0beb81ed4215dd43b3fb35de3cde3875.ppt

- Количество слайдов: 21

Roundtable 2: Issues of linking units administrative sources with those in statistical BR Workshop on Business Registers and their Role in Business Statistics in the Eastern UNECE region Luxembourg, 5 October 2009 Norbert Rainer 1 statistik. at

Content Ø Use of administrative sources and issues / problems related Ø Issues of the correct identification of economic activity and institutional sector of statistical units 2

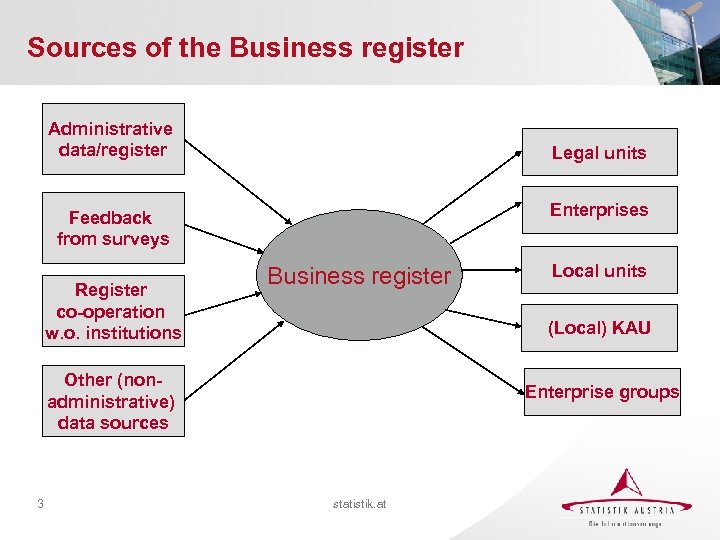

Sources of the Business register Administrative data/register Legal units Enterprises Feedback from surveys Register co-operation w. o. institutions Business register (Local) KAU Other (nonadministrative) data sources 3 Local units Enterprise groups statistik. at

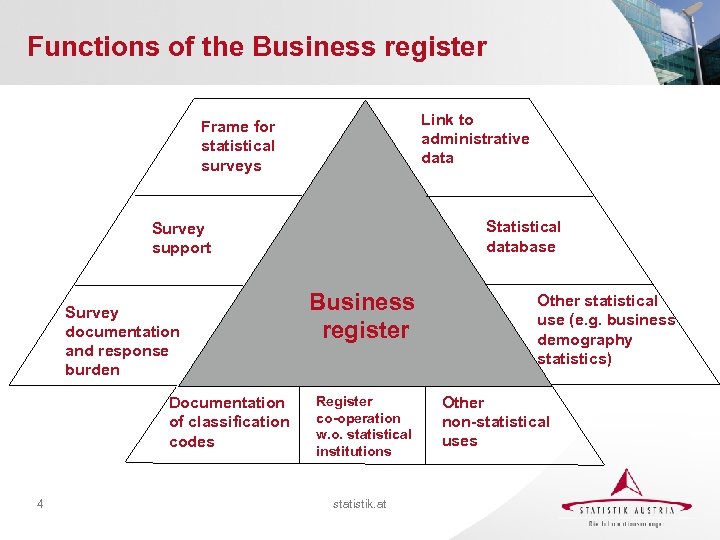

Functions of the Business register Link to administrative data Frame for statistical surveys Statistical database Survey support Survey documentation and response burden Documentation of classification codes 4 Business register Register co-operation w. o. statistical institutions statistik. at Other statistical use (e. g. business demography statistics) Other non-statistical uses

Administrative sources Most important administrative sources: o Value added tax data o Social security data o Personal income tax data o Corporate tax data Also in some countries: single administrative business register 5

Issues / Problems (1) Ø No unique numerical identifier è Data matching methods Ø Different definitions of units è Distinction in the BR between administrative units and statistical units Ø Different continuity rules è Distinction in the BR between administrative units and statistical units 6

Issues / Problems (2) Ø Other quality issues o Up - to - date information o missing data/units o accuracy of characteristics è Using complementary sources 7

Improving the situation Ø Memorandum of Understanding (Service agreements/contacts) o conditions for the supply of data o detailed delivery time tables and data, including metadata o confidentiality and security o regular relationship meetings o resolution of disputes o consultation before changing forms o consultation before altering characteristics o feedback on quality issues o considering statistical needs (based on Ron Mc. Kenzie: Managing the quality of administrative data in the production of economic statistics; 57 th ISI Conference, August 2009) 8

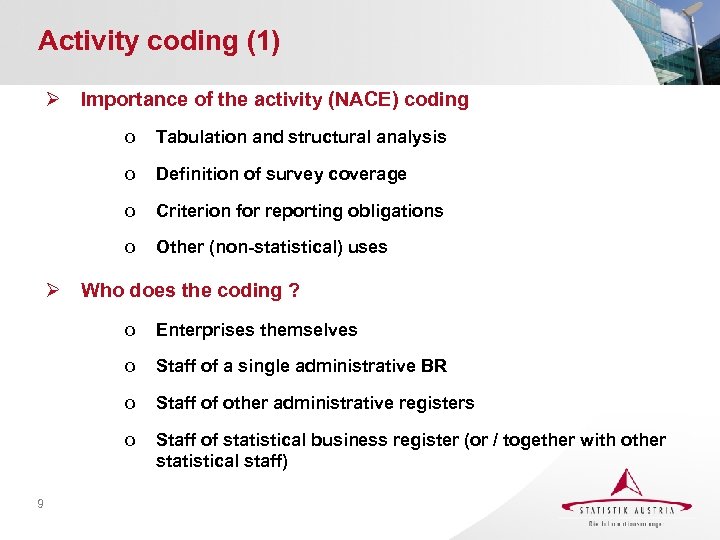

Activity coding (1) Ø Importance of the activity (NACE) coding o Tabulation and structural analysis o Definition of survey coverage o Criterion for reporting obligations o Other (non-statistical) uses Ø Who does the coding ? o o Staff of a single administrative BR o Staff of other administrative registers o 9 Enterprises themselves Staff of statistical business register (or / together with other statistical staff)

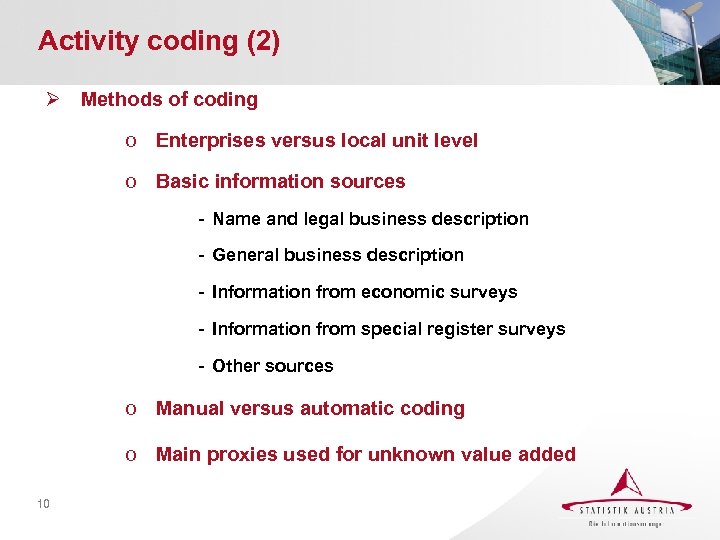

Activity coding (2) Ø Methods of coding o Enterprises versus local unit level o Basic information sources - Name and legal business description - General business description - Information from economic surveys - Information from special register surveys - Other sources o Manual versus automatic coding o Main proxies used for unknown value added 10

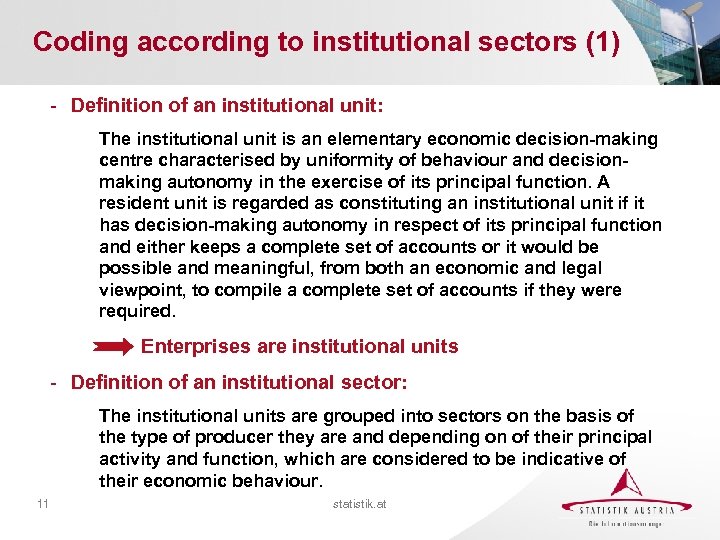

Coding according to institutional sectors (1) - Definition of an institutional unit: The institutional unit is an elementary economic decision-making centre characterised by uniformity of behaviour and decisionmaking autonomy in the exercise of its principal function. A resident unit is regarded as constituting an institutional unit if it has decision-making autonomy in respect of its principal function and either keeps a complete set of accounts or it would be possible and meaningful, from both an economic and legal viewpoint, to compile a complete set of accounts if they were required. Enterprises are institutional units - Definition of an institutional sector: The institutional units are grouped into sectors on the basis of the type of producer they are and depending on of their principal activity and function, which are considered to be indicative of their economic behaviour. 11 statistik. at

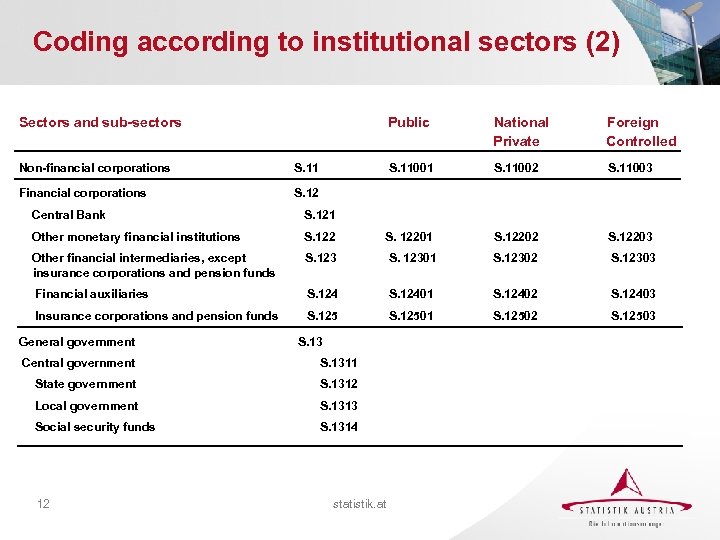

Coding according to institutional sectors (2) Sectors and sub-sectors Public Non-financial corporations Foreign Controlled S. 11001 S. 11 National Private S. 11002 S. 11003 S. 12 Central Bank S. 121 Other monetary financial institutions S. 12201 S. 12202 S. 12203 Other financial intermediaries, except insurance corporations and pension funds S. 12301 S. 12302 S. 12303 Financial auxiliaries S. 12401 S. 12402 S. 12403 Insurance corporations and pension funds S. 12501 S. 12502 S. 12503 General government S. 13 Central government S. 1311 State government S. 1312 Local government S. 1313 Social security funds S. 1314 12 statistik. at

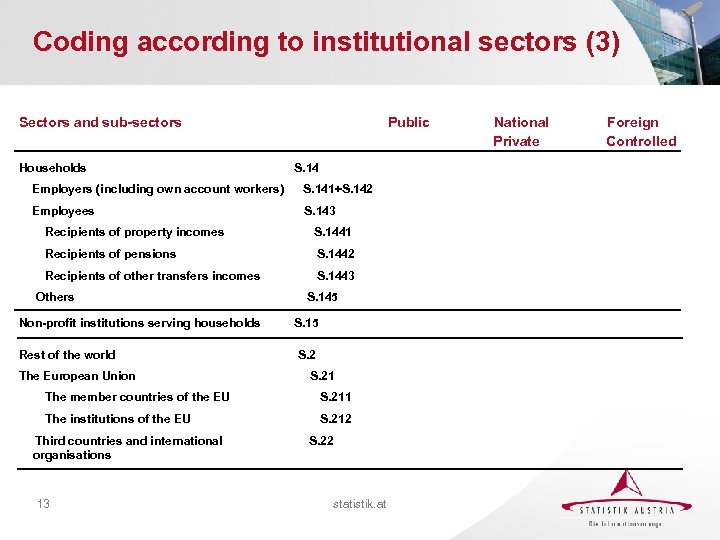

Coding according to institutional sectors (3) Sectors and sub-sectors Households Public S. 14 Employers (including own account workers) S. 141+S. 142 Employees S. 143 Recipients of property incomes S. 1441 Recipients of pensions S. 1442 Recipients of other transfers incomes S. 1443 Others S. 145 Non-profit institutions serving households S. 15 Rest of the world S. 2 The European Union S. 21 The member countries of the EU S. 211 The institutions of the EU S. 212 Third countries and international organisations 13 S. 22 statistik. at National Private Foreign Controlled

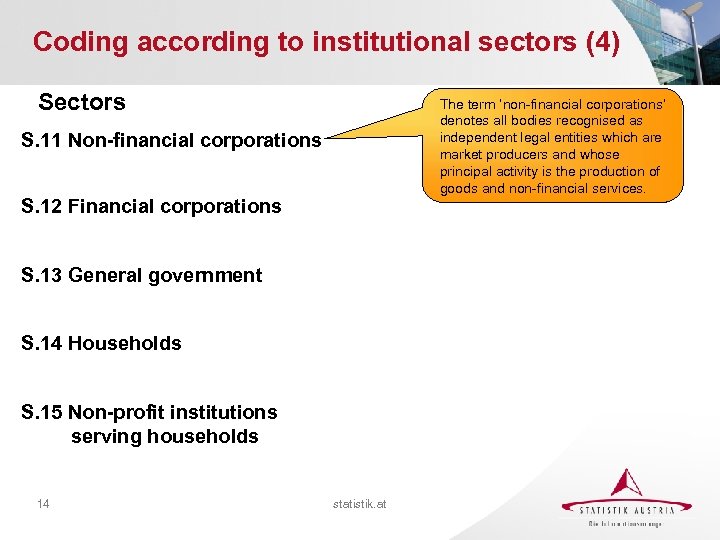

Coding according to institutional sectors (4) Sectors The term ‘non-financial corporations’ denotes all bodies recognised as independent legal entities which are market producers and whose principal activity is the production of goods and non-financial services. S. 11 Non-financial corporations S. 12 Financial corporations S. 13 General government S. 14 Households S. 15 Non-profit institutions serving households 14 statistik. at

Coding according to institutional sectors (5) Sectors S. 11 Non-financial corporations The sector financial corporations (S. 12) consists of all corporations and quasicorporations which are principally engaged in financial intermediation (financial intermediaries) and/or in auxiliary financial activities (financial auxiliaries) S. 12 Financial corporations S. 13 General government S. 14 Households S. 15 Non-profit institutions serving households 15 statistik. at

Coding according to institutional sectors (6) Sectors S. 11 Non-financial corporations S. 12 Financial corporations The sector general government (S. 13) includes all institutional units which are other non-market producers (see paragraph 3. 26. ) whose output is intended for individual and collective consumption, and mainly financed by compulsory payments made by units belonging to other sectors, and/or all institutional units principally engaged in the redistribution of national income and wealth. S. 13 General government S. 14 Households S. 15 Non-profit institutions serving households 16 statistik. at

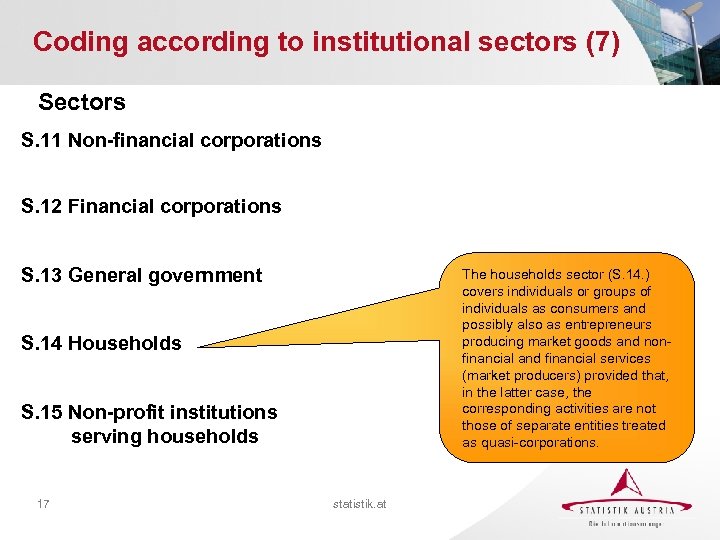

Coding according to institutional sectors (7) Sectors S. 11 Non-financial corporations S. 12 Financial corporations S. 13 General government The households sector (S. 14. ) covers individuals or groups of individuals as consumers and possibly also as entrepreneurs producing market goods and nonfinancial and financial services (market producers) provided that, in the latter case, the corresponding activities are not those of separate entities treated as quasi-corporations. S. 14 Households S. 15 Non-profit institutions serving households 17 statistik. at

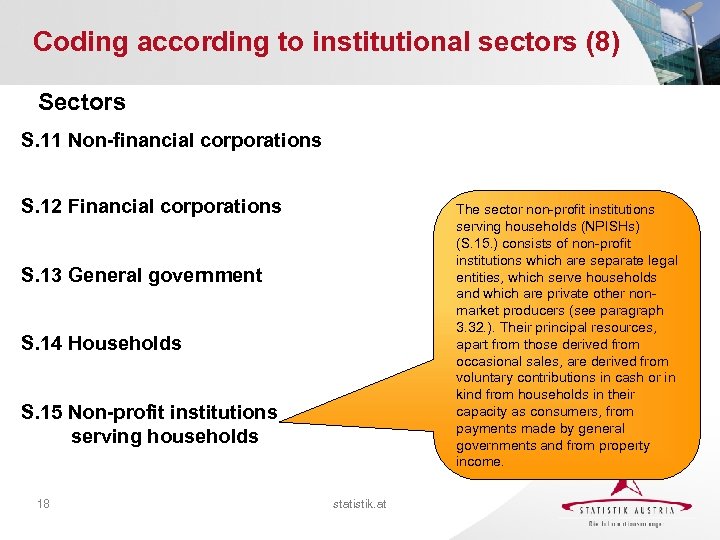

Coding according to institutional sectors (8) Sectors S. 11 Non-financial corporations S. 12 Financial corporations The sector non-profit institutions serving households (NPISHs) (S. 15. ) consists of non-profit institutions which are separate legal entities, which serve households and which are private other nonmarket producers (see paragraph 3. 32. ). Their principal resources, apart from those derived from occasional sales, are derived from voluntary contributions in cash or in kind from households in their capacity as consumers, from payments made by general governments and from property income. S. 13 General government S. 14 Households S. 15 Non-profit institutions serving households 18 statistik. at

Coding according to institutional sectors (9) - Variables that can be used for classifying: • • Whether an institutional unit belongs to public administration • 19 Legal form • - NACE activity Whether an institutional unit belongs to non-profit institutions However, the sector classification is basically a national accounts classification. Additional information that is not covered in the BR might necessary (from national accounts; from central bank) statistik. at

Coding according to institutional sectors (10) - Institutional sectors that can be classified by NACE code solely: • • - Enterprises classified in NACE Rev. 2 65. 11 (Central bank) are allocated to sub-sector S. 121 (Central bank) Enterprises classified in NACE Rev. 2 65 (Insurance) are allocated the sub-sector S. 125 (Insurance corporations and pension funds) Institutional sectors that can be classified by legal form solely: • 20 Enterprises with unit legal form sole proprietorship are allocated to sector S. 14 (Households) All other sectors can only by classified by using a combination of criteria statistik. at

Thank you for your attention ! 21 statistik. at

0beb81ed4215dd43b3fb35de3cde3875.ppt