4a77a03a454d245796cb9a47a3c2ede9.ppt

- Количество слайдов: 88

Risk Management Can We? Presented by Dan C. Jones Clinical Assistant Professor University of Houston May 20, 2009 Energy Risk USA 2009

Lets see how well we have done 2

1937 - New London, Texas Natural Gas explosion is school over 200 killed Now use t-butyl mercaptan or thioplane 3

1989 - Exxon Valdez Spilled 10. 8 million gallon of crude of coast of Alaska, Prince William Sound Now require double hull crude carriers in all US ports March 2009 Korean vessel found a drilling rig lost after IKE, Double Hull prevented any spill 4

2004 - Explosion BP plant Texas City Extensive damage. BP admitted fault but ignition came during recovery cycle but fatalities due to location of work trailers 5

2005 - Hurricane Katrina & Rita n Failure of flood gates New Orleans n Inadequate wave clearance & offshore platforms for class 5 storm n Inadequate response FEMA 6

2008 - Hurricane Ike Class 2 winds offshore Class 5 storm surge Galveston Bay and Trinity Bay Now referred to as Integrated Kinetic Energy over 2, 000 million customers lost power. Unforeseen especially by Center. Point. 7

1984 - Bhopal India- Union Carbide pesticide plant 300 killed, thousands injured release of 42 tons of methyl isocyanate Plant was not following safety and operating guidelines of Union Carbide 8

1986 Chernobyl, Ukraine explosion released more than 400 times the radioactivity than with atomic bombing of Hiroshima Built a sarcophagus a cover for the reactor That and Three Mile Island incident stopped any nuclear construction, in US in 1970’s. Now 4 projects being considered in Texas 9

2002 Approved repository site in Yucca Mountain Nevada Operational 2010, to be sealed 2035 Repository in solid rock 1000 feet underground and on average 1000 feet above water table Holds 77000 metric tons of waste Plulonuim-239 has half life of 24000 years Cost $9 billion 2010 budget includes no funding for Yucca Mountain Present 100 nuclear plants-20% of electricity 30 plants in planning stage 10

Asbestos- Alaska Pipe Line recognition Asbestosis and mesothelioma but was used in shipbuilding in 1940’s Used by the Ancient Greeks because of its soft and pliant properties- the miracle mineral Over 80 companies involved with asbestos have filed for chapter 11 beginning with Johns Mansville 11

US Air Flight 1549 Sulley Sullenberger Airbus A 320 -214 N 10 GUS 12

1988 North Sea- Piper Alpha Platform Explosion many workers killed platform severely damaged. Equipment stacked near crew quarters Due to economic effort for more production 13

SEMPRA Energy Owners of San Diego Gas & Electric- SDGE 2007 Wildfires in California Have $1. 1 billion tower of liability insurance on aggregate basis and now totally consumed. 14

But in all my experience, I have never been in any accident… of any sort worth speaking about I have never seen but one vessel in distress in all my years at sea. I never saw a wreck and never have been wrecked nor was I ever in any predicament that threatened to end in any disaster of any sort. 15

EJ Smith Captain-Titanic 1907 16

We can add others not directly part of energy but which impact us all 9 -11 Enron AIG Banking system 2001 2008 2007 -08 We do live in a risky world 17

Retain and pay from internal funds n Control eliminate or minimize losses n Transfer usually by insurance but can include contractual transfer n 18

Insurance Buyer Insurance Manager Risk Manager Director of Risk Management Enterprise Risk Management Sustainability Risk Management 19

Risks we have failed to manage Banks Investment Houses Merrill Lynch Lehman Bros Bear Stearns All from Sub prime Credit Crises Mortgage valued securities CDO’s- Collateralized Debt Obligations Credit Default Swaps AIG- a subject all its own 20

ERM John Hampton- St Peters College COSO Failure 21

New Risks Cyber Liability Gamma- Ray Burst Nanotechnology Somalia Pirates Global Warming 22

http: //www. houstonpress. com/ 23

24

Raises questions How do we? When do we start? Can it make a difference? Should we start with education? 25

UH-GEMI: Founding Vision l A premier human-capital supplier for the energy industry. l A principal venue to join and develop issues of critical interest to the energy industry. l A research partner for the industry. 26

Major Educational Programs l Undergraduate Global Energy Management (GEM) Program l Graduate Energy Certificates l China GEMBA program 27

Global Energy Management (GEM) Program n GEM-Professional Program (Option to do a 5 year BBA/MS in Finance) n GEM-Track n Global Energy Management Minor 28

China GEMBA Program n EMBA program in Beijing and Houston for Senior SINOPEC and CNPC Executives on leadership track n Instruction by UH Faculty in Beijing; Students Come to Houston for a few courses & graduation 29

GEMI Conferences & Workshops n Energy Trading & Marketing n. Recent Trends in the Power Industry n. Petrochemicals & Refining n. Bio-fuels 30

Risk Management Scholarships Bauer- Annual 3 - Houston Marine Insurance Seminar 2 - Local Chapter RIMS 4 - Dedicated Endowments 31

New Courses Carbon Trading- January 2009 EMBA Petroleum Engineering. Degree Plan Fall 2009 32

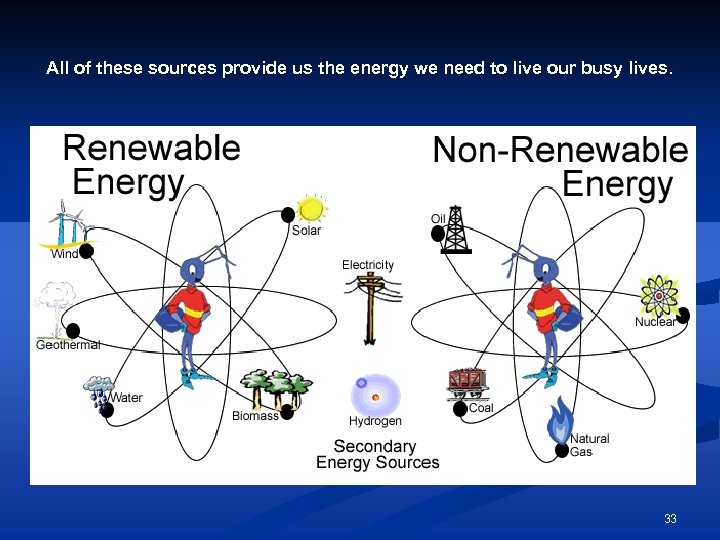

All of these sources provide us the energy we need to live our busy lives. 33

Tier I John Gresham- The Associate Bermuda Monetary Authority 34

Tier I- USA Texas – 3 UT, A&M, Rice California- 9 New York- 7 Research Funds $150 million plus 35

Tier One Committees 1. 2. 3. 4. 5. 6. National Competitiveness Student Success Community Involvement Athletic Competitiveness National and Local Recognition Resource Competitiveness 36

Tier One Contributions 5, 000+ new jobs n $129 million in wages to the regional economy n $7. 5 million in additional state revenue n $202 million in local sales n 37

Insurance Regulation State Regulation Federal Regulation Optional Regulation Insurance CZAR Candidate Opinions 38

Insurance Patriarchs Maurice (Hank) Greenberg Warren Buffet A third one as replacement 39

Is ERM the answer? Is RMI education the answer? Can Tier I help this conundrum? Can insurances continue “business as usual”? 40

Is the insurance market stable? Will the regulation applying to insurance, state vs. federal change? Will we have federal regulation? Will new leaders become known for the insurance industry? 41

Summary We all have risks Our challenge is to finance the losses that occur Risk management is the art of selection of the method(s) to pay We cannot eliminate all risk nor should we 42

Risk Assumption Assume risks that are comfortable and predictable Transfer those risks that could negatively impact your company Be mindful of the risk bearing capacity of your company There are limitations- one is Chapter 11 43

BP April 20, 2010 BP Blow out n Maccando Blow out n Deepwater Horizon Blow out n Vessell - $575, 000 n 11 deaths n 17 injured n 44

Gulf Issues/Energy BP Pollution Liability n Force Majors n Insurance n No Insurance n Available Limits n Inspections n Regulation n 45

Energy Insurance and Risk Management Finance 4397/7397 Professor Dan C. Jones C. T. Bauer College of Business

Risk financing vs. Risk management n Risk and the world n As a society, always sought to reduce uncertainty-tribes/clans n Business but an extension and risk is at heart of ALL business operation n Decisions cross borders and industries-harm to stakeholders n FINA 4397/7397 47

n n n n Language of risk & insurance Risk Speculative risk Pure risk New term-enterprise risk Management of Risks A process n n Identification and evaluation Exploration of Techniques Implementations and review Current Risk management n n FINA 4397/7397 Losses without gain Holistic approach 48

Fundamentals of risk & uncertainty n Risk- variation of outcomes n Uncertainty- the doubt from inability to predict future (outcomes) n Arises from risk n Add managers and becomes complicated n FINA 4397/7397 49

n n n Corporate demand for insurance Risk managers assumed risk neutral Assumption n n n FINA 4397/7397 Increasing wealth leads to inc. Satisfaction AND Marginal utility constant as wealth increases Individuals risk adverse but Owners / shareholders are not Investors require higher return if unable to diversify or systemic risk CAPM theory 50

n n n n FINA 4397/7397 Shareholder risk aversion does not explain why corporations buy insurance why? Insurance companies have comparative advantage Insurance can lower cost of financial distress Insurers may have service efficiencies Insurance can lower tax liabilities (property) Regulated industries have higher demand Compulsory insurance laws Financial consideration of stock price 51

n n n FINA 4397/7397 Practitioners increasingly taking holistic approach Conceptual and applied economic knowledge continues to expand Private markets can not deal with some societal risks Publicly traded companies undergoing evolutionary changes Resources committed to understanding capacity of capital markets A challenge for ALL 52

Economic development n Benefits n More competitive n Better values n Shareholder value increased n Cash flow leveling n Reduces insolvency n Expands credit availability n Loss control / risk control n n FINA 4397/7397 Reduced costs results and better able to compete 53

n n n Property rights and economic freedom Right to own real & personal property Right to enter into contracts Right to be compensated for tortious acts Needed n n FINA 4397/7397 A system and a means to enforce Markets are means of exchanging property rights Insurance can not function without defined ownership interests Restrictive - monopolies, insider trading 54

Hard market n Soft market n Hurricane Andrew n 9/11 n Today n FINA 4397/7397 55

n n n Value of insurance company services Pricing, underwriting, claims handling Pricing - statisticians / actuaries Time lag of loss payments and premium payments Competitive premium is of expected losses, expenses, profit Investment return n FINA 4397/7397 Life companies -calculable Non-life - long tail claims Government treatment 56

n n Internationalization of business creates internationalization of financial services No one market can provide all needed coverage n n n n FINA 4397/7397 Oil refineries Oil tankers Off shore rigs Satellites Jumbo jets Environmental impairment National markets benefit Increase competitiveness 57

The financial environment n Finance and insurance have much in common n Each provide its customers tools for managing risks AND n Valuation methods are the same n Fair value of the security n An insurance policy n Based on discounted cash value of future cash flows n FINA 4397/7397 58

Same definition of risk- the variation of future results from expected values n Rely on same fundamental concepts n Risk pooling n Risk transfer n n FINA 4397/7397 Therefore we have convergence as insurance company managers, owners and customers must recognize and understand 59

Risk management fundamentals n What is risk? n Is risk different if building a new plant in Jakarta? n Currency n Language n Training / hiring n Laws n n Separate Hazard risk management n Financial risk management n FINA 4397/7397 60

Objective of risk management - to contribute to a firms value n Factors n Unmanaged risk reduce value of firm n With increase in risk, cost of doing business increases n Results in lower levels expected cash flow n n Reciprocal is that Reducing risk increases cash flow n Increases value of firm n FINA 4397/7397 61

n Risk assessment Identification of exposure n Analyzing to determine potential impact n n Assets subject to loss Tangible, intangible, human n The analysis should answer n n What assets are exposed n What perils can cause harm n What are potential consequences FINA 4397/7397 62

n n Financial loss Property n n Net income losses (revenue less expenses) n n n FINA 4397/7397 Real property Personal property Intangible property Fire losses Auto accident Employee injury Magnitude function of revenue decrease Insurance terms - time element or business interruption because it is time dependent 63

Liability losses n Occur when parties assert legal rights n Many types - mostly civil in nature n Defective products n Environmental impairment n Injury to employees n Breach of contract n Profession errors or omissions n n FINA 4397/7397 Huge cost associated with defense even if no liability 64

n Personnel losses - human assets Injury n Disability n Death n Retirement n Resignation n Kidnapping n n FINA 4397/7397 Which consumes most time? 65

n n n External influences broadening scope of risks Globalization Industry consolidation Deregulation Regulatory attention to corporate governance n n Sarbanes-Oxley Technological progress enabling better risk quantification and analysis FINA 4397/7397 66

Internal Factors n Increased firm value – the emphasis Reduces inefficiencies inherent in traditional approach n Improving capital efficiencies n Stabilize earnings n Reduce expected costs of external capital n FINA 4397/7397 67

Forces Creating Uncertainty n n n n FINA 4397/7397 Technology and Internet Increased worldwide competition Freer trade and investment worldwide Complex financial instruments, notably derivatives Deregulation of key industries Changes in organizational structures resulting from downsizing, reengineering, and mergers Higher customer expectations for products and services More and larger mergers 68

Enterprise Risk Management (ERM) n Synonymous with: n Integrated Risk Management (IRM) n Holistic Risk Management n Enterprise-wide Risk Management n Strategic Risk Management n FINA 4397/7397 69

Alternatives to Insurance n n n Retentions Self Insurance Captives Mutual Company Industry developments as alternative n n Weather Loss portfolio transfer Finite Securitization FINA 4397/7397 70

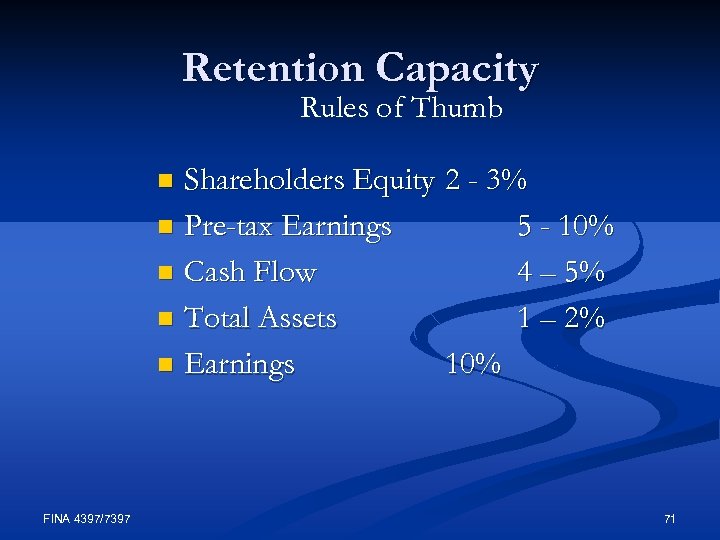

Retention Capacity Rules of Thumb Shareholders Equity 2 - 3% n Pre-tax Earnings 5 - 10% n Cash Flow 4 – 5% n Total Assets 1 – 2% n Earnings 10% n FINA 4397/7397 71

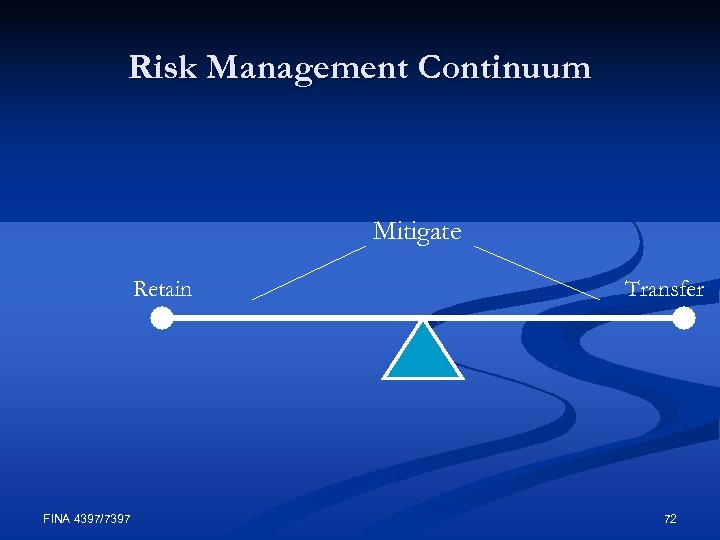

Risk Management Continuum Mitigate Retain FINA 4397/7397 Transfer 72

Lets see how well we have done FINA 4397/7397 73

n 1937 – New London, Texas Natural Gas explosion is school over 200 killed n Now use t-butyl mercaptan or thioplane n FINA 4397/7397 74

n 1989 – Exxon Valdez Spilled 10. 8 million gallon of crude of coast of Alaska, Prince William Sound n Now require double hull crude carriers in all US ports n March 2009 Korean vessel found a drilling rig lost after IKE, Double Hull prevented any spill n FINA 4397/7397 75

n 2004 – Explosion BP plant Texas City n Extensive damage. BP admitted fault but ignition came during recovery cycle but fatalities due to location of work trailers FINA 4397/7397 76

n 2005 – Hurricane Katrina & Rita Failure of flood gates New Orleans n Inadequate wave clearance & offshore platforms for class 5 storm n Inadequate response FEMA n FINA 4397/7397 77

n 2008 – Hurricane Ike Class 2 winds offshore n Class 5 storm surge Galveston Bay and Trinity Bay n Now referred to as Integrated Kinetic Energy n Over 2, 000 million customers lost power. n Unforeseen especially by Center. Point. n FINA 4397/7397 78

n 1984 - Bhopal India- Union Carbide pesticide plant 300 killed, thousands injured release of 42 tons of methyl isocyanate n Plant was not following safety and operating guidelines of Union Carbide n FINA 4397/7397 79

n 1986 Chernobyl, Ukraine explosion released more than 400 times the radioactivity than with atomic bombing of Hiroshima n Built a sarcophagus a cover for the reactor n That and Three Mile Island incident stopped any nuclear construction, in US in 1970’s. n Now 4 projects being considered in Texas n FINA 4397/7397 80

n 2002 n n n n n Approved repository site in Yucca Mountain Nevada Operational 2010, to be sealed 2035 Repository in solid rock 1000 feet underground and on average 1000 feet above water table Holds 77000 metric tons of waste Plulonuim-239 has half life of 24000 years Cost $9 billion 2010 budget includes no funding for Yucca Mountain Present 100 nuclear plants-20% of electricity 30 plants in planning stage FINA 4397/7397 81

Asbestos- Alaska Pipe Line recognition Asbestosis and mesothelioma but was used in shipbuilding in 1940’s n Used by the Ancient Greeks because of its soft and pliant properties- the miracle mineral n Over 80 companies involved with asbestos have filed for chapter 11 beginning with Johns Mansville n FINA 4397/7397 82

US Air Flight 1549 n Sulley Sullenberger n Airbus A 320 -214 n N 10 GUS n FINA 4397/7397 83

n 1988 North Sea- Piper Alpha Platform n Explosion many workers killed platform severely damaged. n Equipment stacked near crew quarters n Due to economic effort for more production n FINA 4397/7397 84

SEMPRA Energy Owners of San Diego Gas & Electric- SDGE n 2007 Wildfires in California n Have $1. 1 billion tower of liability insurance on aggregate basis and now totally consumed. n FINA 4397/7397 85

But in all my experience, I have never been in any accident… of any sort worth speaking about I have never seen but one vessel in distress in all my years at sea. I never saw a wreck and never have been wrecked nor was I ever in any predicament that threatened to end in any disaster of any sort. FINA 4397/7397 86

EJ Smith n Captain-Titanic n 1907 n FINA 4397/7397 87

We can add others not directly part of energy but which impact us all 9 -11 2001 Enron 2001 AIG 2008 Banking system 2007 -08 We do live in a risky world FINA 4397/7397 88

4a77a03a454d245796cb9a47a3c2ede9.ppt