Alua 1st lecture.pptx

- Количество слайдов: 24

RISK SOURCES MARKET RISK MEASUREMENTS OF MARKET RISK 26. 09. 2013 LECTURE MSC NURBAYEVA ALUA

RISK SOURCES MARKET RISK MEASUREMENTS OF MARKET RISK 26. 09. 2013 LECTURE MSC NURBAYEVA ALUA

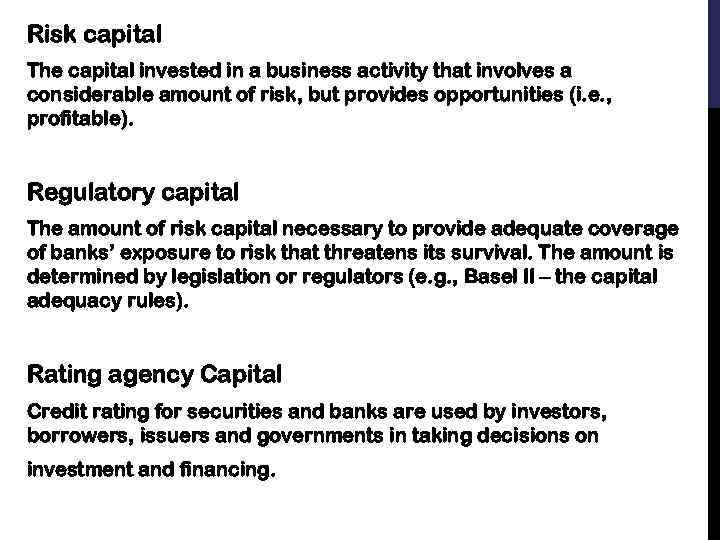

Risk capital The capital invested in a business activity that involves a considerable amount of risk, but provides opportunities (i. e. , profitable). Regulatory capital The amount of risk capital necessary to provide adequate coverage of banks’ exposure to risk that threatens its survival. The amount is determined by legislation or regulators (e. g. , Basel II – the capital adequacy rules). Rating agency Capital Credit rating for securities and banks are used by investors, borrowers, issuers and governments in taking decisions on investment and financing.

Risk capital The capital invested in a business activity that involves a considerable amount of risk, but provides opportunities (i. e. , profitable). Regulatory capital The amount of risk capital necessary to provide adequate coverage of banks’ exposure to risk that threatens its survival. The amount is determined by legislation or regulators (e. g. , Basel II – the capital adequacy rules). Rating agency Capital Credit rating for securities and banks are used by investors, borrowers, issuers and governments in taking decisions on investment and financing.

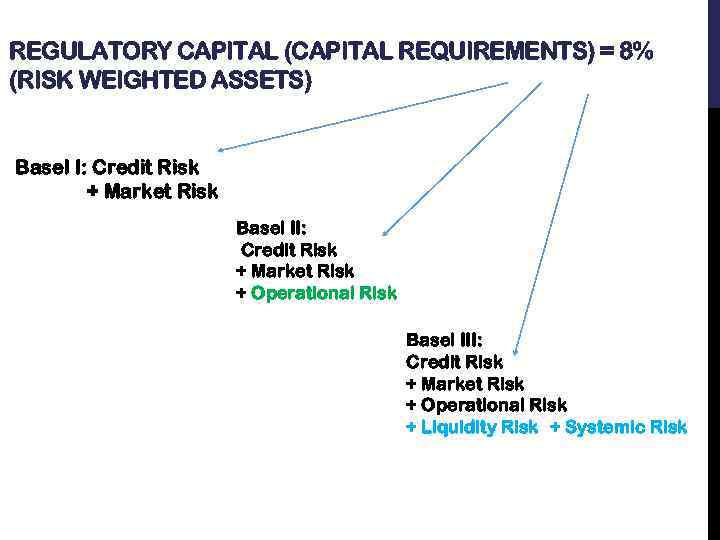

REGULATORY CAPITAL (CAPITAL REQUIREMENTS) = 8% (RISK WEIGHTED ASSETS) Basel I: Credit Risk + Market Risk Basel II: Credit Risk + Market Risk + Operational Risk Basel III: Credit Risk + Market Risk + Operational Risk + Liquidity Risk + Systemic Risk

REGULATORY CAPITAL (CAPITAL REQUIREMENTS) = 8% (RISK WEIGHTED ASSETS) Basel I: Credit Risk + Market Risk Basel II: Credit Risk + Market Risk + Operational Risk Basel III: Credit Risk + Market Risk + Operational Risk + Liquidity Risk + Systemic Risk

Sources of bank’s risk (causing expected loss) and several techniques of managing them

Sources of bank’s risk (causing expected loss) and several techniques of managing them

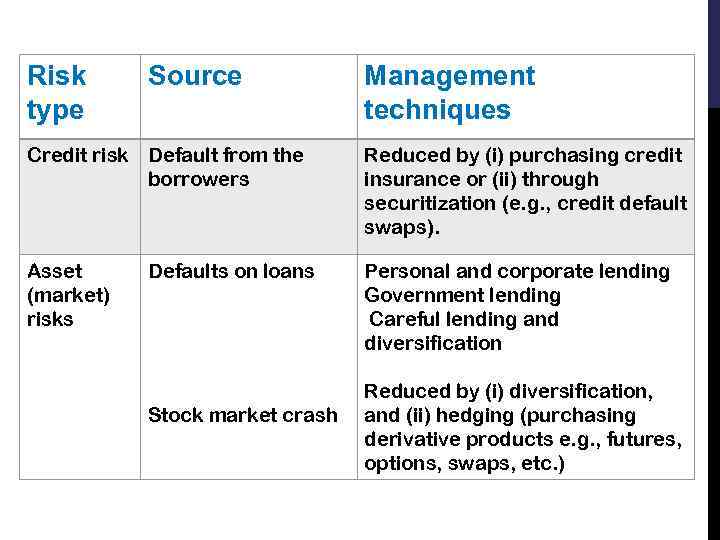

Risk type Source Management techniques Credit risk Default from the borrowers Reduced by (i) purchasing credit insurance or (ii) through securitization (e. g. , credit default swaps). Asset (market) risks Personal and corporate lending Government lending Careful lending and diversification Defaults on loans Stock market crash Reduced by (i) diversification, and (ii) hedging (purchasing derivative products e. g. , futures, options, swaps, etc. )

Risk type Source Management techniques Credit risk Default from the borrowers Reduced by (i) purchasing credit insurance or (ii) through securitization (e. g. , credit default swaps). Asset (market) risks Personal and corporate lending Government lending Careful lending and diversification Defaults on loans Stock market crash Reduced by (i) diversification, and (ii) hedging (purchasing derivative products e. g. , futures, options, swaps, etc. )

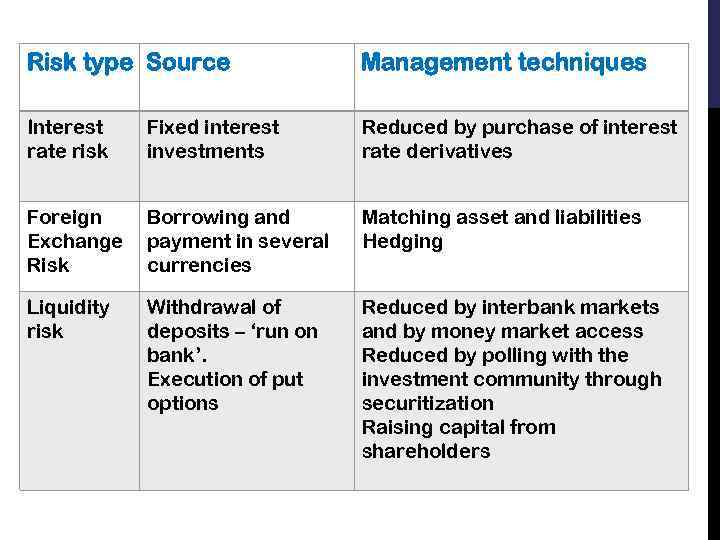

Risk type Source Management techniques Interest rate risk Fixed interest investments Reduced by purchase of interest rate derivatives Foreign Exchange Risk Borrowing and payment in several currencies Matching asset and liabilities Hedging Liquidity risk Withdrawal of deposits – ‘run on bank’. Execution of put options Reduced by interbank markets and by money market access Reduced by polling with the investment community through securitization Raising capital from shareholders

Risk type Source Management techniques Interest rate risk Fixed interest investments Reduced by purchase of interest rate derivatives Foreign Exchange Risk Borrowing and payment in several currencies Matching asset and liabilities Hedging Liquidity risk Withdrawal of deposits – ‘run on bank’. Execution of put options Reduced by interbank markets and by money market access Reduced by polling with the investment community through securitization Raising capital from shareholders

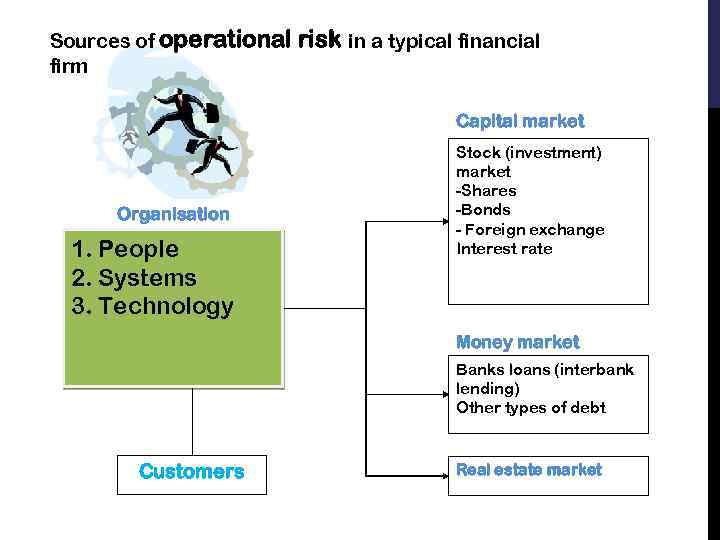

Sources of operational risk in a typical financial firm Capital market Organisation 1. People 2. Systems 3. Technology Stock (investment) market -Shares -Bonds - Foreign exchange Interest rate Money market Banks loans (interbank lending) Other types of debt Customers Real estate market

Sources of operational risk in a typical financial firm Capital market Organisation 1. People 2. Systems 3. Technology Stock (investment) market -Shares -Bonds - Foreign exchange Interest rate Money market Banks loans (interbank lending) Other types of debt Customers Real estate market

MARKET RISK 1. Market risk is the Risk associated with fluctuations in the value of traded assets 2. The risk to loose money due to movements in general market prices

MARKET RISK 1. Market risk is the Risk associated with fluctuations in the value of traded assets 2. The risk to loose money due to movements in general market prices

DEPENDS ON THE MARKET SEGMENTS MARKET RISK COULD BE: • Interest rate risk • Exchange rate risk • Equity risk • Commodity risk • Derivative risk

DEPENDS ON THE MARKET SEGMENTS MARKET RISK COULD BE: • Interest rate risk • Exchange rate risk • Equity risk • Commodity risk • Derivative risk

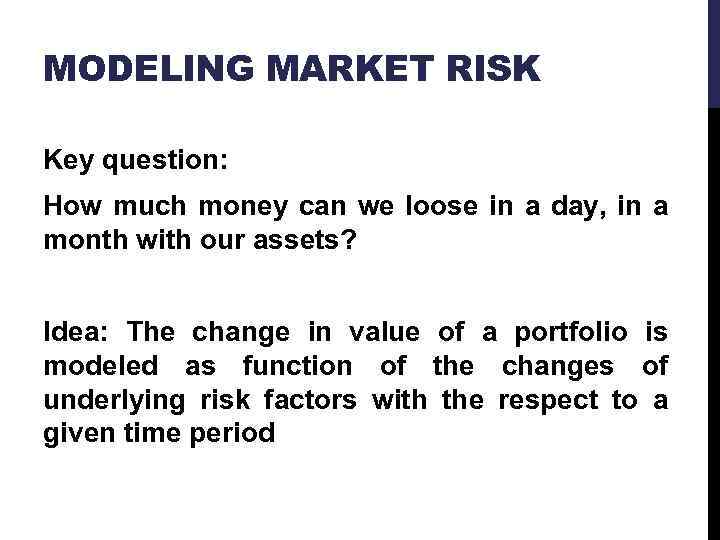

MODELING MARKET RISK Key question: How much money can we loose in a day, in a month with our assets? Idea: The change in value of a portfolio is modeled as function of the changes of underlying risk factors with the respect to a given time period

MODELING MARKET RISK Key question: How much money can we loose in a day, in a month with our assets? Idea: The change in value of a portfolio is modeled as function of the changes of underlying risk factors with the respect to a given time period

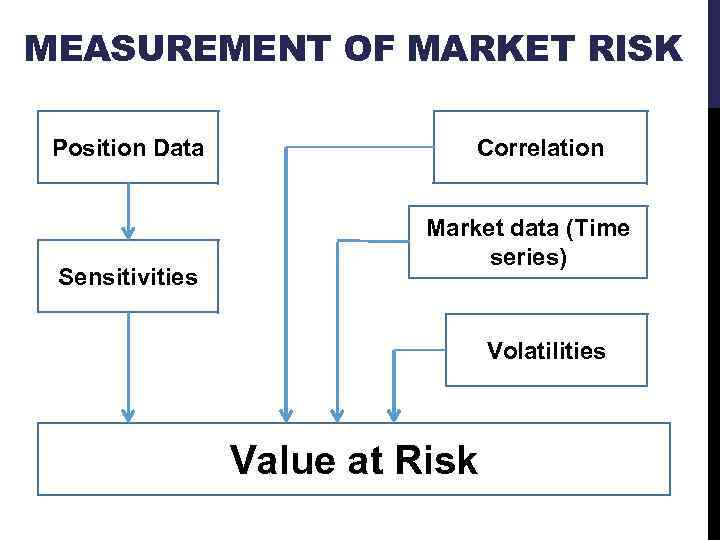

MEASUREMENT OF MARKET RISK Position Data Sensitivities Correlation Market data (Time series) Volatilities Value at Risk

MEASUREMENT OF MARKET RISK Position Data Sensitivities Correlation Market data (Time series) Volatilities Value at Risk

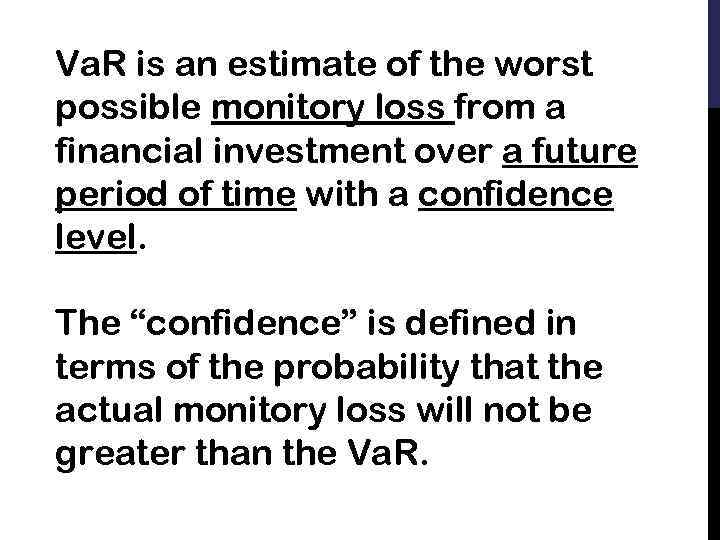

Va. R is an estimate of the worst possible monitory loss from a financial investment over a future period of time with a confidence level. The “confidence” is defined in terms of the probability that the actual monitory loss will not be greater than the Va. R.

Va. R is an estimate of the worst possible monitory loss from a financial investment over a future period of time with a confidence level. The “confidence” is defined in terms of the probability that the actual monitory loss will not be greater than the Va. R.

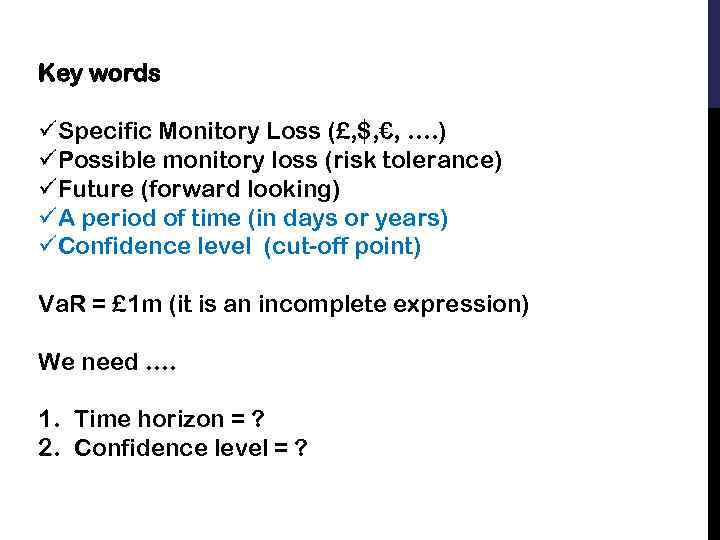

Key words üSpecific Monitory Loss (£, $, €, …. ) üPossible monitory loss (risk tolerance) üFuture (forward looking) üA period of time (in days or years) üConfidence level (cut-off point) Va. R = £ 1 m (it is an incomplete expression) We need …. 1. Time horizon = ? 2. Confidence level = ?

Key words üSpecific Monitory Loss (£, $, €, …. ) üPossible monitory loss (risk tolerance) üFuture (forward looking) üA period of time (in days or years) üConfidence level (cut-off point) Va. R = £ 1 m (it is an incomplete expression) We need …. 1. Time horizon = ? 2. Confidence level = ?

Why do we need confidence level?

Why do we need confidence level?

![Is the [daily] return of an investment portfolio random event? 1. Yes 2. No Is the [daily] return of an investment portfolio random event? 1. Yes 2. No](https://present5.com/presentation/22250279_225649801/image-16.jpg) Is the [daily] return of an investment portfolio random event? 1. Yes 2. No What is about the actual future return of an investment portfolio? 1. Exactly same of any estimate of the future return 2. Generally different (to some extent) from any estimate of the future return Hence, Va. R statement has a confidence level attached, where “confidence” is defined in terms of the probability that the actual monetary loss will not be greater than the Va. R

Is the [daily] return of an investment portfolio random event? 1. Yes 2. No What is about the actual future return of an investment portfolio? 1. Exactly same of any estimate of the future return 2. Generally different (to some extent) from any estimate of the future return Hence, Va. R statement has a confidence level attached, where “confidence” is defined in terms of the probability that the actual monetary loss will not be greater than the Va. R

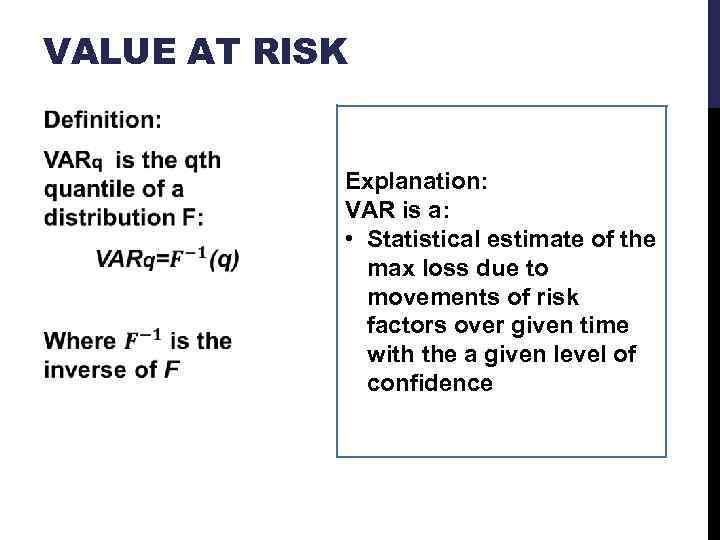

VALUE AT RISK Explanation: VAR is a: • Statistical estimate of the max loss due to movements of risk factors over given time with the a given level of confidence

VALUE AT RISK Explanation: VAR is a: • Statistical estimate of the max loss due to movements of risk factors over given time with the a given level of confidence

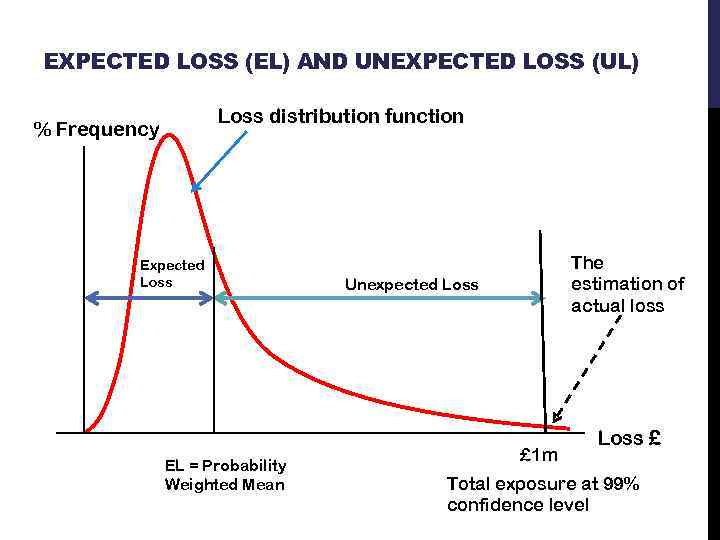

EXPECTED LOSS (EL) AND UNEXPECTED LOSS (UL) Loss distribution function % Frequency Expected Loss EL = Probability Weighted Mean The estimation of actual loss Unexpected Loss £ 1 m Loss £ Total exposure at 99% confidence level

EXPECTED LOSS (EL) AND UNEXPECTED LOSS (UL) Loss distribution function % Frequency Expected Loss EL = Probability Weighted Mean The estimation of actual loss Unexpected Loss £ 1 m Loss £ Total exposure at 99% confidence level

A one day Va. R of £ 1 million on a particular investment with a 99% confidence level

A one day Va. R of £ 1 million on a particular investment with a 99% confidence level

This probability statement means that: There is a 99% probability that the actual loss associated with the investment over the next day will not be worse than £ 1 million It also added a cautionary note suggesting that there exists a 1% (=100 -99) probability that the actual loss will be worse than £ 1 million 1% means 1 in every 100 (i. e. , 1 in every 100 trading days)

This probability statement means that: There is a 99% probability that the actual loss associated with the investment over the next day will not be worse than £ 1 million It also added a cautionary note suggesting that there exists a 1% (=100 -99) probability that the actual loss will be worse than £ 1 million 1% means 1 in every 100 (i. e. , 1 in every 100 trading days)

What determines £ 1 million? a) size of the firm b)its risk attitude

What determines £ 1 million? a) size of the firm b)its risk attitude

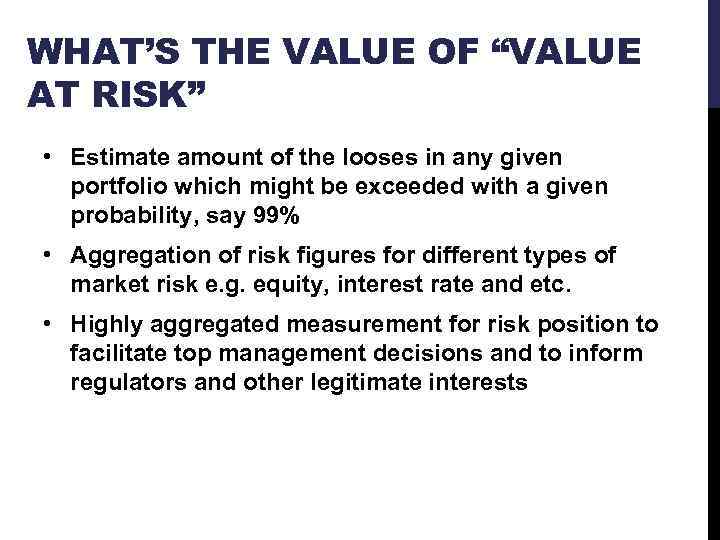

WHAT’S THE VALUE OF “VALUE AT RISK” • Estimate amount of the looses in any given portfolio which might be exceeded with a given probability, say 99% • Aggregation of risk figures for different types of market risk e. g. equity, interest rate and etc. • Highly aggregated measurement for risk position to facilitate top management decisions and to inform regulators and other legitimate interests

WHAT’S THE VALUE OF “VALUE AT RISK” • Estimate amount of the looses in any given portfolio which might be exceeded with a given probability, say 99% • Aggregation of risk figures for different types of market risk e. g. equity, interest rate and etc. • Highly aggregated measurement for risk position to facilitate top management decisions and to inform regulators and other legitimate interests

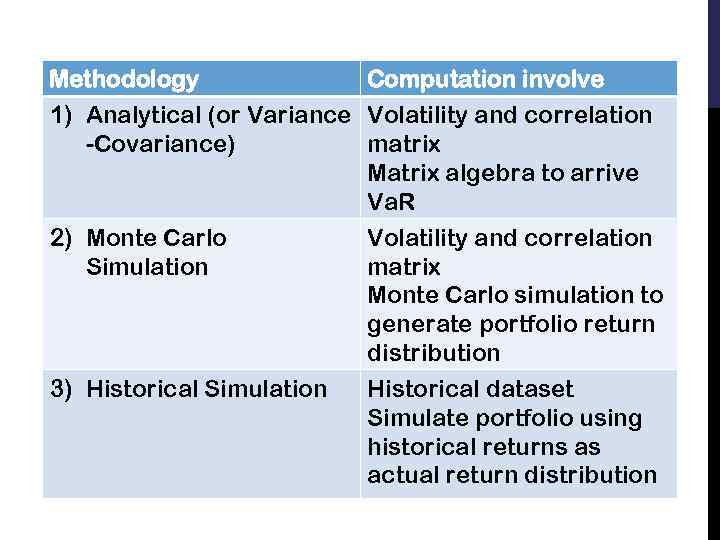

Methodology Computation involve 1) Analytical (or Variance Volatility and correlation -Covariance) matrix Matrix algebra to arrive Va. R 2) Monte Carlo Simulation 3) Historical Simulation Volatility and correlation matrix Monte Carlo simulation to generate portfolio return distribution Historical dataset Simulate portfolio using historical returns as actual return distribution

Methodology Computation involve 1) Analytical (or Variance Volatility and correlation -Covariance) matrix Matrix algebra to arrive Va. R 2) Monte Carlo Simulation 3) Historical Simulation Volatility and correlation matrix Monte Carlo simulation to generate portfolio return distribution Historical dataset Simulate portfolio using historical returns as actual return distribution

Thank you for your attention!!!!

Thank you for your attention!!!!