a54c4b734c64bc9daa5fd7e6b3defc0a.ppt

- Количество слайдов: 35

S&T - IT Outsourcing Strategy at European Standards Victor GRADINESCU, Bucarest, November, 22 2005

S&T - IT Outsourcing Strategy at European Standards Victor GRADINESCU, Bucarest, November, 22 2005

Contents § Overview § S&T at a Glance § S&T Focus § S&T SLA Metrics 2

Contents § Overview § S&T at a Glance § S&T Focus § S&T SLA Metrics 2

Overview 3

Overview 3

By 2010, IT services delivered via globally sourced resources (nearshore and offshore) will grow sixfold from 2004 levels. By 2015, 30 percent of all traditional professional IT services jobs will be delivered from emerging markets rather than first world countries. (Gartner, 2005) 4

By 2010, IT services delivered via globally sourced resources (nearshore and offshore) will grow sixfold from 2004 levels. By 2015, 30 percent of all traditional professional IT services jobs will be delivered from emerging markets rather than first world countries. (Gartner, 2005) 4

Global Sourcing Model Four tiers of global delivery approach: 1. On-site services delivered at client site (project management, business analysis) 2. Off-site services delivered remotely from a center located in same country as the client (center of excellence, development center, shared services center) 3. Nearshore services delivered from a country adjacent to the client, typically providing cost advantages with appropriate language skills/cultural similarities 4. Offshore services delivered from countries remote from client location - choice may depend on geographic preferences, availability of skills and expertise, cultural and language compatibility, and business continuity factors. 5

Global Sourcing Model Four tiers of global delivery approach: 1. On-site services delivered at client site (project management, business analysis) 2. Off-site services delivered remotely from a center located in same country as the client (center of excellence, development center, shared services center) 3. Nearshore services delivered from a country adjacent to the client, typically providing cost advantages with appropriate language skills/cultural similarities 4. Offshore services delivered from countries remote from client location - choice may depend on geographic preferences, availability of skills and expertise, cultural and language compatibility, and business continuity factors. 5

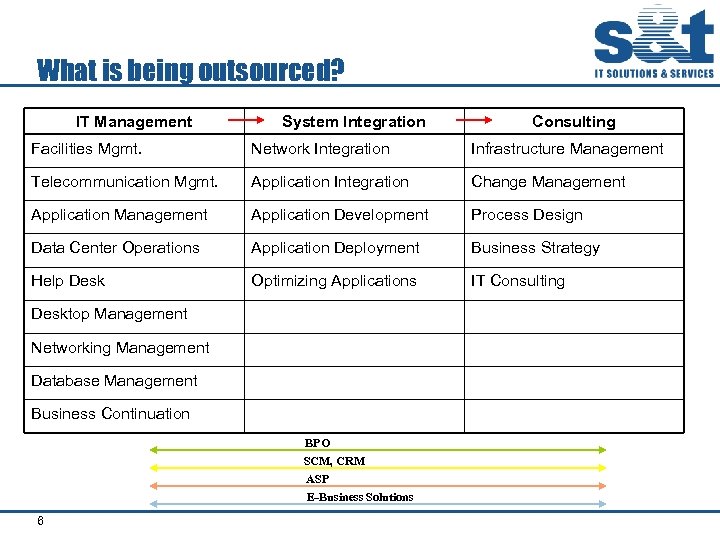

What is being outsourced? IT Management System Integration Consulting Facilities Mgmt. Network Integration Infrastructure Management Telecommunication Mgmt. Application Integration Change Management Application Development Process Design Data Center Operations Application Deployment Business Strategy Help Desk Optimizing Applications IT Consulting Desktop Management Networking Management Database Management Business Continuation BPO SCM, CRM ASP E-Business Solutions 6

What is being outsourced? IT Management System Integration Consulting Facilities Mgmt. Network Integration Infrastructure Management Telecommunication Mgmt. Application Integration Change Management Application Development Process Design Data Center Operations Application Deployment Business Strategy Help Desk Optimizing Applications IT Consulting Desktop Management Networking Management Database Management Business Continuation BPO SCM, CRM ASP E-Business Solutions 6

IT Outsourcing market Outsourcing drivers – – Automation of business processes IT intensive organizations Technology access vs. owning Cost reductions Offshor e BPO Discret e Total (ITO+BPO+Discrete) 200 3 $18 Bn (3%) $180 Bn $112 Bn $275 Bn $567 Bn 200 8 7 ITO $50 Bn (7%) $253 Bn $176 Bn $333 Bn $762 Bn

IT Outsourcing market Outsourcing drivers – – Automation of business processes IT intensive organizations Technology access vs. owning Cost reductions Offshor e BPO Discret e Total (ITO+BPO+Discrete) 200 3 $18 Bn (3%) $180 Bn $112 Bn $275 Bn $567 Bn 200 8 7 ITO $50 Bn (7%) $253 Bn $176 Bn $333 Bn $762 Bn

Outsourcing uptake Constant increasing of outsourcing from the top 100 US companies Spending on externally provided services is growing faster than internal IT budgets worldwide. 8

Outsourcing uptake Constant increasing of outsourcing from the top 100 US companies Spending on externally provided services is growing faster than internal IT budgets worldwide. 8

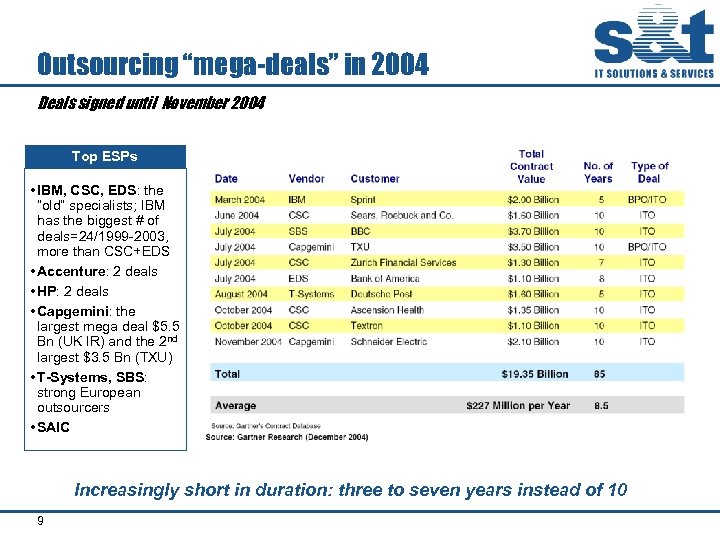

Outsourcing “mega-deals” in 2004 Deals signed until November 2004 Top ESPs • IBM, CSC, EDS: the “old” specialists; IBM has the biggest # of deals=24/1999 -2003, more than CSC+EDS • Accenture: 2 deals • HP: 2 deals • Capgemini: the largest mega deal $5. 5 Bn (UK IR) and the 2 nd largest $3. 5 Bn (TXU) • T-Systems, SBS: strong European outsourcers • SAIC Increasingly short in duration: three to seven years instead of 10 9

Outsourcing “mega-deals” in 2004 Deals signed until November 2004 Top ESPs • IBM, CSC, EDS: the “old” specialists; IBM has the biggest # of deals=24/1999 -2003, more than CSC+EDS • Accenture: 2 deals • HP: 2 deals • Capgemini: the largest mega deal $5. 5 Bn (UK IR) and the 2 nd largest $3. 5 Bn (TXU) • T-Systems, SBS: strong European outsourcers • SAIC Increasingly short in duration: three to seven years instead of 10 9

Global Sourcing Countries for IT Outsourcing Services Status and perspectives (Source: Gartner, 2005) Leader Emerging countries • India Challengers • Brazil • Canada • China • Ireland • Israel • Mexico • Northern Ireland • Philippines • South Africa • Spain 10 • Australia • Belarus • Bulgaria • Costa Rica • Egypt • Estonia • Jamaica • Latvia • Lithuania • Malaysia • Mauritius • New Zeeland • Romania • Singapore • Ukraine Early entrants • Argentina • Cuba • Fiji • Ghana • Korea(S) • Morocco • Nepal • Nicaragua • Pakistan • Senegal • Slovenia • Sri Lanka • Taiwan • Thailand • Tunisia • Turkey • UAE • Venezuela • Vietnam

Global Sourcing Countries for IT Outsourcing Services Status and perspectives (Source: Gartner, 2005) Leader Emerging countries • India Challengers • Brazil • Canada • China • Ireland • Israel • Mexico • Northern Ireland • Philippines • South Africa • Spain 10 • Australia • Belarus • Bulgaria • Costa Rica • Egypt • Estonia • Jamaica • Latvia • Lithuania • Malaysia • Mauritius • New Zeeland • Romania • Singapore • Ukraine Early entrants • Argentina • Cuba • Fiji • Ghana • Korea(S) • Morocco • Nepal • Nicaragua • Pakistan • Senegal • Slovenia • Sri Lanka • Taiwan • Thailand • Tunisia • Turkey • UAE • Venezuela • Vietnam

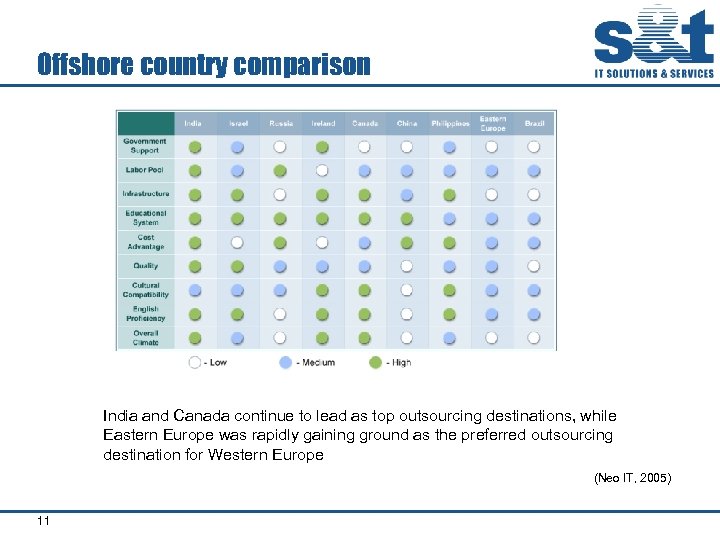

Offshore country comparison India and Canada continue to lead as top outsourcing destinations, while Eastern Europe was rapidly gaining ground as the preferred outsourcing destination for Western Europe (Neo IT, 2005) 11

Offshore country comparison India and Canada continue to lead as top outsourcing destinations, while Eastern Europe was rapidly gaining ground as the preferred outsourcing destination for Western Europe (Neo IT, 2005) 11

Romania As a software outsourcing provider Country specifics • Stable market economy: 8. 3% GDP growth in 2004, • Fiscal IT facilities in place • 80000 IT specialists, average growth 7000 per year • Software industry hiring : 52% of IT jobs, increase to over 63% in the next 5 years • Software & services market estimated at € 500 M in 2005 (30% of total IT market), among the best ratio in CEE Strengths & Weaknesses • Strengths • Good education system for mathematics, engineering and computer science • One of the largest number of graduates of technical universities per capita in the world • Close to Western Europe due to a mix of nationalities and cultural roots • High number of technical certifications, especially for software development Weaknesses • No real leaders in many areas • Relative immature business culture • Limited venture capital available Source: ARIS – Romanian Agency for Foreign Investment (www. arisinvest. ro) Source: INSSE – National Institute of Statistics (March 2005) Source: IDC study for Microsoft, 2004 12

Romania As a software outsourcing provider Country specifics • Stable market economy: 8. 3% GDP growth in 2004, • Fiscal IT facilities in place • 80000 IT specialists, average growth 7000 per year • Software industry hiring : 52% of IT jobs, increase to over 63% in the next 5 years • Software & services market estimated at € 500 M in 2005 (30% of total IT market), among the best ratio in CEE Strengths & Weaknesses • Strengths • Good education system for mathematics, engineering and computer science • One of the largest number of graduates of technical universities per capita in the world • Close to Western Europe due to a mix of nationalities and cultural roots • High number of technical certifications, especially for software development Weaknesses • No real leaders in many areas • Relative immature business culture • Limited venture capital available Source: ARIS – Romanian Agency for Foreign Investment (www. arisinvest. ro) Source: INSSE – National Institute of Statistics (March 2005) Source: IDC study for Microsoft, 2004 12

Central and Eastern Europe can be an important contender to India (Diamond Cluster, 2005) 13

Central and Eastern Europe can be an important contender to India (Diamond Cluster, 2005) 13

S&T at a Glance 14

S&T at a Glance 14

S&T at a Glance S&T is the leading provider for IT solutions and services Ø for Telco, Banking, Manufacturing and Government Ø in 21 countries in CEE Ø at more than 50 local offices Ø with 1800 employees Ø biggest IT company in Austria 15

S&T at a Glance S&T is the leading provider for IT solutions and services Ø for Telco, Banking, Manufacturing and Government Ø in 21 countries in CEE Ø at more than 50 local offices Ø with 1800 employees Ø biggest IT company in Austria 15

S&T Presence in Europe’s Most Dynamic Markets RU PL DE CZ CH AT* UA SK MD HU RO SI HR BA SCG BG AL MK GR MT S&T Countries * Headquarters: Vienna, Austria 16 TR CY CY

S&T Presence in Europe’s Most Dynamic Markets RU PL DE CZ CH AT* UA SK MD HU RO SI HR BA SCG BG AL MK GR MT S&T Countries * Headquarters: Vienna, Austria 16 TR CY CY

IT Market Size in S&T Countries 60. 000 (US$M) IT Spending 50. 000 40. 000 30. 000 20. 000 10. 000 0 France Italy Neth. Spain Belgium Austria S&T CEE EU 12 Russia Source: IDC WW Black Book February 2005 17

IT Market Size in S&T Countries 60. 000 (US$M) IT Spending 50. 000 40. 000 30. 000 20. 000 10. 000 0 France Italy Neth. Spain Belgium Austria S&T CEE EU 12 Russia Source: IDC WW Black Book February 2005 17

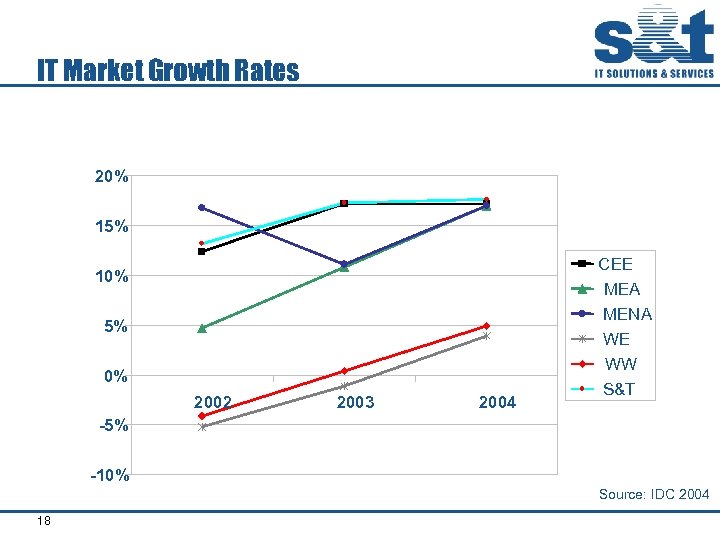

IT Market Growth Rates 20% 15% 10% 5% 0% 2002 2003 2004 CEE MEA MENA WE WW S&T -5% -10% Source: IDC 2004 18

IT Market Growth Rates 20% 15% 10% 5% 0% 2002 2003 2004 CEE MEA MENA WE WW S&T -5% -10% Source: IDC 2004 18

IT Market Projections in S&T Countries 50000 45000 Value CAGR: 14% 40000 (US$M) 35000 30000 IT Services Packaged Software Hardware 25000 20000 15000 10000 5000 0 2002 2003 2004 S&T Market will be 80% larger in 2008 19 2005 2006 2007 2008 Source: IDC 2004

IT Market Projections in S&T Countries 50000 45000 Value CAGR: 14% 40000 (US$M) 35000 30000 IT Services Packaged Software Hardware 25000 20000 15000 10000 5000 0 2002 2003 2004 S&T Market will be 80% larger in 2008 19 2005 2006 2007 2008 Source: IDC 2004

Foreign Direct Investments in CEE 2005* in Mio. EUR Total = EUR 22. 8 Billion * Forecast Source: BA-CA, 02/2005 20

Foreign Direct Investments in CEE 2005* in Mio. EUR Total = EUR 22. 8 Billion * Forecast Source: BA-CA, 02/2005 20

Group Architecture Go an Fin l cia Region Adriatic (Slovenia, Bosnia-Herzegovina, Croatia, Macedonia, Serbia & Montenegro, Albania) Region Central (Austria, Hungary, Poland, Slovakia, Czech Republic, Switzerland) Region South (Bulgaria, Greece, Romania, Turkey, Malta, Cyprus) t fac u n Ma Region East (Moldova, Russia, Ukraine) Regions 21 Bu s es sin Medical Systems (MED) le Te nm r ve g rin u Managed Services (MS) Ind m co / r Se Customer Support (CS) str u i Ut s ice v Enterprise Systems (ES) ies t en Business Solutions (BS) s ie lit s m eg S t en

Group Architecture Go an Fin l cia Region Adriatic (Slovenia, Bosnia-Herzegovina, Croatia, Macedonia, Serbia & Montenegro, Albania) Region Central (Austria, Hungary, Poland, Slovakia, Czech Republic, Switzerland) Region South (Bulgaria, Greece, Romania, Turkey, Malta, Cyprus) t fac u n Ma Region East (Moldova, Russia, Ukraine) Regions 21 Bu s es sin Medical Systems (MED) le Te nm r ve g rin u Managed Services (MS) Ind m co / r Se Customer Support (CS) str u i Ut s ice v Enterprise Systems (ES) ies t en Business Solutions (BS) s ie lit s m eg S t en

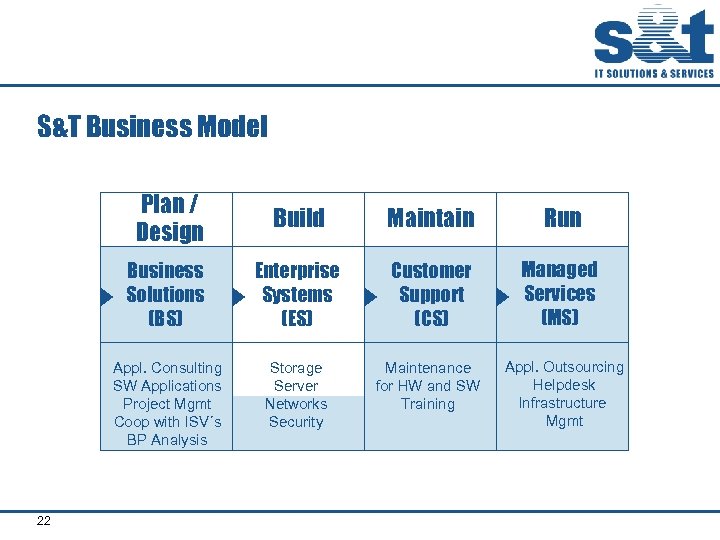

S&T Business Model Plan / Design Maintain Run Business Solutions (BS) Enterprise Systems (ES) Customer Support (CS) Managed Services (MS) Appl. Consulting SW Applications Project Mgmt Coop with ISV´s BP Analysis 22 Build Storage Server Networks Security Maintenance for HW and SW Training Appl. Outsourcing Helpdesk Infrastructure Mgmt

S&T Business Model Plan / Design Maintain Run Business Solutions (BS) Enterprise Systems (ES) Customer Support (CS) Managed Services (MS) Appl. Consulting SW Applications Project Mgmt Coop with ISV´s BP Analysis 22 Build Storage Server Networks Security Maintenance for HW and SW Training Appl. Outsourcing Helpdesk Infrastructure Mgmt

Factors of Outsourcing Vendors Selection and Their Importance – Transition to Business Factors (IDC, 2005) 23

Factors of Outsourcing Vendors Selection and Their Importance – Transition to Business Factors (IDC, 2005) 23

CEE Ranks Very Competitive on Major Decision Making Criteria Resources Skill Factors • Education levels • Resource Availability • Cultural Adaptability • Language Economic Proficiency and Political Factors • Political Commitment • Infrastructure Commitment • Intellectual Property Protection IT Infrastructure Factors Financial Factors • Compensation • Tax and Country -specific costs • Infrastructure • ICT infrastructure availability Business & Regional Factors • Public/private sector coop • Location • Regulatory Issues • Market Experience • Quality Issues (IDC, 2005) 24

CEE Ranks Very Competitive on Major Decision Making Criteria Resources Skill Factors • Education levels • Resource Availability • Cultural Adaptability • Language Economic Proficiency and Political Factors • Political Commitment • Infrastructure Commitment • Intellectual Property Protection IT Infrastructure Factors Financial Factors • Compensation • Tax and Country -specific costs • Infrastructure • ICT infrastructure availability Business & Regional Factors • Public/private sector coop • Location • Regulatory Issues • Market Experience • Quality Issues (IDC, 2005) 24

S&T Focus 25

S&T Focus 25

S&T Experience – Few Examples • Application Server Hosting – Industry Sector • Disaster Recovery Services – Banking Sector • Business Continuity Center – Banking Sector • Co-operation with Global Outsourcing Providers in serving the regional and local entities of multinational companies 26

S&T Experience – Few Examples • Application Server Hosting – Industry Sector • Disaster Recovery Services – Banking Sector • Business Continuity Center – Banking Sector • Co-operation with Global Outsourcing Providers in serving the regional and local entities of multinational companies 26

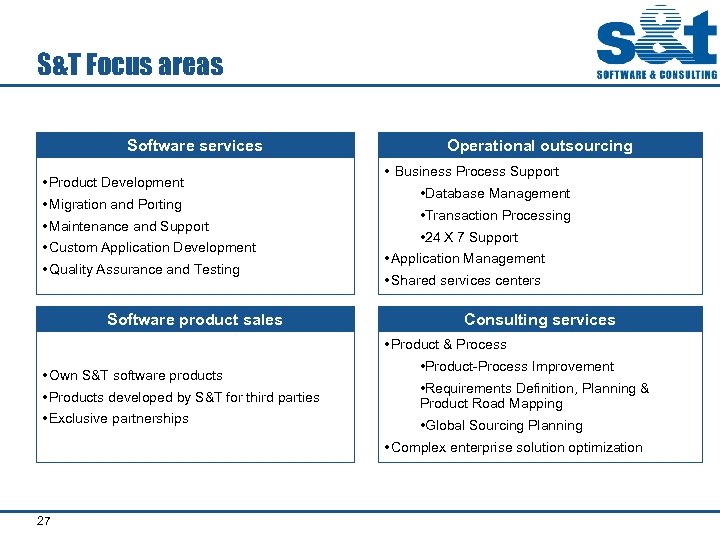

S&T Focus areas Software services • Product Development • Migration and Porting • Maintenance and Support • Custom Application Development • Quality Assurance and Testing Software product sales Operational outsourcing • Business Process Support • Database Management • Transaction Processing • 24 X 7 Support • Application Management • Shared services centers Consulting services • Product & Process • Own S&T software products • Products developed by S&T for third parties • Exclusive partnerships • Product-Process Improvement • Requirements Definition, Planning & Product Road Mapping • Global Sourcing Planning • Complex enterprise solution optimization 27

S&T Focus areas Software services • Product Development • Migration and Porting • Maintenance and Support • Custom Application Development • Quality Assurance and Testing Software product sales Operational outsourcing • Business Process Support • Database Management • Transaction Processing • 24 X 7 Support • Application Management • Shared services centers Consulting services • Product & Process • Own S&T software products • Products developed by S&T for third parties • Exclusive partnerships • Product-Process Improvement • Requirements Definition, Planning & Product Road Mapping • Global Sourcing Planning • Complex enterprise solution optimization 27

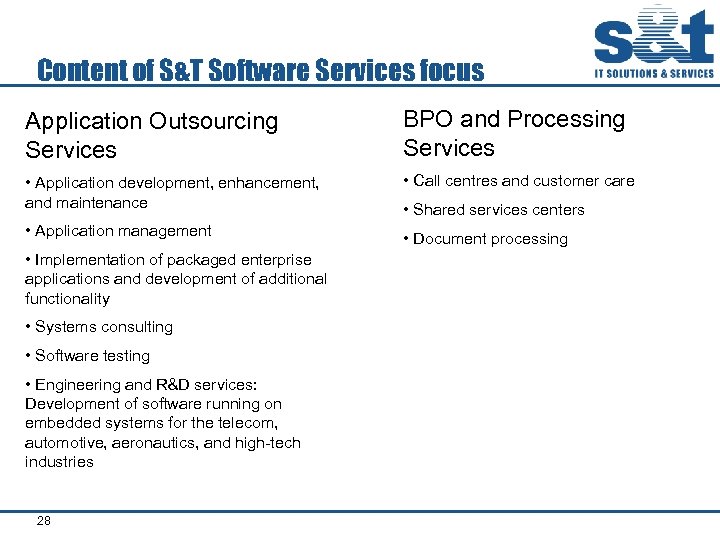

Content of S&T Software Services focus Application Outsourcing Services BPO and Processing Services • Application development, enhancement, and maintenance • Call centres and customer care • Application management • Document processing • Implementation of packaged enterprise applications and development of additional functionality • Systems consulting • Software testing • Engineering and R&D services: Development of software running on embedded systems for the telecom, automotive, aeronautics, and high-tech industries 28 • Shared services centers

Content of S&T Software Services focus Application Outsourcing Services BPO and Processing Services • Application development, enhancement, and maintenance • Call centres and customer care • Application management • Document processing • Implementation of packaged enterprise applications and development of additional functionality • Systems consulting • Software testing • Engineering and R&D services: Development of software running on embedded systems for the telecom, automotive, aeronautics, and high-tech industries 28 • Shared services centers

S&T SLA Metrics 29

S&T SLA Metrics 29

IT Outsourcing SLA – an essential part of any outsourcing project: • Boundaries of the project in terms of the functions and services that the service provider will give to the client • Volume of work that will be accepted and delivered • Acceptance criteria for responsiveness • Quality of deliverables SLA Performance Metrics: • Measure the right performance characteristics • Can be easily collected • Tie all commitments to reasonable, attainable performance level 30

IT Outsourcing SLA – an essential part of any outsourcing project: • Boundaries of the project in terms of the functions and services that the service provider will give to the client • Volume of work that will be accepted and delivered • Acceptance criteria for responsiveness • Quality of deliverables SLA Performance Metrics: • Measure the right performance characteristics • Can be easily collected • Tie all commitments to reasonable, attainable performance level 30

Selecting SLA Metrics Five Principles for Selecting SLA Metrics: • Choose measurements that motivate the right behavior • Ensure metrics reflects factors within the service provider’s control • Choose measurements that are easily collected • Less is more • Set a proper baseline 31

Selecting SLA Metrics Five Principles for Selecting SLA Metrics: • Choose measurements that motivate the right behavior • Ensure metrics reflects factors within the service provider’s control • Choose measurements that are easily collected • Less is more • Set a proper baseline 31

Categories of SLA Metrics 1. Volume of work 2. Quality of work 3. Responsiveness • • • 2. 3. Defect rates Standards compliance Technical quality Service availability Service satisfaction 1. Time-to-market or time-toimplement Time-to-acknowledge Backlog size 4. Efficiency • • • Reporting Metrics Information • Simple • Actionable form • Balanced scorecards 32 Cost/effort efficiency Team utilization Rework levels

Categories of SLA Metrics 1. Volume of work 2. Quality of work 3. Responsiveness • • • 2. 3. Defect rates Standards compliance Technical quality Service availability Service satisfaction 1. Time-to-market or time-toimplement Time-to-acknowledge Backlog size 4. Efficiency • • • Reporting Metrics Information • Simple • Actionable form • Balanced scorecards 32 Cost/effort efficiency Team utilization Rework levels

Conclusion The metrics used to measure and managed performance to SLA commitments are the heart of a successful agreement and are critical long term success factor 33

Conclusion The metrics used to measure and managed performance to SLA commitments are the heart of a successful agreement and are critical long term success factor 33

Thank you 34

Thank you 34

EST LV RU LT BY PL CZ AT* UA SK MD HU RO SI HR BA SCG BG AL MK GR MT 35 TR CY CY

EST LV RU LT BY PL CZ AT* UA SK MD HU RO SI HR BA SCG BG AL MK GR MT 35 TR CY CY