bef4ca0347adafca24d3504ce2bae461.ppt

- Количество слайдов: 9

Russian tax law changes and recent practices affecting the business with Luxembourg counterparties Igor Ershov Senior lawyer CMS, Russia 4 April 2017

Russian tax law changes and recent practices affecting the business with Luxembourg counterparties Igor Ershov Senior lawyer CMS, Russia 4 April 2017

Contents - Trends of the Russian tax tools related to cross-border businesses § existing practice § what is in the pipeline - Russian withholding taxes: domestic law vs Luxembourg-Russia DTT provisions § dividends § interest § royalties § other income - Practical issues of Luxembourg-Russia DTT implementation - Beneficial ownership concept - taxpayers are still to guess what should be done to avoid tax claims Russian tax law changes and recent practices affecting the business with Luxembourg counterparties |4 April 2017

Contents - Trends of the Russian tax tools related to cross-border businesses § existing practice § what is in the pipeline - Russian withholding taxes: domestic law vs Luxembourg-Russia DTT provisions § dividends § interest § royalties § other income - Practical issues of Luxembourg-Russia DTT implementation - Beneficial ownership concept - taxpayers are still to guess what should be done to avoid tax claims Russian tax law changes and recent practices affecting the business with Luxembourg counterparties |4 April 2017

Trends of the Russian tax tools related to cross-border businesses - Existing practice § CFC rules (chapter 3. 4 of the Russian Tax code) § thin capitalization rules (article 269 of the Russian Tax code) § information exchange upon requests (article 26 of the Luxembourg – Russian DTT) § transfer pricing rules (chapters 14. 1 – 14. 6 of the Russian Tax code) § beneficiary ownership concept (articles 7, 312 of the Russian Tax code) - Additional regulations to come § common reporting standards (Russian law Num. 325 -FZ of 04. 11. 2014, Governmental act of 30. 04. 2016 Num. 834 -r) § country by country reporting (bill of 08. 04. 2016) Russian tax law changes and recent practices affecting the business with Luxembourg counterparties |4 April 2017

Trends of the Russian tax tools related to cross-border businesses - Existing practice § CFC rules (chapter 3. 4 of the Russian Tax code) § thin capitalization rules (article 269 of the Russian Tax code) § information exchange upon requests (article 26 of the Luxembourg – Russian DTT) § transfer pricing rules (chapters 14. 1 – 14. 6 of the Russian Tax code) § beneficiary ownership concept (articles 7, 312 of the Russian Tax code) - Additional regulations to come § common reporting standards (Russian law Num. 325 -FZ of 04. 11. 2014, Governmental act of 30. 04. 2016 Num. 834 -r) § country by country reporting (bill of 08. 04. 2016) Russian tax law changes and recent practices affecting the business with Luxembourg counterparties |4 April 2017

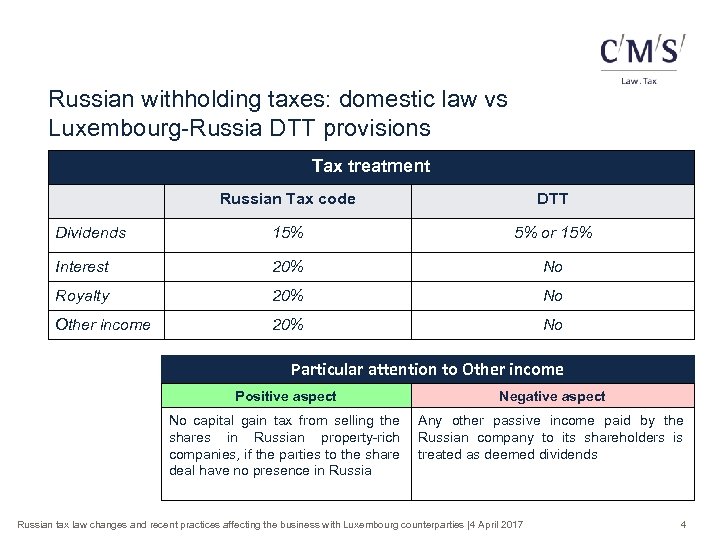

Russian withholding taxes: domestic law vs Luxembourg-Russia DTT provisions Tax treatment Russian Tax code DTT Dividends 15% 5% or 15% Interest 20% No Royalty 20% No Other income 20% No Particular attention to Other income Positive aspect Negative aspect No capital gain tax from selling the shares in Russian property-rich companies, if the parties to the share deal have no presence in Russia Any other passive income paid by the Russian company to its shareholders is treated as deemed dividends Russian tax law changes and recent practices affecting the business with Luxembourg counterparties |4 April 2017 4

Russian withholding taxes: domestic law vs Luxembourg-Russia DTT provisions Tax treatment Russian Tax code DTT Dividends 15% 5% or 15% Interest 20% No Royalty 20% No Other income 20% No Particular attention to Other income Positive aspect Negative aspect No capital gain tax from selling the shares in Russian property-rich companies, if the parties to the share deal have no presence in Russia Any other passive income paid by the Russian company to its shareholders is treated as deemed dividends Russian tax law changes and recent practices affecting the business with Luxembourg counterparties |4 April 2017 4

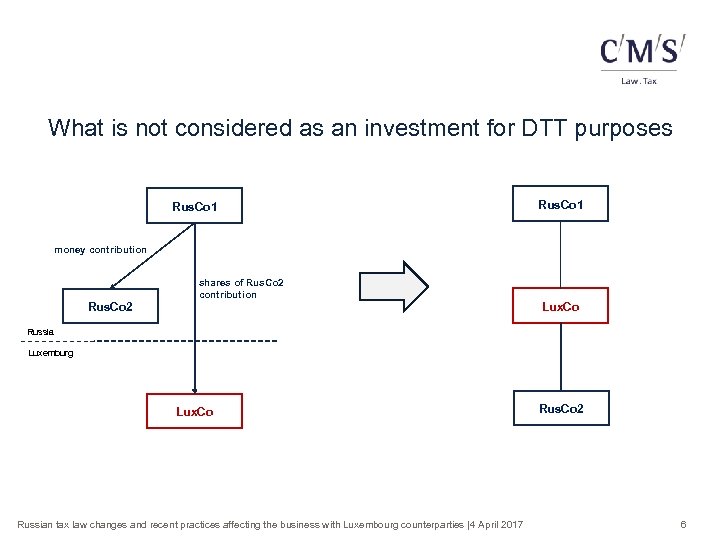

Practical issues Luxembourg-Russia DTT implementation - Treatment of investments for the purposes of DTT direct investment, purchase of Russian shares from third parties vs contributing the Russian shares into the Luxembourg company - Participation requirement 10% of share capital + 80, 000 EUR (FOREX impact considerations) - Tax certificate issuance issuing body: Minister of finance or its authorized representative + Department on direct taxes collection - Tax certificate formalities apostil stamp + periodicity - Beneficial ownership concept Russian tax law changes and recent practices affecting the business with Luxembourg counterparties |4 April 2017

Practical issues Luxembourg-Russia DTT implementation - Treatment of investments for the purposes of DTT direct investment, purchase of Russian shares from third parties vs contributing the Russian shares into the Luxembourg company - Participation requirement 10% of share capital + 80, 000 EUR (FOREX impact considerations) - Tax certificate issuance issuing body: Minister of finance or its authorized representative + Department on direct taxes collection - Tax certificate formalities apostil stamp + periodicity - Beneficial ownership concept Russian tax law changes and recent practices affecting the business with Luxembourg counterparties |4 April 2017

What is not considered as an investment for DTT purposes Rus. Co 1 money contribution Rus. Co 2 shares of Rus. Co 2 contribution Lux. Co Russia Luxemburg Lux. Co Russian tax law changes and recent practices affecting the business with Luxembourg counterparties |4 April 2017 Rus. Co 2 6

What is not considered as an investment for DTT purposes Rus. Co 1 money contribution Rus. Co 2 shares of Rus. Co 2 contribution Lux. Co Russia Luxemburg Lux. Co Russian tax law changes and recent practices affecting the business with Luxembourg counterparties |4 April 2017 Rus. Co 2 6

Beneficial ownership concept – taxpayers are still to guess what should be done to avoid tax claims - set of documents for DTT application § certificate + letter from the shareholder + attachments - letter from the shareholders on beneficial ownership of income: § the shareholder does not act as an intermediary (agent or nominee); § it has a full right to use and enjoy the received income; § it does not have a contractual or legal obligation to pass on the payments received to another person. Russian tax law changes and recent practices affecting the business with Luxembourg counterparties |4 April 2017 7

Beneficial ownership concept – taxpayers are still to guess what should be done to avoid tax claims - set of documents for DTT application § certificate + letter from the shareholder + attachments - letter from the shareholders on beneficial ownership of income: § the shareholder does not act as an intermediary (agent or nominee); § it has a full right to use and enjoy the received income; § it does not have a contractual or legal obligation to pass on the payments received to another person. Russian tax law changes and recent practices affecting the business with Luxembourg counterparties |4 April 2017 7

Beneficial ownership concept – taxpayers are still to guess what should be done to avoid tax claims - attachments to the letter § for dividends – charter + minutes (resolution) § for interest – charter + financial accounts § for royalty – charter + IP documents - practical recommendations § elaboration of “substance” criteria § introducing the respective sections into the local policies § contractual reservations - beneficiary concept in other Russian laws § anti money-laundering law § contractual relationship with state-owned enterprises Russian tax law changes and recent practices affecting the business with Luxembourg counterparties |4 April 2017 8

Beneficial ownership concept – taxpayers are still to guess what should be done to avoid tax claims - attachments to the letter § for dividends – charter + minutes (resolution) § for interest – charter + financial accounts § for royalty – charter + IP documents - practical recommendations § elaboration of “substance” criteria § introducing the respective sections into the local policies § contractual reservations - beneficiary concept in other Russian laws § anti money-laundering law § contractual relationship with state-owned enterprises Russian tax law changes and recent practices affecting the business with Luxembourg counterparties |4 April 2017 8

Thank you for your attention! Igor Ershov CMS, Russia Senior lawyer CMS, Russia T +7 495 786 4000 E igor. ershov@cmslegal. ru Moscow, Presnenskaya nab, 10, C T: +7 495 786 4000 F: +7 495 786 4001 www. cmslegal. ru footer text | footer date 9

Thank you for your attention! Igor Ershov CMS, Russia Senior lawyer CMS, Russia T +7 495 786 4000 E igor. ershov@cmslegal. ru Moscow, Presnenskaya nab, 10, C T: +7 495 786 4000 F: +7 495 786 4001 www. cmslegal. ru footer text | footer date 9