bdc1513c29d56ef1f2cc4cad23853b6d.ppt

- Количество слайдов: 36

Risk Modeling Chapter 20

Risk Modeling Chapter 20

What is "risk"? Some outcomes, such as yields or prices not known with certainty. In risk modelin we often assume that the distribution of a parameter is known with certainty, even particular observation's value is not know with certainty. Risk modeling technique designed to give a robust solution to a problem involving parameters with probability distributions.

What is "risk"? Some outcomes, such as yields or prices not known with certainty. In risk modelin we often assume that the distribution of a parameter is known with certainty, even particular observation's value is not know with certainty. Risk modeling technique designed to give a robust solution to a problem involving parameters with probability distributions.

Ways to deal with risk ® Ignore it. Not always a good option! ® Assume producers are risk neutral and maximize expected returns, deal with risk only as it affects transitions from a one state of nature to the next over time. (A complicated topic. ). ® Assume producers respond to risk as well as expected returns.

Ways to deal with risk ® Ignore it. Not always a good option! ® Assume producers are risk neutral and maximize expected returns, deal with risk only as it affects transitions from a one state of nature to the next over time. (A complicated topic. ). ® Assume producers respond to risk as well as expected returns.

Risk, Decision Making, and Recourse Fundamental distinction between cases: 1) All decisions must be made now with uncertain outcomes resolved later, after all random draws from the distribution ha been taken. 2) Some decisions are made now, then aft some uncertainties are resolved, other decisions are made later.

Risk, Decision Making, and Recourse Fundamental distinction between cases: 1) All decisions must be made now with uncertain outcomes resolved later, after all random draws from the distribution ha been taken. 2) Some decisions are made now, then aft some uncertainties are resolved, other decisions are made later.

Examples 1) Invest at the beginning of the year, dis returns at end of year with no intermedia buying or selling decisions. 2) Invest at the beginning of the year, bu or sell during the year depending on stoc prices.

Examples 1) Invest at the beginning of the year, dis returns at end of year with no intermedia buying or selling decisions. 2) Invest at the beginning of the year, bu or sell during the year depending on stoc prices.

Model Types The first type of model is very common and is generally called a stochastic programming model. The second type is called stochastic programming with recourse.

Model Types The first type of model is very common and is generally called a stochastic programming model. The second type is called stochastic programming with recourse.

Aside: "Discounting" Coefficients Data for LP models are almost never certai Rather than use the expected mean of a stochastic coefficient, a conservative appro is taken in a "deterministic model. " Objective function revenue coefficients ma deflated while cost coefficients are inflated difficulty with this approach is the resulting probability of the solution. Conservative e on all parameters can imply a highly unlike outcome and yield overly conservative dec

Aside: "Discounting" Coefficients Data for LP models are almost never certai Rather than use the expected mean of a stochastic coefficient, a conservative appro is taken in a "deterministic model. " Objective function revenue coefficients ma deflated while cost coefficients are inflated difficulty with this approach is the resulting probability of the solution. Conservative e on all parameters can imply a highly unlike outcome and yield overly conservative dec

Modeling Risk in the Decision Process ® Put both the expected returns and some representation of risk in the objective function, with weights. ® Maximize expected returns subject to a limit on variability. ® Minimize variability subject to an income target. ® Hybrids.

Modeling Risk in the Decision Process ® Put both the expected returns and some representation of risk in the objective function, with weights. ® Maximize expected returns subject to a limit on variability. ® Minimize variability subject to an income target. ® Hybrids.

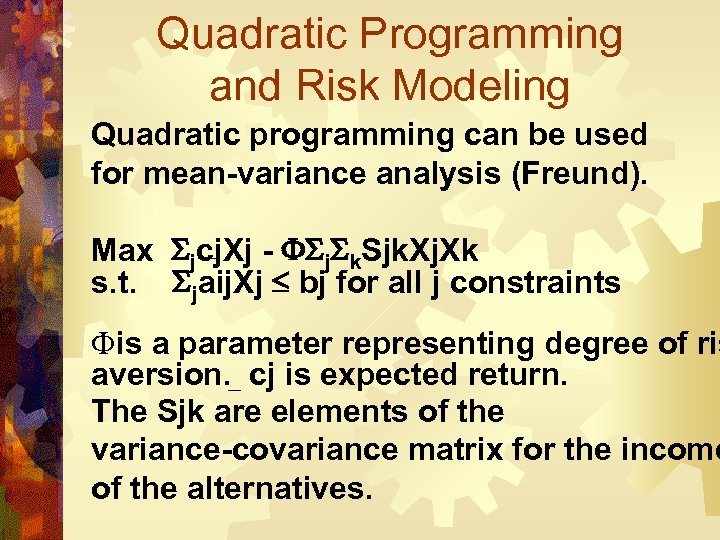

Quadratic Programming and Risk Modeling Quadratic programming can be used for mean-variance analysis (Freund). Max jcj. Xj - j k. Sjk. Xj. Xk s. t. jaij. Xj bj for all j constraints Fis a parameter representing degree of ris aversion. cj is expected return. The Sjk are elements of the variance-covariance matrix for the income of the alternatives.

Quadratic Programming and Risk Modeling Quadratic programming can be used for mean-variance analysis (Freund). Max jcj. Xj - j k. Sjk. Xj. Xk s. t. jaij. Xj bj for all j constraints Fis a parameter representing degree of ris aversion. cj is expected return. The Sjk are elements of the variance-covariance matrix for the income of the alternatives.

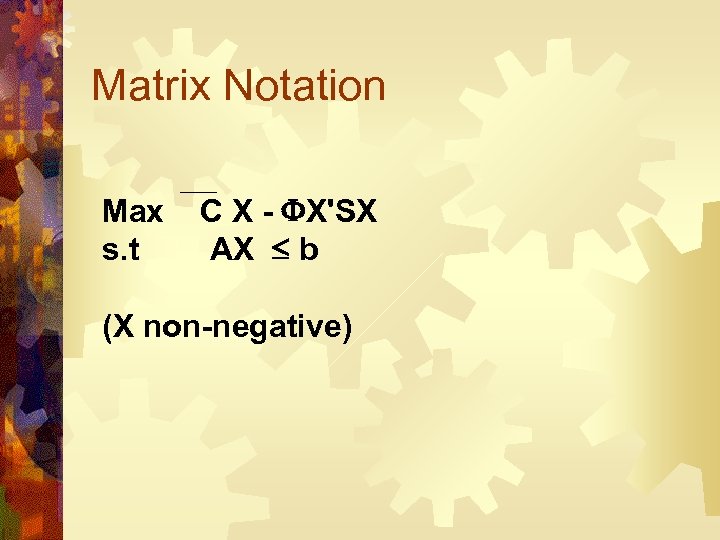

Matrix Notation Max s. t C X - X'SX AX b (X non-negative)

Matrix Notation Max s. t C X - X'SX AX b (X non-negative)

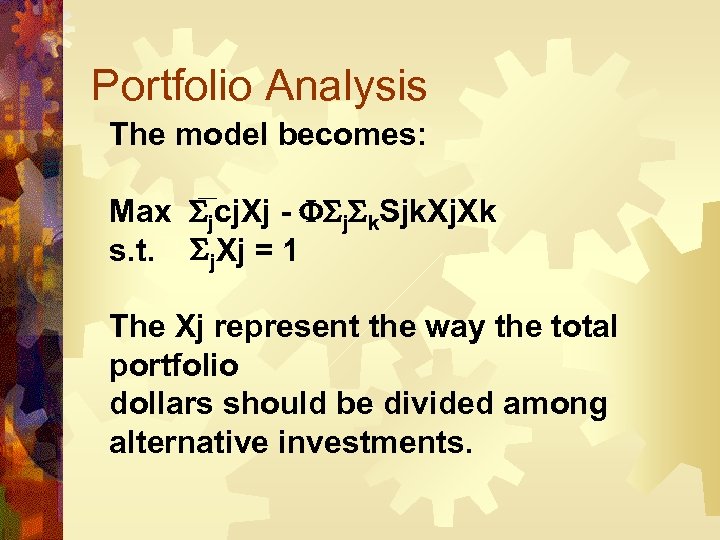

Portfolio Analysis The model becomes: Max jcj. Xj - j k. Sjk. Xj. Xk s. t. j. Xj = 1 The Xj represent the way the total portfolio dollars should be divided among alternative investments.

Portfolio Analysis The model becomes: Max jcj. Xj - j k. Sjk. Xj. Xk s. t. j. Xj = 1 The Xj represent the way the total portfolio dollars should be divided among alternative investments.

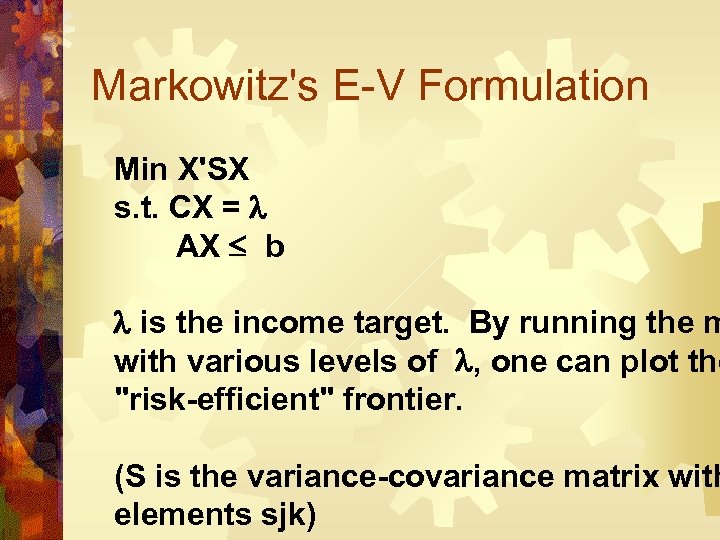

Markowitz's E-V Formulation Min X'SX s. t. CX = AX b is the income target. By running the m with various levels of , one can plot the "risk-efficient" frontier. (S is the variance-covariance matrix with elements sjk)

Markowitz's E-V Formulation Min X'SX s. t. CX = AX b is the income target. By running the m with various levels of , one can plot the "risk-efficient" frontier. (S is the variance-covariance matrix with elements sjk)

Risk Theory and E-V Models Debate has raged since the introduction of E-V analysis in the 1950's on the conditions under which an E-V model leads to choices equivalent to utility maximization. The general consensus is that E-V is consistent with utility maximizat when either: 1) the underlying income distribution is normal and utility function is exponential, or 2) the underlying distribu satisfy Meyer's location and scale restrictio

Risk Theory and E-V Models Debate has raged since the introduction of E-V analysis in the 1950's on the conditions under which an E-V model leads to choices equivalent to utility maximization. The general consensus is that E-V is consistent with utility maximizat when either: 1) the underlying income distribution is normal and utility function is exponential, or 2) the underlying distribu satisfy Meyer's location and scale restrictio

Specifying "risk aversion" For the E-V specification (Freund model) one needs to specify a risk aversion para . (Markowitz's specification avoids that Some researchers have used historical d estimate the risk parameter under the assumption that historical data reflects risk preferences. Others have subjective elicited the risk aversion parameter. There is a vast body of research in this a

Specifying "risk aversion" For the E-V specification (Freund model) one needs to specify a risk aversion para . (Markowitz's specification avoids that Some researchers have used historical d estimate the risk parameter under the assumption that historical data reflects risk preferences. Others have subjective elicited the risk aversion parameter. There is a vast body of research in this a

Linear Approximation Minimization Of Total Absolute Deviations (MOTAD). The measure of risk is the absolute deviation.

Linear Approximation Minimization Of Total Absolute Deviations (MOTAD). The measure of risk is the absolute deviation.

Back up to Chapter 9 MOTAD is a form of "MAD" model, where "MAD" stands for "minimization of absolute deviations. "

Back up to Chapter 9 MOTAD is a form of "MAD" model, where "MAD" stands for "minimization of absolute deviations. "

From 9. 1 Minimize |e| = e+ + es. t. Yi = bj. Xji + ej+ + ej- The Yi are "constants" in this framework

From 9. 1 Minimize |e| = e+ + es. t. Yi = bj. Xji + ej+ + ej- The Yi are "constants" in this framework

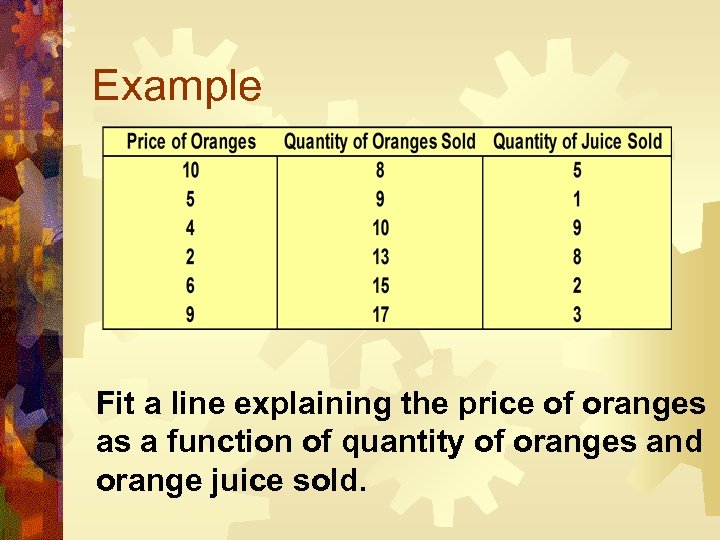

Example Fit a line explaining the price of oranges as a function of quantity of oranges and orange juice sold.

Example Fit a line explaining the price of oranges as a function of quantity of oranges and orange juice sold.

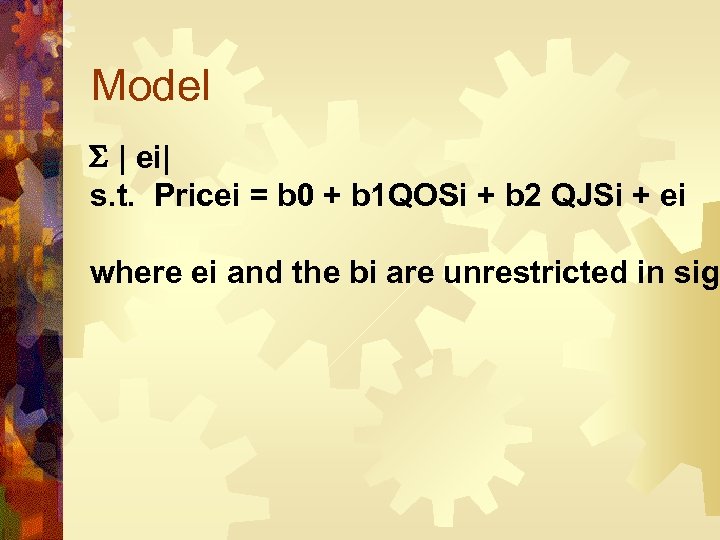

Model | ei| s. t. Pricei = b 0 + b 1 QOSi + b 2 QJSi + ei where ei and the bi are unrestricted in sig

Model | ei| s. t. Pricei = b 0 + b 1 QOSi + b 2 QJSi + ei where ei and the bi are unrestricted in sig

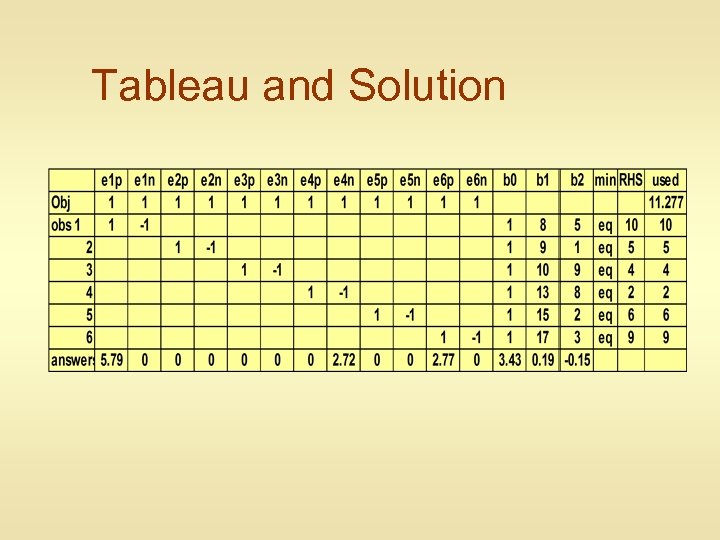

Tableau and Solution

Tableau and Solution

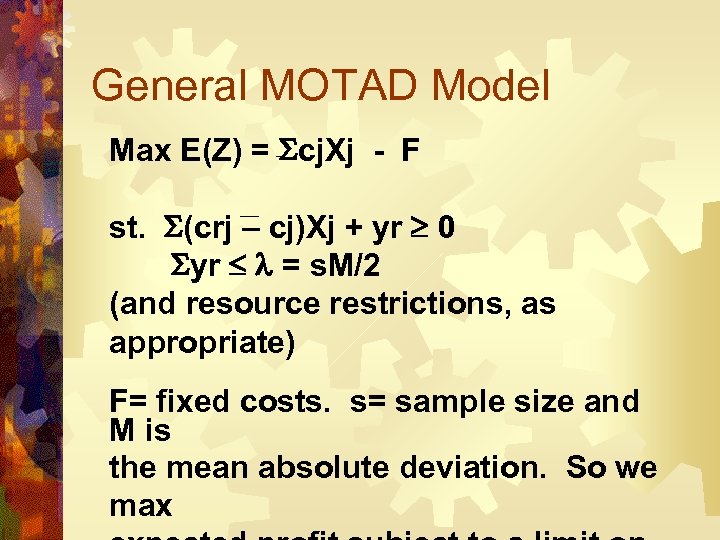

General MOTAD Model Max E(Z) = cj. Xj - F st. (crj – cj)Xj + yr 0 yr = s. M/2 (and resource restrictions, as appropriate) F= fixed costs. s= sample size and M is the mean absolute deviation. So we max

General MOTAD Model Max E(Z) = cj. Xj - F st. (crj – cj)Xj + yr 0 yr = s. M/2 (and resource restrictions, as appropriate) F= fixed costs. s= sample size and M is the mean absolute deviation. So we max

Notice there is only one error term In this case, we are only concerned with negative deviations. If the total deviation given observation is positive, then that y takes the value 0 and the ge constra is satisfied without an error term.

Notice there is only one error term In this case, we are only concerned with negative deviations. If the total deviation given observation is positive, then that y takes the value 0 and the ge constra is satisfied without an error term.

MOTAD Model Example From Anderson, Dillon, and Hardaker Agricultural Decision Analysis Iowa State University Press 1977

MOTAD Model Example From Anderson, Dillon, and Hardaker Agricultural Decision Analysis Iowa State University Press 1977

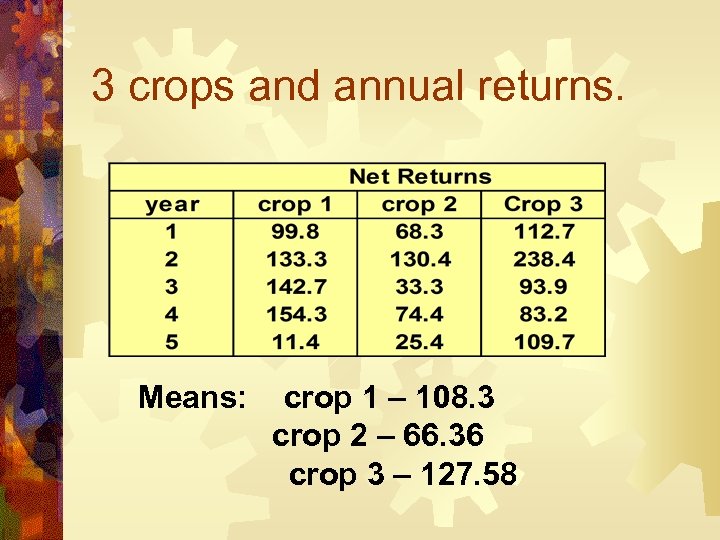

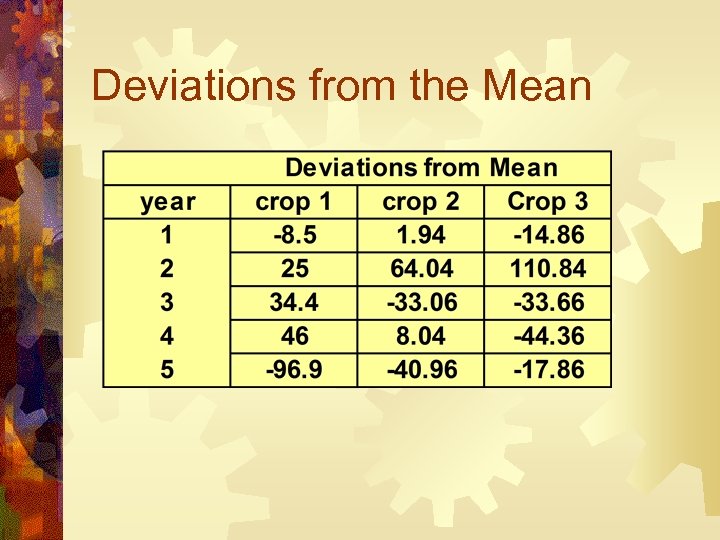

3 crops and annual returns. Means: crop 1 – 108. 3 crop 2 – 66. 36 crop 3 – 127. 58

3 crops and annual returns. Means: crop 1 – 108. 3 crop 2 – 66. 36 crop 3 – 127. 58

Deviations from the Mean

Deviations from the Mean

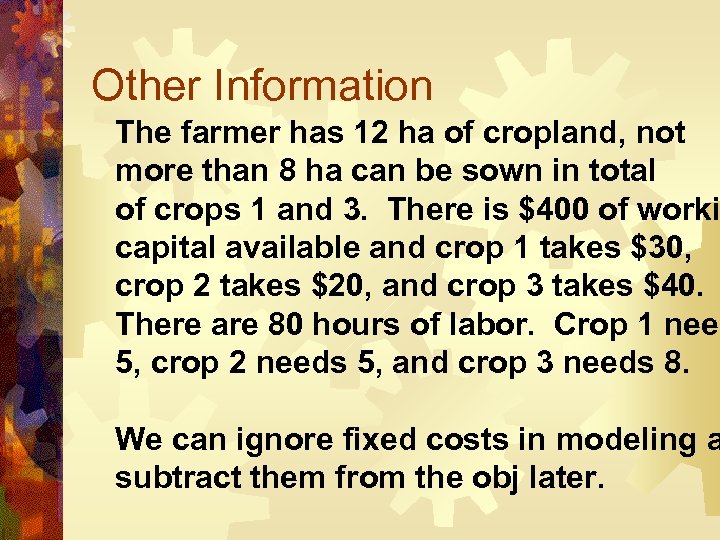

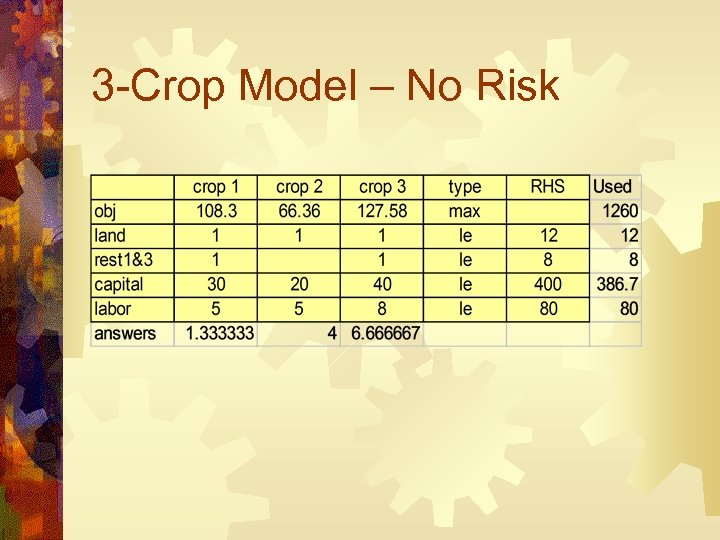

Other Information The farmer has 12 ha of cropland, not more than 8 ha can be sown in total of crops 1 and 3. There is $400 of worki capital available and crop 1 takes $30, crop 2 takes $20, and crop 3 takes $40. There are 80 hours of labor. Crop 1 need 5, crop 2 needs 5, and crop 3 needs 8. We can ignore fixed costs in modeling a subtract them from the obj later.

Other Information The farmer has 12 ha of cropland, not more than 8 ha can be sown in total of crops 1 and 3. There is $400 of worki capital available and crop 1 takes $30, crop 2 takes $20, and crop 3 takes $40. There are 80 hours of labor. Crop 1 need 5, crop 2 needs 5, and crop 3 needs 8. We can ignore fixed costs in modeling a subtract them from the obj later.

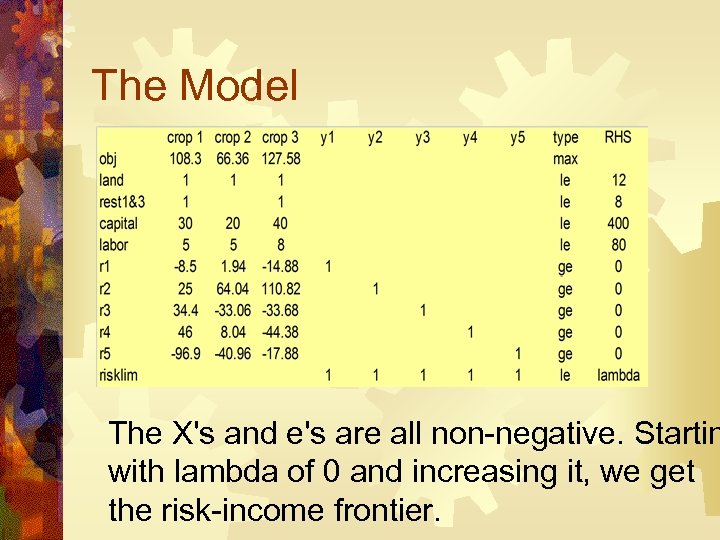

The Model The X's and e's are all non-negative. Startin with lambda of 0 and increasing it, we get the risk-income frontier.

The Model The X's and e's are all non-negative. Startin with lambda of 0 and increasing it, we get the risk-income frontier.

Target MOTAD A modification developed by Lauren Taue (see hand-out) to make MOTAD models more theoretically robust.

Target MOTAD A modification developed by Lauren Taue (see hand-out) to make MOTAD models more theoretically robust.

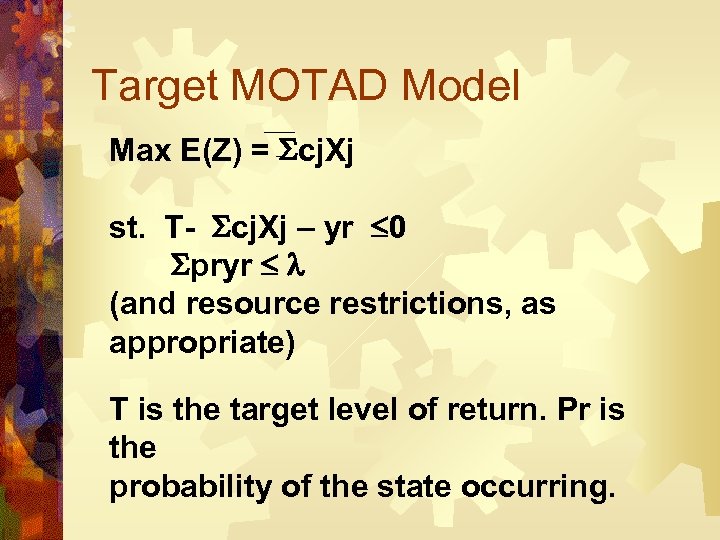

Target MOTAD Model Max E(Z) = cj. Xj st. T- cj. Xj – yr 0 pryr (and resource restrictions, as appropriate) T is the target level of return. Pr is the probability of the state occurring.

Target MOTAD Model Max E(Z) = cj. Xj st. T- cj. Xj – yr 0 pryr (and resource restrictions, as appropriate) T is the target level of return. Pr is the probability of the state occurring.

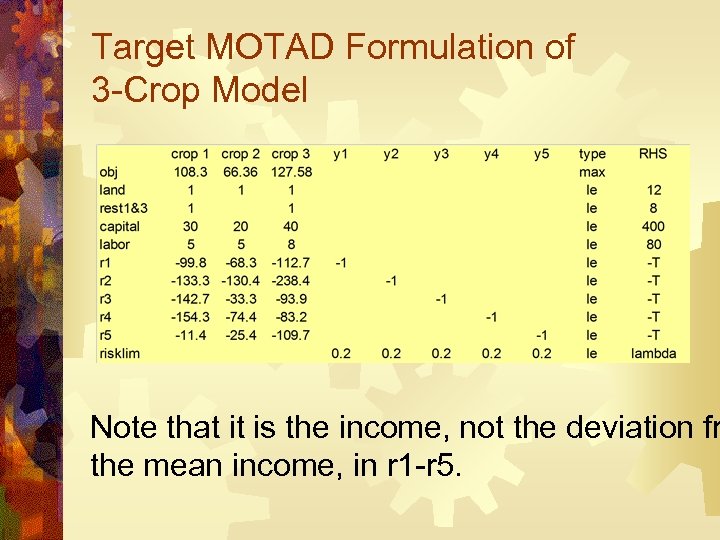

Target MOTAD Formulation of 3 -Crop Model Note that it is the income, not the deviation fr the mean income, in r 1 -r 5.

Target MOTAD Formulation of 3 -Crop Model Note that it is the income, not the deviation fr the mean income, in r 1 -r 5.

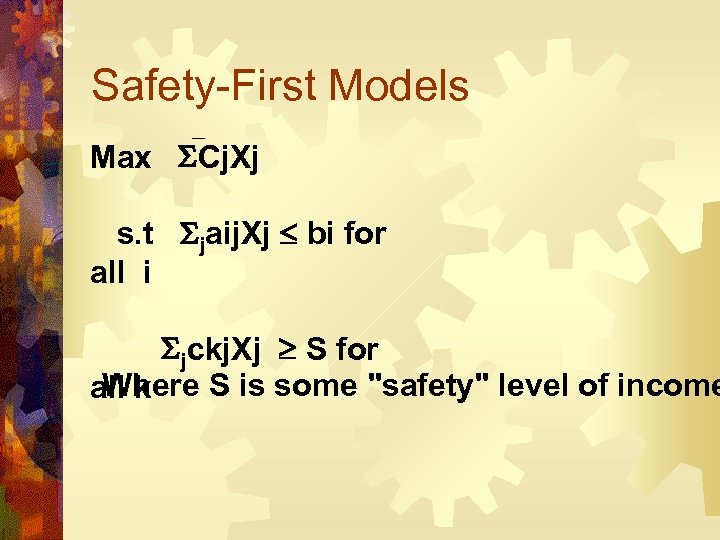

Safety-First Models Max Cj. Xj s. t jaij. Xj bi for all i jckj. Xj S for Where S is some "safety" level of income all k

Safety-First Models Max Cj. Xj s. t jaij. Xj bi for all i jckj. Xj S for Where S is some "safety" level of income all k

3 -Crop Model – No Risk

3 -Crop Model – No Risk

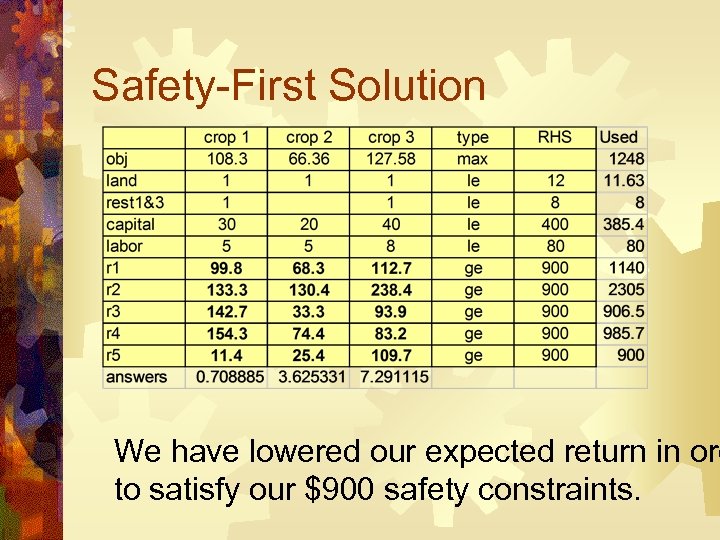

Safety-First Solution We have lowered our expected return in ord to satisfy our $900 safety constraints.

Safety-First Solution We have lowered our expected return in ord to satisfy our $900 safety constraints.

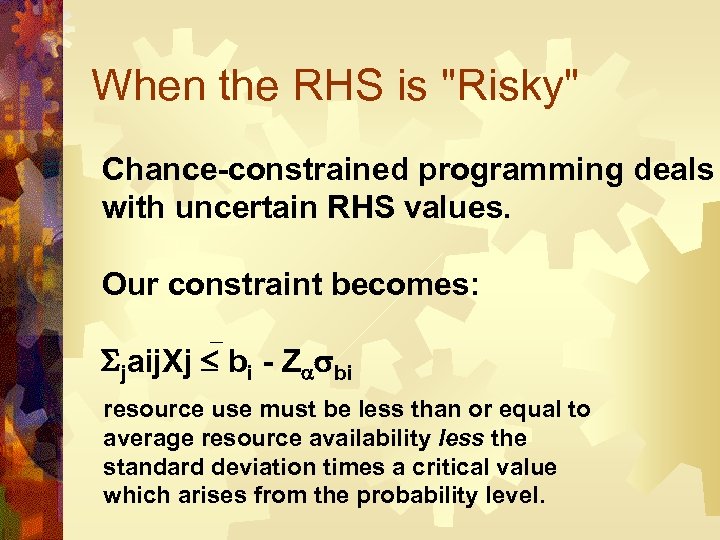

When the RHS is "Risky" Chance-constrained programming deals with uncertain RHS values. Our constraint becomes: jaij. Xj bi - Z bi resource use must be less than or equal to average resource availability less the standard deviation times a critical value which arises from the probability level.

When the RHS is "Risky" Chance-constrained programming deals with uncertain RHS values. Our constraint becomes: jaij. Xj bi - Z bi resource use must be less than or equal to average resource availability less the standard deviation times a critical value which arises from the probability level.

Finding Z Z can be found: a) by making an assumption about the form of the probability distribution of b, e. g. that it is normal, and using values for the lower tail from a standard normal probability table; or b) by uisng Chebyshev's inequality: Z = (1 - )-0. 5

Finding Z Z can be found: a) by making an assumption about the form of the probability distribution of b, e. g. that it is normal, and using values for the lower tail from a standard normal probability table; or b) by uisng Chebyshev's inequality: Z = (1 - )-0. 5

Example We want an 87. 5% probability of satisfyin the constraint. Using the normal distribution we would set Z = 1. 14. Using Chebyshev's inequality, we would set Z = 2. 83. The Chebyshev boundary may be too large for many problems.

Example We want an 87. 5% probability of satisfyin the constraint. Using the normal distribution we would set Z = 1. 14. Using Chebyshev's inequality, we would set Z = 2. 83. The Chebyshev boundary may be too large for many problems.