f7edfab074658c5852749a8299a231a2.ppt

- Количество слайдов: 24

Rural Banker 2000 (RB 2000) Banking Software

Outline t t t t Introduction and history of RB 2000 Development Major Characteristics RB 2000 Modules & Features BSP Reports BSP e. Reports Rollout Status Future Plans

Introduction & Brief History Of RB 2000 Development t t Main purpose and beneficiaries of RB 2000 People behind the RB 2000 development ASEC – RB 2000 developer Rollout companies

Major Characteristics t t t t Open Source Concept Windows-Based Client Server Technology LAN & WAN Capable Wizard Type “Menu-Driven” Setup & Installation Scalable and Portable Data Integrity (Real time Rollback & Commit - SQL) Online Context-Sensitive Help

Major Characteristics t t t t Client Information System Microfinance BSP Reports User-defined Information (Client & Deposit/Loan Account) Multi-currency capable ATM Connectivity/Interface Audit Trail

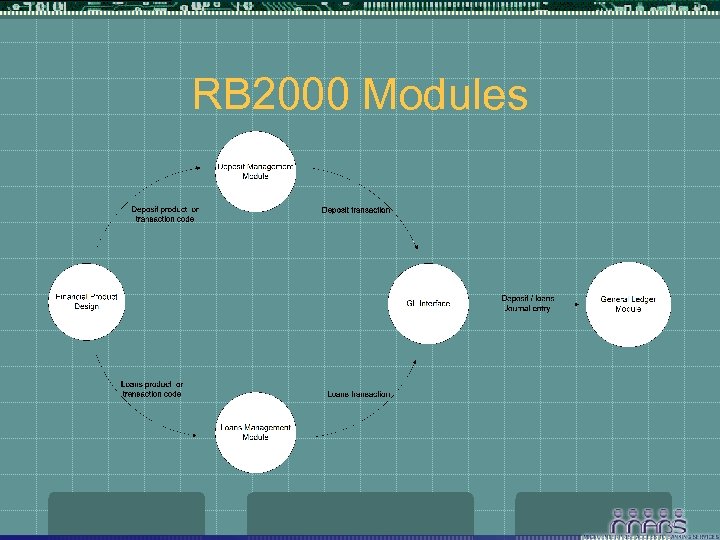

RB 2000 Modules

RB 2000 Features t Financial Product Design Module (FPD) – allows a bank to define their financial products t Customized Banking Products Based on the following: t Savings Account, t Current/NOW Account t Certificate of Time Deposit t Special Savings Deposit t Loan Product

RB 2000 Features t t t Flexible Deposit Interest Computation Parameterized Passbook/Ledger Form Printing User-defined Depositor Type Maintaining Balance Parameterized Bank Charges/Penalties (Deposit & Loan) User-defined Loan Amortization Type User-defined Loan Notices Printing

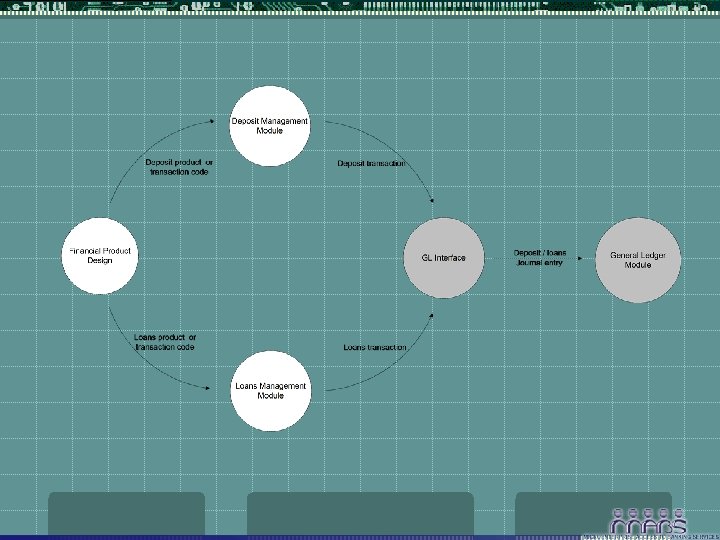

RB 2000 Features t Deposit Management Module (DMM) – allows the effective and efficient administration of deposit products t t t t t Tellering Transactions Back-Office Transactions Inter-Branch Transactions Miscellaneous Transactions Vault, Cashier & Tellers Cash Transferring With Auto-Debit Arrangement Facilities User-defined Deposit Amount Sizing Online Picture & Signature Verification ATM Connectivity ready

RB 2000 Features t Loan Management Module (LMM) – allows Loan Officers and Managers to process transactions such as loan applications and disbursements, and generate loan reports t With Loan Application Processing Monitoring t BSP Loan Classification/Categorization t User-defined Loan Classification/Categorization t Customized Loan Packages offering t With facility to input notes/memos per Loan Account t Accepts Other Charges Transactions t Individual & Group Loans (Microfinance)

RB 2000 Features t General Ledger Interface Module (GLI) – integrates the General Ledger with the Deposit and Loan Management Modules t Deposit Products Transaction Codes GLI Template t Miscellaneous Products Transaction Codes GLI Template t Loan Products Transaction Codes GLI Template

RB 2000 Features t General Ledger Module (GLM) – which records journal entries of bank transactions that occur during the day and allows the printing of various management and Bangko Sentral ng Pilipinas (BSP) required reports t Fully parameterized chart of account maintenance t Parameterized BSP report formatting t Electronic reporting aside from the conventional way t Integrated with deposit and/or loans

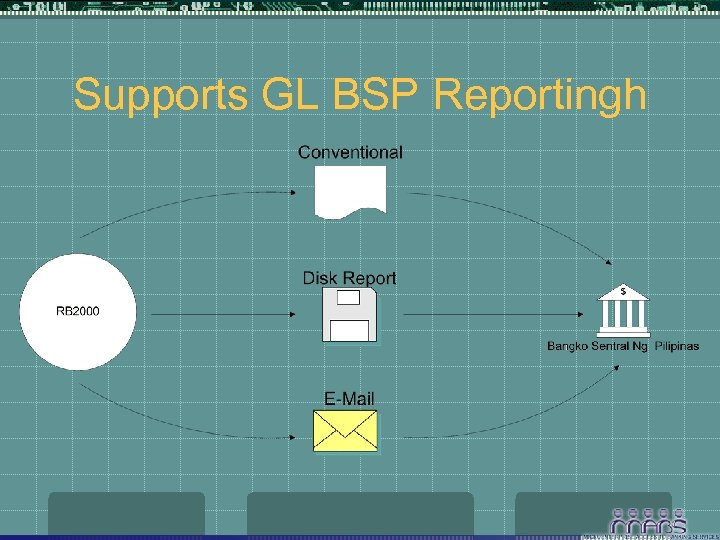

Supports GL BSP Reportingh

BSP Reports - Deposit t Deposit Liabilities Classified as to Source Deposit Liabilities By Size Of Account Schedule of Time Certificate of Deposit by Maturity and Interest Rate

BSP Reports - Loans t t t Schedule of Loan Portfolio and Other Accommodation Report of Compliance with Aggregate Ceiling (DOSRI) Summary Report of Loans Granted

BSP Reports - Loans t t Loan Mapping Worksheet Loans-To-Deposit Ratio Supplementary Information

BSP Reports - GL t t t Statement of Condition Statement of Income and Expense Schedule of Due From Other Banks Schedule of Investments in Bonds and Other Accommodations Schedule of Equity Investment

BSP Reports - GL t t t Schedule of Bills Payable Condensed Statement of Condition Daily Report of Condition Weekly Report of Required and Available Reserves Schedule of Fixed and Other Assets List Of Stockholders and Their Stockholdings

BSP e-Reports t t t General Ledger (Annex D) Accounts Receivable Bills Payable Contingent Account Deposit Liability Equity Investment

BSP e-Reports t t Due From HOBA Investment Subsidiary Stockholder Subsidiary Various Liabilities

BSP Report Testing Status t GL/SL Diskette Reporting t t Actions Taken Copy of Communications

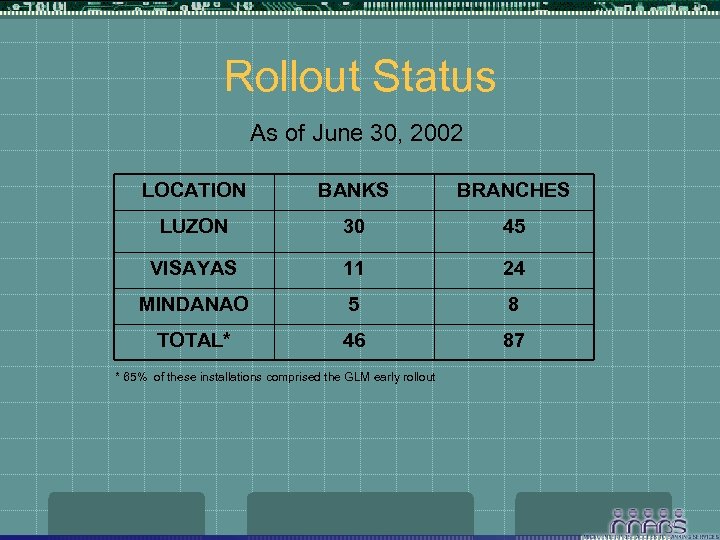

Rollout Status As of June 30, 2002 LOCATION BANKS BRANCHES LUZON 30 45 VISAYAS 11 24 MINDANAO 5 8 TOTAL* 46 87 * 65% of these installations comprised the GLM early rollout

Future Plans t t Personal Digital Assistant (PDA) Interface BSP Additional Reports as of July 1, 2002

f7edfab074658c5852749a8299a231a2.ppt