Teaser2.0.pptx

- Количество слайдов: 4

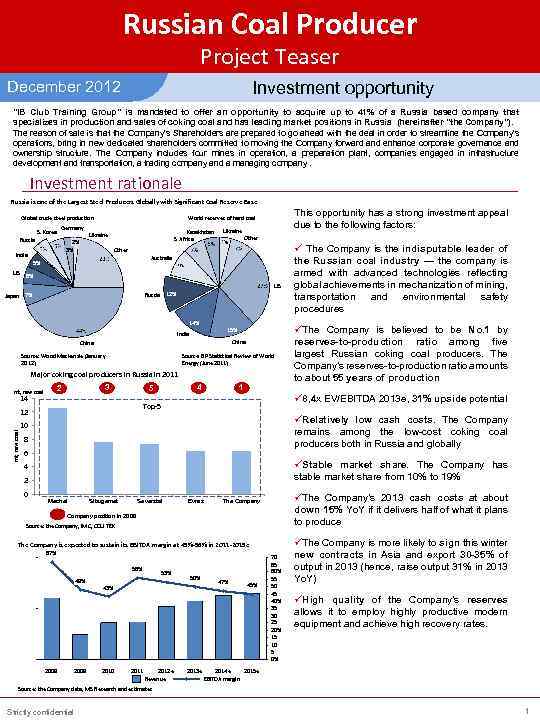

Russian Coal Producer Project Teaser December 2012 Investment opportunity “IB Club Training Group” is mandated to offer an opportunity to acquire up to 41% of a Russia based company that specializes in production and sales of coking coal and has leading market positions in Russia (hereinafter “the Company”). The reason of sale is that the Company’s Shareholders are prepared to go ahead with the deal in order to streamline the Company’s operations, bring in new dedicated shareholders committed to moving the Company forward and enhance corporate governance and ownership structure. The Company includes four mines in operation, a preparation plant, companies engaged in infrastructure development and transportation, a trading company and a managing company. Investment rationale Russia is one of the Largest Steel Producers Globally with Significant Coal Reserve Base Global crude steel production Russia S. Korea Germany 2 2% 3% India 3 Ukraine Kazakhstan S. Africa 4 Ukraine Other 1 Other Australia 5% US This opportunity has a strong investment appeal due to the following factors: World reserves of hard coal 6% US Russia 12% Japan 7% 14% 15% India China Source: Wood Mackenzie (January 2012) Source: BP Statistical Review of World Energy (June 2011) Major coking coal producers in Russia in 2011 3 2 mt, raw coal ü 8, 4 x EV/EBITDA 2013 e, 31% upside potential Top-5 12 10 üRelatively low cash costs. The Company remains among the low-cost coking coal producers both in Russia and globally # 8 6 üStable market share. The Company has stable market share from 10% to 19% 4 2 0 üThe Company is believed to be No. 1 by reserves-to-production ratio among five largest Russian coking coal producers. The Company’s reserves-to-production ratio amounts to about 55 years of production 1 4 5 14 ü The Company is the indisputable leader of the Russian coal industry — the company is armed with advanced technologies reflecting global achievements in mechanization of mining, transportation and environmental safety procedures Mechel Sibugemet Severstal Evraz üThe Company’s 2013 cash costs at about down 15% Yo. Y if it delivers half of what it plans to produce The Company position in 2009 Source: the Company, IMC, CDU TEK The Company is expected to sustain its EBITDA margin at 45%-56% in 2011 -2015 e 67% 56% 48% 2008 2009 53% 50% 43% 2010 2011 2012 e Revenue 2013 e 47% 45% 70 65 60% 55 50 45 40% 35 30 25 20% 15 10 5 0% üThe Company is more likely to sign this winter new contracts in Asia and export 30 -35% of output in 2013 (hence, raise output 31% in 2013 Yo. Y) üHigh quality of the Company’s reserves allows it to employ highly productive modern equipment and achieve high recovery rates. 2014 e 2015 e EBITDA margin Source: the Company data, MS Research and estimates Strictly confidential 1

Company profile ($mn) Revenue 2009 497 2010 706 2011 726 2012 E 577 2013 E 717 2014 E 884 EBIT Net Income EBITDA Margin (%) Net Margin (%) ROE (%) 163 90 51% 27% 10% 189 230 48% 26% 10% 189 57 46% 21% 11% 39 37 33% 6% 0% 156 106 38% 15% 10% 260 189 43% 21% 16% Coking coal price changes, Aust FOB The Company engaged in mining and transportation of coking coal. The Company’s coal production is 100% coking coal. 330 HCC, Aust FOB benchmark, USD/t 300 The Company specializes in production of cooking coal and operates on the domestic market. At the same time the Company sells its production to coke and chemical plants in Ukraine and metallurgical enterprises in Eastern Europe. The Company operates through more than 10 subsidiaries located in Russian Federation. 190 2011 2012 2013 2014 2015 2016 Old Forecast 2017 2018 The Company is one of the largest and most efficient coking coal producers in Russia. Coal output peaked in 2007 but has since slowed because of the drop in demand. Currently, the company operates three underground mines and an open pit. The Company’s M&I coking coal resources exceed 2 bnt. LT New Forecast Source: the Company data, VTB Capital Research 300 PV of FCF ($mn) 242 229 200 162 2014 E 2015 E The Company through operates on the domestic market, as well as sells its production to coke and chemical plants in Ukraine and metallurgical enterprises in Eastern Europe. The Company operates through 11 subsidiaries located in the Russian Federation. 167 105 100 0 2013 E 2016 E The company currently employs 7, 863. 2017 E PV of FCF Development strategy Production and EBITDA dynamics 2. 000 EBITDA, USDmn ROM coal, mntpa 1. 500 1. 000 500 0 2007 2008 2009 2010 Mine 3 Mine 2 Open Pit Source: the Company data, VTB Capital Research Strictly confidential 2011 2012 F Mine 1 2013 F EBITDA, rhs The Company’s strategic goal is to expand total production to 17 mn tonnes of raw coal pa. The Company is more likely to sign this winter new contracts in Asia and export 30 -35% of output in 2013 (hence, raise output 31% in 2013 Yo. Y). Russian Federation was adopted the program on the development of the coal industry up to 2030. So the Company adjusted its program phasing in line with this governmental program and it was adopted through relevant committee. 2

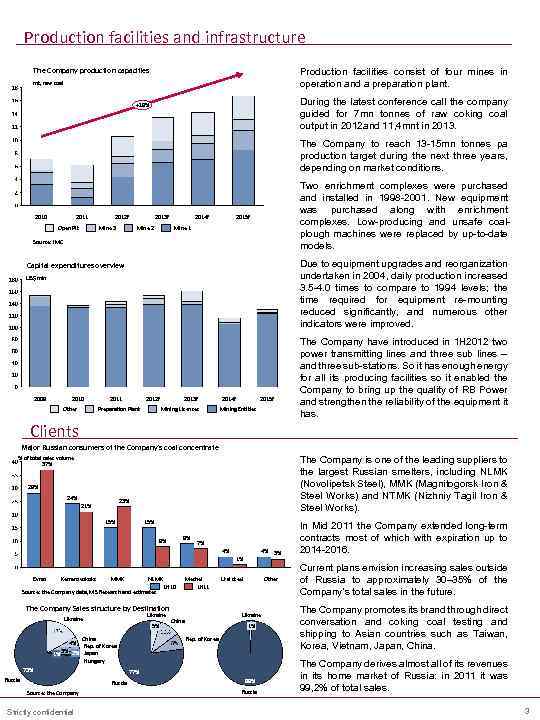

Production facilities and infrastructure The Company production capacities Production facilities consist of four mines in operation and a preparation plant. mt, raw coal During the latest conference call the company guided for 7 mn tonnes of raw coking coal output in 2012 and 11, 4 mnt in 2013. +19% The Company to reach 13 -15 mn tonnes pa production target during the next three years, depending on market conditions. 2010 2011 2012 F Mine 3 Open Pit 2013 F 2014 F Two enrichment complexes were purchased and installed in 1998 -2001. New equipment was purchased along with enrichment complexes. Low-producing and unsafe coalplough machines were replaced by up-to-date models. 2015 F Mine 1 Mine 2 Source: IMC Due to equipment upgrades and reorganization undertaken in 2004, daily production increased 3. 5 -4. 0 times to compare to 1994 levels; the time required for equipment re-mounting reduced significantly, and numerous other indicators were improved. Capital expenditures overview US$ mln 2009 2010 Other 2011 2012 F Preparation Plant 2013 F Mining Licences 2014 F 2015 F Mining Entities The Company have introduced in 1 H 2012 two power transmitting lines and three sub lines -and three sub-stations. So it has enough energy for all its producing facilities so it enabled the Company to bring up the quality of RB Power and strengthen the reliability of the equipment it has. Clients Major Russian consumers of the Company’s coal concentrate The Company is one of the leading suppliers to the largest Russian smelters, including NLMK (Novolipetsk Steel), MMK (Magnitogorsk Iron & Steel Works) and NTMK (Nizhniy Tagil Iron & Steel Works). % of total sales volume 37% 28% 24% 23% 21% 15% 9% 8% 7% 4% 4% 1% Evraz Kemerovokoks MMK NLMK Source: the Company data, MS Research and estimates 1 H 10 Mechel 1 H 11 The Company Sales structure by Destination Ukraine 5% China 4% Rep. of Korea 3% 2% Japan 1% Hungary 73% Russia Strictly confidential Other Ukraine China 1% Rep. of Korea 77% Russia Source: the Company Ural steel 3% 99% Russia In Mid 2011 the Company extended long-term contracts most of which with expiration up to 2014 -2016. Current plans envision increasing sales outside of Russia to approximately 30– 35% of the Company’s total sales in the future. The Company promotes its brand through direct conversation and coking coal testing and shipping to Asian countries such as Taiwan, Korea, Vietnam, Japan, China. The Company derives almost all of its revenues in its home market of Russia: in 2011 it was 99, 2% of total sales. 3

Disclaimer This teaser is made only for education purposes for IB Club by IB Club training group. The information contained in this document is intended to provide prospective readers (“the Recipient”) with a preliminary understanding of the investment opportunity. This teaser is not intended to form the basis of any investment decision or any decision to purchase any equity interests (or other interests), directly or indirectly, in the Projects. IB Club training group does not make any representation or warranty, either expresses as to the accuracy, completeness, reasonableness or reliability of the information contained in this teaser. IB Club training group expressly disclaims any and all liability for any direct or consequential losses relating or resulting from the use of this teaser. This teaser does not purport to be all-inclusive or to contain all of the information that the Recipient may require. No investment, divestment or other financial decisions or actions should be based on the information in this teaser. This teaser and the information contained herein are highly confidential and have been prepared solely for the educational usage. Distribution of this teaser to any person other than the Recipient, who agree to maintain the confidentiality of this material, is unauthorized. This material must not be copied, reproduced, distributed or passed to others at any time without the prior written consent of IB Club. By accepting the delivery of this presentation, you agree to the foregoing. All Rights Reserved. Contacts For more information regarding the investment opportunity please contact: Dmitry Kuzmenkov +7(916)446 67 69 dmitriy. kuzmenkov@gmail. com Pavel Kaptel +7(915)376 20 25 p. kaptel@gmail. com Vitaly Sivolobov +7(925)071 85 05 vasivolobov@mail. ru Igor Nazyrov +7(926)268 55 53 nazyrovi@gmail. com Dmitry Khristoforov +7(916)960 38 02 dmitrykh 92@gmail. com Strictly confidential 4

Teaser2.0.pptx