db60aba7138c08df0529d1be8fcdde4a.ppt

- Количество слайдов: 7

RIIO Gas Transmission Workshop - 5 th Sept Supplementary information Hypothetical examples to illustrate the impact of combining the constraint management incentive schemes 1

RIIO Gas Transmission Workshop - 5 th Sept Supplementary information Hypothetical examples to illustrate the impact of combining the constraint management incentive schemes 1

Introduction ¾ Purpose of these examples is to show the decisions regarding managing constraints on the system would be affected by adopting NGG’s proposed combined scheme for constraint management compared with the current arrangements ¾ NGG proposed that sharing factors should be equal to the RIIO-T 1 efficiency rate applied in the totex incentive mechanism ¾ The examples include “NGG cost” and “Shipper cost” where “Shipper cost” relates to the generality of Users, rather than a specific User ¾ These examples are for illustrative purposes only (i. e. the costs indicated are entirely fictional) and assume that the actions each have the same effect on the system (i. e. there is no consideration that some actions be more effective than others) ¾ Note that the resultant costs/revenues (after application of the sharing factor) would be subject to the appropriate cap/collar 2

Introduction ¾ Purpose of these examples is to show the decisions regarding managing constraints on the system would be affected by adopting NGG’s proposed combined scheme for constraint management compared with the current arrangements ¾ NGG proposed that sharing factors should be equal to the RIIO-T 1 efficiency rate applied in the totex incentive mechanism ¾ The examples include “NGG cost” and “Shipper cost” where “Shipper cost” relates to the generality of Users, rather than a specific User ¾ These examples are for illustrative purposes only (i. e. the costs indicated are entirely fictional) and assume that the actions each have the same effect on the system (i. e. there is no consideration that some actions be more effective than others) ¾ Note that the resultant costs/revenues (after application of the sharing factor) would be subject to the appropriate cap/collar 2

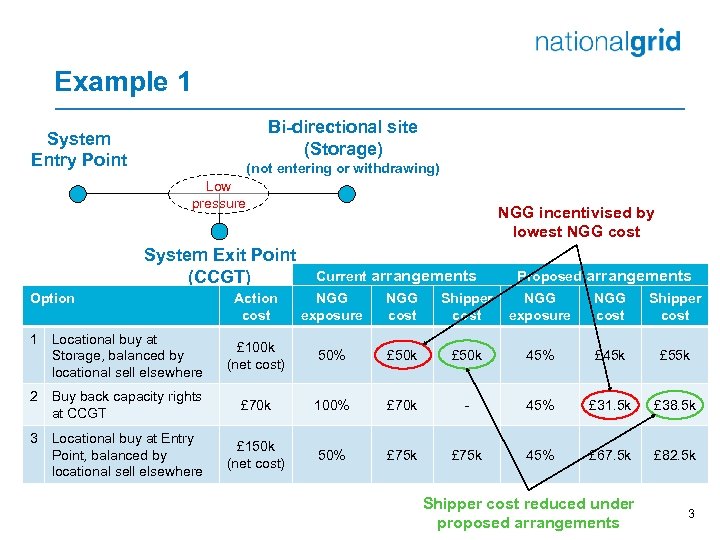

Example 1 Bi-directional site (Storage) System Entry Point (not entering or withdrawing) Low pressure System Exit Point (CCGT) Option NGG incentivised by lowest NGG cost Current arrangements Proposed arrangements Action cost NGG exposure NGG cost Shipper cost Locational buy at Storage, balanced by locational sell elsewhere £ 100 k (net cost) 50% £ 50 k 45% £ 45 k £ 55 k 2 Buy back capacity rights at CCGT £ 70 k 100% £ 70 k - 45% £ 31. 5 k £ 38. 5 k 3 Locational buy at Entry Point, balanced by locational sell elsewhere £ 150 k (net cost) 50% £ 75 k 45% £ 67. 5 k £ 82. 5 k Shipper cost reduced under proposed arrangements 3 1

Example 1 Bi-directional site (Storage) System Entry Point (not entering or withdrawing) Low pressure System Exit Point (CCGT) Option NGG incentivised by lowest NGG cost Current arrangements Proposed arrangements Action cost NGG exposure NGG cost Shipper cost Locational buy at Storage, balanced by locational sell elsewhere £ 100 k (net cost) 50% £ 50 k 45% £ 45 k £ 55 k 2 Buy back capacity rights at CCGT £ 70 k 100% £ 70 k - 45% £ 31. 5 k £ 38. 5 k 3 Locational buy at Entry Point, balanced by locational sell elsewhere £ 150 k (net cost) 50% £ 75 k 45% £ 67. 5 k £ 82. 5 k Shipper cost reduced under proposed arrangements 3 1

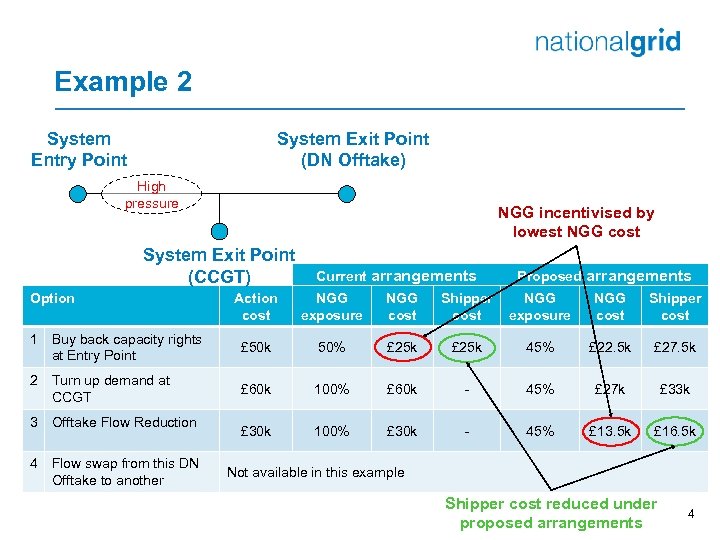

Example 2 System Exit Point (DN Offtake) System Entry Point High pressure NGG incentivised by lowest NGG cost System Exit Point (CCGT) Option Current arrangements Proposed arrangements Action cost NGG exposure NGG cost Shipper cost 1 Buy back capacity rights at Entry Point £ 50 k 50% £ 25 k 45% £ 22. 5 k £ 27. 5 k 2 Turn up demand at CCGT £ 60 k 100% £ 60 k - 45% £ 27 k £ 33 k 3 Offtake Flow Reduction £ 30 k 100% £ 30 k - 45% £ 13. 5 k £ 16. 5 k 4 Flow swap from this DN Offtake to another Not available in this example Shipper cost reduced under proposed arrangements 4

Example 2 System Exit Point (DN Offtake) System Entry Point High pressure NGG incentivised by lowest NGG cost System Exit Point (CCGT) Option Current arrangements Proposed arrangements Action cost NGG exposure NGG cost Shipper cost 1 Buy back capacity rights at Entry Point £ 50 k 50% £ 25 k 45% £ 22. 5 k £ 27. 5 k 2 Turn up demand at CCGT £ 60 k 100% £ 60 k - 45% £ 27 k £ 33 k 3 Offtake Flow Reduction £ 30 k 100% £ 30 k - 45% £ 13. 5 k £ 16. 5 k 4 Flow swap from this DN Offtake to another Not available in this example Shipper cost reduced under proposed arrangements 4

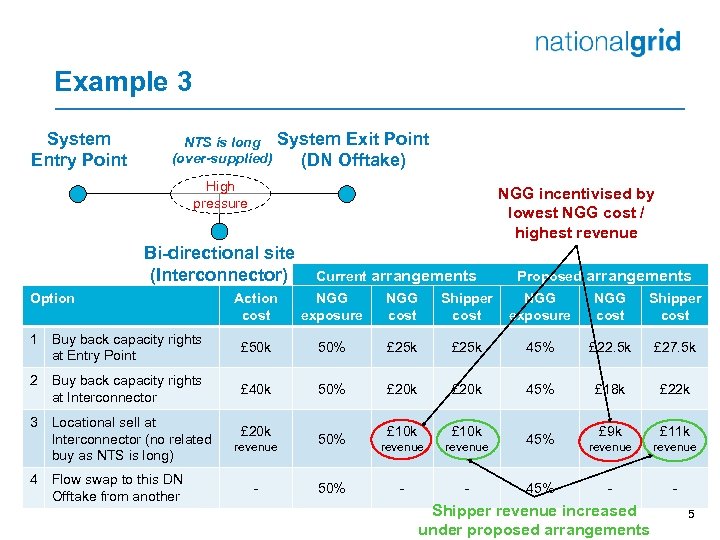

Example 3 System Entry Point NTS is long (over-supplied) System Exit Point (DN Offtake) High pressure NGG incentivised by lowest NGG cost / highest revenue Bi-directional site (Interconnector) Option Current arrangements Proposed arrangements Action cost NGG exposure NGG cost Shipper cost 1 Buy back capacity rights at Entry Point £ 50 k 50% £ 25 k 45% £ 22. 5 k £ 27. 5 k 2 Buy back capacity rights at Interconnector £ 40 k 50% £ 20 k 45% £ 18 k £ 22 k 3 Locational sell at Interconnector (no related buy as NTS is long) 4 Flow swap to this DN Offtake from another £ 20 k revenue - 50% £ 10 k revenue - - 45% £ 9 k £ 11 k revenue - - Shipper revenue increased under proposed arrangements 5

Example 3 System Entry Point NTS is long (over-supplied) System Exit Point (DN Offtake) High pressure NGG incentivised by lowest NGG cost / highest revenue Bi-directional site (Interconnector) Option Current arrangements Proposed arrangements Action cost NGG exposure NGG cost Shipper cost 1 Buy back capacity rights at Entry Point £ 50 k 50% £ 25 k 45% £ 22. 5 k £ 27. 5 k 2 Buy back capacity rights at Interconnector £ 40 k 50% £ 20 k 45% £ 18 k £ 22 k 3 Locational sell at Interconnector (no related buy as NTS is long) 4 Flow swap to this DN Offtake from another £ 20 k revenue - 50% £ 10 k revenue - - 45% £ 9 k £ 11 k revenue - - Shipper revenue increased under proposed arrangements 5

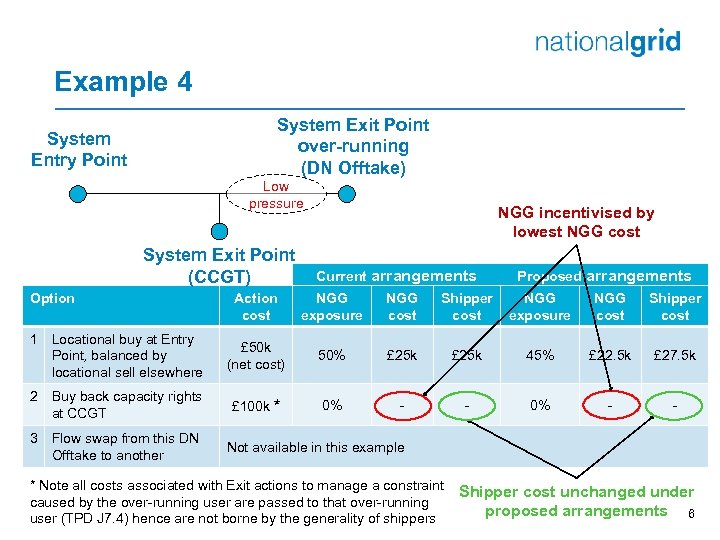

Example 4 System Exit Point over-running (DN Offtake) System Entry Point Low pressure System Exit Point (CCGT) Option NGG incentivised by lowest NGG cost Current arrangements Proposed arrangements Action cost NGG exposure NGG cost Shipper cost Locational buy at Entry Point, balanced by locational sell elsewhere £ 50 k (net cost) 50% £ 25 k 45% £ 22. 5 k £ 27. 5 k 2 Buy back capacity rights at CCGT £ 100 k * 0% - - 3 Flow swap from this DN Offtake to another 1 Not available in this example * Note all costs associated with Exit actions to manage a constraint caused by the over-running user are passed to that over-running user (TPD J 7. 4) hence are not borne by the generality of shippers Shipper cost unchanged under proposed arrangements 6

Example 4 System Exit Point over-running (DN Offtake) System Entry Point Low pressure System Exit Point (CCGT) Option NGG incentivised by lowest NGG cost Current arrangements Proposed arrangements Action cost NGG exposure NGG cost Shipper cost Locational buy at Entry Point, balanced by locational sell elsewhere £ 50 k (net cost) 50% £ 25 k 45% £ 22. 5 k £ 27. 5 k 2 Buy back capacity rights at CCGT £ 100 k * 0% - - 3 Flow swap from this DN Offtake to another 1 Not available in this example * Note all costs associated with Exit actions to manage a constraint caused by the over-running user are passed to that over-running user (TPD J 7. 4) hence are not borne by the generality of shippers Shipper cost unchanged under proposed arrangements 6

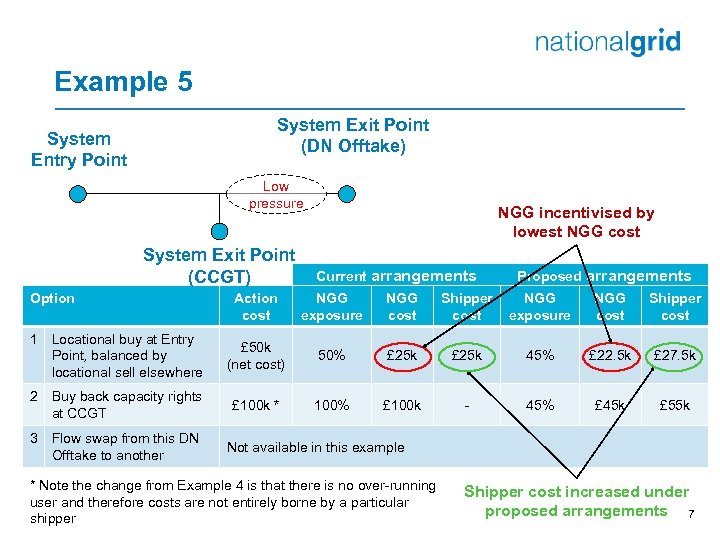

Example 5 System Exit Point (DN Offtake) System Entry Point Low pressure System Exit Point (CCGT) Option NGG incentivised by lowest NGG cost Current arrangements Proposed arrangements Action cost NGG exposure NGG cost Shipper cost Locational buy at Entry Point, balanced by locational sell elsewhere £ 50 k (net cost) 50% £ 25 k 45% £ 22. 5 k £ 27. 5 k 2 Buy back capacity rights at CCGT £ 100 k * 100% £ 100 k - 45% £ 45 k £ 55 k 3 Flow swap from this DN Offtake to another 1 Not available in this example * Note the change from Example 4 is that there is no over-running user and therefore costs are not entirely borne by a particular shipper Shipper cost increased under proposed arrangements 7

Example 5 System Exit Point (DN Offtake) System Entry Point Low pressure System Exit Point (CCGT) Option NGG incentivised by lowest NGG cost Current arrangements Proposed arrangements Action cost NGG exposure NGG cost Shipper cost Locational buy at Entry Point, balanced by locational sell elsewhere £ 50 k (net cost) 50% £ 25 k 45% £ 22. 5 k £ 27. 5 k 2 Buy back capacity rights at CCGT £ 100 k * 100% £ 100 k - 45% £ 45 k £ 55 k 3 Flow swap from this DN Offtake to another 1 Not available in this example * Note the change from Example 4 is that there is no over-running user and therefore costs are not entirely borne by a particular shipper Shipper cost increased under proposed arrangements 7