af250d4e23b66c94bbc89de5d03a0d70.ppt

- Количество слайдов: 22

SABC Presentation to Parliamentary Portfolio Committee of Communications 16 th August 2011

Contents Points for Discussion 1 Chairpersons Report 2 Strategic Focus 4 SABC Structure 5 Operational 5 Government Guarantee Targets 6 Conclusion & Recommendations 3

Chairpersons Opening Remarks Although challenging, a number of objectives have been achieved • In the application for a Government Guarantee, by the Interim Board of the SABC, (09 Oct ‘ 09), a detailed outline of the funding requirements to maintain the SABC as a going concern, were conveyed to the Minister of Communications, Hon General (Ret) Siphiwe Nyanda. • The amount of the Government Guarantee requested was R 1, 473 Bn and was additional to the R 200 million allocation to the SABC in the 2009/10 Adjustment Estimates of National Expenditure. • The GG application was based on the SABC's Corporate Plan, which dealt with the organisation's key performance areas for the MTEF Period 2009 to 2012. It also articulated a turn around strategy designed to stabilise the SABC and return it to profitability by 2012, while fulfilling the SABC's Public Broadcast Mandate. • It was intended that the GG be used to secure medium-term funding from commercial banks, funding which would restore liquidity to the organisation and enable the sign-off of the SABC's Audited Financial Statements and the External Auditors' Report, for the year ending March 2009. • The request for the GG met the requirements of the Public Finance Management Act as well as the Treasury Regulations and the application supported the SABC's Mandate, it's objectives and those of the Government as a whole. 4

Contents Points for Discussion 1 2 Chairpersons Report Strategic Focus 4 SABC Structure 5 Operational 5 Government Guarantee Targets 6 Conclusion & Recommendations 5

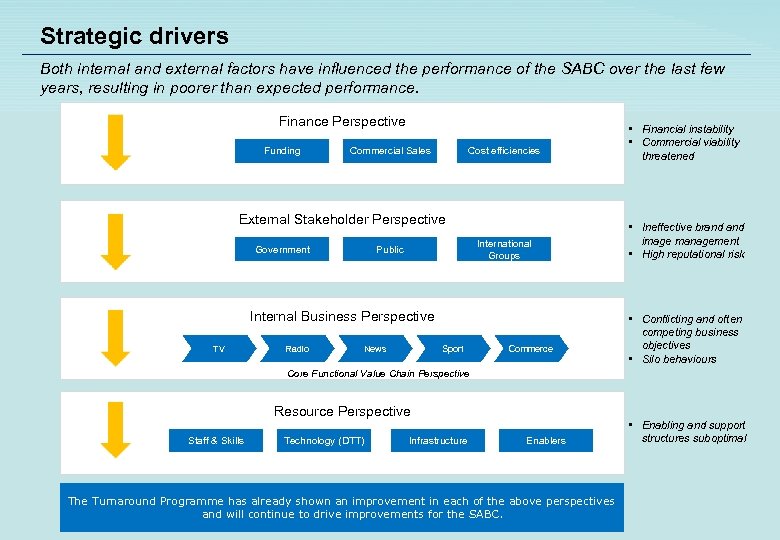

Strategic drivers Both internal and external factors have influenced the performance of the SABC over the last few years, resulting in poorer than expected performance. Finance Perspective Funding Commercial Sales Cost efficiencies External Stakeholder Perspective Government International Groups Public Internal Business Perspective TV Radio News Sport Commerce • Financial instability • Commercial viability threatened • Ineffective brand image management • High reputational risk • Conflicting and often competing business objectives • Silo behaviours Core Functional Value Chain Perspective Resource Perspective Staff & Skills Technology (DTT) Infrastructure Enablers The Turnaround Programme has already shown an improvement in each of the above perspectives and will continue to drive improvements for the SABC. 6 • Enabling and support structures suboptimal

Contents Points for Discussion 1 Chairpersons Report 2 Strategic Focus 4 SABC Structure 5 Operational 5 Government Guarantee Targets 6 Conclusion & Recommendations 7

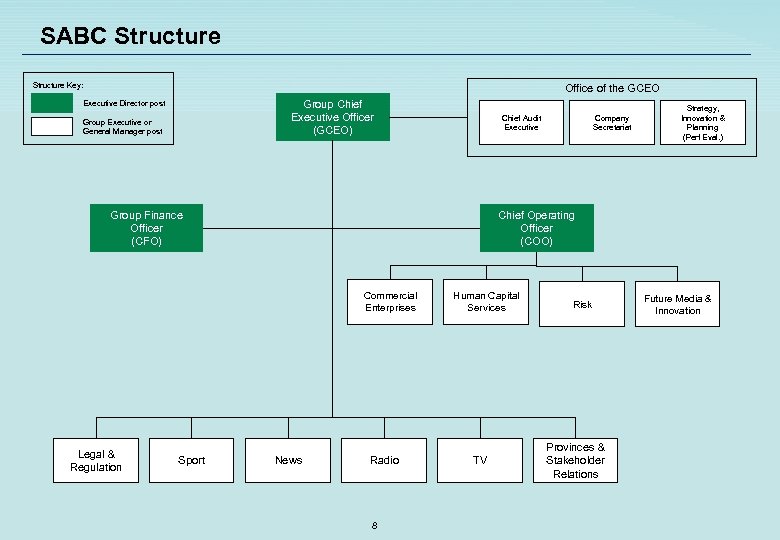

SABC Structure Key: Office of the GCEO Group Chief Executive Officer (GCEO) Executive Director post Group Executive or General Manager post Chief Audit Executive Group Finance Officer (CFO) Sport Strategy, Innovation & Planning (Perf Eval. ) Chief Operating Officer (COO) Commercial Enterprises Legal & Regulation Company Secretariat News Radio 8 Human Capital Services TV Risk Provinces & Stakeholder Relations Future Media & Innovation

Contents Points for Discussion 1 Chairpersons Report 2 Strategic Focus 4 SABC Structure 5 Operational 5 Government Guarantee Targets 6 Conclusion & Recommendations 9

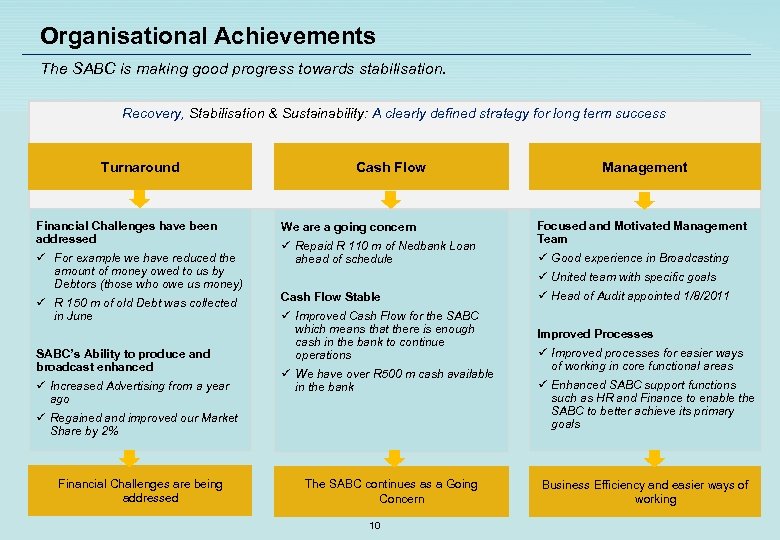

Organisational Achievements The SABC is making good progress towards stabilisation. Recovery, Stabilisation & Sustainability: A clearly defined strategy for long term success Turnaround Financial Challenges have been addressed ü For example we have reduced the amount of money owed to us by Debtors (those who owe us money) ü R 150 m of old Debt was collected in June SABC’s Ability to produce and broadcast enhanced ü Increased Advertising from a year ago Cash Flow We are a going concern ü Repaid R 110 m of Nedbank Loan ahead of schedule Focused and Motivated Management Team ü Good experience in Broadcasting ü United team with specific goals Cash Flow Stable ü Head of Audit appointed 1/8/2011 ü Improved Cash Flow for the SABC which means that there is enough cash in the bank to continue operations Improved Processes ü We have over R 500 m cash available in the bank ü Regained and improved our Market Share by 2% Financial Challenges are being addressed Management The SABC continues as a Going Concern 10 ü Improved processes for easier ways of working in core functional areas ü Enhanced SABC support functions such as HR and Finance to enable the SABC to better achieve its primary goals Business Efficiency and easier ways of working

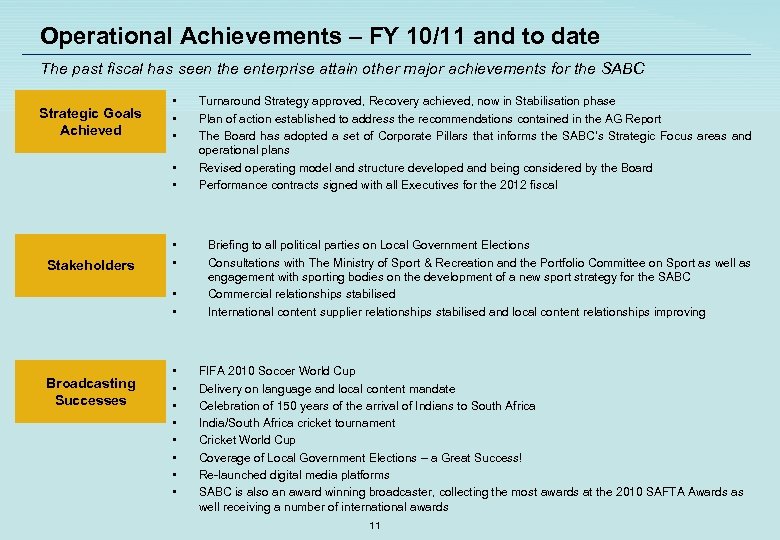

Operational Achievements – FY 10/11 and to date The past fiscal has seen the enterprise attain other major achievements for the SABC Strategic Goals Achieved • • • Stakeholders • • Broadcasting Successes • • Turnaround Strategy approved, Recovery achieved, now in Stabilisation phase Plan of action established to address the recommendations contained in the AG Report The Board has adopted a set of Corporate Pillars that informs the SABC’s Strategic Focus areas and operational plans Revised operating model and structure developed and being considered by the Board Performance contracts signed with all Executives for the 2012 fiscal Briefing to all political parties on Local Government Elections Consultations with The Ministry of Sport & Recreation and the Portfolio Committee on Sport as well as engagement with sporting bodies on the development of a new sport strategy for the SABC Commercial relationships stabilised International content supplier relationships stabilised and local content relationships improving FIFA 2010 Soccer World Cup Delivery on language and local content mandate Celebration of 150 years of the arrival of Indians to South Africa India/South Africa cricket tournament Cricket World Cup Coverage of Local Government Elections – a Great Success! Re-launched digital media platforms SABC is also an award winning broadcaster, collecting the most awards at the 2010 SAFTA Awards as well receiving a number of international awards 11

Contents Points for Discussion 1 Chairpersons Report 2 Strategic Focus 4 SABC Structure 5 Operational 5 6 Government Guarantee Targets Conclusion & Recommendations 12

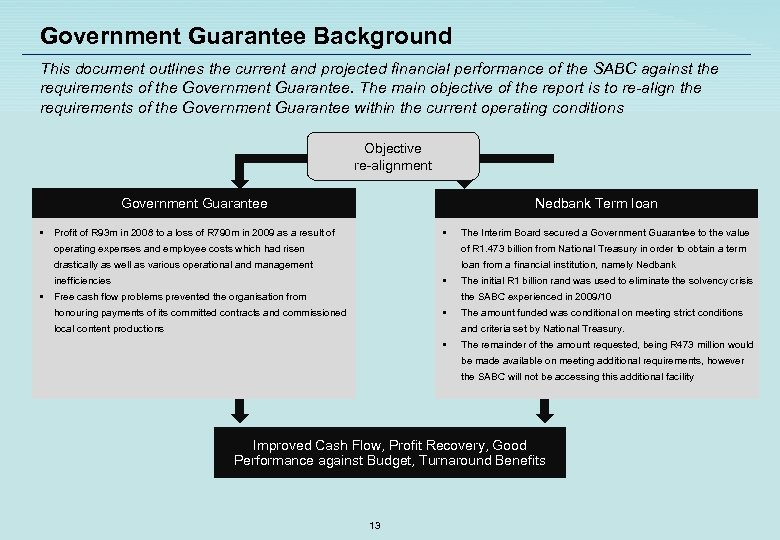

Government Guarantee Background This document outlines the current and projected financial performance of the SABC against the requirements of the Government Guarantee. The main objective of the report is to re-align the requirements of the Government Guarantee within the current operating conditions Objective re-alignment Government Guarantee Nedbank Term loan • Profit of R 93 m in 2008 to a loss of R 790 m in 2009 as a result of • The Interim Board secured a Government Guarantee to the value operating expenses and employee costs which had risen of R 1. 473 billion from National Treasury in order to obtain a term drastically as well as various operational and management loan from a financial institution, namely Nedbank • inefficiencies • Free cash flow problems prevented the organisation from The initial R 1 billion rand was used to eliminate the solvency crisis the SABC experienced in 2009/10 • honouring payments of its committed contracts and commissioned local content productions The amount funded was conditional on meeting strict conditions and criteria set by National Treasury. • The remainder of the amount requested, being R 473 million would be made available on meeting additional requirements, however the SABC will not be accessing this additional facility Improved Cash Flow, Profit Recovery, Good Performance against Budget, Turnaround Benefits 13

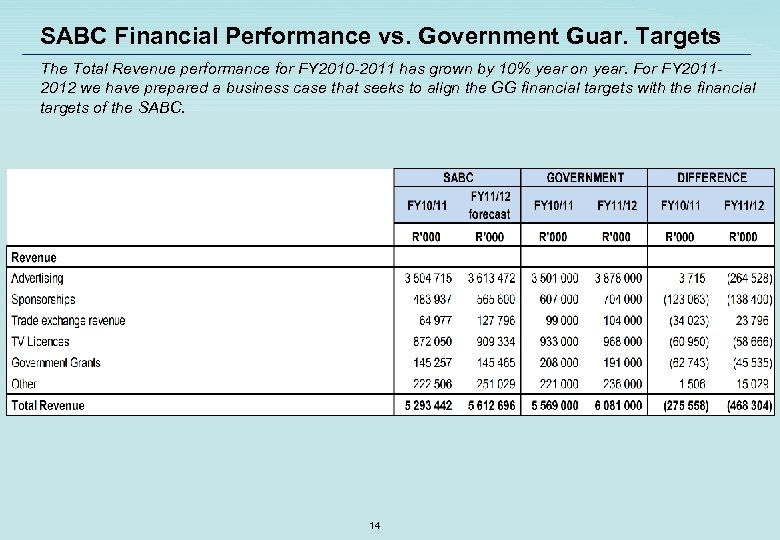

SABC Financial Performance vs. Government Guar. Targets The Total Revenue performance for FY 2010 -2011 has grown by 10% year on year. For FY 20112012 we have prepared a business case that seeks to align the GG financial targets with the financial targets of the SABC. 14

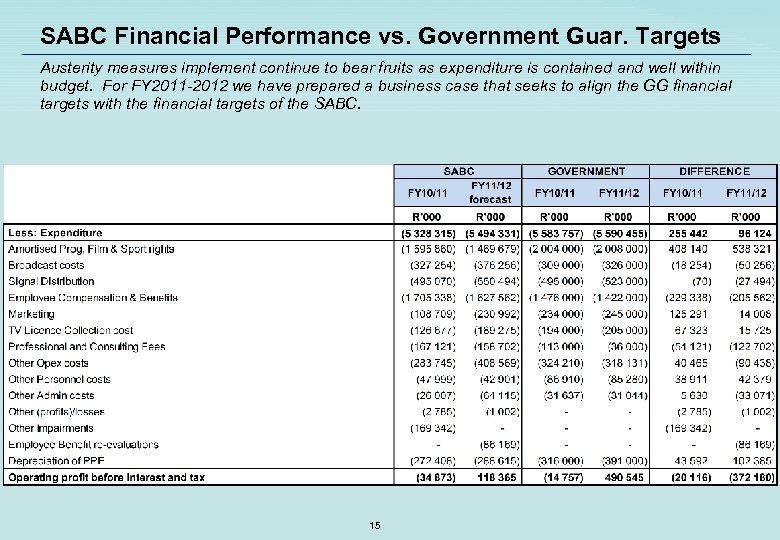

SABC Financial Performance vs. Government Guar. Targets Austerity measures implement continue to bear fruits as expenditure is contained and well within budget. For FY 2011 -2012 we have prepared a business case that seeks to align the GG financial targets with the financial targets of the SABC. 15

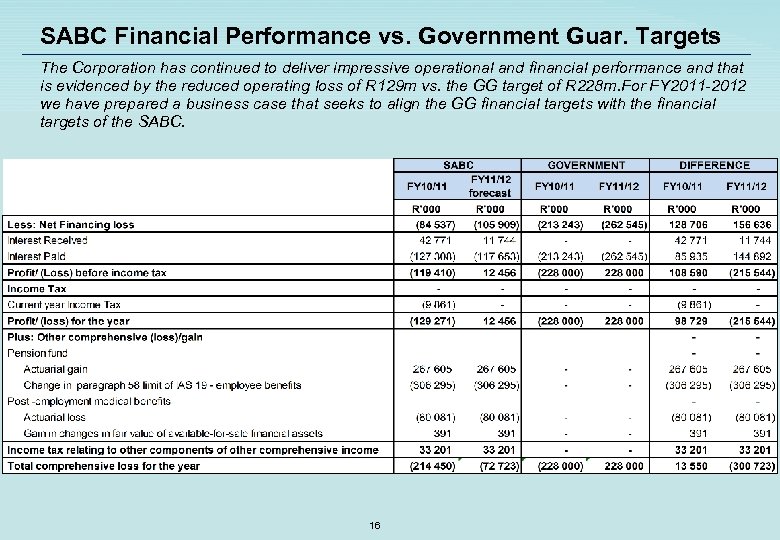

SABC Financial Performance vs. Government Guar. Targets The Corporation has continued to deliver impressive operational and financial performance and that is evidenced by the reduced operating loss of R 129 m vs. the GG target of R 228 m. For FY 2011 -2012 we have prepared a business case that seeks to align the GG financial targets with the financial targets of the SABC. 16

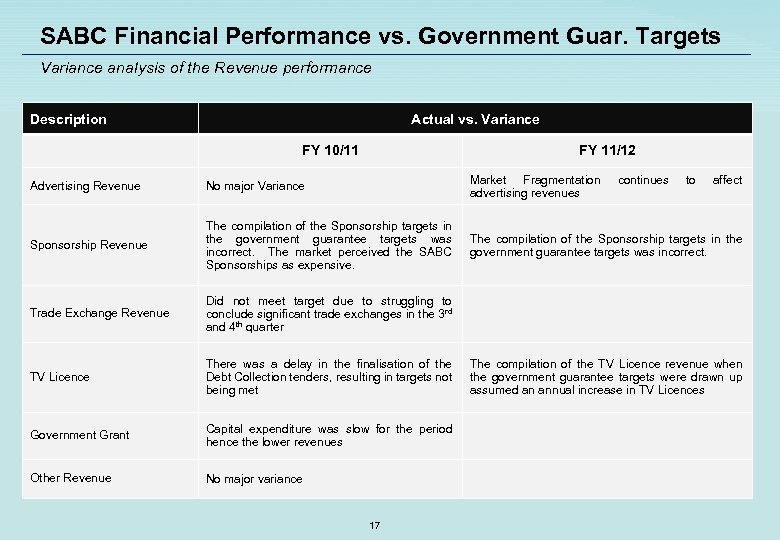

SABC Financial Performance vs. Government Guar. Targets Variance analysis of the Revenue performance Description Actual vs. Variance FY 10/11 FY 11/12 Advertising Revenue No major Variance Market Fragmentation advertising revenues Sponsorship Revenue The compilation of the Sponsorship targets in the government guarantee targets was incorrect. The market perceived the SABC Sponsorships as expensive. The compilation of the Sponsorship targets in the government guarantee targets was incorrect. Trade Exchange Revenue Did not meet target due to struggling to conclude significant trade exchanges in the 3 rd and 4 th quarter TV Licence There was a delay in the finalisation of the Debt Collection tenders, resulting in targets not being met Government Grant Capital expenditure was slow for the period hence the lower revenues Other Revenue No major variance 17 continues to affect The compilation of the TV Licence revenue when the government guarantee targets were drawn up assumed an annual increase in TV Licences

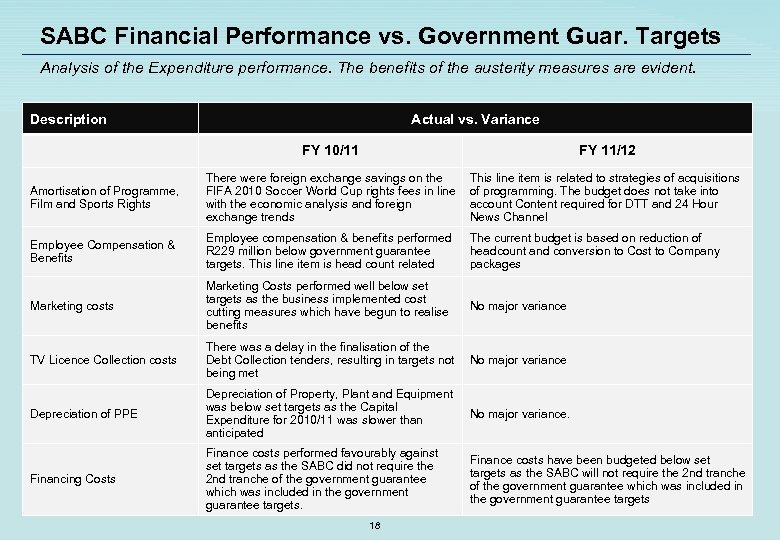

SABC Financial Performance vs. Government Guar. Targets Analysis of the Expenditure performance. The benefits of the austerity measures are evident. Description Actual vs. Variance FY 10/11 FY 11/12 Amortisation of Programme, Film and Sports Rights There were foreign exchange savings on the FIFA 2010 Soccer World Cup rights fees in line with the economic analysis and foreign exchange trends This line item is related to strategies of acquisitions of programming. The budget does not take into account Content required for DTT and 24 Hour News Channel Employee Compensation & Benefits Employee compensation & benefits performed R 229 million below government guarantee targets. This line item is head count related The current budget is based on reduction of headcount and conversion to Cost to Company packages Marketing costs Marketing Costs performed well below set targets as the business implemented cost cutting measures which have begun to realise benefits No major variance TV Licence Collection costs There was a delay in the finalisation of the Debt Collection tenders, resulting in targets not No major variance being met Depreciation of PPE Depreciation of Property, Plant and Equipment was below set targets as the Capital Expenditure for 2010/11 was slower than anticipated No major variance. Financing Costs Finance costs performed favourably against set targets as the SABC did not require the 2 nd tranche of the government guarantee which was included in the government guarantee targets. Finance costs have been budgeted below set targets as the SABC will not require the 2 nd tranche of the government guarantee which was included in the government guarantee targets 18

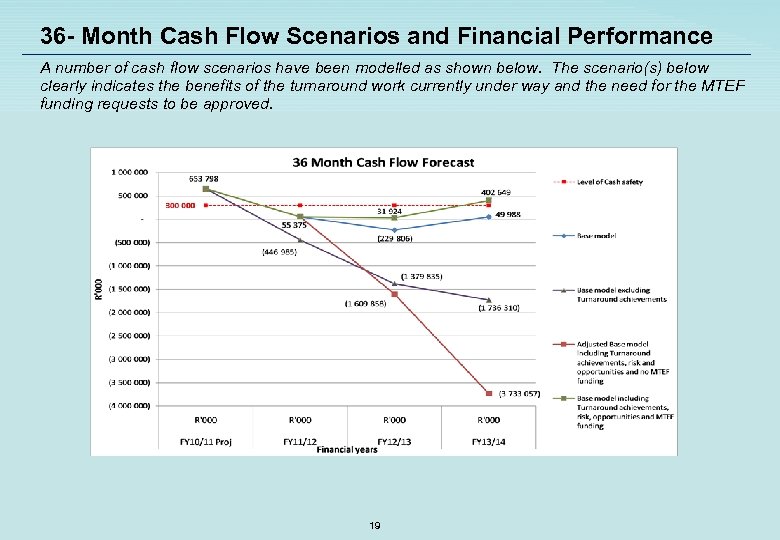

36 - Month Cash Flow Scenarios and Financial Performance A number of cash flow scenarios have been modelled as shown below. The scenario(s) below clearly indicates the benefits of the turnaround work currently under way and the need for the MTEF funding requests to be approved. 19

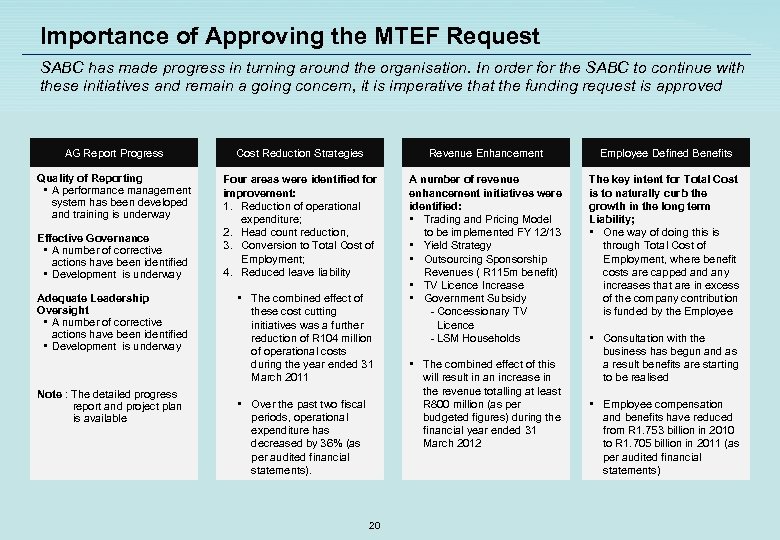

Importance of Approving the MTEF Request SABC has made progress in turning around the organisation. In order for the SABC to continue with these initiatives and remain a going concern, it is imperative that the funding request is approved AG Report Progress Cost Reduction Strategies Revenue Enhancement Employee Defined Benefits Quality of Reporting • A performance management system has been developed and training is underway Four areas were identified for improvement: 1. Reduction of operational expenditure; 2. Head count reduction, 3. Conversion to Total Cost of Employment; 4. Reduced leave liability A number of revenue enhancement initiatives were identified: • Trading and Pricing Model to be implemented FY 12/13 • Yield Strategy • Outsourcing Sponsorship Revenues ( R 115 m benefit) • TV Licence Increase • Government Subsidy - Concessionary TV Licence - LSM Households The key intent for Total Cost is to naturally curb the growth in the long term Liability; • One way of doing this is through Total Cost of Employment, where benefit costs are capped any increases that are in excess of the company contribution is funded by the Employee Effective Governance • A number of corrective actions have been identified • Development is underway Adequate Leadership Oversight • A number of corrective actions have been identified • Development is underway Note : The detailed progress report and project plan is available • The combined effect of these cost cutting initiatives was a further reduction of R 104 million of operational costs during the year ended 31 March 2011 • Over the past two fiscal periods, operational expenditure has decreased by 36% (as per audited financial statements). 20 • The combined effect of this will result in an increase in the revenue totalling at least R 800 million (as per budgeted figures) during the financial year ended 31 March 2012 • Consultation with the business has begun and as a result benefits are starting to be realised • Employee compensation and benefits have reduced from R 1. 753 billion in 2010 to R 1. 705 billion in 2011 (as per audited financial statements)

Contents Points for Discussion 1 Chairpersons Report 2 Strategic Focus 4 SABC Structure 5 Operational 5 Government Guarantee Targets 6 Conclusion & Recommendations 21

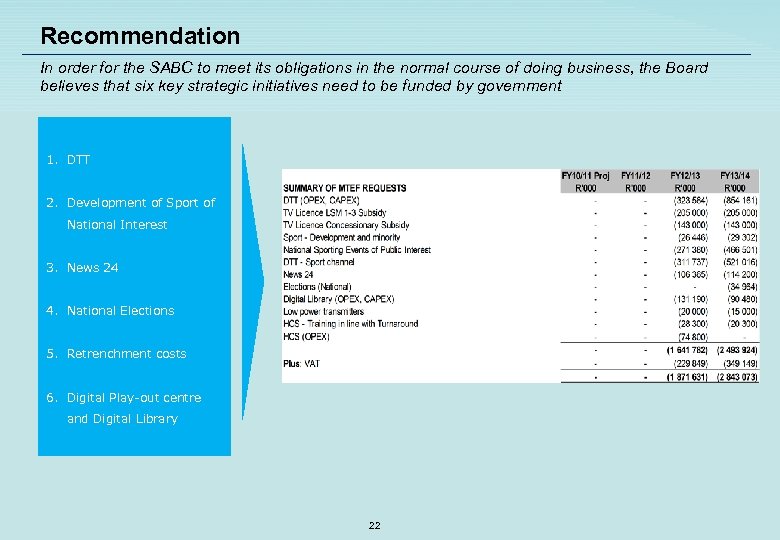

Recommendation In order for the SABC to meet its obligations in the normal course of doing business, the Board believes that six key strategic initiatives need to be funded by government 1. DTT 2. Development of Sport of National Interest 3. News 24 4. National Elections 5. Retrenchment costs 6. Digital Play-out centre and Digital Library 22

Recommendation Based on the analysis above it is evident that the Corporation continues to improve its performance both in terms of revenue and cost reduction. For the next financial year(s), we have prepared a business case which clearly outlines the optimal performance of the SABC. The next step is to align the GG targets with the operational and financial performance of the corporation as outlined in our 36 month financial performance projections. We recommend that the Government Guarantee conditions be amended based on new forecasts as per Actual Results achieved in FY 2010/11 and the 36 month cash flow forecast model. It is important to take note that these forecasts exclude all current MTEF requests including DTT. 23

af250d4e23b66c94bbc89de5d03a0d70.ppt