ef7be5ca76ac4fc94899a9014cd15603.ppt

- Количество слайдов: 21

Risk and Chances for the Lime Industry through the European Emissions Trading System Dipl. -Ing. Andreas von Saldern, ESolutions Gmb. H, Germany 1

Risk and Chances for the Lime Industry through the European Emissions Trading System Dipl. -Ing. Andreas von Saldern, ESolutions Gmb. H, Germany 1

Since 2005 European Emissions Trading System EUAs CO 2 10. 000 Installations 2 CO CO 2 2

Since 2005 European Emissions Trading System EUAs CO 2 10. 000 Installations 2 CO CO 2 2

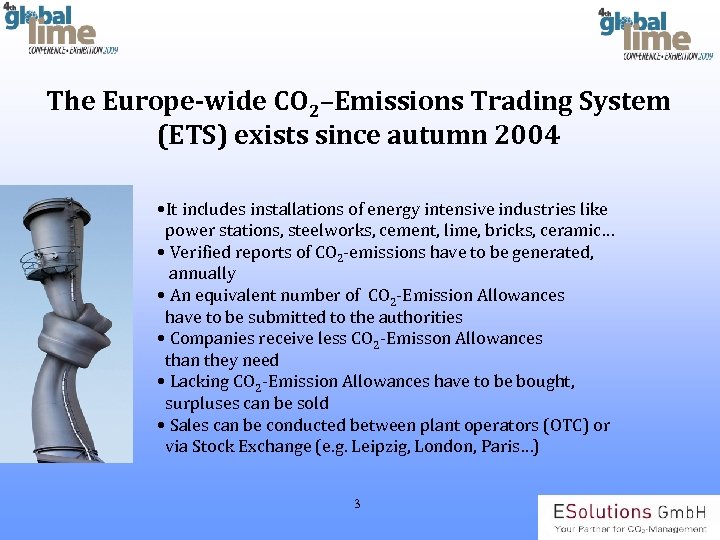

The Europe-wide CO 2–Emissions Trading System (ETS) exists since autumn 2004 • It includes installations of energy intensive industries like power stations, steelworks, cement, lime, bricks, ceramic… • Verified reports of CO 2 -emissions have to be generated, annually • An equivalent number of CO 2 -Emission Allowances have to be submitted to the authorities • Companies receive less CO 2 -Emisson Allowances than they need • Lacking CO 2 -Emission Allowances have to be bought, surpluses can be sold • Sales can be conducted between plant operators (OTC) or via Stock Exchange (e. g. Leipzig, London, Paris…) 3

The Europe-wide CO 2–Emissions Trading System (ETS) exists since autumn 2004 • It includes installations of energy intensive industries like power stations, steelworks, cement, lime, bricks, ceramic… • Verified reports of CO 2 -emissions have to be generated, annually • An equivalent number of CO 2 -Emission Allowances have to be submitted to the authorities • Companies receive less CO 2 -Emisson Allowances than they need • Lacking CO 2 -Emission Allowances have to be bought, surpluses can be sold • Sales can be conducted between plant operators (OTC) or via Stock Exchange (e. g. Leipzig, London, Paris…) 3

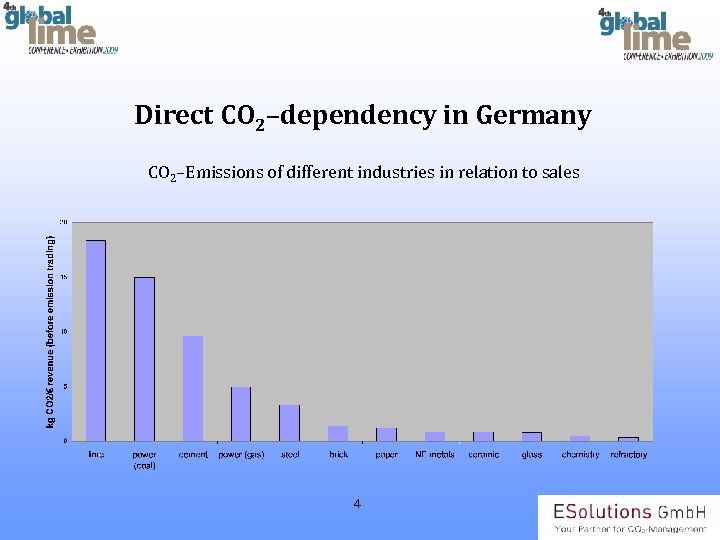

Direct CO 2–dependency in Germany CO 2–Emissions of different industries in relation to sales 4

Direct CO 2–dependency in Germany CO 2–Emissions of different industries in relation to sales 4

Trading Periods • the first trading period lasted 3 years, from 2005 -2007 • the second trading period lasts 5 years, from 2008 -2012 and • the third period will last 8 years, from 2013 -2020. The basic rules have been fixed for the third period, some important details will be determinied in 2009 and 2010 Ø Reduction Target by the end of 2020: Setting I: -21% compared to the emissions of 2005 Setting II: -30% if an ambitious Kioto II agreement will passed 5

Trading Periods • the first trading period lasted 3 years, from 2005 -2007 • the second trading period lasts 5 years, from 2008 -2012 and • the third period will last 8 years, from 2013 -2020. The basic rules have been fixed for the third period, some important details will be determinied in 2009 and 2010 Ø Reduction Target by the end of 2020: Setting I: -21% compared to the emissions of 2005 Setting II: -30% if an ambitious Kioto II agreement will passed 5

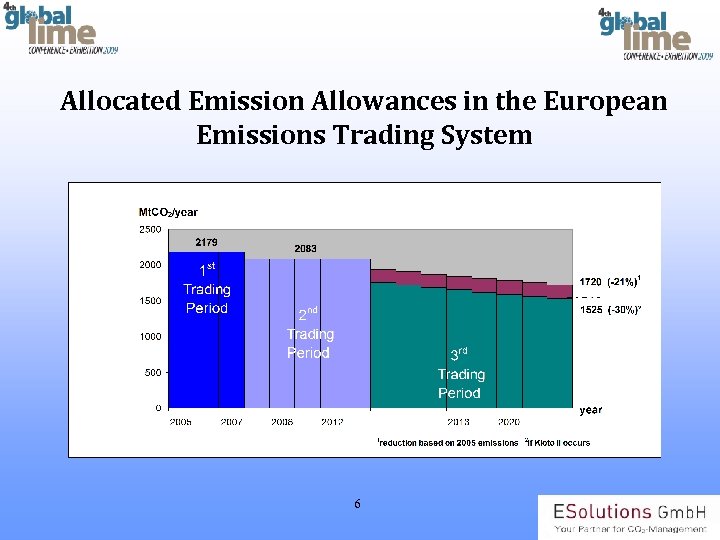

Allocated Emission Allowances in the European Emissions Trading System 6

Allocated Emission Allowances in the European Emissions Trading System 6

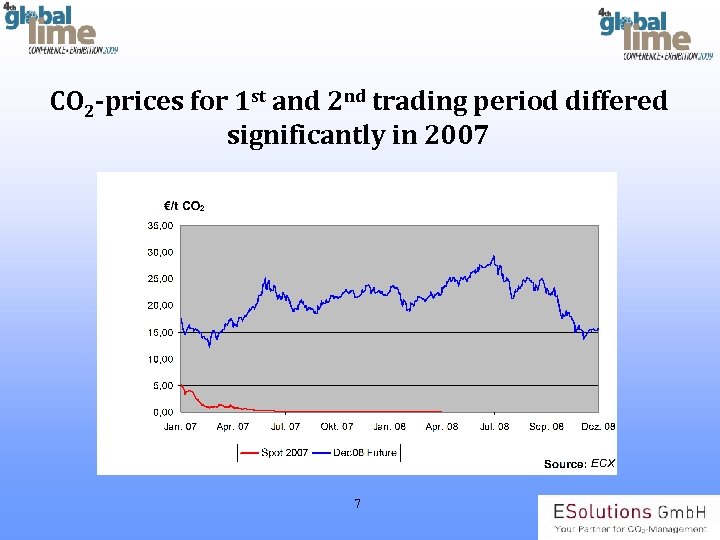

CO 2 -prices for 1 st and 2 nd trading period differed significantly in 2007 7

CO 2 -prices for 1 st and 2 nd trading period differed significantly in 2007 7

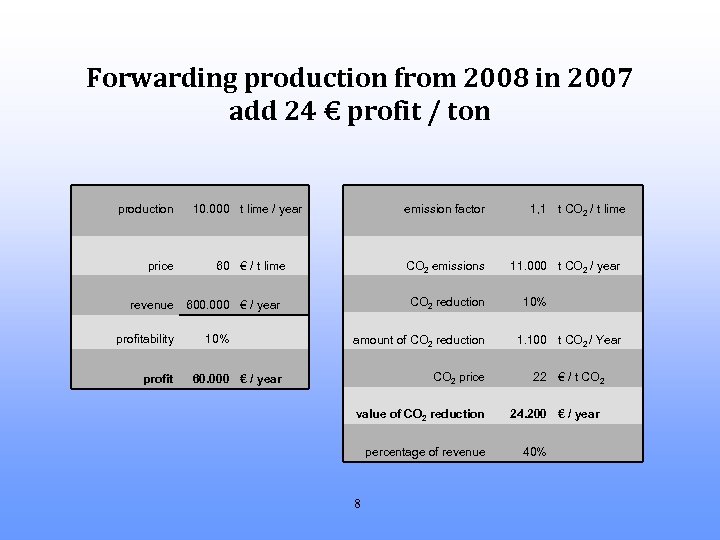

Forwarding production from 2008 in 2007 add 24 € profit / ton production price revenue profitability profit 10. 000 t lime / year emission factor 60 € / t lime CO 2 emissions CO 2 reduction 600. 000 € / year 10% amount of CO 2 reduction CO 2 price 60. 000 € / year value of CO 2 reduction percentage of revenue 8 1, 1 t CO 2 / t lime 11. 000 t CO 2 / year 10% 1. 100 t CO 2 / Year 22 € / t CO 2 24. 200 € / year 40%

Forwarding production from 2008 in 2007 add 24 € profit / ton production price revenue profitability profit 10. 000 t lime / year emission factor 60 € / t lime CO 2 emissions CO 2 reduction 600. 000 € / year 10% amount of CO 2 reduction CO 2 price 60. 000 € / year value of CO 2 reduction percentage of revenue 8 1, 1 t CO 2 / t lime 11. 000 t CO 2 / year 10% 1. 100 t CO 2 / Year 22 € / t CO 2 24. 200 € / year 40%

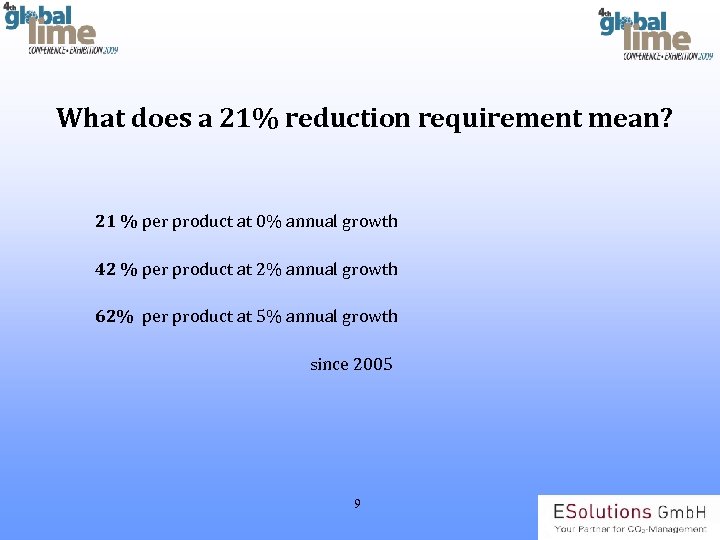

What does a 21% reduction requirement mean? 21 % per product at 0% annual growth 42 % per product at 2% annual growth 62% per product at 5% annual growth since 2005 9

What does a 21% reduction requirement mean? 21 % per product at 0% annual growth 42 % per product at 2% annual growth 62% per product at 5% annual growth since 2005 9

Current number of installation covered through the European Emission Trading System Countries Number of Installations Austria 31 Belgium 294 Czech Republic 394 Denmark 374 Estonia 50 Finland 572 France 1004 Greece 141 Germany 1665 Italy 934 Ireland 106 Latvia 73 Lithuania 98 Luxembourg 14 Malta 2 Netherlands 341 Portugal 212 Romania 217 Slovenia 89 Spain 1006 Sweden 743 United Kingdom 925 EU (total) 10 9285

Current number of installation covered through the European Emission Trading System Countries Number of Installations Austria 31 Belgium 294 Czech Republic 394 Denmark 374 Estonia 50 Finland 572 France 1004 Greece 141 Germany 1665 Italy 934 Ireland 106 Latvia 73 Lithuania 98 Luxembourg 14 Malta 2 Netherlands 341 Portugal 212 Romania 217 Slovenia 89 Spain 1006 Sweden 743 United Kingdom 925 EU (total) 10 9285

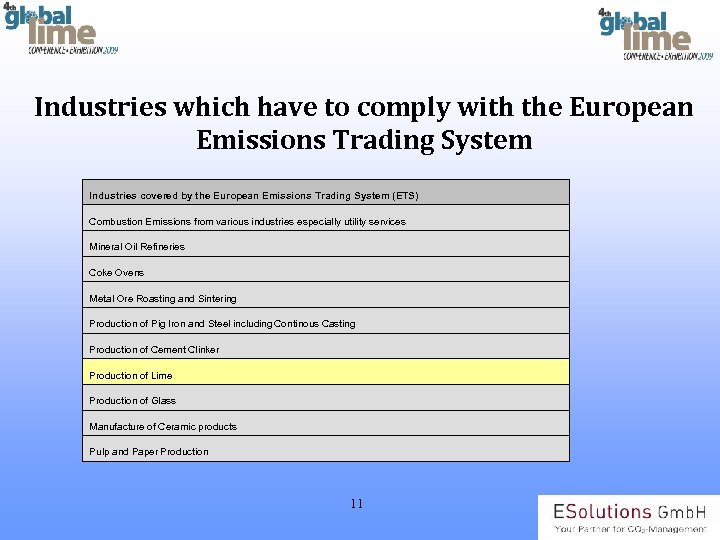

Industries which have to comply with the European Emissions Trading System Industries covered by the European Emissions Trading System (ETS) Combustion Emissions from various industries especially utility services Mineral Oil Refineries Coke Ovens Metal Ore Roasting and Sintering Production of Pig Iron and Steel including Continous Casting Production of Cement Clinker Production of Lime Production of Glass Manufacture of Ceramic products Pulp and Paper Production 11

Industries which have to comply with the European Emissions Trading System Industries covered by the European Emissions Trading System (ETS) Combustion Emissions from various industries especially utility services Mineral Oil Refineries Coke Ovens Metal Ore Roasting and Sintering Production of Pig Iron and Steel including Continous Casting Production of Cement Clinker Production of Lime Production of Glass Manufacture of Ceramic products Pulp and Paper Production 11

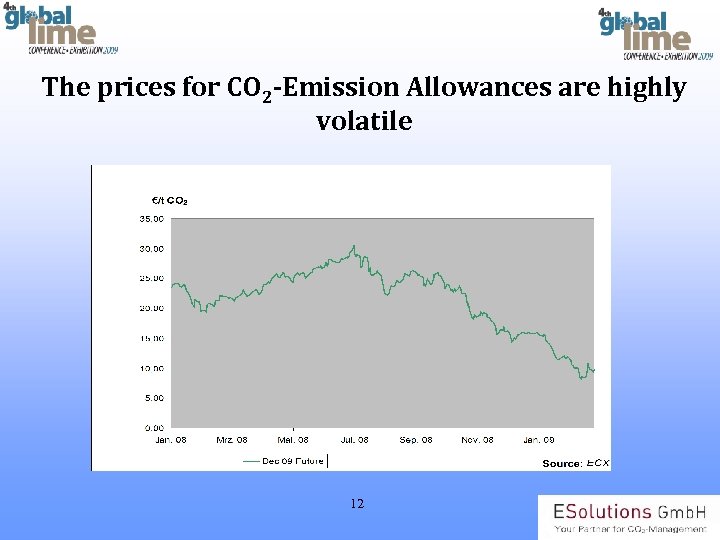

The prices for CO 2 -Emission Allowances are highly volatile 12

The prices for CO 2 -Emission Allowances are highly volatile 12

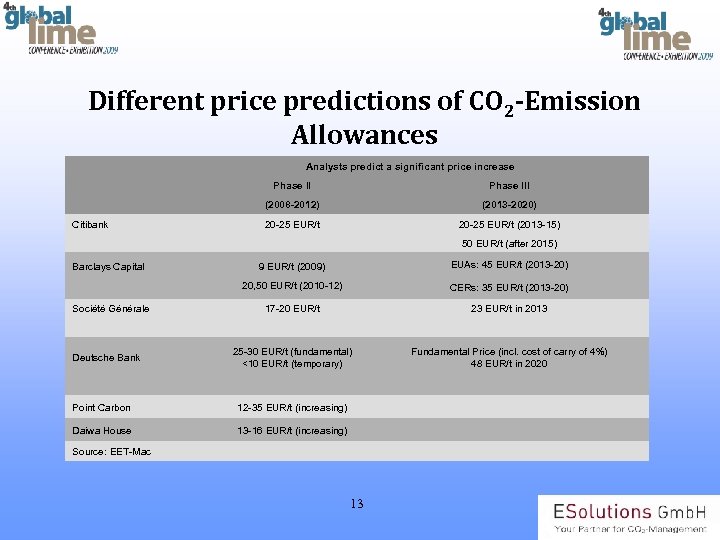

Different price predictions of CO 2 -Emission Allowances Analysts predict a significant price increase Phase III (2008 -2012) (2013 -2020) Citibank 20 -25 EUR/t (2013 -15) 50 EUR/t (after 2015) Barclays Capital 9 EUR/t (2009) EUAs: 45 EUR/t (2013 -20) 20, 50 EUR/t (2010 -12) CERs: 35 EUR/t (2013 -20) Société Générale 17 -20 EUR/t 23 EUR/t in 2013 25 -30 EUR/t (fundamental) <10 EUR/t (temporary) Point Carbon Fundamental Price (incl. cost of carry of 4%) 48 EUR/t in 2020 12 -35 EUR/t (increasing) Daiwa House 13 -16 EUR/t (increasing) Source: EET-Mac Deutsche Bank 13

Different price predictions of CO 2 -Emission Allowances Analysts predict a significant price increase Phase III (2008 -2012) (2013 -2020) Citibank 20 -25 EUR/t (2013 -15) 50 EUR/t (after 2015) Barclays Capital 9 EUR/t (2009) EUAs: 45 EUR/t (2013 -20) 20, 50 EUR/t (2010 -12) CERs: 35 EUR/t (2013 -20) Société Générale 17 -20 EUR/t 23 EUR/t in 2013 25 -30 EUR/t (fundamental) <10 EUR/t (temporary) Point Carbon Fundamental Price (incl. cost of carry of 4%) 48 EUR/t in 2020 12 -35 EUR/t (increasing) Daiwa House 13 -16 EUR/t (increasing) Source: EET-Mac Deutsche Bank 13

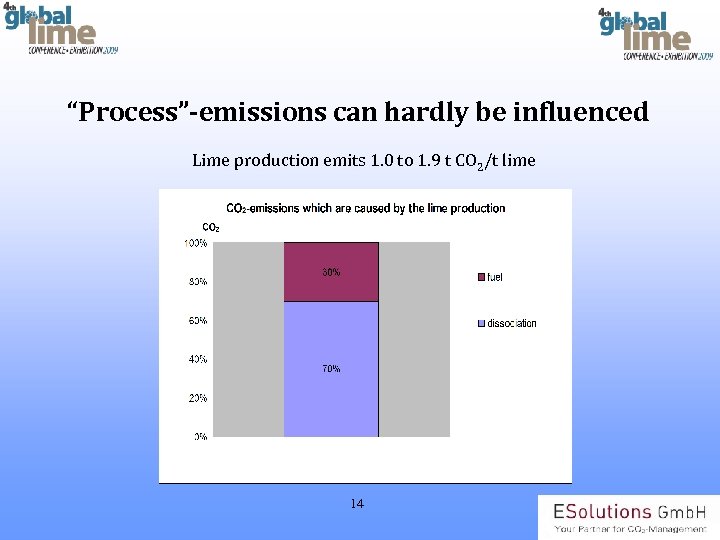

“Process”-emissions can hardly be influenced Lime production emits 1. 0 to 1. 9 t CO 2/t lime 14

“Process”-emissions can hardly be influenced Lime production emits 1. 0 to 1. 9 t CO 2/t lime 14

The duties of enterprises which have to comply with the European Emissions Trading System include: • Monitor their CO 2 -emissions • Compose an annual CO 2 -emissions report • Let the report be verified through an external accredited verifier • Submit an according number of CO 2 -Emission Allowances 15

The duties of enterprises which have to comply with the European Emissions Trading System include: • Monitor their CO 2 -emissions • Compose an annual CO 2 -emissions report • Let the report be verified through an external accredited verifier • Submit an according number of CO 2 -Emission Allowances 15

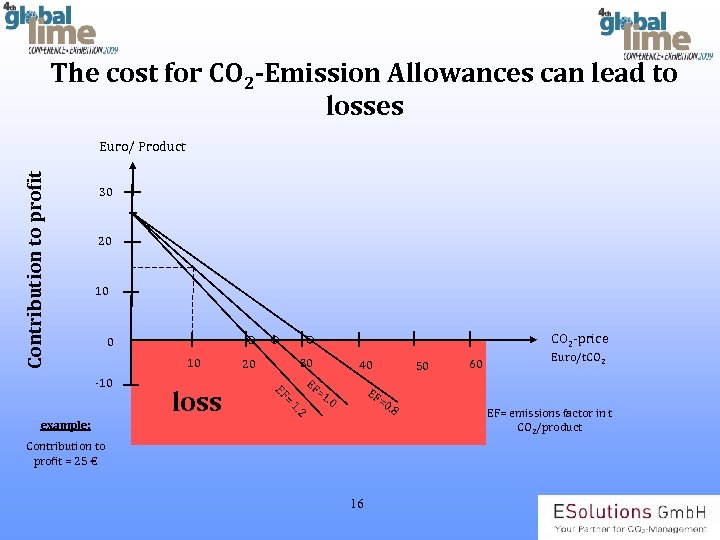

The cost for CO 2 -Emission Allowances can lead to losses Contribution to profit Euro/ Product 30 20 10 CO 2 -price 0 10 -10 40 EF = EF 2 1. example: loss 30 20 =1. 0 EF 50 =0 Contribution to profit = 25 € 16 . 8 60 Euro/t. CO 2 EF= emissions factor in t CO 2/product

The cost for CO 2 -Emission Allowances can lead to losses Contribution to profit Euro/ Product 30 20 10 CO 2 -price 0 10 -10 40 EF = EF 2 1. example: loss 30 20 =1. 0 EF 50 =0 Contribution to profit = 25 € 16 . 8 60 Euro/t. CO 2 EF= emissions factor in t CO 2/product

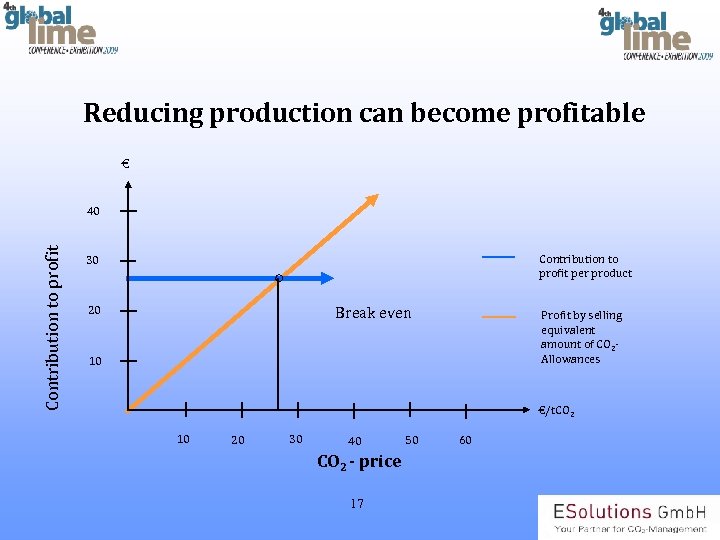

Reducing production can become profitable € Contribution to profit 40 Contribution to profit per product 30 20 Break even Profit by selling equivalent amount of CO 2 Allowances 10 €/t. CO 2 10 20 30 40 CO 2 - price 17 50 60

Reducing production can become profitable € Contribution to profit 40 Contribution to profit per product 30 20 Break even Profit by selling equivalent amount of CO 2 Allowances 10 €/t. CO 2 10 20 30 40 CO 2 - price 17 50 60

What impact does a 10% CO 2 reduction have ? 10% reduction of CO 2 would lead to 40% increase of profit • At a price of 22 € / t CO 2 (average 2008) • 1 t CO 2 / t lime • at 10% profitability (profit / revenue) 18

What impact does a 10% CO 2 reduction have ? 10% reduction of CO 2 would lead to 40% increase of profit • At a price of 22 € / t CO 2 (average 2008) • 1 t CO 2 / t lime • at 10% profitability (profit / revenue) 18

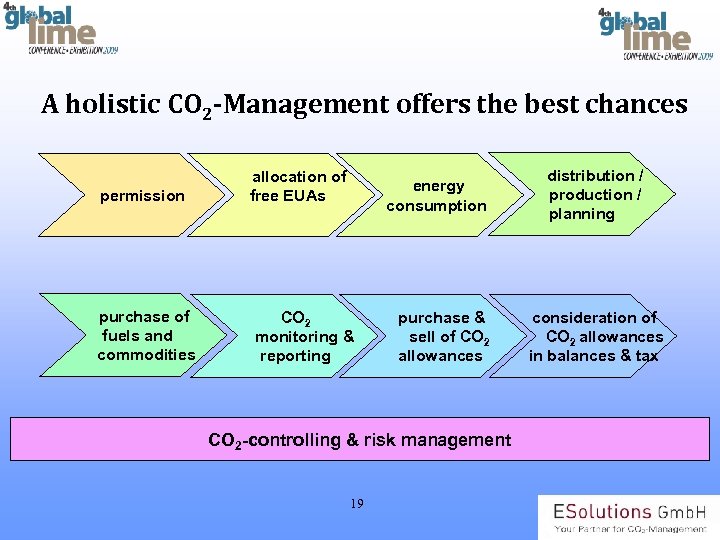

A holistic CO 2 -Management offers the best chances permission purchase of fuels and commodities allocation of free EUAs energy consumption CO 2 monitoring & reporting purchase & sell of CO 2 allowances CO 2 -controlling & risk management 19 distribution / production / planning consideration of CO 2 allowances in balances & tax

A holistic CO 2 -Management offers the best chances permission purchase of fuels and commodities allocation of free EUAs energy consumption CO 2 monitoring & reporting purchase & sell of CO 2 allowances CO 2 -controlling & risk management 19 distribution / production / planning consideration of CO 2 allowances in balances & tax

The CO 2 -Emissions Trading System offer new opportunities - Harvest them! 20

The CO 2 -Emissions Trading System offer new opportunities - Harvest them! 20

Contacts: Dipl. -Ing. Andreas von Saldern CEO / Accredited Environmental Verifier Dr. oec. Susanne Achilles-Kuhnhardt Director Sales and Marketing Schoppastraße 2 D-65719 Hofheim a. Ts. , Germany Close to Frankfurt Airport Phone: +49 (6192) 921 99 – 10 Mobile: +49 (170) 911 84 23 Reinhardtstraße 23 · D-10117 Berlin Phone: Mobile: +49 (30) 88 66 37 80 +49 (171) 33 55 377 E-Mail: Internet: susanne. kuhnhardt@esolutions. eu www. esolutions. eu saldern@esolutions. eu www. esolutions. eu 21

Contacts: Dipl. -Ing. Andreas von Saldern CEO / Accredited Environmental Verifier Dr. oec. Susanne Achilles-Kuhnhardt Director Sales and Marketing Schoppastraße 2 D-65719 Hofheim a. Ts. , Germany Close to Frankfurt Airport Phone: +49 (6192) 921 99 – 10 Mobile: +49 (170) 911 84 23 Reinhardtstraße 23 · D-10117 Berlin Phone: Mobile: +49 (30) 88 66 37 80 +49 (171) 33 55 377 E-Mail: Internet: susanne. kuhnhardt@esolutions. eu www. esolutions. eu saldern@esolutions. eu www. esolutions. eu 21