3129218fe7f09b9ec981a0b1017d5c56.ppt

- Количество слайдов: 12

Risk Management & Real Options I. Introduction n Stefan Scholtes Judge Institute of Management University of Cambridge n MPhil Course 2004 -05 n n n 29 August 2004 Course website with accompanying material http: //www. eng. cam. ac. uk/~ss 248/real_options Understanding the value of flexibility (v 1) Page

Risk Management & Real Options I. Introduction n Stefan Scholtes Judge Institute of Management University of Cambridge n MPhil Course 2004 -05 n n n 29 August 2004 Course website with accompanying material http: //www. eng. cam. ac. uk/~ss 248/real_options Understanding the value of flexibility (v 1) Page

Let’s play a game… n n n Based on US game show “Let’s Make a Deal” You, the contestant, choose one of three closed doors to win the prize behind the door Behind one of the doors is a sports car, behind the other two doors are goats Before he opens your door, Monty Hall, the host, who knows where the car is, opens one of the remaining doors that has a goat behind it The goat jumps on the stage and Monty asks if you want to switch from the chosen door to the remaining closed door 2 September 2004 © Scholtes 2004 2

Let’s play a game… n n n Based on US game show “Let’s Make a Deal” You, the contestant, choose one of three closed doors to win the prize behind the door Behind one of the doors is a sports car, behind the other two doors are goats Before he opens your door, Monty Hall, the host, who knows where the car is, opens one of the remaining doors that has a goat behind it The goat jumps on the stage and Monty asks if you want to switch from the chosen door to the remaining closed door 2 September 2004 © Scholtes 2004 2

Aims and objectives of the course General issue: n How can we use (simple) models to help us understand uncertainty and the consequences of our decisions in an uncertain world? General objectives: n This is a skills-based course. You will learn to use a computer to help you understand improve system value • n Computational tools based on Excel plus a few add-ins But it is also intellectually stretching. I hope to change the way you think about uncertainty in your everyday life 2 September 2004 © Scholtes 2004 3

Aims and objectives of the course General issue: n How can we use (simple) models to help us understand uncertainty and the consequences of our decisions in an uncertain world? General objectives: n This is a skills-based course. You will learn to use a computer to help you understand improve system value • n Computational tools based on Excel plus a few add-ins But it is also intellectually stretching. I hope to change the way you think about uncertainty in your everyday life 2 September 2004 © Scholtes 2004 3

Examples of systems we have in mind n Harbour expansion in Sidney n Designing communications satellites at Motorola n Terminal 5, 3 rd run-way at Heathrow n Satellite-based toll collection system in Germany n Sonic cruiser vs 7 E 7 at Boeing n Fleet planning at BA n Bidding for G 3 telecom licenses n Production sharing contract between BP and Petronas, Malaysia n Drug co-development contract between Cambridge Antibody Technology and Astra Zeneca 2 September 2004 © Scholtes 2004 4

Examples of systems we have in mind n Harbour expansion in Sidney n Designing communications satellites at Motorola n Terminal 5, 3 rd run-way at Heathrow n Satellite-based toll collection system in Germany n Sonic cruiser vs 7 E 7 at Boeing n Fleet planning at BA n Bidding for G 3 telecom licenses n Production sharing contract between BP and Petronas, Malaysia n Drug co-development contract between Cambridge Antibody Technology and Astra Zeneca 2 September 2004 © Scholtes 2004 4

Key challenges n Understanding the system value n Improving the system design n n This course focuses on the valuation and design optimisation of systems that operate in an unpredictable dynamic environment We will mainly focus on economic valuations ($$) as system values but the general framework applies to non-monetary value measures, too 2 September 2004 © Scholtes 2004 5

Key challenges n Understanding the system value n Improving the system design n n This course focuses on the valuation and design optimisation of systems that operate in an unpredictable dynamic environment We will mainly focus on economic valuations ($$) as system values but the general framework applies to non-monetary value measures, too 2 September 2004 © Scholtes 2004 5

What are we concerned with? Starting point: System value is more than a number n We are constantly forced to make decisions with uncertain consequences • n Decision = Allocation of resources We are not good at understanding or communicating effects of uncertainty • We feel uncomfortable with uncertainty and, as a consequence, tend to blend it out in our system valuations n We work with forecasts of uncertain variables (demand, prices, costs, regulation, political scenarios, …) to generate a single output – the “value” BUT THE FORECAST IS ALWAYS WRONG n A single number as system value n • • Gives the wrong impression of certainty and “correctness” Allows for easy “reverse engineering”, i. e. . begin with the value and find uncertainties to explain the value 2 September 2004 © Scholtes 2004 6

What are we concerned with? Starting point: System value is more than a number n We are constantly forced to make decisions with uncertain consequences • n Decision = Allocation of resources We are not good at understanding or communicating effects of uncertainty • We feel uncomfortable with uncertainty and, as a consequence, tend to blend it out in our system valuations n We work with forecasts of uncertain variables (demand, prices, costs, regulation, political scenarios, …) to generate a single output – the “value” BUT THE FORECAST IS ALWAYS WRONG n A single number as system value n • • Gives the wrong impression of certainty and “correctness” Allows for easy “reverse engineering”, i. e. . begin with the value and find uncertainties to explain the value 2 September 2004 © Scholtes 2004 6

What are we concerned with? I. Recognising uncertainty: Values as shapes n The good, the bad and the ugly: • Uncertainty is best represented by a SHAPE (“distribution”) • 2 nd best is a range of possible values • Worst is a single number n If we want to work with shapes, we need a shape calculator n SKILL: LEARN HOW TO USE A SHAPE CALCULATOR n But: Are “shape models” any more trustworthy than the “number models”? 2 September 2004 © Scholtes 2004 7

What are we concerned with? I. Recognising uncertainty: Values as shapes n The good, the bad and the ugly: • Uncertainty is best represented by a SHAPE (“distribution”) • 2 nd best is a range of possible values • Worst is a single number n If we want to work with shapes, we need a shape calculator n SKILL: LEARN HOW TO USE A SHAPE CALCULATOR n But: Are “shape models” any more trustworthy than the “number models”? 2 September 2004 © Scholtes 2004 7

What are we concerned with? II. Developing valuation models: No right answer n Engineering models of systems focus on “the right answers” • n Economic valuation of systems must acknowledge that THERE IS NO RIGHT VALUE … unless the system is traded in the market place • n • gut-feeling and intuition industry comparison Response II: “Hard” modelling is even more important to make sense of complex systems and understand consequences of decisions • n If there is no right answer then there is no right model either! Response I: “Hard” modelling is useless for managers, give up on it and base your decision on • n Precise mathematical model plus reliable data Improved understanding of the system gives competitive advantage BUT: We have to revise our expectations on modelling 2 September 2004 © Scholtes 2004 8

What are we concerned with? II. Developing valuation models: No right answer n Engineering models of systems focus on “the right answers” • n Economic valuation of systems must acknowledge that THERE IS NO RIGHT VALUE … unless the system is traded in the market place • n • gut-feeling and intuition industry comparison Response II: “Hard” modelling is even more important to make sense of complex systems and understand consequences of decisions • n If there is no right answer then there is no right model either! Response I: “Hard” modelling is useless for managers, give up on it and base your decision on • n Precise mathematical model plus reliable data Improved understanding of the system gives competitive advantage BUT: We have to revise our expectations on modelling 2 September 2004 © Scholtes 2004 8

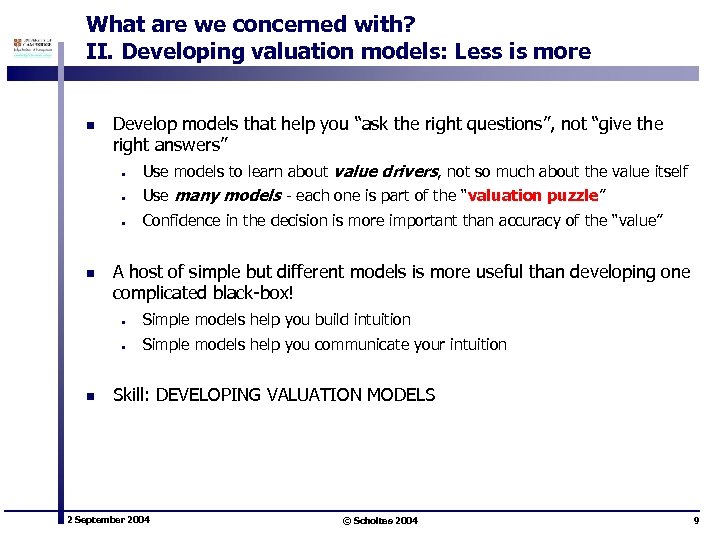

What are we concerned with? II. Developing valuation models: Less is more n Develop models that help you “ask the right questions”, not “give the right answers” • • Use many models - each one is part of the “valuation puzzle” • n Use models to learn about value drivers, not so much about the value itself Confidence in the decision is more important than accuracy of the “value” A host of simple but different models is more useful than developing one complicated black-box! • • n Simple models help you build intuition Simple models help you communicate your intuition Skill: DEVELOPING VALUATION MODELS 2 September 2004 © Scholtes 2004 9

What are we concerned with? II. Developing valuation models: Less is more n Develop models that help you “ask the right questions”, not “give the right answers” • • Use many models - each one is part of the “valuation puzzle” • n Use models to learn about value drivers, not so much about the value itself Confidence in the decision is more important than accuracy of the “value” A host of simple but different models is more useful than developing one complicated black-box! • • n Simple models help you build intuition Simple models help you communicate your intuition Skill: DEVELOPING VALUATION MODELS 2 September 2004 © Scholtes 2004 9

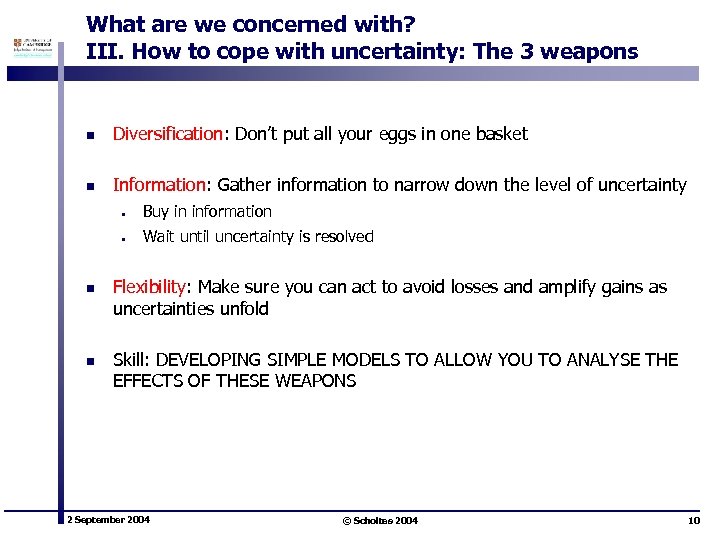

What are we concerned with? III. How to cope with uncertainty: The 3 weapons n Diversification: Don’t put all your eggs in one basket n Information: Gather information to narrow down the level of uncertainty • • n n Buy in information Wait until uncertainty is resolved Flexibility: Make sure you can act to avoid losses and amplify gains as uncertainties unfold Skill: DEVELOPING SIMPLE MODELS TO ALLOW YOU TO ANALYSE THE EFFECTS OF THESE WEAPONS 2 September 2004 © Scholtes 2004 10

What are we concerned with? III. How to cope with uncertainty: The 3 weapons n Diversification: Don’t put all your eggs in one basket n Information: Gather information to narrow down the level of uncertainty • • n n Buy in information Wait until uncertainty is resolved Flexibility: Make sure you can act to avoid losses and amplify gains as uncertainties unfold Skill: DEVELOPING SIMPLE MODELS TO ALLOW YOU TO ANALYSE THE EFFECTS OF THESE WEAPONS 2 September 2004 © Scholtes 2004 10

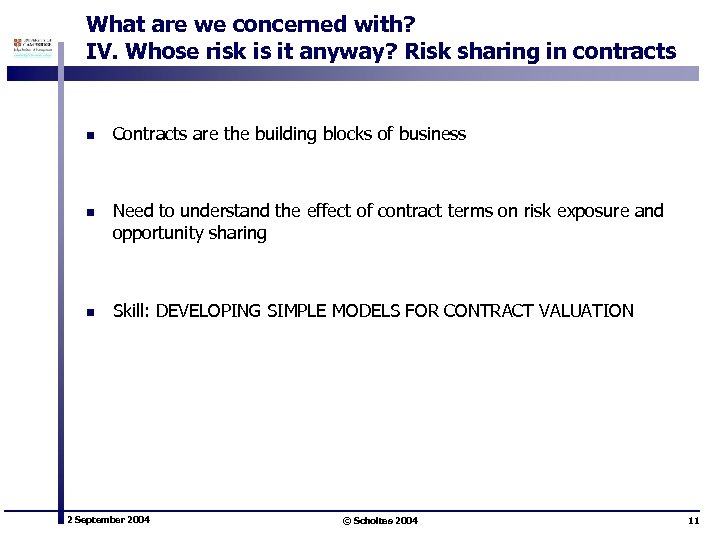

What are we concerned with? IV. Whose risk is it anyway? Risk sharing in contracts n n n Contracts are the building blocks of business Need to understand the effect of contract terms on risk exposure and opportunity sharing Skill: DEVELOPING SIMPLE MODELS FOR CONTRACT VALUATION 2 September 2004 © Scholtes 2004 11

What are we concerned with? IV. Whose risk is it anyway? Risk sharing in contracts n n n Contracts are the building blocks of business Need to understand the effect of contract terms on risk exposure and opportunity sharing Skill: DEVELOPING SIMPLE MODELS FOR CONTRACT VALUATION 2 September 2004 © Scholtes 2004 11

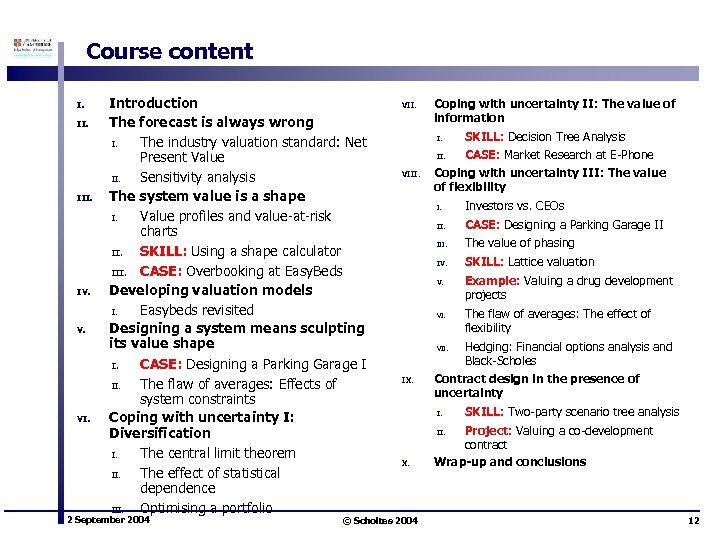

Course content I. II. IV. VI. Introduction The forecast is always wrong I. The industry valuation standard: Net Present Value II. Sensitivity analysis The system value is a shape I. Value profiles and value-at-risk charts II. SKILL: Using a shape calculator III. CASE: Overbooking at Easy. Beds Developing valuation models I. Easybeds revisited Designing a system means sculpting its value shape I. CASE: Designing a Parking Garage I II. The flaw of averages: Effects of system constraints Coping with uncertainty I: Diversification I. The central limit theorem II. The effect of statistical dependence III. Optimising a portfolio 2 September 2004 VII. Coping with uncertainty II: The value of information I. SKILL: Decision Tree Analysis CASE: Market Research at E-Phone Coping with uncertainty III: The value of flexibility II. VIII. Investors vs. CEOs II. CASE: Designing a Parking Garage II III. The value of phasing IV. SKILL: Lattice valuation V. VI. Example: Valuing a drug development projects The flaw of averages: The effect of flexibility Hedging: Financial options analysis and Black-Scholes Contract design in the presence of uncertainty VII. IX. I. SKILL: Two-party scenario tree analysis Project: Valuing a co-development contract Wrap-up and conclusions II. X. © Scholtes 2004 12

Course content I. II. IV. VI. Introduction The forecast is always wrong I. The industry valuation standard: Net Present Value II. Sensitivity analysis The system value is a shape I. Value profiles and value-at-risk charts II. SKILL: Using a shape calculator III. CASE: Overbooking at Easy. Beds Developing valuation models I. Easybeds revisited Designing a system means sculpting its value shape I. CASE: Designing a Parking Garage I II. The flaw of averages: Effects of system constraints Coping with uncertainty I: Diversification I. The central limit theorem II. The effect of statistical dependence III. Optimising a portfolio 2 September 2004 VII. Coping with uncertainty II: The value of information I. SKILL: Decision Tree Analysis CASE: Market Research at E-Phone Coping with uncertainty III: The value of flexibility II. VIII. Investors vs. CEOs II. CASE: Designing a Parking Garage II III. The value of phasing IV. SKILL: Lattice valuation V. VI. Example: Valuing a drug development projects The flaw of averages: The effect of flexibility Hedging: Financial options analysis and Black-Scholes Contract design in the presence of uncertainty VII. IX. I. SKILL: Two-party scenario tree analysis Project: Valuing a co-development contract Wrap-up and conclusions II. X. © Scholtes 2004 12