ec045f485605ae476559e8f79df6f9c6.ppt

- Количество слайдов: 27

RFID Executive Overview © Accenture 2002 February 2004 Silent Commerce Market Offering

Contents • RFID/Silent Commerce Technology Primer • Accenture RFID Solutions Approach • Accenture Activities in the RFID Market Accenture 2004 1

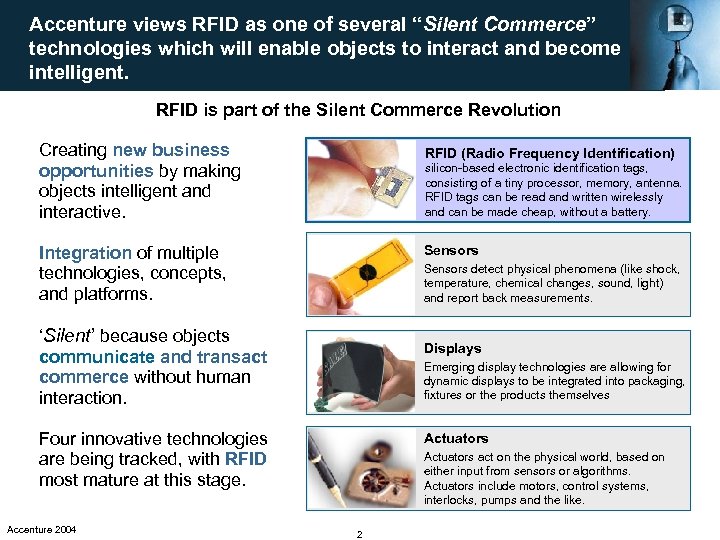

Accenture views RFID as one of several “Silent Commerce” technologies which will enable objects to interact and become intelligent. RFID is part of the Silent Commerce Revolution Creating new business opportunities by making objects intelligent and interactive. RFID (Radio Frequency Identification) Integration of multiple technologies, concepts, and platforms. Sensors silicon-based electronic identification tags, consisting of a tiny processor, memory, antenna. RFID tags can be read and written wirelessly and can be made cheap, without a battery. Sensors detect physical phenomena (like shock, temperature, chemical changes, sound, light) and report back measurements. ‘Silent’ because objects communicate and transact commerce without human interaction. Displays Emerging display technologies are allowing for dynamic displays to be integrated into packaging, fixtures or the products themselves Four innovative technologies are being tracked, with RFID most mature at this stage. Accenture 2004 Actuators act on the physical world, based on either input from sensors or algorithms. Actuators include motors, control systems, interlocks, pumps and the like. 2

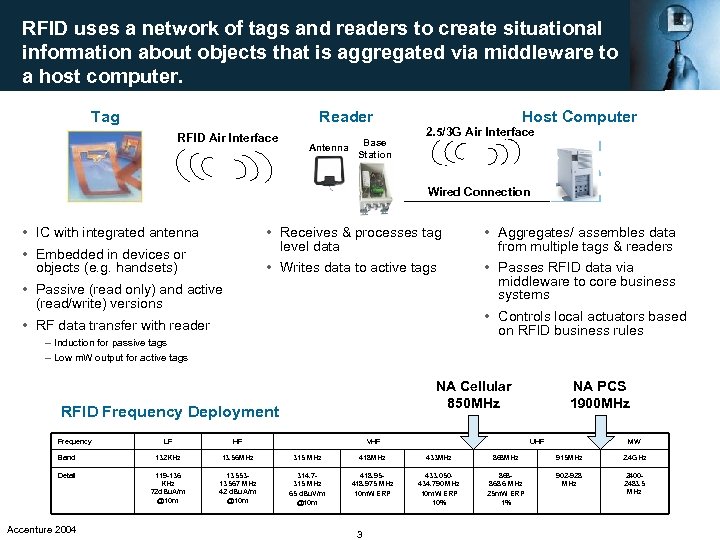

RFID uses a network of tags and readers to create situational information about objects that is aggregated via middleware to a host computer. Tag Reader RFID Air Interface Antenna Base Station Host Computer 2. 5/3 G Air Interface Wired Connection • IC with integrated antenna • Receives & processes tag level data • Writes data to active tags • Embedded in devices or objects (e. g. handsets) • Aggregates/ assembles data from multiple tags & readers • Passes RFID data via middleware to core business systems • Passive (read only) and active (read/write) versions • Controls local actuators based on RFID business rules • RF data transfer with reader – Induction for passive tags – Low m. W output for active tags NA Cellular 850 MHz RFID Frequency Deployment Frequency LF HF Band 132 KHz 13. 56 MHz 315 MHz 418 MHz 433 MHz 868 MHz 915 MHz 2. 4 GHz Detail 119 -136 KHz 72 d. Bu. A/m @10 m 13. 55313. 567 MHz 42 d. Bu. A/m @10 m 314. 7315 MHz 65 d. Bu. V/m @10 m 418. 95418. 975 MHz 10 m. W ERP 433. 050434. 790 MHz 10 m. W ERP 10% 868868. 6 MHz 25 m. W ERP 1% 902 -928 MHz 24002483. 5 MHz Accenture 2004 VHF NA PCS 1900 MHz 3 UHF MW

Actual RFID deployments will consist of numerous combinations of tag types, tagging levels and locations where tags are read. RFID Physical Configurations Tags Types Level of Application Reading Locations Unit Smart Shelves Case Conveyor Pallet Fork Truck Passive Semi-Passive Active Container Accenture 2004 4 Storage Location

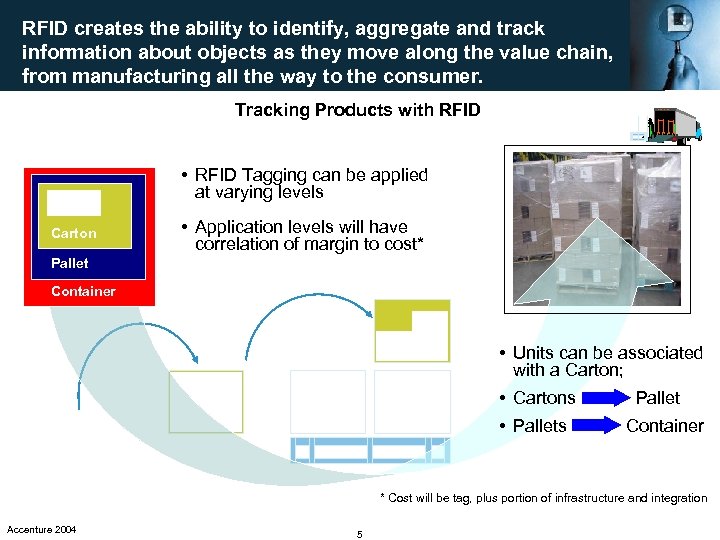

RFID creates the ability to identify, aggregate and track information about objects as they move along the value chain, from manufacturing all the way to the consumer. Tracking Products with RFID Unit Carton • RFID Tagging can be applied at varying levels • Application levels will have correlation of margin to cost* Pallet Container • Units can be associated with a Carton; • Cartons Pallet • Pallets Container * Cost will be tag, plus portion of infrastructure and integration Accenture 2004 5

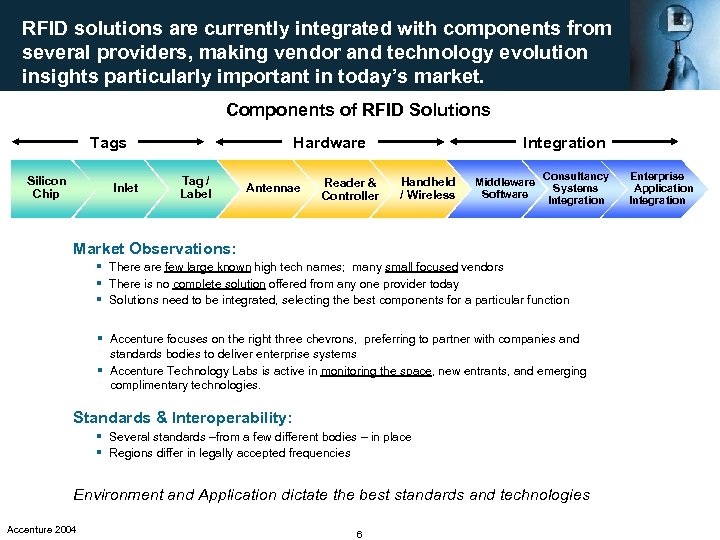

RFID solutions are currently integrated with components from several providers, making vendor and technology evolution insights particularly important in today’s market. Components of RFID Solutions Tags Silicon Chip Inlet Integration Hardware Tag / Label Antennae Reader & Controller Handheld / Wireless Middleware Software Consultancy Systems Integration Market Observations: § There are few large known high tech names; many small focused vendors § There is no complete solution offered from any one provider today § Solutions need to be integrated, selecting the best components for a particular function § Accenture focuses on the right three chevrons, preferring to partner with companies and standards bodies to deliver enterprise systems § Accenture Technology Labs is active in monitoring the space, new entrants, and emerging complimentary technologies. Standards & Interoperability: § Several standards –from a few different bodies – in place § Regions differ in legally accepted frequencies Environment and Application dictate the best standards and technologies Accenture 2004 6 Enterprise Application Integration

Accenture Technology Labs (our R&D organization) monitors the products and capabilities of numerous RFID vendors. Passive Tag Technology Key Providers - Tags KSW Microtec Zebra Balogh Intermec ASK Global ID MBBS TI Global ID SCS Tag. Sys Markem Avery Dennison Matrics Tag. Sys Balogh Global ID TI EMS Balogh SCS RFID Inc Siemens Philips Siemens Omron Infineon Intermec Rafsec RF Saw Alien ASK MBBS NCR EMS ASK Sokymat Internl Paper Matrics Flex. Chip MBBS RF Saw Omron Sokymat Silicon Chip Active Tag Technology Wallace P. Flipchip STMicro Accenture 2004 RF Saw Rafsec TI Where. Net Savi Siemens Identec 7 Cashs Flex. Chip Siemens Sensormatic Tag /Label, labeling devices Inlet IDSystems Flint. Ink KSW Microtec Bold Accenture relationship XXX Primarily US presence XXX Primarily EMEA presence Member Auto-id Center

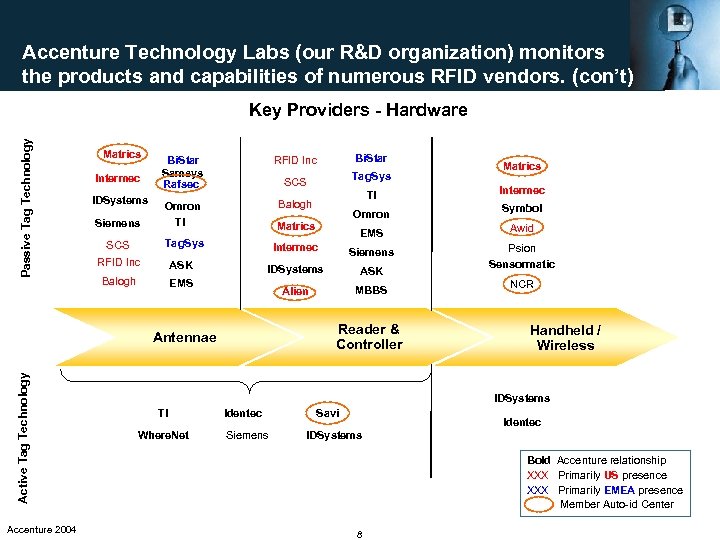

Accenture Technology Labs (our R&D organization) monitors the products and capabilities of numerous RFID vendors. (con’t) Passive Tag Technology Key Providers - Hardware Matrics Bi. Star Samsys Rafsec RFID Inc Bi. Star SCS Tag. Sys Siemens Omron TI Balogh Matrics SCS Tag. Sys RFID Inc ASK Balogh EMS Intermec IDSystems Active Tag Technology Omron Intermec Symbol EMS Awid Intermec Siemens IDSystems ASK Psion Sensormatic Alien MBBS Reader & Controller Antennae Accenture 2004 TI Matrics NCR Handheld / Wireless IDSystems TI Where. Net Identec Siemens Savi Identec IDSystems Bold Accenture relationship XXX Primarily US presence XXX Primarily EMEA presence Member Auto-id Center 8

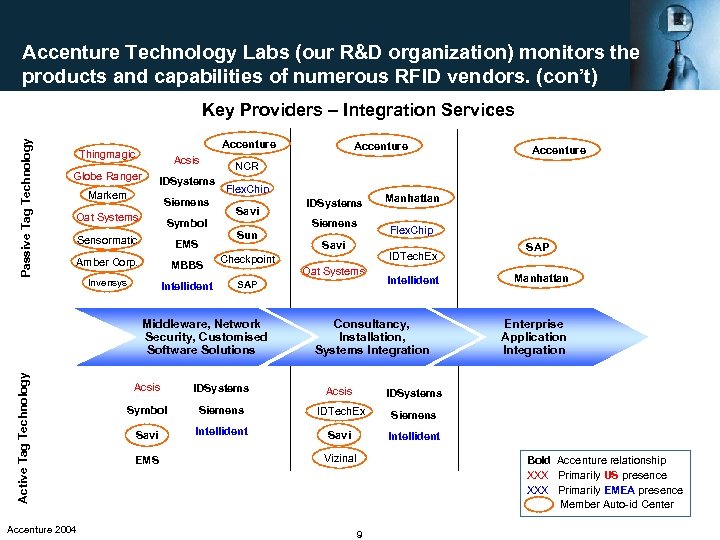

Accenture Technology Labs (our R&D organization) monitors the products and capabilities of numerous RFID vendors. (con’t) Passive Tag Technology Key Providers – Integration Services Accenture Thingmagic Acsis Globe Ranger IDSystems Markem Siemens Oat Systems Symbol Sensormatic EMS Amber Corp. MBBS Invensys Intellident Active Tag Technology Accenture NCR Flex. Chip Savi Sun IDSystems Siemens Manhattan Flex. Chip Savi IDTech. Ex Checkpoint Oat Systems SAP Middleware, Network Security, Customised Software Solutions Accenture 2004 Accenture Intellident Consultancy, Installation, Systems Integration Acsis IDSystems Acsis Siemens IDTech. Ex Intellident Savi Enterprise Application Integration Siemens Savi Manhattan IDSystems Symbol SAP Intellident EMS Vizinal Bold Accenture relationship XXX Primarily US presence XXX Primarily EMEA presence Member Auto-id Center 9

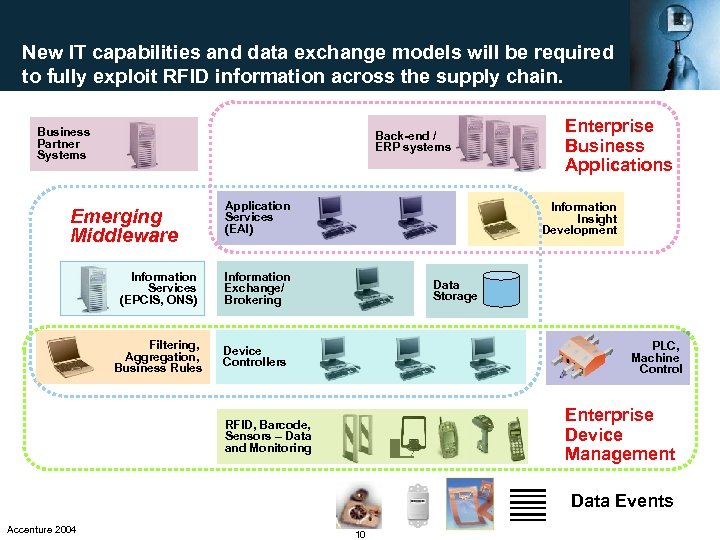

New IT capabilities and data exchange models will be required to fully exploit RFID information across the supply chain. Business Partner Systems Back-end / ERP systems Emerging Middleware Application Services (EAI) Information Services (EPCIS, ONS) Information Insight Development Information Exchange/ Brokering Filtering, Aggregation, Business Rules Enterprise Business Applications Device Controllers Data Storage PLC, Machine Control Enterprise Device Management RFID, Barcode, Sensors – Data and Monitoring Data Events Accenture 2004 10

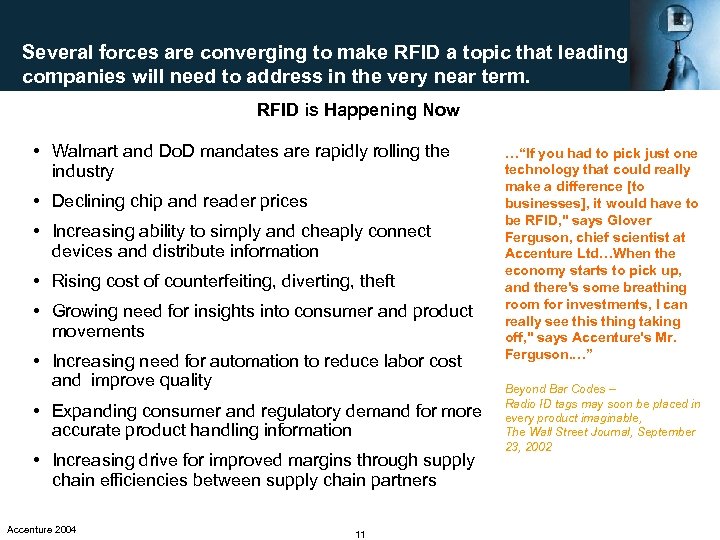

Several forces are converging to make RFID a topic that leading companies will need to address in the very near term. RFID is Happening Now • Walmart and Do. D mandates are rapidly rolling the industry • Declining chip and reader prices • Increasing ability to simply and cheaply connect devices and distribute information • Rising cost of counterfeiting, diverting, theft • Growing need for insights into consumer and product movements • Increasing need for automation to reduce labor cost and improve quality • Expanding consumer and regulatory demand for more accurate product handling information • Increasing drive for improved margins through supply chain efficiencies between supply chain partners Accenture 2004 11 …“If you had to pick just one technology that could really make a difference [to businesses], it would have to be RFID, " says Glover Ferguson, chief scientist at Accenture Ltd…When the economy starts to pick up, and there's some breathing room for investments, I can really see this thing taking off, " says Accenture's Mr. Ferguson. …” Beyond Bar Codes – Radio ID tags may soon be placed in every product imaginable, The Wall Street Journal, September 23, 2002

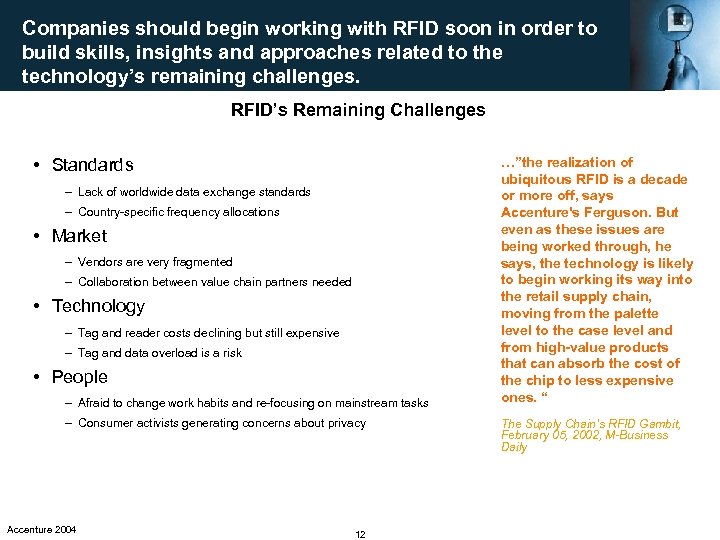

Companies should begin working with RFID soon in order to build skills, insights and approaches related to the technology’s remaining challenges. RFID’s Remaining Challenges • Standards – Lack of worldwide data exchange standards – Country-specific frequency allocations • Market – Vendors are very fragmented – Collaboration between value chain partners needed • Technology – Tag and reader costs declining but still expensive – Tag and data overload is a risk • People – Afraid to change work habits and re-focusing on mainstream tasks – Consumer activists generating concerns about privacy Accenture 2004 12 …”the realization of ubiquitous RFID is a decade or more off, says Accenture's Ferguson. But even as these issues are being worked through, he says, the technology is likely to begin working its way into the retail supply chain, moving from the palette level to the case level and from high-value products that can absorb the cost of the chip to less expensive ones. “ The Supply Chain’s RFID Gambit, February 05, 2002, M-Business Daily

Contents • RFID/Silent Commerce Technology Primer • Accenture RFID Solutions Approach • Accenture Activities in the RFID Market Accenture 2004 13

Accenture’s RFID solution development approach leverages our proprietary tools and assets to rapidly deliver business results. Crafting RFID Solutions – From Innovation to Delivery Pilot Execution Ideas Generation Opportunity Definition Pilot Scoping & Costing Roll-out & Operate Test & Refine Models Innovation Workshop Value Targeting Toolkit Cost-Benefit Calculator Prototype & Pilot Strategic Delivery Model Accenture 2004 14

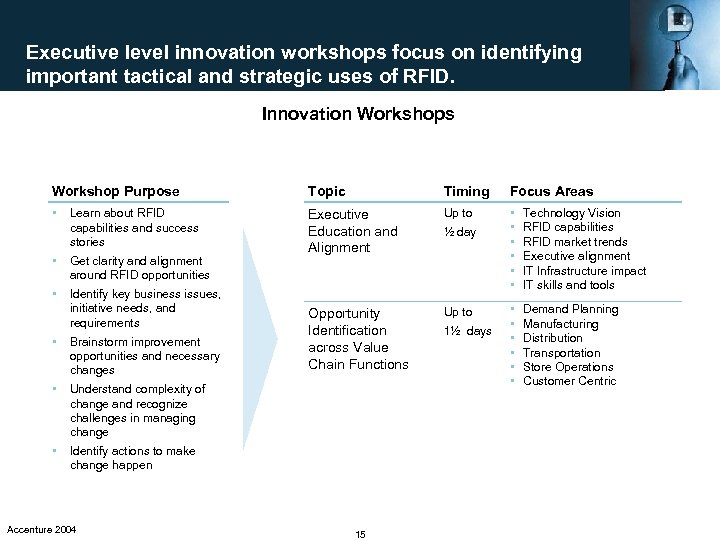

Executive level innovation workshops focus on identifying important tactical and strategic uses of RFID. Innovation Workshops Workshop Purpose Topic Timing Focus Areas • Executive Education and Alignment Up to • • • Technology Vision RFID capabilities RFID market trends Executive alignment IT Infrastructure impact IT skills and tools Opportunity Identification across Value Chain Functions Up to • • • Demand Planning Manufacturing Distribution Transportation Store Operations Customer Centric Learn about RFID capabilities and success stories • Get clarity and alignment around RFID opportunities • Identify key business issues, initiative needs, and requirements • Brainstorm improvement opportunities and necessary changes • Understand complexity of change and recognize challenges in managing change • Identify actions to make change happen Accenture 2004 15 ½ day 1½ days

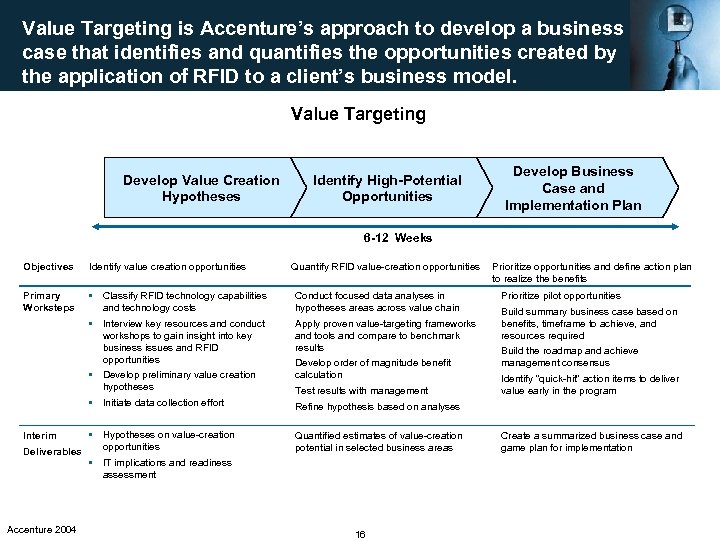

Value Targeting is Accenture’s approach to develop a business case that identifies and quantifies the opportunities created by the application of RFID to a client’s business model. Value Targeting Develop Value Creation Hypotheses Identify High-Potential Opportunities Develop Business Case and Implementation Plan 6 -12 Weeks Objectives Identify value creation opportunities Primary Worksteps • Classify RFID technology capabilities and technology costs • Interview key resources and conduct workshops to gain insight into key business issues and RFID opportunities • Develop preliminary value creation hypotheses • Initiate data collection effort • Hypotheses on value-creation opportunities Deliverables • IT implications and readiness assessment Interim Accenture 2004 Quantify RFID value-creation opportunities Prioritize opportunities and define action plan to realize the benefits • Conduct focused data analyses in hypotheses areas across value chain • Apply proven value-targeting frameworks and tools and compare to benchmark results • Develop order of magnitude benefit calculation • Test results with management • Refine hypothesis based on analyses • Prioritize pilot opportunities • Build summary business case based on benefits, timeframe to achieve, and resources required • Build the roadmap and achieve management consensus • Identify “quick-hit” action items to deliver value early in the program • Quantified estimates of value-creation potential in selected business areas • Create a summarized business case and game plan for implementation 16

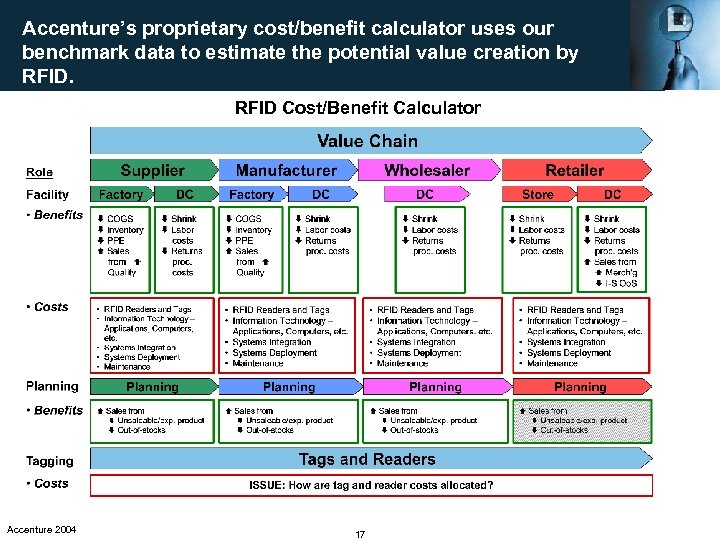

Accenture’s proprietary cost/benefit calculator uses our benchmark data to estimate the potential value creation by RFID Cost/Benefit Calculator Accenture 2004 17

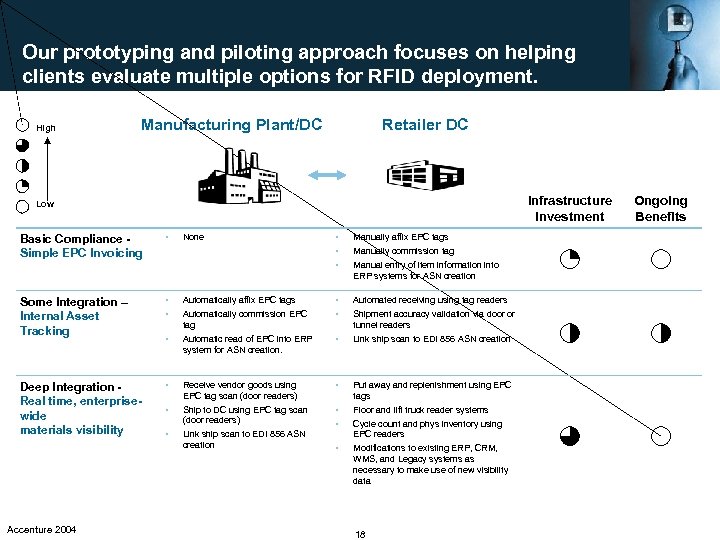

Our prototyping and piloting approach focuses on helping clients evaluate multiple options for RFID deployment. High Manufacturing Plant/DC Retailer DC Infrastructure Investment Low Basic Compliance Simple EPC Invoicing • Some Integration – Internal Asset Tracking • • Automatically affix EPC tags • Deep Integration Real time, enterprisewide materials visibility Accenture 2004 • • • Manually affix EPC tags • • Automated receiving using tag readers Automatic read of EPC into ERP system for ASN creation. • Link ship scan to EDI 856 ASN creation • Receive vendor goods using EPC tag scan (door readers) • Put away and replenishment using EPC tags • Ship to DC using EPC tag scan (door readers) • • Floor and lift truck reader systems • Link ship scan to EDI 856 ASN creation • Modifications to existing ERP, CRM, WMS, and Legacy systems as necessary to make use of new visibility data None Automatically commission EPC tag Manually commission tag Manual entry of item information into ERP systems for ASN creation Shipment accuracy validation via door or tunnel readers Cycle count and phys inventory using EPC readers 18 Ongoing Benefits

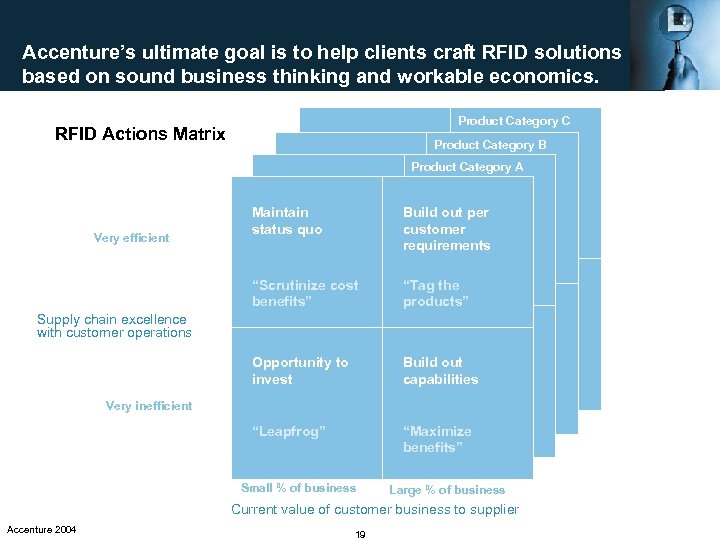

Accenture’s ultimate goal is to help clients craft RFID solutions based on sound business thinking and workable economics. Product Category C RFID Actions Matrix Product Category B Product Category A Build out per customer requirements “Scrutinize cost benefits” “Tag the products” Opportunity to invest Build out capabilities “Leapfrog” Very efficient Maintain status quo “Maximize benefits” Supply chain excellence with customer operations Very inefficient Small % of business Large % of business Current value of customer business to supplier Accenture 2004 19

Contents • RFID/Silent Commerce Technology Primer • Accenture RFID Solutions Approach • Accenture Activities in the RFID Market Accenture 2004 20

Accenture views RFID as one of the most important technologies for the next decade. RFID Market Perspectives • Radio Frequency ID (RFID) is expected to be the next “killer application” – Not just a replacement for barcodes, but a radically new technology – Capabilities will enable new wave of business model innovation • RFID is no longer a “science experiment” – Walmart requires Top 100 suppliers to utilize RFID by 1/1/2005, all suppliers by 12/2006 – Department of Defense announces use required by 1/2005 • RFID economics are no longer cost prohibitive – Costs are dropping rapidly as uptake and purchase commitments increase – Walmart requirement will drive new scale economies, particularly around EPC standard • Market activity in RFID is growing rapidly – Fastest growing area of Accenture’s practice – Almost all our major clients are asking what it will mean to them • Accenture is an industry leader in RFID – Board membership at Auto-ID center, sponsor of seven industry vertical value propositions – Longstanding leadership in RFID vision and prototypes through Accenture Technology Labs – Leading development of industry vertical solutions in pharmaceuticals and electronics Accenture 2004 21

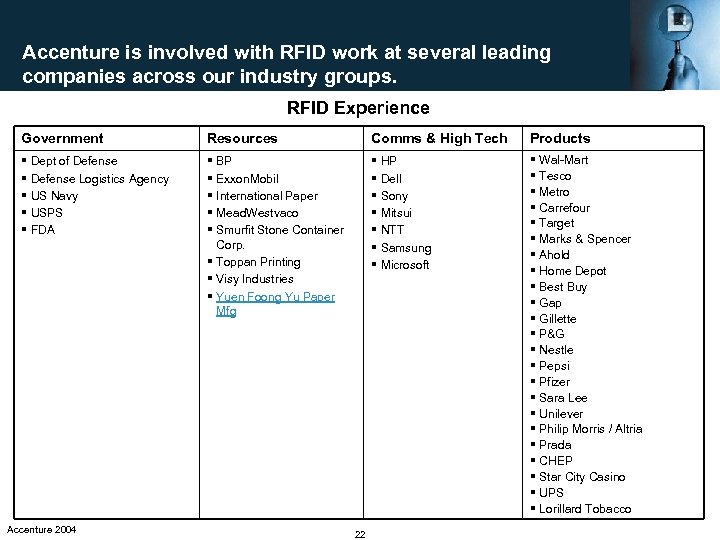

Accenture is involved with RFID work at several leading companies across our industry groups. RFID Experience Government Resources Comms & High Tech Products § § § § § § § § § § Dept of Defense Logistics Agency US Navy USPS FDA Accenture 2004 BP Exxon. Mobil International Paper Mead. Westvaco Smurfit Stone Container Corp. § Toppan Printing § Visy Industries § Yuen Foong Yu Paper Mfg 22 HP Dell Sony Mitsui NTT Samsung Microsoft Wal-Mart Tesco Metro Carrefour Target Marks & Spencer Ahold Home Depot Best Buy Gap Gillette P&G Nestle Pepsi Pfizer Sara Lee Unilever Philip Morris / Altria Prada CHEP Star City Casino UPS Lorillard Tobacco

We are helping our clients evolve their RFID strategies and capabilities through a range of solutions. Established Unformed Client’s RFID Strategy/Vision Evolution of RFID Capabilities & Solutions Industry-Level Solutions Individual Client Solutions Industry Vertical Solutions Walmart Jumpstart Single Enterprise Implementation Proprietary/ Go-to-Market Solutions RFID Strategy & Value Targeting/Business Case Initial RFID Discussions/ Workshops Narrower Broader RFID Value Proposition Accenture 2004 23

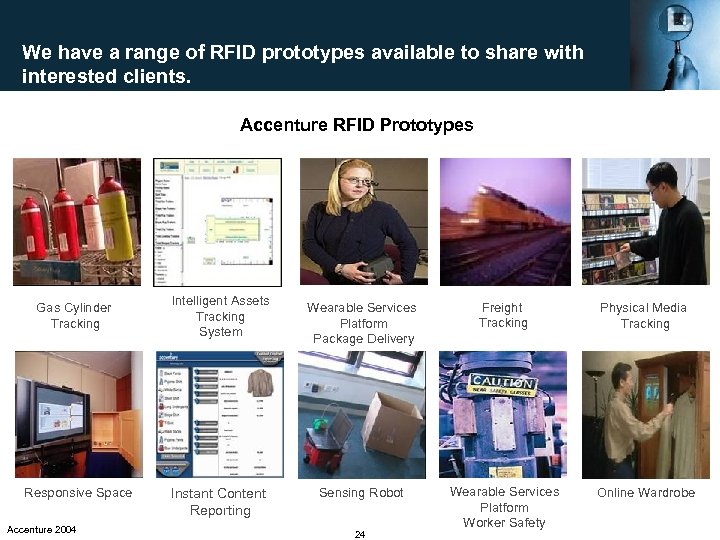

We have a range of RFID prototypes available to share with interested clients. Accenture RFID Prototypes Gas Cylinder Tracking Responsive Space Accenture 2004 Intelligent Assets Tracking System Instant Content Reporting Wearable Services Platform Package Delivery Freight Tracking Physical Media Tracking Sensing Robot Wearable Services Platform Worker Safety Online Wardrobe 24

Accenture has several RFID white papers and business cases that were developed in partnership with the Auto. ID Center. • Value Chain White Paper – Auto-ID Across the Value Chain: From Dramatic Potential to Greater Efficiency & Profit - 432 KB – Ajit Kambil & Jefferey D. Brooks Published 6/1/2002 – http: //www. autoidcenter. org/research/ACN-AUTOID-BC-001. pdf • Industry/Function White Papers – Auto-ID in the Box: The Value of Auto-ID Technology in Retail Stores - 793 KB – Gavin Chappell, David Durdan, Greg Gilbert, Lyle Ginsburg, Jeffrey Smith, Joseph Tobolski – http: //www. accenture. com/xdoc/en/services/technology/vision/tech_auto_id_value. pdf – – – if You Build It, They Will Come: Electronic Product Codes (EPC) Forum Market Sizing Analysis- 830 KB Joe Dunlap, Greg Gilbert, Lyle Ginsburg, Jeffrey Smith, Joseph Tobolski, Paul Schmidt, Jeffrey Smith http: //www. accenture. com/xdoc/en/services/technology/vision/tech_epc_forum. pdf – – – Auto-ID on the Line: The Value of Auto-ID Technology in Manufacturing – 803 KB Gavin Chappell, Lyle Ginsburg, Paul Schmidt, Jeffrey Smith, Joseph Tobolski http: //www. accenture. com/xdoc/en/services/technology/vision/tech_auto_id_manufacturing. pdf – – – Auto-ID on Demand: The Value of Auto-ID Technology in Consumer Packaged - 694 KB Gavin Chappell, Lyle Ginsburg, Paul Schmidt, Jeffrey Smith, Joseph Tobolski http: //www. autoidcenter. com/research/ACN-AUTOID-BC-002. pdf – – – Auto-ID on the Move: The Value of Auto-ID Technology in Freight Transportation - 604 KB Michael Boushka, Lyle Ginsburg, Jennifer Haberstroh, Thaddeus Haffey, Jason Richard, Joseph Tobolski http: //www. autoidcenter. com/research/ACN-AUTOID-BC-003. pdf – – – Auto-ID on Delivery: The Value of Auto-ID Technology in the Retail Supply Chain - 694 KB Gavin Chappell, David Durdan, Greg Gilbert, Lyle Ginsburg, Jeff Smith, Joseph Tobolski http: //www. autoidcenter. com/research/ACN-AUTOID-BC-004. pdf Accenture 2004 25

For More Information of RFID: • For additional information of Accenture’s RFID capabilities, please contact any of the following individuals: Ed Starr Global Managing Partner, Communications & High Tech Supply Chain 312. 693. 4299 c. edwin. starr@accenture. com Terry Breen Global Managing Partner, Electronics Industry 617. 454. 7316 terry. breen@accenture. com Richard J. Emerson Partner, Accenture, Communications & High-Tech, Asia, Seoul Office 82. 2. 3777. 8844 richard. j. emerson@Accenture. com Accenture 2004 26

ec045f485605ae476559e8f79df6f9c6.ppt