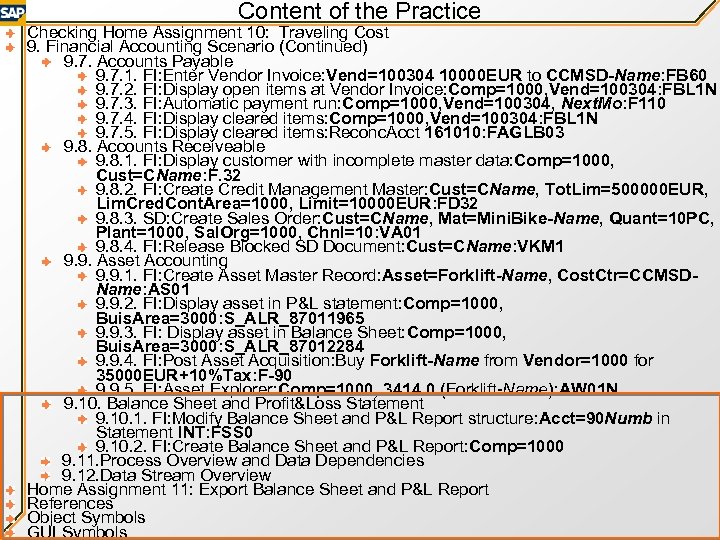

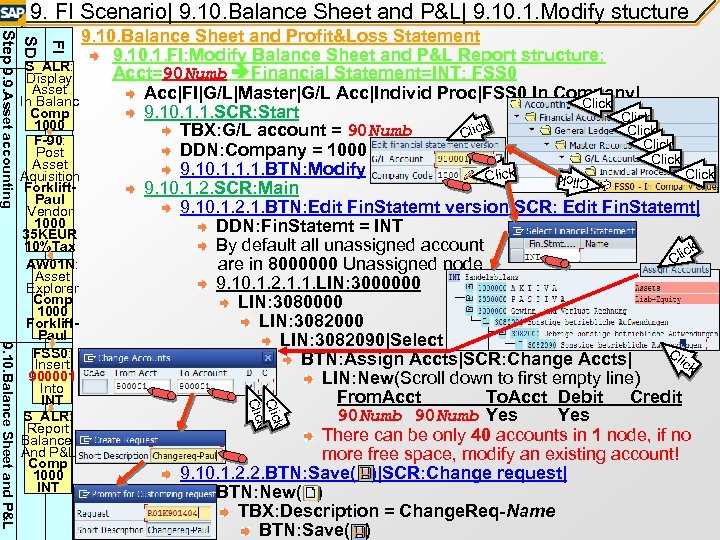

Content of the Practice Checking Home Assignment 10: Traveling Cost 9. Financial Accounting Scenario (Continued) 9. 7. Accounts Payable 9. 7. 1. FI: Enter Vendor Invoice: Vend=100304 10000 EUR to CCMSD-Name: FB 60 9. 7. 2. FI: Display open items at Vendor Invoice: Comp=1000, Vend=100304: FBL 1 N 9. 7. 3. FI: Automatic payment run: Comp=1000, Vend=100304, Next. Mo: F 110 9. 7. 4. FI: Display cleared items: Comp=1000, Vend=100304: FBL 1 N 9. 7. 5. FI: Display cleared items: Reconc. Acct 161010: FAGLB 03 9. 8. Accounts Receiveable 9. 8. 1. FI: Display customer with incomplete master data: Comp=1000, Cust=CName: F. 32 9. 8. 2. FI: Create Credit Management Master: Cust=CName, Tot. Lim=500000 EUR, Lim. Cred. Cont. Area=1000, Limit=10000 EUR: FD 32 9. 8. 3. SD: Create Sales Order: Cust=CName, Mat=Mini. Bike-Name, Quant=10 PC, Plant=1000, Sal. Org=1000, Chnl=10: VA 01 9. 8. 4. FI: Release Blocked SD Document: Cust=CName: VKM 1 9. 9. Asset Accounting 9. 9. 1. FI: Create Asset Master Record: Asset=Forklift-Name, Cost. Ctr=CCMSDName: AS 01 9. 9. 2. FI: Display asset in P&L statement: Comp=1000, Buis. Area=3000: S_ALR_87011965 9. 9. 3. FI: Display asset in Balance Sheet: Comp=1000, Buis. Area=3000: S_ALR_87012284 9. 9. 4. FI: Post Asset Acquisition: Buy Forklift-Name from Vendor=1000 for 35000 EUR+10%Tax: F-90 9. 9. 5. FI: Asset Explorer: Comp=1000, 3414 0 (Forklift-Name): AW 01 N 9. 10. Balance Sheet and Profit&Loss Statement 9. 10. 1. FI: Modify Balance Sheet and P&L Report structure: Acct=90 Numb in Statement INT: FSS 0 9. 10. 2. FI: Create Balance Sheet and P&L Report: Comp=1000 9. 11. Process Overview and Data Dependencies 9. 12. Data Stream Overview Home Assignment 11: Export Balance Sheet and P&L Report References Object Symbols GUI Symbols

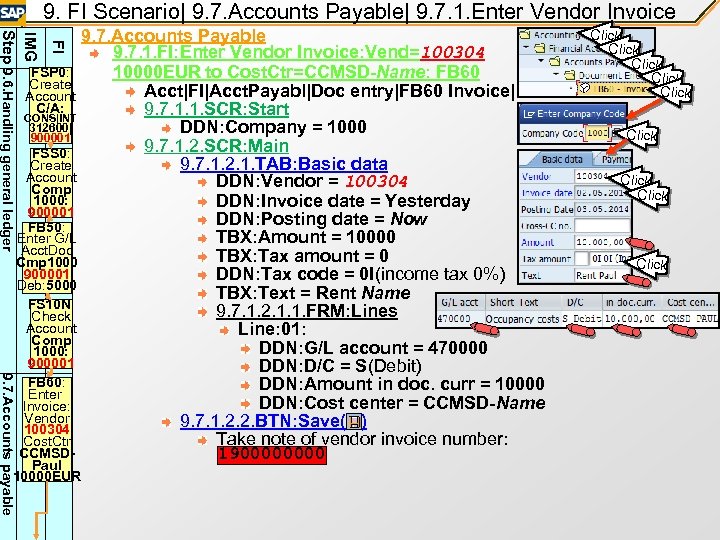

9. FI Scenario| 9. 7. Accounts Payable| 9. 7. 1. Enter Vendor Invoice FI IMG Step 9. 6. Handling general ledger 9. 7. Accounts Payable 9. 7. 1. FI: Enter Vendor Invoice: Vend=100304 FSP 0: 10000 EUR to Cost. Ctr=CCMSD-Name: FB 60 Create Acct|FI|Acct. Payabl|Doc entry|FB 60 Invoice| Account C/A: 9. 7. 1. 1. SCR: Start CONS|INT 312600| DDN: Company = 1000 900001 9. 7. 1. 2. SCR: Main FSS 0: 9. 7. 1. 2. 1. TAB: Basic data Create Account DDN: Vendor = 100304 Comp 1000: DDN: Invoice date = Yesterday 900001 DDN: Posting date = Now FB 50: Enter G/L TBX: Amount = 10000 Acct. Doc TBX: Tax amount = 0 Cmp 1000 900001 DDN: Tax code = 0 I(income tax 0%) Deb: 5000 TBX: Text = Rent Name FS 10 N: 9. 7. 1. 2. 1. 1. FRM: Lines Check Account Line: 01: Comp DDN: G/L account = 470000 1000: 900001 DDN: D/C = S(Debit) FB 60: DDN: Amount in doc. curr = 10000 Enter DDN: Cost center = CCMSD-Name Invoice: Vendor 9. 7. 1. 2. 2. BTN: Save( ) 100304 Take note of vendor invoice number: Cost. Ctr CCMSD 190000 9. 7. Accounts payable Paul 10000 EUR Click Click Click

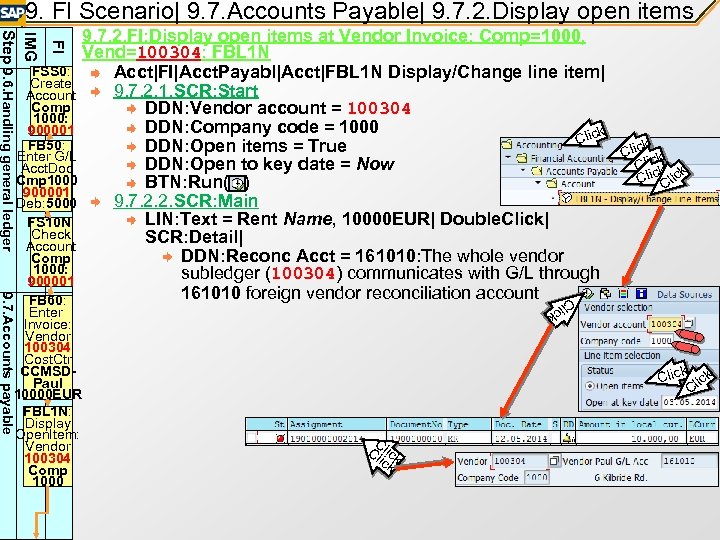

9. FI Scenario| 9. 7. Accounts Payable| 9. 7. 2. Display open items FI ick 9. 7. Accounts payable Enter Invoice: Vendor 100304 Cost. Ctr CCMSDPaul 10000 EUR FBL 1 N: Display Open. Item: Vendor 100304 Comp 1000 k Clic k k Clic Cl IMG Step 9. 6. Handling general ledger 9. 7. 2. FI: Display open items at Vendor Invoice: Comp=1000, Vend=100304: FBL 1 N FSS 0: Acct|FI|Acct. Payabl|Acct|FBL 1 N Display/Change line item| Create 9. 7. 2. 1. SCR: Start Account Comp DDN: Vendor account = 100304 1000: DDN: Company code = 1000 900001 k Clic FB 50: DDN: Open items = True Enter G/L DDN: Open to key date = Now Acct. Doc Cmp 1000 BTN: Run( ) 900001 9. 7. 2. 2. SCR: Main Deb: 5000 LIN: Text = Rent Name, 10000 EUR| Double. Click| FS 10 N: Check SCR: Detail| Account DDN: Reconc Acct = 161010: The whole vendor Comp 1000: subledger (100304) communicates with G/L through 900001 161010 foreign vendor reconciliation account FB 60: k Clic lick C C Cl lick

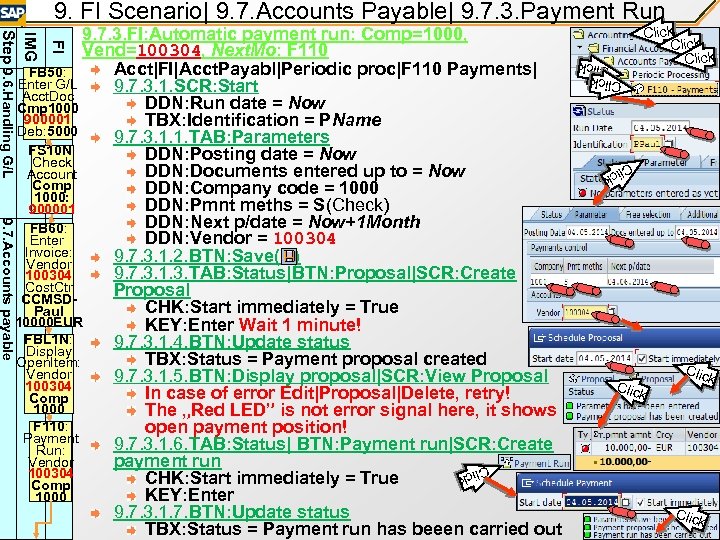

9. FI Scenario| 9. 7. Accounts Payable| 9. 7. 3. Payment Run Click FI Click Cli ck IMG Step 9. 6. Handling G/L 9. 7. 3. FI: Automatic payment run: Comp=1000, Vend=100304, Next. Mo: F 110 Acct|FI|Acct. Payabl|Periodic proc|F 110 Payments| FB 50: Enter G/L 9. 7. 3. 1. SCR: Start Acct. Doc DDN: Run date = Now Cmp 1000 900001 TBX: Identification = PName Deb: 5000 9. 7. 3. 1. 1. TAB: Parameters FS 10 N: DDN: Posting date = Now Check DDN: Documents entered up to = Now Account Comp DDN: Company code = 1000: DDN: Pmnt meths = S(Check) 900001 DDN: Next p/date = Now+1 Month FB 60: DDN: Vendor = 100304 Enter Invoice: 9. 7. 3. 1. 2. BTN: Save( ) Vendor 9. 7. 3. 1. 3. TAB: Status|BTN: Proposal|SCR: Create 100304 Cost. Ctr Proposal CCMSDCHK: Start immediately = True Paul 10000 EUR KEY: Enter Wait 1 minute! FBL 1 N: 9. 7. 3. 1. 4. BTN: Update status Display TBX: Status = Payment proposal created Open. Item: Vendor 9. 7. 3. 1. 5. BTN: Display proposal|SCR: View Proposal 100304 In case of error Edit|Proposal|Delete, retry! Comp 1000 The „Red LED” is not error signal here, it shows F 110: open payment position! Payment 9. 7. 3. 1. 6. TAB: Status| BTN: Payment run|SCR: Create Run: Vendor payment run 100304 CHK: Start immediately = True Comp KEY: Enter 1000 9. 7. 3. 1. 7. BTN: Update status TBX: Status = Payment run has beeen carried out 9. 7. Accounts payable Clic k k Clic k

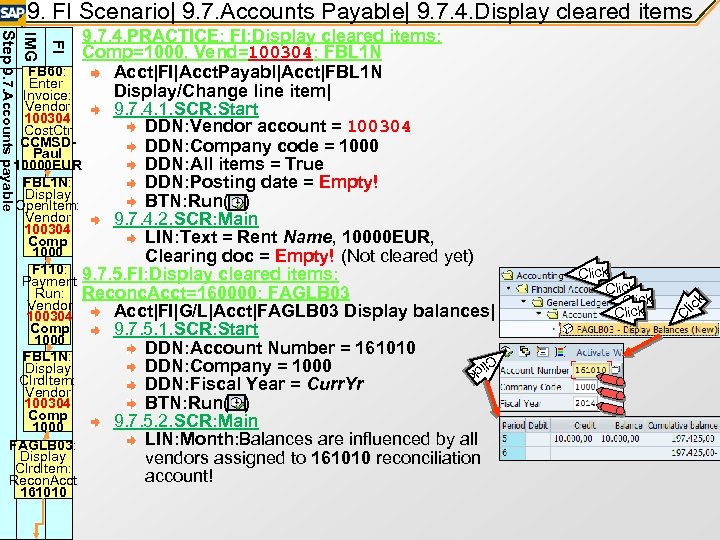

9. FI Scenario| 9. 7. Accounts Payable| 9. 7. 4. Display cleared items FI IMG Step 9. 7. Accounts payable 9. 7. 4. PRACTICE: FI: Display cleared items: Comp=1000, Vend=100304: FBL 1 N FB 60: Acct|FI|Acct. Payabl|Acct|FBL 1 N Enter Display/Change line item| Invoice: Vendor 9. 7. 4. 1. SCR: Start 100304 DDN: Vendor account = 100304 Cost. Ctr CCMSDDDN: Company code = 1000 Paul DDN: All items = True 10000 EUR FBL 1 N: DDN: Posting date = Empty! Display BTN: Run( ) Open. Item: Vendor 9. 7. 4. 2. SCR: Main 100304 LIN: Text = Rent Name, 10000 EUR, Comp 1000 Clearing doc = Empty! (Not cleared yet) F 110: 9. 7. 5. FI: Display cleared items: Payment Run: Reconc. Acct=160000: FAGLB 03 Vendor Acct|FI|G/L|Acct|FAGLB 03 Display balances| 100304 Comp 9. 7. 5. 1. SCR: Start 1000 DDN: Account Number = 161010 FBL 1 N: DDN: Company = 1000 Display Clrd. Item: DDN: Fiscal Year = Curr. Yr Vendor 100304 BTN: Run( ) Comp 9. 7. 5. 2. SCR: Main 1000 LIN: Month: Balances are influenced by all FAGLB 03: Display vendors assigned to 161010 reconciliation Clrd. Item: account! Recon. Acct ick Cl 161010 Click k ic Cl

Content of the Practice Checking Home Assignment 10: Traveling Cost 9. Financial Accounting Scenario (Continued) 9. 7. Accounts Payable 9. 7. 1. FI: Enter Vendor Invoice: Vend=100304 10000 EUR to CCMSD-Name: FB 60 9. 7. 2. FI: Display open items at Vendor Invoice: Comp=1000, Vend=100304: FBL 1 N 9. 7. 3. FI: Automatic payment run: Comp=1000, Vend=100304, Next. Mo: F 110 9. 7. 4. FI: Display cleared items: Comp=1000, Vend=100304: FBL 1 N 9. 7. 5. FI: Display cleared items: Reconc. Acct 161010: FAGLB 03 9. 8. Accounts Receiveable 9. 8. 1. FI: Display customer with incomplete master data: Comp=1000, Cust=CName: F. 32 9. 8. 2. FI: Create Credit Management Master: Cust=CName, Tot. Lim=500000 EUR, Lim. Cred. Cont. Area=1000, Limit=10000 EUR: FD 32 9. 8. 3. SD: Create Sales Order: Cust=CName, Mat=Mini. Bike-Name, Quant=10 PC, Plant=1000, Sal. Org=1000, Chnl=10: VA 01 9. 8. 4. FI: Release Blocked SD Document: Cust=CName: VKM 1 9. 9. Asset Accounting 9. 9. 1. FI: Create Asset Master Record: Asset=Forklift-Name, Cost. Ctr=CCMSDName: AS 01 9. 9. 2. FI: Display asset in P&L statement: Comp=1000, Buis. Area=3000: S_ALR_87011965 9. 9. 3. FI: Display asset in Balance Sheet: Comp=1000, Buis. Area=3000: S_ALR_87012284 9. 9. 4. FI: Post Asset Acquisition: Buy Forklift-Name from Vendor=1000 for 35000 EUR+10%Tax: F-90 9. 9. 5. FI: Asset Explorer: Comp=1000, 3414 0 (Forklift-Name): AW 01 N 9. 10. Balance Sheet and Profit&Loss Statement 9. 10. 1. FI: Modify Balance Sheet and P&L Report structure: Acct=90 Numb in Statement INT: FSS 0 9. 10. 2. FI: Create Balance Sheet and P&L Report: Comp=1000 9. 11. Process Overview and Data Dependencies 9. 12. Data Stream Overview Home Assignment 11: Export Balance Sheet and P&L Report References Object Symbols GUI Symbols

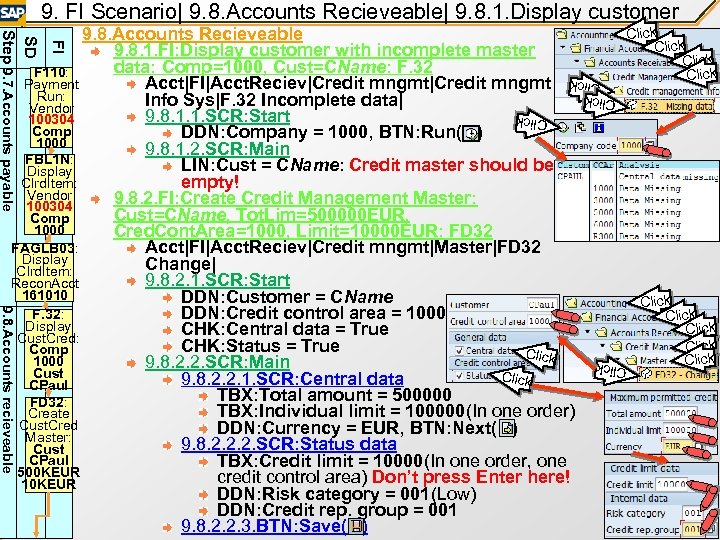

9. FI Scenario| 9. 8. Accounts Recieveable| 9. 8. 1. Display customer FI Click Click 9. 8. Accounts recieveable Click SD Step 9. 7. Accounts payable 9. 8. Accounts Recieveable 9. 8. 1. FI: Display customer with incomplete master data: Comp=1000, Cust=CName: F. 32 F 110: Payment Acct|FI|Acct. Reciev|Credit mngmt Run: Info Sys|F. 32 Incomplete data| Vendor 9. 8. 1. 1. SCR: Start 100304 Comp DDN: Company = 1000, BTN: Run( ) 1000 9. 8. 1. 2. SCR: Main FBL 1 N: LIN: Cust = CName: Credit master should be Display empty! Clrd. Item: Vendor 9. 8. 2. FI: Create Credit Management Master: 100304 Cust=CName, Tot. Lim=500000 EUR, Comp 1000 Cred. Cont. Area=1000, Limit=10000 EUR: FD 32 FAGLB 03: Acct|FI|Acct. Reciev|Credit mngmt|Master|FD 32 Display Change| Clrd. Item: 9. 8. 2. 1. SCR: Start Recon. Acct 161010 DDN: Customer = CName DDN: Credit control area = 1000 F. 32: Display CHK: Central data = True Cust. Cred: CHK: Status = True Comp Click 1000 9. 8. 2. 2. SCR: Main Cust Click 9. 8. 2. 2. 1. SCR: Central data CPaul TBX: Total amount = 500000 FD 32: TBX: Individual limit = 100000(In one order) Create Cust. Cred DDN: Currency = EUR, BTN: Next( ) Master: 9. 8. 2. 2. 2. SCR: Status data Cust CPaul TBX: Credit limit = 10000(In one order, one 500 KEUR credit control area) Don’t press Enter here! 10 KEUR DDN: Risk category = 001(Low) DDN: Credit rep. group = 001 9. 8. 2. 2. 3. BTN: Save( ) Click Click

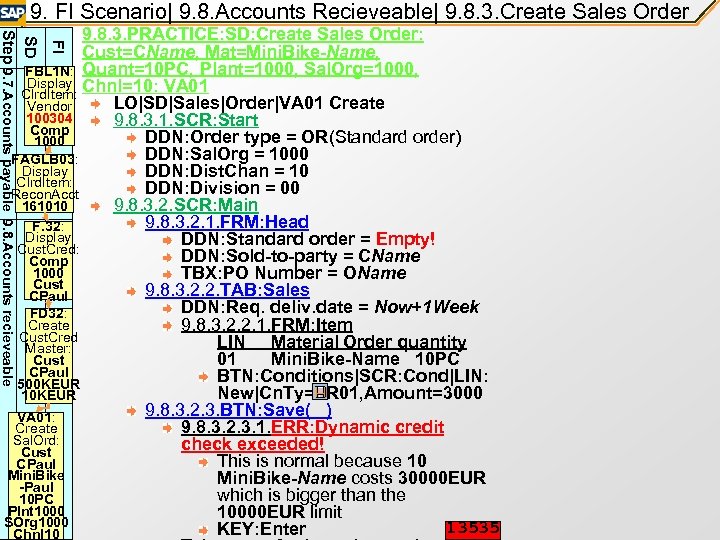

9. FI Scenario| 9. 8. Accounts Recieveable| 9. 8. 3. Create Sales Order FI SD Step 9. 7. Accounts payable 9. 8. Accounts recieveable 9. 8. 3. PRACTICE: SD: Create Sales Order: Cust=CName, Mat=Mini. Bike-Name, FBL 1 N: Quant=10 PC, Plant=1000, Sal. Org=1000, Display Chnl=10: VA 01 Clrd. Item: LO|SD|Sales|Order|VA 01 Create Vendor 100304 9. 8. 3. 1. SCR: Start Comp DDN: Order type = OR(Standard order) 1000 DDN: Sal. Org = 1000 FAGLB 03: Display DDN: Dist. Chan = 10 Clrd. Item: DDN: Division = 00 Recon. Acct 161010 9. 8. 3. 2. SCR: Main 9. 8. 3. 2. 1. FRM: Head F. 32: Display DDN: Standard order = Empty! Cust. Cred: DDN: Sold-to-party = CName Comp 1000 TBX: PO Number = OName Cust 9. 8. 3. 2. 2. TAB: Sales CPaul DDN: Req. deliv. date = Now+1 Week FD 32: Create 9. 8. 3. 2. 2. 1. FRM: Item Cust. Cred LIN Material Order quantity Master: 01 Mini. Bike-Name 10 PC Cust CPaul BTN: Conditions|SCR: Cond|LIN: 500 KEUR New|Cn. Ty=PR 01, Amount=3000 10 KEUR 9. 8. 3. 2. 3. BTN: Save( ) VA 01: 9. 8. 3. 2. 3. 1. ERR: Dynamic credit Create Sal. Ord: check exceeded! Cust This is normal because 10 CPaul Mini. Bike-Name costs 30000 EUR -Paul which is bigger than the 10 PC Plnt 10000 EUR limit SOrg 1000 13535 KEY: Enter Chnl 10

Content of the Practice Checking Home Assignment 10: Traveling Cost 9. Financial Accounting Scenario (Continued) 9. 7. Accounts Payable 9. 7. 1. FI: Enter Vendor Invoice: Vend=100304 10000 EUR to CCMSD-Name: FB 60 9. 7. 2. FI: Display open items at Vendor Invoice: Comp=1000, Vend=100304: FBL 1 N 9. 7. 3. FI: Automatic payment run: Comp=1000, Vend=100304, Next. Mo: F 110 9. 7. 4. FI: Display cleared items: Comp=1000, Vend=100304: FBL 1 N 9. 7. 5. FI: Display cleared items: Reconc. Acct 161010: FAGLB 03 9. 8. Accounts Receiveable 9. 8. 1. FI: Display customer with incomplete master data: Comp=1000, Cust=CName: F. 32 9. 8. 2. FI: Create Credit Management Master: Cust=CName, Tot. Lim=500000 EUR, Lim. Cred. Cont. Area=1000, Limit=10000 EUR: FD 32 9. 8. 3. SD: Create Sales Order: Cust=CName, Mat=Mini. Bike-Name, Quant=10 PC, Plant=1000, Sal. Org=1000, Chnl=10: VA 01 9. 8. 4. FI: Release Blocked SD Document: Cust=CName: VKM 1 9. 9. Asset Accounting 9. 9. 1. FI: Create Asset Master Record: Asset=Forklift-Name, Cost. Ctr=CCMSDName: AS 01 9. 9. 2. FI: Display asset in P&L statement: Comp=1000, Buis. Area=3000: S_ALR_87011965 9. 9. 3. FI: Display asset in Balance Sheet: Comp=1000, Buis. Area=3000: S_ALR_87012284 9. 9. 4. FI: Post Asset Acquisition: Buy Forklift-Name from Vendor=1000 for 35000 EUR+10%Tax: F-90 9. 9. 5. FI: Asset Explorer: Comp=1000, 3414 0 (Forklift-Name): AW 01 N 9. 10. Balance Sheet and Profit&Loss Statement 9. 10. 1. FI: Modify Balance Sheet and P&L Report structure: Acct=90 Numb in Statement INT: FSS 0 9. 10. 2. FI: Create Balance Sheet and P&L Report: Comp=1000 9. 11. Process Overview and Data Dependencies 9. 12. Data Stream Overview Home Assignment 11: Export Balance Sheet and P&L Report References Object Symbols GUI Symbols

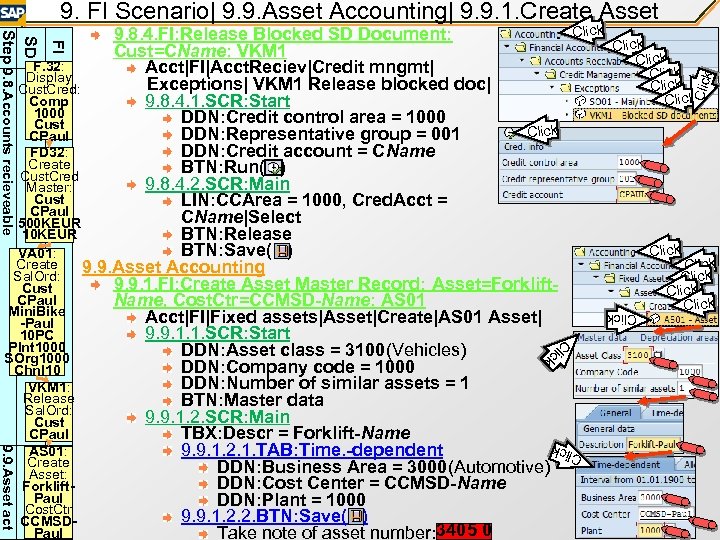

Click Click Clic FI Click C lic k k 9. 9. Asset act Clic SD Step 9. 8. Accounts recieveable 9. 8. 4. FI: Release Blocked SD Document: Cust=CName: VKM 1 F. 32: Acct|FI|Acct. Reciev|Credit mngmt| Display Exceptions| VKM 1 Release blocked doc| Cust. Cred: Comp 9. 8. 4. 1. SCR: Start 1000 DDN: Credit control area = 1000 Cust Click DDN: Representative group = 001 CPaul DDN: Credit account = CName FD 32: Create BTN: Run( ) Cust. Cred 9. 8. 4. 2. SCR: Main Master: Cust LIN: CCArea = 1000, Cred. Acct = CPaul CName|Select 500 KEUR 10 KEUR BTN: Release BTN: Save( ) VA 01: Create 9. 9. Asset Accounting Sal. Ord: 9. 9. 1. FI: Create Asset Master Record: Asset=Forklift. Cust CPaul Name, Cost. Ctr=CCMSD-Name: AS 01 Mini. Bike Acct|FI|Fixed assets|Asset|Create|AS 01 Asset| -Paul 9. 9. 1. 1. SCR: Start 10 PC Plnt 1000 DDN: Asset class = 3100(Vehicles) SOrg 1000 DDN: Company code = 1000 Chnl 10 DDN: Number of similar assets = 1 VKM 1: Release BTN: Master data Sal. Ord: 9. 9. 1. 2. SCR: Main Cust CPaul TBX: Descr = Forklift-Name AS 01: 9. 9. 1. 2. 1. TAB: Time. -dependent Create DDN: Business Area = 3000(Automotive) Asset: DDN: Cost Center = CCMSD-Name Forklift. Paul DDN: Plant = 1000 Cost. Ctr 9. 9. 1. 2. 2. BTN: Save( ) CCMSDPaul Take note of asset number: 3405 0 k 9. FI Scenario| 9. 9. Asset Accounting| 9. 9. 1. Create Asset Click

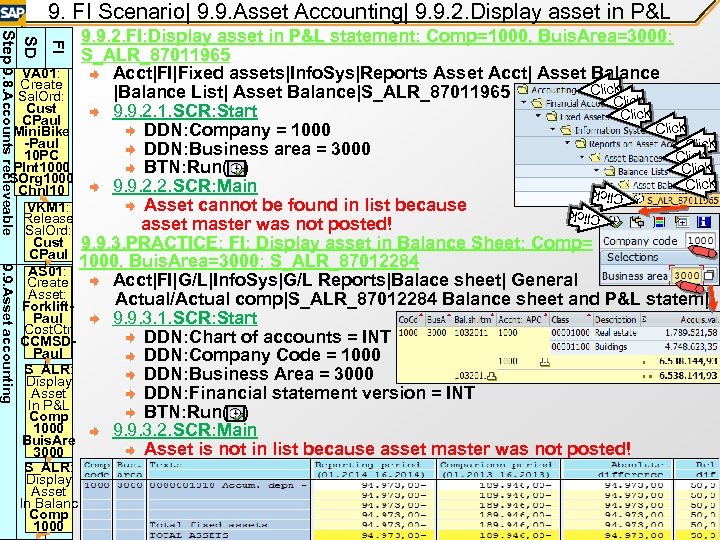

9. FI Scenario| 9. 9. Asset Accounting| 9. 9. 2. Display asset in P&L FI 9. 9. Asset accounting S_ALR: Display Asset In Balanc Comp 1000 Click SD Step 9. 8. Accounts recieveable 9. 9. 2. FI: Display asset in P&L statement: Comp=1000, Buis. Area=3000: S_ALR_87011965 VA 01: Acct|FI|Fixed assets|Info. Sys|Reports Asset Acct| Asset Balance Create Click |Balance List| Asset Balance|S_ALR_87011965 Sal. Ord: Click Cust 9. 9. 2. 1. SCR: Start Click CPaul Click DDN: Company = 1000 Mini. Bike -Paul Click DDN: Business area = 3000 10 PC Click Plnt 1000 BTN: Run( ) Click SOrg 1000 Click 9. 9. 2. 2. SCR: Main Chnl 10 Asset cannot be found in list because VKM 1: Release asset master was not posted! Sal. Ord: Cust 9. 9. 3. PRACTICE: FI: Display asset in Balance Sheet: Comp= CPaul 1000, Buis. Area=3000: S_ALR_87012284 AS 01: Acct|FI|G/L|Info. Sys|G/L Reports|Balace sheet| General Create Asset: Actual/Actual comp|S_ALR_87012284 Balance sheet and P&L statem| Forklift. Paul 9. 9. 3. 1. SCR: Start Cost. Ctr DDN: Chart of accounts = INT CCMSDPaul DDN: Company Code = 1000 S_ALR: DDN: Business Area = 3000 Display Asset DDN: Financial statement version = INT In P&L BTN: Run( ) Comp 1000 9. 9. 3. 2. SCR: Main Buis. Are Asset is not in list because asset master was not posted! 3000

9. FI Scenario| 9. 9. Asset Accounting| 9. 9. 4. Post Asset Acquisition 10%Tax Click FI SD Step 9. 8. Recievbl 9. 9. Asset accounting 9. 9. 4. FI: Post Asset Acquisition: Buy Forklift-Name from Vendor=1000 for 35000 EUR+10%Tax: F-90 Acct|FI|Fixed assets| Posting| Aquisition| VKM 1: Release External| F-90 With vendor| Sal. Ord: 9. 9. 4. 1. SCR: Main Cust CPaul 9. 9. 4. 1. 1. FRM: Header DDN: Document date = Now DDN: Posting date = Now AS 01: Create 9. 9. 4. 1. 2. FRM: Line item 1 Asset: DDN: Posting key(Pstky) = 31(Invoice) Forklift. Paul DDN: Vendor Account = 1000 Cost. Ctr 9. 9. 4. 1. 2. 1. KEY: Enter CCMSDPaul TBX: Amount = 38500 S_ALR: TBX: Tax amount = 3500 Display DDN: Tax Code = 1 I(Income tax 10%) Asset In P&L 9. 9. 4. 1. 3. FRM: Line item 2 Comp DDN: Posting key 1000 (Pstky) = 70(Assets debit) Buis. Are 3000 DDN: Account = 3405 0(Forklift-Name) S_ALR: DDN: Transaction type = 100(External Display Asset acquisition) In Balanc DDN: New Company Code = Empty! Comp 1000 9. 9. 4. 1. 3. 1. KEY: Enter F-90: DDN: Amount = 35000 Post DDN: Tax Code = 1 I(Income tax 10%) Asset Aquisition 9. 9. 4. 1. 4. BTN: Save( ) Forklift. Take note of asset document number: Paul 1900000021 Vendor 1000 Asset should show up now in P&L 35 KEUR Click Click

9. FI Scenario| 9. 9. Asset Accounting| 9. 9. 5. Asset Explorer FI SD Step 9. 9. Asset accounting 9. 9. 5. PRACTICE: FI: Display Asset in Asset Explorer: Comp=1000, 3405 0(Forklift-Name): AW 01 N AS 01: Acct|FI|Fixed assets|Asset|AW 01 N Asset explorer| Create 9. 9. 5. 1. SCR: Main Asset: Forklift. DDN: Company = 1000 Paul DDN: Asset = 3405 0(Forklift-Name) Cost. Ctr CCMSD 9. 9. 5. 2. SCR: Main Paul 9. 9. 5. 2. 1. FRM: Up. Left S_ALR: Display LIN: Deprec. Area = 01(Book depreciation US-GAAP)|Select Asset 9. 9. 5. 2. 2. FRM: Right In P&L Comp 9. 9. 5. 2. 2. 1. TAB: Planned values 1000 LIN: Months Buis. Are 3000 COL: Depreciation = 2333 S_ALR: 9. 9. 5. 2. 2. 2. TAB: Posted values Display Asset LIN: Months In Balanc COL: Depreciation = 0(Will be computed only after Comp 1000 depreciation run!) F-90: Post Asset Aquisition Forklift. Paul Vendor 1000 35 KEUR 10%Tax AW 01 N: Asset Explorer Comp 1000 Forklift. Paul

Content of the Practice Checking Home Assignment 10: Traveling Cost 9. Financial Accounting Scenario (Continued) 9. 7. Accounts Payable 9. 7. 1. FI: Enter Vendor Invoice: Vend=100304 10000 EUR to CCMSD-Name: FB 60 9. 7. 2. FI: Display open items at Vendor Invoice: Comp=1000, Vend=100304: FBL 1 N 9. 7. 3. FI: Automatic payment run: Comp=1000, Vend=100304, Next. Mo: F 110 9. 7. 4. FI: Display cleared items: Comp=1000, Vend=100304: FBL 1 N 9. 7. 5. FI: Display cleared items: Reconc. Acct 161010: FAGLB 03 9. 8. Accounts Receiveable 9. 8. 1. FI: Display customer with incomplete master data: Comp=1000, Cust=CName: F. 32 9. 8. 2. FI: Create Credit Management Master: Cust=CName, Tot. Lim=500000 EUR, Lim. Cred. Cont. Area=1000, Limit=10000 EUR: FD 32 9. 8. 3. SD: Create Sales Order: Cust=CName, Mat=Mini. Bike-Name, Quant=10 PC, Plant=1000, Sal. Org=1000, Chnl=10: VA 01 9. 8. 4. FI: Release Blocked SD Document: Cust=CName: VKM 1 9. 9. Asset Accounting 9. 9. 1. FI: Create Asset Master Record: Asset=Forklift-Name, Cost. Ctr=CCMSDName: AS 01 9. 9. 2. FI: Display asset in P&L statement: Comp=1000, Buis. Area=3000: S_ALR_87011965 9. 9. 3. FI: Display asset in Balance Sheet: Comp=1000, Buis. Area=3000: S_ALR_87012284 9. 9. 4. FI: Post Asset Acquisition: Buy Forklift-Name from Vendor=1000 for 35000 EUR+10%Tax: F-90 9. 9. 5. FI: Asset Explorer: Comp=1000, 3414 0 (Forklift-Name): AW 01 N 9. 10. Balance Sheet and Profit&Loss Statement 9. 10. 1. FI: Modify Balance Sheet and P&L Report structure: Acct=90 Numb in Statement INT: FSS 0 9. 10. 2. FI: Create Balance Sheet and P&L Report: Comp=1000 9. 11. Process Overview and Data Dependencies 9. 12. Data Stream Overview Home Assignment 11: Export Balance Sheet and P&L Report References Object Symbols GUI Symbols

9. FI Scenario| 9. 10. Balance Sheet and P&L| 9. 10. 1. Modify stucture FI Click SD Step 9. 9. Asset accounting 9. 10. Balance Sheet and Profit&Loss Statement 9. 10. 1. FI: Modify Balance Sheet and P&L Report structure: S_ALR: Acct=90 Numb Financial Statement=INT: FSS 0 Display Asset Acc|FI|G/L|Master|G/L Acc|Individ Proc|FSS 0 In Company| In Balanc Click Comp 9. 10. 1. 1. SCR: Start Click 1000 Click TBX: G/L account = 90 Numb lick C F-90: Click DDN: Company = 1000 Post Click Asset 9. 10. 1. 1. 1. BTN: Modify Click Aquisition Forklift 9. 10. 1. 2. SCR: Main Paul 9. 10. 1. 2. 1. BTN: Edit Fin. Statemt version|SCR: Edit Fin. Statemt| Vendor 1000 DDN: Fin. Statemt = INT 35 KEUR By default all unassigned account 10%Tax ick Cl AW 01 N: are in 8000000 Unassigned node Asset 9. 10. 1. 2. 1. 1. LIN: 3000000 Explorer Comp LIN: 3080000 1000 LIN: 3082000 Forklift. Paul LIN: 3082090|Select Cl FSS 0: ick BTN: Assign Accts|SCR: Change Accts| Insert 900001 LIN: New(Scroll down to first empty line) Into From. Acct To. Acct Debit Credit INT 90 Numb Yes S_ALR: Report There can be only 40 accounts in 1 node, if no Balance And P&L more free space, modify an existing account! Comp 9. 10. 1. 2. 2. BTN: Save( )|SCR: Change request| 1000 INT BTN: New( ) TBX: Description = Change. Req-Name BTN: Save( ) k Clic 9. 10. Balance Sheet and P&L

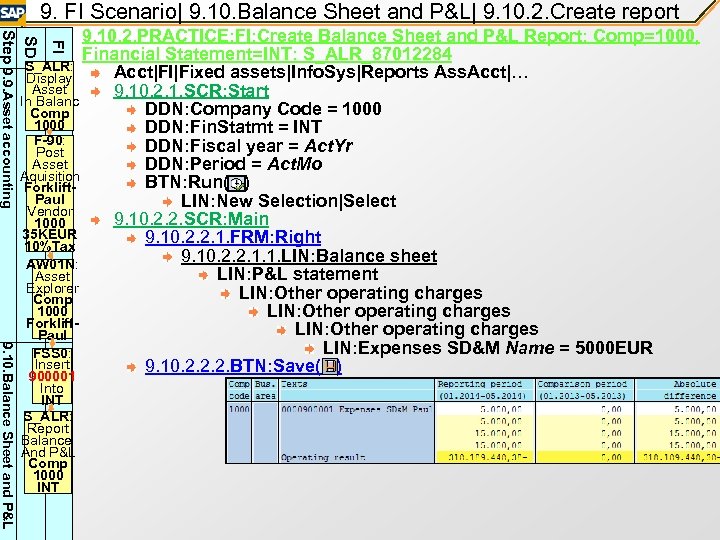

9. FI Scenario| 9. 10. Balance Sheet and P&L| 9. 10. 2. Create report FI SD Step 9. 9. Asset accounting 9. 10. 2. PRACTICE: FI: Create Balance Sheet and P&L Report: Comp=1000, Financial Statement=INT: S_ALR_87012284 S_ALR: Acct|FI|Fixed assets|Info. Sys|Reports Ass. Acct|… Display Asset 9. 10. 2. 1. SCR: Start In Balanc DDN: Company Code = 1000 Comp 1000 DDN: Fin. Statmt = INT F-90: DDN: Fiscal year = Act. Yr Post Asset DDN: Period = Act. Mo Aquisition BTN: Run( ) Forklift. Paul LIN: New Selection|Select Vendor 9. 10. 2. 2. SCR: Main 1000 35 KEUR 9. 10. 2. 2. 1. FRM: Right 10%Tax 9. 10. 2. 2. 1. 1. LIN: Balance sheet AW 01 N: LIN: P&L statement Asset Explorer LIN: Other operating charges Comp 1000 LIN: Other operating charges Forklift. LIN: Other operating charges Paul LIN: Expenses SD&M Name = 5000 EUR FSS 0: Insert 9. 10. 2. 2. 2. BTN: Save( ) 9. 10. Balance Sheet and P&L 900001 Into INT S_ALR: Report Balance And P&L Comp 1000 INT

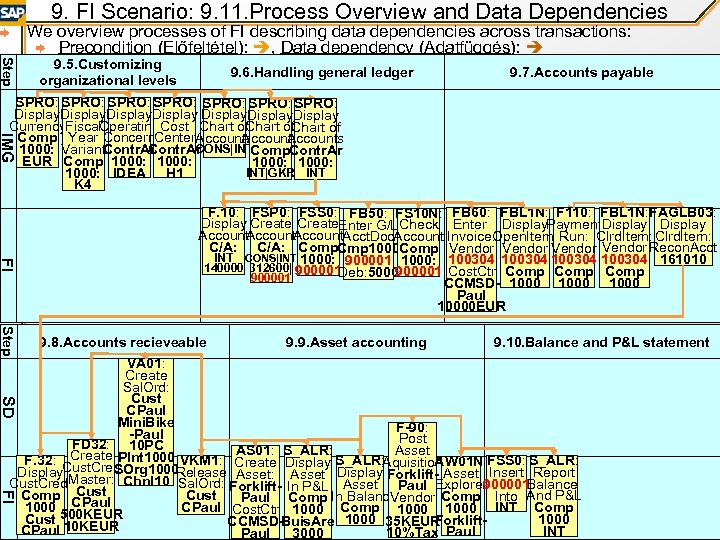

9. FI Scenario: 9. 11. Process Overview and Data Dependencies We overview processes of FI describing data dependencies across transactions: Precondition (Előfeltétel): , Data dependency (Adatfüggés): Step 9. 5. Customizing organizational levels 9. 6. Handling general ledger 9. 7. Accounts payable IMG SPRO: SPRO: Display Currency. Fiscal Operating. Cost Chart of Comp Year Concern. Center. Accounts CONS|INT 1000: Variant. Contr. Ar Comp. Contr. Ar EUR Comp 1000: INT|GKR INT 1000: IDEA H 1 K 4 FI F. 10: FSP 0: FSS 0: FB 50: FS 10 N: FB 60: FBL 1 N: F 110: FBL 1 N: FAGLB 03: Display Create. Enter G/L Check Enter Display. Payment. Display Account. Acct. Doc. Account Invoice: Open. Item: Run: Clrd. Item: C/A: Comp. Cmp 1000 Comp Vendor Recon. Acct INT CONS|INT 1000: 900001 1000: 100304 161010 140000 312600| 900001 Cost. Ctr Comp Deb: 5000 900001 CCMSD- 1000 Paul 10000 EUR Step 9. 8. Accounts recieveable 9. 9. Asset accounting 9. 10. Balance and P&L statement SD VA 01: Create Sal. Ord: Cust CPaul Mini. Bike F-90: -Paul Post FD 32: 10 PC Asset AS 01: S_ALR: F. 32: Create Plnt 1000 VKM 1: Create Display S_ALR: AW 01 N: FSS 0: S_ALR: Aquisition SOrg 1000 Display. Cust. Cred Release Asset: Asset Display Forklift- Asset Insert Report Master: Chnl 10 Sal. Ord: Forklift- In P&L Asset Paul Explorer Cust. Cred: Balance 900001 Comp Cust Paul Comp In Balanc Vendor Comp Into And P&L 1000 CPaul Cost. Ctr 1000 Comp 1000 INT Comp Cust 500 KEUR 1000 Forklift. CCMSD-Buis. Are 1000 35 KEUR CPaul 10 KEUR INT 10%Tax Paul 3000 FI

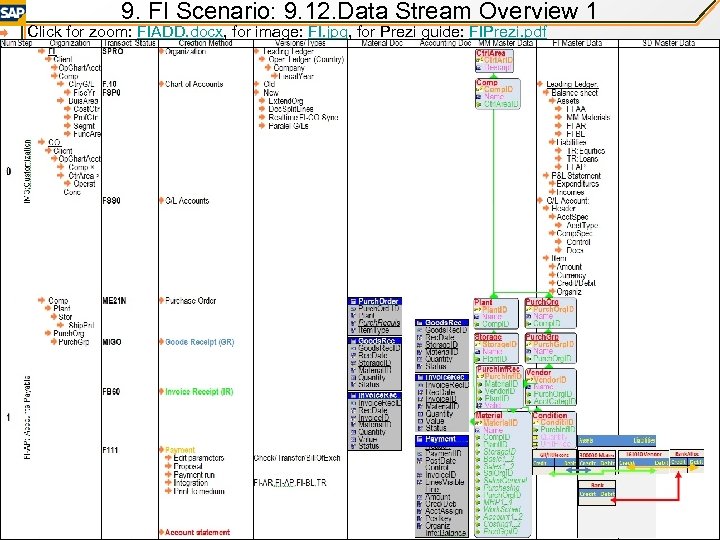

9. FI Scenario: 9. 12. Data Stream Overview 1 Click for zoom: FIADD. docx, for image: FI. jpg, for Prezi guide: FIPrezi. pdf

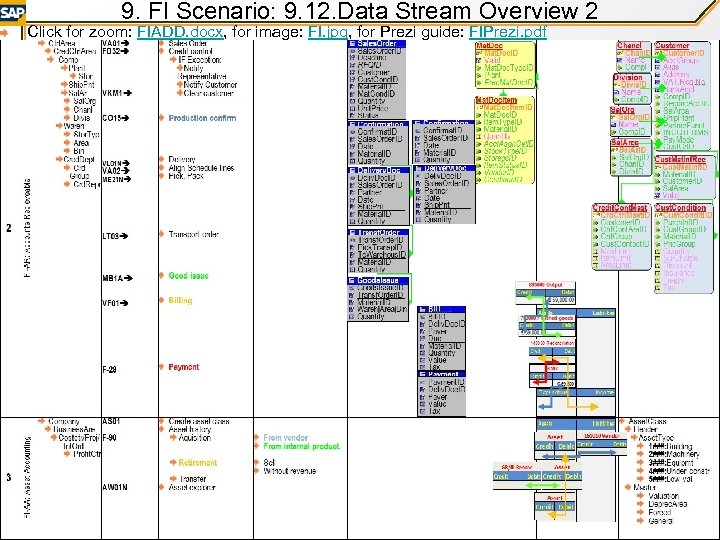

9. FI Scenario: 9. 12. Data Stream Overview 2 Click for zoom: FIADD. docx, for image: FI. jpg, for Prezi guide: FIPrezi. pdf

Home Assignment 11: Export Balance Sheet and P&L Report generated in Step 9. 10. 2. in Excel and upload the file tho the Facebook group of the course! (5 points)

References http: //www. sap-img. com/abap. htm http: //erpgenie. com/ http: //help. sap. com/search/sap_trex. jsp http: //sap. ittoolbox. com/groups/technical-functional/sap-abap/

Értékesítés támogatás (Sales Promotion) Direkt mail (Direct mail) Ajánlat (Offer) Árazás (Pricing) Rendelés (Order) Validáció (Validation) Szerződés (Contract) Szállítás (Transport) Hitel (Credit) Ütemezés (Scheduling) Szerviz (Service) Vevőszolgálat (Customer Service) Kattintás (Click) Dupla kattintás (Double Click) Adatbevitel (Write) Csak olvasható (Read Only) t ick igh k Cl RClic Cég (Company) Gyár (Plant) Értékesítési szervezet (Sales Department) Üzletkötő csoport (Sales Representative Group) Értékesítési integráció (Sales Integration) Csatorna (Channel) Földrajzi hely (Geographic Location) Kiszállítási hely (Delivery Location) Szállítási mód (Transportation Mode) Rakodási pont (Loading Point) Árucsoport (Product Group) Értékesítési terület (Sales Area) Object Symbols Partner (Partner) Anyag (Material) Sarzs (Batch) Bevitt anyag (Partner material) Készlet (Inventory) Raktár (Deposit) Gyári szám (Serial number) Darabjegyzék (Bill of materials) Szortiment (Sortiment) Anyagmeghatározás (Material Identification) Árazás (Pricing) Engedmény (Allowance) Fizetési mód (Payment Method) Számla (Invoice) Bizonylat (Voucher)

GUI Symbols To make GUI usage descriptions more short and straightforward, we will use standardized denotions of GUI controls, which can be nested into each other: DEF: -definition, PRC: -process, ALT: -alternatives, CYC: -cycle, -follows, -(dis)advantage, Aaa|Bbb|-Menu/Submenu, SCR: -Screen, FRM: -Frame, ID-Unique. ID, BTN: -Button, TXB: -Textbox, DDN: -Dropdown, TAB: -Page tab, CHK: -Checkbox (any of them can be checked) RAD: -Radiobox (one can be checked only), LIN: -Tableline, KEY: -Hotkey, WRN: -Warning box ERR: -Errorbox

cd76b654971e37fbfb2e6b61c615168d.ppt