429f75358b344520009a3debbad95b69.ppt

- Количество слайдов: 22

Rural and Agricultural Lending Bob Price FINCA International

l Overview of Microfinance l FINCA: Village Banking and Rural Applications l Case Studies: Rural Microfinance l The Frontier: New Directions & Products

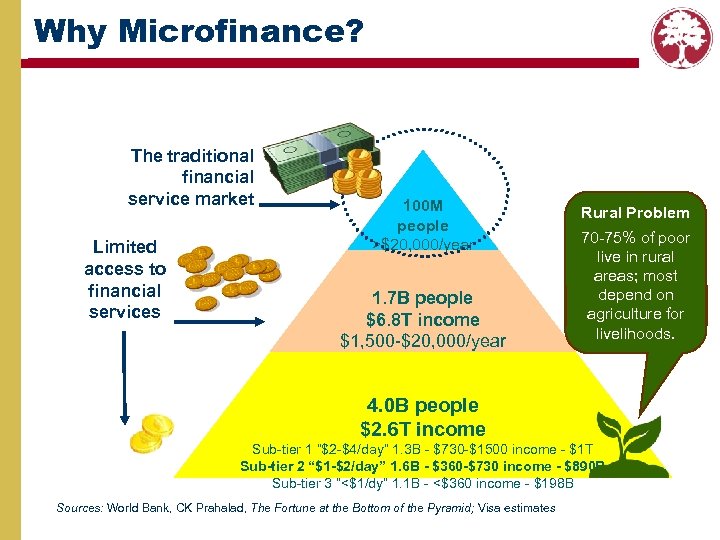

Why Microfinance? The traditional financial service market Limited access to financial services 100 M people >$20, 000/year 1. 7 B people $6. 8 T income $1, 500 -$20, 000/year Rural Problem 70 -75% of poor live in rural areas; most depend on agriculture for livelihoods. 4. 0 B people $2. 6 T income Sub-tier 1 “$2 -$4/day” 1. 3 B - $730 -$1500 income - $1 T Sub-tier 2 “$1 -$2/day” 1. 6 B - $360 -$730 income - $890 B Sub-tier 3 “<$1/dy” 1. 1 B - <$360 income - $198 B Sources: World Bank, CK Prahalad, The Fortune at the Bottom of the Pyramid; Visa estimates

How Finance Helps Access to financial services Increases & diversifies income Builds assets & security EMPOWERS WOMEN Builds confidence in the future and willingness to make long-term investments

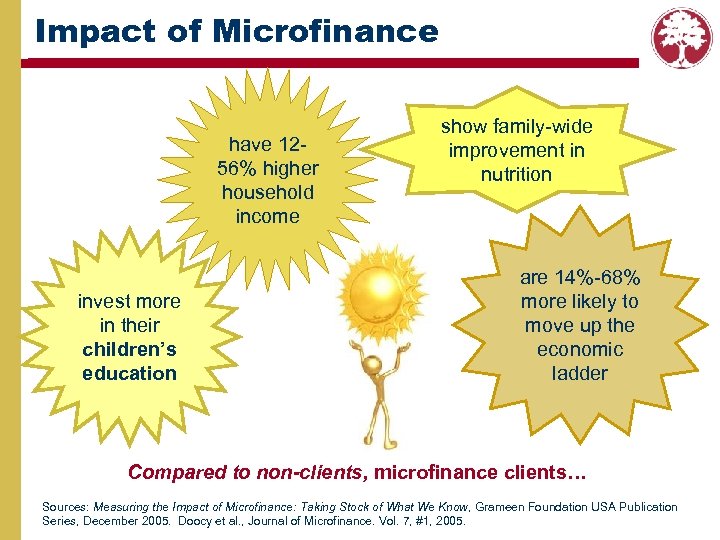

Impact of Microfinance have 1256% higher household income invest more in their children’s education show family-wide improvement in nutrition are 14%-68% more likely to move up the economic ladder Compared to non-clients, microfinance clients… Sources: Measuring the Impact of Microfinance: Taking Stock of What We Know, Grameen Foundation USA Publication Series, December 2005. Doocy et al. , Journal of Microfinance. Vol. 7, #1, 2005.

l Overview of Microfinance l FINCA: Village Banking and Rural Applications l Case Studies: Rural Microfinance l The Frontier: New Directions & Products

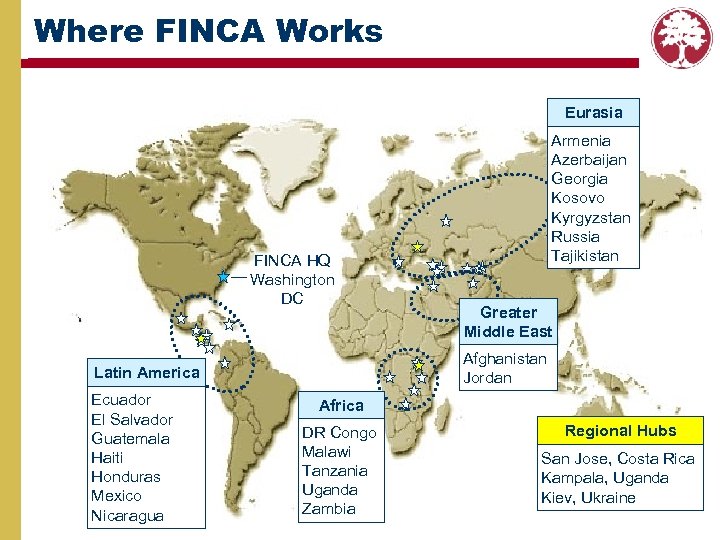

Where FINCA Works Eurasia FINCA HQ Washington DC Greater Middle East Afghanistan Jordan Latin America Ecuador El Salvador Guatemala Haiti Honduras Mexico Nicaragua Armenia Azerbaijan Georgia Kosovo Kyrgyzstan Russia Tajikistan Africa DR Congo Malawi Tanzania Uganda Zambia Regional Hubs San Jose, Costa Rica Kampala, Uganda Kiev, Ukraine

Profile of FINCA’s Clients l 70% of clients are women l 20 -50 years old l Support five family members plus other relatives, neighbors and orphans l Typical Businesses – – Rural clients: smallholder farmers, animal husbandry, agricultural marketers, food processors, etc. Urban clients: street vendors, service providers, artisans, etc

FINCA’s Products l Credit – – Village Banking (i. e. , group loans) Individual Rural Loan Product Housing, etc. l Savings l Insurance – – – l Credit Life Accident Health Remittances

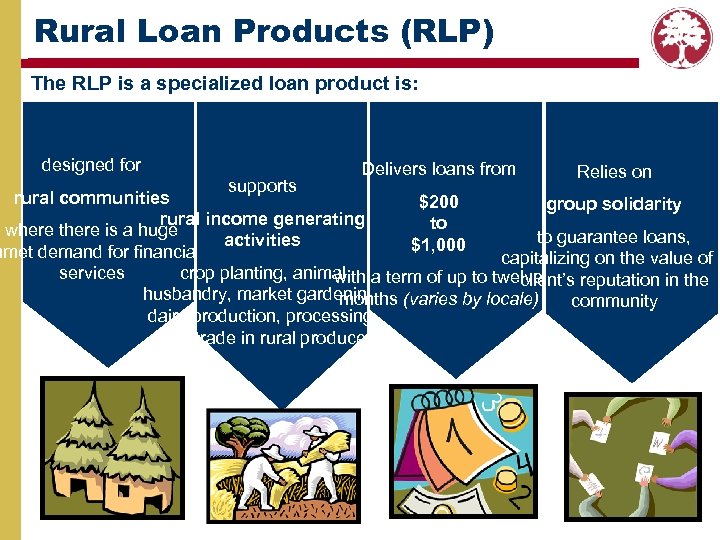

Rural Loan Products (RLP) The RLP is a specialized loan product is: designed for Delivers loans from Relies on supports rural communities $200 group solidarity rural income generating to where there is a huge to guarantee loans, activities $1, 000 nmet demand for financial capitalizing on the value of a crop planting, animal a term of up to twelve services with client’s reputation in the husbandry, market gardening, (varies by locale) months community dairy production, processing, and trade in rural produce

Traditional Agricultural Lending staple crop production • Finances a specific commodity or growing activity. • High risk for client and lending institution.

FINCA Rural Loan Product trade income staple crop production market gardening salaries services income pensions dairy production and sale remittances • Analyzes all income streams. • Constructs a suitable loan treating the rural household as an integrated economic unit.

l Overview of Microfinance l FINCA: Village Banking and Rural Applications l Case Studies: Rural Microfinance l The Frontier: New Directions & Products

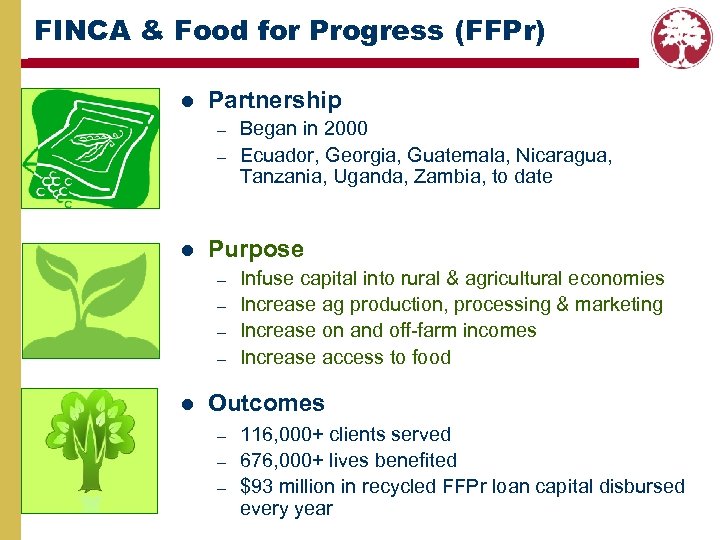

FINCA & Food for Progress (FFPr) l Partnership – – l Purpose – – l Began in 2000 Ecuador, Georgia, Guatemala, Nicaragua, Tanzania, Uganda, Zambia, to date Infuse capital into rural & agricultural economies Increase ag production, processing & marketing Increase on and off-farm incomes Increase access to food Outcomes – – – 116, 000+ clients served 676, 000+ lives benefited $93 million in recycled FFPr loan capital disbursed every year

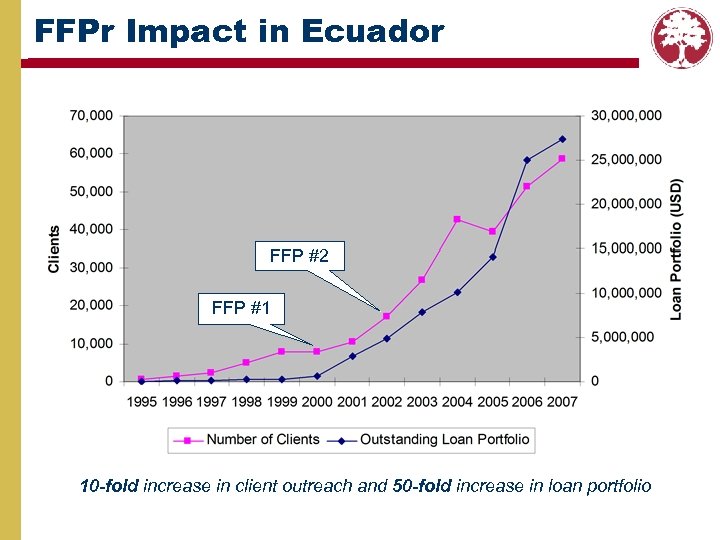

FFPr Impact in Ecuador FFP #2 FFP #1 10 -fold increase in client outreach and 50 -fold increase in loan portfolio

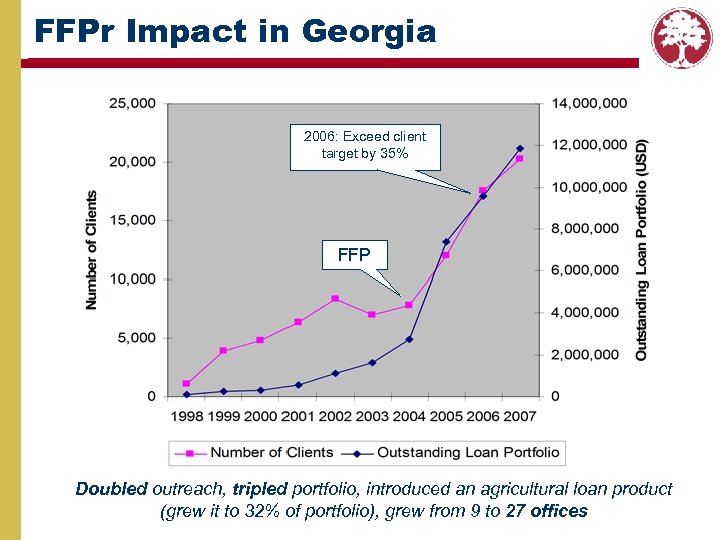

FFPr Impact in Georgia 2006: Exceed client target by 35% FFP Doubled outreach, tripled portfolio, introduced an agricultural loan product (grew it to 32% of portfolio), grew from 9 to 27 offices

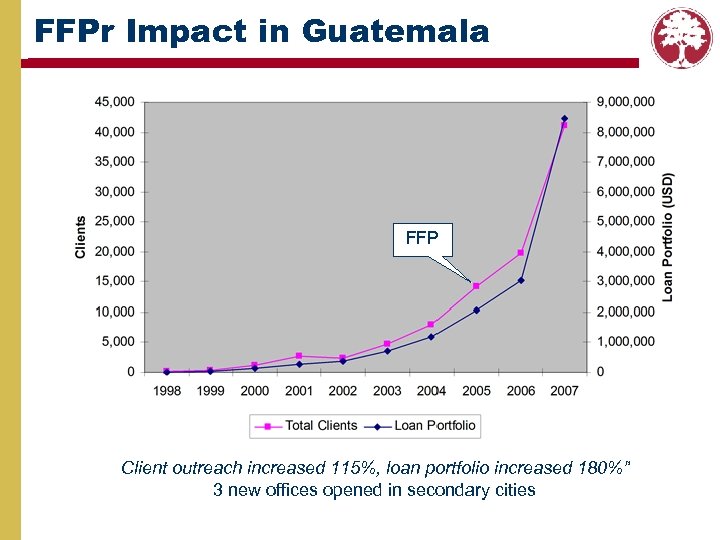

FFPr Impact in Guatemala FFP Client outreach increased 115%, loan portfolio increased 180%” 3 new offices opened in secondary cities

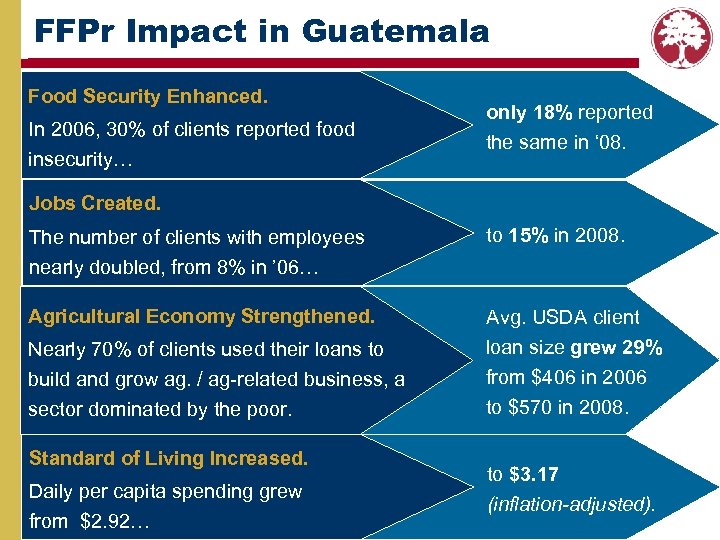

FFPr Impact in Guatemala Food Security Enhanced. In 2006, 30% of clients reported food insecurity… only 18% reported the same in ‘ 08. Jobs Created. The number of clients with employees to 15% in 2008. nearly doubled, from 8% in ’ 06… Agricultural Economy Strengthened. Nearly 70% of clients used their loans to build and grow ag. / ag-related business, a sector dominated by the poor. Standard of Living Increased. Daily per capita spending grew from $2. 92… Avg. USDA client loan size grew 29% from $406 in 2006 to $570 in 2008. to $3. 17 (inflation-adjusted).

l Overview of Microfinance l FINCA: Village Banking and Rural Applications l Case Studies: Rural Microfinance l The Frontier: New Directions & Products

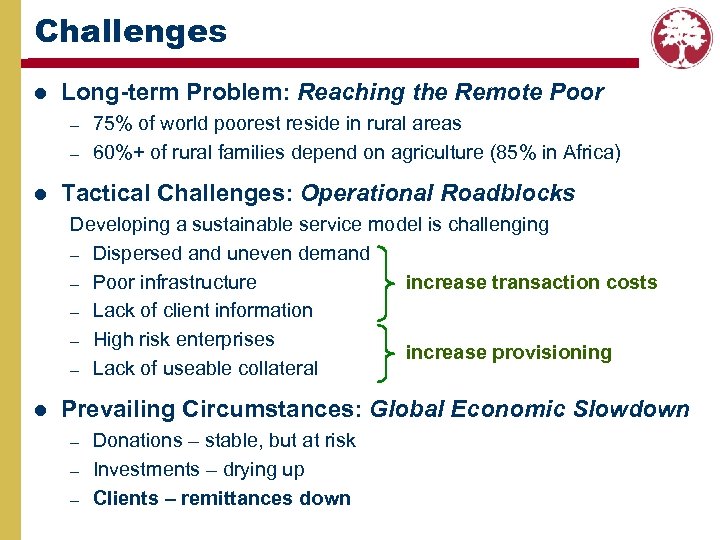

Challenges l Long-term Problem: Reaching the Remote Poor – – l 75% of world poorest reside in rural areas 60%+ of rural families depend on agriculture (85% in Africa) Tactical Challenges: Operational Roadblocks Developing a sustainable service model is challenging – Dispersed and uneven demand – Poor infrastructure increase transaction costs – Lack of client information – High risk enterprises increase provisioning – Lack of useable collateral l Prevailing Circumstances: Global Economic Slowdown – – – Donations – stable, but at risk Investments – drying up Clients – remittances down

Future Directions & Innovations l Build Safety Nets to Enhance Resilience – l savings, insurance, targeted loan products (e. g. , micro-energy) Deploy Technology (mobile phones, ATMs, Po. S) – expand to un-served rural areas – reduce human resource costs – improve availability of client information (performance / risk) l Build Partnerships & Strengthen Existing Mechanisms – provide credit to the dairy value chain (outgrowth of FFPr activity in Zambia)

Thank You

429f75358b344520009a3debbad95b69.ppt