77ce5881069842ec2a243ce634f7cadc.ppt

- Количество слайдов: 68

Risk Management for Construction Dr. Robert A. Perkins, PE Civil and Environmental Engineering University of Alaska Fairbanks

Class for DOT Construction Managers • Get started – Who we are – Where we are – Why are we here? • Book and Syllabus • Handout Material – Electronic – http: //www. faculty. uaf. edu/ffrap/CM%20 Cours e%20 Info/CM%20 Index. html

Risk and Safety

Class Outline • Class 1, Basic risk concepts applied to project and construction management • Class 2, Specific risk concepts applied to construction – qualitative risk analysis • Class 3, Quantitative risk analysis, a little probability, tools. • Class 4, Risk Assessment

• Class 5, – Risk Management, owner’s perspective – How contractors manage risks • Class 6, Presentations and Wrap up

Today • • • Risk in general Risk in projects Risk in construction Analysis of Risk Management of Risk

Assessments • Quiz following Class 4, 30% – Definitions – Problems • Practicum, 60% – Team project – Risks from a project – Plan for handling them

“Clouded his future is… The future is always in motion”

Estimation of Future Events • • AKA “divining” Oracle at Delphi to my financial analyst Pigeon guts, Roman augers “The diviners have seen a lie, and have told false dreams; they comfort in vain (Zechariah 10. 2).

Management • An understanding of and dealing with the stochastic nature of management systems. – designating a process having an infinite progression of jointly distributed random variables. – of, pertaining to, or arising from chance; involving probability; random – from the Greek stochastikos meaning, proceeding by guesswork

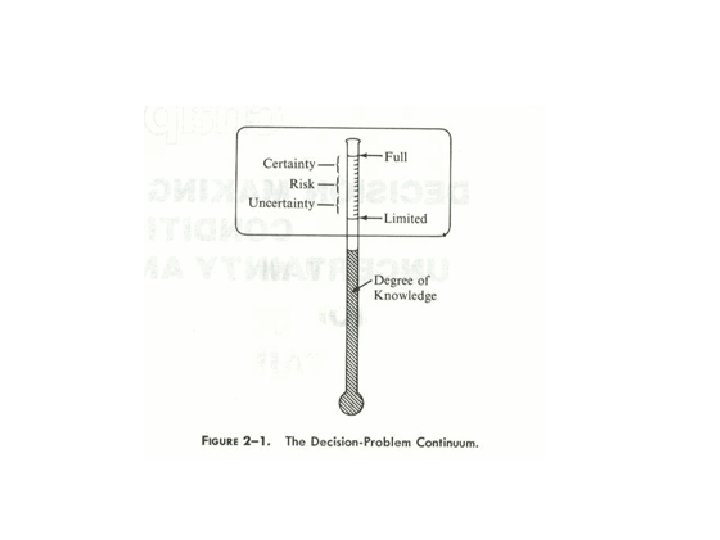

Estimates • Estimates are essentially guesses and often have a serious downside if they are wrong. • The reason they are guesses is that there are future events (“states of nature”) that are uncontrollable and these events will control the outcome. • Regarding what we can say about these future events, there is a continuum.

Terms • Certainty – If we have full knowledge (we believe) of the future. We might approximate that if we have a firm quote from a bonded sub or supplier. • Risk – Many estimating decisions are made under “risk. ” In technical terms, “risk” means we feel we can state the probability of the events. For example, we know the price of concrete in the summer is likely to be $200/CY but may vary by 15%. • Uncertainty – We recognize alternate states of nature may happen, but we don’t have a clue how likely they are. – Note the difference between the technical use of terms and the common usage. While the entire future is “uncertain, ” if we feel confident we know the probability of the future we say there is “risk” and limit the use of “uncertain” to situations where we do not know the probability of events.

• Knowns • Known-unknowns • Unknown-unknowns

• Road freeze up by October 1 • Foreman quitting

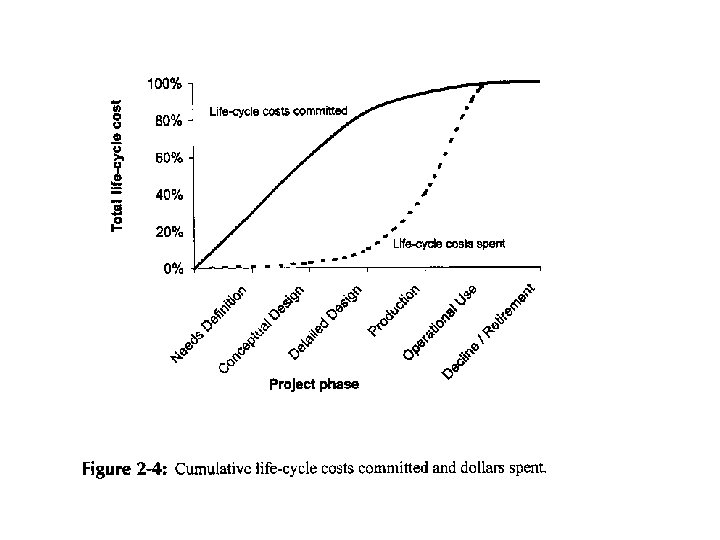

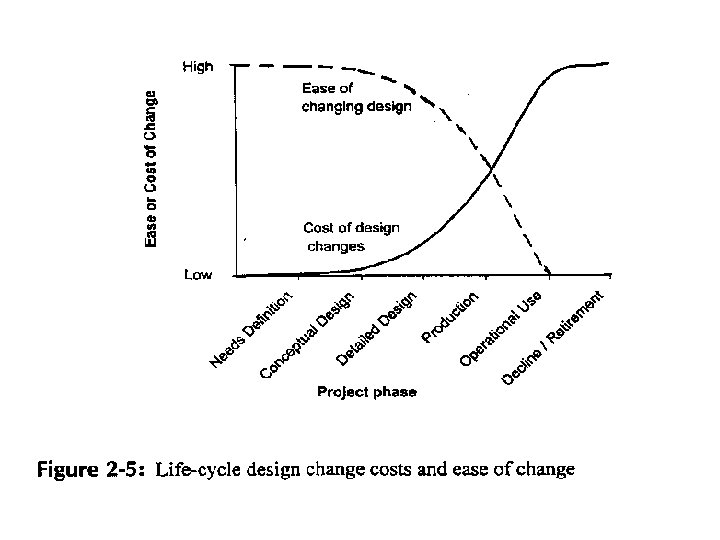

Examples – Projects • Nature of Projects – – • DOT Projects – – • Project cycle » Graphs, ease of change vs. completion » Cost of change vs. design Work Breakdown Structure Type What can go wrong? Participation

• Risks must be evaluated according to the project cycle.

WBS • • Work Breakdown Structure The tasks needed to complete the project Tie WBS to risks Contracting strategies

High Level WBS • • • Planning Pre-design Design Procurement Construction M&O

Mid-level Pre-design • • • Survey Soils ROW Environmental Public Other

More Detail - Soils • • • Review Records Schedule Drilling Drill Analysis Report

Finer Detail - Drill • Costs – Labor – Equipment – Subcontract • Schedule – Permits and approvals – Section A – Section B – Section C

And more • Labor – Bare – Benefits • Vacation – Supervision

Nomenclature - sometimes • • Program Project Phase Task Sub-task Work Packages Etc.

More • Coordination Matrix • Who is responsible, involved, needs to be copied, and, almost forgot, • Who will do the work • Contract v. In-house

WBS to RMP • Risk Management Plan • Risks should be considered with respect to the WBS • Who is responsible for apprizing risk • Minimizing Risk • Reporting on Risk

Forecasting, Time • Short-term – 1 -3 years – Generally based on current knowledge • Medium-term – 3 -15 years – typically the issue • Long-term – >15 years

Your Organization’s Risks • • Discuss Who manages? Technical Risks Performance Risks – AKA Programmatic Risks

Forecasting Methods • Subjective methods – from within firm • User Expectation methods – from outside the firm • Statistical Methods – extrapolation • Modeling methods

User Expectation Methods • Customers asked to forecast needs – Availability of gravel • Pilot trials – test demand in one location – Alyeska tests of trenching in permafrost

Statistical • Time series

Subjective Methods • Jury of Executive Opinion – meeting of in-house experts • Delphi Method – Aims to remove domineering effect of senior company officials – Three rounds • 1 st anonymous • 2 d knows results of first, but not authors • 3 d discussion following 2 d round

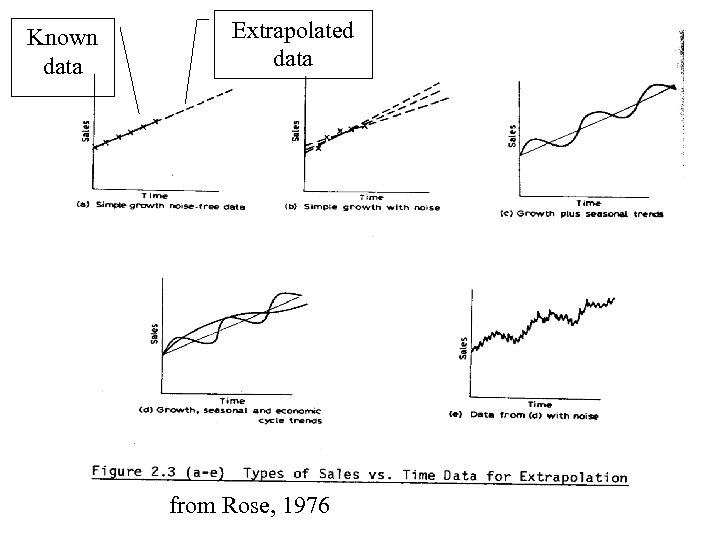

Extrapolation • • • From time series (See next) Various methods of extrapolation All based on past data Which is likely to change in future

Known data Extrapolated data from Rose, 1976

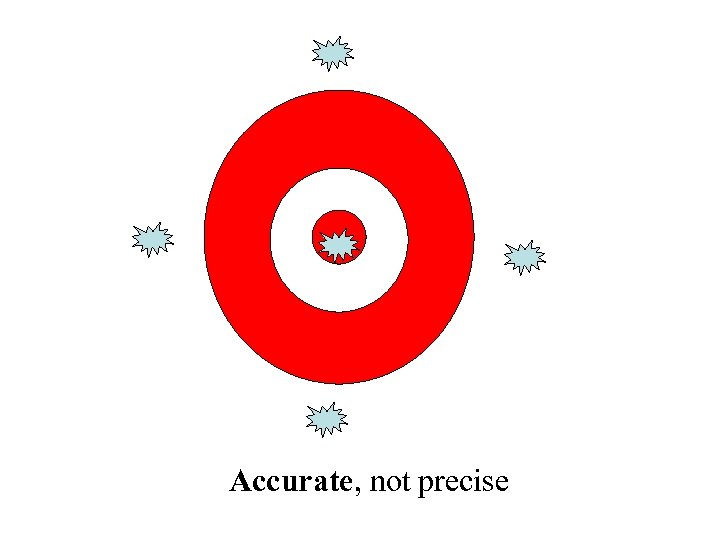

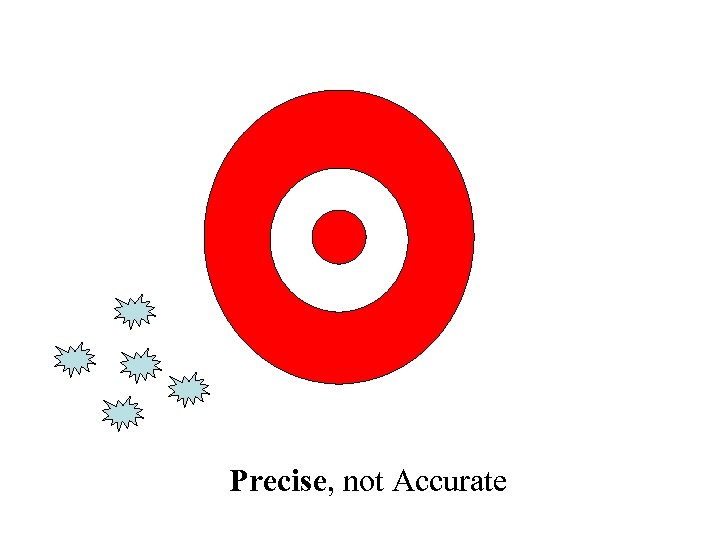

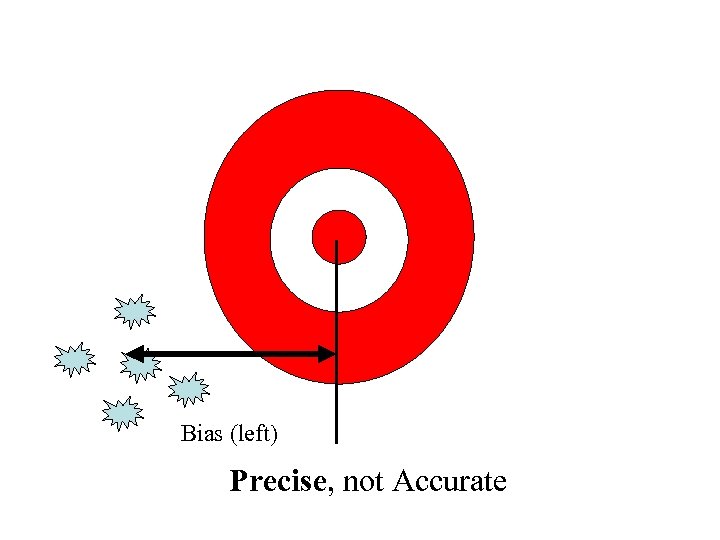

Some terms • • Precision Accuracy Biased Precise estimate

Accurate, not precise

Precise, not Accurate

Bias (left) Precise, not Accurate

Experts • Feedback – Jury – Delphi – Etc. • Get parameters

“Precise Estimate” • Use the best number(s) you have.

Other Precise • Breakeven • Sensitivity • Examine the impact that variability will have

Problems • Problems (or events) => Decisions • Kinds of problems – Simple • Cash or credit card – Intermediate • Buy or lease equipment – Complex • Open a new plant in New Jersey or Alabama

The Decision Process

Rational Decision Making • Recognition of problem • Definition of goal • Assembly of data • Select criteria • Interrelationship – – objective alternatives data criteria • Predict outcomes • Choice of best

Recognition of Problem Define the problem area, carefully and completely determine all uncontrollable conditions (random events) inherent in the situation.

Define Goal or Objective • A problem is something that prevents us from achieving our goal • Determine the objective(s) to be achieved and how attainment of the objectives is to be measured. • But what is the objective?

Assembly of Data • • Accounting Data Cost Benefits Difficulties – Allocation of Overhead – non-market consequences (shadow prices) – Intangibles • Define precisely all alternative actions that can be taken, and calculate the payoff (degree of attainment of objectives) in each case.

Identify Feasible Alternatives • Do nothing • Brainstorming

Select Criteria • Non-profits • Time • Use money most efficiently – Fixed input – Fixed output – Neither fixed

Model Interrelationships • Select and apply a decision criterion (rule) which orders the alternatives and defines which one is the best or optimum alternative.

Model Interrelationships • Room Capacity = (l * w )/ k • k is factor based on seating – k = 0. 5 for expensive fixed seats – k = 0. 7 for cheap movable seats

Numeric Models: Scoring • Unweighted 0 -1 Factor Model • Unweighted Factor Scoring Model • Weighted Factor Scoring Model • Constrained Weighted Factor Scoring Model • Goal Programming with Multiple Objectives Chapter 2 -6

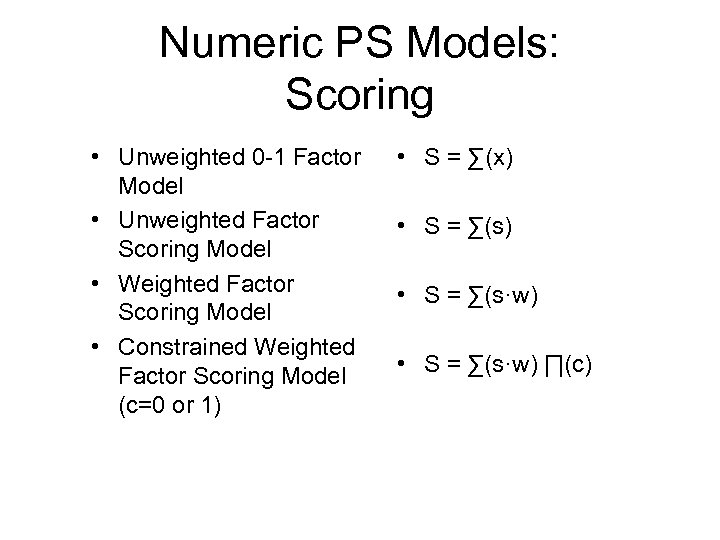

Numeric PS Models: Scoring • Unweighted 0 -1 Factor Model • Unweighted Factor Scoring Model • Weighted Factor Scoring Model • Constrained Weighted Factor Scoring Model (c=0 or 1) • S = ∑(x) • S = ∑(s·w) ∏(c)

Predict Outcomes • From model • Arrange in orderly way • Resolve consequences – market – extra-market • State intangibles

Choose Best • Using all relevant experience and judgment, make a choice from among the alternatives.

Home Fire Insurance • House cost $150, 000 • full insurance cost $1400/yr • p of fire 0. 004/year

More on Models • Idealized view of reality • Representing the STRUCTURE of the problem, not the detail • Deterministic or stochastic

Caveats • Project decisions are made by Project Manager --- NOT by models! • A model APPROXIMATES, but does NOT DUPLICATE reality!

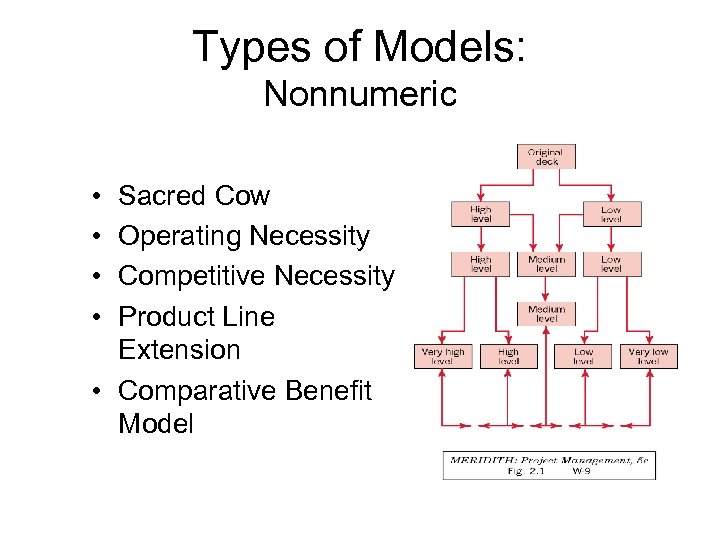

Types of Models: Nonnumeric • • Sacred Cow Operating Necessity Competitive Necessity Product Line Extension • Comparative Benefit Model

Choosing the Model • Dependent on wishes and philosophy of management • 80% of Fortune 500 firms choose “nonnumeric” models • Firms with outside funding often chose scoring models • Firms without outside funding often chose profit / profitability models

Risk in Construction • All the risks belong to who? • Unless • Which party should bear risk?

Risk management • • • Minimizing risks – regardless of whose risk it is Equitable sharing of risks among the various project partners. Contrast with Risk Assessment

• The parties must be prepared to discuss and decide on the following issues: • What are the levels of risk are realistic to assume? • Who can best assume each risk? • What levels and kinds of risks are properly and most economically passed on to insurance carriers?

Fisk’s Categories of risk • Construction-related risks – Crane failure • Physical risks (subsurface conditions) – Differing site conditions • Contractual and legal risks – Law suits

• Performance risks – Project does not meet expectations • Economic risks – Loose money or cost overruns • Political and public risks – Lots

Exculpatory Clauses • Seek to reduce risk with contract language • Limitation thereof

77ce5881069842ec2a243ce634f7cadc.ppt