39f816cfe718c28bd7dc0274b23f5f63.ppt

- Количество слайдов: 54

Ripoll, Henry and Cooper - impacts on advisers and advice • Graeme Colley • National Technical Manager • May 2010 • www. ing. com. au

Ripoll, Henry and Cooper - impacts on advisers and advice • Graeme Colley • National Technical Manager • May 2010 • www. ing. com. au

Government enquiries: • Ripoll • Johnson • Henry • Cooper 2

Government enquiries: • Ripoll • Johnson • Henry • Cooper 2

Main Impacts • Ripoll • • Disclosure • • Impact on the accountants exemption and SMSFs Retail or wholesale clients Henry • Changes to superannuation contributions • • SG Contribution caps; and Low income earners Cooper • Structure • Competency • Education • Regulation and education 3

Main Impacts • Ripoll • • Disclosure • • Impact on the accountants exemption and SMSFs Retail or wholesale clients Henry • Changes to superannuation contributions • • SG Contribution caps; and Low income earners Cooper • Structure • Competency • Education • Regulation and education 3

Ripoll

Ripoll

The future of financial advice • Ban on conflicted remuneration structures • Adviser charging regime • Statutory fiduciary duty • Other initiatives 5

The future of financial advice • Ban on conflicted remuneration structures • Adviser charging regime • Statutory fiduciary duty • Other initiatives 5

The future of financial advice • Chris Bowen released “The Future of Financial Advice” on 26 April 2010 • Provides details of the Government’s proposed response to the Ripoll Inquiry’s (PJC Inquiry into Financial Products and Services) recommendations • Government’s response guided by two overriding principles: • Financial advice must be in the best interest of clients • Financial advice should not be put of reach of those who would benefit from it • Legislation required to implement these reforms • Government has indicated it will consult with stakeholders 6

The future of financial advice • Chris Bowen released “The Future of Financial Advice” on 26 April 2010 • Provides details of the Government’s proposed response to the Ripoll Inquiry’s (PJC Inquiry into Financial Products and Services) recommendations • Government’s response guided by two overriding principles: • Financial advice must be in the best interest of clients • Financial advice should not be put of reach of those who would benefit from it • Legislation required to implement these reforms • Government has indicated it will consult with stakeholders 6

Ban on conflicted remuneration structures • The Government has proposed a prospective ban on: • All commission payments from any financial services business, relating to the distribution and provision of advice for retail financial products • Any form of payment relating to volume or sales targets relating to the distribution and provision of advice for retail financial products • Percentage based fees can only be charged on ungeared products or investment amounts • Ban applies to all financial products (including managed investments, superannuation and margin loans) but does not initially apply to risk insurance • Further consultation is expected around potentially extending the ban to risk insurance • The ban does not initially apply to soft-dollar benefits • Further consultation will be undertaken around the best way to ban material soft-dollar payments • These measures proposed to apply from 1 July 2012 7

Ban on conflicted remuneration structures • The Government has proposed a prospective ban on: • All commission payments from any financial services business, relating to the distribution and provision of advice for retail financial products • Any form of payment relating to volume or sales targets relating to the distribution and provision of advice for retail financial products • Percentage based fees can only be charged on ungeared products or investment amounts • Ban applies to all financial products (including managed investments, superannuation and margin loans) but does not initially apply to risk insurance • Further consultation is expected around potentially extending the ban to risk insurance • The ban does not initially apply to soft-dollar benefits • Further consultation will be undertaken around the best way to ban material soft-dollar payments • These measures proposed to apply from 1 July 2012 7

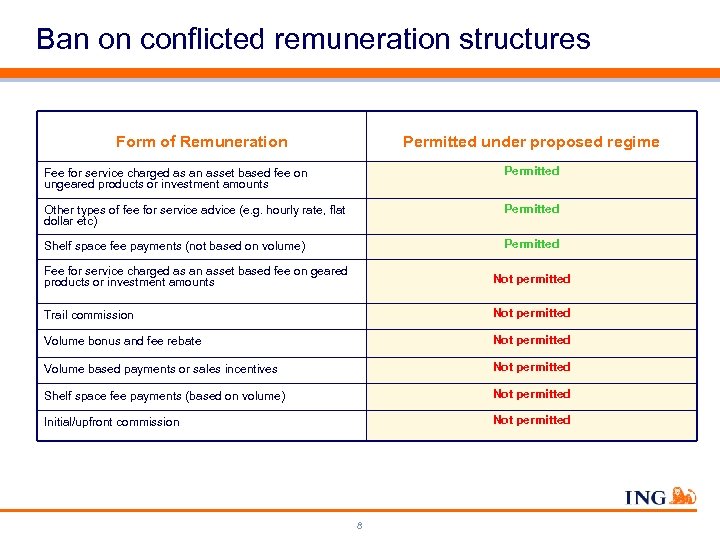

Ban on conflicted remuneration structures Form of Remuneration Permitted under proposed regime Fee for service charged as an asset based fee on ungeared products or investment amounts Permitted Other types of fee for service advice (e. g. hourly rate, flat dollar etc) Permitted Shelf space fee payments (not based on volume) Permitted Fee for service charged as an asset based fee on geared products or investment amounts Not permitted Trail commission Not permitted Volume bonus and fee rebate Not permitted Volume based payments or sales incentives Not permitted Shelf space fee payments (based on volume) Not permitted Initial/upfront commission Not permitted 8

Ban on conflicted remuneration structures Form of Remuneration Permitted under proposed regime Fee for service charged as an asset based fee on ungeared products or investment amounts Permitted Other types of fee for service advice (e. g. hourly rate, flat dollar etc) Permitted Shelf space fee payments (not based on volume) Permitted Fee for service charged as an asset based fee on geared products or investment amounts Not permitted Trail commission Not permitted Volume bonus and fee rebate Not permitted Volume based payments or sales incentives Not permitted Shelf space fee payments (based on volume) Not permitted Initial/upfront commission Not permitted 8

Adviser charging regime • A new regime for charging of adviser fees • Will, in part, override the proposed operation of the IFSA Super Member Charter and the FPA Financial Planner Remuneration standard • Advisers will be required to agree their fees directly with clients • Charging structure to be disclosed in a clear manner • Adviser charges to be disclosed in dollar terms • Fees can be deducted from the client’s investment • Initial fees can be charged upfront or a “payment plan” • Initial fees could be paid over an extended period • Ongoing fees require express annual renewal by the client • These measures to apply from 1 July 2012 9

Adviser charging regime • A new regime for charging of adviser fees • Will, in part, override the proposed operation of the IFSA Super Member Charter and the FPA Financial Planner Remuneration standard • Advisers will be required to agree their fees directly with clients • Charging structure to be disclosed in a clear manner • Adviser charges to be disclosed in dollar terms • Fees can be deducted from the client’s investment • Initial fees can be charged upfront or a “payment plan” • Initial fees could be paid over an extended period • Ongoing fees require express annual renewal by the client • These measures to apply from 1 July 2012 9

Statutory fiduciary duty • Statutory fiduciary duty for AFSLs and authorised representatives requiring them to act in the best interests of their clients • In no circumstances is it permissible for advisers to place their own interests ahead of their clients’ interests • Will include a “reasonable steps” qualification • Allows an adviser to take “reasonable steps” to discharge their duty • Will not require an assessment of every single product in the market • If an adviser cannot recommend a product that is in the best interests of the client from their own APL then the fiduciary duty may require them to search beyond the APL or advise the client to see another adviser • This measure to apply from 1 July 2012 10

Statutory fiduciary duty • Statutory fiduciary duty for AFSLs and authorised representatives requiring them to act in the best interests of their clients • In no circumstances is it permissible for advisers to place their own interests ahead of their clients’ interests • Will include a “reasonable steps” qualification • Allows an adviser to take “reasonable steps” to discharge their duty • Will not require an assessment of every single product in the market • If an adviser cannot recommend a product that is in the best interests of the client from their own APL then the fiduciary duty may require them to search beyond the APL or advise the client to see another adviser • This measure to apply from 1 July 2012 10

Other initiatives • Accountants licensing exemption on SMSF advice to be removed • Expansion of intra-fund advice measures to include: • • • TTR Intra-pension advice Nomination of beneficiaries Super and Centrelink payments Retirement planning • FSGs to more effectively disclose material restrictions on advice, any potential conflicts of interest and remuneration structures • Enhanced powers for ASIC in relation to licensing and banning of individuals • Expert review of the need for a statutory compensation scheme 11

Other initiatives • Accountants licensing exemption on SMSF advice to be removed • Expansion of intra-fund advice measures to include: • • • TTR Intra-pension advice Nomination of beneficiaries Super and Centrelink payments Retirement planning • FSGs to more effectively disclose material restrictions on advice, any potential conflicts of interest and remuneration structures • Enhanced powers for ASIC in relation to licensing and banning of individuals • Expert review of the need for a statutory compensation scheme 11

Henry

Henry

Rumours and innuendo 13

Rumours and innuendo 13

Rumours that did not eventuate • Adding the value of your home to your assets when working out your age pension entitlement • Death taxes (taxes payable by an estate) • Land tax payable on your family home • Ending dividend imputation • Immediately increasing the GST • Abolishing tax free super for over 60 s • Any other major changes to the age pension 14

Rumours that did not eventuate • Adding the value of your home to your assets when working out your age pension entitlement • Death taxes (taxes payable by an estate) • Land tax payable on your family home • Ending dividend imputation • Immediately increasing the GST • Abolishing tax free super for over 60 s • Any other major changes to the age pension 14

Government response 15

Government response 15

No super tax on mynas 16

No super tax on mynas 16

Proposals post Henry review - super • Increase SG rate to 12% • Raise the maximum SG age from 70 to 75 • Low income earners Government contribution • Maintaining the higher concessional contribution cap 17

Proposals post Henry review - super • Increase SG rate to 12% • Raise the maximum SG age from 70 to 75 • Low income earners Government contribution • Maintaining the higher concessional contribution cap 17

SG changes 1. Increase age limit for SG from 70 to 75 2. Incrementally increase the SG rate to 12%, starting in 2013/14 18

SG changes 1. Increase age limit for SG from 70 to 75 2. Incrementally increase the SG rate to 12%, starting in 2013/14 18

Superannuation Guarantee increase Year Rate 2013 -14 9. 25% 2014 -15 9. 5% 2015 -16 10% 2016 -17 10. 5% 2017 -18 11% 2018 -19 11. 5% 2019 -20 12% 19

Superannuation Guarantee increase Year Rate 2013 -14 9. 25% 2014 -15 9. 5% 2015 -16 10% 2016 -17 10. 5% 2017 -18 11% 2018 -19 11. 5% 2019 -20 12% 19

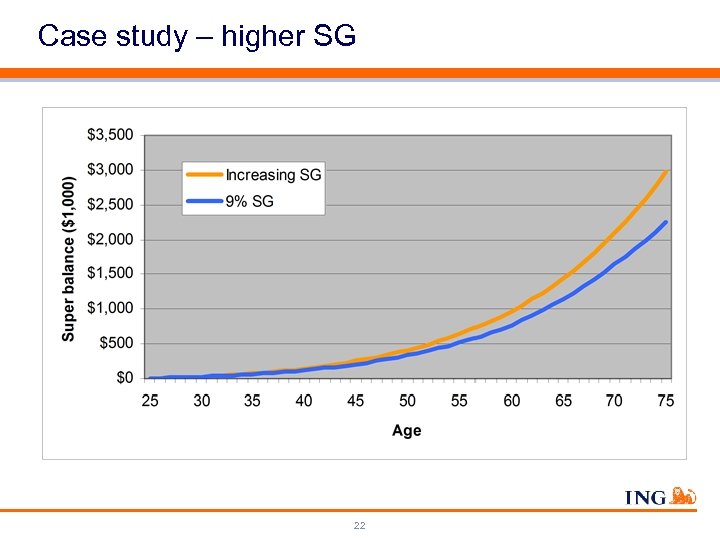

Case study – higher SG • Jerome (25) starts working on 1 July 2010 • He earns $45, 000 which increases at 4% (3% CPI plus 1% for pay raises) until he turns 65 when it flattens out • Jerome’s super returns 7% pa (3% income which is 20% franked and 4% capital gain) • He makes no contributions other than SG How much more will Jerome have in his super account if SG increases as proposed? 20

Case study – higher SG • Jerome (25) starts working on 1 July 2010 • He earns $45, 000 which increases at 4% (3% CPI plus 1% for pay raises) until he turns 65 when it flattens out • Jerome’s super returns 7% pa (3% income which is 20% franked and 4% capital gain) • He makes no contributions other than SG How much more will Jerome have in his super account if SG increases as proposed? 20

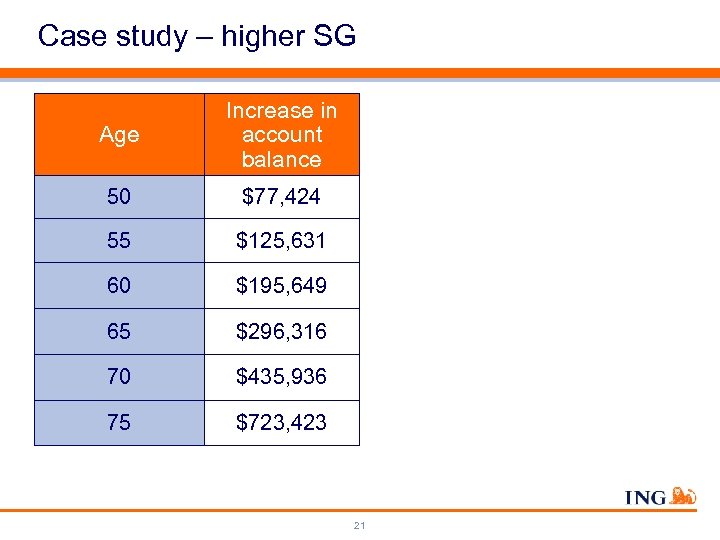

Case study – higher SG Age Increase in account balance 50 $77, 424 55 $125, 631 60 $195, 649 65 $296, 316 70 $435, 936 75 $723, 423 21

Case study – higher SG Age Increase in account balance 50 $77, 424 55 $125, 631 60 $195, 649 65 $296, 316 70 $435, 936 75 $723, 423 21

Case study – higher SG 22

Case study – higher SG 22

Low income earners government contribution • From 1 July 2012, the Government proposes to make a contribution for low income earners to compensate for contributions tax • For those with adjusted taxable income up to $37, 000, the government will make a contribution equal to the lesser of: • 15% x SG contributions • $500 23

Low income earners government contribution • From 1 July 2012, the Government proposes to make a contribution for low income earners to compensate for contributions tax • For those with adjusted taxable income up to $37, 000, the government will make a contribution equal to the lesser of: • 15% x SG contributions • $500 23

Case study – government contribution • Joe works for Tick Tock Pty Ltd earning $28, 000 pa • His SG contributions total $2, 520 ($28, 000 x 9%) • The Government will make a contribution of $378 ($2, 520 x 15%) to compensate Joe for his contributions tax paid 24

Case study – government contribution • Joe works for Tick Tock Pty Ltd earning $28, 000 pa • His SG contributions total $2, 520 ($28, 000 x 9%) • The Government will make a contribution of $378 ($2, 520 x 15%) to compensate Joe for his contributions tax paid 24

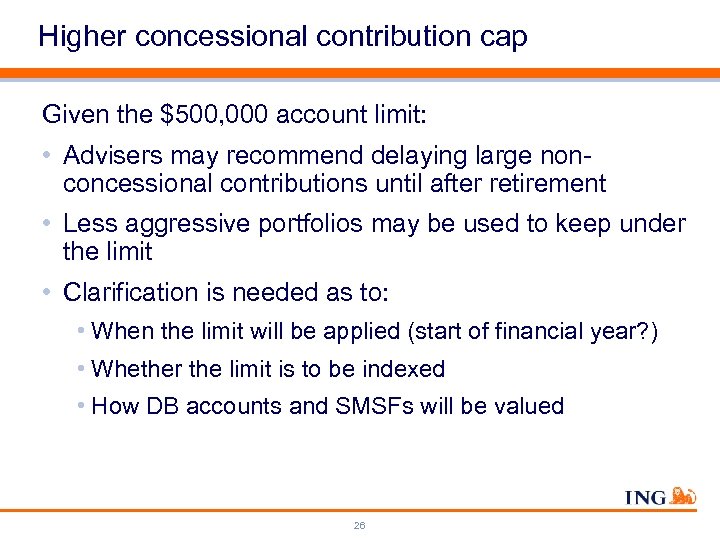

Higher concessional contribution cap • From 1 July 2012, the higher concessional cap for those 50 or older ($50, 000) is set to end. • This cap is proposed to be implemented permanently • From 1 July 2012, it is only available to those with under $500, 000 in super 25

Higher concessional contribution cap • From 1 July 2012, the higher concessional cap for those 50 or older ($50, 000) is set to end. • This cap is proposed to be implemented permanently • From 1 July 2012, it is only available to those with under $500, 000 in super 25

Higher concessional contribution cap Given the $500, 000 account limit: • Advisers may recommend delaying large nonconcessional contributions until after retirement • Less aggressive portfolios may be used to keep under the limit • Clarification is needed as to: • When the limit will be applied (start of financial year? ) • Whether the limit is to be indexed • How DB accounts and SMSFs will be valued 26

Higher concessional contribution cap Given the $500, 000 account limit: • Advisers may recommend delaying large nonconcessional contributions until after retirement • Less aggressive portfolios may be used to keep under the limit • Clarification is needed as to: • When the limit will be applied (start of financial year? ) • Whether the limit is to be indexed • How DB accounts and SMSFs will be valued 26

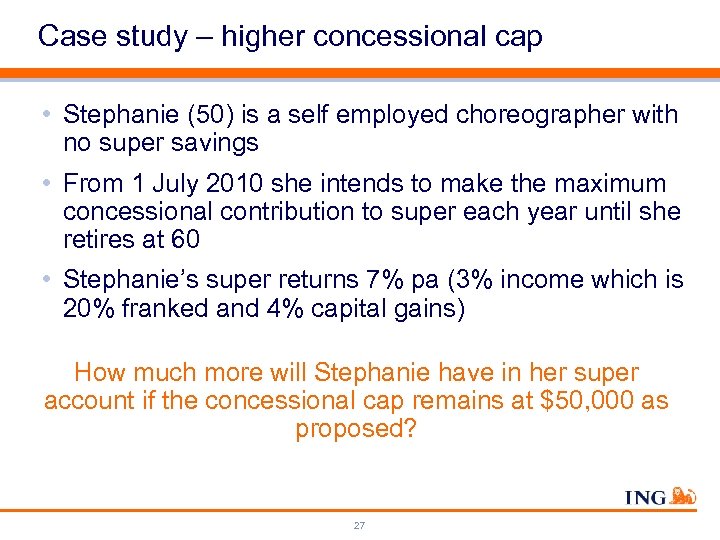

Case study – higher concessional cap • Stephanie (50) is a self employed choreographer with no super savings • From 1 July 2010 she intends to make the maximum concessional contribution to super each year until she retires at 60 • Stephanie’s super returns 7% pa (3% income which is 20% franked and 4% capital gains) How much more will Stephanie have in her super account if the concessional cap remains at $50, 000 as proposed? 27

Case study – higher concessional cap • Stephanie (50) is a self employed choreographer with no super savings • From 1 July 2010 she intends to make the maximum concessional contribution to super each year until she retires at 60 • Stephanie’s super returns 7% pa (3% income which is 20% franked and 4% capital gains) How much more will Stephanie have in her super account if the concessional cap remains at $50, 000 as proposed? 27

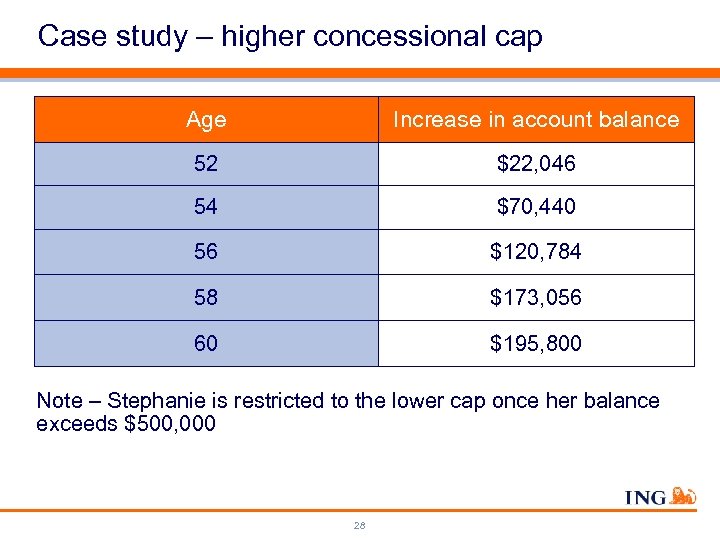

Case study – higher concessional cap Age Increase in account balance 52 $22, 046 54 $70, 440 56 $120, 784 58 $173, 056 60 $195, 800 Note – Stephanie is restricted to the lower cap once her balance exceeds $500, 000 28

Case study – higher concessional cap Age Increase in account balance 52 $22, 046 54 $70, 440 56 $120, 784 58 $173, 056 60 $195, 800 Note – Stephanie is restricted to the lower cap once her balance exceeds $500, 000 28

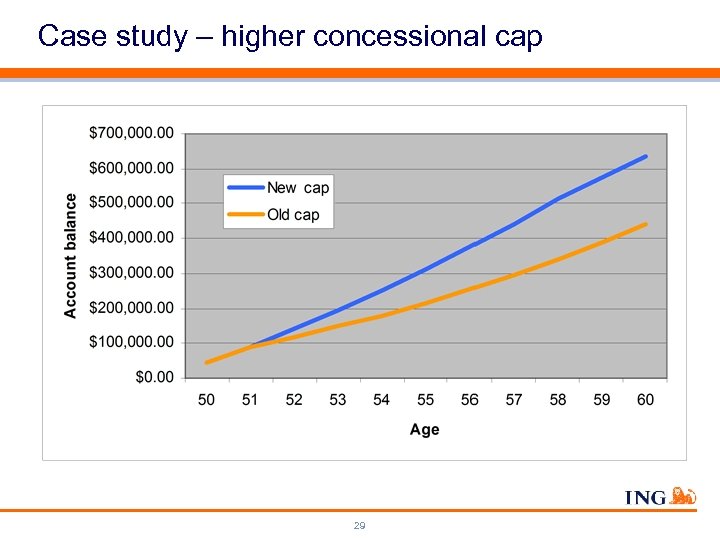

Case study – higher concessional cap 29

Case study – higher concessional cap 29

Cooper

Cooper

What is My. Super? • My. Super is a proposal from the Cooper Super System Review • Proposal is not yet final • Final report to be delivered to the Government by 30 June 2010 • Requires Government acceptance of the recommendations and legislative reform to be effective • Designed to provide a simple, cost-effective super product for those members invested in the default option in their current super fund • Replaces the “universal” part of the choice architecture model outlined in the Review’s interim report of December 2009 • No change to member choice-of-fund • My. Super is NOT a single national default fund • The Panel is not recommending such an outcome 31

What is My. Super? • My. Super is a proposal from the Cooper Super System Review • Proposal is not yet final • Final report to be delivered to the Government by 30 June 2010 • Requires Government acceptance of the recommendations and legislative reform to be effective • Designed to provide a simple, cost-effective super product for those members invested in the default option in their current super fund • Replaces the “universal” part of the choice architecture model outlined in the Review’s interim report of December 2009 • No change to member choice-of-fund • My. Super is NOT a single national default fund • The Panel is not recommending such an outcome 31

Key elements of My. Super • My. Super structure • My. Super trustee duties • My. Super investments • My. Super insurance • My. Super fees • My. Super and advice • My. Super as a default employer super fund • My. Super retirement benefits • My. Super e-super functionality 32

Key elements of My. Super • My. Super structure • My. Super trustee duties • My. Super investments • My. Super insurance • My. Super fees • My. Super and advice • My. Super as a default employer super fund • My. Super retirement benefits • My. Super e-super functionality 32

My. Super structure • My. Super can be offered by any super fund provider • Intended that existing default fund or default investment option can be modified to conform with the My. Super product requirements • It will be possible for a member to have part of their super in the My. Super product and the balance in other investment options • Easy switching between My. Super and other options • Individual members cannot be offered more than one My. Super product (by a super provider) and they can only be defaulted into a single My. Super product • There will be situations where a mastertrust has multiple My. Super sub-funds for different employers • Reduced disclosure requirements 33

My. Super structure • My. Super can be offered by any super fund provider • Intended that existing default fund or default investment option can be modified to conform with the My. Super product requirements • It will be possible for a member to have part of their super in the My. Super product and the balance in other investment options • Easy switching between My. Super and other options • Individual members cannot be offered more than one My. Super product (by a super provider) and they can only be defaulted into a single My. Super product • There will be situations where a mastertrust has multiple My. Super sub-funds for different employers • Reduced disclosure requirements 33

My. Super trustee duties • Optimising investment performance and overall cost to members • Trustee to have a clear and transparent justification for both the investment strategy and the overall cost and net return to members • Scale • Trustee to form the view on an annual basis that its My. Super product has sufficient scale to provide optimal retirement savings for its members • Only alternative is to merge with other funds if scale insufficient • Diversified asset allocation / single investment strategy • See next slide 34

My. Super trustee duties • Optimising investment performance and overall cost to members • Trustee to have a clear and transparent justification for both the investment strategy and the overall cost and net return to members • Scale • Trustee to form the view on an annual basis that its My. Super product has sufficient scale to provide optimal retirement savings for its members • Only alternative is to merge with other funds if scale insufficient • Diversified asset allocation / single investment strategy • See next slide 34

My. Super investments • A single, diversified investment strategy designed to suit members as a whole • Appropriately diversified allocation of growth and defensive assets • May be a lifecycle strategy • Trustees to disclose targeted level of return with an indication of risk and volatility • Eg. Target of X% above inflation with a likelihood of a negative return once every Y years • To include reference to the maximum potential loss that could be reasonably expected • Emphasis on low cost, but not at the expense of investment returns 35

My. Super investments • A single, diversified investment strategy designed to suit members as a whole • Appropriately diversified allocation of growth and defensive assets • May be a lifecycle strategy • Trustees to disclose targeted level of return with an indication of risk and volatility • Eg. Target of X% above inflation with a likelihood of a negative return once every Y years • To include reference to the maximum potential loss that could be reasonably expected • Emphasis on low cost, but not at the expense of investment returns 35

My. Super insurance • Compulsory insurance • Death cover would have to be offered on an opt-out basis • No minimum default or maximum levels specified • Trustee best placed to judge • Optional insurance • TPD and/or Income Protection (Salary Continuance) insurance would both be optional • Premium can not include or fund a sales commission or like payment • The trustee could pay brokerage for services rendered by a broker or agent on a fee for service basis 36

My. Super insurance • Compulsory insurance • Death cover would have to be offered on an opt-out basis • No minimum default or maximum levels specified • Trustee best placed to judge • Optional insurance • TPD and/or Income Protection (Salary Continuance) insurance would both be optional • Premium can not include or fund a sales commission or like payment • The trustee could pay brokerage for services rendered by a broker or agent on a fee for service basis 36

My. Super fees • No mandated overall fee cap • No entry (contribution) fees • Exit fees can be charged on a cost-recovery basis • Buy and sell spreads can be charged provided they are closely linked to costs incurred and they are paid to the fund • Switching fees can be charged provided they are paid to the fund • Restrictions apply to performance based fees • All fee schedules and discounts are to be explicit and not subject to negotiation or rebates • The Panel is considering whether the same My. Super product could be offered at different price points to different employers • To reflect differences in scale 37

My. Super fees • No mandated overall fee cap • No entry (contribution) fees • Exit fees can be charged on a cost-recovery basis • Buy and sell spreads can be charged provided they are closely linked to costs incurred and they are paid to the fund • Switching fees can be charged provided they are paid to the fund • Restrictions apply to performance based fees • All fee schedules and discounts are to be explicit and not subject to negotiation or rebates • The Panel is considering whether the same My. Super product could be offered at different price points to different employers • To reflect differences in scale 37

My. Super and advice • No bundled personal advice (except for intra-fund advice) • My. Super funds must provide “free, quality information” on the fund’s website • My. Super funds must provide intra-fund advice • Cost of intra-fund advice can either be shared across the My. Super membership or charged to those who use the service • Fees for advice (outside intra-fund advice) would be on a fee-for -service basis • Negotiated between member and adviser • Paid from the member’s account • Payments for advice would require express annual renewal • No upfront or trail commission • No shelf-space or volume rebates 38

My. Super and advice • No bundled personal advice (except for intra-fund advice) • My. Super funds must provide “free, quality information” on the fund’s website • My. Super funds must provide intra-fund advice • Cost of intra-fund advice can either be shared across the My. Super membership or charged to those who use the service • Fees for advice (outside intra-fund advice) would be on a fee-for -service basis • Negotiated between member and adviser • Paid from the member’s account • Payments for advice would require express annual renewal • No upfront or trail commission • No shelf-space or volume rebates 38

My. Super as a default employer super fund • Only My. Super products could be a “default” super fund for the purposes of either the Superannuation Guarantee Act or Modern Award requirements • Choice-of-fund will continue to allow employees to opt-out of the employer-chosen default fund 39

My. Super as a default employer super fund • Only My. Super products could be a “default” super fund for the purposes of either the Superannuation Guarantee Act or Modern Award requirements • Choice-of-fund will continue to allow employees to opt-out of the employer-chosen default fund 39

My. Super retirement benefits • Compulsory provision of forecasts of retirement benefits • Reference to model proposed in ASIC’s Consultation Paper 122: Superannuation Forecasts • My. Super funds to offer a post-retirement product • Either on its own or in conjunction with another product? 40

My. Super retirement benefits • Compulsory provision of forecasts of retirement benefits • Reference to model proposed in ASIC’s Consultation Paper 122: Superannuation Forecasts • My. Super funds to offer a post-retirement product • Either on its own or in conjunction with another product? 40

My. Super e-functionality • Member disclosure requirements minimised • Comprehensive information to be made available online • My. Super members could opt-in to electronic statements • PDS’s available online • Super. Stream proposals for electronic administration to apply 41

My. Super e-functionality • Member disclosure requirements minimised • Comprehensive information to be made available online • My. Super members could opt-in to electronic statements • PDS’s available online • Super. Stream proposals for electronic administration to apply 41

Other Employer Super advice issues • Award Modernisation and super • Employers can generally no longer freely choose a default super fund for their employer contributions • Default funds are specified in Modern Awards (since 1 January 2010) • The eligible default fund can still include any fund to which the employer was making super contributions for the benefit of employees before 12 September 2008 • Award Modernisation does not override employee choice • The default fund nominated in the Modern Award will only apply where a member has not nominated a choice fund • Obvious impact on employer super advice • ING has a range of adviser and employer support materials to assist 42

Other Employer Super advice issues • Award Modernisation and super • Employers can generally no longer freely choose a default super fund for their employer contributions • Default funds are specified in Modern Awards (since 1 January 2010) • The eligible default fund can still include any fund to which the employer was making super contributions for the benefit of employees before 12 September 2008 • Award Modernisation does not override employee choice • The default fund nominated in the Modern Award will only apply where a member has not nominated a choice fund • Obvious impact on employer super advice • ING has a range of adviser and employer support materials to assist 42

Other Employer Super advice issues • Government response to Ripoll recommendations • “The Future of Financial Advice”, 26 April 2010 • Prospective ban on “conflicted remuneration structures”, including commissions and any form of volume based payment (including shelfspace fees) • Introduction of “adviser charging regime” • Requires clients to agree to fees and to annually renew • Introduction of a statutory fiduciary duty for advisers • Advisers required to act in “best interests” of clients • Includes a “reasonable steps” qualification to discharge duty • No expectation of review of every single product available • Expansion of intra-fund advice • TTR, intra-pension advice, nomination of beneficiaries, Super and Centrelink, retirement planning etc • Legislation to be released following industry consultation • Expected commencement 1 July 2010 43

Other Employer Super advice issues • Government response to Ripoll recommendations • “The Future of Financial Advice”, 26 April 2010 • Prospective ban on “conflicted remuneration structures”, including commissions and any form of volume based payment (including shelfspace fees) • Introduction of “adviser charging regime” • Requires clients to agree to fees and to annually renew • Introduction of a statutory fiduciary duty for advisers • Advisers required to act in “best interests” of clients • Includes a “reasonable steps” qualification to discharge duty • No expectation of review of every single product available • Expansion of intra-fund advice • TTR, intra-pension advice, nomination of beneficiaries, Super and Centrelink, retirement planning etc • Legislation to be released following industry consultation • Expected commencement 1 July 2010 43

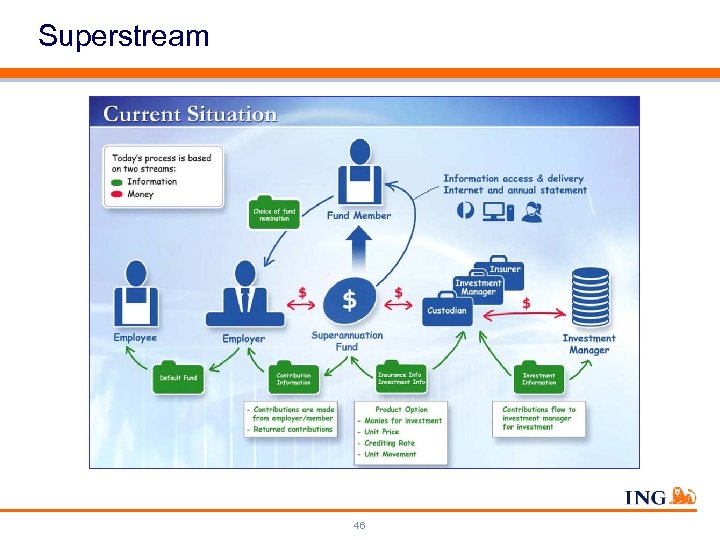

Superstream Current problems Lack of data industry standards Multiple technology platforms Manual processes continue with some No true member identifier Employers required to make contributions to many funds No alignment of contribution and pay cycles Rollovers made difficult 44

Superstream Current problems Lack of data industry standards Multiple technology platforms Manual processes continue with some No true member identifier Employers required to make contributions to many funds No alignment of contribution and pay cycles Rollovers made difficult 44

Superstream • Improving data quality • Better use of technology • E-commerce solutions • Use of TFN as primary identifier • Easier consolidation of multiple member accounts • Simpler rollovers and consolidations 45

Superstream • Improving data quality • Better use of technology • E-commerce solutions • Use of TFN as primary identifier • Easier consolidation of multiple member accounts • Simpler rollovers and consolidations 45

Superstream 46

Superstream 46

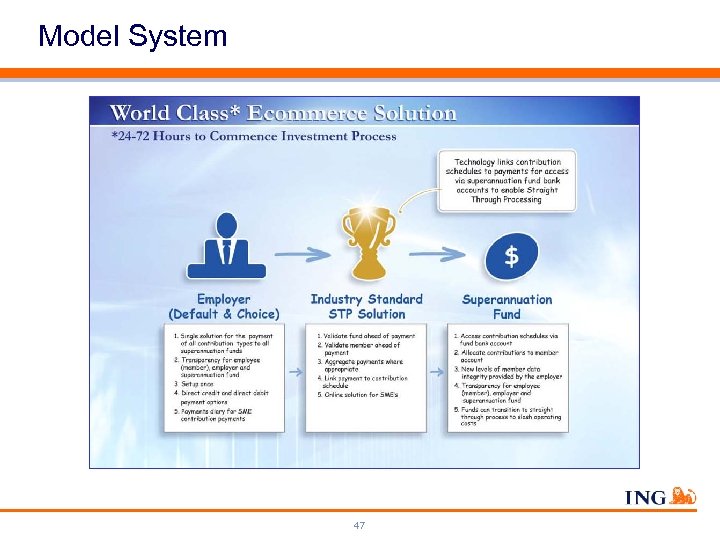

Model System 47

Model System 47

SMSFs

SMSFs

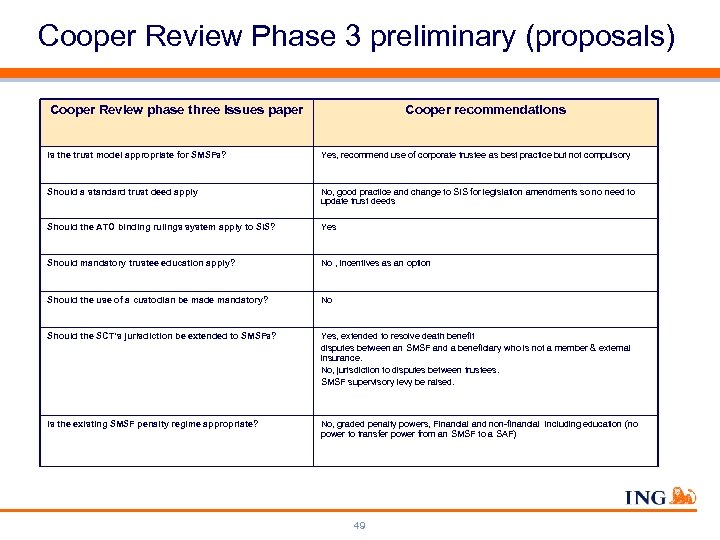

Cooper Review Phase 3 preliminary (proposals) Cooper Review phase three issues paper Cooper recommendations Is the trust model appropriate for SMSFs? Yes, recommend use of corporate trustee as best practice but not compulsory Should a standard trust deed apply No, good practice and change to SIS for legislation amendments so no need to update trust deeds Should the ATO binding rulings system apply to SIS? Yes Should mandatory trustee education apply? No , incentives as an option Should the use of a custodian be made mandatory? No Should the SCT’s jurisdiction be extended to SMSFs? Yes, extended to resolve death benefit disputes between an SMSF and a beneficiary who is not a member & external insurance. No, jurisdiction to disputes between trustees. SMSF supervisory levy be raised. Is the existing SMSF penalty regime appropriate? No, graded penalty powers, Financial and non-financial including education (no power to transfer power from an SMSF to a SAF) 49

Cooper Review Phase 3 preliminary (proposals) Cooper Review phase three issues paper Cooper recommendations Is the trust model appropriate for SMSFs? Yes, recommend use of corporate trustee as best practice but not compulsory Should a standard trust deed apply No, good practice and change to SIS for legislation amendments so no need to update trust deeds Should the ATO binding rulings system apply to SIS? Yes Should mandatory trustee education apply? No , incentives as an option Should the use of a custodian be made mandatory? No Should the SCT’s jurisdiction be extended to SMSFs? Yes, extended to resolve death benefit disputes between an SMSF and a beneficiary who is not a member & external insurance. No, jurisdiction to disputes between trustees. SMSF supervisory levy be raised. Is the existing SMSF penalty regime appropriate? No, graded penalty powers, Financial and non-financial including education (no power to transfer power from an SMSF to a SAF) 49

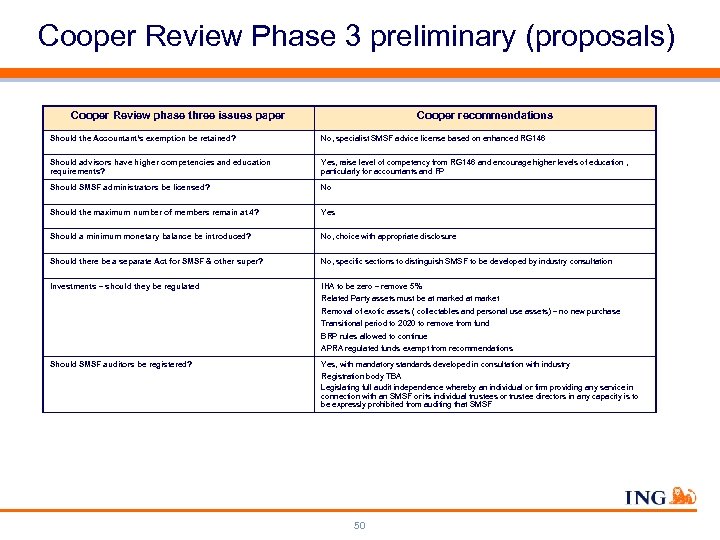

Cooper Review Phase 3 preliminary (proposals) Cooper Review phase three issues paper Cooper recommendations Should the Accountant’s exemption be retained? No, specialist SMSF advice license based on enhanced RG 146 Should advisors have higher competencies and education requirements? Yes, raise level of competency from RG 146 and encourage higher levels of education , particularly for accountants and FP Should SMSF administrators be licensed? No Should the maximum number of members remain at 4? Yes Should a minimum monetary balance be introduced? No, choice with appropriate disclosure Should there be a separate Act for SMSF & other super? No, specific sections to distinguish SMSF to be developed by industry consultation Investments – should they be regulated IHA to be zero – remove 5% Related Party assets must be at marked at market Removal of exotic assets ( collectables and personal use assets) – no new purchase Transitional period to 2020 to remove from fund BRP rules allowed to continue APRA regulated funds exempt from recommendations Should SMSF auditors be registered? Yes, with mandatory standards developed in consultation with industry Registration body TBA Legislating full audit independence whereby an individual or firm providing any service in connection with an SMSF or its individual trustees or trustee directors in any capacity is to be expressly prohibited from auditing that SMSF 50

Cooper Review Phase 3 preliminary (proposals) Cooper Review phase three issues paper Cooper recommendations Should the Accountant’s exemption be retained? No, specialist SMSF advice license based on enhanced RG 146 Should advisors have higher competencies and education requirements? Yes, raise level of competency from RG 146 and encourage higher levels of education , particularly for accountants and FP Should SMSF administrators be licensed? No Should the maximum number of members remain at 4? Yes Should a minimum monetary balance be introduced? No, choice with appropriate disclosure Should there be a separate Act for SMSF & other super? No, specific sections to distinguish SMSF to be developed by industry consultation Investments – should they be regulated IHA to be zero – remove 5% Related Party assets must be at marked at market Removal of exotic assets ( collectables and personal use assets) – no new purchase Transitional period to 2020 to remove from fund BRP rules allowed to continue APRA regulated funds exempt from recommendations Should SMSF auditors be registered? Yes, with mandatory standards developed in consultation with industry Registration body TBA Legislating full audit independence whereby an individual or firm providing any service in connection with an SMSF or its individual trustees or trustee directors in any capacity is to be expressly prohibited from auditing that SMSF 50

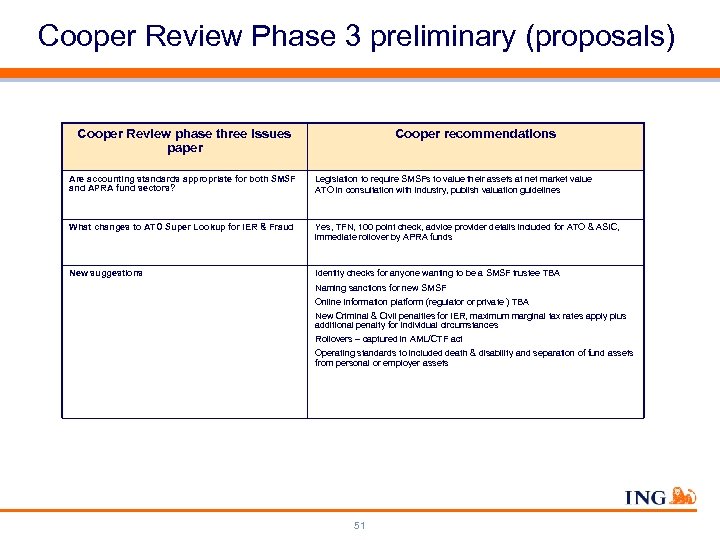

Cooper Review Phase 3 preliminary (proposals) Cooper Review phase three issues paper Cooper recommendations Are accounting standards appropriate for both SMSF and APRA fund sectors? Legislation to require SMSFs to value their assets at net market value ATO in consultation with industry, publish valuation guidelines What changes to ATO Super Lookup for IER & Fraud Yes, TFN, 100 point check, advice provider details included for ATO & ASIC, immediate rollover by APRA funds New suggestions Identity checks for anyone wanting to be a SMSF trustee TBA Naming sanctions for new SMSF Online information platform (regulator or private ) TBA New Criminal & Civil penalties for IER, maximum marginal tax rates apply plus additional penalty for individual circumstances Rollovers – captured in AML/CTF act Operating standards to included death & disability and separation of fund assets from personal or employer assets 51

Cooper Review Phase 3 preliminary (proposals) Cooper Review phase three issues paper Cooper recommendations Are accounting standards appropriate for both SMSF and APRA fund sectors? Legislation to require SMSFs to value their assets at net market value ATO in consultation with industry, publish valuation guidelines What changes to ATO Super Lookup for IER & Fraud Yes, TFN, 100 point check, advice provider details included for ATO & ASIC, immediate rollover by APRA funds New suggestions Identity checks for anyone wanting to be a SMSF trustee TBA Naming sanctions for new SMSF Online information platform (regulator or private ) TBA New Criminal & Civil penalties for IER, maximum marginal tax rates apply plus additional penalty for individual circumstances Rollovers – captured in AML/CTF act Operating standards to included death & disability and separation of fund assets from personal or employer assets 51

Questions 52

Questions 52

Disclaimer This information is a summary based on ING’s understanding of the relevant legislation. It is only intended to be general financial product advice. It is general in nature and may not be relevant to individual circumstances. You should not do or refrain from doing anything in reliance on this information without obtaining suitable professional advice. You should consider any relevant Product Disclosure Statement before making any decision about whether to acquire any product. ING Product Disclosure Statements are available on request by calling ING or by visiting the ING website. Certain of the statements contained herein are statements of future expectations and other forward-looking statements. These expectations are based on management's current views and assumptions and involve known and unknown risks and uncertainties. Actual results, performance or events may differ materially from those in such statements due to, among other things, (i) general economic conditions, in particular economic conditions in ING’s core markets, (ii) performance of financial markets, including emerging markets, (iii) the frequency and severity of insured loss events, (iv) mortality and morbidity levels and trends, (v) persistency levels, (vi) interest rate levels, (vii) currency exchange rates (viii) general competitive factors, (ix) changes in laws and regulations, (x) changes in the policies of governments and/or regulatory authorities. ING assumes no obligation to update any forward-looking information contained in this document. www. ing. com. au 53

Disclaimer This information is a summary based on ING’s understanding of the relevant legislation. It is only intended to be general financial product advice. It is general in nature and may not be relevant to individual circumstances. You should not do or refrain from doing anything in reliance on this information without obtaining suitable professional advice. You should consider any relevant Product Disclosure Statement before making any decision about whether to acquire any product. ING Product Disclosure Statements are available on request by calling ING or by visiting the ING website. Certain of the statements contained herein are statements of future expectations and other forward-looking statements. These expectations are based on management's current views and assumptions and involve known and unknown risks and uncertainties. Actual results, performance or events may differ materially from those in such statements due to, among other things, (i) general economic conditions, in particular economic conditions in ING’s core markets, (ii) performance of financial markets, including emerging markets, (iii) the frequency and severity of insured loss events, (iv) mortality and morbidity levels and trends, (v) persistency levels, (vi) interest rate levels, (vii) currency exchange rates (viii) general competitive factors, (ix) changes in laws and regulations, (x) changes in the policies of governments and/or regulatory authorities. ING assumes no obligation to update any forward-looking information contained in this document. www. ing. com. au 53

54

54