4b9b6194aa619a142bcd9b60a1ae1138.ppt

- Количество слайдов: 140

Sales and Consumer Issues Objective 09. 01 Interpret sales contracts and warranties within the rights and law of consumers. WARRANTIES AND GUARANTEES

Warranties and Guarantees • Implied warranty – A guarantee of quality imposed by law but not in writing – Implied warranty deals with sale of goods – Regulated by UCC – Given by all sellers

Implied Warranties • Warranty of fitness for a particular purpose – – Seller knows the purpose for which goods are needed Seller advises buyer in making purchase Buyer relies on seller’s advice to make decision Seller infers that the goods are fit for a particular purpose – A warranty exists

Implied Warranties • Warranty of Merchantability – Given by a merchant only – Merchant infers that goods pass in the trade without objection – Goods are fit for the ordinary purpose such goods are used for – Conform to any promises or statements made on the container or label

Implied Warranties • Warranty of Title – Seller warrants that the title is good and transfer is rightful – Seller warrants that goods will be delivered free of any financial obligations about which the buyer had no knowledge

Sale of Stolen Goods • If stolen goods are sold to an innocent purchaser, the true owner is entitled to return of the goods • The buyer can pursue remedy against the seller for breach of warranty of title

Usage of Trade • An implied warranty that is a well established custom or practice among people in specific trades or businesses – Example: When a person sells a thoroughbred horse there is an implied warranty that papers are provided to prove the animal’s pedigree as a thoroughbred. It is expected in the horse trading business

Express Warranty • Express warranty is also called a guarantee – “Guaranteed satisfaction or your money back” – “Lifetime guarantee” – The promise or assurance of the quality or life of a product

Express Warranties • Can be oral or written • Written form recommended • Parol evidence rule applies: evidence of oral statements made before signing a written contract cannot be presented in court to change or add to the terms of that written agreement

Express Warranties • Puffery by salesman is not a warranty, but an opinion of the salesperson. • Express warranties created by: – Statement of fact or promise by seller – Description of goods – Use of same item or model

Full Warranties • A full warranty requires that the defective product be repaired or replaced for free within a reasonable length of time after complaint is made. • If the product cannot be fixed, the consumer has the option to get their money refunded. • Have you ever tried to return merchandise that you thought was under warranty but was not?

Limited Warranty • A limited warranty provides a restricted guarantee. • Must state “Limited” Warranty • Be sure to read and understand the limits of the warranty before purchasing…caveat emptor!

Caveat Emptor • Latin for “Buyer Beware” – Warning: It is the duty of the consumer to make informed decisions. – Be sure to read labels and research products before buying. Comparison shop. – It is the duty of the seller to provide appropriate information for the consumer.

Caveat Venditor • Latin for “Seller Beware” – Warning: It is the duty of the seller to make informed decisions. – Example: Banks, credit card companies and businesses who extend credit to customers check credit histories and applications before extending credit.

Growth of Consumerism • Ralph Nader - “ Father of the Consumer Movement” – Lectured widely against corporate carelessness and greed – Gained national fame in 1965 with his book “Unsafe At Any Speed” about the Chevrolet Corvair – Followers were known as “Nader’s Raiders” – Brought attention to products that were not safe for consumers.

Lemon Laws • • Purpose: To protect consumers against chronically defective or “LEMON” products Commonly relates to vehicles, but can be other products Can be either federal or state law Buyer can get replacement of part or reimbursement of purchase price.

Lemon Laws • Apply if a dealership tries unsuccessfully to fix a vehicle returned by consumer with a major defect • Duty of the Buyer: – Must notify the seller • Recommend certified letter to give documentary evidence of notice given and received • Only relates to “substantially” defective products

Used Car Rule • Purpose: To help consumers make better decisions when buying used cars • Established in 1985 by the FTC • Requires dealers of used cars to post a “Buyers Guide” on every car

Used Car Rule The Buyer’s Guide • Must advise or suggest: – If warranty, what is covered? – If no warranty, “AS IS”, or implied only – To have inspection before purchasing – What are some major car problems – To get warranties in writing

Regulation of Warranties • Federal Trade Commission (FTC) encourages manufacturers to make warranties very clear. • FTC is a federal agency that ensures fair economic practices among businesses.

Magnuson-Moss Act (1975) • Expands the FTC ‘s authority over written warranties • Regulates the advertisement of warranties and enforces guidelines • Requires written warranties to be in clear and understandable language

Express Written Warranties must disclose: • Which part of product is guaranteed? • What part is not guaranteed? • What is the time limit? – Lifetime of purchaser? Or of product? • How is a claim made? • What are options for settlement? • Who is making the guarantee?

Magnuson-Moss Act • Requires that written warranties be labeled as full or limited • Limits exclusions on implied warranties • Requires that an exclusion or disclaimer to the written warranty be: – In writing – CONSPICUOUS

Breach of Warranty • Requirements: – Buyer should give notification to seller within a reasonable time – Seller may refund $ or make restitution or offer to replace defective goods – Buyer may claim damages

Sales and Consumer Issues Objective 09. 01 Interpret sales contracts and warranties within the rights and law of consumers CONSUMER PROTECTION ISSUES

Consumer Protection Laws • Purpose: – To assist consumers in judging the quality of a product and its advantages or disadvantages, and – To create an equal field with the sellers in an affluent and technology oriented marketplace.

Why have consumer protection laws? • To ensure consumers get adequate decisionmaking information to compare products • to ensure fairness and competition in the marketplace • to protect consumers against unfair and deceptive practices or the sale of substandard or dangerous goods • to require licenses and inspections to ensure compliance with the law and • to provide remedies for injured parties

Consumer Protection Laws • Legislation passed at local, state and federal levels. • Federal Trade Act is a broad consumer law enforced by the Federal Trade Commission (FTC). • Unfair and Deceptive Trade Practices is any practice that misleads (or has the potential to mislead) a consumer.

Unfair and Deceptive Trade Practices Includes: – – – – Price fixing on goods Deceptive prices on service contracts Door-to-Door Sales Fraudulent Misrepresentation Telemarketing Fraud Work at home schemes Illegal Lotteries and Scams Gambling

Door-to-Door Sales • The cooling-off rule was adopted by the FTC to give consumers three business days to cancel most contracts made with door to door salespersons. The rule relates to sales of $25 or more made outside the salesperson’s regular place of business.

Telemarketing Fraud • Buyer Beware… – When an unsolicited caller contacts you. – When the caller asks for personal information; social security #, credit card #, bank account #s, etc. – Telemarketing scams often charge for their services through 1 -900 phone numbers. When the deals seems to good to be true … it probably is not true! – Good web resource: FBI and US Postal Service fraud website www. Looks. Too. Good. To. Be. True. com

Work at Home Schemes • An advertisement to make big money easily at home by calling a number or buying a book or video. • Frequently the scam includes payment up front for “lists”, other undisclosed charges, limited or non-existent training. • If it appears you can “GET RICH QUICK”, it is probably a scam. Be careful!!

Lottery Scams • A con artist contacts you by mail stating you have won a lottery drawing and to contact him immediately to claim your prize. • Upon contact the con states once you pay your “clearance fee” a certified check will come in the mail. • You pay the fee and your check never comes. “Gotcha”. • ? ? How can you win a lottery you did not enter? ?

False Advertising • Bait and Switch is advertising a nonexistent bargain to lure customers so they can be sold a more expensive item. • Cease and desist orders are a legally binding order issued by the court to stop a practice of using advertising that would mislead the public.

Shopping by Mail • When ordered, should ship within 30 days, or • If order delayed, seller must provide notice of back order or out of stock. • Any unsolicited merchandise received is considered a gift or free sample and receiver has no obligation to pay.

Internet Shopping • Use reputable business sites. • When the buyer clicks “I accept” and online cyber contract is created and the parties are bound to the contract. • Protect private information when shopping online. • Do not respond to pop up emails when online.

Internet Scams • A potential buyer contacts you on a website where you are selling an item. • Payment is made by cashier’s check but buyer overpays the agreed upon price. • The buyer asks you to mail or wire the refund amount back to him. You comply. • A few weeks later the cashier’s check is returned “counterfeit”. • Good web resource: www. fraudaid. com

International Law - Internet Sales • Check out the company before doing business with internet company. – Company may be international and the laws of the US do not always apply. A consumer has little or no recourse for defective products or illegal schemes. – International fraud, identity theft, privacy, and sale of personal information are much harder to prosecute in the global legal environment.

Spam • Spamming is sending mass, unsolicited advertisements over the internet. • Spammers apply First Amendment freedom of speech rights to their right to send emails. • Spam grabs user’s attention and time. • Comparable to junk mail processed by United States Postal Service • Some states have laws pending or passed to regulate spamming. • New technology is constantly changing laws.

Licensing • For the protection of consumers, government agencies require licensing of suppliers of consumer services. – Examples: • Health services- doctors, nurses, pharmacists • Other professionals- teachers, realtors, insurance agents, lawyers, accountants, beauticians, and others

Product Liability • Consumer Product Safety Act of 1972 – Created the Consumer Product Safety Commission (CPSC) – Sets product standards for hazardous products – Requires manufacturer or seller to test quality and reliability before marketing product – Can require recall, repair, replacement or refunding of the purchase price, of unsafe products – Examples: • Children’s toys with dangerous parts • Defective vehicle tires that cause accidents

Food, Drug and Cosmetic Act • Created the Food and Drug Administration (FDA) • Passed in 1903 after President Teddy Roosevelt read “The Jungle” by Upton Sinclair • Prohibits adulteration or mislabeling of foods, drugs or cosmetics • Creates standards for packaged foods, drugs and cosmetics • Approves new pharmaceuticals (prescription drugs)

Food and Drug Administration • FDA regulates packaged Food, Drugs, Cosmetics including: – Inspecting production facilities for cleanliness – Setting standards of purity and quality – Approving ingredient lists as to fitness for human consumption or use – Requiring labeling with manufacturer, packager, distributor, weight & nutritional information to assist consumer in informed decision making

Food and Drug Administration • New drugs cannot be marketed in the US without FDA approval. • FDA is sometimes criticized for being too cautious in granting new drug approvals. • Some Americans go to other countries to get drugs the FDA has not approved that they feel may be life-saving. • FDA recalls drugs from the market when dangerous side effects are identified.

What kinds of problems does FDA regulate? • Adulterated products • A product that contains any substance that will reduce its quality or strength below the minimum standard • Misbranded products • A product with false or misleading labeling or packaging • Injurious products • A product that could injure consumers

Labeling and Packaging – Marketers may use puffery, but not fraud. • “new and improved” – Marketers may use facts. • package contains “x” % more free – Can you name other legal label information used by marketers? – Can you name promotional information that seems misleading?

United States Department of Agriculture (USDA) • Regulates preparation and sale of fresh produce, meats and dairy products • Inspects canners, packers and processors and distributors for sanitary conditions and handling • Inspects products to ensure freedom from disease and fit for human consumption

Delaney Amendment • 1958 Amendment to FDA – Removes products from the market which are carcinogenic (Cancer Causing) – Examples: • Saccharin – sugar substitute from 1960 s • Red dye #3 – Can you name other items?

Food and Drug Administration • FDA discourages the sale of harmful products through: – Imposing high taxes. – Issuing label or package warning. – Prohibiting the sale of the product. • Examples: tobacco, alcohol, saccharin – Can you name other examples?

Weights and Measures Division of the National Institute of Standards • Promotes uniformity in weights and measures laws, regulations, and standards • Allows consumers to make comparison shopping decisions such as unit pricing

What if I have a complaint? § § First, contact company customer service department to give notice of the problem and allow time to resolve conflict with involved parties. Frequently, companies will resolve the problem with a consumer at this stage by replacement, repair, or restitution for the item. The company desires to keep the customer satisfied to ensure future business and positive goodwill. If complaint is unresolved, proceed to next contact.

Better Business Bureau (BBB) § § § A private, non-government agency available at local and state levels Logs complaints from consumers Passes complaint information to businesses that are members, frequently resolving issue Makes complaints available for public viewing Tries to steer consumers to reliable businesses that conduct business ethically

Consumer Contacts • If you do not get resolution, then • Contact the government regulatory agency related to your complaint. • Examples: – Consumer Product Safety Commission – Federal Communication Commission – Federal Trade Commission – US Postal Service

Consumer Contacts • Try the state of federal attorney general’s office for assistance. • Last option, if all else fails to resolve the conflict: – Go to small claims court or – Seek legal counsel to: • File individual litigation or • Join a class action lawsuit.

Sales and Consumer Issues Objective 09. 01 Interpret sales contracts and warranties within the rights and law of consumers. LAW OF SALES

What is a Sale? • Sale- a contract by which ownership of goods is transferred by the seller to the buyer for a consideration called price – *Sales Contract must have all required elements. • Goods- tangible (touchable) personal property that can be physically weighed, measured, and moved • Buyer- the purchaser or vendee Services are not covered in law of sales

Is the seller a merchant or casual seller? • Seller (Vendor) – Merchant- a seller who deals regularly in a particular type of goods or who claims special knowledge in a certain type of sales transaction • Why is a merchant held to a higher standard of accountability than a casual seller? – Casual Seller- any seller who does not meet the definition of a merchant

Seller Comparison • Merchant vs. • Casual Seller – Car dealership selling new cars – Individual selling used car after purchasing a new one – Clothing store at mall selling new clothes – Person selling clothes at a garage/yard sale

Student Response: Can you think of other… • MERCHANTS? • CASUAL SELLERS?

Price • Consideration in sales contract. Items used for consideration include: – Money – Services – Other goods (barter) – Real estate

Cash and Carry • Sale where the buyer pays for the goods and takes ownership of the goods upon payment. • Ownership transfers at the time of the transaction. • Risk of loss attaches upon receipt of goods. • Risk of loss- the responsibility for loss or damage to goods

Cash and Carry Most common payment and delivery method – Examples: • Groceries, clothing • Usually low priced goods • Frequent purchases – Can you name other examples of cash and carry?

Sale on Credit • Similar to cash and carry EXCEPT payment is made at a later date by agreement of the parties. • Examples: – Appliances, furniture, vehicles – Usually bigger ticket items

COD - Collect on Delivery • Goods are shipped to buyer • Carrier collects price and transportation charges upon delivery • Carrier is the transportation company • Carrier transmits the funds to the seller • Can you name examples of carriers? – UPS, Yellow Freight, Fedex

Collect on Delivery (COD) • When price is paid at delivery: – Risk transfers to new owner – Ownership transfers to new owner • Until goods are delivered and price is paid, no transfer of risk or ownership.

Collect on Delivery (COD) • Example: Michelle ordered a birthday gift for her sister from a Lands End catalog. It was shipped to the office where Michelle worked. When the UPS delivery came, Michelle had to pay for the goods and the cost of shipping and handling before the package could be left. After delivery, UPS submits the money to Lands End.

Sales on Credit-Consumer • A sale that by agreement of the parties, calls for payment of the goods at a later date. • When a consumer buys goods on credit, but pays for them at a later date. – Examples: • When furniture, cars, appliances are bought on an installment credit plan • Any credit card or charge card purchase made by a consumer

Sales on Credit-Businesses • A business uses trade accounts to buy goods from another business with an agreement to pay for them at a later date – Example: • One business sends an invoice to another business, with whom they regularly trade with terms for payment. • Office Depot buys printers and supplies from Hewlitt Packard but does not pay before the goods are shipped to them. HP will send an invoice for the amount due and the terms of payment.

Sales on Credit-Businesses • Invoices- the bill for goods shipped • Terms- the statement of a due date of payment and any allowable discounts or late fees charged • Due date- the time the payment is due to the invoicing company • Discounts- a % reduction on the invoice price if the bill is paid within a specified time • Net – when 100% of an invoice is due, no discounting allowed • Late fees- a % add on to the invoice price if not paid on time

Discounts • If terms are 2/10, n 30 – Purchaser may take a 2% discount on the cost of invoice if paid within 10 days, – Purchaser will pay net (full 100% of invoice), if paying after 10 days but before 30 days – Example: Invoice billed on July 1 st for $1, 000 with terms 2/10, n 30. If paid by July 10, buyer can take discount of $20 (2% x 1000), and pay $980. If bill is paid July 11 - July 31 amount will be net or $1000.

Late Fees • Also called Past Due Fees • Frequently vendors state a separate amount of interest due on accounts that are past due. • Example: “ 1. 5 % per month on all unpaid past due accounts”

Consignment Sale • Goods are sent by a manufacturer to a retailer, but ownership and risk remain with the manufacturer until goods are sold. • Retailer generally does not make payment for the goods unless goods are sold to consumer. • If goods do not sell, retailer has right to return unsold goods to manufacturer.

Consignment Sales Example: Jean owns a retail clothing store. A supplier, Awesome Duds, offers Jean a new line of accessories saying, “If you’ll display this new product line, I will make you a deal. You’ll take no risk. I will not invoice you. If they don’t sell, return them all to me. When they sell, send me the wholesale price quoted. ”

Sale or Return • A completed sale in which the merchant-buyer has the option of returning the goods. • The merchant-buyer gains ownership and risk of loss upon delivery. • If goods are returned within the agreed upon time, or a reasonable time, ownership and risk return to seller. • Returned goods must be in essentially their original condition.

Sale on Approval • A sale in which goods are delivered to the buyer in an “on trial” or “on satisfaction” basis. • Ownership and risk of loss do not attach until prospective buyer approves goods.

Auction • A public sale to the highest bidder. • Auctioneer offers goods for sale and accepts offers called bids. • Auctioneer accepts the bid on behalf of the owner of the goods. • An Auction sale with reserve means the auctioneer does not have to sell to the highest bidder. For example, if all bids are very low, the bid can be rejected and sale stopped. • Ownership passes when auctioneer closes bidding and accepts the highest bid. “SOLD!” • Risk of loss passes when auctioneer gives buyer right to possess (usually after payment).

Bulk Transfer • A transfer, generally by sale, of all or a major part of the goods of a business in one unit at one time. • To protect creditors, the UCC requires merchants to give creditors written notice of bulk transfers so the merchant cannot sell all inventory and leave without payment to creditors.

Transfer of Ownership • People who own goods have title to the goods. Title is the right of ownership of goods. • True owners or titleholders may transfer goods. – If the seller of goods is a thief, the seller’s title is void. • Authorized persons or agents of the owner may transfer goods. (Examples: Merchant in a consignment sale or an auctioneer)

What are title documents? • A document of title is a written document giving the person who possesses it the right to receive the goods named in the document. – Bill of lading is a receipt for shipment of goods given by a transportation company to a shipper when the carrier accepts the goods for shipment – Warehouse receipt is given by a warehouse to a customer whose goods are stored in the warehouse. – Bill of sale is given to a buyer as evidence of ownership. (Property tax collectors may require a bill of sale to remove a sold vehicle from your tax bill. License tag offices may require bill of sale to transfer a vehicle title and issue a tag. )

Can a voidable title be transferred? • Voidable Title-when goods can be returned and the money paid for them is refunded. – Minors have voidable titles. – Victims of fraud who purchase goods have voidable titles. • Under UCC law, someone with a voidable title can transfer good title to someone who buys in good faith for something of value.

When does ownership pass and risk of loss attach? • Identified goods -goods that have been specifically designated as the subject matter of a particular sales contract • Once goods are identified, title passes to buyer when seller meets contract requirements. • IN CONTRAST: goods that are not both existing and identified are called future goods and neither ownership or risk of loss pass at time of agreement. These goods can be the subject matter of a contract to sell in the future, but not a sale. No one has title to future goods because they do not exist. Example: crops or goods to be manufactured in future.

When does ownership pass and risk of loss attach? • In a shipment contract– Seller transfers goods to a carrier for delivery to buyer. – Title and risk of loss pass to buyer when seller turns over goods to carrier. – Seller has no responsibility once goods reach carrier. – Invoice designation is f. o. b. (free on board) shipping point. This means the buyer is responsible for freight cost (and risk) once seller delivers goods to carrier or to the shipping point.

When does ownership pass and risk of loss attach? • In a destination contract– Contract requires seller to deliver goods to a specific destination. – Title and risk of loss retained by seller until delivered to the destination point. – Invoice designation is f. o. b. (free on board) destination. This means the seller is responsible for goods until they have been delivered.

Sales and Consumer Issues Objective 09. 01 Interpret sales contracts and warranties within the rights and law of consumers. REGULATION OF SALES

Regulation of Sales • Uniform Sales Act of 1906 – Revised to become the current Uniform Commercial Code • Uniform Commercial Code (UCC) 1952 – Article 2 regulates sales – Article 3 regulates negotiable Instruments

Purpose of UCC • Combine laws of trade from all states • Simplify, clarify and modernize laws • Expand encourage commerce across state lines • Enable consumers to apply a uniform sales law when they travel across state lines** except Louisiana

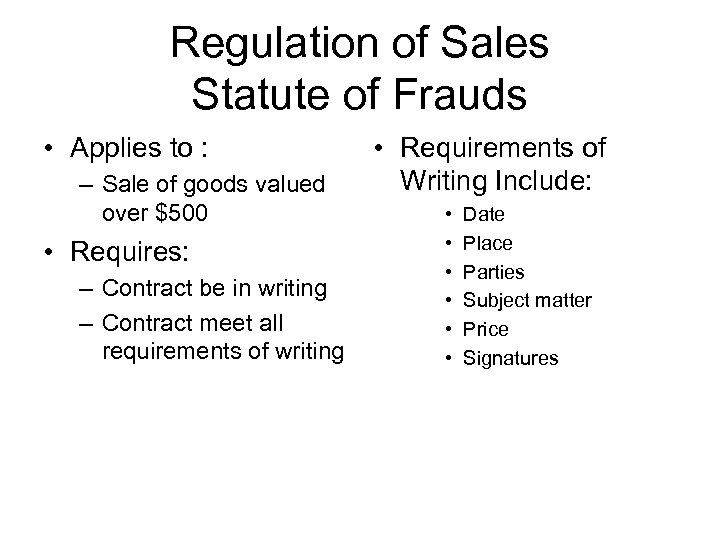

Regulation of Sales Statute of Frauds • Applies to : – Sale of goods valued over $500 • Requires: – Contract be in writing – Contract meet all requirements of writing • Requirements of Writing Include: • • • Date Place Parties Subject matter Price Signatures

Regulation of Sales in the US Constitution • Commerce Clause of Constitution – Article 2, Section 8, [3] – Federal government derives its power to regulate business from the Commerce Clause – Congress has the power to regulate commerce “among the several states” – Federal government regulates any business that affects “interstate commerce” – Federal powers broadened in 1900 s by Supreme Court rulings – Many federal regulatory acts and agencies enforce the statutory and administrative laws created to protect consumers

Interstate Commerce Commission (ICC) • Regulates trade (commerce) between states in US • Determines trade practices, rates and routes for business crossing between state lines • Affects all states who have adopted the laws of the Uniform Commerical Code

Federal Trade Commission (FTC) • • • Prohibits deceptive and unfair trade practices among businesses Key concept: FAIR PRACTICES Very broad act that created numerous laws and agencies to regulate special areas

Antitrust Laws • Purpose: – To foster competition and fair trade – To eliminate restraint of trade caused by • • • Monopolies Price fixing Price discrimination – Are all monopolies a bad thing for consumers? – Why are some monopolies, such as utility companies, legal?

Antitrust Acts • Sherman Antitrust Act of 1890 – First antitrust law – Evolved from the “Robber Baron” historical period • Clayton Antitrust Act of 1914 – Clarifies laws on monopolies, fair trade, price fixing and price discrimination • Robinson-Patman Act of 1936 – Protects small businesses from price discrimination

United States Postal Service (USPS) • • Established to provide a federal system of mail Protects consumers from mail fraud with federal USPS regulations

Federal Communications Commission • Licenses and regulates the operation of airwaves that are utilized in: – Television – Radio – Telephone – Telegraph

International Law-Regulation of Sales Contracts for International Sale of Goods (CISG) A United Nations (UN) agreement PURPOSES: 1. To develop international trade 2. To remove legal barriers that limit trade between countries 3. To promote friendly business relations between countries Governs contract formation and the rights and obligations of the buyers and sellers.

International Law-NAFTA • North American Free Trade Agreement – Purpose: to reduce trade barriers and encourage free trade between countries in North America and to stimulate economic growth – Agreement between: • United States • Canada • Mexico

International Law The European Union (EU) • An economic coalition of Western European Countries • Purpose: to reduce barriers to commerce and stimulate economic growth among the member nations

European Union Actions • Established a common monetary unit – the Euroin Western European countries to reduce the barrier of exchange rates and multiple currencies • Reduced tariffs between member nations to encourage commerce • Modified commercial laws to simplify trade among member nations

Real and Personal Property Objective 09. 02 Compare the legal rights of acquisition, transferal and renting/leasing of real or personal property. BAILMENTS

Bailment • An agreement created by the temporary delivery of personal property by the owner to someone who is not the owner for a specific purpose. • Both parties agree that the property will be returned to the bailor. • Bailee - has in their temporary possession property that belongs to someone else. • Bailor – owner of property who gives up possession to someone else temporarily.

Examples of Bailments • • • Leather jacket left at a dry cleaners Vehicle delivered to parking valet Goods transported by common carrier Truck taken to dealership for service check Diamond ring taken to jeweler for cleaning or repair • Leaving your clothes in dressing room while trying on new sweater • Goods delivered to a consignment shop

Mutual Benefit Bailments • Invokes the duty of ordinary care on the bailee • Results from a contract (for service, repair, storage, rental) with consideration exchanged • Both bailor and bailee receive benefit • A pledge as security for a loan is also a mutual benefit bailment • Most bailments are mutual benefit

Bailment by Necessity • Implied by law, a customer must give up possession of property. – Example: When you rent skates and leave your own shoes while you skate – Example: When you leave your clothes temporarily in the dressing room while you try on a new outfit

Other Bailments • Gratuitous Bailment – Free of charge (lend something to a friend). – Only one party benefits • Extraordinary bailment – A common carrier or hotel is strictly liable for damage to bailed goods

Rights and Duties of Bailee • Rights: – To hold a Mechanic’s Lien -the right to retain property of another, if not paid for service rendered – To expect payment for services rendered • Duties: – Of reasonable care and protection of goods while in custody of bailee – To comply with terms of bailment

Rights and Duties of Bailor • Rights – to have goods protected – to receive service as agreed upon – to have goods returned in timely manner • Duties – to pay for service provided – to warn of dangers or special care required – to pick up goods in a reasonable time

Tortious Bailee • What is a tortious bailee? – A party who wrongfully retains lost property or stolen property – A party who wrongfully uses a bailed article for a purpose other than that agreed upon by the parties • Examples: – Student who finds necklace and knows who it belongs to but does not return it to the rightful owner – Parking valet who takes your hot car on a joy ride – Dry cleaner’s employee who wears your leather jacket

Real and Personal Property Objective 09. 02 Compare the legal rights of acquisition, transferal and renting/leasing of real or personal property. PROPERTY OWNERSHIP

Real Property • Land anything permanently attached, including: – Buildings, structures, fixtures – Water, water rights – Minerals on and below the surface of the earth. – Trees & crops – Air space above the surface

Personal Property • Anything other than real property, including: – – – Clothing, jewelry, furniture, appliances in a home Automobiles, ATVs, lawnmowers Equipment & machinery used in business Copyrights, patents, trademarks Software, stocks, loans, mutual funds • Must be delivered in order to transfer ownership. • May be tangible or intangible.

Rights of Ownership • Possess, use and enjoy the property • Dispose of, sell, consume, modify, insure or destroy the property • Give the property away by will after death • Lease the property to a tenant

Intellectual Property • Includes copyrights, patents, trademarks and trade secrets • Is an original work fixed in a tangible medium of expression. • Examples: literature, computer software, musical scores and lyrics, choreography, dramatic works, unique product or process, symbols or word that identify a product, commercially valuable information that is kept secret

Methods to Acquire Property • Purchase contract – earn money and use it to buy • Gift – includes intent, delivery and acceptance • Intellectual labor – creation of property • Inheritance – wills and trusts • Accession – farm animals naturally increase • Found property – lost or mislaid • Occupancy – possession of property that belongs to no one else

Real Property Transfers • Grantor - conveys a deed to real property • Grantee – receives the deed

Types of Deed • Quitclaim – Transfers a seller’s interest in a property but doesn’t warrant that the seller owns any interest • General Warranty Deed – Warrants the title – Most desirable for the buyer • Bargain and Sale Deed – Transfers title to property without giving warranties

Personal Property Transfers • Transfer of title (ownership) to property • Not all transfers require written titles – Purchases of goods from a retail store • Certain transfers have formal titles. Vehicles – Are registered with the state – MUST BE NOTARIZED – Require odometer reading disclosure statements – Require damage disclosure statements

Limits on Use of Property • • Police powers by government Nuisance ordinances enacted by cities Zoning ordinances enacted by cities to regulate Health and public safety issues Certain physical rights Eminant domain Deed restrictions Easements

Property Rights • Physical rights apply to: – Surface (the right to occupy the land, and develop it with buildings, etc. ) – Subterranean Minerals or Water (rights to remove or conserve) – Air (right extends into upper atmosphere-but cannot exclude aircraft from flying over property)

Eminent Domain • Right to make private property into public if it is for the public good. • When highways are widened, private property is taken by eminent domain. • Owners are paid the fair market value of the property, but they cannot refuse to release property.

Limits on Use of Property • Restrictive Covenants – Deed restrictions – Example- a homeowners association restricts parking cars in the street • Easements for limited use – Example- Gas lines end at my driveway but a neighbor wants to build a new home on an adjacent lot. I can sign an easement release so the utility company can continue the line to his new home by crossing my property.

Why buy a home? • Rent = Zero Ownership • Home = Equity • Equity = Value of Home - Principle of Loan, or • Equity = Market Value - Debt in Property • Home = Personal Asset Accumulation

Why rent an apartment? • • • No large down payment required No long term commitment to location No upkeep to grounds and property Not ready to own Bad credit, cannot get a loan More freedom to move • NEGATIVE: NO ASSET ACCUMULATION

How to Increase Equity • Options: – Pay off or reduce loan amount – Increase value of home • Your home is not only a place to live but also a major investment and asset for the family.

Foreclosure • Right of mortgage holder to seize property for payment of debt that is past due • Comparable to repossession of personal property

Real and Personal Property Objective 09. 02 Compare the legal rights of acquisition, transferal and renting/leasing of real or personal property. RELATIONSHIP BETWEEN LANDLORDS AND TENANTS

Relationship between Landlords and Tenants • Parties to the contract to lease or rent – Lessor/Landlord – Lessee/Tenant • Tenant - Wants possession and occupancy free from interference or annoyance • Landlord – Wants rent money and property in good condition at the end of rental term

Rights and Duties: Covenants of the Contract • • Covenant = Promise Affect both the landlord and the tenant May be express or implied Number and type vary depending on type of property

Quiet Enjoyment • Tenants have a right to: – expect the undisturbed possession of the property called quiet enjoyment. – expect exclusive use of the property free from interference or annoyances. • State laws vary and the landlord may or may not have the right to enter the premise without prior notice. – Add covenant to lease to address entry issue

Implied Covenants • Implied warranty of habitability by landlord – May be enforced by city housing codes – Health and safety of citizens is considered – Duty of landlord to provide property free of defective conditions • Waste - The landlord expects reasonable wear and tear by tenant, but unreasonable damage is called waste and tenant can be required to pay the cost to repair waste.

Assignment and Subletting • Assignment and subletting – When a tenant transfers the remaining period of time on a lease to another party • May or may not be allowed by landlord • May have to get prior approval by landlord

Renewals of Lease • Tenancy ends at the expiration of stated time • Lease may have renewal clause making provisions for renewal by the parties to contract • Agreement usually requires either party to give advance notice of their intent to nonrenew the lease

Security Deposits • A money deposit as security for payment of rent due or repairs for damages done by the tenant • Most landlords require one or two month’s rent in advance as security deposit • When lease expires, if all rent is paid in full and there is no waste, the security deposit is returned to tenant by landlord.

Payment of Rent • A critical issue to both parties. Be sure contract is clear on: – What is cost of monthly rent/lease? – When is payment due? – Is there a late fee if payment is late? – What constitutes “late”? – Is late payment grounds for breach of contract and termination of tenant rights?

Termination of Lease • If the contract has a specified term, it is a tenancy for years. • Leases can be terminated prior to the end of the term by either party, but penalty clauses may apply. • Breach of contract exists if the tenant chooses to vacate and the property cannot be leased to new tenant in a timely manner. • Landlord may sue for monetary damages. Landlord must attempt to lease property and mitigate any damages from loss of rents.

Rent Control • Rent control is the maximum rent that can be charged for a property. • Applies in many large cities where housing is in short supply. • Tenant organizations asked for laws to keep rent from going up. • Laws vary greatly on rent control.

Anti-Discrimination • Anti-discrimination laws such as the Civil Rights Act bind landlords in the selection of tenants. • Special emphasis is given on human rights and needs. • Law forbids discrimination on basis of race, religion, color, national origin, sex, age, ancestry, marital status, blindness, military service or future plans to have children.

Tort Liability • Applies to both landlord and tenant • May require responsibility for injuries occurring on the premise • Landlord is usually responsible for common areas where landlord is in control • Tenant is usually responsible for injury caused by defects in the portion of the premise over which he/she has control.

Fixtures • Fixtures are items of personal property attached to real property. • The addition of fixtures by the tenant causes problems when tenant prepares to vacate the premise. – Who owns fixtures that become real property? – What damage will be caused if item is removed? – Will tenant be reimbursed for improvement to premise?

Breach of Lease and Remedies • Eviction – The landlord has the right to deprive the tenant of physical possession of the premises but landlord – Must obtain a court order allowing removal of tenant – Must provide just cause, such as: • Nonpayment of rent • Damage to property • Violations of lease provision • Lien may also be attached to tenant’s property to pay back rent or costs of repair due to waste

Breach of Lease and Remedies • Constructive eviction – When the landlord breaches his or her duties of the lease covenant, the tenant may consider the lease terminated, leave premise and cease rent payment • Example: Landlord deprives tenant of gas, electricity, or other fundamental service

4b9b6194aa619a142bcd9b60a1ae1138.ppt