13584abd2d535c850a5b17206825d02f.ppt

- Количество слайдов: 33

Safe Harbour This presentation contains statements that constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements appear in a number of places in this presentation and include statements regarding the intent, belief or current expectations of the customer base, estimates regarding future growth in the different business lines and the global business, market share, financial results and other aspects of the activities and situation relating to the Company. Such forward looking statements are not guarantees of future performance and involve risks and uncertainties, and actual results may differ materially from those in the forward looking statements as a result of various factors. Analysts are cautioned not to place undue reliance on those forward looking statements, which speak only as of the date of this presentation. Telefónica undertakes no obligation to release publicly the results of any revisions to these forward looking statements which may be made to reflect events and circumstances after the date of this presentation, including, without limitation, changes in Telefónica´s business or acquisition strategy or to reflect the occurrence of unanticipated events. Analysts and investors are encouraged to consult the Company´s Annual Report on Form 20 -F as well as periodic filings made on Form 6 -K, which are on file with the United States Securities and Exchange Commission. Investor Conference March 2001, Rio de Janeiro.

To create consumer habits through multiplatform contents and leading brands for Telefonica’s clients in the Spanish and Portuguese speaking world. Investor Conference March 2001, Rio de Janeiro.

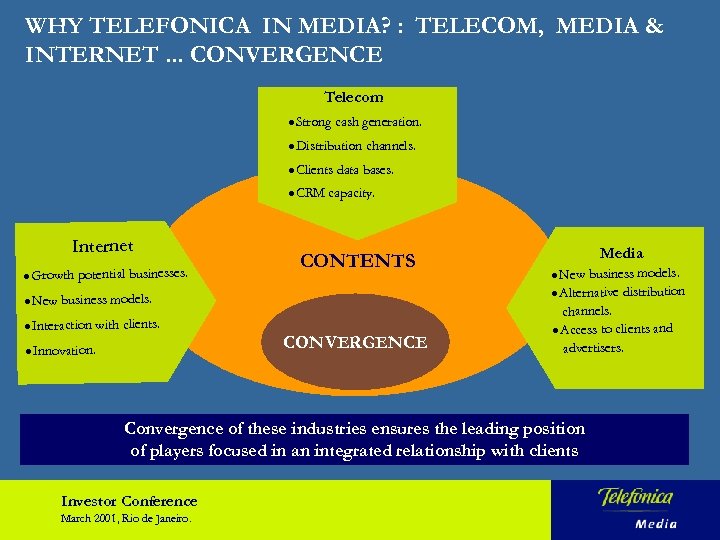

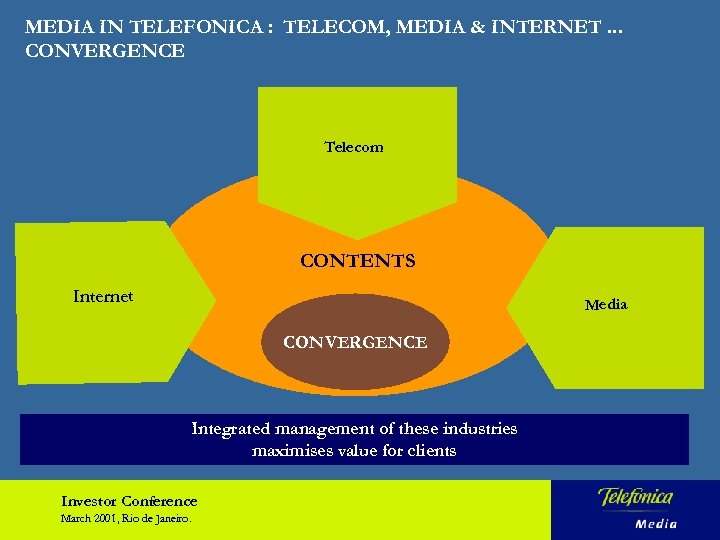

WHY TELEFONICA IN MEDIA? : TELECOM, MEDIA & INTERNET. . . CONVERGENCE Telecom l Strong cash generation. l Distribution l Clients l CRM Internet l Growth l New potential businesses. channels. data bases. capacity. CONTENTS business models. l Interaction with clients. l Innovation. CONVERGENCE Media business models. l Alternative distribution channels. l Access to clients and advertisers. l New Convergence of these industries ensures the leading position of players focused in an integrated relationship with clients Investor Conference March 2001, Rio de Janeiro.

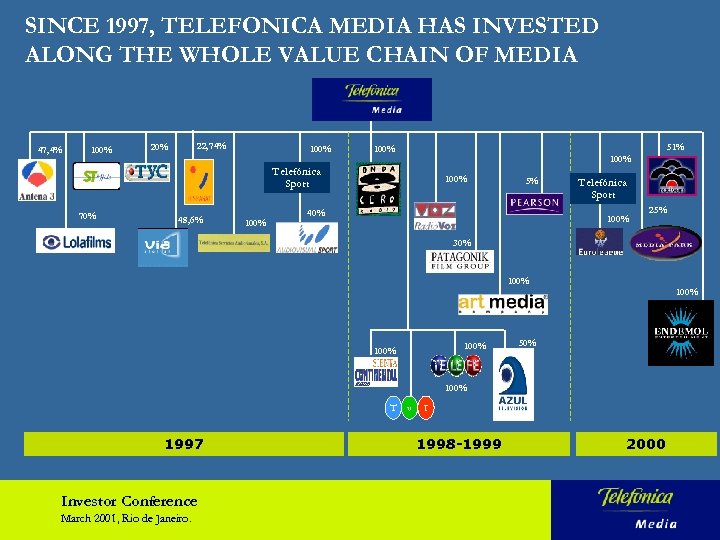

SINCE 1997, TELEFONICA MEDIA HAS INVESTED ALONG THE WHOLE VALUE CHAIN OF MEDIA 47, 4% 100% 22, 74% 20% 100% 51% 100% Telefónica Sport 70% 48, 6% 100% 5% 40% Telefónica Sport 100% 25% 30% 100% 50% 100% T 1997 Investor Conference March 2001, Rio de Janeiro. v I 1998 -1999 2000

TELEFONICA MEDIA: SELECTED COMPANIES I) Free-to-air-TV & Radio l l The most attractive audiences for advertisers (best commercial profile) l Successful turnaround track record of management team. l (Spain) Number one channel in terms of TV-advertising in 2000. Outstanding profitability and high growth. l Excellent non-advertising growth potential (i. e. : New Media, theme channels, events, etc. ). l Telefe has been the number one player over the last ten years in Argentina. l Excellent brand recognition. l Potential for cross-fertilization with Antena 3. l Number 2 radio company in Spanish market. l Consolidation play on Spanish market. l Re-structuring plans of new management recently in place. (Argentina) (Spain) Investor Conference March 2001, Rio de Janeiro.

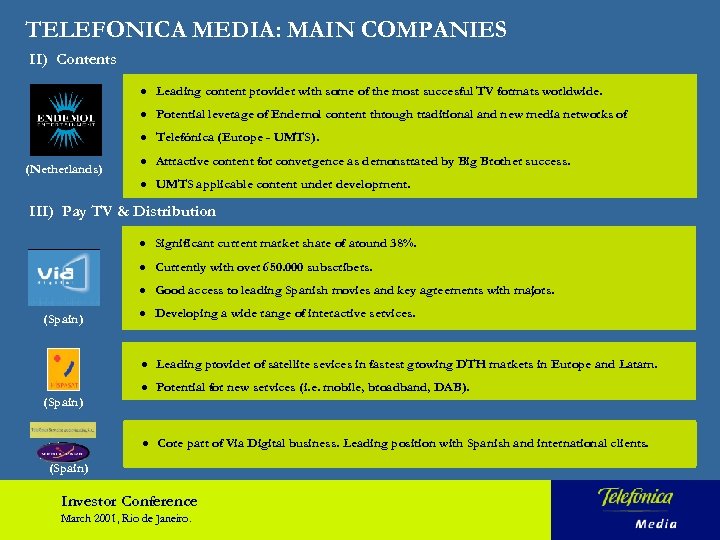

TELEFONICA MEDIA: MAIN COMPANIES II) Contents l l Potential leverage of Endemol content through traditional and new media networks of l Telefónica (Europe - UMTS). l Attractive content for convergence as demonstrated by Big Brother success. l (Netherlands) Leading content provider with some of the most succesful TV formats worldwide. UMTS applicable content under development. III) Pay TV & Distribution l l Currently with over 650. 000 subscribers. l Good access to leading Spanish movies and key agreements with majors. l Developing a wide range of interactive services. l Leading provider of satellite sevices in fastest growing DTH markets in Europe and Latam. l Potential for new services (i. e. mobile, broadband, DAB). l (Spain) Significant current market share of around 38%. Core part of Via Digital business. Leading position with Spanish and international clients. (Spain) Investor Conference March 2001, Rio de Janeiro.

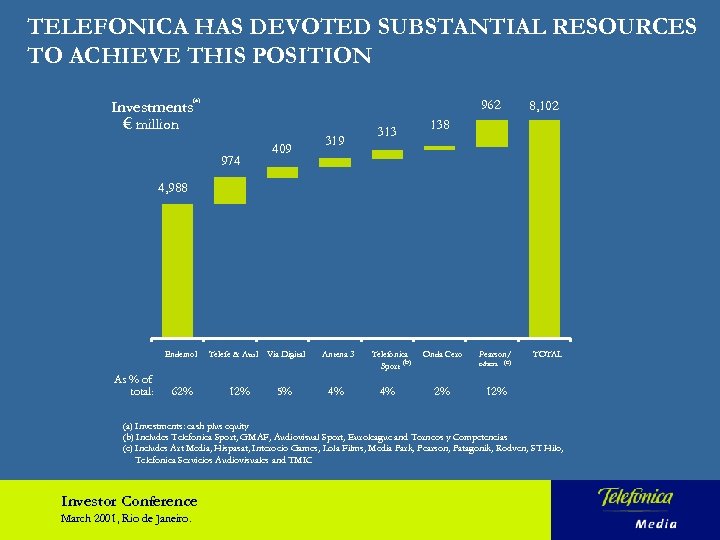

TELEFONICA HAS DEVOTED SUBSTANTIAL RESOURCES TO ACHIEVE THIS POSITION (a) 962 Investments € million 974 409 313 8, 102 138 4, 988 Endemol As % of total: 62% Telefe & Azul 12% Vía Digital Antena 3 5% 4% Telefonica (b) Sport 4% Onda Cero 2% Pearson/ others (c) TOTAL 12% (a) Investments: cash plus equity (b) Includes Telefonica Sport, GMAF, Audiovisual Sport, Euroleague and Torneos y Competencias (c) Includes Art Media, Hispasat, Interocio Games, Lola Films, Media Park, Pearson, Patagonik, Rodven, ST Hilo, Telefonica Servicios Audiovisuales and TMIC Investor Conference March 2001, Rio de Janeiro.

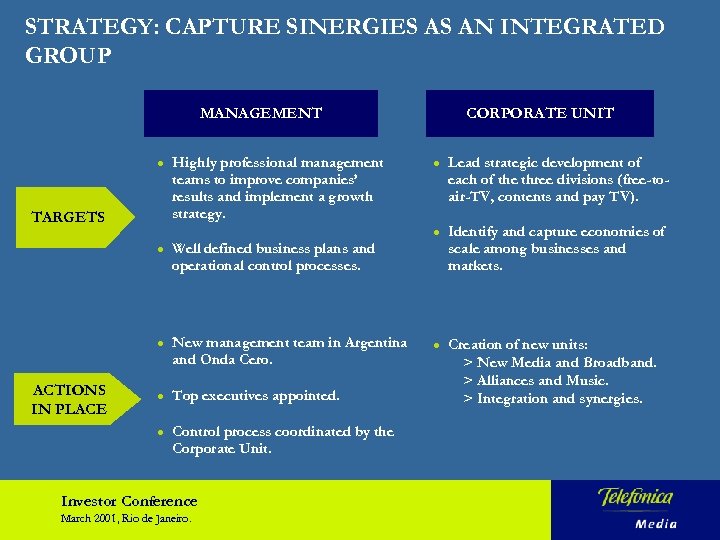

STRATEGY: CAPTURE SINERGIES AS AN INTEGRATED GROUP MANAGEMENT TARGETS l l Top executives appointed. l ACTIONS IN PLACE New management team in Argentina and Onda Cero. Control process coordinated by the Corporate Unit. Lead strategic development of each of the three divisions (free-toair-TV, contents and pay TV). Identify and capture economies of scale among businesses and markets. l Creation of new units: > New Media and Broadband. > Alliances and Music. > Integration and synergies. Well defined business plans and operational control processes. l l Highly professional management teams to improve companies’ results and implement a growth strategy. CORPORATE UNIT Investor Conference March 2001, Rio de Janeiro.

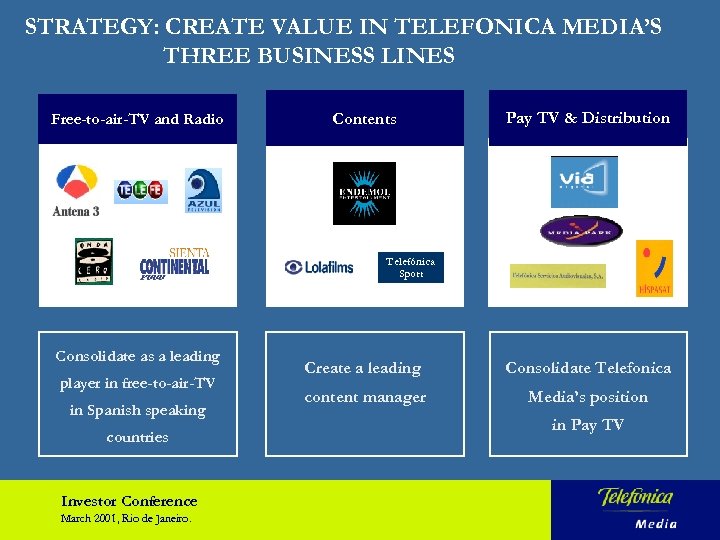

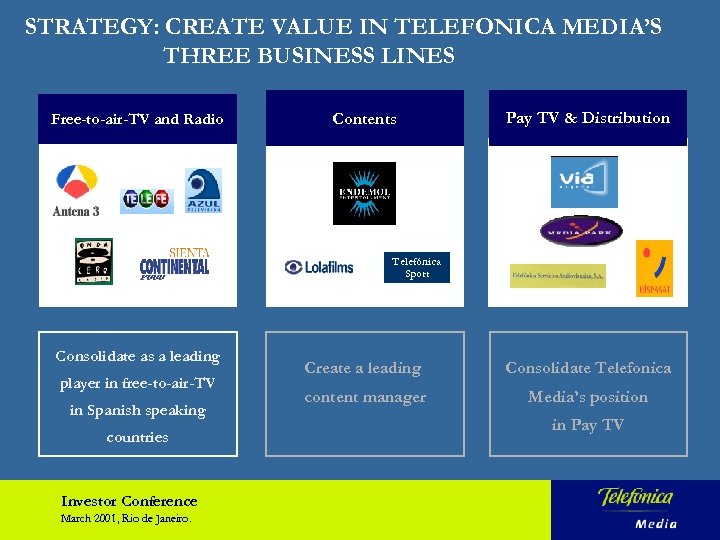

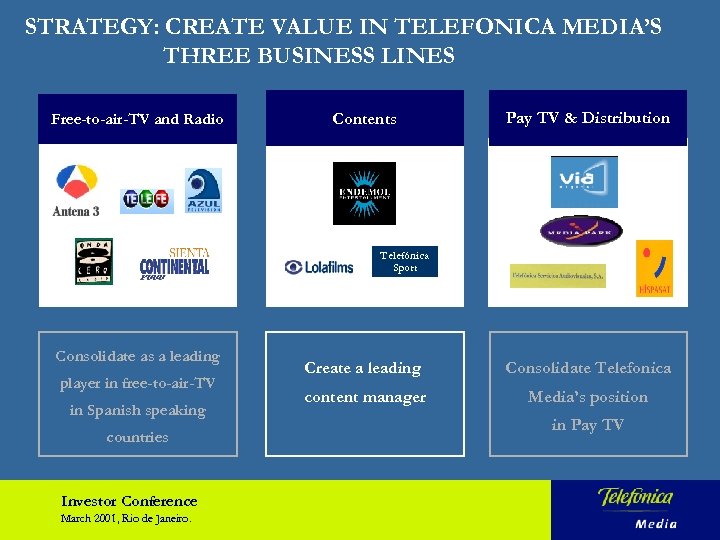

STRATEGY: CREATE VALUE IN TELEFONICA MEDIA’S THREE BUSINESS LINES Free-to-air-TV and Radio Contents Pay TV & Distribution Telefónica Sport Consolidate as a leading player in free-to-air-TV in Spanish speaking countries Investor Conference March 2001, Rio de Janeiro. Create a leading Consolidate Telefonica content manager Media’s position in Pay TV

STRATEGY: CREATE VALUE IN TELEFONICA MEDIA’S THREE BUSINESS LINES Free-to-air-TV and Radio Contents Pay TV & Distribution Telefónica Sport Consolidate as a leading player in free-to-air-TV in Spanish speaking countries Investor Conference March 2001, Rio de Janeiro. Create a leading Consolidate Telefonica content manager Media’s position in Pay TV

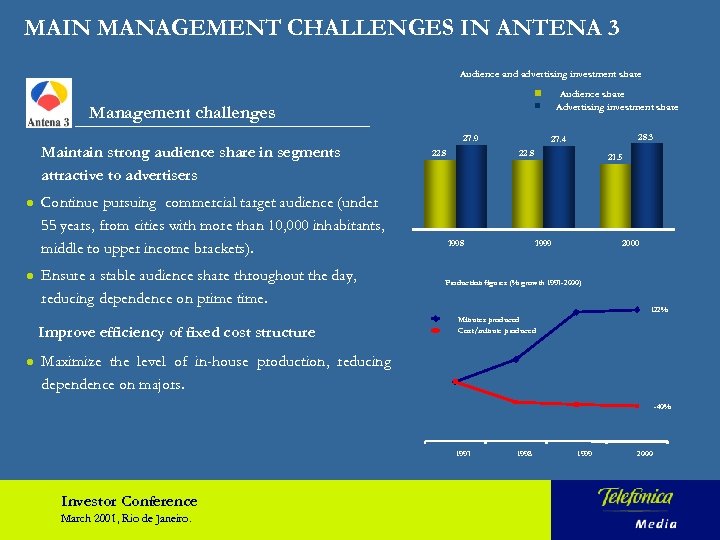

MAIN MANAGEMENT CHALLENGES IN ANTENA 3 Audience and advertising investment share Audience share Advertising investment share Management challenges Maintain strong audience share in segments attractive to advertisers l l Continue pursuing commercial target audience (under 55 years, from cities with more than 10, 000 inhabitants, middle to upper income brackets). Ensure a stable audience share throughout the day, reducing dependence on prime time. Improve efficiency of fixed cost structure l 27. 9 22. 8 28. 3 27. 4 22. 8 1998 21. 5 1999 2000 Production figures (% growth 1997 -2000) 122% Minutes produced Cost/minute produced Maximize the level of in-house production, reducing dependence on majors. -40% 1997 Investor Conference March 2001, Rio de Janeiro. 1998 1999 2000

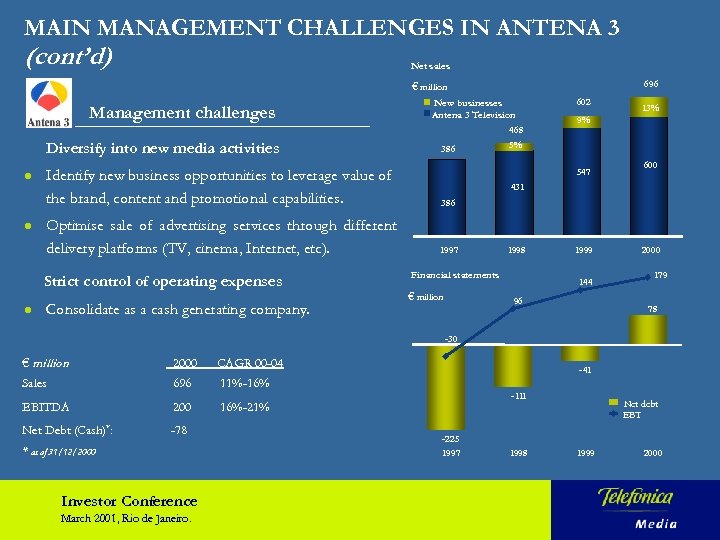

MAIN MANAGEMENT CHALLENGES IN ANTENA 3 (cont’d) Net sales 696 € million Management challenges Diversify into new media activities l l 386 Identify new business opportunities to leverage value of the brand, content and promotional capabilities. Optimise sale of advertising services through different delivery platforms (TV, cinema, Internet, etc). 1997 468 5% 602 13% 9% 600 386 Strict control of operating expenses l New businesses Antena 3 Television Consolidate as a cash generating company. 547 431 1998 Financial statements € million 1999 144 96 2000 179 78 -30 € million 2000 CAGR 00 -04 Sales 696 11%-16% EBITDA 200 16%-21% Net Debt (Cash)*: -78 * as of 31/12/2000 Investor Conference March 2001, Rio de Janeiro. -41 -111 -225 1997 1998 Net debt EBT 1999 2000

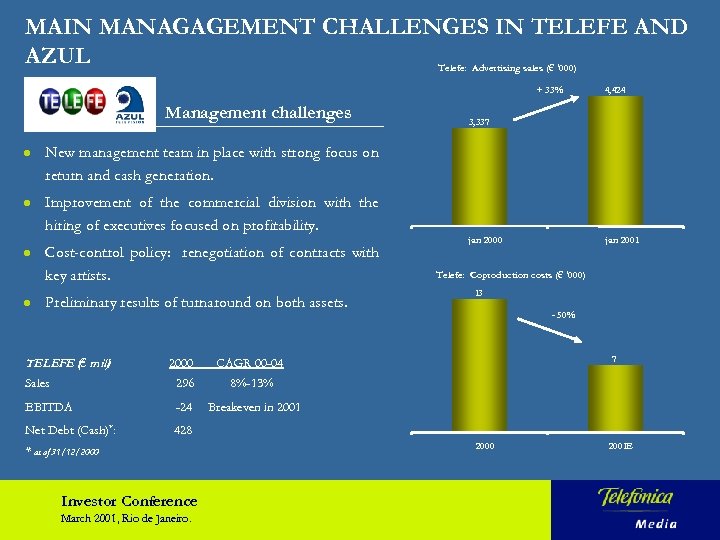

MAIN MANAGAGEMENT CHALLENGES IN TELEFE AND AZUL Telefe: Advertising sales (€ '000) + 33% Management challenges l 3, 337 New management team in place with strong focus on return and cash generation. l 4, 424 Improvement of the commercial division with the hiring of executives focused on profitability. l l Cost-control policy: renegotiation of contracts with key artists. Preliminary results of turnaround on both assets. TELEFE (€ mill ) 2000 296 -24 - 50% 7 Breakeven in 2001 Net Debt (Cash)*: 13 8%-13% EBITDA jan 2001 Telefe: Coproduction costs (€ '000) CAGR 00 -04 Sales jan 2000 428 * as of 31/12/2000 Investor Conference March 2001, Rio de Janeiro. 2000 2001 E

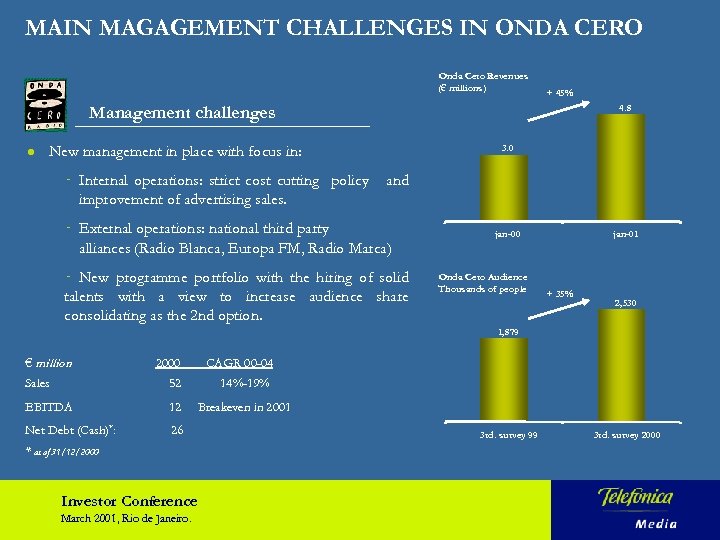

MAIN MAGAGEMENT CHALLENGES IN ONDA CERO Onda Cero Revenues (€ millions) + 45% Management challenges l 4. 8 New management in place with focus in: 3. 0 q Internal operations: strict cost cutting policy improvement of advertising sales. and q External operations: national third party alliances (Radio Blanca, Europa FM, Radio Marca) New programme portfolio with the hiring of solid talents with a view to increase audience share consolidating as the 2 nd option. q jan-00 Onda Cero Audience Thousands of people jan-01 + 35% 2, 530 1, 879 € million 2000 CAGR 00 -04 Sales 52 14%-19% EBITDA 12 Breakeven in 2001 Net Debt (Cash)*: 26 * as of 31/12/2000 Investor Conference March 2001, Rio de Janeiro. 3 rd. survey 99 3 rd. survey 2000

REINFORCE PRESENCE IN LATINAMERICA Main trends 1. Growth strategy Attractive growth market: l Acquire assets in those markets where Advertising investment above - Telefonica has presence (Peru, Brasil, US$ 50, 000 mill. in 2000. - Chile). 500 mill. inhabitants. l entry barriers (Brasil, Mexico). 1. Industry deregulation. 2. Absence of a global main player due to the high number of family owned companies. 3. Higher segmentation and a more sophisticated audience. Investor Conference March 2001, Rio de Janeiro. Create alliances in those markets with high l In an selective way, acquire presence in other markets through (Colombia, Uruguay). acquisitions

REPLICATE SUCCESSFUL DIVERSIFICATION MODELS IN OTHER MARKETS Successful model in Spain Free-to-air-TV Children Argentina T v I Megatrix Argentina Peru Chile Cinema advertising Brasil Artists’ management Events Direct marketing New Media Investor Conference March 2001, Rio de Janeiro. FAMA Argentina Mexico Battres Argentina Colombia

STRATEGY: CREATE VALUE IN TELEFONICA MEDIA’S THREE BUSINESS LINES Free-to-air-TV and Radio Contents Pay TV & Distribution Telefónica Sport Consolidate as a leading player in free-to-air-TV in Spanish speaking countries Investor Conference March 2001, Rio de Janeiro. Create a leading Consolidate Telefonica content manager Media’s position in Pay TV

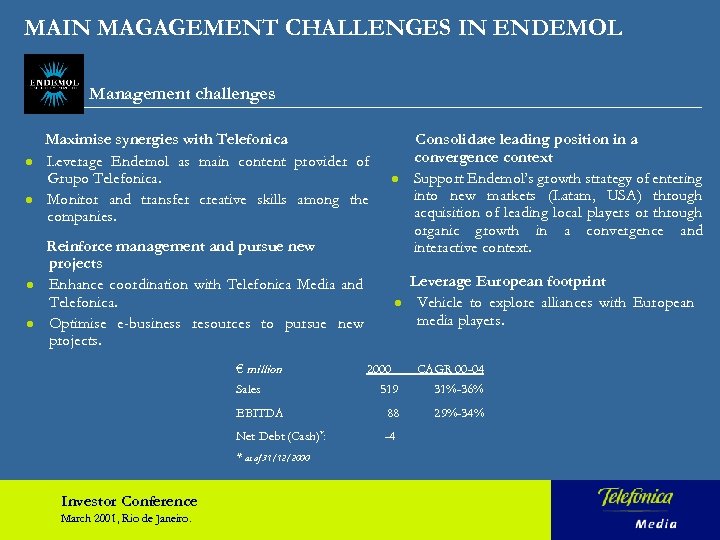

MAIN MAGAGEMENT CHALLENGES IN ENDEMOL Management challenges l l Maximise synergies with Telefonica Leverage Endemol as main content provider of Grupo Telefonica. Monitor and transfer creative skills among the companies. l Reinforce management and pursue new projects Enhance coordination with Telefonica Media and Telefonica. Optimise e-business resources to pursue new projects. € million Sales l 2000 Consolidate leading position in a convergence context Support Endemol’s growth strategy of entering into new markets (Latam, USA) through acquisition of leading local players or through organic growth in a convergence and interactive context. Leverage European footprint Vehicle to explore alliances with European media players. CAGR 00 -04 519 31%-36% EBITDA 88 29%-34% Net Debt (Cash)*: -4 * as of 31/12/2000 Investor Conference March 2001, Rio de Janeiro.

STRATEGY: CREATE VALUE IN TELEFONICA MEDIA’S THREE BUSINESS LINES Free-to-air-TV and Radio Pay TV & Distribution Contents SPORT Consolidate as a leading player in free-to-air-TV in Spanish speaking countries Investor Conference March 2001, Rio de Janeiro. Create a leading Consolidate Telefonica content manager Media’s position in Pay TV

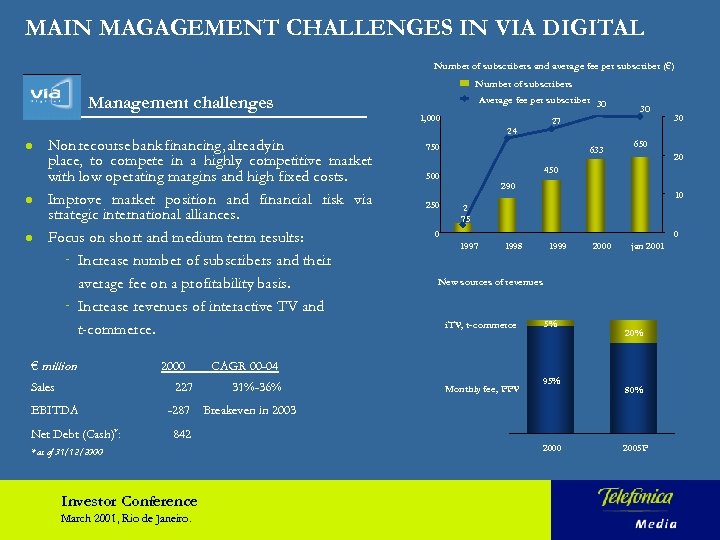

MAIN MAGAGEMENT CHALLENGES IN VIA DIGITAL Number of subscribers and average fee per subscriber (€) Number of subscribers Management challenges l l l Non recourse bank financing, already in place, to compete in a highly competitive market with low operating margins and high fixed costs. Improve market position and financial risk via strategic international alliances. Focus on short and medium term results: q Increase number of subscribers and their average fee on a profitability basis. q Increase revenues of interactive TV and t-commerce. € million Sales 2000 227 EBITDA Net Debt (Cash)*: -287 Average fee per subscriber 30 1, 000 24 27 750 633 650 20 290 10 2 75 0 0 1997 1998 1999 2000 jan 2001 New sources of revenues i. TV, t-commerce 5% 20% CAGR 00 -04 31%-36% Monthly fee, PPV 95% 80% Breakeven in 2003 842 * as of 31/12/2000 Investor Conference March 2001, Rio de Janeiro. 30 450 500 250 30 2005 P

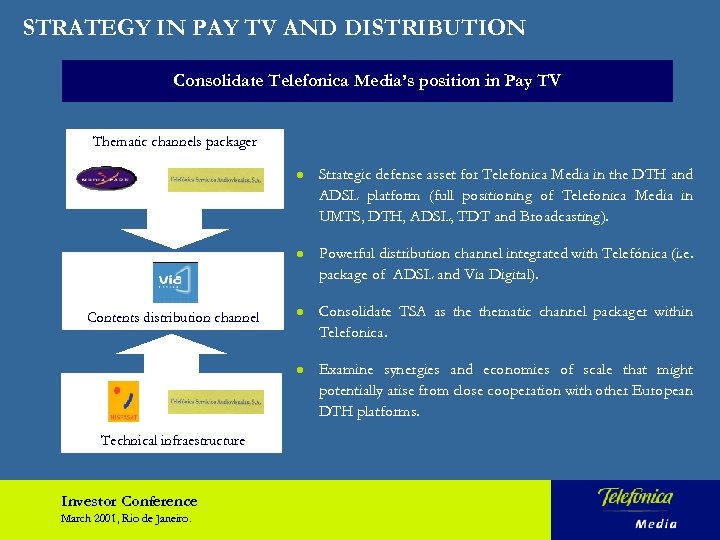

STRATEGY IN PAY TV AND DISTRIBUTION Consolidate Telefonica Media’s position in Pay TV Thematic channels packager l l Technical infraestructure Investor Conference March 2001, Rio de Janeiro. Powerful distribution channel integrated with Telefónica (i. e. package of ADSL and Via Digital). l Consolidate TSA as thematic channel packager within Telefonica. l Contents distribution channel Strategic defense asset for Telefonica Media in the DTH and ADSL platform (full positioning of Telefonica Media in UMTS, DTH, ADSL, TDT and Broadcasting). Examine synergies and economies of scale that might potentially arise from close cooperation with other European DTH platforms.

IN THE NEW MEDIA ARENA WE ARE WELL POSITIONED TO CAPTURE VALUE Cash Flow Growth New Media Traditional media Free TV Pay TV Broadband Radio Events Brand promotion Internet New channels Interactive advertising Technological standards Transmission, distribution streaming Digital content management Telephone Investor Conference March 2001, Rio de Janeiro. i. TV

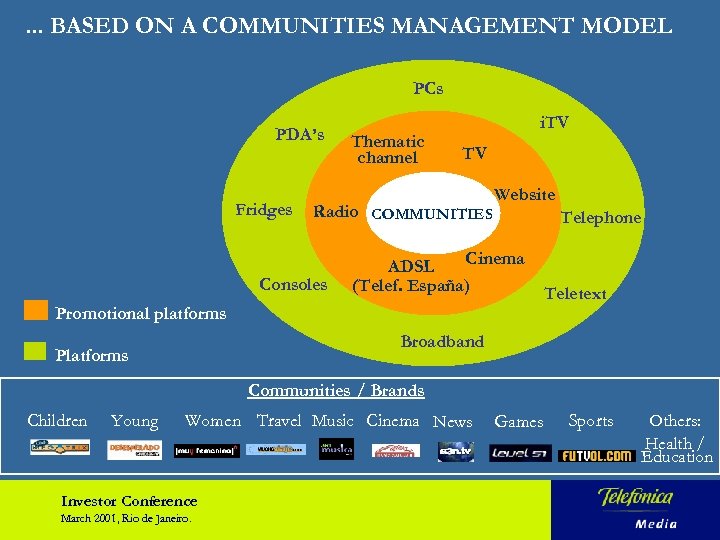

. . . BASED ON A COMMUNITIES MANAGEMENT MODEL PCs PDA’s Fridges Thematic channel i. TV TV Radio COMMUNITIES Consoles Website Telephone Cinema ADSL (Telef. España) Teletext Promotional platforms Broadband Platforms Communities / Brands Children Young Women Travel Music Cinema News Investor Conference March 2001, Rio de Janeiro. Games Sports Others: Health / Education

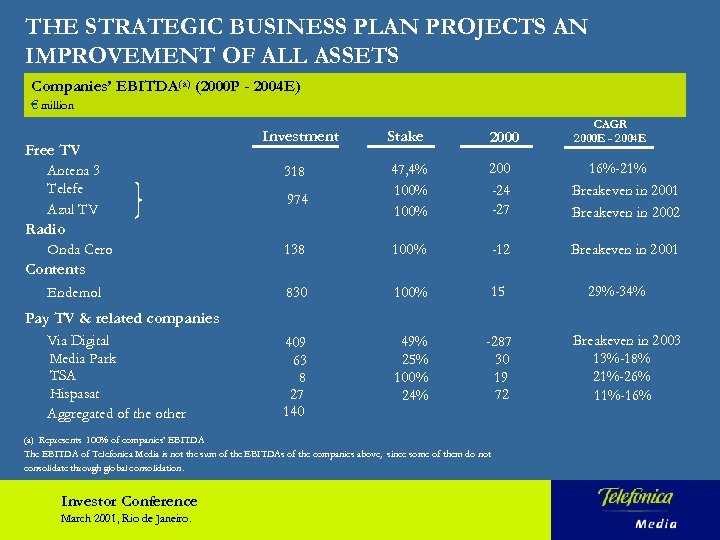

THE STRATEGIC BUSINESS PLAN PROJECTS AN IMPROVEMENT OF ALL ASSETS Companies’ EBITDA(a) (2000 P - 2004 E) € million Free TV Antena 3 Telefe Azul TV Stake 2000 CAGR 2000 E - 2004 E 47, 4% 100% 200 -24 -27 16%-21% Breakeven in 2001 Breakeven in 2002 138 100% -12 Breakeven in 2001 830 100% 15 409 63 8 27 140 49% 25% 100% 24% -287 30 19 72 Investment 318 974 Radio Onda Cero Contents Endemol 29%-34% Pay TV & related companies Via Digital Media Park TSA Hispasat Aggregated of the other (a) Represents 100% of companies’ EBITDA The EBITDA of Telefonica Media is not the sum of the EBITDAs of the companies above, since some of them do not consolidate through global consolidation. Investor Conference March 2001, Rio de Janeiro. Breakeven in 2003 13%-18% 21%-26% 11%-16%

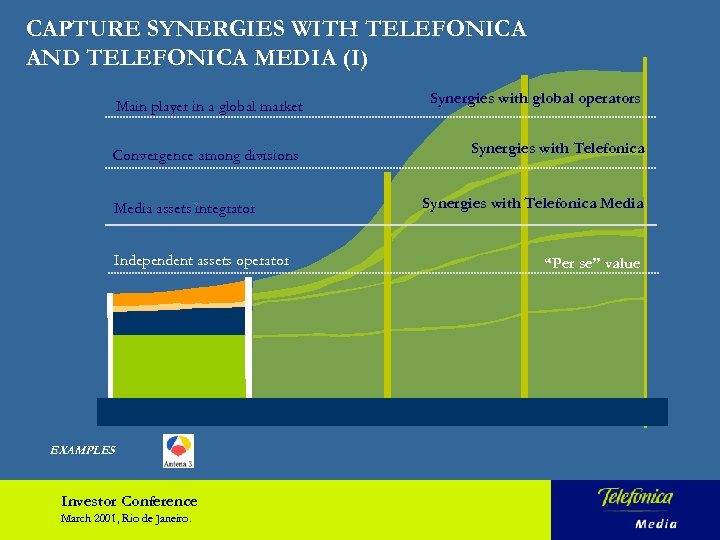

CAPTURE SYNERGIES WITH TELEFONICA AND TELEFONICA MEDIA (I) Main player in a global market Convergence among divisions Media assets integrator Independent assets operator EXAMPLES Investor Conference March 2001, Rio de Janeiro. Synergies with global operators Synergies with Telefonica Media “Per se” value

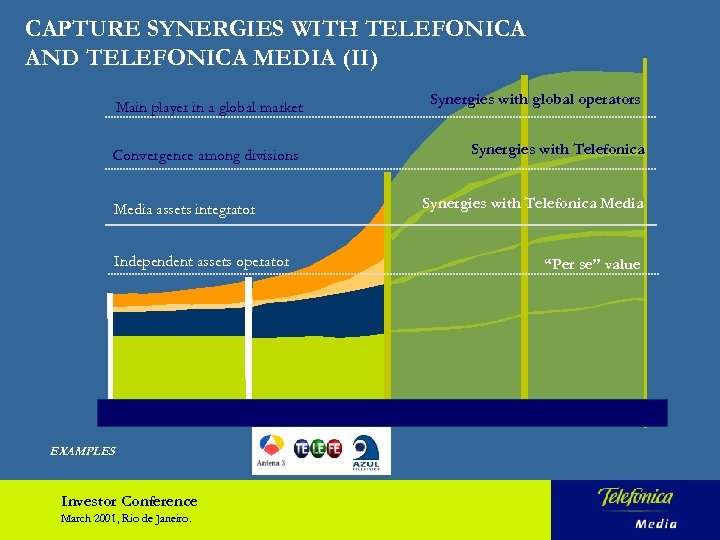

CAPTURE SYNERGIES WITH TELEFONICA AND TELEFONICA MEDIA (II) Main player in a global market Convergence among divisions Media assets integrator Independent assets operator EXAMPLES Investor Conference March 2001, Rio de Janeiro. Synergies with global operators Synergies with Telefonica Media “Per se” value

MEDIA IN TELEFONICA : TELECOM, MEDIA & INTERNET. . . CONVERGENCE Telecom CONTENTS Internet Media CONVERGENCE Integrated management of these industries maximises value for clients Investor Conference March 2001, Rio de Janeiro.

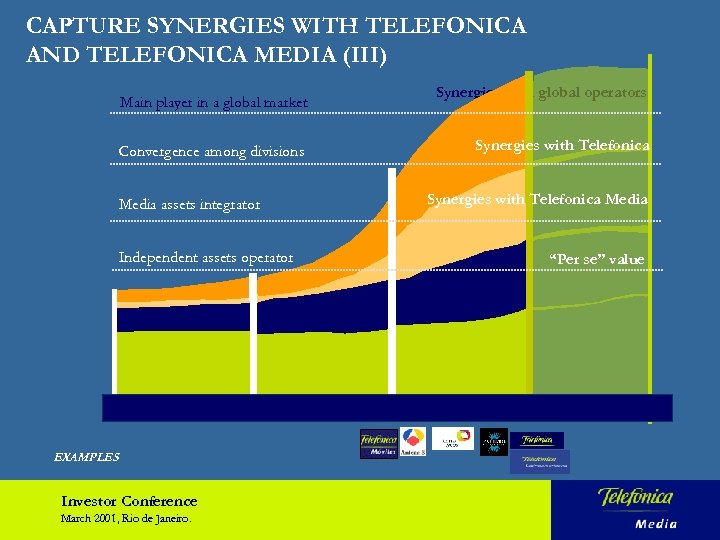

CAPTURE SYNERGIES WITH TELEFONICA AND TELEFONICA MEDIA (III) Main player in a global market Convergence among divisions Media assets integrator Independent assets operator EXAMPLES Investor Conference March 2001, Rio de Janeiro. Synergies with global operators Synergies with Telefonica Media “Per se” value

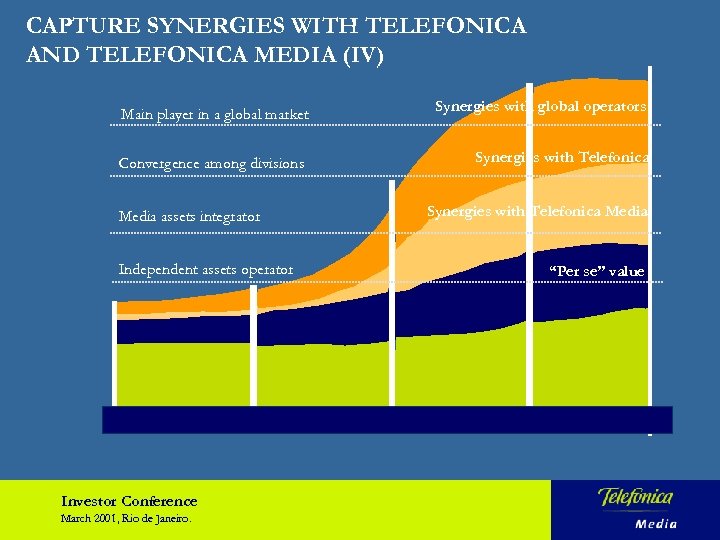

CAPTURE SYNERGIES WITH TELEFONICA AND TELEFONICA MEDIA (IV) Main player in a global market Convergence among divisions Media assets integrator Independent assets operator Investor Conference March 2001, Rio de Janeiro. Synergies with global operators Synergies with Telefonica Media “Per se” value

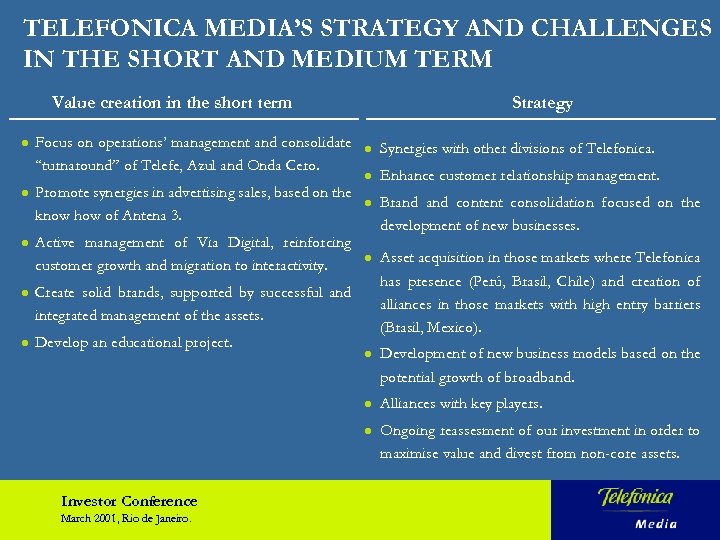

TELEFONICA MEDIA’S STRATEGY AND CHALLENGES IN THE SHORT AND MEDIUM TERM Value creation in the short term Strategy Focus on operations’ management and consolidate “turnaround” of Telefe, Azul and Onda Cero. l Synergies with other divisions of Telefonica. l l Promote synergies in advertising sales, based on the know how of Antena 3. Enhance customer relationship management. l l Active management of Via Digital, reinforcing customer growth and migration to interactivity. Brand content consolidation focused on the development of new businesses. l Asset acquisition in those markets where Telefonica has presence (Perú, Brasil, Chile) and creation of alliances in those markets with high entry barriers (Brasil, Mexico). l Development of new business models based on the potential growth of broadband. l Alliances with key players. l Ongoing reassesment of our investment in order to maximise value and divest from non-core assets. l l Create solid brands, supported by successful and integrated management of the assets. l Develop an educational project. Investor Conference March 2001, Rio de Janeiro.

To create consumer habits through multiplatform contents and leading brands for Telefonica’s clients in the Spanish and Portuguese speaking world. Investor Conference March 2001, Rio de Janeiro.

Investor Conference March 2001, Rio de Janeiro.

13584abd2d535c850a5b17206825d02f.ppt