Lecture Moscow.ppt

- Количество слайдов: 28

roduction to readiness investor

roduction to readiness investor

3 aims • Presentation skills • Content – the investment proposal • Plan for long-term private equity funding for growth

3 aims • Presentation skills • Content – the investment proposal • Plan for long-term private equity funding for growth

Investor mind-set • • • What is the business concept? Who is the team and why will you succeed ? What is the market or market niche ? What are the competitive advantages? What is unique ? What is the business model ? What is the capital need? How will the invested funds be used? What is the exit strategy ?

Investor mind-set • • • What is the business concept? Who is the team and why will you succeed ? What is the market or market niche ? What are the competitive advantages? What is unique ? What is the business model ? What is the capital need? How will the invested funds be used? What is the exit strategy ?

Value drivers • • • • Industry sector (size, growth, margin etc. )? Commercial competence in the team? Team members – previous entrepreneurial and exit experience ? IP? Scalable business model? Great net profit? Positive balance sheet? Recurring revenues? Multiple revenue streams ? Proof of concept ? First move advantage ? Shorter exit period than 3 years ? Market disturbing exit strategy ? Comparable exits ?

Value drivers • • • • Industry sector (size, growth, margin etc. )? Commercial competence in the team? Team members – previous entrepreneurial and exit experience ? IP? Scalable business model? Great net profit? Positive balance sheet? Recurring revenues? Multiple revenue streams ? Proof of concept ? First move advantage ? Shorter exit period than 3 years ? Market disturbing exit strategy ? Comparable exits ?

”THE WORLD IS THE HOME MARKET"

”THE WORLD IS THE HOME MARKET"

Born globals • Start-ups go international much earlier than before • Private equity funding is the new trend in internationalization

Born globals • Start-ups go international much earlier than before • Private equity funding is the new trend in internationalization

The concept • Fundraising forums for start-ups and investors • Pitch Training Camps to make start-ups investor-ready • A process to reduce the risk on investment

The concept • Fundraising forums for start-ups and investors • Pitch Training Camps to make start-ups investor-ready • A process to reduce the risk on investment

The Process • • Nomination Pitch training camp Evaluation Fundraising forums

The Process • • Nomination Pitch training camp Evaluation Fundraising forums

Investors mind-set • • • To reduce the risk Start-ups investor ready High quality deal-flow Syndicate investments Networking with investors

Investors mind-set • • • To reduce the risk Start-ups investor ready High quality deal-flow Syndicate investments Networking with investors

Types of investors • Private investors – Friends, family and founders (FFF) – Business Angels (BA) • Structured capital – – Seed Funds Venture Funds (VC) Corporate Venture Family offices

Types of investors • Private investors – Friends, family and founders (FFF) – Business Angels (BA) • Structured capital – – Seed Funds Venture Funds (VC) Corporate Venture Family offices

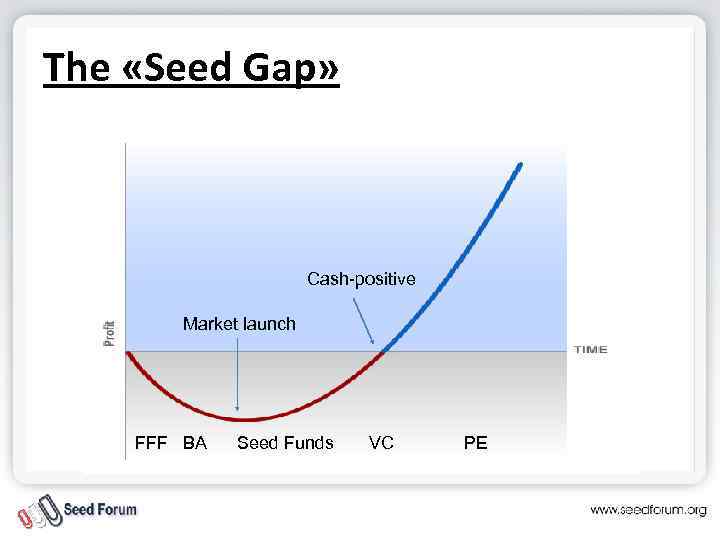

The «Seed Gap» Cash-positive Market launch FFF BA Seed Funds VC PE

The «Seed Gap» Cash-positive Market launch FFF BA Seed Funds VC PE

Start-up mind-set • • Funding Internationalization and growth Competence – investor readiness B 2 B

Start-up mind-set • • Funding Internationalization and growth Competence – investor readiness B 2 B

Seed Forum 2002 – 2012 • • 16000 investors in Seed Forum database 2000 nominators in the network 2200 members in the start-up alumni community More than 200 partners globally that contributes to Seed Forum Investor matchmaking forums in 27 countries Local forums in 5 countries Companies selected to present from 23 countries

Seed Forum 2002 – 2012 • • 16000 investors in Seed Forum database 2000 nominators in the network 2200 members in the start-up alumni community More than 200 partners globally that contributes to Seed Forum Investor matchmaking forums in 27 countries Local forums in 5 countries Companies selected to present from 23 countries

Seed Forum International 2012

Seed Forum International 2012

A global concept • A not-for-profit best practice initiative • A global concept for internationalization of start-ups • Export process from Scandinavian innovation • A global community for investors, start-ups and key-persons in innovation

A global concept • A not-for-profit best practice initiative • A global concept for internationalization of start-ups • Export process from Scandinavian innovation • A global community for investors, start-ups and key-persons in innovation

A complete concept • • Fundraising forums Business Angel Networks I-HUB accelerators Internationalisation

A complete concept • • Fundraising forums Business Angel Networks I-HUB accelerators Internationalisation

Investor approach • • Your own direct talks With a Corporate Finance Partner / broker Fundraising forums – Seed Forum Combination of all above

Investor approach • • Your own direct talks With a Corporate Finance Partner / broker Fundraising forums – Seed Forum Combination of all above

The forum format • • • Last minute brief Morning event + networking Evening reception Late Night Seed Forum Round-up session

The forum format • • • Last minute brief Morning event + networking Evening reception Late Night Seed Forum Round-up session

Round-up session • Leads sorted in 3 priority groups - A: Immediate meetings - B: Immediate e-mails - C: Courtesy • Creating concrete follow-up strategies

Round-up session • Leads sorted in 3 priority groups - A: Immediate meetings - B: Immediate e-mails - C: Courtesy • Creating concrete follow-up strategies

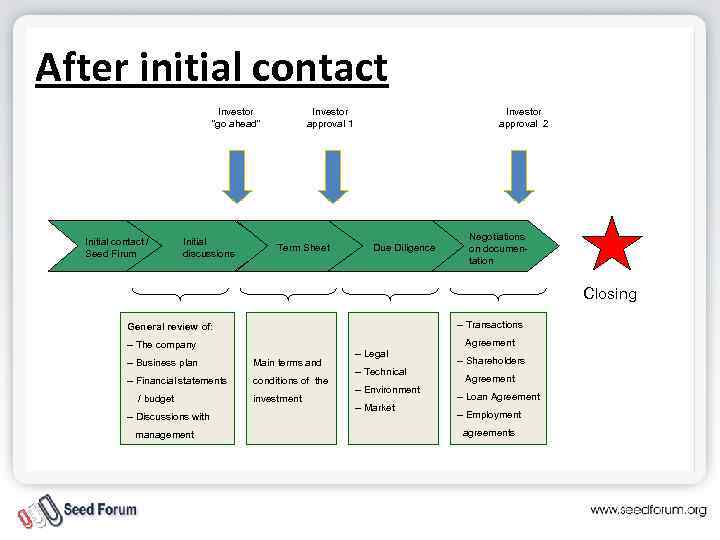

After initial contact Investor ”go ahead” Initial contact / Seed Firum Initial discussions Investor approval 1 Innledende Sheet Term diskusjoner Investor approval 2 Due Diligence Negotiations on documentation Closing – Transactions General review of: – The company – Business plan Main terms and – Financial statements conditions of the / budget – Discussions with management investment – Legal – Technical – Environment – Market Agreement – Shareholders Agreement – Loan Agreement – Employment agreements

After initial contact Investor ”go ahead” Initial contact / Seed Firum Initial discussions Investor approval 1 Innledende Sheet Term diskusjoner Investor approval 2 Due Diligence Negotiations on documentation Closing – Transactions General review of: – The company – Business plan Main terms and – Financial statements conditions of the / budget – Discussions with management investment – Legal – Technical – Environment – Market Agreement – Shareholders Agreement – Loan Agreement – Employment agreements

Documents to prepare • BS - Seed Forum Business Summary • PP investor presentation • IM - Investment Memorandum (and IM summary) • Miniature due diligence booklet • Non-disclosure agreement

Documents to prepare • BS - Seed Forum Business Summary • PP investor presentation • IM - Investment Memorandum (and IM summary) • Miniature due diligence booklet • Non-disclosure agreement

Development of pitch 1) Make standard presentation according to investors mind-set 2) Find the trigger points / value drivers 2) Practice standard presentation 4) Make your presentation special

Development of pitch 1) Make standard presentation according to investors mind-set 2) Find the trigger points / value drivers 2) Practice standard presentation 4) Make your presentation special

The concept of DRAMA

The concept of DRAMA

How to present persuasively • • • Framing Hyping Enthusiasm The WOW factor Presenting as a ”Super profit” opportunity AND – THE ART OF NETWORKING

How to present persuasively • • • Framing Hyping Enthusiasm The WOW factor Presenting as a ”Super profit” opportunity AND – THE ART OF NETWORKING

The art of networking • • Don`t speak with other Entrepreneurs Don`t sit down – chairs are forbidden Talking is more important than eating Don`t drink to much alcohol if served Dress code This is sales – you must do the approach 2 persons: Plan the venue and audience

The art of networking • • Don`t speak with other Entrepreneurs Don`t sit down – chairs are forbidden Talking is more important than eating Don`t drink to much alcohol if served Dress code This is sales – you must do the approach 2 persons: Plan the venue and audience

A cultural difference • • • The UK The US Germany Russia China

A cultural difference • • • The UK The US Germany Russia China

Investor mind-set • • • What is the business concept? Who is the team and why will you succeed ? What is the market or market niche ? What are the competitive advantages? What is unique ? What is the business model ? What is the capital need? How will the invested funds be used? What is the exit strategy ?

Investor mind-set • • • What is the business concept? Who is the team and why will you succeed ? What is the market or market niche ? What are the competitive advantages? What is unique ? What is the business model ? What is the capital need? How will the invested funds be used? What is the exit strategy ?

Value drivers • • • • Industry sector (size, growth, margin etc. )? Commercial competence in the team? Team members – previous entrepreneurial and exit experience ? IP? Scalable business model? Great net profit? Positive balance sheet? Recurring revenues? Multiple revenue streams ? Proof of concept ? First move advantage ? Shorter exit period than 3 years ? Market disturbing exit strategy ? Comparable exits ?

Value drivers • • • • Industry sector (size, growth, margin etc. )? Commercial competence in the team? Team members – previous entrepreneurial and exit experience ? IP? Scalable business model? Great net profit? Positive balance sheet? Recurring revenues? Multiple revenue streams ? Proof of concept ? First move advantage ? Shorter exit period than 3 years ? Market disturbing exit strategy ? Comparable exits ?