90d63fca2029a6e6d1d4bf47de4ee642.ppt

- Количество слайдов: 21

Risk Management & Real Options IX. Flexibility in Contracts n Stefan Scholtes Judge Institute of Management University of Cambridge n MPhil Course 2004 -05 n n 29 August 2004 Understanding the value of flexibility (v 1) Page

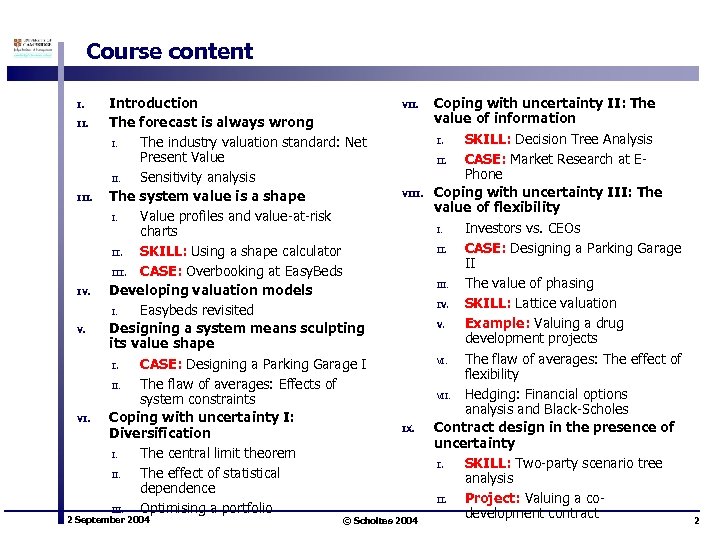

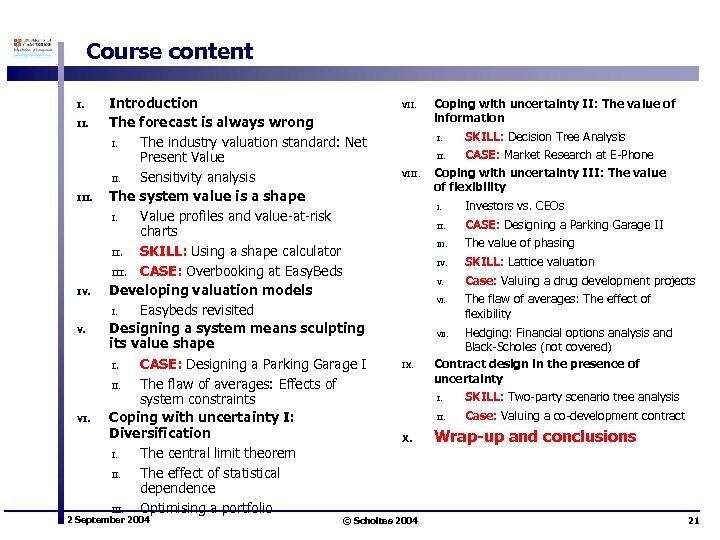

Course content I. II. IV. VI. Introduction The forecast is always wrong I. The industry valuation standard: Net Present Value II. Sensitivity analysis The system value is a shape I. Value profiles and value-at-risk charts II. SKILL: Using a shape calculator III. CASE: Overbooking at Easy. Beds Developing valuation models I. Easybeds revisited Designing a system means sculpting its value shape I. CASE: Designing a Parking Garage I II. The flaw of averages: Effects of system constraints Coping with uncertainty I: Diversification I. The central limit theorem II. The effect of statistical dependence III. Optimising a portfolio 2 September 2004 VIII. IX. © Scholtes 2004 Coping with uncertainty II: The value of information I. SKILL: Decision Tree Analysis II. CASE: Market Research at EPhone Coping with uncertainty III: The value of flexibility I. Investors vs. CEOs II. CASE: Designing a Parking Garage II III. The value of phasing IV. SKILL: Lattice valuation V. Example: Valuing a drug development projects VI. The flaw of averages: The effect of flexibility VII. Hedging: Financial options analysis and Black-Scholes Contract design in the presence of uncertainty I. SKILL: Two-party scenario tree analysis II. Project: Valuing a codevelopment contract 2

Co-development contracts: Risk Sharing n Contracts are the building blocks of business n Example: Co-development contracts between biotech & pharma • • Share responsibilities • Share required capital • n Exploit core competencies, IP Share risk Further example: Production sharing contracts between BP and national oil company 2 September 2004 © Scholtes 2004 3

Co-development contracts: Risk Sharing n Risk in a phased project: • • Long lead time until revenues occur • n Technical risk of phase failures Market risk after launch Typical contract terms: • Investment split Share capital commitment • Milestone payments upon successful phase completions Reward for taking technical risk • Royalty payments (e. g. % of sales revenue) n Share market risk What is the effect of payment terms on contract value? 2 September 2004 © Scholtes 2004 4

Co-development contracts: Control n Two parties take downstream decisions to cut losses and amplify gains • n Contract specifies feasible actions through “control structure” Loosing control increases exposure to risk and lowers the contract value • Cure: Understand the interest of the partner and incentivise through contract terms to take actions in your interest n Maintaining or gaining control increases value n What is the effect of the control structure on contract value? 2 September 2004 © Scholtes 2004 5

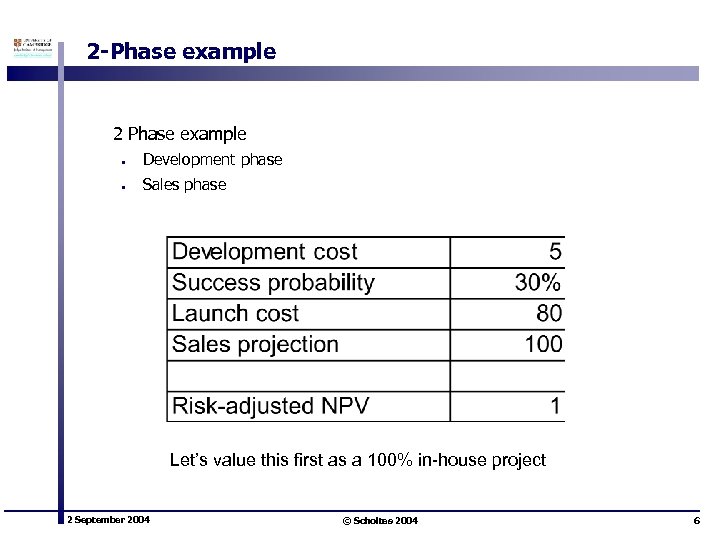

2 -Phase example 2 Phase example • Development phase • Sales phase Let’s value this first as a 100% in-house project 2 September 2004 © Scholtes 2004 6

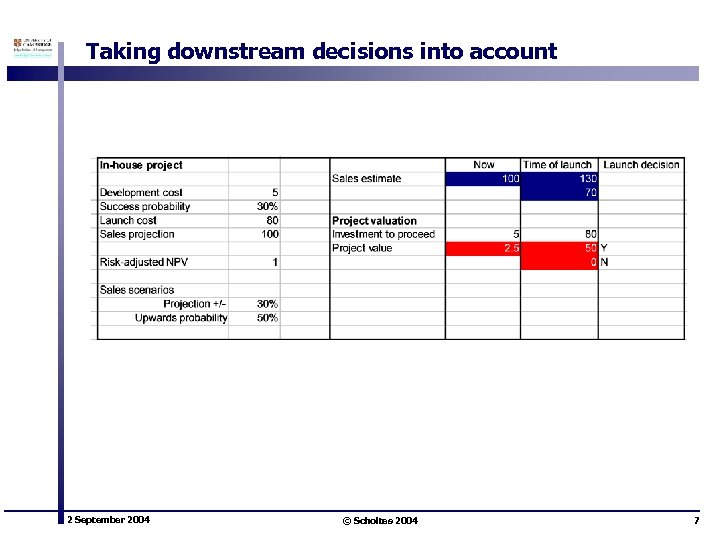

Taking downstream decisions into account 2 September 2004 © Scholtes 2004 7

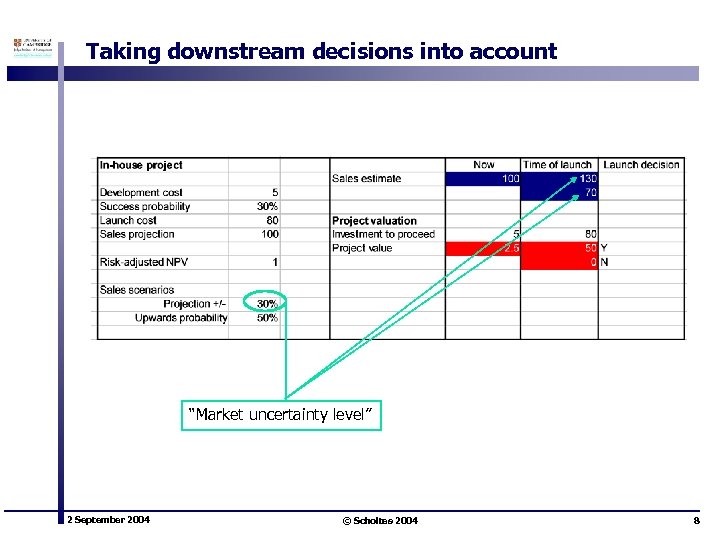

Taking downstream decisions into account “Market uncertainty level” 2 September 2004 © Scholtes 2004 8

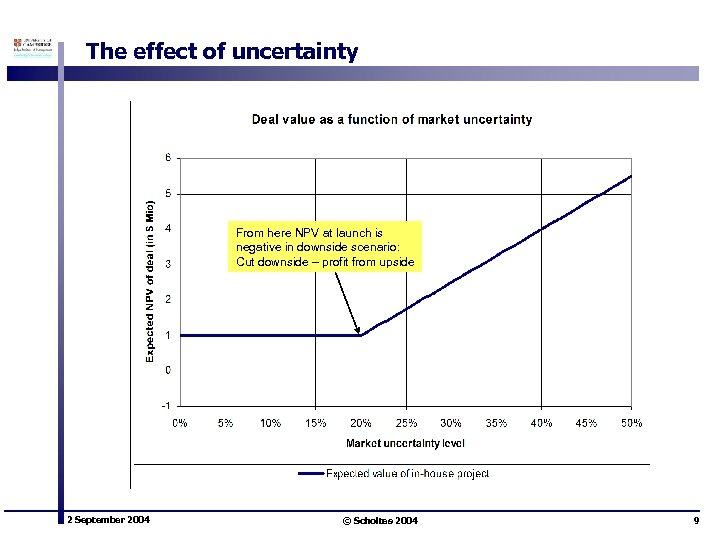

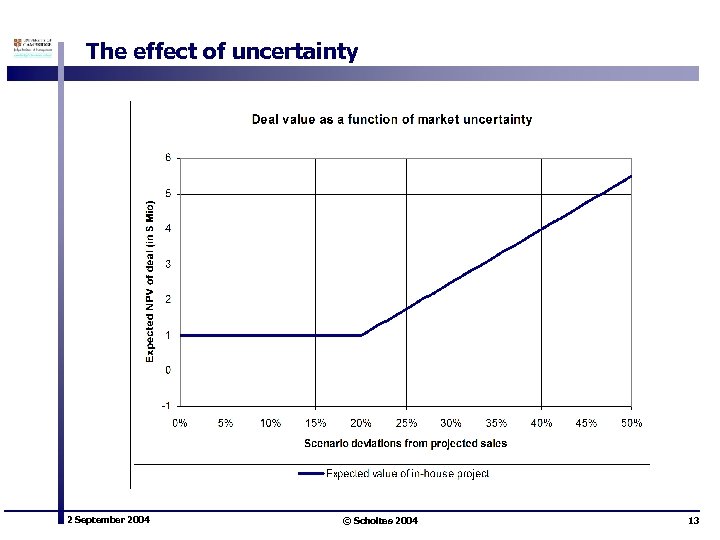

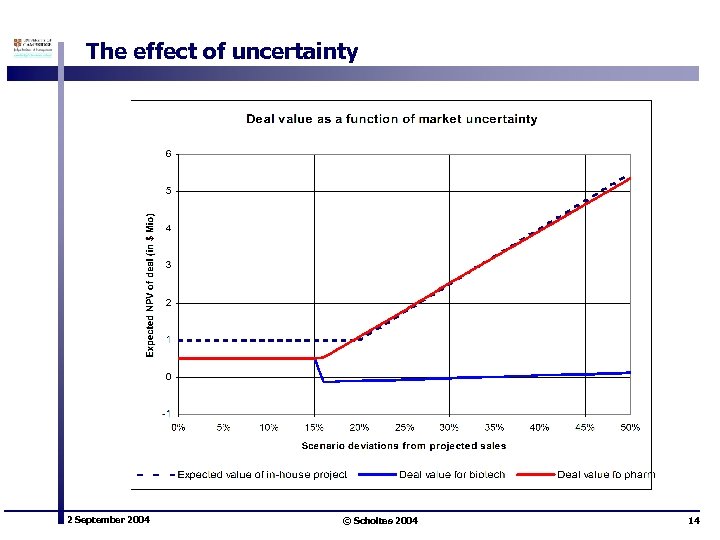

The effect of uncertainty From here NPV at launch is negative in downside scenario: Cut downside – profit from upside 2 September 2004 © Scholtes 2004 9

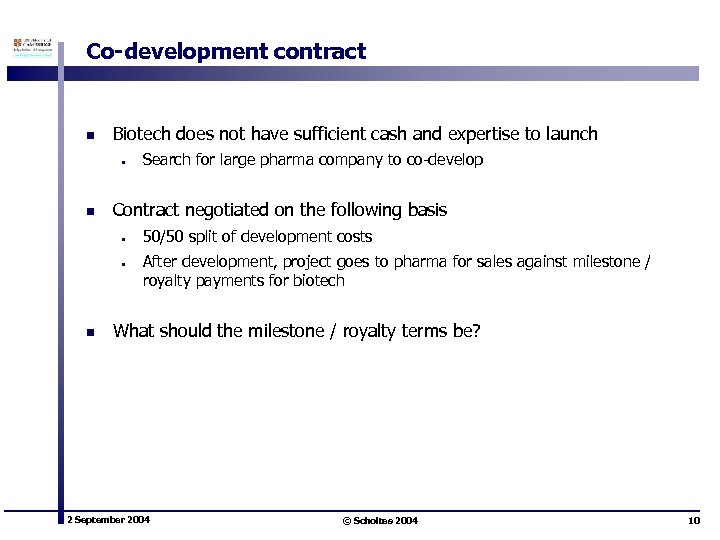

Co-development contract n Biotech does not have sufficient cash and expertise to launch • n Contract negotiated on the following basis • • n Search for large pharma company to co-develop 50/50 split of development costs After development, project goes to pharma for sales against milestone / royalty payments for biotech What should the milestone / royalty terms be? 2 September 2004 © Scholtes 2004 10

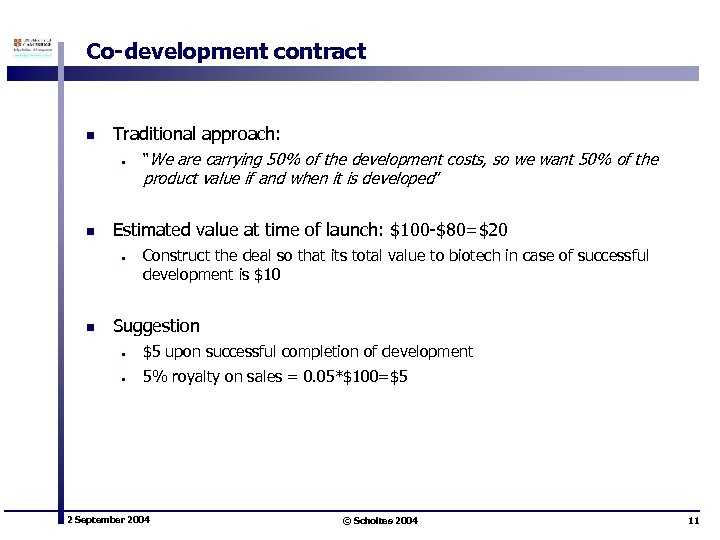

Co-development contract n Traditional approach: • n Estimated value at time of launch: $100 -$80=$20 • n “We are carrying 50% of the development costs, so we want 50% of the product value if and when it is developed” Construct the deal so that its total value to biotech in case of successful development is $10 Suggestion • $5 upon successful completion of development • 5% royalty on sales = 0. 05*$100=$5 2 September 2004 © Scholtes 2004 11

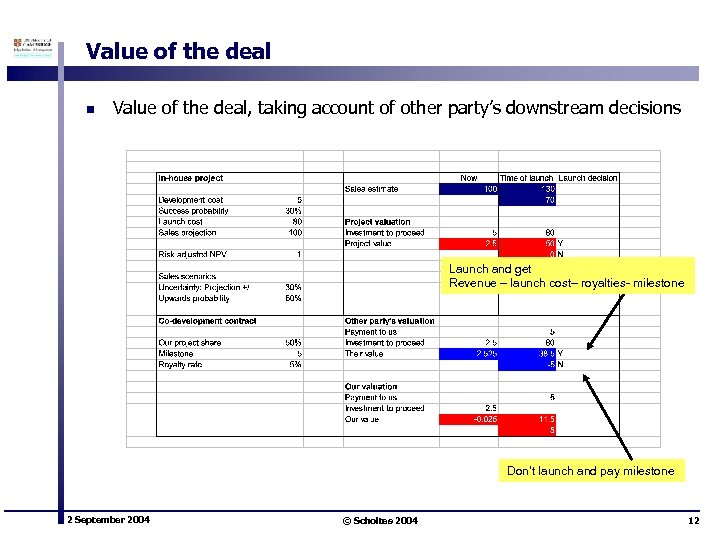

Value of the deal n Value of the deal, taking account of other party’s downstream decisions Launch and get Revenue – launch cost– royalties- milestone Don’t launch and pay milestone 2 September 2004 © Scholtes 2004 12

The effect of uncertainty 2 September 2004 © Scholtes 2004 13

The effect of uncertainty 2 September 2004 © Scholtes 2004 14

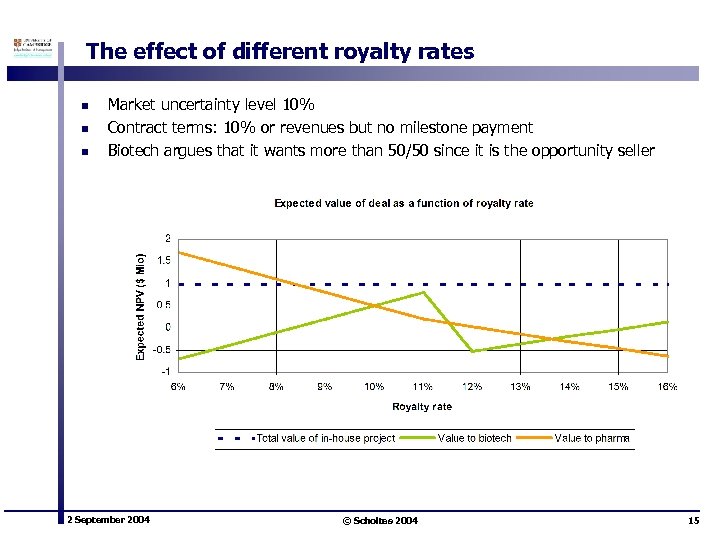

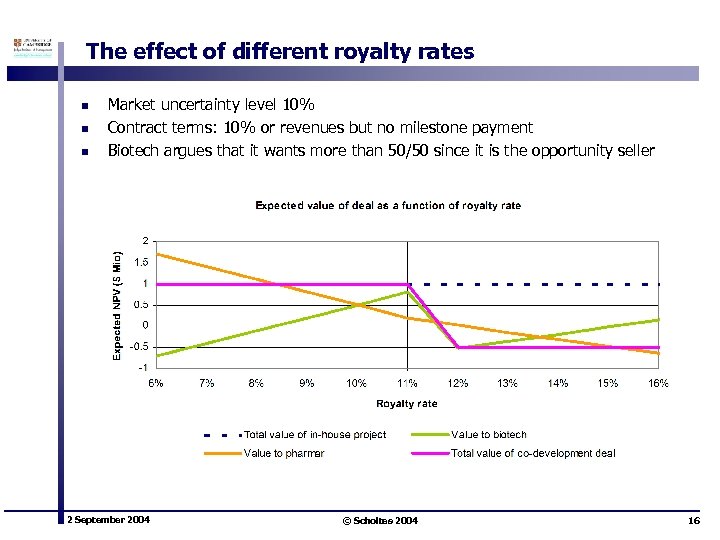

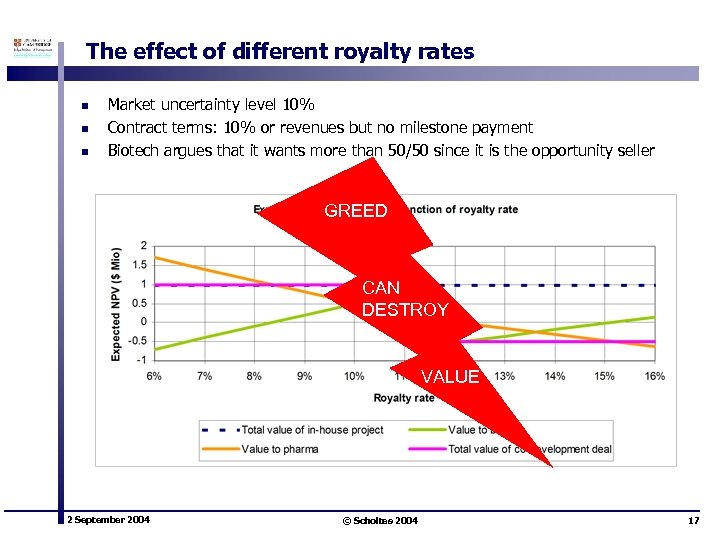

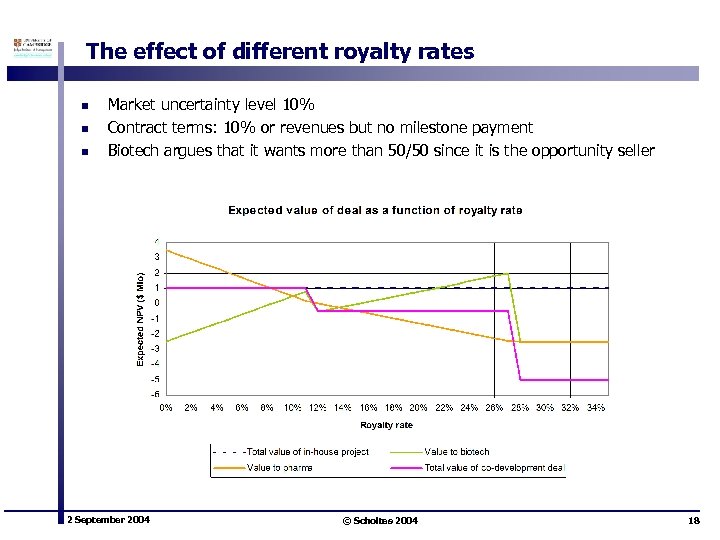

The effect of different royalty rates n n n Market uncertainty level 10% Contract terms: 10% or revenues but no milestone payment Biotech argues that it wants more than 50/50 since it is the opportunity seller 2 September 2004 © Scholtes 2004 15

The effect of different royalty rates n n n Market uncertainty level 10% Contract terms: 10% or revenues but no milestone payment Biotech argues that it wants more than 50/50 since it is the opportunity seller 2 September 2004 © Scholtes 2004 16

The effect of different royalty rates n n n Market uncertainty level 10% Contract terms: 10% or revenues but no milestone payment Biotech argues that it wants more than 50/50 since it is the opportunity seller GREED CAN DESTROY VALUE 2 September 2004 © Scholtes 2004 17

The effect of different royalty rates n n n Market uncertainty level 10% Contract terms: 10% or revenues but no milestone payment Biotech argues that it wants more than 50/50 since it is the opportunity seller 2 September 2004 © Scholtes 2004 18

Summary n Gaining or maintaining control has significant value • n Launch decision Milestones and royalties have different associated risks • • Milestone payments are sunk at time of launch and have no impact on launch decision Increasing royalties gives disincentive to launch and can destroy total value of co-development deal 2 September 2004 © Scholtes 2004 19

Key messages n Traditional valuation techniques have severe limitations when applied to the valuation of multi-stage projects • • n Need to take downstream flexibility into account Have seen Monte Carlo simulation and scenario tree approaches Effect is magnified in contract valuation • Need to take account of your own as well as your contract partner’s flexibility • Need to understand incentives provided by contract terms • Have seen how scenario tree approach can be used 2 September 2004 © Scholtes 2004 20

Course content I. II. IV. VI. Introduction The forecast is always wrong I. The industry valuation standard: Net Present Value II. Sensitivity analysis The system value is a shape I. Value profiles and value-at-risk charts II. SKILL: Using a shape calculator III. CASE: Overbooking at Easy. Beds Developing valuation models I. Easybeds revisited Designing a system means sculpting its value shape I. CASE: Designing a Parking Garage I II. The flaw of averages: Effects of system constraints Coping with uncertainty I: Diversification I. The central limit theorem II. The effect of statistical dependence III. Optimising a portfolio 2 September 2004 VII. Coping with uncertainty II: The value of information I. SKILL: Decision Tree Analysis CASE: Market Research at E-Phone Coping with uncertainty III: The value of flexibility II. VIII. Investors vs. CEOs II. CASE: Designing a Parking Garage II III. The value of phasing IV. SKILL: Lattice valuation V. Case: Valuing a drug development projects VI. The flaw of averages: The effect of flexibility Hedging: Financial options analysis and Black-Scholes (not covered) Contract design in the presence of uncertainty VII. IX. I. II. X. © Scholtes 2004 SKILL: Two-party scenario tree analysis Case: Valuing a co-development contract Wrap-up and conclusions 21

90d63fca2029a6e6d1d4bf47de4ee642.ppt