81d7471e4653c185d98af5eb2bb05f67.ppt

- Количество слайдов: 26

RISKS EXPOSURE IN INTERNATIONAL BUSINESS 1. COMMERCIAL RISK EXPO. 2. POLITICAL RISK EXPO. 3. ACCIDENTAL RISK EXPO. 4. INTEREST RATE RISK EXPO.

RISKS EXPOSURE IN INTERNATIONAL BUSINESS 5. FOREIGN EXCHANGE EXPO. ECONOMIC EXPO. TRANSLATION EXPO. TRANSCATION EXPO.

ECONOMIC EXPOSURE- MANAGERIAL CONCEPT THE RISKS ARISING FROM : - STRUCTURE OF BUSINESS -STRUCTURE OF COMPETITORS (as a reaction to exchange)

![TRANSLATION EXPOSURE Foreign Currency Assets Liabilities [Translated Into] Home Currency TRANSLATION EXPOSURE Foreign Currency Assets Liabilities [Translated Into] Home Currency](https://present5.com/presentation/81d7471e4653c185d98af5eb2bb05f67/image-5.jpg)

TRANSLATION EXPOSURE Foreign Currency Assets Liabilities [Translated Into] Home Currency

TRANSLATION EXPOSURE Example : Foreign Currency loan to Purchase Assets Dr Fixed Asset – Rs. 500, 000. 00 Cr USD Loan – Rs. 500, 000. 00 All translation Exposure will become transaction exposure at one stage.

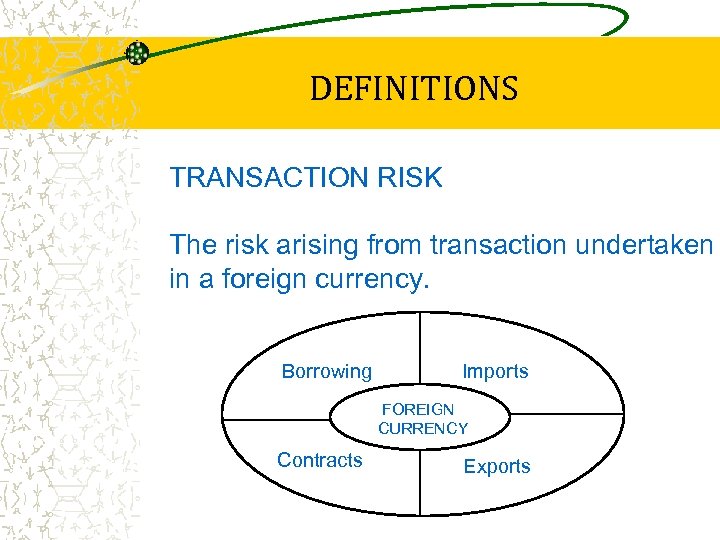

DEFINITIONS TRANSACTION RISK The risk arising from transaction undertaken in a foreign currency. Borrowing Imports FOREIGN CURRENCY Contracts Exports

HEDGING POLICY - NOT TO HEDGE EXPOSURE - TO FIX A FORWARD EXCHANGE CONTRACT - TO TRADE IN & OUT OF EXPOSURE - TO PURCHASE A CURRENCY OPTION

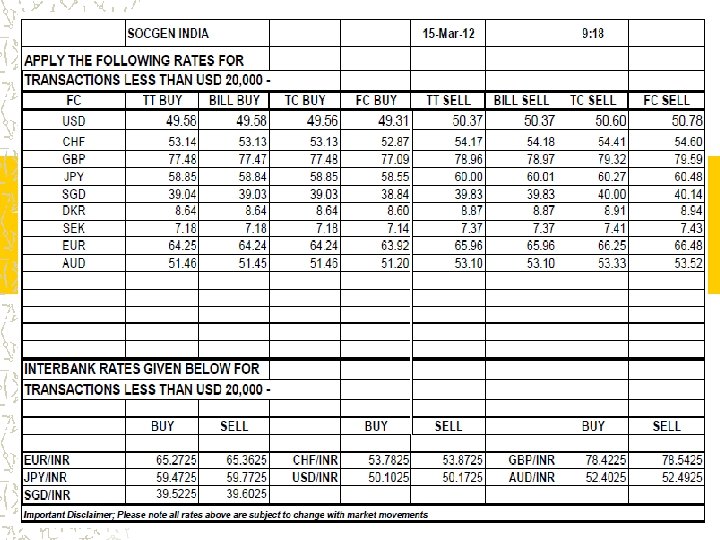

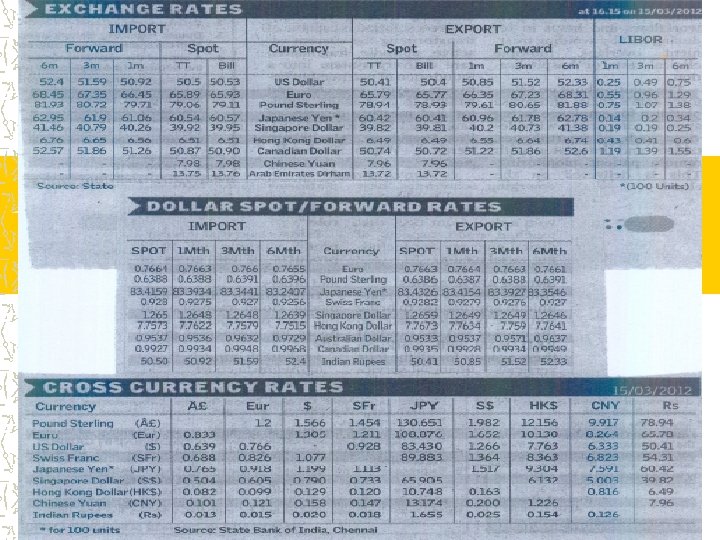

FEATURES OF EXCHANGE RATES - PREMIUM / DISCOUNT - SPOT / CASH / FORWARD - DIFFERENT RATES FOR DIFFERENT BANKS - RBI DO NOT CONTROL

Forward Exchange Market in India 1. Persons Resident in India ( other than banks) 2. Persons Resident Outside India 3. Authorised Dealers Category

Persons Resident In India 1. Contracted Exposure 2. Past Performance Facility 3. Special Dispensation

Products under Contracted Exposure 1. Forward Foreign Exchange Contracts 2. Cross Currency Options ( not in INR) 3. Foreign Currency –INR Options 4. Foreign Currency –INR Swaps 5. Cost Reduction structures 6. Cross Currency Swaps, Interest Rate Swaps, Coupan Swap

Probable exposure based on Past Performance 1. Forward Foreign Exchange Contracts 2. Cross Currency Options ( not in INR) 3. Foreign Currency –INR Options 4. . Cost Reduction structures

Special Dispensation 1. SME s ( no need of underlying contracts) only product allowed- Forward 2. Resident Individuals only product allowed- Forward Without documents only upto USD 100, 000

Persons Resident Outside India Who can book 1. FII 2. Persons having FDI in India 3. Non Residents Indians Products permitted 1. Forward Foreign exchange contracts 2. Foreign Currency – INR options

FORWARD EXCHANGE CONTRACTS A. TO COVER GENUINE EXPOSURES B. PRESENCE OF CONTRACT C. DELIVERY PERIOD D. CROSS CURRENCY CONTRACTS

FORWARD EXCHANGE CONTRACTS E. EARLY DELIVERY LATE DELIVERY CANCELLATION DELIVERY F. ROLL OVER FORWARD CONTRACTS G. CANCELLATION & REBOOKING H. SUBSTITUTION OF CONTRACTS

ADVANTAGES - No effect of subsequent movements - No front end payments

DISADVANTAGES - Opportunity loss , if subsequent movements are favourable - Irrevocable commitment to honour the contract - Agreed rate to be honoured

OPTIONS Gives the right not the obligation to buyer – to or sell a given amount of currency at a specific exchange rate Seller (writer of option contract) has a binding obligation to perform if the buyer exercises its right

TYPE OF OPTIONS Call Option – Purchaser has a right but not the obligation to buy a currency Put Option – Right but not obligation to sell a currency American Option – can be exercised on or before its expiry date European Option – can be exercised only on expiry date

TYPE OF OPTIONS At The Money (ATM) – an option whose strike price is the same as the current market exchange rate (CMER) In The Money (ITM) – SP is better than the CMER - Will attract high premium Out Of The Money (OTM) – SP is less favourable than CMER - Will attarct a low premium

FACTORS EFFECTING EXCHANGE RATES 1. TRADE BALANCE 2. ECONOMIC GROWTH 3. INFLATION 4. CAPITAL FLOWS & INTEREST RATES

FACTORS EFFECTING EXCHANGE RATES 5. MONETARY & FISCAL POLICIES 6. POLITICAL FACTORS 7. RELATIVE PRICES 8. MISC FACTORS

81d7471e4653c185d98af5eb2bb05f67.ppt