8001f50a1f8e01a0fa0bcb0c2fc42a9e.ppt

- Количество слайдов: 23

ROMANIA Luxury Market MARKET REVIEW 2009

Table of Contents 1. 2. 3. 4. 5. 6. GENERAL COUNTRY PRESENTATION FASHION ACCESSORIES JEWELRIES / WATCHES HOSPITALITY SPA 7. OTHER LUXURY SEGMENTS: 8. AUTO 9. TRAVEL 10. SELECTIVE RETAIL 11. INTERIOR DECORATIONS / FURNITURE 12. 8. ORGANIC CONCEPTS/CHOCOLATERIE 13. 9. DATA ON THE LUXURY INDUSTRY IN ROMANIA 14. 10. OPPORTUNITIES

1. GENERAL COUNTRY PRESENTATION Romania is the second largest market in Eastern Europe, coming in second after Poland with 23. 5 million inhabitants. Romanian people’s tastes and high interest for luxury goods and services make this one of the most attractive markets in the region. There is a rising segment of wealthy people on the market, proven by the recent tops made for people with money. Case studies highlight the fact that there are over 800 people with an income greater than 10 million Euros per year and 100 people with an income of over 100 million Euros per year. A case study recently made by CPP reveals that there are 13. 000 people with an income greater than one million euro per year, most of which are in target for luxury goods and services. There are 12 international banks on the market which have private banking, summing up over 9000 Romanian people with deposits of at least 100. 000 Euros. One major player on the market, Unicredit Tiriac Bank, has stated recently that the eligibility rule for private banking clientele has reached 300. 000 Euros instead of previously accepted 100. 000 Euros. Bucharest is home to some of the wealthiest people in Romania, most of which reside in the northern part of the city, in areas like Pipera or Baneasa. The central areas which concentrate most of the wealthy people are Primaverii, Herastrau, Domenii, Floreasca, Dacia, Dorobanti. In the second half of 2008, the northern area Pipera/Tunari has reached a new height in the decline of sales for luxury houses and condos. Construction sites on halt have added to the general negative image of the area, making some people classify the area as mass market. Some of the other reasons that lead to this were the fact that both the construction for DN 1 and the Bucharest-Brasov Highway was put on hold. A recent case study published by The Economist placed Romania in top of the countries with the highest increases in salaries in 2007, but the trend did not continue in 2008. In fact, starting with September, we’ve witnessed a decline in salaries and increase in the unemployment rates, on the background of the international crisis. The average net salary estimated in 2008 was 550 Euros. The rate of unemployment has risen with 2 percent by the end of 2008.

GENERAL COUNTRY PRESENTATION (cont. ) Romania has five cities with a population of over 300. 000 inhabitants, each with an annexed international airport which increases the general attractiveness foreign investors. The wealthiest part of the country is Transylvania, with cities like Timisoara, Cluj, Sibiu and Oradea. Concerning the demand for luxury goods, Constanta and Iasi are at the top, with most wealthy Romanians preferring luxury branded goods and services. Most Romanians in Transylvania have an Anglo Saxon type of attitude, the decision to buy being based more on whether the product or service is qualitative and less on the brand notoriety. TOP Capital 300 – a previous edition which listed the wealthiest people in Romania, underlined the fact that more than half of them reside in Bucharest. „Capital” magazine has stated that the summed up wealth of the top 300 reaches over 40 billion dollars. www. capital. ro „Adevarul” newspaper has published in 2008 its first top of the wealthiest people in Romania. Except for the top ten positions probably changed by marketing and promotion reasons, this top had many similarities as the one published in the „Capital” magazine. www. adevarul. ro Concerning increases in GDP, Romania is fifth in Europe, after Poland. 2008 has seen an economic growth of 5, 9 percent. The most productive sectors have been constructions and businesses, at least for the first 9 months of 2008. However, massive drops have been recorded as soon as access to credits has been limited by the banks in Romania. Drops in prices registered in the last 3 months of the year across all real estate segments, as well as at the Bucharest Stock Exchange, have almost cancelled all growth registered in the first quarters of 2008. Inflation has steeped starting November 2008 and purchasing power has dropped by 18% due to the slow down in personal loans.

GENERAL COUNTRY PRESENTATION (cont. ) Many wealthy people found themselves at a lack of cash, especially those who have invested heavily in real estate and did not sell or rent at the proper time. All real estate segments have registered heavy drops during the last three months of 2008. This has lead to a halt in furniture and luxury decorations sales. We estimate that drops for these segments are at 30 percent compared with last year. 2008 has seen the launch of BANEASA Shopping City, the biggest Mall in Romania with 115. 00 sqm (www. baneasa. ro). However, it looks like due to the global crisis, people in Bucharest have kept themselves away from this commercial center, even with the high number of brands available. During week days, all traffic is 50 percent lower than that registered by the competition – Plaza Romania and Bucharest Mall. At the end of 2008, during the unfolding crisis, Mivan Kier has launched the sixth mall in Bucharest – Liberty Center (www. libertycenter. ro) Being much smaller than the competition, it looks like Liberty has succeeded in gathering a large number of visitors, especially because of being located in a densely populated area. While Baneasa Mall has two stores with luxury brands (M Missoni and Bvlgari/Chimento) and a multibrand with Red Valentino, Alexander Mc. Queen and Versace , Liberty is an exclusively mass market mall. Efforts made by Baneasa to attract other luxury brands were sold with negative answers. It was also said that multibrand fashion store Peek & Cloppenburg (Joop, Boss, Diesel, K Lagerfeld, Energie) in Baneasa Mall has positioned itself as luxury. However, a middle level concept that sells casual lines 2 and 3 for luxury brands but also outlet products cannot be positioned as luxury. International Transport has also seen an important growth in 2008. International airport Henri Coanda Bucharest has registered over nine million passengers in 2008, with new companies opening new direct lines with big capitals of the world. However, by the end of 2008, Tarom had retired from the Milano route and Alitalia had kept but one flight out of five. This was because of the global crisis but also because of the explosion of low cost flights. Limited flights were scheduled for Istanbul and Budapest, other important shopping destinations for luxury products.

2. FASHION The luxury fashion market has seen considerable development during the first part of 2008, especially due to international luxury brands that have entered the market through multibrand stores. Christian Dior, Burberry, Bottega Veneta, Ralph Lauren, Missoni, Givenchy are among the brands represented by products from the newest collections. Although still small in numbers, the fact that they have entered the market shows a sign of maturity for the market. Until recently, wealthy people used to go for luxury shopping exclusively abroad, in Paris and Milano. Customers have become more selective and educated concerning brands. Unfortunately though, there are still some multibrand stores that sell last year collections and counterfeit products. MONOBRAND / FRANCHISE Most of the brands available in franchise systems (Max Mara, La Perla, Canali, Pal Zileri and Zegna) have registered constant growth in 2008, with an average of 20 to 30 percent. Hugo Boss is the only brand in a monobrand franchise whose sales stayed constant throughout 2008, recording losses by the end of the year. The owners of the franchise Max Mara have launched monobrand franchises Mariella Burani and Marella on Calea Victoriei, while RTC Holding took over the monobrand store of luxury brand Bally on Magheru Boulevard from Furla’s franchise owners. 2008 has also seen the openings of franchises for Paul & Shark (Calea Victoriei) and M Missoni (Baneasa Mall). We think that, on a long term, the least performing ones will be Mariella Burani, Marella and Paul & Shark. This is because of the fact that all three have little notoriety on the Romanian market but also they have limited attractiveness. On Calea Victoriei there’s also been launched a monobrand store through means of exclusive distribution for the brand Cerrutti 1881. The shop is owned by a company from Bacau, Romania which is also the distributor for Ramsey (mass market brand from Turkey). The products sold here are made in Turkey by a company who owns a partial license in order to manufacture under the French name. The classic style, basic collections could prove unsuccessful for the store on a long term basis.

FASHION (cont. ) Worldwide luxury giant Louis Vuitton has opened its first store in 2008, at the JW Marriott commercial galleries. However, most of the businessmen who take part in conferences at JW are unlikely to represent targets for the Vuitton store. Unfortunately, it looks like Vuitton did not make the best choice in this matter, something that CPP has signaled since the official announcement. As a matter of fact, a series of brands including Korloff, Davidoff and Mont Blanc have decided to relocate. From our sources, two other monobrand stores will have left the galleries by mid-2009. The reasons for this are: exclusively corporate traffic, mid level weddings, mid level corporate events, inaccessible location for wealthy people who live in the center, center-north and to the north. Valentino and Versace (both first lines) monobrands are planned to open late 2009. Hermes has recently confirmed to CPP its interest in opening in Romania and Bulgaria mid to late 2010 under a frachise / concession type of development. MULTIBRAND Victoria 46, the biggest multibrand concept store is also located on Calea Victoriei, around Odeon theatre and Majestic Ramada hotel. Although it has an excellent mix of brands and exquisite architecture, Victoria 46 is still avoided by most of the wealthy people in Bucharest because of limited parking space and specialized employees. The poor representation of season collections and the small number of orders are still unsatisfying for most of the brands that are present. Best selling brands from Victoria 46 are still Roberto Cavalli, Alexander Mc Queen and Christian Dior, worst performing are YSL, Chloe and Baldessarini. Another important player on the luxury fashion market is The Place Concept Store, a multibrand concept initiated by ID Sarrieri Group on Calea Dorobanti. In 2008, The Concept Store has introduced the brands Bottega Veneta, Zac Posen, Marni, Jimmy Choo and Givenchy, extending the line of products with Vertu cell phones and luxury laptops. Starting with 2008, The Place has moved all men’s fashion in the ex accessories store, also on Calea Dorobanti. This was in an attempt to better show men’s fashion collections that were not in the attention of the public. Most of the luxury market associates Iulia Dobrin’s image with women’s fashion, and less with man’s fashion. Once the global crisis had made itself felt, the owner’s right hand, Izabela Coman, has left the company in order to join Louis Vuitton Romania on a consultancy PR position.

FASHION (cont. ) The Place Concept Store’s direct competition is Mengotti, owned by the Italian business man with the same name. With an exceptional design, the multibrand store was opened in spring 2008. The brands present here are Giorgio Armani (main line accessories), Dolce Gabbana (first line accessories), Prada (accessories), Neil Barret, Fendi (fashion, accessories) and Dior Homme. The largest volumes of Mengotti are on Fendi and Neil Baret. Unfortunately, the extremely limited product range, as well as the lack of any marketing strategy/promotions, has brought some difficulties to Mengotti. Sources in the market say that the store will almost certainly close by mid 2009. Mengotti’s strategy has been to identify franchises in the big cities in the country so that it could keep a constant level of orders for its brands. However, since they did not have a coherent concept, they were unable to correctly identify a possible franchised in the country. This was also because the conditions imposed were impossible to apply in a reasonable business plan. Jolie Ville Galleria is the first multibrand opened in Bucharest, dating from 2003. Its location is Jolie Ville Mall, in the residential area Iancu Nicolae. Although surrounded by luxury real estate, Jolie Ville did not manage to attract the residents in this area. Besides being a multibrand for fashion and accessories, Jolie Ville also includes a medium sized super-market. More recently, a World Class health club has been launched in Jolie Ville, trying to further attract customers in the area. One of the reasons for Jolie Ville’s lack of success is the fact that the brand selection has been changed numerous times. Currently the following selection of brands can be found: GF Ferre, Valentino Red, Emilio Pucci, Versace Jeans, Just Cavalli, John Galliano, Moschino Jeans. Most of them are outlet products or older collections. The customer service level is at its lowest here, compared to all other luxury multibrand stores in Bucharest. Salvatore Ferragamo has entered the Romanian market in 2008 through a mulibrand store located on Calea Dorobantilor including Testoni as well. Unfortunately the launch in summer 2008 coincided with the beginning of the global crisis. Another problem is the subdued, classic style of Ferragamo which targets very few wealthy people in Romania.

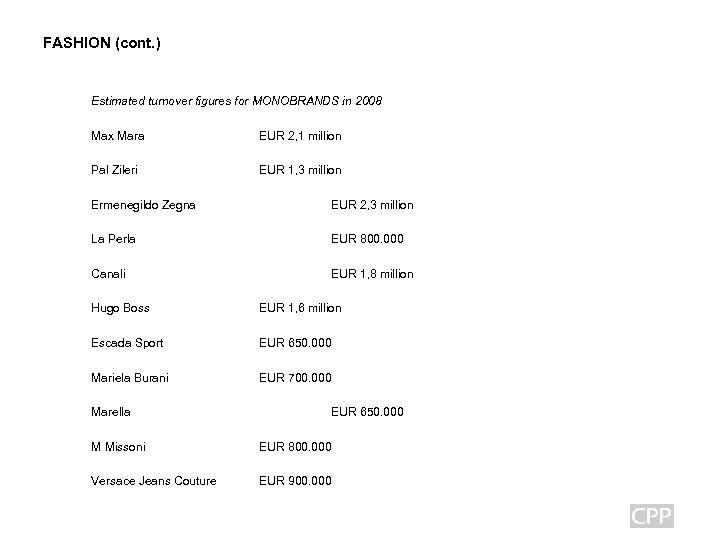

FASHION (cont. ) Estimated turnover figures for MONOBRANDS in 2008 Max Mara Pal Zileri Ermenegildo Zegna La Perla Canali EUR 2, 1 million Hugo Boss EUR 1, 6 million Escada Sport EUR 650. 000 Mariela Burani EUR 700. 000 Marella EUR 1, 3 million EUR 2, 3 million EUR 800. 000 EUR 1, 8 million EUR 650. 000 M Missoni EUR 800. 000 Versace Jeans Couture EUR 900. 000

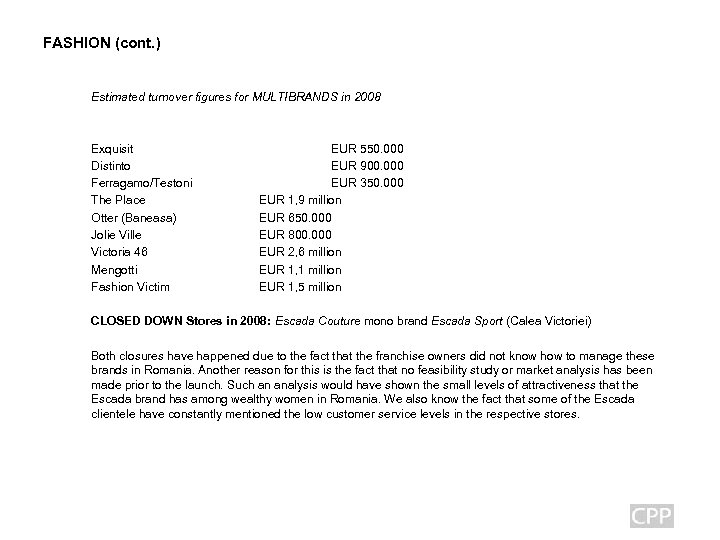

FASHION (cont. ) Estimated turnover figures for MULTIBRANDS in 2008 Exquisit Distinto Ferragamo/Testoni The Place Otter (Baneasa) Jolie Ville Victoria 46 Mengotti Fashion Victim EUR 550. 000 EUR 900. 000 EUR 350. 000 EUR 1, 9 million EUR 650. 000 EUR 800. 000 EUR 2, 6 million EUR 1, 1 million EUR 1, 5 million CLOSED DOWN Stores in 2008: Escada Couture mono brand Escada Sport (Calea Victoriei) Both closures have happened due to the fact that the franchise owners did not know how to manage these brands in Romania. Another reason for this is the fact that no feasibility study or market analysis has been made prior to the launch. Such an analysis would have shown the small levels of attractiveness that the Escada brand has among wealthy women in Romania. We also know the fact that some of the Escada clientele have constantly mentioned the low customer service levels in the respective stores.

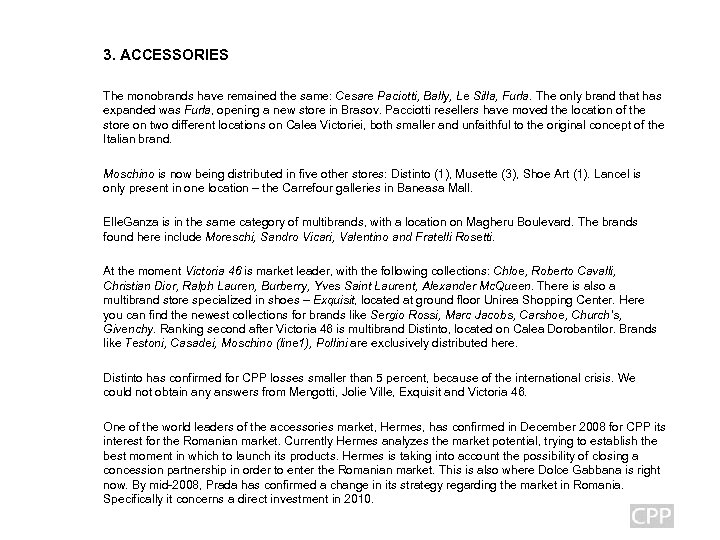

3. ACCESSORIES The monobrands have remained the same: Cesare Paciotti, Bally, Le Silla, Furla. The only brand that has expanded was Furla, opening a new store in Brasov. Pacciotti resellers have moved the location of the store on two different locations on Calea Victoriei, both smaller and unfaithful to the original concept of the Italian brand. Moschino is now being distributed in five other stores: Distinto (1), Musette (3), Shoe Art (1). Lancel is only present in one location – the Carrefour galleries in Baneasa Mall. Elle. Ganza is in the same category of multibrands, with a location on Magheru Boulevard. The brands found here include Moreschi, Sandro Vicari, Valentino and Fratelli Rosetti. At the moment Victoria 46 is market leader, with the following collections: Chloe, Roberto Cavalli, Christian Dior, Ralph Lauren, Burberry, Yves Saint Laurent, Alexander Mc. Queen. There is also a multibrand store specialized in shoes – Exquisit, located at ground floor Unirea Shopping Center. Here you can find the newest collections for brands like Sergio Rossi, Marc Jacobs, Carshoe, Church’s, Givenchy. Ranking second after Victoria 46 is multibrand Distinto, located on Calea Dorobantilor. Brands like Testoni, Casadei, Moschino (line 1), Pollini are exclusively distributed here. Distinto has confirmed for CPP losses smaller than 5 percent, because of the international crisis. We could not obtain any answers from Mengotti, Jolie Ville, Exquisit and Victoria 46. One of the world leaders of the accessories market, Hermes, has confirmed in December 2008 for CPP its interest for the Romanian market. Currently Hermes analyzes the market potential, trying to establish the best moment in which to launch its products. Hermes is taking into account the possibility of closing a concession partnership in order to enter the Romanian market. This is also where Dolce Gabbana is right now. By mid-2008, Prada has confirmed a change in its strategy regarding the market in Romania. Specifically it concerns a direct investment in 2010.

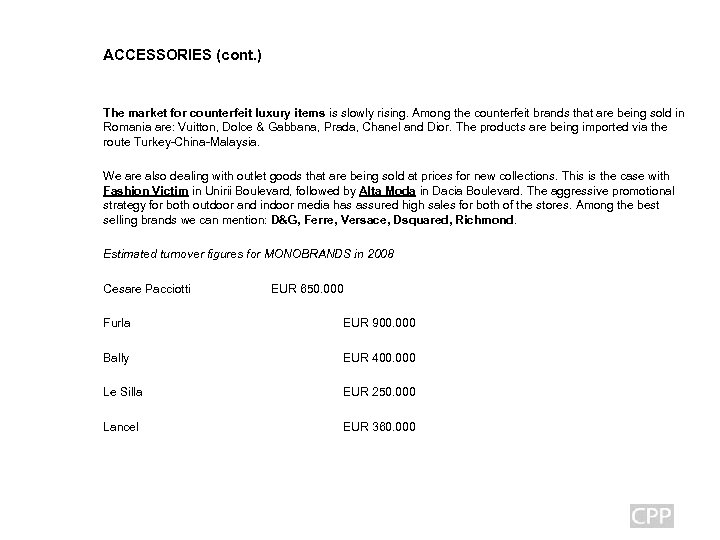

ACCESSORIES (cont. ) The market for counterfeit luxury items is slowly rising. Among the counterfeit brands that are being sold in Romania are: Vuitton, Dolce & Gabbana, Prada, Chanel and Dior. The products are being imported via the route Turkey-China-Malaysia. We are also dealing with outlet goods that are being sold at prices for new collections. This is the case with Fashion Victim in Unirii Boulevard, followed by Alta Moda in Dacia Boulevard. The aggressive promotional strategy for both outdoor and indoor media has assured high sales for both of the stores. Among the best selling brands we can mention: D&G, Ferre, Versace, Dsquared, Richmond. Estimated turnover figures for MONOBRANDS in 2008 Cesare Pacciotti EUR 650. 000 Furla EUR 900. 000 Bally EUR 400. 000 Le Silla EUR 250. 000 Lancel EUR 360. 000

4. JEWELRY / WATCHES Currently there are three major players on the market: Cellini. This is the biggest jewelry and watches retailer, with more than 9 stores in Bucharest and 3 in other big cities in Romania. Brands that are being sold here: Faberge, Mauboussin, Swarowski, Baraka. In 2008 Cellini became the first official distributor for Vertu. The best selling brand in Cellini’s portfolio in 2008 has been Bell & Ross. Micri Gold has two locations on Magheru Boulevard. One of them is dedicated to Bvlgari and Chopard (with two distinct spaces) while the second is dedicated to Damiani, Dior, De Grisogono, Versace si Claudio Fiorentino. Micri gold is considered the specialist in jewelries, starting in 1994 with its own collection of jewelries made out of gold and platinum. In 2008 Micri Gold has launched a second store in Baneasa Mall, with two dedicated spaces for Chopard and Chimento. Helventansa is one of the oldest retailers for watches and jewelries, starting in 1991. At the moment they have only one location on Calea Victoriei, with jewelries from Chaumet and Piaget. Helvetansa represents all the brands owned by Group Richemont, including Cartier, Piaget, Vacheron Constantin, and so on. Even if they are on the market for over 10 years, Helvetansa did not manage to establish an exclusivity contract with any of the brands in its portfolio. A multibrand system like this one is an opportunity for international retailers for luxury watches and jewelries who are analyzing the market. In 2008, Helvetansa has become authorized dealer for Boucheron and Dior (jewelries). From our sources, Audermas Piguet is the poorest performer in Helvetansa’s portfolio. Another important name on the watches and jewelries segment is Korloff, with an ever growing segment of customers. The monobrand franchise store situated in Marriott Shopping Gallery has been closed at the end of 2008. The store’s owners had in plan the relocation of the store on Magheru Boulevard, which is planned for March 2009.

JEWELRY / WATCHES (cont. ) The watches segment is probably the most developed one on the local luxury market and most of the international luxury brands are already present on the market. Another player on the market, Galt, owns two locations: one on Calea Dorobanti and the other at Marriott Shopping Galleries. Galt sells the following brands: Girard-Perregaux, Zenith, Omega, Longines, Rado, Boss, Sector, Revue-Thommen, Mondaine and Grovana, being the official distributor for the brands Longines and Omega in Romania. However it is still surprising the lack of expansion for the company, even with all these brands in its portfolio. In spite of all announces about an expansion, Chronolink, the distributor for Rolex has limited its growth to just one store at JW Marriott Shopping galleries. Unfortunately the lack of a coherent marketing and communication strategy and the location contribute to keeping away the customers. The Rolex store in Marriott also distributes the Mikimoto jewelries collection. 2008 has also seen the opening of the monobrand of FRANCK MULLER within the Marriott galleries. It has been developed by the same company that owns the boutique in Sofia, Bulgaria. The sole international brand for luxury watches that is not yet present on the Romanian market is Patek Phillippe. However, customers in Romania are loyal to the brand in Paris, New York or London.

5. HOSPITALITY Bucharest is one of the most developed markets in the region on the five star segment: JW Marriott, Athenee Palace Hilton, Inter. Continental, Crowne Plaza, Howard Johnson and since spring 2008, Radisson SAS. The target market are represented by business people. Rack prices place Bucharest on the third place after Moscow, at 200 Euros per night, with a decline in the trend since 2007. Analysis made on the hospitality business show that in Bucharest there is enough demand for almost 2000 luxury rooms, especially when high class events take place. Kempinski, Four Seasons and Mandarin Oriental are just some of the international luxury brands interested in Romania. Four Seasons now holds hotels in Budapest and Prague and Mandarin has recently opened in Prague, with Moscow to soon follow. Kempinski owns hotels in Budapest, Sofia and Moscow and added a new hotel in Prague in 2008. The occupancy rates for the five star hotels have been around 65% during the first 9 months of 2008, dropping to 50 percent during the last months of the year. This trend will continue in the same direction in 2009, especially for the Radisson and Howard Johnson hotels. Hilton announced its first franchise hotel in Romania – Palace Resort & Spa in Sibiu. This decision is quite peculiar judging from where it is located and how it is equipped. A positioning like Hilton Garden Inn could have been better. The most expensive and luxurious hotel in Romania, Carol Parc Hotel, has registered good performances in 2008, having had some exceptional VIP guests. The global crisis also affected Carol Parc, starting with November 2008. Romania is one of the most luxury-based countries from Eastern Europe, due to economic growth and Latin origin of the people. More and more people show off with the brands that they buy. The same pattern can be applied on the hospitality market, for the five star cafes, ballrooms and shopping galleries in the hotels.

HOSPITALITY (cont. ) Opportunities The five star hospitality market in Romania is ready for a luxury project, like one coming from companies such as Four Seasons and Mandarin Oriental. The only condition is identifying a central location. Projects The most attractive project is Casa Radio with a hive star hotel that would include 200 rooms. Elbit Medical (Israel) announced at the beginning of 2008 that they closed a deal with REZIDOR, the deluxe division of Radisson SAS, for Plaza Center Complex. Elbit Medical announced in January 2009 that the project would halt for a couple of months, because of the international crisis. The developer would concentrate on opening smaller Malls in Romania, which would not require big investments. In 2008, Cefin Holding announced the opening of a 400 room hotel on Barbu Vacarescu Boulevard, scheduled for 2010. This is following the signing of a management contract with Swissotel. The hotel will have the biggest SPA and health club in Bucharest, covering 4000 square meters. Swissotel officials have confirmed for CPP that they don’t have any hotels opening in 2009/2010. The crisis might have forced Cefin to revise the strategy for this project, which is also relying on office spaces.

HOSPITALITY (cont. ) Starwood has been unable to confirm its Le Meridien / Sheraton franchise for the Calea Victoriei building currently under construction (near Casino Palace) due to a legal dispute between The Romanian state Post and the Comnord private company that is developing the site. Works have began enthusiastically, but the November change in political governance has put a halt on the construction. Positioned in a central area, Grand Hotel du Boulevard, was supposed to be past the process of restoration and renovation by the end of 2008. However, this did not happen. Having 89 rooms individually decorated and the best of services, Grand Hotel du Boulevard hoped to be part of an international luxury hospitality chain. The hotel is located on the corner of Calea Victoriei and Elisabeta Boulevard and will have a small shopping gallery at the ground floor. Most likely the holding that owns the hotel has revised its strategy, as fewer banks nowadays are willing to finance projects like this one without a franchise contract or international management chain. Opera Plaza Hotel in Cluj is no longer the only five star hotel outside of Bucharest. Aurelius Imparatul Romanilor is the new five star hotel in Poiana Brasov. This hotel is owned by the chain Imparatul Romanilor. Unfortunately, its opening coincided with the peak of the crisis and apparently the management is having a hard time in attracting customers. The Romanian seaside now has two five star hotels, with Vega being the most recent one, opened in Mamaia. However the leader remains Grand Hotel Rex, which is open all over the year. The hotel owners have invested in 2008 in making a lounge and restoring several apartments.

6. SPA The SPA segment is the least developed one from all the sectors of the luxury industry. There are many beauty saloons in Bucharest that describe their services as being „SPA”, but there is still a long way towards reaching that objective (Miko Beauty, Blues Line and so on) The market for health clubs in five star hotels is dominated by the Swedish company World Class. The company owns three locations in Bucharest: JW Marriott, Radisson SAS and more recently Jolie Ville. Estee Lauder owns two treatments rooms at its store on Calea Victoriei. Silhouette is another beauty center that managed to get a hold of the market in the last years. They use the Academie professional cosmetics for their SPA treatments. Silhouette is also one of the main distributors for Guinot cosmetics. Eden Spa is one of the pioneers for the beauty sector, offering a large range of corporal therapy and facial treatments. Eden SPA services are being sold directly to corporate system as well, adding to the brand’s notoriety. One obvious stage for further developing Eden SPA centers would be the amount of know how obtained from the association with international companies. Eden has opened in 2008 its third location: Asian SPA, in the four star hotel Monte Carlo Palace. Currently there are no SPA services for men, the only cosmetics lines sold in Romania with men; s lines: Clinique, Clarins, Lancome, Shiseido. There are many international brands that have expressed their interest over time to enter the Romanian market. Among these we could mention Molton Brown, Biodroga and Givenchy. E’SPA announced the signing of a contract for project Silver Mountain (Radisson) in Poiana Brasov, but it looks like it is going to be postponed by the international crisis. Tiriac Imobiliare announced that the SPA Shiseido is to be included in the residential project Stejarii, in the northern part of Bucharest. The company has declared that the project is not postponed, and it looks like 2009 will see the opening of the first sections for this project.

7. OTHER LUXURY SEGMENTS AUTO Almost all international luxury brands are officially represented. Rolls Royce, Maybach, Maseratti, Ferrari, Audi, Porche, and so on, each with its own showroom. In 2007, sales in the region were after those in Russia and the Ukraine. Maserati is the only luxury auto brand in Romania that stated that they are not affected by the international crisis. In May 2008 the official launch of Ferrari took place. Forza Rossa opened a showroom on Bucuresti Ploiesti street, close to the Confort hotels. Although officials that own and manage Forza Rossa stated many times that there have been no canceled orders, we disagree with this statement due to our sources. Actually, the target for 2009 will be impossible to reach. The extremely small service and limited array of services that are offered drive the customers to choose Forza Rossa only for parking in car sitting mode, while they rely on Germany or Austria for new acquisitions. In 2008, Porsche Romania has opened the first Bentley / Lamborghini showroom, located in the north of the city (Pipera). Bentley is one of the best selling luxury brands in Romania. Its official presence in Romania is a good sign for potential customers but also for those that are already owners. From our sources, BMW Group has sold only 2 Rolls Royce cars in 2008, but this is yet to be confirmed officially. Many customers probably prefer the more extended locations from Germany or Austria.

OTHER LUXURY SEGMENTS (cont. ) TRAVEL There are no specialized travel agencies in the luxury industry. This sector is full of opportunity, especially when there already two companies specialized in private flights. There is a growing number of people in Romania who opt for first class travel, be it business or vacation. Business Class tickets bought in Bucharest represent 7% of all sales made by the air companies. SELECTIVE RETAIL Sephora and Marionnaud are leaders on the selective retail market, with many locations in Bucharest and 5 other major cities. However, the first place goes to Sephora, with more than six locations in Romania. INTERIOR DECORATIONS/FURNITURE At the moment there are some international brands on the Romanian market, brought through mono brand stores: Armani Casa, Ligne Rosset, Casina and Natuzzi. Many other Italian luxury brands like Versace Home, Fendi Casa, Moroni are present in multibrand stores. The main local operator is Class Living, with the biggest spaces dedicated to luxury furniture and inside decorations. The franchised Natuzzi store is also operated by Class Mob. This segment of the luxury industry has great opportunity due to the growth in luxury real estate in Romania. In 2008 we have also seen the official entry of Frette, being distributed by Kartel, a local company with many international brands under distribution.

8. ORGANIC CONCEPTS/ CHOCOLATERIE There are no stores for organic products, and some of them can be found in the traditional markets. The gourmet market is also at the beginning. There are only two companies that operate three specialized stores who deal with a large range of gourmet products. Among these, caviar and foi gras can be found. The first brands that entered the Romanian market were Leonida’s, Jeff de Bruges and Laederach. Because of the financial crisis, Jeff de Bruges closed down its store in Calea Mosilor. They still have one location in Iasi. Laederach are also the owners of the Heidi Brand, with only one location in Plaza Romania Mall. In 2008 the company launched the first online shopping site for pralines. In 2008 the first luxury tea place was opened. Triangle D’Or is situated on Mihalache Boulevard and it is the distributor for the French brand Marriage Freres. The same company owns the chocolaterie Reine Astrid, in a nearby location. At the end of 2008 we’ve witnessed the opening of the first integrated organic concept. We are talking about the franchise Oliviers&Co, with a store situated in Piata Dorobanti. The store sells exclusively organic products made out of olives: cosmetics, sweets, spices, and so on.

9. DATA ON THE LUXURY INDUSTRY IN ROMANIA CPP estimates that the value of the local luxury industry is above 190 million Euros. Segments included are: fashion, accessories, jewelries, watches, auto and inside decorations/furniture. Figures do not include segments like hospitality and cosmetics. The luxury industry has grown with 23 percent during the first 9 months of 2008, in comparison to last year. However, by the end of the year it dropped by 14 percent on all of the luxury industry segments. This trend will be maintained throughout 2009 as well, but it will not exceed losses greater than 20 percent. CPP sees a slight comeback for the industry starting with November 2009. The analysis made by CPP is based of estimative sales, as official figures haven’t been released by the operators and owners of the luxury brands present on the market.

10. OPPORTUNITIES Fashion Women - Wedding dresses - Business suits and formal clothing for women - Accessories Men - Shoes, bags and leather accessories Hospitality - Boutique type hotels - Designer branded hotels - SPA Hotels (especially day SPA)

8001f50a1f8e01a0fa0bcb0c2fc42a9e.ppt