Risk MICROECONOMICS Principles and Analysis Frank Cowell Almost

1042-risk.ppt

- Количество слайдов: 45

Risk MICROECONOMICS Principles and Analysis Frank Cowell Almost essential Consumption and Uncertainty Prerequisites November 2006

Risk MICROECONOMICS Principles and Analysis Frank Cowell Almost essential Consumption and Uncertainty Prerequisites November 2006

Risk and uncertainty In dealing with uncertainty a lot can be done without introducing probability. Now we introduce a specific probability model This could be some kind of exogenous mechanism Could just involve individual’s perceptions Facilitates discussion of risk Introduces new way of modelling preferences

Risk and uncertainty In dealing with uncertainty a lot can be done without introducing probability. Now we introduce a specific probability model This could be some kind of exogenous mechanism Could just involve individual’s perceptions Facilitates discussion of risk Introduces new way of modelling preferences

Overview... Probability Risk comparisons Special Cases Lotteries Risk An explicit tool for model building

Overview... Probability Risk comparisons Special Cases Lotteries Risk An explicit tool for model building

Probability What type of probability model? A number of reasonable versions: Public observable Public announced Private objective Private subjective Need a way of appropriately representing probabilities in economic models. Lottery government policy? coin flip emerges from structure of preferences.

Probability What type of probability model? A number of reasonable versions: Public observable Public announced Private objective Private subjective Need a way of appropriately representing probabilities in economic models. Lottery government policy? coin flip emerges from structure of preferences.

Ingredients of a probability model We need to define the support of the distribution The smallest closed set whose complement has probability zero Convenient way of specifying what is logically feasible (points in the support) and infeasible (other points). Distribution function F Represents probability in a convenient and general way. Encompass both discrete and continuous distributions. Discrete distributions can be represented as a vector Continuous distribution – usually specify density function Take some particular cases: a collection of examples

Ingredients of a probability model We need to define the support of the distribution The smallest closed set whose complement has probability zero Convenient way of specifying what is logically feasible (points in the support) and infeasible (other points). Distribution function F Represents probability in a convenient and general way. Encompass both discrete and continuous distributions. Discrete distributions can be represented as a vector Continuous distribution – usually specify density function Take some particular cases: a collection of examples

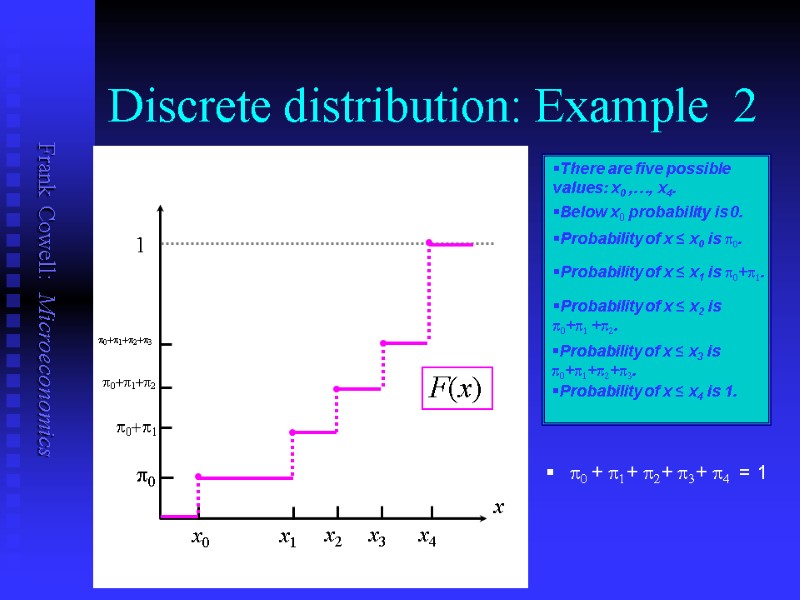

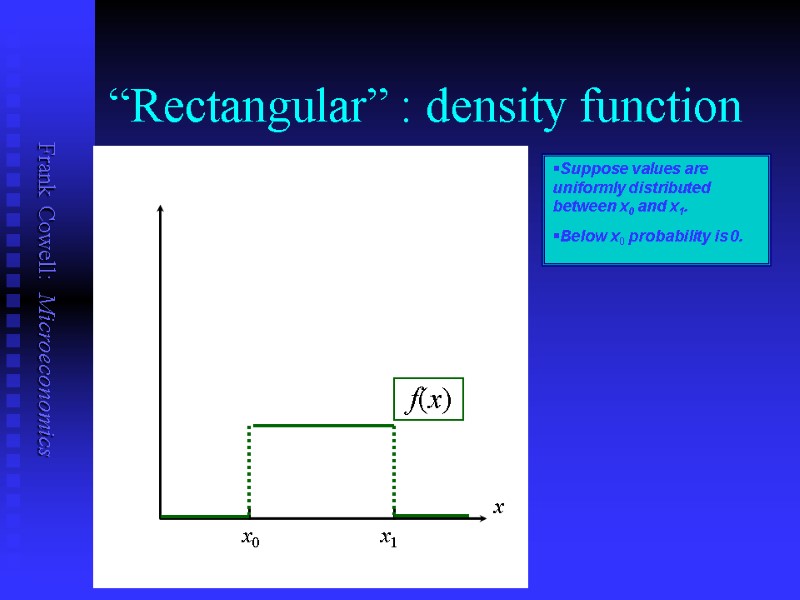

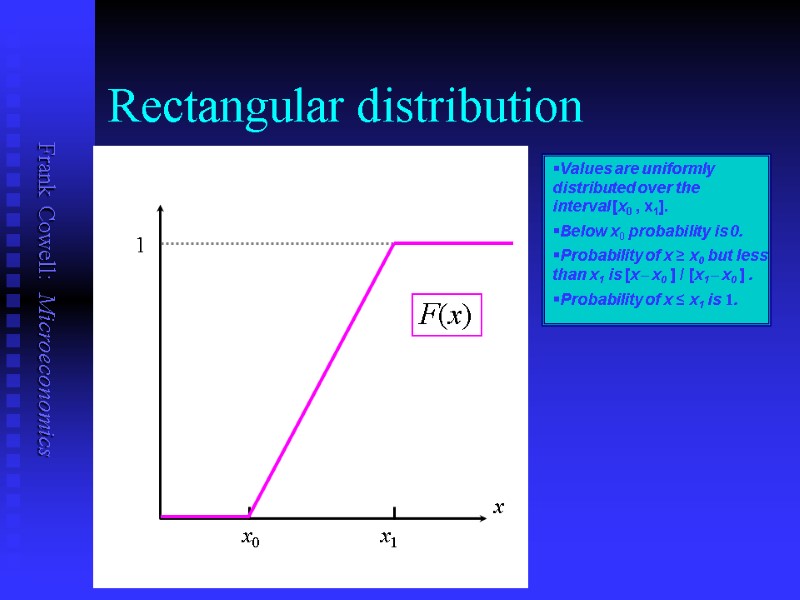

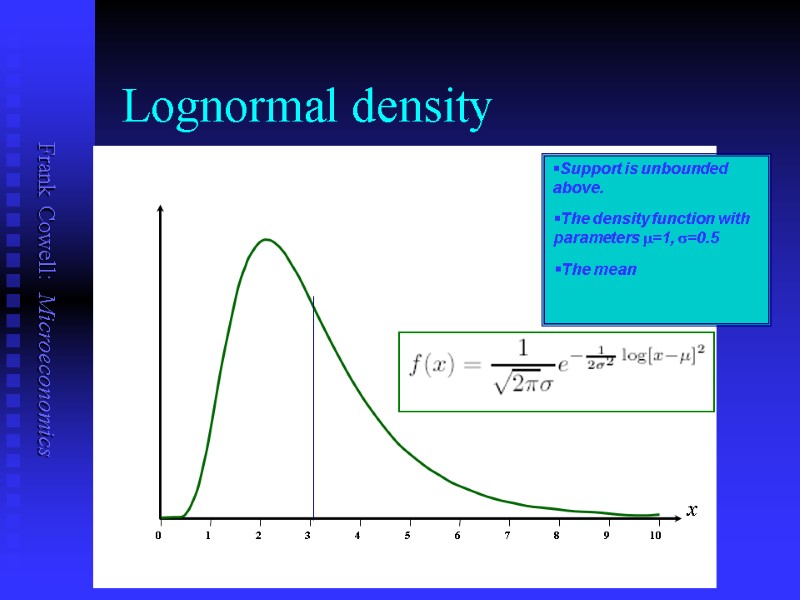

Some examples Begin with two cases of discrete distributions #W = 2. Probability p of value x0; probability 1–p of value x1. #W = 5. Probability pi of value xi, i = 0,...,4. Then a simple example of continuous distribution with bounded support The rectangular distribution – uniform density over an interval. Finally an example of continuous distribution with unbounded support

Some examples Begin with two cases of discrete distributions #W = 2. Probability p of value x0; probability 1–p of value x1. #W = 5. Probability pi of value xi, i = 0,...,4. Then a simple example of continuous distribution with bounded support The rectangular distribution – uniform density over an interval. Finally an example of continuous distribution with unbounded support

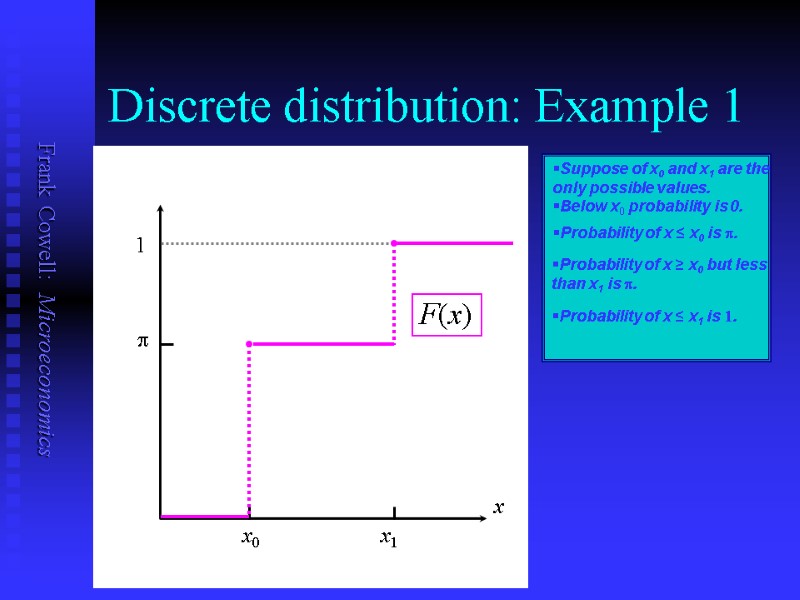

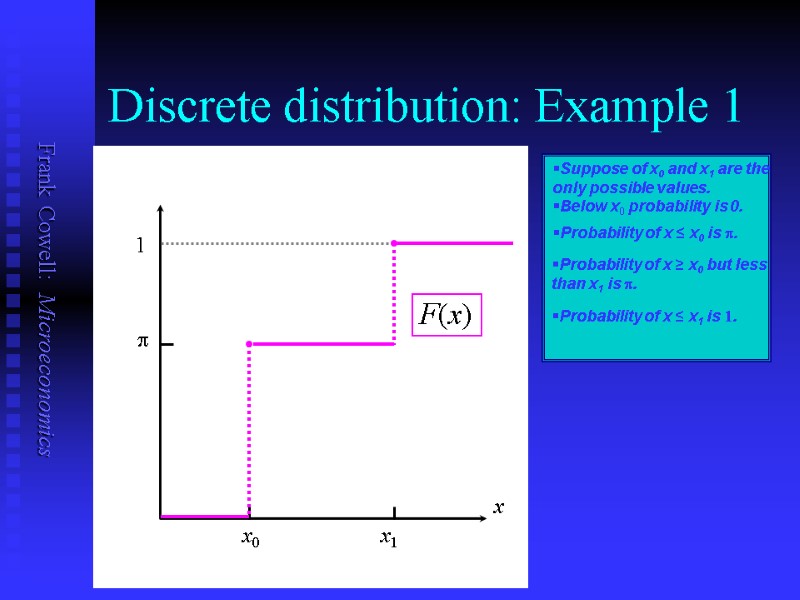

Discrete distribution: Example 1 x Below x0 probability is 0. Probability of x ≤ x0 is p. x1 x0 1 p Probability of x ≤ x1 is 1. Suppose of x0 and x1 are the only possible values. F(x) Probability of x ≥ x0 but less than x1 is p.

Discrete distribution: Example 1 x Below x0 probability is 0. Probability of x ≤ x0 is p. x1 x0 1 p Probability of x ≤ x1 is 1. Suppose of x0 and x1 are the only possible values. F(x) Probability of x ≥ x0 but less than x1 is p.

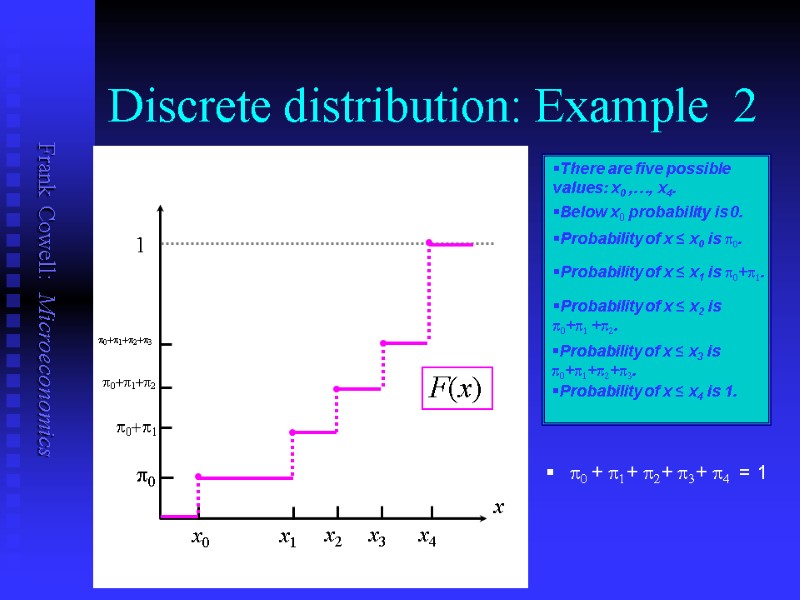

Discrete distribution: Example 2 x Below x0 probability is 0. Probability of x ≤ x0 is p0. x1 x0 1 p0 Probability of x ≤ x1 is p0+p1. There are five possible values: x0 ,…, x4. F(x) p0+p1 p0+p1+p2+p3 Probability of x ≤ x2 is p0+p1 +p2. x4 x2 x3 p0+p1+p2 Probability of x ≤ x3 is p0+p1+p2+p3. Probability of x ≤ x4 is 1. p0 + p1+ p2+ p3+ p4 = 1

Discrete distribution: Example 2 x Below x0 probability is 0. Probability of x ≤ x0 is p0. x1 x0 1 p0 Probability of x ≤ x1 is p0+p1. There are five possible values: x0 ,…, x4. F(x) p0+p1 p0+p1+p2+p3 Probability of x ≤ x2 is p0+p1 +p2. x4 x2 x3 p0+p1+p2 Probability of x ≤ x3 is p0+p1+p2+p3. Probability of x ≤ x4 is 1. p0 + p1+ p2+ p3+ p4 = 1

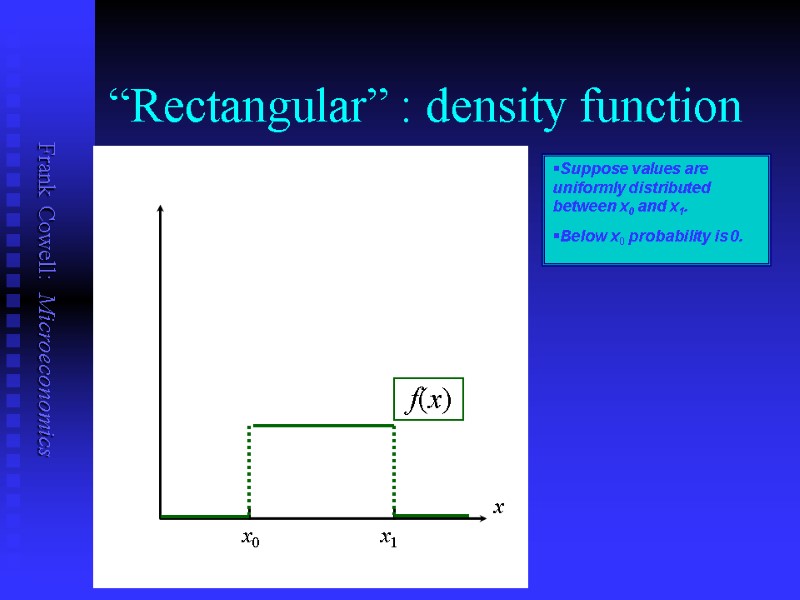

“Rectangular” : density function x Below x0 probability is 0. x1 x0 Suppose values are uniformly distributed between x0 and x1. f(x)

“Rectangular” : density function x Below x0 probability is 0. x1 x0 Suppose values are uniformly distributed between x0 and x1. f(x)

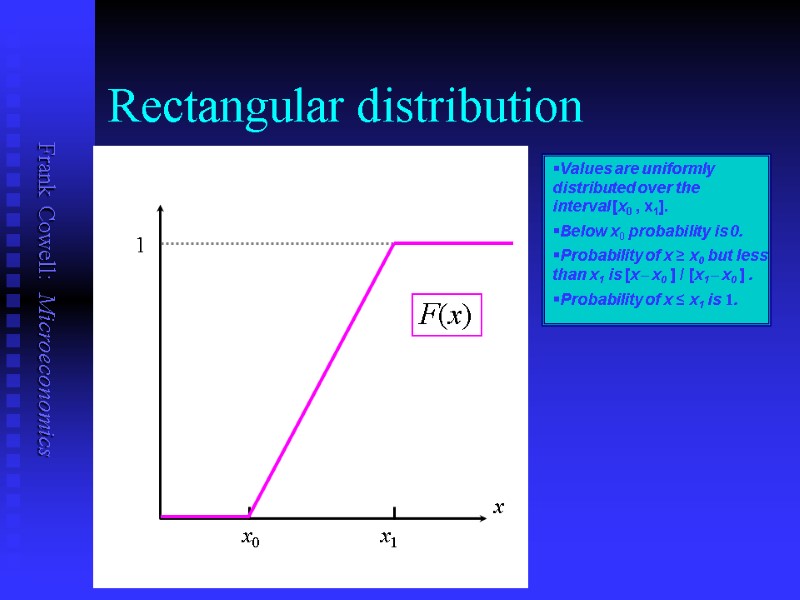

Rectangular distribution x Below x0 probability is 0. Probability of x ≥ x0 but less than x1 is [x x0 ] / [x1 x0 ] . x1 x0 1 Probability of x ≤ x1 is 1. Values are uniformly distributed over the interval [x0 , x1]. F(x)

Rectangular distribution x Below x0 probability is 0. Probability of x ≥ x0 but less than x1 is [x x0 ] / [x1 x0 ] . x1 x0 1 Probability of x ≤ x1 is 1. Values are uniformly distributed over the interval [x0 , x1]. F(x)

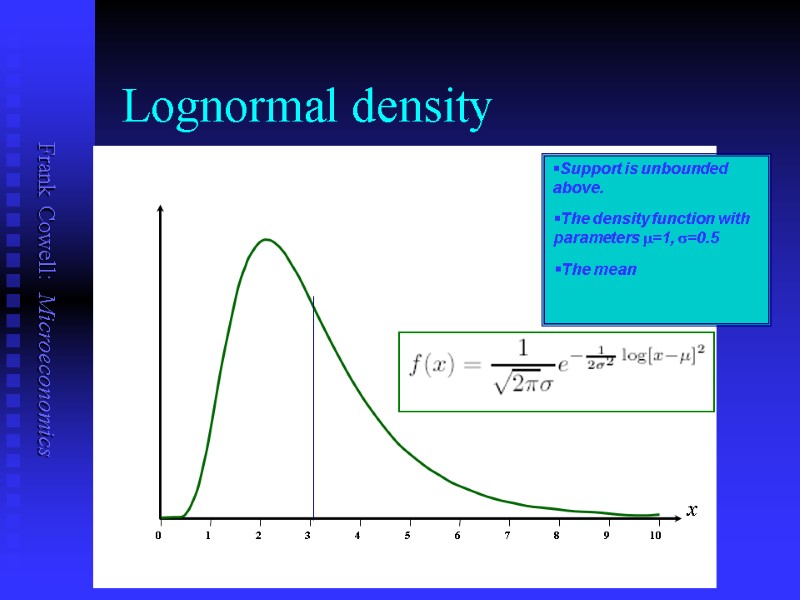

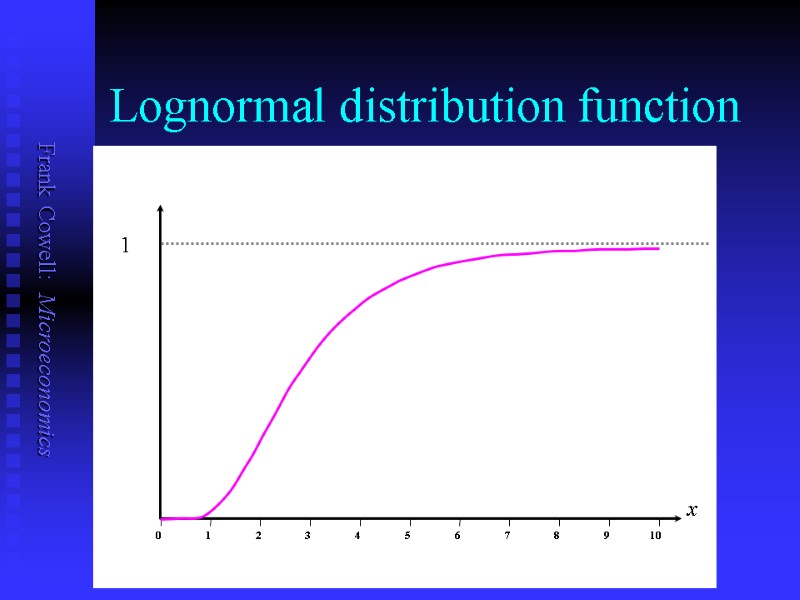

Lognormal density x 0 1 2 3 4 5 6 7 8 9 10 Support is unbounded above. The density function with parameters m=1, s=0.5 The mean

Lognormal density x 0 1 2 3 4 5 6 7 8 9 10 Support is unbounded above. The density function with parameters m=1, s=0.5 The mean

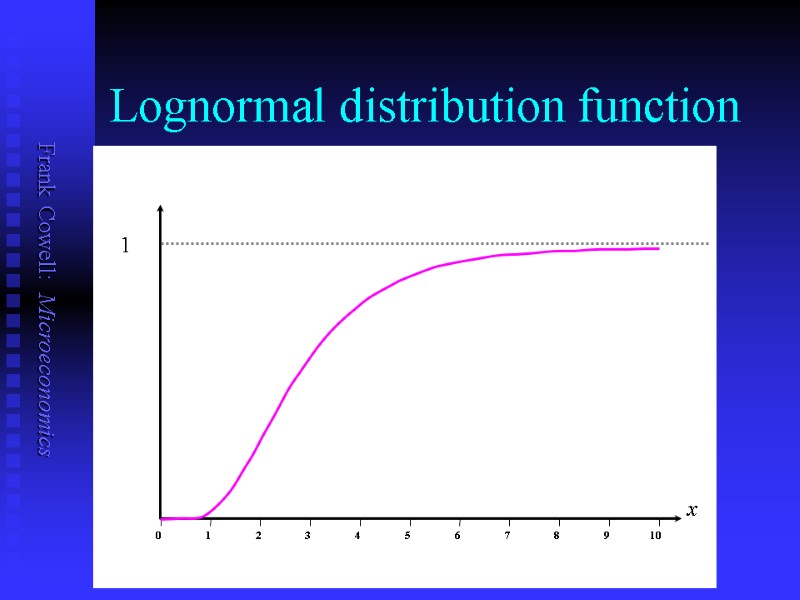

Lognormal distribution function 1

Lognormal distribution function 1

Overview... Probability Risk comparisons Special Cases Lotteries Risk Shape of the u-function and attitude to risk

Overview... Probability Risk comparisons Special Cases Lotteries Risk Shape of the u-function and attitude to risk

Risk aversion and the function u With a probability model it makes sense to discuss risk attitudes in terms of gambles Can do this in terms of properties of “felicity” or “cardinal utility” function u Scale and origin of u are irrelevant But the curvature of u is important. We can capture this in more than one way We will investigate the standard approaches... ...and then introduce two useful definitions

Risk aversion and the function u With a probability model it makes sense to discuss risk attitudes in terms of gambles Can do this in terms of properties of “felicity” or “cardinal utility” function u Scale and origin of u are irrelevant But the curvature of u is important. We can capture this in more than one way We will investigate the standard approaches... ...and then introduce two useful definitions

Risk aversion and choice Imagine a simple gamble Two payoffs with known probabilities: xRED with probability pRED. xBLUE with probability pBLUE. Expected value Ex = pREDxRED + pBLUExBLUE. A “fair gamble”: stake money is exactly Ex . Would the person accept all fair gambles? Compare Eu(x) with u(Ex) depends on shape of u

Risk aversion and choice Imagine a simple gamble Two payoffs with known probabilities: xRED with probability pRED. xBLUE with probability pBLUE. Expected value Ex = pREDxRED + pBLUExBLUE. A “fair gamble”: stake money is exactly Ex . Would the person accept all fair gambles? Compare Eu(x) with u(Ex) depends on shape of u

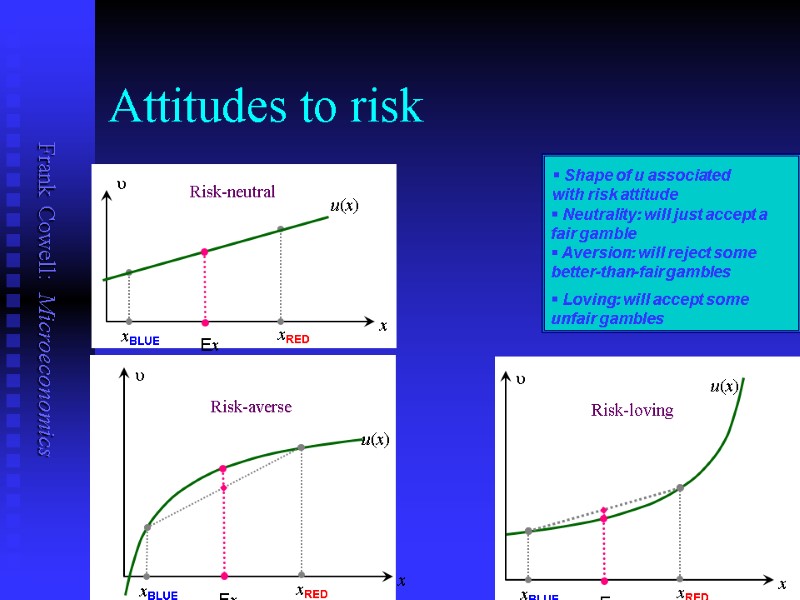

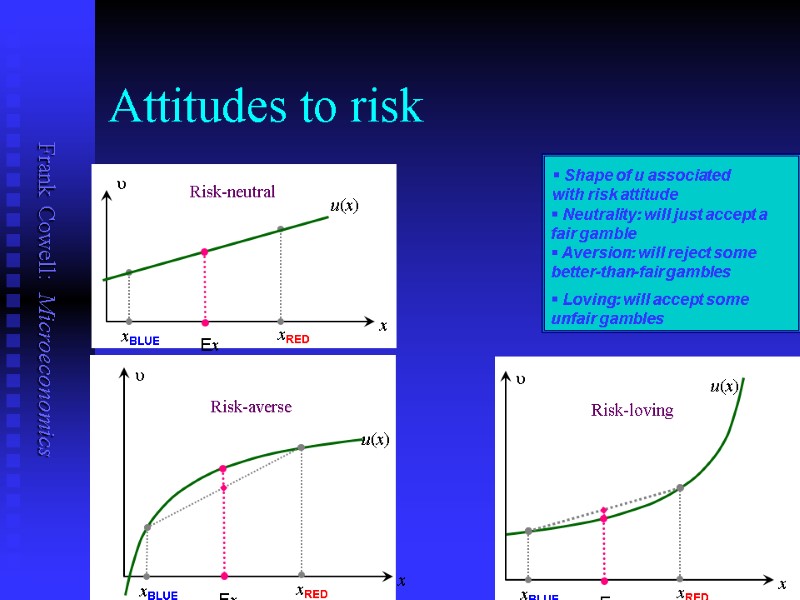

Attitudes to risk Shape of u associated with risk attitude Neutrality: will just accept a fair gamble Aversion: will reject some better-than-fair gambles Loving: will accept some unfair gambles

Attitudes to risk Shape of u associated with risk attitude Neutrality: will just accept a fair gamble Aversion: will reject some better-than-fair gambles Loving: will accept some unfair gambles

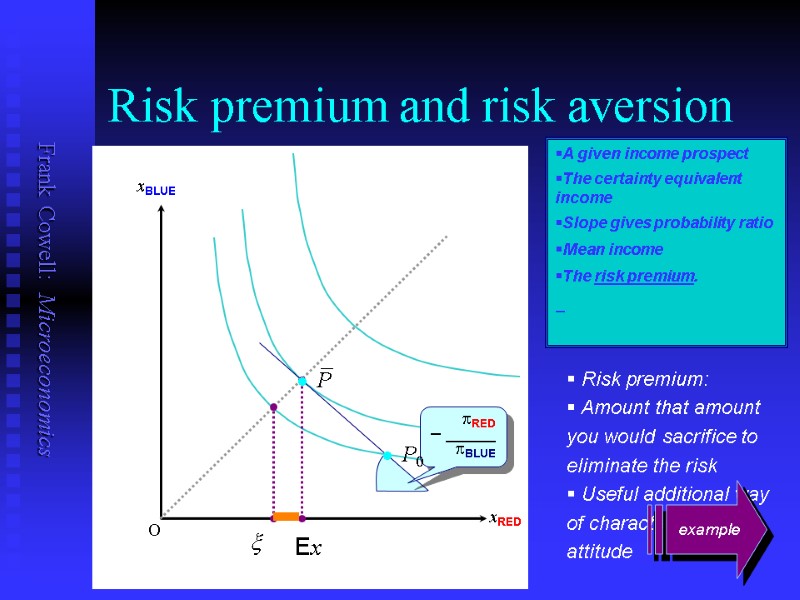

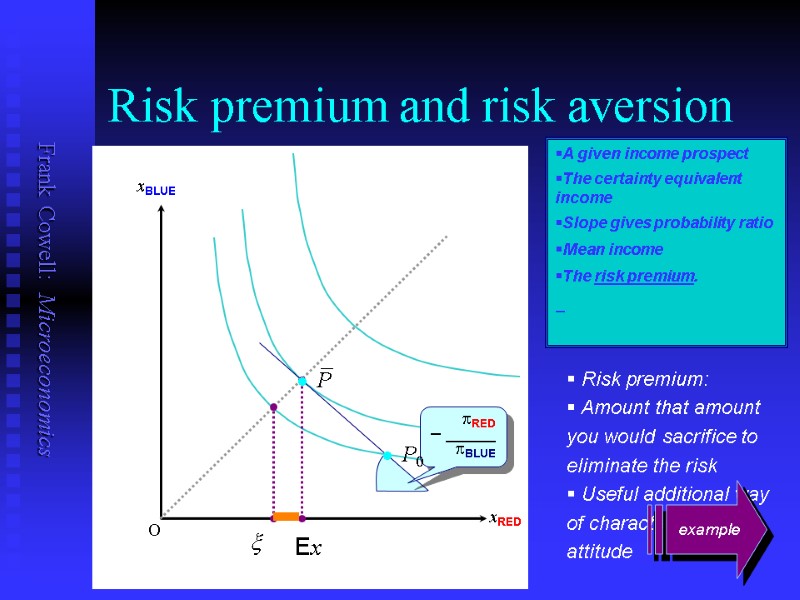

Risk premium and risk aversion xBLUE xRED O The certainty equivalent income A given income prospect Slope gives probability ratio Ex x Mean income The risk premium. P0 P Risk premium: Amount that amount you would sacrifice to eliminate the risk Useful additional way of characterising risk attitude – _ example

Risk premium and risk aversion xBLUE xRED O The certainty equivalent income A given income prospect Slope gives probability ratio Ex x Mean income The risk premium. P0 P Risk premium: Amount that amount you would sacrifice to eliminate the risk Useful additional way of characterising risk attitude – _ example

An example... Two-state model Subjective probabilities (0.25, 0.75) Single-commodity payoff in each case

An example... Two-state model Subjective probabilities (0.25, 0.75) Single-commodity payoff in each case

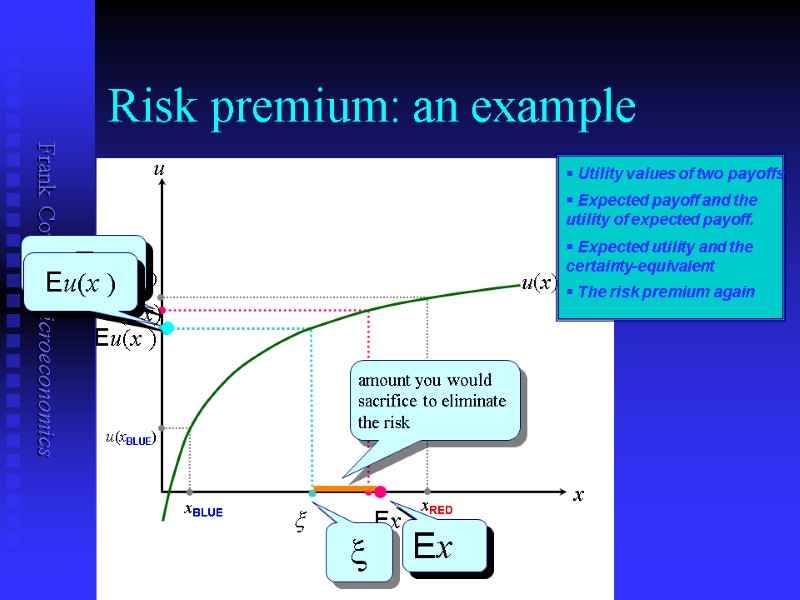

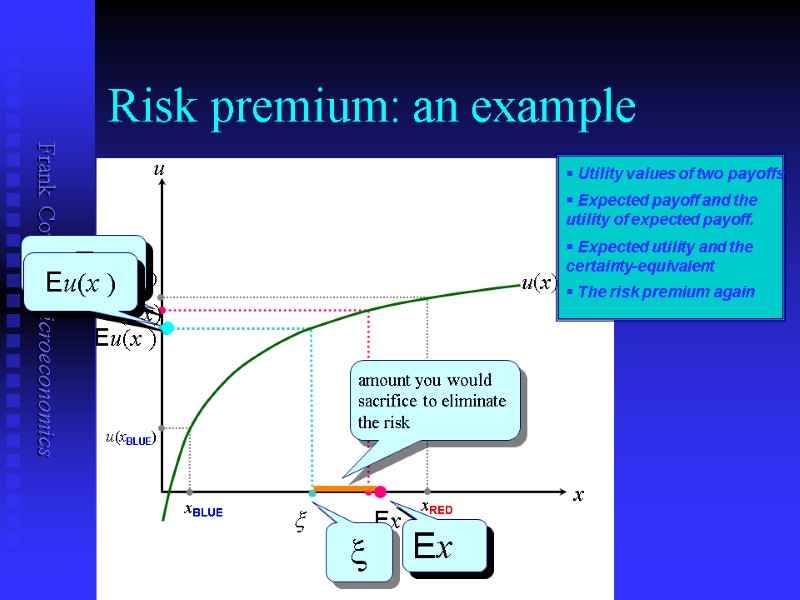

Risk premium: an example u u(x) xBLUE x xRED u(xBLUE) u(xRED) Ex u(Ex) x Eu(x ) amount you would sacrifice to eliminate the risk u(Ex) x Expected payoff and the utility of expected payoff. Expected utility and the certainty-equivalent The risk premium again Utility values of two payoffs

Risk premium: an example u u(x) xBLUE x xRED u(xBLUE) u(xRED) Ex u(Ex) x Eu(x ) amount you would sacrifice to eliminate the risk u(Ex) x Expected payoff and the utility of expected payoff. Expected utility and the certainty-equivalent The risk premium again Utility values of two payoffs

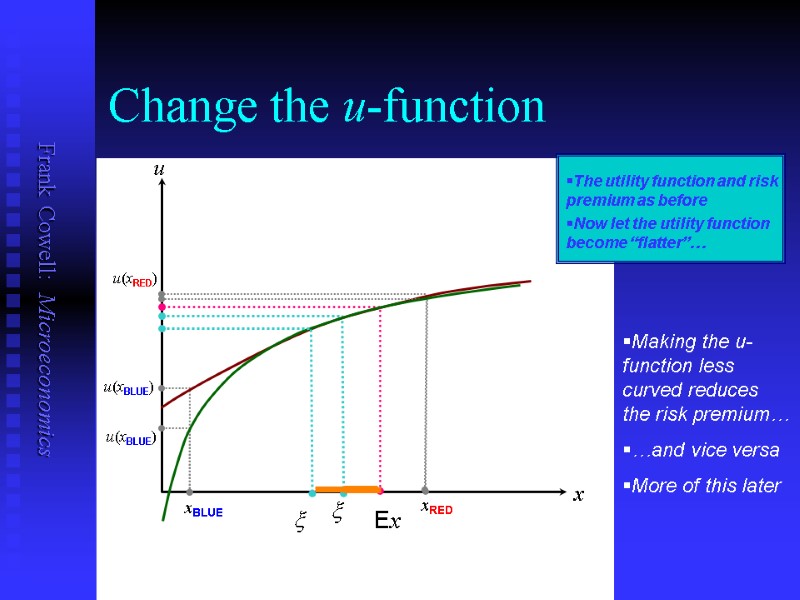

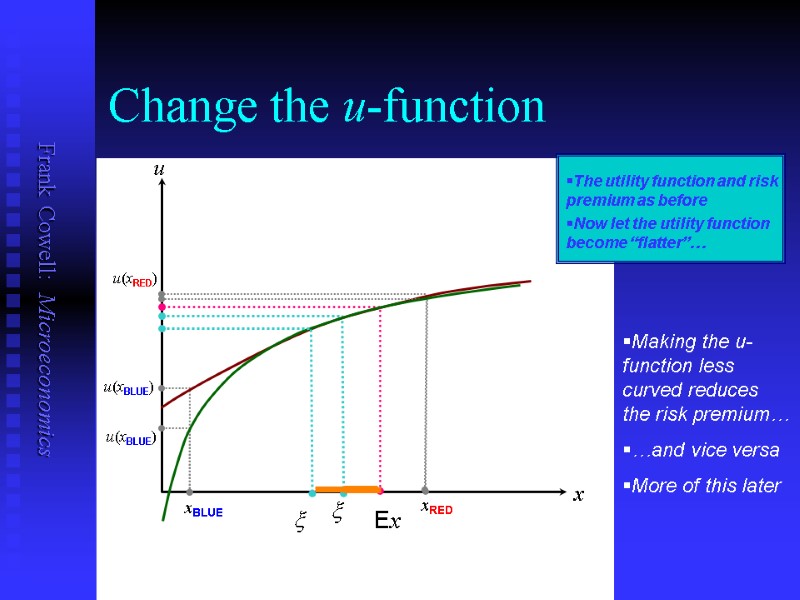

Change the u-function u xBLUE x xRED u(xBLUE) u(xRED) Ex x The utility function and risk premium as before Now let the utility function become “flatter”… u(xBLUE) x Making the u-function less curved reduces the risk premium… …and vice versa More of this later

Change the u-function u xBLUE x xRED u(xBLUE) u(xRED) Ex x The utility function and risk premium as before Now let the utility function become “flatter”… u(xBLUE) x Making the u-function less curved reduces the risk premium… …and vice versa More of this later

An index of risk aversion? Risk aversion associated with shape of u second derivative or “curvature” But could we summarise it in a simple index or measure? Then we could easily characterise one person as more/less risk averse than another There is more than one way of doing this

An index of risk aversion? Risk aversion associated with shape of u second derivative or “curvature” But could we summarise it in a simple index or measure? Then we could easily characterise one person as more/less risk averse than another There is more than one way of doing this

Absolute risk aversion Definition of absolute risk aversion for scalar payoffs. uxx(x) a(x) := ux(x) For risk-averse individuals a is positive. For risk-neutral individuals a is zero. Definition ensures that a is independent of the scale and the origin of u. Multiply u by a positive constant… …add any other constant… a remains unchanged.

Absolute risk aversion Definition of absolute risk aversion for scalar payoffs. uxx(x) a(x) := ux(x) For risk-averse individuals a is positive. For risk-neutral individuals a is zero. Definition ensures that a is independent of the scale and the origin of u. Multiply u by a positive constant… …add any other constant… a remains unchanged.

Relative risk aversion Definition of relative risk aversion for scalar payoffs: uxx(x) r(x) := x ux(x) Some basic properties of r are similar to those of a: positive for risk-averse individuals. zero for risk-neutrality. independent of the scale and the origin of u Obvious relation with absolute risk aversion: r(x) = x a(x)

Relative risk aversion Definition of relative risk aversion for scalar payoffs: uxx(x) r(x) := x ux(x) Some basic properties of r are similar to those of a: positive for risk-averse individuals. zero for risk-neutrality. independent of the scale and the origin of u Obvious relation with absolute risk aversion: r(x) = x a(x)

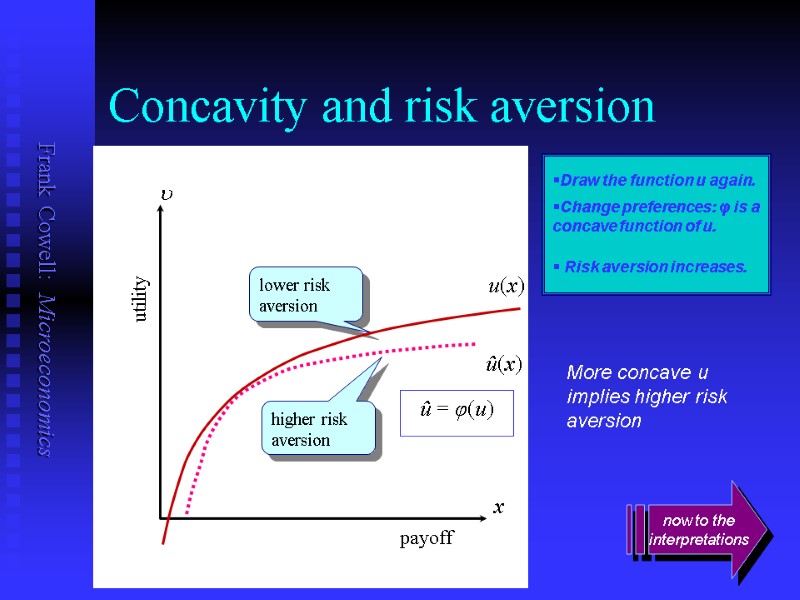

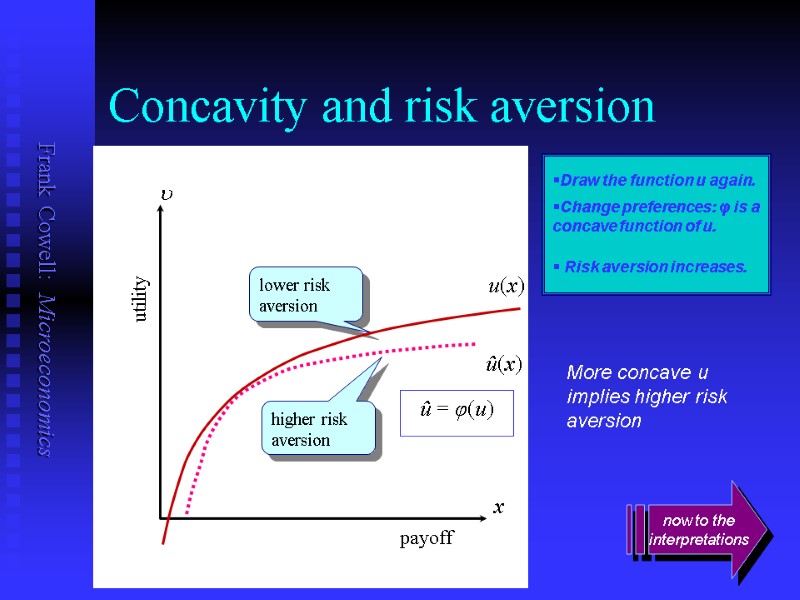

Concavity and risk aversion u u(x) payoff utility x û(x) Draw the function u again. Change preferences: φ is a concave function of u. Risk aversion increases. More concave u implies higher risk aversion now to the interpretations lower risk aversion higher risk aversion û = φ(u)

Concavity and risk aversion u u(x) payoff utility x û(x) Draw the function u again. Change preferences: φ is a concave function of u. Risk aversion increases. More concave u implies higher risk aversion now to the interpretations lower risk aversion higher risk aversion û = φ(u)

Interpreting a and r Think of a as a measure of the concavity of u. Risk premium is approximately ½ a(x) var(x). Likewise think of r as the elasticity of marginal u. In both interpretations an increase in the “curvature” of u increases measured risk aversion. Suppose risk preferences change… u is replaced by û , where û = φ(u) and φ is strictly concave Then both a(x) and r(x) increase for all x. An increase in a or r also associated with increased curvature of IC…

Interpreting a and r Think of a as a measure of the concavity of u. Risk premium is approximately ½ a(x) var(x). Likewise think of r as the elasticity of marginal u. In both interpretations an increase in the “curvature” of u increases measured risk aversion. Suppose risk preferences change… u is replaced by û , where û = φ(u) and φ is strictly concave Then both a(x) and r(x) increase for all x. An increase in a or r also associated with increased curvature of IC…

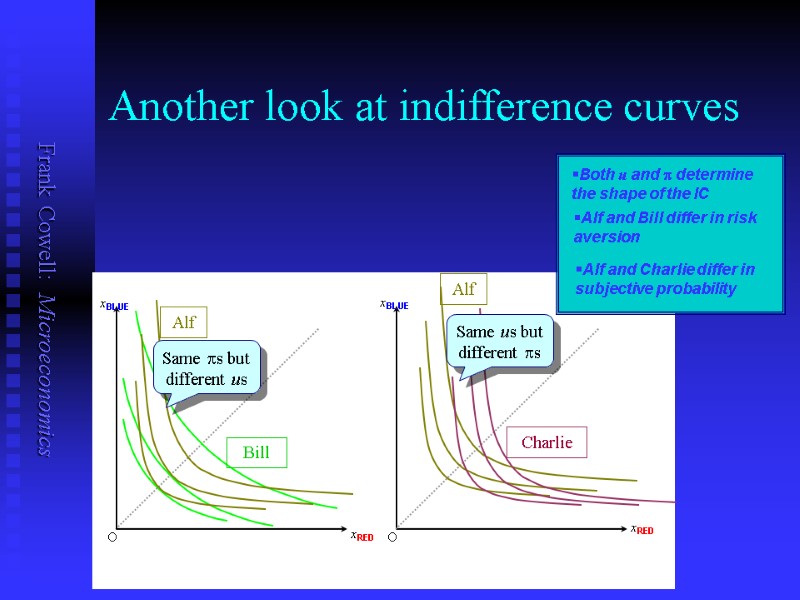

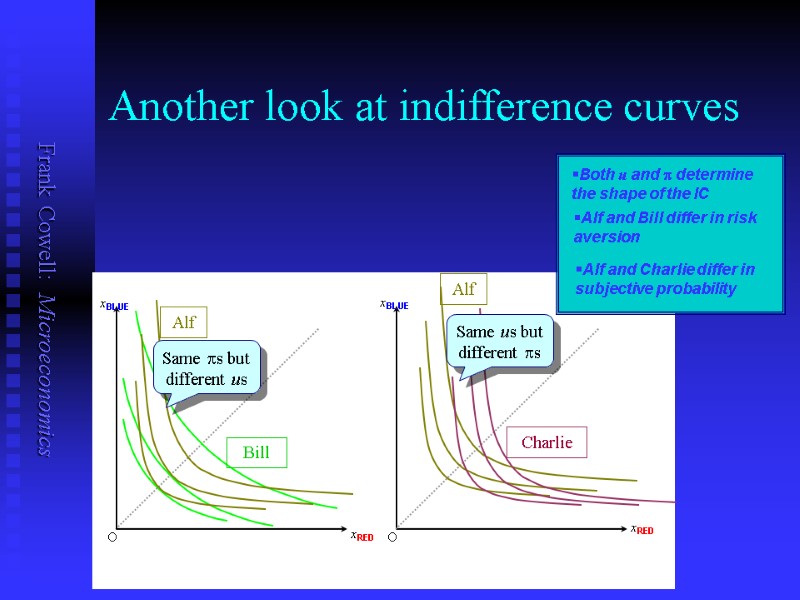

Another look at indifference curves Both u and p determine the shape of the IC Alf and Bill differ in risk aversion Alf and Charlie differ in subjective probability Same us but different ps Same ps but different us

Another look at indifference curves Both u and p determine the shape of the IC Alf and Bill differ in risk aversion Alf and Charlie differ in subjective probability Same us but different ps Same ps but different us

Overview... Probability Risk comparisons Special Cases Lotteries Risk CARA and CRRA

Overview... Probability Risk comparisons Special Cases Lotteries Risk CARA and CRRA

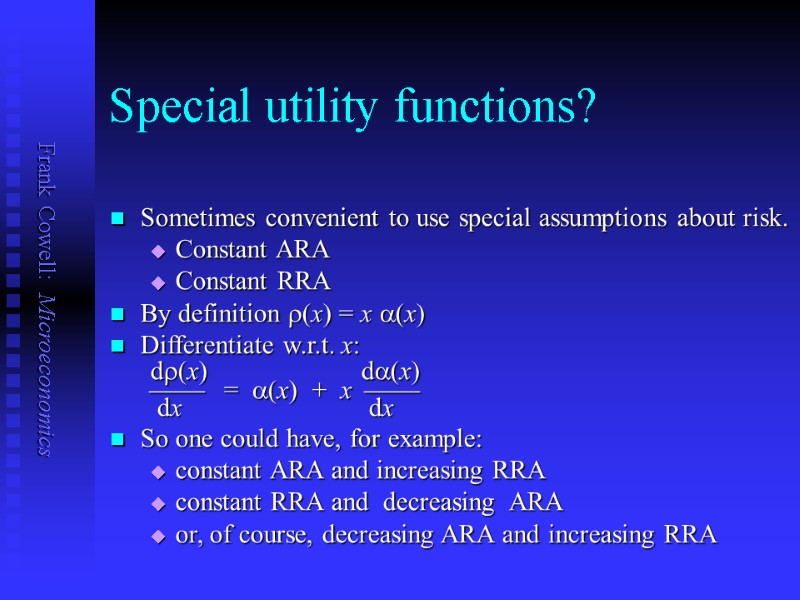

Special utility functions? Sometimes convenient to use special assumptions about risk. Constant ARA Constant RRA By definition r(x) = x a(x) Differentiate w.r.t. x: dr(x) da(x) = a(x) + x dx dx So one could have, for example: constant ARA and increasing RRA constant RRA and decreasing ARA or, of course, decreasing ARA and increasing RRA

Special utility functions? Sometimes convenient to use special assumptions about risk. Constant ARA Constant RRA By definition r(x) = x a(x) Differentiate w.r.t. x: dr(x) da(x) = a(x) + x dx dx So one could have, for example: constant ARA and increasing RRA constant RRA and decreasing ARA or, of course, decreasing ARA and increasing RRA

Special case 1: CARA We take a special case of risk preferences Assume that a(x) = a for all x Felicity function must take the form 1 u(x) := eax a Constant Absolute Risk Aversion This induces a distinctive pattern of indifference curves...

Special case 1: CARA We take a special case of risk preferences Assume that a(x) = a for all x Felicity function must take the form 1 u(x) := eax a Constant Absolute Risk Aversion This induces a distinctive pattern of indifference curves...

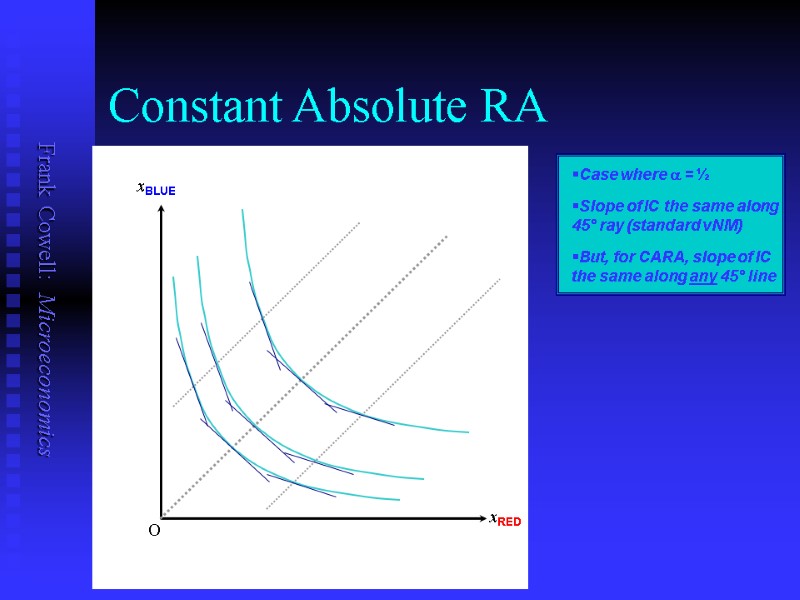

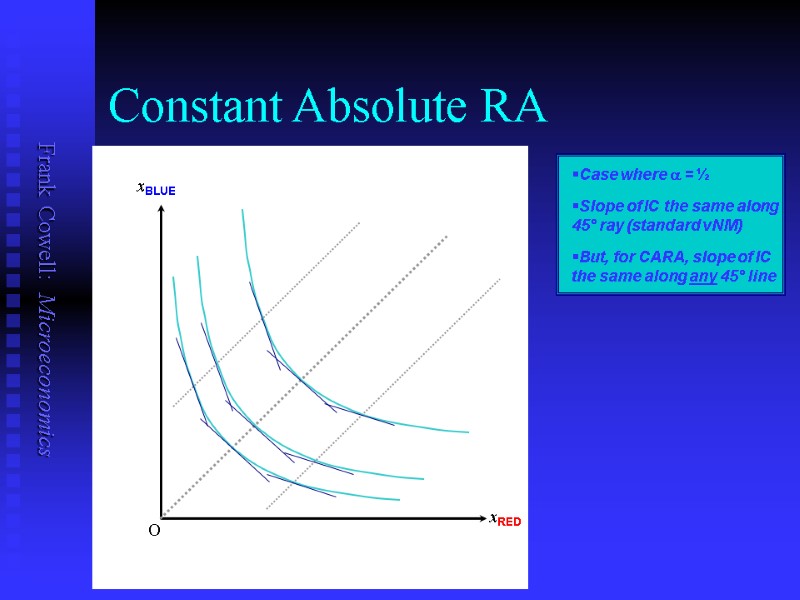

Constant Absolute RA Case where a = ½ Slope of IC the same along 45° ray (standard vNM) But, for CARA, slope of IC the same along any 45° line xBLUE xRED O

Constant Absolute RA Case where a = ½ Slope of IC the same along 45° ray (standard vNM) But, for CARA, slope of IC the same along any 45° line xBLUE xRED O

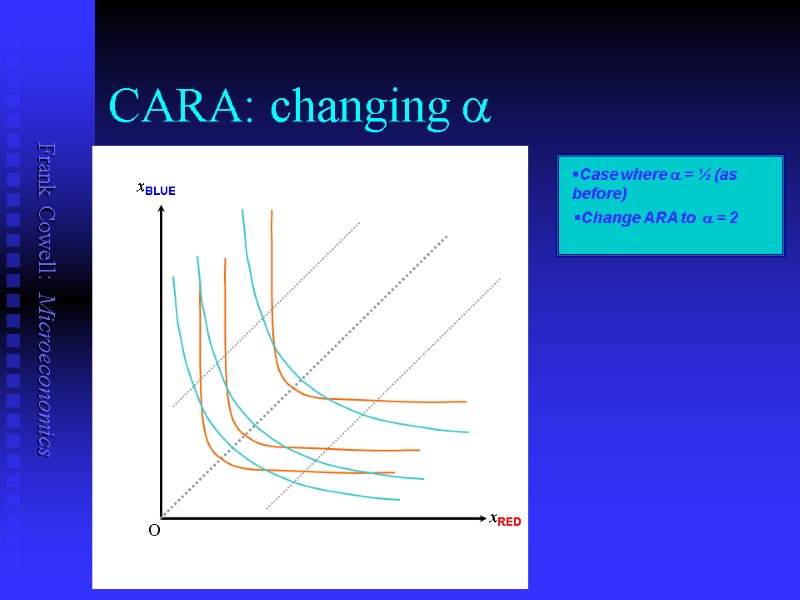

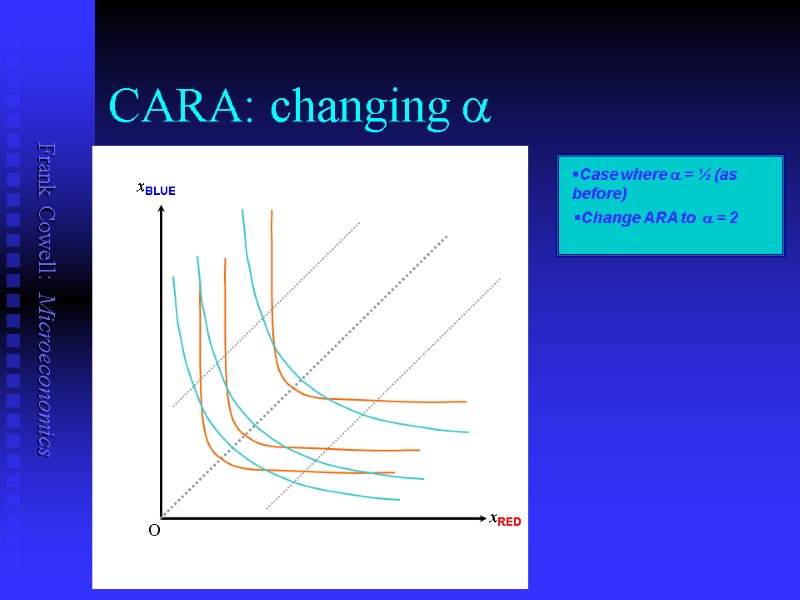

CARA: changing a Case where a = ½ (as before) Change ARA to a = 2 xBLUE xRED O

CARA: changing a Case where a = ½ (as before) Change ARA to a = 2 xBLUE xRED O

Special case 2: CRRA Another important special case of risk preferences. Assume that r(x) = r for all x. Felicity function must take the form 1 u(x) := x1 r 1 r Constant Relative Risk Aversion Again induces a distinctive pattern of indifference curves...

Special case 2: CRRA Another important special case of risk preferences. Assume that r(x) = r for all x. Felicity function must take the form 1 u(x) := x1 r 1 r Constant Relative Risk Aversion Again induces a distinctive pattern of indifference curves...

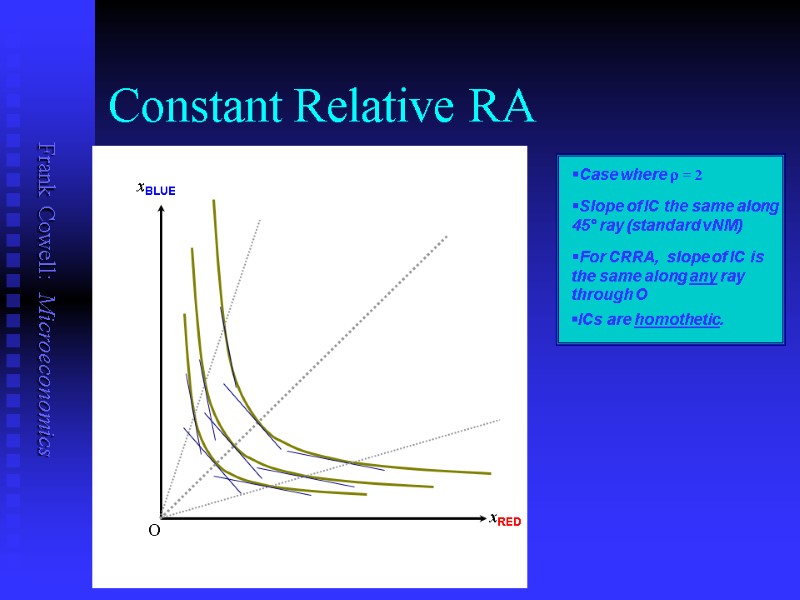

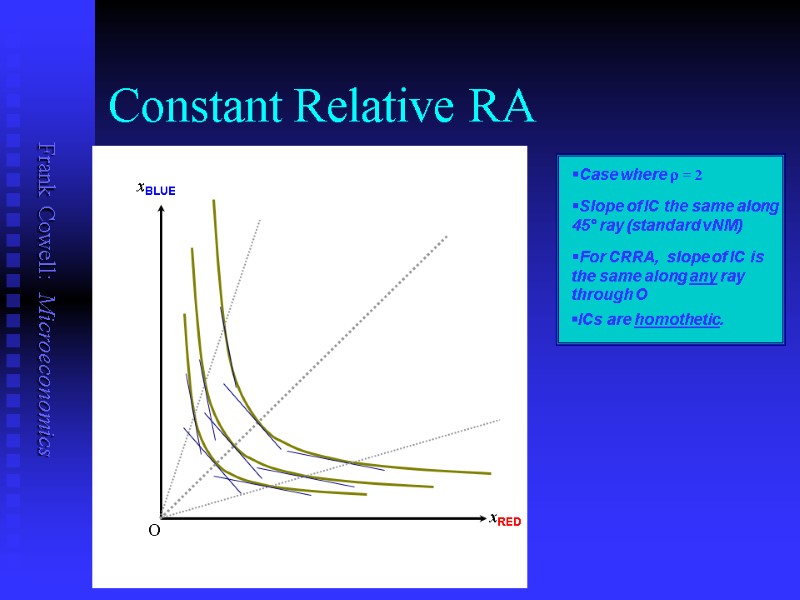

Constant Relative RA Case where r = 2 Slope of IC the same along 45° ray (standard vNM) For CRRA, slope of IC is the same along any ray through O ICs are homothetic. xBLUE xRED O

Constant Relative RA Case where r = 2 Slope of IC the same along 45° ray (standard vNM) For CRRA, slope of IC is the same along any ray through O ICs are homothetic. xBLUE xRED O

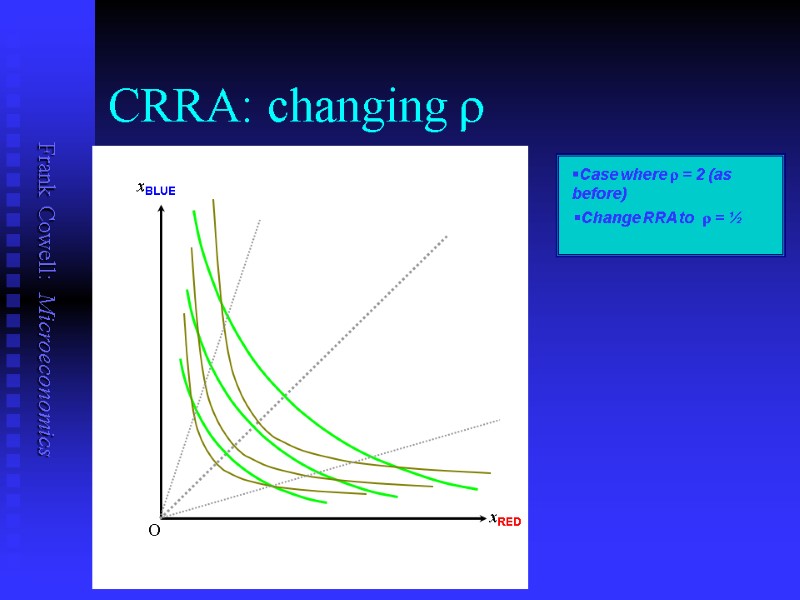

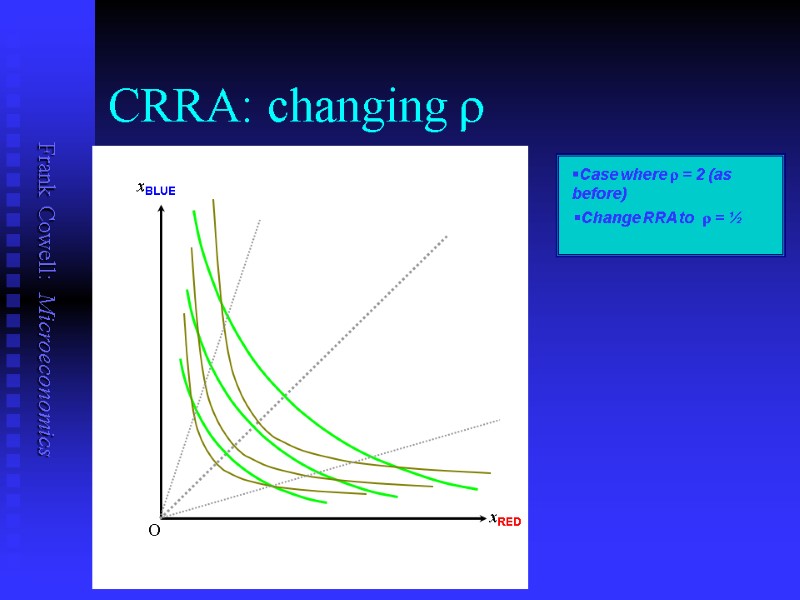

CRRA: changing r xBLUE xRED O Case where r = 2 (as before) Change RRA to r = ½

CRRA: changing r xBLUE xRED O Case where r = 2 (as before) Change RRA to r = ½

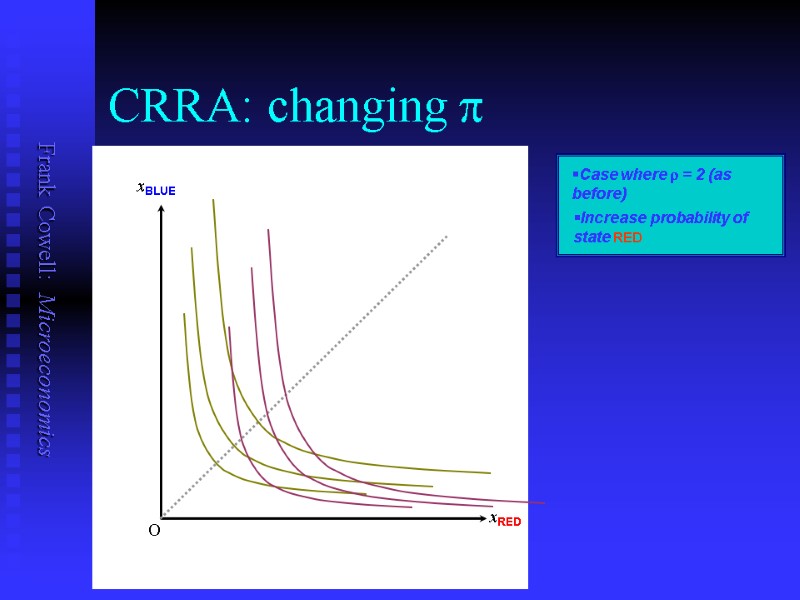

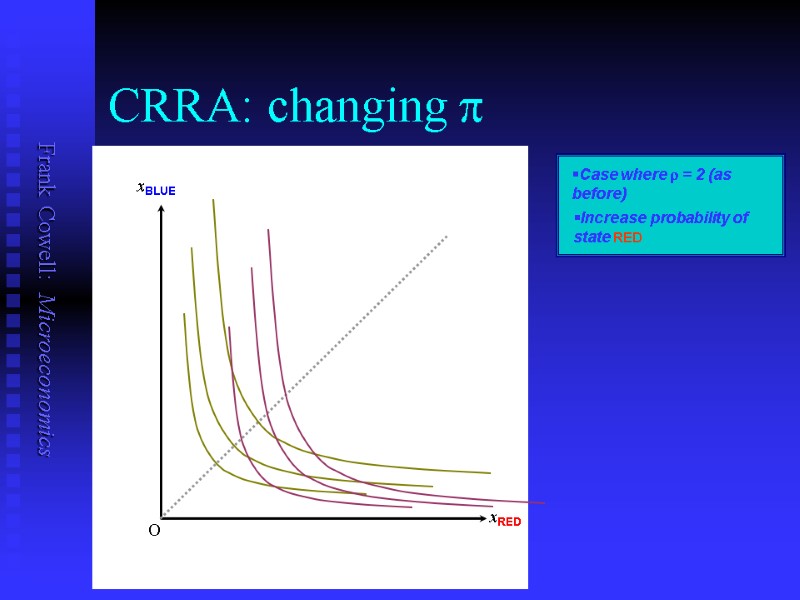

CRRA: changing p xBLUE xRED O Case where r = 2 (as before) Increase probability of state RED

CRRA: changing p xBLUE xRED O Case where r = 2 (as before) Increase probability of state RED

Overview... Probability Risk comparisons Special Cases Lotteries Risk Probability distributions as objects of choice

Overview... Probability Risk comparisons Special Cases Lotteries Risk Probability distributions as objects of choice

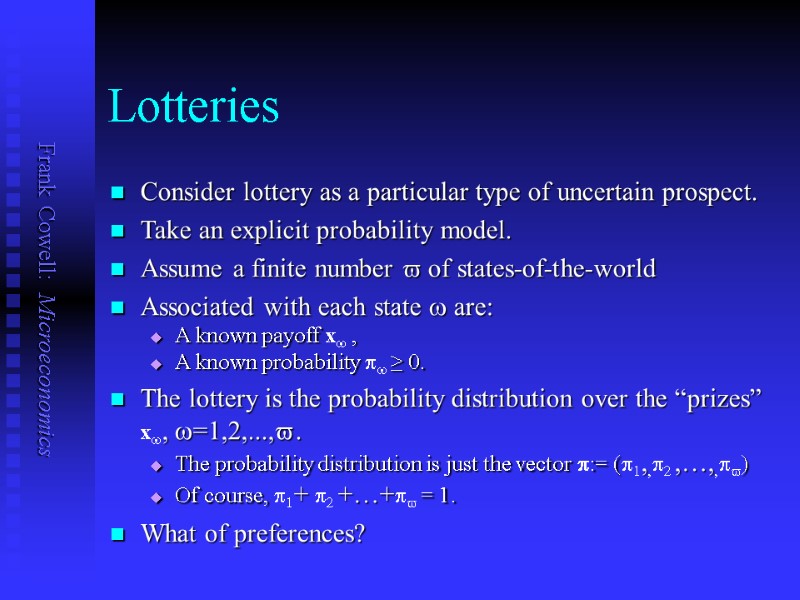

Lotteries Consider lottery as a particular type of uncertain prospect. Take an explicit probability model. Assume a finite number of states-of-the-world Associated with each state w are: A known payoff xw , A known probability pw ≥ 0. The lottery is the probability distribution over the “prizes” xw, w=1,2,...,. The probability distribution is just the vector p:= (p1,,p2 ,…,,p) Of course, p1+ p2 +…+p = 1. What of preferences?

Lotteries Consider lottery as a particular type of uncertain prospect. Take an explicit probability model. Assume a finite number of states-of-the-world Associated with each state w are: A known payoff xw , A known probability pw ≥ 0. The lottery is the probability distribution over the “prizes” xw, w=1,2,...,. The probability distribution is just the vector p:= (p1,,p2 ,…,,p) Of course, p1+ p2 +…+p = 1. What of preferences?

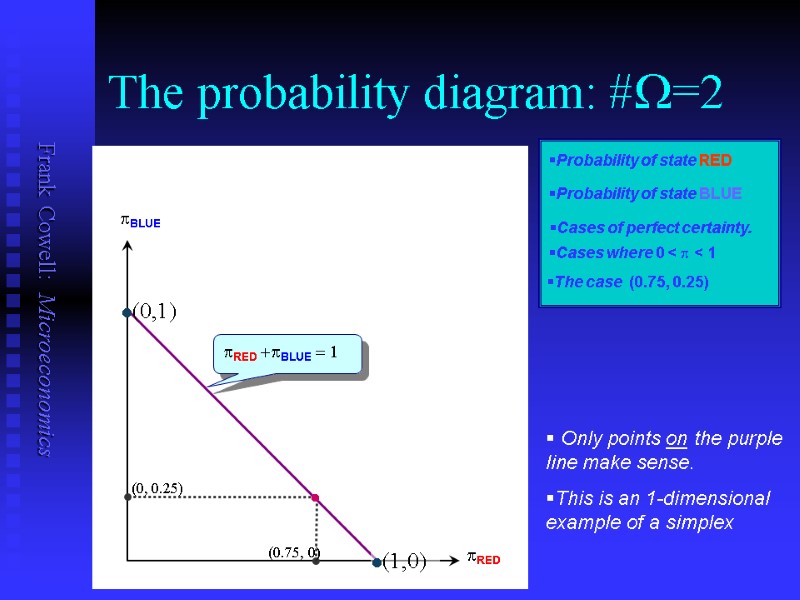

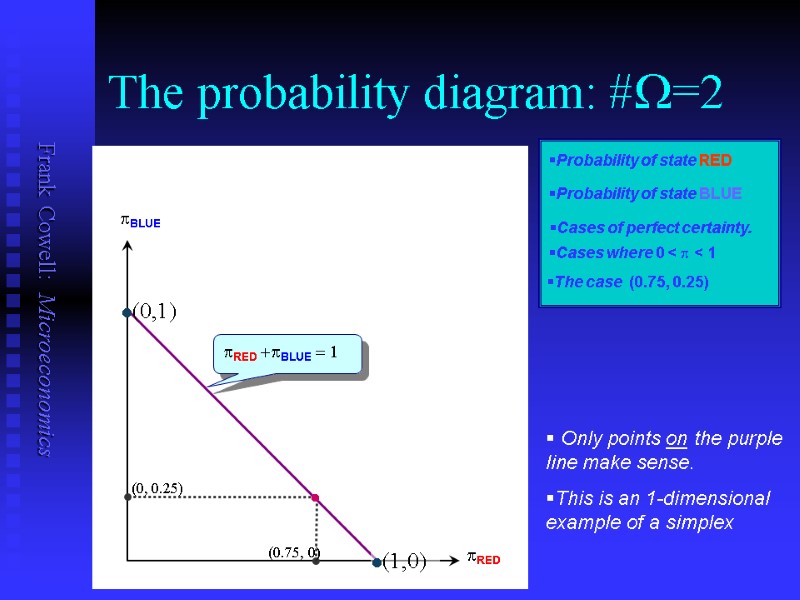

The probability diagram: #W=2 pBLUE pRED (1,0) (0,1) Cases where 0 < p < 1 Probability of state BLUE Cases of perfect certainty. Probability of state RED pRED +pBLUE = 1 The case (0.75, 0.25) • (0, 0.25) (0.75, 0) Only points on the purple line make sense. This is an 1-dimensional example of a simplex

The probability diagram: #W=2 pBLUE pRED (1,0) (0,1) Cases where 0 < p < 1 Probability of state BLUE Cases of perfect certainty. Probability of state RED pRED +pBLUE = 1 The case (0.75, 0.25) • (0, 0.25) (0.75, 0) Only points on the purple line make sense. This is an 1-dimensional example of a simplex

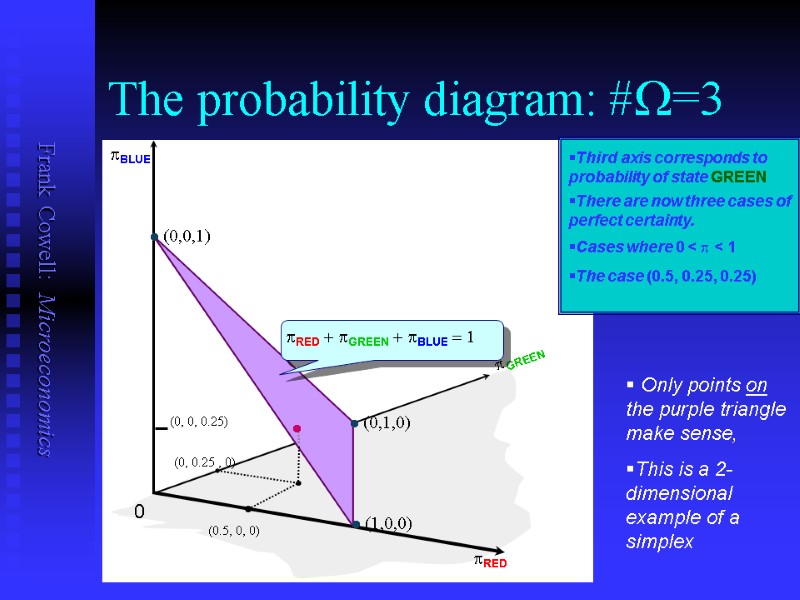

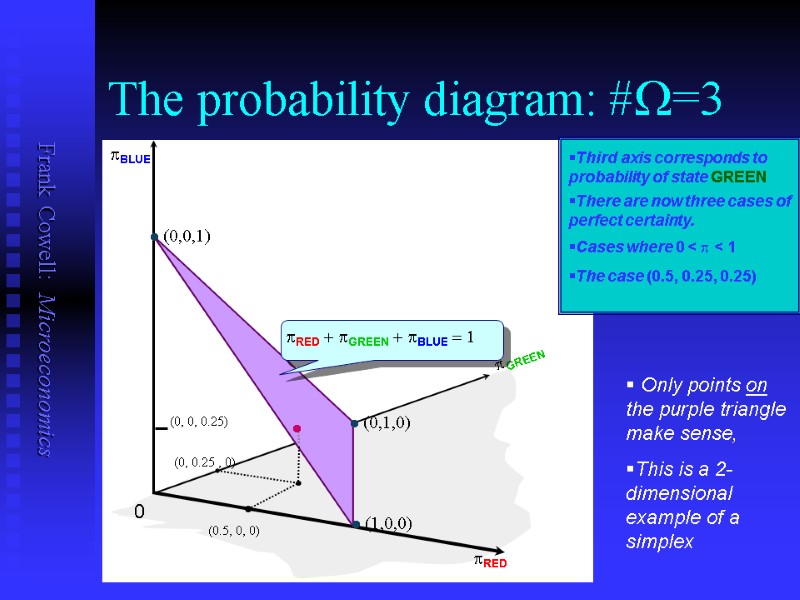

The probability diagram: #W=3 0 pBLUE pRED pGREEN Third axis corresponds to probability of state GREEN (1,0,0) (0,0,1) (0,1,0) There are now three cases of perfect certainty. Cases where 0 < p < 1 pRED + pGREEN + pBLUE = 1 • (0, 0, 0.25) (0.5, 0, 0) (0, 0.25 , 0) The case (0.5, 0.25, 0.25) Only points on the purple triangle make sense, This is a 2-dimensional example of a simplex

The probability diagram: #W=3 0 pBLUE pRED pGREEN Third axis corresponds to probability of state GREEN (1,0,0) (0,0,1) (0,1,0) There are now three cases of perfect certainty. Cases where 0 < p < 1 pRED + pGREEN + pBLUE = 1 • (0, 0, 0.25) (0.5, 0, 0) (0, 0.25 , 0) The case (0.5, 0.25, 0.25) Only points on the purple triangle make sense, This is a 2-dimensional example of a simplex

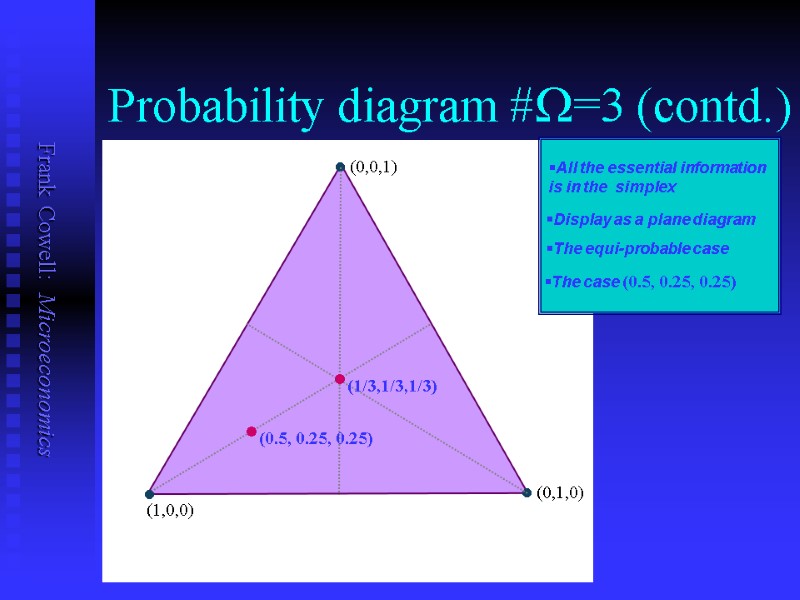

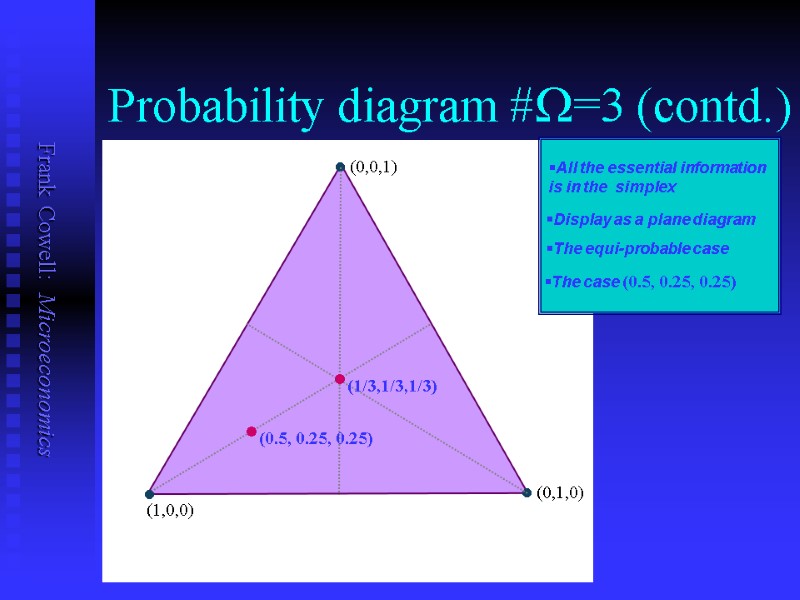

Probability diagram #W=3 (contd.) (1,0,0) (0,0,1) (0,1,0) . •(0.5, 0.25, 0.25) All the essential information is in the simplex Display as a plane diagram The equi-probable case The case (0.5, 0.25, 0.25) •(1/3,1/3,1/3)

Probability diagram #W=3 (contd.) (1,0,0) (0,0,1) (0,1,0) . •(0.5, 0.25, 0.25) All the essential information is in the simplex Display as a plane diagram The equi-probable case The case (0.5, 0.25, 0.25) •(1/3,1/3,1/3)

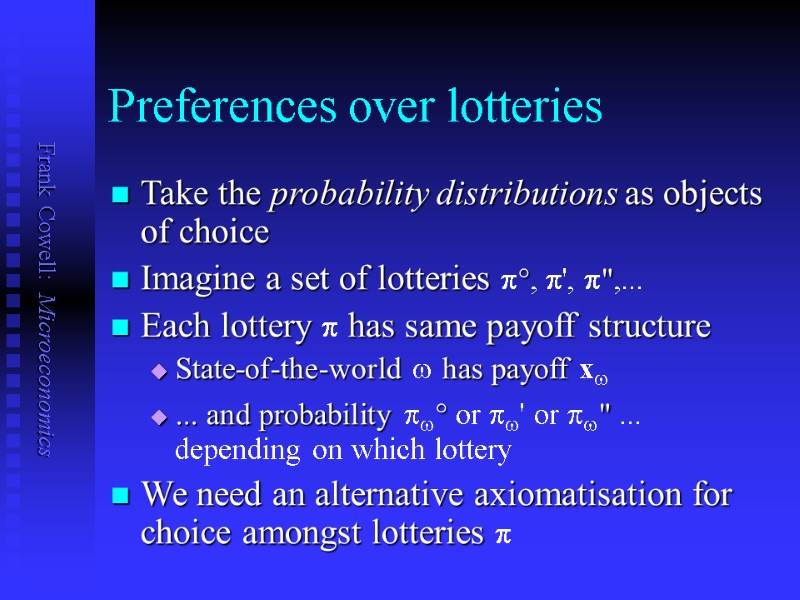

Preferences over lotteries Take the probability distributions as objects of choice Imagine a set of lotteries p°, p', p",... Each lottery p has same payoff structure State-of-the-world w has payoff xw ... and probability pw° or pw' or pw" ... depending on which lottery We need an alternative axiomatisation for choice amongst lotteries p

Preferences over lotteries Take the probability distributions as objects of choice Imagine a set of lotteries p°, p', p",... Each lottery p has same payoff structure State-of-the-world w has payoff xw ... and probability pw° or pw' or pw" ... depending on which lottery We need an alternative axiomatisation for choice amongst lotteries p

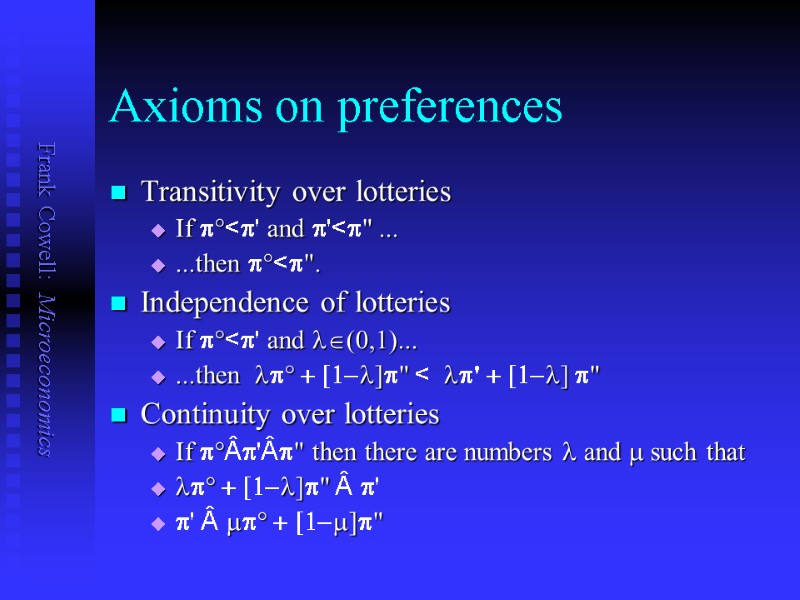

Axioms on preferences Transitivity over lotteries If p°

Axioms on preferences Transitivity over lotteries If p°

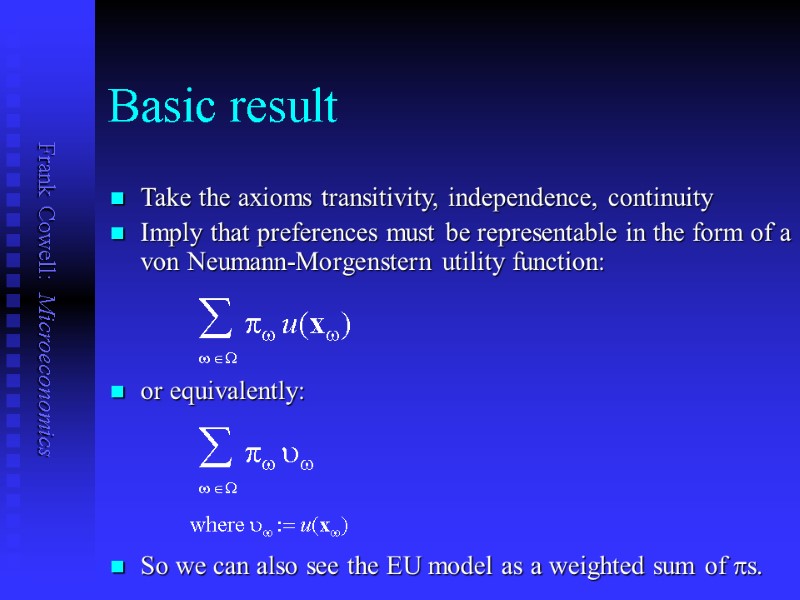

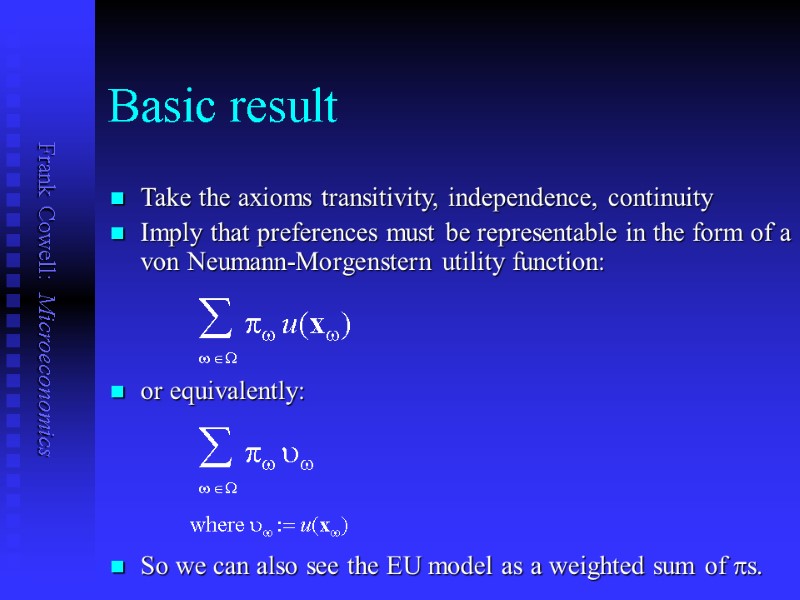

Basic result Take the axioms transitivity, independence, continuity Imply that preferences must be representable in the form of a von Neumann-Morgenstern utility function: å pw u(xw) w ÎW or equivalently: å pw uw w ÎW where uw := u(xw) So we can also see the EU model as a weighted sum of ps.

Basic result Take the axioms transitivity, independence, continuity Imply that preferences must be representable in the form of a von Neumann-Morgenstern utility function: å pw u(xw) w ÎW or equivalently: å pw uw w ÎW where uw := u(xw) So we can also see the EU model as a weighted sum of ps.

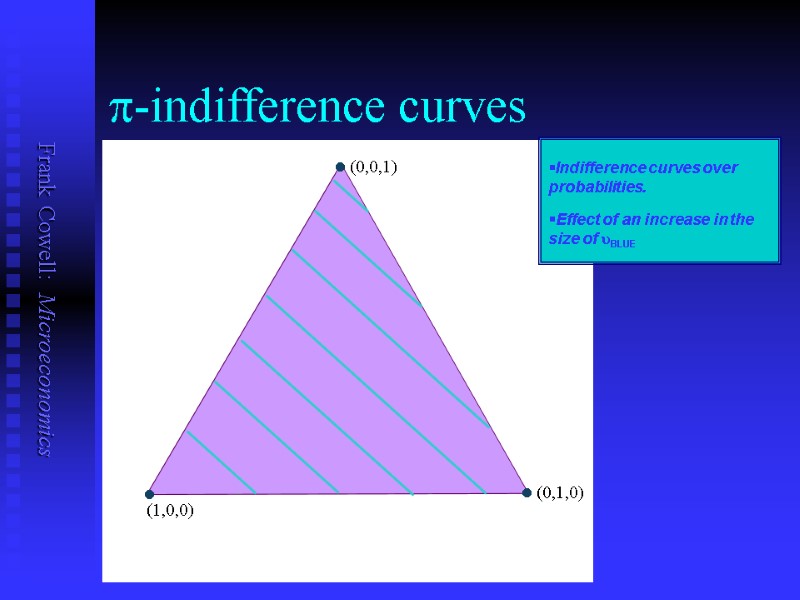

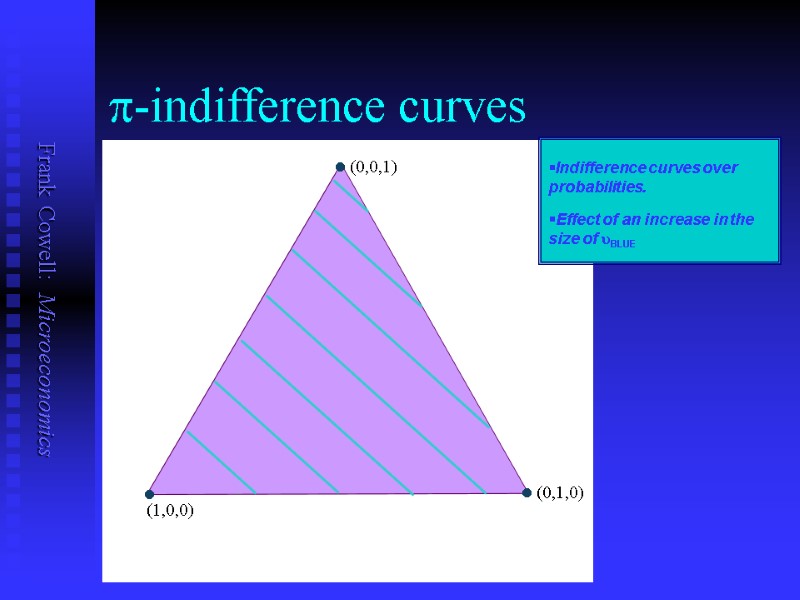

p-indifference curves Indifference curves over probabilities. Effect of an increase in the size of uBLUE (1,0,0) (0,0,1) (0,1,0) .

p-indifference curves Indifference curves over probabilities. Effect of an increase in the size of uBLUE (1,0,0) (0,0,1) (0,1,0) .

What next? Simple trading model under uncertainty Consumer choice under uncertainty Models of asset holding Models of insurance This is in the presentation Risk Taking

What next? Simple trading model under uncertainty Consumer choice under uncertainty Models of asset holding Models of insurance This is in the presentation Risk Taking