9817b616c23a16c44eb9dfdd7d5ea4a8.ppt

- Количество слайдов: 14

Risk Management for Hedge Funds Tackling Rare Events with an Incomplete History A. Jaun 1, 2, S. Umansky 1, H. El Showk 1 1 Signet Capital Management Limited 2 Assoc. Prof. Royal Institute Technology, Stockholm Contact info@signetmanagement. com Gdansk Conference, 11 -12 May 2007

Risk Management for Hedge Funds Tackling Rare Events with an Incomplete History A. Jaun 1, 2, S. Umansky 1, H. El Showk 1 1 Signet Capital Management Limited 2 Assoc. Prof. Royal Institute Technology, Stockholm Contact info@signetmanagement. com Gdansk Conference, 11 -12 May 2007

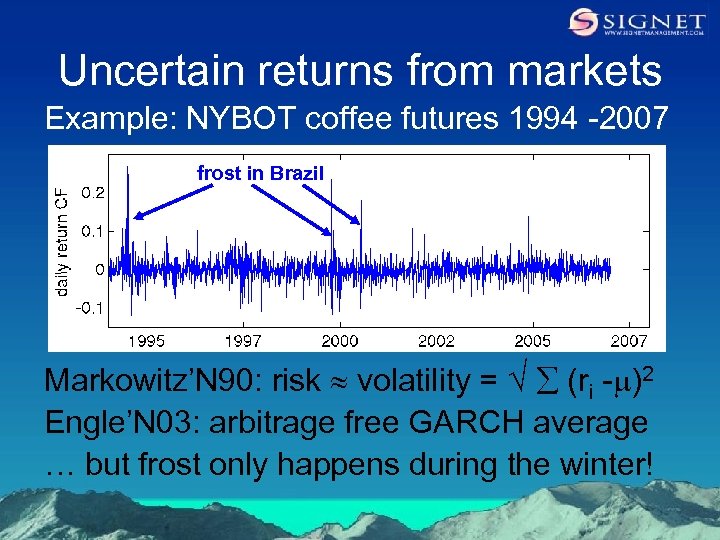

Uncertain returns from markets Example: NYBOT coffee futures 1994 -2007 frost in Brazil Markowitz’N 90: risk volatility = (ri -m)2 Engle’N 03: arbitrage free GARCH average … but frost only happens during the winter!

Uncertain returns from markets Example: NYBOT coffee futures 1994 -2007 frost in Brazil Markowitz’N 90: risk volatility = (ri -m)2 Engle’N 03: arbitrage free GARCH average … but frost only happens during the winter!

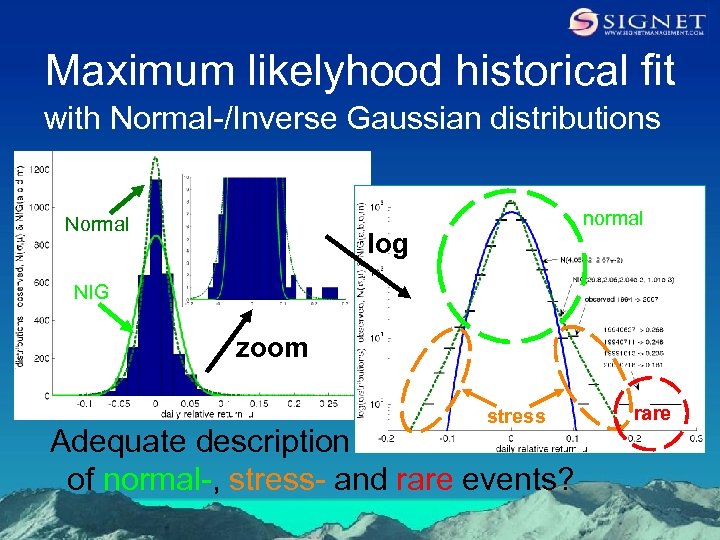

Maximum likelyhood historical fit with Normal-/Inverse Gaussian distributions Normal normal log NIG zoom stress Adequate description of normal-, stress- and rare events? rare

Maximum likelyhood historical fit with Normal-/Inverse Gaussian distributions Normal normal log NIG zoom stress Adequate description of normal-, stress- and rare events? rare

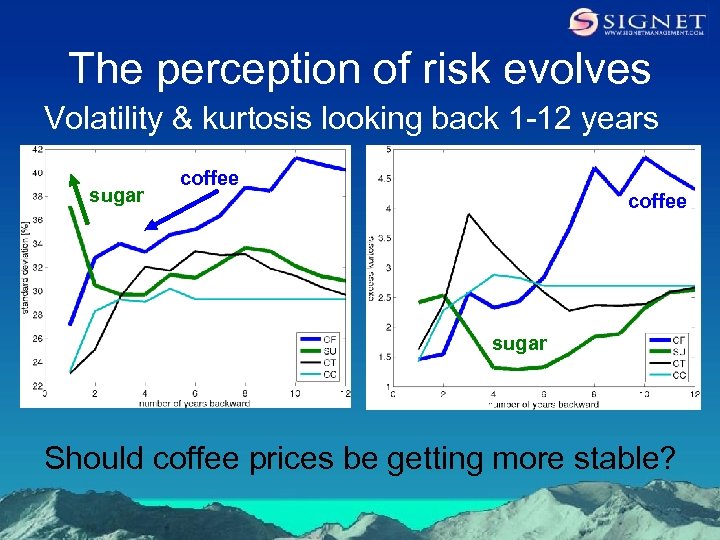

The perception of risk evolves Volatility & kurtosis looking back 1 -12 years sugar coffee sugar Should coffee prices be getting more stable?

The perception of risk evolves Volatility & kurtosis looking back 1 -12 years sugar coffee sugar Should coffee prices be getting more stable?

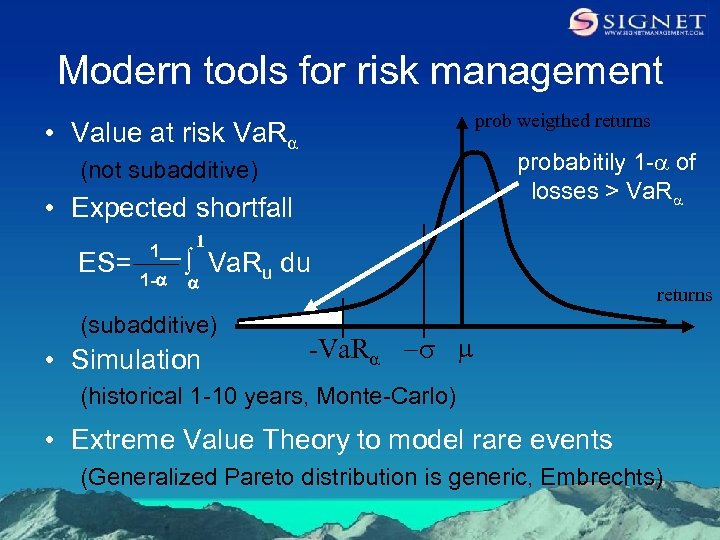

Modern tools for risk management prob weigthed returns • Value at risk Va. Ra (not subadditive) • Expected shortfall 1 1 ES= 1 -a Va. Ru du probabitily 1 -a of losses > Va. Ra a (subadditive) • Simulation returns -Va. Ra -s m (historical 1 -10 years, Monte-Carlo) • Extreme Value Theory to model rare events (Generalized Pareto distribution is generic, Embrechts)

Modern tools for risk management prob weigthed returns • Value at risk Va. Ra (not subadditive) • Expected shortfall 1 1 ES= 1 -a Va. Ru du probabitily 1 -a of losses > Va. Ra a (subadditive) • Simulation returns -Va. Ra -s m (historical 1 -10 years, Monte-Carlo) • Extreme Value Theory to model rare events (Generalized Pareto distribution is generic, Embrechts)

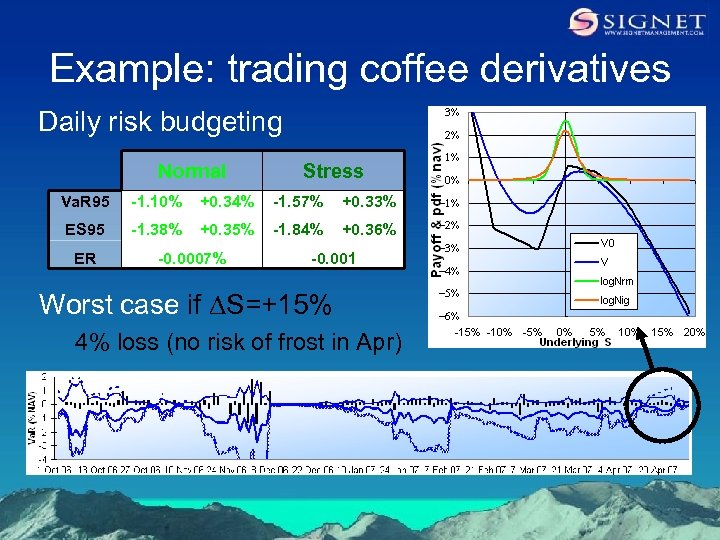

Example: trading coffee derivatives Daily risk budgeting Normal Stress Va. R 95 -1. 10% +0. 34% -1. 57% +0. 33% ES 95 -1. 38% +0. 35% -1. 84% +0. 36% ER -0. 0007% -0. 001 Worst case if DS=+15% 4% loss (no risk of frost in Apr)

Example: trading coffee derivatives Daily risk budgeting Normal Stress Va. R 95 -1. 10% +0. 34% -1. 57% +0. 33% ES 95 -1. 38% +0. 35% -1. 84% +0. 36% ER -0. 0007% -0. 001 Worst case if DS=+15% 4% loss (no risk of frost in Apr)

And when there is not enough data Ex: avalanche risk • little/no history • incomplete data Take the right decision. . . before it is too late!

And when there is not enough data Ex: avalanche risk • little/no history • incomplete data Take the right decision. . . before it is too late!

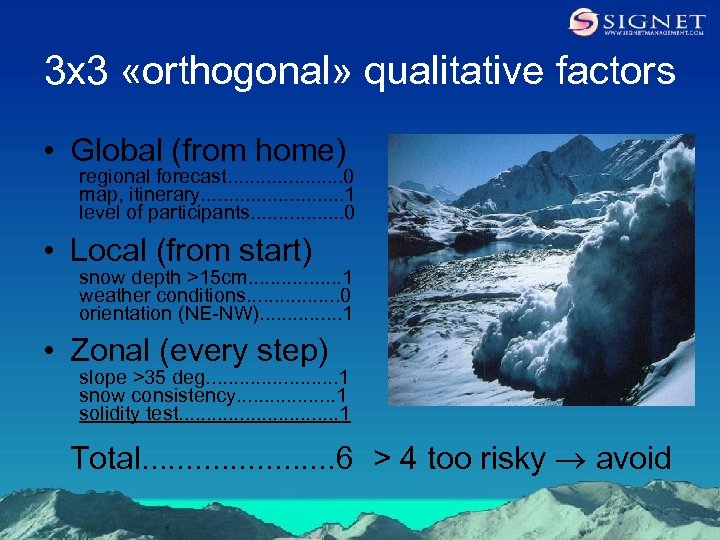

3 x 3 «orthogonal» qualitative factors • Global (from home) regional forecast. . . . . 0 map, itinerary. . . 1 level of participants. . . . 0 • Local (from start) snow depth >15 cm. . . . 1 weather conditions. . . . 0 orientation (NE-NW). . . . 1 • Zonal (every step) slope >35 deg. . . 1 snow consistency. . . . 1 solidity test. . . . 1 Total. . . . . 6 > 4 too risky avoid

3 x 3 «orthogonal» qualitative factors • Global (from home) regional forecast. . . . . 0 map, itinerary. . . 1 level of participants. . . . 0 • Local (from start) snow depth >15 cm. . . . 1 weather conditions. . . . 0 orientation (NE-NW). . . . 1 • Zonal (every step) slope >35 deg. . . 1 snow consistency. . . . 1 solidity test. . . . 1 Total. . . . . 6 > 4 too risky avoid

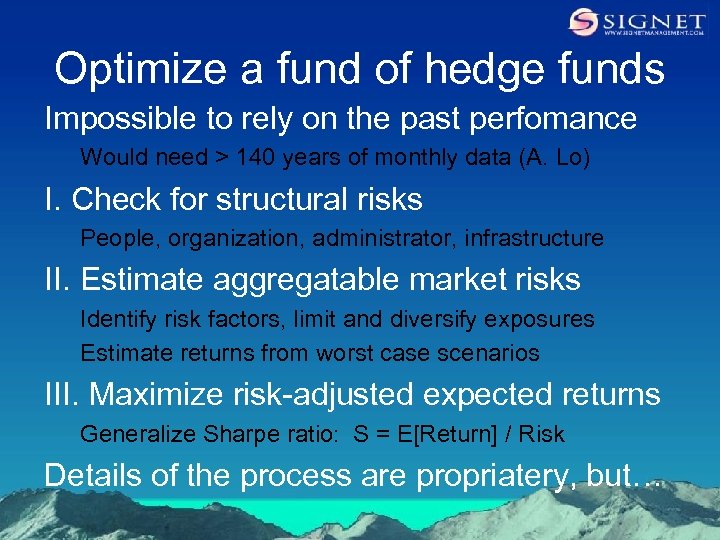

Optimize a fund of hedge funds Impossible to rely on the past perfomance Would need > 140 years of monthly data (A. Lo) I. Check for structural risks People, organization, administrator, infrastructure II. Estimate aggregatable market risks Identify risk factors, limit and diversify exposures Estimate returns from worst case scenarios III. Maximize risk-adjusted expected returns Generalize Sharpe ratio: S = E[Return] / Risk Details of the process are propriatery, but…

Optimize a fund of hedge funds Impossible to rely on the past perfomance Would need > 140 years of monthly data (A. Lo) I. Check for structural risks People, organization, administrator, infrastructure II. Estimate aggregatable market risks Identify risk factors, limit and diversify exposures Estimate returns from worst case scenarios III. Maximize risk-adjusted expected returns Generalize Sharpe ratio: S = E[Return] / Risk Details of the process are propriatery, but…

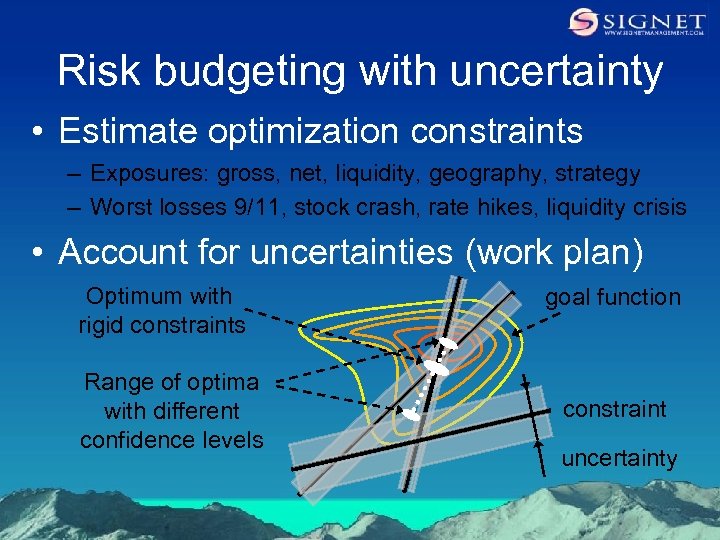

Risk budgeting with uncertainty • Estimate optimization constraints – Exposures: gross, net, liquidity, geography, strategy – Worst losses 9/11, stock crash, rate hikes, liquidity crisis • Account for uncertainties (work plan) Optimum with rigid constraints Range of optima with different confidence levels goal function constraint uncertainty

Risk budgeting with uncertainty • Estimate optimization constraints – Exposures: gross, net, liquidity, geography, strategy – Worst losses 9/11, stock crash, rate hikes, liquidity crisis • Account for uncertainties (work plan) Optimum with rigid constraints Range of optima with different confidence levels goal function constraint uncertainty

Risk-adjusted expected returns Returns from probability weighted scenarios E. g. 30% stagflation, 50% soft landing, 20% hard landing Risk from a fund = lack of confidence in Our own judgement (insufficient knowledge) Future expected returns (forward looking volatility) The preservation of capital (exposure to rare events) Estimates should be back-tested (work plan) How well does past performance match forecasts?

Risk-adjusted expected returns Returns from probability weighted scenarios E. g. 30% stagflation, 50% soft landing, 20% hard landing Risk from a fund = lack of confidence in Our own judgement (insufficient knowledge) Future expected returns (forward looking volatility) The preservation of capital (exposure to rare events) Estimates should be back-tested (work plan) How well does past performance match forecasts?

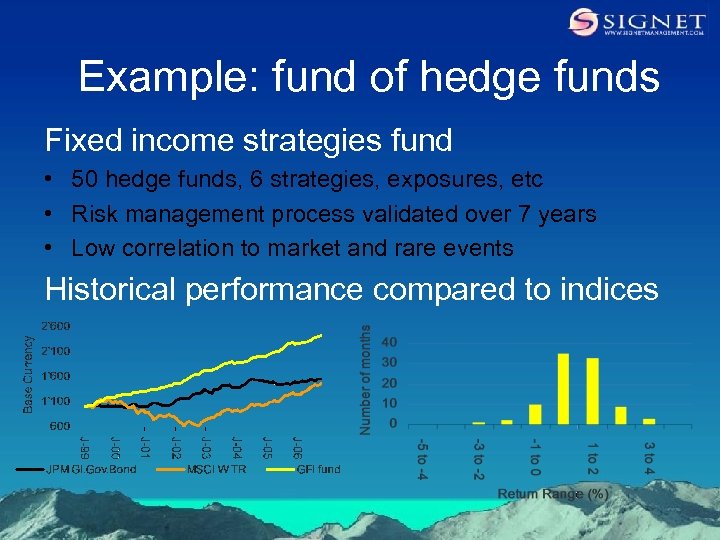

Example: fund of hedge funds Fixed income strategies fund • 50 hedge funds, 6 strategies, exposures, etc • Risk management process validated over 7 years • Low correlation to market and rare events Historical performance compared to indices

Example: fund of hedge funds Fixed income strategies fund • 50 hedge funds, 6 strategies, exposures, etc • Risk management process validated over 7 years • Low correlation to market and rare events Historical performance compared to indices

Conclusions Distribution of returns to describe market risks Max likelihood to fit Normal, NIG, Pareto distributions Choice of the historical time span is the main issue When there is not enough data Identify aggregatable & orthogonal risk factors Bayesian estimate of returns for rare events Estimates can be back-tested and refined with time Rare events do happen and define our lives!

Conclusions Distribution of returns to describe market risks Max likelihood to fit Normal, NIG, Pareto distributions Choice of the historical time span is the main issue When there is not enough data Identify aggregatable & orthogonal risk factors Bayesian estimate of returns for rare events Estimates can be back-tested and refined with time Rare events do happen and define our lives!

Disclaimer United Kingdom. This document has been issued and approved for the purposes of Section 21 of the Financial Services & Markets Act 2000 (“FSMA”) by Signet Capital Management Limited (“SCML”), which is authorised and regulated by the UK's Financial Services Authority. Neither the receipt of the document by any person nor any information contained herein or supplied with it or subsequently communicated to any person is to be taken as constituting the giving of investment advice by SCML to any such person. The document has been issued in the United Kingdom solely for the information of persons authorised under the FSMA to carry on investment business and may only be issued or passed on by such persons to other authorised persons and/or to other categories of investor to whom unregulated collective investment schemes can be marketed without contravening Section 238 of the FSMA. The issue of this document in the United Kingdom to any other person may be an offence. An investment in any security described herein must only be made in conjunction with the most recent Offering Memorandum pertaining to such security and particular attention must be paid to the information contained therein. This document is confidential and provides general advice only. It is not an information memorandum nor is it an offer, solicitation or recommendation to apply for or invest in securities. The information in this document has been derived from sources believed to be accurate and reliable and its contents have been produced in good faith. Nevertheless, no representation or warranty, expressed or implied, is given by SCML as to the accuracy or completeness of the information and opinions contained herein and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information or opinions. The document shall not and does not form the basis of any contract. Switzerland. The securities mentioned herein are not authorized for public distribution by the Swiss Federal Financial Market Supervisory Authority. Therefore, in accordance with the Swiss investment fund regulations, no public offering or professional distribution of these securities may be done in or from Switzerland. United States. The securities described herein have not been and will not be registered under the United States Securities Act of 1933 and may not be directly or indirectly offered or sold in the United States or to or for the benefit of a United States person, being a citizen or resident of the United States; a corporation or partnership created or organised in or under the laws of the United States or any State thereof (unless, in the case of a partnership, Treasury Regulations otherwise provide); or an estate or fund, the income of which is subject to United States federal income tax regardless of its source. The information in this document is not for distribution and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United Sates of America to or for the benefit of United States persons. Other Juridictions. This document may not be mailed or distributed or redistributed or otherwise sent into, and does not constitute any offer to sell or the solicitation of any offer to buy securities in or from any territory where the same would require compliance with any regulatory filing or like requirement or where the same would constitute an offence. It is accordingly not to be made available in any such jurisdiction.

Disclaimer United Kingdom. This document has been issued and approved for the purposes of Section 21 of the Financial Services & Markets Act 2000 (“FSMA”) by Signet Capital Management Limited (“SCML”), which is authorised and regulated by the UK's Financial Services Authority. Neither the receipt of the document by any person nor any information contained herein or supplied with it or subsequently communicated to any person is to be taken as constituting the giving of investment advice by SCML to any such person. The document has been issued in the United Kingdom solely for the information of persons authorised under the FSMA to carry on investment business and may only be issued or passed on by such persons to other authorised persons and/or to other categories of investor to whom unregulated collective investment schemes can be marketed without contravening Section 238 of the FSMA. The issue of this document in the United Kingdom to any other person may be an offence. An investment in any security described herein must only be made in conjunction with the most recent Offering Memorandum pertaining to such security and particular attention must be paid to the information contained therein. This document is confidential and provides general advice only. It is not an information memorandum nor is it an offer, solicitation or recommendation to apply for or invest in securities. The information in this document has been derived from sources believed to be accurate and reliable and its contents have been produced in good faith. Nevertheless, no representation or warranty, expressed or implied, is given by SCML as to the accuracy or completeness of the information and opinions contained herein and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information or opinions. The document shall not and does not form the basis of any contract. Switzerland. The securities mentioned herein are not authorized for public distribution by the Swiss Federal Financial Market Supervisory Authority. Therefore, in accordance with the Swiss investment fund regulations, no public offering or professional distribution of these securities may be done in or from Switzerland. United States. The securities described herein have not been and will not be registered under the United States Securities Act of 1933 and may not be directly or indirectly offered or sold in the United States or to or for the benefit of a United States person, being a citizen or resident of the United States; a corporation or partnership created or organised in or under the laws of the United States or any State thereof (unless, in the case of a partnership, Treasury Regulations otherwise provide); or an estate or fund, the income of which is subject to United States federal income tax regardless of its source. The information in this document is not for distribution and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United Sates of America to or for the benefit of United States persons. Other Juridictions. This document may not be mailed or distributed or redistributed or otherwise sent into, and does not constitute any offer to sell or the solicitation of any offer to buy securities in or from any territory where the same would require compliance with any regulatory filing or like requirement or where the same would constitute an offence. It is accordingly not to be made available in any such jurisdiction.