24106e849a7dac91cdbb6ce1f6b8b8c0.ppt

- Количество слайдов: 20

Ruby Pipeline Ed Miller EPWP Dan Fitzgerald PG&E Wyoming Pipeline Authority January 15, 2008

El Paso Corporation Overview • El Paso Corporation provides natural gas and related energy products in a safe, efficient, dependable manner. We own North America’s largest natural gas pipeline system and are one of North America’s largest independent natural gas producers. We are organized around regulated and nonregulated businesses. 2

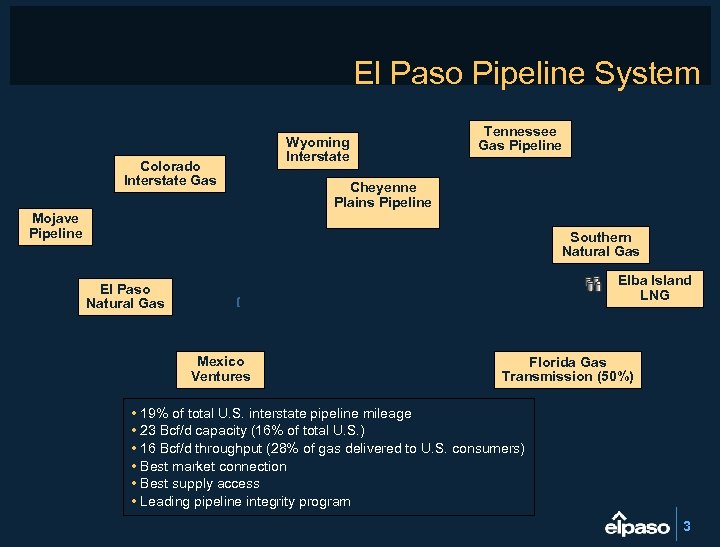

El Paso Pipeline System Colorado Interstate Gas Wyoming Interstate Tennessee Gas Pipeline Cheyenne Plains Pipeline Mojave Pipeline Southern Natural Gas Elba Island LNG El Paso Natural Gas Mexico Ventures Florida Gas Transmission (50%) • 19% of total U. S. interstate pipeline mileage • 23 Bcf/d capacity (16% of total U. S. ) • 16 Bcf/d throughput (28% of gas delivered to U. S. consumers) • Best market connection • Best supply access • Leading pipeline integrity program 3

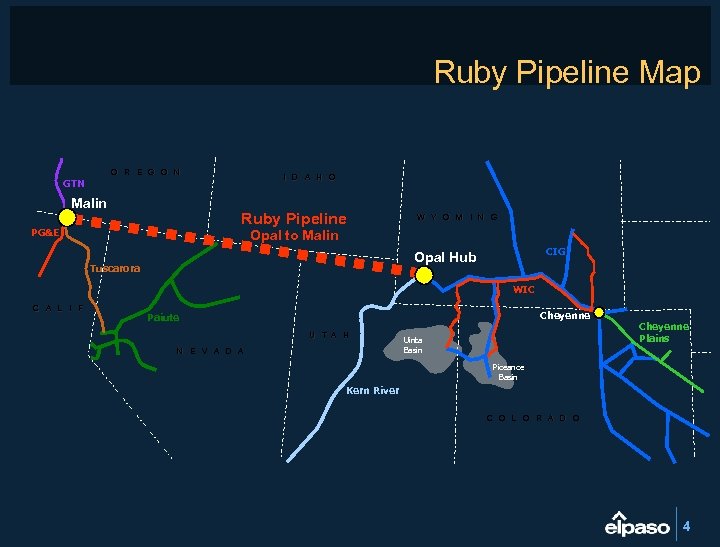

Ruby Pipeline Map O R E G O N I D A H O GTN Malin Ruby Pipeline PG&E W Y O M I N G Opal to Malin CIG Opal Hub Tuscarora WIC C A L I F. Cheyenne Paiute U T A H N E V A D A Uinta Basin Cheyenne Plains Piceance Basin Kern River C O L O R A D O 4

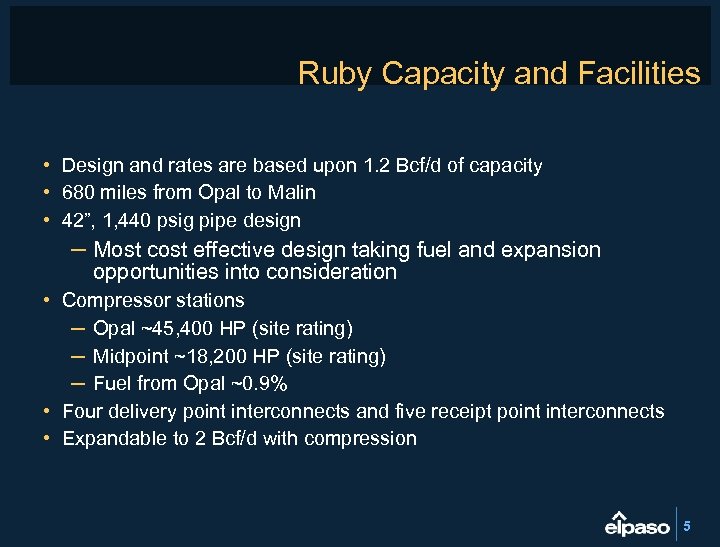

Ruby Capacity and Facilities • Design and rates are based upon 1. 2 Bcf/d of capacity • 680 miles from Opal to Malin • 42”, 1, 440 psig pipe design – Most cost effective design taking fuel and expansion opportunities into consideration • Compressor stations – Opal ~45, 400 HP (site rating) – Midpoint ~18, 200 HP (site rating) – Fuel from Opal ~0. 9% • Four delivery point interconnects and five receipt point interconnects • Expandable to 2 Bcf/d with compression 5

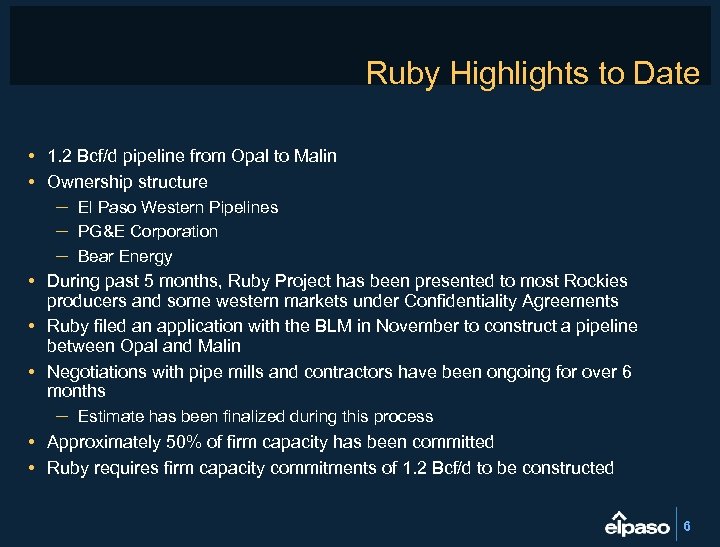

Ruby Highlights to Date • 1. 2 Bcf/d pipeline from Opal to Malin • Ownership structure – El Paso Western Pipelines – PG&E Corporation – Bear Energy • During past 5 months, Ruby Project has been presented to most Rockies producers and some western markets under Confidentiality Agreements • Ruby filed an application with the BLM in November to construct a pipeline between Opal and Malin • Negotiations with pipe mills and contractors have been ongoing for over 6 months – Estimate has been finalized during this process • Approximately 50% of firm capacity has been committed • Ruby requires firm capacity commitments of 1. 2 Bcf/d to be constructed 6

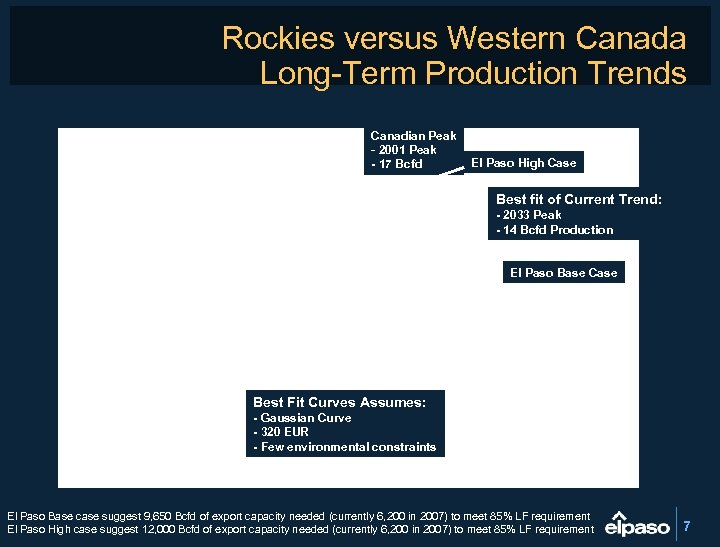

Rockies versus Western Canada Long-Term Production Trends Canadian Peak - 2001 Peak - 17 Bcfd El Paso High Case Best fit of Current Trend: - 2033 Peak - 14 Bcfd Production El Paso Base Case Best Fit Curves Assumes: - Gaussian Curve - 320 EUR - Few environmental constraints El Paso Base case suggest 9, 650 Bcfd of export capacity needed (currently 6, 200 in 2007) to meet 85% LF requirement El Paso High case suggest 12, 000 Bcfd of export capacity needed (currently 6, 200 in 2007) to meet 85% LF requirement 7

Rocky Mountain Production by Basin (Volumes are Wellhead – Measured in MMcfd) 1990 -2005: Wellhead total data from IHS database 2006: Estimate 2007 -2015: El Paso forecast 8

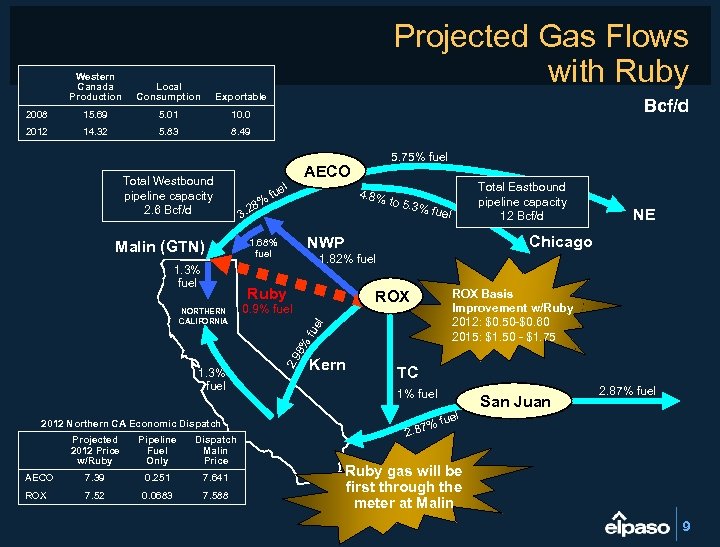

Projected Gas Flows with Ruby Western Canada Production Local Consumption Exportable 2008 15. 69 5. 01 10. 0 2012 14. 32 5. 83 8. 49 Total Westbound pipeline capacity 2. 6 Bcf/d Malin (GTN) 1. 3% fuel 8% Bcf/d AECO el fu 4. 8% 3. 2 to 5. 3 % fue Projected 2012 Price w/Ruby Pipeline Fuel Only Dispatch Malin Price AECO 7. 39 0. 251 7. 641 ROX 7. 52 0. 0683 7. 588 NE Chicago ROX fue l 0. 9% fuel 8% 2012 Northern CA Economic Dispatch l 1. 82% fuel 2. 9 1. 3% fuel Total Eastbound pipeline capacity 12 Bcf/d NWP 1. 68% fuel Ruby NORTHERN CALIFORNIA 5. 75% fuel Kern ROX Basis Improvement w/Ruby 2012: $0. 50 -$0. 60 2015: $1. 50 - $1. 75 TC 1% fuel % 2. 87 fuel San Juan 2. 87% fuel Ruby gas will be first through the meter at Malin 9

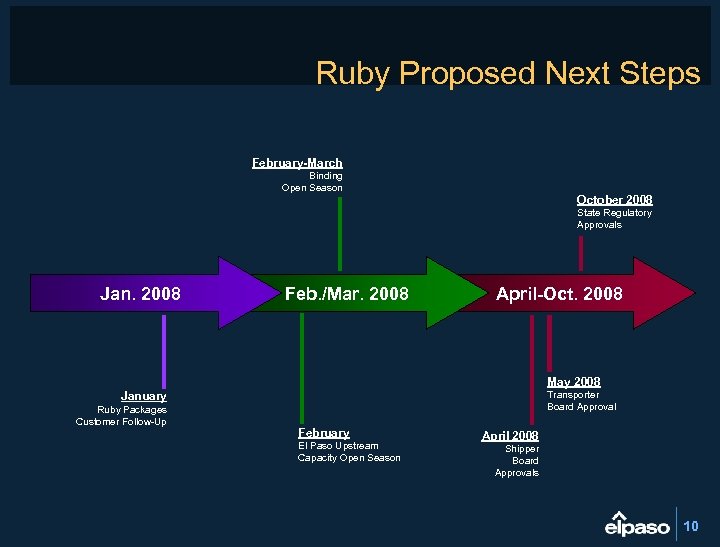

Ruby Proposed Next Steps February-March Binding Open Season October 2008 State Regulatory Approvals Jan. 2008 Feb. /Mar. 2008 April-Oct. 2008 May 2008 January Ruby Packages Customer Follow-Up Transporter Board Approval February El Paso Upstream Capacity Open Season April 2008 Shipper Board Approvals 10

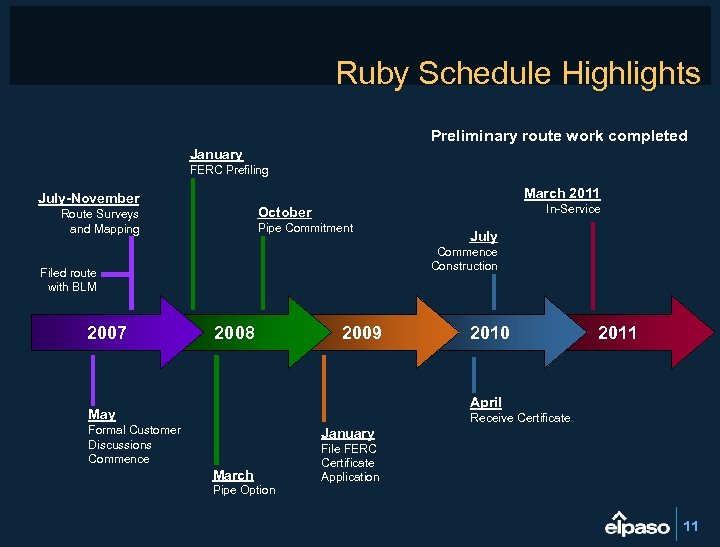

Ruby Schedule Highlights Preliminary route work completed January FERC Prefiling March 2011 July-November In-Service October Route Surveys and Mapping Pipe Commitment Commence Construction Filed route with BLM 2007 July 2008 2009 2010 2011 April May Receive Certificate Formal Customer Discussions Commence January March Pipe Option File FERC Certificate Application 11

Market Overview 12

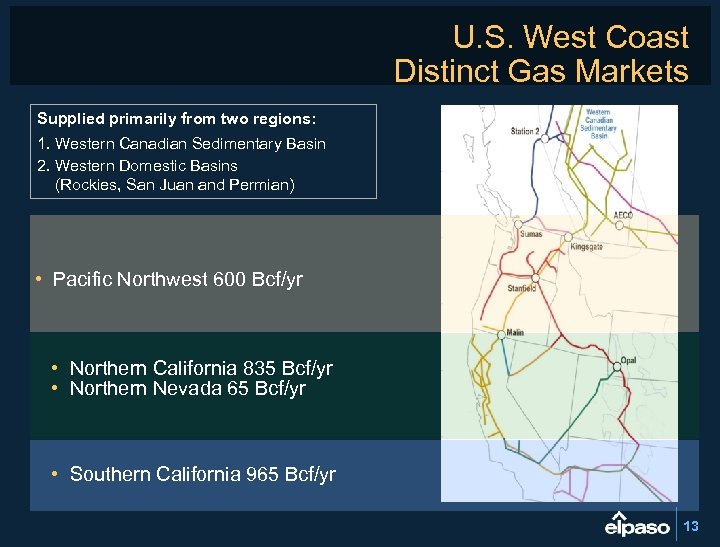

U. S. West Coast Distinct Gas Markets Supplied primarily from two regions: 1. Western Canadian Sedimentary Basin 2. Western Domestic Basins (Rockies, San Juan and Permian) • Pacific Northwest 600 Bcf/yr • Northern California 835 Bcf/yr • Northern Nevada 65 Bcf/yr • Southern California 965 Bcf/yr 13

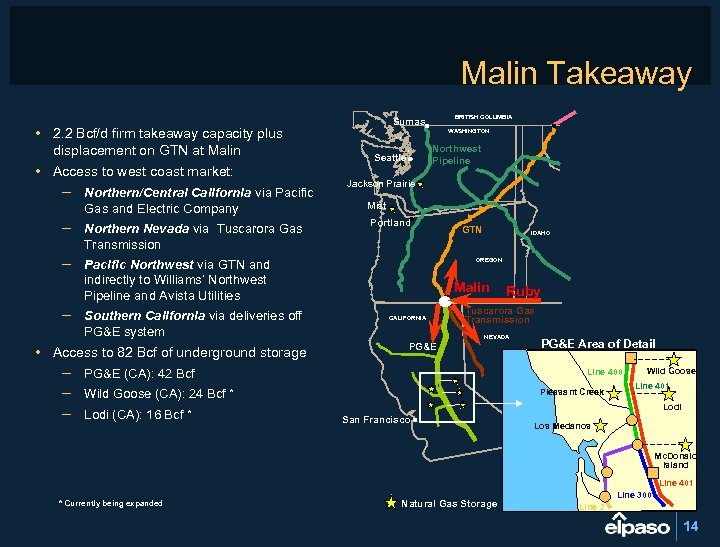

Malin Takeaway • 2. 2 Bcf/d firm takeaway capacity plus displacement on GTN at Malin • Access to west coast market: – Northern/Central California via Pacific Gas and Electric Company – Northern Nevada via Tuscarora Gas BRITISH COLUMBIA Sumas WASHINGTON Northwest Pipeline Seattle Jackson Prairie Mist Portland GTN IDAHO Transmission – Pacific Northwest via GTN and OREGON indirectly to Williams’ Northwest Pipeline and Avista Utilities – Southern California via deliveries off Malin CALIFORNIA PG&E system • Access to 82 Bcf of underground storage – PG&E (CA): 42 Bcf – Wild Goose (CA): 24 Bcf * – Lodi (CA): 16 Bcf * Ruby Tuscarora Gas Transmission NEVADA PG&E Area of Detail Line 400 Pleasant Creek Wild Goose Line 401 Lodi San Francisco Los Medanos Mc. Donald Island Line 401 * Currently being expanded Natural Gas Storage Line 300 Line 2 14

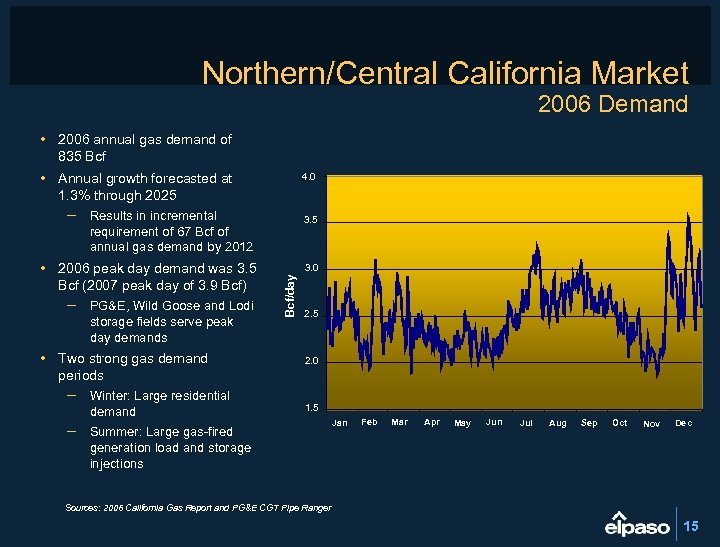

Northern/Central California Market 2006 Demand • 2006 annual gas demand of 835 Bcf • Annual growth forecasted at 1. 3% through 2025 4. 0 – Results in incremental 3. 5 requirement of 67 Bcf of annual gas demand by 2012 – PG&E, Wild Goose and Lodi storage fields serve peak day demands • Two strong gas demand periods – Winter: Large residential demand 3. 0 Bcf/day • 2006 peak day demand was 3. 5 Bcf (2007 peak day of 3. 9 Bcf) 2. 5 2. 0 1. 5 – Summer: Large gas-fired Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec generation load and storage injections Sources: 2006 California Gas Report and PG&E CGT Pipe Ranger 15

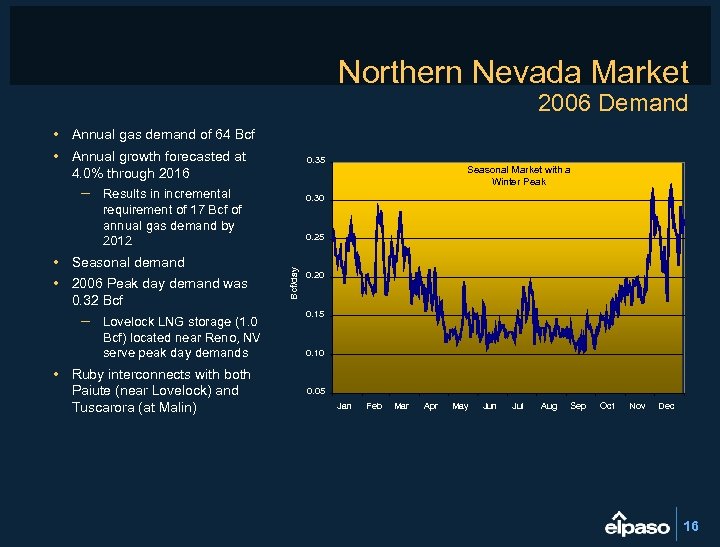

Northern Nevada Market 2006 Demand • Annual gas demand of 64 Bcf • Annual growth forecasted at 4. 0% through 2016 0. 35 – Results in incremental 0. 30 requirement of 17 Bcf of annual gas demand by 2012 • 2006 Peak day demand was 0. 32 Bcf – Lovelock LNG storage (1. 0 Bcf) located near Reno, NV serve peak day demands • Ruby interconnects with both Paiute (near Lovelock) and Tuscarora (at Malin) 0. 25 Bcf/day • Seasonal demand Seasonal Market with a Winter Peak 0. 20 0. 15 0. 10 0. 05 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 16

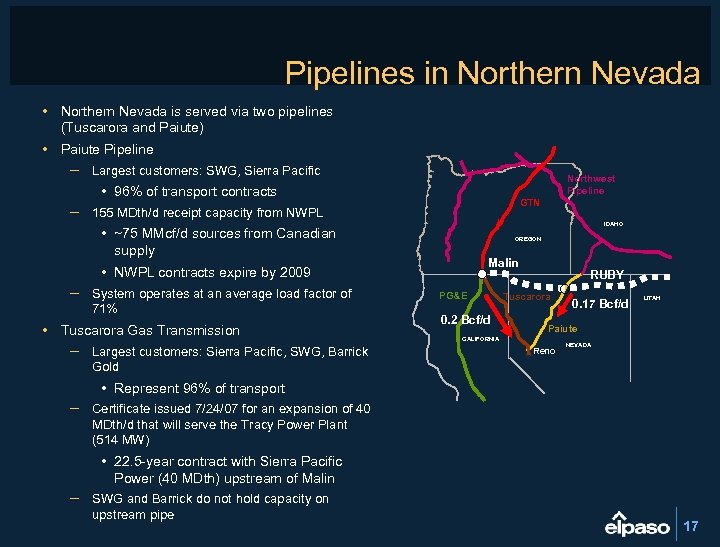

Pipelines in Northern Nevada • Northern Nevada is served via two pipelines (Tuscarora and Paiute) • Paiute Pipeline – Largest customers: SWG, Sierra Pacific Northwest Pipeline • 96% of transport contracts GTN – 155 MDth/d receipt capacity from NWPL IDAHO • ~75 MMcf/d sources from Canadian supply OREGON Malin • NWPL contracts expire by 2009 – System operates at an average load factor of 71% • Tuscarora Gas Transmission – Largest customers: Sierra Pacific, SWG, Barrick PG&E 0. 2 Bcf/d RUBY Tuscarora 0. 17 Bcf/d UTAH Paiute CALIFORNIA Reno NEVADA Gold • Represent 96% of transport – Certificate issued 7/24/07 for an expansion of 40 MDth/d that will serve the Tracy Power Plant (514 MW) • 22. 5 -year contract with Sierra Pacific Power (40 MDth) upstream of Malin – SWG and Barrick do not hold capacity on upstream pipe 17

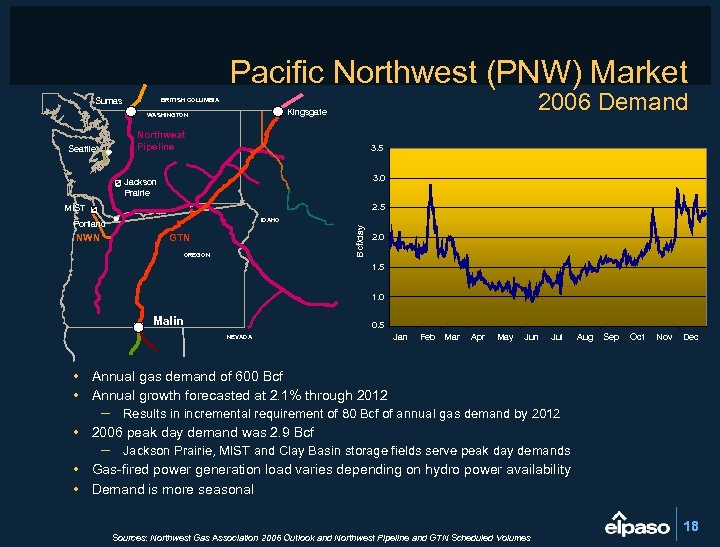

Pacific Northwest (PNW) Market 2006 Demand BRITISH COLUMBIA Sumas Kingsgate WASHINGTON Northwest Pipeline Seattle 3. 5 3. 0 s Jackson Prairie 2. 5 MIST s IDAHO NWN Bcf/day Portland GTN OREGON 2. 0 1. 5 1. 0 Malin 0. 5 NEVADA Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec • Annual gas demand of 600 Bcf • Annual growth forecasted at 2. 1% through 2012 – Results in incremental requirement of 80 Bcf of annual gas demand by 2012 • 2006 peak day demand was 2. 9 Bcf – Jackson Prairie, MIST and Clay Basin storage fields serve peak day demands • Gas-fired power generation load varies depending on hydro power availability • Demand is more seasonal Sources: Northwest Gas Association 2006 Outlook and Northwest Pipeline and GTN Scheduled Volumes 18

Contacts El Paso Western Pipelines PG&E Ed Miller Business Development 719. 520. 4305 Edward. Miller@elpaso. com Dan Fitzgerald 415. 267. 7041 Daniel. Fitzgerald@pcgpipeline. com Roland Harris Business Development 719. 520. 4380 Roland. Harris@elpaso. com Bear Energy Jeff Rawls 713. 236. 3380 JRawls@bear. com Russ Council Engineering 719. 520. 4865 Russ. Council@elpaso. com Jennifer Webster Government Affairs 719. 520. 4327 Jennifer. Webster@elpaso. com 19

Ruby Pipeline Ed Miller EPWP Dan Fitzgerald PG&E Wyoming Pipeline Authority January 15, 2008

24106e849a7dac91cdbb6ce1f6b8b8c0.ppt