c71e26dee3f1402edfed9ee86a06da72.ppt

- Количество слайдов: 21

Romanian Credit Bureau Trans. Union/CRIF Approach to Successful Implementation and Value-added Services Bucharest, February 10 th, 2004 Petr Kucera Senior Regional Manager

Table of contents Trans. Union, CRIF & IPACRI Introduction Credit Bureau Experience Credit Bureau Solution overview; Proposed involvement The future: Added-value credit bureau services • Romanian Credit Bureau

Trans. Union Introduction • Trans. Union The USA’s leading consumer credit reporting agency. Operate credit bureaux in more than 10 and have offices in over 20 markets. One of the largest databases of consumer information in the world. More that 4 million credit reports sold daily (1 million online, 3 million in off-line/batch mode). Receive 12, 500 input files per month from 9, 000 data contributors. 3. 4 billion rows of data updated monthly on 200 million consumers. 33 thousand public records updated each day. Strict policy enforcement to protect credit information confidentiality.

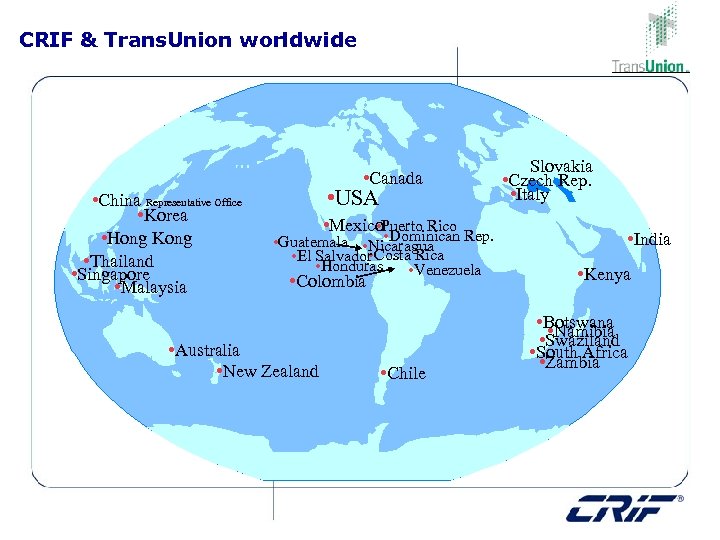

CRIF & Trans. Union worldwide • Canada • China Representative Office • Korea • Hong Kong • Thailand • Singapore • Malaysia • USA • • Mexico. Puerto Rico • Dominican Rep. • Guatemala • Nicaragua • • El Salvador Costa Rica • Honduras • Venezuela • Colombia • Australia • New Zealand • Chile Slovakia • Czech Rep. • Italy • India • Kenya • Botswana • Namibia • Swaziland • South Africa • Zambia

CRIF Introduction • CRIF A European, private- and bank-owned company with headquarters in Bologna (IT). Over 500 employees in 6 countries; extensive growth in terms of revenues and employees. Leading European provider of information, decision systems, technology and consultancy to evaluate credit risk and develop marketing strategies. Started in 1988 as the Italian Credit Bureau for the retail and small-medium business credit market (over 90% of market share). More than 24. 000 Users’ branches connected daily on-line. More than 60 million managed and updated lines of information in CRIF databases. Over 400 scoring and decision solutions systems in 10 countries. Services provided to Banks, Financial Houses, Insurance Companies and Utilities.

Local Partnership • IPACRI Romania Established in 1994 as a joint venture with ELSAG (Italy). ELSAG involved in the TRANSFOND project for Clearing and Settlement project. Key competences in financial/banking market, postal systems, public administration, wireless/PDA applications, document management. IPACRI Banking and Finance experience covers namely retail banking, treasury systems, credit and market risk management, e-and m-banking. International exposure: Italy, Germany, Denmark, Saudi Arabia, USA. Focus on integrated Credit Risk Management Solutions with special regard to Basel II requirements.

Credit Bureau Experience Credit Bureau Operations Current Trans. Union and CRIF credit bureau operations in more than 15 markets USA, Canada, Mexico, Italy, Australia, South Africa, Hong Kong, Thailand, China…. Credit Bureau Scoring US, Canada, South Africa, Bundes Schufa – Germany; Serasa – Brasil; Buro de Credito – Mexico; ICB – Ireland; KSV – Austria (Feasibility study); BIK Poland; Czech Credit Bureau (2 Q 04) Credit Bureau Feasibility Studies Association Panamena de Credito – Panama; Tireasias - Greece Other Credit Bureau related activities KEY FACTOR: Cross-border Data Exchange; ACCIS

Eastern European Experience Czech Credit Bureau Launched in June 2002 (2 years of preparations); 5 founding members (90% of the market); Trans. Union, CRIF and a local partner selected by BA. High hit-rate of 70%; c. 4, 500 inquiries daily; expansion of the bureau to leasing companies and construction savings banks (telecommunications). Slovak Credit Bureau Current establishment process; 3 largest banks as shareholders (TU-CRIF are operators); EURISC System in outsourcing (Bologna); currently passed legislation (consent not necessary for historical data inclusion) Croatian Credit Bureau Banking Association selected Trans. Union/CRIF as operators in July 2003; Newco establishment in progress (Feb 04); all Croatian retail banks to participate. Other CEE markets Credit bureau project activities: Romania, Russia, Hungary, Bulgaria, Serbia. BIK Poland: Credit Bureau scoring

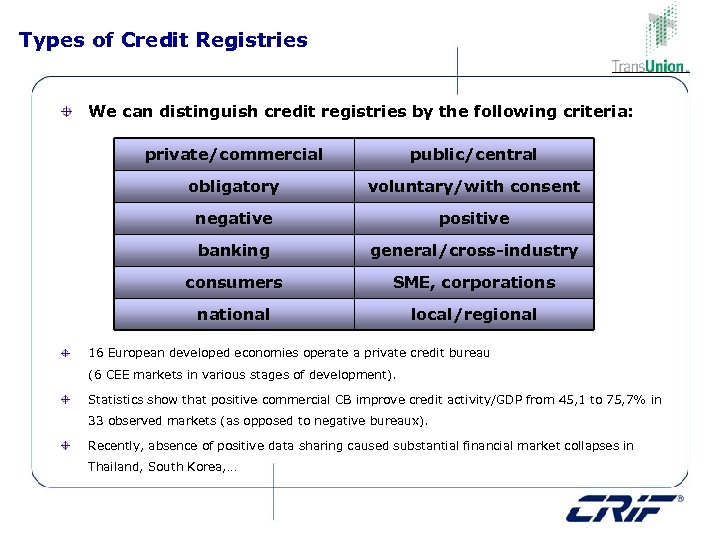

Types of Credit Registries We can distinguish credit registries by the following criteria: private/commercial public/central obligatory voluntary/with consent negative positive banking general/cross-industry consumers SME, corporations national local/regional 16 European developed economies operate a private credit bureau (6 CEE markets in various stages of development). Statistics show that positive commercial CB improve credit activity/GDP from 45, 1 to 75, 7% in 33 observed markets (as opposed to negative bureaux). Recently, absence of positive data sharing caused substantial financial market collapses in Thailand, South Korea, …

Private Credit Bureau CEE situation

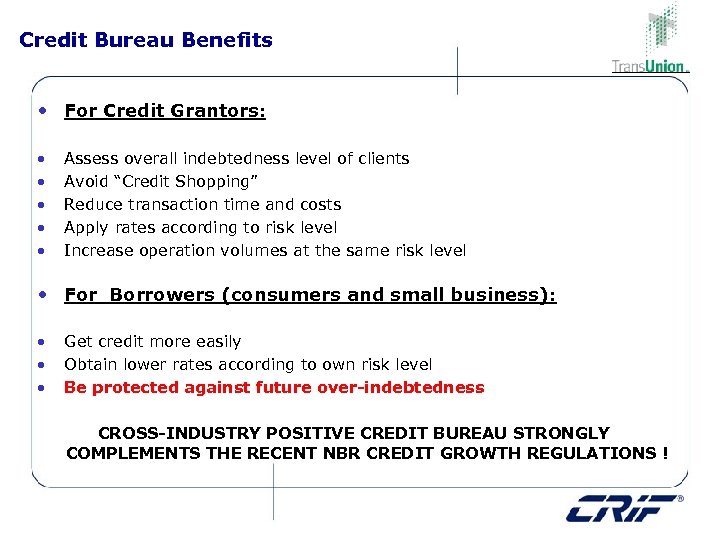

Credit Bureau Benefits • For Credit Grantors: • • • Assess overall indebtedness level of clients Avoid “Credit Shopping” Reduce transaction time and costs Apply rates according to risk level Increase operation volumes at the same risk level • For Borrowers (consumers and small business): • • • Get credit more easily Obtain lower rates according to own risk level Be protected against future over-indebtedness CROSS-INDUSTRY POSITIVE CREDIT BUREAU STRONGLY COMPLEMENTS THE RECENT NBR CREDIT GROWTH REGULATIONS !

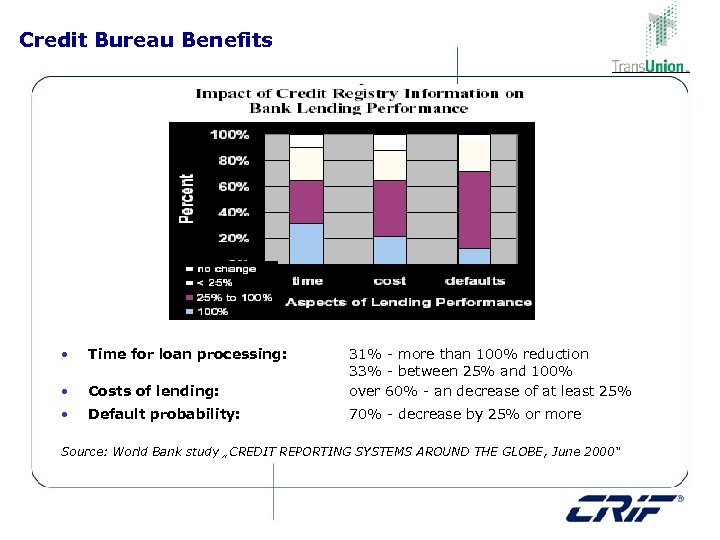

Credit Bureau Benefits • Time for loan processing: • Costs of lending: 31% - more than 100% reduction 33% - between 25% and 100% over 60% - an decrease of at least 25% • Default probability: 70% - decrease by 25% or more Source: World Bank study „CREDIT REPORTING SYSTEMS AROUND THE GLOBE, June 2000“

Credit Bureau Data Flow • Data Flow Overview Control Committee monitoring usage Credit Bureau Request sent to CB BANK Client requesting a loan Credit report retrieved Bank sends an online/batch data update (to close open contracts) Bank Production data Client & Contract info appended or updated in master CB db CB DB Data update accepted Or anomalies report generated (other reports)

Trans. Union-CRIF proposed involvement • Project management involvement • Operations and organisational consultancy • Assistance to the technical architecture and data-centre operations setup • Credit Bureau system implementation • Ongoing system maintenance • Constant upgrades via other markets´ installations • Development of ancillary value-added services

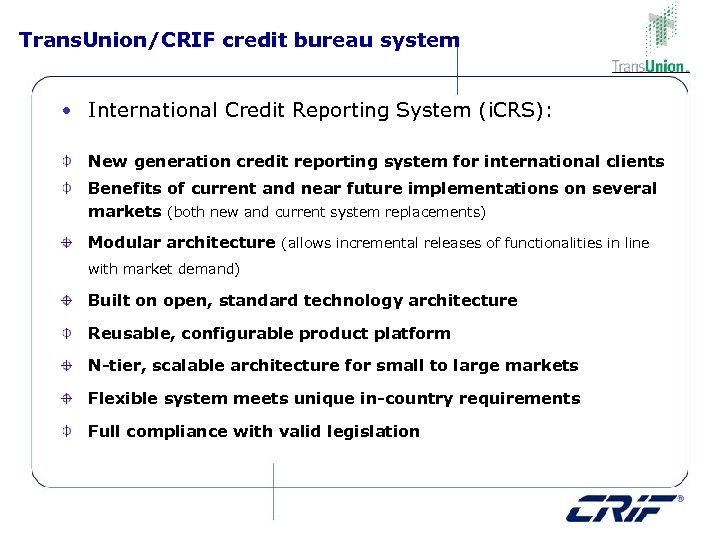

Trans. Union/CRIF credit bureau system • International Credit Reporting System (i. CRS): New generation credit reporting system for international clients Benefits of current and near future implementations on several markets (both new and current system replacements) Modular architecture (allows incremental releases of functionalities in line with market demand) Built on open, standard technology architecture Reusable, configurable product platform N-tier, scalable architecture for small to large markets Flexible system meets unique in-country requirements Full compliance with valid legislation

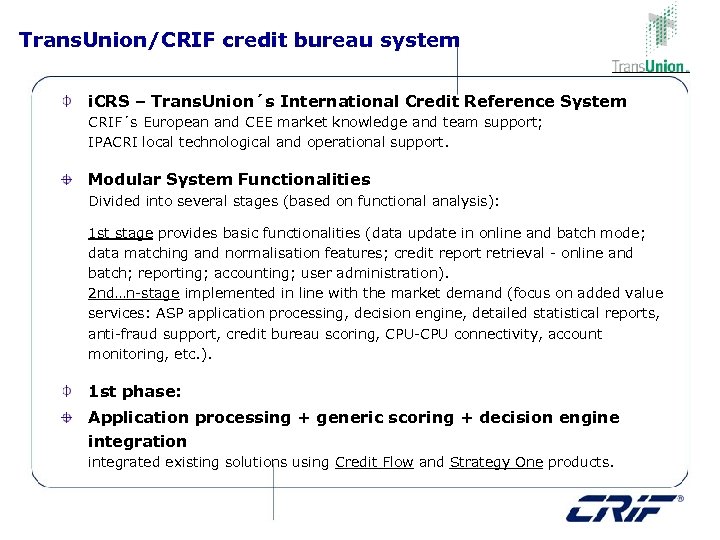

Trans. Union/CRIF credit bureau system i. CRS – Trans. Union´s International Credit Reference System CRIF´s European and CEE market knowledge and team support; IPACRI local technological and operational support. Modular System Functionalities Divided into several stages (based on functional analysis): 1 st stage provides basic functionalities (data update in online and batch mode; data matching and normalisation features; credit report retrieval - online and batch; reporting; accounting; user administration). 2 nd…n-stage implemented in line with the market demand (focus on added value services: ASP application processing, decision engine, detailed statistical reports, anti-fraud support, credit bureau scoring, CPU-CPU connectivity, account monitoring, etc. ). 1 st phase: Application processing + generic scoring + decision engine integration integrated existing solutions using Credit Flow and Strategy One products.

Data security and confidentiality issues Technological security: • • Secure private lines (VPN technology, data and transmission encryption, CA) Detailed access logs; automatic monitoring of excessive use Personal & organizational security: • • • Closed-end user group; reciprocity rule (only data contributors have access to data) Strict contractual regulations (MFA, membership agreement: strict rules and regulations, sanctioning system towards members) Physical access rules; personnel requirements on CB staff Control committee: • • • Composed of CB staff and users´ representatives Monitors activity logs; makes inspections at users Authority to impose immediate rectification, temporary disconnection, and sanctions.

Operational & organisational consultancy Long-term success of a credit bureau is more dependent on the following operational issues than on the software solution itself. For this reason, majority of efficient bureaux work in partnership with established credit referencing agencies. • Shareholding/corporate structure/decisioning issues; business model • Legal support: Personal Data Protection, Consumer protection laws, Anti-Monopoly, cross-industry data sharing, consumer consent, etc. • Pricing structure (model) for Users • Contractual agreements between members • Organisation of Control Committee • Help-desk/client centre organisation (operations manual, etc. ) • Support for consumers (issuance of reports for general public, compliance) • Legal disputes handling (individuals; authorities) • Public Relations & Media issues

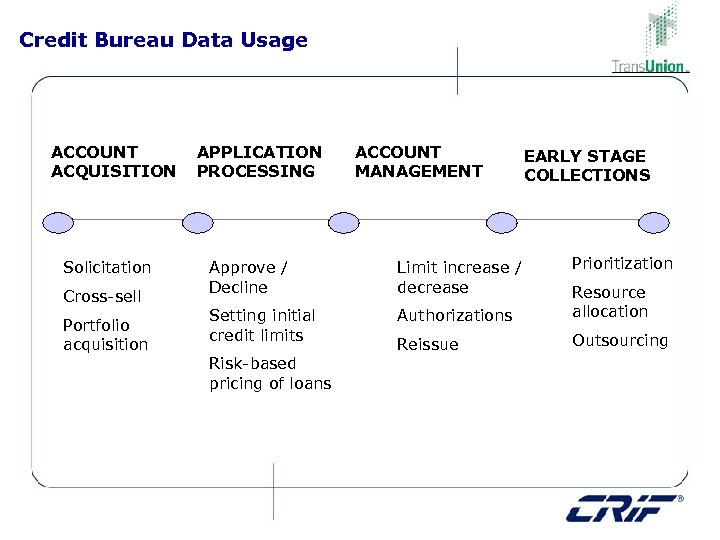

Credit Bureau Data Usage ACCOUNT ACQUISITION Solicitation Cross-sell Portfolio acquisition APPLICATION PROCESSING ACCOUNT MANAGEMENT EARLY STAGE COLLECTIONS Prioritization Approve / Decline Limit increase / decrease Setting initial credit limits Authorizations Resource allocation Reissue Outsourcing Risk-based pricing of loans

Value-added Credit Bureau Services Basic and future functionalities of the Credit Bureau System: CREDIT DATA SUBMISSION (ONLINE AND BATCH) CREDIT REPORT RETRIEVAL (ONLINE AND BATCH) APPLICATION PROCESSING SUPPORT (INTEGRATION OF GENERIC/CUSTOM SCORING MODELS AND CREDIT STRATEGIES) INTEGRATION WITH STRATEGY DESIGN & MANAGEMENT SW PACKAGES AND OTHER PRODUCTS OF TRANSUNION AND CRIF CUSTOMISED STATISTICAL AND USAGE REPORTS AUTOMATED MONITORING FEATURES (ALERTS) MONITORING OF TOTAL CREDIT EXPOSURE ANTI-FRAUD SYSTEM CREDIT BUREAU SCORE IMPLEMENTATION SUPPORT FOR INTERNAL RATING SYSTEMS (BASEL II) ………

Romanian Credit Bureau – Summary Credit Bureau is NOT an IT project Know-how transfer; Proprietary Trans. Union/CRIF knowledge of banking systems in many markets; Complex data normalization/validation checks, … Handling Personal Data Protection & Anti-monopoly Laws… Specific ability to overcome obstacles in „non-IT“ areas. Proven CB solution providers for CEE markets Trans. Union/CRIF are the only players with experience in CEE markets (current CB work in progress in 6 CEE markets); dedicated CEE team of professionals. Synergies with Additional Services Application processing, Credit scoring; Anti-fraud database systems, etc. … Cross-border Data Exchange CRIF is the initiator of Key Factor (information sharing among European credit bureaux). Strong local market support IPACRI Romania is an established local company providing services on the Romanian financial market.

c71e26dee3f1402edfed9ee86a06da72.ppt