b295ab7590d338b574ec9073112ce398.ppt

- Количество слайдов: 133

Rulings and Cases Chapter 17 pp. 571 -646 2016 National Income Tax Workbook™

Rulings and Cases Chapter 17 pp. 571 -646 2016 National Income Tax Workbook™

Rulings and Cases 571 -572 § Court cases § Treasury regulations § Revenue procedures § IRS rulings § IRS notices § Chief counsel advice pp.

Rulings and Cases 571 -572 § Court cases § Treasury regulations § Revenue procedures § IRS rulings § IRS notices § Chief counsel advice pp.

p. 573 Substantial Authority § 20% accuracy-related penalty for substantial understatement of tax § Exceptions: 1. “Substantial authority” for position 2. Adequate disclosure on return, with “reasonable basis” for position

p. 573 Substantial Authority § 20% accuracy-related penalty for substantial understatement of tax § Exceptions: 1. “Substantial authority” for position 2. Adequate disclosure on return, with “reasonable basis” for position

p. 573 Reasonable Basis § Less stringent standard § Some authority exists even if weight of contrary authority is greater § Disclosure required to avoid penalty for substantially understating tax if the IRS proposes a deficiency and wins in court

p. 573 Reasonable Basis § Less stringent standard § Some authority exists even if weight of contrary authority is greater § Disclosure required to avoid penalty for substantially understating tax if the IRS proposes a deficiency and wins in court

pp. 574 -582 Substantial Authority § Do not have to believe there is > 50% chance of winning case § Substantial authority can exist for more than one position relating to same item § Code, regulations (including proposed), IRS releases, federal court cases, treaties, congressional reports. . .

pp. 574 -582 Substantial Authority § Do not have to believe there is > 50% chance of winning case § Substantial authority can exist for more than one position relating to same item § Code, regulations (including proposed), IRS releases, federal court cases, treaties, congressional reports. . .

pp. 580 -581 Jurisdiction § Tax Court has jurisdiction over all of the US § Circuit court of appeals decisions bind only a geographic area (Figure 17. 5) § Taxpayers living outside circuit still can (and must) consider opinions in determining substantial authority

pp. 580 -581 Jurisdiction § Tax Court has jurisdiction over all of the US § Circuit court of appeals decisions bind only a geographic area (Figure 17. 5) § Taxpayers living outside circuit still can (and must) consider opinions in determining substantial authority

A Word of Caution § This chapter contains short summaries. Be sure to read the complete text of a case, ruling, notice, or regulation before using as authority for a return position.

A Word of Caution § This chapter contains short summaries. Be sure to read the complete text of a case, ruling, notice, or regulation before using as authority for a return position.

p. 583 ACA Prop. Regs. §§ 1. 36 B-2, -3, -5 § Tax years > 12/31/16 but TPs may rely on some provisions for years > 12/31/13 § Recklessly gives false info to Exchange 1. If final HHI < 100% not treated as applicable TP 2. Gives bad info to make ineligible for Medicaid, CHIP, etc → treated as eligible

p. 583 ACA Prop. Regs. §§ 1. 36 B-2, -3, -5 § Tax years > 12/31/16 but TPs may rely on some provisions for years > 12/31/13 § Recklessly gives false info to Exchange 1. If final HHI < 100% not treated as applicable TP 2. Gives bad info to make ineligible for Medicaid, CHIP, etc → treated as eligible

p. 583 ACA Prop. Regs. §§ 1. 36 B-2, -3, -5 3. Nonappropriated Fund Health Benefits Program treated as ER program 4. If declines ER coverage one year & not given chance to enroll the next, treated as ineligible for ER coverage 5. If offered only excepted benefits, PTC o. k. with Marketplace insurance 6. Expand/clarify opt-out arrangements

p. 583 ACA Prop. Regs. §§ 1. 36 B-2, -3, -5 3. Nonappropriated Fund Health Benefits Program treated as ER program 4. If declines ER coverage one year & not given chance to enroll the next, treated as ineligible for ER coverage 5. If offered only excepted benefits, PTC o. k. with Marketplace insurance 6. Expand/clarify opt-out arrangements

pp. 583 -584 ACA Prop. Regs. §§ 1. 36 B-2, -3, -5 7. Rules for when Exchange delays in stopping APTC after TP stop request 8. APTC eligible after appeal, retroactive enrollment, covered for a month if pays by 120 days after appeal decision 9. PTC/month lesser of: § Premium reduced by any refund § SLCSP over contribution amount

pp. 583 -584 ACA Prop. Regs. §§ 1. 36 B-2, -3, -5 7. Rules for when Exchange delays in stopping APTC after TP stop request 8. APTC eligible after appeal, retroactive enrollment, covered for a month if pays by 120 days after appeal decision 9. PTC/month lesser of: § Premium reduced by any refund § SLCSP over contribution amount

p. 584 ACA Prop. Regs. §§ 1. 36 B-2, -3, -5 10. APTC reconciled by one who attests to the intention to claim exemption 11. Multiple families in single QHP with APTC, 1095 -A premiums = allocable prem. share based on SLCSP share 12. Full month SLCSP if terminate midmo. or if enroll mid-month due to birth, adoption, foster, court order date

p. 584 ACA Prop. Regs. §§ 1. 36 B-2, -3, -5 10. APTC reconciled by one who attests to the intention to claim exemption 11. Multiple families in single QHP with APTC, 1095 -A premiums = allocable prem. share based on SLCSP share 12. Full month SLCSP if terminate midmo. or if enroll mid-month due to birth, adoption, foster, court order date

p. 584 ACA Prop. Regs. §§ 1. 36 B-2, -3, -5 13. Regs changed to make specific form references: 1095 -B, 1095 -C

p. 584 ACA Prop. Regs. §§ 1. 36 B-2, -3, -5 13. Regs changed to make specific form references: 1095 -B, 1095 -C

p. 585 Brinks Gilson & Lione v Comm § § § Excessive comp: comp vs dividend Allocated all of book income to comp Closing agreement for deduction Appeal of accuracy-related penalty TP cases not applicable No substantial authority = penalty

p. 585 Brinks Gilson & Lione v Comm § § § Excessive comp: comp vs dividend Allocated all of book income to comp Closing agreement for deduction Appeal of accuracy-related penalty TP cases not applicable No substantial authority = penalty

pp. 585 -586 Richard Schiffmann v Comm § CEO & CFO aware of unpaid emp taxes § Wrote checks for other creditors with loans and investment $$ § IRS sought recovery from CEO & CFO § Main factor: extent of decision-making authority § Court: Willfully failed to pay emp. Trust fund taxes → personally liable

pp. 585 -586 Richard Schiffmann v Comm § CEO & CFO aware of unpaid emp taxes § Wrote checks for other creditors with loans and investment $$ § IRS sought recovery from CEO & CFO § Main factor: extent of decision-making authority § Court: Willfully failed to pay emp. Trust fund taxes → personally liable

pp. 586 -587 Rev. Proc. 2016 -40 § Examples of distributions of controlled corp stock to distributing corp SHs - no challenge for lacking substance § Applicable transactions: p. 586 § If transaction under a safe harbor 1. No action taken within 24 months 2. Unanticipated third-party transaction

pp. 586 -587 Rev. Proc. 2016 -40 § Examples of distributions of controlled corp stock to distributing corp SHs - no challenge for lacking substance § Applicable transactions: p. 586 § If transaction under a safe harbor 1. No action taken within 24 months 2. Unanticipated third-party transaction

pp. 587 -588 Letter Ruling 2016 -23 -013 § Unincorporated association to maintain private common driveway to 4 homes § Account to make payments § Revenue from fee assessments § Formed for benefit of members, does not meet requirements for a community → cannot be a 501(c)(4)

pp. 587 -588 Letter Ruling 2016 -23 -013 § Unincorporated association to maintain private common driveway to 4 homes § Account to make payments § Revenue from fee assessments § Formed for benefit of members, does not meet requirements for a community → cannot be a 501(c)(4)

pp. 588 -590 CCA Letter 2016 -06 -027 § Issue 1: PN guarantees qualified nonrecourse debt if PS states in writing unable to pay – no longer qualified nonrecourse for § 752? § Ruling: Debt is no longer qualified nonrecourse debt

pp. 588 -590 CCA Letter 2016 -06 -027 § Issue 1: PN guarantees qualified nonrecourse debt if PS states in writing unable to pay – no longer qualified nonrecourse for § 752? § Ruling: Debt is no longer qualified nonrecourse debt

pp. 588 -590 CCA Letter 2016 -06 -027 § Issue 2: PS in business of acquiring, renovating, and maintaining hotels w/o part in day-to-day operations – “activity of holding real property” for § 465(b)(6)? § Ruling: Yes, PS is engaged in activity of holding real property

pp. 588 -590 CCA Letter 2016 -06 -027 § Issue 2: PS in business of acquiring, renovating, and maintaining hotels w/o part in day-to-day operations – “activity of holding real property” for § 465(b)(6)? § Ruling: Yes, PS is engaged in activity of holding real property

pp. 588 -590 CCA Letter 2016 -06 -027 § Issue 3: If PN guarantees PS qualified non-recourse debt can nonguaranteeing PNs treat debt as qualified non-rec. ? § Ruling: If the guarantee is bona fide and enforceable by creditors, the debt is no longer qualified non-recourse debt.

pp. 588 -590 CCA Letter 2016 -06 -027 § Issue 3: If PN guarantees PS qualified non-recourse debt can nonguaranteeing PNs treat debt as qualified non-rec. ? § Ruling: If the guarantee is bona fide and enforceable by creditors, the debt is no longer qualified non-recourse debt.

pp. 588 -590 CCA Letter 2016 -06 -027 § Issue 4: PS agreement: if guar PN pays § Make other PN’s contribute capital or § Ratable portions = loans to other PNs Nonguarantee’g PNs personally liable? § Ruling: Not sufficient to make nonguaranteeing PNs personally liable

pp. 588 -590 CCA Letter 2016 -06 -027 § Issue 4: PS agreement: if guar PN pays § Make other PN’s contribute capital or § Ratable portions = loans to other PNs Nonguarantee’g PNs personally liable? § Ruling: Not sufficient to make nonguaranteeing PNs personally liable

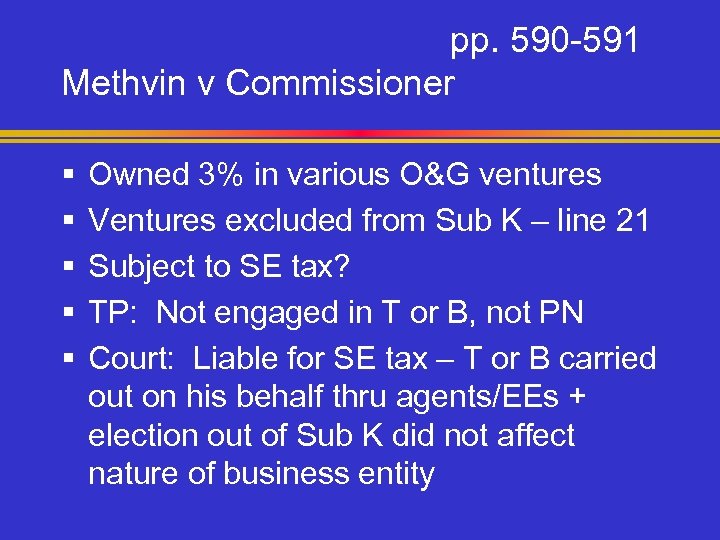

pp. 590 -591 Methvin v Commissioner § § § Owned 3% in various O&G ventures Ventures excluded from Sub K – line 21 Subject to SE tax? TP: Not engaged in T or B, not PN Court: Liable for SE tax – T or B carried out on his behalf thru agents/EEs + election out of Sub K did not affect nature of business entity

pp. 590 -591 Methvin v Commissioner § § § Owned 3% in various O&G ventures Ventures excluded from Sub K – line 21 Subject to SE tax? TP: Not engaged in T or B, not PN Court: Liable for SE tax – T or B carried out on his behalf thru agents/EEs + election out of Sub K did not affect nature of business entity

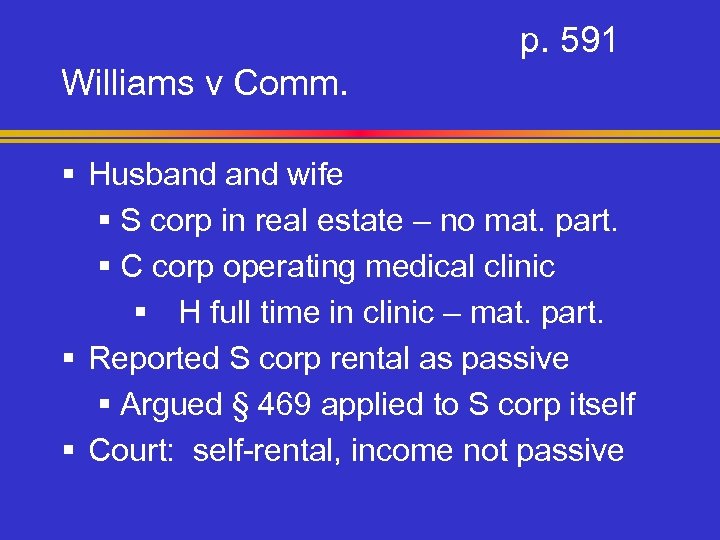

p. 591 Williams v Comm. § Husband wife § S corp in real estate – no mat. part. § C corp operating medical clinic § H full time in clinic – mat. part. § Reported S corp rental as passive § Argued § 469 applied to S corp itself § Court: self-rental, income not passive

p. 591 Williams v Comm. § Husband wife § S corp in real estate – no mat. part. § C corp operating medical clinic § H full time in clinic – mat. part. § Reported S corp rental as passive § Argued § 469 applied to S corp itself § Court: self-rental, income not passive

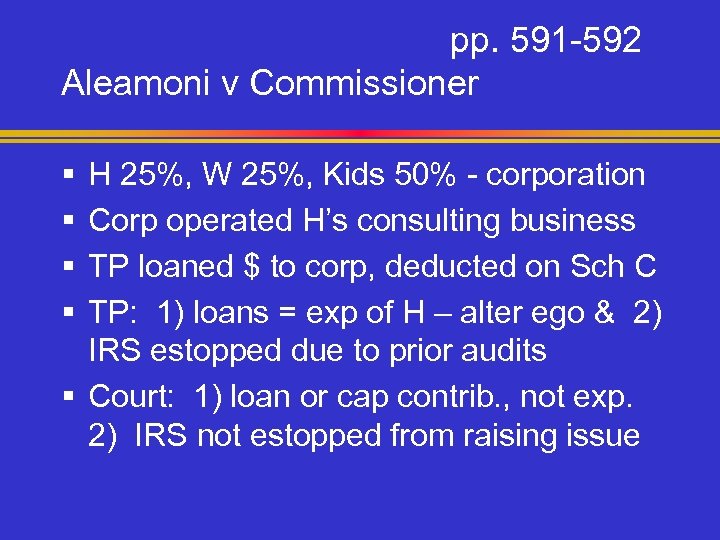

pp. 591 -592 Aleamoni v Commissioner § § H 25%, W 25%, Kids 50% - corporation Corp operated H’s consulting business TP loaned $ to corp, deducted on Sch C TP: 1) loans = exp of H – alter ego & 2) IRS estopped due to prior audits § Court: 1) loan or cap contrib. , not exp. 2) IRS not estopped from raising issue

pp. 591 -592 Aleamoni v Commissioner § § H 25%, W 25%, Kids 50% - corporation Corp operated H’s consulting business TP loaned $ to corp, deducted on Sch C TP: 1) loans = exp of H – alter ego & 2) IRS estopped due to prior audits § Court: 1) loan or cap contrib. , not exp. 2) IRS not estopped from raising issue

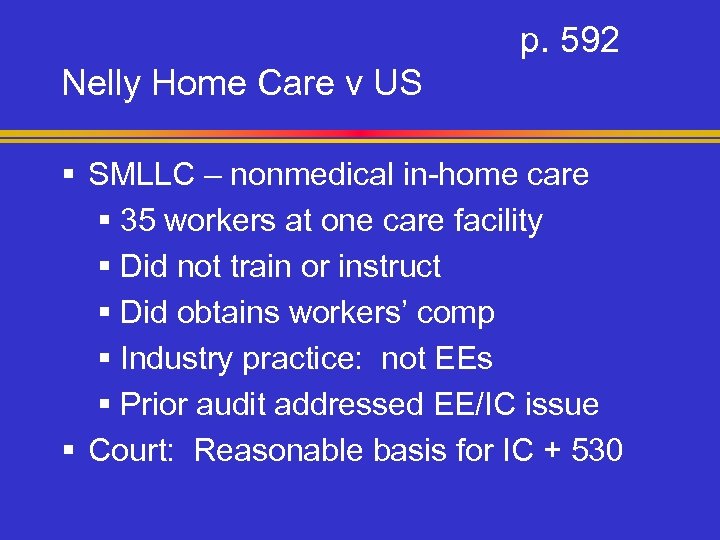

p. 592 Nelly Home Care v US § SMLLC – nonmedical in-home care § 35 workers at one care facility § Did not train or instruct § Did obtains workers’ comp § Industry practice: not EEs § Prior audit addressed EE/IC issue § Court: Reasonable basis for IC + 530

p. 592 Nelly Home Care v US § SMLLC – nonmedical in-home care § 35 workers at one care facility § Did not train or instruct § Did obtains workers’ comp § Industry practice: not EEs § Prior audit addressed EE/IC issue § Court: Reasonable basis for IC + 530

p. 593 Udeobong v Commissioner § Medical supply company – cash basis § 2005 insurance reimb. returned < 2010 § 2010: settlement pay from ins. Comp. to pay returned amounts § TP: not 2010 income, already taxed § Court: § 1341 – deduction for repaym’t, in 2010, payment = income

p. 593 Udeobong v Commissioner § Medical supply company – cash basis § 2005 insurance reimb. returned < 2010 § 2010: settlement pay from ins. Comp. to pay returned amounts § TP: not 2010 income, already taxed § Court: § 1341 – deduction for repaym’t, in 2010, payment = income

pp. 593 -594 H. W. Johnson v Commissioner § Family owned – construction business § Mother 51%, 2 sons 24. 5% each § Sons paid 2003: $4 M+, 2004, $7. 3 M+ § Part disallowed as > industry standard § Successful in managing expansion § Court: Hypothetical investor test – 10% return of equity met – comp o. k.

pp. 593 -594 H. W. Johnson v Commissioner § Family owned – construction business § Mother 51%, 2 sons 24. 5% each § Sons paid 2003: $4 M+, 2004, $7. 3 M+ § Part disallowed as > industry standard § Successful in managing expansion § Court: Hypothetical investor test – 10% return of equity met – comp o. k.

p. 594 Letter Ruling 2016 -17 -002 § Business property condemned – eminent domain for highway expansion § Relocation payments used for relocate and replace equipment not moveable § Taxable? § Ruling: 1) No taxable income, 2) no deduction to extent of payments used, 3) no basis to extent of payments used

p. 594 Letter Ruling 2016 -17 -002 § Business property condemned – eminent domain for highway expansion § Relocation payments used for relocate and replace equipment not moveable § Taxable? § Ruling: 1) No taxable income, 2) no deduction to extent of payments used, 3) no basis to extent of payments used

pp. 594 -595 In re Medley § Involuntary chapter 7: Nov & Dec 2013 § Orders of relief filed in Jan & Feb 2014 – effective date of filing § No election to close debtors’ tax years § S corp 2014 K-1’s – Who is taxed? § Court: Filing before end of S tax year, income flows to estate not debtors

pp. 594 -595 In re Medley § Involuntary chapter 7: Nov & Dec 2013 § Orders of relief filed in Jan & Feb 2014 – effective date of filing § No election to close debtors’ tax years § S corp 2014 K-1’s – Who is taxed? § Court: Filing before end of S tax year, income flows to estate not debtors

pp. 595 -596 Letter Ruling 2016 -11 -007 § § § Parent corp of 2 subsidiaries EEs of subs transferred to new corp Substantially all assets to new corp Is new corp successor ER for emp tax? Ruling: Yes 1) All property acquired, 2) Successor employs one from former & 3) Wages in year of acquisition

pp. 595 -596 Letter Ruling 2016 -11 -007 § § § Parent corp of 2 subsidiaries EEs of subs transferred to new corp Substantially all assets to new corp Is new corp successor ER for emp tax? Ruling: Yes 1) All property acquired, 2) Successor employs one from former & 3) Wages in year of acquisition

p. 596 Ryther v Commissioner § § § Solely owned corp – steel fabricating Corp liquidated in chapter 7 Bank. estate abandoned steel scrap TP sold scrap over 7 yrs, 2/month Reported as misc – no SE tax Court: No SE income, not a T or B

p. 596 Ryther v Commissioner § § § Solely owned corp – steel fabricating Corp liquidated in chapter 7 Bank. estate abandoned steel scrap TP sold scrap over 7 yrs, 2/month Reported as misc – no SE tax Court: No SE income, not a T or B

pp. 596 -597 Peterson v Commissioner § IC sold cosmetics – commissions from sales of TP and downline sales § Retirement pay based on average commissions year before retirement § Retirement pay = SE income? § Court: Yes, subject to SE tax § Deferred comp based on income prior to retirement

pp. 596 -597 Peterson v Commissioner § IC sold cosmetics – commissions from sales of TP and downline sales § Retirement pay based on average commissions year before retirement § Retirement pay = SE income? § Court: Yes, subject to SE tax § Deferred comp based on income prior to retirement

p. 597 Hess v Commissioner § § § H&W – Amway distributorship H: Full-time software manager No business plan (other than Amway’s) Receipts for expenses, no sales records Court; Not operated w/profit intent - not in businesslike manner, no expertise, no advise outside Amway, never a profit

p. 597 Hess v Commissioner § § § H&W – Amway distributorship H: Full-time software manager No business plan (other than Amway’s) Receipts for expenses, no sales records Court; Not operated w/profit intent - not in businesslike manner, no expertise, no advise outside Amway, never a profit

pp. 597 -598 Delia v Commissioner § Employed full-time + hair braiding bus. § Mall – evenings & weekends § Never produced a profit § Maintained separate records § Made attempts to increase customers § Court: Had intent to make a profit (only negative factor was lack of profit)

pp. 597 -598 Delia v Commissioner § Employed full-time + hair braiding bus. § Mall – evenings & weekends § Never produced a profit § Maintained separate records § Made attempts to increase customers § Court: Had intent to make a profit (only negative factor was lack of profit)

p. 598 Roberts v Commissioner § Horse breeding/racing 2005 -2008 § IRS disallowed losses in all four years § Court: Losses allowable 1) businesslike manner, 2) advice of experts, 3) significant time spent, 4) appreciation expectation, 5) other successes, 6) losses beyond his control, 7) not much pleasure/recreat.

p. 598 Roberts v Commissioner § Horse breeding/racing 2005 -2008 § IRS disallowed losses in all four years § Court: Losses allowable 1) businesslike manner, 2) advice of experts, 3) significant time spent, 4) appreciation expectation, 5) other successes, 6) losses beyond his control, 7) not much pleasure/recreat.

pp. 598 -599 Letter Ruling 2016 -19 -003 § Facts: § Farmer’s cooperative implemented an online patronage application § Issue: § Does the online application constitute a valid “consent in writing” under I. R. C. § 1388(c)(2)(A)?

pp. 598 -599 Letter Ruling 2016 -19 -003 § Facts: § Farmer’s cooperative implemented an online patronage application § Issue: § Does the online application constitute a valid “consent in writing” under I. R. C. § 1388(c)(2)(A)?

pp. 598 -599 Letter Ruling 2016 -19 -003 Continued § Analysis: § No special form is required for consent as long as it adequately discloses terms § Ruling: § Online application is a signed written document

pp. 598 -599 Letter Ruling 2016 -19 -003 Continued § Analysis: § No special form is required for consent as long as it adequately discloses terms § Ruling: § Online application is a signed written document

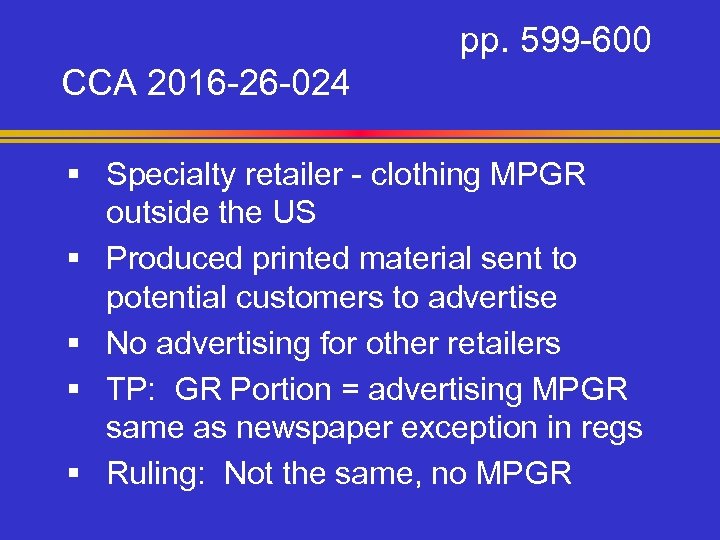

pp. 599 -600 CCA 2016 -26 -024 § Specialty retailer - clothing MPGR outside the US § Produced printed material sent to potential customers to advertise § No advertising for other retailers § TP: GR Portion = advertising MPGR same as newspaper exception in regs § Ruling: Not the same, no MPGR

pp. 599 -600 CCA 2016 -26 -024 § Specialty retailer - clothing MPGR outside the US § Produced printed material sent to potential customers to advertise § No advertising for other retailers § TP: GR Portion = advertising MPGR same as newspaper exception in regs § Ruling: Not the same, no MPGR

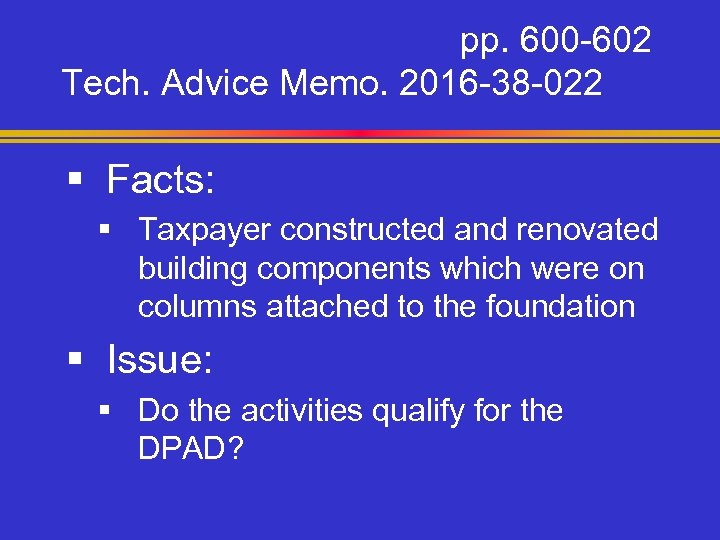

pp. 600 -602 Tech. Advice Memo. 2016 -38 -022 § Facts: § Taxpayer constructed and renovated building components which were on columns attached to the foundation § Issue: § Do the activities qualify for the DPAD?

pp. 600 -602 Tech. Advice Memo. 2016 -38 -022 § Facts: § Taxpayer constructed and renovated building components which were on columns attached to the foundation § Issue: § Do the activities qualify for the DPAD?

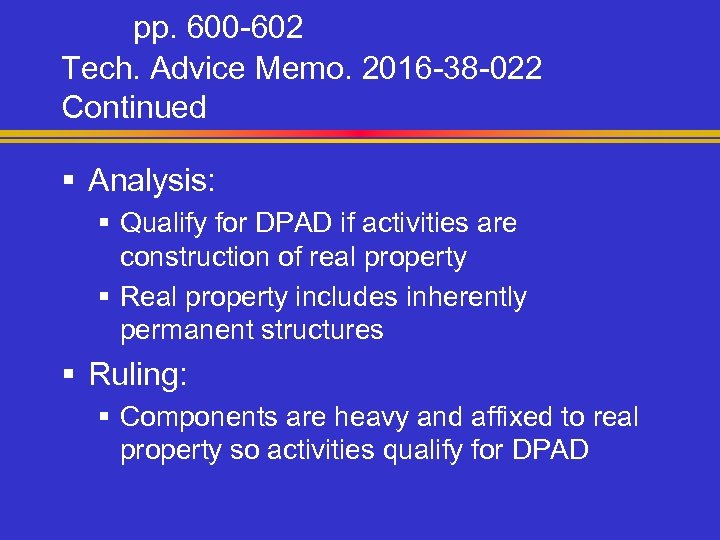

pp. 600 -602 Tech. Advice Memo. 2016 -38 -022 Continued § Analysis: § Qualify for DPAD if activities are construction of real property § Real property includes inherently permanent structures § Ruling: § Components are heavy and affixed to real property so activities qualify for DPAD

pp. 600 -602 Tech. Advice Memo. 2016 -38 -022 Continued § Analysis: § Qualify for DPAD if activities are construction of real property § Real property includes inherently permanent structures § Ruling: § Components are heavy and affixed to real property so activities qualify for DPAD

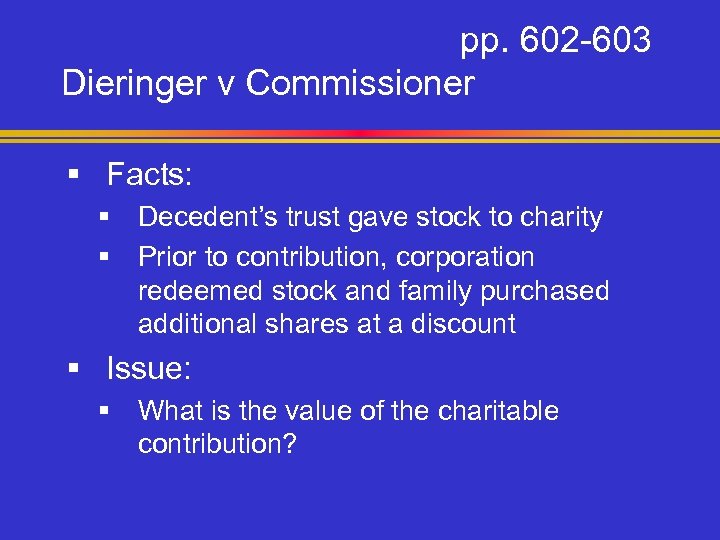

pp. 602 -603 Dieringer v Commissioner § Facts: § Decedent’s trust gave stock to charity § Prior to contribution, corporation redeemed stock and family purchased additional shares at a discount § Issue: § What is the value of the charitable contribution?

pp. 602 -603 Dieringer v Commissioner § Facts: § Decedent’s trust gave stock to charity § Prior to contribution, corporation redeemed stock and family purchased additional shares at a discount § Issue: § What is the value of the charitable contribution?

pp. 602 -603 Dieringer v Commissioner Continued § Analysis: § Charitable contribution deduction usually date of death value but limited by trustee’s powers § Ruling: § Value of stock transferred to charity was reduced because trustee had substantial power prior to distribution

pp. 602 -603 Dieringer v Commissioner Continued § Analysis: § Charitable contribution deduction usually date of death value but limited by trustee’s powers § Ruling: § Value of stock transferred to charity was reduced because trustee had substantial power prior to distribution

pp. 603 -604 Estate of Holliday v Commissioner § Facts: § Decedent’s children helped him form family LLP and took a discount for value of decedent’s LLP interest § Issue: § What is the value of the LLP interest/assets to be included in the gross estate?

pp. 603 -604 Estate of Holliday v Commissioner § Facts: § Decedent’s children helped him form family LLP and took a discount for value of decedent’s LLP interest § Issue: § What is the value of the LLP interest/assets to be included in the gross estate?

pp. 603 -604 Estate of Holliday v Commissioner Continued § Analysis: § I. R. C. § 2036 inclusion if retained interest – exception for bona fide sale § Ruling: § Decedent retained an interest in LLP income and contribution of assets to LLP was not a bona fide sale – value of LLP assets included in gross estate

pp. 603 -604 Estate of Holliday v Commissioner Continued § Analysis: § I. R. C. § 2036 inclusion if retained interest – exception for bona fide sale § Ruling: § Decedent retained an interest in LLP income and contribution of assets to LLP was not a bona fide sale – value of LLP assets included in gross estate

p. 604 Singer v Commissioner § Executor made distributions of estate property before full pay of estate tax § IRS sought tax payment from executor § Court: Executor not liable § Estate not insolvent @ distribution § NY law right of contribution form beneficiaries for state/fed taxes

p. 604 Singer v Commissioner § Executor made distributions of estate property before full pay of estate tax § IRS sought tax payment from executor § Court: Executor not liable § Estate not insolvent @ distribution § NY law right of contribution form beneficiaries for state/fed taxes

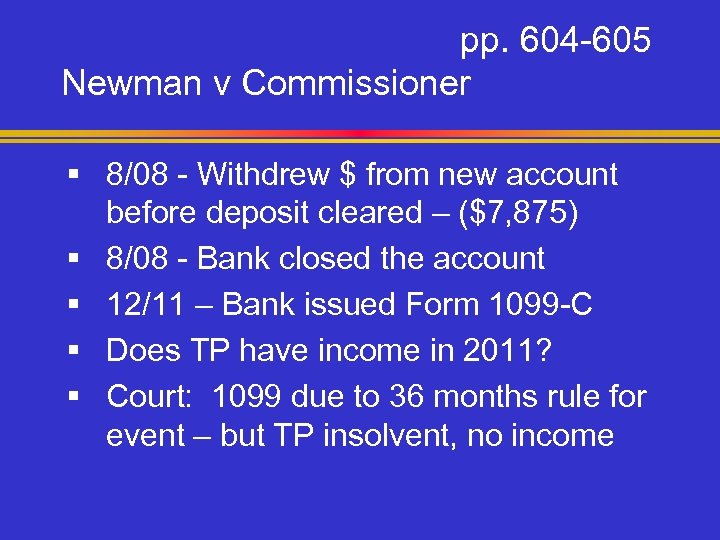

pp. 604 -605 Newman v Commissioner § 8/08 - Withdrew $ from new account before deposit cleared – ($7, 875) § 8/08 - Bank closed the account § 12/11 – Bank issued Form 1099 -C § Does TP have income in 2011? § Court: 1099 due to 36 months rule for event – but TP insolvent, no income

pp. 604 -605 Newman v Commissioner § 8/08 - Withdrew $ from new account before deposit cleared – ($7, 875) § 8/08 - Bank closed the account § 12/11 – Bank issued Form 1099 -C § Does TP have income in 2011? § Court: 1099 due to 36 months rule for event – but TP insolvent, no income

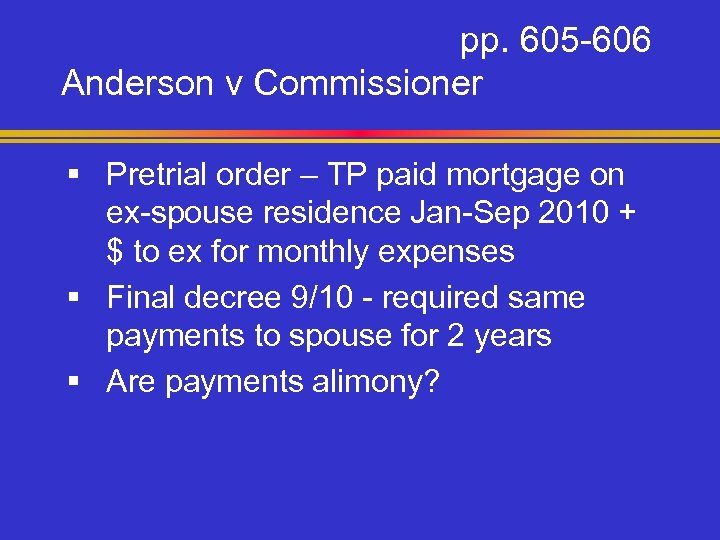

pp. 605 -606 Anderson v Commissioner § Pretrial order – TP paid mortgage on ex-spouse residence Jan-Sep 2010 + $ to ex for monthly expenses § Final decree 9/10 - required same payments to spouse for 2 years § Are payments alimony?

pp. 605 -606 Anderson v Commissioner § Pretrial order – TP paid mortgage on ex-spouse residence Jan-Sep 2010 + $ to ex for monthly expenses § Final decree 9/10 - required same payments to spouse for 2 years § Are payments alimony?

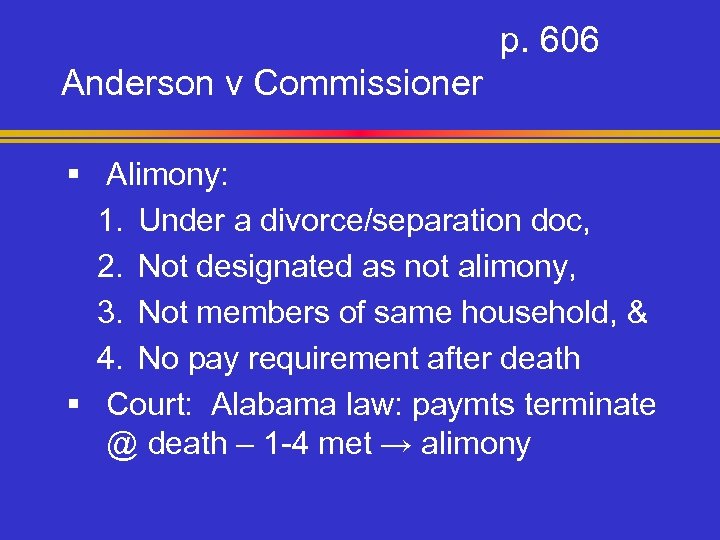

p. 606 Anderson v Commissioner § Alimony: 1. Under a divorce/separation doc, 2. Not designated as not alimony, 3. Not members of same household, & 4. No pay requirement after death § Court: Alabama law: paymts terminate @ death – 1 -4 met → alimony

p. 606 Anderson v Commissioner § Alimony: 1. Under a divorce/separation doc, 2. Not designated as not alimony, 3. Not members of same household, & 4. No pay requirement after death § Court: Alabama law: paymts terminate @ death – 1 -4 met → alimony

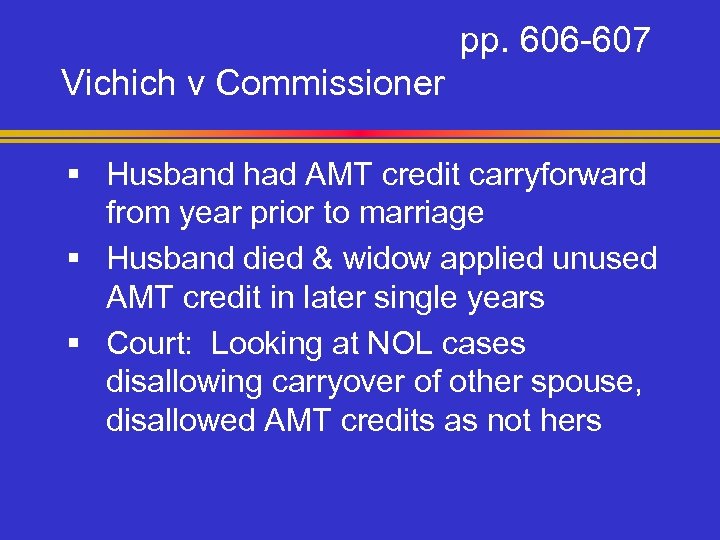

pp. 606 -607 Vichich v Commissioner § Husband had AMT credit carryforward from year prior to marriage § Husband died & widow applied unused AMT credit in later single years § Court: Looking at NOL cases disallowing carryover of other spouse, disallowed AMT credits as not hers

pp. 606 -607 Vichich v Commissioner § Husband had AMT credit carryforward from year prior to marriage § Husband died & widow applied unused AMT credit in later single years § Court: Looking at NOL cases disallowing carryover of other spouse, disallowed AMT credits as not hers

p. 607 Alphonso v Commissioner § § SH in coop housing corporation Retaining wall collapse, SHs assessed TP claimed casualty loss TP: 2 -years’ heavy rain + faulty drainage system caused collapse § Court: No loss - Caused by gradual deterioration accelerated by rain

p. 607 Alphonso v Commissioner § § SH in coop housing corporation Retaining wall collapse, SHs assessed TP claimed casualty loss TP: 2 -years’ heavy rain + faulty drainage system caused collapse § Court: No loss - Caused by gradual deterioration accelerated by rain

pp. 607 -608 Riley v Commissioner § 2003 -2008 invested $ with friend developing software § Suspicious – asks for repay in 2010 § No repay – claimed theft loss in 2010 § Need to prove 1) theft occurred, 2) Loss amount, 3) year discovered § Court: Friend claimed willingness to repay → no loss

pp. 607 -608 Riley v Commissioner § 2003 -2008 invested $ with friend developing software § Suspicious – asks for repay in 2010 § No repay – claimed theft loss in 2010 § Need to prove 1) theft occurred, 2) Loss amount, 3) year discovered § Court: Friend claimed willingness to repay → no loss

p. 608 Adkins v US § H & W invested w/broker-dealer § “Pump and dump” scheme § 2002 Filed claim w/NASD – arbitration § Arbitration suspended w/criminal inv. § 2004 claimed theft loss § IRS disallowed as claim still open § Court: No loss, claim not worthless

p. 608 Adkins v US § H & W invested w/broker-dealer § “Pump and dump” scheme § 2002 Filed claim w/NASD – arbitration § Arbitration suspended w/criminal inv. § 2004 claimed theft loss § IRS disallowed as claim still open § Court: No loss, claim not worthless

p. 609 Green v Commissioner § Trust to make charitable donations § Sole owner of LLC § 99% limited PN in PS – retail stores § Purchased & donated real property § Claimed: FMV IRS: tax basis § Court: § 642(c)(1) – no limit on ded. as exists for 1040 s, allowed FMV

p. 609 Green v Commissioner § Trust to make charitable donations § Sole owner of LLC § 99% limited PN in PS – retail stores § Purchased & donated real property § Claimed: FMV IRS: tax basis § Court: § 642(c)(1) – no limit on ded. as exists for 1040 s, allowed FMV

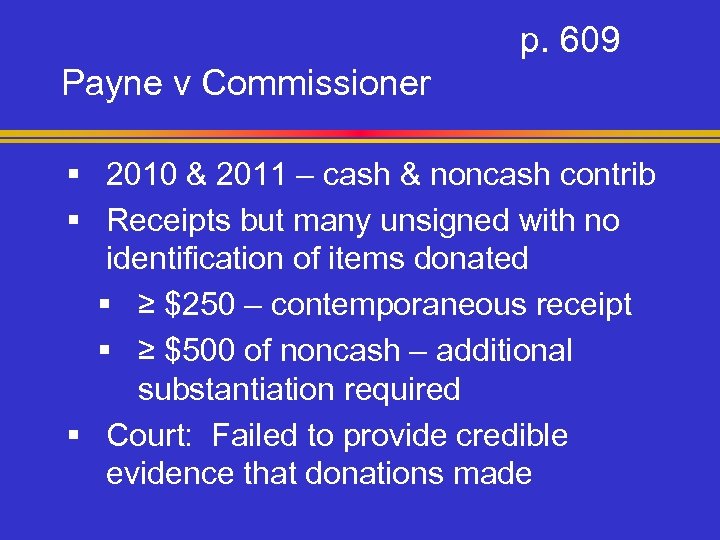

p. 609 Payne v Commissioner § 2010 & 2011 – cash & noncash contrib § Receipts but many unsigned with no identification of items donated § ≥ $250 – contemporaneous receipt § ≥ $500 of noncash – additional substantiation required § Court: Failed to provide credible evidence that donations made

p. 609 Payne v Commissioner § 2010 & 2011 – cash & noncash contrib § Receipts but many unsigned with no identification of items donated § ≥ $250 – contemporaneous receipt § ≥ $500 of noncash – additional substantiation required § Court: Failed to provide credible evidence that donations made

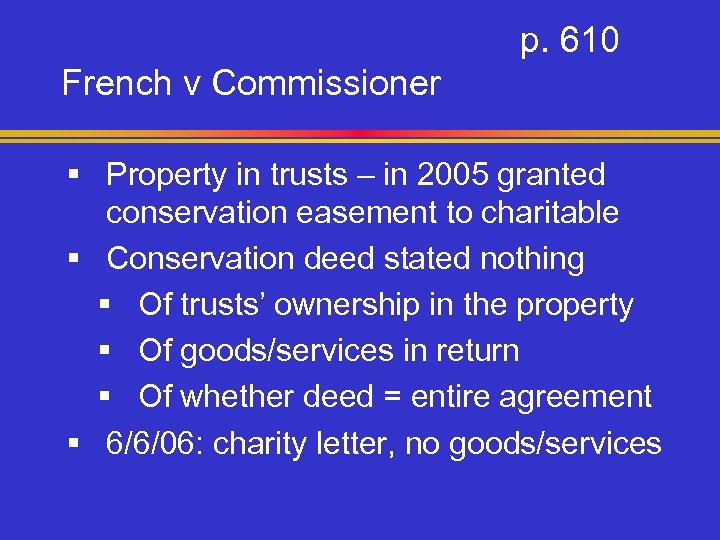

p. 610 French v Commissioner § Property in trusts – in 2005 granted conservation easement to charitable § Conservation deed stated nothing § Of trusts’ ownership in the property § Of goods/services in return § Of whether deed = entire agreement § 6/6/06: charity letter, no goods/services

p. 610 French v Commissioner § Property in trusts – in 2005 granted conservation easement to charitable § Conservation deed stated nothing § Of trusts’ ownership in the property § Of goods/services in return § Of whether deed = entire agreement § 6/6/06: charity letter, no goods/services

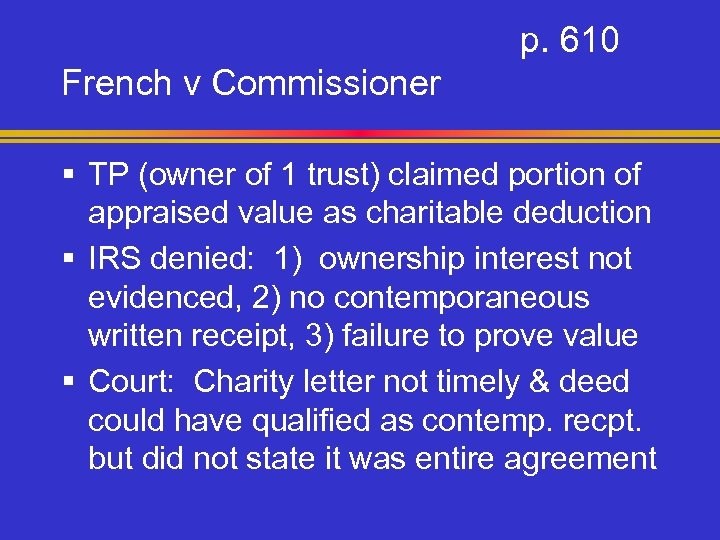

p. 610 French v Commissioner § TP (owner of 1 trust) claimed portion of appraised value as charitable deduction § IRS denied: 1) ownership interest not evidenced, 2) no contemporaneous written receipt, 3) failure to prove value § Court: Charity letter not timely & deed could have qualified as contemp. recpt. but did not state it was entire agreement

p. 610 French v Commissioner § TP (owner of 1 trust) claimed portion of appraised value as charitable deduction § IRS denied: 1) ownership interest not evidenced, 2) no contemporaneous written receipt, 3) failure to prove value § Court: Charity letter not timely & deed could have qualified as contemp. recpt. but did not state it was entire agreement

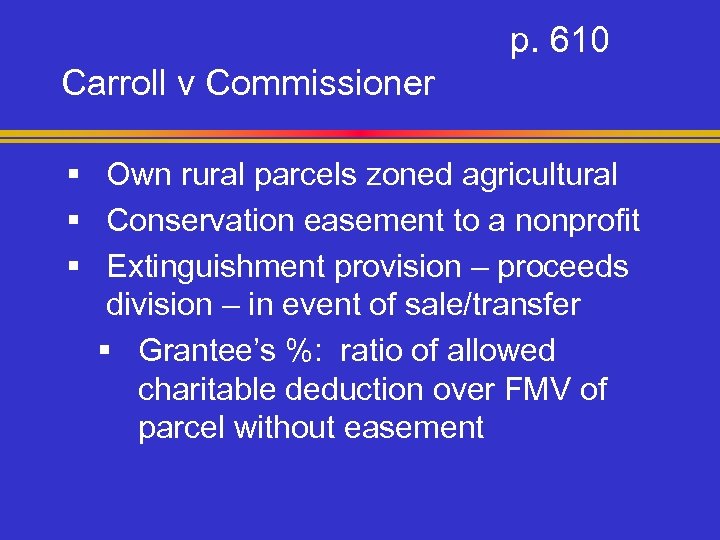

p. 610 Carroll v Commissioner § Own rural parcels zoned agricultural § Conservation easement to a nonprofit § Extinguishment provision – proceeds division – in event of sale/transfer § Grantee’s %: ratio of allowed charitable deduction over FMV of parcel without easement

p. 610 Carroll v Commissioner § Own rural parcels zoned agricultural § Conservation easement to a nonprofit § Extinguishment provision – proceeds division – in event of sale/transfer § Grantee’s %: ratio of allowed charitable deduction over FMV of parcel without easement

p. 611 Carroll v Commissioner § Court: No charitable deduction § Treas. Reg. § 1. 170 A-14(g)(6)(ii): Grantee’s share must be determined by ratio of value of the easement over FMV of land without easement § Not granted in perpetuity as grantee would not receive any proceeds at sale

p. 611 Carroll v Commissioner § Court: No charitable deduction § Treas. Reg. § 1. 170 A-14(g)(6)(ii): Grantee’s share must be determined by ratio of value of the easement over FMV of land without easement § Not granted in perpetuity as grantee would not receive any proceeds at sale

p. 611 RP Golf v Commissioner § LLC (PS) owns/operates 2 golf courses § Borrowed $ with courses as collateral § Requires lender consent for actions re: property § TP granted conservation easements § 7 mos later lender consented to subordinate loans to easement holder § IRS denied deduction

p. 611 RP Golf v Commissioner § LLC (PS) owns/operates 2 golf courses § Borrowed $ with courses as collateral § Requires lender consent for actions re: property § TP granted conservation easements § 7 mos later lender consented to subordinate loans to easement holder § IRS denied deduction

p. 611 RP Golf v Commissioner § If subject to mortgage, mortgagee must subordinate its rights to the qualified organization effective on the date of the easement transfer § Court: Deduction denied § Subordination not @ transfer date § Easement could be defeated by enforcement of the loans

p. 611 RP Golf v Commissioner § If subject to mortgage, mortgagee must subordinate its rights to the qualified organization effective on the date of the easement transfer § Court: Deduction denied § Subordination not @ transfer date § Easement could be defeated by enforcement of the loans

pp. 611 -612 Barnes v Commissioner § § § EE of retail clothing company Required: purchase/wear ER’s goods TP claimed as EE business expense IRS denied & Court agreed To deduct must be 1) required, 2) not suitable for general/personal and 3) must not be so worn

pp. 611 -612 Barnes v Commissioner § § § EE of retail clothing company Required: purchase/wear ER’s goods TP claimed as EE business expense IRS denied & Court agreed To deduct must be 1) required, 2) not suitable for general/personal and 3) must not be so worn

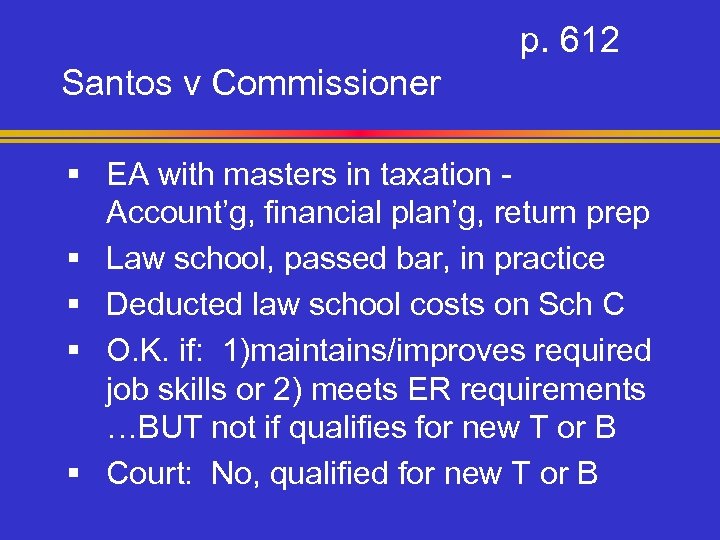

p. 612 Santos v Commissioner § EA with masters in taxation Account’g, financial plan’g, return prep § Law school, passed bar, in practice § Deducted law school costs on Sch C § O. K. if: 1)maintains/improves required job skills or 2) meets ER requirements …BUT not if qualifies for new T or B § Court: No, qualified for new T or B

p. 612 Santos v Commissioner § EA with masters in taxation Account’g, financial plan’g, return prep § Law school, passed bar, in practice § Deducted law school costs on Sch C § O. K. if: 1)maintains/improves required job skills or 2) meets ER requirements …BUT not if qualifies for new T or B § Court: No, qualified for new T or B

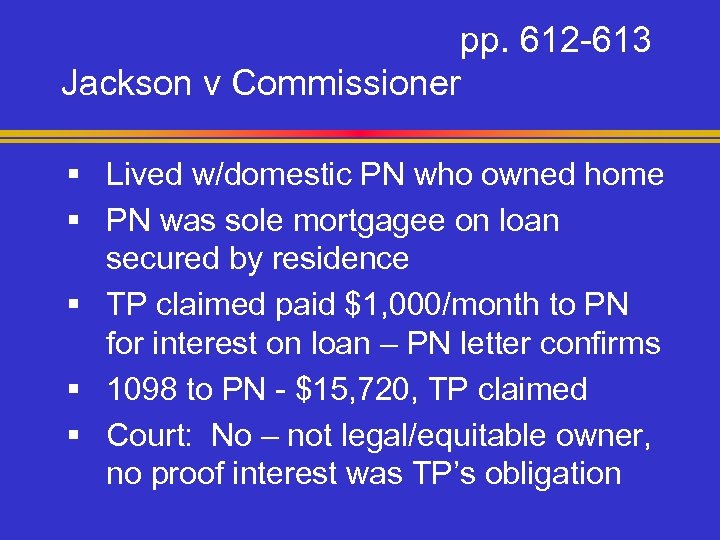

pp. 612 -613 Jackson v Commissioner § Lived w/domestic PN who owned home § PN was sole mortgagee on loan secured by residence § TP claimed paid $1, 000/month to PN for interest on loan – PN letter confirms § 1098 to PN - $15, 720, TP claimed § Court: No – not legal/equitable owner, no proof interest was TP’s obligation

pp. 612 -613 Jackson v Commissioner § Lived w/domestic PN who owned home § PN was sole mortgagee on loan secured by residence § TP claimed paid $1, 000/month to PN for interest on loan – PN letter confirms § 1098 to PN - $15, 720, TP claimed § Court: No – not legal/equitable owner, no proof interest was TP’s obligation

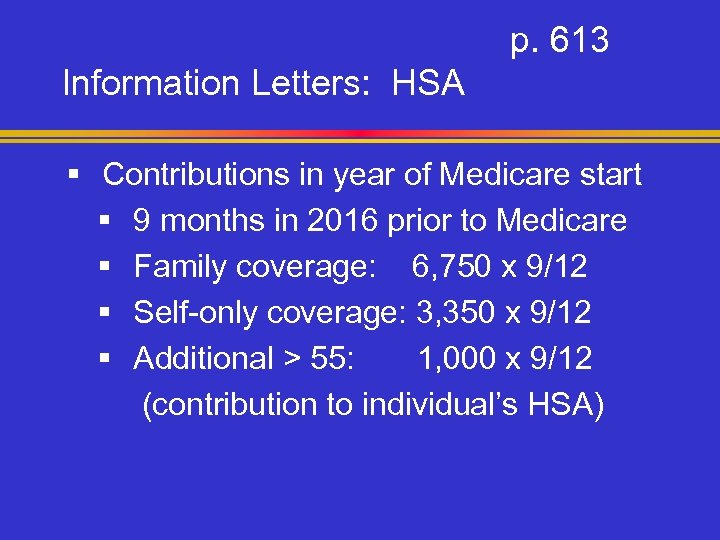

p. 613 Information Letters: HSA § Contributions in year of Medicare start § 9 months in 2016 prior to Medicare § Family coverage: 6, 750 x 9/12 § Self-only coverage: 3, 350 x 9/12 § Additional > 55: 1, 000 x 9/12 (contribution to individual’s HSA)

p. 613 Information Letters: HSA § Contributions in year of Medicare start § 9 months in 2016 prior to Medicare § Family coverage: 6, 750 x 9/12 § Self-only coverage: 3, 350 x 9/12 § Additional > 55: 1, 000 x 9/12 (contribution to individual’s HSA)

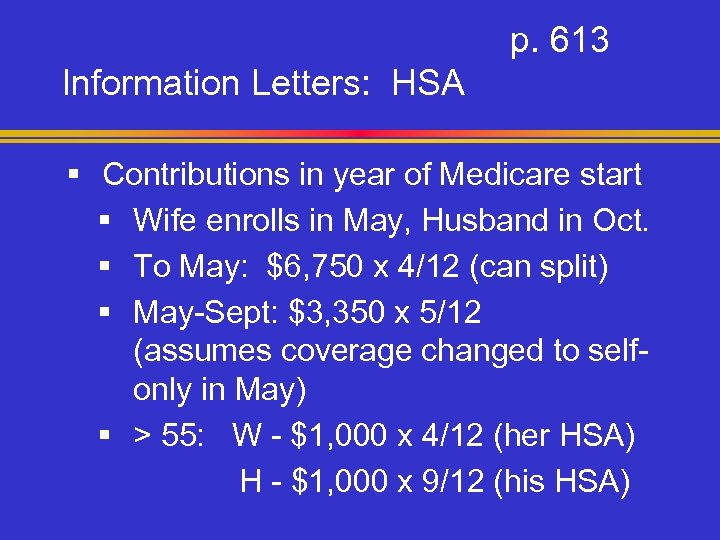

p. 613 Information Letters: HSA § Contributions in year of Medicare start § Wife enrolls in May, Husband in Oct. § To May: $6, 750 x 4/12 (can split) § May-Sept: $3, 350 x 5/12 (assumes coverage changed to selfonly in May) § > 55: W - $1, 000 x 4/12 (her HSA) H - $1, 000 x 9/12 (his HSA)

p. 613 Information Letters: HSA § Contributions in year of Medicare start § Wife enrolls in May, Husband in Oct. § To May: $6, 750 x 4/12 (can split) § May-Sept: $3, 350 x 5/12 (assumes coverage changed to selfonly in May) § > 55: W - $1, 000 x 4/12 (her HSA) H - $1, 000 x 9/12 (his HSA)

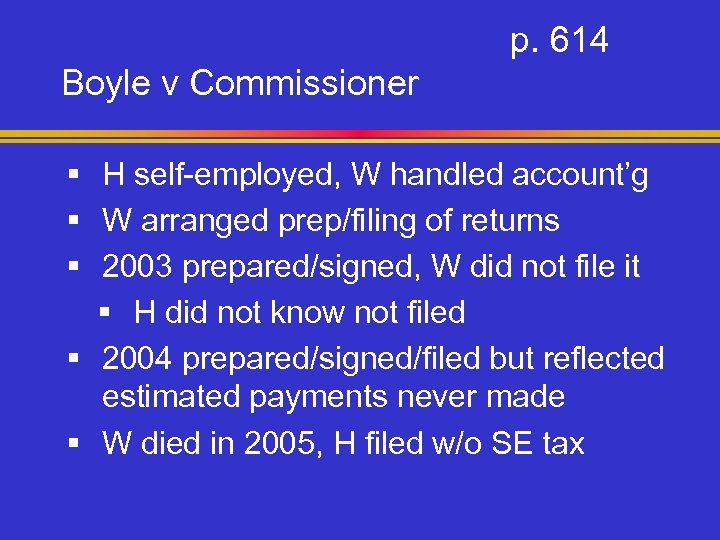

p. 614 Boyle v Commissioner § H self-employed, W handled account’g § W arranged prep/filing of returns § 2003 prepared/signed, W did not file it § H did not know not filed § 2004 prepared/signed/filed but reflected estimated payments never made § W died in 2005, H filed w/o SE tax

p. 614 Boyle v Commissioner § H self-employed, W handled account’g § W arranged prep/filing of returns § 2003 prepared/signed, W did not file it § H did not know not filed § 2004 prepared/signed/filed but reflected estimated payments never made § W died in 2005, H filed w/o SE tax

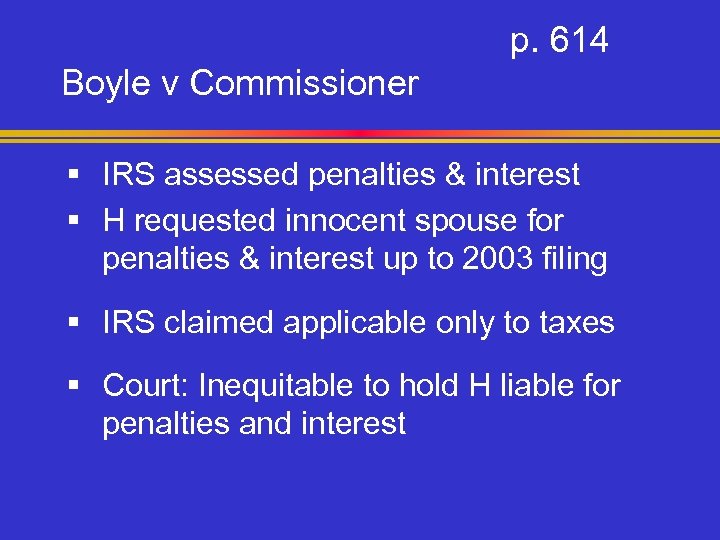

p. 614 Boyle v Commissioner § IRS assessed penalties & interest § H requested innocent spouse for penalties & interest up to 2003 filing § IRS claimed applicable only to taxes § Court: Inequitable to hold H liable for penalties and interest

p. 614 Boyle v Commissioner § IRS assessed penalties & interest § H requested innocent spouse for penalties & interest up to 2003 filing § IRS claimed applicable only to taxes § Court: Inequitable to hold H liable for penalties and interest

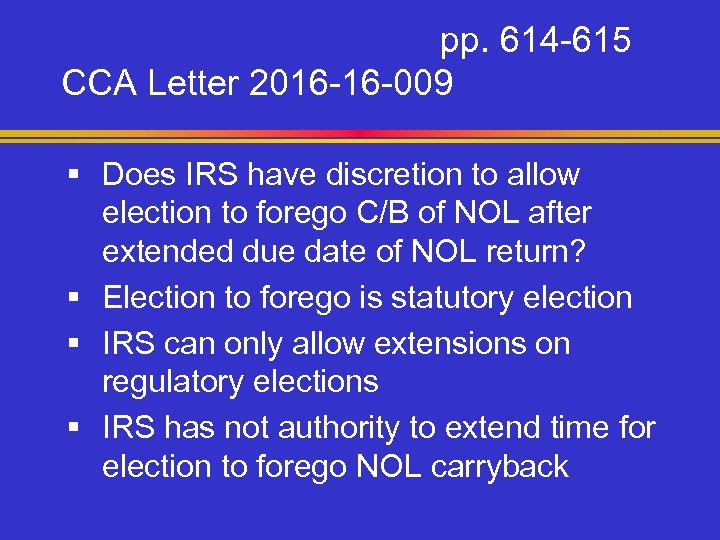

pp. 614 -615 CCA Letter 2016 -16 -009 § Does IRS have discretion to allow election to forego C/B of NOL after extended due date of NOL return? § Election to forego is statutory election § IRS can only allow extensions on regulatory elections § IRS has not authority to extend time for election to forego NOL carryback

pp. 614 -615 CCA Letter 2016 -16 -009 § Does IRS have discretion to allow election to forego C/B of NOL after extended due date of NOL return? § Election to forego is statutory election § IRS can only allow extensions on regulatory elections § IRS has not authority to extend time for election to forego NOL carryback

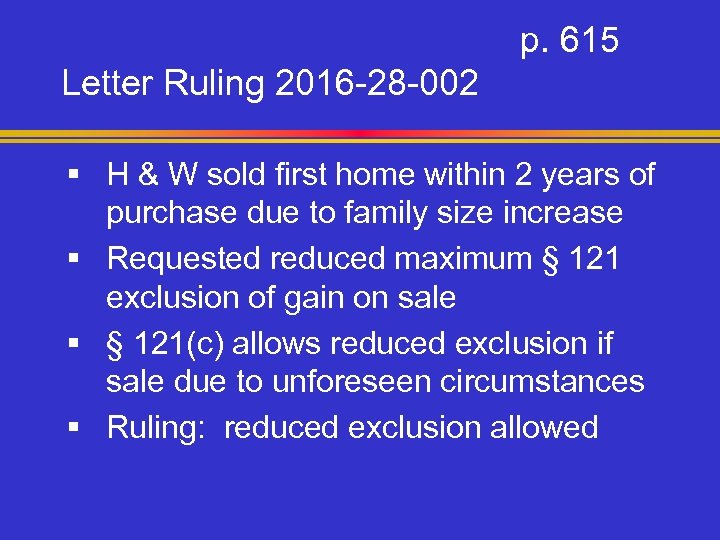

p. 615 Letter Ruling 2016 -28 -002 § H & W sold first home within 2 years of purchase due to family size increase § Requested reduced maximum § 121 exclusion of gain on sale § § 121(c) allows reduced exclusion if sale due to unforeseen circumstances § Ruling: reduced exclusion allowed

p. 615 Letter Ruling 2016 -28 -002 § H & W sold first home within 2 years of purchase due to family size increase § Requested reduced maximum § 121 exclusion of gain on sale § § 121(c) allows reduced exclusion if sale due to unforeseen circumstances § Ruling: reduced exclusion allowed

pp. 616 -617 CCA Letter 2016 -22 -031 Taxation of employer wellness programs Situation 1: § Wellness benefits at no cost to EEs § If participate may earn cash rewards § Not medical, e. g. gym membership Ruling: Well program benefits excludable, Cash/FMV rewards = wages subj. to FICA

pp. 616 -617 CCA Letter 2016 -22 -031 Taxation of employer wellness programs Situation 1: § Wellness benefits at no cost to EEs § If participate may earn cash rewards § Not medical, e. g. gym membership Ruling: Well program benefits excludable, Cash/FMV rewards = wages subj. to FICA

pp. 616 -617 CCA Letter 2016 -22 -031 Situation 2: § Wellness benefits at no cost to EEs § If participate, required contribution paid by salary reduction thru § 125 plan § May earn cash rewards § Not medical, e. g. gym membership Ruling: Well program benefits excludable, Cash/FMV rewards = wages subj. to FICA

pp. 616 -617 CCA Letter 2016 -22 -031 Situation 2: § Wellness benefits at no cost to EEs § If participate, required contribution paid by salary reduction thru § 125 plan § May earn cash rewards § Not medical, e. g. gym membership Ruling: Well program benefits excludable, Cash/FMV rewards = wages subj. to FICA

pp. 616 -617 CCA Letter 2016 -22 -031 Situation 3: § Same as Situation 2 – No cost wellness benefits, required contribution paid by salary reduction, earn cash rewards § + Reimbursement for required contrib. Ruling: Well program benefits excludable, Cash/FMV rewards = wages subj. to FICA Reimbursements = wages subj. to FICA

pp. 616 -617 CCA Letter 2016 -22 -031 Situation 3: § Same as Situation 2 – No cost wellness benefits, required contribution paid by salary reduction, earn cash rewards § + Reimbursement for required contrib. Ruling: Well program benefits excludable, Cash/FMV rewards = wages subj. to FICA Reimbursements = wages subj. to FICA

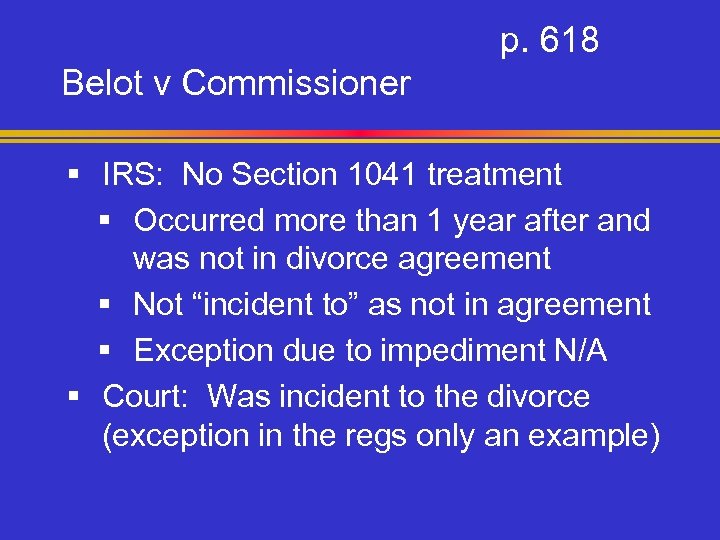

p. 617 Belot v Commissioner § § § TPs owned 3 businesses – unequal % Divorced – split in equal shares W/in 1 year, W files to force H to sell New settlement agreement: Sale to W Nontaxable if incident to divorce § Occurs within 1 year of divorce § Is related to cessation of marriage

p. 617 Belot v Commissioner § § § TPs owned 3 businesses – unequal % Divorced – split in equal shares W/in 1 year, W files to force H to sell New settlement agreement: Sale to W Nontaxable if incident to divorce § Occurs within 1 year of divorce § Is related to cessation of marriage

p. 618 Belot v Commissioner § IRS: No Section 1041 treatment § Occurred more than 1 year after and was not in divorce agreement § Not “incident to” as not in agreement § Exception due to impediment N/A § Court: Was incident to the divorce (exception in the regs only an example)

p. 618 Belot v Commissioner § IRS: No Section 1041 treatment § Occurred more than 1 year after and was not in divorce agreement § Not “incident to” as not in agreement § Exception due to impediment N/A § Court: Was incident to the divorce (exception in the regs only an example)

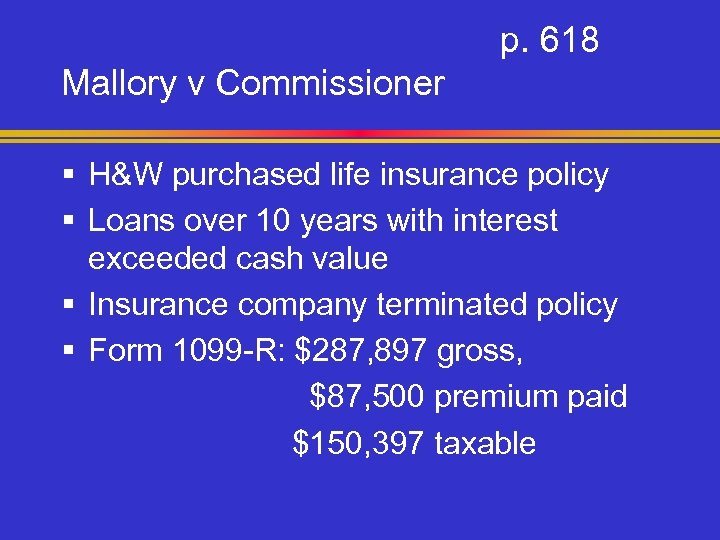

p. 618 Mallory v Commissioner § H&W purchased life insurance policy § Loans over 10 years with interest exceeded cash value § Insurance company terminated policy § Form 1099 -R: $287, 897 gross, $87, 500 premium paid $150, 397 taxable

p. 618 Mallory v Commissioner § H&W purchased life insurance policy § Loans over 10 years with interest exceeded cash value § Insurance company terminated policy § Form 1099 -R: $287, 897 gross, $87, 500 premium paid $150, 397 taxable

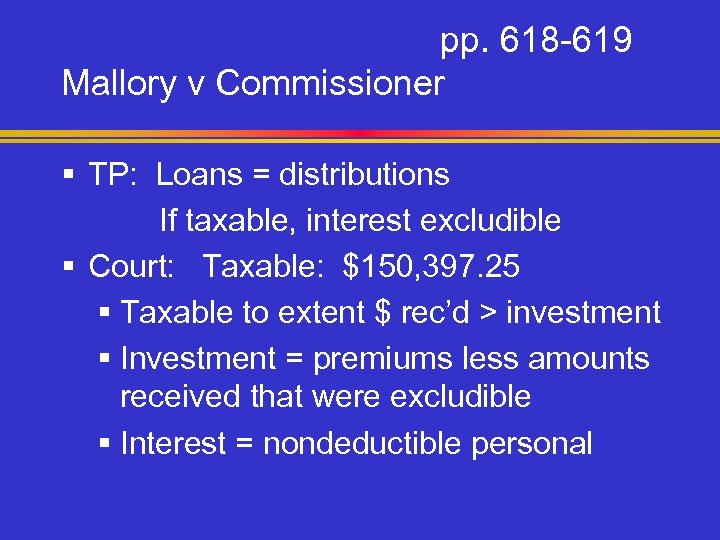

pp. 618 -619 Mallory v Commissioner § TP: Loans = distributions If taxable, interest excludible § Court: Taxable: $150, 397. 25 § Taxable to extent $ rec’d > investment § Investment = premiums less amounts received that were excludible § Interest = nondeductible personal

pp. 618 -619 Mallory v Commissioner § TP: Loans = distributions If taxable, interest excludible § Court: Taxable: $150, 397. 25 § Taxable to extent $ rec’d > investment § Investment = premiums less amounts received that were excludible § Interest = nondeductible personal

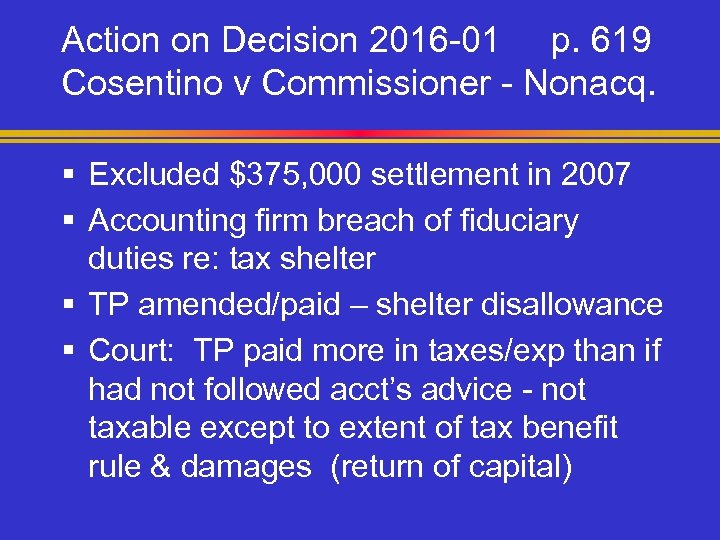

Action on Decision 2016 -01 p. 619 Cosentino v Commissioner - Nonacq. § Excluded $375, 000 settlement in 2007 § Accounting firm breach of fiduciary duties re: tax shelter § TP amended/paid – shelter disallowance § Court: TP paid more in taxes/exp than if had not followed acct’s advice - not taxable except to extent of tax benefit rule & damages (return of capital)

Action on Decision 2016 -01 p. 619 Cosentino v Commissioner - Nonacq. § Excluded $375, 000 settlement in 2007 § Accounting firm breach of fiduciary duties re: tax shelter § TP amended/paid – shelter disallowance § Court: TP paid more in taxes/exp than if had not followed acct’s advice - not taxable except to extent of tax benefit rule & damages (return of capital)

p. 619 White v Commissioner § Pastor over 30 years - WEOC § 2001: recommended board restructure “corporation sole as an office of the church” § Domestic nonprofit corp - “The Office of Presiding Head Apostle, of Ronald White” § 11/27/01 White signed “Vow of poverty” future income to WEOC, WEOC to provide for all his needs

p. 619 White v Commissioner § Pastor over 30 years - WEOC § 2001: recommended board restructure “corporation sole as an office of the church” § Domestic nonprofit corp - “The Office of Presiding Head Apostle, of Ronald White” § 11/27/01 White signed “Vow of poverty” future income to WEOC, WEOC to provide for all his needs

pp. 619 -620 White v Commissioner § WEOC set up bank account for his use on which White had signatory authority § White filed no tax returns § No timely filing of SE tax exemption § IRS substitutes for return: 2006 -2009 § TP: Vow of poverty insulates him from all taxes

pp. 619 -620 White v Commissioner § WEOC set up bank account for his use on which White had signatory authority § White filed no tax returns § No timely filing of SE tax exemption § IRS substitutes for return: 2006 -2009 § TP: Vow of poverty insulates him from all taxes

p. 620 White v Commissioner Court: Taxable and subject to SE tax § Rev. Rul. 77 -290: Not taxable: member of religious order, vow of poverty, services for order/church, remit back $$ § White did not remit back income § § 1402(c)(4) – exemption for ministers – Form 4361 by due date of 2 nd SE year § No exemption filed

p. 620 White v Commissioner Court: Taxable and subject to SE tax § Rev. Rul. 77 -290: Not taxable: member of religious order, vow of poverty, services for order/church, remit back $$ § White did not remit back income § § 1402(c)(4) – exemption for ministers – Form 4361 by due date of 2 nd SE year § No exemption filed

pp. 620 -621 United States v Smith § Jointly owned residence in Washington – community property state § H failed to pay taxes on his income § Appealed assessment – Tax Court entered judgment for IRS, granted judgment lien on residence, allowed federal tax lien on property § TP lost: No proof not community debt

pp. 620 -621 United States v Smith § Jointly owned residence in Washington – community property state § H failed to pay taxes on his income § Appealed assessment – Tax Court entered judgment for IRS, granted judgment lien on residence, allowed federal tax lien on property § TP lost: No proof not community debt

p. 621 Brown v Commissioner § Negotiated settlement on $33. 5 M taxes § IRS made jeopardy assessment lien § High amount & threat of sale § TP: lien not needed – offered means of payment § IRS: Not full pay w/in collection period § TP: rejection an abuse of discretion

p. 621 Brown v Commissioner § Negotiated settlement on $33. 5 M taxes § IRS made jeopardy assessment lien § High amount & threat of sale § TP: lien not needed – offered means of payment § IRS: Not full pay w/in collection period § TP: rejection an abuse of discretion

p. 621 Brown v Commissioner § Installment agreement allowed but § IRS can require extension on collection statute § Agreement can contain terms to protect interest of Government § Court: Rejection not arbitrary

p. 621 Brown v Commissioner § Installment agreement allowed but § IRS can require extension on collection statute § Agreement can contain terms to protect interest of Government § Court: Rejection not arbitrary

pp. 621 -622 WRK Rarities, LLC v United States § Jewelry store – filed for chapter 11 – delinquent income/employment taxes § New LLC, same owner, same EEs, same bank account, same inventory § IRS levied LLC’s assets as none left in original – “alter ego” successor or fraudulent transferee

pp. 621 -622 WRK Rarities, LLC v United States § Jewelry store – filed for chapter 11 – delinquent income/employment taxes § New LLC, same owner, same EEs, same bank account, same inventory § IRS levied LLC’s assets as none left in original – “alter ego” successor or fraudulent transferee

p. 622 WRK Rarities, LLC v United States § Property interests - state law: § Ohio: buyer not liable for seller debts § Unless assumes § Unless consolidation/merger § Unless buyer is continuance § Unless fraud/to escape liability § Court: Continuation & fraudulent

p. 622 WRK Rarities, LLC v United States § Property interests - state law: § Ohio: buyer not liable for seller debts § Unless assumes § Unless consolidation/merger § Unless buyer is continuance § Unless fraud/to escape liability § Court: Continuation & fraudulent

p. 622 Collection Financial Standards § Updated standards for general expenses items such as food, clothing, health care, transportation § New data applicable to financial analyses after 3/28/16 § Link to website on page 622

p. 622 Collection Financial Standards § Updated standards for general expenses items such as food, clothing, health care, transportation § New data applicable to financial analyses after 3/28/16 § Link to website on page 622

p. 622 Alphson v Commissioner § Owed approx. $200, 000 in 2011 § OIC offer to pay $2, 400 § Unemployed, liabilities > asset values § IRS: Reas. Collection Potential > $3 M § Assets rec’d in 2008 -2010 – settlemt § Settlement funds spent § Pursued lien against property

p. 622 Alphson v Commissioner § Owed approx. $200, 000 in 2011 § OIC offer to pay $2, 400 § Unemployed, liabilities > asset values § IRS: Reas. Collection Potential > $3 M § Assets rec’d in 2008 -2010 – settlemt § Settlement funds spent § Pursued lien against property

p. 623 Alphson v Commissioner § Discretion abused if decision based on error or law, clearly erroneous findings of facts, or officer ruled irrationally § Is settlement RCP as dissipated assets? § Not included if > 5 years prior to OIC § If used on nonpriority, included § Court: OIC rejection not an abuse

p. 623 Alphson v Commissioner § Discretion abused if decision based on error or law, clearly erroneous findings of facts, or officer ruled irrationally § Is settlement RCP as dissipated assets? § Not included if > 5 years prior to OIC § If used on nonpriority, included § Court: OIC rejection not an abuse

p. 623 CCA Letter 2016 -21 -012 § Contract with fed agency – classified info – contract existence & all parties § ID of officials involved in contract required in secured locations by those with top-secret clearances § § 7602(c) satisfied if advance notice that 3 rd party contacts may be made & names provided to TP in secure location

p. 623 CCA Letter 2016 -21 -012 § Contract with fed agency – classified info – contract existence & all parties § ID of officials involved in contract required in secured locations by those with top-secret clearances § § 7602(c) satisfied if advance notice that 3 rd party contacts may be made & names provided to TP in secure location

pp. 623 -624 Rev. Proc. 2016 -22 § § Admin appeals practices if docketed Policies to ensure consistent handling Updates titles etc. Clarifies Counsel will refer to Appeals for settlement consideration (nearly always) § Promotes Appeals independence § Procedures for Counsel aid to Appeals

pp. 623 -624 Rev. Proc. 2016 -22 § § Admin appeals practices if docketed Policies to ensure consistent handling Updates titles etc. Clarifies Counsel will refer to Appeals for settlement consideration (nearly always) § Promotes Appeals independence § Procedures for Counsel aid to Appeals

p. 624 Yasgur v Commissioner § H and W live apart – W home address of record with IRS § Joint 2003 with no payment as believed K-1 incorrect § Assessed and 2 notice of levies sent § Wife did not forward to husband § No timely request for hearing

p. 624 Yasgur v Commissioner § H and W live apart – W home address of record with IRS § Joint 2003 with no payment as believed K-1 incorrect § Assessed and 2 notice of levies sent § Wife did not forward to husband § No timely request for hearing

pp. 624 -625 Yasgur v Commissioner § Amended return file to lower tax § Requested CDP or equivalent hearing § IRS said untimely as to levy & lien § Granted equivalent hearing: TP could not challenge tax owed § Court: Allowed tax challenge – no deliberate acts to avoid notices

pp. 624 -625 Yasgur v Commissioner § Amended return file to lower tax § Requested CDP or equivalent hearing § IRS said untimely as to levy & lien § Granted equivalent hearing: TP could not challenge tax owed § Court: Allowed tax challenge – no deliberate acts to avoid notices

p. 625 Romano-Murphy v Commissioner § CEO of corp providing nursing services § Financial control, signed emp tax return § Corp failed to pay withholdings § Notice to hold personally liable § Timely protest, IRS did not forward § Assessed, notice of levy, lien § CDP hearing - TP was liable

p. 625 Romano-Murphy v Commissioner § CEO of corp providing nursing services § Financial control, signed emp tax return § Corp failed to pay withholdings § Notice to hold personally liable § Timely protest, IRS did not forward § Assessed, notice of levy, lien § CDP hearing - TP was liable

p. 625 Romano-Murphy v Commissioner § Appealed: Failure to provide earlier appeal invalidated assessment § Court: IRS failure to provide appeal after timely protest improper – TP had no opportunity to challenge tax § Remanded for determination if IRS failure invalidated assessment

p. 625 Romano-Murphy v Commissioner § Appealed: Failure to provide earlier appeal invalidated assessment § Court: IRS failure to provide appeal after timely protest improper – TP had no opportunity to challenge tax § Remanded for determination if IRS failure invalidated assessment

p. 626 Cropper v Commissioner § Failed to file 2006, 2007, 2008 § Substitute returns by IRS, Stat notice, no response, lien notice, levy notice § CDP hearing but failed to appear – then thru correspondence § Claimed did not receive stat notice – no evidence provided to support claim or re: tax challenge

p. 626 Cropper v Commissioner § Failed to file 2006, 2007, 2008 § Substitute returns by IRS, Stat notice, no response, lien notice, levy notice § CDP hearing but failed to appear – then thru correspondence § Claimed did not receive stat notice – no evidence provided to support claim or re: tax challenge

pp. 626 -627 Cropper v Commissioner § Appeals upheld levy action & amount of liabilities § TP: Not allowed to challenge tax, not given face-to-face CDP hearing, not given evidence supporting tax, IRS had not met requirements for levy – did not receive notice – notice should be voided § Court: Held for the IRS

pp. 626 -627 Cropper v Commissioner § Appeals upheld levy action & amount of liabilities § TP: Not allowed to challenge tax, not given face-to-face CDP hearing, not given evidence supporting tax, IRS had not met requirements for levy – did not receive notice – notice should be voided § Court: Held for the IRS

pp. 627 -628 CCA Letter 2016 -23 -010 § § § On disability income – no filing for 9 yrs IRS – substitutes, stat notice, assessed Form 843 - 5 th, 14 th amendment claims IRS assessed frivolous $5, 000 penalty District Court: Not competent/stand trial Can request reduction request – Form 14402 - Rev. Proc. 2012 -43

pp. 627 -628 CCA Letter 2016 -23 -010 § § § On disability income – no filing for 9 yrs IRS – substitutes, stat notice, assessed Form 843 - 5 th, 14 th amendment claims IRS assessed frivolous $5, 000 penalty District Court: Not competent/stand trial Can request reduction request – Form 14402 - Rev. Proc. 2012 -43

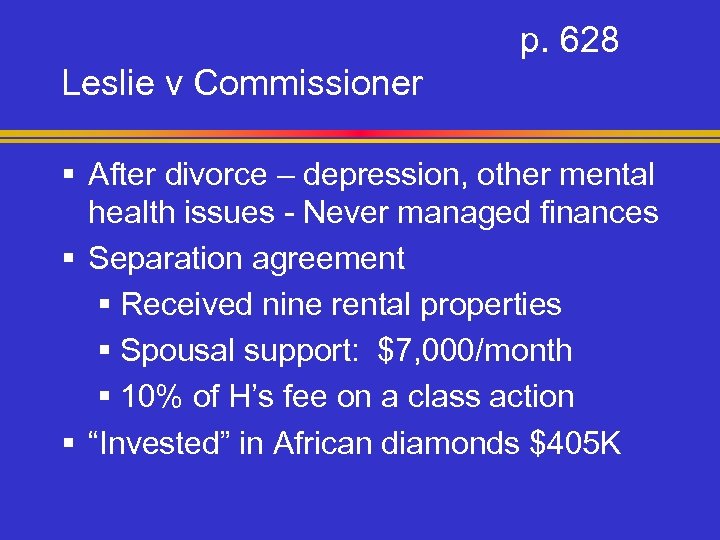

p. 628 Leslie v Commissioner § After divorce – depression, other mental health issues - Never managed finances § Separation agreement § Received nine rental properties § Spousal support: $7, 000/month § 10% of H’s fee on a class action § “Invested” in African diamonds $405 K

p. 628 Leslie v Commissioner § After divorce – depression, other mental health issues - Never managed finances § Separation agreement § Received nine rental properties § Spousal support: $7, 000/month § 10% of H’s fee on a class action § “Invested” in African diamonds $405 K

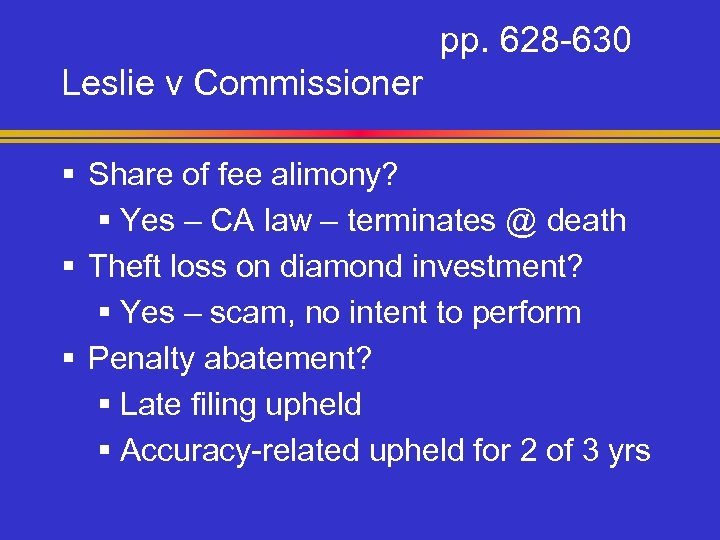

pp. 628 -630 Leslie v Commissioner § Share of fee alimony? § Yes – CA law – terminates @ death § Theft loss on diamond investment? § Yes – scam, no intent to perform § Penalty abatement? § Late filing upheld § Accuracy-related upheld for 2 of 3 yrs

pp. 628 -630 Leslie v Commissioner § Share of fee alimony? § Yes – CA law – terminates @ death § Theft loss on diamond investment? § Yes – scam, no intent to perform § Penalty abatement? § Late filing upheld § Accuracy-related upheld for 2 of 3 yrs

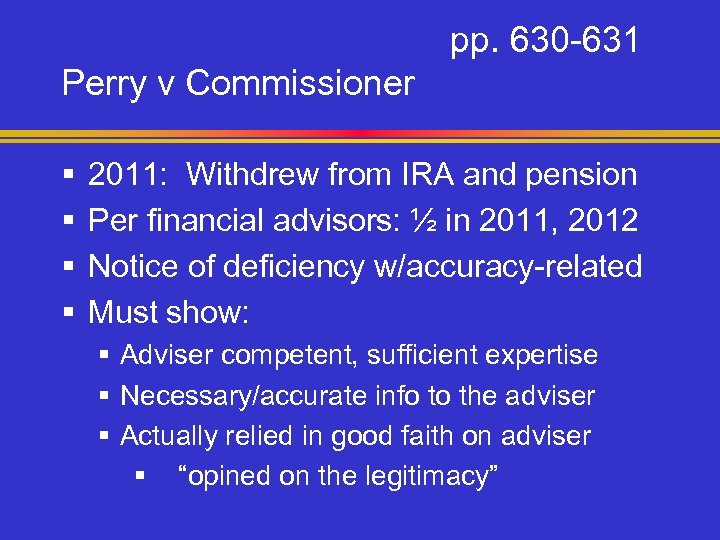

pp. 630 -631 Perry v Commissioner § § 2011: Withdrew from IRA and pension Per financial advisors: ½ in 2011, 2012 Notice of deficiency w/accuracy-related Must show: § Adviser competent, sufficient expertise § Necessary/accurate info to the adviser § Actually relied in good faith on adviser § “opined on the legitimacy”

pp. 630 -631 Perry v Commissioner § § 2011: Withdrew from IRA and pension Per financial advisors: ½ in 2011, 2012 Notice of deficiency w/accuracy-related Must show: § Adviser competent, sufficient expertise § Necessary/accurate info to the adviser § Actually relied in good faith on adviser § “opined on the legitimacy”

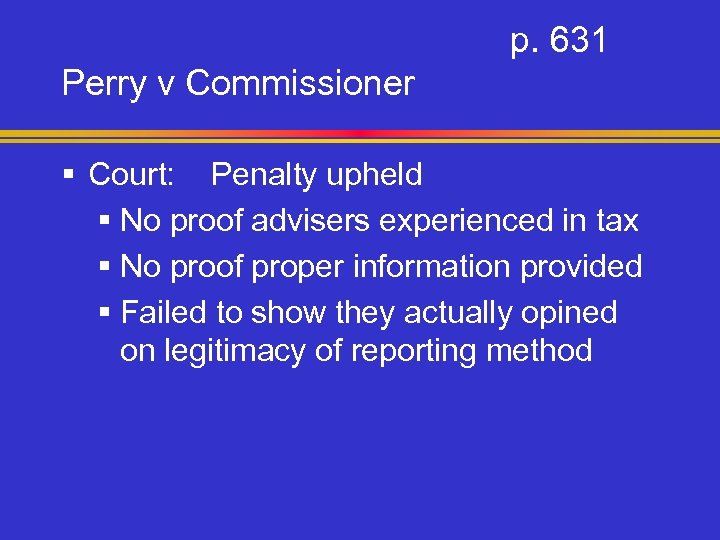

p. 631 Perry v Commissioner § Court: Penalty upheld § No proof advisers experienced in tax § No proof proper information provided § Failed to show they actually opined on legitimacy of reporting method

p. 631 Perry v Commissioner § Court: Penalty upheld § No proof advisers experienced in tax § No proof proper information provided § Failed to show they actually opined on legitimacy of reporting method

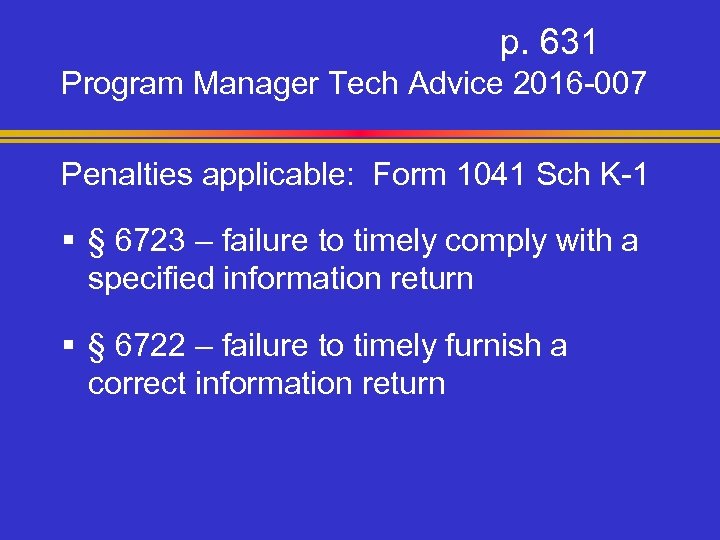

p. 631 Program Manager Tech Advice 2016 -007 Penalties applicable: Form 1041 Sch K-1 § § 6723 – failure to timely comply with a specified information return § § 6722 – failure to timely furnish a correct information return

p. 631 Program Manager Tech Advice 2016 -007 Penalties applicable: Form 1041 Sch K-1 § § 6723 – failure to timely comply with a specified information return § § 6722 – failure to timely furnish a correct information return

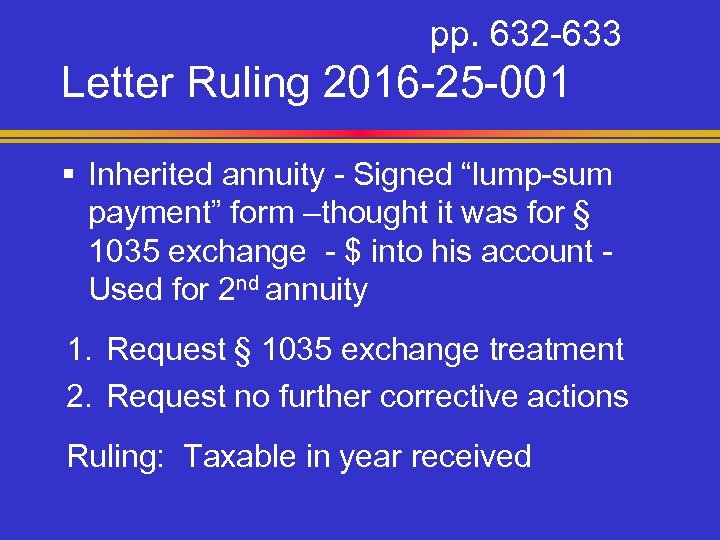

pp. 632 -633 Letter Ruling 2016 -25 -001 § Inherited annuity - Signed “lump-sum payment” form –thought it was for § 1035 exchange - $ into his account Used for 2 nd annuity 1. Request § 1035 exchange treatment 2. Request no further corrective actions Ruling: Taxable in year received

pp. 632 -633 Letter Ruling 2016 -25 -001 § Inherited annuity - Signed “lump-sum payment” form –thought it was for § 1035 exchange - $ into his account Used for 2 nd annuity 1. Request § 1035 exchange treatment 2. Request no further corrective actions Ruling: Taxable in year received

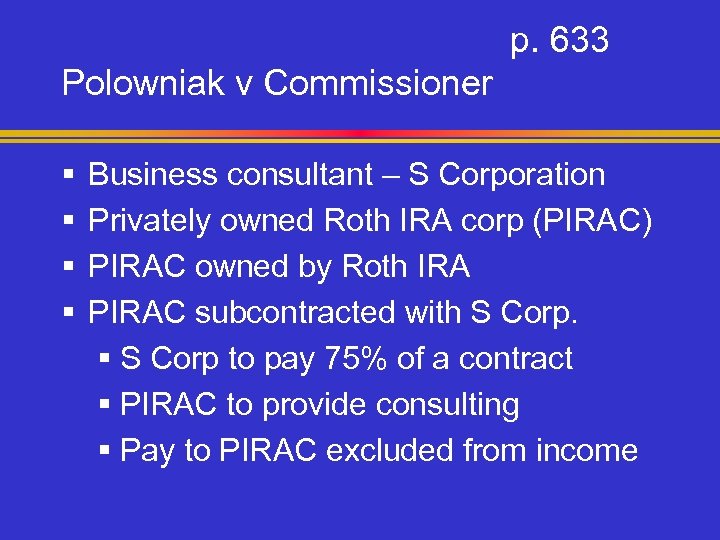

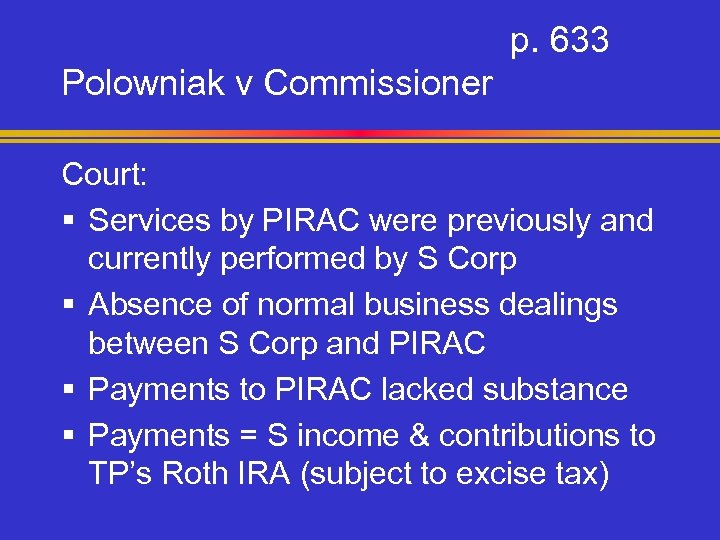

p. 633 Polowniak v Commissioner § § Business consultant – S Corporation Privately owned Roth IRA corp (PIRAC) PIRAC owned by Roth IRA PIRAC subcontracted with S Corp. § S Corp to pay 75% of a contract § PIRAC to provide consulting § Pay to PIRAC excluded from income

p. 633 Polowniak v Commissioner § § Business consultant – S Corporation Privately owned Roth IRA corp (PIRAC) PIRAC owned by Roth IRA PIRAC subcontracted with S Corp. § S Corp to pay 75% of a contract § PIRAC to provide consulting § Pay to PIRAC excluded from income

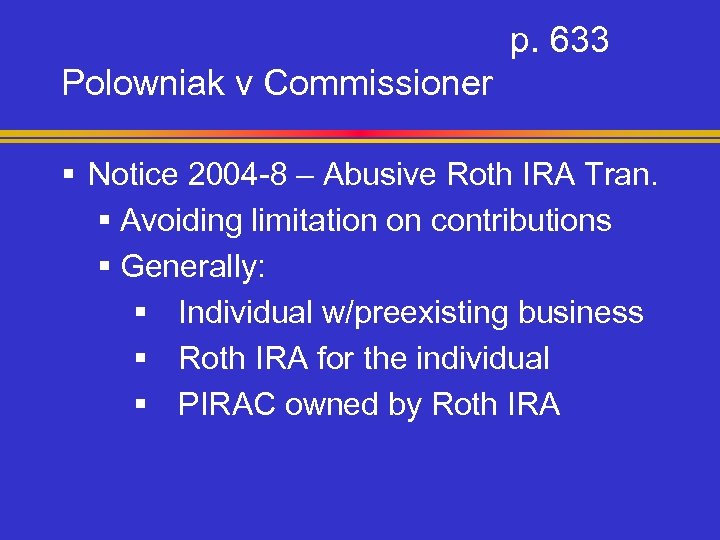

p. 633 Polowniak v Commissioner § Notice 2004 -8 – Abusive Roth IRA Tran. § Avoiding limitation on contributions § Generally: § Individual w/preexisting business § Roth IRA for the individual § PIRAC owned by Roth IRA

p. 633 Polowniak v Commissioner § Notice 2004 -8 – Abusive Roth IRA Tran. § Avoiding limitation on contributions § Generally: § Individual w/preexisting business § Roth IRA for the individual § PIRAC owned by Roth IRA

p. 633 Polowniak v Commissioner Court: § Services by PIRAC were previously and currently performed by S Corp § Absence of normal business dealings between S Corp and PIRAC § Payments to PIRAC lacked substance § Payments = S income & contributions to TP’s Roth IRA (subject to excise tax)

p. 633 Polowniak v Commissioner Court: § Services by PIRAC were previously and currently performed by S Corp § Absence of normal business dealings between S Corp and PIRAC § Payments to PIRAC lacked substance § Payments = S income & contributions to TP’s Roth IRA (subject to excise tax)

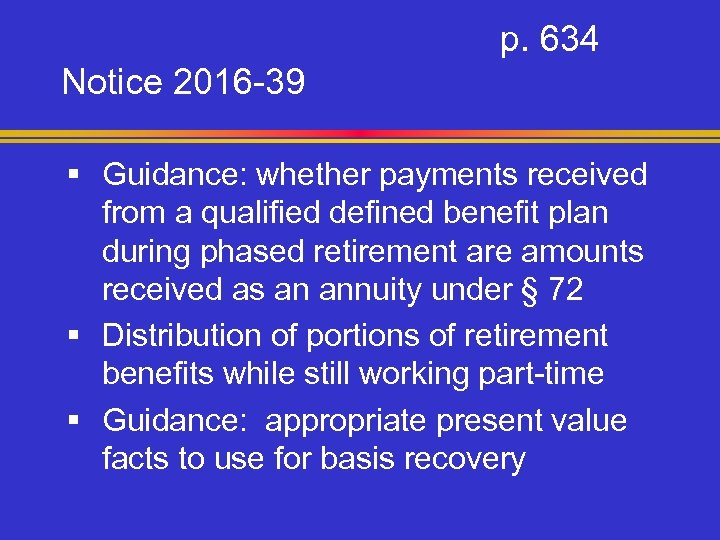

p. 634 Notice 2016 -39 § Guidance: whether payments received from a qualified defined benefit plan during phased retirement are amounts received as an annuity under § 72 § Distribution of portions of retirement benefits while still working part-time § Guidance: appropriate present value facts to use for basis recovery

p. 634 Notice 2016 -39 § Guidance: whether payments received from a qualified defined benefit plan during phased retirement are amounts received as an annuity under § 72 § Distribution of portions of retirement benefits while still working part-time § Guidance: appropriate present value facts to use for basis recovery

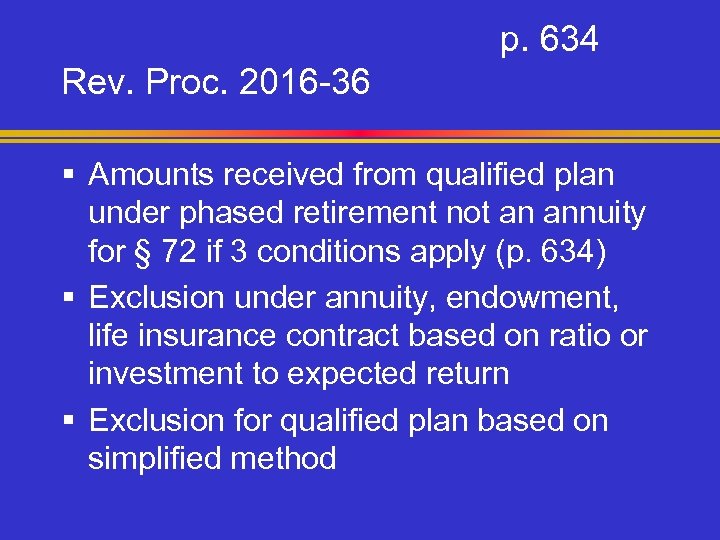

p. 634 Rev. Proc. 2016 -36 § Amounts received from qualified plan under phased retirement not an annuity for § 72 if 3 conditions apply (p. 634) § Exclusion under annuity, endowment, life insurance contract based on ratio or investment to expected return § Exclusion for qualified plan based on simplified method

p. 634 Rev. Proc. 2016 -36 § Amounts received from qualified plan under phased retirement not an annuity for § 72 if 3 conditions apply (p. 634) § Exclusion under annuity, endowment, life insurance contract based on ratio or investment to expected return § Exclusion for qualified plan based on simplified method

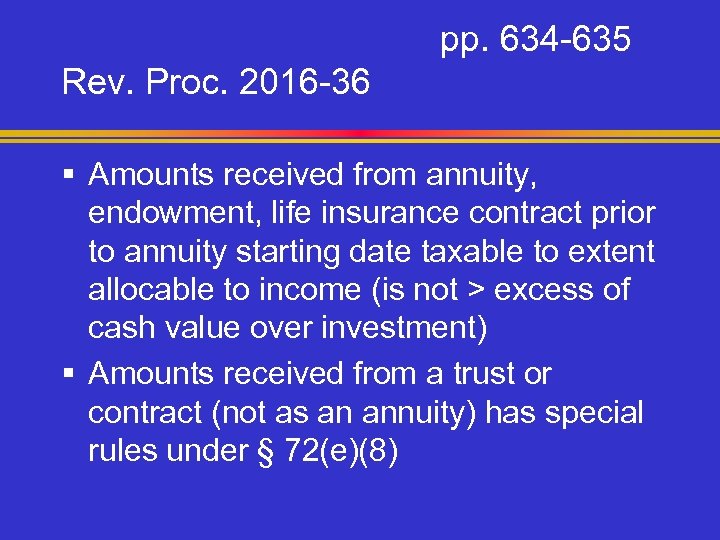

pp. 634 -635 Rev. Proc. 2016 -36 § Amounts received from annuity, endowment, life insurance contract prior to annuity starting date taxable to extent allocable to income (is not > excess of cash value over investment) § Amounts received from a trust or contract (not as an annuity) has special rules under § 72(e)(8)

pp. 634 -635 Rev. Proc. 2016 -36 § Amounts received from annuity, endowment, life insurance contract prior to annuity starting date taxable to extent allocable to income (is not > excess of cash value over investment) § Amounts received from a trust or contract (not as an annuity) has special rules under § 72(e)(8)

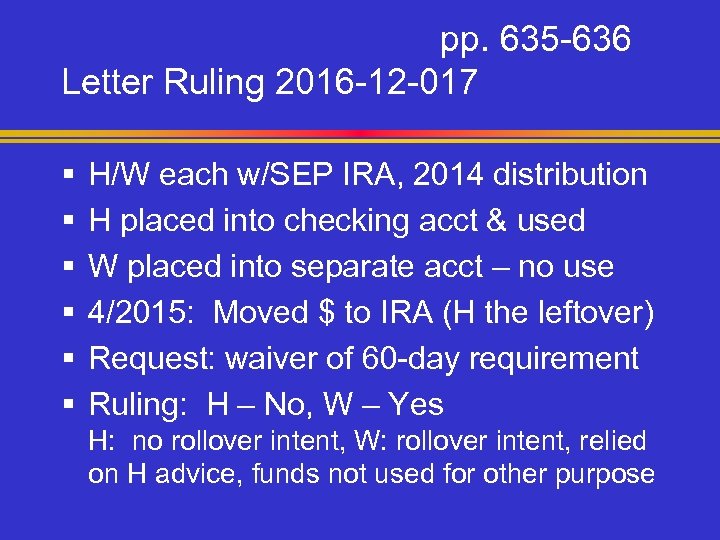

pp. 635 -636 Letter Ruling 2016 -12 -017 § § § H/W each w/SEP IRA, 2014 distribution H placed into checking acct & used W placed into separate acct – no use 4/2015: Moved $ to IRA (H the leftover) Request: waiver of 60 -day requirement Ruling: H – No, W – Yes H: no rollover intent, W: rollover intent, relied on H advice, funds not used for other purpose

pp. 635 -636 Letter Ruling 2016 -12 -017 § § § H/W each w/SEP IRA, 2014 distribution H placed into checking acct & used W placed into separate acct – no use 4/2015: Moved $ to IRA (H the leftover) Request: waiver of 60 -day requirement Ruling: H – No, W – Yes H: no rollover intent, W: rollover intent, relied on H advice, funds not used for other purpose

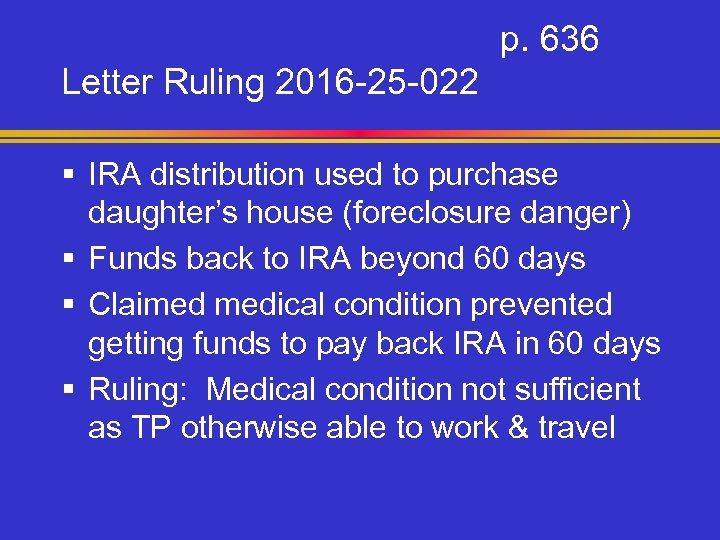

p. 636 Letter Ruling 2016 -25 -022 § IRA distribution used to purchase daughter’s house (foreclosure danger) § Funds back to IRA beyond 60 days § Claimed medical condition prevented getting funds to pay back IRA in 60 days § Ruling: Medical condition not sufficient as TP otherwise able to work & travel

p. 636 Letter Ruling 2016 -25 -022 § IRA distribution used to purchase daughter’s house (foreclosure danger) § Funds back to IRA beyond 60 days § Claimed medical condition prevented getting funds to pay back IRA in 60 days § Ruling: Medical condition not sufficient as TP otherwise able to work & travel

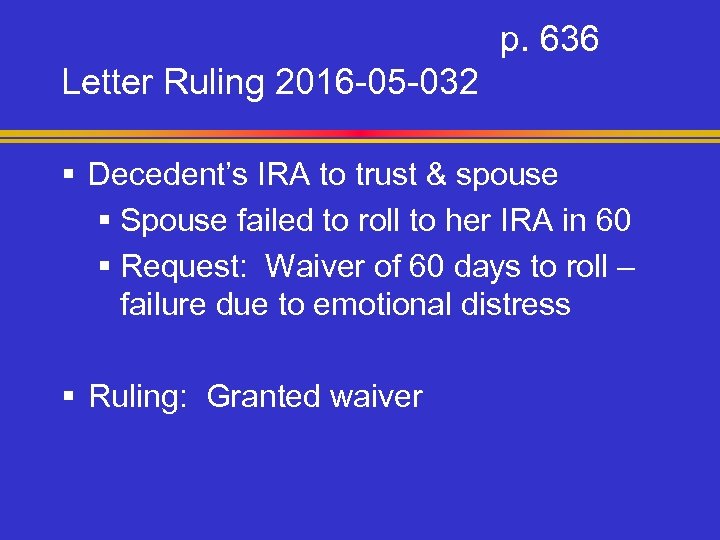

p. 636 Letter Ruling 2016 -05 -032 § Decedent’s IRA to trust & spouse § Spouse failed to roll to her IRA in 60 § Request: Waiver of 60 days to roll – failure due to emotional distress § Ruling: Granted waiver

p. 636 Letter Ruling 2016 -05 -032 § Decedent’s IRA to trust & spouse § Spouse failed to roll to her IRA in 60 § Request: Waiver of 60 days to roll – failure due to emotional distress § Ruling: Granted waiver

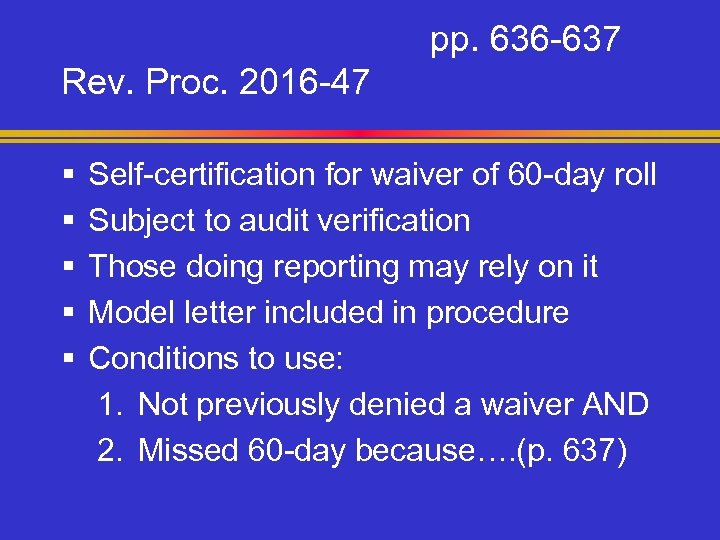

pp. 636 -637 Rev. Proc. 2016 -47 § § § Self-certification for waiver of 60 -day roll Subject to audit verification Those doing reporting may rely on it Model letter included in procedure Conditions to use: 1. Not previously denied a waiver AND 2. Missed 60 -day because…. (p. 637)

pp. 636 -637 Rev. Proc. 2016 -47 § § § Self-certification for waiver of 60 -day roll Subject to audit verification Those doing reporting may rely on it Model letter included in procedure Conditions to use: 1. Not previously denied a waiver AND 2. Missed 60 -day because…. (p. 637)

p. 637 Rev. Proc. 2016 -47 § Rollover must be made to plan or IRA as soon as reason(s) no longer prevent contribution § Requirement deemed satisfied if made within 30 days after no longer prevented

p. 637 Rev. Proc. 2016 -47 § Rollover must be made to plan or IRA as soon as reason(s) no longer prevent contribution § Requirement deemed satisfied if made within 30 days after no longer prevented

p. 637 Letter Ruling 2016 -23 -001 § Community property state – decedent designated child as IRA sole beneficiary § Widow filed claim for ½ community prop § Settlement reached w/ estate § State court approved and ordered assignment to spouse as spousal IRA rollover

p. 637 Letter Ruling 2016 -23 -001 § Community property state – decedent designated child as IRA sole beneficiary § Widow filed claim for ½ community prop § Settlement reached w/ estate § State court approved and ordered assignment to spouse as spousal IRA rollover

pp. 637 -638 Letter Ruling 2016 -23 -001 § Request: 1. Distribution classified as community property interest 2. Treat spouse as payee of inherited IRA 3. Custodian can distribute to her in form of a surviving spouse rollover IRA 4. Distribution not taxable event

pp. 637 -638 Letter Ruling 2016 -23 -001 § Request: 1. Distribution classified as community property interest 2. Treat spouse as payee of inherited IRA 3. Custodian can distribute to her in form of a surviving spouse rollover IRA 4. Distribution not taxable event

p. 638 Letter Ruling 2016 -23 -001 § § Ruling: Cannot accomplish state order Cannot rule on #1 – involves state law Spouse cannot be treated as payee Spouse may not rollover any amounts § If into an IRA = subject to contrib. limits § Assignment of interest to spouse = taxable distribution to child

p. 638 Letter Ruling 2016 -23 -001 § § Ruling: Cannot accomplish state order Cannot rule on #1 – involves state law Spouse cannot be treated as payee Spouse may not rollover any amounts § If into an IRA = subject to contrib. limits § Assignment of interest to spouse = taxable distribution to child

p. 638 Vandenbosch v Commissioner § At 42, rec’d distribution from SEP IRA, transferred between accounts, and then loaned friend to invest § Loaned by TP personally, not by IRA § TP: Investment by IRA § IRS: Not bonafide IRA investment § Court: Taxable – TP had unfettered control over funds at all times

p. 638 Vandenbosch v Commissioner § At 42, rec’d distribution from SEP IRA, transferred between accounts, and then loaned friend to invest § Loaned by TP personally, not by IRA § TP: Investment by IRA § IRS: Not bonafide IRA investment § Court: Taxable – TP had unfettered control over funds at all times

pp. 638 -639 Rev. Proc. 2016 -29 § Revised account method changes to which the automatic change procedures apply § Listed – p. 638 -639 § Effective for Form 3155 filed on or after May 5, 2016 for a year of change ending on or after September 30, 2015

pp. 638 -639 Rev. Proc. 2016 -29 § Revised account method changes to which the automatic change procedures apply § Listed – p. 638 -639 § Effective for Form 3155 filed on or after May 5, 2016 for a year of change ending on or after September 30, 2015

pp. 639 -640 CCA Letter 2016 -14 -037 § TP makes automatic change to use final tangible property regs § TP takes § 481(a) adjustment into account § IRS cannot require TP to change its method of accounting for a prior year

pp. 639 -640 CCA Letter 2016 -14 -037 § TP makes automatic change to use final tangible property regs § TP takes § 481(a) adjustment into account § IRS cannot require TP to change its method of accounting for a prior year

pp. 640 -641 Tech Advice Memo 2016 -10 -017 § Multinational e-commerce & physical retailer § Sold gift cards that do not expire § No admin fee charged on cards § Can defer amounts received for gift cards to extent it can make an appropriate estimate of deferral $ under Reg. § 1. 451 -5

pp. 640 -641 Tech Advice Memo 2016 -10 -017 § Multinational e-commerce & physical retailer § Sold gift cards that do not expire § No admin fee charged on cards § Can defer amounts received for gift cards to extent it can make an appropriate estimate of deferral $ under Reg. § 1. 451 -5

p. 641 Giant Eagle Inc. v Commissioner § § Owned & operated retail food stores Points give on customer store cards Points redeemable as fuel discount Deducted estimated costs of redeeming a portion of the points earned each year but not redeemed by year end § Court: Deduction allowed

p. 641 Giant Eagle Inc. v Commissioner § § Owned & operated retail food stores Points give on customer store cards Points redeemable as fuel discount Deducted estimated costs of redeeming a portion of the points earned each year but not redeemed by year end § Court: Deduction allowed

pp. 641 -642 Mc. Auliffe v Commissioner § § Owned & operated retail food stores Points give on customer store cards Points redeemable as fuel discount Deducted estimated costs of redeeming a portion of the points earned each year but not redeemed by year end § Court: Deduction allowed

pp. 641 -642 Mc. Auliffe v Commissioner § § Owned & operated retail food stores Points give on customer store cards Points redeemable as fuel discount Deducted estimated costs of redeeming a portion of the points earned each year but not redeemed by year end § Court: Deduction allowed

p. 642 Atuke v Commissioner § After CDP hearing, determination by certified letter to Kenya § TP filed Tax Court petition to appeal § Postmarked Dec. 3, 2015 – 50 days after determination mailed § Sought more time due to mail delay § Court: 30 days set by statute, lacked jurisdiction to hear the appeal

p. 642 Atuke v Commissioner § After CDP hearing, determination by certified letter to Kenya § TP filed Tax Court petition to appeal § Postmarked Dec. 3, 2015 – 50 days after determination mailed § Sought more time due to mail delay § Court: 30 days set by statute, lacked jurisdiction to hear the appeal

p. 642 Duckett v Commissioner § Beneficiary of irrevocable trust of parents § Distributions of income & principal at discretion of trustee for her support § IRS sent notice of levy for taxes owed by beneficiary

p. 642 Duckett v Commissioner § Beneficiary of irrevocable trust of parents § Distributions of income & principal at discretion of trustee for her support § IRS sent notice of levy for taxes owed by beneficiary

pp. 642 -643 Duckett v Commissioner § Court: 1. Look to state law to determine beneficiary’s property interest 2. Look to federal tax law to determine if interest subject to levy § Beneficiary had sufficient control over trust corpus for tax lien to attach

pp. 642 -643 Duckett v Commissioner § Court: 1. Look to state law to determine beneficiary’s property interest 2. Look to federal tax law to determine if interest subject to levy § Beneficiary had sufficient control over trust corpus for tax lien to attach

pp. 643 -644 Letter Ruling 2016 -28 -010 § Irrevocable domestic trust – beneficiaries: grantor, grantor’s 2 children & children’s lineal descendants § During grantor’s lifetime trust could make distributions of income/principal at direction of distribution committee or at grantor’s direction § Committee: Beneficiaries + 3 rd party

pp. 643 -644 Letter Ruling 2016 -28 -010 § Irrevocable domestic trust – beneficiaries: grantor, grantor’s 2 children & children’s lineal descendants § During grantor’s lifetime trust could make distributions of income/principal at direction of distribution committee or at grantor’s direction § Committee: Beneficiaries + 3 rd party

pp. 643 -644 Letter Ruling 2016 -28 -010 § Committee must have 2 eligible individuals at all times § Adult descendants of grantor, parent of minor descendant, legal guardian of minor descendant or other person with adverse interest to grantor § If ever < 2, ceases to function, no distributions made requiring consent

pp. 643 -644 Letter Ruling 2016 -28 -010 § Committee must have 2 eligible individuals at all times § Adult descendants of grantor, parent of minor descendant, legal guardian of minor descendant or other person with adverse interest to grantor § If ever < 2, ceases to function, no distributions made requiring consent

pp. 643 -644 Letter Ruling 2016 -28 -010 § At grantor’s death, committee disbands § Trustee makes decisions § Remaining balance to or for benefit of any person/entity other than grantor’s estate or creditors, or creditors of the estate

pp. 643 -644 Letter Ruling 2016 -28 -010 § At grantor’s death, committee disbands § Trustee makes decisions § Remaining balance to or for benefit of any person/entity other than grantor’s estate or creditors, or creditors of the estate

pp. 643 -644 Letter Ruling 2016 -28 -010 § Grantor retained consent power over the income and principal of the trust § Retention of power causes transfer of property to trust to be incomplete for gift tax purposes

pp. 643 -644 Letter Ruling 2016 -28 -010 § Grantor retained consent power over the income and principal of the trust § Retention of power causes transfer of property to trust to be incomplete for gift tax purposes

pp. 644 -646 Valuations – Proposed Regs. § Valuation of interests in corporations & partnerships for estate, gift, & generation skipping transfer tax purposes 1. To address what constitutes control of an LLC or other entity that is not corp or PS

pp. 644 -646 Valuations – Proposed Regs. § Valuation of interests in corporations & partnerships for estate, gift, & generation skipping transfer tax purposes 1. To address what constitutes control of an LLC or other entity that is not corp or PS

pp. 644 -646 Valuations – Proposed Regs. 2. Address deathbed transfers that result in lapse of a liquidation right & to clarify treatment of transfer resulting in creation of assignee interest 3. Amend definition of “applicable restriction”

pp. 644 -646 Valuations – Proposed Regs. 2. Address deathbed transfers that result in lapse of a liquidation right & to clarify treatment of transfer resulting in creation of assignee interest 3. Amend definition of “applicable restriction”

pp. 644 -646 Valuations 4. Address restrictions on liquidation of individual interest in an entity & the effect of insubstantial interests held by persons outside the family

pp. 644 -646 Valuations 4. Address restrictions on liquidation of individual interest in an entity & the effect of insubstantial interests held by persons outside the family

Questions?

Questions?